#Fish Feed Pellet Making Machine Market

Text

Fish Feed Pellet Making Machine Market Outlook, Current and Future Landscape Analysis 2023 to 2033

The global fish feed pellet making machines market is expected to reach US$ 2,167.9 million in 2033, growing at a 5.6% CAGR between 2023 and 2033. The market is expected to reach $1,257.2 million by 2023.

According to FMI, increased exports of fish and other seafood products from various countries around the world are expected to drive market sales. International companies are expected to enter emerging economies in order to capture the overall industry.

Furthermore, rising awareness of the importance of sustainability as well as animal welfare is expected to boost sales of organic farming. As a result, fish farmers use organic farming methods to provide chemical-free and genetically modified products.

The growing consumer preference for organic foods is expected to compel key manufacturers to increase their organic feed production capacity. Other factors that would accelerate market sales include changing eating habits and lifestyles of consumers in both developed and developing countries.

Request a Sample to Obtain Authentic Analysis @

https://www.futuremarketinsights.com/reports/sample/rep-gb-16533

Key Takeaways from the Fish Feed Pellet Making Machine Market Study:

Top 3 countries in the global fish feed pellet making machine market are projected to generate a share of 8% in the next ten years.

The global fish feed pellet making machine market is estimated to be valued at US$ 1,190.5 million by the end of 2022 from a valuation of US$ 1,006.0 million in 2018.

The USA fish feed pellet making machine market is anticipated to generate the lion’s share of nearly 8% by 2033.

Germany fish feed pellet making machine market is predicted to account for a considerable share of about 3% in Europe during the estimated time frame.

In Asia Pacific, India is likely to witness moderate growth and exhibit a CAGR of 3% from 2023 to 2033.

“Key companies in the fish feed pellet making machine market are anticipated to invest huge sums in the manufacturing of dry pelleted fish feed. This type of feed is projected to be extensively used for improving digestibility and balance of nutrients for matching specific needs of various fish species,” says a lead analyst at Future Market Insights.

Competition Landscape: Fish Feed Pellet Making Machine Market

Leading players in the fish feed pellet making machine market are CPM Asia, Andritz Group, Buhler AG, Salmco Ltd., and Zhengchang Group among others. These companies are aiming to strengthen their positions in the global market by launching state-of-the-art equipment. A few other players are striving to generate more shares by joining hands with local companies across the globe.

Get Valuable Insights into Fish Feed Pellet Making Machine Market

FMI, in its new offering, provides an unbiased analysis of the fish feed pellet making machine market presenting historical demand data (2018 to 2022) and forecast statistics for the period from (2023 to 2033). The study divulges compelling insights on the demand for fish feed pellet making machine market based on type (ring die pellet mill, flat die pellet mill), by application (small-scale aquaculture, large-scale aquaculture, others), by sales channel (online, offline), and by region (North America, Europe, Asia Pacific, Latin America, the Middle East and Africa).

For More Information on this Report @

https://www.futuremarketinsights.com/reports/fish-feed-pellet-making-machine-market

Fish Feed Pellet Making Machine Market Outlook by Category

By Type:

Ring Die Pellet Mill

Flat Die Pellet Mill

By Application:

Small-Scale Aquaculture

Large-Scale Aquaculture

Others

By Sales Channel:

Online

Offline

By Region:

North America

Europe

Asia Pacific

Latin America

MEA

RoW

0 notes

Text

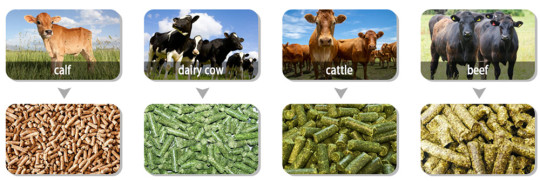

How to Start A Cattle Feed Plant?

In recent years, with the strong support of various countries in the world, the feed processing industry has also become a popular industry. Maybe you are also considering whether to start processing and production of feed. Among them, the production of cattle feed has also attracted much attention. More and more people choose to buy a complete set of cattle feed plants to produce cattle feed.

youtube

For beef cattle feed production, establishing a cattle feed production plant is the first step in your business. However, before choosing equipment and project plans for your cattle feed processing plant, you'd better understand the local cattle feed formula and processing technology in advance. According to your formula requirements, select the corresponding processing technology. Then select the appropriate production equipment according to your processing technology, and then plan the layout and construction of the factory according to the choice of equipment.

How to start a cattle feed processing plant can be divided into the following six steps:

1. Cattle feed formula and processing technology selection

2. Selection of cattle feed processing equipment

3. Layout and construction of cattle feed processing plant

4. Purchase and install cattle feed processing equipment

5. Purchase raw materials for processing cattle feed

6. Produced cattle feed marketing

How to select the cattle feed formula?

Classification of Ruminant Animal Feed

Plant Feed: Green fodder, succulent feedstuff and roughage (hay, straw), grain feed (Gramineae and Leguminosae seeds), grain processing by-products (bran, oil cake, dregs)

The feed of Animal Origin: skim milk powder, meat, bone meal, blood meal, fish meal, meat, silkworm chrysalis powder, etc.

Constant Element Feed: salt, stone powder, calcium carbonate powder, bone meal, oyster, etc.

Trace Element Feed: Copper sulfate, iron sulfate, zinc sulfate, manganese sulfate, sodium selenite, cobalt sulfate, etc.

Buy Cattle Feed Processing Equipment for Your Cattle Feed Pellet Business

The feed processing machinery you need to buy depends on the type of feed you want to produce. Among them, Feed Pellet Machine, Feed Pellet Crumbler, Feed Mixer, Feed Cooler Machine, Feed Dryer, Feed Seasoning Machine, Automatic Packing Machine, etc. are some of the necessary feed processing equipment in a complete cattle feed processing plant.

Here you can see the design drawing of a cattle feed production plant with a capacity of 3-5 tons/hour. This process and layout were designed for one of our clients in West Africa. Please feel free to contact us for more information about this African feed processing plant.

If you just want to start a small-scale cattle feed pellet processing plant, and produce feed pellets for your own use or sell in your own local area, then a small cattle feed pellet machine is enough. If you want to start a small-scale feed production business in your village, then our small cattle feed factory will be your best choice.

Purchase the Ingredients for Feed Processing

Based on the feed formula you have decided to use, go ahead and get the ingredients. Here is the breakdown, most of which are readily available in Africa, Asia, America, and more.

Maize, cassava grits, and corn are popular for energy.

Get wheat or noodle wastes for proteins and some carbohydrates.

Bone meals, fish, oyster shells, dagga, and palm kernel for oils, salts, and minerals.

Marketing of Your Cattle Feed Pellets

This is the challenging part, especially for beginners. How do you get your pelleted feed product out there? There are many ways you can adopt

Supply stores: Introduce your feed to livestock supply stores and let them act as middlemen

Direct sales representatives: Search for the sales representatives for your feed product

Establishing a cattle feed processing plant and starting your own feed-making business can have huge potential to get profits. For example, in many African families, animals are the most valuable property, from which they get dairy products, and plow power among others. This traditional way of life offers a big opportunity for livestock feed processing mills since there are increasing demands for high-quality feeds for farmers and farms. So, start your cattle feed processing business from now on!

Henan Herm Machinery Co., Ltd was established in 2010 and has been devoted to the research and development of Feed Mill Machinery ever since. With more than 10 years of experience, Herm® has become a leading manufacturer and supplier of animal feed machines and complete animal feed production lines, cattle feed plants, poultry feed plants, animal feed pellet production lines, etc. It always endeavored to improve the quality of products and aims to meet the new requirements of the international market.

If You Are Ready to Start a Feed Pellet Plant Business, please contact us for the feed mill machine. We Can Provide Professional Design and Comprehensive Guidance According to Your Needs. Get in touch with us now!

Welcome Contact Us!

Henan Herm Machinery Co., Ltd

Email: [email protected]

Whatsapp: 0086 18037508651

0 notes

Text

Pellet sell-it: Manufacturing Feed Pellets

The Feed Pellet machine has multiple angles in which someone can operate a business. Being realtivley cheap to start up wit ha price of under $10000, it can be a good investment for developing or developed countries depending on where one lives.

