#Global Automated Storage and Retrieval System Market demand

Explore tagged Tumblr posts

Text

Pharmacy Automation Devices Market to boom with 8–9% CAGR due to accurate dispensing by 2029

The pharmacy automation devices market is experiencing steady growth, with a projected CAGR of approximately 8-9% during the forecast period. This expansion is driven by the increasing need for efficient medication management systems, rising demand in hospitals and retail pharmacies, and the growing focus on patient safety through error reduction.

Pharmacy automation devices are systems designed to streamline various pharmacy processes, such as medication dispensing, packaging, labelling, and inventory management. These devices reduce human errors, enhance efficiency, and ensure proper medication tracking, particularly in large hospitals and retail pharmacies. The technology behind automation devices includes robotic dispensing systems, automated storage and retrieval systems, and medication compounding systems. Their implementation helps improve patient safety, reduce operational costs, and optimise workflow within healthcare facilities.

🔗 Want deeper insights? Download the sample report:https://meditechinsights.com/pharmacy-automation-devices-market/request-sample/

Increasing Demand for Automated Solutions in Chronic Disease Management

A key factor driving the growing adoption of pharmacy automation devices is the rising need for effective chronic disease management. As the global population ages, the incidence of long-term conditions such as diabetes, cardiovascular disease, and respiratory disorders is surging, requiring continuous medication management. This growing burden on healthcare systems demands error-free, efficient, and scalable dispensing processes to ensure patient safety and timely delivery of prescriptions. Automation technology plays a crucial role by streamlining these tasks, reducing human error, and allowing pharmacies to handle high prescription volumes more effectively. With chronic disease cases expected to rise further, the demand for automated pharmacy systems is anticipated to increase, making them essential for hospitals and retail pharmacies to keep pace with patient needs.

AI and Predictive Analytics: A Game-Changer for Pharmacy Automation

The integration of AI and predictive analytics is emerging as a game-changing trend in the pharmacy automation market. AI-enabled systems are significantly improving the ability to forecast medication demand by analyzing consumption patterns, patient data, and inventory levels, allowing pharmacies to optimize stock management and reduce the risk of shortages or overstocking. In addition, machine learning algorithms are enabling more accurate and personalized medication dispensing, ensuring the right dose is provided based on individual treatment plans. This not only enhances operational efficiency but also improves patient outcomes by minimizing dispensing errors. The rise of AI-driven solutions is transforming the pharmacy landscape, positioning these advancements as vital for the future of automation in healthcare settings.

Gain a competitive edge-request a sample report now! https://meditechinsights.com/pharmacy-automation-devices-market/request-sample/

Competitive Landscape Analysis

The global pharmacy automation devices market is marked by the presence of established and emerging market players such as Amerisource Bergen Corporation (Cencora); Accu-Chart Plus; Healthcare Systems, Inc.; Omnicell, Inc.; McKesson Corporation; Pearson Medical Technologies; Baxter; Scriptpro LLC; Deenova S.R.L; Fulcrum Pharmacy Management, Inc.; Swisslog Healthcare, and Yuyama Co. Ltd among others. Some of the key strategies adopted by market players include product innovation and development, strategic partnerships and collaborations, and geographic expansion.

About Medi-Tech Insights

Medi-Tech Insights is a healthcare-focused business research & insights firm. Our clients include Fortune 500 companies, blue-chip investors & hyper-growth start-ups. We have completed 100+ projects in Digital Health, Healthcare IT, Medical Technology, Medical Devices & Pharma Services in the areas of market assessments, due diligence, competitive intelligence, market sizing and forecasting, pricing analysis & go-to-market strategy. Our methodology includes rigorous secondary research combined with deep-dive interviews with industry-leading CXO, VPs, and key demand/supply side decision-makers.

Contact:

Ruta Halde Associate, Medi-Tech Insights +32 498 86 80 79 [email protected]

0 notes

Text

Retail Automation Market Sees Technological Innovation Reshaping Traditional Retail and Consumer Interaction

The retail automation market is undergoing a remarkable transformation driven by technological advancements, evolving consumer preferences, and the increasing need for operational efficiency. Retailers across the globe are embracing automation solutions to enhance customer experiences, reduce costs, streamline operations, and stay competitive in an increasingly digital economy. This rapid adoption is significantly reshaping the retail landscape across both developed and emerging markets.

Market Overview

Retail automation involves the use of technology to automate retail processes such as inventory management, billing, customer engagement, and product tracking. It includes a wide range of solutions such as self-checkout systems, vending machines, electronic shelf labels (ESLs), barcode and RFID systems, interactive kiosks, and automated storage and retrieval systems (AS/RS). These solutions not only reduce dependency on manual labor but also improve accuracy, speed, and customer satisfaction.

The global retail automation market has seen robust growth over the past few years. As of 2024, the market size is valued at over USD 20 billion and is projected to surpass USD 35 billion by 2030, growing at a CAGR of over 8% during the forecast period. This growth is largely driven by advancements in AI, IoT, robotics, and cloud computing.

Key Drivers of Growth

Increased Consumer Demand for Contactless Shopping The COVID-19 pandemic accelerated the adoption of contactless technologies. Customers today prefer minimal physical interaction, which has driven retailers to invest in self-checkout systems and mobile payment solutions. These technologies also reduce wait times and improve convenience.

Rising Labor Costs and Labor Shortages Retailers are increasingly facing labor-related challenges, especially in developed countries. Automation offers a sustainable alternative by minimizing human error and lowering operating costs in the long run.

Data-Driven Decision Making Retail automation tools collect vast amounts of real-time data that help retailers make informed decisions regarding inventory levels, customer preferences, and product placement. AI-powered analytics tools enhance this further by providing predictive insights.

Enhanced In-Store Experience Interactive kiosks, smart mirrors, and AR/VR technology allow retailers to provide immersive shopping experiences that improve customer engagement and satisfaction, helping brick-and-mortar stores compete with e-commerce.

Market Segmentation

The retail automation market can be segmented by product type, end-user, and region.

By Product Type: Point-of-sale (POS) terminals, barcode & RFID systems, electronic shelf labels, self-checkout systems, and vending machines.

By End-User: Supermarkets, hypermarkets, convenience stores, fuel stations, and online retailers.

By Region: North America holds the largest market share, followed by Europe and Asia-Pacific. However, the Asia-Pacific region is expected to witness the fastest growth due to increasing urbanization, rising disposable incomes, and rapid digitalization in countries like China and India.

Competitive Landscape

The market is highly competitive and fragmented. Major players include Honeywell International Inc., Fujitsu Limited, Diebold Nixdorf, Zebra Technologies, NCR Corporation, and Toshiba Global Commerce Solutions. These companies are investing heavily in R&D and forming strategic partnerships to expand their product offerings and reach.

Startups are also playing a significant role by introducing innovative solutions, particularly in AI-driven analytics and cashier-less checkout technologies. Amazon Go is a notable example, setting new benchmarks for automation in retail environments.

Challenges and Limitations

Despite the benefits, the adoption of retail automation is not without challenges. High initial investment costs can be a barrier for small and medium-sized enterprises (SMEs). There are also concerns around data privacy, cybersecurity, and job displacement. Retailers must ensure a balanced integration of automation and human labor to maintain both efficiency and customer trust.

Future Outlook

The future of the retail automation market looks promising. Emerging technologies such as AI, machine learning, robotics, and edge computing will continue to drive innovation. Personalization will become a key focus, with automation enabling hyper-personalized shopping experiences tailored to individual consumer behavior.

Moreover, sustainability will play an increasing role, with automated systems helping reduce waste and optimize energy consumption in stores. As competition intensifies and consumer expectations rise, retailers that strategically invest in automation will be better positioned to succeed in the evolving landscape.

