#High-Performance Computing HPC as a Service Industry

Explore tagged Tumblr posts

Text

#High-Performance Computing HPC as a Service Market#High-Performance Computing HPC as a Service Market Share#High-Performance Computing HPC as a Service Market Size#High-Performance Computing HPC as a Service Market Research#High-Performance Computing HPC as a Service Industry#What is High-Performance Computing HPC as a Service?

0 notes

Text

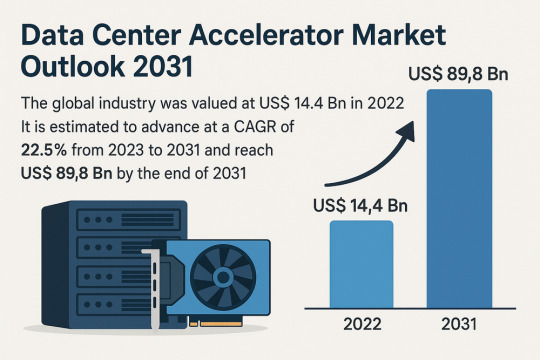

Data Center Accelerator Market Set to Transform AI Infrastructure Landscape by 2031

The global data center accelerator market is poised for exponential growth, projected to rise from USD 14.4 Bn in 2022 to a staggering USD 89.8 Bn by 2031, advancing at a CAGR of 22.5% during the forecast period from 2023 to 2031. Rapid adoption of Artificial Intelligence (AI), Machine Learning (ML), and High-Performance Computing (HPC) is the primary catalyst driving this expansion.

Market Overview: Data center accelerators are specialized hardware components that improve computing performance by efficiently handling intensive workloads. These include Graphics Processing Units (GPUs), Tensor Processing Units (TPUs), Field Programmable Gate Arrays (FPGAs), and Application-Specific Integrated Circuits (ASICs), which complement CPUs by expediting data processing.

Accelerators enable data centers to process massive datasets more efficiently, reduce reliance on servers, and optimize costs a significant advantage in a data-driven world.

Market Drivers & Trends

Rising Demand for High-performance Computing (HPC): The proliferation of data-intensive applications across industries such as healthcare, autonomous driving, financial modeling, and weather forecasting is fueling demand for robust computing resources.

Boom in AI and ML Technologies: The computational requirements of AI and ML are driving the need for accelerators that can handle parallel operations and manage extensive datasets efficiently.

Cloud Computing Expansion: Major players like AWS, Azure, and Google Cloud are investing in infrastructure that leverages accelerators to deliver faster AI-as-a-service platforms.

Latest Market Trends

GPU Dominance: GPUs continue to dominate the market, especially in AI training and inference workloads, due to their capability to handle parallel computations.

Custom Chip Development: Tech giants are increasingly developing custom chips (e.g., Meta’s MTIA and Google's TPUs) tailored to their specific AI processing needs.

Energy Efficiency Focus: Companies are prioritizing the design of accelerators that deliver high computational power with reduced energy consumption, aligning with green data center initiatives.

Key Players and Industry Leaders

Prominent companies shaping the data center accelerator landscape include:

NVIDIA Corporation – A global leader in GPUs powering AI, gaming, and cloud computing.

Intel Corporation – Investing heavily in FPGA and ASIC-based accelerators.

Advanced Micro Devices (AMD) – Recently expanded its EPYC CPU lineup for data centers.

Meta Inc. – Introduced Meta Training and Inference Accelerator (MTIA) chips for internal AI applications.

Google (Alphabet Inc.) – Continues deploying TPUs across its cloud platforms.

Other notable players include Huawei Technologies, Cisco Systems, Dell Inc., Fujitsu, Enflame Technology, Graphcore, and SambaNova Systems.

Recent Developments

March 2023 – NVIDIA introduced a comprehensive Data Center Platform strategy at GTC 2023 to address diverse computational requirements.

June 2023 – AMD launched new EPYC CPUs designed to complement GPU-powered accelerator frameworks.

2023 – Meta Inc. revealed the MTIA chip to improve performance for internal AI workloads.

2023 – Intel announced a four-year roadmap for data center innovation focused on Infrastructure Processing Units (IPUs).

Gain an understanding of key findings from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=82760

Market Opportunities

Edge Data Center Integration: As computing shifts closer to the edge, opportunities arise for compact and energy-efficient accelerators in edge data centers for real-time analytics and decision-making.

AI in Healthcare and Automotive: As AI adoption grows in precision medicine and autonomous vehicles, demand for accelerators tuned for domain-specific processing will soar.

Emerging Markets: Rising digitization in emerging economies presents substantial opportunities for data center expansion and accelerator deployment.

Future Outlook

With AI, ML, and analytics forming the foundation of next-generation applications, the demand for enhanced computational capabilities will continue to climb. By 2031, the data center accelerator market will likely transform into a foundational element of global IT infrastructure.

Analysts anticipate increasing collaboration between hardware manufacturers and AI software developers to optimize performance across the board. As digital transformation accelerates, companies investing in custom accelerator architectures will gain significant competitive advantages.

Market Segmentation

By Type:

Central Processing Unit (CPU)

Graphics Processing Unit (GPU)

Application-Specific Integrated Circuit (ASIC)

Field-Programmable Gate Array (FPGA)

Others

By Application:

Advanced Data Analytics

AI/ML Training and Inference

Computing

Security and Encryption

Network Functions

Others

Regional Insights

Asia Pacific dominates the global market due to explosive digital content consumption and rapid infrastructure development in countries such as China, India, Japan, and South Korea.

North America holds a significant share due to the presence of major cloud providers, AI startups, and heavy investment in advanced infrastructure. The U.S. remains a critical hub for data center deployment and innovation.

Europe is steadily adopting AI and cloud computing technologies, contributing to increased demand for accelerators in enterprise data centers.

Why Buy This Report?

Comprehensive insights into market drivers, restraints, trends, and opportunities

In-depth analysis of the competitive landscape

Region-wise segmentation with revenue forecasts

Includes strategic developments and key product innovations

Covers historical data from 2017 and forecast till 2031

Delivered in convenient PDF and Excel formats

Frequently Asked Questions (FAQs)

1. What was the size of the global data center accelerator market in 2022? The market was valued at US$ 14.4 Bn in 2022.

2. What is the projected market value by 2031? It is projected to reach US$ 89.8 Bn by the end of 2031.

3. What is the key factor driving market growth? The surge in demand for AI/ML processing and high-performance computing is the major driver.

4. Which region holds the largest market share? Asia Pacific is expected to dominate the global data center accelerator market from 2023 to 2031.

5. Who are the leading companies in the market? Top players include NVIDIA, Intel, AMD, Meta, Google, Huawei, Dell, and Cisco.

6. What type of accelerator dominates the market? GPUs currently dominate the market due to their parallel processing efficiency and widespread adoption in AI/ML applications.

7. What applications are fueling growth? Applications like AI/ML training, advanced analytics, and network security are major contributors to the market's growth.