Let's take a close look at the numbers and how they can be incorporated into the business model for starting a pet food brand using a fish feed granulator:

Power: 15KW

Staff: 1

Area: 20M2

Raw Materials: Amino acids, stalks, cereals, oils, etc.

Environmental Impact: LOW

Production Capacity: 150KG/HOUR

Other Produce: Dog feed, pig feed, cat feed, etc.

Minimum Budget: $100-$10,000

More details...

To calculate the production cost of pet food pellets, you need to consider the cost of raw materials, labor, and electricity.

Raw Materials Cost: The cost of raw materials depends on the type and quality of the ingredients used. Let's assume that the raw material cost for producing 1kg of pet food pellets is $1.

Labor Cost: Since the staff requirement for operating the fish feed granulator is only one person, let's assume a monthly salary of $1000.

Electricity Cost: The power consumption of the fish feed granulator is 15KW per hour. Let's assume that the cost of electricity is $0.10 per KW. So, the electricity cost for producing 1kg of pet food pellets is $1.50.

Therefore, the total production cost for 1kg of pet food pellets would be:

Raw Materials Cost + Labor Cost + Electricity Cost = $1 + $1000/30 days + $1.50 = $33.17 per 150kg produced per hour.

Assuming you sell the pet food pellets at a price of $2 per kg, your revenue for producing 150kg per hour would be $300.

Starting a pet food brand using a fish feed granulator has numerous advantages, including small area requirements, low environmental impact, high production capacity, the ability to produce multiple types of animal feed, manageable electricity usage, and a low minimum budget. With these advantages, there are various business models that you could consider while starting your pet food brand:

Direct Sales to Pet Owners: You can sell your pet food pellets directly to pet owners through pet stores, online marketplaces, and social media channels. This model is ideal if you are targeting a specific niche market such as organic or grain-free pet food. The high production capacity of the fish feed granulator allows you to fulfill customer demand quickly, while the low environmental impact aligns with the values of environmentally conscious pet owners.

Wholesale to Pet Stores: Another option is to sell your pet food pellets in bulk to pet stores, veterinary clinics, and animal shelters. The high production capacity of the fish feed granulator makes it easier to supply large quantities of animal feed, while the low minimum budget and manageable electricity usage enable you to offer competitive pricing to retailers.

Private Labeling: Private labeling your pet food pellets can be a profitable business model as it allows you to sell under a pre-existing brand name. You can offer custom formulations to different retailers to cater to their unique customer base. The ability to produce multiple types of animal feed using the fish feed granulator allows you to cater to the specific needs of each retailer. Combing this method with an automatic labeling machine can further automate your business.

Online Sales: Establishing an e-commerce website is essential in today's digital age, allowing pet owners to order your pet food pellets online. A strong online presence with effective marketing strategies like SEO optimization, email marketing, and social media advertising can help you reach a wider audience. The low minimum budget and manageable electricity usage also make it easier to maintain profitability with online sales.

Distribution Partnership: Partnering with a distributor can help expand your pet food brand reach to new markets. The high production capacity of the fish feed granulator enables you to supply large quantities of animal feed to distributors, while the low environmental impact aligns with the values of environmentally conscious distributors.

Value-Added Services: Offering value-added services such as nutrition consultation, feed formulation, and pet care services can differentiate your brand from competitors and add value to your business. The ability to produce multiple types of animal feed using the fish feed granulator allows you to offer a wide range of value-added services to pet owners and retailers.

Food pellets are also used as a source of energy for cooking and heating in some parts of the continent. Pellets made from agricultural waste, such as rice husks and sawdust, can be burned in specially designed stoves to provide a cleaner and more sustainable alternative to traditional fuels like charcoal and firewood. Using this alternate method of energy creation, there are new avenues to explore.

https://kichuguu.com/blog/feed-pellet-manufacturing

https://kichuguu.com/

0 notes

Photo

Ghana Fish Feed Production Machine And Fish Farming Market

http://www.feedpelletmills.com/blog/fish-feed-pellet-line/ghana-fish-farming-market.html

The growing global and national demand for fish and the dwindling supply of the Ghanaian economy is another reason for the development of aquaculture. In Ghana, more and more people are shunning red meat as a source of protein and turning to fish because of the health effects.

Fish feed pellet machine can make fish feed pellets, Zhengzhou Fusmar Machinery is a professional fish feed extruder manufacturer. If you want to build your own fish feed plant, please contact us.

Aquaculture Market in Ghana

These are the main drivers of the market and the industry. Also due to the role of fisheries in its contribution to GDP, the government has promoted aquaculture as a means of increasing the annual decline in ocean fishing, providing food and employment to the population.

Ghana has a high domestic demand for fish and one of the highest per capita consumption rates in the world (20-25 kg/year). Rapid population growth and urbanization mean that Ghana’s aquaculture market is also expanding, un-habitat predicts. Currently, 87% of households in Ghana are recorded as consumers of tilapia, especially smokers. Ghana also spends heavily on hotels, restaurants, and other food services.

Extruders For Fish Feed Production

Fish feed extruder is used to produce extruded pet food, (floating) extruded aquatic feed and extruded animal feed.

The extrusion cooking process will lead to a large number of starch gelatinization, so the feed has good water stability. It can produce both “extruded” floating feed and sinking feed. The process also improves the digestibility of the product.

Fish feed pellets that contain ingredients such as soybean meal and cereal grains are more digestible and therefore more nutritious. Floating feed is made by extruder machine, and sinking feed with high water stability can also be made by extruder machine. In some cases, extruders are used only to prepare feed materials, such as the dry extrusion of soybeans.

Basically, the extruder is a long barrel with an auger that is specifically designed to expose the incoming mixture to high heat and steam pressure. When the feed comes out of the die at the end of the barrel, the captured steam is quickly blown away, and the soft warm pellets expand, producing a low-density floating pellets. The extruder is widely used and can be made into feed with many different characteristics.

Fish Feed In Ghana

Feed constitutes the highest production cost (above 60%) in fish farming, especially in cage farming where complete floating feeds are used. Floating feeds are partly imported and produced in Ghana. The price of fish feeds fluctuates depending on the availability and prices of raw material on international markets. Locally manufactured feeds are on average 30% cheaper than imported feeds.

In Ghana, fish feed is imported duty-free and operated by the private sector. All imported feeds are float-expanded feeds with particle sizes ranging from 0.3 mm to 6 mm. Powder/shredded fish feed is also imported.

Beside commercially produced feeds, farm-made feeds and supplemental feeds (agriculture by-products) are being used locally, mainly in pond farming. The formulation of farm-made feeds is mainly depending on the costs of ingredients rather than the nutritional requirement of the fish. Feeds are pelletized using simple other purpose build electric devices and presented to fish either as wet doughs and moist feeds during the rainy season and as dried feeds during the dry season. Very few farmers use premixes in the feeds. Farm-made feeds are poorly bound and quickly disintegrate in contact with water. They are also poorly digestible. Small-scale pond farmers practice supplemental feeding additional to pond fertilization. Common supplemental feed ingredients are wheat bran, maize bran, rice bran, and other cereal brans, which are readily available on the market. A minority of pond farmers use commercial floating feeds.

#fish feed pellets#fish feed plant#fish feed production line#fish feed machine#fish feed extruder#fish farming#fishkeeping

2 notes

·

View notes

Text

Breeding Mode of Tilapia

1. Intensive cultivation mode

The intensive cultivation mode of tilapia developed rapidly in the past few years. Intensive cultivation, that is, pure tilapia cultivation, can produce more than 5,000 kilograms per mu, creating a lot of tilapia myths. The representative areas of the intensive breeding model are tropical and subtropical breeding areas such as Wenchang, Hainan and Nanning, Guangxi. Ponds need to be equipped with strong oxygenation capacity, and ponds with good conditions even have sewage systems.

Hainan, taking advantage of its unique climate, can raise three fish a year; Nanning, on the other hand, relies on its advantages in the domestic market, and the price of fish has been relatively strong. Tilapia in intensive culture mode grow fast and yield high, so they are highly respected by farmers in the two places. In addition, the peak market period of tilapia is from October to December, which is also the time when the price is the lowest. Tilapia under the intensive culture mode can be listed one month earlier, and farmers can make a time difference to avoid the peak fish output and impact the fish price.

