#How Algo Trading Works

Explore tagged Tumblr posts

Text

How Algo Trading Works: An In-Depth Exploration

Discover how algo trading works in this in depth guide Learn about automated strategies, market analysis, and the benefits of algorithmic trading

1 note

·

View note

Text

How Effective is Crypto Algo Trading Bot in the Trading Journey

The cryptocurrency market is well-known for its volatility and quick price changes. Amidst this activity, crypto algo trading bots have appeared as effective tools for guiding the complexity of trading. These automated systems, driven by algorithms and advanced data analysis, offer the potential to improve trading efficiency and profitability. But how effective are they truly in a trader's journey?

Comprehending Crypto Algo Trading Bots

Crypto algo trading bots are computer programs developed to perform trades automatically based on predefined parameters. They work on various strategies, from simple trend-following to complex arbitrage opportunities. These bots can analyze market data at sparky speed, recognizing patterns and executing trades exactly, often exceeding human capabilities.

Key Advantages of Crypto Algo Trading Bots

Emotional detachment: One of the biggest advantages of algo trading is the elimination of human emotions. Fear and desire can often cloud judgment, leading to impulsive decisions. Bots operate in a pure sense, without emotional preferences, ensuring disciplined trading.

Speed and efficiency: Humans have limitations in processing data and responding to market changes. Algo bots can execute trades in milliseconds, capitalizing on quick opportunities that humans might miss.

All time function: The crypto market never sleeps. Algo bots can trade constantly, without the need for rest or breaks, maximizing potential profits.

Backtesting and optimization: Before deploying a bot, traders can backtest its performance on recorded data to assess its significance. This allows for the optimization of trading strategies and risk management parameters.

Diversification: Algo bots can manage numerous trading strategies simultaneously, diversifying risk and increasing the possibility for constant returns.

Impact and Success Stories

Multiple traders have reported significant benefits from using crypto algo trading bots. Some have achieved consistent profitability, outperforming manual trading strategies. These bots have been confirmed particularly effective in high-frequency trading, where speed is essential. Additionally, they can be valuable for arbitrage opportunities, using price differences across different exchanges.

However, it's essential to recognize that not all algo trading bots are created equal. The point of a bot depends on several aspects, including the underlying trading method, the quality of data used, and the bot's ability to adjust to market conditions.

Challenges and Concerns

While the potential advantages of crypto algo trading bots are important, it's crucial to approach them with real expectations. Overfitting to historical data can lead to suboptimal performance in future market conditions.

Moreover, developing and maintaining a good algo trading system requires specialized expertise and continuous monitoring. Traders should carefully evaluate the risks involved and consider their ability and help before launching into algo trading.

Conclusion

Crypto algo trading bots have the prospect of being effective tools in a trader's journey. They offer advantages in terms of speed, efficiency, and emotional detachment. While not a guaranteed path to riches, they can significantly improve trading performance when used wisely.

It's important to approach algo trading with a combination of confidence and notice. Thorough research, backtesting, and ongoing monitoring are essential for increasing the benefits and reducing risks. As with any investment, diversification is key. Combining algo trading with other strategies can help create a well-rounded investment portfolio.

In conclusion, crypto algo trading bots represent an exciting frontier in the world of trading. While challenges exist, the potential rewards are significant for those who approach this technology with knowledge and discipline.

Get a opportunity to grab a FREE DEMO - Crypto Algo Trading Bot Development

2 notes

·

View notes

Text

What’s the Best Automated Trading for Beginners?

Looking to dip your toes into trading without headaches? The answer’s clear: AI-powered algo trading—especially those that are fully automated, hassle-free, and beginner-friendly.

But what is the best AI trading if you are new to trading? SureShotFx is the best automated trading for beginners looking for trade and learn.

Have you ever wondered how some traders make trades at lightning speed, even when sleeping? Well, that’s the magic of algorithmic trading.

How Does the SureShotFx Algo Work?

When you get an Algo, your provider will either set it up on their own with your account credentials, or they will send you a licensed Expert Advisor (EA) that you can just drag on your MT4/MT5 chart and set up according to the manual.

According to the New York Post, Institutional giants like AQR & Citadel are increasingly relying on AI; early adopters report +12–17% profit lifts and major cost savings. Apart from this, AI trading now fuel ~50% of HFT (High Frequency Trades), with open-source systems leading the charge.

Why Pick SureShotFX for Automated Trading?

SureShotFX Algo is ideal for the complete beginner, easy with each trade executed automatically, 24/7.

Effortless setup – Connect it once, and it automatically copies and executes verified signals (image or text-based).

Zero VPS or tech skills needed—just link and go.

Pro-level strategies —so beginners gain like professionals.

0 notes

Text

Master Profitable Algorithmic Strategies with the Best Algo Trading Course at ICFM – Stock Market Institute

Learn Algorithmic Trading with ICFM’s Industry-Leading Algo Trading Course in India

In today’s tech-driven financial landscape, algorithmic trading has rapidly gained prominence among retail and institutional traders alike. With the power of automation and quantitative models, traders can now execute strategies with speed, accuracy, and discipline. For individuals interested in tapping into this high-potential domain, enrolling in a top-tier algo trading course is essential. ICFM – Stock Market Institute stands out as a leading institution offering a comprehensive and practical algo trading course that prepares traders to develop, test, and execute strategies using algorithms in real market environments.

Why Choose ICFM’s Algo Trading Course for Practical Algorithmic Training

The algo trading course at ICFM is designed specifically for Indian financial markets and customized to suit both beginners and intermediate-level traders. What makes ICFM’s program stand out is its hands-on, application-oriented approach, where students learn by doing. Unlike generic online tutorials, the algo trading course at ICFM delves deep into the actual tools, coding languages, and broker integrations needed to succeed in algorithmic trading. The institute leverages real-time data, simulations, and back-testing environments to ensure every student builds confidence in their strategies before going live.

What the Algo Trading Course Covers at ICFM – Stock Market Institute

ICFM’s algo trading course offers a complete roadmap that begins with the basics of algorithmic trading and progresses to advanced strategy creation. The course introduces students to the foundations of quantitative finance, market microstructure, and order types. It then moves on to programming essentials—particularly in Python, which is the most widely used language in algorithmic trading. Students learn how to work with data feeds, historical data analysis, and strategy logic development.

A key feature of the algo trading course is its focus on back-testing and optimization. Learners are trained to test their strategies using historical market data, tweak parameters for better performance, and avoid overfitting. They also explore API integration with popular broker terminals, enabling them to automate their strategies in a live trading environment. With the right mix of theory, coding, and practical market application, this algo trading course sets students on a professional trajectory.

Real-Time Practice and Market-Integrated Learning

At ICFM, the algo trading course is not just about learning how algorithms work but also about understanding how they interact with real markets. Students are guided through market simulations where their codes run in real-time environments to analyze tick-by-tick data. This invaluable exposure helps them understand latency issues, slippage, and the importance of execution logic in algorithmic trading. By integrating trading platforms, brokers, and data providers, ICFM ensures that students can deploy their strategies in NSE and BSE markets seamlessly.

Expert Faculty and Advanced Mentoring Support

The algo trading course at ICFM is conducted by seasoned professionals with expertise in trading, financial modeling, and quantitative analysis. These mentors bring years of industry experience and guide students beyond just the curriculum. Their insights into how institutional-level strategies are built and deployed provide learners with a deep edge. The instructors encourage interaction, discussion, and one-on-one mentoring throughout the algo trading course. Even after course completion, students have access to ICFM’s support ecosystem where they can ask questions, troubleshoot errors, and receive updates on market developments relevant to algo trading.

