#Forex brokers for us traders

Text

HeroFX: Key Concerns and Issues

HeroFX is an online trading platform established in 2021, offering various trading instruments like forex, indices, shares, futures, crypto, metals, and energies. However, several serious concerns make it a risky choice for traders.

🚨 Regulatory Concerns

No Regulation: HeroFX is not licensed by any major financial authority.

High Risk: Without regulation, there's no guarantee of fund safety or fair trading practices.

📉 User Feedback

Withdrawal Issues: Many users report problems withdrawing their funds.

Security Breaches: There are reports of security issues and possible fraud.

Poor Support: Customer support is often unhelpful and slow to respond.

💵 Minimum Deposit and Trading Conditions

Low Deposit: HeroFX advertises a low minimum deposit of $20.

High Leverage: Leverage up to 1:500.

Hidden Fees: Users report unexpected fees and unclear terms.

Crypto Payments: Reliance on cryptocurrency payments raises transparency and security concerns.

🖥️ Platform Reliability

MT5 Platform: HeroFX uses the popular MetaTrader 5 platform.

Technical Issues: Users report frequent technical problems and platform downtimes.

Unreliable: Lack of regulation undermines trust in the platform’s reliability and security.

🛑 Conclusion

HeroFX's lack of regulation, numerous user complaints, and unclear trading conditions make it a high-risk choice for traders. It's advised to be extremely cautious with HeroFX and consider safer, regulated alternatives.

If you would like a thorough analysis, please visit the full review on ForexJudge.

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

64 notes

·

View notes

Text

HeroFX Review: A Comprehensive Look at the Alleged Forex Scam

In the vast and often volatile world of forex trading, the presence of unscrupulous brokers is a constant threat to both novice and seasoned traders. HeroFX, a broker that has recently come under scrutiny, is the subject of many discussions and concerns. This review delves into the various aspects of HeroFX to determine whether it is a legitimate broker or a potential scam.

Background and Overview

HeroFX claims to offer a comprehensive trading platform with a wide range of assets, including forex, commodities, indices, and cryptocurrencies. Promising competitive spreads, high leverage, and a user-friendly interface, HeroFX aims to attract traders looking for a reliable trading experience.

Regulation and Licensing

One of the primary red flags for any forex broker is the lack of proper regulation and licensing. HeroFX is reportedly not registered with any reputable financial regulatory authority. This absence of regulation means that traders are not protected by any governing body, increasing the risk of fraudulent activities and loss of funds.

Trading Platform and Tools

HeroFX offers its own proprietary trading platform, which is marketed as intuitive and feature-rich. While the platform appears to be functional, there have been numerous complaints about its reliability and execution speed. Some users have reported significant delays in order execution, leading to potential losses.

The broker also provides various tools and resources for traders, such as educational materials, market analysis, and trading signals. However, the quality and accuracy of these resources are questionable, with many users alleging that the information provided is often outdated or misleading.

Customer Support

Effective customer support is crucial for any forex broker, especially when dealing with complex financial transactions. HeroFX has received mixed reviews in this area. While some traders have reported satisfactory interactions with the support team, many others have experienced long wait times, unhelpful responses, and unresolved issues. This inconsistency in customer service further undermines the broker's credibility.

Withdrawal and Deposit Issues

One of the most significant concerns surrounding HeroFX is the difficulty many traders face when trying to withdraw their funds. Numerous complaints highlight delayed withdrawals, with some users claiming they never received their money. This pattern of behavior is often indicative of a scam broker, as legitimate brokers prioritize transparent and efficient fund transfers.

Additionally, the deposit process has also raised suspicions. HeroFX allegedly encourages large initial deposits and offers enticing bonuses that come with restrictive terms and conditions, making it challenging for traders to access their funds.

User Reviews and Complaints

A cursory glance at various online forums and review sites reveals a plethora of negative feedback from traders who have used HeroFX. Common grievances include:

Unresponsive or hostile customer service.

Manipulated trading conditions leading to unexpected losses.

Inability to withdraw funds.

Suspiciously positive reviews that appear fabricated.

These recurring themes paint a concerning picture of HeroFX and suggest a pattern of unethical practices.

Conclusion

In conclusion, while HeroFX presents itself as a reputable forex broker with attractive features, the overwhelming evidence points to the contrary. The lack of regulation, persistent withdrawal issues, and numerous negative user reviews all indicate that HeroFX may not be a trustworthy broker. Traders are advised to exercise extreme caution and conduct thorough research before engaging with this broker. In the unpredictable world of forex trading, it is always better to err on the side of caution and choose a broker with a proven track record of reliability and transparency.

For more check out this article: Herofx-review

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

60 notes

·

View notes

Text

Buying and Selling Currency Pairs

Introduction

Are you intrigued by the world of Forex trading? Buying and selling currency pairs is a fundamental aspect of this exciting financial market. In this article, we'll dive deep into what currency pairs are, how they work, and how you can start trading them effectively.

Understanding Currency Pairs

Major, Minor, and Exotic Pairs

Currency pairs are the foundation of Forex trading. They are divided into three categories: major, minor, and exotic pairs. Major pairs include the most traded currencies, such as EUR/USD and USD/JPY. Minor pairs are less commonly traded, like EUR/GBP. Exotic pairs involve a major currency paired with a currency from an emerging economy, like USD/TRY.

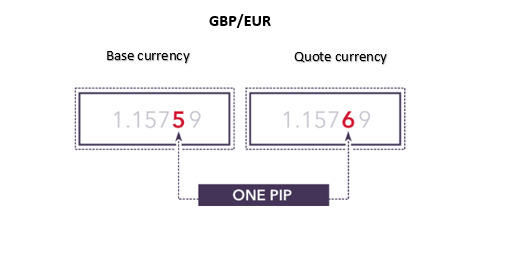

Base and Quote Currency

In every currency pair, the first currency is the base currency, and the second is the quote currency. For example, in EUR/USD, EUR is the base currency, and USD is the quote currency. The value of the base currency is always 1, and the quote currency shows how much of it is needed to buy 1 unit of the base currency.