However, in the past two years, intensively cultured tilapia has faced the double test of streptococcosis and weak exports. Under the circumstance that the market situation in the past two years is still unclear, many large tilapia farmers are still in a wait-and-see mood.

2. Tilapia-shrimp polyculture mode

The tilapia-shrimp polyculture model can be regarded as a relatively classic breeding model, which is also due to the frequent occurrence of shrimp diseases and the downturn of the tilapia market in recent years. This pattern is distributed in Taishan, Zhuhai, Zhanjiang and Maoming in Guangdong.

The tilapia-shrimp polyculture model is dominated by tilapia and supplemented by prawns. The two complement each other and improve the ability to resist risks. Farmers generally start to label rough tilapia fry and shrimp fry in the middle and late March. The seedling density of tilapia is 2500-3000/mu, and the shrimp fry is 20000-30000/mu, mainly the second generation. After the standard thickness, the size of tilapia fry reaches 50/catties, and when the size of shrimp fry reaches 800/catties, tilapia and prawns can be mixed in ponds.

The prawns can be harvested at the beginning of June, and the land cages are used for catching. The annual output per mu is about 200 catties. Calculated at an average price of 15-20 yuan/catties, the per-mu output value of prawns is 3000-4000 yuan, which can offset most of the tilapia. feed expenditure. Tilapia can be marketed in batches in mid-September, with a bait coefficient of about 1.3 and a yield of 2,500-3,000 catties per mu. Taking advantage of the high value-added characteristics of prawns, this model can greatly improve the farming income of tilapia. So you can see the dry type fish feed pellet machine in Lima.

3. Intensive breeding of large-sized tilapia

In recent years, the market for large-sized tilapia of 3-4 catties has been very stable, with an average price of about 10 yuan / catty, and the profit margin is not small. It is chased by some farmers. The breeding areas are mainly concentrated in Zhuhai and Foshan. Near high-consumption cities. In this mode, the seedlings are generally invested in March, and the amount of seedlings per mu is 3000-4000 (size 7-8). After 3 months of breeding, farmers can choose to remove some commercial fish or separate ponds for breeding to speed up capital. Turnover and reduce farming risks in hot seasons. After raising until the end of the year, the size of tilapia reaches 3-4 kilograms, and farmers can produce fish in batches according to market conditions. Taking the farmers in Pingsha, Zhuhai as an example, under this model, the annual output of tilapia can reach 6,000 kilograms, and the profit per mu is as high as 12,000-15,000 yuan.

Although profitable, this farming model is only suitable for farming areas close to wholesale markets or urban consumer groups. These areas not only have strong consumption capacity for large-sized tilapia, but farmers can also directly connect with the market to obtain greater profit margins.

In addition, raising large-sized tilapia must overwinter, because the price of tilapia is the highest after the year when the green and yellow are not in contact. Whether it can survive the winter has become the most concerned issue for tilapia farmers. Therefore, this model is only suitable for ponds with winter sheds and sufficient groundwater or geothermal heat. This model has a long breeding cycle and high cost. Farmers should choose according to their own pond environment and market environment, and do not blindly follow the trend.

4. Three-dimensional breeding mode

Stereoscopic farming includes traditional fish-duck polyculture and fish-pig polyculture, which are mainly concentrated in eastern Guangdong and inland large-water aquaculture areas. Taking the mixed breeding of fish and ducks in eastern Guangdong as an example, the stocking density of tilapia is 800-1000 tails/mu (size 8-9), and it is also matched with filter-feeding and omnivorous fish such as bighead carp, silver carp and dace. kind. Feeding open feed in the fry stage to improve the survival rate, no feed or less feed in the middle of the breeding period, when the fish reaches a size of more than half a catty, they start feeding tilapia feed for fertilization, and some farmers will feed duck feed when they are waiting for the price of fish . The bait coefficient of the whole process is about 0.6-0.8, and the breeding cost is 2-3 yuan/catties.

According to an industry personnel analysis, the cost of intensive tilapia culture is generally 3.5 to 4 yuan per kilogram, polyculture is 3 to 3.5 yuan per kilogram, and the cost of three-dimensional culture is 2 to 3 yuan per kilogram. Under the current situation, the first two breeding modes are loss-making transactions. Therefore, for now, three-dimensional farming is still the best farming mode for tilapia farmers to avoid market risks.

In the short term, the three-dimensional breeding model will not disappear, but as the policy level shifts and the breeding industry and environmental protection are linked, the government will strengthen the management and control of the pond breeding environment.

Some areas have banned the construction of pig houses and duck sheds in ponds. In the long run, farmers still have to make timely changes to cope with changes in the general environment.

Welcome to see the fish feed making machine for production line in Lima.

#lima#lima fish feed machines#animal feed pellet machine#lima feed machine#fish feed extruder machine#dry type fish feed pellet machine#fish feed making machine for production line

0 notes

Text

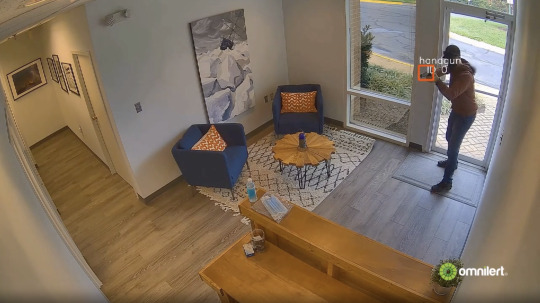

Gun Detection AI is Being Trained With Homemade ‘Active Shooter’ Videos

In Huntsville, Alabama, there is a room with green walls and a green ceiling. Dangling down the center is a fishing line attached to a motor mounted to the ceiling, which moves a procession of guns tied to the translucent line.

The staff at Arcarithm bought each of the 10 best-selling firearm models in the U.S.: Rugers, Glocks, Sig Sauers. Pistols and long guns are dangled from the line. The motor rotates them around the room, helping a camera mounted to a mobile platform photograph them from multiple angles. “It’s just like a movie set,” said Arcarithm president and CEO Randy E. Riley.

This process creates about 5,000 images of each gun floating ethereally. Arcarithm’s computer programmers then replace the green backdrop with different environments, like fields, forests, and city streets. They add rain or snow or fog or sun. A program then randomly distorts the images. The result is 30,000 to 50,000 images of the same gun, from multiple angles, in different synthetic settings and of varying degrees of visibility.

The point of creating this vast portfolio of digital gun art is to feed an algorithm made to detect a firearm as soon as a security camera catches it being drawn by synthetically creating tens of thousands of ways each gun may appear. Arcarithm is one of several companies developing automated active shooter detection technology in the hopes of selling it to schools, hotels, entertainment venues and the owners of any location that could be the site of one of America’s 15,000 annual gun murders and 29,000 gun injuries.

Among the other sellers are Omnilert, a longtime vendor of safety notification software, and newcomers ZeroEyes, Defendry, and Athena Securities. Some cities employ a surveillance system of acoustic sensors to instantly detect gunshots. These companies promise to do one better and save precious minutes by alerting police or security personnel before the first shot is fired.

They are all maneuvering around a problem: Algorithms, at their most basic level, collect data that is categorized, so they can independently determine if something new is of that category. In the tech industry, it’s generally believed that more data means a sharper algorithm. For companies that want to detect gunmen, therein lies one dilemma.

Screenshot from a promotional video for Omnilert's Gun Detect software

Visual detection machine learning has been developed for a wide range of uses, including diagnosing medical conditions and identifying pedestrians in a roadway. Researchers behind those efforts have access to nearly limitless pictures of tumors and inflammation and videos of joggers or dog walkers.

However, due to sensitivity, little footage from the start of shootings is readily available, certainly not enough to program a system that is supposed to differentiate a gun from a cell phone or a hairbrush reliably hundreds or thousands of times a day. Such footage is scrubbed from all but the darkest corners of the internet. There’s no inventory of it on Roboflow, Amazon Mechanical Turk, and other libraries of images for machine learning (though Roboflow does have a supply of still photos of guns).

The reliability of gun detection systems is of serious consequence to the people they monitor. This year, the Lockport City School District, in Upstate New York, implemented an algorithmic system to recognize faces and detect weapons. The technology misidentified black children at a higher rate, and emails between employees of its creator, ST Technologies, show the Canadian company was struggling to stop the system from mistaking broom handles for guns after it was implemented.