Flexible Learning Modes and Recognized Certification

To accommodate the diverse needs of working professionals, students, and traders, ICFM offers both classroom and online formats for the algo trading course. Learners can join sessions physically in Delhi or opt for remote learning with full access to live classes, recordings, and learning material. The flexibility of this model allows for a more personalized pace and style of learning. Upon successful completion of the algo trading course, students are awarded a certificate from ICFM – Stock Market Institute. This certification is well-regarded in the financial industry and adds weight to professional profiles for roles in trading, quant research, and financial analysis.

Success Stories and Career Pathways After the Algo Trading Course

Over the years, ICFM’s algo trading course has empowered hundreds of students to launch successful careers in trading and finance. Many have gone on to become independent algo traders, quant analysts, and strategy developers for proprietary trading firms. The course has also helped business professionals add automation to their investment routines and optimize performance. Testimonials frequently highlight the clarity of instruction, depth of the content, and real-world application as key reasons for their successful transition into the algo trading space. Whether someone is looking to scale their trading operations or enter the world of quant finance, this algo trading course provides a strong foundation.

Conclusion: Take the Smart Step Towards Automated Trading with ICFM’s Algo Trading Course

As financial markets become faster and more data-driven, traditional manual trading methods are gradually being replaced by algorithmic strategies. If you aspire to stay ahead in this rapidly evolving domain, the algo trading course by ICFM – Stock Market Institute is your ideal entry point. With expert-led training, cutting-edge tools, live market exposure, and continuous support, ICFM equips you to confidently navigate the world of algorithmic trading. Enroll today in India’s most comprehensive algo trading course and take control of your trading future with technology and precision.

Read more: https://www.icfmindia.com/blog/stock-market-courses-in-delhi-online-free-get-ahead-without-spending-a-rupee

Read more: https://www.openpr.com/news/4065877/shocking-air-india-crash-triggers-stock-market-panic-across

0 notes

Text

Enroll in ICFM’s Algo Trading Course and Transform Your Financial Skills with Real-World Automated Trading Experience

Welcome to the Future of Trading: Why Algo Trading Matters Today

In today’s digital age, speed and accuracy define success in the stock market. Manual trading strategies, while still relevant, often fail to match the precision and efficiency of automated systems. That’s where algorithmic trading—commonly known as algo trading—takes center stage. For those looking to dive into this advanced method of trading, enrolling in a specialized algo trading course is essential. And when it comes to quality training in this domain, ICFM – Stock Market Institute offers one of the most comprehensive and practical programs in India.

ICFM’s Algo Trading Course – Learn to Trade with Logic, Speed, and Discipline

ICFM has developed a uniquely structured algo trading course that helps students, finance professionals, and traders understand the mechanics behind automated systems. This course is designed to provide a strong foundation in algorithmic logic, strategy creation, backtesting, and real-time execution. It goes beyond theory and dives deep into the actual workings of automation tools, trading APIs, and risk control mechanisms. The program is tailored to bridge the gap between traditional trading practices and the modern, data-driven approach that dominates today’s financial world.

How ICFM Makes Algo Trading Easy to Understand and Apply

One of the common misconceptions about algorithmic trading is that it’s only for coders or IT professionals. ICFM breaks this myth through its thoughtfully curated algo trading course, where even non-technical learners can understand complex concepts with ease. The course is taught using simple language, practical examples, and live demonstrations. Whether you're a trader aiming to automate your strategy or a student aspiring to enter the fintech world, this course equips you with actionable knowledge to start building and deploying trading algorithms efficiently.

Course Structure Designed for Real-World Market Application

The curriculum of ICFM’s algo trading course has been designed by industry experts with years of experience in algorithmic trading. The course begins with an introduction to the basics of financial markets and gradually moves into advanced topics like Python programming for trading, API integration, strategy development, and algo testing environments. Each module is aligned with real-world trading needs. By the end of the course, learners not only understand the concepts but also develop the skills to implement their own trading algorithms confidently.

Live Market Exposure and Hands-On Practice

Unlike many theory-heavy courses available online, ICFM’s algo trading course emphasizes practical learning. Students work on actual datasets, simulate trades, and test their strategies in real market conditions. This hands-on approach is what sets ICFM apart. It allows learners to troubleshoot in real-time, observe the behavior of different trading models, and fine-tune their strategies for better accuracy and profitability. The live trading lab provides the perfect environment to transition from a theoretical learner to a capable algo trader.

Ideal for Beginners, Professionals, and Financial Enthusiasts

ICFM’s algo trading course has been designed to cater to learners from all backgrounds. Whether you are a student of finance, an MBA graduate, a software developer, or even a self-taught trader, this course can help enhance your understanding of algorithmic trading. For working professionals already in the trading space, the course adds depth and automation to their existing skillset. For new entrants, it builds the entire framework needed to enter the domain with confidence and clarity.

Tools, Technologies, and Industry-Relevant Knowledge

In the rapidly evolving financial sector, keeping up with new tools and technologies is critical. ICFM’s algo trading course introduces learners to a variety of software and platforms commonly used in the industry. From Python and SQL to broker APIs and backtesting libraries, students become familiar with everything needed to execute an automated trading strategy. Additionally, the course keeps learners informed about current regulations, risk management practices, and the ethical use of algorithms in the financial markets.

Expert Faculty and Personalized Mentorship

The success of any educational program lies in its faculty, and ICFM doesn’t compromise here. Every instructor involved in the algo trading course is a seasoned market practitioner with a background in algo development, financial modeling, or quantitative research. Their real-world experience translates into practical teaching that goes far beyond textbook knowledge. ICFM also offers mentorship support throughout the course, where students can clarify doubts, receive career guidance, and get help in building customized trading bots.

Career Prospects After Completing the Algo Trading Course

Completing ICFM’s algo trading course opens the doors to several career opportunities. Graduates can work as algorithmic traders, quant analysts, strategy developers, or even independent automated traders. The fintech industry in India and abroad is witnessing exponential growth, and demand for skilled algo professionals is at an all-time high. ICFM’s certification and real-market training make students job-ready and highly competitive in the global job market.

Why Choose ICFM Over Other Institutes?

There are many online courses available on algorithmic trading, but few match the depth, support, and live exposure offered by ICFM. Their algo trading course is structured for serious learners who want more than just theoretical knowledge. With access to experienced mentors, real-time platforms, and industry-specific training, ICFM helps learners evolve into full-fledged algo traders.

Conclusion: Embrace the Future of Trading with ICFM’s Algo Trading Course

Technology is redefining financial markets, and those who adapt early will lead tomorrow’s trading landscape. By enrolling in the algo trading course offered exclusively by ICFM – Stock Market Institute, you gain the tools, techniques, and confidence to navigate and excel in automated trading. Whether you're planning to start your career or scale your existing skills, this course is your gateway to the future of finance. It’s not just about learning to trade—it’s about learning to trade smarter.

#algo trading course#online algo trading course#learn algorithmic trading#algo trading course with certification#algo trading classes#algo trading course near me#practical algo trading course

1 note

·

View note

Text

How Can You Automate Your Crypto Trades With Algo Bot?

Trading cryptocurrency can be fun and give good profits. But it also takes time, attention, and quick action. The crypto market is open all the time, and prices change very fast. It is hard for people to watch the market every minute.

This is why an Algo Trading Bot is very useful. It helps you trade easily, quickly, and better. Let’s see how you can use an Algo Bot to automate your crypto trading and why it is a smart idea.

What is an Algo Bot?

An Algo Bot (algorithmic trading bot) is a software tool that trades for you. This bot has a set of rules (called an algorithm) that you choose. You tell the bot when to buy and when to sell, and at what price. After you set it up, the bot trades for you — even when you are sleeping or doing other things.