Explore Latest Research Reports by Transparency Market Research: Tactile Switches Market: https://www.transparencymarketresearch.com/tactile-switches-market.html

GaN Epitaxial Wafers Market: https://www.transparencymarketresearch.com/gan-epitaxial-wafers-market.html

Silicon Carbide MOSFETs Market: https://www.transparencymarketresearch.com/silicon-carbide-mosfets-market.html

Chip Metal Oxide Varistor (MOV) Market: https://www.transparencymarketresearch.com/chip-metal-oxide-varistor-mov-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected] of Form

Bottom of Form

0 notes

Text

HPE Servers' Performance in Data Centers

HPE servers are widely regarded as high-performing, reliable, and well-suited for enterprise data center environments, consistently ranking among the top vendors globally. Here’s a breakdown of their performance across key dimensions:

1. Reliability & Stability (RAS Features)

Mission-Critical Uptime: HPE ProLiant (Gen10/Gen11), Synergy, and Integrity servers incorporate robust RAS (Reliability, Availability, Serviceability) features:

iLO (Integrated Lights-Out): Advanced remote management for monitoring, diagnostics, and repairs.

Smart Array Controllers: Hardware RAID with cache protection against power loss.

Silicon Root of Trust: Hardware-enforced security against firmware tampering.

Predictive analytics via HPE InfoSight for preemptive failure detection.

Result: High MTBF (Mean Time Between Failures) and minimal unplanned downtime.

2. Performance & Scalability

Latest Hardware: Support for newest Intel Xeon Scalable & AMD EPYC CPUs, DDR5 memory, PCIe 5.0, and high-speed NVMe storage.

Workload-Optimized:

ProLiant DL/ML: Versatile for virtualization, databases, and HCI.

Synergy: Composable infrastructure for dynamic resource pooling.

Apollo: High-density compute for HPC/AI.

Scalability: Modular designs (e.g., Synergy frames) allow scaling compute/storage independently.

3. Management & Automation

HPE OneView: Unified infrastructure management for servers, storage, and networking (automates provisioning, updates, and compliance).

Cloud Integration: Native tools for hybrid cloud (e.g., HPE GreenLake) and APIs for Terraform/Ansible.

HPE InfoSight: AI-driven analytics for optimizing performance and predicting issues.

4. Energy Efficiency & Cooling

Silent Smart Cooling: Dynamic fan control tuned for variable workloads.

Thermal Design: Optimized airflow (e.g., HPE Apollo 4000 supports direct liquid cooling).

Energy Star Certifications: ProLiant servers often exceed efficiency standards, reducing power/cooling costs.

5. Security

Firmware Integrity: Silicon Root of Trust ensures secure boot.

Cyber Resilience: Runtime intrusion detection, encrypted memory (AMD SEV-SNP, Intel SGX), and secure erase.

Zero Trust Architecture: Integrated with HPE Aruba networking for end-to-end security.

6. Hybrid Cloud & Edge Integration

HPE GreenLake: Consumption-based "as-a-service" model for on-premises data centers.

Edge Solutions: Compact servers (e.g., Edgeline EL8000) for rugged/remote deployments.

7. Support & Services

HPE Pointnext: Proactive 24/7 support, certified spare parts, and global service coverage.

Firmware/Driver Ecosystem: Regular updates with long-term lifecycle support.

Ideal Use Cases

Enterprise Virtualization: VMware/Hyper-V clusters on ProLiant.

Hybrid Cloud: GreenLake-managed private/hybrid environments.

AI/HPC: Apollo systems for GPU-heavy workloads.

SAP/Oracle: Mission-critical applications on Superdome Flex.

Considerations & Challenges

Cost: Premium pricing vs. white-box/OEM alternatives.

Complexity: Advanced features (e.g., Synergy/OneView) require training.

Ecosystem Lock-in: Best with HPE storage/networking for full integration.

Competitive Positioning

vs Dell PowerEdge: Comparable performance; HPE leads in composable infrastructure (Synergy) and AI-driven ops (InfoSight).

vs Cisco UCS: UCS excels in unified networking; HPE offers broader edge-to-cloud portfolio.

vs Lenovo ThinkSystem: Similar RAS; HPE has stronger hybrid cloud services (GreenLake).

Summary: HPE Server Strengths in Data Centers

Reliability: Industry-leading RAS + iLO management. Automation: AI-driven ops (InfoSight) + composability (Synergy). Efficiency: Energy-optimized designs + liquid cooling support. Security: End-to-end Zero Trust + firmware hardening. Hybrid Cloud: GreenLake consumption model + consistent API-driven management.

Bottom Line: HPE servers excel in demanding, large-scale data centers prioritizing stability, automation, and hybrid cloud flexibility. While priced at a premium, their RAS capabilities, management ecosystem, and global support justify the investment for enterprises with critical workloads. For SMBs or hyperscale web-tier deployments, cost may drive consideration of alternatives.

0 notes

Text

Liquid Cooling for Data Center Market Growth Analysis, Market 2025

The global Liquid Cooling for Data Center market was valued at approximately USD 1,982 million in 2023, and it is projected to reach USD 11,101.99 million by 2032, reflecting a robust CAGR of 21.10% during the forecast period. This rapid growth trajectory is attributed to the increasing need for efficient thermal management in data centers, especially as organizations adopt AI, IoT, and other data-intensive technologies.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/913/Liquid-Cooling-for-Data-Center-Market+

Liquid cooling for data centers refers to the use of liquid-based technologies typically water or specialized coolants to absorb and dissipate heat generated by high-performance computing (HPC) systems, servers, storage devices, and networking hardware. The global liquid cooling for data centre market is experiencing rapid growth as hyperscale and enterprise data centres face increasing demands for high performance and energy efficiency. Traditional air cooling methods are struggling to manage the heat generated by high-density computing workloads, especially with the rise of AI, machine learning, and high-performance computing (HPC). As a result, liquid cooling technologies such as direct-to-chip and immersion cooling are gaining traction due to their ability to reduce power usage effectiveness (PUE) and support sustainable operations.

For instance, Meta announced plans to deploy immersion cooling technologies across select data centres to reduce energy consumption and carbon footprint highlighting a shift toward environmentally conscious infrastructure.

Market Size

Global Liquid Cooling for Data Center Market Size and Forecast

In North America, the market was estimated at USD 720.15 million in 2023 and is anticipated to expand at a CAGR of 18.09% from 2025 through 2032. The United States leads the regional market due to the presence of numerous hyperscale data centers and cloud service providers.

The market expansion is also supported by growing investments in green data center infrastructure, along with regulatory mandates aimed at improving energy efficiency and reducing greenhouse gas emissions. The long-term outlook for the liquid cooling market is promising, with continued innovation and adoption of advanced technologies across the globe.

Market Dynamics (Drivers, Restraints, Opportunities, and Challenges)

Drivers

Rising Data Processing Demands Are Driving the Shift to Liquid Cooling

The rise in data processing demands, especially from AI, big data analytics, and high-performance computing (HPC), is one of the main factors propelling the expansion of liquid cooling in data centers. Compared to conventional applications, these workloads produce a lot more heat, which makes air cooling ineffective and expensive. Liquid cooling technologies such as direct-to-chip and immersion cooling offer up to 1,000 times greater heat dissipation efficiency than air-based systems.

For instance, Intel and Submer collaborated to implement next-generation immersion cooling in Intel's data centers, claiming better thermal performance for AI workloads and lower energy consumption. This is in line with a larger trend in the industry, where liquid cooling is being used more and more by hyperscale data centers to preserve operational stability and satisfy ESG objectives.

