#SecureVerification

Explore tagged Tumblr posts

Text

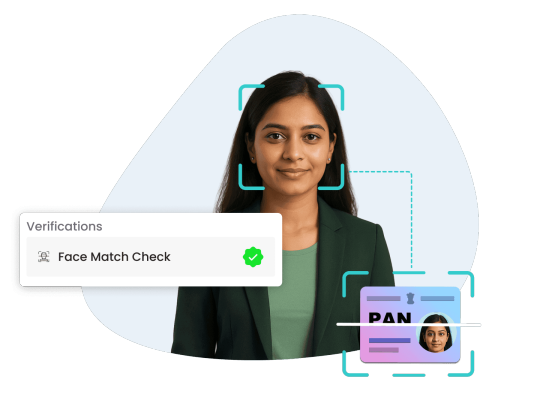

Face Match: The Future of Identity Verification Is Here

In today’s fast-paced digital world, verifying a person’s identity quickly and securely is more critical than ever. Whether it’s onboarding a new employee, authenticating a user during KYC, or reducing fraud in digital services, identity verification must be accurate, fast, and reliable. This is where face match technology steps in as a transformative solution.

Face match, also known as facial recognition or face verification, refers to the process of comparing a live image of a person's face with the photo on their official ID to verify if they are the same person. OnGrid’s Face Match Check enhances this process by not only ensuring visual similarity but also detecting real-time presence through advanced liveness detection.

How Does OnGrid’s Face Match Check Work?

OnGrid’s Face Match Check is powered by advanced AI algorithms that compare the user's live selfie or video with their ID document photo. Here’s how it simplifies and strengthens the verification process:

Face Comparison: Matches facial features between a live image and the ID photo with high accuracy.

Liveness Detection: Ensures that the person is physically present and not using a static image, video spoof, or mask.

Real-time Results: Verification is completed instantly, enabling seamless onboarding or access control.

Scalable Integration: The service can be easily embedded into web or mobile platforms via API.

Why Businesses Are Adopting Face Match Verification

Face match technology has rapidly gained adoption across sectors like BFSI, HR tech, gig platforms, healthcare, and edtech. Here’s why:

Improved Security: It eliminates impersonation, identity theft, and document tampering by relying on real-time biometric verification.

Faster Onboarding: With instant facial recognition, users don’t need to visit physical offices or submit paperwork—everything happens online.

Regulatory Compliance: It supports compliance with KYC/AML regulations by verifying identities accurately and audibly.

User Convenience: A selfie is all it takes to verify identity—making the process user-friendly and contactless.

Use Cases of Face Match in Real Life

Digital KYC: Verifying users in financial services, lending platforms, or wallets.

Employment Verification: Ensuring that candidates' identities match submitted ID documents during background checks.

Gig Economy: Quickly verifying freelancers or delivery personnel without in-person interaction.

Access Control: Granting entry to physical or digital spaces only after identity is confirmed.

Why Choose OnGrid for Face Match Verification?

OnGrid brings its credibility as a trusted background verification and digital identity service provider in India. Its Face Match Check is:

Accurate: Built on strong AI and ML models trained on diverse datasets.

Secure: End-to-end encrypted with data privacy compliance.

Customizable: API-first design that integrates seamlessly into your workflow.

Conclusion

Face match technology isn’t just a digital convenience—it’s a necessity in a world where trust and verification go hand in hand. With OnGrid’s Face Match Check, organizations can make identity verification smarter, faster, and more secure.

#FaceMatch#IdentityVerification#DigitalOnboarding#LivenessDetection#KYC#FacialRecognition#OnGrid#SecureVerification#DigitalIdentity#BackgroundVerification#RealTimeVerification#ContactlessVerification#FaceMatchTechnology#AIinKYC#VerificationSolutions

0 notes

Text

Masked Aadhaar: The Key to Secure and Private Identity Verification

Masked Aadhaar, introduced by UIDAI, is a secure version of the Aadhaar card that enhances privacy by masking the first eight digits of the Aadhaar number. Designed for non-governmental use, it is ideal for private sector KYC processes, hotel check-ins, or third-party transactions. Retaining key details like name, photo, and address, it balances usability with privacy.

Tamper-proof and generated directly from UIDAI’s portal, it complies with data protection standards, such as India’s Digital Personal Data Protection Act, 2023. While unsuitable for government subsidies, Masked Aadhaar mitigates identity theft risks and ensures safer sharing of personal data in an increasingly digital world, supporting secure and compliant identity verification.