Why Use an Algo Bot?

Here are some good reasons:

Fast: Bots can react in seconds and catch good deals faster than humans.

Always on: Bots work 24/7. You won’t miss any chances.

No emotions: Bots follow your rules, not feelings.

Test strategies: You can test your plan on past data before trading.

Stay consistent: Bots follow your plan every time.

How to Automate Crypto Trades with an Algo Bot

Here is a simple way to start:

1. Pick a Good Bot

First, choose a trusted bot. Some popular bots are:

3Commas

Cryptohopper

Bitsgap

Pionex

Binance, Coinbase, and Kraken are the exchanges the bot works on. Pick a bot that is easy to use and safe.

2. Create an Account

Go to the bot’s website and make an account. Many bots let you try them for free first.

3. Connect to Your Exchange

Link your exchange account (like Binance) to your bot with an API key. The bot will trade for you but cannot move your money. For safety, allow only trading, not withdrawals.

4. Choose Your Trading Plan

Now, set your plan. You can:

Use ready-made plans from the bot

Make your own plan

Copy plans from top traders

5. Set Your Trading Rules

Decide:

Which coins to trade

How much to invest per trade

Stop-loss level to avoid big loss

Take-profit level to keep gains

How many trades per day

Clear rules help the bot trade well.

6. Test Your Plan

Before going live, test your plan on old market data. This helps you see if it works well. Many bots have testing tools. Change the plan if needed.

7. Go Live and Watch

Now start your bot. It will trade on its own based on your plan. You can watch your results on the dashboard and change settings anytime

Tips for Success

Start small: Begin with little money to learn.

Keep learning: Update your plans often.

Diversify: Trade different coins, not just one.

Use risk control: Always use stop-loss and take-profit.

Stay secure: Use strong passwords and turn on 2FA (Two-Factor Authentication).

Benefits of Using an Algo Bot

More efficient: Trades fast and smart.

Less stress: No emotional trading or panic.

Consistent: Follow your plan every time.

Flexible: You can trade anytime, anywhere.

Conclusion

Using a crypto algo trading bot to trade crypto is smart and modern. Whether you are new or experienced, an Algo Bot helps you save time, avoid stress, and trade better. Start small, learn step by step, and soon you will enjoy the benefits of automated crypto trading.

0 notes

Text

Best Wealth Management Firms in Bangalore, India

When most people think of managing money, they think of recurring FDs, PFs, or an occasional insurance policy. But is that wealth-building? Or more importantly, legacy building?

The truth is that wealth management goes far beyond just investing in stocks or choosing a savings scheme. It's about crafting a long-term financial plan that grows with you and protects the generations that come after you.

In this blog, we'll walk you through what wealth management means, why it matters, especially for entrepreneurs and how to pick the right wealth management firm in India.

What is Wealth Management?

Wealth management is the professional service of handling or managing an individual's or a firm's wealth holistically. It combines investment advice, financial planning, retirement and estate planning, tax strategies, and risk management, all customized to your life goals.

Most people don't have the time, tools, or expertise to analyze markets daily, optimize taxes, or align investments with future goals. That's why many end up parking their money in default choices like fixed deposits or EPFs.

Wealth management steps in with

Personalized planning: Your financial needs, income sources, liabilities, dependents, and aspirations are considered.

Risk profiling: Are you a risk-taker, moderately conservative, or risk-averse? Your portfolio should reflect that.

Goal-based investing: Whether it's buying a home, children's education, or early retirement, investments are mapped to goals.

This is not about chasing hot stocks or timing the market. It's about strategy, discipline, and long-term vision.

How Entrepreneurs Can Benefit from Wealth Management Services

Entrepreneurs often spend most of their energy building their businesses, and rightly so. But in the process, their finances get sidelined.

Here's why wealth management is crucial for business owners:

No time to track markets: While you scale your business, a team can manage your investments.

Diversification of risk: Your business might be high-risk or cyclical. Wealth management helps balance this with a more stable financial portfolio.

Liquidity planning: Tax payments, working capital gaps, or sudden expenses need to be planned.

Business exit or succession planning: Legacy isn't just about money; it's about passing on a financial roadmap to the next generation.

And here's a fun insight: investing in businesses (via equity markets) is similar to your startup journey. The key difference? You don't have to run those businesses; just invest in the right ones.

How to Choose the Right Wealth Management Firm in India

Whether you're based in Mumbai, Delhi, or Bangalore, choosing a trustworthy wealth partner is key. Here's what to look for:1. SEBI-Registered Professionals

This is non-negotiable. Always work with SEBI-registered investment advisors (RIAs). For example, our CEO, Mr. Hariprasad K., is a SEBI-registered RA and ensures compliance, transparency, and client-first service.2. No Money Transfer Scams

If someone asks you to transfer money to their personal or firm account for "account handling," then run. Legitimate wealth management firms only operate by linking their tools to your own DMAT account. You maintain control and ownership.3. Technology-Backed Strategy

At Livelong Wealth, we use Blackbox Algo Trading, which plugs into your DMAT account and executes trades based on rule-based logic without emotional bias or random tips.

You don't just get advice; you get automated execution, regular updates, and a real-time view of your wealth growing.

Read more: https://www.livelongwealth.in/wealth-management-firms-india/340

#best wealth management firms#wealth management#wealth management service#Wealth Management Firm#best wealth management firms india

0 notes

Text

Midjourney Video

With the release of video (silent) on Midjourney, I just can't stop trying to generate images to animate! It's exceptionally easy, but some formats work better than others. Tutorial.

https://videopress.com/v/lSu3UXal?resizeToParent=true&cover=true&loop=true&playsinline=true&preloadContent=metadata&useAverageColor=true

https://videopress.com/v/ATrZHeC9?resizeToParent=true&cover=true&loop=true&playsinline=true&preloadContent=metadata&useAverageColor=true

https://videopress.com/v/HM4jFd1H?resizeToParent=true&cover=true&loop=true&playsinline=true&preloadContent=metadata&useAverageColor=true

https://videopress.com/v/44IogZpY?resizeToParent=true&cover=true&loop=true&playsinline=true&preloadContent=metadata&useAverageColor=true

Source: Midjourney Video

1 note

·

View note

Text

Master Wealth Artistry with Share Market Courses in Delhi

In recent years, share market courses in Delhi have gained immense popularity as more people are seeking ways to secure their financial future through smart investments. Delhi, being a financial and educational hub, offers a wide range of opportunities for aspiring investors and traders. However, finding a comprehensive and practical course that imparts real-time market knowledge can be a challenge. This is where ICFM INDIA steps in as the ultimate solution for individuals looking to master the stock market.

ICFM INDIA (Institute of Career in Financial Market) is not just another training institute—it is a pioneer in delivering quality and industry-relevant education in the stock market. With years of experience and thousands of successful students, ICFM INDIA stands as the exclusive provider of the most trusted share market courses in Delhi.

Why Choose Share Market Courses in Delhi from ICFM INDIA Only?

Delhi hosts several training institutes offering financial education, but ICFM INDIA has carved a unique niche due to its practical approach, experienced trainers, and updated curriculum. Their share market courses in Delhi are not only designed for freshers but also benefit working professionals, entrepreneurs, and homemakers who want to understand market trends and build a second source of income.

The curriculum covers everything from basic stock market terminologies to technical and fundamental analysis, derivatives, options trading, intraday strategies, and even algo trading. The courseware is constantly updated according to the evolving market dynamics to keep learners ahead of the curve.

Who Should Enroll in Share Market Courses in Delhi at ICFM INDIA?

The beauty of ICFM INDIA’s share market courses in Delhi lies in their inclusivity. Whether you're a complete beginner or someone with a basic understanding of the stock market, ICFM INDIA has a course tailored for your needs. These courses are ideal for:

College students seeking career alternatives.

