#How to apply for CGTMSE

Explore tagged Tumblr posts

Text

Collection Security: What Cgtmse provides

For Indian MSME, who are struggling with security requirements, presents the credit guarantee scheme for MSMES (CGTMSE scheme) , an innovative financial solution. This government -supported guarantee scheme redirects traditional credit norms by providing security -free credit access to small businesses.

CGTMSE (Credit Warranty Fund Trust for Micro and Small Enterprises) acts as a special credit guarantee scheme that eliminates the need for physical security. According to this revolutionary system, qualified companies can secure CGTMSE loans without a pledge property or real estate-set lights and a game switch for first generation entrepreneurs.

This MSME credit guarantee scheme works through a unique risk sharing model:

CGTMSE provides 75-85% coverage on the loan

Partner lenders only take partial risk

MSME gets access to formal credit without traditional security

The CGTMSE scheme includes different loan products:

Working capital facilities

Loan loan for equipment

Trade Extension Finance

Modernization Fund

Openness in the operation of the scheme is secured through the Right to Information) Act, so that borrowers can get details on loan approval, guarantee coverage and demand settlement. This responsibility strengthens confidence in the function of the mechanism guarantee scheme.

For MsMes, Cgtmse provides several benefits beyond the security discount:

Quick debt processing

Competitive interest

Flexible repayment terms

Debt historical building

This scheme has proven to be particularly beneficial:

Boot and new efforts

Service sector business

Female entrepreneur

Rural and semi-urban enterprises

By removing the security barrier, the CGTMSE -LENNE facility has democratized

Openness in the operation of the scheme is secured through the Right to Information) Act, so that borrowers can get details on loan approval, guarantee coverage and demand settlement. This responsibility strengthens confidence in the function of the mechanism guarantee scheme.

For MsMes, Cgtmse provides several benefits beyond the security discount:

Quick debt processing

Competitive interest

Flexible repayment terms

Debt historical building

This scheme has proven to be particularly beneficial:

Boot and new efforts

Service sector business

Female entrepreneur

Rural and semi-urban enterprises

By removing the security barrier, the CGTMSE lion facility has democratized access to formal credit. This guarantee scheme represents a paradigming change in MSME financing, focusing on business capacity instead of physical assets. As India's MSME sector continues to expand, the CGTMSE scheme is an important promoter for inclusive economic development.

#government schemes for msmes#How to apply for CGTMSE#Startup funding India#Small business loans India#MSME subsidy programs#CGTMSE scheme#MSME loan guarantee#CGTMSE loan process#Credit guarantee scheme for MSMEs

0 notes

Text

Find out how easy it is to apply for a loan with CGTMSE online. In this long course, we offer guidance, tips, and comprehensive, illustrated instructions for a basic application. Find out more information on the affordability of CGTMSE loans right now.

#cgtmse fee#cgtmse loan#cgtmse loan apply online#cgtmse loan for new business#how to apply for cgtmse loan

0 notes

Text

How Private Limited Companies Can Secure Business Credit Lines Without Collateral

Access to capital is a critical factor in the growth journey of any business. For private limited companies in India, securing business credit lines can unlock essential working capital, fuel expansion, and build creditworthiness. However, one of the biggest hurdles entrepreneurs face is getting a credit line without collateral.

Fortunately, with the right strategy and structure, it is possible for Private Limited Companies to secure unsecured business credit. This blog explains how, and why your company’s legal setup—including Private Limited Company Registration in India—plays a vital role in accessing such credit.

Why Choose a Private Limited Company Structure?

Before diving into credit strategies, let’s understand why the Pvt Ltd Company Registration in India matters. Lenders assess a business’s structure to evaluate risk. A Private Limited Company, as opposed to a sole proprietorship or partnership, is a legally distinct entity. It is considered more credible by banks, NBFCs, and fintech lenders.

If you're still operating as an unregistered business, learning how to register a company in India is your first step toward building financial credibility.

How to Register a Company in India to Improve Credit Access

To secure credit lines, you must first ensure your business is legally registered. Here’s a simplified process to register a company in India:

Choose a business name and get it approved via the Ministry of Corporate Affairs (MCA).