#maskedaadhaar#dataprivacy#identityprotection#secureverification#aadhaarsafety#digitalIndia#kycverification#fraudprevention#privacyfirst#UIDAI

0 notes

Text

Streamline Your KYC Verification Process with SprintVerify API

Is your KYC verification process bogged down by inefficiencies? It's time to revolutionize it with the SprintVerify KYC Verification API!

Why Choose SprintVerify’s KYC Verification API?

Effortless Integration: The SprintVerify KYC Verification API integrates seamlessly with your existing systems, ensuring a smooth transition and minimal disruption.

Enhanced Security: Protect your customer data with advanced encryption and security protocols, ensuring compliance with industry standards.

Real-Time Verification: Instant verification means no more waiting. Validate customer identities in real-time, improving user experience and reducing drop-offs.

Global Reach: Whether your customers are local or international, our KYC Verification API supports verification across multiple countries, catering to your global needs.

Scalable Solution: From startups to large enterprises, SprintVerify’s KYC Verification API scales with your business, providing reliable performance regardless of your growth stage.

Key Features of the KYC Verification API:

Automated Data Extraction: Eliminate manual entry errors with automated data extraction from documents.

Facial Recognition: Utilize cutting-edge facial recognition technology for an added layer of security.

Comprehensive Compliance: Stay ahead with compliance updates and ensure your business meets all regulatory requirements.

How the KYC Verification API Works:

User Onboarding: Customers upload their identification documents.

Data Processing: Our API extracts and verifies the data in real-time.

Verification Result: Instantly receive a verification result, enabling swift decision-making.

Transform Your KYC Verification Process Today!

Join the future of KYC verification with SprintVerify’s robust API solution. Experience faster onboarding, increased security, and global verification capabilities.

💬 Ready to get started? Reach out to us today to learn more about how SprintVerify’s KYC Verification API can revolutionize your business.

0 notes

Text

Aadhaar Verification – Authenticate with Accuracy! Ensure secure Aadhaar-based identity verification with SevenUnique Tech Solution. Conduct instant eKYC, fraud prevention, and document checks for businesses.

📞Call: 9119101723 📨[email protected] . . . #AadhaarVerification#eKYC#IdentityCheck#SecureVerification#LegalTech#India#FraudPrevention#KYCCompliance#DigitalIdentity#AadhaarAuthentication#UserVerification#DataSecurity#DocumentVerification#IdentityProtection#OnlineVerification#SmartSecurity#IdentityManagement#SafeBusiness#LegalSupport#SevenUniqueTechSolution#ComplianceSolutions#RiskPrevention#BusinessSecurity#InstantVerification#DigitalSafety#IdentityTech#DataProtection

0 notes

Text

🌟 Discover 2024’s AI Breakthroughs: Hidden Gems on NASDAQ! 🌟

Get in on the latest AI innovation wave with these rising stars shaping the future of tech and business! 🚀

🔹 Mitek Systems (NASDAQ: MITK): Leadership-Driven Growth in Digital Identity

With new executive Michael Fay on board, Mitek is doubling down on its mission to expand fraud detection solutions. Trusted by major U.S. banks, it’s set to make big moves in secure digital verification! 🔐 #DigitalIdentity #SecureVerification

🔹 Domo (NASDAQ: DOMO): Powering AI-Driven Business Intelligence

Named a “BI One to Watch” by Snowflake, Domo integrates with the AI Data Cloud to bring real-time data insights. It’s helping businesses turn data into action faster than ever. 📊 #BusinessIntelligence #AIAnalytics

🔹 SoundHound AI (NASDAQ: SOUN): Voice AI Leader with 140% Stock Surge

Voice tech is booming, and SoundHound is leading the charge! From vehicles to customer service, its voice AI is enhancing experiences across industries. Analysts are buzzing over SoundHound’s revenue growth! 🎤 #VoiceAI #Innovation

🔹 Remark Holdings (NASDAQ: MARK): Smart City Safety Innovations

Optimized with Intel tech, Remark’s Smart Safety Platform is boosting real-time alerts and video analytics for smarter, safer cities. It’s carving out a critical role in public safety and smart city solutions. 🏙️ #SmartCity #PublicSafety

🚀 The Road Ahead for These AI Pioneers 🚀

As these AI-driven companies redefine industries, staying agile and innovative will be key to their success. Keep an eye on these hidden gems as they continue to shape the future!

