#Group insurance

Text

Understanding the Basics of Business Insurance

Usually, people get insurance because it's needed. Before a person may run a business, most states have policies that require such insurance or a standard for coverage. You might like to contact an insurance agent. It's a lot of fun starting a company, but ensure you have your foundation covered from the very beginning. Getting the right business health insurance would lower the risk and make you more accessible to potential investors.

2 notes

·

View notes

Text

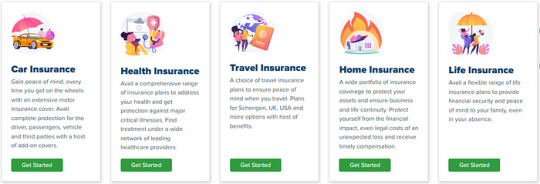

Exploring Different Types of Group Insurance Plans

Group insurance plans come in various forms, each tailored to meet the specific needs of employers, organizations, or affinity groups. Understanding the different types of group insurance plans can help employers select the most suitable option for their workforce, while also providing valuable coverage and benefits to employees. Here are some common types of group insurance plans:

Group Health Insurance: Group health insurance is one of the most common types of group insurance plans, providing medical coverage to employees and their dependents. These plans typically offer a range of benefits, including doctor visits, hospitalization, prescription drugs, preventive care, and mental health services. Group health insurance premiums are shared between the employer and employees, with contributions deducted from employees' paychecks on a pre-tax basis. Employers can choose from various plan options, such as HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and high-deductible health plans (HDHPs), to meet the needs of their workforce.

Group Life Insurance: Group life insurance provides a death benefit to employees' beneficiaries in the event of the employee's death. These plans offer financial protection and security to employees' families, helping to cover funeral expenses, outstanding debts, and ongoing living expenses. Group life insurance typically provides coverage in the form of a multiple of the employee's salary, with options for additional coverage through voluntary employee contributions. Employers may offer basic group life insurance as a standard benefit, with the option for employees to purchase supplemental coverage for themselves and their dependents.

Group Disability Insurance: Group disability insurance provides income replacement benefits to employees who are unable to work due to illness, injury, or disability. These plans offer financial protection against the loss of income during periods of disability, ensuring that employees can meet their financial obligations and maintain their standard of living. Group disability insurance may be offered as short-term disability (STD) or long-term disability (LTD) coverage, with benefits typically expressed as a percentage of the employee's salary. Employers may choose to provide basic disability coverage or offer supplemental options for employees to purchase additional coverage.

Group Dental Insurance: Group dental insurance provides coverage for preventive, diagnostic, and restorative dental services to employees and their families. These plans typically include benefits such as routine cleanings, X-rays, fillings, extractions, and major dental procedures, such as crowns and root canals. Group dental insurance may have different levels of coverage, such as basic, intermediate, and comprehensive plans, with options for employees to select the level of coverage that best meets their dental care needs. Employers may offer standalone dental insurance plans or include dental coverage as part of a comprehensive health insurance package.

Group Vision Insurance: Group vision insurance offers coverage for vision care services, including eye exams, prescription eyewear, and corrective procedures such as LASIK surgery. These plans help employees maintain good eye health and vision by providing access to routine eye care and vision correction services. Group vision insurance may cover expenses such as eye exams, prescription glasses, contact lenses, and discounts on vision correction surgery. Employers may offer standalone vision insurance plans or include vision coverage as part of a comprehensive health insurance package.

Group Critical Illness Insurance: Group critical illness insurance provides a lump-sum payment to employees diagnosed with covered critical illnesses, such as cancer, heart attack, stroke, or organ failure. These plans offer financial protection against the high costs associated with serious illnesses, helping employees cover medical expenses, ongoing treatment, and non-medical expenses during recovery. Group critical illness insurance can provide employees with peace of mind and security knowing that they have financial support in the event of a serious health diagnosis. Employers may offer group critical illness insurance as a voluntary benefit, allowing employees to opt in and pay premiums through payroll deductions.