Apply for Digital Signature Certificates (DSC) and Director Identification Numbers (DIN).

Draft incorporation documents, including the Memorandum and Articles of Association.

File for registration with the Registrar of Companies (RoC) through the SPICe+ portal.

Once approved, you’ll receive a Certificate of Incorporation, PAN, and TAN.

With increasing digitization, many entrepreneurs now prefer company registration online in India, which allows the entire process to be completed from anywhere with minimal paperwork.

Still unsure how to register a startup company in India? Expert services are available to guide you through compliance, documentation, and legal formalities.

Strategies to Get Business Credit Without Collateral

Once your Private Limited Company is properly registered, here’s how you can improve your chances of securing unsecured business credit:

1. Build a Strong Business Credit Profile

Open a current account under your company name, pay vendors and employees through traceable means, and ensure all regulatory filings (GST, income tax, ROC) are done on time. This builds your creditworthiness.

2. Maintain Clean Financial Records

Audited financials, income tax returns, and bank statements are key documents lenders review. Having transparent, professionally managed books increases your chances of approval.

3. Use Fintech Lending Platforms

Many modern lenders use alternate data (like cash flow, digital payments, and e-commerce history) to assess risk, allowing Private Limited Companies to borrow without pledging assets.

4. Apply for Government-Supported Schemes

Schemes like Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) offer loans without collateral to eligible businesses, especially for startups and MSMEs.

5. Leverage Vendor and Customer Relationships

Some credit lines are extended based on your contractual revenue or supply chain relationships. If you have predictable invoices or clients with strong credit histories, lenders may use this to justify extending unsecured credit.

Why Company Registration Online in India Matters

A formally registered company holds greater trust in the eyes of financial institutions. That’s why Company Registration in India—especially using online company registration portals—is a critical foundation step. Whether you’re an early-stage startup or scaling SME, registering a Private Limited Company opens up access to:

Institutional lending

Government schemes

Invoice financing

Trade credit

Venture capital and angel investment

Final Thoughts

If you're serious about scaling your business, registering a Private Limited Company in India is more than a compliance step—it’s a strategic move to unlock credit and growth. Understanding how to register a company in India and building a strong business credit profile go hand in hand.

And with options for Company registration online in India, there's no reason to delay. Whether you're figuring out how to register a startup company in India or ready to scale a growing venture, start by getting your business structure right—and the capital will follow.

#Private limited company registration in India#Pvt Ltd Company Registration in India#Company Registration in India#how to register a company in India#register a company in India#how to register a startup company in India#Company registration online in India#company registration online in India

0 notes

Text

MSME Loans Made Simple: Fast & Trusted Solutions by Vibho Associates

In today's competitive economy, Micro, Small, and Medium Enterprises (MSMEs) form the backbone of India's economic growth. They generate employment, foster innovation, and contribute significantly to GDP. However, one of the biggest hurdles MSMEs face is access to timely and sufficient financing. That’s where Vibho Associates comes into play with its fast, reliable, and customer-centric MSME loan solutions.

Understanding MSME Loans

MSME loans are specialized financial products aimed at supporting the unique needs of small and medium-sized businesses. These loans can be used for a variety of purposes, including:

Business expansion

Purchasing equipment and machinery

Working capital requirements

Inventory management

Technology upgrades

With the right financial support, MSMEs can boost their operations and compete effectively in both domestic and international markets.

Challenges MSMEs Face in Securing Loans

Many small businesses struggle with loan approval due to:

Lack of collateral

Limited credit history

Complex documentation

Delayed processing

Unfavorable interest rates

Vibho Associates addresses these challenges with a customer-first approach, ensuring that every entrepreneur gets a fair chance to grow.

Why Choose Vibho Associates for MSME Loans?

1. Speedy Processing:

Time is money, especially in business. Vibho Associates is known for its quick turnaround time, from loan application to disbursal. Most loans are approved within 48-72 hours, subject to documentation.

2. Minimal Documentation:

Forget the endless paperwork. Vibho Associates simplifies the process with a minimal documentation requirement, allowing you to focus on running your business.

3. Personalized Support:

Each MSME is unique. The experts at Vibho Associates offer personalized financial consultation to understand your needs and suggest the best loan product.

