#HOMEBUYERS

Note

Hi!

Thanking for answering my ask,

If you don’t mind I would love it if you could get into the tax part, I just want to know as much as I can. 😆

Ok this is fun, prepare to have your mind blown.

I have to disclose that I am not a financial advisor or an accountant <3

Trusts: You want to consider purchasing the properties under a trust. Tax implications can vary under trusts. Revocable living trust will allow you to be treated as the owner, but in an irrevocable trust, it is a separate entity. In some structures, you would only pain capital gains, which can also be transferred to a separate trust, and you do not end up paying capital gains on the property. You do this with a charitable remainder trust. Generally, if a property is held in a trust, rental income generated from that property is typically subject to income tax. The trust itself may be responsible for paying those taxes, or the tax liability might pass through to the beneficiaries, depending on the type of trust and its specific provisions. This will change the amount you would pay in taxes. If the property was purchased as a primary home, there could also be capital gain exceptions depending on the trust. Your income affects the rates you pay on specific trusts. Before I continue, I want to suggest speaking to an actual attorney, not an accountant. Most are not knowledgable or equipped to properly guide you here. Same as with traditional, in a trust you can deduct property related expenses like mortgage interest, property taxes, maintenance costs, and depreciation, from the rental income. This can help reduce the taxable income generated by the property.

IRA's: You can use a self directed IRA or other retirement accounts to invest in real estate. The gain from these investments grow tax deferred within your account. This is something you should also consider doing.

Depreciating assets: Real estate can depreciate overtime. This doesn't include land. But when it depreciates, you can deduct the properties cost. This would offset the income you would pat taxes on.

1031 Exchange: Filing a 1031 will allow you to defer paying capital gains on an investment property when it's sold, as long as another "like kind" property is purchased with the profit gained from the sale.

Mortgage Interest Deduction: Interest paid on mortgages for investment properties can be deducted.

Carry Forward: If your expenses exceed your rental income, you could have a net loss. Some of these losses can be used to offset other taxable income, while others might be carried forward to future years.

Living in the property: If you live in the property for 2 years. you can exclude a portion of the capital gains from your taxable income when you sell.

Opportunity Zones: Opportunity zones offer tax incentives, including deferring and potentially reducing capital gains taxes.

Expenses: All repair expenses can be deducted.

Installments: You can structure your sale to receive payments over time. This spreads out the capital gains and reduces tax impact.

Tax Credits: There are a ton of tax credits for investors. Would research in your state.

More deductions: Interest on a mortgage for an investment property is typically tax deductible, as are property taxes and many other expenses related to the property like Insurance premiums.

Cost segregations: You can hire someone to reclassify certain areas of your property to accelerate depreciation. This will give you a significant upfront tax deduction.

Pass throughs: Certain pass through entities (like LLCs, S Corporations, and partnerships) may be eligible for a deduction of up to 20% of their business income from rental properties.

I can keep going on this, but strongly recommend you read these books:

Loopholes of the Rich: How the Rich Legally Make More Money and Pay Less Tax

Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your Taxes

92 notes

·

View notes

Link

Taxpayer-Funded Program Offers $30,000 to Non-Citizen Homebuyers in Oregon, Excluding U.S. Citizens

A taxpayer-funded program in Oregon offers $30,000 in down payment assistance to non-citizens, raising concerns over the exclusion of U.S. citizens from eligibility.

6 notes

·

View notes

Text

Here’s My Latest Listing!

A Must See!! 3019 Sq Ft 2 Homes 12.84 usable Acres!

“List With Lewis" Hughes Real Estate Broker & Get it SOLD!! Interested in Listing Your Home? Want it Sold Fast Then List it with Lewis!! Now Taking Listings for Homes/Condos/Duplex's in Thurston, Lewis, Cowlitz, Mason, Pierce & South King Counties! Call Lewis Hughes Realtor 360-790-7664

#realestate#home selling#realestateforsale#realestatebroker#property for sale#properties#homebuyers#propertyinvestment#home for sale

4 notes

·

View notes

Text

Budget 2024 - What It Means for The Real Estate Industry - Part III

The Indian Union Budget 2024 has been released, and its implications for the real estate sector are substantial. This article will delve into the various facets of the budget, examining how the proposed changes will impact the real estate industry. As one of the most dynamic real estate markets in India, Gurugram's developments are keenly watched by investors, developers, and homebuyers alike. For a comprehensive overview of real estate in Gurugram and to stay updated on market trends, visit Ehouzer.

