#RealTimeVerification

Explore tagged Tumblr posts

Text

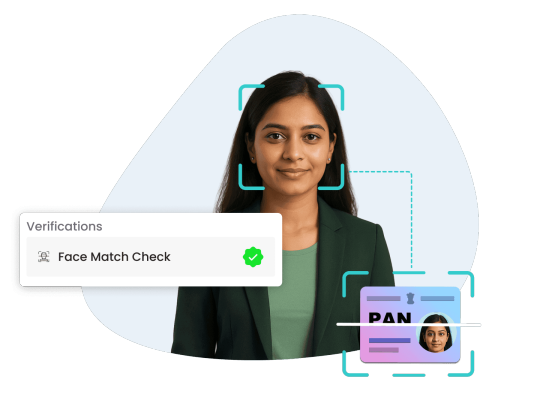

Face Match: The Future of Identity Verification Is Here

In today’s fast-paced digital world, verifying a person’s identity quickly and securely is more critical than ever. Whether it’s onboarding a new employee, authenticating a user during KYC, or reducing fraud in digital services, identity verification must be accurate, fast, and reliable. This is where face match technology steps in as a transformative solution.

Face match, also known as facial recognition or face verification, refers to the process of comparing a live image of a person's face with the photo on their official ID to verify if they are the same person. OnGrid’s Face Match Check enhances this process by not only ensuring visual similarity but also detecting real-time presence through advanced liveness detection.

How Does OnGrid’s Face Match Check Work?

OnGrid’s Face Match Check is powered by advanced AI algorithms that compare the user's live selfie or video with their ID document photo. Here’s how it simplifies and strengthens the verification process:

Face Comparison: Matches facial features between a live image and the ID photo with high accuracy.

Liveness Detection: Ensures that the person is physically present and not using a static image, video spoof, or mask.

Real-time Results: Verification is completed instantly, enabling seamless onboarding or access control.

Scalable Integration: The service can be easily embedded into web or mobile platforms via API.

Why Businesses Are Adopting Face Match Verification

Face match technology has rapidly gained adoption across sectors like BFSI, HR tech, gig platforms, healthcare, and edtech. Here’s why:

Improved Security: It eliminates impersonation, identity theft, and document tampering by relying on real-time biometric verification.

Faster Onboarding: With instant facial recognition, users don’t need to visit physical offices or submit paperwork—everything happens online.

Regulatory Compliance: It supports compliance with KYC/AML regulations by verifying identities accurately and audibly.

User Convenience: A selfie is all it takes to verify identity—making the process user-friendly and contactless.

Use Cases of Face Match in Real Life

Digital KYC: Verifying users in financial services, lending platforms, or wallets.

Employment Verification: Ensuring that candidates' identities match submitted ID documents during background checks.

Gig Economy: Quickly verifying freelancers or delivery personnel without in-person interaction.

Access Control: Granting entry to physical or digital spaces only after identity is confirmed.

Why Choose OnGrid for Face Match Verification?

OnGrid brings its credibility as a trusted background verification and digital identity service provider in India. Its Face Match Check is:

Accurate: Built on strong AI and ML models trained on diverse datasets.

Secure: End-to-end encrypted with data privacy compliance.

Customizable: API-first design that integrates seamlessly into your workflow.

Conclusion

Face match technology isn’t just a digital convenience—it’s a necessity in a world where trust and verification go hand in hand. With OnGrid’s Face Match Check, organizations can make identity verification smarter, faster, and more secure.

#FaceMatch#IdentityVerification#DigitalOnboarding#LivenessDetection#KYC#FacialRecognition#OnGrid#SecureVerification#DigitalIdentity#BackgroundVerification#RealTimeVerification#ContactlessVerification#FaceMatchTechnology#AIinKYC#VerificationSolutions

0 notes

Text

Seamless Identity Checks with Gridlines' Voter ID Verification API

Discover how Gridlines' Voter ID Verification API streamlines digital identity checks using Election Commission records—ideal for fintechs, lenders, and onboarding platforms.

#VoterIDVerificationAPI#DigitalKYC#IdentityVerification#ElectionCommissionData#RealTimeVerification#KYCautomation#FintechAPI#OnboardingSolutions#GridlinesAPI#APIVerification

0 notes

Text

🔐 Prevent UPI Fraud with Ekychub’s Real-Time Verification API

The rapid growth of UPI (Unified Payments Interface) has revolutionized digital transactions in India. However, this surge in usage has also led to a sharp rise in UPI-related fraud. Fake UPI IDs, misrouted transactions, and impersonation scams are now major threats for businesses and customers alike.

To combat this, Ekychub offers the fastest and most secure UPI Fraud Prevention API, designed to help businesses verify UPI IDs in real time, safeguard their platforms, and build user trust.

