#GST Training Course

Explore tagged Tumblr posts

Text

Top GST Online Certification Course | GST Courses Available in India

Explore the top GST online certification courses in India. Get your GST course certificate, learn with leading GST training institutes, and understand GST course fees and details.

#online gst course certificate#gst certification course india#gst certificate course online#gst online certification course#gst online course with certificate#gst course certificate#gst course#gst course in kolkata#gst training#gst online course#gst certification course#gst training institute#gst courses#gst course fees#gst course online#gst courses online#best gst certification course#gst training course#gst certification course online#gst diploma course online#gst courses in india#gst training course kolkata#gst course fees in kolkata

0 notes

Text

NIFM Institute in Mumbai — Best Stock Market Training Courses in Mumbai

NIFM Institute in Mumbai is the best share market classes in Mumbai for stock market trading & training. At NIFM, we’ve always been partial to independent thinkers. Where we’ll teach you not only how to trade in the share or financial market but also how to make a living out of it in our stock market courses in Mumbai. NIFM share market training programs are simple to understand and easy to follow with practical case studies in an organized manner with a systematic flow. In our stock market courses, we will teach you to learn every factor that can affect stock market industry ups and downs, when to enter or exit, money-making strategies, discipline in the stock market, and control risk and loss.

Overview of Stock Market Courses in Mumbai

Trading in the stock market is a process that requires constant thinking, analysis, and discipline. What you think and what you choose determines your success in the business.

NIFM is the pioneer institute of stock market trading courses in Mumbai. Our institution has been focusing on providing qualitative stock market trading knowledge for over a decade in India. NIFM believes in classroom & practical sessions where the interaction of experienced trainers and other participants brings out the best results and clears all doubts about the toughest topics and makes them crystal clear. NIFM has helped thousands of investors learn the skills necessary to have the ability and confidence of the pros. We are the only stock market institution having 20+ branches all over India, where 50,000+ students have done certification of stock market courses, Job oriented courses, investor & trader courses under the supervision of industry experts. We have exclusively developed job oriented courses with 100% placement assistance for those who want to make a career in the stock market. NIFM has 6+ branches or institutes for stock market courses in Maharashtra.

Services offered by NIFM — Share Market Courses in Mumbai

Here in Mumbai, NIFM is offering 20+ stock market courses with certification and 100% placement assistance in top companies. They focus on more practical (75%) training than theoretical (25%) training. Students work on practicalities with the budget in hand to get more enhanced knowledge of trades, when to buy or sell stocks, market ups, and downs. This builds more confidence in students to find out when is the best time to enter the market or the right time to invest in stocks.

NIFM has courses for all 12th pass out students, graduated students, businessmen, investors, traders, housewives, retired persons. The availability of every generation of students makes our atmosphere more interesting, where all students can learn with the life experiences of others.

Stock Market Beginners Courses: If you are a fresher or beginner in the stock market then this certification course is for you. We helped you to learn all the basics of the share market with experts and be a market expert within 3 months.

Beginners to Advance level courses: NIFM offers Diploma & Advance Diploma courses in the stock market. Learn fundamental, technical analysis, industry up and down, the best time to buy and sell stocks. These courses offer 100% job assistance.

Job Oriented Courses: NIFM has exclusively developed job oriented courses for those who want to make their careers in the financial market or the stock market. They trained students according to the best industry requirements.

Trading and Investment Courses: This is one of the best courses to become a trader or investor in the stock market.

Technical Analysis Courses: Technical Analysis not only helps you understand the profit target but also aware of the risk involved in the trade. We teach the secrets of successful traders, We teach unique ideas to trade in Intraday, Swing trade, Short term delivery, Futures & Options.

NCFM NSE certification courses: Courses for NCFM Certification exam, and exclusively developed mock test papers which covers all syllabus for the examination.

NISM SEBI certification courses: NISM Certification courses to help students to crack the examination.

Diploma in Equity Sales Certification: This course is divided into 6 modules: Capital Market Module, Derivative Market Module, Currency derivatives module, Mutual Fund Distributors module, Investment Advisor (Level 1) and Equity Sales module.

Fundamental Analysis Crash Course: This course will help to understand all these aspects analysis of data, news, events, correlation, the impact of these while trading in the stock market or investing in other market segments.