“I have concerns about the reliability of the object detection system and that system misidentifying a student holding a baseball bat and [police] will go and harass that student with a baseball bat,” said Daniel Lawrence, a researcher at the Urban Institute’s Justice Policy Center, who has studied technology in crime detection.

Alternatively, Lawrence said, police tend to take these alerts less seriously if they are always detecting low-priority activity or making false positives. “Everything depends on accuracy,” he said.

To train a computer program to recognize a gun as soon as it’s drawn—and then to test that program—companies have to get creative. And a bit weird.

Arcarithm, founded as a military and security contractor by three former Lockheed Martin employees, started by programming cameras to detect drones overhead. A client challenged them to come up with a system to detect guns. “If we can do drones, we can do anything,” said Riley, “so we spent the next ten years trying to tell if a guy has a gun or a broom and it turns out we can.”

Theoretically, the vast array of distortions and alterations in images feeding Arcarithm’s algorithm would account for ways a gun is obscured in real footage—by hands, by climate, or by distance. Through seeing so many common guns so many ways, the algorithm would supposedly become so familiar with guns, it could spot one instantly.

To test if their algorithm responds to the intended stimuli, Arcarithm staffers have staged armed invasions of their own headquarters using airsoft guns, which use condensed gas to shoot tiny, non-lethal plastic pellets. They’ve also taken to a nearby field to record themselves. It is programmers and desk employees cosplaying as criminals or militiamen. “All the guys are doing it,” said Riley. “They usually work on the development end.” He adds that they warn the sheriff’s department, which usually sends an observer.

Arcarithm has not found any buyers outside the U.S. military, which seeks an alert system for armed people coming towards a base. Riley said he has approached the operator of a theme park and a school system near Huntsville.

Of the other U.S. companies selling gun detection technology, Athena did not respond to an interview request from Motherboard, and seems to have pivoted to making a dubiously marketed technology that monitors people’s temperature amidst the COVID-19 pandemic. A spokesperson for ZeroEyes said its technology is proprietary so they would not discuss it. A representative for Defendry said the company declined because it did not want its name in an article published by VICE Media.

Omnilert has supplied notification systems, mainly to colleges and universities, since 2003, and unveiled its Gun Detect software in October.

CEO Dave Fraser describes a kitchen sink approach to the data-to-feed-the-algorithm problem. His company has used technology made to produce video games to create CGI simulations of the first moments of hold-ups and shooting sprees. They’ve trained the algorithm on Hollywood movies (he named John Wick). And there is also what Fraser dubbed “pajama videos,” homemade clips of employees walking around with guns (real and toy) recorded in their homes during the COVID-19 remote work months. He’s also outsourced the task to a few video content creators.

“We’ve built up an internet database of ourselves and our contractors brandishing guns,” said Fraser. “We have thousands of hours of data we created and we own.” Homemade videos are used to both feed and test the algorithm.

The videos fill up the company Slack channel, he said. And programmers and other desk employees are tasked with creating them.

Even their public director of marketing, Elizabeth Venafro, has contributed self-filmed clips of herself marching through her home toting a toy rifle, which “felt very weird, as a non-gun-owner,” she said.

A graphic demonstrating Arcarithm's Exigent-GR gun detection system

Experts in academia say that machine learning can now identify objects, even from a distance, but the process hinges on sufficient data.

“Today, we are much better than we were five years ago,” Ali Farhadi, an associate professor at the University of Washington working in computer vision and machine learning, told Motherboard. “We can detect objects fairly reliably.” Each year, smaller and more specialized objects are detectable and computer scientists can program algorithms to identify the body motions and context around them. “Not only can we see scissors but we know how people act when they are cutting things,” he said.

Visual identification requires a vast amount of varied data. Even differences in the sun path between the northern and southern hemispheres and subtle differences in background scenery can cause the program to be less effective, he said. “You want something that works as well in American cities as Indian cities,” said Farhadi. It’s even best to get footage from the types of cameras one expects to be in the field obtaining the feed, he said.

Karthik Ramani, a professor in mechanical engineering at Purdue University, completed a project that trained computer learning to identify mechanical objects so as to help engineers find exact matches and replacements. Machine learning is capable of identifying detailed objects, he said, but synthetic data is no replacement for the thing.

In CGI-created images, “I was seeing a loss of energy,” said Ramani. “You don’t get the real-world noise and reflections and metals are shiny and things can get confused. As humans, we see this and we get used to it. The machine doesn’t know these things yet.”

Some false positives are inevitable, Fraser and Riley both conceded. But both claim the technology can give first responders a few precious minutes, or seconds, to save lives.

Lawrence, of the Urban Institute, said once any surveillance or analytic technology comes into the hands of police departments, it's inevitably used to target poor, minority areas. “It is over-applied in communities with persons of color,” he said. Such neighborhoods are disproportionately policed, and the use of technology like predictive policing is a major driver of those statistics, creating a feedback loop.

“This technology is very expensive and it makes no sense to have it applied to the entire city,” he said.

However, Lawrence does not think cities will buy gun detection software in the near future. The summer racial justice protests and the “defund the police” movement have caused cities to shrink from buying expensive, futuristic equipment for police purposes. “I think as a society, we are redefining what policing is and how much money should be allotted to what and how much money should go to the police,” he said. “I think we are on the precipice of using money to combat crime and the causes of crime in a different way.”

He thinks the buyers of the next generation of gun detection software will be private companies, but once a gun is thought to be detected, “the call will go to the police.”

It is widely acknowledged that the ubiquity of guns in the United States is one reason the number of police killings in the U.S. dwarf those of other countries. Police shootings of Black people sometimes begin with the excuse that the officer thought the person had a gun, including the deaths of Casey Goodman, Stephon Clark, Tamir Rice, and Amadou Diallo. During a traffic stop, Philando Castile informed an officer he possessed a legal gun and the cop immediately opened fire.

Like many companies who make automated systems, Omnilert defends its gun-detection technology by noting that the final decision is made by a human being. “It could automatically lock the door on a suspect,” said Riley. “Now it’s up to the police to show up and see what this person does.”

As for a police overreaction, Fraser said, “It’s a possibility. We tend to look at this as ‘no technology is perfect.’ We tend to think it’s a positive to put this technology in our customer’s hands rather than have them rely on hearsay or gunshots when it’s too late.”

The possibility is enough for Meredith Whittaker, faculty director of the AI Now Institute at New York University, to reject the use of the technology outright. Whittaker and other AI ethicists and scholars have noted that all algorithmic systems contain bias, and this fundamental flaw can't simply be fixed with more data or a software update.

“They shouldn’t purchase anything like this,” she said of those who would buy gun-detection technology. “There is no dataset that would make this work. They are flawed, they are racist and they are being put into schools.”

Gun Detection AI is Being Trained With Homemade ‘Active Shooter’ Videos syndicated from https://triviaqaweb.wordpress.com/feed/

0 notes

Text

%news%

New Post has been published on %http://paulbenedictsgeneralstore.com%

Usa today Butter Gritty, radish stink, goatnapping: News from around our 50 states

Usa today

Usa today Alabama

Decatur: Extra than 800,000 gallons of untreated sewage spilled from the metropolis’s utility plant and at closing reached the Tennessee River at some point of two days of heavy rains, documents filed by Decatur Utilities display conceal. Disclosures filed with the Alabama Department of Environmental Management mark that about 8 million gallons of raw sewage cling escaped the Decatur Utilities sanitary sewer machine this 365 days in 81 overflows, The Decatur Everyday reports. A truly noteworthy discharge came about closing week when rain overwhelmed mature pipes, and sewage started pouring from a manhole discontinuance to the utility’s headquarters. It took the metropolis-owned firm more than 40 hours to give up the overflow. Decatur Utilities told the Environmental Department the heavy rains triggered the command, though the newspaper says the same corporations in neighboring communities reported few to no sewer overflows at some point of the identical length.

Usa today Alaska

Anchorage: An air provider that suffered a cyberattack has skilled more disruption than first and main projected, in accordance to a firm announcement. The RavnAir Community on Dec. 20 skilled what it known as a “malicious” cyberattack on its data technology network, Anchorage tv put of living KTVA reports. The firm canceled some Alaska flights of Plug 8 aircraft and said passengers could perchance well predict more time desk changes. This week the firm announced the disruption used to be worse than first and main reported. Restoration of programs could perchance well bear to a month, the firm said. Further flight cancellations and delays are likely for the team’s three airlines, RavnAir Alaska, PenAir and RavnAir Join, the firm said. The firm is working with the FBI, a cybersecurity firm and others to restore programs.

