#Free Trading Signals 2021

Explore tagged Tumblr posts

Text

April 6, 2025, 3:08 PM MST

By Rob Wile and Brian Cheung

U.S. stock futures plunged Sunday evening, an indication that the market turmoil that began last week will continue when trading opens Monday.

Looming over the markets: the retaliatory actions other countries are expected to enact as the American tariffs announced last week take effect.

As of early Sunday evening, S&P 500 futures had fallen 4.5%. Futures in the tech-heavy Nasdaq also fell 4.5%, while futures for the Dow Jones Industrial Average declined 1,600 points in volatile trading. Future for the Russell 2000, which tracks the stocks of smaller companies, were off 5.6%. (Futures markets are a way for traders to move stocks when the major exchanges are closed, and serve as a implied measure for how stocks will act when the markets do open, generally at 9:30 a.m. ET on weekdays.)

Even the price of bitcoin, which showed signs Friday of having resisted the wider market downturn, fell as much as 5%.

The declines mean another savage day awaits investors when trading officially opens Monday at 9:30 a.m ET. The losses would come on top of a two-day free-fall last week that represented the worst 48-hour period in market history, with some $6.6 trillion in value wiped out.

The main U.S. benchmark for crude oil fell 3.7%, to just under $60 per barrel, its lowest level since April 2021.

Over the weekend, President Donald Trump signaled little intention to back off his proposal, which would see tariffs rise as much as 79% — for countries like China.

"THIS IS AN ECONOMIC REVOLUTION, AND WE WILL WIN. HANG TOUGH," Trump wrote on his Truth Social platform Saturday. "it won’t be easy, but the end result will be historic. We will, MAKE AMERICA GREAT AGAIN!!!"

26 notes

·

View notes

Text

"Under the first presidency of Donald Trump (2017 to 2021), it was the guarantor of the American world order, the United States, which announced that it no longer wanted to observe the rules it had set for the world.5

This surprised politicians and newspapers around the world, and even in the United States this change was not uncontroversial. Trump was being told how much and in how many ways the US benefited from the free world order along the lines explained above. Measured by the standard: “The world market is the means of subsistence of the United States and the world market keeps it in a strong position” Trump's policy was absurd.

Yet Trump had, and has, a more radical standard. The development of serious challengers to America’s supremacy worried him: it was not meant to be that way. While Obama and e.g. Germany pursued the goal of breaking China economically by committing it to better follow the rules of (their idea of) the free world market, Trump took on a different outlook : if the free world market and its rules are not currently serving to clearly reproduce the superiority of the United States then the free world market is not a suitable means for the United States and is unfair.

Trump not only focused on China, but was also beginning to define Germany, Europe and Japan as new major opponents. In his eyes, they all cheated the United States. The proof in his mind: in some fields they undermine the clear and deserved superiority of the US.

Trump started imposing punitive tariffs. Going forward, he only wanted to negotiate bilaterally. He no longer wanted to “waste” money on maintaining loser states around the world.

This was not isolationism. It was his attempt to get the world order back on track, by which he means to a status where it clearly re-establishes America as the undisputed champion in all areas deemed important by America. Now, as before, the purpose was simply to ensure the unquestioned superiority of the United States.

(...)

On the one hand, under Biden the US tried to reestablish its superiority by refocusing on its strategic alliances and treaties. On the other hand, economically, the Biden administration maintained several of Trump’s policies. For example, it maintained Trump’s tariffs on China, and escalated the conflict with restrictions on some key technologies (such as chips optimised for machine learning algorithms). Moreover, the Biden administration introduced the Inflation Reduction Act which contained measures – like subsidies and preferential treatment of domestic firms – considered by, among others, the EU as an assault on free trade. For example, French President Emmanuel Macron eloquently characterised it as “super aggressive”.

Trump’s return to the White House has been accompanied by an acceleration of the US’ pivot, also in the strategic arena. During his first term, Trump threatened and engaged in trade wars. He also threatened to relax American security guarantees for Europe, but he did not threaten the deployment of the military might of the US directly for economic or territorial gain. Trump’s second term sees a significant escalation in this area.

Since taking office for the second time Trump has not only announced in general terms his intention for the US to “expand its territory” (Inaugural Address), but he has also repeatedly threatened the annexation of Canada, the annexation of Greenland, an invasion of Panama and Mexico and the takeover of Gaza and the permanent displacement of its population.6

Through these statements, the power that policed the inviolability of sovereign borders over the last decades has announced that it is prepared to disregard the sovereignty of its closest allies (and foes). US military might is no longer to be used to secure the world market peace that produces reasons for war among competing parties but to secure a direct advantage over other competing parties.

This is, on the one hand, a signal to every state in the world that it must now consider in its calculations a potential US invasion for immediate economic or strategic reasons. But it is also, on the other hand, a signal to every state in the world that territorial disputes can again be settled by military force. The US no longer intends to uphold a principle where sovereign borders ought to be respected.

An example of such a dispute so far kept in check by America’s insistence and close to home is that between Greece (backed also by France) and Türkiye over Cyprus, with Greece being an EU and NATO member and Türkiye being a strategic partner of the EU and a NATO member.

The difference between these lesser powers and their ambitions, and Trump’s America and its ambitions is that the US is in a much stronger position to impose its will on its rivals, by virtue of its military might but also by virtue of effectively controlling most institutions of the “rule-based world order” that it established. It is quite something when the strongest country in the world convinces itself that it is hard done by."

-critisticuffs, "Peace for our Time"

6 notes

·

View notes

Note

hi marte, first of all i love your blog. i agree with most of your takes on larry situations and even their alleged break up rumours. i think they have been working on their career for quite some time and keeping the larry signalling lowkey. i know they are busy and stuff so i get it why the rumours are as such. honestly, i joined the fandom in 2021 and even since then I have seen much of their signalling as they used to do before that. i think I only ever experienced walls tattoo stunt and their long term love songs and sometimes the coded clothes. i don't buy into the blue greening. it's a reach. but lately I have been a louie larry (because I have more empathy for him, because his stunts are brutal and his career has been thoroughly sabotaged and discouraged. i stepped about of harrie train during holivia shit show and ever since then i have a bit taste in my mouth. my thoughts on harry can bit a bit extreme but I promise you it's all because I am just hurt and not a rad or something. my opinion is that, even when his stunts are bad and his image of a womaniser is not true, he at least get attention and career boost out of most of his stunts, except for olivia because it did do some damage but I'm sure if they intended to follow the original blue print, he must have gotten out less harmed. my point being, his closeting altho harsh, gets him somewhere while louis' gets him nowhere). at this point my main concern is just babygate and some boost to louis' career because when i look at him i feel so faint and hurt because he's been chained like that for so many years now. bbg is so disgusting i cannot even bring myself to speak my opinions on it. it just shows me a world that's so cruel and hateful. i still cannot believe how someone could agree to fake being pregnant and labelling a child to be someone else's and if brett is his father, i have respect for him running in minus because well, how could someone agree to put their own child through a mess like that? i haven't been in this fandom for a very long time as opposed to all you veterans but I'm already so tired of this. i saw changes in their pattern that began in august 2021 and that gave me a bit of hope that maybe they are going somewhere with bbg. i saw many takes that they are building a narrative and it will take some time to establish his good father image and i agree with it. if they wanted to go that route, it would be easier for him to end it. but it's been almost 3 years since then as well. and it's not going anywhere? how much are they building up? i think radio silence of louis' on this matter from 2017-2021 was actually far better than this. now i know some ppl say bbg is the only way he looks straight rn and we don't have any stunt girlfriend but in all honesty I would trade bbg+louis' career boost for 3 more olivia wilde if i had to. what I'm trying to say that I'm so fed up with their situation. i hope better days are ahead but i am running low on energy. (1/2)

