#TallyPrime Online Course

Explore tagged Tumblr posts

Text

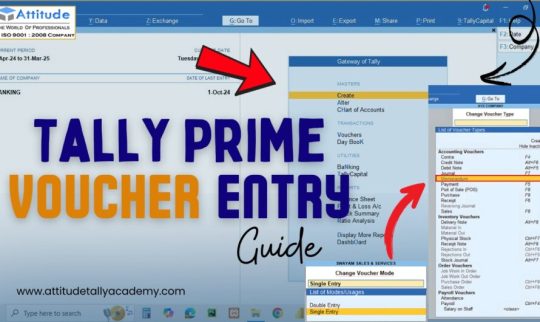

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

Easy Guide to Migrating Your Data to TallyPrime

It is not easy to transfer your data from one software application to another, and this is even more complicated when the data involves critical business information such as accounting and finance. If you are planning to migrate your data to TallyPrime – India’s most popular business accounting software, you have made the right decision.

TallyPrime has a number of features that can make your accounting easier and allow you to manage your company more effectively. In this article, you will get to know how to transfer your data to TallyPrime, along with some guidelines that will facilitate the process of migration.

Why migrate to TallyPrime?

TallyPrime is not just an accounting software but a complete business management software which is easy to use and deliver high results. Here are some key reasons why businesses choose TallyPrime:

1. User-friendly interface:

TallyPrime has a user-friendly interface which makes the running of the business easy as in invoicing, stock control among others.

2. Real-time data access:

TallyPrime provides time-bound access to data to help decision makers make the right decisions at the right time.

3. Customization and scalability:

TallyPrime is versatile and can be programmed according to your business’s requirements and can be upgraded as the business increases.

Preparing for data migration to TallyPrime

Before starting the migration, it’s crucial to prepare adequately. Here are some preliminary steps you should take:

1. Assess your current data

Examine your existing data in detail. Whether you’re using an older version of Tally (such as Tally.ERP 9) or different accounting software, it’s essential to understand what data you have and how it’s organized. Identify the types of data you want to migrate, such as:

Masters (e.g., ledger, stock items)

Transactions (e.g., sales, purchases)

Balances and closing data

2. Backup your data

Before proceeding with any migration process it is always advisable to have a backup of the current data. This way you have a backup in case of any problems during the migration process.

3. Clean and validate data

Data migration is a perfect time to clean and validate data as well. Verify for any gaps, overlapping or mistakes in your information. It is vital that all records are up to date as these issues when encountered can cause some complications within the migration process as well as result in errors in your new system.

Steps to migrate your data to TallyPrime

All the requirements are set, and you can proceed with the migration process. Here’s a step-by-step guide on how to transfer your data to TallyPrime efficiently:

Step 1: Install TallyPrime

If you haven’t done this already, ensure that TallyPrime is installed on your computer. The installation wizard will appear and help you with the installation process. It is advisable to check that your system is capable of supporting the software in order to achieve the best results.

Step 2: Open the TallyPrime migration tool

The TallyPrime Data Migration Tool is a special feature that helps to migrate data from Tally.ERP 9 and other similar formats. This tool is easily found within TallyPrime under the migration section. This tool supports data transfer without any glitches and retains data consistency.

Step 3: Start the migration process

Open the migration tool:

First of all, open the TallyPrime Data Migration Tool and choose the company file that you are willing to migrate.

Configure migration settings:

As a software solution may differ from the one you use now, you may have to configure some settings for it to work properly. For instance, while importing from Tally.ERP 9 you will be able to tick mark the options for ledger migration, voucher migration and inventory migration.

Initiate migration:

To start the migration process you need to click the “Start Migration” button. The tool will read your data and then translate it into formats that can be used in TallyPrime. It can take some time depending on the size and the format of your data set that you are working with.

Step 4: Review migration logs

The migration is done, check out the logs that the tool has produced for your reference. These logs contain the status of migration, and any problems that may exist in the course of the migration. It is advised to fix all the errors that are reflected in the logs for a successful and error-free migration.