Online Stock Market Courses: NIFM also offers online courses for those who want to learn online about day trading, trading basic terminology, how online trading systems work, Forex trading, swing trading, stock prices, live trading, and the stock exchange.

Why Choose NIFM, Best Stock Market Courses in Mumbai

Depth knowledge with practical exposure

75% practical exposure, 25% theoretical exposure

Certification after completion of course

Faculties over 30+ years of experience.

We work for all-round development for the student.

Students visits in NSE, BSE, SEBI offices

100% job assistance in topmost companies

100% support given to pass out students if any updating took place in course.

Conducting regular seminars for students by experts & industry.

Some unique courses are available only with NIFM.

Advance lab equipment/software for practical training.

Stock Market Courses Free Videos

NIFM made stock market trading learning easy for you with these free videos, you can watch and learn fast and earn fast with NIFM.

Click to enjoy your free videos today!

NIFM Preferred Employers

Our clients- Axis Securities, HDFC Securities, Kotak Securities, ICICI Direct, Motilal Oswal, Standard Securities, NIIT, Tradebulls, Bajaj Capital, SMC, Angel Broking, Advisory Mandi, Indiabulls Ventures, Nirmal Bang, Safe Express, IDBI Capital, Elite Wealth, Bonanza, Karvy Stock Broking, SAS Online, Mansukh, Silver skills, Parasram, Trustline, Zerodha, Jana Bank, LKP, BLB, etc

Seminars & Workshops at NIFM MUMBAI

NIFM organized seminars, events, and workshops to get engaged with our students and keep them up-to-date according to industry requirements. Click the link to watch some glimpse of our NIFM Capital Market Conclave 2019.

Any Doubts or Enquiries?

If you have any doubts and inquiries regarding the stock market industry or want brief counseling for your course, please reach us by filling this form — Contact Us for stock market courses enquiries. Our Counselor will reach and help you to suggest the best courses for your career, investment or trading purposes.

Reach NIFM MUMBAI

We are established in a prominent location in Parel, Mumbai. It is an effortless task in commuting to our establishment as there are various modes of transport readily available. It is at Shop №6, Kingston Tower, GD Ambekar, Road, Parel East, Mumbai, Maharashtra 400033

Source of Content: https://www.nifm.in/blog-details/387/stock-market-courses-in-mumbai.php

#stock broking courses in mumbai#share market training in mumbai#share trading courses in mumbai#stock market classes in mumbai#accounting taxation course in mumbai#stock market institute in mumbai#stock trading courses in mumbai#market investment courses in mumbai#stock market courses in mumbai#share market courses in mumbai#share market classes in mumbai#trading institute in mumbai#share market coaching in mumbai#trading classes in mumbai#share market institute in mumbai#best stock market institute in mumbai#accounting & taxation courses in mumbai#gst certification course in mumbai#gst course online in mumbai#gst online classes in mumbai#gst filing course in mumbai#gst online course with certificate in mumbai#gst certification course online in mumbai#gst course in mumbai#stock market trading in mumbai#share market trading in mumbai#trading course in mumbai#stock market for beginners in mumbai#financial accounting in mumbai#online accounting courses in mumbai

2 notes

·

View notes

Text

Unlock Career Opportunities by Joining the Best GST Course in Noida at GVT Academy

Looking to kickstart or upskill your career in taxation? At GVT Academy, our Best GST Course in Noida is designed with real industry challenges in mind, ensuring practical and job-ready training. This course is perfect for students, professionals, and business owners who want to gain hands-on knowledge of Goods and Services Tax and become job-ready.

Why Choose GVT Academy?

✅ Comprehensive Curriculum – Learn everything from GST Basics, ITC, Registration, Returns, and E-Way Bill to advanced concepts like Audit, Refunds, TDS, and E-commerce taxation. ✅ Real-time Practical Training – File real client data on GST Portal, Tally, and BUSY software with expert guidance. ✅ Includes Income Tax & TDS Modules – Understand personal taxation, ITR filing, TDS returns, exemptions, and much more. ✅ Exclusive Tally + BUSY Training – Learn to generate GSTR reports, TDS returns, and balance sheets directly in accounting software. ✅ Finalization & Banking Module – Gain advanced skills in balance sheet creation, CMA data, project reports, and tax planning.

Learn from experienced faculty and get certified training that enhances your resume and boosts your career growth!