Working professionals aiming to diversify their income.

Retired individuals looking for active investments.

Homemakers with time to invest in financial literacy.

Entrepreneurs who want better control over their investments.

Each module is structured to ensure that learners of every level can comprehend and apply the knowledge in live markets with confidence.

Detailed Overview of Share Market Courses Offered by ICFM INDIA

ICFM INDIA offers a structured learning path through its various share market courses in Delhi, ensuring clarity, skill development, and market readiness. Here's an overview of the major topics covered:

Basic Introduction to the Share Market

The course begins with a foundation in capital markets, where students learn the basics of equity, trading platforms like NSE and BSE, the role of SEBI, and how the Indian stock market functions. This forms the bedrock for advanced topics.

Technical and Fundamental Analysis

ICFM INDIA’s advanced modules teach students how to read charts, patterns, candlestick indicators, and moving averages. Simultaneously, fundamental analysis trains learners to study company performance, P/E ratios, financial statements, and economic trends.

Derivatives and Options Trading

A key differentiator of ICFM INDIA’s share market courses in Delhi is their in-depth training in derivatives trading, including futures and options. These complex instruments are explained in an easy-to-understand manner, with real examples and trading strategies.

Intraday and Swing Trading Techniques

Short-term trading is highly popular among young investors. The course explores intraday techniques, swing trading, position sizing, stop-loss strategy, and risk management to help traders avoid common pitfalls and optimize profits.

Practical Live Market Training

What sets ICFM INDIA apart is its live market training. Students get hands-on experience by analyzing stocks in real-time, making virtual trades, and building trading strategies under expert guidance. This unique feature helps bridge the gap between theory and practice.

Benefits of Learning from ICFM INDIA in Delhi

The credibility of ICFM INDIA lies not only in its curriculum but also in its results. Here are some tangible benefits that learners gain by enrolling in their share market courses in Delhi:

1. Expert Faculty and Market Professionals

Courses are taught by real-time traders and industry experts who bring in years of experience, ensuring learners understand practical market movements.

2. Updated Course Content

The syllabus is regularly revised according to changes in SEBI regulations, trading technologies, and market trends.

3. Convenient Location and Flexible Batches

Located in Delhi, ICFM INDIA offers weekday and weekend batches, making it easy for working professionals and students to attend.

4. Placement Support and Career Guidance

After completing the course, ICFM INDIA provides placement support and helps students explore career paths like equity analyst, trader, investment advisor, and portfolio manager.

5. Certification and Recognition

Upon course completion, learners receive a certification that enhances their professional credibility and opens doors to new job opportunities in the finance sector.

ICFM INDIA’s Impact on Delhi’s Trading Community

Thousands of students, working professionals, and entrepreneurs across Delhi have benefited from the expertise and training provided by ICFM INDIA. The institute has helped build a strong community of confident, disciplined, and financially literate individuals who actively participate in the Indian stock market.

Learners report improved portfolio returns, increased confidence in their trading strategies, and even career transitions into full-time financial roles, all thanks to the solid foundation laid by ICFM INDIA’s share market courses in Delhi.

Affordability and Value for Money

One of the standout features of ICFM INDIA is the affordability of its courses. Unlike many overpriced institutes, ICFM INDIA believes in delivering value. Their share market courses in Delhi are reasonably priced, with options for EMI and discounts on early enrollments. The return on investment is significant, considering the lifetime skills you acquire.

How to Enroll in Share Market Courses in Delhi by ICFM INDIA?

Enrolling is simple. Interested candidates can visit ICFM INDIA’s official website or contact their Delhi center directly for counseling. The team assists with course selection based on your background, goals, and schedule availability.

You can also book a demo session to experience the teaching quality before enrolling. The institute’s counselors are well-versed in guiding students on which course fits them best, ensuring personalized attention from the very beginning.

Final Thoughts on Choosing ICFM INDIA for Share Market Education

If you're serious about understanding and succeeding in the stock market, choosing the right educational partner is crucial. Among all the options available, ICFM INDIA stands tall as the most reliable, practical, and result-oriented institution offering share market courses in Delhi.

Their legacy of financial education, hands-on training methodology, and consistent student success make them the go-to destination for anyone looking to make a mark in the stock market. From beginner to advanced level, their courses are designed to turn market rookies into confident investors.

Conclusion: Start Your Share Market Journey with ICFM INDIA Today

Learning how the stock market works is no longer a luxury—it’s a necessity in today’s volatile financial landscape. If you’re based in Delhi or nearby and are looking for the most comprehensive and trusted training institute, look no further than ICFM INDIA. Their exclusive share market courses in Delhi are tailored to turn your passion for trading into a practical, profitable skill.

Now is the perfect time to take charge of your financial future. Enroll in ICFM INDIA’s course and begin your journey toward financial freedom and stock market mastery.

#Share market courses in Delhi#Stock market courses in Delhi online#Share market courses in delhi for beginners

0 notes

Text

Best Stock Market Courses in India for Beginners and Experts

Are you looking for the best stock market courses in India that actually teach you how to trade and invest with confidence? Do you want to learn how the share market works, but you’re tired of confusing videos and outdated textbooks? Then it’s time you hear about ICFM (Institute of Career in Financial Market) – one of the most trusted names when it comes to financial education in India.

In a country where millions are interested in stock trading, finding the best stock market courses in India is not always easy. There are too many online promises and shortcut methods, but very few real, practical learning options. That’s where ICFM stands out. ICFM offers complete, career-focused, and practical learning for anyone who wants to succeed in the stock market.

Why You Need the Best Stock Market Courses in India

The stock market is not gambling. It is a skill – and like every skill, it needs training, guidance, and practice. If you are someone who wants to trade for profits, or someone who wants a job in the finance sector, you cannot afford to learn from random sources.

What you need are the best stock market courses in India that are structured, well-designed, and taught by real market experts. ICFM provides exactly that.

ICFM’s courses are not just theory-based. You learn by doing. From day one, you will be working with live charts, trading tools, and real market data. You will understand how professional traders think and how the market actually works in real time.

That’s why people from all over the country are choosing ICFM when they search for the best stock market courses in India.

ICFM Offers the Best Stock Market Courses in India for Every Level

One of the best things about ICFM is that it has something for everyone. Whether you are a beginner or someone with some market knowledge, you will find the right course to match your goals.

ICFM provides beginner to advanced level courses that include trading, investing, technical analysis, options and futures, algo trading, and more. Each program is updated with the latest market strategies and real-life trading practice. These are truly the best stock market courses in India for students, professionals, entrepreneurs, and even retired individuals looking to earn from home.

You don’t need a finance background to join. The language is simple, and the concepts are broken down in a way that even a school student can understand. That’s what makes ICFM a leader in delivering the best stock market courses in India.

Learn Online or Offline – The Choice Is Yours

ICFM understands that different students have different needs. That’s why it offers both classroom training and online learning. If you live in Delhi or nearby, you can attend regular sessions at their center. But even if you are from another city, you can join their live online classes from anywhere in India.

These online classes are interactive, live, and full of practical insights. You can ask questions, watch real-time charts, and even practice live trading under expert guidance. No matter where you live, you can now access the best stock market courses in India from the comfort of your home, only through ICFM.

And the best part? You get lifetime access to recorded sessions, so you can revisit the lessons anytime you want.

Career Support After Completing the Best Stock Market Courses in India

Many people want to join the best stock market courses in India not just to learn, but to build a career. If that’s your goal, ICFM has you covered. After completing your course, ICFM helps you with career guidance, internships, and even job opportunities in stockbroking companies, trading firms, and financial institutions.