Key Highlights of Budget 2024

Increased Infrastructure Investment

One of the most significant announcements in the 2024 Budget is the increased allocation for infrastructure development. The government has earmarked an additional ₹2 trillion for infrastructure projects, which includes improvements in transportation, urban planning, and public utilities. This investment is expected to have a ripple effect on the real estate sector.

For Gurugram, this means enhanced connectivity and infrastructure. New roads, metro lines, and better public services will make the city more attractive to investors and homebuyers. Improved infrastructure typically leads to an increase in property values and a boost in real estate activities.

Affordable Housing Incentives

The Budget 2024 continues to emphasize affordable housing, a key focus area for the government. The introduction of new incentives for developers who build affordable housing projects is expected to drive the construction of more budget-friendly residential options. This initiative aligns with the government's goal of providing housing for all and is likely to stimulate demand in the residential real estate sector.

In Gurugram, the demand for affordable housing has been on the rise due to the influx of professionals and the growing population. With these new incentives, developers are likely to invest more in affordable housing projects in the region. For detailed insights into the real estate opportunities in Gurugram, explore Ehouzer

Tax Reforms and Benefits

The Budget introduces several tax reforms that are expected to benefit both developers and homebuyers. Key among these is the increase in the tax deduction limit on home loan interest payments. Homebuyers will benefit from higher deductions, making homeownership more affordable.

For developers, the Budget proposes tax incentives for the construction of green buildings and eco-friendly projects. This shift towards sustainability is expected to influence real estate development trends, encouraging the adoption of green building practices.

These tax reforms will likely boost the real estate market in Gurugram, as more homebuyers and developers take advantage of these benefits. To understand how these changes may impact your real estate investments, visit Ehouzer.

Impact on Residential Real Estate

Demand for Residential Properties

The combination of increased infrastructure investment and affordable housing incentives is expected to drive up demand for residential properties. In Gurugram, the residential real estate market is likely to see a surge in demand as more people look to invest in property due to improved infrastructure and attractive housing options.

This uptick in demand is also anticipated to influence property prices. While affordable housing projects may provide budget-friendly options, the overall rise in property demand could lead to increased prices in other segments of the residential market.

Shift Towards Sustainable Living

The Budget’s emphasis on green building incentives is expected to accelerate the shift towards sustainable living. Developers in Gurugram are likely to adopt more eco-friendly practices and technologies in their projects. This shift not only aligns with global sustainability trends but also meets the growing demand from environmentally-conscious homebuyers.

Sustainable living features, such as energy-efficient appliances, solar panels, and green spaces, are becoming increasingly popular. Homebuyers in Gurugram will benefit from these developments, gaining access to more sustainable and energy-efficient housing options.

Commercial Real Estate Developments

Growth in Office Spaces

The infrastructure investment outlined in the Budget is likely to benefit the commercial real estate sector, particularly the office space market. Enhanced connectivity and improved urban infrastructure will make Gurugram an even more attractive location for businesses.

Companies are expected to seek out modern, well-connected office spaces to accommodate their growing operations. This increased demand for office space will drive commercial real estate development in Gurugram, with new projects and expansions likely to emerge.

Retail and Mixed-Use Developments

The commercial real estate market in Gurugram will also see growth in retail and mixed-use developments. The increased focus on infrastructure and urban development will attract more retail businesses and mixed-use projects, which combine residential, commercial, and recreational spaces.

These developments are expected to enhance the urban landscape of Gurugram, providing residents and visitors with more shopping, dining, and entertainment options. For insights into the latest commercial real estate trends and opportunities, visit Ehouzer.

Investment Opportunities

Real Estate Investment Trusts (REITs)

The Budget 2024 includes provisions for the growth of Real Estate Investment Trusts (REITs), which offer a viable investment option for those looking to invest in real estate without directly purchasing property. REITs provide an opportunity to invest in a diversified portfolio of real estate assets and benefit from rental income and capital appreciation.