How Currency Pairs Work

The Concept of Exchange Rates

Exchange rates indicate how much one currency is worth in terms of another. For example, if the EUR/USD exchange rate is 1.10, it means 1 Euro can be exchanged for 1.10 US Dollars.

Bid and Ask Price

The bid price is the highest price a buyer is willing to pay for a currency pair, while the ask price is the lowest price a seller is willing to accept. The difference between these two prices is known as the spread, which is a key component of Forex trading costs.

The Forex Market

What is Forex?

The Foreign Exchange (Forex) market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. It operates 24 hours a day, five days a week, allowing traders from all over the globe to participate.

Trading Hours and Global Reach

Forex trading is divided into four main sessions: Sydney, Tokyo, London, and New York. This continuous cycle allows for seamless trading as one market closes and another opens, providing opportunities around the clock.

Getting Started with Forex Trading

Choosing a Broker

Selecting a reliable Forex broker is crucial. Look for one that is regulated by a reputable financial authority, offers competitive spreads, and provides a user-friendly trading platform.

Setting Up a Trading Account

Once you've chosen a broker, you'll need to open a trading account. This typically involves providing personal information, verifying your identity, and funding your account with an initial deposit.

CLICK THE LINK BELOW TO LEARN MORE IN DETAIL.

4 notes

·

View notes

Text

You can learn about my work and contact me from my linktree!

Hello everyone, I am the business manager from vantage, my name is Dora Wong, I am new to using Tumble, I am mainly looking for excellent traders for long-term affiliate cooperation - Introducing Broker and CPA affiliate Programs, of course the cooperation is It is global in nature. If you become my partner, you will get sustainable and considerable commission reports with my help. The author is an official cooperation. If you are interested, please feel free to contact us!

Love everyone and good luck to everyone in 2024!

#forex #forextrading #investmoney #affiliateprograms #forextrader #forextrading #forexmarkets #xauusd #trader

#forextrading#forexsignals#how to trade forex#investment#forexsuccess#forextips#forexprofit#forexscalping#for example#forexstrategy

8 notes

·

View notes

Text

Understanding Swap in Forex Trading

Swap, or rollover interest, is a crucial concept in Forex trading that can significantly impact your trading performance. When you hold a position overnight in the Forex market, you incur a swap fee, either positive or negative, based on the interest rate differential between the two currencies involved in the trade.

Each currency pair in Forex has its own interest rate, determined by the respective central banks. When you buy a currency with a higher interest rate against one with a lower rate, you may earn interest. Conversely, if you sell a higher interest rate currency against a lower one, you may have to pay interest. These interest rate differentials are applied to your position at the end of each trading day, typically at 5 PM EST.

Understanding swap rates is essential for traders, especially those who hold positions for several days or weeks. Positive swaps can add to your profits, while negative swaps can eat into your gains. Traders can use swaps to their advantage by strategically holding positions that yield positive interest rates, a practice known as carry trading.

To make informed trading decisions, always check the swap rates offered by your broker and factor them into your overall strategy. By mastering the concept of swaps, you can enhance your profitability and optimize your trading performance.

3 notes

·

View notes

Text

Day Trading Forex: Everything You NEED To Know!

Are you interested in exploring the world of forex trading and want to take advantage of short-term price movements? Day trading forex might be the perfect strategy for you.

In this article, we will delve into the ins and outs of day trading forex, from understanding the forex market to developing effective strategies and managing risks. So let’s get started!

Introduction to Day Trading Forex

Benefits of Day Trading Forex

Day trading forex offers several advantages compared to other trading styles. Some of the benefits include:

Potential for quick profits: Day traders seek to profit from intraday price movements, aiming to close positions before the market closes.

High liquidity: The forex market is the largest and most liquid financial market globally, providing ample trading opportunities.

Flexibility: Traders can choose from a wide range of currency pairs and trade during different market sessions.

Lower capital requirements: Compared to other markets, forex trading allows for smaller initial investments, enabling traders to start with less capital.

Understanding Forex Market

To become a successful day trader in forex, it’s essential to have a solid understanding of the market dynamics.

Major Currency Pairs

The forex market consists of various currency pairs, but some major pairs dominate the trading volume. These include EUR/USD, GBP/USD, USD/JPY, and USD/CHF, among others. Familiarize yourself with these major currency pairs and their characteristics.

Market Hours

The forex market operates 24 hours a day, five days a week. However, certain trading sessions offer higher volatility and trading opportunities. The major sessions include the London, New York, Tokyo, and Sydney sessions. Knowing the active market hours can help you optimize your trading strategy.

Getting Started with Day Trading Forex

Before diving into day trading forex, you need to set up your trading infrastructure.

Setting Up a Trading Account

Choose a reputable forex broker that provides a user-friendly trading platform, competitive spreads, reliable execution, and comprehensive customer support. Ensure the broker is regulated by a recognized authority.

Selecting a Reliable Forex Broker

Research different forex brokers and compare their offerings, including trading costs, available currency pairs, leverage options, and deposit/withdrawal methods. Read reviews from other traders to gauge the broker’s reputation and reliability.

Funding Your Trading Account

Technical and Fundamental Analysis

Successful day trading forex relies on a combination of technical and fundamental analysis techniques.

Candlestick Patterns

Candlestick patterns provide valuable insights into price dynamics. Learn to identify patterns such as doji, engulfing, and hammer, which can signal potential reversals or continuations in the market.

Moving Averages

Moving averages help smooth out price fluctuations and identify trends. Experiment with different moving average periods, such as the 50-day and 200-day moving averages, to identify potential entry and exit points.

