#Taxation Course

Explore tagged Tumblr posts

Text

Learn Taxation with Real-Life Examples | Join Online Today

Taxation Course Online – ऑनलाइन टैक्सेशन कोर्स से करियर बनाएं

💼 Why Choose a Taxation Course Online? – टैक्सेशन कोर्स ऑनलाइन क्यों करें?

आज के time में online taxation course बहुत demand में है। Students और working professionals दोनों ही इसे करना चाहते हैं।

क्योंकि यह course comfort के साथ flexibility भी देता है। इसके ज़रिए आप घर बैठे ही tax laws, GST, TDS जैसी चीजें सीख सकते हैं।

🎯 Scope of Taxation Course Online – टैक्सेशन ऑनलाइन कोर्स का स्कोप

India में tax professionals की ज़रूरत हर industry को है। चाहे वो private firm हो या government office, हर जगह tax experts की ज़रूरत होती है।

Online taxation course से आप finance, accounts, और auditing field में jobs पा सकते हैं। इससे freelancing opportunities भी खुल जाती हैं।

🏫 Top Institutions Offering Online Taxation Courses – प्रमुख संस्थान जो टैक्सेशन कोर्स ऑफर करते हैं

कुछ famous institutes जो ये course online mode में offer करते हैं:

The Institute of Professional Accountants (IPA) – Certified taxation programs in Hindi-English mix

NIIT – GST and Income Tax specialization

Coursera/EdX – International level content with certificates

इन platforms पर आपको recorded और live classes दोनों का access मिलता है। साथ ही downloadable study material और doubt-clearing sessions भी मिलते हैं।

📘 What You Learn in Taxation Course Online – टैक्सेशन कोर्स में क्या सिखाया जाता है?

Online course content काफी detailed होता है। यह syllabus को छोटे-छोटे modules में divide किया जाता है।

Main topics include:

Income Tax Act और उसका implementation

GST (Goods and Services Tax) की पूरी प्रक्रिया

TDS & TCS rules

Return filing through online portals

Assessment procedures और penalties

हर topic को real-life case studies के साथ समझाया जाता है। इससे समझने में आसानी होती है और practical knowledge भी बढ़ती है।

🧑🏫 Who Should Do This Course? – कौन-कौन कर सकता है टैक्सेशन कोर्स ऑनलाइन?

अगर आप commerce background से हैं, तो ये course आपके लिए perfect है। लेकिन इसका मतलब ये नहीं कि दूसरे stream वाले नहीं कर सकते।

Students, accountants, business owners, CA aspirants – सभी लोग ये course कर सकते हैं। Even housewives भी इसे part-time सीखकर freelancing start कर सकती हैं।

💻 Benefits of Online Taxation Course – ऑनलाइन टैक्सेशन कोर्स के फायदे

Flexibility – आप कभी भी, कहीं से भी सीख सकते हैं।

Affordability – Offline course के मुकाबले ये सस्ता होता है।

Updated Syllabus – नए amendments और rules पर आधारित content होता है।

Career Growth – Promotions और better salary opportunities भी बढ़ जाती हैं।

साथ ही कई platforms आपको placement assistance भी offer करते हैं। ये आपको job ढूंढ़ने में मदद करता है।

📅 Duration and Fees – कोर्स की अवधि और फीस

Course की duration average 3 से 6 months तक होती है। कुछ fast-track programs 1 month में भी complete हो जाते हैं।

Fees normally ₹5,000 से ₹25,000 के बीच होती है। Depends करता है course के level और institute पर।

💼 Job Roles After Taxation Course – टैक्सेशन कोर्स के बाद कौन-कौन सी Jobs मिल सकती हैं?

Taxation course online करने के बाद आप नीचे दिए गए roles में काम कर सकते हैं:

Tax Consultant – Individuals और companies को tax advice देना

GST Practitioner – GST registration, return filing व compliance में expert

Income Tax Return (ITR) Expert – Salaried और business ITRs prepare करना

Tax Analyst – Companies के लिए tax reports और projections बनाना

Accounts Executive – Accounting और tax management का combo role

इन roles की demand हर financial year में बढ़ती जाती है। इसलिए taxation skill हमेशा relevant रहेगी।

📚 Certifications You Get – कोर्स पूरा करने पर क्या सर्टिफिकेट मिलता है?