4. Competitive Interest Rates:

With partnerships across leading banks and NBFCs, Vibho Associates ensures competitive interest rates that fit your budget and repayment capacity.

5. Trusted by Thousands:

With a strong track record and numerous happy clients, Vibho Associates has built a reputation as a trusted MSME loan facilitator in India.

Types of MSME Loans Offered

Vibho Associates offers a variety of loan products to cater to different MSME needs:

Working Capital Loans: To meet day-to-day operational costs.

Term Loans: For purchasing machinery, property, or infrastructure expansion.

Line of Credit: Flexible credit facility for recurring business needs.

Equipment Finance: For buying new or upgrading existing machinery.

Invoice Financing: Get loans against unpaid invoices to maintain cash flow.

Eligibility Criteria

Though eligibility may vary slightly based on the lender, the general criteria include:

Business should be registered as an MSME

Operational history of at least 1 year (for some products)

Valid business PAN card and GST registration

Minimum annual turnover as specified by the lender

Required Documents

Identity & address proof

Business registration documents

Bank statements (last 6-12 months)

ITR and financial statements

GST returns

How to Apply with Vibho Associates?

The application process is simple and can be initiated both online and offline:

Consultation: Speak with a loan advisor from Vibho Associates.

Document Submission: Share the necessary documents.

Loan Assessment: Your application is assessed for eligibility.

Approval & Disbursal: Once approved, funds are disbursed quickly to your bank account.

Real Success Stories

Many businesses have benefited from Vibho Associates’ MSME loans. From local manufacturers in tier-2 cities to small tech startups, Vibho has empowered entrepreneurs to expand, invest in innovation, and create jobs.

Government Schemes for MSMEs

Vibho Associates also assists clients in availing government-backed MSME loan schemes such as:

CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises)

PMEGP (Prime Minister’s Employment Generation Programme)

MUDRA Loans under the Pradhan Mantri Mudra Yojana

These schemes offer benefits like collateral-free loans, interest subsidies, and flexible repayment terms.

Why MSME Loans Are More Important Than Ever

Post-pandemic recovery, rising digitization, and global economic opportunities make it crucial for MSMEs to invest in technology, talent, and infrastructure. MSME loans act as the fuel to power this growth engine.

With rising demand and growing competition, access to quick and affordable financing can mean the difference between stagnation and growth.

Final Thoughts

Vibho Associates is committed to supporting the dreams and ambitions of India's MSME sector. Whether you're a manufacturer, retailer, trader, or service provider, Vibho has a loan solution tailored just for you.

MSME Loans are no longer complex. With Vibho Associates, they are fast, trusted, and hassle-free.

#MSMELoan#BusinessLoan#SmallBusinessSupport#LoanForBusiness#MSMEIndia#StartupFinance#EntrepreneurSupport#FinancialGrowth#BusinessFunding#SMELoan

0 notes

Text

2025 Guide to Best Startup & MSME Business Loans in India: Govt Schemes + Private Lender Insights

Starting or Expanding a Business in 2025? This Guide is Just for You

Whether you're a first-time startup founder, a self-employed professional, or a seasoned small business owner looking for expansion, getting the right business loan in India can feel overwhelming. With countless options, variable interest rates, and complex eligibility criteria, most entrepreneurs don’t know where to begin.

In this detailed guide, we’ll discuss the top 10 business loan options in India for 2025, covering everything from the best interest rates and government schemes for small businesses to instant loan approvals online.

Why Business Loans Are a Game-Changer in 2025

The Indian business ecosystem is evolving rapidly. With the government’s push for Atmanirbhar Bharat and increased funding to MSMEs and startups, more businesses than ever are tapping into online business loans to scale quickly.

But with so many providers and schemes, how do you find the best business loan in India with the lowest interest rates and fast approval?

We’re here to help you figure that out — simply, clearly, and with real answers.

Top 10 Business Loan Options in India (2025)

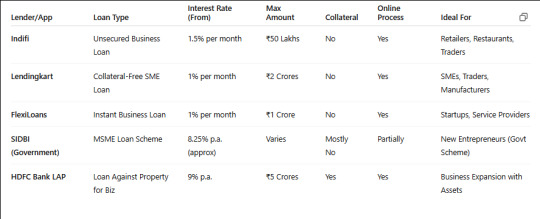

Here’s a detailed table comparing the top business loan providers in India, their interest rates, and key features.