Usa today Arizona

Tucson: Three mountain lions came upon feeding on human remains discontinuance to a current Tucson mountain climbing lunge were killed, authorities said Wednesday. They weren't suspected of killing the particular person however were particular to be a hazard to the general public on story of they confirmed no alarm of officers looking out to amass the remains, the Arizona Game and Fish Department said in a assertion. The put of living within the Coronado Nationwide Wooded space used to be closed for a day while officials attempted unsuccessfully to trap the mountain lions. The medical examiner will work to establish the title and situation off of death for the particular person came upon Tuesday morning off the Pima Canyon Skedaddle. The lunge at the imperfect of Mount Lemmon used to be reopened Wednesday, sooner than a planned Jan. 14 reopening, after authorities made up our minds there used to be no hazard to the general public.

Usa today Arkansas

Minute Rock: A contemplate on Thursday ordered the metropolis to reinstate a police officer who used to be fired for fatally taking pictures a sunless motorist. Pulaski County Circuit Resolve Tim Fox reversed the Minute Rock Civil Service Commission’s ruling upholding the termination of Officer Charles Starks over the fatal taking pictures of Bradley Blackshire. Starks fired no less than 15 times by the windshield of a automobile Blackshire used to be using in February. Starks and but every other officer were trying a motor automobile give up at the time. Police commanders fired Starks in Can also, saying he violated department coverage. Fox upheld the fee’s ruling that Starks violated coverage requiring officers to pass out of an oncoming automobile’s path if likely other than fire. Nonetheless the contemplate said a 30-day suspension and reduction in wage to an entry-stage officer are more acceptable sanctions.

Usa today California

Corona: A Southern California quarantine zone has been expanded to be ready to give up the unfold of a illness that threatens the issue’s multibillion-greenback citrus exchange. The addition of 107 sq. miles encompassing the cities of Corona and Norco and phase of Chino followed the invention of a dozen trees with citrus greening illness in Corona, The Press-Endeavor reports. The quarantine zone now covers 1,127 sq. miles in sides of Riverside, San Bernardino, Los Angeles and Orange counties. The quarantine forbids motion of fruit, citrus crops or foliage, however the fruit also can be consumed on properties the put it used to be grown. Citrus greening illness is mostly is named Huanglongbing or HLB. It is a ways unfold by a little, aphid-tackle computer virus known as the Asian citrus psyllid. Contaminated trees obtain mottled leaves, manufacture deformed fruit and at closing die.

Usa today Colorado

Denver: Two affiliated organizations with ties to hospitals and insurance companies cling launched a six-figure public family ad blitz against the creation of a “public” medical insurance option within the issue. The advertising and marketing and marketing and marketing campaign started in December and springs sooner than the 2020 legislative session, which begins subsequent week and is expected to characteristic an intense struggle over how and whether or to no longer operate the general public option, the Colorado Sun reports. The so-known as public option, as proposed by Gov. Jared Polis’ administration, would in actuality be bustle by private insurance companies that will offer plans with authorities oversight. The plans could perchance well perhaps be on hand first and main most efficient to other folks that take coverage on their very non-public, with out wait on from an employer. Nonetheless Polis administration officials cling said they hope to expand the general public option to minute employers within a couple of years.

Usa today Connecticut

Hartford: The issue’s Department of User Safety is urging consumers to invent their homework before signing a contract with a gym or gymnasium. Commissioner Michelle Seagull says better health is known as a Recent 365 days’s resolution, and there tends to be a spike in unusual gym and gymnasium memberships in January. “Nonetheless on occasion the pleasure of belief wears off after a couple of months, and consumers are stuck in gymnasium contracts that they real don’t dispute,” she says. “That’s why we’re encouraging consumers to invent their homework and to be neat before making a dedication.” Connecticut law requires health clubs to cling contracts in writing. The actual person protection department urges consumers to be taught them carefully and know the device vital they'll pay, when the bill will are obtainable and what the cancellation coverage will likely be. The department additionally recommends studying online studies, talking to contemporary prospects and visiting the membership in particular person.

Usa today Delaware

Middletown: The 2020 Hummers Parade went off with out a hitch Wednesday following closing 365 days’s controversy, though parade watchers said it used to be no longer as real as past years and had a ways fewer marchers. Accompanying this 365 days’s parade used to be a team of more than 50 protesters retaining indicators decrying racism. Hundreds more lined the streets to ogle the annual parade that drew national scrutiny closing 365 days for a drift depicting young other folks in cages that many deemed offensive. The loosely organized parade is a spoof of the Mummers Parade in Philadelphia, and floats most regularly satire top news studies of the past 365 days. The parade used to be led by unofficial Big Marshal Jack Schreppler, who held an usual American flag with 13 stars. Just a few dozen and a half of minute teams and some lone other folks paraded by downtown Middletown on Recent 365 days’s Day. The most current topic depicted this 365 days used to be the Delabear from earlier this iciness.

Usa today District of Columbia

Washington: An it appears intoxicated man fell onto the tracks of a Metro put of living, causing one of the well-known most main delays of the unusual 365 days, in accordance to authorities. The actual person fell early Wednesday morning and used to be taken to a sanatorium with injuries no longer considered lifestyles-threatening, news stores declare. The fall is being investigated as an accident, in accordance to a Washington Metropolitan Role Transit Authority assertion that says the particular person gave the influence to be “below the influence.” The actual person’s identity wasn’t without lengthen launched.

Usa today Florida

Deland: Fifteen automobiles were shot at while using alongside Interstate 4 and Interstate 95 in Central Florida, authorities said Thursday. No injuries were reported, and the disaster from the Wednesday shootings appears to were triggered by a BB or pellet gun, in accordance a assertion by the Volusia County Sheriff’s Set apart of labor. The automobiles hit within the shootings were discontinuance to Deltona, DeLand and Daytona Seaside, in accordance to a assertion from the sheriff’s place of job. Look for accounts of the suspect automobile differ. An investigation used to be ongoing.

Usa today Georgia

Brunswick: The issue’s waters are closing to miniature fishing Jan. 15, however whelk season opens the following day. The annual miniature fishery closure aims to enable miniature to breed in neat ample amounts and grow to neat ample dimension to with pretty of luck present for a real miniature harvest within the coming 365 days, The News reports. The miniature fishery tends to reopen in dull Can also or early June, looking out on stipulations at the time. Meanwhile, the issue’s whelk season is to open at 7 a.m. Jan. 16 and bustle by 8: 15 p.m. March 31. Regulatory requirements for whelk trawls consist of the dispute of minimum 4-lunge stretch mesh trawl tools and a licensed turtle excluder instrument. Fishermen additionally need a issue commercial fishing license with a whelk endorsement.

Usa today Hawaii

Honolulu: Hawaiian Telcom painted over an unauthorized mural on one among its constructions by neatly-known marine artist Robert Wyland. The artist acknowledged he didn't cling permission to spray-paint the Maui building, The Honolulu Smartly-known particular person-Advertiser reports. The lifestyles-dimension image stretching 65 ft depicted a female humpback whale. Wyland said he apologized and hoped Hawaiian Telcom would no longer paint over the mural he created at some point of work over two days. “I converse regret for no longer running it up the meals chain,” he said Monday. “I’m so passionate. I allege to God I don’t focal point on these items. I form of painted it and explore forgiveness later.” Hawaiian Telcom by no means bought a without lengthen apology from Wyland, the firm said.

Usa today Idaho

Carey: Reveal land administration officials cling secured a conservation land dispute easement on the Cenarrusa Ranch ensuring the land in that put of living is no longer developed. The Bureau of Land Management and The Nature Conservancy in Idaho finalized the easement within the Pioneer Mountain foothills discontinuance to Carey after years of debate, The Cases-News reports. The easement ensures protection of about 13 sq. miles of land collectively with myth grouse habitat and migration corridors for wildlife, officials said. One of many longest pronghorn migrations within the west, a 160-mile scamper crosses the ranch and involves grouse breeding grounds, land officials said. The easement is additionally expected to advise unusual game opportunities collectively with more than 3 miles of gather entry to routes, officials said. “It’s the style of predicament that makes Idaho Idaho,” Nature Conservancy Conservation Supervisor Tess O’Sullivan said.

