#Fluid Power Equipment Market Trends

Text

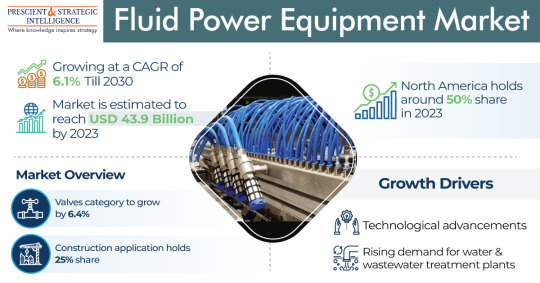

Fluid Power Equipment Market Will Touch USD 66.0 Billion in 2030

The fluid power equipment market was USD 43.9 billion in 2023, which will rise to USD 66.0 billion, advancing at a 6.1% compound annual growth rate, by 2030.

The growth of this industry is mainly because of the increasing need for water and wastewater treatment plants, and the continuous technological developments.

In 2023, hydraulic led the type category, with a revenue of USD 26.3 billion. This can be ascribed to the cost-effectiveness and high efficiency of this type, and its extensive adoption in oil & gas and construction applications.

The pneumatic category, on the other hand, will propel at a healthy rate during this decade. This is because these systems rely on compressed air pressure to send power and are extensively employed in numerous industrial applications.

Furthermore, pneumatic valves are available in different designs, sizes, and configurations, and thus, allow free flow in a single direction and avoid flow in the opposite direction.

In 2023, the construction category, based on end user, was the largest contributor to the fluid power equipment market, with a 25% share. This can be because of the high usefulness of these components in various applications like material demolition or handling in the construction sector.

The automotive category, on the other hand, is advancing at a tremendous rate, because of the increasing customer's disposable salary, along with the increasing standards of living, worldwide.

Motors is leading the component category. This can be because motor components provide great torque & power, and are extensively employed across various sectors, including agriculture, construction, and automotive.

Moreover, the developments in motor technologies enhance their performance and efficiency, and thus, are cost-effective solutions for businesses to utilize for different applications.

On the other hand, the valves category will advance at the highest rate during this decade. This is ascribed to the growing requirement for valves to track high pressure, which will boost the demand for valve components.

North America led the industry in 2023, with a 50% share. This can be attributed to the existence of greater infrastructure, coupled with the rising progression in R&D and manufacturing activities.

Moreover, the increasing count of initiatives implemented to guarantee the worker's safety in oil & gas and chemicals sectors further boost the regional industry growth.

APAC will propel at the highest rate, of 6.5%, in the coming years. This will be because of the surging urbanized populace along with the increasing requirement for energy, and the progression of the construction and automobile sectors in Japan, China, and India.

With the rise in the requirement for water & wastewater treatment plants, the fluid power equipment industry will continuously progress in the coming years.

Source: P&S Intelligence

#Fluid Power Equipment Market Share#Fluid Power Equipment Market Size#Fluid Power Equipment Market Growth#Fluid Power Equipment Market Applications#Fluid Power Equipment Market Trends

1 note

·

View note

Text

My headcanon Universe 6 technology

1)U6FD Combat Light Armor Suit is a specialized and unique Light Armor in Universe 6 designed specifically for the needs of assassins and other specialized covert operatives.

This light armour possesses enhanced mobility tools, such as an accelerator to increase speed and mobility. Additionally, the Light Armor includes a Ki Oscillator, which acts as a powerful weapon capable of emitting destructive blasts.

U6FD combat light armour also features a Ki circumventor, which is engineered to hide the user’s presence, preventing Ki detecting mechanisms or other Ki-focused devices from identifying their presence.(It made by Frost company, is it a trend product on the black market)

2)The Ki Oscillator is a unique weapon in Universe 6, which allows its user to wield immense power through the use of energy fluctuations that amplify and manipulate external energy into destructive energy waves. This weapon can harness an extraordinary amount of Ki,This energy then oscillates and magnifies, allowing it to emit destructive beams and blasts. The Ki Oscillator is an incredibly powerful, yet difficult-to-master weapon, requiring extensive training and discipline in advanced Ki manipulation.

Ki Oscillator actually is a type of special microchip that put in human body, most for it will put at arm or palm. Ki Oscillator have 101~1k logic gates or 1,001~10k transistors. Ki Oscillator is a Nanoscale devices. Ki Oscillator is made by nanomaterials that come from a Nanoorganisms and mix with specail Ki-conductor mental. (Only the part that connect to human body use nanomaterials that come from a Nanoorganisms.) Ki Oscillator no need to use electricity, it use Ki as the Power source.

3)Ki Energy Fluid (KEF) is a specialized product in Universe 6, which utilizes specialized technology to process Ki particles into a conductive liquid state. This liquid possesses immense potential energy due to the high concentration of Ki, allowing it to be used for a number of applications, such as energy generation, propulsion, or even as a power source.

KEF can be harvested from large numbers of individuals with high Ki levels, or can be extracted and processed in specialized facilities.

4)Suspend (SUS) is a technology product Universe 6, which acts as a special form of suspension technology, designed to hold an individual in suspension. This state of suspended animation has various uses, including keeping individuals in a stasis for medical purposes, or preventing a dangerous individual from acting.

Suspension technology is used extensively in Universe 6, both by individuals for specific purposes, and occasionally as part of various technological systems.

5)The Ki Energy-Gathering Object (KEGO) is a technology product in the Universe 6, which acts as a device capable of gathering and concentrating the user's Ki, the life force of beings in the setting. It utilizes a special crystal which acts as a vessel for the concentrated Ki, and redirects the energy to create bursts of destruction, or as a source of energy to enhance a person's capabilities. It can also be used to draw out hidden Ki and reveal hidden power in individuals, making it a highly sought after tool for anyone who wishes to master their Ki energy.

6)Organic Matter Conversion Ki Technology (OMCKT) is a technology used within Universe 6, which allows for the manipulation of organic matter into a form of Ki energy. This technology uses a specialized device which converts the molecular structure of organic materials into a synthetic version of the life energy, allowing for the controlled and targeted conversion of living beings into an energy source to enhance one's Ki and power.

7)R7SS-20 Photon Armor Suit: Contains cloaking technology that allows the wearer to become virtually invisible in the environment.

Equipped with 20 energy shield that activates when attacked, providing additional protection.

It integrates biological monitoring technology and can monitor the wearer's physiological parameters in real time, such as heart rate, body temperature, etc.

Equipped with an intelligent system, it can interact with the wearer to provide information, navigation or execute instructions.

Contains a series of enhanced functions, such as enhanced strength, speed, endurance, allowing the wearer to perform special tasks or survive in extreme environments.

have Ki circumventor, which is engineered to hide the user’s presence, preventing Ki detecting mechanisms or other Ki-focused devices from identifying their presence.(It made by Frost company, is it a trend product on the black market).

8)Optical Brain: It is a computer system based on optical components and a brain-computer interface technology that uses light signals to interact with computers or other devices.

2 notes

·

View notes

Text

Hydraulic Generator Market Size | Industry Research by 2024-2032 | Reports and Insights

The Reports and Insights, a leading market research company, has recently releases report titled “Hydraulic Generator Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032.” The study provides a detailed analysis of the industry, including the global Hydraulic Generator Market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Hydraulic Generator?