Flexible Timings: 📌 Weekday and Weekend Batches Available 📌 Morning and Afternoon Slots

Join GVT Academy today and become a certified GST expert! Limited Seats – Book Your Spot Now!

1. Google My Business: http://g.co/kgs/v3LrzxE

2. Website: https://gvtacademy.com

3. LinkedIn: www.linkedin.com/in/gvt-academy-48b916164

4. Facebook: https://www.facebook.com/gvtacademy

5. Instagram: https://www.instagram.com/gvtacademy/

6. X: https://x.com/GVTAcademy

7. Pinterest: https://in.pinterest.com/gvtacademy

8. Medium: https://medium.com/@gvtacademy

#gvt academy#gst course#e accounting#data analytics#advanced excel training#data science#python#sql course#advanced excel training institute in noida#best powerbi course#power bi#advanced excel

0 notes

Text

Why Woking Individuals Need The Best Income Tax Course Online?

Working professionals worldwide struggle to make sense of taxes imposed on them. And they are not alone; most salaried persons are confused when it comes to filing their tax returns, claiming deductions, or absorbing the complexities of new tax laws. Without the proper knowledge, there is a chance you could be overpaying or foregoing some important benefits. That is why enrolling in the best income tax course online can be life-changing. It bestows upon you the power to control your own money and confidently manage your taxes. Learned tax skills are the keys to everywhere else in this world of knowledge. The reasons each working person needs them are listed below.

Knowledge of Taxation Saves You Money

One must know that taxes can be paid on time and can also be saved. Once you know which deductions or exemptions apply to you, you will be avoiding enormous taxation. Selecting the best online income tax course will teach you how to save legally and wisely. Handle salary slips, investments, HRA, and more. It will help you in better planning and retaining a larger percentage of the money you earn.

Freedom from Dependence on Others

Many people will tend to give their tax returns to agents or friends to do on their behalf. This puts them at risk for errors and even missing filing deadlines. Proper training enables you to file returns by yourself. It is straightforward and unbelievably easy when rightly explained. The best online income tax course walks you through the steps confidently so that you are able to do it without anyone's assistance.

Embedded Amidst Life Rushing Through One's Working Hours

Study at your convenience with online courses. Classes are in session on the weekends and during most breaks or down at night. An hour-long commute is just not one of its priorities. The courses are easy to follow with videos, PDFs, and even live sessions. A certificate is given to support the file of a resume.

Conclusion

Every working person should understand taxes. This is not just to save money; it is really to become financially free. The best online income tax course equips you with all the tools necessary. You will be able to move forward with confidence, save more, and even consider additional avenues for career growth.

Are you looking on Google for the best-chartered accountant for the best income tax course online? If yes, you can choose RTS Professional Study experts. You can contact us at 7530813450 or email us at [email protected]. We are available 24/7 to help you out and grow your business.

Resources: https://rtsprofessionalstudyindia.wordpress.com/2025/05/28/why-woking-individuals-need-the-best-income-tax-course-online/

#gst registration service#income tax certification course#partnership firm registration services#gst filing training

0 notes

Text

Top Reasons to Learn Tally with GST in 2025: A Career Booster for Commerce Students

In 2025, the demand for skilled accountants and finance professionals continues to grow — and one of the best ways for commerce students to boost their career prospects is by learning Tally with GST. Whether you're a recent graduate or still studying, mastering Tally ERP with GST opens doors to job-ready opportunities in the accounting world.

1. High Demand Across Industries Almost every business, from small startups to large enterprises, uses Tally for managing accounts, inventory, payroll, and GST compliance. A certified Tally GST expert is always in demand, especially in thriving commercial cities like Vadodara.

2. Practical Accounting Knowledge Enrolling in a Tally GST course in Vadodara equips students with real-world skills such as GST filing, voucher entry, and final account preparation. It’s more than just software—it's a complete learning experience in modern accounting.

3. Affordable and Quick to Learn Most Tally GST classes in Vadodara are short-term, affordable, and focus on practical training. This makes it perfect for students looking to upskill quickly without long-term commitment.

4. Ideal for Freelancers and Entrepreneurs If you're planning to freelance or start a business, Tally GST in Vadodara gives you the confidence to manage your own accounts and ensure GST compliance without external help.

