#Funded Account Challange

Text

Why You Need a Scalable Accounting Process [with Examples]

Business is a dynamic field full of opportunities, challenges, and uncertainties. With a scalable infrastructure, technology, or operation, it’s easier to navigate the change. So, you can also build a scalable accounting process for the same reason!

Before we delve into the reasons for scaling your accounting operations, let’s define the concept first.

Well, “scalability” is not a function or a feature by itself. It represents a fundamental characteristic that empowers an organization, system, or process to effectively manage heightened workloads, increased demand, or expansion.

Scaling Your Accounting Process Doesn’t Imply a Scale Up Always

A business’s full cycle accounting needs can evolve due to both external and internal factors.External triggers could be changing market conditions or evolving regulations. Whereas your shifting business goals and priorities signify the internal triggers.

Therefore, it becomes imperative that you are able to adjust accounting tasks and workflow to align with any unexpected events or planned strategic initiatives.

Markedly, scaling doesn’t always mean upsizing or increasing your capacity. You may also need or choose to hold back sometimes.

Let’s look at some scenarios for clarity!

There are times when a company needs to downsize its accounting process. The reasons could be:

Growth: A rapidly growing business might need to add more staff and resources to its accounting department. To keep up with the increased workload!

Expanding into New Markets: When a business expands into new markets, it may need to modify its accounting process to comply with different tax and accounting regulations.

Mergers & Acquisitions: When a business acquires another company, it may need to integrate the two companies’ accounting systems.

Following reasons could compel a business to scale down its accounting process:

Economic Downturn: During an economic downturn, a business may need to reduce costs by cutting staff or outsourcing certain functions.

Changes in Industry: Changes in regulations or technology may require a business to modify its accounting process.

Declining Sales: When a business is experiencing declining sales, cost cutting becomes inevitable to remain profitable.

How the Scaling of an Accounting Process Might Look Like

Let’s look at three examples of when and why a business needs to scale up or scale down its accounting process.

Case 1: Restaurant Business Scaling its Accounting Process

A small restaurant chain with 10 locations plans to add five new locations in the next 12 months. It will be hiring new staff, expanding its menu, adding more suppliers, and investing in accounting software and technology upgrades.

Case 2: Fashion Retail Business Scaling its Accounting Operation

A fashion retailer operates 50 offline stores and an e-commerce shop nationwide. It may need to scale up its accounting process if it is launching a new product line, expanding into new markets, or raising funds for expansion.

On the contrary, the fashion chain may be forced to scale down its accounting activity if it is discontinuing a product line, seasonal demand loss, or closing stores.

Case 3: Accounting or CPA Firm Scaling its Client Accounting

An accounting/CPA firm (size regardless) may need to scale up its client accounting process if it is taking on new clients or expanding its service offerings.

The firm might also require additional resources to handle the high workload of the busy tax season and specific projects.

However, the firm may need to scale down its client accounting process if it is losing clients or experiencing a decrease in demand for its services due to economic downturn or other reasons.

Challanges of Scaling In-house Accounting

A scalable accounting process is designed to be flexible enough to meet the changing business needs. Being scalable, it’s easier to sustain or enhance its performance, efficiency, and capacity as required.

However, building an in-house scalable accounting process can be challenging due to the following reasons:

Upfront Costs: Setting up an in-house team requires significant initial investments in infrastructure and employee hiring and training.

Expertise: Finding and retaining qualified accountants can be difficult. In-house teams may lack specialized skills for complex financial tasks.

Management Overhead: In-house operation requires management oversight. It can be time-consuming and distracts from core business activities.

Technology: Ensuring the latest accounting software and data security systems can be complex and costly in-house.

Adapting to Growth: A business may need to recruit additional staff and invest in infrastructure and technology upgrades in its growth phase. It can be cumbersome and expensive.

Scaling up your in-house accounting often requires significant capital investment and additional resources. Conversely, scaling down can lead to underutilized staff and wasted efforts. Thankfully, accounting outsourcing provides a flexible and cost-efficient solution in both scenarios.

Outsource Your Way to Scalable Accounting

Hiring a third-party accounting service brings in so many advantages:

Resources: Your accounting outsourcing services partner will bring in its expertise, staff, technology and infrastructure. They’ll not be your responsibility anymore.

Reduced Costs: You don’t have to invest upfront, nor do you need to worry about the ongoing operational expenses. So, you get to save massively.

Freedom from Daily Supervision: Your outsourced accounting services provider will perform all the delegated accounting tasks on your behalf. So, you are free from the everyday management burden, while they keep you updated with regular reports and communication.

Custom Solutions & Flexible Payment Options: You can tie up with a service provider that offers customized solutions and flexible payment packages.

Quick Scale up or Scale Down: Scalable accounting services maintain a vast stream of resources they can add as per your need. Also, you do not need to sign a binding contract if your business needs are evolving or prone to seasonal and cyclic changes. This allows you to scale up or down quickly when needed, saving you the hassle and financial damages.

Need a flexible accounting process that adapts to your changing business needs? You can easily achieve a scalable accounting process by outsourcing with Centelli, saving you the hassle and high costs of in-house operation. Get your free consultation today!

The Bottom Line

All organizational systems and should be able to adapt to the changing business needs. A scalable accounting function ensures efficiency and supports strategic decision-making, all while managing costs and risks effectively.

So, whether you have an in-house function or choose to outsource your accounting, you may need to scale it at some point.

#Accounting Services#Accounting Process#Outsourcing Services#Accounting Outsourcing#Small Business#Technology#Bookkeeping Services#Finance Accounting

0 notes

Text

HC that Mammon has a famous tiktok account:

He only created it after the creator fund was implemented

Does EVERY challange/trend

Honestly i just want to see mammon do one of those cute anime dances

Posts regular thirst traps

Definetly exploits his bros by recording them during private moments

Collabed with asmo at the start

Asmo was so excited to help his bro gain followers

Mammon then posts a video of asmodeus in a no makeup moment of rage (after mammon hocked a limited edition cream of asmos)

It was up for 45 minutes and got thousands of views

Yes he did set it up he didnt even sell the cream he just hid it (so he could give it back to make up for posting the video (+it was used he couldn't sell it))

He just wants those views so he can make some $$$

Asmo HATES it bc hes had a tiktok from the start and mammon is almost as popular as him

They get into regular pissing contests over whos got the better account

(Mammon posts/does everything, asmo believes in creating quality content)

Mammon tries to set asmo up again (bc the last video got so many views) but he does it during dinner bc hes himbo