The hydraulic generator market is expected to grow at a CAGR of 8.3% during the forecast period of 2024 to 2032.

What are Hydraulic Generator Market?

A hydraulic generator is a device that transforms hydraulic energy into electrical power by utilizing the flow of pressurized fluid to drive a generator. Commonly used in industries like construction, marine, and other sectors where hydraulic systems are present, these generators efficiently convert the kinetic energy of moving fluid into electricity. Known for their durability, compactness, and ability to generate power in remote or mobile settings, hydraulic generators offer a practical and reliable solution for applications that require on-demand electrical power without a conventional power grid.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1917

What are the growth prospects and trends in the Hydraulic Generator Market industry?

The hydraulic generator market growth is driven by various factors and trends. The hydraulic generator market is experiencing consistent growth, driven by the rising demand for dependable and efficient power generation solutions across industries such as construction, mining, marine, and heavy industrial operations. Hydraulic generators are highly regarded for their capability to generate electricity in remote or off-grid environments by leveraging existing hydraulic circuits, making them essential for mobile equipment and heavy-duty machinery. Market expansion is further supported by increasing infrastructure development, innovations in hydraulic systems, and a shift towards sustainable energy practices. Major regions driving this growth include North America, Europe, and Asia-Pacific. Hence, all these factors contribute to hydraulic generator market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Power Rating:

Low Power Hydraulic Generators

Medium Power Hydraulic Generators

High Power Hydraulic Generators

By Application:

Construction

Mining

Oil & Gas

Telecommunications

Marine

Others

By End-Use:

Residential

Commercial

Industrial

Market Segmentation By Region:

North America:

United States

Canada

Europe:

Germany

United Kingdom

France

Italy

Spain

Russia

Poland

BENELUX

NORDIC

Rest of Europe

Asia Pacific:

China

Japan

India

South Korea

ASEAN

Australia & New Zealand

Rest of Asia Pacific

Latin America:

Brazil

Mexico

Argentina

Rest of Latin America

Middle East & Africa:

Saudi Arabia

South Africa

United Arab Emirates

Israel

Rest of MEA

Who are the key players operating in the industry?

The report covers the major market players including:

Atlas Copco

Generac Power Systems, Inc.

Enerpac Tool Group

Wacker Neuson SE

HIMOINSA S.L.

KOHLER Co.

Caterpillar Inc.

Cummins Inc.

Stanley Infrastructure, Ltd.

Mitsubishi Heavy Industries, Ltd.

Briggs & Stratton Corporation

Doosan Corporation

Discover more: https://www.reportsandinsights.com/report/hydraulic-generator-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd.

1820 Avenue M, Brooklyn, NY, 11230, United States

Contact No: +1-(347)-748-1518

Email: [email protected]

Website: https://www.reportsandinsights.com/

Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/

Follow us on twitter: https://twitter.com/ReportsandInsi1

#Hydraulic Generator Market Size#Hydraulic Generator Market Share#Hydraulic Generator Market Demand#Hydraulic Generator Market Analysis

0 notes

Text

Future Outlook of the Dielectric Fluid Market: A 7.2% CAGR Forecast to 2034

The dielectric fluid market is set to experience significant growth from 2024 to 2034, driven by increased demand for efficient insulating and cooling mediums in electrical and electronic systems. Dielectric fluids, also known as insulating oils, are used to enhance the performance, safety, and longevity of electrical equipment such as transformers, capacitors, and switchgear. With rapid industrialization, expansion of renewable energy projects, and increasing electrification across various sectors, dielectric fluids are becoming an essential component of power management systems. The market is also seeing innovation, with environmentally friendly fluids gaining traction over traditional petroleum-based ones.

The global dielectric fluid industry, valued at US$ 5.5 billion in 2023, is projected to grow at a CAGR of 7.2% from 2024 to 2034, reaching US$ 11.9 billion by 2034.The increasing adoption of renewable energy systems such as wind and solar power, coupled with advancements in electric vehicle (EV) infrastructure, will significantly contribute to this market’s growth. Technological innovations in fluid composition, especially those focusing on biodegradable and synthetic dielectric fluids, are expected to further propel market expansion.

For More Details, Request for a Sample of this Research Report: https://www.transparencymarketresearch.com/dielectric-fluid-market.html

Market Segmentation

By Service Type:

Supply and Delivery

Fluid Processing and Maintenance

Disposal and Recycling Services

By Sourcing Type:

Petroleum-based Fluids

Synthetic Fluids

Bio-based Fluids

By Application:

Transformers

Capacitors

Switchgear

Electric Vehicles (EVs)

Others (e.g., aerospace, medical equipment)

By Industry Vertical:

Power Generation and Distribution

Automotive

Telecommunications

Manufacturing

Renewable Energy

By Region:

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

Regional Analysis

North America: Driven by technological advancements and increasing investments in smart grid infrastructure, North America holds a substantial share of the dielectric fluid market. The region is seeing rapid growth in renewable energy projects and electric vehicle adoption, both of which require high-performance dielectric fluids.

Europe: The market in Europe is dominated by stringent environmental regulations, leading to increased adoption of bio-based and synthetic dielectric fluids. The region's focus on sustainability and energy efficiency is a significant driver for innovation.

Asia-Pacific: As the largest market for dielectric fluids, Asia-Pacific is witnessing rapid urbanization, industrialization, and infrastructure development. The region is home to major manufacturing hubs and is experiencing strong growth in power distribution networks, making it a key player in the global market.

Latin America and Middle East & Africa: These regions are experiencing moderate growth, driven by ongoing energy projects and the expansion of grid infrastructure. There is also potential for increased market penetration as the adoption of renewable energy systems grows.

Market Drivers and Challenges

Drivers:

Growing demand for efficient power distribution systems and increased reliance on renewable energy.

Rapid electrification in developing economies, especially in Asia-Pacific.

Rising need for environmentally friendly dielectric fluids, driven by regulatory pressures and sustainability goals.

Challenges:

Volatile prices of raw materials used in dielectric fluid production.

Environmental concerns over the disposal of petroleum-based fluids.

Technical challenges in developing fluids with enhanced performance for high-voltage applications.

Market Trends

Sustainability and Green Energy: The shift toward bio-based dielectric fluids is gaining momentum as companies and governments push for greener alternatives. Bio-based fluids offer lower environmental impact and improved biodegradability compared to traditional mineral oils.

Electrification and Renewable Energy: With the rapid expansion of renewable energy sources and the electrification of transport (e.g., EVs), dielectric fluids tailored for these applications are seeing increasing demand.

Technological Innovations: Advancements in synthetic fluids that offer superior cooling and insulating properties, particularly for high-voltage and high-temperature applications, are expected to fuel market growth.

Future Outlook

The dielectric fluid market is poised for substantial growth over the next decade, driven by a combination of technological advancements and shifting regulatory landscapes. The demand for innovative, sustainable, and high-performance fluids is expected to grow as global electrification and renewable energy projects expand. Additionally, developments in EVs and smart grid technology will open up new opportunities for the dielectric fluid market.

Key Market Study Points

Analysis of the growing demand for bio-based and synthetic dielectric fluids.

The impact of electrification in transport and renewable energy on the dielectric fluid market.

Regional market dynamics and their influence on the overall market.