5. Strong Resume Booster Employers are actively hiring candidates with software and tax knowledge. A certification from a reputed Tally GST training institute in Vadodara like Bright Computer Education can give your resume a strong edge.

Join the best Tally GST classes in Vadodara today and take the first step toward a successful career in accounting and finance!

#tally gst classes in vadodara#tally gst course in vadodara#Tally GST in Vadodara#tally gst training institute in vadodara#best tally gst classes in vadodara

0 notes

Text

Your Path to Tally Mastery, at DICS

In the digital age, businesses are rapidly shifting from traditional bookkeeping to modern accounting software — and Tally stands out as the most trusted platform. If you’re looking to master Tally and elevate your accounting career, enrolling in the Best Tally Course in Laxmi Nagar is your smartest move.

Why Tally is a Must-Have Skill

Tally isn’t just another accounting software. It’s the lifeline of small to mid-sized businesses, helping manage everything from financial accounting and taxation to payroll and inventory. Learning Tally gives you the power to manage real-world business finances efficiently, whether you work for a firm or run your own business.

From GST compliance to balance sheet generation, Tally simplifies complex processes and ensures accurate reporting. That’s why skilled Tally professionals are in high demand in every industry.

Discover the Best Tally Course in Laxmi Nagar

Our institute offers the Best Tally Institute in Laxmi Nagar, carefully designed for beginners and professionals alike. The course curriculum is aligned with industry standards and includes:

Tally Prime fundamentals

GST implementation

Inventory and billing system

Payroll processing

Cost centers and budgets

Advanced reporting & MIS

Each student receives personal attention and practical training through live projects. We go beyond classroom teaching to ensure you gain real accounting experience.

What Makes Us the Best Tally Institute?

We believe quality education is the key to success. As the Best Tally Institute in Laxmi Nagar, we offer:

Certified and experienced faculty

Hands-on training with real-time scenarios

Job-oriented modules

Placement support and career guidance

Official Tally certifications

Affordable fee structure with installment options

Our goal is not just to teach software, but to create confident and skilled professionals who can thrive in a competitive job market.

Who Should Join?

This course is ideal for:

Commerce students and graduates

Working professionals in finance

Entrepreneurs and business owners

Anyone looking to switch to an accounting career

Start Your Journey Today

Accounting is the backbone of any successful business, and Tally is your gateway into that world. Don’t miss the opportunity to learn from the best. Enroll today at the Best Tally Institute in Laxmi Nagar and unlock a rewarding career with the Best Tally Course in Laxmi Nagar.

0 notes

Text

Accounting Academy in jaipur

1 note

·

View note

Text

http://cacms.in/quickbooks/

Quickbook training course | Quickbook training in Amritsar - CACMS

CACMS Quickbook training course will get the candidates well versed with latest accounting techniques and tools and will help them work efficiently and easily by mastering this tool. Get best Quickbook training in Amritsar.

0 notes

Text

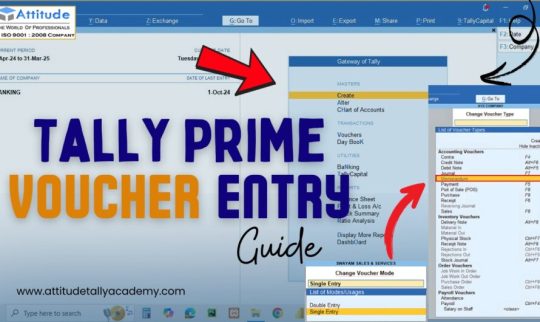

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

GST Course in Delhi, "Learn Direct Tax Code 2025" 110075, NCR by SLA. GST and Accounting Institute, Taxation and ERP Tally Prime Institute in Delhi, Noida, "Free SAP FICO till 31 March 2025" [ Learn New Skills of Accounting & SAP Finance for 100% Job] in SBI Bank

Mastering GST Certification Course by SLA Consultants India

Learn Comprehensive Guide to GST Returns by CA Trainer of SLA Institute

The Goods and Services Tax (GST) is a crucial aspect of India’s indirect tax system, requiring businesses to comply with various return filings. Understanding these returns is essential for accurate tax reporting and avoiding penalties. In this SLA Institute blog, we will cover the key GST returns, their importance, and the consequences of late filing. GST Course in Delhi

Understanding GST Returns

GST returns are periodic statements that registered taxpayers must file to declare their tax liabilities and claim input tax credits. Here’s a detailed look at the various GST returns:

1. GSTR-1: Outward Supplies Details

GSTR-1 is a monthly or quarterly return that captures details of outward supplies of goods and services. It helps the government track sales transactions and input tax credit claims.