Usa today Illinois

Chicago: The metropolis appears to cling closed out 2019 with a drop within the need of homicides for the third consecutive 365 days, police grunt. Preliminary numbers Tuesday confirmed there had been 490 homicides in 2019, making it the main time the yearly quantity has dipped below 500 since 2015, when it used to be 491. The need of homicides in 2019 dropped 13% in contrast with 2018, when there were 565 homicides, in accordance to police statistics. The declines came about across the metropolis, collectively with in historically excessive-crime areas. Police cling credited the metropolis’s dip in crime to the dispute of technology historic to predict the put shootings could perchance well occur, while specialists additionally credited anti-violence programs that offer jobs and gang warfare mediation.

Usa today Indiana

Indianapolis: The metropolis is a bombed-out wretchedness put of living in an upcoming G.I. Joe comedian e book. Being depicted as a warfare zone is less than flattering, however author Paul Allor isn’t picking on the metropolis. He lives right here, and the story gifts Indianapolis as placing up a fight against the execrable guys of Cobra – prolonged-running nemesis of the G.I. Joe physique of workers. Unfortunately, Cobra principles the world in Allor’s story. The organization has no command making a cautionary instance of Indianapolis. “Cobra genuinely wipes the metropolis off the scheme,” Allor said. What’s left? Downtown’s Infantrymen and Sailors Monument, no less than, is considered on the conceal of “G.I. Joe” No. 5, scheduled to attain in stores Jan. 8. And a survivalist biker gang, the Dreadnoks, is placing out at the Indianapolis Art work Center. Abundant Ripple resident Allor additionally incorporates a reference to Guilford Avenue’s multicolored “rainbow” bridge.

Usa today Iowa

Fruitland: A provider membership intends to manufacture a memorial for veterans in this Muscatine County team. The Fruitland Community Lions Club desires to predicament it discontinuance to Fruitland Community Center other than at a cemetery. A membership committee made up our minds the put of living discontinuance to the center would enable more other folks to search it and would deter vandals, the Muscatine Journal reports. The committee worked with Louisa-Muscatine High College artwork students to predicament a manageable and affordable obtain. This could perchance well cling sunless granite walls with seating, a flag and lighting. Every dilapidated could perchance well perhaps cling two traces on the wall, ample room to list names and provider data, for $100. The memorial can match 400 names. “We don’t wish to leave somebody off real on story of there’s no room. We’ll salvage room – we’ll take more granite if we would like to,” says Janina Hawley, the committee chairwoman.

Usa today Kansas

Wichita: The issue has been ready to attenuate its carbon-dioxide emissions for a 10th straight 365 days largely due to the expeditiously adoption of wind energy and a dull pass a ways from coal-powered electricity. About 36% of all electricity produced in Kansas is from wind, the supreme share of any U.S. issue, the Kansas News Service reports. In 2019 on my own, Kansas noticed four unusual wind farms, adding ample capability to energy 190,000 homes for a 365 days. In 2017, about half of of Kansas’ total carbon-dioxide emissions came from burning fossil fuels, equivalent to coal and natural fuel, to operate electricity. Plant upgrades and federal environmental rules since cling compelled coal crops to neat up what used to be popping out of their smoke stacks. Carbon-dioxide emissions contribute to global warming.

Usa today Kentucky

Ashland: The metropolis is net hosting a dedication ceremony for loads of unusual statues, collectively with two of Roman deities. Ashland’s Friday festivities will consist of a lighting ceremony, catered meals, stay song and a presentation by the artist, Gines Serran-Pagan, The Just reports. The bronzed clay and fiberglass statues of Venus, Vulcan and the belief of Genesis were commissioned by an anonymous donor who hoped to memorialize three sure sides of their fatherland, in accordance to the newspaper. “I'm so grateful that Serran-Pagan’s magnificent statues will likely be phase of Ashland’s riverfront panorama,” metropolis supervisor Mike Graese said. “The generosity of the donor is, individually, reflective of Ashland’s giving spirit. Mayor Steve Gilmore said he’s confident the statues will scheme tourists from in every single put.

Usa today Louisiana

Baton Rouge: Authorities announced Thursday that a man has been arrested in connection with the deaths of three homeless other folks. Jeremy Anderson, 29, used to be arrested and charged with two counts of first-level homicide and one depend of 2d-level homicide, Baton Rouge Police Chief Murphy Paul told news stores at a press convention. Paul said evidence came upon inside Anderson’s residence helped hyperlink him to the murders. The first two killings came about Dec. 13 when Christina Fowler, 53, and Gregory Corcoran, 40, were came upon fatally shot under an overpass, huddled in blankets beside an empty browsing cart. On Dec. 27, investigators came upon 50-365 days-mature Tony Williams shot to death on the porch of a vacant residence about two blocks a ways from the put Fowler and Corcoran were came upon. Paul said Anderson lives two blocks a ways from the put each and each shootings occurred.

Usa today Maine

Freeport: Coastal Maine has quite a lot of seaweed and an supreme need of cows. A team of scientists and farmers think that pairing the 2 could perchance well wait on unlock a skill to tackle a warming world. The researchers – from a marine science lab, an agriculture center and universities in northern Recent England – are engaged on a thought to feed seaweed to cows to gauge whether or no longer that could perchance well wait on reduce back the greenhouse fuel emissions that contribute to climate exchange. Just a few quarter of the methane within the nation comes from cattle, which manufacture the fuel when they belch or flatulate. The belief that of feeding seaweed to cows has won traction in contemporary years thanks to a few studies that cling confirmed its doable to attenuate aid on methane. One of many immense questions is which forms of seaweed offer the supreme lend a hand to farmers wanting to attenuate methane, says Nichole Label, a senior compare scientist at Bigelow Laboratory for Ocean Sciences in East Boothbay, Maine, and the project’s chief.

Usa today Maryland

Annapolis: The governor has indicated he’ll proceed to enable refugees into the issue. The Capital Gazette reports Gov. Larry Hogan’s place of job launched a letter Wednesday that used to be sent to the Trump administration. The letter said the issue would proceed to settle for neatly vetted refugees. The White Home had situation a Jan. 21 reduce back-off date for states and cities to contemplate whether or no longer they would proceed to enable refugees to determine within their jurisdictions. “We are keen to settle for refugees who the federal authorities has particular are neatly and legally wanting for refugee predicament and were adequately vetted,” Hogan wrote in his letter. “This, as , is varied from any form of ‘sanctuary predicament’ for these within the United States unlawfully.” Maryland has accredited practically 10,000 refugees below Hogan’s management since 2016. Nonetheless the Republican used to be among 31 governors who wanted to refuse Syrian refugees in 2015 out of alarm of terrorism.

Usa today Massachusetts

Boston: The issue is extending its electric automobile rebate program. Republican Gov. Charlie Baker and Lt. Gov. Karyn Polito announced the rebates were being prolonged Wednesday to closing by no less than Dec. 31, 2021, and the administration will originate no less than $27 million on hand per 365 days in 2020 and 2021. The program used to be phased out from Sept. 30 by Tuesday on story of a fleet sigh in applications triggered an absence of funding, Baker and Polito said, however the funding thought they proposed for an extension used to be largely adopted in a contemporary supplemental funds. Since 2014, the issue has allotted more than $31 million for the bother, to incentivize the bewitch of more than 15,000 electric automobiles and reduce back the issue’s greenhouse fuel emissions by an estimated 39,000 metric heaps every 365 days, Baker and Polito said.

Usa today Michigan

Delta Township: The team has solved an olfactory mystery that will likely be dubbed “The Case of the Rancid Radishes.” Residents known as officials in Delta Township closing month, fascinated a couple of smell they notion could perchance well very neatly be natural fuel or sewer leaks. Township Supervisor Brian Reed and his employees bought to the, neatly, root of the command: rotting radishes in within sight farm fields. To be more real, it used to be the unseemly smell of decomposing daikon radishes, a Japanese root vegetable. They had been planted in fields within the township and surrounding areas as a conceal crop after a moist spring. The radish differ is among these urged by natural resources officials to plant at some point of such classes – to no longer reap however to decompose in a say to nourish the soil, aerate it and prevent erosion. Decompose they did, and when temperatures rose in December the scent permeated the air. The stench need to composed subside with consistently less warm climate.