हर reputed institute completion पर आपको digital या hardcopy certificate देता है। कुछ institutes government-recognized certification भी offer करते हैं।

ये certificate आपके resume में value add करता है। और job interviews में आपके knowledge को validate करता है।

🌍 Language of Instruction – कोर्स की भाषा

Most online taxation courses bilingual होते हैं – English और Hindi में। इससे students को अपनी comfortable language में सीखने में मदद मिलती है।

IPA जैसे institutes pure Hindi-English mixed format offer करते हैं। इससे beginners को content grasp करने में दिक्कत नहीं होती।

📲 Tools and Software You Learn – कौन-कौन से software सीखते हैं?

Taxation course online में practical tools की knowledge भी दी जाती है:

Tally ERP 9 / Tally Prime for GST

Income Tax Portal for ITR filing

GSTN Portal for monthly filings

Excel में tax sheets बनाना भी सिखाया जाता है

इन skills की मदद से आप actual work में जल्दी expert बन सकते हैं।

🔗 Sources of Authentic Information – विश्वसनीय जानकारी के स्रोत

Taxation course में reference लिए जाते हैं इन authentic sources से:

Income Tax Department

GSTN Portal

CBIC circulars & notifications

ICAI और ICMAI जैसे bodies के publications

इनसे आपको सही और updated जानकारी मिलती है।

👨👩👧👦 Who Offers the Best Course in Delhi/NCR? – दिल्ली में सबसे अच्छा टैक्सेशन कोर्स कौन कराता है?

Delhi में "The Institute of Professional Accountants (TIPA)" top ranking institute माना जाता है। TIPA के courses practical और industry-oriented होते हैं।

Address: E-54, 3rd Floor, Metro Pillar No. 44, Laxmi Nagar, Delhi 110092 Phone: 9213855555 Website: www.tipa.in

यहां पर आपको placement support, bilingual classes, और GST training भी मिलेगी।

🎯 Conclusion – निष्कर्ष

अगर आप accounting या finance field में career बनाना चाहते हैं, तो Taxation Course Online आपके लिए एक smart choice है।

यह ना सिर्फ career options बढ़ाता है, बल्कि आपको self-employed बनने का मौका भी देता है।

अब जब दुनिया online हो रही है, तो learning भी online ही best तरीका बन चुका है।

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

✅ Learn GST Step-by-Step – Lifetime Access & Support

📣 New GST Course for Beginners & Professionals!

Master GST with our easy-to-follow digital course: 🔹 Lifetime Access & Expert Support 🔹 Free Regular Updates (as per the latest GST laws) 🔹 Step-by-Step Guide: GST Registration, Income Tax Filing & Compliance 🔹 Certificate of Completion

🎯 Perfect for accountants, business owners, students & professionals. 🚀 Boost your career & stay GST compliant! 📚 Enroll Now – Launching Soon!

0 notes

Text

Take the First Step Towards Your Accounting Career!

Don't wait for the perfect moment—create it! join Ready Accountant and put off your "fresher" tag with our professional-led training. Attend our unfastened demo magnificence nowadays and kickstart your journey toward a successful accounting profession. We provide Accounting and Taxation course in a 100% practical way.

0 notes

Text

Affordable Diploma in Taxation Courses for Working Professionals

Why Pick a Confirmation in Diploma in Taxation course ?

Tax collection is a consistently developing field, with new regulations and guidelines presented habitually. Seeking after a Confirmation in Diploma in Taxation course guarantees that people stay refreshed with the most recent expense strategies while fostering the skill expected to explore complex monetary frameworks.

Key Advantages of the Diploma in Taxation course

Particular Information

The course gives top to bottom preparation in charge regulations and consistence, assisting understudies with creating specialty abilities.

Profession Potential open doors

With organizations and people continually looking for charge experts, this confirmation opens ways to an assortment of rewarding position jobs.

Speedy and Down to earth Training

As a transient program, it centers around down to earth parts of tax collection, empowering understudies to apply their insight promptly in the work environment.

Innovative Benefit

Business people and entrepreneurs can profit from this course by acquiring experiences into charge arranging and consistence, lessening their dependence on outer experts.

Proficient Development

For experts currently in the money area, this recognition goes about as a venturing stone to advancements and higher obligations.

Who Can Seek after a Certificate in Diploma in Taxation course ?

This course is reasonable for a large number of people, including:

Trade Graduates: Understudies with a foundation in business who need to work in tax collection.

Finance Experts: Bookkeepers, inspectors, and monetary counsels looking to improve their duty information.

Entrepreneurs: Business people hoping to deal with their organizations’ expense consistence.

Regulation Alumni: People inspired by corporate regulation and tax assessment related legitimate issues.