0 notes

Text

AI in Action: Intelligent Solutions for the Document Management System Market

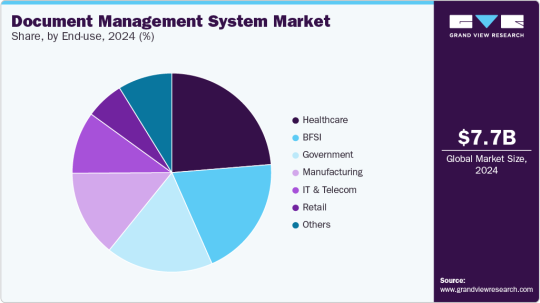

The global document management system market was valued at USD 7.68 billion in 2024 and is projected to reach USD 18.17 billion by 2030, demonstrating a robust Compound Annual Growth Rate (CAGR) of 15.9% from 2025 to 2030. This expansion is primarily fueled by organizations' increasing need to securely manage and store vast volumes of digital information.

As businesses worldwide embrace digital transformation and move towards paperless operations, the demand for effective solutions for document storage, retrieval, and management has escalated. The accelerated adoption of cloud-based DMS solutions has further spurred this trend, offering businesses scalable, cost-effective, and readily accessible options. Moreover, the heightened focus on compliance and regulatory mandates is significantly contributing to the growth of the DMS industry. Enterprises operating in heavily regulated sectors like healthcare, finance, and legal are increasingly implementing DMS to ensure strict adherence to data security, privacy, and record-keeping regulations. These systems facilitate streamlined audits, maintain secure document trails, and mitigate the risk of non-compliance penalties.

Key Market Trends & Insights:

Regional Leadership: The North American document management system market commanded a substantial revenue share of almost 40.0% in 2024, driven by the escalating demand for digital transformation across various industries.

Component Dominance: The software segment held the largest market share, exceeding 67.0% of the revenue in 2024. This dominance is attributed to the growing demand for cloud-based, AI-driven, and compliance-ready solutions.

Deployment Preference: The cloud segment led the market with a revenue share of over 67.0% in 2024. This is propelled by the integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA) into cloud DMS platforms.

Enterprise Size Leadership: Large enterprises accounted for nearly 67.0% of the market's revenue share in 2024. This is due to the immense volume of enterprise-grade documents they manage and their critical need for scalable, secure, and intelligent document workflows.

End-Use Sector Dominance: The healthcare segment generated over 23.0% of the market's revenue share in 2024. A significant driver here is the accelerating shift towards Electronic Health Records (EHRs) and paperless systems within the healthcare industry.

Order a free sample PDF of the Document Management System Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 7.68 billion

2030 Projected Market Size: USD 18.17 billion

CAGR (2025-2030): 15.9%

North America: Largest market in 2024

Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Leading companies in the document management system (DMS) industry, including Microsoft, IBM Corporation, Oracle Corporation, Open Text Corporation, and Hyland Software, Inc., are actively engaged in strategic initiatives to enhance their competitive edge. These strategies largely involve new product development, forging partnerships and collaborations, and entering into agreements.

Illustrative of these efforts, in April 2025, Hyland Software, Inc. significantly expanded its product offerings by integrating advanced AI capabilities. Through substantial updates to Hyland Automate, Hyland Knowledge Discovery, and key improvements to Hyland OnBase and Hyland Alfresco, the company aims to provide organizations with sophisticated tools for optimizing content, processes, and application intelligence. Their Hyland Content Intelligence product line is designed to empower businesses with actionable insights derived from simple natural language queries, thereby streamlining complex searches and delivering precise information from vast enterprise content.

Similarly, in March 2025, IBM Corporation launched IBM Storage Ceph as a Service, broadening its suite of flexible on-premises infrastructure solutions. This new service complements IBM Power delivered as a service, offering a distributed compute platform with diverse form factors and adaptable consumption models. The IBM Storage Ceph service facilitates the integration of cloud-based solutions with on-premises environments, providing a unified software-defined storage solution that encompasses block, file, and object data. Its goal is to help organizations eliminate data silos and modernize their data lakes and virtual machine storage, delivering a seamless cloud storage experience within their own data centers.

Further demonstrating industry innovation, in December 2024, OpenText introduced Core Digital Asset Management (Core DAM). This solution is engineered to optimize the digital content supply chain by incorporating powerful features that yield tangible results. Core DAM leverages practical AI to automate tasks such as image tagging, video transcript generation, and the creation of design inspiration images using OpenText Experience Aviator, significantly boosting the efficiency and accuracy of creative workflows. It also provides global content access, enabling users to generate instant links for high-performance display worldwide.

Key Players

Agiloft, Inc.

Alfresco Software Inc.

Cflowapps

DocLogix

Hyland Software, Inc.

IBM Corporation

Integrify

Browse Horizon Databook for Global Document Management System Market Size & Outlook

Conclusion

The document management system (DMS) market is rapidly growing, driven by the need for secure digital information management and paperless transitions. Cloud-based solutions and regulatory compliance are key growth factors. North America leads the market, with software and cloud deployments dominating. Large enterprises and the healthcare sector are major adopters. Leading companies are innovating with AI and strategic collaborations to enhance their offerings.

0 notes

Text

Material Handling Equipment Market Outlook Global Trends, Statistics, Size, Share, Regional Analysis by Key Players (2021-2031)

The Material handling equipment market size is expected to reach US$ 92.63 billion by 2031 from US$ 60.05 billion in 2024. The market is estimated to record a CAGR of 6.51% from 2025 to 2031.

Executive Summary and Global Market Analysis

The global material handling equipment market is experiencing strong growth. This is largely due to rapid industrialization, increased warehouse automation, and the expanding e-commerce sector. The market includes a wide array of equipment used for transporting, storing, controlling, and protecting materials throughout various processes, including manufacturing, distribution, and disposal.

The industry's expansion is primarily driven by a growing need for operational efficiency, the increasing adoption of automation technologies, and a demand for better supply chain transparency. In response, manufacturers are developing innovative solutions that integrate advanced technologies like artificial intelligence (AI), the Internet of Things (IoT), and robotics to optimize warehouse operations and logistics infrastructure. Geographically, the Asia-Pacific region leads the market, thanks to significant infrastructure investments and rapid urbanization in countries like China and India.

Download our Sample PDF Report

@ https://www.businessmarketinsights.com/sample/BMIPUB00031690

Material Handling Equipment Market Segmentation Analysis

The material handling equipment market analysis is derived from key segments: technology, material, application, and end user.

By Equipment Type, the market is segmented into:

Cranes and Lifting Equipment

Industrial Trucks

Automated Storage and Retrieval Systems (AS/RS)

Conveying Systems

Racking and Storage Equipment

Automated Guided Vehicles (AGVs)

Bulk Material Handling Equipment

Others

By End-Use Industry, the market is segmented into:

Logistics

Automotive

Construction

Food & Beverages

Pharmaceuticals/Healthcare

Semiconductor & Electronics

By Application Type, the market is segmented into:

Assembly

Transportation

Distribution

Others

Material Handling Equipment Market Drivers and Opportunities

The rapid expansion of e-commerce is a significant driver for the material handling equipment market. As online retail grows, companies like Amazon and Alibaba are investing in automated warehouses to manage high order volumes. This, in turn, increases the demand for equipment such as forklifts, conveyors, and Automated Guided Vehicles (AGVs).

Urbanization and rising consumer expectations for quick deliveries further boost the need for efficient logistics systems. The growth of warehousing in regions like Asia-Pacific and North America directly fuels equipment sales. As e-commerce continues its upward trend, the demand for advanced material handling solutions to streamline operations and reduce delivery times will significantly propel market expansion.

Material Handling Equipment Market Size and Share Analysis

By Equipment Type: Cranes and Lifting Equipment, along with Industrial Trucks, Automated Storage and Retrieval Systems (AS/RS), Conveying Systems, Racking andStorage Equipment, Automated Guided Vehicles (AGVs), and Bulk Material Handling Equipment, are crucial. Cranes and lifting equipment are vital across construction, manufacturing, heavy engineering, automotive, and logistics for efficiently moving heavy materials and payloads. The construction industry, in particular, drives substantial demand due to ongoing urbanization, infrastructure development, and large-scale industrial projects.