In conclusion, group insurance plans offer valuable coverage and benefits to employers and employees across various industries and organizations. By understanding the different types of group insurance plans available, employers can tailor their benefits packages to meet the diverse needs of their workforce and provide comprehensive insurance coverage that promotes employee well-being and financial security. Whether it's health insurance, life insurance, disability insurance, dental insurance, vision insurance, or critical illness insurance, group insurance plans play a vital role in ensuring access to essential healthcare services and financial protection for employees and their families.

0 notes

Text

Group Health Insurance: Benefits, Coverage, and Eligibility

Group insurance is a type of insurance coverage that provides medical benefits to a group of people associated with an organization, such as employees of a company, members of a professional association, or members of a trade union. These plans offer several benefits, extensive coverage, and eligibility criteria that make them a preferred choice for both employers and employees.

Benefits of Group Health Insurance:

Cost-Effective Coverage: Group health insurance plans often offer more cost-effective coverage than individual policies. Since the risk is spread across a larger pool of individuals, premiums are typically lower. Additionally, employers often subsidize a portion of the premiums, further reducing the financial burden on employees.

Comprehensive Coverage: Group health insurance plans generally provide comprehensive coverage for a wide range of medical services, including hospitalization, outpatient care, prescription drugs, preventive services, and more. This comprehensive coverage ensures that employees have access to the healthcare they need without facing significant out-of-pocket expenses.

Employer Contributions: Many employers contribute to the cost of premiums for group health insurance plans as part of their employee benefits package. This employer contribution demonstrates a commitment to the well-being of their workforce and helps make healthcare coverage more affordable for employees.

No Medical Underwriting: Group health insurance plans typically do not require medical underwriting, meaning employees cannot be denied coverage or charged higher premiums based on their health status. This ensures equal access to healthcare for all eligible employees, regardless of their medical history.

Tax Benefits: Both employers and employees may enjoy tax benefits associated with group health insurance plans. Employer contributions to premiums are often tax-deductible as a business expense, reducing the company's taxable income. Additionally, employees' contributions to premiums are often made on a pre-tax basis, lowering their taxable income and increasing their take-home pay.

Coverage Offered by Group Health Insurance:

Hospitalization: Group health insurance plans typically cover expenses related to hospital stays, including room charges, surgical procedures, and other medical services provided during the hospitalization.

Outpatient Care: Coverage for outpatient services, such as doctor visits, diagnostic tests, specialist consultations, and outpatient procedures, is often included in group health insurance plans.

Prescription Drugs: Many group health insurance plans provide coverage for prescription medications, either through a formulary or a prescription drug benefit that helps offset the cost of medications.

Preventive Services: Group health insurance plans often cover preventive services at no cost to the insured, including routine screenings, immunizations, and preventive care visits.

Maternity Care: Maternity benefits, including prenatal care, childbirth, and postnatal care, are typically included in group health insurance plans, providing coverage for expectant mothers and their newborns.

Mental Health and Substance Abuse Treatment: Group health insurance plans may offer coverage for mental health services, including therapy and counseling, as well as treatment for substance abuse disorders.

Eligibility for Group Health Insurance:

Eligibility criteria for group health insurance plans may vary depending on the insurer and the employer's specific plan. However, common eligibility requirements typically include:

Employment Status: Employees who work full-time or part-time for an eligible employer may be eligible for group health insurance coverage. Some plans may also extend coverage to eligible dependents, such as spouses and children.

Waiting Period: Some employers may impose a waiting period before new employees become eligible for group health insurance benefits. This waiting period helps ensure that employees remain with the company for an extended period before accessing healthcare benefits.

Enrollment Periods: Employers typically offer annual enrollment periods during which employees can enroll in or make changes to their group health insurance coverage. Outside of the annual enrollment period, employees may be able to enroll in coverage due to qualifying life events, such as marriage, birth/adoption of a child, or loss of other coverage.