Restraints

High Initial Investment and Infrastructure Complexity Limit Adoption

Despite its benefits, the high initial cost and difficulty of integrating these systems into the current data center infrastructure pose serious barriers to the widespread use of liquid cooling technologies. Large-scale server rack, plumbing, and safety system redesigns are frequently necessary when retrofitting legacy buildings with liquid cooling, which can interfere with ongoing operations and raise the risk of downtime.For instance, many small to medium-sized data centre operators hesitate to adopt liquid cooling because the costs and operational challenges outweigh the immediate benefits, slowing widespread market penetration.

Opportunities

Growing Demand from Hyperscale Data Centres

A major growth opportunity for the liquid cooling market is the quick development of hyperscale data centers, which are being fueled by cloud computing giants like Microsoft Azure, Google Cloud, and Amazon Web Services. To handle the excessive heat loads produced by dense server configurations, these facilities need cooling solutions that are both scalable and extremely efficient.One efficient method for raising energy efficiency and lowering operating expenses on a large scale is liquid cooling.Moreover the growing demand for high-performance computing and AI workloads has led to significant investments in liquid cooling technologies. Companies are forming strategic partnerships to enhance cooling efficiency and reduce environmental impact.

For instance, in May 2025, Microsoft and NVIDIA announced a collaboration to integrate NVIDIA's next-generation GPUs with Microsoft's liquid cooling systems. This partnership aims to optimize AI workloads by providing efficient thermal management solutions. The integration is expected to enhance computational performance while maintaining energy efficiency.

Challenges

Lack of Industry Standards and Interoperability Slows Adoption

The absence of unified industry standards and interoperability frameworks for liquid cooling systems presents a significant challenge. Data centre operators often deal with proprietary solutions that lack compatibility with diverse server hardware, which complicates integration and raises vendor lock-in concerns.For example, while companies like Submer, LiquidStack, and Vertiv offer cutting-edge immersion and direct-to-chip solutions, their systems can differ widely in design, connector types, and thermal interface materials. This fragmentation makes it difficult for operators to scale or transition between providers without major redesigns.

According to a survey by Castrol, For the industry to continue seeing performance gains, experts predict that immersion cooling must be implemented within the next three years. Those who don't do this run the risk of lagging behind competitors at a time when data centers are under a lot of strain due to AI surges.

Regional Analysis

Market Trends by Region

North America remains at the forefront of adopting liquid cooling technologies, primarily driven by the escalating demands of AI and high-performance computing workloads. Meta has initiated a transition to direct-to-chip liquid cooling for its AI infrastructure, aiming to enhance energy efficiency and support higher-density computing. Europe is witnessing significant advancements, propelled by stringent sustainability goals and innovative collaborations. In Germany, Equinix has partnered with local entities to channel excess heat from its Frankfurt data centres into a district heating system, set to supply approximately 1,000 households starting in 2025. Similarly, in the Netherlands, Equinix signed a letter of intent with the Municipality of Diemen to explore utilizing residual heat from its AM4 data centre to support local heating needs.Asia-Pacific is emerging as a dynamic market for liquid cooling solutions. In Japan, NTT Communications, in collaboration with Mitsubishi Heavy Industries and NEC, commenced a demonstration of two-phase direct-to-chip cooling in an operational Tokyo data centre. This initiative aims to enhance cooling capacity without significant modifications to existing facilities, aligning with energy-saving and CO₂ reduction goals.South America's data centre market is experiencing significant growth, driven by the increasing adoption of cloud services, digital transformation initiatives, and a focus on sustainable infrastructure.Amazon Web Services (AWS) announced a $4 billion investment to establish its first data centres in Chile, marking its third cloud region in Latin America after Brazil and Mexico.The MEA region is witnessing a surge in data centre developments, fueled by digital transformation, increased internet penetration, and government initiatives promoting technological advancement

Competitor Analysis

Major Players and Market Landscape

The Liquid Cooling for Data Center market is moderately consolidated with several global and regional players competing based on product innovation, energy efficiency, scalability, and reliability.

Key players include:

Vertiv: Offers integrated liquid cooling systems with scalable modularity.

Stulz: Specializes in precision cooling and modular cooling technologies.

CoolIT Systems: Known for direct-to-chip liquid cooling.

Schneider Electric: Provides EcoStruxure cooling systems for high-density environments.

Submer and Green Revolution Cooling: Leaders in immersion cooling solutions.

Most companies are focusing on partnerships, R&D investments, and strategic acquisitions to strengthen their market position and expand their product portfolios.

2025, Intel advanced its Superfluid cooling technology, utilizing microbubble injection and dielectric fluids to improve heat transfer. This innovation supports Nvidia's megawatt-class rack servers, addressing the thermal demands of high-performance AI infrastructures.

October 2024,Schneider Electric agreed to buy a majority share in Motivair Corp.for about USD 850 million, a leader in liquid cooling for high-performance computing. By taking this action, Schneider Electric hopes to improve its standing in the data center cooling industry.

December 2024, Vertiv acquired BiXin Energy (China), specializing in centrifugal chiller technology, enhancing Vertiv's capabilities in high-performance computing and AI cooling solutions.

December 2023,Equinix, Inc.a global digital infrastructure company, announced plans to extend support for cutting-edge liquid cooling technologies, such as direct-to-chip, to over 100 of its International Business Exchange® (IBX®) data centers located in over 45 metropolitan areas worldwide.

December 2023, Vertiv expanded its portfolio of cutting-edge cooling technologies with the acquisition of CoolTera Ltd (UK), a business specializing in liquid cooling infrastructure solutions.

Global Liquid Cooling for Data Center Market: Market Segmentation Analysis

This report provides a deep insight into the global Liquid Cooling for Data Center Market, covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and assessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Liquid Cooling for Data Center Market. This report introduces in detail the market share, market performance, product situation, operation situation, etc., of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Liquid Cooling for Data Center Market in any manner.

Market Segmentation (by Cooling Type)

Direct-to-Chip (Cold Plate) Cooling

Immersion Cooling

Other Liquid Cooling Solutions

Market Segmentation (by Data Center Type)

Hyperscale Data Centers

Enterprise Data Centers

Colocation Providers

Modular/Edge Data Centers

Cloud Providers

Market Segmentation (by End Use Industry)

IT & Telecom

BFSI (Banking, Financial Services, and Insurance)

Healthcare

Government & Defense

Energy & Utilities

Manufacturing

Cloud & Hyperscale Providers

Others

Key Company

Vertiv

Stulz

Midas Immersion Cooling

Rittal

Envicool

CoolIT

Schneider Electric

Sugon

Submer

Huawei

Green Revolution Cooling

Eco-atlas

Geographic Segmentation

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Russia, Italy, Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific)

South America (Brazil, Argentina, Columbia, Rest of South America)

The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of MEA)

FAQs :

▶ What is the current market size of the Liquid Cooling for Data Center Market?

As of 2023, the global Liquid Cooling for Data Center market was valued at approximately USD 1,982 million.

▶ Which are the key companies operating in the Liquid Cooling for Data Center Market?

Major players include Vertiv, Stulz, CoolIT Systems, Schneider Electric, Submer, Huawei, and Green Revolution Cooling, among others.