Technological advancements in dielectric fluid formulations to enhance efficiency and sustainability.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=77247<ype=S

Competitive Landscape

The dielectric fluid market is highly competitive, with key players focusing on innovation and product differentiation to maintain market share. Leading companies include:

ABB Ltd.

Siemens AG

Cargill Inc.

Shell International

Ergon International

These companies are investing in R&D to develop next-generation fluids, focusing on sustainability and high-performance applications.

Recent Developments

Several companies have introduced bio-based dielectric fluids designed to meet stringent environmental regulations, catering to growing demand for eco-friendly products.

Major partnerships and collaborations are emerging, aimed at enhancing fluid technologies for smart grids and electric vehicles.

Key players are expanding their market presence in developing regions, particularly Asia-Pacific, to capitalize on growing industrialization and power distribution needs.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

0 notes

Text

Lubricant Market: Trends, Size & Key Industry Players

The global lubricant market is a vital component of the automotive, industrial, and machinery sectors, serving as a critical factor in ensuring the smooth functioning and longevity of equipment. Lubricants reduce friction, wear, and tear, leading to improved efficiency and performance in various applications. This market has shown robust growth over the years, driven by the increasing demand from end-use industries, technological advancements, and the expansion of the automotive sector. In this blog, we will explore the market size, share, and growth of the lubricant market, analyze current market trends, identify key players, discuss the challenges facing the market, and conclude with insights into its future trajectory.

Market Size, Share, and Growth

As of 2023, the global lubricant market was valued at approximately USD 163 billion. This market is expected to grow at a compound annual growth rate (CAGR) of 3.2% from 2024 to 2030, reaching a value of around USD 205 billion by the end of the forecast period. The growth of this market can be attributed to the rising demand for lubricants in emerging economies, the expansion of the automotive industry, and the increasing industrialization and mechanization of various sectors.

The automotive sector accounts for the largest share of the lubricant market, holding nearly 50% of the market revenue. This dominance is primarily due to the extensive use of lubricants in engine oils, gear oils, and transmission fluids, which are essential for the maintenance and efficiency of vehicles. The industrial segment follows closely, with significant demand from manufacturing, power generation, and other heavy machinery sectors.

Market Trends

Several key trends are shaping the growth and evolution of the lubricant market:

Shift Towards Synthetic and Bio-Based Lubricants: Environmental concerns and the need for sustainability have led to a significant shift from conventional mineral-based lubricants to synthetic and bio-based alternatives. Synthetic lubricants, known for their superior performance, longer life, and better thermal stability, are gaining traction, especially in developed markets. Bio-based lubricants, derived from renewable resources, are also seeing increased adoption due to their biodegradable nature and lower environmental impact.

Rising Demand from Emerging Markets: Emerging economies in Asia-Pacific, particularly China and India, are driving the demand for lubricants. Rapid industrialization, increasing automotive sales, and infrastructure development in these regions are key factors contributing to market growth. The Asia-Pacific region holds the largest market share, accounting for nearly 40% of the global lubricant consumption.

Technological Advancements: Innovation in lubricant formulation and production processes is a significant trend in the market. Companies are focusing on developing high-performance lubricants that offer better fuel efficiency, reduced emissions, and extended service intervals. Additionally, advancements in additive technology are enhancing the overall quality and functionality of lubricants.

Growing Focus on Energy Efficiency: Energy efficiency has become a critical factor in industrial operations and automotive applications. Lubricants that reduce friction and energy losses are in high demand, as they contribute to lower operating costs and improved sustainability. This trend is particularly evident in the manufacturing and transportation sectors, where energy efficiency is directly linked to profitability and environmental impact.

Key Market Players and Their Market Share

The global lubricant market is highly competitive, with several key players dominating the industry. These companies are involved in extensive research and development activities, mergers and acquisitions, and strategic partnerships to maintain their market positions. Some of the leading players in the lubricant market include:

Royal Dutch Shell Plc: Shell is a global leader in the lubricant market, holding a market share of approximately 12%. The company offers a wide range of lubricants under its Shell Helix, Shell Rimula, and Shell Tellus brands. Shell’s strong global presence, innovative product portfolio, and commitment to sustainability have helped it maintain a leading position in the market.

ExxonMobil Corporation: ExxonMobil is another major player in the lubricant industry, with a market share of around 10%. The company’s Mobil 1, Mobil Delvac, and Mobil SHC brands are well-known for their high performance and reliability. ExxonMobil’s focus on technological innovation and its extensive distribution network contribute to its strong market presence.

BP Plc (Castrol): BP, through its Castrol brand, holds a significant share of the lubricant market, estimated at 8%. Castrol’s lubricants are widely used in automotive, industrial, and marine applications. The company’s focus on developing environmentally friendly products and its strong brand reputation have been key factors in its success.

TotalEnergies SE: TotalEnergies is a prominent player in the global lubricant market, with a market share of approximately 7%. The company offers a diverse range of lubricants under its Total Quartz, Total Rubia, and Total Azolla brands. TotalEnergies’ commitment to sustainability and its extensive presence in emerging markets are driving its growth in the industry.

Chevron Corporation: Chevron, with its Havoline and Delo brands, holds a market share of around 6%. The company is known for its high-quality lubricants, which are used in a wide range of applications, including automotive, industrial, and marine sectors. Chevron’s focus on innovation and customer satisfaction has helped it maintain a strong position in the market.

Market Challenges

Despite the positive growth outlook, the lubricant market faces several challenges that could impact its development:

Environmental Regulations: Stringent environmental regulations regarding emissions and waste disposal are a significant challenge for the lubricant industry. Governments worldwide are implementing stricter standards to reduce environmental impact, which is driving the shift towards synthetic and bio-based lubricants. However, the high cost of these alternatives can be a barrier to their widespread adoption, particularly in price-sensitive markets.

Fluctuating Raw Material Prices: The lubricant industry is highly dependent on the availability and cost of raw materials, particularly crude oil. Fluctuations in crude oil prices can significantly impact the profitability of lubricant manufacturers. Additionally, the increasing demand for synthetic and bio-based lubricants is putting pressure on the supply of raw materials, leading to potential supply chain disruptions.

Technological Disruption: The rapid pace of technological advancement in the automotive and industrial sectors poses a challenge to the lubricant market. The development of electric vehicles (EVs), for example, requires less lubrication compared to traditional internal combustion engine vehicles. This shift could reduce the demand for automotive lubricants in the long term.

Market Fragmentation: The lubricant market is highly fragmented, with numerous small and medium-sized players competing with established giants. This fragmentation can lead to intense price competition, which can erode profit margins and hinder market growth. Additionally, the presence of counterfeit products in certain regions poses a challenge to maintaining product quality and brand reputation.

Conclusion

The global lubricant market is poised for steady growth in the coming years, driven by increasing demand from emerging economies, technological advancements, and the ongoing shift towards synthetic and bio-based products. However, the market faces significant challenges, including stringent environmental regulations, fluctuating raw material prices, and technological disruption. To navigate these challenges, industry players must focus on innovation, sustainability, and strategic partnerships. Companies that can adapt to changing market dynamics and meet the evolving needs of consumers will be well-positioned to succeed in this competitive landscape. In conclusion, the lubricant market remains a critical component of the global economy, supporting a wide range of industries and applications. While challenges exist, the market's resilience and adaptability suggest a promising future, with continued opportunities for growth and development.