Business Loan Comparison Table (2025)

What Types of Business Loans Can You Choose From?

Here are the most searched business loan types in 2025:

Startup Loans for New Business

Working Capital Loans

Business Loan Against Property

Unsecured Business Loans

Government Schemes like Mudra & CGTMSE

Let’s go deeper into what users are searching for and how you can benefit from each.

Startup Loans for New Businesses (Startup India Scheme)

Many first-time entrepreneurs struggle with funding. Fortunately, Startup India loan eligibility and benefits have expanded in 2025. Government schemes like Stand-Up India, Mudra, and SIDBI Make in India Soft Loan Fund offer support for:

Women entrepreneurs

SC/ST-owned startups

Tech-based early-stage businesses

Wondering how to get a startup loan without collateral in India?Most government-backed loans like Mudra (Shishu/Tarun) don’t need any collateral and offer low interest starting at 7.3%.

Business Loan Against Property: Lower Rates, Higher Value

If you have real estate, you can get a secured business loan at a lower interest.

Interest Rates: As low as 8.75%

Loan Amount: Up to ₹5 Cr or more

Ideal for: Business expansion, factory set-up, purchasing machinery

Business loan against property interest rate is much lower compared to unsecured loans, but note: you risk asset seizure on non-repayment.

Unsecured Business Loans for Self-Employed Professionals

These are ideal if you don’t have collateral but need fast funds. The best unsecured business loans for self-employed individuals are offered by private banks and NBFCs.

Quick online process

Minimal documentation

Flexible EMIs

Instant online approval for business loans is now possible via apps like HDFC BizLoan, ICICI InstaBiz, and Bajaj Finserv.

Working Capital Loans for MSMEs: Short-Term Lifeline

Short-term working capital loans for MSMEs help businesses meet day-to-day expenses like raw material purchase, salaries, and bills.

Tenure: 6–24 months

Type: Overdraft, Line of Credit, Bill Discounting

Providers: SBI, Axis, SIDBI, Bank of Baroda

Steps to Apply for a Business Loan Online in India

Applying online is fast, but you must be ready with:

Documents Required:

PAN & Aadhaar

GST certificate

Business proof (registration or ITR)

6–12 months' bank statement

Application Steps:

Visit the lender’s website or app

Fill out the online loan form

Upload KYC & income documents

Get loan approval within 24–72 hours

Things to Consider Before Choosing a Business Loan

Compare current interest rates for business loans in India

Check repayment flexibility

Assess processing fees & hidden charges

Understand your eligibility

Choose the right lender for your business type

Real People, Real Experiences

"I didn’t know I could get a ₹10 Lakh loan without property as collateral. Thanks to Mudra, I started my own printing business in Delhi."

— Arun Gupta, MSME Owner

"I used ICICI’s InstaBiz loan option. Got ₹15 Lakh in 24 hours! No paperwork hustle."

— Priya S., Interior Designer, Mumbai

These stories highlight why choosing the right loan type matters more than simply picking a bank.

Frequently Asked Questions (FAQs)

1. What is the best business loan provider in India in 2025?

Answer: HDFC, SBI, and ICICI are leading providers. However, for unsecured loans, NBFCs like Bajaj Finserv and Tata Capital are excellent.

2. How do I get a startup loan without collateral in India?

Answer: Apply under schemes like Mudra, Stand-Up India, or through fintech lenders offering unsecured loans with just business proof and turnover.

3. What is the interest rate for business loans in India right now?

Answer: As of 2025, rates range between 8.75% to 22%, depending on the lender, loan type, and your credit profile.

4. Can I apply for a business loan online in 2025?

Answer: Yes! Almost all banks and NBFCs have instant online portals. Approval times are as quick as 24–72 hours.

5. What is the ideal business loan for MSMEs needing short-term funds?

Answer: Working capital loans from SIDBI, SBI, or Axis Bank with flexible tenures (up to 24 months) are best suited.