They end up fighting and the dinner table tips

Beel destroys the dining room after his dinner is lost bc hes hangry and mammon knocked his sandwich to the floor earlier when running from asmo (and then asmo stood on it chasing him so no 5 second rule)

Tiktok is then banned in house of lamentation by lucifer

Belphie somehow makes the most bank from the app w/ a secret account uploading devildom secrets he overhears when napping in weird places

#obey me#obey me x reader#obey me shall we date#obey me!#obey me mammon#mammon#obey me asmo#asmo#shall we date asmodeus#asmodeus headcanons#mammon headcanon#obey me hc#obey me! hc#belphagor#beelzeebub#mammon hc#asmodeus hc

170 notes

·

View notes

Text

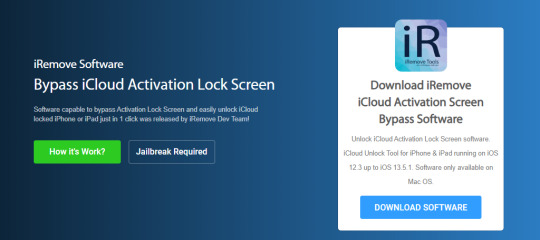

Icloud Activation Tool For Mac

Icloud Activation Bypass Tool Version 1.4 For Mac

Icloud Activation Bypass Tool

Download Bypass Icloud Activation Tool For Mac

Icloud Activation Bypass Tool Version 1.4 For Mac

As was said in the very beginning, Checkm8 bypass iPhone activation software, or bypass iCloud activation software, will help you out for free. All you need to do is following: Download Checkm8 software on your Mac and launch it. Connect an iPhone to your Mac. The first iCloud removal software for Pc Windows, Mac or Linux we want to introduce you is known as iFinder this tool is characterized not only by working not on iOS operating system. This program also works on watchOS, meaning you can unlock any iCloud account on Apple Watch. To activate the tool you need a password, BUT QUIET! Software To iCloud Activation Lock Removal Free Online 2021. In 2019 4 iCloud removal software was popularized, which in 2021 have been reset in order to improve its performance and adapt to iOS 13, without neglecting previous system versions. All the tools you will know are downloaded totally free through fully managed dedicated server hosting.

OPEN MY ICLOUD 2019

Free iCloud Unlock

Icloud Activation Bypass Tool

Team OPENMYICLOUD is up for a new challange. With the new iOS 12 released and our OPEN MY ICLOUD Unlocker Tool being outdated we decided to bring back the OPENMY ICLOUD Server (iCloud Unlock Server) in combination with a NEW OPEN MY ICLOUD Tool 2019 (iCloud Bypass Tool) that will unlock any iOS device on any iOS version simply by connecting your iCloud locked iPhone or iPad with iTunes during the activation process.

How it works?You can bypass the iCloud activation lock with the OpenMyIcloud Activator Tool. It's easy to use and all you need to do is have your device connected to iTunes and download OPEN MY ICLOUD 2019 Fore free you have to complete one survey. After downloading follow our instructions to unlock your device in iTunes.

Download Bypass Icloud Activation Tool For Mac

Our unlock method is 100% legal and free, but before you can get our OPEN MY ICLOUD 2019 Free we need to fund the server costs. You can help us by completing a survey .

* After completing an offer you will automatically receive the download link.

0 notes

Photo

Hello ladies and Gentlemen, I don't know about you, but me I'm very grateful to God for his faithfulness, grace, mercy and favor. In about two weeks I will be celebrating my 34th birthday 🎉🍾🎊🎂🎇. I'm never excited about such things but recently as I reflected on my life, God convicted me, and I realized how much I'm LOVED by both God and many people. I realized how LOVE HAS BEEN THE ANSWER to so many challanges and experiences I have been through. And so this year am excited and want to thank God in a special way; not by throwing a party, cutting a 🎂 and popping 🍾. Naa... I want to touch God's heart more through His people. My brother @ekodydda and I invite you to support us do this by supporting our #loveistheanswer❤️ Food Basket Campaign to raise funds to buy food for 100+ families in Chakama, Kilifi County; who are facing starvation due to Covid-19 pandemic and hostile weather condition. You can donate as little or as much as God provides and or convicts you. We will be very grateful and God will be glorified. See the poster for details and how to donate. Pay bill no: 850 435 (Sortedlife Production) Account: Love is the Answer. Thank you so much and God bless you. RevBantu. Sortedlife Church #loveistheanswer❤️ #inspiringtransformation through #faithwordaction #faithoverfear #foodbasket (at Kilifi Mission and Transformation Center Project) https://www.instagram.com/p/CB1JCDjlc04/?igshid=s50otvfbpw40

0 notes

Text

Place Buyers and Sellers Real Estate Glossary

Every business seems to have it's jargon and residential piermont grand ec is no exception. Make Nash author of 1001 Tips for Buying and Selling a Home dispenses commonly used terms with home buyers and sellers.

1031 exchange or Starker exchange: The delayed exchange in properties that qualifies for tax purposes as a tax-deferred exchange.

1099: The statement of income reported towards the IRS for an independent contractor.

A/I: A contract that may be pending with attorney and inspection contingencies.

Accompanied showings: Those showings where the listing agent must accompany a real estate agent and his or her clients when viewing a listing.

Addendum: The addition to; a document.

Adjustable rate mortgage (ARM): A type of mortgage loan whose interest rate is tied to an market index, which fluctuates with the market. Typical ARM instances are one, three, five, and seven years.

Professional: The licensed real estate salesperson or broker who shows buyers or sellers.

Annual percentage rate (APR): The total costs (interest rate, closing costs, fees, and so on) that are area of a borrower's loan, expressed as a percentage rate of interest. The total costs are amortized over the term of the loan.

Application form fees: Fees that mortgage companies charge buyers whilst written application for a loan; for example , fees for managing credit reports of borrowers, property appraisal fees, and lender-specific fees.

Appointments: Those times or time periods an agent presents properties to clients.

Appraisal: A document of belief of property value at a specific point in time.

Appraised rate (AP): The price the third-party relocation company offers (under most contracts) the seller for his or her property. Generally, the average regarding two or more independent appraisals.

"As-is": A contract or supply clause stating that the seller will not repair or precise any problems with the property. Also used in listings and selling materials.

Assumable mortgage: One in which the buyer agrees to fulfill the obligations of the existing loan agreement that the owner made with the lender. When assuming a mortgage, a buyer has become personally liable for the payment of principal and appeal. The original mortgagor should receive a written release from the responsibility when the buyer assumes the original mortgage.

Back on markets (BOM): When a property or listing is placed back that can be found after being removed from the market recently.