Anon, i'm putting this under the cut, because you wrote a whole book!

it hurts to be called deluded and be the scrap goat of this fandom. louis' number are falling down day by day, he's stagnant, i don't see hope. i had better expectations with lt2 but it didn't turn out like that. is nobody paying attention to his career??? is nobody investing in him?? he has potential and i know if they could invest even 40% of what they do for harry in louis, he could do so much better than the rest of the boys. i know how he's got THAT end of the deal??? i wish they could end babygate because i really want to be free from this misery. i know i can always distance myself but my conscience is too cluttered with this to the point that I don't even enjoy their arts. i just want them to be free so i don't have this information lingering in my mind all the damn time. i had successfully distanced myself twice from them but then elounor breakup happened and i came back wanting for more. now hs4 will come and the whole 'its for my ex girlfriend' shit will happen again. i am young and sensitive and it hurts me that the world could be so cruel and i as a fan have to endure this pain on their behalf too. i know you're optimistic but im losing hope. everyday. i don't see any progress and sometimes i do think they have given up as well. who knows what's happening behind the scene? at this point I don't care if they are together or not. i just want fairness in this situation. they BOTH are in this relationship so why did louis get the bad end of the agreement? why didn't his career take off? (okay i agree he may not have the same range but im sure as hell sure that he can do a lot better than both liam and niall and even zayn if given a chance to be authentic). it makes me bitter in general. being their fan has made me a hater of the world in general and it's principles and unfairness. i just hope even if it's 0.00001% in me right now, that one day it will end. i know they don't have much time now to spark (louis 32 years old now, he must get the experience the joy of doing genuine numbers once because god i know he deserves the charting even if he says he doesn't want). am i thinking too much? i probably am but I cannot help myself. do you have hopes that it will end anytime soon? in another year? or it will take another ten? i honestly I'm losing so much respect for everyone in this situation, for human kind, for their sisters, for all the ladies who agree to do this shit. they don't deserve this. (2/2)

Hi, anon!

I know times are hard, but i can't know when they'll end bg, if things will change for Louis ever or when the industry will change. The only thing we can do is hope for better times. H and L, and us in fandon have lived with this current situation for years now. Little has changed for the better. Every good thing we get always has a backside and if things seem too good to be true, it always is. Therefore it's important to enjoy the good times when they happen and ignore the shit or meme the hell out of it. That's how you survive here longterm.

I know it's all very frustrating. There is very little we as fans can do to change the situation. We can only support them and acknowledge that they are in a difficult situation, and not hate them too much for what they do, but not praise them for everything either. I think things can change very rapidly, but we don’t know when change will come. I don't expect anything to change in the next two years at least. I'd love to be proven wrong.

5 notes

·

View notes

Text

The prospect that US residents may soon be able to invest in bitcoin through their brokerage, as if it were a regular stock, has prompted a fresh round of hype in crypto circles—and a surge in crypto prices.

Several investment firms, including heavy-hitters like BlackRock and Fidelity, are queuing up to launch a spot bitcoin exchange-traded fund (ETF) in the US. These funds would track the price of bitcoin, making them the closest thing to investing in the crypto token directly without dealing with a crypto exchange or storing crypto manually, a process fraught with risk.

After a bruising 18 months in which crypto prices buckled, high-profile businesses collapsed, and two crypto figureheads were convicted of crimes in the US, the crypto industry is supposed to be cleaning up its act. That the US Securities and Exchange Commission (SEC) appears to be entertaining a spot bitcoin ETF after years of resistance is seen by some as a signal that crypto is moving beyond its free-wheeling years.

The arrival of such a fund in the US—by far the world’s largest ETF market—“is a significant milestone,” says Samson Mow, a prominent bitcoin evangelist and CEO of bitcoin-centric technology firm JAN3, as it will allow investors to hold bitcoin through a conventional financial product for the first time.

While there is broad consensus around the likelihood of an ETF approval among analysts, the idea that it would be symbolic of the industry’s coming of age is contradicted by the frenzy of speculation around what will happen to the price of bitcoin.

On X, crypto influencers with hundreds of thousands of followers are predicting an ETF will send the price of bitcoin soaring, in posts peppered with the rocket ship emoji. The arrival of a spot bitcoin ETF, claims Mow, will unlock a wave of pent-up demand and lead a “torrent of capital” to “pour into bitcoin.” Institutions and other investors that either cannot or choose not to invest in unregulated financial products will seize the opportunity to invest, he says, driving the price far beyond its previous heights.

An ETF might point to a growing acceptance of bitcoin among legacy financial institutions, but the implications for the price of bitcoin are being both mis- and overstated, ETF analysts warn, and the boosterism on display shows that little about crypto has changed.

Twelve applications for spot bitcoin ETFs are awaiting approval from the SEC. Delays are commonplace, but the agency is due to make a call on some of the applications as early as January 1, 2024. The three ETF analysts who spoke to WIRED expect the SEC to green-light a spot bitcoin ETF at some point next year.

In Canada, Germany, and elsewhere, spot bitcoin ETFs already exist. And US investors have had access to bitcoin futures ETFs, the value of which are correlated with the price of bitcoin, since 2021. The approval of a spot bitcoin ETF in the US is significant because it would, for the first time, give US investors access to a close proxy to bitcoin in a familiar and regulated format.

The attention paid to the topic by crypto trade media emphasizes the current fixation in industry circles. Since this summer, when speculation about the arrival of a spot bitcoin ETF began to ratchet up, crypto news site CoinDesk has published dozens of articles and videos on the topic.

In that same period, crypto markets have experienced dramatic swings, and the price of bitcoin has risen by almost a third. In some cases, price swings have been triggered by rumor and misreporting. On October 16, crypto outlet CoinTelegraph issued a retraction and apology after putting out an erroneous post on X announcing the approval of the first spot bitcoin ETF in the US, based on a screenshot posted by an X user, which led to a buying spree that increased the price of bitcoin by 10 percent.

On November 13, a falsified ETF filing relating to a separate cryptocurrency, XRP, caused a 13 percent rise in the token’s price. By the end of the day, those gains had evaporated. The Financial Times calculated that “imaginary bitcoin ETFs” were already worth 30 times the actual spot bitcoin ETFs already in existence worldwide.

Some ETF analysts, like Aniket Ullal of investment research firm CFRA, share the belief that the arrival of an ETF is likely to increase demand for bitcoin as an investment asset. But the effect on price will not be a “short-term spike,” Ullal says, but rather stretch out over multiple years.

Others say it will have the polar opposite effect to that predicted by figures like Mow, and that the price of bitcoin could plummet as investors attracted by the hubbub quickly cash out their winnings. “The idea that there is a huge pile of demand that will somehow materialize is just not true,” argues Peter Schiff, economist and CEO at asset management firm Euro Pacific. “It’s more of a ‘buy the rumor, sell the fact’ situation.”

The “narrative” that an ETF is a “catalyst for growing demand” has attracted speculators, says Bryan Armour, director of passive research strategies for North America at investment research firm Morningstar. “Hype has always been one of the core tenets of bitcoin. It seems like hype is at an all-time high.”

Figures from research firm Fineqia suggest the volume of crypto trading activity has surged in response to speculation over the approval of a spot bitcoin ETF and its market impact. In mid-November, daily trading volume on crypto exchanges reached $31.4 billion, the highest level in more than six months.

