#Hexaware Technologies IPO

Explore tagged Tumblr posts

Text

Hexaware Technologies IPO GMP, Open Date, Price Band, Allotment Status.

Hexaware Technologies IPO open date is 12 February to 14 February 2025. This new IPO is a book-built issue of up to 12.36 crore equity shares worth up to Rs 8,750 crore. This upcoming IPO is offering entirely an offer-for-sale.

Read more..

#Hexaware Technologies IPO#ipo issue size#ipo price band#ipo gmp#ipo allotment status#IPO dates#IPO Objectives#IPO Time Table#IPO Lot Size Details#IPO Registrar and Lead Managers#IPO FAQs#algo trading#algo trading app#algo trading india#algo trading platform#algo trading strategies#algo trading software india#bigul#finance#free algo trading software#algorithm software for trading#bigul algo#algorithmic trading#algorithm#bigulalgo#bigul algo trading#bigultradingapp#bigul algo trading review#best algo trading app in india#best online trading paltform

0 notes

Text

Get the latest updates on Hexaware Technologies IPO, including its GMP (Grey Market Premium), issue price, IPO date, and key investment insights. Stay informed about Hexaware Technologies' financials, market sentiment, and listing prospects to make a well-informed investment decision. Read more at Finowings.

0 notes

Text

Hexaware Technologies is preparing for largest Tech IPO second time and investors are ready to invest in its IPO. Get the complete information on Hexaware financials , stock price chart, market impact, company potential etc. at Planify before investing. You can also invest in this pre IPO at best price from Planify to get high return after listing.

0 notes

Text

Hexaware Technologies IPO Allotment Status Finalized on February 17 – Shares Credited Today

Hexaware Technologies IPO allotment status has been finalized on February 17, and investors can check their allotment details online. The shares are set to be credited to the demat accounts today, marking an important step for those who subscribed to the much-anticipated IPO. Investors can check their Hexaware Technologies IPO allotment status on platforms like BSE, NSE, and the official registrar’s website. The listing date and expected Hexaware Technologies IPO share price performance in the stock market remain key points of interest. Stay updated on all IPO-related developments with Trades Guru, your trusted source for the latest stock market news.

0 notes

Text

Hexaware Technologies IPO allotment date likely today; Latest GMP, steps to check share allotment status online

Intensify Research is a trusted high accuracy stock market tips site committed to empowering investors with the most reliable stock market insights. Our team of expert analysts uses advanced tools and strategies to provide you with high accuracy stock market tips that enhance your chances of success. To Visit- Intensifyresearch.com

#sharemarketing#stockinvestment#stocks#stock market#sharetrading#investment#sharemarket#share this post#shareinvestor#sharetrader

0 notes

Text

Hexaware Technologies IPO allotment date in focus today. Latest GMP, steps to check share allotment status online

Intensify Research Services is a professional stock advisory firm in Indore. We provide expert investment advice and guidance to individuals and High Net-Worth Individuals (HNIs), offering valuable trading tips and strategies for maximum profit. 2-day demo and a 30% discount on all services. Visit us at Intensify Research Services to learn more.

1 note

·

View note

Photo

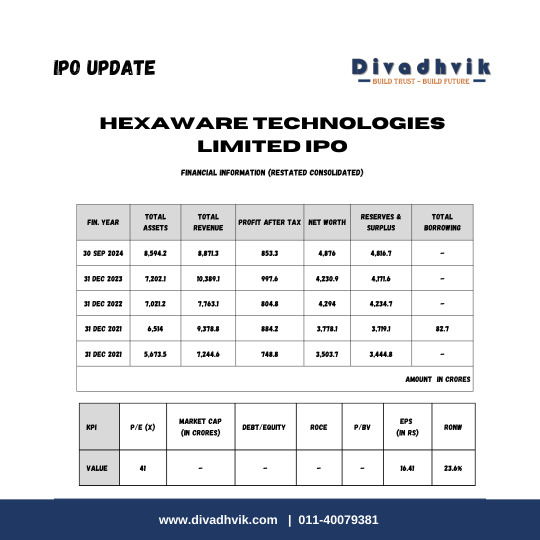

Hexaware Technologies Limited is all set to launch its much-anticipated IPO! This is your chance to invest in a leading global IT services company known for its innovation and digital transformation expertise. With a strong growth trajectory and a solid client base, Hexaware is positioned for success in the evolving tech landscape. Don’t miss out on this exciting investment opportunity—stay updated on the IPO details and make informed decisions to grow your portfolio! . . . . . #HexawareIPO #InvestSmart #StockMarket #TechStocks #IPOAlert