Final Thoughts: Choose Smart, Grow Fast

In 2025, the loan landscape will have become incredibly friendly for businesses, startup founders, MSMEs, and self-employed professionals, all have tailor-made solutions available.

Whether you need quick cash, want government support, or are looking for low interest rates with zero collateral, the right choice can empower your business journey.

Need help choosing the right loan? Drop a comment or reach out — we’ll guide you like a friend, not a banker.

#Best business loan providers in India#Current interest rates for business loans in India#Government schemes for small business loans#Startup India loan eligibility and benefits#How to get a startup loan without collateral in India#Business loan against property interest rate#Steps to apply for business loan online in India#Instant online approval for business loans#Best unsecured business loan for self-employed#Short term working capital loan for MSMEs

0 notes

Text

How Udyam Registration Can Accelerate Your Business Growth

Introduction

In today’s fast-paced business environment, small and medium enterprises (SMEs) are facing numerous challenges, from accessing capital to navigating complex regulations. One of the most effective ways for businesses to unlock growth opportunities is by obtaining Udyam Registration. Introduced by the Ministry of Micro, Small, and Medium Enterprises (MSME), Udyam Registration is a simple online process that certifies your business as an MSME, enabling it to access various government schemes, financial support, and growth opportunities.

What is Udyam Registration?

Udyam Registration is an online process for businesses to register as Micro, Small, and Medium Enterprises (MSMEs). This process simplifies the traditional registration system and offers a hassle-free way for businesses to formalize their operations. Once a business completes the registration, it receives a unique Udyam Certificate that categorizes it as either a micro, small, or medium enterprise based on investment and turnover thresholds.

How Udyam Registration Supports Business Growth

1. Access to Financial Support and Credit

One of the most significant benefits of Udyam Registration is the easy access to financial support. Udyam-registered MSMEs can apply for collateral-free loans under various government schemes, such as the Pradhan Mantri Mudra Yojana (PMMY) and the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). These schemes offer businesses an opportunity to secure funding without the need for tangible assets as collateral, which can be a game-changer for small businesses that do not have valuable property or inventory to pledge.

2. Government Schemes and Subsidies

Udyam Registration opens doors to a variety of government schemes and incentives that are designed to support the growth and development of MSMEs. These schemes can significantly reduce operational costs and improve overall business efficiency.

Subsidies for Technology Upgradation: The Technology Upgradation Fund Scheme (TUFS) helps MSMEs modernize their production processes by providing financial assistance for purchasing new machinery and adopting cutting-edge technologies. This can result in improved productivity, reduced costs, and higher-quality products, enabling businesses to compete with larger competitors.

Export Promotion: Udyam-registered businesses can take advantage of government programs aimed at promoting exports. By participating in schemes like Market Development Assistance (MDA) and Export Promotion Schemes, businesses can showcase their products at international trade fairs, exhibitions, and online marketplaces, opening up new revenue streams in global markets.

Subsidized Training and Skill Development: MSMEs often face challenges in terms of skill gaps within their workforce. The government offers subsidies for training and skill development programs under schemes like the National Skill Development Corporation (NSDC). With Udyam Registration, businesses can access these resources, improving the overall skill set of their employees and increasing productivity.

3. Tax Benefits and Exemptions

Udyam-registered businesses enjoy various tax benefits that make them more financially viable. These benefits are aimed at providing financial relief and encouraging business growth:

Lower GST Rates: MSMEs with Udyam Registration are eligible to apply for the Composition Scheme under the Goods and Services Tax (GST) Act. This scheme allows businesses to pay a reduced GST rate and simplifies compliance, reducing the tax burden on small businesses.

Income Tax Exemptions: Udyam-registered businesses may also qualify for income tax exemptions or reduced rates under certain conditions. The government provides tax relief to MSMEs in the form of exemptions for small businesses with annual turnover below a specified threshold, helping to free up capital for reinvestment in business expansion.

4. Ease of Doing Business and Compliance

Government Procurement: One of the most significant advantages of Udyam Registration is eligibility for government procurement contracts. Many government agencies prioritize MSMEs in the procurement process, providing them with opportunities to secure contracts for the supply of goods and services. This is a lucrative opportunity for small businesses to increase revenue and gain credibility.