Support and Resistance Levels

Support and resistance levels are price levels at which the market tends to bounce or reverse. Identify key support and resistance levels using horizontal lines on your charts and incorporate them into your trading decisions.

Economic Indicators

Economic indicators, such as GDP growth, inflation rates, and employment data, can significantly impact currency prices. Stay informed about major economic releases and their potential effects on the forex market.

News Events

Popular Day Trading Strategies

To succeed in day trading forex, you need to implement effective trading strategies that suit your trading style and risk appetite.

Scalping

Scalping involves making multiple trades within a short time frame, aiming to capture small profits from quick price movements. Scalpers often rely on tight spreads and fast execution to capitalize on these rapid price changes.

Breakout Trading

Breakout traders look for significant price breakouts above resistance or below support levels. They aim to enter trades early in a new trend to maximize profit potential. Breakout strategies often utilize technical indicators to confirm breakouts.

Momentum Trading

Risk Management in Day Trading Forex

Managing risk is crucial in day trading forex to protect your capital and preserve long-term profitability. Here are a few ways to help manage your risk:

Setting Stop-Loss Orders

Always use stop-loss orders to limit potential losses on each trade. Determine an appropriate level for your stop-loss order based on your risk tolerance and the characteristics of the currency pair you are trading.

Implementing Proper Position Sizing

Calculate your position size based on the size of your trading account and the percentage of capital you are willing to risk per trade. Avoid overexposing your account by trading positions that are too large relative to your account size.

Managing Leverage

Emotions and Psychology in Day Trading

Controlling emotions and maintaining a disciplined mindset are crucial in day trading forex.

Controlling Greed and Fear

Greed and fear are common emotions that can cloud judgment and lead to irrational trading decisions. Develop self-awareness and discipline to overcome these emotions and make objective trading choices.

Maintaining Discipline

Stick to your trading plan and avoid impulsive trades driven by emotions. Follow your strategy and trading rules consistently, even when faced with market fluctuations.

Developing a Trading Plan

Building a Trading Routine

Establishing a structured trading routine can help you stay organized and make better trading decisions.

Pre-market Analysis

Before the market opens, conduct a thorough analysis of the currency pairs you are interested in trading. Review economic calendars, technical indicators, and news events that may impact the market.

Executing Trades

Once the trading day begins, execute your trades based on your predefined strategies and analysis. Stick to your risk management rules and avoid impulsive trades based on emotions.

Reviewing and Analyzing Trades

Resources and Tools for Day Traders

Several resources and tools can assist day traders in their trading activities.

Educate Yourself

It is important to stay up to date and learn constantly when you are day trading. It’s always a good idea to begin your journey with a day trading forex course such as the Cash on Demand Trades Education or The Ultimate Forex Strategy

Trading Platforms

Choose a user-friendly trading platform that provides real-time charts, technical indicators, order execution capabilities, and access to relevant news and analysis.

Charting Software

Utilize charting software to analyze price patterns, apply technical indicators, and identify potential trade setups. Popular charting platforms include MetaTrader, TradingView, and NinjaTrader.

Economic Calendars

Stay informed about upcoming economic events and news releases using economic calendars. These calendars provide information on scheduled economic indicators, central bank meetings, and other market-moving events.

Online Communities and Forums

Engage with other day traders through online communities and forums. Participate in discussions, share ideas, and learn from experienced traders. Collaborating with like-minded individuals can enhance your trading knowledge and skills.

Tips for Successful Day Trading

Consider the following tips to improve your day trading performance:

Stay Informed and Educated: Continuously update your knowledge about the forex market, trading strategies, and risk management techniques. Follow reputable sources of market analysis and stay informed about economic developments.

Practice Risk Management: Always prioritize risk management to protect your capital. Implement appropriate stop-loss orders, manage your position sizes, and avoid overtrading.

Start with Small Positions: When starting out, focus on small position sizes to minimize risk. Gradually increase your position sizes as you gain experience and confidence in your trading abilities.

Keep Emotions in Check: Emotions can cloud judgment and lead to poor trading decisions. Maintain emotional discipline, stick to your trading plan, and avoid impulsive actions driven by fear or greed.

Review and Learn from Your Trades: Regularly review your trading performance, analyze your trades, and identify areas for improvement. Learn from both successful and unsuccessful trades to refine your strategy.

Final Thoughts

Day trading forex offers exciting opportunities for traders to profit from short-term price movements in the forex market.

By understanding the market dynamics, implementing effective strategies, managing risks, and maintaining emotional discipline, you can increase your chances of success in day trading forex.

4 notes

·

View notes

Text

Navigating the Forex Market: A Beginner's Guide to Currency Trading

https://www.brokersview.com

In today's interconnected world, the foreign exchange (forex) market stands as the largest and most liquid financial market globally, with a daily trading volume exceeding $6 trillion. As a newcomer to the world of finance, understanding the basics of forex trading can be the first step toward harnessing its potential. In this post, we'll provide an introductory guide to help you navigate the forex market.

What is Forex Trading?

Forex, short for foreign exchange, involves the buying and selling of currencies from different countries. The forex market operates 24 hours a day, five days a week, due to the global nature of currency trading. It serves various purposes, from facilitating international trade to allowing investors to speculate on currency price movements.

Key Players in the Forex Market

Central Banks: Central banks, such as the Federal Reserve (Fed) in the United States and the European Central Bank (ECB), play a significant role in the forex market by setting interest rates and implementing monetary policies that impact currency values.

Commercial Banks: Commercial banks participate in forex trading on behalf of their clients and themselves, serving as major liquidity providers in the market.

Hedge Funds and Investment Firms: Large financial institutions and hedge funds engage in forex trading to diversify their portfolios and capitalize on price fluctuations.

Retail Traders: Individual traders like you and me participate in the forex market through online trading platforms provided by brokers.