#Lubricant Sector#Marine Lubricant Market#Global Lubricant Industry#Top 20 Lubricants Companies#Lubricant Market Players#Lubricant Market Revenue#Lubricant Market Size

0 notes

Text

Hydro Turbine Generator Unit Market poised to exhibit steady growth amid rising adoption of renewable energy sources

The hydro turbine generator unit market has experienced steady growth over the past few years, driven primarily by the increasing adoption of renewable energy sources across the globe. Hydro turbine generator units play a key role in hydropower plants by converting the kinetic energy of flowing water into clean electricity. These units consist mainly of turbines that spin powered by flowing water and generators, which rely on turbine rotations to convert mechanical energy into electrical energy. Compared to traditional power generation methods, hydroelectric power plants offer numerous advantages such as lower greenhouse gas emissions, reduced environmental pollution, and lower operational costs. Most hydropower dams now employ sophisticated hydro turbine generator units with higher efficiency to maximize clean electricity output.

The Global Hydro Turbine Generator Unit Market is estimated to be valued at USD 2.98 Bn in 2024 and is expected to reach USD 4.01 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 4.3% from 2024 to 2031.

With growing global focus on renewable energy and climate change mitigation policies, demand for environment-friendly hydroelectric power is surging rapidly. This rising installation of new hydropower projects along with modernization of aging hydropower infrastructure is fueling growth of the hydro turbine generator unit market.

Key Takeaways

Key players operating in the Hydro Turbine Generator Unit market are Abbott Laboratories, Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, Johnson & Johnson, Dr. Reddy’s Laboratories Ltd, Pfizer, Inc., Cipla Inc., Lupin Limited, Averitas Pharma, Inc., and NeuroBo Pharmaceuticals, Inc. Major players are investing heavily in research and development to introduce advanced hydro turbine generator units with higher efficiency, reliability and customizable designs.

Growing global Hydro Turbine Generator Unit Market Demand for renewable energy along with favorable government policies and incentives supporting hydropower development across nations is accelerating the hydro turbine generator unit market growth. The market is witnessing higher equipment demand from emerging economies looking to strengthen their indigenous power supply through domestic hydropower projects while cutting fossil fuel import dependence.

Globally, China, Canada, Brazil, United States and Russia have been leading the hydropower development due to their immense hydroelectric potential. However, over the recent past, many developing Asian, African and Latin American nations have increasingly been investing in large and small-scale hydropower projects to provide reliable baseload electricity to their populations from a indigenous renewable source. This rising global hydropower fleet is propelling the worldwide need for advanced hydro turbine generator units.

Market key trends

One of the key Hydro Turbine Generator Unit Market Size and Trends gaining momentum in the hydro turbine generator unit market is the growing focus on innovations in turbine blade design backed by advanced computational fluid dynamics modeling. Blade design modifications focused on reducing cavitation and vibration issues are helping manufacturers develop turbine units with improved output efficiency over 95%. Another notable trend is the use of composite materials and 3D printing technologies in hydro turbine manufacturing which is helping lower unit costs and reduce downtime from improved corrosion resistance. The hydroturbine market is also witnessing growing research into developing smaller modular turbine designs suitable for mini and micro hydropower projects (below 10 MW power rating) to boost decentralized renewable power production globally.

Porter's Analysis

The threat of new entrants in the hydro turbine generator unit market is moderate. Building a new hydropower plant requires high initial capital investment and obtaining regulatory approvals which are time-consuming processes.

The bargaining power of buyers in this market is high as there are many manufacturers supplying hydro turbine generator units.

The bargaining power of suppliers is moderate. While there are few component suppliers, manufacturers can choose from various suppliers globally.

The threat of new substitutes is moderate due to the emergence of renewable energy sources like solar and wind. However, hydro power continues to be one of the most cost-effective sources of renewable energy.

The competitive rivalry in the market is high due to the presence of numerous global and regional players competing on product quality, design, and pricing.

The geographical region where the hydro turbine generator unit market is most concentrated in terms of value is Asia Pacific. Countries like China, India, Japan, and Southeast Asian nations have a large number of hydropower plants and continue adding new capacity. North America is the fastest growing regional market for hydro turbine generator units. Countries like the US and Canada are investing heavily in upgrading aging hydropower infrastructure as well as capacity expansion projects.

Get more insights on Hydro Turbine Generator Unit Market

Alice Mutum is a seasoned senior content editor at Coherent Market Insights, leveraging extensive expertise gained from her previous role as a content writer. With seven years in content development, Alice masterfully employs SEO best practices and cutting-edge digital marketing strategies to craft high-ranking, impactful content. As an editor, she meticulously ensures flawless grammar and punctuation, precise data accuracy, and perfect alignment with audience needs in every research report. Alice's dedication to excellence and her strategic approach to content make her an invaluable asset in the world of market insights.

(LinkedIn: www.linkedin.com/in/alice-mutum-3b247b137 )

0 notes

Text

Industrial Agitators Market Dynamics: Navigating the Rapid Growth

The global industrial agitators market size is estimated to be worth USD 2.6 billion in 2023 and is projected to reach USD 3.2 billion by 2028, at a CAGR of 4.0% during the forecast period.

Increasing demand for homogeneous mixing, growing need for energy efficient mixing equipment or industrial mixer in pharmaceutical, chemical and food & beverage industries, and growing adoption of customized industrial agitators are some of the major factors driving the industrial agitators market growth globally.

The major agitator companies in the industrial agitators market include SPX Flow, Inc. (US), Xylem Inc. (US),Ekato Group (Germany), Sulzer Ltd. (Switzerland) and NOV Inc (US).

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=59649096

Driver: Growing need for energy efficiency, flow maximization, rapid mixing, waste reduction, and other advancements

The increasing requirement of optimizing mixing processes is pushing industrial agitator companies to develop industrial mixer that helps achieve low power consumption, flow maximization, rapid mixing, and other advancements. Mixing, blending, fluid handling, separation, thermal heat transfer, and other processes are integral to companies for production and manufacturing across various industries, such as chemical, food & beverage, pharmaceutical, and other industrial markets. Rapid innovations and emerging trends in industrial mixer application are driving the need for more energy-efficient, speedy mixing and low costs mixing/agitation technologies in the said market. For instance, in 2022, SPX FLOW launched a new APV Flex-Mix Pilot industrial Mixer for the food & beverage industry to test small-scale pilot batches of low to high-viscosity product samples using a single unit. This pilot industrial mixer is useful for companies focusing on small-scale production or craft producers producing a variety of products in small batches. This helps cut costs and reduce waste during the testing phase due to small batch production.

Restraint: High costs for maintenance and repairs of industrial agitators

Industrial agitators require significant upfront investment by agitator companies. This might create a barrier for some agitator companies, especially smaller ones. The cost of industrial mixer can vary depending on their size, materials, and complexity. Furthermore, the maintenance process for industrial mixer consists of replacing worn parts and changing the lubricant, bearings, seals, and other components. Any wear and tear or fault in a component of the industrial agitators can lead to an expense to the client. The maintenance activity applies to various factors in an industrial mixer, including simple adjustments in components of the industrial mixer, troubleshooting by standard exchanges, fault identification and diagnostics, repairs, mechanical corrections, renovation, reconstruction, or complete exchange of the rotating part, and so on. However, the impact of this restraint is expected to reduce with time due to the growing advancements in agitation technology and the subsequently increasing opportunities for industrial agitators market.