🚨 Why Is UPI Fraud Prevention So Important?

Every second, thousands of UPI transactions are processed across platforms. Even a small lapse in verification can lead to:

Financial loss for the business or the customer

Damaged reputation due to failed or fraudulent transactions

Compliance issues in regulated industries

That’s where Ekychub steps in — providing a simple yet powerful solution to instantly verify UPI IDs before payment.

⚡ Ekychub’s UPI Fraud Prevention API – Key Features

✅ Real-Time UPI ID Verification

Our API instantly checks the validity of a UPI ID and confirms if it’s linked to a legitimate account.

👤 Fetch Account Holder Name

Match the UPI ID to the account holder’s name to detect impersonation or mismatches before processing payments.

🛡️ Fraud Detection & Prevention

Automatically flag suspicious UPI IDs or unknown patterns, minimizing the risk of fraud.

🔄 Seamless Integration

The API is lightweight, fast, and easily integrates into your existing payment system or app.

📈 Scalable & Secure

Whether you're handling hundreds or millions of transactions, our infrastructure is built to scale while keeping data encrypted and secure.

💼 Who Should Use This API?

Ekychub’s UPI Fraud Prevention API is ideal for:

Payment Gateways & Processors

Fintech Platforms & Digital Wallets

Lending & BNPL Apps

eCommerce & Marketplace Platforms

Subscription-Based Services

Basically, any business that accepts UPI payments should prioritize fraud prevention and user verification.

🧠 How It Works

Input the UPI ID into your platform (e.g., during checkout or onboarding).

Ekychub’s API validates the ID in real time.

Receive verified details including the account holder name and status.

Process the transaction securely with full confidence.

🚀 Benefits of Using Ekychub’s UPI Fraud Prevention API

Reduce failed transactions and chargebacks

Protect your customers and your brand

Speed up the verification process with automation

Build trust and ensure regulatory compliance

Lower operational costs related to fraud handling

🔗 Get Started Today

Don’t wait for fraud to affect your business. Integrate Ekychub’s UPI Verification API and take the first step toward secure, reliable UPI transactions.

#techinnovation#identityvalidation#tech#technology#technews#aadhaarintegration#fintech#ekychub#kycverificationapi#aadhaarverificationapi#UPIFraudPrevention#UPIVerification#SecurePayments#KYCAPI#DigitalKYC#Ekychub#FintechSolutions#InstantUPIValidation#PaymentSecurity#FraudDetectionAPI#🔐 “Stay ahead of scammers! Use Ekychub’s UPI Fraud Prevention API to validate users instantly and protect every transaction.”#UPIVerificationAPI#FraudDetection#RealTimeVerification#SecureUPI#aadharverificationapi#bankverificationapi#panverificationapi#ekycverificationapi

1 note

·

View note

Text

SprintVerify Mobile Number Lookup API

SprintVerify's Mobile Number Lookup API provides a fast, reliable way to validate and gather details about mobile numbers, enhancing communication efforts and reducing fraud.

Key Features

Real-time Verification: Instantly verify if a mobile number is active and reachable.

Carrier Information: Get details about the mobile network operator.

Location Data: Access geographic information linked to the number.

Fraud Detection: Identify and flag suspicious numbers.

Data Enrichment: Enhance customer profiles with additional data points like line type.

Benefits

Improved Engagement: Ensure accurate customer contact for SMS marketing and support.

Operational Efficiency: Automate verification processes to save time and resources.

Data Quality: Maintain an updated and accurate contact database.

Fraud Mitigation: Protect against scams and fraudulent activities.

Cost Savings: Avoid undeliverable messages and calls to optimize communication costs.

Use Cases

E-commerce: Validate customer numbers during checkout.

Banking: Secure customer transactions with verified contact details.

Telecommunications: Verify phone numbers and carrier information.

Logistics: Ensure accurate delivery with validated recipient contact info.

Hospitality: Confirm reservation details and communicate seamlessly with guests.

Integration

SprintVerify’s API integrates easily with existing systems, supported by comprehensive documentation and a dedicated support team.

Conclusion

Enhance your business's communication and security with SprintVerify's Mobile Number Lookup API. Contact us to learn more and start optimizing your verification processes today.

#MobileNumberLookup#VerificationAPI#SprintVerify#RealTimeVerification#DataEnrichment#FraudDetection#CustomerEngagement#OperationalEfficiency#DataQuality#BusinessSolutions#EcommerceVerification#BankingSecurity#TelecomSolutions#LogisticsManagement#HospitalitySolutions#TechInnovation#APISolutions#SecureTransactions#BusinessGrowth#OptimizeCommunication

1 note

·

View note

Text

Streamline Employee Verification with Gridlines’ EPFO API

In today’s digital economy, trust and speed are essential—especially when it comes to verifying employment history. Whether you're hiring, underwriting loans, or conducting background checks, outdated and manual verification processes can delay operations and introduce risks.