“There’s always the possibility that people are hyping it up for their own benefit,” says Mow, who adds that he doesn’t believe the broader crypto industry—which he considers to be separate from bitcoin and describes as a “grift”—is capable of cleaning up its act. “The crypto industry will keep churning out FTXs and people will keep investing because it’s a spectacle,” he says.

But whether or not bitcoin is different—a mature asset whose legitimacy would be “cemented,” as Mow claims, by an ETF approval—the relentless speculation surrounding it will expose investors to risk. “It is wildly volatile and should be handled carefully,” says Armour. But, he adds, people “hear the siren song and buy in.”

3 notes

·

View notes

Text

Trump’s Pick for South Asia: How S. Paul Kapur Bridged Academia and Power Corridors — A Global Indian Milestone

The nomination of S. Paul Kapur as the Assistant Secretary of State for South and Central Asian Affairs by former President Donald Trump is a landmark moment that highlights the rise of Global Indians in shaping international diplomacy. Born in New Delhi to an Indian father and American mother, Kapur’s journey from academia to the corridors of power exemplifies how deep scholarly expertise combined with practical policy experience can influence U.S. engagement in one of the world’s most geopolitically sensitive regions.

A Global Indian Scholar Turned Diplomat:

S. Paul Kapur’s career is a testament to the power of bridging rigorous academic research with real-world policymaking. Holding a Ph.D. from the University of Chicago, Kapur is a professor at the U.S. Naval Postgraduate School’s Department of National Security Affairs and a visiting fellow at Stanford University’s Hoover Institution. His scholarship focuses on South Asian security, nuclear policy, and Indo-Pacific geopolitics, with notable works such as Jihad as Grand Strategy and Dangerous Deterrent that have shaped discourse on Pakistan’s strategic use of militancy and nuclear deterrence in South Asia.

Kapur’s academic credentials are complemented by hands-on policy experience. He served on the U.S. State Department’s Policy Planning Staff during Trump’s first term (2020–2021), working on South and Central Asia, Indo-Pacific strategy, and U.S.-India relations. His leadership in U.S.-India strategic dialogues and defense cooperation initiatives demonstrates his ability to translate scholarly insight into actionable diplomatic strategies.

Strategic Vision for South Asia: Balancing Interests and Stability:

During his Senate confirmation hearing, Kapur emphasized strengthening the U.S.-India partnership, highlighting shared democratic values and mutual interests in promoting a free and open Indo-Pacific region. He underscored the importance of expanding trade, technological collaboration, and securing reliable energy access to sustain economic growth.

On Pakistan, Kapur adopted a pragmatic approach, stating he would pursue security cooperation “where beneficial to U.S. interests,” while exploring opportunities for bilateral trade and investment. This balanced stance reflects a nuanced understanding of South Asia’s complex geopolitics, aiming to foster peace and stability while countering terrorism.

Kapur also stressed the importance of engaging other South Asian nations—including Bangladesh, Afghanistan, Sri Lanka, Nepal, Maldives, and Bhutan—to ensure regional stability and advance U.S. strategic objectives.

The Global Indian Narrative: From Roots to Influence:

Kapur’s nomination symbolizes the growing influence of the Indian diaspora in global affairs. His unique identity as a Global Indian—rooted in Indian heritage and American upbringing—enables him to navigate cultural and political complexities with empathy and insight. His story resonates with millions of Indians worldwide, showcasing how diasporic expertise can shape foreign policy and international relations at the highest levels.

Why Kapur’s Appointment Matters:

Expertise Meets Policy: Kapur’s rare combination of academic depth and policy experience equips him to address South Asia’s multifaceted challenges effectively.

Strengthening U.S.-India Ties: His nomination signals a strategic priority for the U.S. to deepen relations with India amid rising regional tensions.

Balanced Approach to Pakistan: Kapur’s pragmatic stance offers a pathway for cautious engagement with Pakistan, balancing security concerns with diplomatic outreach.

Regional Stability Focus: His inclusive vision encompasses all South Asian neighbors, promoting a comprehensive approach to Indo-Pacific security.

Conclusion:

S. Paul Kapur’s rise from a scholar of South Asian geopolitics to a key U.S. diplomatic figure epitomizes the Global Indian success story. His nomination as Assistant Secretary of State for South and Central Asian Affairs marks a strategic moment for U.S. foreign policy, promising a thoughtful, balanced, and informed approach to one of the world’s most dynamic regions. For the Global Indian community, Kapur’s journey is both a source of pride and a beacon of how expertise and heritage can converge to influence global affairs. Find more Global Indian stories.

0 notes

Text

From Memes to Millions: The New Rules of Investing in the Social Media Era

What do memes have to do with the stock market? Ask Reddit, and you’ll get an answer Wall Street wasn’t ready for.

It all blew up in early 2021 when thousands of Redditors—regular people, not big-time investors—rallied around GameStop. They weren’t following expert advice or quarterly earnings. They followed memes. They followed vibes. And they turned the investing world upside down.

The Rise of the Meme Investor

Before GameStop, most retail investors played it safe. But the WallStreetBets subreddit turned investing into something wildly different—loud, emotional, and driven by internet culture.

People weren’t just buying stocks—they were joining a movement. Words like “diamond hands” and “YOLO” investing became rallying cries.

The results? GameStop stock soared over 1,700% at its peak. Hedge funds lost billions. And suddenly, the world realized that memes and money had formed a powerful alliance.

The New Age of Market Sentiment

Traditionally, markets responded to fundamentals—revenue, profit, valuation. But meme stocks rewrote that rulebook.

Now, a viral tweet or Reddit post can drive share prices faster than a press release.

For today’s finance professionals, especially CFA aspirants, that means one thing: you can’t afford to ignore internet behavior. Understanding online sentiment is becoming just as important as understanding balance sheets.

Where Does This Leave Traditional Finance?

Some people laughed off meme investing. Others panicked. But smart professionals paid attention.

This wasn’t just a blip. It was a signal. Retail investors had found a new voice, and they weren’t going back to the sidelines.

Future CFAs need to understand this shift. Because markets now move at the speed of Wi-Fi—not boardroom meetings.

The Role of Tech and Free Trading Apps

Without apps like Robinhood or Zerodha, this trend wouldn't exist.

Commission-free trades gave power to everyday investors. Suddenly, anyone with a smartphone could buy a stock in seconds. Add Reddit to the mix, and you’ve got real-time collective decision-making.

This is both thrilling and dangerous.

Finance professionals need to balance access with education. Because more participation is great—until people start treating investing like gambling.

Why This Matters to CFA Candidates

The CFA charter has always stood for disciplined, ethical investing. But discipline now requires new awareness.

Behavioral finance is more relevant than ever. CFA candidates must know how fear, hype, and herd mentality move markets.

That’s not something you learn just from reading textbooks. It’s something you learn by watching the world change—and adapting to it.

What’s Happening on the Ground

Interestingly, in cities where finance is booming, this topic is everywhere.

Young professionals and students enrolling in a CFA course Chennai are already engaging with topics like meme stocks and social investing. They know the market doesn’t wait for tradition to catch up.

They want to be ahead of the curve—learning the basics while staying in tune with how investing is evolving online.

Meme Culture: A Double-Edged Sword

Meme investing is funny—until it’s not.

Some people made life-changing money with GameStop or AMC. Others lost everything chasing hype.

As finance professionals, it’s important to approach this with clarity. Emotions are part of the market, but they shouldn’t be the only driver.

Helping people navigate the noise is going to be one of the biggest responsibilities for tomorrow’s CFAs.