Back-up agent: An authorized agent who works with clients when their agent is without a doubt unavailable.

Balloon mortgage: A type of mortgage that is generally paid out over a short period of time, but is amortized over a more lengthy period of time. The borrower typically pays a combination of principal and even interest. At the end of the loan term, the entire unpaid harmony must be repaid.

Back-up offer: When an offer will be accepted contingent on the fall through or voiding of each accepted first offer on a property.

Bill of selling: Transfers title to personal property in a transaction.

Panel of REALTORS® (local): An association of REALTORS® in a special geographic area.

Broker: A state licensed individual who acts because agent for the seller or buyer.

Broker of listing: The person registered with his or her state licensing expert as the managing broker of a specific real estate sales clinic.

Broker's market analysis (BMA): The real estate broker's judgment of the expected final net sale price, determined just after acquisition of the property by the third-party company.

Broker's travel: A preset time and day when real estate sales people can view listings by multiple brokerages in the market.

Patron: The purchaser of a property.

Buyer agency: A real home broker retained by the buyer who has a fiduciary challange to the buyer.

Buyer agent: The agent who demonstrates the buyer's property, negotiates the contract or provide you with for the buyer, and works with the buyer to close all the transaction.

Carrying costs: Cost incurred to maintain a property (taxes, interest, insurance, utilities, and so on).

Closing: The end of any transaction process where the deed is delivered, documents are actually signed, and funds are dispersed.

CLUE (Comprehensive Decline Underwriting Exchange): The insurance industry's national database in which assigns individuals a risk score. CLUE also has an electronic file of a properties insurance history. These files will be accessible by insurance companies nationally. These files could result the ability to sell property as they might contain information that your particular prospective buyer might find objectionable, and in some cases not even insurable.

Fee: The compensation paid to the listing brokerage by the homeowner for selling the property. A buyer may also be required to pay off a commission to his or her agent.

Commission split: The actual percentage split of commission compen-sation between the real estate sales and profits brokerage and the real estate sales agent or broker.

Competitive Current market Analysis (CMA): The analysis used to provide market advice to the seller and assist the real estate broker through securing the listing.

Condominium association: An association of all users in a condominium.

Condominium budget: A financial forecast not to mention report of a condominium association's expenses and savings.

Condominium by-laws: Rules passed by the condominium association used in managing of the condominium property.

Condominium declarations: A document which usually legally establishes a condominium.

Condominium right of first of all refusal: A person or an association that has the first opportunity to order condominium real estate when it becomes available or the perfect to meet any other offer.

Condominium rules and regulation: Guidelines of a condominium association by which owners agree to abide.

Mishap: A provision in a contract requiring certain acts to generally be completed before the contract is binding.

Continue to show: Every time a property is under contract with contingencies, but the retailer requests that the property continue to be shown to prospective buyers until finally contingencies are released.

Contract for deed: A revenues contract in which the buyer takes possession of the property however seller holds title until the loan is paid. Aka an installment sale contract.

Conventional mortgage: A type of home finance loan that has certain limitations placed on it to meet secondary current market guidelines. Mortgage companies, banks, and savings and borrowing products underwrite conventional mortgages.

Cooperating commission: A commission wanted to the buyer's agent brokerage for bringing a new buyer to the selling brokerage's listing.

Cooperative (Co-op): Where the investors of the corporation are the inhabitants of the building. Each shareholder has the right to lease a specific unit. The difference in between a co-op and a condo is in a co-op, one particular owns shares in a corporation; in a condo one keeps the unit fee simple.

Counteroffer: The response to an offer you or a bid by the seller or buyer after the first offer or bid.

Credit report: Includes all of the history for just a borrower's credit accounts, outstanding debts, and payment timelines on past or current debts.

Credit score: A fico score assigned to a borrower's credit report based on information contained therein.

Curb appeal: The visual impact a property projects from street.

Days on market: The number of days a property has long been on the market.

Decree: A judgment of the court that pieces out the agreements and rights of the parties.

Disclosures: Federal, state, county, and local requirements of disclosure that the seller provides and the buyer acknowledges.

Divorce: Any legal separation of a husband and wife effected by a court decree that totally dissolves the marriage relationship.

DOM: Months on market.

Down payment: The amount of cash put toward a fabulous purchase by the borrower.

Drive-by: When a buyer or supplier agent or broker drives by a property listing and / or potential listing.

Dual agent: A state-licensed individual who presents the seller and the buyer in a single transaction.

Earnest money put in: The money given to the seller at the time the offer is made in the form of sign of the buyer's good faith.

Escrow account for real estate property taxes and insurance: An account into which borrowers spend monthly prorations for real estate taxes and property ınsurance coverage.

Exclusions: Fixtures or personal property that are excluded out of your contract or offer to purchase.

Expired (listing): A property advertising that has expired per the terms of the listing commitment.

Fax rider: A document that treats facsimile sign as the same legal effect as the original document.

Advice: The real estate sales agent and/or his or her client's reaction to a listing or property. Requested by the listing agent.

Fee straight forward: A form of property ownership where the owner has the right to utilize and dispose of property at will.

FHA (Federal Home Administration) Loan Guarantee: A guarantee by the FHA that a ratio of a loan will be underwritten by a mortgage company or perhaps banker.

Fixture: Personal property that has become part of the property by means of permanent attachment.

Flat fee: A predetermined amount of compensation been given or paid for a specific service in a real estate transaction.

Fsbo (FSBO): A property that is for sale by the owner of the real estate.

Gift letter: A letter to a lender stating than a gift of cash has been made to the buyer(s) and also the person gifting the cash to the buyer is not expecting the actual gift to be repaid. The exact wording of the gift notice should be requested of the lender.

Good faith estimate: Within Real Estate Settlement Procedures Act, within three days of any application submission, lenders are required to provide in writing to future borrowers a good faith estimate of closing costs.

Uncouth sale price: The sale price before any concessions.

Hazard insurance: Insurance that covers losses to properties from damages that might affect its value.

Homeowner's insurance plans: Coverage that includes personal liability and theft insurance as well as hazard insurance.

HUD/RESPA (Housing and Urban Development/Real Residence Settlement Procedures Act): A document and statement which will details all of the monies paid out and received at a real-estate closing.

Hybrid adjustable rate: Offers a fixed rate the earliest 5 years and then adjusts annually for the next twenty five years.

IDX (Internet Data Exchange): Allows real estate brokers to push each other's listings posted to listing databases including multiple listing service.

Inclusions: Fixtures or personal property that are within a contract or offer to purchase.

