#GST with Tally Course

Explore tagged Tumblr posts

Text

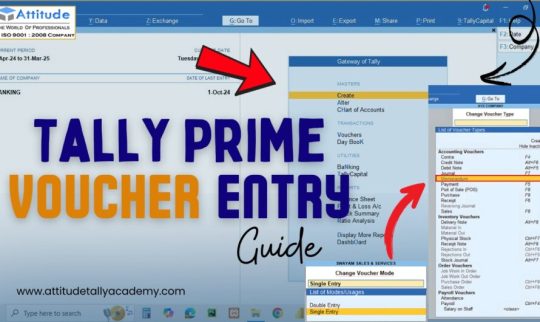

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

Top Reasons to Learn Tally with GST in 2025: A Career Booster for Commerce Students

In 2025, the demand for skilled accountants and finance professionals continues to grow — and one of the best ways for commerce students to boost their career prospects is by learning Tally with GST. Whether you're a recent graduate or still studying, mastering Tally ERP with GST opens doors to job-ready opportunities in the accounting world.

1. High Demand Across Industries Almost every business, from small startups to large enterprises, uses Tally for managing accounts, inventory, payroll, and GST compliance. A certified Tally GST expert is always in demand, especially in thriving commercial cities like Vadodara.

2. Practical Accounting Knowledge Enrolling in a Tally GST course in Vadodara equips students with real-world skills such as GST filing, voucher entry, and final account preparation. It’s more than just software—it's a complete learning experience in modern accounting.

3. Affordable and Quick to Learn Most Tally GST classes in Vadodara are short-term, affordable, and focus on practical training. This makes it perfect for students looking to upskill quickly without long-term commitment.

4. Ideal for Freelancers and Entrepreneurs If you're planning to freelance or start a business, Tally GST in Vadodara gives you the confidence to manage your own accounts and ensure GST compliance without external help.

5. Strong Resume Booster Employers are actively hiring candidates with software and tax knowledge. A certification from a reputed Tally GST training institute in Vadodara like Bright Computer Education can give your resume a strong edge.

Join the best Tally GST classes in Vadodara today and take the first step toward a successful career in accounting and finance!

#tally gst classes in vadodara#tally gst course in vadodara#Tally GST in Vadodara#tally gst training institute in vadodara#best tally gst classes in vadodara

0 notes

Text

GST Tally Course in Delhi – Practical Training at NEW DELHI YMCA IOM

Learn industry-relevant skills with the gst tally course in Delhi at NEW DELHI YMCA IOM. This course offers in-depth training in Tally ERP, GST compliance, billing, inventory, and financial management. Designed for students, professionals, and job seekers, it provides hands-on experience and real-world applications. With expert faculty and practical modules, you’ll gain the knowledge and confidence needed to succeed in the accounting and finance sector. Enroll now and upgrade your career with YMCA IOM.

0 notes

Text

Your Path to Tally Mastery, at DICS

In the digital age, businesses are rapidly shifting from traditional bookkeeping to modern accounting software — and Tally stands out as the most trusted platform. If you’re looking to master Tally and elevate your accounting career, enrolling in the Best Tally Course in Laxmi Nagar is your smartest move.

Why Tally is a Must-Have Skill

Tally isn’t just another accounting software. It’s the lifeline of small to mid-sized businesses, helping manage everything from financial accounting and taxation to payroll and inventory. Learning Tally gives you the power to manage real-world business finances efficiently, whether you work for a firm or run your own business.

From GST compliance to balance sheet generation, Tally simplifies complex processes and ensures accurate reporting. That’s why skilled Tally professionals are in high demand in every industry.

Discover the Best Tally Course in Laxmi Nagar

Our institute offers the Best Tally Institute in Laxmi Nagar, carefully designed for beginners and professionals alike. The course curriculum is aligned with industry standards and includes:

Tally Prime fundamentals

GST implementation

Inventory and billing system

Payroll processing

Cost centers and budgets

Advanced reporting & MIS

Each student receives personal attention and practical training through live projects. We go beyond classroom teaching to ensure you gain real accounting experience.

What Makes Us the Best Tally Institute?