In conclusion, group health insurance plans offer numerous benefits, extensive coverage, and eligibility criteria that make them an attractive option for employers and employees alike. From cost-effective coverage and comprehensive benefits to employer contributions and tax advantages, group health insurance plays a vital role in supporting the health and well-being of workforce populations. Understanding the benefits, coverage options, and eligibility requirements of group health insurance can help employers make informed decisions about providing healthcare benefits to their employees.

0 notes

Text

The Benefits of Offering Group Insurance for Attracting Top Talent

Group insurance can be a powerful tool for attracting top talent to your organization. In a competitive job market, where skilled professionals are in high demand, offering comprehensive group insurance packages can set your company apart and make it an employer of choice. This not only helps in attracting top-tier candidates but also contributes to employee retention and overall satisfaction. In this article, we will explore the benefits of offering group insurance for attracting top talent.

Firstly, group insurance provides financial security and peace of mind to employees. Comprehensive health insurance, dental coverage, and life insurance are attractive benefits that can make potential candidates view your organization as one that cares about the well-being of its employees. Knowing that they and their families are covered in case of unexpected medical expenses or life events can be a significant motivator for talented professionals to join your company.

Moreover, group insurance often comes at a lower cost for employees compared to individual plans. This is because group insurance plans leverage the collective bargaining power of a large pool of employees, resulting in lower premiums. Offering cost-effective insurance options can be a compelling factor for top talent, especially those who may have to consider the financial impact of individual insurance plans on their overall compensation.

Additionally, group insurance can contribute to a positive company culture. When employees feel that their employer is invested in their well-being, they are more likely to be engaged and satisfied with their work. A positive work environment and a supportive corporate culture are critical factors that top talent considers when evaluating potential employers. By offering group insurance, your organization demonstrates a commitment to the health and happiness of its workforce, creating a more attractive workplace.

Beyond health-related benefits, group insurance can also include retirement plans, disability coverage, and other perks that contribute to the overall compensation package. A robust benefits package can be a deal-breaker for top talent, as it showcases a commitment to employee development and long-term satisfaction. In a job market where professionals seek not just a job but a career, the presence of comprehensive group insurance can make your organization stand out.

Furthermore, offering group insurance can positively impact recruitment efforts by simplifying the hiring process. Many candidates actively seek employers who provide comprehensive benefits, and advertising a strong insurance package can attract top talent to apply for open positions. The perception of your company as a caring and responsible employer can enhance its reputation in the industry, making it easier to attract qualified candidates.

In conclusion, the benefits of offering group insurance for attracting top talent are multifaceted. Beyond the obvious financial advantages for employees, it signals a commitment to their well-being and contributes to a positive company culture. In a competitive job market, where talent is a valuable commodity, organizations that prioritize the health and happiness of their employees through comprehensive group insurance packages are more likely to attract and retain top-tier professionals.

0 notes

Video

youtube

Seeking to find the hidden potential of self-funded health insurance solutions? Discover how this model grants employers full control over their healthcare plan, reduces costs significantly, and provides transparency into where healthcare dollars are being spent and wasted. Learn how self-funding empowers businesses to tailor plans to their workforce needs, saving over 12-15% annually. Find out why 100% of Fortune 500 companies and 97% of employers who have tried it have found success with this approach. For more click here

#youtube#employee benefits#insurance#human resources#wellness programs#reducing employee turnover#employee benefits trends#why employee benefits matter#self insured employee benefits#self insurance#employee benefits explained#self funded#self funded insurance#employee benefits and services#employer benefits#group insurance#group benefits#small business employee benefits#employee benefit#risk analysis#self-funded health care#employee benefits for small business

1 note

·

View note

Text

#term life insurance#whole life insurance#life insurance#insurance policy#health insurance#insurance#group insurance#bsjakhar#balbir singh jakhar

0 notes

Text

What Is Group Health Insurance?