By End-User Industry: The global growth of automobile production necessitates efficient material handling systems to manage the flow of materials and finished vehicles within factories and distribution centers. Automotive manufacturing plants are increasingly adopting modernized material handling infrastructure to improve assembly processes, reduce turnaround times, and support lean manufacturing principles, all of which require advanced handling equipment. The automotive industry's adoption of automation, robotics, and IoT-enabled material handling solutions enhances operational efficiency and safety, further boosting the demand for sophisticated equipment.

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

0 notes

Text

Automated Warehouse Systems: Revolutionizing Supply Chain Efficiency

Introduction

In the rapidly evolving world of logistics and supply chain management, automated warehouse systems have emerged as a transformative solution. From streamlining operations to enhancing productivity, automation is redefining how warehouses function. With rising customer expectations and global e-commerce expansion, businesses are increasingly turning to automation to remain competitive and agile.

What Are Automated Warehouse Systems?

Automated warehouse systems are technology-driven solutions that perform warehousing functions—such as storage, retrieval, sorting, and packaging—with minimal human intervention. These systems integrate hardware like automated storage and retrieval systems (AS/RS), conveyor belts, robotic arms, and automated guided vehicles (AGVs) with intelligent software to manage inventory and workflows efficiently.

Key Components of Warehouse Automation

Automated Storage and Retrieval Systems (AS/RS): Mechanized systems that place and retrieve goods from specific locations in the warehouse, improving storage density and speed.

Robotics and AGVs: Robots and self-driving vehicles transport goods throughout the warehouse, reducing the need for forklifts or manual labor.

Warehouse Management Systems (WMS): Software platforms that coordinate data, monitor inventory, and optimize task assignments in real-time.

Sortation Systems: High-speed sorters classify and direct items to their respective locations, essential for handling thousands of parcels daily.

Conveyor Systems: Automated conveyors streamline movement across packing, picking, and shipping stations.

Benefits of Automated Warehouse Systems

Increased Efficiency: Automation significantly reduces picking and handling time, allowing warehouses to process more orders faster.

Enhanced Accuracy: With advanced sensors and tracking systems, errors in inventory management and order fulfillment drop dramatically.

Lower Operational Costs: While initial investment may be high, automation reduces long-term labor and operational costs.

Scalability: Automated systems can easily adapt to demand fluctuations and business growth.

Improved Safety: By minimizing manual handling and using robots for repetitive or heavy tasks, workplace injuries are reduced.

Challenges in Implementing Automation

High Initial Investment: The upfront cost for equipment, software, and integration can be substantial.

Technical Complexity: Requires skilled professionals for maintenance, troubleshooting, and optimization.

Change Management: Employees may need to be retrained, and workflows must be adapted to new systems.

Real-World Applications

E-commerce Fulfillment Centers: Giants like Amazon and Alibaba use automated warehouses to manage millions of orders daily.

Cold Storage Facilities: Automation ensures fast, efficient handling in temperature-sensitive environments.

Pharmaceutical and Healthcare Logistics: Ensures accuracy, compliance, and timely delivery of sensitive medical supplies.

The Future of Warehouse Automation

The future looks promising with the rise of AI, machine learning, and IoT-enabled devices enhancing automation capabilities. Predictive analytics, real-time data monitoring, and fully autonomous operations are set to become standard in modern warehouse facilities.

Conclusion

Automated warehouse systems are not just a trend—they are the future of efficient, reliable, and scalable logistics. As technology advances and market demands grow, automation will play a critical role in ensuring operational excellence across the supply chain.

0 notes

Text

Automated Storage and Retrieval Systems Market Growth Driven by Labor Shortages and Warehouse Automation Demands

The global Automated Storage and Retrieval Systems market is witnessing a robust expansion, powered by the continuous evolution in supply chain and warehouse automation. ASRS are a key solution in optimizing storage density, improving inventory control, and enhancing picking accuracy in warehouses and manufacturing facilities. These systems, including unit load, mini load, carousel-based, and shuttle-based ASRS, are enabling companies to increase operational efficiency and reduce labor dependency. The market growth is being driven by a range of significant factors, which are accelerating their adoption across sectors such as e-commerce, food & beverage, pharmaceuticals, automotive, and retail.

Growing Demand for Warehouse Automation One of the primary drivers of the ASRS market is the escalating demand for warehouse automation. With the global boom in e-commerce and omnichannel retailing, businesses are pressured to manage complex and high-volume order fulfillment operations. ASRS offer an automated solution to these challenges by optimizing inventory management, increasing throughput rates, and reducing operational costs. Companies are increasingly deploying ASRS to stay competitive and meet the rising expectations for rapid and accurate order deliveries. Automation also provides real-time inventory visibility, an essential requirement in modern warehousing.

Labor Shortages and Rising Labor Costs Another critical market driver is the global labor shortage, particularly in logistics and warehousing roles. As finding and retaining skilled warehouse staff becomes more difficult, businesses are turning to automated systems to fill the gap. Moreover, rising labor costs in developed economies are prompting companies to adopt ASRS as a cost-saving measure. By reducing the reliance on manual labor, these systems not only ensure consistent productivity but also improve workplace safety and reduce human error. This trend is particularly strong in regions like North America and Europe, where wages are higher and labor availability is declining.

Increased Need for Space Optimization Space utilization is a vital consideration for modern warehouses, especially in high-cost urban areas. ASRS enable high-density storage and allow vertical use of space, thereby reducing the overall warehouse footprint. This is particularly beneficial for businesses operating in cities where real estate costs are a significant burden. Space optimization through automated systems helps maximize storage capacity without the need for warehouse expansion, contributing to significant cost savings in the long run.

Technological Advancements and Integration with Industry 4.0 Technological innovation is another strong driver behind the ASRS market growth. The integration of ASRS with advanced technologies such as IoT, AI, machine learning, and data analytics has enhanced their functionality and appeal. These technologies enable predictive maintenance, performance monitoring, and smart decision-making in real-time. The emergence of Industry 4.0 has encouraged the adoption of intelligent automation solutions, and ASRS are a cornerstone of this digital transformation in logistics. As technology becomes more accessible and affordable, more small and medium enterprises are expected to adopt ASRS to stay technologically relevant.

Growth in E-commerce and Omnichannel Retailing The rapid expansion of e-commerce is significantly contributing to the adoption of ASRS globally. Online retailers deal with high order volumes, frequent returns, and a wide range of SKUs, all of which demand advanced storage and retrieval capabilities. ASRS enable e-commerce companies to manage inventory dynamically, streamline picking and packing processes, and meet tight delivery schedules. The trend of omnichannel retailing, which requires synchronization between online and offline channels, further strengthens the need for efficient warehouse solutions, propelling the ASRS market.

Government Initiatives and Supportive Regulations Governments in various countries are promoting the adoption of automation technologies through subsidies, incentives, and favorable regulations. These initiatives aim to enhance manufacturing and logistics infrastructure, increase industrial productivity, and create smart cities. Such policies are encouraging more companies to invest in ASRS and related technologies. For instance, government-backed initiatives in countries like China, Germany, and Japan are promoting smart manufacturing and digital logistics, thereby indirectly fueling the ASRS market growth.

Resilience in Times of Disruption The COVID-19 pandemic highlighted the vulnerability of supply chains that relied heavily on human labor. In response, many companies began investing in ASRS to increase operational resilience and reduce dependence on workforce availability. Automated systems are capable of maintaining operations even during periods of labor shortages, lockdowns, or health-related disruptions. This long-term shift towards resilient and flexible supply chains is expected to continue, with ASRS playing a vital role.