Investors in Gurugram should consider exploring REITs as a way to diversify their investment portfolio and gain exposure to the commercial real estate market. The growth of REITs in India presents new opportunities for both individual and institutional investors.

Affordable Housing Projects

With the new incentives for affordable housing, developers are likely to focus on projects that cater to the budget segment. Investors looking to capitalize on this trend can explore opportunities in affordable housing projects in Gurugram. These projects are expected to offer attractive returns due to the high demand for affordable housing.

For more information on investment opportunities in the real estate sector, including affordable housing and REITs, visit Ehouzer.

Regulatory Changes and Their Impact

Simplified Land Acquisition Processes

The Budget proposes measures to simplify land acquisition processes, which is expected to benefit real estate developers. Streamlined procedures will reduce delays and lower costs associated with land acquisition, facilitating faster project completion.

In Gurugram, these regulatory changes will likely lead to a more efficient real estate development process. Developers will be able to expedite their projects, which will, in turn, enhance the overall growth of the real estate market in the region.

Enhanced Transparency and Accountability

The Budget emphasizes the need for greater transparency and accountability in the real estate sector. New regulations are expected to address issues such as project delays, non-compliance, and financial transparency. These changes aim to build trust among investors and homebuyers.

For stakeholders in Gurugram, these regulatory changes will contribute to a more transparent and reliable real estate market. Developers and investors can benefit from the increased clarity and accountability in real estate transactions.

Challenges and Considerations

Potential Impact on Property Prices

While the Budget's initiatives are likely to boost the real estate sector, there are concerns about the potential impact on property prices. Increased demand for residential and commercial properties may lead to higher prices, which could affect affordability for some buyers.

Homebuyers and investors in Gurugram should consider these factors when making real estate decisions. It is essential to stay informed about market trends and property price movements to make well-informed investment choices.

Balancing Supply and Demand

The growth in real estate development, driven by increased infrastructure investment and affordable housing incentives, must be balanced with supply and demand dynamics. Overbuilding or misalignment between supply and demand could impact the stability of the real estate market.

Developers and investors in Gurugram should carefully assess market conditions and demand trends to ensure that new projects align with the needs of the market.

Conclusion

The Union Budget 2024 presents a range of opportunities and challenges for the real estate industry, with significant implications for the market in Gurugram, Haryana. Increased infrastructure investment, incentives for affordable housing, tax reforms, and regulatory changes are set to shape the future of real estate in the region.

As the real estate landscape evolves, stakeholders in Gurugram must stay informed and adapt to the changes to leverage new opportunities and address potential challenges. For more detailed insights into the real estate market in Gurugram and to explore investment opportunities, visit Ehouzer.

For personalized advice and assistance with your real estate investments, contact us.

#realestate#budget 2024#gurugram#housingmarket#infrastructure#affordablehousing#commercial real estate#residential property#investment#sustainableliving#greenbuilding#urban development#property#realestateinvesting#homebuyers#propertyinvestment#realestatemarket#realestatenews#realestatetips#housing development#economicgrowth#urban planning#propertyvalue

2 notes

·

View notes

Text

Thank you everyone who came out to see us at the NeighborWorks Community Home Fair this weekend! It was so nice meeting everyone!

Do you have questions about property issues like Mold, Radon, or Asbestos? Please feel free to call our offices, we're always here to help!

#home #house #homesweethome #homeinspection #homeinspector #realestate #realtor #DisasterBlaster #homebuyer #homebuyers #homebuying #mold #asbestos #radon

#home#house#homesweethome#homeinspection#homeinspector#realestate#realtor#DisasterBlaster#homebuyer#homebuyers#homebuying#mold#asbestos#radon

2 notes

·

View notes

Text

When you're ready for the new home selfie, I'm here for you 😉

#homebuyers#homebuying#firsttimehomebuyers#selfie#newhome#homesforsale#teamproperties#tpg#tonyastahl#gillettewy#gilletterealestate

2 notes

·

View notes

Text

Hey everyone! It's been such a fantastic investment for everyone! The location is so convenient, with easy access to transportation and all the necessary amenities. The community is also super friendly and welcoming, making it a great place to call home. If you're a young investor looking for a solid investment opportunity, I highly recommend checking out Urban Deca Homes Ortigas. Trust me; you don't want to miss out on the chance to invest in your future. #UrbanDecaHomesOrtigas #InvestInYourFuture #YoungHomeowner

Please message me if you want to learn more about Urban Deca Homes Ortigas and how it could be the perfect investment opportunity. I'm always here to assist you and provide any additional information or support you may need. Let's connect and explore this exciting opportunity together!