We believe quality education is the key to success. As the Best Tally Institute in Laxmi Nagar, we offer:

Certified and experienced faculty

Hands-on training with real-time scenarios

Job-oriented modules

Placement support and career guidance

Official Tally certifications

Affordable fee structure with installment options

Our goal is not just to teach software, but to create confident and skilled professionals who can thrive in a competitive job market.

Who Should Join?

This course is ideal for:

Commerce students and graduates

Working professionals in finance

Entrepreneurs and business owners

Anyone looking to switch to an accounting career

Start Your Journey Today

Accounting is the backbone of any successful business, and Tally is your gateway into that world. Don’t miss the opportunity to learn from the best. Enroll today at the Best Tally Institute in Laxmi Nagar and unlock a rewarding career with the Best Tally Course in Laxmi Nagar.

0 notes

Text

1 note

·

View note

Text

Learn Accounting After 12th Step by Step

How to Become an Accountant After 12th | 12वीं के बाद अकाउंटेंट कैसे बनें?

अगर आप सोच रहे हैं how to become an accountant after 12th, तो आप सही जगह पर हैं। This guide will help you understand every step in simple Hinglish language.

Accountant बनने के आसान तरीके | Simple Steps to Become an Accountant

Step 1 – सही Stream का चुनाव करें | Choose the Right Stream

अगर आप accountant बनना चाहते हैं, तो Commerce stream चुनना बेहतर है। Commerce में accounts, economics, और business studies पढ़ाए जाते हैं।

ये subjects accounting field के लिए strong foundation create करते हैं। Without a doubt, यही पहला कदम होता है accountant बनने की journey में।

Step 2 – Graduation Course Select करें | Choose a Graduation Degree

12वीं के बाद आपको Bachelor’s degree लेनी होगी। सबसे popular choice होती है B.Com या BBA in Accounting।

अगर आप CA या CMA बनना चाहते हैं, तो भी B.Com best रहता है। ये degree theoretical knowledge और practical skills develop करती है।

Step 3 – Practical Skills सीखें | Learn Practical Accounting Skills

Theoretical knowledge के साथ-साथ practical skills भी ज़रूरी हैं। Tally, GST filing, और Excel जैसे tools सीखना बहुत important होता है।

आजकल कई institutes short-term accounting courses offer करते हैं। इनमें से आप कोई भी choose कर सकते हैं अपनी जरूरत के अनुसार।

Advanced Career Options | Accountant बनने के बाद क्या करें?

Chartered Accountant (CA)

अगर आप high-level professional accountant बनना चाहते हैं, तो CA best option है। CA बनने के लिए आपको ICAI की exam देनी होती है।

यह exam तीन levels में होती है: Foundation, Intermediate और Final। CA बनकर आप auditing, taxation और financial advising में expert बन सकते हैं।

Cost Management Accountant (CMA)

CMA बनने के लिए ICMAI के तहत exam pass करनी होती है। ये भी तीन stages में होता है, similar to CA process।

CMA professionals industries में cost control और management में काम करते हैं। यह career भी बहुत rewarding और respected होता है।

Certified Public Accountant (CPA)

CPA एक international level का accountant qualification होता है। यह American standard है और USA में valid होता है।

अगर आप abroad काम करना चाहते हैं, तो CPA अच्छा option है। लेकिन इसके लिए English fluency और international laws की knowledge जरूरी है।

Essential Skills | Accountant के लिए ज़रूरी Skills

H3: Attention to Detail

Accounting में गलती की कोई गुंजाइश नहीं होती। इसलिए ध्यान से काम करना ज़रूरी है।

H3: Analytical Thinking

Data को analyse करने और समझने की skill होनी चाहिए। Accountant को financial decisions में support देना होता है।

H3: Computer Knowledge

Basic computer knowledge, especially Excel और Tally, बहुत जरूरी है। ये tools accounting operations को आसान बनाते हैं।

Accounting Courses After 12th | 12वीं के बाद Accountancy Courses

B.Com (Bachelor of Commerce)

यह तीन साल का degree course होता है। Accounts, Economics, Business Law, और Taxation इसके main subjects होते हैं।