▶ What are the key growth drivers in the Liquid Cooling for Data Center Market?

Key growth drivers include rising power densities in data centers, the demand for energy-efficient solutions, and the growing deployment of AI and HPC applications.

▶ Which regions dominate the Liquid Cooling for Data Center Market?

North America currently leads the market, followed by Europe and Asia-Pacific. Asia-Pacific is expected to witness the fastest growth in the forecast period.

▶ What are the emerging trends in the Liquid Cooling for Data Center Market?

Emerging trends include the growing adoption of immersion cooling, development of sustainable coolant technologies, and integration of AI-based monitoring systems for thermal management.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/913/Liquid-Cooling-for-Data-Center-Market+

0 notes

Text

High-Performance Computing Market Size, Share, Analysis, Forecast, and Growth Trends to 2032: Powering Advanced Scientific Research

High-Performance Computing Market was worth USD 47.07 billion in 2023 and is predicted to be worth USD 92.33 billion by 2032, growing at a CAGR of 7.80 % between 2024 and 2032.

High-Performance Computing Market is undergoing a dynamic transformation as industries across the globe embrace data-intensive workloads. From scientific research to financial modeling, the demand for faster computation, real-time analytics, and simulation is fueling the rapid adoption of high-performance computing (HPC) systems. Enterprises are increasingly leveraging HPC to gain a competitive edge, improve decision-making, and drive innovation.

High-Performance Computing Market is also seeing a notable rise in demand due to emerging technologies such as AI, machine learning, and big data. As these technologies become more integral to business operations, the infrastructure supporting them must evolve. HPC delivers the scalability and speed necessary to process large datasets and execute complex algorithms efficiently.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/2619

Market Keyplayers:

NEC Corporation

Hewlett Packard Enterprise

Sugon Information Industry Co. Ltd

Intel Corporation

International Business Machines Corporation

Market Analysis

The HPC market is characterized by strong investment from both government and private sectors aiming to enhance computational capabilities. Healthcare, defense, automotive, and academic research are key segments contributing to the rising adoption of HPC. The proliferation of cloud-based HPC and integration with AI are redefining how organizations manage and process data.

Market Trends

Increasing integration of AI and ML with HPC systems

Growing popularity of cloud-based HPC services

Shift towards energy-efficient supercomputing solutions

Rise in demand from genomics, climate modeling, and drug discovery

Accelerated development in quantum computing supporting HPC evolution

Market Scope

The potential for HPC market expansion is extensive and continues to broaden across industries:

Healthcare innovations powered by HPC-driven diagnostics and genomics

Smart manufacturing leveraging real-time data analysis and simulation

Financial analytics enhanced by rapid processing and modeling

Scientific research accelerated through advanced simulation tools

Government initiatives supporting HPC infrastructure development

These evolving sectors are not only demanding more robust computing power but also fostering an ecosystem that thrives on speed, accuracy, and performance, reinforcing HPC's pivotal role in digital transformation.

Market Forecast

The future of the HPC market holds promising advancements shaped by continuous innovation, strategic partnerships, and increased accessibility. As industries push for faster processing and deeper insights, HPC will be central in meeting these demands. The convergence of HPC with emerging technologies such as edge computing and 5G will unlock new possibilities, transforming how industries analyze data, forecast outcomes, and deploy intelligent systems. The market is poised for exponential growth, with cloud solutions, scalable architectures, and hybrid models becoming the norm.

Access Complete Report: https://www.snsinsider.com/reports/high-performance-computing-market-2619

Conclusion

The High-Performance Computing Market is more than a technological trend—it is the backbone of a data-driven future. As industries demand faster insights and smarter decisions, HPC stands as a transformative force bridging innovation with execution. Stakeholders ready to invest in HPC are not just adopting new tools; they are stepping into a future where speed, intelligence, and precision define success.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#High-Performance Computing Market#High-Performance Computing Market Scope#High-Performance Computing Market Trends

0 notes

Text

Future of GPU As A Service Market: Trends and Forecast

The global GPU as a Service (GPUaaS) market is projected to reach USD 12.26 billion by 2030, growing at a CAGR of 22.9% from 2025 to 2030, according to a recent report by Grand View Research, Inc. This growth is being largely fueled by the increasing deployment of Artificial Intelligence (AI) and Machine Learning (ML) technologies across a wide range of industries. These technologies require extensive computational resources, a demand that Graphics Processing Units (GPUs) are well-equipped to meet. GPUaaS offers users the advantage of scalability, enabling them to adjust computing power in alignment with project-specific needs. As a result, demand for GPUaaS is rising in tandem with the broader adoption of AI and ML.

The rapid expansion of cloud computing has further accelerated the growth of GPUaaS. Leading cloud service providers are offering GPU-powered virtual machines to support tasks such as deep learning, data processing, graphics rendering, and scientific computing. These services democratize access to powerful computing capabilities, making high-performance GPUs available to users who may not be able to afford or manage on-premise hardware. For example, Amazon Web Services (AWS) delivers a range of GPU instances through its Amazon EC2 platform, designed to support varying computational requirements.

GPUaaS gives users—whether enterprises or individual developers—the flexibility to scale their GPU usage dynamically, adapting to different workload demands. This elasticity is especially attractive for organizations with fluctuating or project-based GPU needs. Google Cloud Platform (GCP) exemplifies this flexibility by offering high-performance GPU instances such as NVIDIA A100 Tensor Core GPUs, which are built on the NVIDIA Ampere architecture. These GPUs provide significant performance gains, particularly for AI, ML, and high-performance computing (HPC) workloads.

North America leads the market in terms of revenue generation. The region’s strong emphasis on digital transformation, particularly among enterprise sectors, makes GPUaaS a strategic asset in deploying AI and big data technologies. North America plays a critical role in the global cloud ecosystem, with increasing investments in infrastructure to support GPU-intensive operations.

On the other hand, the Asia Pacific region is anticipated to be the fastest-growing market over the forecast period. This growth is attributed to the region’s proactive adoption of emerging technologies, with countries like China, India, Japan, South Korea, Australia, and Singapore leading the way. Their investments in AI research, smart cities, and digital platforms continue to fuel the demand for scalable GPU resources.

Curious about the GPU As A Service Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

GPU as a Service (GPUaaS) Market: Frequently Asked Questions

1. What is the expected size of the GPUaaS market by 2030?

The global GPUaaS market is projected to reach USD 12.26 billion by 2030, growing at a CAGR of 22.9% from 2025 to 2030.

2. What’s driving the demand for GPUaaS?

Rising adoption of AI and ML, increasing data volumes, demand for flexible cloud computing solutions, and growing use of GPU-accelerated applications across industries.

3. What are the benefits of GPUaaS?

• Scalability on demand

• Cost-efficiency

• Easy integration with AI and data analytics tools

• Faster time-to-market for compute-heavy applications

4. Which industries benefit most from GPUaaS?

Key sectors include:

• Healthcare (medical imaging, genomics)

• Finance (fraud detection, algorithmic trading)

• Automotive (autonomous vehicle training)

• Entertainment (3D rendering, VFX)

• Research & academia

5. Which region leads the GPUaaS market?

North America is the largest market, driven by strong cloud infrastructure, tech adoption, and enterprise digital transformation efforts

6. Which region is expected to grow the fastest?

Asia Pacific is anticipated to grow rapidly due to aggressive investment in emerging tech by countries like China, India, Japan, and South Korea.