Group health insurance is a type of health coverage provided by employers to a group of individuals, usually employees. Group health insurance plans offer comprehensive medical coverage, often including hospitalization, preventive care, and other services. Employers typically contribute to premium costs, making it more affordable for employees. The group dynamic helps stabilize premiums by spreading the risk. Employees benefit from a shared responsibility for healthcare costs and may have access to a network of preferred providers.

0 notes

Text

How Group Insurance Can Help You Save Money on Healthcare Costs?

Group insurance can be a powerful tool to save money on healthcare costs for individuals, families, and businesses. By leveraging the benefits of group insurance plans, participants can access more affordable healthcare options and enjoy cost savings in various ways. In this article, we will explore how group insurance can help you save money on healthcare costs.

Lower Premiums: One of the primary ways group insurance helps save money is by offering lower premiums compared to individual insurance plans. Group insurance spreads the risk across a larger pool of participants, which allows insurers to negotiate better rates. As a result, individuals and businesses pay reduced premiums, making healthcare coverage more affordable.

Employer Contributions: Many group insurance plans are sponsored by employers who contribute a portion of the premiums. Employer contributions can significantly reduce the financial burden on employees, making it easier for them to afford comprehensive healthcare coverage.

Reduced Out-of-Pocket Expenses: Group insurance plans often include provisions that reduce out-of-pocket expenses for participants. This can be achieved through lower deductibles, copayments, and coinsurance rates, making healthcare services more accessible and affordable.

Comprehensive Coverage: Group insurance plans typically offer comprehensive coverage, including medical, dental, and vision services. By having all these services bundled into one plan, individuals and families can avoid purchasing separate policies, leading to potential cost savings.

Negotiated Rates with Healthcare Providers: Insurance companies negotiate rates with a network of healthcare providers in group insurance plans. Participants who use in-network providers can benefit from these negotiated rates, resulting in lower costs for medical services.

Preventive Care and Wellness Programs: Many group insurance plans emphasize preventive care and wellness programs. By focusing on early detection and disease prevention, participants can avoid more costly treatments in the future, leading to overall cost savings in healthcare spending.

Prescription Drug Discounts: Group insurance plans often include prescription drug coverage with negotiated discounts on medication costs. This helps participants save money on essential medications and chronic disease management.

Access to Telehealth Services: Group insurance plans may offer access to telehealth services, which allow participants to consult with medical professionals remotely. Telehealth visits are often more cost-effective than in-person consultations, leading to potential savings.

Improved Health Outcomes: By providing access to regular healthcare services and preventive care, group insurance plans can lead to improved health outcomes for participants. Better health can result in reduced medical expenses over time.

Cost Sharing among Employees: In some cases, employers with group insurance plans may choose to implement cost-sharing arrangements where employees contribute to the premiums. This distribution of costs can still result in significant savings compared to individual insurance options.

Financial Protection: Group insurance plans offer financial protection in case of unexpected medical emergencies or major health events. Participants are less likely to face financial ruin due to high medical bills, contributing to long-term cost savings.

Tax Savings: In many countries, premiums paid for group insurance coverage are tax-deductible for businesses. This tax benefit can provide additional savings for businesses offering group insurance plans to their employees.

In conclusion, group insurance can be a valuable tool for saving money on healthcare costs for individuals, families, and businesses. The cost-effectiveness of group insurance is driven by lower premiums, employer contributions, and negotiated rates with healthcare providers.

Comprehensive coverage, preventive care, and wellness programs can further lead to reduced healthcare expenses. Access to telehealth services and prescription drug discounts provide additional cost-saving opportunities.

By promoting better health outcomes and offering financial protection, group insurance plans help individuals and businesses save money while ensuring access to essential healthcare services. For individuals and employers looking to manage healthcare costs effectively, group insurance is a smart and beneficial option.