You also get to build your own trading strategy with the help of expert mentors. Whether you want to become a full-time trader or a research analyst, ICFM will help you reach your goal step by step.

This kind of support is rare, and it’s one more reason why ICFM’s programs are truly the best stock market courses in India.

Affordable Learning from India’s Top Market Educators

High-quality education doesn’t have to cost a fortune. ICFM offers the best stock market courses in India at very affordable prices. The institute believes that financial education should be accessible to all, whether you're a student, homemaker, or working professional.

You don’t need lakhs of rupees to get started. ICFM’s courses are budget-friendly, and often come with combo discounts or short-term modules that help you learn at your pace.

In short, you get world-class education without the world-class price tag.

Real People, Real Results

Thousands of students have completed their training from ICFM and are now successfully trading in the market or working in reputed financial companies. These are not paid reviews or fake success stories – these are real people who found real value in the best stock market courses in India by ICFM.

Some of them now trade full-time from home. Some have become SEBI-registered advisors. Others are working in leading stockbroking firms across India. This is the impact of practical learning and proper mentorship – the kind that ICFM is known for.

Conclusion

When it comes to learning stock trading the right way, shortcuts don’t work. What you need is a proper foundation, hands-on training, and real support from experienced mentors. That’s exactly what ICFM offers through its expert-designed programs.

If you’re serious about your trading journey or want a stable career in the financial market, don’t waste time on free tips or YouTube videos. Invest your time in the best stock market courses in India by ICFM – and build the skills that actually make money in the market.

The journey of becoming a successful trader or investor starts with one right step. And that step is joining ICFM – the provider of the most practical and powerful best stock market courses in India.

#Best stock market courses in india#Best stock market courses in india for beginners#Best stock market courses in india with certificate#Top 10 stock market training institute in India#Best online stock trading courses in India#Stock market courses online free with certificate#Top 10 stock market institute in Delhi

0 notes

Text

How Algo Trading Works | Algo Trading in India & AI for Trading

How Algo Trading Works: A Beginner's Guide

Introduction

Imagine if you had a super-fast robot that could buy and sell stocks for you while you sit back and relax. Sounds amazing, right? That’s exactly what algorithmic trading (algo trading) does! It uses computer programs to make trades automatically based on set rules.

But how does it really work? And how is artificial intelligence for trading changing the game? Let’s break it down in simple terms.

Discover how algo trading in India works and how artificial intelligence for trading is transforming the stock market. Learn the basics in a simple way.

What is Algo Trading?

Algo trading, or algorithmic trading, is the use of computer programs to place trades automatically in financial markets. These programs follow predefined rules to decide when to buy or sell stocks, currencies, or other assets.

Think of it like a self-driving car but for stock trading—it operates based on set conditions without manual input.

How Does Algo Trading Work?

Algo trading works by following specific instructions such as:

Buy a stock if its price drops below ₹100.

Sell a stock if its price goes above ₹150.

Execute trades in milliseconds to take advantage of price changes.

These instructions are written in programming languages like Python, C++, or Java and are executed automatically by the software.

Why is Algo Trading Popular?

Algo trading has gained popularity because it:

Eliminates human emotions from trading.

Executes trades faster than manual trading.

Finds profitable opportunities using advanced data analysis.

Works 24/7 without needing breaks.

Key Components of Algo Trading

Algo trading consists of:

Market Data Feeds – Real-time stock prices and trends.

Trading Algorithms – The logic that decides buy/sell actions.

Execution Systems – Where the trade is placed on the stock exchange.

Risk Management – Ensures losses are minimized.

Artificial Intelligence in Algo Trading

AI is revolutionizing algo trading by:

Using machine learning to analyze past data and predict trends.

Adapting to market changes automatically.

Detecting trading patterns that humans might miss.

Types of Algo Trading Strategies

Some common algo trading strategies include:

Trend Following – Buying when prices are rising, selling when they fall.

Arbitrage Trading – Profiting from small price differences in different markets.

Market Making – Placing both buy and sell orders to earn a profit from the spread.

Benefits of Algo Trading

Faster Execution – Trades happen in microseconds.

Higher Accuracy – No emotional decision-making.

Reduced Transaction Costs – No need for a human broker.

Better Risk Management – Algorithms follow strict rules.

Challenges and Risks in Algo Trading

Technical Failures – Software bugs can cause huge losses.

Market Volatility – Unexpected events can disrupt strategies.

Regulatory Compliance – Strict rules apply, especially in India.

Algo Trading in India: Rules & Regulations

In India, SEBI (Securities and Exchange Board of India) regulates algo trading. Traders must:

Use exchange-approved algorithms.

Have risk management measures in place.

Follow market surveillance rules.

How to Start Algo Trading?

To get started:

Choose a reliable broker that offers algo trading.

Learn basic programming or use ready-made software.

Test strategies with paper trading before investing real money.

Follow SEBI guidelines for safe trading.

Best Software for Algo Trading in India

Some top platforms include:

Quanttrix – No coding needed.

Amibroker – Advanced analysis tools.

AlgoTrader – AI-powered trading.

MetaTrader 4 & 5 – Used worldwide.

Future of Algo Trading with AI

The future of algo trading in India will see:

More AI-powered trading bots.

Faster execution with high-speed internet.

Better fraud detection using machine learning.

Conclusion

Algo trading is revolutionizing the stock market by making trading faster, smarter, and more efficient. With artificial intelligence for trading, the industry is evolving rapidly. While there are challenges, the potential benefits make it an exciting space for investors and traders alike.

FAQs

Is algo trading legal in India?

Yes, algo trading is legal in India but regulated by SEBI to ensure fair trading practices.

Can beginners do algo trading?

Yes! Many platforms allow beginners to use ready-made algorithms without coding knowledge.

What is the best software for algo trading in India?

Some popular ones include Quanttrix, Amibroker, and MetaTrader.

Does AI improve algo trading?

Yes! AI can analyze massive amounts of data and improve trade accuracy and decision-making.

What are the risks of algo trading?

Technical failures, market volatility, and regulatory compliance issues are key risks to consider.

1 note

·

View note

Text

Top 5 Benefits of Enrolling in Stock Market Classes in Pune Today

In the ever-evolving world of financial markets, having the right knowledge is your greatest asset. Whether you're an aspiring trader or someone seeking better control over personal investments, stock market classes in Pune offer a solid starting point. As financial literacy becomes increasingly vital, structured education can help you navigate the stock market with clarity, confidence, and strategy.

If you're located in Pune or nearby, you're in luck, our city has quickly emerged as a hotspot for credible trading education. Here are the top five benefits of enrolling in professional stock market classes in Pune that can transform your trading journey.

1. Master the Basics with Practical Learning

Understanding the fundamentals is the first step toward becoming a smart investor. From concepts like equities and derivatives to risk management and portfolio building, professional classes offer structured modules that simplify complex topics.

Our institute, Wealth Note, has found that students who start with a foundation-based curriculum often progress faster in real-world trading. With hands-on sessions, live market demos, and real-time chart analysis, students can learn not just theory, but its practical application in the Indian stock market.

2. Learn Proven Strategies from Industry Experts

One of the most compelling reasons to join stock market classes in Pune is access to seasoned trainers who’ve experienced market cycles, volatility, and evolving trading tools. Unlike free online content that is often generic and scattered, certified instructors offer curated strategies backed by years of experience.

These sessions often include real trading case studies, guidance on using trading platforms, and understanding market psychology, all tailored to current market conditions. You not only learn how to identify trading opportunities but also how to manage losses wisely.

3. Gain Confidence with Risk Management Tools

No matter how strong your analysis is, trading without risk control is like sailing without an anchor. One of the most important modules in our curriculum at Wealth Note is dedicated to understanding risk-reward ratios, stop-loss techniques, and capital allocation.