Opportunity: Rising usage of industrial mixing technologies in several applications

Advancements in technology have led to the development of more efficient and effective industrial mixer that can offer greater control and precision in mixing. As more industries seek to improve their manufacturing processes and achieve greater product consistency, the demand for industrial mixer is increasing. This presents an opportunity for agitator companies to offer new and improved mixing equipment that can meet the needs of industries looking to optimize their manufacturing processes. Furthermore, there is a growing need for customized mixing solutions that can meet specific requirements. This presents an opportunity for agitator companies to offer specialized products that can be tailored to meet specific needs of different industries such as pharmaceutical, chemical and food & beverage. In June 2022, considering the increasing importance of using industrial agitators and industrial mixer in different industrial processes, Sulzer launched its latest addition to the SALOMIX industrial agitator family, the SSF150.

Challenge: Emerging trend of renting industrial mixer due to high costs or shorter time span usage

Users or purchasers of industrial agitators or industrial mixer may look for options other than capital purchases. If a client is not able to afford the industrial mixer or needs the industrial mixer for a shorter time, then renting industrial mixer can be considered the most reliable option. This is one of the suitable alternatives garnering attention in the industrial agitators market for rental industrial agitators/industrial mixer. Rental industrial mixer offers a fast and cost-effective way of fulfilling the need without the high cost of a capital purchase, allowing purchasers to fulfill their mixing needs at a fraction of the original industrial mixer cost. This would largely benefit the buyers at a time when most of the end-user industries are considering or have already slashed their capital expenditure budgets.

0 notes

Text

Unveiling the World of Transformers Procurement Intelligence 2024 - 2030

Procurement of transformers benefits buyers from several end-use sectors by minimizing energy losses, improving power quality, and enhancing grid reliability. The global market size was estimated at USD 87.3 billion in 2023. Key drivers of the industry include rising demand for electric vehicles (EVs), a shift towards renewable energy, grid modernization initiatives, and technological advancements in design. APAC accounted for the largest share (~30%) of the global industry in 2023. Rapid urbanization, smart city projects, and favorable incentives and subsidies were the major factors driving the APAC market in 2023.

The global industry has been substantially impacted by raw material price volatility, replacement costs of aging infrastructure and equipment, disruptions in supply chain and logistics, high capital investments, and energy transition challenges. For instance, fluctuating prices of copper, steel, and specialized insulation materials are affecting production costs and timelines. At the same time, delays in shipping and transportation, exacerbated by geopolitical tensions and global trade uncertainties, are causing supply chain bottlenecks. Similarly, the rapid pace of technological advancements is rendering existing technologies to become obsolete, thus posing a challenge for manufacturers to keep up to date.

Key technology trends that are driving the growth of the industry in 2024 include integration of 3D printing, use of innovative cooling systems, adoption of IoT-integrated smart transformers, and utilization of digital twins. For instance, the integration of 3D printing offers numerous benefits, including enhanced customization, efficient prototyping, material efficiency, and production flexibility. Similarly, innovative cooling systems such as liquid immersion cooling and hybrid cooling are being used to improve reliability and lifespan. In liquid immersion cooling, the windings of the equipment are directly immersed in cooling fluid to improve heat transfer and enhance cooling capacity.

Order your copy of the Transformers Procurement Intelligence Report, 2024 - 2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Government initiatives are playing a crucial role in influencing the growth of this industry globally. For instance, in India, certain programs, namely the ‘Green Energy Corridors’ (GEC) initiative and the ‘Revamped Distribution Sector Scheme,’ are improving electrification, advancing transmission infrastructure, and safeguarding last-mile connectivity. Renewable energy capacity of ~19 GW is set to be included in the intra-state scheme under the ‘GEC-II’ initiative. This is not only boosting the demand for transformers but is also driving investments in modernization and capacity enhancement throughout the value chain of the power sector.

Key suppliers are focusing on developing renewable energy-compatible equipment (such as the ‘Green Power Transformers’ series developed by GE), specifically designed for wind farms and solar power plants. They are also emphasizing the use of energy-efficient and eco-friendly materials. Smart grid technologies are crucial for managing the complexities of renewable energy integration. Suppliers are also investing in Amorphous Metal Transformers (AMTs), which utilize a core made out of thin layers of amorphous metal alloy (typically composed of iron, boron, and silicon). Compared to traditional silicon steel cores, AMTs exhibit lower core losses and higher energy efficiency.

Key factors leading to fluctuations in transformer prices include design and specifications, raw material price fluctuations, demand and supply fluctuations, and transportation and logistics. For instance, design and specifications such as power rating/capacity and voltage/frequency ratings lead to significant price variations. Similarly, transformers designed for handling larger voltages require specialized insulation systems, larger clearance distances, and robust designs. These factors contribute to higher manufacturing costs and, subsequently, higher prices.

During the COVID-19 pandemic, this industry experienced significant challenges as a result of component shortages, logistical bottlenecks, supply chain disturbances, manufacturing delays, and demand fluctuations. For instance, lockdowns and travel restrictions imposed by several countries disrupted the movement of electrical and electronic components across borders, leading to delays in procurement and delivery. At the same time, reduced air and sea freight capacity, coupled with a rise in shipping costs, further intensified supply chain disruptions, which made it challenging for manufacturers to access essential components.

Transformers Sourcing Intelligence Highlights

• This market consists of a fragmented landscape, with the players engaged in robust competition.

• Buyers within this market have substantial bargaining power due to relatively low product differentiation and low costs of switching to alternative suppliers.

• India, China, Vietnam, Mexico, and Colombia are preferred as low-cost or best-cost countries within their regions for sourcing and procurement due to low raw material costs, cheap labor costs, economies of scale, and favorable government policies.

• The key components of the cost structure involve raw materials, labor, equipment and tools, energy and utilities, logistics, and others as the key components. Other costs include R&D, compliance, warranty, rent, general and administrative, and marketing and sales.

Browse through Grand View Research’s collection of procurement intelligence studies:

• Point of Sale Materials (PoSM) Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

• Electric Coolant Pumps Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Transformers - Key Suppliers

• ABB Ltd.

• Alstom SA

• CG Power & Industrial Solutions Ltd.

• Eaton Corporation plc

• General Electric Company

• Hitachi Energy Ltd.

• Hyosung Heavy Industries

• Hyundai Heavy Industries Co., Ltd.