Independent contractor: A genuine estate sales agent who conducts real estate business through a brokering service. This agent does not receive salary or benefits from any broker.

Inspection rider: Rider to purchase agreement between alternative party relocation company and buyer of transferee's property documenting that property is being sold "as is. " Most of inspection reports conducted by the third party company are shared to the buyer and it is the buyer's duty to do his/her own inspections and tests.

Installment land contract: A fabulous contract in which the buyer takes possession of the property with regards to seller retains the title to the property until the bank loan is paid.

Interest rate float: The borrower decides for you to delay locking their interest rate on their loan. They can float their rate in expectation of the rate moving downward. At the end of the float period they must lock a rate.

Interest rate lock: When the borrower and lender agree to lock an interest rate on loan. Can have terms and conditions attached to the lock.

Record date: Actual date the property was listed with the latest broker.

List price: The price of a property through a listing transaction.

Listing: Brokers written agreement to represent a dealer and their property. Agents refer to their inventory of negotiating with sellers as listings.

Listing agent: The real property sales agent that is representing the sellers and their property, through a listing agreement.

Listing agreement: A document that ensures the real estate agent's agreement with the sellers to characterize their property in the market.

Listing appointment: The time when a real estate telemarketer meets with potential clients selling a property to secure an inventory agreement.

Listing exclusion: A clause included in the listing understanding when the seller (transferee) lists his or her property with a dealer.

Loan: An amount of money that is lent to a borrower what person agrees to repay the amount plus interest.

Loan application: A article that buyers who are requesting a loan fill out and upload to their lender.

Loan closing costs: The costs a mortgage lender charges to close a borrower's loan. These rates vary from lender to lender and from market to plug.

Loan commitment: A written document telling the individuals that the mortgage company has agreed to lend them a precise amount of money at a specific interest rate for a specific period of time. The particular loan commitment may also contain conditions upon which the home loan commitment is based.

Loan package: The group of mortgage papers that the borrower's lender sends to the closing or escrow.

Loan processor: An administrative individual who is assigned to take a look, verify, and assemble all of the documents and the buyer's dollars and the borrower's loan for closing.

Loan underwriter: Person who underwrites a loan for another. Some lenders have buyers underwrite a buyer's loan.

Lockbox: A tool that allows risk-free storage of property keys on the premises for professional use. A combo uses a rotating dial to gain accessibility with a combination; a Supra® (electronic lockbox or ELB) features a keypad.

Managing broker: A person licensed by the talk about as a broker who is also the broker of track record for a real estate sales office. This person manages the particular daily operations of a real estate sales office.

Marketing stage: The period of time in which the transferee may market his or her building (typically 45, 60, or 90 days), as instructed by the third-party company's contract with the employer.

Mortgage bank: One who lends the bank's funds to borrowers and also brings lenders and borrowers together.

Mortgage broker: A business the fact that or an individual who unites lenders and borrowers plus processes mortgage applications.

Mortgage loan servicing company: A company who collects monthly mortgage payments from borrowers.

Multiple listing service (MLS): An email finder service that compiles available properties for sale by member providers.

Multiple offers: More than one buyers broker present an feature on one property where the offers are negotiated at the same time.

Countrywide Association of REALTORS® (NAR): A national association comprised of real estate sales agents.

Net sales price: Gross sales price much less concessions to the buyers.

Off market: A property listing which was removed from the sale inventory in a market. A property are generally temporarily or permanently off market.

Offer to purchase: Because a buyer proposes certain terms and presents these words and phrases to the seller.

Office tour/caravan: A walking or operating tour by a real estate sales office of listings depicted by agents in the office. Usually held on a set evening and time.

Parcel identification number (PIN): A demanding authority's tracking number for a property.

Pending: A real personal contract that has been accepted on a property but the transaction has never closed.

Personal assistant: A real estate sales agent administrative associate.

Planned unit development (PUD): Mixed-use development that identifies aside areas for residential use, commercial use, as well as public areas such as schools, parks, and so on.

Preapproval: A more significant level of buyer/borrower prequalification required by a mortgage lender. Some preapprovals have conditions the borrower must meet.

Prepaid fascination: Funds paid by the borrower at closing based on the volume of days left in the month of closing.

Prepayment charge: A fine imposed on the borrower by the lender when the payday loan is paid off before it comes due.

Prequalification: Typically the mortgage company tells a buyer in advance of the formalized mortgage application, how much money the borrower can afford to receive. Some prequalifications have conditions that the borrower must interact with.

Preview appointment: When a buyer's agent views a property only to see if it meets his or her buyer's needs.

Discounts: When the potential seller's agent goes to the potential record property to view it for marketing and pricing usages.

Principal: The amount of money a buyer borrows.

Principal, interest, taxation's, and insurance (PITI): The four parts that make up an important borrower's monthly mortgage payment. Private mortgage insurance (PMI): A special insurance paid by a borrower in monthly installments, normally of loans of more than 80 percent of the value from the property.

Professional designation: Additional nonlicensed real estate education accomplished by a real estate professional.

Professional regulation: A state licensing recognized that oversees and disciplines licensees.

Promissory note: An important promise-to-pay document used with a contract or an deliver to purchase.

R & I: Estimated and actual fix and improvement costs.

Real estate agent: An individual who is licensed by your state and who acts on behalf of his or her client, the individual or seller. The real estate agent who does not have the broker's license must work for a licensed broker.

Real estate written agreement: A binding agreement between buyer and seller. The software consists of an offer and an acceptance as well as thought (i. e., money).

REALTOR®: A registered trademark of your National Association of REALTORS® that can be used only by the members.

Release deed: A written document stating which a seller or buyer has satisfied his or her obligation about the debt. This document is usually recorded.

Relist: Property which was listed with another broker but relisted with a present broker.

Rider: A separate document that is attached to a insurance in some way. This is done so that an entire document does not need that should be rewritten.

Salaried agent: A real estate sales agent or agent who receives all or part of his or her compensation on real estate sales in the form of a salary.

Sale price: The price settled a listing or property.

Seller (owner): The owner of a property who may have signed a listing agreement or a potential listing agreement.

Exhibiting: When a listing is shown to prospective buyers or typically the buyer's agent (preview).

Special assessment: A special and additional fee to a unit in a condominium or cooperative. Also an exclusive real estate tax for improvements that benefit a property.

Talk about Association of REALTORS®: An association of REALTORS® in a exact state.

Supra®: An electronic lockbox (ELB) that holds house keys to a property. The user must have a Supra keypad to try the lockbox.

Temporarily off market (TOM): A placed property that is taken off the market due to illness, travel, expected repairs, and so on.