When you're part of a structured learning environment, you're taught how to safeguard your investments, especially during volatile market conditions. This is crucial not only for daily traders but also for long-term investors. The goal is not just profits but sustainable success.

4. Get Career-Ready with Certification and Support

If you're planning a career in finance or investment advisory, completing a certified course in stock market trading boosts your credibility. Many reputable stock market classes in Pune now offer certification that’s recognized across the industry.

Apart from that, you benefit from placement support, career guidance, and access to alumni trading communities. Whether you want to become a full-time trader, portfolio manager, or work with a brokerage firm, such certifications give you a competitive edge in the job market.

5. Stay Updated with Market Trends and Tools

The financial world never stops evolving, and neither should your learning. Being part of an ongoing learning community ensures you stay updated with the latest trading software, market news, and regulatory changes.

At Wealth Note, our students get regular updates, market insights, and access to workshops,even after course completion. This ensures they remain active learners who can adapt to market changes confidently.

Additionally, some courses include modules on technical analysis, Algo trading, and behavioral finance, ensuring you're always ahead of the curve.

Final Thoughts

Enrolling in stock market classes in Pune is more than just an academic decision—it’s a strategic move toward financial independence. From understanding the market pulse to managing real-time trades with confidence, professional guidance makes a significant difference.

Our institute, Wealth Note, is committed to providing quality trading education that’s practical, future-ready, and tailored for today’s dynamic financial landscape. Whether you're just starting or looking to upgrade your trading game, there's never been a better time to invest in your financial education.

0 notes

Text

Complete Guide to Calendar Spread: Master the Timing Game in Options Trading

🚀 What is a Calendar Spread and Why It Deserves a Spot in Your Strategy Arsenal?

A Calendar Spread—also known as a time spread—involves buying a longer-term option and selling a shorter-term option with the same strike price. This isn’t just a bet on direction—it's a play on time, volatility, and market inefficiency.

In simple terms, you profit from the difference in time decay (Theta) and changes in implied volatility (IV). The longer-dated option loses value slower than the short-term one. That’s your edge.

🔍 Let’s Decode How Calendar Spreads Actually Work

Imagine Nifty 50 is trading at 22,500. You’re moderately bullish and expect volatility to rise. You execute a Call Calendar Spread: 💼 Buy: Nifty 22,500 CE expiring in July 💼 Sell: Nifty 22,500 CE expiring in June

Both have the same strike. Different expiry. As time passes, the June option loses value faster than the July option. If volatility increases before June expiry, the value of July option jumps.

This strategy benefits from: 📉 Time decay on the short option 📈 Volatility expansion on the long option

🎯 Tools like Strike Money allow you to visualize volatility skew, time decay impact, and option Greeks—making your entries more precise and data-backed.

💹 Bullish or Bearish? Calendar Spreads Adapt to Your Market View

📈 Bullish Calendar Spread: Set up at or slightly below ATM strike 📉 Bearish Calendar Spread: Set up at or slightly above ATM strike

Example from India: During March 2024, Infosys was trading around ₹1,400. Traders expected a move post earnings but wanted to limit risk. They created a bearish calendar spread: 🛒 Buy July 1,420 CE 🛒 Sell April 1,420 CE

Post earnings, IV jumped. The April leg expired worthless, while July gained value—yielding a 4.5% ROI within 10 trading days.

🧪 According to NSE data (2023), option strategies involving time spreads performed better in low-IV regimes—common in pre-budget and post-earnings calm.

⚡ Why Volatility is the Engine of Calendar Spreads

The calendar spread thrives in low IV environments with expectations of rising volatility. Think pre-earnings or macro events like RBI meetings.

Let’s take an example: In February 2025, ahead of the Union Budget, Bank Nifty saw IVs dip below 15%. Traders used Call Calendar Spreads, anticipating budget-related volatility surge.

🎯 Here's the trick: 🧠 Buy options in low IV ⚡ Sell options in even lower IV or approaching expiry

📉 Implied Volatility (IV) increases—your long option appreciates faster. 🔬 Strike Money’s IV Charts show historical vs. current IV to pinpoint ideal entries.

📈 Studies by CBOE and NSE-India confirm that calendar spreads outperform when IV Rank is below 30—a signal many algo-traders use to build positions.

🛠 Real-World Execution Using Strike Money & Indian Platforms

Let’s simulate a real calendar spread using Strike Money charting:

🎯 Underlying: Nifty 50 at 22,000 📆 Entry Date: June 1st 🛒 Buy: 22,000 CE July expiry @ ₹160 🛒 Sell: 22,000 CE June expiry @ ₹80

Total Debit: ₹80

Using Strike Money, you observe: 📈 July IV = 18% 📉 June IV = 14% 📊 Theta differential = ₹6/day in favor

If Nifty stays between 21,800–22,200 till June expiry, and IV rises, your position gains. The payoff is non-linear. Theta works like gravity—pulling value out of the short leg while your long option floats.

🧩 Combine this with data from NSE’s Option Chain and Open Interest analytics to refine entries.

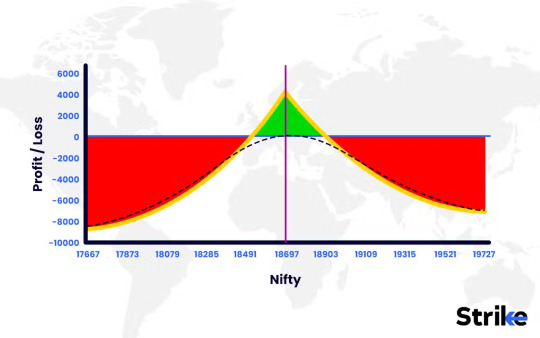

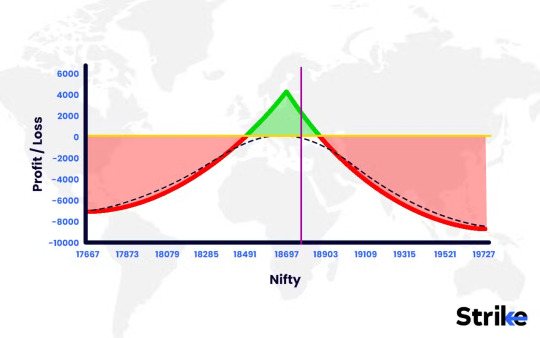

📐 Let’s Talk Numbers: Profit, Breakeven & Loss Potential

Calendar spreads are defined-risk strategies. You know your maximum loss upfront—limited to the net debit (premium paid).

📊 Breakeven typically lies near the strike, but it's dynamic—shifted by IV and time decay.

For example: ✅ Net Debit: ₹80 ✅ Maximum Profit: When underlying closes near strike on short expiry ✅ Maximum Loss: If underlying moves far from strike or IV collapses

🎯 Greeks to Watch: 📉 Theta – benefits you due to faster time decay of short option 📈 Vega – long option gains as IV increases 🔁 Gamma – limited, unless price moves violently

Strike Money lets you simulate P&L curves, dynamically adjusting for changes in IV, DTE, and underlying price.

🔄 Managing Calendar Spreads Like a Pro: When to Roll or Exit?

The lifecycle of a calendar spread is crucial. Don’t just “set and forget”.

📆 As the short option nears expiry: ✔ If price is near strike, let it expire ✔ If price moves away, consider rolling to a further month

Let’s say your Infosys April 1,420 CE is about to expire OTM, and July still has 45 days. Roll to May 1,420 CE to keep collecting theta.