• Mitsubishi Electric Corporation

• Schneider Electric SE

• Siemens AG

• Toshiba Corporation

Transformers Procurement Intelligence Report Scope

• Growth Rate: CAGR of 6% from 2024 to 2030

• Pricing Growth Outlook: 5% - 10% increase (Annually)

• Pricing Models: Cost-plus pricing, volume-based pricing, demand-based pricing, competition-based pricing

• Supplier Selection Scope: Cost and pricing, past engagements, productivity, geographical presence

• Supplier Selection Criteria: Geographical service provision, industries served, years in service, employee strength, revenue generated, key clientele, regulatory certifications, transformer type (power/distributed/SST/others), voltage type (high/medium/low), cooling type (oil-cooled/air-cooled), customer service, lead time, and others

• Report Coverage: Revenue forecast, supplier ranking, supplier matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

• Market Intelligence involving – market size and forecast, growth factors, and driving trends

• Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

• Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

• Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions

#Transformers Procurement Intelligence#Transformers Procurement#Procurement Intelligence#Transformers Market#Transformers Industry

0 notes

Text

Industry Giants Invest in Advanced VFD Technologies to Capture Growing Market Share"

Overview :

Variable Frequency Drives market size is expected to be worth around USD 37.6 billion by 2033, from USD 23.3 billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/variable-frequency-drives-market/#requestSample

The Variable Frequency Drives (VFD) Market refers to the sector that deals with devices used to control the speed and torque of electric motors by varying the frequency and voltage of the electrical power supplied to them. VFDs are critical components in many applications, from HVAC systems in commercial and residential buildings to automation in industrial processes. By adjusting motor speed, VFDs enhance energy efficiency, reduce wear and tear on equipment, and improve operational control, making them an integral part of modern energy management systems.

The market for VFDs is experiencing growth due to increased adoption across various sectors. The rise of connected devices and smart technologies in commercial, residential, and automotive applications is driving demand for more efficient and flexible motor control solutions. Additionally, significant investments in infrastructure development are boosting the need for advanced HVAC systems, which rely heavily on VFDs for optimal performance. As these systems become more prevalent and technology advances, the VFD market is set to expand, reflecting broader trends toward automation and energy efficiency in modern industry and infrastructure.

Market Segments :

By Product Type

AC Drives

DC Drives

Servo Drives

By Power Range

Micro (0-5 kW)

Low (6-40 kW)

Medium (41-200 kW)

High (>200 kW)

By Application

Pumps

Electric Fans

Conveyors

HVAC

Extruders

Other Applications

By End-Use

Oil & Gas

Power Generation

Infrastructure

Other End-Uses

Product Type Analysis:In 2023, AC Drives dominated the Variable Frequency Drives (VFD) market, capturing about 68.6% of the share. Their widespread use across industries like food and beverage, power generation, and automotive highlights their importance in controlling motor speed and enhancing operational efficiency. Meanwhile, DC Drives are expected to grow at a 6.1% CAGR through 2032.

Power Ranges Analysis :Low Power drives led the market in 2023, accounting for over 42.3% of the share. They are commonly used in applications such as pumps and fans where moderate power is required. The medium power range drives are also seeing growth, expected to increase by 6.8% from 2023 to 2032, due to their versatility in industries like mining and petrochemicals.

Application Analysis:Pumps were the leading application in 2023, holding over 30.2% of the market share. They are crucial for moving fluids in various industries and benefit significantly from the energy-saving capabilities of VFDs. The HVAC segment is projected to grow by 5.9% between 2023 and 2032, driven by the rising demand for energy-efficient climate control systems.

End-Use Analysis:Oil and gas applications led the VFD market in 2023, with over 20.3% of the share. VFDs are essential in processes like pumping, drilling, and refining, enhancing efficiency and reducing power consumption. The infrastructure sector is expected to grow at a 6.8% CAGR through 2032, driven by increased industrial activities and the shift from mechanical to electric motors.

Маrkеt Кеу Рlауеrѕ

ABB Ltd

Siemens AG

Danfoss A/S

Rockwell Automation

GE Power

Toshiba International Corporation

Schneider Electric

Mitsubishi Electric Corporation

Honeywell International Inc.

Emerson Industrial Automation

Fuji Electric Co. Ltd

Johnson Controls Inc.

Eaton PLC

Hitachi Ltd.

Nord Drive Systems

Eaton

Drivers:Variable Frequency Drives (VFDs) are increasingly essential across industries due to their energy-saving capabilities and precise motor control. Major projects in countries like China and India, which involve substantial cement and paper production, drive demand for these drives. VFDs help optimize energy use in millions of motors worldwide, leading to cost savings and enhanced efficiency.

Restraints:The oil and gas sector, a significant user of VFDs, has faced stagnation due to reduced exploration and production activities. Volatile oil prices create uncertainty, causing companies to hesitate on new investments in VFD technology. Additionally, stringent regulations aimed at reducing greenhouse gas emissions impose further challenges, potentially leading to decreased VFD usage as companies navigate the complexities of compliance and pollution control.

Opportunities:Upgrades to aging power infrastructure present a significant opportunity for VFD manufacturers. In regions like the US and Canada, improving outdated power networks and reducing power outages are critical needs. New regulations and investments in power systems create a growing demand for VFDs, offering a chance for companies to capitalize on the expanding market for these essential components in power management.

Challenges:The COVID-19 pandemic disrupted the production of electric motors and VFDs due to factory closures and supply chain interruptions. Key manufacturing hubs in China and the US experienced slowdowns, impacting the availability and cost of components. This has led to financial strain for companies reliant on these parts, complicating production and distribution efforts in the VFD market.

0 notes

Text

2032, Vehicle Workshop Equipment Market Analysis, Size by 2024-2032

The Reports and Insights, a leading market research company, has recently releases report titled “Vehicle Workshop Equipment Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032.” The study provides a detailed analysis of the industry, including the global Vehicle Workshop Equipment Market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Vehicle Workshop Equipment Market?

The global vehicle workshop equipment market size reached US$ 5.5 billion in 2023. Looking forward, Reports and Insights expects the market to reach US$ 14.9 billion in 2032, exhibiting a growth rate (CAGR) of 5.3% during 2024-2032.

What are Vehicle Workshop Equipment?

Vehicle workshop equipment encompasses a variety of tools and machinery utilized in automotive repair and maintenance facilities to efficiently service vehicles. This equipment includes car lifts, tire changers, wheel balancers, diagnostic tools, and fluid management systems, among others. These tools are essential for tasks such as vehicle inspections, repairs, and part replacements, contributing to the speed and accuracy of automotive services and ensuring vehicles are properly maintained and safe for operation.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1938

What are the growth prospects and trends in the Vehicle Workshop Equipment industry?

The vehicle workshop equipment market growth is driven by various factors. The market for vehicle workshop equipment is on a consistent growth trajectory, powered by the escalating intricacy of vehicles and the requirement for sophisticated tools for repair and maintenance. Key drivers include technological advancements in automotive systems, a rising demand for vehicle customization and restoration, and the expansion of the automotive aftermarket sector. Moreover, the increasing ownership of vehicles and a heightened focus on vehicle safety and efficiency are further propelling the adoption of vehicle workshop equipment. Hence, all these factors contribute to vehicle workshop equipment market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Equipment Type:

Wheel Alignment Equipment

Tire Changers

Wheel Balancers

Lifting Equipment

Diagnostic Equipment

Air Compressors

Brake Lathes

Paint Booths

Exhaust Ventilation Systems

Others

By Vehicle Type:

Passenger Vehicles

Commercial Vehicles

Two-Wheelers

By End-Use:

OEM Dealerships

Independent Workshops

Franchise Workshops

Market Segmentation By Region:

North America:

United States

Canada

Latin America:

Brazil

Mexico

Argentina

Rest of Latin America

Asia Pacific:

China

India

Japan

Australia & New Zealand

ASEAN

Rest of Asia Pacific

Europe:

Germany

The U.K.