Currency Pairs

In forex trading, currencies are quoted in pairs, where one currency is exchanged for another. The first currency in the pair is the base currency, and the second is the quote currency. The exchange rate reflects how much of the quote currency is needed to purchase one unit of the base currency. For example, in the EUR/USD pair, the EUR is the base currency, and the USD is the quote currency. If the EUR/USD exchange rate is 1.20, it means 1 Euro can buy 1.20 US Dollars.

How Forex Trading Works

Forex trading involves speculating on whether a currency pair's value will rise (appreciate) or fall (depreciate) in the future. Traders can take two primary positions:

Long Position (Buy): A trader buys a currency pair if they believe the base currency will strengthen against the quote currency.

Short Position (Sell): A trader sells a currency pair if they expect the base currency to weaken compared to the quote currency.

Risk Management

Forex trading carries inherent risks due to the volatility of currency markets. It's crucial to implement risk management strategies, including setting stop-loss orders to limit potential losses and diversifying your trading portfolio.

Choosing a Forex Broker

Selecting the right forex broker is a critical step for beginners. Look for brokers regulated by reputable authorities, offering user-friendly trading platforms, competitive spreads, and excellent customer support.

Educational Resources

Learning is an ongoing process in forex trading. Take advantage of educational resources provided by brokers, online courses, webinars, and trading forums to enhance your understanding of the market.

Conclusion

Forex trading offers opportunities for profit, but it's essential to approach it with knowledge, discipline, and caution. As a beginner, start with a demo account to practice your trading strategies without risking real money. Over time, you can gain confidence and experience to make informed decisions in the dynamic world of forex trading. Remember that success in forex trading requires continuous learning and adaptation to changing market conditions.

2 notes

·

View notes

Text

Forex Trading 101: A Comprehensive Guide for Beginners

Forex Trading 101: A Comprehensive Guide for Beginners

Introduction

Forex trading has come decreasingly popular among commodities and businesses looking to subsidize on the global currency request. With its eventuality for high returns and 24- hour availability, forex trading offers initiative openings for newcomers. Still, navigating the forex request can be dispiriting without solid understanding of its fundamentals. In this comprehensive companion, we will give newcomers with a step-by- step preface to forex trading. we will cover essential motifs similar as request dynamics, trading strategies, threat operation, and the part of a forex broker. By the end of this companion, you'll have the knowledge and confidence to begin your forex trading trip successfully.

Role of forex broker:

When it comes to forex trading, a forex broker plays a pivotal part in easing your participation in the request. let us explore the crucial functions and services offered by forex brokers.

Providing Access to the Forex Market:

A forex broker acts as a conciliator, granting you access to the forex request. they have established connections with liquidity providers and fiscal institutions, allowing you to trade currency dyads. Without a forex broker, it would be challenging for individual dealers to directly pierce the interbank request.

Offering Trading Platforms:

Forex brokers give trading platforms, which are software operations that enable you to execute trades, cover the request, and dissect maps. These platforms come with colorful features and tools, including real-time price quotations, charting capabilities, and order prosecution options. Popular platforms include MetaTrader 4( MT4) and MetaTrader 5( MT5).

1.3 Account Types and Features

Forex brokers offer different types of trading accounts to cater to the different requirements of dealers. These accounts may vary in terms of minimal deposit conditions, influence, spreads, and fresh features. Common types of accounts include standard accounts for educated dealers and mini or micro accounts for newcomers.

Market Analysis and Tools

To assist customers in making informed opinions, forex brokers provide request analysis tools and coffers. These may include profitable timetables, specialized pointers, and exploration accoutrements. By exercising these tools, customers can analyse request trends, identify implicit trading openings, and develop trading strategies.

Customer Support

Forex brokers understand the significance of good client support. They offer assist and guidance to traders whenever required. Whether you have technical issues with the trading platform or want explanation on trading conceptions, a reputed forex broker will have a responsive client support team to address your queries.

Benefits of Using a Forex Broker

When engaging in forex trading, applying the services of a forex broker can offer multiple advantages. Let's explore some of the crucial benefits that come with using a forex broker.

Expertise and Guidance:

Forex brokers have deep knowledge and experience in the financial requests. They can provide precious guidance and advice to beginner traders, helping them navigate the difficulties of forex trading. Brokers constantly offer educational resources, webinars, and tutorials to enhance traders' understanding of the market and trading strategies.

Access to Market Liquidity:

Forex brokers provide access to market liquidity, which is critical for executing trades efficiently. They've established relations with liquidity providers and banks, allowing traders to enter competitive bid- ask spreads and execute trades instantly. Without a broker, individual traders would face challenges in entering the interbank market directly.

Security of Funds:

Reputed forex brokers prioritize the security of their customers' funds. They adhere to strict regulatory conditions and oftentimes hold customer funds in segregated accounts. This means that traders' funds are kept separate from the broker's operational funds, providing an extra layer of protection in a case of any financial difficulties faced by the broker.

Educational Resources:

Forex brokers understand the significance of education in successful trading. They provide educational resources, alike as trading guides, webinars, and market analysis, to help traders enhance their knowledge and expertise. These resources can be inestimable for beginners, equipping them with the necessary tools to make informed trading decisions.

Trading Flexibility and Options:

Forex brokers offer a wide range of trading instruments, allowing traders to diversify their portfolios. In addition to major currency pairs, brokers constantly provide access to minor pairs, exotic pairs, commodities, indices, and even cryptocurrencies. This inflexibility enables dealers to explore different requests and take advantage of colourful trading openings.

Introduction to White Label Solutions

In this dynamic business, staying ahead of the competition is vital, and White Label Solutions offer a game-changing strategy to achieve just that. With our comprehensive White Label Solution, you can easily enhance your brand's presence and expand your service offerings without the need for extensive resources or specialized expertise. Let us guide you through the myriad possibilities of White Label Solutions and show you how they can revolutionize your business, making it stands out in the crowd.