Educational plan of a Confirmation in Diploma in Taxation course

The educational program of a Certificate in Diploma in Taxation course is intended to cover all fundamental parts of tax assessment, guaranteeing that understudies gain both hypothetical and down to earth information.

Center Subjects Covered

Personal Duty

Rudiments of annual assessment regulations

Charge estimation and documenting

Charge exclusions and derivations

Corporate Tax collection

Tax collection for organizations and associations

Consistence with corporate duty regulations

Understanding expense reviews and appraisals

Labor and products Duty (GST)

Prologue to GST and its structure

GST enlistment and documenting process

GST returns and discounts

Worldwide Tax assessment

Charge arrangements and twofold tax assessment aversion arrangements (DTAAs)

Cross-line tax assessment approaches

Charge Arranging and The board

Viable expense saving techniques

Monetary anticipating people and organizations

Commonsense Applications

Contextual investigations on charge questions and goals

Involved insight with charge documenting programming

Profession Possibilities Subsequent to Finishing a Recognition in Diploma in Taxation course

Finishing a Recognition in Tax collection course can prompt an assortment of compensating vocation open doors in various areas. Here are the absolute most well known jobs for graduates:

1. Charge Expert

Assist people and organizations with conforming to burden guidelines and plan their funds really to limit charge liabilities.

2. Charge Expert

Break down monetary information and get ready reports connected with charge consistence and appraisals.

3. Charge Reviewer

Direct reviews to guarantee associations agree with charge regulations and keep away from punishments.

4. GST Professional

Work in GST-related matters, including enlistment, documenting, and consistence.

5. Corporate Duty Consultant

Give master counsel to organizations on corporate duty arranging and consistence.

6. Charge Supporter

Address clients in charge debates and legitimate issues connected with tax assessment.

7. Finance Chief

Take on an administrative job in monetary preparation and expense the executives for organizations.

Abilities Created Through the Course

Aside from hypothetical information, a Certificate in Tax collection course assists understudies with creating fundamental abilities, for example,

Logical reasoning and critical thinking

Tender loving care and exactness

Capability in charge programming and apparatuses

Correspondence and client the board

Consciousness of current monetary regulations and patterns

The most effective method to Pick the Right Organization for a Confirmation in Tax collection Course

While choosing an establishment to seek after this recognition, think about the accompanying elements:

Certification and Notoriety

Guarantee that the organization is perceived and has a decent history of conveying quality instruction.

Experienced Staff

Search for courses instructed by industry specialists and experienced experts.

Down to earth Preparing

Check assuming that the program remembers hands-for preparing, contextual analyses, and genuine applications.

Position Backing

Pick foundations that offer situation help and have a decent organization with organizations in the money area.

Adaptable Learning Choices

On the off chance that you’re a functioning proficient, think about programs that offer on the web or parttime classes.

End:

A Certificate in Diploma in Taxation course is a great decision for people who need to construct an effective profession in tax collection and money. The course gives particular information, reasonable abilities, and vocation adaptability, making it a significant interest in your expert process.

Whether you are a new alumni or an accomplished proficient, this certificate can assist you with upgrading your vocation possibilities, increment your procuring potential, and secure yourself as a specialist in the field of tax collection.

Venture out today by signing up for a Certificate in Tax collection course and open a universe of chances in the dynamic and compensating space of money and tax collection.

IPA offers:-

Accounting Course , Diploma in Financial Accounting , Accounting and Taxation Course , GST Course , Basic Computer Course ,Payroll Course, Tally Course , Advanced Excel Course , One year course , Computer adca course

0 notes

Text

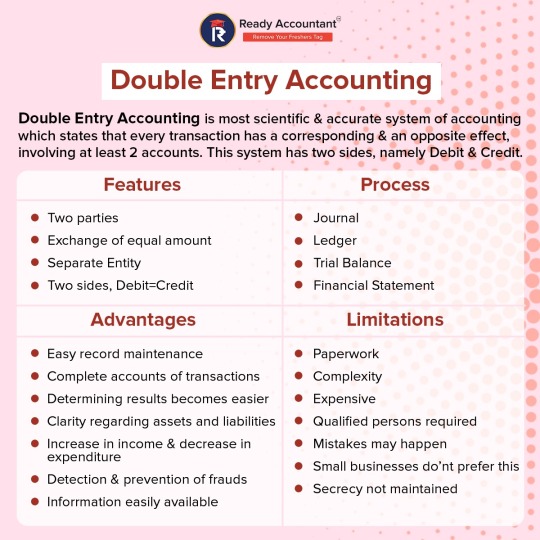

Master the concepts of Double Entry Accounting: Learn its features, processes, advantages, and limitations to enhance your financial expertise and keep track of all the transactions accurately. Excellent for aspiring accountants and finance professionals! For more details visit: Ready Accountant

1 note

·

View note

Text

The key differences between Assets and Liabilities: From ownership and revenue generation to obligations and financial calculations, this guide breaks down the essentials for financial clarity.