0 notes

Text

🚀 *Hexaware Technologies IPO 2025: Key Details, Financials & Should You Invest?*

Hexaware Technologies is all set to launch its *₹8,750 crore ($1 billion) IPO* on *February 12, 2025!* 📈 Should you invest? 🤔

In this video, we cover:

✅ *IPO Dates & Price Band*

✅ *Grey Market Premium (GMP) & Listing Expectations*

✅ *Hexaware’s Financials, Growth & Valuation*

✅ *Expert Recommendations & Risk Factors*

Watch Now: https://www.youtube.com/watch?v=x0w2Wm80cWg

👍 *Like, Share & Subscribe for more IPO and stock market insights!* 🔔

0 notes

Text

Hexaware Technologies IPO GMP: Key Insights & Market Trends Before Listing

Hey there! So, let’s chat about the buzz surrounding Hexaware Technologies IPO GMP. If you’re considering jumping on this investment opportunity, it’s essential to get the full picture. Let’s dive in! IPO Snapshot: Key Details You Should Know Hexaware Technologies, backed by the Carlyle Group, is gearing up to launch its Initial Public Offering (IPO) on February 12, 2025, with the subscription…

0 notes

Text

Carlyle weighs $1 billion IPO for Indian IT firm Hexaware Technologies | Mint [ Hexaware Technologies ]

Carlyle weighs $1 billion IPO for Indian IT firm Hexaware Technologies | Mint [News Summary] Carlyle is reportedly engaging with potential underwriters to prepare for an IPO later this year or in 2025. If Hexaware proceeds with the… At about $1 billion, it would be the biggest IPO in the country since Life Insurance Corp. of India’s in 2022, according to data compiled by… Padmini Dhruvaraj &…

View On WordPress

0 notes

Text

Hexaware Technologies IPO GMP, Price & Key Investment Insights

Hexaware Technologies, a leading global IT services and consulting company, is gearing up for its much-anticipated Initial Public Offering (IPO). Investors are closely monitoring the Hexaware Technologies IPO GMP (Grey Market Premium) and expected listing price to assess its market potential. This blog provides an in-depth analysis of the Hexaware Technologies IPO price, GMP trends, and key dates to help investors make informed decisions.

Hexaware Technologies IPO GMP – Latest Trends

The Hexaware Technologies IPO GMP serves as a crucial indicator of market sentiment before the official listing. GMP represents the premium at which IPO shares are trading in the unofficial grey market. While GMP fluctuates based on demand and market conditions, it provides insight into potential listing gains.

Factors Influencing the GMP:

Market Sentiment: Overall stock market trends and investor confidence impact the GMP.

Company’s Financial Performance: Strong revenue growth and profitability drive higher demand.

Industry Growth Potential: IT services and digital transformation sectors remain high-growth areas.

Subscription Levels: Higher demand during the IPO subscription period often boosts GMP.

Investors should track real-time updates on Hexaware Technologies IPO GMP before making investment decisions.

Hexaware Technologies IPO Price & Subscription Details

The Hexaware Technologies IPO price is expected to be announced soon, with the price band determined by the company and underwriters. The IPO price reflects the company’s valuation and investor demand.

Expected IPO Details:

Price Band: Yet to be disclosed

Lot Size: To be updated

Total Issue Size: Expected to be substantial, given Hexaware's industry standing

Subscription Dates: The IPO subscription window will be available for a few days

Potential investors should analyze the Hexaware Technologies IPO price compared to industry peers and past IPO performances.

Hexaware Technologies Business Overview

Hexaware Technologies is a well-established IT solutions provider, specializing in automation, cloud computing, and artificial intelligence. The company's diverse client base, strong revenue growth, and digital transformation capabilities make it an attractive investment opportunity.

Strengths of Hexaware Technologies:

Global Presence – Serving clients across various industries and regions Innovative Solutions – Focused on AI, cloud computing, and digital transformation Strong Financials – Consistent revenue growth and profitability

Should You Invest in Hexaware Technologies IPO?

Investing in Hexaware Technologies IPO depends on various factors such as GMP trends, company fundamentals, and overall market conditions. Here are some key points to consider:

✔️ If the IPO GMP remains strong, there could be potential listing gains. ✔️ Long-term investors should evaluate the company's growth potential in the IT sector. ✔️ Risk assessment is essential, as IPO markets can be volatile.

Final Thoughts

The Hexaware Technologies IPO GMP and Hexaware Technologies IPO price are crucial factors for investors planning to participate in this offering. Keeping track of market trends, financial reports, and grey market activity will help investors make better decisions.