Simplified Compliance: Udyam Registration helps streamline the compliance process by reducing paperwork and ensuring that businesses meet the required standards for MSME benefits. This simplifies the often complex process of adhering to labor, tax, and environmental regulations.

5. Improved Credibility and Market Visibility

In today’s competitive business environment, credibility plays a vital role in attracting customers, suppliers, investors, and partners. Udyam Registration helps improve your business’s credibility, as it is an official government recognition of your business’s status as an MSME. The Udyam Certificate can be shared with potential clients and partners to demonstrate that your business is legitimate and compliant with government regulations.

6. Access to Digital Transformation Tools

The government of India has been pushing for the digital transformation of MSMEs through initiatives like the Digital MSME Scheme and the National Digital MSME Program. Udyam-registered businesses can avail themselves of financial support and guidance to adopt digital tools such as cloud-based enterprise solutions, e-commerce platforms, digital marketing, and online payment systems. By embracing these tools, businesses can:

Expand their customer reach: E-commerce platforms allow businesses to access a national or even global customer base.

Improve operational efficiency: Digital tools help automate business processes, manage inventory, and handle finances with greater accuracy.

Enhance customer engagement: Digital marketing strategies like social media campaigns and email marketing can help businesses reach and retain customers more effectively.

7. Fostering Innovation and Research

Udyam Registration also unlocks access to government schemes that promote innovation and research within MSMEs. For example, under the MSME Innovation Scheme, businesses can receive financial assistance for product development, process innovation, and new technology adoption. With access to funding and government support, MSMEs can stay competitive by introducing new products or services and improving existing offerings.

Note: You can now quickly update Udyam Certificate via the Udyam portal.

Conclusion

In a rapidly evolving business landscape, Udyam Registration is not just a formality; it’s a strategic move that can significantly accelerate the growth of your business. By offering access to financial support, government schemes, tax benefits, and digital transformation tools, Udyam Registration empowers MSMEs to scale effectively and compete with larger enterprises. Whether you’re looking to expand operations, reach new markets, or modernize your technology, Udyam Registration provides the resources and credibility needed to achieve your business goals.

0 notes

Text

How DPIIT Registration Can Boost Your Startup Growth

Startups in India's vibrant entrepreneurial ecosystem must overcome several obstacles in their pursuit of expansion and scalability. Getting DPIIT Registration through the Startup India Initiative is a potent way to overcome these obstacles. Numerous advantages provided by DPIIT Recognition greatly aid in the development of companies. This essay examines how DPIIT Registration might help startups seize new opportunities, get beyond obstacles to growth, and succeed in the long run.

Recognizing DPIIT Registration

Startups that fulfill certain qualifying requirements under the Startup India Scheme are officially acknowledged by the Department for Promotion of Industry and Internal Trade (DPIIT) through DPIIT Registration. This process, which was formerly known as DIPP Registration, honors startups that support innovation, growth, and job creation.

What is DPIIT Recognition?

DPIIT Recognition attests to a startup's compliance with the government's eligibility requirements. After being acknowledged, entrepreneurs are eligible to receive a Startup India Certificate, which opens up a number of benefits like tax breaks, financial opportunities, and regulatory assistance.

Significance of Startup India Certificate

The Startup India Certificate serves as official validation for startups. It make sure that the startup is eligible for benefits offered under various government schemes, including financial aid, networking platforms, and tax relaxations.

Why DPIIT Registration is Critical for Startup Growth

1. Increasing Credibility and Trust

The startup's credibility with investors, clients, and business partners is increased by DPIIT registration. The Startup India Certificate serves as evidence that the company complies with the integrity and innovation standards set by the government. Startups find it simpler to recruit investors and form partnerships as a result of their increased credibility.

2. Access to Government Funding Schemes

The Fund of Funds for Startups (FFS), a government program that provides early-stage venture support through SIDBI-registered funds, is available to startups having DPIIT Recognition. For firms looking to expand and spur innovation, this money is essential.

3. Tax Benefits and Exemptions

Registered startups enjoy income tax exemption for three consecutive financial years under Section 80-IAC of the Income Tax Act. Also, they are exempt from Angel Tax under Section 56(2)(viib), confirming smoother funding processes from angel investors.