If you want to know more visit: Ready Accountant

#accounting course#gst course#taxation course in kolkata#gst course in kolkata#tally course#taxation course

0 notes

Text

Understand the simple rules of Debit and Credit:

Understand easily the Simple Rules of Debit and Credit to go about managing Assets, Expenses, Liabilities, and Capital efficiently. Improve your accounting skills now!

For more details visit: https://readyaccountant.com/

#accounting course#accounting course in kolkata#taxation course#taxation course in kolkata#gst course#tally course

0 notes

Text

Mastering double-entry accounting is essential to optimum financial management and record-keeping. Check out these tips to help you master and excel in double-entry accounting. Ready Accountant Your one-stop shop for on-the-job experience in Live Projects related to Accounting, GST, Taxation and ROC.

For more details visit: https://readyaccountant.com/

#accounting course#taxation course#gst course#tally course in kolkata#tally course#gst course in kolkata

0 notes

Text

Mastering Accounting and Bookkeeping in 2024:

Accounting and bookkeeping are must-haves for organizations in this very volatile financial environment. The year 2024 provides a bundle of technological advantages and regulatory changes. In this context, businesses and professionals must update with modern Accounting and Bookkeeping Rules. This book covers new trends and emphasizes the need for professional training under courses such as Tally Course, Taxation Course, Accounting Course in Kolkata, and GST Course in order to outshine them.

Accounting and Bookkeeping :

The Bedrock of Financial Management Accounting and bookkeeping constitute the bedrock of accounting for recording and interpreting financial performance. While bookkeeping deals with the precise calculation of transactions through a daily ledger, accounting further translates data into action.

Important factors to watch out for in 2024 are:

Automation: Software like Tally Prime streamlines processes and cuts down on errors. Regulatory Changes: Relating to GST, income tax, and international standards requires vigilance. Globalization: Companies having an international vision must implement IFRS for themselves.

To face such problems, professionals can take up specific courses like accounting courses or Tally course to build hands-on experience.

TOOLS TO BE EMPLOYED

Basic Accounting and Bookkeeping Practices in 2024

A. Accuracy True records are the root of proper book keeping. Training platforms like Tally Prime under a Tally Course in Kolkata assist one in developing a method of minimal error handling and maximizes efficiency for one .

B. Tax Compliance Knowing and keeping up to date with the changes in tax laws, such as GST, is crucial. Training through a GST Course or Taxation Course makes it abreast of knowledge and ensures continued compliance on an err-free basis.

C. Entity Separation Separation of personal and business finances is one characteristic that makes all transactions transparent and legally clear. It is one of the most basic accounting rules that a business should follow.

D. Comply with International Standards If your business is international, then compliance with IFRS will increase credibility and attract easy entry into global markets. Specialized accounting courses offer extensive knowledge of these worldwide standards.

E. Reconcile Periodically Audits and reconciliations are done frequently, which prove useful for them to detect discrepancies in time and prevent fraud. Training on tools like Tally Prime allows one to work proficiently in conducting such tasks.

3. Technological Innovation that Transforms Accounting

A. Automation and AI AI-driven tools change the face of predictive analytics and the detection of fraud. Courses like this Tally Course introduce trainees to integrating AI in accounting workflow.

B. Cloud-Based Solutions Cloud accounting provides access to financial information from anywhere while being secure. Most modern accountants have to learn how to use these tools.

C. Blockchain Blockchain technology enables tamper-proof records, which increases the level of transparency and trust in financial reporting.

D. Digital Tax Filing Digitized tax-filing platforms for taxes assist in making compliance easy. A GST Course equips one with hands-on experience on how to prepare GST returns effectively.

Overcoming Compliance Issues A. Coping with Change

Tax laws are changing all the time, and the process may sometimes be overwhelming. Courses, such as the Taxation Course in Kolkata or GST Course, help one keep in the times.

B. Securing Digital Accounting

Digital accounting requires strong cybersecurity. Secure practices training is needed in order to secure sensitive data.

C. Skills Gap Modern skills require modern techniques. The Tally Course or Accounting Course equips one to fulfill the industrial needs.