Conclusion The Automated Storage and Retrieval Systems market is being driven by a confluence of technological, economic, and social factors. The need for efficiency, speed, and resilience in logistics and warehousing is accelerating the adoption of ASRS across diverse industries. As businesses look to future-proof their operations and navigate an increasingly competitive landscape, the deployment of these systems is set to rise, positioning the market for substantial growth in the coming years.

0 notes

Text

Biobanking Market Size, Share, Trends, Demand, Growth, Challenges and Competitive Analysis

Executive Summary Biobanking Market :

Biobanking Market report endows with superior market perspective in terms of product trends, marketing strategy, future products, new geographical markets, future events, sales strategies, customer actions or behaviours. The report also measures market drivers, market restraints, challenges, opportunities and key developments in the market. This market report is an accurate study of the industry which gives estimations about new triumphs that will be made in the Biobanking Market Market in 2018-2025. The Biobanking Market Market report exhibits important product developments and tracks recent acquisitions, mergers and research in the industry by the key players.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Biobanking Market Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-biobanking-market

Biobanking Market Market Overview

**Segments**

- **By Sample Type** - Blood Products - Human Tissues - Cell Lines - Nucleic Acids

- **By Equipment** - Storage Equipment - Storage System - Support Devices

- **By Services** - Processing - Storage - Supply

- **By Type** - Human Biobanking - Environment Biobanking - Drug Discovery Biobanking

Biobanking is a crucial aspect of medical research that involves the collection and storage of biological samples for future analysis. The global biobanking market is segmented based on sample type, equipment, services, and type. The sample type segment includes blood products, human tissues, cell lines, and nucleic acids. Blood products segment is anticipated to witness significant growth due to the increasing demand for blood-related research. The equipment segment consists of storage equipment, storage systems, and support devices. The rise in demand for advanced storage solutions is expected to drive the growth of the storage equipment sub-segment. Services offered in the biobanking market include processing, storage, and supply services. The type segment includes human biobanking, environmental biobanking, and drug discovery biobanking, each catering to specific research needs.

**Market Players**

- Thermo Fisher Scientific Inc. - PHC Holdings Corporation - Tecan Trading AG - QIAGEN - Hamilton Company - Brooks Life Sciences - Panasonic Healthcare Co., Ltd. - Promega Corporation - Chart Industries - Becton Dickinson and Company

Market players in the global biobanking market are crucial entities that provide the necessary infrastructure, equipment, and services for efficient biobanking operations. Thermo Fisher Scientific Inc., a prominent player in this market, offers a wide range of biobanking solutions, including storage systems and related equipment. PHC Holdings Corporation is another key player known for its innovative biobanking technologies. Tecan Trading AG specializes in automation solutions for biobanking processes, enhancing efficiency and accuracy. QIAGEN is a leading provider of sample processing and analysis solutions for biobanking applications. Other notable market players include Hamilton Company, Brooks Life Sciences, Panasonic Healthcare Co., Ltd., Promega Corporation, Chart Industries, and Becton Dickinson and Company.

Another key driver of market growth is the rising prevalence of chronic diseases globally, prompting the need for extensive research to understand the underlying mechanisms and develop effective treatments. Biobanking enables researchers to access a wide range of samples for studying disease progression, biomarker identification, and treatment efficacy. Moreover, the integration of artificial intelligence and big data analytics in biobanking operations is enhancing sample management, retrieval, and analysis, thereby accelerating research outcomes.

In terms of market dynamics, increasing collaborations among biobanks, research institutions, and pharmaceutical companies are fostering innovation and the development of novel therapies. These partnerships facilitate the sharing of resources, expertise, and samples, leading to more comprehensive research outcomes. Additionally, regulatory initiatives aimed at standardizing biobanking practices, ensuring sample quality, and protecting patient privacy are further bolstering market growth.

Furthermore, the COVID-19 pandemic has underscored the importance of biobanking in infectious disease research and vaccine development. Biobanks worldwide have contributed to collecting and storing biological samples related to the virus, supporting epidemiological studies and vaccine trials. This experience has highlighted the need for robust biobanking infrastructure to respond swiftly to emerging health threats and accelerate research timelines.

Moreover, the integration of artificial intelligence and big data analytics into biobanking operations is revolutionizing sample management, retrieval, and analysis processes, thereby accelerating research outcomes. Collaborations among biobanks, research institutions, and pharmaceutical companies are fostering innovation and the development of novel therapies. These partnerships enable the sharing of resources, expertise, and samples, leading to more comprehensive research results. Regulatory initiatives aimed at standardizing biobanking practices, ensuring sample quality, and safeguarding patient privacy are further boosting market growth by enhancing trust and compliance within the industry.

The COVID-19 pandemic has underscored the critical role of biobanking in infectious disease research and vaccine development. Biobanks worldwide have played a crucial role in collecting and storing biological samples related to the virus, supporting epidemiological studies and vaccine trials. This experience has emphasized the need for robust biobanking infrastructure to respond swiftly to emerging health threats and expedite research efforts. Looking ahead, the global biobanking market is poised for sustained growth, driven by technological advancements, increased research investments, and the adoption of precision medicine approaches.

Market players are focusing on developing automated sample handling systems, implementing secure data management solutions, and expanding service offerings to meet the evolving needs of researchers and healthcare providers. The biobanking sector is set to continue playing a pivotal role in advancing medical research, drug development, and ultimately enhancing patient outcomes across various therapeutic areas. The market's trajectory indicates a promising future for biobanking as a critical component of the healthcare and research landscape.

The Biobanking Market Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-biobanking-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Benefits of the Report:

This study presents the analytical depiction of the global Biobanking Market Marketindustry along with the current trends and future estimations to determine the imminent investment pockets.

The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the global Biobanking Market Market share.

The current market is quantitatively analyzed from to highlight the Global Biobanking Market Market growth scenario.

Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

The report provides a detailed global Biobanking Market Market analysis based on competitive intensity and how the competition will take shape in coming years

Browse More Reports:

Global Waterproof Breathable Textiles (WBT) Market Global Water Cooler Market Global Waldenstrom’s Macroglobulinemia (WM) Treatment Market Global Virtual Agents Intelligent Process Automation Market Global Vehicle Cargo Box Market Global Vascular Stent Market Global Vaccine Contract Manufacturing Market Global Urothelial Cancer Drugs Market Global Urolithiasis Management Devices Market Global Turf Protection Market Global Tumor Markers Testing Market Global Tropical Sprue Treatment Market Global Traveler Security Services Market Global Transverse Myelitis Treatment Market Global Transport E-Toll Market Global Tortilla Chips Market Global Torque Limiter Market Global Topoisomerase Inhibitors Market Global Tool Steel Market Global Titanium Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us: Data Bridge Market Research US: +1 614 591 3140 UK: +44 845 154 9652 APAC : +653 1251 975 Email:- [email protected]

Tag

Biobanking Market Market Size, Biobanking Market Market Share, Biobanking Market Market Trend, Biobanking Market Market Analysis, Biobanking Market Market Report, Biobanking Market Market Growth, Latest Developments in Biobanking Market Market, Biobanking Market Market Industry Analysis, Biobanking Market Market Key Player, Biobanking Market Market Demand Analysis

0 notes

Text

Logistics Automation Market

Logistics Automation Market size is estimated to reach $56.9 billion by 2030, growing at a CAGR of 7.9% during the forecast period 2024–2030.

🔗 𝐆���𝐭 𝐑𝐎𝐈-𝐟𝐨𝐜𝐮𝐬𝐞𝐝 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝟐𝟎𝟐𝟓-𝟐𝟎𝟑𝟏 → 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐍𝐨𝐰

Logistics Automation Market is rapidly transforming global supply chains by integrating technologies such as AI, robotics, IoT, and machine learning to enhance efficiency, reduce costs, and improve accuracy. Automation solutions — including autonomous mobile robots (AMRs), automated storage and retrieval systems (AS/RS), and real-time tracking — are increasingly adopted across warehousing, transportation, and last-mile delivery.