Usa today Minnesota

Minneapolis: Reveal Attorney Same old Keith Ellison on Thursday known as for the Minnesota Board of Public Defense to search the assignment that ended in the suspension of Hennepin County’s chief public defender, saying he believes Mary Moriarty used to be focused for talking out against racial bias within the prison justice machine. One after the other, law clerks and attorneys in Moriarty’s place of job wrote to the board in her defense, praising her management and dedication to clients and calling for her reinstatement. And dozens of public defenders and public curiosity attorneys open air Minnesota signed onto a letter objecting to her suspension. Moriarty, appointed in 2014, used to be positioned on paid leave closing week. She said officials expressed concerns about her administration style, what they known as inflexibility with varied prison justice officials and confrontations on the wretchedness of racial inequality. They additionally questioned a series of tweets about historic lynchings within the Deep South, she said.

Usa today Mississippi

Hattiesburg: The Hattiesburg Cultural Center hosted a jazz brunch Wednesday in honor of Jeanette Smith, a prominent chief within the metropolis’s civil rights motion within the dull 1950s and early 1960s, WDAM-TV reports. She used to be 78 years mature when she died in Atlanta in 2018. Her dull husband, Dr. C.E. Smith, additionally used to be instrumental in Hattiesburg’s civil rights motion. Both of them served because the president of the Forrest County NAACP, which they joined in 1959. The heart plans on net hosting the brunch again subsequent 365 days to honor these that cling made a distinction for the civil rights organization, in accordance to the put of living.

Usa today Missouri

Jefferson Metropolis: The issue’s levees need to composed be reinforced and repaired, severely in rural areas hit onerous by prolonged flooding in 2019, in accordance to an advisory team appointed by Gov. Mike Parson. St. Louis Public Radio reports the Flood Recovery Advisory Working Community on Tuesday launched its declare on ways to tackle flooding within the issue and reinforce flood restoration. Parson signed an executive say in July creating the 24-member advisory team. File flooding early closing 365 days and within the summertime overtopped and breached dozens of levees alongside the Missouri and Mississippi rivers. Some sides of western Missouri skilled flooding for up to seven months. Rebuilding in flood-prone areas has ended in repeated disaster, said Dru Buntin, deputy director of the Missouri Department of Natural Sources.

Usa today Montana

Helena: Wildlife officials cling opened the enable lottery for non-motorized watercraft on the Smith River in central Montana. Montana Fish, Wildlife and Parks every 365 days awards floating permits to groups of up to 15 other folks to gather entry to a 59-mile half of the Smith River east of Helena. Applications need to composed be submitted by Feb. 13 with a $10 non-refundable fee. The enable drawing is scheduled for March 2, officials said. The issue regulates the river to combat overcrowding and enable users to take quality, multiday floats, park officials said. About 10,070 other folks utilized for private floating permits closing 365 days, and about 1,300 were awarded, officials said. Folks can additionally take a gamble to hold a neat enable for $5 till March 12, officials said. That enable enables floaters to earn any day they wish to take the river time out, park officials said. The overall drift time out most regularly takes about four days and begins discontinuance to White Sulphur Springs, officials said.

Usa today Nebraska

Brownville: Federal inspectors thought to be taught about how neatly a nuclear energy plant handled a water provider safety command blamed on a silt buildup from the Missouri River, which overwhelmed or broke by levees closing spring. The Cooper Nuclear Station discontinuance to Brownville used to be running on corpulent energy Dec. 6 when employees detected that water wasn’t flowing by a pipe related to one among the plant’s two safety mills, the Nuclear Regulatory Commission said in a news launch Thursday. The mills weren’t running on story of they're designed to kick in and supply energy for the plant’s cooling programs most efficient when all 5 traces that energy the plant are knocked out. If wanted, the quite quite a lot of generator used to be on hand, the NRC said. The plant generated energy at some point of the command.

Usa today Nevada

Carson Metropolis: The issue Supreme Court has ruled that workers’ compensation rates for injured inmates are situation at inmate pay rates other than the minimum wage. Inmate Darrell White used to be assigned to the Forestry Division when he suffered a finger hurt that left him temporarily disabled for 144 days in 2016, the Nevada Attraction reports. White filed for employees’ compensation incapacity advantages at the minimum wage situation within the issue Structure after his launch, however an appeals officer ruled that issue law sets the amount of compensation at the moderate monthly wage the prisoner in actuality bought when the hurt occurred, officials said. White argued his compensation need to composed be situation at the constitutionally assured $7.25 an hour. Court officials argued compensation need to composed be about 50 cents a day, or $22.93 every month, in accordance to what he used to be in actuality being paid.

Usa today Recent Hampshire

Dover: The Metropolis Corridor clock tower, which officials grunt has misplaced its sheen and is sorely in need of a fundamental beauty overhaul, will likely be getting a corpulent facelift sooner than the metropolis’s 400th birthday event in 2023. Metropolis Supervisor Mike Joyal says the 80-foot tower wants quite a lot of labor to gather it in display conceal-mighty condition for the metropolis’s immense birthday bash, the massive majority of that also can very neatly be neatly-known at some point of a 10-day time desk sooner than July 4, 2023. The historic bell atop the tower used to be rung July 4, 1976, to celebrate the nation’s bicentennial, in accordance to metropolis records. After that, Joyal says, to this point as he has been ready to resolve, the closing time the bell used to be rung used to be Sept. 11, 2001. The importance of the bell to Dover’s historic past makes it a need to for ringing on the metropolis’s 400th birthday, in accordance to Mayor-elect Robert Provider.

Usa today Recent Jersey

Howell: A particular person that situation off fireworks discontinuance to a movie theater as his pal made a marriage proposal created dismay among moviegoers who mistook the fireworks for gunshots, main to 911 calls and an evacuation, authorities said. Howell Township police answered to the Xscape Theater about 6 p.m. Wednesday and soon realized the theater supervisor had confronted a man who had lighted fireworks open air but every other industrial discontinuance to the theater, authorities said. The remnants of the fireworks were positioned, and it used to be particular that no pictures had been fired. A 23-365 days-mature Lakewood man told police he had situation off the fireworks as phase of his pal’s marriage proposal at the quite quite a lot of business. Whereas noting there used to be no intent to situation off dismay at the theater, a post on the Howell police Facebook page said that “obviously this used to be a in fact unfortunate resolution other than an overt act.”

Usa today Recent Mexico

Santa Fe: A newly solid steel instrument that could perchance well pinpoint the lunge of stars and planets across the night time sky the dispute of the bare peer is a throwback to the years real before the creation of telescopes, returning stargazers within the hills of northern Recent Mexico to the necessities of astronomy within the past. Keep in at St. John’s College by graduates, the instrument is a remake of prolonged-misplaced originals devised by Danish astronomer Tycho Brahe within the dull 16th century to chart the put of living of stars and the orbits of planets. It consists of 4 interlocking rings – solid of precision steel and aligned with the north huge title and equator – blended with a sliding viewfinder that is moved by hand to measure angles between the any celestial object, the horizon and the equator. Lengthy, painstaking measurements from such an instrument within the dull-1500s allowed Johannes Kepler to display conceal that Mars revolved in an elliptical orbit around the sun.

Usa today Recent York

Victor: The head Republican within the Reveal Meeting used to be charged Recent 365 days’s Eve with using while intoxicated in his issue-issued automobile, real per week after he wrote a newspaper column warning residents against getting dull the wheel inebriated. Brian M. Kolb, a Republican from Canandaigua who represents a district real open air Rochester, used to be arrested discontinuance to his residence after what he known as a “lapse in judgement.” Authorities said they were known as to a smash in Victor real before 10: 30 p.m. after a automobile like a flash met a ditch. Kolb used to be came upon to be the motive force of the 2018 GMC Acadia that crashed in front of his residence. An Ontario County sheriff’s deputy administered self-discipline sobriety tests, which Kolb failed, before taking him to jail. Whereas there, authorities said a breath take a look at indicated Kolb’s blood-alcohol express used to be over 0.08%, the ethical limit for using in Recent York.