France

Spain

Italy

Russia

Poland

BENELUX

NORDIC

Rest of Europe

Middle East & Africa:

Saudi Arabia

United Arab Emirates

South Africa

Egypt

Israel

Rest of MEA

Who are the key players operating in the industry?

The report covers the major market players including:

Snap-on Incorporated

Hunter Engineering Company

Stanley Black & Decker, Inc.

Bosch Automotive Service Solutions Inc.

Dover Corporation

Rotary Lift

Vehicle Service Group

MAHA Maschinenbau Haldenwang GmbH & Co. KG

Corghi S.p.A.

Beissbarth GmbH

Nussbaum Automotive Solutions

Hofmann Megaplan GmbH

Ravaglioli S.p.A.

Launch Tech Co., Ltd.

Autel Intelligent Technology Corp., Ltd.

Others

View Full Report: https://www.reportsandinsights.com/report/Vehicle Workshop Equipment-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd.

1820 Avenue M, Brooklyn, NY, 11230, United States

Contact No: +1-(347)-748-1518

Email: [email protected]

Website: https://www.reportsandinsights.com/

Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/

Follow us on twitter: https://twitter.com/ReportsandInsi1

#Vehicle Workshop Equipment Market share#Vehicle Workshop Equipment Market size#Vehicle Workshop Equipment Market trends

0 notes

Text

Oilfield Service Firms Struggle Amid Mega-Mergers in Oil Sector - Journal Important Internet - #GLOBAL

https://www.merchant-business.com/oilfield-service-firms-struggle-amid-mega-mergers-in-oil-sector/?feed_id=146797&_unique_id=66a69d6b32713

SLB and Halliburton reported second-quarter results last week, and both noted strong international business and weaker performance at home. Baker Hughes, which posted its report on Thursday, also noted the strength of its international business—and didn’t boast the performance of its business at home. It’s a trend that’s strengthening.The series of megadeals in the oil and gas space in the United States that started last year and continued into this year has had an impact across the industry. Yet this impact was perhaps felt most acutely in oilfield services—and it was not a positive one.“When customers combine, you might have a guy who was running seven rigs, and a guy who was running five rigs, that adds together to 12. But when they come back, they run 10,” Chris Wright, chief executive of Liberty Energy, told Reuters. Liberty, by the way, had better fortunes last quarter and exceeded expectations with its bottom line. Yet the outlook both for the company and the oilfield services sector remains rather gloomy, per Zacks.The latest Dallas Fed Energy Survey, which was published in June, revealed a deteriorating picture in the industry, with its equipment utilization index slipping below zero and the same thing happening to OSPs’ operating margin index. The price index for oilfield service firms remains positive but dropped precipitously, from 25 to 3.9.Things are not looking good for oilfield service providers. This is because the pool of clients they now have is much smaller than it was two years ago—and they are really going after those synergies that merging companies like so much. Reuters noted that Diamondback Energy, for one, expected synergy savings of some $550 million annually after its takeover of Endeavor Energy. Most of that would come from operations, meaning oilfield services.The consolidation wave, then, means less work on offer for oilfield service providers. But this is only part of the challenge. “Industry consolidation is the main driver of change in the industry currently,” one Dallas Fed Energy Survey respondent said for the June edition of the survey.Related: Technology and EVs Send China’s Power Demand Surging“Many competitors are extremely consolidated in their work profile and customer base,” he added. “As consolidation occurs, often the acquiring company will not pick up the existing service companies. Once cut loose, these companies are searching for a lifeline and in many instances willing to work for negative margin rates, doing whatever they can to put money toward fixed period costs.”This trend has hurt mostly small players in the field, and some have been driven to bankruptcy while the rest seek to secure long-term commitments from their shrinking client base. Fracking services provider Nitro Fluids, for instance, filed for Chapter 11 bankruptcy protection earlier this year, citing a massive drop in revenues because of the E&P industry’s consolidation. Reuters noted in a report the company’s revenues had gone from some $1.2 million per month last year to less than $100,000 this year.“Everyone is scrambling and fighting for less scraps,” the chief executive of one sector player, Oifield Service Professionals, told the publication. “The operators know that they can get better rates. They can just go out into the market and say, ‘Well, who wants my business?'”It’s a buyers’ market in oilfield services, and it is likely to remain a buyers’ market for the observable future as the consolidation among producers continues. This will, in turn, prompt consolidation in the oilfield services sector as companies try to survive.“Too many equipment providers are chasing too few E&P customers. Without consolidation within service or equipment providers, it will be a race

to the bottom for pricing,” one respondent to the Dallas Fed Energy Survey said earlier this year.The race is already on, and some are falling behind. The rest are starting to consolidate. Since the start of the year, the value of mergers and acquisitions in the oilfield services space has hit $12 billion, according to Enverus data cited by Reuters. This compares with $5.3 for all of last year, pointing to a clear trend in a consolidation direction.“As the industry consolidates across the board you will see these bigger (producers) working with bigger service companies, so the service companies that have scale will have the advantage over time,” Rystad Energy vice president Thomas Jacobs told Reuters. They will also be working with them under longer-term contracts, which OSPs are increasingly seeking to insulate themselves against sudden loss of business.In other words, the same thing that last year started happening in the exploration and production sector is now happening in the oilfield services sector because there is really no other option for oilfield service firms. The process looks set to continue in a survival-of-the-fittest fashion until the amount of competition in oilfield service providers matches the competition among exploration and production players. But it won’t be painless: “The outlook is a bloodbath,” said Rystad’s Jacobs.By Irina Slav for Oilprice.comMore Top Reads From Oilprice.com:Download The Free Oilprice App TodayBack to homepageIrina Slav

Irina is a writer for Oilprice.com with over a decade of experience writing on the oil and gas industry.More InfoRelated postsLeave a commentSource of this programme “This is one interesting constituent.”“SLB and Halliburton reported second-quarter results last week, and both noted strong international business and weaker performance at home. Baker Hughes, which posted its report on Thursday, also noted the strength of…”Source: Read MoreSource Link: https://oilprice.com/Energy/Energy-General/Oilfield-Service-Firms-Struggle-Amid-Mega-Mergers-in-Oil-Sector.html#Business – BLOGGER – Business

http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/07/pexels-photo-24023627.jpeg

BLOGGER - #GLOBAL

0 notes

Text

Oilfield Service Firms Struggle Amid Mega-Mergers in Oil Sector - Journal Important Internet - BLOGGER

https://www.merchant-business.com/oilfield-service-firms-struggle-amid-mega-mergers-in-oil-sector/?feed_id=146796&_unique_id=66a69d6a3709b