0 notes

Text

We are your partners in securing your financial future. With a comprehensive range of insurance solutions including life insurance, Super Visa insurance, and group insurance, we are dedicated to providing personalized, transparent, and expert guidance to our clients across Canada. Trust Yinsure.ca to be your source of financial security and peace of mind.

0 notes

Text

Life Insurance Terminology You Should Know

Understanding life insurance terminology is crucial when it comes to safeguarding your future. In the realm of PA health insurance, here are some essential terms to know. Premium refers to the amount paid for coverage. The policyholder indicates the individual who owns the policy. The beneficiary is the person who receives the death benefit upon the policyholder's demise.

0 notes

Text

Why Small Business Health Insurance Is A Must-Have In Today's Climate?

In today's climate, small business health insurance is essential for attracting and retaining top talent, as employees prioritize benefits like healthcare coverage. It protects both employers and employees from the financial burden of unexpected medical expenses, promotes employee well-being and productivity, and demonstrates a commitment to workforce satisfaction and stability. Moreover, offering group insurance can help small businesses remain competitive in the market and comply with regulatory requirements.

#Small business health insurance#Health insurance#group insurance#group health#business health insurance

0 notes

Text

Why Group Insurance Is The Ultimate Team Player?

In the realm of workplace benefits, group insurance emerges as the ultimate team player, providing a comprehensive safety net for employees and employers alike. Offering a wide range of coverage options, group insurance fosters a sense of security and well-being within the workforce.

This article delves into the reasons why group insurance stands out as an essential and collaborative player in supporting the overall health and success of both employees and businesses.

Strength in Numbers: The fundamental principle behind group insurance is the pooling of risks and resources. By bringing together a large number of individuals within a workplace, group insurance leverages the strength in numbers. This collective approach enables cost-sharing, making insurance premiums more affordable for both employees and employers.

Comprehensive Coverage: Group insurance typically provides comprehensive coverage that extends beyond what individual plans might offer. From health and dental to life and disability insurance, the breadth of coverage ensures that employees have access to a wide range of benefits to address their diverse needs and circumstances.

Affordability for Employees: Group insurance is often more cost-effective for individual employees compared to purchasing insurance independently. The group dynamic allows for lower premiums, making quality coverage more accessible to a broader spectrum of employees, regardless of their age or health status.

Employer Contribution: Employers commonly contribute to the cost of group insurance premiums, showcasing their commitment to the well-being of their workforce. This financial support not only enhances the affordability of insurance for employees but also demonstrates the employer's investment in the overall health and satisfaction of their team.

Employee Recruitment and Retention: Group insurance serves as a powerful tool for attracting and retaining top talent. In a competitive job market, comprehensive benefits, including health insurance, can set an employer apart. Prospective employees often consider the value of benefits when evaluating job offers, making group insurance a crucial factor in recruitment efforts.

Customization for Diverse Needs: Group insurance plans are designed to be flexible and customizable to cater to the diverse needs of employees. Employers can select plans that align with the demographics and preferences of their workforce, offering a tailored approach to benefits that reflects the unique composition of the team.

Streamlined Administration: The administration of group insurance is typically more streamlined compared to managing individual plans for each employee. This efficiency benefits both employers and employees, reducing administrative burdens and ensuring that benefits are effectively communicated and managed.

Continuity of Coverage: Group insurance offers a sense of continuity for employees, especially in the event of job changes or transitions. Many group plans allow for the continuation of coverage, providing a seamless experience and eliminating the need for individuals to navigate new insurance arrangements during periods of change.

Wellness Programs Integration: Group insurance plans often integrate wellness programs, promoting a holistic approach to employee health. Wellness initiatives may include fitness programs, preventive screenings, mental health support, and other resources that contribute to the overall well-being of the workforce.

Risk Mitigation for Employers: For employers, group insurance serves as a risk mitigation strategy. By providing comprehensive health coverage, employers contribute to the preventive care and well-being of their employees. This, in turn, can lead to reduced absenteeism, improved productivity, and a healthier, more engaged workforce.