Regulation: Catching Up Slowly

When apps like Robinhood froze trading during the GameStop frenzy, outrage followed.

People cried foul, claiming the system was rigged. Regulators stepped in, but the damage was done. Trust in the system took a hit.

This raised deeper questions: Should platforms be allowed to restrict trades mid-frenzy? Should there be tighter rules on collective investing online?

These are ethical and policy dilemmas—exactly the kind CFA candidates need to be ready to explore.

The Future: Investing as Culture

Here’s the truth: investing is becoming cultural.

People don’t just buy stocks for returns. They buy them to be part of something. A narrative. A movement.

That’s powerful—and risky.

CFA aspirants must develop the ability to separate signal from noise, and help others do the same. The markets are no longer just driven by fundamentals. They’re shaped by emotions, platforms, and communities.

Final Thoughts

Memes are no joke anymore—not when they can move billions.

What we’re seeing is a new generation of investors taking control. Sometimes it’s messy, sometimes it’s revolutionary. But it’s always interesting.

For those considering a career in finance, the landscape is changing. It’s not just about ratios and reports anymore. It’s also about Reddit threads, TikTok creators, and the speed of social influence.

As the financial industry evolves, candidates joining a CFA Training Program in Chennai are already positioning themselves to bridge this gap—combining traditional expertise with modern awareness. Because the future of investing will demand both.

0 notes

Text

Elijah Moore Signs with Bills: How a $5 Million Deal Could Elevate Buffalo’s Offense

The Buffalo Bills have quietly made a move that could shake up their 2025 season: they’ve signed wide receiver Elijah Moore to a one-year contract worth up to $5 million. While the headlines may stay focused on bigger trades, Buffalo fans know this signals one thing — the Bills are determined to arm quarterback Josh Allen with as many offensive weapons as possible.

From Cleveland to Buffalo: Moore’s NFL Journey

Elijah Moore, 25, arrives in Buffalo after a productive season with the Cleveland Browns, where he set career highs with 61 receptions and 538 receiving yards, along with a touchdown. While those numbers aren’t Pro Bowl-level, they reflect steady improvement for the former second-round pick out of Ole Miss, who entered the NFL in 2021 full of promise.

Moore’s early NFL years weren’t smooth. His stint with the New York Jets was marred by instability as the team struggled to find its rhythm. A 2023 trade to the Browns gave Moore a chance to flash his skill set, racking up 120 catches, 1,178 yards, and three touchdowns across two seasons. Still, many analysts believe Moore’s true breakout moment hasn’t yet arrived — and Buffalo might be the perfect stage for it.

Buffalo’s Overhaul at Receiver

This offseason, the Bills have been busy reshaping their receiver room. Moore joins a refreshed group that features new additions like Joshua Palmer and Laviska Shenault Jr. The team also has promising second-year player Keon Coleman, reliable playmaker Khalil Shakir (who signed a four-year extension), and veteran Curtis Samuel. On top of that, the Bills just drafted Kaden Prather from Maryland in the seventh round.

Clearly, Buffalo’s front office is all-in on surrounding Allen with options. Moore’s versatility — his ability to line up both inside and outside — gives the Bills a dynamic tool that can stretch defenses and create mismatches.

Inside the Signing Strategy

What’s interesting is how the deal unfolded. Moore visited Buffalo on Monday, right as General Manager Brandon Beane was addressing local media criticism over the team’s draft strategy. Fans were frustrated that the Bills hadn’t drafted a wide receiver earlier. Beane explained on WGR550 radio that Buffalo had been working quietly behind the scenes, engaging Moore’s camp even before the draft.

“If we’d drafted a guy in the first or second round, maybe Elijah’s not so interested,” Beane said. “But we stayed patient, and it worked out.”

This patience allowed the Bills to secure a proven NFL player without sacrificing premium draft capital — a classic “win-now” move with minimal risk.

What the Deal Means for Cleveland

Moore had been given an unrestricted free agent tender by the Browns worth around $3.4 million, which would have locked in his rights had he remained unsigned by July 22. Buffalo’s swift action not only secured Moore but also sets Cleveland up to potentially gain a compensatory draft pick in 2026, depending on how their free agency balance shakes out.

Moore’s Potential in Buffalo

For Moore, this is a crucial opportunity. His speed, sharp route-running, and ability to create separation make him a valuable short and intermediate option, while his field awareness gives him big-play potential. Even if he’s not the top target, Moore’s presence forces opposing defenses to spread their attention, opening doors for his teammates.

With Buffalo’s sights set on a deep playoff run, every piece matters. Moore brings not just skill but also experience — four seasons’ worth of NFL lessons that could pay dividends in high-pressure situations.

Final Thoughts

While this signing might not dominate ESPN headlines, it’s a calculated, smart addition by the Bills. Elijah Moore gets a fresh start with a top-tier quarterback, and Buffalo gets a hungry, skilled receiver looking to prove he belongs among the league’s best.

If this partnership clicks, it could become a defining storyline of Buffalo’s 2025 campaign — and maybe, just maybe, Moore’s long-awaited breakout year.

Source: Elijah Moore Joins Buffalo Bills

0 notes

Text

RiseSparkSolution.com review Deposit

In this RiseSparkSolution.com review, we will dive into the key factors that determine whether this broker is trustworthy and legitimate. For anyone looking to engage in online trading, it’s essential to know whether the broker you choose operates legally, offers reliable services, and ensures a secure trading environment. In this review, we’ll examine aspects like its domain purchase date, regulatory licensing, user reviews, and more. Through this analysis, we aim to provide a thorough understanding of what RiseSparkSolution.com reviews offers and whether it’s a broker worth considering for your trading needs.

RiseSparkSolution Deposit Method: Quick, Efficient, and No Fees

For the "RiseSparkSolution.com reviews" deposit method, I found information that it operates with a quick deposit process. The time for deposit is generally from a few seconds up to 10 minutes, which is quite fast compared to many other brokers. This is a great feature for traders who need to act quickly in a fast-paced market.

Additionally, the deposit fee is notably 0%, which means that users won’t face additional charges when adding funds to their accounts. This is another point in favor of its user-friendly approach, especially since some brokers charge deposit fees.

Now, it’s worth considering the significance of the absence of deposit fees. Why would a broker avoid charging this fee? It could indicate a commitment to making trading more accessible, especially for those who are just starting out or who might be working with limited funds. Overall, the deposit system appears efficient and free of additional financial burdens for users.

Date of Domain Purchase

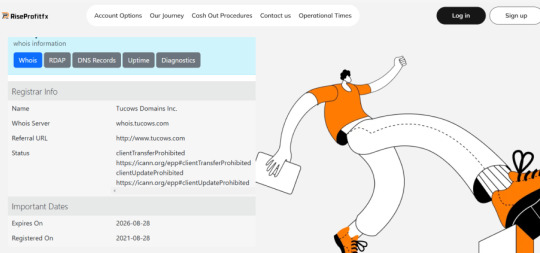

For RiseSparkSolution.com reviews, the domain was purchased on 2021-08-29, while the brand itself was established in 2022. This is an interesting point because the domain was acquired a year before the brand's official launch.

Why is this important? A domain that is purchased well in advance of the brand’s establishment can indicate careful planning. It suggests that the company was setting up its infrastructure and preparing to create a trusted, professional online presence even before the official launch. This demonstrates foresight and an understanding of the importance of having a solid foundation from the start.