Advantages of White Label Solutions

White-label solutions offer a host of advantages for businesses looking to establish a presence in the market with their brand. One of the key benefits is cost-effectiveness, as white-label solutions save businesses from the time and resources required to develop a trading platform from scratch. By leveraging existing infrastructure, companies can focus on marketing and client acquisition, accelerating their entry into the market. Additionally, white-label solutions provide branding and customization options, allowing businesses to create a unique brand identity and stand out from competitors. Moreover, the regulatory compliance aspect is addressed by the parent company, ensuring businesses operate within the legal framework without the burden of navigating complex regulations. Overall, white-label solutions empower businesses with a reliable, established, and scalable trading infrastructure, enabling them to offer top-notch services under their brand name and compete effectively in the competitive forex market.

Branding and Customization

White label solutions provide businesses with the occasion to establish their own brand identity within the forex market. The trading platform and other services can be customized with the company's trademark, colours, and design fundamentals, creating a unique and recognizable brand. This branding and customization help businesses difference themselves from competitions and construct brand faith among their clients.

Cost and Time Efficiency

One of the primary advantages of white label solutions is the cost and time effectiveness they offer. Developing a trading platform from scratch can be a complex and premium bid. By utilizing a white label solution, businesses can bypass the lengthy development process and associated costs. They can focus on their core abilities, marketing, and client acquisition, saving significant time and resources.

Infrastructure and Technology

White label solutions allow businesses to leverage the existing infrastructure and technology of the parent company. This includes the trading platform, back-office systems, liquidity providers, and regulatory compliance solutions. By exercising well- established structure, businesses can profit from a robust and dependable system without having to invest in the development and maintenance of their own technology.

Regulatory Compliance

Navigating the regulatory landscape can be a complex task, especially for businesses entering multiple authorities. With a white label solution, the parent company generally handles regulatory compliance, ensuring that the white label broker operates within the legal frame. This saves businesses the time and trouble needed to understand and adhere to various regulatory conditions, enabling them to focus on their core operations.

Considerations for Choosing a Forex Broker or White Label Solution

Choosing the right forex broker or white label solution is crucial for successful and rewarding trading experience. There are several factors to consider before deciding. Let us explore the key considerations to keep in a mind:

Reputation and Regulation

The reputation of a forex broker or white label solution provider is paramount. Look for well- established companies with a proven track record in the industry. Research customer reviews, testimonials, and industry rankings to gauge the credibility and trust ability of the broker. Additionally, regulatory compliance is essential for ensuring the safety of your finances and adherence to industry standards. Choose brokers regulated by reputable financial authorities, as this provides added layer of protection for your investments.

Trading Conditions

Estimate the trading conditions offered by the forex broker or white label solution. This includes factors such as spreads, commissions, leverage, and minimum deposit conditions. Lower spreads and competitive trading costs can significantly impact your trading profitability. Also, consider the range of tradable instruments available, as having access to different selection of currency pairs, commodities, indices, and cryptocurrencies can open various trading opportunities.

Technology and Platform

The trading platform is the gateway to the forex market, so it is critical to assess its features and capabilities. Look for a user-friendly platform that offers quick order execution, real-time market data, advanced charting tools, and risk management features. A stable and dependable platform is essential to execute trades efficiently, especially during times of request volatility. Additionally, consider whether the platform is available as a web-based, desktop, or mobile operation, providing you with the flexibility to trade on the go.

Customer Support

Effective and reliable customer support is vital when it comes to forex trading. You may encounter technical issues, have questions about your account, or need assistance with trading strategies. A responsive and knowledgeable customer support team can make a significant difference in resolving queries promptly and ensuring smooth trading experience. Look for brokers or white label providers that offer multiple channels of communication, similar as live chat, an email, and telephone support.

Conclusion

Forex trading can be an economic endeavour for beginners, but understanding the role of forex brokers and the concept of white label solutions is essential. Forex brokers act as intermediaries, providing access to the forex market, trading platforms, and support. White label solutions offer time-efficient and cost-effective way for companies to enter the forex market under their own brand. When choosing a forex broker or considering a white label solution, consider factors such as reputation, regulation, trading conditions, technology, and customer support. With a solid foundation and the right partner, you can embark on a successful forex trading journey.

2 notes

·

View notes

Text

How to Short Forex: Short Selling Currency Details

This article explores the basics of short selling forex, using the EUR/USD currency pair as an example to explain the steps involved. It also advises on suitable risk management throughout the trade journey.

What does short selling currencies involve?

The term ‘short selling’ often confuses many new traders. After all, how can we sell something if we don’t own it?

This is a relationship that began in stock markets before forex was even thought of. Traders that wanted to speculate on the price of a stock going down created a fascinating mechanism by which they could do so.

Traders wanting to speculate on price moving down may not own the stock they want to bet against; but likely, somebody else does. Brokers began to see this potential opportunity; in matching up their clients that held the stock with other clients that wanted to sell it without owning it. The traders holding the stock long (buy position) can be doing so for any number of reasons. Perhaps they have a low purchasing price and do not want to enact a capital gains tax.

How to short forex: EUR/USD short selling example

Taking a short position in forex involves understanding currency pairs, trading system functionality and risk management.

First, each currency quote is provided as a ‘two-sided transaction.’ This means that if you are selling the EUR/USD currency pair, you are not only selling Euros; but you are buying dollars. Because of this, no ‘borrowing,’ needs to take place to enable the short sale. As a matter of fact, quotes are provided in a very easy-to-read format that makes short-selling more simplistic.

Want to sell the EUR/USD?

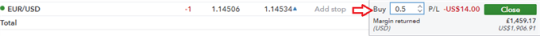

Easy. Just click on the side of the quote that says ‘Sell.’ After you have sold, to close the position, you would want to ‘Buy,’ the same amount (if you end up buying at a lower price than where it was sold, you would end up with a profit — excluding commission and fees). You could also choose to close a partial portion of your trade.