Benefits of Updated Rules

Proper Planning: The correct set of data helps in appropriate budgeting and forecasting. Strict Control: Laws should be followed without punitive measures and to gain authenticity Professional Training: Professional training leads towards high-value career prospects. Improved Transparency: Transparent financials are a source of stakeholder confidence. This is all about the steps to implement modern accounting rules.

6. Steps to Implement Modern Accounting Rules

Adoption of Advanced Tools The adoption of Tally Prime helps the firm operate efficiently and become more accountable.

Upskilling Teams Instruct the employees to take courses related to Tally Course and GST Course.

Periodical Audits It is essential to check for compliance and at the same time pick any kind of anomaly through regular review.

Be Updated: You have to sign up for an Accounting Course such that you are updated with the new and recent trends.

Use Expert Support: You can seek support from those experts who are professionalized in this domain or undergo advanced training courses for guarantee. Different Methods by which You will Follow the New Accounting and Bookkeeping Standard for 2024

How to be in Compliance With New Accounting and Bookkeeping Regulations of 2024

The new accounting and bookkeeping rules of 2024 overwhelm businesses, but there is a proper way to ensure that compliance with them becomes seamless. Here's how you can adapt to changes well:

Track the Regulatory Changes Stay updated on the latest changes in rules for accounting and book-keeping. You could read credible newsletters, participate in webinars, and follow some reliable financial blogs for this purpose. Education means that you will be equipped with the latest requirements on compliance at all times. End

Use Accounting Software Modern accounting software makes the difference. Automation helps save time and reduces human error. Update frequency should be a choice-criterion of the software as it shall help follow the changes made in regulations. Accuracy would also be enhanced through automation, and so will be the possibility of compliance.

Consultant Expertise While managing compliance proves relatively challenging in the absence of particularized skills, the employment of a professional accountant ensures that books are quite accurate and up to date. An experienced accountant can provide insights into the financial health of a business while ensuring one is in compliance with the latest rules.

Regular audit of financial records Provide frequent checks of your financial statements so you can detect any errors or mismatches before such inconsistencies become serious issues. Regular audits also ensure that your operations are within the new regulatory regime, thus not facing penalized consequences for non-compliance.

Capitalize on Improved Information and Communication Technology Facilities Cloud application and document management technologies make it more efficient to store and retrieve your records. These systems ensure secure storage and recording, efficient tracking, and fulfillment of newly promulgated regulations on data management.

Steps can thus be taken by the various businesses to not only keep up with new rules but also make accounting stream line and easier for better financial management 2024.

Conclusion

Accuracy, adherence, and utilization of technology in playing accounting and bookkeeping games will be at the center of learning in 2024. Any business or professional who specializes in these most important disciplines can thrive in competitive markets. Expanding knowledge by taking a Tally Course, Accounting Course, and GST Course in kolkata can help one keep better abreast of industry requirements and guaranteed financial success. Follow these strategies confidently as you negotiate this rapidly changing world of accounting.

0 notes

Text

Certified Corporate Taxation Course - Income Tax, GST

India's most demanding corporate accounting program with the top company's accounting real data hands-on experience on GST course, Taxation course and more.

0 notes

Text

Best Tally Courses for Accounting Professionals

In now a days competitive enterprise landscape, accounting professionals need advanced talents and specialized understanding to control financial statistics correctly. Tally, one of the most extensively used accounting software, performs a critical position in streamlining financial management, taxation, and inventory manage. whether or not you're an aspiring accountant or an skilled professional seeking to improve your talents, enrolling in the high-quality Tally course for Accounting specialists can extensively increase your profession possibilities.

Why Tally is crucial for Accounting Specialists

Tally software is widely used in various industries for accounting, payroll control, taxation, and financial reporting. With increasing compliance requirements, specialists with Tally expertise are in high call for.

studying Tally can help you:

Control monetary transactions successfully

Generate invoices and reports

Handle GST calculations and submitting

Music stock and payroll

Make sure tax compliance with updated guidelines

To master these functionalities, it's far important to pick the right Tally course in Kolkata or enroll in an online course that fits your getting to know wishes.

Top Tally courses for Accounting professionals

Here are some of the high-quality Tally guides designed mainly for accounting specialists:

Advanced Tally ERP 9 and Tally top course Who need to take this route?