BBA in Finance & Accounting

यह course भी 3 साल का होता है, लेकिन थोड़ा business-oriented होता है। यह course management और accounts का अच्छा blend देता है।

Diploma in Financial Accounting (DFA)

ये एक short-term course है जो 6 से 12 महीनों का हो सकता है। यह practical accounting knowledge देता है।

Tally and GST Certification

ये छोटे-छोटे courses होते हैं जो job-ready skills provide करते हैं। Tally ERP 9 और GST filing आज के accountants के लिए जरूरी हैं।

Accountant की Salary और Job Scope | Income & Career Growth

Accountant बनने के बाद starting salary ₹15,000 से ₹25,000 प्रति माह हो सकती है। Experience बढ़ने के साथ salary भी ₹60,000+ तक जा सकती है।

Private companies, MNCs, और Government departments में jobs available होती हैं। CA या CMA बनने पर आप अपना खुद का practice भी खोल सकते हैं।

FAQs | अक्सर पूछे जाने वाले सवाल

H3: 12वीं के बाद accountant बनने में कितने साल लगते हैं?

Simple graduation में 3 साल लगते हैं। CA या CMA करने पर extra 3 से 5 साल लग सकते हैं।

H3: क्या science वाले accountant बन सकते हैं?

जी हां, पर उन्हें commerce subjects की knowledge लेनी होगी। Better होगा पहले accounting basics सीखें।

H3: क्या बिना degree के accountant बन सकते हैं?

Technically, आप short-term courses करके job पा सकते हैं। लेकिन growth के लिए degree या certification ज़रूरी है।

Final Thoughts | अंत में निष्कर्ष

Accountant बनना एक rewarding career है। अगर आपने अभी 12वीं पास की है, तो आगे का रास्ता clear है।

Right stream चुनें, right skills सीखें, और एक strong portfolio बनाएं। अगर dedication और मेहनत है, तो आप एक successful accountant जरूर बनेंगे।Pro Tip: Tally, Excel, और GST जैसे tools सीखें। ये आपको job में जल्दी help करेंगे। Aaj ke time में accountant बनना मुश्किल नहीं है, बस सही दिशा में मेहनत ज़रूरी है।

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

#business accounting and taxation (bat) course#diploma in taxation#tally course#sap fico course#gst course#payroll management course

0 notes

Text

Accounting Academy in jaipur

1 note

·

View note

Text

Scope Computers

Want to handle accounts and GST like a pro? 💼📚 Learn Tally Prime the smart way! 🚀

In our Tally Prime + GST Course, you’ll master: 🔹 Company creation, ledgers & vouchers 🔹 GST setup, billing & return filing 🔹 Inventory management & reports 🔹 Real-world accounting practices

Course Highlights: ✅ Practical, hands-on training ✅ Latest Tally Prime version ✅ Govt. approved certificate 🎓 ✅ Personal doubt-clearing support 💬

Start your journey to success today! 🌟📈 Enroll now! 🏆

#course#diploma#courses#tally#tallyhair#coursework#staythecourse#digitalmarketingcourse#maincourse#diplomacourse#tallycourse#tallyprimecourse#diplomacourses#coursecreation#diplomatic#coursecreators#jodhpur#accounting#gst

1 note

·

View note

Text

professional english speaking course near me | free english speaking course near me | tally erp 9 gst classes near me

Boost Your Career with the Best English & Tally Courses in Kanpur

Are you searching for a professional English speaking course near me or Tally ERP 9 GST classes near me? Look no further! ASDC Kanpur offers expert-led courses that equip you with the skills you need to succeed in today’s competitive world. Whether you're a student, a job seeker, or a working professional, our institute provides the perfect learning environment tailored to your needs.

At ASDC, we understand the importance of communication in the modern workplace. That’s why our free English speaking course near me is designed to help you build fluency, confidence, and accuracy in spoken English. You’ll engage in real-time conversations, group discussions, and practical scenarios that mirror real-life situations. For more information or to enroll, visit ASDC Kanpur Contact Page.

In addition to language courses, ASDC Kanpur offers comprehensive training in financial software. If you've been looking for Tally ERP 9 GST classes near me, you’re in the right place. Our Tally course is tailored to cover everything from basic accounting to advanced GST filing, helping you gain hands-on expertise. We provide practical training to ensure you're ready for any job or business opportunity. Start your journey by reaching out through our Contact Page.