That’s where the Gridlines EPFO Employment History API steps in—a powerful tool that allows you to fetch verified employment data directly from India’s Employees' Provident Fund Organisation (EPFO) database. With just a few inputs, businesses can instantly access an individual's active and historical employment records, helping them make informed, risk-free decisions.

What is the EPFO API?

The EPFO (Employees' Provident Fund Organisation) is a central government body that manages retirement savings and employment contributions for salaried individuals in India. Every registered employer contributes to the EPF account, making it a reliable source for tracking employment history.

Gridlines’ EPFO API leverages this verified data source to help organizations fetch:

Current and past employers

Tenure of employment

PF account activity

UAN (Universal Account Number)-linked details

This provides an unmatched level of accuracy and transparency in employment verification—eliminating the need for lengthy document submissions or third-party calls.

How It Works

The EPFO Employment History API can be integrated into your platform in a few simple steps. By entering the UAN and mobile number (with OTP-based consent), the API pulls verified employment records in real time. The data returned is structured, secure, and instantly usable for:

HR Tech Platforms for onboarding

Lenders assessing loan eligibility

Insurance Providers verifying income sources

Background Verification Agencies streamlining checks

Benefits of Using Gridlines’ EPFO API

Instant Verification: Reduce verification time from days to seconds.

Real-Time Data: Access live, government-backed records.

Reduced Fraud Risk: Eliminate fake or misrepresented job histories.

Consent-Based: Ensures privacy with OTP-based user authentication.

Seamless Integration: Plug-and-play API fits easily into your existing tech stack.

Why Gridlines?

Gridlines combines robust data access with AI-powered insights to enable smarter decisions across fintech, HR, and compliance workflows. Its EPFO API is part of a larger suite of verification tools trusted by leading businesses for secure and scalable onboarding.

Final Thoughts

If your business depends on validating employment records—don’t rely on outdated processes. With Gridlines’ EPFO API, you gain speed, accuracy, and trust—all in real time.Explore the API and see how effortless employment history verification can be: 👉 https://gridlines.io/products/epfo-api

#EPFOAPI#EmploymentVerification#HRTech#BackgroundCheck#FintechIndia#KYCVerification#DigitalOnboarding#VerifyWithGridlines#RealTimeVerification#GridlinesAPI

0 notes

Text

Instant Identity Verification with Gridlines Voter ID Verification API

Gridlines' Voter ID Verification API offers a robust solution for verifying voter IDs, a critical document held by all Indian citizens over the age of 18. This API ensures instant validation of voter registration details, enhancing the accuracy and speed of user identity checks during onboarding. By confirming essential information such as address, age, and gender, the API reduces onboarding friction and provides a seamless experience for your users. With features like real-time voter ID validation, efficient address and age verification, and enhanced customer onboarding, the API simplifies the process while detecting potential fraud through flagging inconsistencies in voter ID information.

Choosing Gridlines means benefiting from meticulous verification of every Voter ID, ensuring trust and authenticity. The seamless API integration facilitates quick and reliable identity checks, giving you access to essential user details for a comprehensive understanding. Additionally, Gridlines' robust verification system enhances security, protecting your operations from potential fraud. Optimize your onboarding process and ensure compliance with industry standards using Gridlines' Voter ID Verification API, delivering reliability and efficiency for your user base.

#SecureOnboarding#FraudPrevention#APIIntegration#RiskManagement#GridlinesAPI#VoterID#DigitalTrust#RealTimeVerification

0 notes

Text

Protect Your Business from Fraud: Gridlines Bank Account Verification API

The Gridlines Bank Account Verification API is a powerful tool designed to protect your business from fraud by verifying bank account details submitted by users, partners, or employees. This API ensures that bank accounts are legitimate and belong to the individual at the time of onboarding, making the process seamless and efficient. Instantly confirm bank account details and existence with real-time verification, expediting customer sign-ups and enhancing risk management by providing valuable insights into customer financials. Simplify your KYC compliance effortlessly through efficient bank account checks.

Choose Gridlines for immediate confirmation of bank account details, ensuring their accuracy for real-time transactions. Our API introduces stringent security measures to mitigate the risk of fraud, facilitating smooth financial transactions and improving user experience and operational efficiency. Additionally, it ensures compliance with banking regulations, helping your business maintain high legal standards. Enhance your security measures, streamline operations, and stay compliant with the Gridlines Bank Account Verification API. Protect your business from fraud and ensure the legitimacy of bank accounts with ease.