For example, let’s assume we initiated a short position for $100 000 and sold EUR/USD when price was at 1.29.

If the price has moved lower, the trader could realize a profit on the trade (excluding commissions and fees). But let’s assume for a moment that our trader expected further declines and did not want to close the entire position. Rather, they wanted to close half of the position to cover the initial cost, while still retaining the ability to stay in the trade.

Our trader, at that point, would have realized the price difference on half of the trade (50k) from their 1.29 entry price to the lower price they were able to close on. The remainder of the trade would continue in the market until the trader decided to buy another 50k in EUR/USD to ‘offset,’ the rest of the position.

How to manage the risk of short selling currencies

Short selling forex carries high risk as there is no maximum loss on a trade. Losses are unlimited, as forex values can theoretically increase to infinity. On a long (buy) trade, the value of a currency can never fall below zero which provides a maximum loss level.

Managing risk on accounts was a trait we discovered with successful traders. Fortunately, there are ways to mitigate this short selling risk:

Implement stop losses.

Monitor key levels of support and resistance for entry/exit points.

Stay up to date with the latest economic news and events for potential downside risk.

Employ price alerts on trades is a good way to stay informed when you’re away from your platform. Price alerts are mobile/email notifications that update traders when certain price levels are reached on a specific market. These price alerts can be predetermined to suit the traders key levels.

Short selling forex is preferred for down trending markets, however careful consideration is required before trading as it brings extra risk even with a bearish outlook. It has been utilised by large institutions/traders as hedges, or by traders looking to trade descending markets. Risk management is essential for proper application, and the methods mentioned in this article should be given the utmost consideration as adverse movements in price can be detrimental.

Further reading recommendations

Many forex traders have significant experience trading in other markets, and their technical and fundamental analysis is often quite good. However, this is not the case 100% of the time. Take a look at What is the Number One Mistake Forex Traders Make? for more insight.

Successful trading requires sound risk management and self-discipline. Find out how much capital to risk on your open trades.

We host multiple webinars throughout the day, covering a lot of topics related to the Forex market like central bank movements, currency news, and technical chart patterns being followed.

To get involved in the large and exciting world of forex check out our Forex for beginners trading guide.

#financialservices#forextrading#gambit#marketing#youtube#forexbot#accounting#forex online trading#wealthmanagement#forex

2 notes

·

View notes

Text

Imperial Wealth International

Regulation and security at forex broker Imperial Wealth International

Safety and security are important aspects when choosing a forex broker. When considering, it can be noted that this broker provides a high level of security for its clients.

The forex broker is regulated and licensed by one of the reputable financial institutions. The broker is committed to complying with international regulations and requirements in the financial services industry. The regulation provides additional security for clients and ensures that the broker's activities are of a high standard.

In addition, the company employs state-of-the-art security technology to ensure client confidentiality and data protection. The broker uses data encryption and rigorous identity verification procedures to prevent fraud and unauthorized access to traders' accounts.

Importantly, the broker works with trusted banks and financial institutions to process clients' financial transactions. This helps to ensure the security of deposits and fast processing of client funds.

In case of disputes or complaints, the company has a conflict resolution procedure which allows clients to raise a concern and get their case dealt with fairly. The broker also provides full information on its trading conditions and policies so that clients can be aware of their rights and obligations.

Overall, Imperial Wealth International provides a high level of security and protection for its clients. Regulation, the use of modern security technology and working with reliable financial partners all make the broker a reliable choice for traders who are looking for a safe and secure environment for their financial transactions in the forex market.

2 notes

·

View notes

Text

5 Must-Know Tips For Choosing The Right Cryptocurrency Exchange

It is an unwise business, especially if you trade without knowing its basics. There are huge gains to be made however, you could even be in debt before you have even begun to study the market. You must be aware of several things such as how to choose (0.07 eth to gbp exchanges. Making the wrong choice with regards to cryptocurrency exchange could lead down a path filled by distractions and wasted time. Read on for five important tips that will help you pick the most suitable cryptocurrency exchange.

1. Examine the authenticity of the exchange and security

You can choose a safe and reliable exchange service by doing thorough research. Some insecure exchanges not just expose scams and investors, but also allow scammers to swindle investors with small amounts of money. Before you choose an exchange, find out whether it will protect you from fraud.

2. Compare the fee structures

Different fees and transaction charges apply for cryptocurrency exchanges. This is often overlooked and people end up choosing high-cost exchanges, even though they could have picked an exchange with lower transaction costs. An exchange with tokens often offers lower transaction costs than the ones without. If you're looking to compare two exchanges that use tokens, pick the one that has more. You can evaluate crypto exchanges to find which one has the best fee structure. Click this link to learn more about cryptocurrency exchange right now.

3. Know the different types of cryptocurrency exchanges

There are three typesof platforms: brokers, P2P and trading platforms. Find out what each entails. By setting prices and providing buyers a platform to buy cryptocurrencies the cryptocurrency brokers act as forex brokers.

P2P exchanges link buyers and sellers for direct interaction and allow them to reach an agreement on transactions. They provide a secure platform for secure cryptocurrency exchanges. Traders use trading platforms. Each party has a direct interaction with the platform, rather than being in direct contact with buyers and sellers. Sellers place their cryptocurrency on the platform, while buyers make their purchases. The transaction fee is charged by the platform. Before you decide, learn the basics of each. You can research the advantages and disadvantages of each one that appeals most to you.

4. Purchase methods

Cryptocurrency purchase methods vary depending on the exchange. Some platforms require that users make use of PayPal or bank transfer, while some allow debit and credit card purchases. Some platforms require that buyers make purchases with 0.3 eth to gbp. Find out the time it takes to complete a purchase on an exchange before you choose one. It is preferential to get transactions processed quickly rather than taking several days, or perhaps weeks.