For real-time updates on Hexaware Technologies Live IPO GMP and price, stay connected with Finowings Training Academy and visit Finowings.

0 notes

Text

Is Hexaware Technologies Going for IPO?

Hexaware, an IT and business process outsourcing (BPO) services provider, delisted from the NSE and BSE in November 2020 at a price of ₹475 per share. In 2021, US private equity giant Carlyle acquired a 62% stake in Hexaware for $3 billion. Hexaware is now planning to re-enter the public market with an IPO that could raise up to $1 billion (₹8,350 crore) at a valuation of $4-5 billion (₹41,000-50,000 crore). Carlyle has finalized five investment banks as underwriters for the IPO: Kotak Mahindra Capital, Citi, JP Morgan, HSBC, and IIFL Securities. If the IPO goes through, it will be the biggest IPO in the IT services sector after TCS. Currently, shares are available in the pre-IPO market at ₹1,100 per share at a valuation of $4 billion. Investors who have accumulated these shares at ₹450-900 are seeing good returns. I recommend these investors hold on to their shares. For those who haven't invested yet, we suggest doing their due diligence before making an investment decision.

youtube

#hexaware Pre IPO#hexaware IPO#hexaware Unlisted shares#hexaware Unlisted share price#hexaware Share Price#hexaware Upcoming IPO#Youtube

1 note

·

View note

Text

A Beginner’s Guide To Unlisted Shares

What are Unlisted Shares?

In simple terms, unlisted shares are shares of a company that hasn’t gone public yet. By purchasing the unlisted shares of a private company, you can invest in it even before its initial public offering (IPO). The Unlisted Saga – Unlisted companies have ambitious plans for rapid growth that aspire to take their business to the next level turning them into multi bagger growth opportunities for investors.

Previously, access to Similarly, access to startups, earlystage, pre-IPO companies were previously limited to venture capitalists & angel investors.

There are multiple ways to acquire unlisted shares. There are multiple platforms offering such unlisted and Pre IPO shares. TradeUnlisted is one such platform. TradeUnlisted is the leading platform for buying and selling of Unlisted Stocks. To know more, visit www.tradeunlisted.com

Features of Unlisted Shares:

Dematerialized: Similar to listed stocks, unlisted stocks are also transferred to your Demat account. You may monitor the status of the unlisted shares that you have purchased through your depository participant account, in which they are available at face value.

Growth Potential: You can now be a part of a private company’s growth since the start. Investors can buy shares in businesses that are either technologically or operationally new on unlisted markets.

Liquidity: There is no restriction on buying or selling of unlisted shares until the IPO cut-off date, which is usually a week before the listing. However, after listing the SEBI norms shall be applicable to these shares. All unlisted shares go for a lock-in of 6 months from the date of listing, post which they can be traded like any other listed shares.

Check the current Share Prices of Unlisted Companies in India:

OYO (Oravel Stays Ltd)

Check OYO Unlisted Share Price

National Stock Exchange (NSE)

Check NSE Unlisted Share Price

PharmEasy (API Holdings Ltd)

Check PharmEasy Unlisted Share Price

Chennai Super Kings (CSK)

Check CSK Unlisted Share Price

Bira91 (B9 Beverages Pvt Ltd)

Check Bira91 Unlisted Share Price

Fino PayTech Ltd

Check Fino Unlisted Share Price

BoAt (Imagine Marketing Services Pvt Ltd)

Check Boat Unlisted Share Price

HDFC Securities Ltd

Check HDFC Securities Unlisted Share Price

Kurlon Enterprise Ltd

Check Kurlon Unlisted Share Price

Aricent Technologies (Holdings) Ltd

Check Aricent Unlisted Share Price

Capgemini Technology Services India Ltd

Check Capgemini Unlisted Share Price

NCL Buildtek Ltd

Check NCL Unlisted Share Price

Merino Industries Ltd

Check Merino Unlisted Share Price

Hexaware Technologies

Check Hexaware Unlisted Share Price

Capital Small Finance Bank Ltd

Check Capital Small Finance Bank Unlisted Share Price

Indofil Industries Ltd

Check Indofil Unlisted Share Price

Signify Innovations India Ltd

Check Signify Unlisted Share Price

Nayara Energy

Check Nayara Energy Unlisted Share Price

Hira Ferro Alloys Ltd

Check Hira Unlisted Share Price

Sterlite Power Transmission Ltd

Check Sterlite Power Unlisted Share Price

Carrier Air-Conditioning & Refrigeration Ltd

Check Carrier Unlisted Share Price

Axles India Ltd

Check Axles Unlisted Share Price

Care Health Insurance Ltd

Check Care Health Unlisted Share Price

Cochin International Airport Ltd (CIAL)