#CondoLiving #RealEstateInvesting #LuxuryCondos #PropertyMarket #UrbanLiving #HomeBuyers #RealEstateTrends #CondoLife #InvestmentProperty #CityLiving #NewHomeSearch #CondoCommunity #HousingMarket #RealEstateNews #CondoViews #DreamHome #AffordableHousing #RealEstateGoals #CondoStyle #SellingProperty #CondoDesign #HomeOwnership #RealEstateTips #CondoInvestments #RealEstateAgent

#Hey everyone! It's been such a fantastic investment for everyone! The location is so convenient#with easy access to transportation and all the necessary amenities. The community is also super friendly and welcoming#making it a great place to call home. If you're a young investor looking for a solid investment opportunity#I highly recommend checking out Urban Deca Homes Ortigas. Trust me; you don't want to miss out on the chance to invest in your future.#UrbanDecaHomesOrtigas#InvestInYourFuture#YoungHomeowner#Please message me if you want to learn more about Urban Deca Homes Ortigas and how it could be the perfect investment opportunity. I'm alwa#CondoLiving#RealEstateInvesting#LuxuryCondos#PropertyMarket#UrbanLiving#HomeBuyers#RealEstateTrends#CondoLife#InvestmentProperty#CityLiving#NewHomeSearch#CondoCommunity#HousingMarket#RealEstateNews#CondoViews#DreamHome#AffordableHousing#RealEstateGoals#CondoStyle#SellingProperty#CondoDesign#HomeOwnership

7 notes

·

View notes

Text

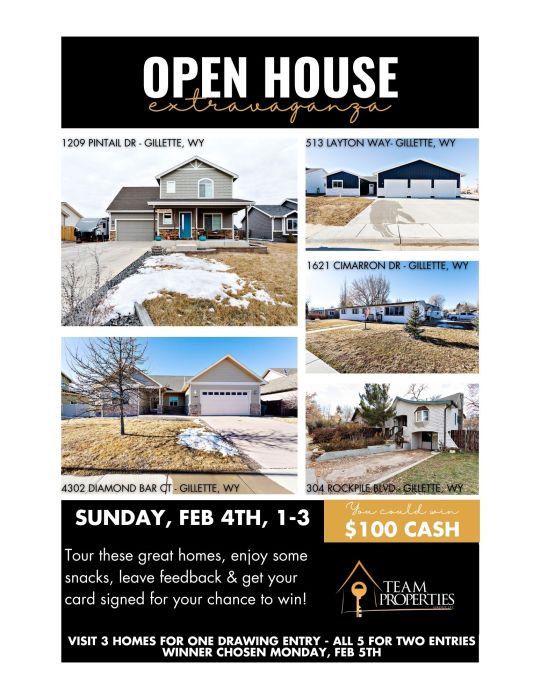

🎈𝕆𝕡𝕖𝕟 ℍ𝕠𝕦𝕤𝕖 𝐸𝓍𝓉𝓇𝒶𝓋𝒶𝑔𝒶𝓃𝓏𝒶🎈Join us in Gillette this Sunday, February 4th from 1-3! Tour homes, enjoy some snacks, leave feedback and be entered for a 𝓬𝓱𝓪𝓷𝓬𝓮 𝓽𝓸 𝔀𝓲𝓷 $𝟏𝟎𝟎 𝓬𝓪𝓼𝓱!