Order a free sample PDF of the GPU As A Service Market Intelligence Study, published by Grand View Research.

#GPU As A Service Market#GPU As A Service Market Size#GPU As A Service Market Share#GPU As A Service Market Analysis

0 notes

Text

Revolutionizing AI Development with Affordable GPU Cloud Pricing and Flexible Cloud GPU Rental Options

In today’s data-driven world, the demand for high-performance computing is growing at an unprecedented pace. Whether you’re training deep learning models or running complex simulations, access to powerful GPUs can make all the difference. Fortunately, modern platforms now offer cost-effective GPU cloud pricing and flexible cloud GPU rental services, making cutting-edge computing accessible to everyone, from startups to research institutions.

Why Affordable GPU Cloud Pricing Matters

Efficient GPU cloud pricing ensures that businesses and developers can scale their operations without incurring massive infrastructure costs. The ability to access high-end GPUs on a pay-as-you-go model is especially beneficial for AI workloads that require intensive computation.

Budget-Friendly Rates: Platforms are now offering some of the most competitive pricing models in the industry, with hourly rates significantly lower than traditional hyperscalers.

No Hidden Fees: Transparent pricing with no data transfer charges allows users to control their budget while maximizing performance fully.

Diverse GPU Options: From advanced NVIDIA A100s to AMD's latest offerings, users can choose from various GPUs to meet their unique workload requirements.

Cloud GPU Rental: The Key to Flexibility

Cloud GPU rental empowers users to access the right hardware at the right time. This flexibility is ideal for project-based work, startups testing AI models, or research teams running simulations.

On-Demand Access: Users can rent GPUs exactly when they need them—scaling up or down depending on their workflow.

Scalable Solutions: From single-user tasks to enterprise-level needs, modern platforms accommodate all scales of usage with ease.

Secure and Reliable: Enterprise-grade infrastructure housed in Tier III and IV data centers ensures minimal downtime and maximum performance.

Cost-Effective Performance at Your Fingertips

One of the biggest advantages of cloud GPU rental is the massive cost savings. Modern providers offer rates up to 50% lower than traditional cloud platforms, making them an ideal choice for budget-conscious teams.

All-Inclusive Pricing: What you see is what you pay—no extra charges for data transfer or system maintenance.

Tailored for AI & HPC: These platforms are built from the ground up with AI, deep learning, and HPC needs in mind, ensuring high-speed, low-latency performance.

Custom Discounts: Users with long-term needs or bulk usage requirements can take advantage of volume discounts and custom plans.

Designed for Developers and Innovators

Whether you’re building the next breakthrough AI application or analyzing large-scale scientific data, cloud GPU rental services offer the tools you need without the overhead.

Virtual Server Configuration: Customize your virtual environment to fit your project, improving efficiency and cutting waste.

Integrated Cloud Storage: Reliable and scalable cloud storage ensures your data is always accessible, secure, and easy to manage.

Final Thoughts

The landscape of high-performance computing is changing rapidly, and access to affordable GPU cloud pricing and flexible cloud GPU rental is at the heart of this transformation. Developers, researchers, and enterprises now have the freedom to innovate without being held back by hardware limitations or financial constraints. By choosing a provider that prioritizes performance, transparency, and flexibility, you can stay ahead in a competitive digital world.

#GPUCloudPricing#CloudGPURental#AIComputing#MachineLearningTools#DeepLearningHardware#FlexibleCloudGPU#AffordableAI

0 notes

Text

The QUANTUM WR-5246-40: A NeW HPC Test Chambers

AES, a leading environmental test chamber manufacturer, introduces the QUANTUM WR-5246-40, a cutting-edge walk-in test chamber for data centre component testing and high-performance computing.

As business relies more on HPC systems for AI, machine learning, and large-scale simulations, it has never been more important to ensure their reliability in hostile climates. The QUANTUM WR-5246-40 pushes thermal testing with a 250kW live load testing capabilities. This chamber was collaboratively designed and standardised with one of the top three HPC leaders to fulfil server rack testing requirements after several deployments, comprehensive field testing, and important field service team feedback.

Extreme HPC Testing Performance

The QUANTUM WR-5246-40 simulates data centre conditions. This chamber supports GPU, CPU, ASIC, and other high-power electronics testing. Notable traits include:

Floorless design allows two full server racks to be easily wheeled in and out.

Precision Airflow Control: Data centre airflow maximises static pressure to evaluate cooling.

Fast temperature cycling and high-power load capacity: Accurate performance assessment for demanding workloads in hot settings.

Customised Solutions: It chambers can contain full-scale server racks and cooling systems and fulfil AI hardware manufacturers' testing requirements.

Large multi-pane viewing windows with LED DUT monitoring illumination improve visibility and safety. handle for operator safety within emergency egress.

Large-Scale Deployments: AES designs and implements large-scale HPC lab layouts to optimise testing conditions and efficiency. Consider equipment flow, placement, and data collection.

Server Rack Reliability Testing Future

AES CEO Michael Shirley said, “At AES, it recognised the evolving needs of AI-driven infrastructure and high-performance computing.” The collaborative process is shown by the QUANTUM WR-5246-40, a reliable HPC industrial solution. This product launch is great for AES as it expands and adds products. It also involves moving into a larger industrial location that will quadruple capacity and promote innovation and expansion.

To meet top industry expectations, AES has created innovative environmental test solutions. The QUANTUM WR-5246-40 continues that legacy by offering a premier high-power electronics testing platform.

QUANTUM-WR-5246-40

The QUANTUM Series WR-5246-40 is a high-performance version of AES's popular floor-style devices designed for modern server testing. This chamber, designed with help from a major manufacturer, improves cooling efficiency, airflow control, and durability and use.

STRUCTURE

Our robust and simple-to-use QUANTUM WR floorless design makes wheeling server racks in and out for testing straightforward. #4 finish Interior corrosion resistance, durability, and cleanliness are guaranteed with 304 stainless steel. Large multi-pane windows and LED lights reveal the DUT. An interior emergency exit handle allows for quick escape in an emergency.

The inside workstation is lined with type 304 stainless steel for vaportightness. The ramp on the heated low-profile floor makes two computer/server racks easy to move into the workstation. Between the layers is low-k, high-efficiency thermal insulation.

PERFORMANCE

Server testing requires front-to-back airflow, which this chamber provides. Static pressure's precise management with the changing airflow system lets engineers evaluate its impact on systems. Parallel coils offer more equal cooling, ensuring consistent workstation conditions. Air driers reduce chamber moisture and increase uptime, making them suitable for testing fragile electronics. Chamber's variable frequency drive (VFD) adjusts fan speed to manage airflow. Large hot access ports allow DUT interaction without peripherals.

Three centrally located, equally spaced cable access ports are on each side. Left and right side walls have six-inch ports.