Temporary housing: Housing a transferee uses up until permanent housing is selected or becomes attainable.

Transaction: The real estate process from offer to ending or escrow.

Transaction management fee (TMF): A bill charged by listing brokers to the seller as part of the list of agreement.

Transaction sides: The two sides of a transaction, owners and buyers. The term used to record the number of transactions in which a real estate sales agent or broker was involved during a precise period.

24-hour notice: Allowed by law, tenants must be up to date of showing 24 hours before you arrive.

Under contract: A home that has an accepted real estate contract between seller and patron.

VA (Veterans Administration) Loan Guarantee: A guarantee on a property loan amount backed by the Department of Veterans Affairs.

Electronic tour: An Internet web/cd-rom-based video presentation of a place.

VOW's (Virtual Office web sites): An Internet based realty brokerage business model that works with real estate consumers in unique way as a brick and mortar real estate brokerage.

W-2: The Internal Revenue style issued by employer to employee to reflect recompense and deductions to compensation.

W-9: The Internal Revenue develop requesting taxpayer identification number and certification.

Walk-through: The showing before closing or escrow that permits the individuals one final tour of the property they are purchasing.

Will probably: A document by which a person disposes of his or her property once death.

0 notes

Text

Place Buyers and Sellers Real Estate Glossary

Every business seems to have it's jargon and residential real estate is no exception. Make Nash author of 1001 Tips for Buying and Selling a Home dispenses commonly used terms with home buyers and sellers.

1031 exchange or Starker exchange: The delayed exchange in properties that qualifies for tax purposes as a tax-deferred exchange.

1099: The statement of income reported towards the IRS for an independent contractor.

A/I: A contract that may be pending with attorney and inspection contingencies.

Accompanied showings: Those showings where the listing agent must accompany a real estate agent and his or her clients when viewing a listing.

Addendum: The addition to; a document.

Adjustable rate mortgage (ARM): A type of mortgage loan whose interest rate is tied to an market index, which fluctuates with the market. Typical ARM instances are one, three, five, and seven years.

Professional: The licensed Ola salesperson or broker who shows buyers or sellers.

Annual percentage rate (APR): The total costs (interest rate, closing costs, fees, and so on) that are area of a borrower's loan, expressed as a percentage rate of interest. The total costs are amortized over the term of the loan.

Application form fees: Fees that mortgage companies charge buyers whilst written application for a loan; for example , fees for managing credit reports of borrowers, property appraisal fees, and lender-specific fees.

Appointments: Those times or time periods an agent presents properties to clients.

Appraisal: A document of belief of property value at a specific point in time.

Appraised rate (AP): The price the third-party relocation company offers (under most contracts) the seller for his or her property. Generally, the average regarding two or more independent appraisals.

"As-is": A contract or supply clause stating that the seller will not repair or precise any problems with the property. Also used in listings and selling materials.

Assumable mortgage: One in which the buyer agrees to fulfill the obligations of the existing loan agreement that the owner made with the lender. When assuming a mortgage, a buyer has become personally liable for the payment of principal and appeal. The original mortgagor should receive a written release from the responsibility when the buyer assumes the original mortgage.

Back on markets (BOM): When a property or listing is placed back that can be found after being removed from the market recently.

Back-up agent: An authorized agent who works with clients when their agent is without a doubt unavailable.

Balloon mortgage: A type of mortgage that is generally paid out over a short period of time, but is amortized over a more lengthy period of time. The borrower typically pays a combination of principal and even interest. At the end of the loan term, the entire unpaid harmony must be repaid.

Back-up offer: When an offer will be accepted contingent on the fall through or voiding of each accepted first offer on a property.

Bill of selling: Transfers title to personal property in a transaction.

Panel of REALTORS® (local): An association of REALTORS® in a special geographic area.

Broker: A state licensed individual who acts because agent for the seller or buyer.

Broker of listing: The person registered with his or her state licensing expert as the managing broker of a specific real estate sales clinic.

Broker's market analysis (BMA): The real estate broker's judgment of the expected final net sale price, determined just after acquisition of the property by the third-party company.

Broker's travel: A preset time and day when real estate sales people can view listings by multiple brokerages in the market.

Patron: The purchaser of a property.

Buyer agency: A real home broker retained by the buyer who has a fiduciary challange to the buyer.

Buyer agent: The agent who demonstrates the buyer's property, negotiates the contract or provide you with for the buyer, and works with the buyer to close all the transaction.

Carrying costs: Cost incurred to maintain a property (taxes, interest, insurance, utilities, and so on).

Closing: The end of any transaction process where the deed is delivered, documents are actually signed, and funds are dispersed.

CLUE (Comprehensive Decline Underwriting Exchange): The insurance industry's national database in which assigns individuals a risk score. CLUE also has an electronic file of a properties insurance history. These files will be accessible by insurance companies nationally. These files could result the ability to sell property as they might contain information that your particular prospective buyer might find objectionable, and in some cases not even insurable.

Fee: The compensation paid to the listing brokerage by the homeowner for selling the property. A buyer may also be required to pay off a commission to his or her agent.

Commission split: The actual percentage split of commission compen-sation between the real estate sales and profits brokerage and the real estate sales agent or broker.

Competitive Current market Analysis (CMA): The analysis used to provide market advice to the seller and assist the real estate broker through securing the listing.

Condominium association: An association of all users in a condominium.

Condominium budget: A financial forecast not to mention report of a condominium association's expenses and savings.

Condominium by-laws: Rules passed by the condominium association used in managing of the condominium property.

Condominium declarations: A document which usually legally establishes a condominium.

Condominium right of first of all refusal: A person or an association that has the first opportunity to order condominium real estate when it becomes available or the perfect to meet any other offer.

Condominium rules and regulation: Guidelines of a condominium association by which owners agree to abide.

Mishap: A provision in a contract requiring certain acts to generally be completed before the contract is binding.

Continue to show: Every time a property is under contract with contingencies, but the retailer requests that the property continue to be shown to prospective buyers until finally contingencies are released.

Contract for deed: A revenues contract in which the buyer takes possession of the property however seller holds title until the loan is paid. Aka an installment sale contract.

Conventional mortgage: A type of home finance loan that has certain limitations placed on it to meet secondary current market guidelines. Mortgage companies, banks, and savings and borrowing products underwrite conventional mortgages.

Cooperating commission: A commission wanted to the buyer's agent brokerage for bringing a new buyer to the selling brokerage's listing.

Cooperative (Co-op): Where the investors of the corporation are the inhabitants of the building. Each shareholder has the right to lease a specific unit. The difference in between a co-op and a condo is in a co-op, one particular owns shares in a corporation; in a condo one keeps the unit fee simple.