🔐 Risk Management Tips: ⚠ Don’t trade calendars in high IV environments ⚠ Avoid low liquidity stocks ⚠ Always monitor spreads with Strike Money’s payoff graphs

🚫 When Not to Trade Calendar Spreads: Avoid These Traps

❌ Avoid high IV environments – especially near earnings when IV collapse is expected ❌ Stay away from wide bid-ask spreads – slippage eats profits ❌ Do not hold too close to expiry – Gamma risk increases, and moves become sharp ❌ No overnight trades during events – Budget, RBI meet, or global triggers

🧠 Pro Tip: Check IV Rank using Strike Money—ideally enter below 30 for long calendars.

Case in point: In June 2023, Tata Motors saw IV above 45 pre-earnings. A trader entered a calendar spread, expecting IV to rise. Post results, IV crashed. Despite price holding steady, the trade lost 60% of debit.

Lesson: IV crush is real. Respect it.

⚔️ Calendar Spread vs. Diagonal Spread: Which One Works Best?

Think of the Diagonal Spread as the cousin of the Calendar. But there's one key difference—it combines different strikes AND different expiries.

🧩 Example: Diagonal: Buy 22,000 CE July Sell 22,500 CE June

Use when you have a directional bias.

Calendar: Buy 22,000 CE July Sell 22,000 CE June

Use when you expect sideways movement or minor directional moves with IV expansion.

💡 Strike Money helps compare payoff between both strategies—so you can choose based on your view.

🔮 Is the Calendar Spread Still Relevant in 2025’s Market Landscape?

Absolutely. In fact, calendar spreads are tailor-made for volatile but rangebound markets—which is what 2025 is shaping up to be.

🎯 With rising geopolitical noise, inflation uncertainty, and RBI’s cautious stance, expect short-term rangebound movements with periodic volatility bursts.

This is the perfect storm for calendar spreads.

📊 Data from NSE 2024 Options Insights Report shows that multi-leg strategies like calendars are being adopted by more than 32% of active F&O traders—up from just 18% in 2021.

🧠 Institutional traders are using machine learning models to time entry and exits—based on IV behavior and historical pattern recognition. Tools like Strike Money democratize this edge for retail traders.

🧭 Final Thoughts: Should You Use Calendar Spreads?

If you're looking for: ✅ Defined risk ✅ Strategic use of volatility ✅ Minimal capital outlay ✅ Advanced yet approachable tactics

Then yes—Calendar Spreads belong in your playbook.

But remember—it’s a game of patience, precision, and process.

🎯 Use tools like Strike Money to analyze Greeks, IV, payoff and risk metrics in real-time. 📊 Trade with intent. Monitor with discipline. Exit with clarity.

🔥 Want to take it further? Explore advanced variations like double calendar spreads, or combine with earnings season data for explosive setups.

Let the clock work for you, not against you.⌛

0 notes

Text

Is Algo Trading Safe? Here’s the Truth

Algo trading—or algorithmic trading—is safe as long as it is built with expert and real human strategies and settings. It basically uses bots to execute trades based on pre-programmed rules. It's fast, data-driven, and emotion-free. But is it safe?

Let’s break it down:

✅ The Upside

Speed & Efficiency: Bots can analyze charts and execute trades in milliseconds, way faster than humans.

No Emotion: No FOMO. No panic selling. Just logic.

Backtestable: You can test strategies on years of data before going live.

24/7 Execution: Your bot doesn’t sleep. It works across time zones, even while you're offline.

⚠️ The Risks

Bad Code = Bad Trades: A single bug or miscalculation in your logic can blow your account.

Market Shocks: Flash crashes or news events can confuse or mislead bots that aren't adaptive.

Over-Optimization: Many strategies look great in backtests but fail in live markets.

No Human Oversight: If you walk away and the system malfunctions, you might not know until it’s too late.

So, Is Algorithmic Trading Safe?

Algo trading is as safe as its design and the discipline behind it. A well-coded, well-tested system running with risk controls can be safer than manual trading. But a copy-paste script or a black-box EA you bought online? That’s a gamble.

For the best use of Algo trading, you must try SureShotFX once for the best trading strategies experience. Here you will get automated trading backed by expert trading strategies and analysis. So, no fear of getting flashed out or getting ripped off in the name of Algo trading bot.

Yes, SureShotFx provides an EA file for the Algo trading. But the EA includes strong analysis and strategy setup that you can relax after setting up on your trading platform.

Final Thought

Use risk management. Monitor results. Backtest ruthlessly. Algo trading isn’t a cheat code—it’s an EA of trading. Like any EA file, it can build wealth or destroy it depending on how you use it.

Safety = Smart Setup + Active Monitoring.

0 notes

Text

Best Algo Trading Software in India | Quanttrix.io

Best Algo Trading Software in India – Quanttrix.io

Introduction

Ever wondered if machines could trade smarter than humans? Well, welcome to the world of algorithmic trading—where intelligent software takes the driver’s seat in the financial markets. With the growing popularity of algo trading in India, it's no surprise that traders are looking for reliable platforms. But out of all the options, Quanttrix.io stands out as a top choice.

Whether you're a curious beginner or someone who's tired of emotional trading decisions, this article will break down everything you need to know about the best algorithmic trading software India has seen—Quanttrix.io.

Explore the best algo trading software in India . Discover why Quanttrix.io tops the list of the best algorithmic trading software India has to offer.

What is Algorithmic Trading?

Algorithmic trading, or algo trading, is the use of computer programs to place trades automatically based on pre-defined conditions. Think of it like having a robot that follows strict instructions and doesn’t get emotional—unlike us humans.

Imagine telling a robot, “Buy stock A if it goes above ₹500 and sell it if it drops below ₹480.” The robot will follow this without blinking or panicking.

Why Is Algo Trading Gaining Popularity in India?

India's financial markets are evolving. With better internet access, more retail investors, and increasing financial literacy, traders are looking for smarter tools. And guess what? Algo trading fits the bill.

More people want to trade efficiently, save time, and reduce risk. Plus, with the help of SEBI-approved platforms like Quanttrix.io, it’s never been easier to jump in.

Key Features of Algorithmic Trading Software

A good algorithmic trading software should offer:

Customizable strategies

Real-time data feeds

Backtesting tools

Low latency execution

Risk management settings

Not every platform gets this right. But as you'll see, Quanttrix.io hits all the right notes.

Challenges Faced by Manual Traders

Before we dive deeper, let’s look at the pain points of manual trading:

Emotional decisions

Lack of discipline

Missed opportunities

Time-consuming monitoring

Sound familiar? If yes, it's time to automate.

Introduction to Quanttrix.io

Quanttrix.io is an Indian algo trading platform designed for everyone—from beginners to pros. It allows users to automate their trades using powerful algorithms with minimal setup.

Whether you’re trading in stocks, futures, or options, Quanttrix has you covered.

Why Quanttrix.io is the Best Algo Trading Software in India

So, what makes Quanttrix.io the best algorithmic trading software India has right now?

Locally built: Tailored for Indian markets.

Easy setup: No coding needed.

Trusted by traders: Excellent user feedback.

Regulatory compliant: Works with SEBI-approved brokers.

User-Friendly Interface for Beginners

No coding skills? No problem.

Quanttrix.io offers a drag-and-drop interface where you can build your own trading strategies. It's like building a Lego set—except this one helps grow your money.

The dashboard is clean, intuitive, and beginner-friendly.

Advanced Strategies for Pro Traders

If you’re a seasoned trader, you’ll love the advanced features:

Custom scripting options

Multi-leg strategies

Indicator combinations

Smart risk filters

Quanttrix.io adapts to your level of experience.

Real-Time Data & Speed

In algo trading, speed is everything. Quanttrix.io ensures real-time market data and low latency order execution, meaning your trades happen exactly when they should.