Driven by e-commerce growth, labor shortages, and rising demand for faster delivery, the market is expanding globally. Key sectors embracing logistics automation include retail, manufacturing, healthcare, and food & beverage.

🚚 𝐊𝐞𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐫𝐢𝐯𝐞𝐫𝐬

📦 𝐄-𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐁𝐨𝐨𝐦

Rapid growth in online shopping increases demand for faster, more efficient order fulfillment and delivery systems.

🤖 𝐋𝐚𝐛𝐨𝐫 𝐒𝐡𝐨𝐫𝐭𝐚𝐠𝐞𝐬 & 𝐑𝐢𝐬𝐢𝐧𝐠 𝐂𝐨𝐬𝐭𝐬

Shortages in skilled labor and rising wages are pushing companies to adopt automation to maintain productivity and reduce operational costs.

📈 𝐃𝐞𝐦𝐚𝐧𝐝 𝐟𝐨𝐫 𝐒𝐮𝐩𝐩𝐥𝐲 𝐂𝐡𝐚𝐢𝐧 𝐕𝐢𝐬𝐢𝐛𝐢𝐥𝐢𝐭𝐲

Businesses seek real-time tracking and data analytics to enhance decision-making and responsiveness across logistics networks.

⚙️ 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐢𝐜𝐚𝐥 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐦𝐞𝐧𝐭𝐬

Innovations in AI, robotics, IoT, and machine learning are making logistics automation more scalable, affordable, and adaptable.

🔗 𝐍𝐞𝐞𝐝 𝐟𝐨𝐫 𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐚𝐥 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲

Companies aim to streamline warehousing, inventory management, and transportation to boost speed, accuracy, and cost-effectiveness.

𝐋𝐢𝐦𝐢𝐭𝐞𝐝-𝐓𝐢𝐦𝐞 𝐎𝐟𝐟𝐞𝐫: 𝐆𝐞𝐭 $𝟏𝟎𝟎𝟎 𝐎𝐟𝐟 𝐘𝐨𝐮𝐫 𝐅𝐢𝐫𝐬𝐭 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞

𝐓𝐨𝐩 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

EXL | Ryder System, Inc. | Wesco | GXO Logistics, Inc. | CJ Logistics America | DSC Logistics | Invio Automation | Lineage | Geek+ | Vee Technologies | Bastian Solutions | Iris Software Inc. | TGW North America | GoComet | OnProcess Technology | Unipart | Danos Group

#LogisticsAutomation #WarehouseAutomation #SupplyChainAutomation #SmartLogistics #LogisticsTech #DigitalSupplyChain #AutomatedLogistics #AutomationInLogistics #LogisticsInnovation #SupplyChainTech

0 notes

Text

Warehouse Automation Market Growth Driven by E-commerce Expansion and Smart Logistics Integration Globally

In recent years, warehouse automation has emerged as a critical component of modern supply chain management. With global commerce expanding and customer expectations rising, businesses are under increasing pressure to enhance efficiency, reduce errors, and streamline operations. The warehouse automation market has responded to this demand with innovative technologies that are reshaping the way goods are stored, sorted, picked, and shipped.

The Driving Forces Behind Warehouse Automation

The surge in e-commerce has been one of the most significant catalysts for warehouse automation. Consumers now expect rapid order fulfillment and real-time tracking, which necessitates precise inventory management and faster logistics. Manual processes, while still common in many warehouses, can no longer keep pace with the volume and speed of modern retail. Automation technologies fill this gap by providing scalable, data-driven solutions that improve accuracy and throughput.

Labor shortages have also played a role in accelerating automation adoption. Warehousing jobs often involve repetitive tasks and physically demanding work, leading to high turnover rates and recruitment challenges. Automated systems such as robotic arms, automated guided vehicles (AGVs), and autonomous mobile robots (AMRs) can handle these tasks efficiently while reducing the dependency on human labor.

Moreover, the increasing availability of affordable sensors, AI-driven software, and cloud-based warehouse management systems (WMS) has made automation more accessible to businesses of all sizes. Even small and mid-sized companies are now exploring automation solutions to remain competitive in a rapidly changing marketplace.

Key Technologies Shaping the Market

Several technologies are central to the transformation of warehouse operations:

Robotics: Robotic systems are being widely used for picking, packing, and transporting goods within warehouses. These systems use machine learning and computer vision to navigate and perform tasks with high precision.

Automated Storage and Retrieval Systems (AS/RS): AS/RS use cranes, shuttles, and conveyors to store and retrieve products efficiently. These systems are especially beneficial in high-density storage environments.

Conveyor and Sortation Systems: These enable rapid sorting of packages based on size, weight, destination, or priority, which is essential in high-volume distribution centers.

Warehouse Management Software (WMS): A robust WMS integrates with hardware systems to provide real-time visibility into inventory, order status, and workforce productivity.

Internet of Things (IoT): Sensors and connected devices provide data on equipment performance, warehouse temperature, and stock levels, allowing predictive maintenance and better resource management.

Market Outlook and Growth Trends

According to market analysts, the warehouse automation market is expected to continue its robust growth trajectory over the next decade. Valued at approximately $22 billion in 2024, it is projected to surpass $60 billion by 2030, growing at a compound annual growth rate (CAGR) of over 14%.

Geographically, North America and Europe have been early adopters of warehouse automation, driven by well-established logistics infrastructure and high labor costs. However, Asia-Pacific is rapidly catching up, fueled by booming e-commerce sectors in countries like China and India, as well as a strong push toward industrial modernization.

Industries beyond retail are also embracing automation. Sectors such as pharmaceuticals, food and beverage, and electronics are increasingly investing in warehouse technologies to meet stringent quality standards and ensure traceability throughout the supply chain.

Challenges to Implementation

Despite its benefits, warehouse automation is not without challenges. High upfront investment remains a significant barrier for many companies, particularly in emerging markets. Additionally, the complexity of integrating new technologies into existing systems can lead to downtime and operational disruptions during the transition phase.

There is also the issue of workforce displacement. While automation reduces the need for manual labor, it also necessitates upskilling workers to manage and maintain automated systems. Companies must invest in training and change management to ensure a smooth technological transition.

Cybersecurity is another growing concern. As warehouses become more digitally connected, the risk of cyberattacks increases. Ensuring robust data protection and system security is critical for preventing operational disruptions and safeguarding sensitive information.

The Road Ahead

The warehouse automation market is at a pivotal juncture. As technological capabilities expand and the cost of automation continues to decline, its adoption will become increasingly widespread. Businesses that embrace automation early stand to gain a competitive edge through improved efficiency, reduced operational costs, and enhanced customer satisfaction.

However, success in this space requires more than just investment in hardware and software. It demands a holistic strategy that includes employee training, supply chain integration, and a commitment to continuous innovation. By reimagining warehouse operations through the lens of automation, companies can not only meet today’s demands but also build a more agile and resilient logistics ecosystem for the future.

0 notes

Text

Digital Pathology Market Set to Surge to US$ 4.2 Bn by 2035: Key Insights and Projections

The global digital pathology market is witnessing a paradigm shift, transforming how pathologists diagnose and collaborate across distances. This transition from conventional microscopy to digital platforms is not only enhancing diagnostic accuracy and workflow efficiency but is also paving the way for AI integration in modern pathology. Valued at US$ 1.1 Bn in 2024, the market is projected to surge to over US$ 4.2 Bn by 2035, expanding at a CAGR of 12.4% from 2025 to 2035.

Introduction: The Digital Evolution in Pathology

Digital pathology, the practice of digitizing glass slides using whole-slide imaging and storing them for analysis and collaboration, is a crucial advancement in modern healthcare. Traditional pathology involved microscopic analysis of tissue samples, a time-intensive and geographically restricted process. With digital tools, pathologists can now view, annotate, and share high-resolution images from virtually any location, leading to quicker, more consistent diagnoses.