“Get Live Practical Classes on GST Portal in SLA Consultants India”

GST Course in Delhi, "Learn Direct Tax Code 2025" 110075, NCR by SLA. GST and Accounting Institute, Taxation and ERP Tally Prime Institute in Delhi, Noida, "Free SAP FICO till 31 March 2025" [ Learn New Skills of Accounting & SAP Finance for 100% Job] in SBI Bank.

2. GSTR-2A & GSTR-2B: Auto-Generated Invoices for Recipients

GSTR-2A is an auto-drafted statement reflecting invoices uploaded by suppliers. Taxpayers can use this to verify input tax credits.

GSTR-2B is a static statement that provides a summary of eligible and ineligible input tax credits, helping taxpayers in ITC reconciliation.

“Get Live Practical Classes on GST Portal by CA from SLA Consultants India”

3. GSTR-2: Details of Inward Supplies (Currently Suspended)

GSTR-2 was designed to capture inward supplies of a taxpayer, but it has been suspended since the introduction of GSTR-2A and GSTR-2B.

4. GSTR-3 & GSTR-3B: Monthly Tax Summary & Payment

GSTR-3 (Currently Suspended) was meant to be a monthly tax return summarizing sales, purchases, and tax liabilities.

GSTR-3B is a simplified monthly return where taxpayers report summarized tax liabilities and input tax credits. It is mandatory for all regular taxpayers.

5. GSTR-4: Composition Scheme Taxpayers

GSTR-4 is an annual return filed by businesses under the composition scheme, which allows small businesses to pay a fixed percentage of turnover as tax.

6. GSTR-5 & GSTR-5A: Non-Resident & OIDAR Service Providers

GSTR-5 is for non-resident taxable persons who conduct business in India.

GSTR-5A is for Online Information and Database Access or Retrieval (OIDAR) service providers supplying services to unregistered Indian consumers.

7. GSTR-6: Input Service Distributor (ISD)

GSTR-6 is filed by Input Service Distributors to distribute input tax credit among their branches. GST Training Course in Delhi

8. GSTR-7: Tax Deduction at Source (TDS)

GSTR-7 is filed by entities required to deduct TDS under GST, mainly government departments and large businesses.

9. GSTR-8: E-Commerce Operators

E-commerce operators file GSTR-8 to report tax collected at source (TCS) on transactions conducted through their platforms.

10. GSTR-9, GSTR-9A & GSTR-9C: Annual Returns & Audit

GSTR-9 is the annual return summarizing all monthly/quarterly returns filed during the year.

GSTR-9A is for composition taxpayers but has been waived for certain years.

GSTR-9C is a reconciliation statement and audit report for businesses with an annual turnover exceeding ₹5 crore.

“Get Live Practical GST Certification Course in Delhi on GST Portal in SLA Institute”

11. GSTR-10: Final Return for Canceled GST Registration

GSTR-10 is filed by taxpayers whose GST registration has been canceled or surrendered, providing final tax details.

12. GSTR-11: Special Returns for UIN Holders

GSTR-11 is filed by foreign diplomatic missions and embassies to claim GST refunds on purchases made in India.

Consequences of Late Filing of GST Returns

Filing GST returns after the due date attracts penalties and interest:

Late Fee: ₹50 per day (₹25 CGST + ₹25 SGST) for normal taxpayers, and ₹20 per day (₹10 CGST + ₹10 SGST) for NIL returns.

Interest: 18% per annum on the outstanding tax liability.

Restriction on ITC Claims: Late filers may lose access to input tax credits.

Suspension of GST Registration: Continuous non-compliance may lead to suspension or cancellation of GST registration. GST Training Institute in Delhi

Conclusion

Staying compliant with GST return filing is crucial for businesses to avoid penalties and ensure smooth tax operations. Taxpayers should stay updated with GST norms, maintain proper records, and file returns on time to remain compliant. If needed, professional assistance can help in managing GST efficiently.