5. Consumer encounter

When trading cryptocurrency for the first-time, it is important to think about the user experience and functions. Exchanges with good user experiences are the most popular for transaction volumes. You might find some platforms offering tokens for free. It's a good idea to choose an cryptocurrency exchange that has such deals.

Endnote

It is essential to think about all aspects when investing in cryptocurrency. Different exchanges offer various user experiences as well as security. {Consider all options and pick the exchange that ensures the safety of users.|Check out all the options and pick the one that offers safety.

10 notes

·

View notes

Text

Mysteel UK Limited

Broker Modus UK Limited offers a wide range of financial instruments for trading in international markets. This includes currency pairs, stocks, indices, commodities and other financial assets. The variety of instruments allows traders to choose the ones that best suit their trading strategies and objectives.

Metatrader 4 (MT4): This is a popular trading platform that provides ample opportunities to analyse the market, develop trading strategies and execute trades. MT4 has an intuitive interface and an extensive suite of tools for technical analysis.

Metatrader 5 (MT5): This is an enhanced version of the MT4 platform offering more advanced functionality, including a wider selection of tools and the ability to trade not only in Forex, but also in other markets.

WebTrader: This is a web-based platform, which enables traders to trade directly via a web browser without the need to download and install any software. WebTrader provides flexibility and accessibility, allowing traders to trade from their computer or mobile device from anywhere in the world.

Mobile applications: Mysteel UK Limited broker also offers mobile applications for trading on iOS and Android platforms. This allows traders to be flexible and trade anytime, anywhere using their smartphones or tablets.

3 notes

·

View notes

Text

What is the best way to trade currencies?

Trading currencies, also known as forex trading, involves buying one currency while simultaneously selling another. Here are some steps and tips for effectively trading currencies:

1. Educate Yourself

Learn the Basics: Understand currency pairs, how the forex market operates, and basic trading terminology.

Study Market Influences: Know what affects currency prices, such as economic indicators, geopolitical events, and market sentiment.

2. Choose a Reliable Broker

Regulation: Select a broker that is regulated by a reputable financial authority.

Trading Platform: Ensure the broker offers a user-friendly and stable trading platform.

Fees and Spreads: Compare transaction costs, including spreads and commissions.

Customer Service: Choose a broker with reliable customer support.

3. Develop a Trading Plan

Define Goals: Set clear, realistic, and measurable trading goals.

Risk Management: Determine your risk tolerance and establish rules for risk management, such as stop-loss and take-profit levels.

Strategy: Choose a trading strategy that suits your style, whether it’s scalping, day trading, swing trading, or long-term trading.

4. Use Technical and Fundamental Analysis

Technical Analysis: Utilize charts and technical indicators (e.g., moving averages, RSI, MACD) to identify trading opportunities.

Fundamental Analysis: Analyze economic data, central bank policies, and geopolitical events to understand market trends and potential price movements.

5. Practice with a Demo Account

Simulated Trading: Use a demo account to practice trading without risking real money. This helps you get familiar with the trading platform and refine your strategy.

6. Start Small and Scale Up

Begin with a Small Capital: Start with a small amount of capital and gradually increase your investment as you gain experience and confidence.

Leverage: Use leverage cautiously, as it can amplify both gains and losses.

7. Keep a Trading Journal

Record Trades: Document all your trades, including entry and exit points, the rationale behind the trade, and the outcome.

Analyze Performance: Regularly review your trading journal to identify strengths, weaknesses, and areas for improvement.

8. Stay Informed and Adapt

Market News: Stay updated with the latest market news and economic reports.

Adaptability: Be prepared to adjust your trading strategy in response to changing market conditions.

9. Maintain Discipline and Emotional Control

Stick to Your Plan: Follow your trading plan and avoid making impulsive decisions based on emotions.

Avoid Overtrading: Don’t trade excessively. Quality over quantity is key.

10. Continuous Learning

Ongoing Education: Continue learning about the forex market, new trading strategies, and market analysis techniques.

Networking: Engage with other traders, join forums, and participate in webinars and trading communities.

Each strategy requires specific tools, market understanding, and disciplined risk management.

For more detailed guidance, visit Market Investopedia.

2 notes

·

View notes

Text

4 Best Forex brokers 2022

Exness

Exness is rated #2 of the recommended FX brokers with an overall rating of 4.9/5. It reserves a minimum deposit of $10 and offers low trading fees across its total of 97 currency pairs and crypto. Exness can be traded on various trading desks including MT4, MT5, MT4 WebTerminal, mobile (iOS & Android, Exness Trader) and offers an affiliate program with commissions of up to $45 for every registration, depending on the country and the platform.

Exness Pros and Cons

Pros

-Regulated by both CySEC and FCA

-Client funds kept in segregated accounts

-Tight spreads

-130+ Currency Pairs with Multiple Trading Platforms

Cons

-No multi-currency accounts available

Avatrade

Ranked #1 for recommended FX brokers with an overall rating of 4.8/5. Avatrade offers a minimum deposit fee of $100 for a total of 55+ currency pairs and cryptocurrencies which is traded on various trading desks namely: MetaTrader 4, MetaTrader 5, Ava Social, Ava Protect, Trading Central with low trading fees.

AvaTrade offers 4 affiliate programs:

CPA

You get a fixed payment for every client you refer to AvaTrade and this program' commission structure guarantees a consistent rate for every new investing trader.

RevShare

RevShare is a long-term affiliation where you can maintain receiving your revenue share as long as your referral keeps trading.

Dynamic CPA

This is recommended for people who bring big clients, and you get an incentive of their first-time deposit.

Master Affiliate

Get paid for your clients’ traffic and trading, as well as a fixed percentage of your sub-affiliates' performance.