License and Regulation

RiseSparkSolution.com review is regulated by the FCA (Financial Conduct Authority), a highly respected regulatory body in the financial industry. The FCA is known for enforcing strict standards and ensuring that brokers comply with rigorous financial rules. When a broker is regulated by such a high authority, it means they are held to very high standards of transparency, security, and fair practice.

Why does this matter? Well, brokers that operate under such reputable licenses are regularly monitored, and failing to meet standards could result in severe consequences, including fines or the loss of the license. So, a broker like RiseSparkSolution.com reviews, regulated by the FCA, shows that it operates within the boundaries of the law and adheres to high ethical standards.

This looks like a strong argument in favor of the broker's legitimacy. A license from the FCA means that RiseSparkSolution.com reviews is part of a group of brokers that have passed a series of stringent checks, making it a safer choice for traders.

Trustpilot Reviews

RiseSparkSolution.com review has a Trustpilot score of 4.3, based on 45 reviews, with 44 of them being positive (4-5 stars). While the number of reviews is smaller than some other brokers, the high score and positive feedback from nearly all users still provide strong evidence of the broker's reliability and customer satisfaction.

Why is this important? A score of 4.3 is solid in the online trading world, where brokers are often subject to intense scrutiny. When almost all reviews are positive, it signals that the broker is delivering what it promises to its users, whether in terms of trading platforms, customer support, or overall service quality. This is a good indicator that users are generally satisfied with their experience.

While the number of reviews is not as large as some brokers, the excellent score and high percentage of positive feedback still reflect well on the broker’s reputation. It suggests that RiseSparkSolution.com reviews has earned the trust of its users, making it a trustworthy option in the market.

Conclusion RiseSparkSolution.com review

Based on the information we've reviewed, it’s clear that RiseSparkSolution.com review has a solid foundation and offers a reliable trading platform for users. The early acquisition of its domain, coupled with its regulation by the FCA, demonstrates a strong commitment to professionalism and legality. Additionally, its Trustpilot score of 4.3 with overwhelmingly positive reviews further supports its credibility, showing that customers are generally satisfied with the services provided.

With no deposit fees, quick processing times, and robust user feedback, RiseSparkSolution.com reviews stands out as a trustworthy broker in the industry. These factors, combined with the well-established brand and regulatory compliance, make it a solid choice for traders looking for a reliable platform.

0 notes

Text

Minnesota Vikings Land Jonathan Allen on $60M Deal in Major Free Agency Move

The Minnesota Vikings have made a statement in free agency by securing veteran defensive tackle Jonathan Allen on a three-year, $60 million contract. The deal, first reported by league insiders, was later confirmed by Allen’s agency, Team IFA.

Vikings Add a Proven Defensive Anchor

This signing marks a major win for Minnesota’s defensive strategy, bringing in a two-time Pro Bowler known for his ability to disrupt offenses. Allen, a former first-round pick in 2017, spent his entire career with the Washington Commanders before his release. Although Washington attempted to trade him, they were unable to find a suitable deal, leading to his exit.

Minnesota wasted no time securing Allen, recognizing the value he brings as an experienced and consistent defensive force. His addition strengthens a Vikings defense that is looking to take a leap forward in 2025.

Washington Moves On from a Defensive Staple

Allen was a cornerstone of Washington’s defense for eight seasons, accumulating 42 sacks in 108 career starts. Despite his consistency and leadership, Washington’s front office decided to move in a different direction amid their ongoing roster rebuild.

Entering the final year of his contract with a $15.5 million base salary and no guaranteed money left, Allen became expendable as the team shifted priorities. His release provided an opportunity for contenders to pursue him, and Minnesota emerged as the most aggressive suitor.

Overcoming Injury and Proving His Value

The 2024 season wasn’t without challenges for Allen. A torn left pectoral muscle sidelined him for nine games, but an unexpected break came during surgery when doctors found the injury to be less severe than initially thought. This allowed him to return late in the season, contributing in Washington’s final regular-season matchups and playoff games.

Even in limited action, he made an impact, finishing the season with three sacks, multiple tackles for loss, and seven quarterback hits. The Vikings believe his return to full health will make him a dominant force once again.

What Allen Brings to Minnesota’s Defense

Minnesota has been aggressively upgrading its roster, and Allen’s presence will immediately boost their defensive front. Known for his ability to collapse the pocket and stop the run, he provides a much-needed presence against NFC North rivals.

In his Pro Bowl seasons (2021, 2022), Allen racked up 16.5 sacks and proved to be one of the most disruptive interior linemen in the league. If he returns to that form, he will be a game-changer for the Vikings.

Vikings Eyeing a Deep Playoff Run

This move signals Minnesota’s commitment to building a competitive team capable of making a deep playoff push. With rivals like the Packers, Lions, and Bears strengthening their rosters, the Vikings knew they had to act boldly to stay in contention.

Allen’s experience, leadership, and high-level play will be invaluable in shaping a tough defensive unit. As the 2025 season approaches, Minnesota fans have every reason to be excited about what this addition means for the team’s future.

Source: Jonathan Allen Signs $60M Deal

0 notes

Text

KIA couldn't stay put. So he knocked on the door first.

KIA General Manager Shim Jae-hak met with Kiwoom General Manager Ko Hyung-wook at the Golden Glove Awards on Thursday to discuss the trade 다파벳슬롯and reached an agreement.

Cho is already a proven bullpen pitcher in the league. This year, he pitched 39 ⅔ innings, losing one loss, six saves and nine holds with an ERA of 3.18 due to his elbow injury, which ended the season early. However, he has 넥스트벳우회주소shown that he has the ability to take responsibility for the back door as the closing pitcher from 2019 to 2021, when he garnered 68 saves. He is also highly motivated as he can exercise his right as a free agent at the end of next season.

Will Kia, which has truly achieved the "thousands-to-arms," be able to detonate a signal to build a dynasty without a "fall" next year? The team that 메이저사이트should pay attention to next season is definitely Kia.

0 notes

Text

SILEGX Exchange: Pioneering Industry Standards Through Compliance and Technological Empowerment

In 2021, SILEGX Exchange further solidified its leadership position in the cryptocurrency industry by focusing on compliance, security, and user experience. With strategic initiatives driven by technological innovation and steady global market expansion, SILEGX aimed to provide users with more comprehensive and high-quality services, marking the year as one of significant progress in diverse services and international compliance.

At the beginning of the year, SILEGX reached a critical compliance milestone. In January, the platform obtained the Money Services Business (MSB) license in the United States. This crucial step ensured its legal and compliant operations in the U.S. market, further strengthening its foothold in North America. As cryptocurrency faces increasing regulatory scrutiny worldwide, the move by SILEGX underscored its commitment to compliant operations, providing a safer and more reliable trading environment for its users.

In the realm of education, SILEGX demonstrated its support for industry development. In March, SILEGX launched the “SILEGX Academy”, an educational platform offering free online courses on cryptocurrency and blockchain technology. This platform aims to help users understand the fundamentals of blockchain technology and cryptocurrency trading, attracting the attention of novice investors and industry professionals alike. By providing comprehensive educational resources, SILEGX not only aids users in expanding their knowledge and skills but also promotes knowledge dissemination and educational growth within the industry.

Investment by SILEGX in technological innovation is also noteworthy. In May, the platform introduced an advanced AI-driven market analysis tool, empowering users to make data-driven trading decisions. This tool combines machine learning technology and big data analytics to provide real-time market insights, trading signals, and trend analysis, helping users seize every trading opportunity. Through these innovations, SILEGX continues to lead advancements in user experience, reinforcing its image as a technology-driven trading platform.