Cooling/heating

To provide accurate temperature management within ±0.5°C, QUANTUM WR test chambers have open multiple nichrome heaters on both sides.Nichrome heaters on both sides of the QUANTUM WR test chamber ensure precise temperature management within ±0.5°C. The cooling system includes a cascade mechanical refrigeration system and a water-cooled condenser. Increase cooling using liquid LN2 or CO2 for faster pull-down speeds during stress testing. Basic cascade refrigeration systems from AES have the quickest change rates in the industry without boost cooling.

INSTRUMENTATION

The QUANTUM WR Series Test Chambers use AESONE CONNECT, a dependable linked device with a standard interface, to simplify operation and test monitoring.

#technology#technews#govindhtech#news#technologynews#QUANTUM WR-5246-40#QUANTUM WR#QUANTUM#QUANTUM Series#QUANTUM WR Series#HPC testing

0 notes

Text

#High-Performance Computing HPC as a Service Market#High-Performance Computing HPC as a Service Market Share#High-Performance Computing HPC as a Service Market Size#High-Performance Computing HPC as a Service Market Research#High-Performance Computing HPC as a Service Industry#What is High-Performance Computing HPC as a Service?

0 notes

Text

Blog 6

Quantum Computing: Current Trends and Future Potential

Quantum computing is revolutionizing the way we process information by leveraging the principles of quantum mechanics. Unlike classical computers that use bits (0s and 1s), quantum computers use qubits, which can exist in multiple states simultaneously thanks to superposition and entanglement. This allows them to solve complex problems exponentially faster than traditional systems.

Current Trends in Quantum Computing

1. Advancements in Qubit Technology

Researchers are exploring different qubit implementations, including:

Superconducting qubits (used by IBM and Google)

Trapped ions (pioneered by IonQ and Honeywell)

Photonic qubits (being developed by Xanadu and PsiQuantum)

Silicon spin qubits (pursued by Intel and startups like Silicon Quantum Computing)

Each approach has trade-offs in terms of stability, scalability, and error rates.

2. Quantum Error Correction (QEC)

Qubits are highly sensitive to environmental noise, leading to errors. Companies like Google and IBM are making strides in error-corrected quantum computing, using techniques like surface codes to improve reliability.

3. Hybrid Quantum-Classical Systems

Since fully fault-tolerant quantum computers are still years away, hybrid algorithms (combining classical and quantum processing) are gaining traction. Companies like NVIDIA and Amazon Braket are integrating quantum processing with classical high-performance computing (HPC).

4. Quantum Cloud Platforms

Major tech players are offering cloud-based quantum computing access:

IBM Quantum (IBM Q System One)

Google Quantum AI

Microsoft Azure Quantum

Amazon Braket

Rigetti’s Quantum Cloud Services

This allows researchers and businesses to experiment with quantum algorithms without owning hardware.

5. Industry-Specific Applications

Quantum computing is being tested in fields like:

Cryptography (post-quantum encryption to counter Shor’s algorithm threats)

Drug Discovery (molecular simulations for new medicines)

Finance (optimizing portfolios and risk analysis)

Logistics (solving complex optimization problems)

Challenges Ahead

Despite progress, key hurdles remain:

Qubit decoherence (maintaining quantum states long enough for computation)

Scalability (building large, stable quantum processors)

Cost and accessibility (making quantum computing practical for businesses)

The Future of Quantum Computing

While we’re still in the Noisy Intermediate-Scale Quantum (NISQ) era, breakthroughs in error correction, qubit stability, and algorithm development are accelerating. Experts predict that within the next decade, we may see fault-tolerant quantum computers capable of solving problems beyond classical reach.

Quantum computing is no longer just a theoretical concept—it’s an emerging reality with transformative potential. Stay tuned as this exciting field continues to evolve!

0 notes

Text

Data Center Liquid Cooling Market Regional and Global Industry Insights to 2033

Introduction

The exponential growth of data centers globally, driven by the surge in cloud computing, artificial intelligence (AI), big data, and high-performance computing (HPC), has brought thermal management to the forefront of infrastructure design. Traditional air-based cooling systems are increasingly proving inadequate in terms of efficiency and scalability. This has led to the rapid adoption of liquid cooling solutions, which offer higher thermal performance and energy efficiency. The data center liquid cooling market is poised for significant growth through 2032, fueled by the increasing density of IT equipment and a global push for sustainable and energy-efficient data centers.

Market Overview

The global data center liquid cooling market is expected to witness a compound annual growth rate (CAGR) of over 20% from 2023 to 2032. Valued at approximately USD 2.5 billion in 2022, the market is forecasted to surpass USD 12 billion by 2032, according to industry estimates. North America leads the market, followed closely by Europe and Asia-Pacific.

Key drivers include:

Growing need for high-performance computing in AI and ML workloads.

Increase in data center construction across hyperscale, edge, and colocation segments.

Environmental regulations promoting energy efficiency and sustainability.

Download a Free Sample Report:-https://tinyurl.com/34z8dxuk

Market Segmentation

By Type of Cooling

Direct-to-Chip (D2C) Cooling In D2C systems, liquid coolant flows through pipes in direct contact with the chip or processor. These systems are highly effective in cooling high-density servers and are gaining traction in HPC and AI applications.

Immersion Cooling This method involves submerging entire servers in dielectric coolant fluid. Immersion cooling offers superior thermal management and reduced operational noise. It's increasingly used in crypto mining and AI/ML workloads.

Rear Door Heat Exchangers These solutions replace traditional server cabinet doors with heat exchangers that transfer heat from air to liquid. This hybrid approach is popular among data centers looking to enhance existing air cooling systems.

By Component

Coolants (Dielectric fluids, water, glycol, refrigerants)

Pumps

Heat Exchangers

Plumbing systems

Cooling Distribution Units (CDUs)

By Data Center Type

Hyperscale Data Centers

Enterprise Data Centers

Colocation Data Centers

Edge Data Centers

By Application

High-Performance Computing

Artificial Intelligence & Machine Learning

Cryptocurrency Mining

Cloud Service Providers

Banking, Financial Services, and Insurance (BFSI)

Key Market Trends

1. Rising Power Densities

Modern servers used for AI and HPC workloads often exceed power densities of 30 kW per rack, making traditional air cooling impractical. Liquid cooling efficiently handles heat loads upwards of 100 kW per rack, prompting widespread adoption.

2. Sustainability and ESG Goals

With energy consumption by data centers accounting for nearly 1% of global electricity use, companies are under pressure to reduce their carbon footprint. Liquid cooling systems reduce Power Usage Effectiveness (PUE), water usage, and total energy costs, aligning with environmental goals.

3. Edge Computing Growth

The rise of 5G and IoT technologies necessitates edge data centers, which are often space-constrained and located in harsh environments. Liquid cooling is ideal in such scenarios due to its silent operation and compact form factor.

4. Innovation in Coolant Technologies

Companies are investing in advanced non-conductive and biodegradable dielectric fluids. These innovations enhance performance while reducing environmental impact and regulatory compliance costs.

5. Strategic Partnerships and Investments

Major tech players like Google, Microsoft, and Amazon are investing heavily in liquid cooling R&D. Partnerships between data center operators and liquid cooling vendors are accelerating product development and commercialization.

Competitive Landscape

Key Players

Vertiv Group Corp.