This transformation is being driven by several interconnected trends: increasing prevalence of chronic diseases, the rising demand for precision diagnostics, and technological advancements in AI and machine learning. Additionally, the global focus on personalized medicine and remote healthcare delivery models is further propelling adoption. As healthcare systems worldwide strive to improve diagnostic outcomes while optimizing operational efficiency, digital pathology emerges as a key enabler of next-generation pathology workflows.

Market Drivers: Fueling the Growth of Digital Pathology

Enhancing Lab Efficiency through Digital Adoption

One of the most significant drivers of the digital pathology market is the technology's potential to improve laboratory efficiency. By digitizing tissue slides, laboratories can reduce reliance on physical storage, streamline workflows, and cut down turnaround times. Digital pathology enables easier archiving, faster retrieval, and automated analysis—enhancing both accuracy and productivity.

During the COVID-19 pandemic, the urgent need for remote diagnostics accelerated the adoption of digital and telepathology solutions. Laboratories that implemented digital workflows experienced fewer disruptions, ensuring continuity of care. These benefits have made digital pathology not just a convenience but a strategic necessity for modern healthcare systems.

Accelerating Drug Discovery and Research Applications

In research and drug development, digital pathology offers high-throughput analysis and deep insights into tissue morphology. Researchers can examine multiple samples in parallel, annotate complex data, and integrate molecular diagnostics seamlessly. AI-powered image analysis further boosts accuracy and scalability.

The technology also supports longitudinal studies by enabling consistent data archiving and retrieval, vital for tracking disease progression and evaluating therapeutic responses. As pharmaceutical companies intensify their search for novel targets and biomarkers, digital pathology stands at the forefront of research innovation.

Product Insights: Devices Dominate Digital Pathology Offerings

Among the various product categories, devices—including whole-slide imaging systems, scanners, and visualization equipment—account for the largest market share. These devices play a central role in converting physical samples into digital images with ultra-high resolution.

The demand for devices is being driven by the increasing need for precision diagnostics, especially in oncology and chronic disease management. Modern scanners now offer automated slide loading, faster processing speeds, and integration with cloud platforms. These improvements reduce time-to-diagnosis and enhance collaboration among specialists, particularly in multidisciplinary teams. As imaging technologies become more affordable and scalable, their adoption is expected to grow across both developed and emerging healthcare systems.

Application Analysis: A Multi-disciplinary Utility

Digital pathology has broad applicability across clinical, academic, and research domains. It is increasingly used in:

Drug Discovery & Development: Supporting target identification, biomarker validation, and toxicity studies.

Academic Research: Enabling scalable image analysis and remote collaboration in histological studies.

Disease Diagnosis: Particularly in oncology, where precise cellular imaging is critical to patient care.

Other Applications: Including forensic pathology, veterinary diagnostics, and regulatory toxicology.

With AI tools enhancing image analysis, digital pathology is poised to redefine disease detection and monitoring by providing highly granular tissue-level insights.

End-user Analysis: Who's Using Digital Pathology?

The major end-users of digital pathology solutions include:

Hospitals: Leveraging digitized workflows for faster diagnosis and better clinical outcomes.

Biotech & Pharma Companies: Employing image analytics in preclinical and clinical research.

Diagnostic Laboratories: Seeking to scale operations and enable remote consultations.

Academic & Research Institutes: Utilizing digital platforms for education and advanced research.

Hospitals and large diagnostic chains are expected to maintain dominance due to the volume of cases processed, but adoption is rising across all segments, particularly with the expansion of telepathology in rural and underserved areas.

Regional Outlook: North America Leads the Way

North America commands the largest share of the global digital pathology market, thanks to a mature healthcare ecosystem and early technological adoption. The U.S., in particular, benefits from favorable regulations, substantial investments in health IT, and a strong network of hospitals and research institutions.

Furthermore, collaborations between tech giants and healthcare providers are fostering the development of AI-driven pathology tools. The region is also witnessing rapid growth in digital health startups, creating a fertile ground for innovation and scalability.

Europe follows closely, with countries like Germany and the UK leading in digital imaging integration. Asia Pacific is emerging as a high-growth region, with investments in healthcare infrastructure and digitization in countries such as China, India, and Japan.

Competitive Landscape: Key Players and Innovations

The digital pathology market is competitive and innovation-driven, with key players continuously enhancing their offerings through partnerships, acquisitions, and product development. Leading companies include:

Leica Biosystems

Koninklijke Philips N.V.

F. Hoffmann-La Roche Ltd.

EVIDENT

Morphle Labs, Inc.

Hamamatsu Photonics

Fujifilm Holdings

PathAI

OptraSCAN

Sectra AB

Siemens Healthcare

3DHISTECH Ltd.

Recent developments include:

Charles River Laboratories and Deciphex (Feb 2025): A collaboration to integrate AI-powered digital pathology in toxicologic pathology.

Sectra and Region Västra Götaland (Feb 2025): Expansion of a 20-year partnership for integrated digital pathology and radiology systems aimed at enhancing cancer diagnostics.

These strategic initiatives underscore the importance of integrated solutions that combine imaging, AI, and cloud capabilities for scalable diagnostics.

Conclusion: A Digital Future for Pathology

The digital pathology market is on a fast trajectory, underpinned by technological innovations, a growing need for diagnostic accuracy, and a systemic push toward healthcare digitization. As AI becomes more integral and cloud infrastructures mature, digital pathology will become the norm in modern laboratories and healthcare institutions.

From academic research and drug development to routine diagnostics and personalized medicine, digital pathology holds the promise of improving patient outcomes while optimizing operational efficiency. Stakeholders across the healthcare value chain must invest in scalable, secure, and interoperable solutions to fully harness the potential of this transformative technology.

Discover key insights by visiting our in-depth report -

0 notes

Text

Emerging Trends in Logistics Automation: Market Dynamics and Forecast

The global logistics automation market was valued at USD 34.56 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 15.0% from 2024 to 2030. Logistics automation encompasses a broad range of hardware and software solutions designed to streamline and enhance key logistics operations, including transportation, storage, retrieval, and data management. By automating these functions, businesses can significantly improve operational efficiency, reduce manual errors, and decrease turnaround times. The adoption of automation enables companies to scale operations effectively, as larger volumes of goods can be managed more efficiently with the aid of autonomous mobile robots (AMRs), conveyor systems, automated guided vehicles (AGVs), and automated storage and retrieval systems (AS/RS).

One of the primary drivers behind the rapid expansion of this market is the growing consumer preference for online shopping, which is accompanied by increasing expectations for faster and more efficient delivery services. This shift in consumer behavior has led to a significant rise in the number of fulfillment centers, particularly those catering to last-mile delivery and on-demand or quick-delivery services. These centers are increasingly turning to advanced automation technologies, evolving from basic mechanized solutions to fully autonomous, operator-free systems. As robotics and automated vehicle technologies continue to advance and mature, their applications in logistics and warehousing are expected to expand further, opening up substantial growth opportunities for the market throughout the forecast period.

However, the logistics automation industry also faces a number of challenges and barriers to adoption. Key among these is the intensifying competition among market players, which exerts pressure on pricing and innovation cycles. Another significant hurdle is the lack of standardization within the industry. The absence of universal standards across platforms and processes complicates integration and interoperability, making it difficult to implement uniform, scalable supply chain solutions. As a result, companies often incur high development and customization costs to create tailored systems for specific operational needs.

Moreover, the sector is affected by a shortage of skilled labor, particularly in developing economies such as India and China. The sophisticated nature of automation equipment and related software systems requires specialized training and expertise, which is not always readily available. This gap in technical workforce availability can slow down the implementation of automation projects and limit their effectiveness.

Despite these challenges, the overall outlook for the logistics automation market remains highly positive. With technological advancements, increasing investments in smart warehouses, and growing pressure on businesses to improve speed, accuracy, and efficiency, automation is set to play a central role in the transformation of logistics and supply chain operations worldwide.