What makes us stand out? Our team of experienced trainers, a flexible schedule, and a proven track record of student success. Whether you're looking for a professional English speaking course near me to improve your communication or a free English speaking course near me to learn without financial burden, ASDC Kanpur has you covered. Connect with us today at our Contact Page.

Don't let language or technical skills hold you back. Empower yourself with ASDC’s industry-relevant courses. Discover more and get started by visiting our Contact Page.

#professional english speaking course near me#free english speaking course near me#tally erp 9 gst classes near me

0 notes

Text

Master Tally Prime with MWCEDU – Your Gateway to Professional Accounting!

Looking to build a strong foundation in accounting and business management? Our Tally Prime course is designed to help you gain real-world skills and confidence. Learn the latest features of Tally Prime, India’s most trusted accounting software. Understand accounting principles, GST, TDS, payroll, inventory, and financial reporting. Ideal for students, job seekers, entrepreneurs, and accounting professionals. No prior experience required – we start from the basics and move to advanced topics. Step-by-step video tutorials make learning easy and effective. Practice with real business scenarios and practical assignments. Get access to downloadable study materials and resources. Learn at your own pace with lifetime access to the course. Doubt-clearing sessions and expert support throughout your journey. Stay updated with the latest Tally Prime features and updates. Improve your resume and stand out in interviews. Earn an industry-recognized certificate upon successful completion. Trusted by thousands of learners across India and beyond. Join a community of learners and grow your network. Affordable, flexible, and packed with value. Enroll now at www.mwcedu.com and take the first step toward a successful career in accounting!

#tallyprime with gst online course#tallyprime course#tally prime course in india#tally prime with gst course#tally prime full course in english

0 notes

Text

How e-Accounting Helps You Stay Ahead in Finance Jobs

Introduction

In today’s fast-evolving financial industry, employers are no longer just looking for candidates who know traditional accounting. They need professionals who understand e-Accounting, GST compliance, e-filing, and modern tools like Tally Prime. This is where e-Accounting steps in as a game-changer—especially for students who want to stand out in the finance job market.

Whether you’re from Yamuna Vihar, Uttam Nagar, or any part of Delhi, gaining practical knowledge in e-Accounting can open doors to career paths in finance, taxation, and business management.

What is e-Accounting and Why Does It Matter?

e-Accounting stands for “electronic accounting”—a modern accounting system where financial data is recorded and managed digitally using software such as Tally ERP 9 and Tally Prime.

In today’s digital economy, companies prefer hiring candidates who are skilled in:

Online GST return filing

e-Taxation and compliance

Payroll processing

Advanced Excel

Cloud-based financial record keeping

These skills are in high demand across industries and are often taught through specialized e-Accounting training in Delhi, e-filing courses, and GST training.

Benefits of Learning e-Accounting for Finance Jobs

1. Stay Job-Ready with Practical Knowledge

Finance recruiters today expect job seekers to be industry-ready. Completing an financial e-accounting course in Uttam Nagar gives students hands-on experience in preparing ledgers, filing GST, processing payroll, and generating reports—all essential for finance jobs.

2. Master Tally Prime and GST Filing

Tally is still the backbone of accounting for thousands of businesses. Institutes offering Tally classes in Yamuna Vihar or Tally Prime courses in Uttam Nagar focus on the latest updates like GST integration and advanced inventory management. You’ll also learn about Tally with GST certification, which is a must for accounting roles in MSMEs and startups.

3. Gain Expertise in Taxation and E-Filing

From managing tax deductions to filing returns, taxation plays a huge role in every organization. Specialized e-taxation courses and e-filing training empower you with complete understanding of Indian tax systems and help you support businesses in staying compliant.

4. Explore Diverse Career Options

By pursuing professional courses in financial e-accounting, you become eligible for roles like:

Accounts Executive

GST Practitioner

Tax Assistant

Payroll Executive

Audit Assistant

Institutes offering GST coaching and e-accounting training offer real-time projects and mock return filing which build confidence and experience.