Schneider Electric SE

LiquidStack

Submer

Iceotope Technologies

GRC (Green Revolution Cooling)

Asetek

Midas Green Technologies

These companies are focused on product innovation, strategic acquisitions, and expanding into emerging markets to gain a competitive edge.

Recent Developments

In 2023, Microsoft expanded its partnership with LiquidStack to deploy immersion cooling in Azure data centers.

Google announced plans to test immersion cooling in its data centers to improve energy efficiency.

Intel unveiled its open IP immersion cooling design to promote standardized adoption across the industry.

Regional Insights

North America

Dominates the market due to high demand from hyperscale cloud providers and advanced R&D capabilities. The U.S. government's energy regulations also promote adoption of energy-efficient systems.

Europe

Adoption is fueled by strict carbon emission regulations and sustainability initiatives. Countries like Germany, the UK, and the Netherlands are leading the charge.

Asia-Pacific

The fastest-growing region, driven by increasing digitization, rapid cloud adoption, and government-led smart city initiatives. China and India are key markets due to massive data center expansions.

Challenges and Restraints

High Initial Investment: Liquid cooling systems have higher upfront costs compared to traditional air cooling, which can deter smaller operators.

Maintenance Complexity: Requires specialized maintenance and training.

Market Fragmentation: Lack of standardization in liquid cooling solutions can slow down interoperability and integration.

Future Outlook (2024–2032)

The next decade will see mainstream adoption of liquid cooling, especially among hyperscale data centers and AI-focused operations. Regulatory support, combined with a clear ROI on energy savings, will drive adoption across all regions.

Key predictions:

Over 30% of new data centers will incorporate liquid cooling technologies by 2030.

Hybrid cooling systems combining air and liquid methods will bridge the transition period.

Liquid cooling-as-a-service (LCaaS) will emerge, especially for edge deployments and SMEs.

Conclusion

The data center liquid cooling market is at a pivotal point in its growth trajectory. As workloads become more compute-intensive and sustainability becomes non-negotiable, liquid cooling is emerging not just as an alternative—but as a necessity. Stakeholders across the ecosystem, from operators to manufacturers and service providers, are recognizing the benefits in cost, performance, and environmental impact. The next decade will witness liquid cooling go from niche to norm, fundamentally transforming how data centers are designed and operated.

Read Full Report:-https://www.uniprismmarketresearch.com/verticals/chemicals-materials/data-center-liquid-cooling.html

0 notes

Text

Pioneering Excellence in EMS Manufacturing with Absolute Electronics Inc

In the rapidly evolving world of technology, Silicon Valley is where innovation has no bounds, and companies vie with each other to come up with novel products in markets like aerospace, medical devices, high-performance computing, and AI. To shape these innovations, companies require reliable and cutting-edge Electronics Manufacturing Services (EMS). Absolute Electronics Inc. is at the forefront when it comes to this, delivering EMS manufacturing services in Silicon Valley that ensure precision, speed, and quality beating all others.

Setting the Standard for EMS Manufacturing

As one of the leading EMS providers in the region, Absolute Electronics Inc. offers end-to-end EMS manufacturing solutions in Silicon Valley that streamline the entire production process, from concept to end assembly. Their advanced capabilities enable companies to optimize product development without having to sacrifice on industry standards.

Expert PCB Assembly & System Integration

Printed Circuit Board ( assembly (PCBA) is the basis of contemporary electronics manufacturing. Absolute EMS excels in:

Automated Surface Mount Technology (SMT) for scalable, defect-free assembly.

Automated Solder Paste Inspection ((SPI), Automated Optical Inspection (AOI) and X-ray Inspection, eliminating defects before final production.

Conformal Coating For parts intended to withstand harsh conditions.

Unwavering Commitment to Quality with Industry-Leading Certifications

Absolute EMS has a commendable reputation for maintaining the best quality level at all times. With internationally renowned certifications, Absolute EMS ensures its operations not just meet but surpass industry requirements. Some of these significant certifications are:

AS9100D & ISO 9001: These are the central pillars of Absolute EMS's quality management system. They guarantee improved product qulaity as well as strict adherence to industry norms. AS9100D specifically ensures conformity to aerospace and defense-focused projects with utmost quality and reliability standards.

ISO 13485: This certification demonstrates Absolute EMS's emphasis on the medical device industry, in which its manufacturing processes meet rigid regulatory standards for dependability and safety.

J-STD-001: A testimony to the firm's superiority in electronics assembly, this certification of all operators provides assurance that the soldering and assembly operations at Absolute EMS comply with the superior durability and performance requirements.

By holding these elite certifications, Absolute EMS solidifies its commitment to providing top-notch quality across many high-reliability industries.

Innovative Manufacturing Solutions for Diverse Industries

Partnering with Absolute EMS is equivalent to gaining access to the most up-to-date manufacturing solutions tailored for different industries. The firm has multi-industry expertise with precision, reliability, fast time-to-market turnarounds, and performance. Some of the most important industry solutions include:

AI & High-Performance Computing (HPC): As a preeminent Silicon Valley EMS company, Absolute EMS is on the leading edge of facilitating the HPC sector. Absolute EMS is skilled at producing high-speed, advanced assemblies created to exact specifications for enhanced performance and reliability.

Automotive: At the forefront of the evolving automotive sector, Absolute EMS supports next-generation technologies, including Advanced Driver-Assistance Systems (ADAS) and key components like LiDAR and RADAR for autonomous driving.

Aerospace & Satellite Systems: Absolute EMS provides lightweight but highly robust PCB assemblies for aerospace and satellite applications. With its rigid-flex assembly capabilities, Absolute EMS offers solutions for harsh space conditions.

With innovation and quality at its core, Absolute EMS continues to advance technology across industries.

Smart Manufacturing: The Future of EMS

Absolute EMS isn’t just keeping up with the future—it’s building it. Their award-winning Factory 4.0 approach integrates:

End-to-end automation for increased accuracy and production efficiency.

Real-time process monitoring to minimize errors and optimize yield rates.

Predictive maintenance systems to prevent downtime and improve reliability.

Why Choose Absolute Electronics Inc.?

Why choose EMS manufacturing services in Silicon Valley? The area houses a number of the world's most technologically sophisticated businesses, providing:

Access to World-class Engineering Expertise: Work with engineers who are experts in electronic manufacturing.

State-of-the-Art Technology: Utilize the latest computer-aided manufacturing technology.

Shorter Turnaround Times: With less complicated prototyping and manufacturing, you can get to the market sooner with your products.

Companies can tap into the best of Silicon Valley innovation and the finest manufacturing expertise by partnering with Absolute Electronics Inc.

Partner with Absolute EMS for Next-Level Manufacturing

Whether you are a startup looking for rapid prototyping or an existing company looking for high-quality EMS manufacturing services in Silicon Valley, Absolute EMS is your best bet. With a sterling track record of success, stringent quality control measures, and a customer-centric approach, they are dedicated to producing every project that adheres to the industry's highest standards.

Let’s Build the Future Together

Seeking a reliable EMS partner to turn your concepts into realities? Reach out to Absolute Electronics Inc. now and discover how their state-of-the-art electronics manufacturing services can take your next game-changer idea to new heights.