Avatrade Pros and cons

Pros

-Easy and fast account activation

-Free deposit and withdrawal options

-Provides good educational tools

Cons

-outdated research tools

-There's an inactivity fee payable

-Does not adequately support mobile phones

HFM

Although it is ranked #6 FX broker with an overall rating of 4.8/5, it is a good platform with very good customer support. HFM has a minimum deposit of $5 and offers low trading fees. The platform has a total of 50+ currency pairs and cryptocurrencies but its trading desks are limited to MetaTrader4, MetaTrader5 and the HFM platform.

HF Markets Pros and Cons

Pros

- Low deposit requirement for new traders with Micro accounts

-Offers good customer support

-There's a variety of premium trader tools available

Cons

-Limited range of instruments

- Difficult account opening

-US clients not accepted

XM

Rated #68 for recommended FX Brokers with a minimum deposit of $5 and no trading fees. XM is a widely used and well-loved online brokerage which operates in 196 countries and offers trading on an enormous range of assets. You can trade more than 1,000 companies through stock contracts for difference (CFDs), commodities, forex, and cryptocurrencies.

Here is a preview of the accounts it offers and their Pros and Cons

Based on the above analysis, which broker is best suitable for you?

12 notes

·

View notes

Text

Mysteel UK Limited

Professional Technical Support: Uninterrupted Help from Mysteel UK Limited Broker

One of the important factors for successful forex trading is quality technical support from a broker. The broker offers its clients professional technical support that ensures uninterrupted operation and help in case of problems. In this article, we will look at why tech support is a reliable tool for successful trading.

The company has a team of highly qualified specialists who are ready to help their clients at any time. The broker provides different ways of contacting the technical support, including phone support, e-mail and online chat. Traders can rest assured that they will receive prompt and professional answers to their questions and solutions to any technical problems.

The support team has an in-depth knowledge of the trading platforms and tools provided by the broker. They are ready to help traders understand how to use the platform, set up indicators and automated strategies, and provide advice and tips to improve trading results. The support team is a reliable partner ready to support traders every step of the way.

Thanks to high-quality technical support, traders can feel confident in their trading. They know that in case of problems or questions, they have a reliable partner ready to help. Professional technical support is an important aspect of dealing with a broker, and Mysteel UK Limited offers high-quality support to its clients.

3 notes

·

View notes

Text

Forex For Dummies: A Hobbyist’s Guide to Currency Trading

Hello there, fellow traders and aspiring enthusiasts! I’ve been navigating the fascinating world of Forex trading as a hobby for a good few years now. If you’re considering diving into this exhilarating pastime, you’ve come to the right place. This article will serve as your introduction to Forex trading, breaking down the key terms, concepts, and processes you’ll need to know.

Quick Plug: Hey, I’m Ingrid Olsen, dabbling in Forex trading whenever I get a chance. I’ve been using decodefx.com (by Decode Global) for my trades and seriously, it’s a game-changer. User-friendly, secure, and filled with useful features — it’s got everything you need for a smooth trading experience. Give it a go, and you’ll see what I mean!

The ABCs of Forex

Forex — short for foreign exchange — is all about trading one currency for another. It’s the world’s most liquid financial market, with daily trading volumes exceeding a staggering $5 trillion. What’s unique about Forex is that it’s decentralized — there’s no central exchange, and trades happen directly between two parties, round the clock, five days a week.

Let’s Talk Pairs

In the Forex market, currencies are traded in pairs, like EUR/USD (Euro/US Dollar). The first currency listed (EUR) is known as the ‘base’ currency, and the second one (USD) is the ‘quote’ or ‘counter’ currency. The value of a currency pair indicates how much of the quote currency it takes to buy one unit of the base currency. So, if EUR/USD is trading at 1.20, it means you need 1.20 US dollars to buy 1 Euro.

Interpreting Forex Quotes

When you see a Forex quote, you’ll notice two prices: the ‘bid’ and ‘ask’ price. The ‘bid’ is the price you can sell the base currency for, while the ‘ask’ is the price you can buy it. The difference between these two prices is the ‘spread’ — which is essentially your broker’s commission for the trade.

Going Long or Short

In Forex trading, you can ‘go long’ or ‘go short’. Going long means you’re buying the base currency because you believe it will increase in value against the quote currency. Conversely, going short means you’re selling the base currency as you think its value will decrease.

The Power of Leverage

One distinctive aspect of Forex trading is the use of ‘leverage’. Leverage is like a loan from your broker, allowing you to control a much larger amount than your actual investment. For instance, with 100:1 leverage, you can control $100,000 with just a $1,000 investment. But be careful — while leverage can amplify your gains, it can also magnify your losses.

The Art of Analysis

Successful Forex trading involves market analysis. This usually involves:

Fundamental Analysis: Examining economic data, political events, and social factors that could affect currency values. These can range from policy changes to economic reports and global events.

Technical Analysis: Using charts and statistical indicators to predict future price movements. Techniques might include analyzing trend lines, support and resistance levels, and using mathematical indicators.

Minimizing Risk

Forex trading, like any investment, carries risk. It’s crucial to manage this risk by setting stop-loss orders to limit potential losses, never risking more than a small percentage of your trading capital on a single trade, and keeping emotions out of trading decisions.

Finding a Broker

To start trading Forex, you’ll need to open an account with a Forex broker. Look for a regulated broker with a user-friendly platform, competitive spreads, good customer service, and hassle-free deposit and withdrawal options.

Final Thoughts

Forex trading can be a thrilling hobby, but it’s important to understand the basics before jumping in. Take the time to learn and practice (many brokers offer demo accounts), and don’t be afraid to ask for advice. Remember, the aim is not just to make profits, but also to enjoy the journey of becoming a savvy Forex trader. Happy trading!

Ingrid Olsen

3 notes

·

View notes