Group insurance is undeniably the ultimate team player in the realm of workplace benefits. Its strength in numbers, affordability, and comprehensive coverage make it a valuable asset for both employees and employers. By fostering a collaborative approach to health and well-being, group insurance contributes to the overall success and satisfaction of the workforce, creating a win-win scenario that makes it an indispensable player in the world of employee benefits.

0 notes

Text

Group Insurance: The Key to Employee Retention and Satisfaction

Group insurance plays a pivotal role in employee retention and satisfaction within a company. It goes beyond being a benefit; it is a strategic tool that can significantly impact the overall well-being of employees, fostering a positive work environment. Here are key aspects highlighting the importance of group insurance in employee retention and satisfaction:

Comprehensive Health Coverage: Group health insurance provides employees with access to comprehensive healthcare coverage, including medical, dental, and vision benefits. This coverage promotes preventive care, allowing employees to address health concerns proactively. When employees feel that their well-being is a priority, it positively influences their job satisfaction and commitment to the organization.

Financial Security: Group insurance, particularly life and disability coverage, offers financial security to employees and their families in times of unexpected events. In the unfortunate event of an employee's death or disability, these insurance benefits provide a safety net, helping to cover funeral expenses and outstanding debts, and ensuring financial stability for the employee's dependents. The peace of mind that comes with financial security contributes significantly to employee satisfaction and loyalty.

Cost-Effective Benefit for Employees: Group insurance plans are generally more cost-effective for employees than individual insurance policies. The employer often subsidizes a portion of the premiums, making it more affordable for the workforce. This cost efficiency enhances the perceived value of the benefit, making employees appreciate the support their employer provides for their healthcare needs.

Talent Attraction and Retention: In a competitive job market, attractive benefits, including group insurance, play a crucial role in talent attraction and retention. Prospective employees often consider the quality of the benefits package when evaluating potential employers. Offering a robust group insurance plan can set a company apart, making it more appealing to top talent. Additionally, existing employees are more likely to stay with a company that prioritizes their well-being through comprehensive insurance coverage.

Employee Engagement and Productivity: Employees who feel cared for and supported by their employer are likely to be more engaged and productive. Knowing that they have access to health coverage for themselves and their families fosters a sense of security. This, in turn, contributes to a positive workplace culture, where employees are motivated to give their best effort, leading to increased productivity and overall job satisfaction.

Reduced Stress and Absenteeism: Access to health insurance reduces the financial burden associated with healthcare costs. When employees have coverage, they are more likely to seek timely medical attention, reducing the risk of serious health issues. This proactive approach to health not only contributes to overall well-being but also helps minimize stress and absenteeism related to untreated health conditions.

Customization and Flexibility: Group insurance plans can be customized to meet the diverse needs of the workforce. Employers can offer flexibility in choosing coverage options, allowing employees to select plans that align with their circumstances. This customization enhances the relevance of the benefits, ensuring that employees feel their unique needs are considered.

Employee Perception of Value: The availability of group insurance contributes to the overall perception of value that employees associate with their compensation package. When employees recognize that their employer invests in their health and financial security, they are more likely to view their total compensation favorably. This positive perception enhances employee satisfaction and loyalty to the organization.

In conclusion, group insurance is a key factor in employee retention and satisfaction. Beyond the tangible benefits of healthcare coverage, it sends a powerful message to employees that their employer cares about their well-being. Companies that prioritize comprehensive group insurance are better positioned to attract and retain top talent, create a positive workplace culture, and foster a loyal and engaged workforce.