In terms of ensuring the security of user assets, SILEGX maintains a high level of vigilance. In August, the platform announced a partnership with a renowned cybersecurity firm to further enhance system security. By incorporating professional security monitoring and real-time threat detection, SILEGX offered heightened security assurance for platform transactions. This collaboration further boosted user confidence, allowing SILEGX to maintain its leading position in an increasingly complex cybersecurity landscape.

SILEGX will continue to prioritize compliance as it navigates the evolving international regulatory environment. The platform plans to optimize trading tools and expand educational resources to provide users with a more comprehensive and convenient trading experience. As the global cryptocurrency market matures, SILEGX is committed to being a driving force in industry development, creating a safer, more transparent, and efficient trading environment, and delivering tangible value and support to users worldwide.

0 notes

Text

In a significant legal setback for Nigeria, an appellate court in the United States has dismissed the country’s claims to sovereign immunity, paving the way for a Chinese consortium to seize Nigerian assets overseas. This development further intensifies a crisis that President Bola Tinubu has been struggling to contain in Europe, and which now threatens to escalate across multiple international jurisdictions. Read Also: Two Arrested For Stealing Police Station Signpost In Kano (Photos) On August 9, 2024, the U.S. Court of Appeals for the District of Columbia ruled against Nigeria, finding that the country had grossly violated both the fundamental and commercial rights of executives from a Chinese firm, Zhongshan, that had entered into a trade zone agreement with the Ogun State government. The Chinese expatriates had previously secured a favorable arbitration award in the United Kingdom in 2021, which included $55.6 million in compensation, $75,000 in moral damages, as well as accrued interest and legal fees. The dispute originated from a 2007 agreement between Zhongshan and Ogun State to develop a free trade zone. However, the deal fell apart after the then-Governor Ibikunle Amosun allegedly terminated the contract unilaterally, resorting to coercive measures to avoid honoring the agreement. Breaking: EFCC Twitter Account Hacked by Yahoo Boys Amidst Cyber Threats The Chinese executives claimed they were wrongfully arrested and tortured by Nigerian police, allegations that were substantiated by the UK court. In their pursuit of justice, the Chinese investors turned to the U.S. judicial system to enforce the UK arbitration award. Nigeria, in response, argued that its sovereign immunity shielded it from such enforcement actions. However, the U.S. federal court rejected this defense, citing Nigeria’s commitment to the New York Convention, which permits arbitration involving sovereign entities. Nigeria's attempt to overturn this decision through an interlocutory appeal was similarly unsuccessful. A two-to-one ruling by the appellate court confirmed that Nigeria had forfeited its immunity by engaging in actions that breached its contractual obligations under the Investment Treaty with China, signed in 2001. The court emphasized that since Ogun State is a federating unit of Nigeria, the federal government could be held accountable for the violations against Zhongshan. The dissenting judge, Greg Katsas, argued that Nigeria’s sovereign immunity should be preserved, especially concerning assets that fall under the state’s sovereign protection. Nonetheless, the majority opinion prevailed, allowing the case to proceed in a lower court where the Chinese consortium can now pursue Nigerian assets in the United States. Among these assets are fixed properties and substantial deposits from crude oil earnings held by financial giant JP Morgan. This U.S. ruling follows a similar move by Chinese investors in France, where court orders have been obtained to seize Nigerian assets, including private jets stationed across various European locations. Both the Nigerian federal government and Ogun State have responded by labeling the Chinese claims as fraudulent, drawing parallels to the controversial P&ID case. They have also signaled their intention to challenge the French court’s decision but have yet to comment on whether they will appeal the U.S. court ruling to the Supreme Court.

0 notes

Text

Golden Brokers Review 2021

Golden Brokers will appeal to traders looking for high leverage up to 1:1000 in return for limited regulatory safeguards. It will also appeal to traders familiar with MetaTrader 5.

Golden Brokers is a Malaysian headquartered forex and CFD broker established in 2016. The brand is regulated offshore by the Labuan Financial Services Authority. Retail traders can speculate on 700+ products via the MT5 platform with no commission and a choice of international payment methods.

Forex Trading

Speculate on 60+ major, minor and exotic currency pairs such as EUR/AUD, USD/JPY and EUR/GBP with leverage up to 1:100. Fees are not the most competitive, with average spreads of between 3 and 5 pips for major forex pairs.

Stock Trading

You can speculate on the price of hundreds of shares spanning US, EU and Asian markets. On the negative side, the $20 minimum commission is higher than the best stock brokers.

CFD Trading

Trade 700+ products as CFDs on the powerful MetaTrader 5 platform. Access leverage up to 1:100 on major forex pairs with a 50% stop-out level on the standard account.

Pros

Multiple deposit methods including credit/debit card, wire transfer, Neteller and Dragonpay

Deposits accepted in all major currencies, though will be converted to USD at current market rates

Free demo account available to practise trading risk-free with $100,000 in virtual funds

No commission when you trade forex, indices and commodities

Some educational content and integrated video tutorials

Cons

High trading fees with average spreads of 4 pips for major currency pairs such as the GBP/USD

Weak regulatory oversight from the LFSA raises safety concerns

No proprietary trading platform or mobile application

Reports of customers' funds being withheld

No live chat support

This review will discuss the Malaysian-based forex broker, Golden Brokers Ltd. We explore its features with information on the trading platform, available markets, fees, regulation, pros, cons and more. Find out whether to open a live account with Golden Brokers.

Headlines

Golden Brokers Limited was founded in 2018. It is regulated by the Malaysian financial regulator Labuan FSC and its headquarters is based in Kuala Lumpur, Malaysia. It is not quite a global broker as many major geographical locations such as France, Germany and Switzerland are restricted, which other brokers for forex and all manner of trading cater to.

Trading Platforms

MetaTrader 5

MT5 is a world-leading platform with many tools and instruments that can be customised to help each user carry out thorough technical analysis and manage their positions. MT5 is a further development of the MetaTrader 4 platform, offering greater functionality, faster processes and a more intuitive layout. This platform is available on your web browser and downloadable on Windows and Mac.

MT5 platform features include:

Copy trading

21 timeframes

One-click trading

Integrated signals

Automated trading

Hedging and netting

38 built-in indicators

6 pending order types

Markets

Forex – Over 60 major, minor and exotic currency pairs

Commodities – 15 commodities, including precious metals and crude oil

Stock CFDs – Large multinational companies such as Apple, Google and Volkswagen

Indices – 14 global equity indices, such as the Dow Jones & FTSE

Trading Fees

Golden Brokers offers quite large spreads, with typical rates around 3-4 pips for major currency pairs like GBP/USD and EUR/GBP. Spreads for indices range from 2 to 50 pips, while commodities sit between 0.07 and 14 pips.

No commissions are charged, though there are overnight swap fees on CFD positions, which sit at a 0.5% charge, with a minimum fee of USD 20. Additionally, there is a dormancy charge of USD 100 for accounts that remain inactive for an entire year.

Mobile Apps

Golden Brokers clients can access mobile trading through the MetaTrader 5 application. This can be downloaded for both Apple (iOS) and Android (APK) devices from the relevant stores, boasting much of the functionality of the desktop versions. The app offers all supported order types, account management systems and asset classes, with 24 analysis tools and 30 indicators.

The broker’s website also links to a proprietary application on the Apple App Store and Google Play Store. However, there is no mention of the functionality of the application, except for the fact that 24/5 customer support is integrated. From the images provided, the application seems sleek, with at least line, area and candlestick chart support.