For more insights on GST compliance, keep following our blog!

GST(Goods and Services Tax) Training Course Modules Module 1 - GST- Goods and Services Tax- By Chartered Accountant- (Indirect Tax) Module 2 - Income Tax/TDS - By Chartered Accountant (Direct Tax) Module 3 - Finalization of Balance sheet/ preparation of Financial Statement- By Chartered Accountant Module 4 - Banking and Finance Instruments - By Chartered Accountant Module 5 - Customs / Import and Export Procedures - By Chartered Accountant

0 notes

Text

Scope Computers

Master Tally with Our Prime Tally Course! 🎓

Learn Tally from basics to advanced, including GST, payroll, and financial reporting. Perfect for students, professionals, and business owners.

✅ Hands-on Training ✅ Expert Guidance ✅ Certification Included

📅 Enroll Today and Elevate Your Accounting Skills

#tally#tallyprime#tallyeducation#tally course#tally training#financialaccounting#tally expert#tally certification#payroll management#skill development#boost your career#gst training

0 notes

Text

Top GST Accounting Course in Kolkata 2024

Are you looking for the best gst training online course from the leading gst training institute in Kolkata? visit George Telegraph Institute Of Accounts now and know your course fees details.

#certified gst course#certification course on gst#gst course#course on gst#gst accounting course#certificate course in gst#gst courses in kolkata#gst training online#gst training#gst certification course#gst course in kolkata#gst training institute#gst courses#gst course online#gst training course#gst courses online#best gst certification course#gst taxation course#gst and taxation course#taxation and gst course#gst and taxation course near me

0 notes

Text

Learn GST online with our comprehensive online course. Learn the fundamentals of Goods and Services Tax, GST registration, filing, and compliance from industry experts at S20.in. Enroll now to gain practical insights and boost your career!

1 note

·

View note

Text

Want to Become a GST Expert in 2025?

GST isn’t just a tax update—it’s a powerful boost for your career path! If you're dreaming of becoming a certified GST practitioner, tax consultant, or accounts executive, then this is your moment. Step into the world of taxation with GVT Academy’s Best GST Course in Noida — expertly crafted to make you industry-ready from day one.

🔥 What Makes Our GST Course the Best in Noida?

✅ Includes every essential concept and detail related to GST From GST basics, registration, returns, ITC, e-way bill, to refunds—our course covers ALL 174 GST sections with 100% practical implementation.

✅ Income Tax + TDS Training Included Learn to file ITRs under all heads—Salary, Business, Capital Gains & more using real offline utilities.

✅ Tally + BUSY Mastery Become a pro in GST-enabled accounting software. Gain hands-on skills in GSTR filing, reconciliation, and ledger auditing using Tally and BUSY software.

✅ Live Client Data Practice No boring theory. We train you on real data with actual return filings, so you learn exactly what the job demands.

✅ Finalization of Balance Sheet & Tax Planning Learn how to finalize books like a CA, avoid tax scrutiny, and prepare CMA/project reports to impress your future employers.

🎓 Who Should Join? Students, working accountants, tax consultants, freelancers, or anyone who wants a high-paying, future-proof career in finance.

🎯 If you're looking for the Best GST Course in Noida with a real chance at career growth, practical skills, and job opportunities, GVT Academy is where your future begins.

1. Google My Business: http://g.co/kgs/v3LrzxE

2. Website: https://gvtacademy.com

3. LinkedIn: www.linkedin.com/in/gvt-academy-48b916164

4. Facebook: https://www.facebook.com/gvtacademy

5. Instagram: https://www.instagram.com/gvtacademy/

6. X: https://x.com/GVTAcademy

7. Pinterest: https://in.pinterest.com/gvtacademy

8. Medium: https://medium.com/@gvtacademy

#gvt academy#gst course#data analytics#advanced excel training#data science#python#sql course#best powerbi course#power bi#gst services

0 notes

Text

Looking for the best GST return filing online course? You are in the right place. The Course covers How to prepare & Claim GST Refund from the Basic to Advanced level, covering all Taxation parts related to GST Refund, legal aspects, major compliances and Procedures. Join today! For more information, you can call us at 7530813450.

#gst registration service#income tax certification course#best income tax course#partnership firm registration services#gst filing training#basic gst course online#best income tax course online#best income tax preparation courses

0 notes