Usa today North Carolina

Raleigh: The issue says it has secured an agreement with Duke Energy to excavate practically 80 million a entire bunch coal ash at six facilities. The Department of Environmental Quality said in a Thursday press launch that this could perchance well very neatly be the supreme coal ash cleanup within the nation’s historic past. It additionally settles quite a lot of ethical disputes between Duke and parties that consist of environmental and team teams. For an extended time, coal ash has been saved in landfills or in ponds, most regularly discontinuance to waterways into which toxins can leach. Duke Energy will cling coal ash from the Allen, Belews Creek, Cliffside, Marshall, Mayo and Roxboro sites into on-predicament lined landfills. “This agreement is a historic cleanup of coal ash pollution in North Carolina,” said Frank Holleman, senior attorney at the Southern Environmental Legislation Center.

Usa today North Dakota

Mandan: Authorities grunt an ice jam alongside the Missouri River discontinuance to Mandan is causing water to upward push, threatening property alongside the shoreline. Morton County officials grunt water within the Sq. Butte Creek put of living alongside Willow Street and Rosy Lane has risen roughly 18 inches since Tuesday. Commission Chairman Bruce Strinden toured the put of living Sunday afternoon. He says residents could perchance well wish to pass objects from low areas. Authorities grunt they're working with the U.S. Navy Corps of Engineers to cling aid on increased releases at Garrison Dam till the ice jam wretchedness has been resolved. The Corps had increased discharges from the dam earlier within the week and planned but every other enhance Thursday.

Usa today Ohio

Cleveland: A ban on single-dispute plastic baggage took manufacture Wednesday in Cuyahoga County, though the ban won’t be enforced with fines till July 1. Despite the prolonged roll-out, most Enormous Eagle grocery stores within the county eliminated the bags origin Recent 365 days’s Day, Fox 8-TV reports. The firm could perchance well perhaps cling reusable baggage for bewitch, and prospects will gather fuel perks for every reusable gather historic. Just a few suburbs opted out of the ban, and Cleveland additionally opted out till July 1 to give a working team time to hunt for the affect of reducing plastic baggage on corporations. Some issue lawmakers and industrial teams grunt such local bans originate it more troublesome for grocers and varied corporations to operate, and proposed bills would prohibit local governments from forbidding the dispute of plastic baggage. Nonetheless Gov. Mike DeWine opposes these efforts, saying it could perchance well perhaps be a mistake for issue lawmakers to override local authorities choices.

Usa today Oklahoma

Sand Springs: A particular person stole a pickup truck with a drowsing passenger and a goat inside it and drove it the entire skill from Missouri to Oklahoma before releasing the terrorized victim and animal and at closing being arrested, authorities grunt. Essentially basically based mostly on an arrest declare, two men within the truck parked open air an adult video store in Carthage, Missouri, early Wednesday morning. The driver went at some point of the store, and the passenger fell asleep. When the passenger woke up, a masked man used to be using the truck and pointing a gun at his head, Tulsa TV put of living KOTV reports. The carjacking suspect, 40-365 days-mature Brandon Kirby, drove from Missouri by Kansas. All the device by the 130-mile ordeal, Kirby took methamphetamine, pistol-whipped the victim and consistently threatened him, in accordance to the arrest declare. The Sand Springs Police Department said on Facebook: “OK 2020, it most efficient took you 4.5 hours to gather uncommon. Let’s dull down on the carjacking-goatnapping calls for the the relaxation of the 365 days.”

Usa today Oregon

Salem: The need of nonaffiliated voters within the issue has increased by practically 60,000 for the reason that origin of this 365 days, in accordance to the Oregon Secretary of Reveal’s place of job. As of closing month, there were 951,908 nonaffiliated voters in Oregon – an enhance of nearly 7% since January 2019. The enhance of nonaffiliated voters is basically due to the issue’s “motor voter” law, handed in 2016, which mechanically registers eligible Oregonians as nonaffiliated voters when they register with the Oregon DMV. “There are no less than 300,000 unusual registrants since 2016 thanks to OMV (the Oregon Motor Voter Act),” says Paul Gronke, a political science professor at Reed College and political director of DHM Be taught. “And 80% or more of these didn't acknowledge to a postcard permitting them to affiliate.”

Usa today Pennsylvania

Harrisburg: The butter sculpture for this 365 days’s Pennsylvania Farm Present used to be unveiled Thursday, that comprises three of the issue’s professional sports activities physique of workers mascots. This 365 days’s sculpture, crafted from about 1,000 pounds of donated butter, reveals Gritty, Swoop and Steely McBeam, mascots for the Philadelphia Flyers and Eagles and the Pittsburgh Steelers. The Farm Present in Harrisburg, which calls itself the nation’s supreme indoor agricultural match, involves 12,000 competitive reveals and draws about 500,000 attendees yearly. It runs from Saturday by Jan. 11. Admission is free, however parking in Farm Present Advanced heaps is no longer. After the display conceal ends, the butter sculpture will likely be taken to a farm in Juniata County to be converted into energy by a methane digester. Recent to the display conceal this 365 days are onerous cider sales, an expanded rabbit competitors and a waterfowl habitat with stay ducks within the poultry put of living. There additionally will likely be a demonstration by other folks with bows using horses.

Usa today Rhode Island

Providence: The issue’s residents need to now cling medical insurance or face a penalty on their taxes. The taxation division launched a list of tax changes taking manufacture Wednesday, collectively with the unusual medical insurance mandate. Residents who invent no longer cling minimum crucial coverage in 2020 and invent no longer qualify for an exemption will face a penalty subsequent 365 days when filing a issue tax return for 2020. A federal appeals court ruling this month in Recent Orleans struck down the Cheap Care Act’s requirement that folks cling medical insurance, leaving President Barack Obama’s signature health care law in ethical limbo. Rhode Island’s Same old Meeting handed legislation that used to be signed by the governor to enact the requirement and penalty within the issue, with an efficient date of Jan. 1, 2020.

Usa today South Carolina

Charleston: The issue’s Department of Natural Sources is calling for residents to recycle historic oyster shells and discarded Christmas trees by programs aimed at boosting estuary health and promoting sigh of marine lifestyles. The issue is continuous to expand its oyster recycling and restoration program, the put South Carolinians and drinking locations can drop off historic oyster shells, severely after events equivalent to oyster bakes and holiday parties, The Post and Courier reports. The recycled shells are reintroduced to local waters, the put they give a ground for unusual oysters to grow, natural resources officials grunt. Stay oysters then filter water, defend against erosion, and attract fish and varied sea creatures to their reefs. The issue’s Coastal Conservation Affiliation and Natural Sources Department collectively donated more than $100,000 in tools to earn up and transport the shells, the newspaper reports.

Usa today South Dakota

Sioux Falls: South Dakota’s minimum wage is increasing pretty with the the open of the unusual 365 days. The issue’s minimum wage is now $9.30 per hour – an enhance of 20 cents from 2019. Workers who gather pointers are seeing their minimum wage upward push to $4.65 per hour. The need enhance are phase of a voter-licensed measure in 2014 to elevate the minimum wage, which used to be $7.25 an hour at the time, to $8.50 an hour. KELO-TV reports the minimum wage will proceed to enhance at the rate of the fee of living measured within the particular person fee index. The issue’s minimum wage used to be below $4 till 1992. The $7.25 minimum wage used to be situation in 2010.

Usa today Tennessee

Memphis: Elvis Presley’s Graceland is planning an public sale of artifacts to be held at some point of the dull entertainer’s 85th birthday event Jan. 8. The overall objects up for public sale Wednesday come from third-birthday party collectors however were thoroughly researched and licensed by Graceland Authenticated, in accordance to a news launch from Elvis Presley Enterprises Inc. The mansion and all artifacts within the Graceland Archives proceed to be owned by Lisa Marie Presley and continuously are no longer for sale. The 288 artifacts consist of a golf cart, clothes, jewelry, autographs, live performance memorabilia and Hollywood objects. As neatly as, loads of Graceland experiences will likely be auctioned, with the proceeds benefiting the Elvis Presley Charitable Foundation. Items to be included within the general public sale were announced Monday alongside with registration data. The catalog is on hand at Graceland’s official online store.

Usa today Texas