Step 5: Verify data in TallyPrime

After following the migration process mentioned above, switch on TallyPrime and check the data which has been migrated. It should be ensured that all account balances, ledger balances, transactions and accounts are correct. Make a few trial buys to ensure that all is well and that the experience is as you intended it to be.

Post-migration best practices

After successfully migrating your data to TallyPrime, consider the following best practices to optimize your experience:

Set up user permissions:

TallyPrime provides a feature of configuring the access rights of different users based on their roles. Create special permissions and access levels for your team members in order to improve the security of your account.

Update reports and dashboards:

Update your reports and dashboards to the current data and ensure that you have set up automated reporting if that is what you want.

Train your team:

Make certain that all users of TallyPrime are conversant with the functions and operations. Training courses or some form of materials can be helpful for your team to catch up with the work to be done.

Regular backups:

Ensure you take back up of your TallyPrime data at regular intervals to avoid data loss and ensure continuity of business.

Conclusion

Simple data migration to TallyPrime is possible. Following these above steps will make your migration easy. TallyPrime improves accounting, corporate control, and comprehension.Take an online Tally training to master TallyPrime and boost productivity. Super 20 Training Institute provides the best Tally course online (www.s20.in) for learners at all levels of experience. This training gives business, accounting, and finance professionals the TallyPrime skills they need. Super 20 Training Institute's online course can help you become a Tally expert.

0 notes

Text

Master Tally Prime with MWCEDU – Your Gateway to Professional Accounting!

Looking to build a strong foundation in accounting and business management? Our Tally Prime course is designed to help you gain real-world skills and confidence. Learn the latest features of Tally Prime, India’s most trusted accounting software. Understand accounting principles, GST, TDS, payroll, inventory, and financial reporting. Ideal for students, job seekers, entrepreneurs, and accounting professionals. No prior experience required – we start from the basics and move to advanced topics. Step-by-step video tutorials make learning easy and effective. Practice with real business scenarios and practical assignments. Get access to downloadable study materials and resources. Learn at your own pace with lifetime access to the course. Doubt-clearing sessions and expert support throughout your journey. Stay updated with the latest Tally Prime features and updates. Improve your resume and stand out in interviews. Earn an industry-recognized certificate upon successful completion. Trusted by thousands of learners across India and beyond. Join a community of learners and grow your network. Affordable, flexible, and packed with value. Enroll now at www.mwcedu.com and take the first step toward a successful career in accounting!

#tallyprime with gst online course#tallyprime course#tally prime course in india#tally prime with gst course#tally prime full course in english

0 notes

Text

Certified Diploma in Financial Reporting and Tax Analysis

Earn a certified diploma in financial reporting and tax analysis with our comprehensive program. Prepare for industry certifications and advance your career with specialized expertise in accounting and taxation.

1 note

·

View note

Text

Career Update

Just completed the TallyEssential course, and it's a game-changer! If you're looking to boost your accounting skills, this is the course to take. Here's why:

Beginner-Friendly: No prior accounting knowledge needed.

Hands-On Learning: Practical exercises using TallyPrime software.

Comprehensive Curriculum: Covers GST, payroll, inventory, and more.

Industry-Relevant Skills: Perfect for job seekers and professionals.

Flexible Learning: Online and offline options available

Ready to get started? Enroll now at Tally Education.

1 note

·

View note

Text

Kickstart Your Career with Tally Courses After 10th!

Just finished 10th grade and wondering what to do next? Learning Tally can be a game-changer! Whether you dream of working in finance, accounting, or business, a Tally course gives you the practical skills to land a job early.

Why Choose a Tally Course?

No commerce background? No problem! Anyone can learn.

Master accounting, GST, TDS, and payroll management.

Start earning early as an Accounts Assistant, Data Entry Operator, or GST Executive.

Work freelance or get placed in small & medium businesses.

Where to Learn?

Online platforms like IIM SKILLS offer certified Tally courses with hands-on training. Gain real-world experience and step into the finance world with confidence!

Ready to level up? Start your Tally journey today!

#TallyCourses #FinanceJobs #CareerAfter10th #AccountingSkills #LearnTally #JobReady #IIMSKILLS #TallyERP9 #TallyPrime

0 notes

Text

Join S20's Online Accounting Course and gain expertise in TallyPrime, GST configuration, and practical accounting skills. Learn essential concepts like bank reconciliation, depreciation, and finalization of accounts. Designed by industry experts to boost your career!