Detailed Segmentation:

Component Insights

Based on components, the hardware segment dominated the market with the largest revenue share of 66.6% in 2023. Based on the hardware, the market is further segmented into automated sorting systems, autonomous robots, conveyor systems, de-palletizing/palletizing systems, automated storage and retrieval systems, automatic identification and data collection.

Vertical Insights

Based on vertical, the retail and e-commerce segment dominated the market with the largest revenue share in 2023. The sector uses logistics automation solutions in order to meet the increasing volumes of orders and shipments. Logistics automation solutions improve reliability and ensure timely delivery, which aligns with the retail and e-commerce industry's interest.

Function Insights

Based on functions, the market is segmented into inventory & storage management and transportation management. The transportation management segment dominated the market with the largest revenue share in 2023. Autonomous robots, conveyor systems, and de-palletizing/palletizing systems are used for transportation management.

Logistics Type Insights

Based on logistics type, sales logistics dominated the market with the largest revenue share in 2023. Sales logistics is the most critical aspect of the supply chain as it involves moving or delivering the goods to the end consumer. Sales logistics include order management, inventory management, shipping management, and vendor management. Automation solutions such as autonomous robots and automated storage and retrieval systems improve efficient

Organization Size Insights

Based on organization size, large enterprises dominated the market with the largest revenue share in 2023. Large enterprises handle huge volumes of products through the entire supply chain processes, which include raw materials, inventory, and final products.

Software Application Insights

Based on software applications, the market is segmented into inventory management, yard management, order management, labor management, vendor management, shipping management, customer support, and others. Among these, the order management segment dominated the market with the largest revenue share in 2023.

Regional Insights

North America led the logistics automation market in 2023, with a revenue share of 35.5%. The region's growth can be attributed to the presence of several logistics automation solution providers and several logistics companies, such as DHL, UPS, and FedEx Corporation, among others, in North America.

Curious about the Logistics Automation Market? Get a FREE sample copy of the full report and gain valuable insights.

Key Logistics Automation Company Insights

Some of the key companies operating in the logistics automation market include SAP., Jungheinrich AG, and Daifuku Co., Ltd., among others.

Jungheinrich AG is a supplier of warehousing technology and material handling equipment, offering extensive products and services. Its diverse product portfolio encompasses a wide range of equipment, including reach trucks, tow tractors, counterbalanced forklift trucks, shuttle and pallet carriers, order pickers, driverless transport systems, high rack stackers, rack servicing cranes, automatic high-rack silo conveyors, and materials handling systems. In addition, Jungheinrich AG provides various electric pedestrian trucks, explosion-proof forklifts, electric pedestrian stackers, batteries, and associated accessories. The company specializes in internal logistics services and delivers innovative solutions in warehousing technology.

Daifuku Co., Ltd. is an engineering, designing, manufacturing, installation, consultation, and after-sales service company for logistics systems and material handling equipment. The company caters to various industries, including automobile, transportation & warehousing, and commerce & retail. It has operations in 26 countries across Asia Pacific, Europe, and North America.

Key Logistics Automation Companies:

The following are the leading companies in the logistics automation market. These companies collectively hold the largest market share and dictate industry trends.

Dematic (Kion Group AG)

Daifuku Co., Ltd.

Swisslog Holding AG (KUKA AG)

Honeywell International Inc.

Murata Machinery, Ltd.

Jungheinrich AG

KNAPP AG

TGW Logistics Group

Kardex

Mecalux, S.A.

BEUMER GROUP

SSI SCHÄFER AG

Vanderlande Industries B.V.

WITRON Logistik

Oracle

One Network Enterprises

SAP

Recent Developments

In February 2024, Dematic announced a partnership with Canadian logistics company Groupe Robert and opened Quebec's first fully automated cold storage facility for third-party logistics. The facility features a high-capacity Automated Storage and Retrieval System (AS/RS) with 130-foot-tall cranes for managing fresh and frozen products. It also prioritizes sustainability and advanced fire safety measures and aims to enhance supply chain efficiency and serve as a central hub for manufacturers distributing products across North America.

In May 2023, Swisslog Holding AG announced a partnership with Northern Tool + Equipment to implement a Swisslog Automation Solution within the latter’s facility in Fort Mill in the U.S. state of South Carolina. The collaboration was aimed at addressing the omnichannel distribution requirements of Northern Tool + Equipment. The solution designed by Swisslog Holding AG’s experts features the AutoStore system optimized using Swisslog Holding AG’s SynQ software. Anticipated to be fully operational by October 2023, the solution would significantly enhance the efficiency and effectiveness of Northern Tool + Equipment's operations.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

Warehouse Automation: 2025 Trends, Types, and Best Practices

Warehouse automation, a cornerstone of the fourth industrial revolution, is transforming logistics by enhancing efficiency, accuracy, and scalability. Technologies like robotic pickers, conveyor belts, and AI-driven systems reduce manual labor and streamline operations to meet soaring e-commerce demands. As global retail sales are projected to hit $7.4 trillion by 2025, automation is critical for staying competitive. This 700-word guide explores the benefits, types, trends, and best practices for warehouse automation in 2025.

What is Warehouse Automation?

Warehouse automation leverages advanced technologies—robotics, software, and automated systems—to optimize tasks with minimal human involvement. It replaces repetitive, error-prone manual processes with faster, more accurate solutions. For instance, robotic arms sort goods, while conveyor systems move items seamlessly, saving time, cutting costs, and boosting efficiency in today’s fast-paced logistics landscape.

Benefits of Warehouse Automation

Enhancing Efficiency and Productivity

Automation streamlines workflows, accelerating tasks like storage and retrieval. Automated Storage and Retrieval Systems (AS/RS) maximize space, while robotic pick-and-pack stations enable rapid order fulfillment, supporting services like overnight shipping. Operating 24/7, automated systems reduce bottlenecks and boost productivity.

Reducing Errors and Improving Accuracy

Technologies like barcode readers achieve near-100% data capture, eliminating picking and tracking errors. Real-time monitoring ensures accurate inventory, and precise systems deliver 99.9% picking accuracy, minimizing costly mistakes and enhancing order reliability.

Lowering Operational Costs

Automation reduces labor and material waste, offering significant savings. AS/RS systems provide a 3–5-year payback period and can last 30 years, optimizing resources. By automating repetitive tasks, businesses lower operational expenses and achieve sustainable cost reductions.

Scaling Operations Seamlessly

Automated solutions adapt to seasonal spikes or growth without major overhauls. Scalable systems like Autonomous Mobile Robots (AMRs) integrate new technologies, ensuring warehouses remain agile in dynamic markets.

Types of Warehouse Automation Technologies

Collaborative Robots (Cobots)

Cobots work alongside humans, handling repetitive tasks like sorting or packing. Equipped with safety sensors, they prevent collisions and free workers for complex duties, such as quality checks, improving efficiency and safety.

Autonomous Mobile Robots (AMRs)

AMRs use AI and sensors to navigate warehouses, transporting goods precisely. Integrated with Warehouse Management Systems (WMS), they enhance inventory tracking, reduce labor costs, and operate 24/7 to support peak periods.

Conveyor and Sortation Systems

Conveyor belts and sortation systems use barcode scanners and RFID to move and sort goods efficiently, streamlining picking, packing, and shipping while reducing manual labor.

Automated Storage and Retrieval Systems (AS/RS)

AS/RS use robots or cranes to store and retrieve items, maximizing vertical space and speeding up inventory management. Integrated with WMS, they reduce congestion and boost throughput.

Key Trends in Warehouse Automation for 2025

Advancements in Robotics

Robots now handle picking, packing, and sorting with 99.9% accuracy. AI and machine learning enable them to manage complex tasks, like handling delicate items. The robotic picking market is expected to reach $5.7 billion by 2028.

Growth of AI Applications

AI optimizes restocking and demand forecasting, preventing stockouts and overstocking. AI-driven systems enhance quality control and adapt to customer demands, integral to modern WMS.