Counteroffer: The response to an offer you or a bid by the seller or buyer after the first offer or bid.

Credit report: Includes all of the history for just a borrower's credit accounts, outstanding debts, and payment timelines on past or current debts.

Credit score: A fico score assigned to a borrower's credit report based on information contained therein.

Curb appeal: The visual impact a property projects from street.

Days on market: The number of days a property has long been on the market.

Decree: A judgment of the court that pieces out the agreements and rights of the parties.

Disclosures: Federal, state, county, and local requirements of disclosure that the seller provides and the buyer acknowledges.

Divorce: Any legal separation of a husband and wife effected by a court decree that totally dissolves the marriage relationship.

DOM: Months on market.

Down payment: The amount of cash put toward a fabulous purchase by the borrower.

Drive-by: When a buyer or supplier agent or broker drives by a property listing and / or potential listing.

Dual agent: A state-licensed individual who presents the seller and the buyer in a single transaction.

Earnest money put in: The money given to the seller at the time the offer is made in the form of sign of the buyer's good faith.

Escrow account for real estate property taxes and insurance: An account into which borrowers spend monthly prorations for real estate taxes and property ınsurance coverage.

Exclusions: Fixtures or personal property that are excluded out of your contract or offer to purchase.

Expired (listing): A property advertising that has expired per the terms of the listing commitment.

Fax rider: A document that treats facsimile sign as the same legal effect as the original document.

Advice: The real estate sales agent and/or his or her client's reaction to a listing or property. Requested by the listing agent.

Fee straight forward: A form of property ownership where the owner has the right to utilize and dispose of property at will.

FHA (Federal Home Administration) Loan Guarantee: A guarantee by the FHA that a ratio of a loan will be underwritten by a mortgage company or perhaps banker.

Fixture: Personal property that has become part of the property by means of permanent attachment.

Flat fee: A predetermined amount of compensation been given or paid for a specific service in a real estate transaction.

Fsbo (FSBO): A property that is for sale by the owner of the real estate.

Gift letter: A letter to a lender stating than a gift of cash has been made to the buyer(s) and also the person gifting the cash to the buyer is not expecting the actual gift to be repaid. The exact wording of the gift notice should be requested of the lender.

Good faith estimate: Within Real Estate Settlement Procedures Act, within three days of any application submission, lenders are required to provide in writing to future borrowers a good faith estimate of closing costs.

Uncouth sale price: The sale price before any concessions.

Hazard insurance: Insurance that covers losses to properties from damages that might affect its value.

Homeowner's insurance plans: Coverage that includes personal liability and theft insurance as well as hazard insurance.

HUD/RESPA (Housing and Urban Development/Real Residence Settlement Procedures Act): A document and statement which will details all of the monies paid out and received at a real-estate closing.

Hybrid adjustable rate: Offers a fixed rate the earliest 5 years and then adjusts annually for the next twenty five years.

IDX (Internet Data Exchange): Allows real estate brokers to push each other's listings posted to listing databases including multiple listing service.

Inclusions: Fixtures or personal property that are within a contract or offer to purchase.

Independent contractor: A genuine estate sales agent who conducts real estate business through a brokering service. This agent does not receive salary or benefits from any broker.

Inspection rider: Rider to purchase agreement between alternative party relocation company and buyer of transferee's property documenting that property is being sold "as is. " Most of inspection reports conducted by the third party company are shared to the buyer and it is the buyer's duty to do his/her own inspections and tests.

Installment land contract: A fabulous contract in which the buyer takes possession of the property with regards to seller retains the title to the property until the bank loan is paid.

Interest rate float: The borrower decides for you to delay locking their interest rate on their loan. They can float their rate in expectation of the rate moving downward. At the end of the float period they must lock a rate.

Interest rate lock: When the borrower and lender agree to lock an interest rate on loan. Can have terms and conditions attached to the lock.

Record date: Actual date the property was listed with the latest broker.

List price: The price of a property through a listing transaction.

Listing: Brokers written agreement to represent a dealer and their property. Agents refer to their inventory of negotiating with sellers as listings.

Listing agent: The real property sales agent that is representing the sellers and their property, through a listing agreement.

Listing agreement: A document that ensures the real estate agent's agreement with the sellers to characterize their property in the market.

Listing appointment: The time when a real estate telemarketer meets with potential clients selling a property to secure an inventory agreement.

Listing exclusion: A clause included in the listing understanding when the seller (transferee) lists his or her property with a dealer.

Loan: An amount of money that is lent to a borrower what person agrees to repay the amount plus interest.

Loan application: A article that buyers who are requesting a loan fill out and upload to their lender.

Loan closing costs: The costs a mortgage lender charges to close a borrower's loan. These rates vary from lender to lender and from market to plug.

Loan commitment: A written document telling the individuals that the mortgage company has agreed to lend them a precise amount of money at a specific interest rate for a specific period of time. The particular loan commitment may also contain conditions upon which the home loan commitment is based.

Loan package: The group of mortgage papers that the borrower's lender sends to the closing or escrow.

Loan processor: An administrative individual who is assigned to take a look, verify, and assemble all of the documents and the buyer's dollars and the borrower's loan for closing.

Loan underwriter: Person who underwrites a loan for another. Some lenders have buyers underwrite a buyer's loan.

Lockbox: A tool that allows risk-free storage of property keys on the premises for professional use. A combo uses a rotating dial to gain accessibility with a combination; a Supra® (electronic lockbox or ELB) features a keypad.

Managing broker: A person licensed by the talk about as a broker who is also the broker of track record for a real estate sales office. This person manages the particular daily operations of a real estate sales office.

Marketing stage: The period of time in which the transferee may market his or her building (typically 45, 60, or 90 days), as instructed by the third-party company's contract with the employer.

Mortgage bank: One who lends the bank's funds to borrowers and also brings lenders and borrowers together.

Mortgage broker: A business the fact that or an individual who unites lenders and borrowers plus processes mortgage applications.

Mortgage loan servicing company: A company who collects monthly mortgage payments from borrowers.

Multiple listing service (MLS): An email finder service that compiles available properties for sale by member providers.

Multiple offers: More than one buyers broker present an feature on one property where the offers are negotiated at the same time.

Countrywide Association of REALTORS® (NAR): A national association comprised of real estate sales agents.

Net sales price: Gross sales price much less concessions to the buyers.

Off market: A property listing which was removed from the sale inventory in a market. A property are generally temporarily or permanently off market.