For more info visit at: https://s20.in/courses/online-accounting/

0 notes

Text

TallyPrime Full Course I Learn Complete TallyPrime in 4Hrs I Vedanta Educational Academy

View Online Course*** : … source

0 notes

Text

Tally Course Online: A Complete Guide

In the digital age, managing financial records efficiently is crucial for businesses of all sizes. Tally, a powerful accounting software, has become the go-to solution for professionals and organizations worldwide. With the growing demand for remote learning, many students and working professionals are now turning to Tally courses online to enhance their accounting skills from the comfort of their homes.

This article provides an in-depth look at Tally courses online, including their benefits, syllabus, eligibility, career prospects, and how to choose the right course.

What is Tally?

Tally (Transactions Allowed in a Linear Line Yards) is a robust accounting software developed by Tally Solutions Pvt. Ltd. It is widely used in India and abroad for accounting, inventory management, payroll, taxation, GST, and other financial tasks. Tally ERP 9 and the latest version, TallyPrime, are user-friendly and feature-rich platforms suitable for small to medium-sized enterprises (SMEs).

Why Learn Tally Online?

The demand for professionals proficient in Tally has increased due to GST implementation and the need for accurate financial management. Learning Tally online offers numerous benefits, such as:

1. Flexibility

Online courses allow students and professionals to learn at their own pace. Whether you are a college student or a full-time employee, you can schedule your learning around your daily routine.

2. Cost-Effective

Online Tally courses are often more affordable than traditional classroom training. Many platforms also offer free trial classes, EMI options, or certification at competitive rates.

3. Access to Updated Content

Online platforms regularly update their course content to include the latest features and GST regulations, ensuring you stay industry-relevant.

4. Interactive Learning

Many online courses include video lectures, quizzes, live sessions, and downloadable resources, which help in better understanding and retention.

Tally Course Online: Syllabus & Modules

The syllabus of an online Tally course is designed to make learners proficient in various aspects of accounting and financial management. Here’s a typical module breakdown:

1. Introduction to Tally

Overview of Tally software

Installation and setup

Company creation and configuration

2. Basic Accounting Principles

Fundamentals of accounting

Journal entries

Ledger creation

3. Inventory Management

Stock groups and categories

Units of measurement

Godowns and stock valuation

4. Voucher Entry

Types of vouchers: Contra, Payment, Receipt, Sales, Purchase

Debit and Credit notes

Reversing journal entries

5. Taxation in Tally

Introduction to Indian taxation system

GST setup and configuration

Filing GST returns using Tally

6. Payroll Management

Employee details and attendance

Salary structure and payslip generation

PF, ESI, and TDS calculations

7. Bank Reconciliation

Reconciling bank statements with cash books

Post-dated cheque entries

Bank ledger creation

8. MIS Reports and Analysis

Profit & Loss account

Balance sheet

Cash flow and fund flow statements

9. TallyPrime Features

Navigation and interface of TallyPrime

Remote access and security control

Data synchronization and backup

Who Should Enroll?

An online Tally course is suitable for a wide range of learners, including:

Commerce and Business Students: To enhance academic understanding with practical software skills.

Working Professionals: To boost career growth in accounting, finance, or taxation.

Entrepreneurs and Small Business Owners: To manage their finances independently.

Freelancers: To offer bookkeeping or accounting services to clients.

Eligibility Criteria

There are generally no strict prerequisites to enroll in a Tally course online. However, having the following helps:

Basic knowledge of accounting or commerce (preferred but not mandatory)

Familiarity with using computers

Understanding of financial documents like invoices and ledgers

Duration and Certification

The duration of an online Tally course typically ranges from 1 to 3 months, depending on the depth of the curriculum and the learner's pace.

Upon completion, participants receive a Certificate of Completion or Certificate of Proficiency from the training institute or platform. Some courses may also offer assessments and project work to validate your learning.