Centers provide short-term and diploma-level courses in Tally ERP 9, Tally Prime, e-Taxation, and e-filing, including free tally eBooks, video tutorials, and downloadable Tally PDFs for self-practice.

If you're from Bhajanpura, Shahdara, or nearby areas, you can also explore or tally classes near Yamuna vihar for convenient access.

Online and Offline Support for Learners

In addition to classroom training, students can:

Download free tally study material for self-paced learning.

Watch Tally ERP 9 video tutorials to revise concepts anytime.

Access GST coaching classes near me using location-based search.

Opt for accounting internships or project-based learning for practical exposure.

Institutes also offer dedicated Tally coaching centres in Yamuna Vihar and Uttam Nagar, so students can choose according to their locality.

Final Thoughts

The finance industry is transforming rapidly, and digital skills are no longer optional. Investing in an e-Accounting course or a financial e-accounting training gives you a head start in your career.

Whether you're a fresher, commerce student, or working professional looking to upskill, e-Accounting combined with GST, Tally, and taxation training is the perfect formula to stay ahead in finance jobs.

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

#tally prime course#tally prime with GST course#e Accounting course in uttam nagar#e Accounting course in yamuna vihar#ms excel#advance ms excel#GST course with e Filling

0 notes

Text

GST for Online Business and E-commerce: A Step-by-Step Guide

E-commerce and online businesses have totally transformed the global economy. Entrepreneurship is made easy now since it is much simpler for entrepreneurs to sell goods and services across geographical boundaries. But ease brings along with it the problem of compliance, particularly in the case of the Goods and Services Tax (GST). In this blog post, we will look at how GST has impacted e-commerce and online businesses, main compliance requirements, and how businesses can remain compliant while also obtaining maximum returns.

GST for E-commerce Businesses

GST is an indirect tax that is imposed on the supply of goods and services. It consolidates various indirect taxes such as VAT, service tax, and excise duty into one uniform tax system. E-commerce companies are governed by certain provisions of the GST Act, hence it is critical for online sellers, marketplaces, and service providers to know their tax liability.

Who Have to Get Registered Under GST in E-commerce?

E-commerce Operators (Marketplaces): Marketplaces in e-commerce such as Amazon, Flipkart, and Shopify who process sales on sellers' behalf must follow GST law.

Online Sellers & Vendors: Companies which sell products or services online either through third-party marketplaces or their own web pages are necessary to get registered for GST without regard to turnover.

Dropshipping Businesses: Those businesses running dropshipping models need to be GST compliant too, if they sell taxable goods or services.

Freelancers & Digital Service Providers: Freelancers offering digital services like graphic designing, content writing, programming, or consulting services through digital platforms need to get GST registered, if their turnover exceeds the threshold limit.

GST Registration Threshold for E-commerce Businesses

Unlike regular business units, GST registration is required only when turnover exceeds ₹40 lakhs for goods and ₹20 lakhs for services (₹10 lakhs for special category states), while e-commerce vendors have to mandatorily register under GST irrespective of turnover under Section 24 of the CGST Act.

Tax Collected at Source (TCS)

E-commerce operators (marketplaces) need to collect 1% TCS (0.5% CGST + 0.5% SGST or 1% IGST) from the sellers on the platform. The amount is withheld while paying sellers and has to be remitted to the government.

GST Return Filing

E-commerce companies need to file GST returns from time to time, depending upon their registration type:

GSTR-1: Quarterly or monthly return of outward supplies (sales).

GSTR-3B: Combined monthly tax liability return.

GSTR-8: Filed by e-commerce operators reporting TCS collected.

Place of Supply & GST Applicability

Place of supply plays an important role in identifying whether CGST, SGST, or IGST applies. For e-commerce transactions:

Intra-state sales (seller and buyer within the same state) attract CGST + SGST.

Inter-state sales (seller and buyer in different states) attract IGST.

Exports are considered zero-rated supplies, and firms are entitled to recover refund of GST paid on inputs.

Reverse Charge Mechanism (RCM)

E-commerce firms need to understand RCM, where the purchaser is required to pay GST in lieu of the supplier in certain situations (i.e., obtaining services from unregistered persons).