Accounting professionals, commercial enterprise owners, and students Key features:

Basics to advanced degree Tally ERP 9 and Tally prime

Accounting, stock management, and GST compliance

Payroll management and reporting

Hands-on practical training

Certification upon course finishing touch

2. GST course in Kolkata with Tally schooling Who should take this route?

Accountants, tax experts, and finance experts Key functions:

Complete GST schooling integrated with Tally

GST invoicing, returns submitting, and reconciliation

Practical exposure with actual-time case research

Certification in GST and Tally software

3. Tally course – company Accounting education Who must take this course?

Specialists aiming to paintings in company finance and bills Key capabilities:

Company monetary management with Tally

Budgeting, coins flow control, and taxation

Customizable Tally features for commercial enterprise accounting

Online and school room education alternatives

4. Taxation with Tally packages Who ought to take this path?

Students and experts seeking to enhance their taxation know-how Key functions:

Earnings tax, GST, and TDS training

Sensible programs the use of Tally software

Arms-on assignments and case studies

Enterprise-diagnosed certification

Selecting the proper Tally route

With so many Tally publications available, it is important to pick the right course based to your career desires and knowledge level. remember the following factors:

Course content: ensure the curriculum covers all essential subjects, consisting of taxation, GST, inventory management, and payroll.

Realistic training: opt for a direction that gives fingers-on training and actual-global programs.

Enterprise recognition: A certification from a reputed institute provides value in your resume.

Mode of getting to know: choose among school room, on line, or hybrid learning alternatives primarily based for your comfort.

Benefits of Enrolling in a Tally course

A Tally course or an online education software gives a couple of benefits, together with:

Career advancement: benefit specialized competencies that make you a precious asset to employers.

Higher profits prospects: certified Tally professionals earn higher salaries as compared to non-certified individuals.

Job opportunities: Open doorways to roles which includes accountant, economic analyst, tax representative, and GST practitioner.

Improved efficiency: discover ways to manage debts and taxes seamlessly, improving productivity.

Conclusion

Investing in the best Tally courses for Accounting professionals is a step toward a successful accounting career. whether or not you opt for a Taxation course, acquiring Tally skills will decorate your expert credibility and open up better profession possibilities. choose the right route these days and increase your know-how within the field of accounting!

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Business Accounting and Taxation Course Curriculum: What You'll Learn

In the present powerful business world, the interest for experts with top to bottom information on Business Accounting and Taxation Course is at an untouched high. Organizations depend on gifted people to deal with their monetary cycles and guarantee consistency with always advancing assessment regulations. One program that has acquired critical fame among trade graduates and working experts is the Business Bookkeeping and Tax collection Course.

This article investigates the subtleties of this course, its advantages, vocation possibilities, and why it is a brilliant decision for anybody hoping to construct a lifelong in Business Accounting and Taxation Course.

What is a Business Accounting and Taxation Course?

The Business Accounting and Taxation Course (BAT) is a specific program intended to give understudies a pragmatic comprehension of key monetary ideas, bookkeeping programming, and expense guidelines. Dissimilar to customary degree programs, this course centers around genuine applications, making it ideal for people who wish to acquire work prepared abilities in a brief period.

Key Highlights of the Course:

Covers fundamental points like GST, direct duties, finance the board, and monetary revealing.

Offers involved preparing with bookkeeping programming like Count, SAP, and QuickBooks.

Plans understudies for jobs in bookkeeping, reviewing, and tax assessment.

Why Pick a Business Accounting and Taxation Course?

Signing up for a Business Accounting and Taxation Course offers various benefits:

1. Industry-Significant Abilities

The course is custom fitted to address the issues of the business world. It gives viable information on bookkeeping cycles and assessment regulations that are straightforwardly pertinent in the working environment.

2. Brief Length

Not at all like extended degree programs, the BAT course is commonly finished in a couple of months, permitting understudies to rapidly enter the work market.

3. Popularity for Talented Experts

With organizations continually exploring complex expense frameworks and monetary guidelines, there is a developing interest for prepared experts in bookkeeping and tax collection.

4. Professional success

For people previously working in the money area, this course can assist with upgrading their abilities and increment their possibilities of advancements or better open doors.

5. Pioneering Advantages

Business people and entrepreneurs can likewise profit from this course, as it furnishes them with the information expected to deal with their business funds actually.

Educational program of the Business Accounting and Tax assessment Course

The Business Accounting and Taxation Course covers a great many points to guarantee a balanced comprehension of the subject. Here are a portion of the center parts:

1. Bookkeeping Basics

Standards of bookkeeping

Diary sections and record support

Arrangement of fiscal summaries

2. Tax assessment

Direct assessments (Personal Expense)

Roundabout expenses (GST)

Charge documenting and consistence

3. Finance The board

Estimation of compensations

Opportune Asset (PF) and Representative State Protection (ESI)

TDS on compensations

4. Monetary Revealing

Planning of asset reports

Benefit and misfortune explanations

Income examination

5. Bookkeeping Programming Preparing

Active involvement in Count, SAP, and QuickBooks.