0 notes

Text

Streamline MSME Verification with Gridlines' Robust API Solution

Udyam registration and Udyog Aadhaar reference are unique IDs assigned to small and medium-sized enterprises by the Ministry of MSMEs. These identifiers serve as official government recognition, verifying the legitimacy and operational status of MSMEs. Gridlines’ MSME Verification API provides instant validation of these registrations, reducing fraudulent risks and ensuring compliance with regulatory standards.

Why Gridlines

Instant MSME Validation

Enables immediate confirmation of Udyam registrations, crucial for verifying small and medium enterprise identities as recognized by the Ministry of MSMEs.

Efficient Partner Integration

Accelerates the integration of business partners or merchants, streamlining the onboarding process for better operational flow.

Regulatory Compliance Check

Assures that businesses are operating in accordance with government standards, maintaining legal and regulatory compliance.

Reliable Security Measures

Strengthens the verification process with robust security, ensuring the legitimacy of MSME merchants.

#MSMEVerification#UdyamRegistration#UdyogAadhaar#GridlinesAPI#BusinessCompliance#SecureVerification#InstantValidation#FraudPrevention#DigitalVerification#MSMESolutions#APIIntegration

0 notes

Text

Aadhaar Verification: Fast, Secure, and Reliable for KYC Compliance

Verifying identities has become essential for many businesses. OnGrid’s Aadhaar verification solution offers a seamless, secure, and efficient way to authenticate individuals in just a few clicks.

Why OnGrid's Aadhaar Verification Stands Out:

Quick and Easy Verification: No more waiting for days to confirm Aadhaar details. OnGrid’s technology allows you to verify identities in minutes, making your processes faster and smoother.

Effortless Integration: Our APIs are designed for easy integration into your current systems. Whether you’re a startup or a large organization, you’ll find it simple to add Aadhaar verification without any hassle.

Go Paperless: Forget the piles of paperwork and endless manual tasks. OnGrid’s digital process allows you to verify identities with just a few clicks, streamlining your operations and reducing the workload.

Top-notch Security: Security is at the core of everything we do. OnGrid uses industry-leading protection to keep your data safe and secure, ensuring that all verification processes comply with relevant regulations.

Why Choose OnGrid for Aadhaar Verification?

Accurate and Reliable: Aadhaar verification offers one of the most accurate ways to verify identity, helping to reduce the risk of fraud and errors.

Compliance Ready: With Aadhaar verification, your business stays compliant with government regulations, making it ideal for industries that require mandatory identity checks.

Boost Operational Efficiency: Our quick and efficient process helps reduce administrative time and cost, allowing you to focus on other key business operations.

Data Protection at Its Best: We take data privacy seriously, ensuring that all personal information is secured and only accessible by authorized personnel.

Experience fast, secure, and paperless Aadhaar verification with OnGrid. Simplify your verification processes and enhance customer trust with our reliable solution.

Ready to upgrade your identity verification process? Reach out to us today and see how OnGrid can make a difference.

#AadhaarVerification#DigitalVerification#SecureVerification#IdentityVerification#KYCCompliance#PaperlessVerification#OnGridSolutions#DataSecurity#RegTech#SeamlessVerification

0 notes

Text

Accelerate Onboarding with Fast and Reliable PAN Verification

PAN Verification is a crucial step in confirming the identity of individuals or entities during the onboarding process. By leveraging OnGrid's real-time PAN verification, organizations can instantly verify PAN details, ensuring a smooth and efficient workflow. The process is seamlessly integrated with existing systems, allowing for faster verification and enhanced operational efficiency. Compliance with regulations is paramount, and verifying PAN details helps maintain adherence to the standards set by the Income Tax Department (ITD).

The PAN verification process is designed to reduce the risk of fraud and tax evasion by accurately identifying individuals or entities that may be misusing PAN information. This verification not only confirms the legitimacy of the PAN cardholder but also contributes to a more secure and transparent financial environment. It is especially vital in various financial transactions or business dealings where PAN verification is mandatory.

By utilizing a verified database, the PAN verification process map ensures accurate sourcing and publication of the PAN report. This thorough verification helps organizations uphold regulatory compliance and fosters trust in financial activities. Embrace OnGrid’s PAN verification to streamline your onboarding process, reduce risks, and promote a secure business environment.

#PANVerification#InstantVerification#SeamlessOnboarding#RealTimeResults#IntegratedVerification#ComplianceFirst#EfficientOnboarding#SecureVerification#FraudPrevention#FinancialSecurity#VerifyPAN#OnboardingSolutions#IdentityVerification#DataSecurity#RegulatoryCompliance

0 notes