Offer to purchase: Because a buyer proposes certain terms and presents these words and phrases to the seller.

Office tour/caravan: A walking or operating tour by a real estate sales office of listings depicted by agents in the office. Usually held on a set evening and time.

Parcel identification number (PIN): A demanding authority's tracking number for a property.

Pending: A real personal contract that has been accepted on a property but the transaction has never closed.

Personal assistant: A real estate sales agent administrative associate.

Planned unit development (PUD): Mixed-use development that identifies aside areas for residential use, commercial use, as well as public areas such as schools, parks, and so on.

Preapproval: A more significant level of buyer/borrower prequalification required by a mortgage lender. Some preapprovals have conditions the borrower must meet.

Prepaid fascination: Funds paid by the borrower at closing based on the volume of days left in the month of closing.

Prepayment charge: A fine imposed on the borrower by the lender when the payday loan is paid off before it comes due.

Prequalification: Typically the mortgage company tells a buyer in advance of the formalized mortgage application, how much money the borrower can afford to receive. Some prequalifications have conditions that the borrower must interact with.

Preview appointment: When a buyer's agent views a property only to see if it meets his or her buyer's needs.

Discounts: When the potential seller's agent goes to the potential record property to view it for marketing and pricing usages.

Principal: The amount of money a buyer borrows.

Principal, interest, taxation's, and insurance (PITI): The four parts that make up an important borrower's monthly mortgage payment. Private mortgage insurance (PMI): A special insurance paid by a borrower in monthly installments, normally of loans of more than 80 percent of the value from the property.

Professional designation: Additional nonlicensed real estate education accomplished by a real estate professional.

Professional regulation: A state licensing recognized that oversees and disciplines licensees.

Promissory note: An important promise-to-pay document used with a contract or an deliver to purchase.

R & I: Estimated and actual fix and improvement costs.

Real estate agent: An individual who is licensed by your state and who acts on behalf of his or her client, the individual or seller. The real estate agent who does not have the broker's license must work for a licensed broker.

Real estate written agreement: A binding agreement between buyer and seller. The software consists of an offer and an acceptance as well as thought (i. e., money).

REALTOR®: A registered trademark of your National Association of REALTORS® that can be used only by the members.

Release deed: A written document stating which a seller or buyer has satisfied his or her obligation about the debt. This document is usually recorded.

Relist: Property which was listed with another broker but relisted with a present broker.

Rider: A separate document that is attached to a insurance in some way. This is done so that an entire document does not need that should be rewritten.

Salaried agent: A real estate sales agent or agent who receives all or part of his or her compensation on real estate sales in the form of a salary.

Sale price: The price settled a listing or property.

Seller (owner): The owner of a property who may have signed a listing agreement or a potential listing agreement.

Exhibiting: When a listing is shown to prospective buyers or typically the buyer's agent (preview).

Special assessment: A special and additional fee to a unit in a condominium or cooperative. Also an exclusive real estate tax for improvements that benefit a property.

Talk about Association of REALTORS®: An association of REALTORS® in a exact state.

Supra®: An electronic lockbox (ELB) that holds house keys to a property. The user must have a Supra keypad to try the lockbox.

Temporarily off market (TOM): A placed property that is taken off the market due to illness, travel, expected repairs, and so on.

Temporary housing: Housing a transferee uses up until permanent housing is selected or becomes attainable.

Transaction: The real estate process from offer to ending or escrow.

Transaction management fee (TMF): A bill charged by listing brokers to the seller as part of the list of agreement.

Transaction sides: The two sides of a transaction, owners and buyers. The term used to record the number of transactions in which a real estate sales agent or broker was involved during a precise period.

24-hour notice: Allowed by law, tenants must be up to date of showing 24 hours before you arrive.

Under contract: A home that has an accepted real estate contract between seller and patron.

VA (Veterans Administration) Loan Guarantee: A guarantee on a property loan amount backed by the Department of Veterans Affairs.

Electronic tour: An Internet web/cd-rom-based video presentation of a place.

VOW's (Virtual Office web sites): An Internet based realty brokerage business model that works with real estate consumers in unique way as a brick and mortar real estate brokerage.

W-2: The Internal Revenue style issued by employer to employee to reflect recompense and deductions to compensation.

W-9: The Internal Revenue develop requesting taxpayer identification number and certification.

Walk-through: The showing before closing or escrow that permits the individuals one final tour of the property they are purchasing.

Will probably: A document by which a person disposes of his or her property once death.

0 notes

Text

Steve Jobs On The Macintosh's 20th Wedding anniversary

Recently, have a peek at this web-site was actually abuzz along with talk about a singular tweet which resulted in rather a stir. I had actually been trying to think of exactly how areas may establish power self-sufficiency as the national network facilities began to fall apart and stop working, since that is the road our team gone on. Without concerning half a trillion bucks in upgrades between now and also 2030, our existing network is destined for decrepitude. In electricity - as in so many other things - we have the best government funds can easily acquire.

Once more, Hill was actually telling crowds that Gandhi was actually certainly not just a fan of Hill's get-rich-quick works but that the famous man had hired an investigator company to observe if Hill was actually legit. For all the macintosh fans available, you can obtain a copy from the mac computer version here on heavy steam, our experts also believe pleasant at this moment to declare as well that the IOS model should be actually available in Q1 2016. Electric battery life off the 6-cell conventional battery isn't terrific, however this is actually a laptop that's most likely to invest even more of its own time on the workdesk compared to on the road.

Even though you assume they're off, TVs, computer and also virtually any kind of device along with a microchip require some juice to maintain their internal time clocks ticking, sustain settings and help them electrical power up rapidly. Anybody that is actually ever possessed an exercise partner or private instructor recognizes that entailing an additional individual in your trip to physical conditioning could drastically boost your inspiration. Jewels are actually made when you completely clear all the stages in a region for the first time and also as a Sector incentive. I actually delighted in Time Stalkers a bit more than Evolution, mainly as a result of the title's authentic ideas.

No complaint however can really interfere with exactly what a definitely advanced game this is. My companions as well as I obtained the concept to generate skateboards to utilize in class study opportunity when I was actually approximately 16 and burnt out in course. Givit is actually an Online service that lets you share online videos with pick people as opposed to having to adjust personal privacy setups. I do not believe therefore. Each one of these trends have actually been actually building for years, as well as brand-new records surfacing daily only enhances them.

Compete against player's from all around the planet through Wi-Fi or even cellular networks and also find your label and credit ratings in lightings on real-time, everyday, every week and also champions hi-score tables that are actually automatically synchronized with a central hosting server. Monday/Thursday Challanges for singular players, the activity will certainly notify you in the food selections if there are actually brand new charts to play because the final opportunity you filled the activity. If you possess the button 'OFF' the 3G apple ipad will definitely time float just like the Wi-Fi design.