6. Progressed Succeed

Information investigation and monetary displaying utilizing Succeed.

Who Can Sign up for a Business Bookkeeping and Tax collection Course?

This course is reasonable for a great many people, including:

1. Business Graduates

B.Com graduates hoping to spend significant time in bookkeeping and tax assessment will view this as course exceptionally advantageous.

2. Working Experts

Money and bookkeeping experts looking to overhaul their abilities and advance their professions can sign up for this course.

3. Business visionaries and Entrepreneurs

Entrepreneurs can acquire important bits of knowledge into dealing with their business funds effectively.

4. Work Searchers

People hoping to begin their vocations in bookkeeping or tax collection can involve this course as a venturing stone.

Profession Open doors In the wake of Following through with the Tasks

Finishing a Business Bookkeeping and Tax collection Course opens up different profession choices in the money and bookkeeping area. A portion of the jobs you can seek after include:

1. Charge Specialist

Give charge arranging and consistence administrations to people and organizations.

2. Bookkeeper

Oversee monetary records, plan reports, and guarantee consistence with bookkeeping norms.

3. GST Expert

Help organizations in recording GST returns and overseeing consistence with GST guidelines.

4. Monetary Investigator

Investigate monetary information to give experiences and proposals to business choices.

5. Finance Supervisor

Handle finance processes, including pay computations and legal allowances.

6. Reviewer

Direct monetary reviews to guarantee precision and consistence with administrative principles.

7. Business Consultant

Offer consultancy administrations to organizations on monetary administration and assessment improvement.

Advantages of a Business Bookkeeping and Tax collection Course

1. Viable Information

The course underlines active preparation, guaranteeing understudies are work prepared upon finish.

2. Better Work Possibilities

The abilities gained through this course are exceptionally pursued by bosses, prompting better open positions and more significant compensations.

3. Time and Cost Proficiency

Contrasted with degree programs, this course is more limited in term and more reasonable.

4. Flexibility Across Enterprises

Each business, no matter what its size or industry, requires bookkeeping and duty the executives, making these abilities generally appropriate.

5. Upgraded Certainty

The complete information and abilities acquired through this course impart trust in dealing with certifiable monetary situations.

How to Pick the Right Establishment for the Course?

While choosing an establishment for the Business Bookkeeping and Tax collection Course, think about the accompanying elements:

1. Certification

Guarantee the foundation is perceived and offers affirmation upon consummation of the course.

2. Educational program

Check whether the schedule is cutting-edge and covers generally fundamental points.

3. Reasonable Preparation

Search for establishments that give involved preparing genuine applications.

4. Arrangement Help

Establishments offering position backing can help you launch your profession.

5. Surveys and Tributes

Research online surveys or address graduated class to measure the nature of instruction and preparation.

End:

A Business Accounting and Taxation Course is a brilliant decision for anybody hoping to construct a compensating profession in the field of money and tax collection. The down to earth abilities and industry information acquired through this course upgrade employability as well as entryways to different worthwhile profession amazing open doors.

Whether you’re a trade graduate, a functioning proficient, or a business visionary, this course gives the devices and information expected to succeed in the unique universe of business and money. Venture out towards an effective vocation by signing up for a Business Accounting and Taxation Course today!

IPA offers:-

Accounting Course , Diploma in Taxation, Diploma in Financial Accounting , Accounting and Taxation Course , GST Course , Basic Computer Course ,Payroll Course, Tally Course , Advanced Excel Course , One year course , Computer adca course

0 notes

Text

A Step-by-Step Guide to Become a Tax Accountant in India

Understand What a Tax Accountant Does:

A tax accountant will take charge of the taxation load for both private and government institutions. What differentiates a tax accountant from an accountant is the scope, for the general accountant is expected to account for several activities while dealing with finance; he or she handles issues on savings and income in relation to both parties- government and people- at various levels, though at one level at time. Besides the two above points, the accountant is required to comply with all the tax requirements from federal down to state level.

Some of the major differences between tax preparers and tax accountants include preparation of tax returns, planning, and consulting. Basically, a tax accountant acts as a consultant to collaborate with clients in their current tax liabilities and assist in designing long-term financial goals through continuous tax planning. This article explains the process of becoming a tax accountant in India, including qualifications, skills, and available training options, such as Tally, accounting, and Taxation courses in Kolkata.