Increasing IoT Connectivity

IoT sensors provide real-time data on equipment and inventory, minimizing downtime via predictive maintenance and streamlining workflows for seamless operations.

Adoption of Predictive Analytics

Predictive analytics tools forecast demand, reducing inventory costs (averaging $3.7 million annually). They drive smarter decisions and faster ROI.

Sustainable Automation

Energy-efficient conveyors and AI-driven energy management reduce environmental impact, aligning with green logistics demands.

Steps to Implement Warehouse Automation

Assess Processes: Identify inefficiencies, like slow picking, to prioritize automation’s impact.

Set Goals: Define targets, such as 20% higher order accuracy, aligned with business needs.

Choose Tools: Select scalable solutions like AGVs or robotic arms, balancing cost and ROI.

Pilot Test: Start small in a low-traffic area, measuring metrics like processing time.

Train Workforce: Upskill staff on WMS and robotics for smooth adoption.

Implement in Phases: Begin with simple tasks like barcode scanning, progressing to robotic sorting.

Monitor and Optimize: Track KPIs like order accuracy and adjust workflows to maintain efficiency.

Overcoming Challenges

High Costs: Use financing or grants to offset investments. Solutions like Pio achieve 99.9% accuracy, reducing long-term costs.

Change Resistance: Involve staff, highlight benefits like less physical strain, and share success stories.

Compatibility: Assess systems and test integrations to ensure seamless operation.

Downtime: Schedule implementations during low-demand periods and monitor early stages.

Calculating ROI

Cost Savings: Automation cuts labor and error-related costs, with savings outweighing investments in 2–3 years.

Productivity: Sorting systems process thousands of packages hourly, far surpassing manual labor.

Error Reduction: Accurate systems boost customer retention, as 17% of consumers abandon brands after one error.

Scalability: Dynamic systems handle growth without reinvestment.

Conclusion

Warehouse automation delivers faster, more accurate, and cost-effective operations. Technologies like cobots, AMRs, and AI enable warehouses to meet e-commerce demands and scale efficiently. By starting small, integrating with WMS, and training staff, businesses can maximize ROI and overcome challenges. With the automation market projected to reach $69 billion by 2025, now is the time to invest for sustainable success.

1 note

·

View note

Text

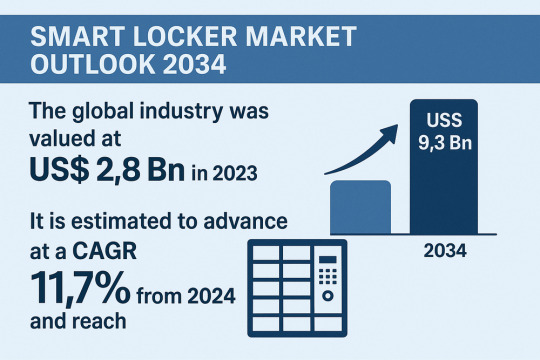

Smart Locker Market to Reach $9.3 Billion by 2034: What’s Driving the Growth?

The global smart locker market, valued at USD 2.8 billion in 2023, is poised for robust expansion over the next decade. Driven by surging e-commerce penetration, the need for secure parcel management, and rapid technology adoption across industries, the market is projected to register a compound annual growth rate (CAGR) of 11.7% from 2024 to 2034, reaching USD 9.3 billion by 2034.

Market Overview

Smart lockers secure, automated storage units integrated with sensors, connectivity, and management software are revolutionizing package handling and asset management across residential, commercial, institutional, industrial, and transportation sectors. They offer 24/7 secure access, real-time notifications, and advanced analytics, mitigating risks of theft, loss, and delivery delays. The COVID-19 pandemic underscored the importance of contactless solutions, accelerating deployments in logistics hubs, last-mile delivery networks, corporate campuses, educational institutions, and multi-family dwellings.

Market Drivers & Trends

E-Commerce Boom & Last-Mile Optimization The exponential rise of online shopping has intensified demand for reliable, contactless pickup and drop-off solutions. Retailers and logistics providers deploy smart lockers at convenient locations—supermarkets, transit stations, apartment complexes—to streamline deliveries, reduce failed delivery attempts, and cut operational costs.

Safety & Security Requirements With package theft (“porch piracy”) on the rise, consumers and businesses are adopting smart lockers to secure shipments. Integrated access control (PIN codes, biometrics, smartphone authentication) ensures only authorized users retrieve parcels.

IoT & Cloud-Based Analytics Connectivity via Wi-Fi, Bluetooth, NFC, and cellular networks enables automated monitoring, predictive maintenance, dynamic allocation of locker space, and utilization insights. AI-driven analytics optimize inventory distribution and enhance user experience.

Customized Solutions for Specialized Goods Temperature-controlled lockers support last-mile delivery of perishable groceries, pharmaceuticals, and laboratory specimens. Thermal management and modular compartmentalization ensure product integrity.

Regulatory & Sustainability Pressures Municipalities and corporations seek solutions to reduce carbon footprint of multiple delivery attempts. Consolidated locker deployments lower vehicle miles traveled and greenhouse gas emissions.

Latest Market Trends

Integration with Mobile Wallets & Apps Users increasingly leverage mobile apps and digital wallets to unlock compartments, track package status, and receive push notifications. Mobile-first interfaces are now standard.

Expansion into Multi-Tenant Residential Buildings Property developers embed smart locker ecosystems into new constructions to offer value-added amenities, improve tenant satisfaction, and differentiate offerings.

Plug-and-Play Modular Systems Scalable locker banks enable businesses to expand capacity on-demand. Plug-and-play modules simplify installation and future upgrades.

Partnerships with Last-Mile Tech Providers Collaboration between parcel locker manufacturers and drone, robotics, or autonomous vehicle companies is emerging to create end-to-end automated delivery networks.

Blockchain for Audit Trails Early pilots utilize distributed ledger technology to record chain-of-custody events for high-value shipments, enhancing transparency and reducing disputes.

Access key findings and insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86223

Key Players and Industry Leaders

Prominent vendors shaping the global smart locker landscape include:

ASSA ABLOY AB – Integrating smart access control across locker portfolios.

Allegion Plc – Broadening product lines with cloud-enabled locker solutions.

Avent Security – Specializing in modular, temperature-controlled lockers.

Dahua Technology – Offering AI-driven surveillance and analytics in locker systems.

dormakaba Group – Combining mechanical expertise with digital management platforms.

Honeywell International Inc. – Delivering enterprise-grade locker management software.

igloocompany Pte Ltd – Pioneering parcel locker networks in Asia.

Master Lock Company LLC. – Known for ruggedized, weatherproof locker designs.

MIWA Lock Co. – Integrating biometric authentication into high-security lockers.

Samsung Electronics Co., Ltd. – Leveraging consumer electronics expertise for locker interface design.

Spectrum Brands, Inc. – Expanding access control offerings into locker portfolios.

Vivint, Inc. – Bundling smart home security with locker access solutions.

These companies focus on R&D, strategic alliances, and targeted acquisitions to enhance technological capabilities and geographic reach.

Recent Developments

November 2023: Blue Dart Express partnered with India Post to install automated digital parcel lockers at select post offices nationwide. Authorized personnel deposit deliveries, and recipients access packages via unique codes—enabling flexible, round-the-clock collection.

March 2022: Quadient and DHL launched an extensive rollout of outdoor smart parcel lockers across Sweden, providing consumers with secure self-service pick-up points and reducing delivery failure rates.

January 2024: igloo expanded its locker network in Singapore’s suburban residential estates, integrating cloud-based analytics to optimize locker utilization and reduce idle capacity.

April 2025: dormakaba introduced biometric-enabled lockers for hospital and laboratory environments, ensuring traceable access to controlled substances and sensitive equipment.

Market New Opportunities and Challenges

Opportunities

Emerging Economies: Rapid urbanization and e-commerce growth in Asia, Latin America, and Africa create fertile ground for locker deployments.