Career Opportunities After Tally Course

Completing a Tally course can open up a range of career opportunities, especially in the accounting and finance domain. Some of the common job roles include:

Accounts Executive

Data Entry Operator

Bookkeeper

Tally Operator

Tax Assistant

Inventory Manager

Billing Executive

Payroll Accountant

With experience and additional qualifications, professionals can move up to roles like:

Senior Accountant

Finance Manager

GST Practitioner

Audit Executive

Average Salary After Tally Course

The average starting salary for professionals skilled in Tally ranges from ₹1.8 LPA to ₹3.5 LPA in India. With experience and expertise in related domains such as GST, payroll, or inventory management, this figure can increase significantly.

Platforms Offering Tally Courses Online

Several reputed platforms and institutes offer Tally courses online with certification:

1. Udemy

Self-paced courses

Lifetime access to content

Affordable pricing

2. Coursera

Courses from universities and colleges

Offers financial aid and certification

3. NIIT

Industry-recognized certification

Virtual instructor-led classes

4. Tally Education Pvt. Ltd.

Official training from the makers of Tally

Courses on TallyPrime and GST

5. Skillshare / Simplilearn / EduBridge

Subscription or module-based learning

Practical assignments and support

Tips for Choosing the Right Tally Course Online

When selecting a Tally course online, consider the following:

Accreditation and Certification: Choose courses that offer recognized certificates.

Curriculum Coverage: Ensure the course covers core modules like GST, inventory, and payroll.

Trainer Experience: Look for trainers with industry knowledge and teaching experience.

Student Reviews: Check ratings and feedback from previous students.

Support Services: Access to forums, doubt-clearing sessions, and career guidance is a plus.

Final Thoughts

An online Tally course is a smart investment for anyone looking to build or advance a career in accounting, finance, or business administration. Its practical applications in GST, payroll, inventory, and financial reporting make it a must-have skill in today’s competitive job market.

With numerous online platforms offering flexible, affordable, and industry-relevant training, mastering Tally has never been easier. Whether you’re a student, a business owner, or a professional aiming for a promotion, enrolling in a Tally course online can pave the way to a brighter financial future.

0 notes

Link

0 notes

Text

Best Tally Training Institute in Kolkata

Kolkata's Top Tally course online in Kolkata - Students learn precisely how to manage and maintain accounts, inventory, and payroll at Tally in our TallyPrime Certificate Course with gst.

#certificate course in tally 9 erp#tally erp 9 certificate course#tally course near me#tally erp course near me#tally course#tally certificate course#tally with gst course in kolkata#tally gst course fees in kolkata#tally course online#learn tally online#online tally course with gst with certificate#online tally course with gst#tally course in kolkata#online tally course#tally prime course

0 notes

Text

How e-Accounting Helps You Stay Ahead in Finance Jobs

Introduction

In today’s fast-evolving financial industry, employers are no longer just looking for candidates who know traditional accounting. They need professionals who understand e-Accounting, GST compliance, e-filing, and modern tools like Tally Prime. This is where e-Accounting steps in as a game-changer—especially for students who want to stand out in the finance job market.

Whether you’re from Yamuna Vihar, Uttam Nagar, or any part of Delhi, gaining practical knowledge in e-Accounting can open doors to career paths in finance, taxation, and business management.

What is e-Accounting and Why Does It Matter?

e-Accounting stands for “electronic accounting”—a modern accounting system where financial data is recorded and managed digitally using software such as Tally ERP 9 and Tally Prime.

In today’s digital economy, companies prefer hiring candidates who are skilled in:

Online GST return filing

e-Taxation and compliance

Payroll processing

Advanced Excel

Cloud-based financial record keeping

These skills are in high demand across industries and are often taught through specialized e-Accounting training in Delhi, e-filing courses, and GST training.

Benefits of Learning e-Accounting for Finance Jobs

1. Stay Job-Ready with Practical Knowledge

Finance recruiters today expect job seekers to be industry-ready. Completing an financial e-accounting course in Uttam Nagar gives students hands-on experience in preparing ledgers, filing GST, processing payroll, and generating reports—all essential for finance jobs.