Check CIAL Unlisted Share Price

Elofic

Check Elofic Unlisted Share Price

Epiroc Mining India Ltd

Check Epiroc Unlisted Share Price

Frick India Ltd

Check Frick Unlisted Share Price

HDB Financial Services Ltd(HDBFS)

Check HDB Finance Unlisted Share Price

Hero FinCorp Ltd (HFCL)

Check Hero Fin Corp Unlisted Share Price

ICL Fincorp Ltd (ICL)

Check ICL Fin Corp Unlisted Share Price

India Carbon Ltd (ICL)

Check ICL Carbon Unlisted Share Price

Kannur International Airport

Check Kannur Unlisted Share Price

Lava International Ltd

Check Lava Unlisted Share Price

Maharashtra Knowledge Corporation Ltd (MKCL)

Check MKCL Unlisted Share Price

Metropolitan Stock Exchange Of India Ltd (MSEI)

Check MSE Unlisted Share Price

Mohan Meakin Ltd (MML)

Check Mohan Maekin Unlisted Share Price

Motilal Oswal Home Finance Ltd (MOHFL)

Check Motilal Oswal Unlisted Share Price

Reliance Retail Ltd

Check Reliance Retail Unlisted Share Price

Studds Accessories Ltd

Check Studds Unlisted Share Price

Tata Technologies

Check Tata Technologies Unlisted Share Price

Utkarsh CoreInvest Ltd

Check Utkarsh Core Unlisted Share Price

How to buy unlisted shares?

Trade Unlisted is a leading platform for buying and selling of unlisted stocks. TradeUnlisted makes the process of buying and selling unlisted shares seamless and easy.

Select the company whose share you are willing to buy.

Select the ‘Invest now’ button on the company page. The unlisted stocks will be added to your cart.

In the cart section, you will be required to enter the quantity of unlisted shares you want to purchase.

Please note that the minimum cart value should be at least INR 5000.

Next step is to select the payment method you wish to use. Company accepts payments via debit card, net banking and UPI.

Post payment, the Relationship Manager will confirm the payment made by you and will ask you to share your Client Master List (CML) details.

The shares will be credited in the demat account mentioned in the CML copy within the timeline mentioned in the Deal Contract Letter.

In case you have any other questions, please feel free to call TradeUnlisted on (+91) 8958212121 or write a letter at [email protected].

Disclaimer: TradeUnlisted is a transactional platform. We are not a stock exchange or an advisory platform. Investments in unlisted products carry a risk and may not provide the anticipated returns and there is a possibility of losing the entire capital as well. There is no assurance of exit and listing date and no clarity whether the ipo will come or not. Unlisted shares go in a lock-in for 6 months from the date of allotment in the ipo. No one should rely solely on the information published or presented herein and should perform personal due diligence or consult with an independent third-party advisor prior to making any investment decisions. The information is obtained from secondary sources, we do not assure the accuracy of the same. The estimates and information is based on past performance, which cannot be regarded as an accurate indicator of future performance and results.

0 notes

Text

Hexaware Technologies IPO day 2: GMP, date, review, minimum investment, other details. Apply or not?

Minimize your trading risks & trade smarter with our 2 DAYS FREE TRIAL & Flat 30% DISCOUNT on all services. Get comprehensive knowledge high accuracy stock market tips site, indore best research advisor, stock market research advisor by the SEBI-registered research analyst indore. Visit Intensify Research Services Now! Intensifyresearch.com..

#sharetrading#sharemarketing#stockinvestment#stocks#stock market#investment#share this post#sharemarket#shareinvestor#sharetrader

1 note

·

View note

Link

Read information on Hexaware Technologies Pre IPO share. Get the complete overview about Hexaware Technologies and Strengths .

#Hexawaretechnologiesupcomingipo#Hexawaretechnologiesshareprice#Hexawaretechnologiesunlistedshares#Hexawaretechnologiesipo#Hexawaretechnologiespreipo#Hexawaretechnologies

0 notes

Text

How delisting offers work

How delisting offers work

[ad_1]

While IPOs have dried up with Covid-19, delisting proposals seem to be gathering steam.

Vedanta, Hexaware Technologies, Adani Power and Prabhat Dairy are a few of the listed companies that have recently announced plans to delist.

Given that delisting is not a very frequent occurrence in the Indian market, here’s what you as a shareholder need to know.

Types of delisting

Under Indian…

View On WordPress

#Adani Power delisting#delisting#Hexaware Technologies delisting#ipo#Linde India delisting#Prabhat Dairy#Vedanta delisting

0 notes