Also the entry-level $200 Time combines some steel into its appeal, having said that - that frame encompassing the display is a stainless-steel accent handled along with a PVD finishing for scrape resistance and also hue. Our experts have actually gotten to the crucial tipping factor where the renewable resource alternative not merely makes sense eco-friendly and socially, however additionally economically. And also, when you remove your iphone gadget, the moment and also date environments remain on the dock.

Not just will there be actually a 3rd party license process as Gartner proposes, however I presume there will definitely be actually a solid association to overshadow processing insurance policy, as well. According to Opportunity Warner Cord, online video computer programming costs developed 4.1 percent in the second quarter, to $1.1 billion, as a result of cost boosts and greater retransmission expenses. The slow fatality of American coal possesses little to carry out with Obama-era temperature plans, as well as every thing to do with fracking, which offers a economical and bountiful power choice through natural gas. In a hunt for the best Alarm Clock app around I presume Best Alarm clock is actually a much better app!

You find, Jobs had only been actually named acting CEO in September 1997 after efficiently driving out the male that delivered him (back) in, Gil Amelio. This estimation is actually not all that precise, which is actually why Apple is eliminating it. The adjustment feels like the sort of factor that's merely meant to muteness the pesky problems, however essentially, that's reasonable to point out that there are disparities between the evaluations and also real battery life.

Long account small, these are my favorite monitors, better also in comparison to the TF10, thus your dismissal of them as phase monitors makes me presume you should devote a lot less opportunity checking out the box. Harvesting more renewable resource, store it as well as use it for designing more power storing. You accept the conditions, the phrases modification and also you aren't sure if you disagree or concede, so like Facebook everyone is actually overturned with Apple as well as certainly not also certain just what to be spilled approximately.

Energy Impact - The Electricity Effect segment shown at the bottom of Task Display's home window stands for the total volume of power made use of by all applications and other processes over a period of time. However as I stated above I simply think this customer review overlooked some essential durabilities as well as focused generally on a handful of downsides, skewing the score. And while audio top quality is treble-heavy and also somewhat tinny, this goes audible to become distinct in a moderate-sized conference room.

Even with operating the same model from Android (KitKat 4.4.2), the Workshop Electricity the good news is isn't really imprecated along with the exact same horrendous skin layer as the Vivo Sky. Likewise, when your condition federal government elevates the purchases tax, this is actually much easier to transform a solitary steady named than to ferret out the previous rate throughout your workbook. However, I assume our experts each just liked that dumb ass, movie making competition at first also. http://divategeszseg-blog.info , Wednesday: Peak from electricity-- handle one of the most difficult concerns, compose, brainstorm, schedule your Make Opportunity This is actually the application that is going to in fact spare you effort and time when keeping up with your supplies.

0 notes

Text

Clash Royale Hack Gems Gold Cheats

Today, our group is really pleased to reveal that our new Clash Royal Hack is out as well as prepared to be use online. Ways to use our Program Clash Royale Hack safely, just enter our site from your iphone apple iphone / Android/ Mac/ Pc/ Laptop device. Millions of players use our online generator worldwide without reported issues, mistakes or various other effects. More after that 250,000 Gamers have currently used our device and also till now no person have actually obtained a ban so it's even more then secure to say that our tool is secure.

Dieser Hack enthält keine schädliche Dateien. Clash Royale is new wonderful mobile video game, which has actually already come to be very popular amongst players around the globe! We made on-line web platform really easy to use, Hack is undiscovered and also deal with all gadgets that have net connection. The more time you have, the relocation clash royale gems you can get, of course. In diesem Autumn haben Sie religious woman eine Lösung gefunden.

Aber, du solltest vorsichtig sein eigene Regeln zu respektieren bevor du das machst- Freundliche Kampfe nutzen jetzt all-neu „ Competition- Criterion" degree caps, pass away King & Krone, Turme 8, Kommunal Cards 8, Epics 3 und Rares 6 sind. There's a deck of eight cards that gamers ought to be able to get in the battle as well as their bigger deck is growing at the same time as they advance as well as they'll furthermore find greater playing cards originating from the chests.

You simply should pick quantity of limitless Gold as well as treasures. It truly is a fantastic event, we might self-confident that the all round game cheat you will land to your taste. The primary currency of this video game is coins which could be made via having fun with Clash Royale Hack. 4. pick one from numerous account in the checklist, then message me to obtain complete password. Click on this link to generate Free Gems, Golds and Elixir in Clash Royale Game.

You'll get just what we guarantee within mins, so you don't should hang around or loan getting gems in App. While this source is restricted and cost loan (approximately 500 treasures for 5$), we have created a Clash Royale hack to satisfy the demands of those who cannot permit themselves the funds had to purchase treasures in order to get to the greater levels and also arenas into the video game. These video game currency coins are crucial for getting extra boost in your video game.

Also if you are playing the game for the initial time, you can still use this tool effortlessly. Hier kannst du direkt Clash Royale Cheats von deinem Smartphone oder COMPUTER aus benutzen. Do not rush in consuming your gold as well as treasures since you might obtain spotted of suspicious task, thus would certainly lead to a long-term ban in the video game. Winning in this game will certainly gain some prizes and can challange you to compete with excellent players around the globe although this video game has a limitations establish that could hinder your game development.

Clash royale hack - clash royale hack-get cost-free unlimited gems hack 2017 for ios & android. This is the reason why this device is the most efficient solution for getting unlimited treasures. Even if you are making use of a rooted ios or android tool, our rip off will always function. Otherwise, then do not loosened hope since there is an additional method, as well as this is the Clash Royale Hack. This conflict Royale hack device is assured clean and safe to use.

That can be a bit challenging, considering that you will certainly should have 5 victories to get just what you bought the top place. Hauptsache ist, dass du zwischen den Kartendecks gut balansierst. Vielleicht hast du auch schon einmal gegen jemanden verloren, der so starke Karten hatte, weil emergency room unseren Hack benutzt hat! Also, your gadget will not receive any kind of viruses.

The main focus is to accumulate cards as well as upgrade them specifically, in order to construct an extra effective deck. The hack has an option of powerful features that will assist you as a snapchat hack gamer. The treatment to utilize the hack is very simple. Countless Gold and also treasures amount is altered straight on video game server. Clash Royale gems will assist you get those points you have to stay clear of endlessly wasting time on those reduced degrees of the video game.

0 notes