0 notes

Text

All You Need To Know About Taking Group Medical Insurance In UAE

Introduction

Group medical policies are an important way to ensure that all of your employees have access to health insurance coverage. Group medical policies provide numerous advantages for both employers and employees, such as lower costs than individual plans, the option to customize coverage, and the ability to cover large groups of people at once. In the UAE specifically, there are a number of additional benefits that make group medical policies even more attractive. By understanding all these aspects of group medical policies in the UAE, you can make sure that you get the best plan possible for your company’s needs.

Comparing Group Medical Policies to Individual Policies

Group medical policies are often significantly less expensive than individual health insurance plans, making them an attractive option for employers and employees alike. While the exact cost of a plan will vary depending on each person’s specific situation, group policies typically have lower premiums because they spread out the risk among a larger pool of people. Most insurers also provide discounts to companies with multiple employees enrolled in their policy, allowing businesses to save even more money.

In terms of coverage differences between group and individual plans, one major difference is that group plans may offer more flexibility when it comes to customization options which can be beneficial if your particular business needs unique coverage, not offered in an individual plan.

Lastly, applying for a group medical policy can be much easier than filing for an individual plan since all members of the company are essentially applying together at once rather than having to go through the process individually. This makes it simpler for both employer and employee alike since there is only one application form needed instead of potentially dozens based on how many individuals are being covered under the same policy.

Particular Benefits of Group Medical Policies in UAE

One of the major benefits of group medical policies in the UAE is the additional coverage for female employees. These benefits may include maternity leave or fertility treatments that are not typically included in individual plans. This can be a great benefit to any company who has female workers, as it will help ensure that their healthcare needs are met and that they have access to necessary services during times of need.

Group medical policies also offer discounts when multiple people from one company enroll in the same policy together. Insurers recognize that they’re taking on less risk by covering multiple people at once, so they often provide cost savings for businesses who choose this option over individual plans.

Finally, larger companies may be able to get subsidies or reduced rates with certain insurers if they sign up for a group medical policy instead of going with individual plans for all members covered under the policy’s umbrella organization structure.

Getting Group Medical Policies for Your Company

When it comes to getting group medical policies for your company, the first step is understanding the requirements. It’s important to be aware of any rules or regulations that may apply in your region as you shop around for a plan. Additionally, you should research how much coverage each policy provides and what other services are included. This will help ensure that you get the best deal possible while still meeting all of your employees’ needs.

Once you have a better idea of what type of plan would work best for your business, it’s time to start comparison shopping. Here at InsurancePolicy.ae, we help you compare among various different insurance brands, policies and prices, so you can get the best value for your money! Comparing quotes side-by-side can also help narrow down which plans offer the most value based on cost and coverage levels.

Conclusion

In conclusion, group medical policies are a great way to provide quality healthcare coverage at an affordable price for companies of all sizes. Additionally, researching discounts available for multiple people enrolled in the same policy or subsidies/reduced rates for larger businesses will enable employers to get even better deals on quality health insurance plans for their entire staff. By taking into account all the aspects mentioned above, employers can ensure that they make informed decisions when it comes to choosing group medical policies in the UAE that meet both their financial needs and those of their employees.

Insurancepolicy.ae as Your Partner for Insurance

Insurancepolicy.ae is a trusted partner for individuals and families looking to purchase insurance in the UAE. The company offers comprehensive services that make it easy for customers to compare quotes, receive secure advice, and complete their policy purchases hassle-free.

When searching for the right insurance policy, insurancepolicy.ae makes it simple to compare quotes from multiple providers quickly and without any pressure or commitment. The website provides an overview of different plans, so customers can easily find what they’re looking for without having to spend time researching each insurer individually. Once a customer has selected their desired plan, they are then able to finalize the details with one of insurance policy’s experienced advisors who will provide tailored advice based on their individual needs — ensuring they get the best possible coverage at a price that fits within their budget!

For anyone looking for reliable insurance solutions in UAE look no further than insurancepolicy.ae — your trusted partner providing quality service and expert guidance every step along the way.

#group health insurance#group health insurance dubai#group medical insurance#insurance#group insurance

0 notes