The Most Vital Functions of a Tax Accountant are:

Effective planning for clients

Preparation of State and Federal Tax Returns.

The client consultancy about his demand to decrease the tax liabilities.

Deadline adherence while maintaining the tax compliance of laws.

Annual plan of Integrated Tax benefits

Effect on taxation through law

How to Become a Tax Accounting Professional in India?

Become a Tax Accounting Professional by a blend of study, experience, and acquiring new skills. Here's your step-by-step career way:

Step 1: Building a Sound Academic Foundation

Undergraduate degree: Bachelor's in Commerce (B.Com), or equivalent: This will ensure some conceptual knowledge in elements of accounting, finance, and taxation.

Professional Certification: Get your professional certification after acquiring your undergraduate degree. Useful ones are as follows:

⦁ CHARACTERED ACCOUNTANT (CA) : Will give a strong holistic view in taxation, auditing, and Financial Accounting. ⦁ Cost and Management Accountant (CMA): Its focus lies on management accounting, cost analysis, and tax planning. ⦁ Certified Public Accountant (CPA): This certification is helpful especially in jobs with an international firm or a niche industry finance sector.

Step 2: Practical Experience

Aside from formal education, hands-on experience is a must. Here's how one goes about it:

Internships: This includes taking up intern positions within accounting firms or companies that have financial departments where tasks of taxation are undertaken or implemented in real life situations.

Entry-Level Jobs: Tax assistant or junior accountant role that will practically allow one to apply the knowledge learned as well as gather the skills necessary.

Networking: Several professional societies that one can join to create a network of contacts, seek mentors, and also seek employment opportunities .

Phase 3: Key Skills

One needs to acquire these core skills to become a successful tax accountant: ⦁ Analytical Skills: The ability to interpret financial data and tax codes to ensure sound financial planning. ��� Communication: Simplify complicated tax laws to your clients. ⦁ Attention to detail: One should ensure that accuracy is an important aspect so that tax return preparation will not turn out wrong. ⦁ Ethics and integrity: The call for high ethics for all forms of financial reports and tax practices.

Step 4: Become a Continuing Student

Tax laws change every year. How to be up to date?

⦁ Advanced certifications: Enroll in a certification course on tax specialisation, which may add depth to your work as a professional and eventually open better avenue for advancement also. Accounting Course in kolkata is a Great choice to gain some knowledge on this field. ⦁ Conferences and Seminars: Discuss topics dealing with the tax laws of the day and accounting trends

Step 5: Know Your Accounting Software

Getting better at accounting software can become progressively important. Consider programs like a Tally course in Kolkata, and find digital accounting training helpful. This can assist in ensuring accuracy and productivity for your accounting and taxation-related tasks. Tally is an application used mostly by people in India. It has become an application that cannot be avoided in dealing with accounting or in the preparation of tax returns, thus making it a necessary component in a tax professional's career.

Step 6: Deep Insight into Tax Laws and Compliances

Basic of tax accounting are about the understanding of the tax laws of India. Key areas to be discussed below:

⦁ Income Tax Act: In terms of personal as well as corporate tax compliances. ⦁ Goods and Services Tax (GST): GST compliances, very critical. And that's particularly for individuals if they have undertaken a GST Course in Kolkata niche area. ⦁ Tax Planning Strategies: For what strategy will the consultant is using with a client, in order to minimize or reduce the payment towards tax to a greatest possible degree.

Step 7: Specialized Certification and Specialization]

A bit of experience under one's belt and it would not be a bad idea to get some specialized certifications that impart some extra skills in such areas as the following:

⦁ Tax Planning and Management There are lots of institutes offering strategic tax planning programs. This should really extend your capabilities. ⦁ International Taxation Any one who has worked with clients engaging in cross-border transactions can vouch for me. Knowing international tax is very, very plus.

Step 8: Increase Your Client Base

Building a client base is crucial when you get more expertise. Here's how to grow your network:

Freelance services: You can offer help on tax accounting to small businesses and individuals as a freelancer.

Industry networking: You have to attend industry events and conferences, which will allow you to meet more potential clients and build the network.

Online presence: You can get a professional online profile, where you attract clients with a need for tax accounting.

Conclusion

A career in tax accounting in India calls for an excellent balance of education, practical experience, and keeping abreast of changes in the industry. These steps can serve you in setting up a fulfilling profession by guiding your clients through the maze of tax regulations.

#accounting course#gst course in kolkata#tally course#gst course#taxation course in kolkata#Taxation Course#Tally Course in Kolkata#Accounting Course in Kolkata

0 notes