2. Master Tally Prime and GST Filing

Tally is still the backbone of accounting for thousands of businesses. Institutes offering Tally classes in Yamuna Vihar or Tally Prime courses in Uttam Nagar focus on the latest updates like GST integration and advanced inventory management. You’ll also learn about Tally with GST certification, which is a must for accounting roles in MSMEs and startups.

3. Gain Expertise in Taxation and E-Filing

From managing tax deductions to filing returns, taxation plays a huge role in every organization. Specialized e-taxation courses and e-filing training empower you with complete understanding of Indian tax systems and help you support businesses in staying compliant.

4. Explore Diverse Career Options

By pursuing professional courses in financial e-accounting, you become eligible for roles like:

Accounts Executive

GST Practitioner

Tax Assistant

Payroll Executive

Audit Assistant

Institutes offering GST coaching and e-accounting training offer real-time projects and mock return filing which build confidence and experience.

Centers provide short-term and diploma-level courses in Tally ERP 9, Tally Prime, e-Taxation, and e-filing, including free tally eBooks, video tutorials, and downloadable Tally PDFs for self-practice.

If you're from Bhajanpura, Shahdara, or nearby areas, you can also explore or tally classes near Yamuna vihar for convenient access.

Online and Offline Support for Learners

In addition to classroom training, students can:

Download free tally study material for self-paced learning.

Watch Tally ERP 9 video tutorials to revise concepts anytime.

Access GST coaching classes near me using location-based search.

Opt for accounting internships or project-based learning for practical exposure.

Institutes also offer dedicated Tally coaching centres in Yamuna Vihar and Uttam Nagar, so students can choose according to their locality.

Final Thoughts

The finance industry is transforming rapidly, and digital skills are no longer optional. Investing in an e-Accounting course or a financial e-accounting training gives you a head start in your career.

Whether you're a fresher, commerce student, or working professional looking to upskill, e-Accounting combined with GST, Tally, and taxation training is the perfect formula to stay ahead in finance jobs.

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

#tally prime course#tally prime with GST course#e Accounting course in uttam nagar#e Accounting course in yamuna vihar#ms excel#advance ms excel#GST course with e Filling

0 notes

Text

0 notes

Text

Best GST Institute in Yamuna VIhar

Are you always on the search to become an accountant? Always searching online in order to learn but can’t seem to find the right path to gain knowledge?

Well, Attitude Academy, the number-one academy to provide Tally classes in Yamuna Vihar, is gonna be your first choice to become an official accountant, and introduce you into the world of job opportunities and accounting with great information and education on how to run the Tally software professionally.

Tally software is being used daily by more than seven million customers, it gains its importance from being one of the most used e-accounting software in India, that’s why it is highly crucial to keep up and learn about this software if you want to be an accountant.

Attitude Academy offers Tally classes in Yamuna Vihar, this class is an introduction to the basic concepts and standards underlying TallyPrime Training system. Attitude Academy has been approved to teach Tally classes in Yamuna Vihar along with a government-recognized certificate.

One of the best things we offer at our Tally classes in Yamuna Vihar, is that you can practice by yourself, online or offline, with a classmate or alone, interact with your teacher or connect with him later for any question you might have, we provide flexibility to help you learn throughout your busy daily schedule, you can work and learn at the same time. In fact, our tally classes in Yamuna Vihar help you become an accountant from day one!

Because TallyPrime is always connected with GST, Attitude Academy, the perfect GST Institute in Yamuna Vihar, crosses between both in its training course. The GST program is highly required today by many small and medium size businesses. In fact, latest studies show that learning about the GST system helps in raising an individual’s salary by 15% to 25% on average.

It increases the number of job opportunities available for individuals, and develops many skills regarding taxation, finance, accounting and professionals. By registering in your number-one GST institute in Yamuna Vihar, you’ll have an assured 100% job assistance and help plus a government-recognized certificate.

You’ll have online/offline assessments for practice, you’ll also receive training on Real Data for making you ready to become an account. After enrolling in the GST institute in Yamuna Vihar, you’ll have a 24/7 lifetime access to all the e-books with more than 500 assignments, over 90 practical videos for covering the course. Choose Attitude Academy for e-accounting learning and always stay updated with the most wanted jobs and requirements in the market of today.