𝟏𝟔𝟐𝟏 𝐂𝐢𝐦𝐚𝐫𝐫𝐨𝐧 𝐃𝐫 - 3 BD, 2 BA, 1380 SQFT, 0.21 ACRES - $299,900

𝟒𝟑𝟎𝟐 𝐃𝐢𝐚𝐦𝐨𝐧𝐝 𝐁𝐚𝐫 𝐂𝐭 - 5 BD, 3.5 BA, 4072 SQFT, 0.18 ACRES - $499,000

𝟓𝟏𝟑 𝐋𝐚𝐲𝐭𝐨𝐧 𝐖𝐚𝐲 - 4 BD, 2.5 BA, 2080 SQFT, 0.26 ACRES - $549,900

𝟏𝟐𝟎𝟗 𝐏𝐢𝐧𝐭𝐚𝐢𝐥 𝐃𝐫 - 3 BD, 2.5 BA, 2215 SQFT, 0.23 ACRES - $440,000

𝟑𝟎𝟒 𝐑𝐨𝐜𝐤𝐩𝐢𝐥𝐞 𝐁𝐥𝐯𝐝 - 3 BD, 2 BA, 1568 SQFT, 0.16 ACRES - $248,000

**Get your card stamped at 3 homes for one drawing entry OR visit all 5 for two entries! Winner will be drawn & contacted on Monday, February 5th!**

Contact our agents at Team Properties Group for more info 📲307.685.8177

#openhouse#homesforsale#wyoming#wyomingrealestate#homesforsaleinwyoming#gillettewy#gilletterealestate#homesforsaleingillettewy#teamproperties#tpg#firsttimehomebuyers#homeownership#homesweethome#homesearch#househunting#homebuyers#homebuying#homesellers#homeselling#realtorsinwyoming#realtorsingillettewy#realestate#realestateagent#realtor#realestatemarket#winnerwinnerchickendinner

4 notes

·

View notes

Text

Comfortsit provides customised sofa chair in Delhi and NCR

Get yourself the best quality affordable chairs today

Call us for best deals on furniture & interior

Email us:

[email protected]

Address

M-8&9, Main Rajapuri furniture market, Matiala, Main rajapuri Road, behind Aakash Hospital, Dwarka, New Delhi,Delhi 110059

#furniture#interior#interior design#home decor#office#delete later#design#living room#bedroom#interiors#interiordecor#interiorinspo#interiorstyling#exterior design#chandelier#property#realestate#homeownership#homebuyers#property management#commercial property#furniture showroom#rugs#homeessentials

6 notes

·

View notes

Link

Duplex for sale near Bishop Arts

[email protected] 214-458-0363

#realestate#passive income#incomeproperty#dallas texas#duplex#bishoparts#real estate investing#texas#home & lifestyle#homebuyers

2 notes

·

View notes

Text

#investing#marketing#realestate#homebuyers#residential#propertyinvestment#property in noida#godrejproperties

2 notes

·

View notes

Text

Godrej Carmichael - Luxury Residential Project

3 notes

·

View notes

Photo

There can be no better source than plants to counter indoor pollution. Some of the plants that can filter the indoor air are Snake Plants, Spider Plants, Aloe Vera, and Devil’s Ivy. These plants remove toxic air pollutants & filter the indoor air. What’s unique about the snake plant is that it’s one of the few plants that can convert carbon dioxide (CO2) into oxygen at night. So, invest in some plants this season to filter and freshen the indoor air.

8 notes

·

View notes

Text

Probiz Real Estate presents a much awaited project from one the best developers in the UAE whose last project sold out in hours.

𝐇𝐢𝐠𝐡𝐥𝐢𝐠𝐡𝐭𝐬:

★ 1% Payment Plan

★ Starting Price just 550K

- Book now !!!

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐮𝐬 𝐟𝐨𝐫 𝐦𝐨𝐫𝐞 𝐢𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧

Call: +971 50 244 6985

Email: [email protected]

#luxurylifestyle#properties#realtors#firsttimehomebuyer#homeforsale#lifestyle#homedecor#remax#listing#invest#investing#love#realestatebroker#newlisting#investmentproperty#homebuyers#investor#money#propertymanagement#realtorsofinstagram#motivation#instagood#realestatetips#openhouse#luxuryliving#homebuying#probizrealestate#oro24

9 notes

·

View notes

Text

Sell Your House Fast: Proven Strategies for a Quick Sale

You can sell your house quickly with B & A Partners LLC's Sell Your House Fast Proven Strategies for a Quick Sale. Discover expert tips and techniques to attract potential buyers, stage your home effectively, and negotiate the best deal. With our comprehensive guide, you'll be on your way to a successful and speedy sale. Don't miss out on this opportunity to sell your house fast. You can find more information on our website or by calling 717-8084269.

2 notes

·

View notes