It’s like being the first to respond to a flash sale—you get the best deals before anyone else.

Backtesting and Optimization Tools

Not sure if your strategy will work? Test it first.

Quanttrix.io’s backtesting engine lets you run your strategy on historical data to see how it would have performed. Then, tweak and optimize it for even better results.

This saves you from “learning the hard way” with real money.

Security and Compliance Features

Worried about security? Don’t be.

Quanttrix.io uses bank-level encryption, secure API integrations, and is compliant with Indian trading regulations. Your data and trades are safe and secure.

Pricing Plans & Affordability

Quanttrix offers flexible algo trading software price plans to suit different traders:

1 Month Plan – ₹3,000

3 Months Plan – ₹7,000

6 Months Plan – ₹15,000

12 Months Plan – ₹29000

Each plan includes automated trading software with AI-powered strategies, real-time analytics, and premium support.

How to Get Started with Quanttrix.io

Here’s how easy it is:

Sign up at Quanttrix.io

Choose your broker and connect via API

Select or build a strategy

Run it live or test in demo mode

Monitor your trades in real-time

That’s it—five simple steps and you're good to go.

Customer Support & Community

Got a question? Quanttrix.io’s support team is responsive and helpful. They also have a growing community of traders who share strategies, ideas, and updates.

You're not just using software—you’re joining a movement.

Future of Algo Trading in India

Algo trading in India is still in its early stages, but it’s growing fast.

As more traders turn to automation, platforms like Quanttrix.io are paving the way for a smarter, faster, and more reliable trading future.

Soon, manual trading may become a thing of the past—like flip phones or dial-up internet.

Conclusion

To sum it all up: If you’re looking for the best algo trading software in India, look no further than Quanttrix.io.

Whether you're a new trader trying to dip your toes into automation or a seasoned professional looking for powerful tools—Quanttrix has everything you need.

No more guesswork. No more missed trades. Just smart, fast, and reliable trading.

FAQs

1. What is the best algo trading software in India?

Quanttrix.io is widely regarded as one of the best algo trading software in India due to its simplicity, speed, and powerful features.

2. Do I need coding skills to use algorithmic trading software like Quanttrix.io?

Not at all! Quanttrix.io offers a no-code, user-friendly interface, making it accessible for beginners.

3. Is algorithmic trading legal in India?

Yes, algorithmic trading is fully legal in India, provided it follows SEBI guidelines and uses approved brokers and platforms like Quanttrix.io.

4. Can I backtest my strategy on Quanttrix.io?

Absolutely. Quanttrix.io provides robust backtesting tools so you can test and optimize strategies before going live.

5. How much does Quanttrix.io cost?

Quanttrix.io offers flexible pricing plans including a free trial. It’s one of the most affordable solutions for both beginners and experienced traders.

0 notes

Text

Decoding Quantitative Finance: How Algorithms Are Shaping the Future of Investing

In the fast-paced world of financial markets, instincts and gut feelings are being replaced by algorithms, data, and mathematical models. Welcome to the world of quantitative finance—where investing meets data science and complex math drives decision-making. If you've ever wondered how hedge funds make split-second trades or how financial analysts forecast market movements with precision, this is your gateway to understanding the game-changing force behind it all.

What Is Quantitative Finance, Really?

At its core, quantitative finance (or "quant finance") uses mathematical models, computer algorithms, and statistical tools to analyze financial markets and securities. Instead of making decisions based on news headlines or market sentiment, quants rely on hard data—price trends, volatility patterns, historical returns, and more—to predict future outcomes and execute trades.

This approach is used extensively by:

Hedge funds and asset management firms

Investment banks

Proprietary trading desks

Financial technology (FinTech) startups

From Wall Street to Dalal Street: The Global Rise of Quants

Quantitative finance isn’t just the secret sauce of Wall Street giants anymore. With the explosion of data and advances in computing, quant strategies are now being adopted across the globe—including in India’s bustling financial hubs like Mumbai, Bangalore, and Kolkata.

Algo trading, high-frequency trading (HFT), and machine learning-based portfolio optimization are no longer buzzwords—they're fundamental tools reshaping the financial landscape.

Popular Quantitative Finance Strategies

Let’s break down a few of the most commonly used strategies that quants deploy:

1. Statistical Arbitrage

Stat arb strategies look for pricing inefficiencies between correlated securities. When two stocks that usually move together diverge in price, an algorithm might buy one and short the other—profiting when the prices revert to the mean.

2. High-Frequency Trading (HFT)

HFT involves executing thousands of trades in milliseconds to capture tiny price movements. This requires powerful computers, ultra-low latency systems, and real-time data feeds.

3. Factor Investing

This strategy involves identifying key "factors" (like value, momentum, size, volatility) that explain returns across a portfolio. Quants build models to tilt investments toward favorable factors.

4. Machine Learning in Finance

Quants now use machine learning algorithms—like decision trees, neural networks, and reinforcement learning—to detect complex patterns and improve prediction accuracy.

Tools of the Trade: What Quants Use

To work in quant finance, one must be fluent in the language of data. Here's a glimpse into the toolkit of a typical quant:

Programming Languages: Python, R, MATLAB, C++, and Julia

Statistical Techniques: Regression analysis, time series modeling, Monte Carlo simulations

Software Platforms: Bloomberg Terminal, QuantConnect, MetaTrader, Jupyter Notebooks

Data: Financial APIs (Yahoo Finance, Quandl), market feeds, and alternative data sources like satellite imagery or social media sentiment

Why Kolkata Is Emerging as a Hotspot for Quant Talent

While Mumbai and Bangalore have long been seen as India’s financial powerhouses, Kolkata is quietly building its reputation as a promising city for finance and analytics careers. The city has witnessed a surge in financial institutions, FinTech startups, and educational centers focused on preparing professionals for modern finance roles.

This is where Certification Courses for Financial Analytics in Kolkata play a crucial role. These programs are designed to bridge the gap between traditional finance education and the cutting-edge skills required in quant finance today.

Certification Courses for Financial Analytics in Kolkata: A Smart Career Move

Whether you're a recent graduate in commerce or an experienced professional in finance, enrolling in Certification Courses for Financial Analytics in Kolkata can give your career a much-needed boost. Here’s why:

Industry-Relevant Curriculum: Learn about financial modeling, machine learning, Python for finance, and risk analytics.

Hands-On Learning: Solve real-world financial problems using datasets and algorithmic trading simulators.

Expert Mentorship: Get trained by professionals with experience in investment banking, hedge funds, and global markets.

Placement Support: Many courses offer job placement support with banks, financial firms, and startups.

If you’re looking to transition into roles like Quant Analyst, Financial Data Scientist, or Algorithmic Trader, these certification programs can be your launchpad.

Careers in Quant Finance: Where Can It Take You?

The opportunities in quantitative finance are vast and growing. Here are a few high-paying, in-demand roles:

Quantitative Analyst (Quant)Build models to price derivatives and forecast risk.

Algorithmic TraderDesign and execute automated trading strategies.

Financial Data ScientistUse AI and ML to make sense of big financial data.

Risk ModelerAssess and predict risk in portfolios and market operations.

Portfolio Manager (Quantitative)Manage investment portfolios based on systematic models.

Final Thoughts: Is Quant Finance for You?

Quant finance isn’t just about crunching numbers—it’s about solving some of the most complex and intellectually stimulating problems in the financial world. It demands a curious mind, strong mathematical aptitude, and comfort with technology.

If you're fascinated by the fusion of finance, coding, and analytics, this could be your calling. And with institutions now offering Certification Courses for Financial Analytics in Kolkata, the path is more accessible than ever.

0 notes

Text

0 notes