SLB and Halliburton reported second-quarter results last week, and both noted strong international business and weaker performance at home. Baker Hughes, which posted its report on Thursday, also noted the strength of its international business—and didn’t boast the performance of its business at home. It’s a trend that’s strengthening.The series of megadeals in the oil and gas space in the United States that started last year and continued into this year has had an impact across the industry. Yet this impact was perhaps felt most acutely in oilfield services—and it was not a positive one.“When customers combine, you might have a guy who was running seven rigs, and a guy who was running five rigs, that adds together to 12. But when they come back, they run 10,” Chris Wright, chief executive of Liberty Energy, told Reuters. Liberty, by the way, had better fortunes last quarter and exceeded expectations with its bottom line. Yet the outlook both for the company and the oilfield services sector remains rather gloomy, per Zacks.The latest Dallas Fed Energy Survey, which was published in June, revealed a deteriorating picture in the industry, with its equipment utilization index slipping below zero and the same thing happening to OSPs’ operating margin index. The price index for oilfield service firms remains positive but dropped precipitously, from 25 to 3.9.Things are not looking good for oilfield service providers. This is because the pool of clients they now have is much smaller than it was two years ago—and they are really going after those synergies that merging companies like so much. Reuters noted that Diamondback Energy, for one, expected synergy savings of some $550 million annually after its takeover of Endeavor Energy. Most of that would come from operations, meaning oilfield services.The consolidation wave, then, means less work on offer for oilfield service providers. But this is only part of the challenge. “Industry consolidation is the main driver of change in the industry currently,” one Dallas Fed Energy Survey respondent said for the June edition of the survey.Related: Technology and EVs Send China’s Power Demand Surging“Many competitors are extremely consolidated in their work profile and customer base,” he added. “As consolidation occurs, often the acquiring company will not pick up the existing service companies. Once cut loose, these companies are searching for a lifeline and in many instances willing to work for negative margin rates, doing whatever they can to put money toward fixed period costs.”This trend has hurt mostly small players in the field, and some have been driven to bankruptcy while the rest seek to secure long-term commitments from their shrinking client base. Fracking services provider Nitro Fluids, for instance, filed for Chapter 11 bankruptcy protection earlier this year, citing a massive drop in revenues because of the E&P industry’s consolidation. Reuters noted in a report the company’s revenues had gone from some $1.2 million per month last year to less than $100,000 this year.“Everyone is scrambling and fighting for less scraps,” the chief executive of one sector player, Oifield Service Professionals, told the publication. “The operators know that they can get better rates. They can just go out into the market and say, ‘Well, who wants my business?'”It’s a buyers’ market in oilfield services, and it is likely to remain a buyers’ market for the observable future as the consolidation among producers continues. This will, in turn, prompt consolidation in the oilfield services sector as companies try to survive.“Too many equipment providers are chasing too few E&P customers. Without consolidation within service or equipment providers, it will be a race

to the bottom for pricing,” one respondent to the Dallas Fed Energy Survey said earlier this year.The race is already on, and some are falling behind. The rest are starting to consolidate. Since the start of the year, the value of mergers and acquisitions in the oilfield services space has hit $12 billion, according to Enverus data cited by Reuters. This compares with $5.3 for all of last year, pointing to a clear trend in a consolidation direction.“As the industry consolidates across the board you will see these bigger (producers) working with bigger service companies, so the service companies that have scale will have the advantage over time,” Rystad Energy vice president Thomas Jacobs told Reuters. They will also be working with them under longer-term contracts, which OSPs are increasingly seeking to insulate themselves against sudden loss of business.In other words, the same thing that last year started happening in the exploration and production sector is now happening in the oilfield services sector because there is really no other option for oilfield service firms. The process looks set to continue in a survival-of-the-fittest fashion until the amount of competition in oilfield service providers matches the competition among exploration and production players. But it won’t be painless: “The outlook is a bloodbath,” said Rystad’s Jacobs.By Irina Slav for Oilprice.comMore Top Reads From Oilprice.com:Download The Free Oilprice App TodayBack to homepageIrina Slav

Irina is a writer for Oilprice.com with over a decade of experience writing on the oil and gas industry.More InfoRelated postsLeave a commentSource of this programme “This is one interesting constituent.”“SLB and Halliburton reported second-quarter results last week, and both noted strong international business and weaker performance at home. Baker Hughes, which posted its report on Thursday, also noted the strength of…”Source: Read MoreSource Link: https://oilprice.com/Energy/Energy-General/Oilfield-Service-Firms-Struggle-Amid-Mega-Mergers-in-Oil-Sector.html#Business – BLOGGER – Business

http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/07/pexels-photo-24023627.jpeg

#GLOBAL - BLOGGER

SLB and Hall...

BLOGGER - #GLOBAL

0 notes

Text

Oilfield Service Firms Struggle Amid Mega-Mergers in Oil Sector - Journal Important Internet - BLOGGER

https://www.merchant-business.com/oilfield-service-firms-struggle-amid-mega-mergers-in-oil-sector/?feed_id=146793&_unique_id=66a69c5562e4c

SLB and Halliburton reported second-quarter results last week, and both noted strong international business and weaker performance at home. Baker Hughes, which posted its report on Thursday, also noted the strength of its international business—and didn’t boast the performance of its business at home. It’s a trend that’s strengthening.The series of megadeals in the oil and gas space in the United States that started last year and continued into this year has had an impact across the industry. Yet this impact was perhaps felt most acutely in oilfield services—and it was not a positive one.“When customers combine, you might have a guy who was running seven rigs, and a guy who was running five rigs, that adds together to 12. But when they come back, they run 10,” Chris Wright, chief executive of Liberty Energy, told Reuters. Liberty, by the way, had better fortunes last quarter and exceeded expectations with its bottom line. Yet the outlook both for the company and the oilfield services sector remains rather gloomy, per Zacks.The latest Dallas Fed Energy Survey, which was published in June, revealed a deteriorating picture in the industry, with its equipment utilization index slipping below zero and the same thing happening to OSPs’ operating margin index. The price index for oilfield service firms remains positive but dropped precipitously, from 25 to 3.9.Things are not looking good for oilfield service providers. This is because the pool of clients they now have is much smaller than it was two years ago—and they are really going after those synergies that merging companies like so much. Reuters noted that Diamondback Energy, for one, expected synergy savings of some $550 million annually after its takeover of Endeavor Energy. Most of that would come from operations, meaning oilfield services.The consolidation wave, then, means less work on offer for oilfield service providers. But this is only part of the challenge. “Industry consolidation is the main driver of change in the industry currently,” one Dallas Fed Energy Survey respondent said for the June edition of the survey.Related: Technology and EVs Send China’s Power Demand Surging“Many competitors are extremely consolidated in their work profile and customer base,” he added. “As consolidation occurs, often the acquiring company will not pick up the existing service companies. Once cut loose, these companies are searching for a lifeline and in many instances willing to work for negative margin rates, doing whatever they can to put money toward fixed period costs.”This trend has hurt mostly small players in the field, and some have been driven to bankruptcy while the rest seek to secure long-term commitments from their shrinking client base. Fracking services provider Nitro Fluids, for instance, filed for Chapter 11 bankruptcy protection earlier this year, citing a massive drop in revenues because of the E&P industry’s consolidation. Reuters noted in a report the company’s revenues had gone from some $1.2 million per month last year to less than $100,000 this year.“Everyone is scrambling and fighting for less scraps,” the chief executive of one sector player, Oifield Service Professionals, told the publication. “The operators know that they can get better rates. They can just go out into the market and say, ‘Well, who wants my business?'”It’s a buyers’ market in oilfield services, and it is likely to remain a buyers’ market for the observable future as the consolidation among producers continues. This will, in turn, prompt consolidation in the oilfield services sector as companies try to survive.“Too many equipment providers are chasing too few E&P customers. Without consolidation within service or equipment providers, it will be a race