1 note

·

View note

Text

Tally Prime Online Competition

❤️ and follow @bpaeducators

📂 Don't forget to save this for future reference!

💥 Follow us on Facebook, Youtube, Instagram, Twitter, LinkedIn and much more for more( Link in Bio)

Course link - https://www.bpaeducators.com/professional-accounting-course/

BPA Community :- https://www.facebook.com/groups/bpamastery

Instagram:- https://www.instagram.com/bpaeducator/

Facebook:- https://www.facebook.com/bpaeducator

www.bpaeducators.com

#bpa #bpaeducators #bestinstituteinrohini #tallyerp

#tallyerp9

#tallyerp9gst

#tallyerp9course

#tallyerp9traininginstitutesinnoida

#tallyerpcustomization

#tallyerpclasses

#tallyprime

#tallyprimedownload

#tallyprime2021

#tallyprimecourse

#tallyprimeshortcutkeys

#tallyactivity

#tallyactivitybpa

#howtoactivate

#tdsintallyprime

0 notes

Text

Online Certification Course To Become A Tax Accountant

Online Certification Course To Become A Tax Accountant

Tax Accountant is one who manages money, capital or credit. They also understand tax reporting requirements and prepare tax returns for both individuals and organistion. Taxation accountant for individuals focuses on income, donations and investment any gain or losses. In business or organisations taxation accountant is more complex, check how the fund is spent and differentiate between taxable and non taxable.

Taxation is important to individuals, businesses or organisations since it is compulsory levies. Taxation Accountants can help them to handle tax and related problems. So the taxation field consists of numerous job opportunities. Some of the best online certified courses you can capture in order to be a Tax Accountant are CBAT, PGBAT, VAT, GST, Diploma in Taxation, Certified Tax Program, Diploma in Taxation Management and more.

CBAT

CBAT(Certification in Business Accounting and Taxation) is a six month accounting and taxation course that provides an idea about most of the accounting software and tax systems. CBAT mainly focuses on topics such as GST return filing, Income Tax, Advanced Tax, cooperate Law and more. It is the best course for accounting and taxation professionals.

PGBAT

PGBAT(PG Diploma In Business Accounting and Taxation) is a one year course in accounting and taxation. This course can make you familiar with the use of accounting software such as SAP FICO ERP software, Tallyprime and Quickbooks. It also provides practical and theoretical knowledge on topics like Basic Accounting, GST, Income Tax, MS Excel tools, Corporate Law, ESI, PF and more. The main career options for this job are Internal Audit, Taxation, Auditing, Real Estate Financing, Budget Analysis, Management Accounting and more.

Diploma In Taxation

Diploma In Taxation is a one year program in accounting and commerce. Both theoretical and practical knowledge of direct and indirect taxes are provided for learners.

Certified Tax Program

The Certified Tax Program(CTP) is an advanced individual income tax course. This course mainly covers issues by high income taxpayers and divorced payers, advises clients on income tax situation, handle individual and small income tax situation.

Diploma in Taxation Management

Diploma in Taxation Management is a one year taxation course. This course mainly focuses on topics such as tax matters, ranging from cooperate, individual update and ethics etc….

These are some of the main taxation courses you can capture if you want to be a tax professional. Taxation courses can explore issues in taxation such as management, evaluation, reporting, auditing and more. A taxation course can provide you with additional skills and knowledge. Taxation is hard to study due to complicated problems and solutions.

If you want to pursue this career, you should understand their roles and responsibilities in order to determine which taxation certification to complete. There are many taxation courses you can capture if you want to be a taxation professional.

There are so many institutes that provide short term courses that help to make professional taxation accountants. Finprov Learning is one of the best institutes to provide Accounting and Taxation courses. The best taxation courses provide by finprov are CBAT, PGBAT, GST and Gulf VAT. Some of the accounting and finance courses provided by Finprov are CMA USA, CA Foundation, PGDIFA, SAP FICO, DIA, CHRPP(HR payroll processing) and more. These courses are provided to learners by the best trainers and with the best technical support.The practical training program supports learners to achieve the best in their career.

1 note

·

View note