GST Benefits & Problems for E-commerce Firms

Benefits:

✅ Uncomplicated Tax Structure: GST is a change from several indirect taxes, making compliance less complex.

✅ Input Tax Credit (ITC): Enterprises can take credit of GST paid on procurement.

✅ Ease of Doing Business: Easy inter-state business due to GST.

✅ Promotes Compliance: Compulsory registration helps ensure transparency.

Concerns:

❌ Mandatory Registration: Small online vendors too must register, thereby enhancing cost of compliance.

❌ Different Return Filing: Multiple GST returns complicate the job of small sellers.

❌ Cash Flow Problems: TCS deduction impacts suppliers' working capital.

How Online Businesses Can Remain Compliant

Register GST Timely: Avail GST registration before initiating an online business.

Keep Proper Invoices & Documents: Provide invoices with GST compliance and keep procurement records.

Submit Returns Timely: Avoid charges by following the due dates of GST returns.

Be Aware of TCS & RCM: Be aware of deductions and liability that apply.

Claim Input Tax Credit: Record GST paid while procuring to minimize tax outgo.

Conclusion

GST compliance is required for online and e-commerce businesses in India. While it brings about challenges such as compulsory registration and TCS deductions, it also offers advantages such as uniformity of tax and input tax credit. If e-commerce companies learn about GST rules and adopt best practices, they can stay compliant while growing their business economically.

For expert assistance with GST registration and filing, consider consulting a tax professional or using online tax compliance tools. Staying informed and proactive can help businesses navigate GST complexities effectively!

#gst course in delhi#gst certification course in delhi#tally gst course in delhi#gst course duration#gst course fee#what is gst course#gst practitioner course in hindi#gst practitioner course in delhi#gst certification course online#gst certification course by government#gst courses in delhi#gst course in delhi by govt

0 notes

Text

tally erp 9 gst classes in gt road| dca advanced course near me| english speaking course near me for adults

At ASDC Kanpur, we are dedicated to empowering individuals with the skills necessary to excel in today's competitive job market. Our comprehensive courses are designed to meet the diverse needs of our students, ensuring they are well-prepared for various professional challenges.

Tally ERP 9 GST Classes in GT Road

Understanding the critical role of financial management in businesses, we offer specialized Tally ERP 9 GST classes at our GT Road campus. This program provides in-depth knowledge of accounting principles, GST regulations, and practical applications of Tally software, equipping students with the expertise required for efficient financial operations. By enrolling in this course at ASDC Kanpur, students gain both theoretical understanding and hands-on experience, making them valuable assets in the accounting and finance sectors.

DCA Advanced Course Near Me

For those seeking to enhance their computer application skills, our Diploma in Computer Applications (DCA) Advanced Course offers a comprehensive curriculum covering advanced topics in computer science and IT applications. Located conveniently for residents in and around Kanpur, ASDC Kanpur ensures that students receive quality education with practical exposure, preparing them for various roles in the IT industry.

English Speaking Course Near Me for Adults

Effective communication is key to professional success. At ASDC Kanpur, we offer an English Speaking Course tailored for adults aiming to improve their language proficiency. This program focuses on enhancing speaking, listening, and comprehension skills, boosting confidence in both personal and professional interactions. Our experienced trainers employ interactive teaching methods to ensure that learning English becomes an engaging and rewarding experience.

At ASDC Kanpur, we believe in holistic development, offering not just courses but a pathway to a brighter future. Join us to embark on a journey of learning and professional growth.

#tally erp 9 gst classes in gt road#dca advanced course near me#english speaking course near me for adults

1 note

·

View note

Text

Tally GST Course in Vashi, Mumbai

Looking to enhance your skills in GST? Join the Tally GST course in Vashi, Mumbai and gain comprehensive knowledge of Goods and Services Tax with hands-on training. This course covers GST fundamentals, filing returns, reconciliation, and much more, equipping you with the expertise to manage GST-related tasks efficiently. Learn from industry experts in a professional environment and boost your career in accounting and taxation. Whether you`re a beginner or looking to upgrade your skills, this course offers the perfect opportunity to advance in the field of GST. Enroll now and become GST certified!

Source url:

0 notes