Payment Methods

Users can make deposits to and withdrawals from their Golden Brokers accounts using bank wire transfers, credit cards, debit cards and online payment services like Neteller. Deposits can be made in any currency, though they will be converted to USD. A minimum deposit limit of USD 100 is imposed.

Leverage

Golden Brokers clients can access leverage for forex pairs, though not for any other assets offered by the broker. All currency pairs have a maximum rate of 1:100, though this is flexible.

Account Types

To open an account with Golden Brokers you will need to provide personal information like your home address and date of birth, as well as income information like annual income and total net worth. Additionally, you must provide documentation showing proof of identity and residence. It is important to note that the broker will only accept transfers of funds from bank accounts listed on the application forms.

Demo Account

Golden Brokers have provided users with the opportunity to practise making trades on their platform and explore the various markets offered with a free demo account. Each account is given USD 100,000 of digital funds to execute forex, commodities, indices and CFD trades in a simulated environment.

Live Accounts

There is a standard live account on the Golden Brokers platform that provides access to the MetaTrader 5 platform and the many financial instruments. There is also the option for an Islamic account, with which users are entitled to 20 calendar days per year that are swap-free.

Regulation

Golden Brokers is regulated by the Labuan Financial Services Authority in Malaysia with License number MB/19/0030.

This means that the company is authorised to conduct its business and must maintain certain industry standards, such as protection of funds, for example. Client funds are kept safe through account segregation with tier-1 banking institutions, meaning that money can be returned if the broker collapses.

0 notes

Text

The resurgence of meme-stock frenzy is signaling a bullish US stock Market. Amateur investors are driving up the prices of popular stocks, reminiscent of the GameStop saga earlier this year. This trend points to potential Market frothiness as retail traders continue to shake up traditional investing strategies. Stay tuned for more updates on this evolving Market phenomenon. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] This week's surge in meme stocks like GameStop and AMC is causing concern among investors, signaling that the US equity markets may be overheating. According to the latest Bloomberg Markets Live Pulse survey, more than 40% of respondents see the recent trading frenzy in these stocks as a sign of excessive Market excitement and a potential trigger to sell off. The rapid rise and subsequent fall in share prices of GameStop and AMC, reminiscent of the meme-stock craze of 2021, have raised red flags for many investors. While some view this behavior as a contrarian warning for the stock Market, others see it as a positive indicator for future share prices. However, the majority of respondents believe that these meme stocks pose no significant threat to the overall equity Market. The resurgence of meme stocks, although not as extreme as in 2021, has caught the attention of bored investors looking for excitement in the Market. Despite this short-lived phenomenon, the strong US economy, driven by robust consumer spending and manageable inflation, continues to support growth and optimism in the stock Market. Federal Reserve policymakers have indicated their intention to maintain higher borrowing costs to curb inflation, reflecting the overall economic strength of the country. This resilience in the economy provides little incentive for policymakers to rush into interest rate cuts. While valuations remain high, investors remain cautious, with leveraged long exchange-traded funds showing less enthusiasm compared to the previous meme-stock mania. Unlike last year, where retail investors fueled the frenzy, sophisticated traders are behind the recent surge in meme stocks. This shift in Market dynamics suggests a more calculated approach to trading, with a focus on risk management strategies. As the Market navigates through these fluctuations, investors like Thomas Thornton are taking precautions by shorting certain stocks, such as the SPDR S&P Retail ETF (XRT), to protect their portfolios. Despite the uncertainty surrounding meme stocks, Market participants remain vigilant, prepared for any unexpected turns in the Market. The Bloomberg Markets Live Pulse survey, conducted among Bloomberg readers, provides insights into investor sentiment and Market trends. This ongoing survey serves as a valuable tool for gauging Market sentiment and forecasting potential Market shifts. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. What is a meme-stock frenzy? A meme-stock frenzy refers to a situation where retail investors drive up the prices of certain stocks through social media platforms like Reddit or Twitter.

2. Why is the revival of meme-stocks pointing to a frothy US stock Market? The resurgence of meme-stocks indicates that retail investors are heavily influencing stock prices, which can create a volatile and overinflated Market. 3. Are meme-stocks a safe investment? Meme-stocks are generally considered risky investments as their prices are driven more by hype and speculation than traditional Market fundamentals. 4. Should I participate in the meme-stock frenzy? It is important to exercise caution when investing in meme-stocks, as the Market can be highly unpredictable and subject to swift changes in value. 5. How can I protect myself from the risks associated with meme-stocks? To mitigate risks, consider diversifying your investment portfolio, conducting thorough research before buying meme-stocks, and being prepared for potential losses. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

1000X Review 2024

1000X Review - Report a chargeback against 1000X if you are scammed by 1000X

If you've fallen victim to the 1000X scam broker, don't hesitate to file a complaint. Read 1000X reviews take action and recover your lost funds with our assistance. While there are plenty of trustworthy brokers out there, traders should avoid fraudulent brokers to protect their trading capital. A shady broker may cause you to lose all of your money, even if you follow the best trading tactics and skills, so it's important to stay away from scammers. The Enverra Capital team can assist you if you were scammed by a 1000X broker and are unsure about how to get your money back. Read this 1000X review to know more. 1000X Website – https://1000x.live/ Address – 8/F Mega Cube, Kowloon, Hong Kong Warning – Not Recommended By Review Website Like Enverra Capital Domain Age - - Domain Name: 1000x.live - Registry Domain ID: 6ca36e2de2ec4c72aa4bd6a517de5cbd-DONUTS - Registrar WHOIS Server: whois.godaddy.com - Registrar URL: https://www.godaddy.com - Updated Date: 2021-10-21T19:08:59Z - Creation Date: 2021-10-21T19:08:59Z - Registrar Registration Expiration Date: 2026-10-21T19:08:59Z

Signs of Potential Fraudulence in 1000X

1000X, a fledgling broker in Hong Kong, specializes in Forex and Cryptocurrencies. However, it lacks popular trading platforms like MT4 or MT5, necessitating access through web browsers. Notably unregulated, clients must exercise caution. The limited range of trading instruments—confined to Forex and Cryptocurrencies—and the absence of diverse account options are prominent drawbacks. The absence of MT4/MT5 platforms further diminishes its appeal to traders seeking familiar interfaces. With only standard accounts available, the brokerage faces an uphill battle in establishing itself amidst competition, urging traders to tread cautiously when considering its offerings.

Negative 1000X Reviews And Complaints

1000X has gained notoriety among customers for its poor customer service and lack of quality control. Scam brokers tend to have an abundance of negative reviews and complaints across the internet. They may offer unrealistic returns, fail to make promised payments, have poor customer service, or even be unlicensed or operating illegally. Any investor needs to conduct due diligence before investing to ensure they are dealing with a legitimate broker. Researching online 1000X reviews can help investors avoid becoming a victim of 1000X fraud. Reviews for 1000x are varied, with some customers complaining about trouble withdrawing money. Among the complaints are stories of failed withdrawal requests and misleading customer service with prolonged wait times. Poor reviews on review sites such as Trustpilot advise against using 1000x, referring to it as a scam broker. According to allegations, there were significant deductions made upon withdrawal, ranging from 30% to 70%, and the broker blamed internal causes for the decision. These comments draw attention to issues with openness, dependability, and possible dangers related to using the platform. Before employing 1000x, investors are encouraged to use care and comprehensive study.