#BankAccountVerification#FraudPrevention#SecureOnboarding#RealTimeVerification#RiskManagement#KYCCompliance#FinancialSecurity#APIIntegration#StreamlinedOnboarding#DigitalTrust#GridlinesAPI

0 notes

Text

Effortless API Integration for Real-Time Driving License Verification

Gridlines Driving License verification API is a vital addition to your KYC processes, offering a reliable method to verify identity and address. Widely accepted as proof of identity, a Driving License provides comprehensive demographic details, including name and address.

Perfect for onboarding drivers, bikers, and delivery executives in the transportation, logistics, and eCommerce sectors, our solution enhances your KYC process by offering users more options to prove their identity. It identifies invalid licenses, detecting fake or suspended ones to ensure only legitimate drivers are onboarded, thus enhancing security. The plug-and-play API ensures effortless integration into your existing systems, streamlining the verification process and improving risk assessment through valuable driver insights.

Incorporate Gridlines Driving License verification API into your KYC solutions to streamline processes, enhance security, and ensure compliance, providing a seamless experience for both your business and users.

#LicenseVerification#KYC#FraudDetection#Compliance#SecureOnboarding#RealTimeVerification#Logistics#eCommerce#DataPrivacy#APIIntegration#DriverVerification#DigitalVerification#Security#TechSolutions

0 notes

Text

OnGrid's Voter ID Verification: Reliable, Real-Time Results for Hiring

Ensure secure and accurate Voter ID verification with OnGrid, designed to enhance your hiring process. Our advanced system provides precise verification processes that reduce errors and improve reliability in voter ID validation. OnGrid's user-friendly platform offers easy access to Voter ID verification services, ensuring convenience and efficiency for users.

Real-time verification results from OnGrid enable prompt decision-making and streamline the hiring process. We prioritize compliance with regulatory standards and maintain full transparency throughout the Voter ID verification process, ensuring fairness and accountability.

Choose OnGrid for dependable Voter ID verification and support a fair, transparent hiring process. Visit our platform to explore our comprehensive Voter ID verification solutions.

#VoterIDVerification#HiringProcess#OnGrid#EmployeeVerification#Compliance#RealTimeVerification#HRSolutions

0 notes

Text

Ensure accurate hiring with Gridlines Employment Verification API

Gridlines Employment Verification API is your solution for instant, accurate employment history confirmation. Whether verifying current or past employment, our API leverages multiple data sources with the individual's consent. This tool streamlines hiring, reduces risk and fraud, and ensures compliance with real-time, reliable data. Key features include instant employment verification, automated employment checks, and simplified onboarding processes.

Why Choose Gridlines:

This Employment Verification API provides instant employment insights with real-time access to employment history via the EPFO API. The API enhances accuracy with quick employee lookup using UAN Lookup. Gridlines prioritizes data security and regulatory adherence, ensuring your data remains safe and compliant. Additionally, our solution offers seamless integration with HR systems, providing a smooth user experience.

#EmploymentVerificationAPI#HiringSolutions#HRTech#BackgroundChecks#Onboarding#FraudPrevention#Compliance#HRInnovation#RealTimeVerification#DataSecurity#EPFOIntegration#Gridlines

0 notes

Text

Empower Your Onboarding Process with “Gridlines” Instant Verification APIs

Elevate your digital onboarding experience to new heights with “Gridlines'' cutting-edge Instant Verification APIs. Our comprehensive suite of over 100 low-latency, plug-and-play APIs empowers businesses to seamlessly verify a myriad of data points, including GSTIN, Aadhaar, PAN, employment history, driving license, and vehicle RC information. With a proven track record of conducting over 250 million verifications, Gridlines ensures unparalleled reliability and accuracy in every verification process.

Benefit from the flexibility and accessibility of Gridlines APIs, allowing you to onboard new users seamlessly at any time of the day. Harness the power of real-time data retrieval and verification from trusted sources, ensuring that your information is always accurate and up to date.

Rest assured knowing that Gridlines prioritizes the highest standards of data security and compliance, holding ISO certification and SOC 2 Type II compliance. Protect your capital, safeguard your reputation, and mitigate fraud risks effectively with Gridlines Instant Verification APIs.

Experience the next evolution in digital onboarding with Gridlines. Unlock the full potential of your verification processes and stay ahead of the curve with Gridlines Instant Verification APIs.

#Gridlines#InstantVerification#DigitalOnboarding#APIs#VerificationServices#ISOCompliant#SOC2#DataSecurity#Reliability#RealTimeVerification#OnboardingSolutions#DataVerification#Compliance#FraudPrevention#SecureOnboarding#BusinessSolutions#TechInnovation#DigitalTransformation#APIIntegration

1 note

·

View note