0 notes

Text

India: The Race to AI Supremacy

Artificial Intelligence (AI) has emerged as the defining technology of the 21st century,

reshaping industries, economies, and global power structures. While countries like the United

States and China have taken an early lead in AI innovation, India is rapidly positioning itself

as a major player in this transformative field. With its robust IT industry, a growing startup

ecosystem, and government-backed initiatives, India is steadily racing toward AI supremacy.

India’s AI Potential: Strengths and Challenges

Strengths:

1. IT and Software Expertise: India has long been a global IT hub, providing software

development and IT services to the world. The expertise gained from decades of

experience in software engineering makes India a natural contender in the AI space.

2. Young and Skilled Workforce: With one of the largest youth populations in the

world, India has a vast talent pool eager to upskill in AI, machine learning, and data

science. Institutions like the Indian Institutes of Technology (IITs) and the Indian

Institutes of Information Technology (IIITs) are producing world-class AI

researchers.

3. Government Support: The Indian government has recognized AI’s potential and

launched various initiatives, including the National AI Strategy by NITI Aayog, and

the AI Mission under Digital India. These policies aim to boost research, encourage

startups, and integrate AI into critical sectors like healthcare, agriculture, and

education.

4. Thriving Startup Ecosystem: India is home to numerous AI-focused startups,

working on solutions in sectors like fintech, healthcare, and retail. Bengaluru,

Hyderabad, and Pune are emerging as AI innovation hubs.

5. Data Abundance: With a population of over 1.4 billion, India generates vast amounts

of data, which is the backbone of AI development. Access to such large datasets can

help train AI models more effectively.

Challenges:

1. Infrastructure Gaps: AI research and deployment require high-performance

computing (HPC) infrastructure, which India is still developing. Access to GPUs,

cloud computing, and data centers remains a challenge.

2. Talent Shortage: While India has a large workforce, the demand for highly skilled AI

researchers and engineers far exceeds supply. Many top AI talents migrate abroad for

better opportunities.

3. Data Privacy Concerns: With increasing AI integration, data security and privacy

concerns have surfaced. Ensuring data protection while leveraging AI will be crucial

for long-term success.

4. Investment Gaps: Compared to the U.S. and China, AI funding in India is still in its

early stages. More venture capital investment and government funding are needed to

support AI research and startups.

To read more visit

0 notes

Text

Exascale Computing Market Size, Share, Analysis, Forecast, and Growth Trends to 2032: The Race to One Quintillion Calculations Per Second

The Exascale Computing Market was valued at USD 3.47 billion in 2023 and is expected to reach USD 29.58 billion by 2032, growing at a CAGR of 26.96% from 2024-2032.

The Exascale Computing Market is undergoing a profound transformation, unlocking unprecedented levels of computational performance. With the ability to process a billion billion (quintillion) calculations per second, exascale systems are enabling breakthroughs in climate modeling, genomics, advanced materials, and national security. Governments and tech giants are investing aggressively, fueling a race for exascale dominance that’s reshaping industries and redefining innovation timelines.

Exascale Computing Market revolutionary computing paradigm is being rapidly adopted across sectors seeking to harness the immense data-crunching potential. From predictive simulations to AI-powered discovery, exascale capabilities are enabling new frontiers in science, defense, and enterprise. Its impact is now expanding beyond research labs into commercial ecosystems, paving the way for smarter infrastructure, precision medicine, and real-time global analytics.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6035

Market Keyplayers:

Hewlett Packard Enterprise (HPE) [HPE Cray EX235a, HPE Slingshot-11]

International Business Machines Corporation (IBM) [IBM Power System AC922, IBM Power System S922LC]

Intel Corporation [Intel Xeon Max 9470, Intel Max 1550]

NVIDIA Corporation [NVIDIA GH200 Superchip, NVIDIA Hopper H100]

Cray Inc. [Cray EX235a, Cray EX254n]

Fujitsu Limited [Fujitsu A64FX, Tofu interconnect D]

Advanced Micro Devices, Inc. (AMD) [AMD EPYC 64C 2.0GHz, AMD Instinct MI250X]

Lenovo Group Limited [Lenovo ThinkSystem SD650 V3, Lenovo ThinkSystem SR670 V2]

Atos SE [BullSequana XH3000, BullSequana XH2000]

NEC Corporation [SX-Aurora TSUBASA, NEC Vector Engine]

Dell Technologies [Dell EMC PowerEdge XE8545, Dell EMC PowerSwitch Z9332F]

Microsoft [Microsoft Azure NDv5, Microsoft Azure HPC Cache]

Amazon Web Services (AWS) [AWS Graviton3, AWS Nitro System]

Sugon [Sugon TC8600, Sugon I620-G30]

Google [Google TPU v4, Google Cloud HPC VM]

Alibaba Cloud [Alibaba Cloud ECS Bare Metal Instance, Alibaba Cloud HPC Cluster]

Market Analysis The exascale computing landscape is characterized by high-stakes R&D, global governmental collaborations, and fierce private sector competition. With countries like the U.S., China, and members of the EU launching national initiatives, the market is shaped by a mix of geopolitical strategy and cutting-edge technology. Key players are focusing on developing energy-efficient architectures, innovative software stacks, and seamless integration with artificial intelligence and machine learning platforms. Hardware giants are partnering with universities, startups, and defense organizations to accelerate deployments and overcome system-level challenges such as cooling, parallelism, and power consumption.

Market Trends

Surge in demand for high-performance computing in AI and deep learning

Integration of exascale systems with cloud and edge computing ecosystems

Government funding and national strategic investments on the rise

Development of heterogeneous computing systems (CPUs, GPUs, accelerators)

Emergence of quantum-ready hybrid systems alongside exascale architecture

Adoption across healthcare, aerospace, energy, and climate research sectors

Market Scope

Supercomputing for Scientific Discovery: Empowering real-time modeling and simulations at unprecedented speeds

Defense and Intelligence Advancements: Enhancing cybersecurity, encryption, and strategic simulations

Precision Healthcare Applications: Supporting drug discovery, genomics, and predictive diagnostics

Sustainable Energy Innovations: Enabling complex energy grid management and fusion research

Smart Cities and Infrastructure: Driving intelligent urban planning, disaster management, and IoT integration

As global industries shift toward data-driven decision-making, the market scope of exascale computing is expanding dramatically. Its capacity to manage and interpret massive datasets in real-time is making it essential for competitive advantage in a rapidly digitalizing world.

Market Forecast The trajectory of the exascale computing market points toward rapid scalability and broader accessibility. With increasing collaborations between public and private sectors, we can expect a new wave of deployments that bridge research and industry. The market is moving from proof-of-concept to full-scale operationalization, setting the stage for widespread adoption across diversified verticals. Upcoming innovations in chip design, power efficiency, and software ecosystems will further accelerate this trend, creating a fertile ground for startups and enterprise adoption alike.

Access Complete Report: https://www.snsinsider.com/reports/exascale-computing-market-6035

Conclusion Exascale computing is no longer a vision of the future—it is the powerhouse of today’s digital evolution. As industries align with the pace of computational innovation, those embracing exascale capabilities will lead the next wave of transformation. With its profound impact on science, security, and commerce, the exascale computing market is not just growing—it is redefining the very nature of progress. Businesses, researchers, and nations prepared to ride this wave will find themselves at the forefront of a smarter, faster, and more resilient future.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

0 notes