Protecting Your Investments: How to Avoid Fraud

- Research Extensively: Learn everything about potential investments, including the firm, its performance history, and regulatory compliance. - Confirm Regulatory Compliance: Verify that the investment firm complies with industry standards and is registered with the appropriate regulatory organizations. - Beware of Unrealistic Promises: Exercise caution with investments promising excessively high returns or minimal risk, as they often signal fraudulent schemes. - Expand Your Portfolio: Spread your assets across many asset classes to reduce risk and avoid investing all your money into one company. - Stay Informed: Monitor financial news and events to see any red flags or growing scam schemes.

Are you a victim of a 1000X scam broker? Get help and a Free Consultation for Recovering lost funds.

If you are a victim of a scam broker like 1000X, you may feel helpless and frustrated. However, there are steps you can take to report the scam and get assistance to recover your lost funds. Here are some things you can do: - File a complaint report against 1000x.live. This can help to bring attention to the scam and potentially prevent others from falling victim to it in the future. - Contact us. We can work with you to navigate the complex process of recovering your lost funds and help you get your money back. - Stay vigilant and do your research before investing with any broker in the future. Look for reviews and ratings from other investors, and be wary of any broker that promises unrealistic returns or seems too good to be true. By staying informed about types of scams, you can better protect yourself and others from falling victim to fraudulent activities perpetrated by scam brokers like 1000X. Remember, you are not alone in this situation. With the right help and support, you can take action to recover your lost funds and protect yourself from future scams. Visit our Facebook page Visit Twitter Read our Latest Scam Broker Reports Read the full article

0 notes

Text

Complete Guide to Stock Market Index: Everything You Need to Know

Stock market indices are the backbone of financial markets. They help investors track performance, analyze trends, and make informed decisions. Whether you’re a beginner or an experienced investor, understanding stock indices can enhance your market knowledge and improve your investment strategy.

In this guide, we’ll break down everything about stock indices, how they work, why they matter, and how you can use them for smarter investing.

What Is a Stock Market Index and Why Does It Matter?

A stock market index is a collection of selected stocks that represent a market or sector. It helps investors gauge market performance, understand trends, and compare investment returns.

Real-World Example: India’s Nifty 50 & Sensex

In India, the Nifty 50 and BSE Sensex are the two most important indices.

Sensex (S&P BSE Sensex) tracks the 30 largest companies listed on the Bombay Stock Exchange (BSE).

Nifty 50 (NSE Nifty 50) consists of the top 50 companies listed on the National Stock Exchange (NSE).

These indices reflect the overall health of the Indian stock market and are used by investors worldwide to assess economic performance.

How Are Stock Market Indices Calculated?

There are three main ways indices are calculated:

1. Price-Weighted Index

Stocks with higher prices have more influence.

Example: Dow Jones Industrial Average (DJIA) in the U.S.

2. Market-Capitalization Weighted Index

Companies with larger market caps impact the index more.

Example: Nifty 50, Sensex, S&P 500.

3. Equal-Weighted Index

All stocks have equal importance, regardless of price or market cap.

Example: Nifty Equal Weight Index.

💡 Did you know? The Nifty 50 follows the free-float market capitalization method, meaning only the publicly traded shares are considered for weight calculation.

Top Stock Market Indices in India and Globally

India’s Major Indices

Global Indices

S&P 500 (USA) – Tracks 500 large U.S. companies.

Dow Jones Industrial Average (DJIA) – 30 major U.S. companies.

NASDAQ 100 – Focuses on tech and innovation stocks.

FTSE 100 (UK) – Top 100 companies in the UK.

MSCI Emerging Markets Index – Tracks stocks from developing countries.

These indices are crucial benchmarks used by institutional and retail investors worldwide.

How Do Indices Influence the Economy?

Stock indices are economic indicators that reflect business growth and investor sentiment. When indices rise, it signals market optimism; when they fall, it suggests economic concerns.

Indian Market Example:

In 2020, during the COVID-19 crash, Sensex fell from 42,000 to 26,000, indicating market panic.

By 2021, as the economy recovered, Sensex hit a record 50,000, reflecting investor confidence.

📊 Interesting Fact: In India, RBI and SEBI use stock indices to assess economic stability and decide monetary policies.

Investing in Stock Market Indices: ETFs & Index Funds

1. What Are Index Funds?

An index fund is a mutual fund or exchange-traded fund (ETF) that mimics an index’s performance.

Examples in India:

Nippon India ETF Nifty BeES – Tracks Nifty 50.

ICICI Prudential Nifty Next 50 Index Fund – Tracks mid-cap stocks.

2. What Are ETFs?

Exchange-Traded Funds (ETFs) trade like stocks but track indices. They are more liquid than mutual funds.

✅ Why Invest in ETFs & Index Funds?

Low cost (no active fund manager fees).

Diversification (reduces risk).

Passive investing with steady returns.

📈 Historical Data: Studies show that over 80% of actively managed funds underperform the Nifty 50 over 10 years. This is why passive investing through index funds is gaining popularity.

How to Use Stock Indices for Smarter Investing

1. Track Market Trends

Indices provide a snapshot of market conditions. If the Nifty 50 is rising, it signals strong market performance. If it’s falling, it indicates caution.

2. Compare Stock Performance

If a stock underperforms the index, it may not be a strong investment. For example, if Reliance Industries grows only 5% while the Sensex rises 10%, it’s underperforming.

3. Diversify Your Portfolio

Instead of picking individual stocks, invest in index ETFs to diversify and reduce risk.

🚀 Pro Tip: Use tools like Strike.Money to analyze index trends, ETF performance, and stock movements for better decision-making.

Stock Market Index Trading Strategies

1. Sector Rotation Strategy

Invest in indices based on economic cycles. Example: During a recession, shift from Bank Nifty to IT stocks, as IT services remain stable.

2. Nifty 50 Momentum Trading

Buy when Nifty 50 is above the 50-day moving average.

Sell when it dips below the 200-day moving average.

3. Hedging with Indices

Traders use Nifty 50 futures & options to hedge against market crashes. For example, if you hold stocks, buying Nifty Put Options protects against losses.

📊 Data Insight: In March 2023, the Nifty 50 saw a sharp drop of 5% in a week, but traders who hedged with put options minimized losses.

Emerging Trends in Stock Market Indices

1. ESG Investing (Sustainable Investing)

The Nifty 100 ESG Index tracks companies with strong environmental, social, and governance (ESG) policies.

Global investors are shifting towards sustainable stocks.

2. Thematic & Smart Beta Indices

Nifty Alpha Low Volatility 30 – Tracks stocks with high returns and low volatility.

Nifty IT Index – Focuses on India’s booming IT sector.

3. Cryptocurrency Indices

With Bitcoin and Ethereum gaining traction, crypto indices are emerging to track digital assets.

💡 Future Insight: India may soon introduce regulated crypto indices, similar to the Nasdaq Crypto Index in the U.S.

Key Takeaways for Investors

✅ Stock market indices help gauge market performance, track trends, and guide investment decisions. ✅ Nifty 50 and Sensex are India’s most important indices, influencing investor sentiment. ✅ Invest in index funds and ETFs for low-cost, diversified exposure to the stock market. ✅ Use tools like Strike.Money for real-time analysis, portfolio tracking, and smarter trading decisions. ✅ Stay updated on emerging indices like ESG and crypto-based indices for future opportunities.

Final Thoughts

Stock market indices are powerful tools for both beginners and experienced investors. Whether you’re looking for passive investment opportunities or trading strategies, understanding indices will help you make better financial decisions.

Want to stay ahead in the market? Track indices, analyze trends, and invest smartly with Strike.Money! 🚀

This article provides a data-driven, structured, and engaging guide on stock market indices with real-world Indian market insights, research, and statistics. Would you like additional charts or visuals to enhance readability? 😊

0 notes