4. Simplified Compliance Norms

DPIIT-registered startups benefit from simplified labor and environmental compliance for five years. This reduces the operational burden, enabling startups to focus on core business activities and accelerate growth.

5. Easier Access to Loans and Credit

Government-backed programs such as the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) make it simple for startups with DPIIT Recognition to obtain credit. This capital availability guarantees more seamless operations and growth.

6. Participation in Government Tenders

Startups are exempted from prior turnover and experience requirements when applying for government tenders. This gives new businesses a fair opportunity to compete and secure valuable contracts, developing business growth.

How DPIIT Registration Drives Investor Confidence

1. Regulatory Compliance Assurance

Investors prefer startups that adhere to regulatory frameworks. DPIIT Recognition assures investors that the startup complies with government regulations, thereby reducing investment risks.

2. Tax Incentives for Investors

Investors in DPIIT-registered startups enjoy tax benefits, which improves the attractiveness of such investments. The exemption from Angel Tax confirms higher returns on investments.

3. Validation of Business Model

DPIIT recognition validates the startup's business model and innovative approach, developing investor confidence and encouraging more funding opportunities.

The DPIIT Registration Process

Step 1: Business Incorporation

The startup must be incorporated as a Private Limited Company, Limited Liability Partnership (LLP), or a Partnership Firm to be eligible for DPIIT Recognition.

Step 2: Register on Startup India Portal

Create an account on the Startup India Registration portal. Provide essential details such as the name, objectives, and nature of the business.

Step 3: Submit Required Documents

Certificate of Incorporation

PAN Card of the business

A brief description of the product or service

Proof of innovative approach or business model

Step 4: Self-Certification

The startup must self-certify that it meets the eligibility criteria concerning turnover, innovation, and business structure.

Step 5: Evaluation and Issuance of Startup India Certificate

Upon successful verification by DPIIT, the startup will receive the Startup India Certificate, marking its official DPIIT Recognition.

Key Growth Opportunities Through DPIIT Recognition

1. Accelerated Access to Global Markets

DPIIT-registered startups benefit from simplified international compliance procedures. For startups planning global expansion, this facilitates faster market entry and scaling opportunities.

2. Intellectual Property Rights (IPR) Benefits

Startups with DPIIT Recognition receive a fast-track process for patent applications with up to 80% rebate on filing fees. This benefit is critical for startups in technology and product-based industries.

3. Participation in Exclusive Networking Events

DPIIT facilitates events and forums where recognized startups can interact with investors, mentors, and potential partners. This helps in building valuable connections that drive growth.

4. Incubation and Mentorship Programs

DPIIT-registered startups are eligible for government-supported incubation programs. These programs offer mentorship, funding guidance, and business development support, aiding faster growth.

5. Priority in Government Initiatives

Startups with DPIIT recognition are prioritized in various government initiatives and schemes. This includes eligibility for state-level startup policies and collaborations with government agencies.

Overcoming Common Challenges in DPIIT Registration

1. Lack of Documentation

Confirm that all documentation, including the Certificate of Incorporation and business descriptions, is accurate and complete.

2. Unclear Business Model

Clearly define the innovative aspect of your business. Highlight how your product or service solves a problem or introduces a novel concept.

3. Delay in Verification Process

Regularly follow up on your application status and respond promptly to any queries from the DPIIT to avoid delays.

4. Misunderstanding Eligibility Criteria

Review the eligibility criteria carefully. Make sure that your business meets all requirements related to turnover, innovation, and registration structure.

Best Practices to Maximize DPIIT Registration Benefits

1. Leverage the Startup India Platform

Involve actively on the Startup India portal to access mentorship, funding guidance, and networking opportunities.

2. Build a Strong Investor Pitch

Highlight the advantages of DPIIT Recognition in your pitch deck. Emphasize tax benefits, simplified compliance, and government-backed incentives to attract investors.

3. Participate in Government Schemes

Regularly check for new schemes and initiatives introduced for startups. Apply for grants and programs that align with your business goals.

4. Seek Professional Guidance

Consider consulting with experts for application support and to understand how to maximize incentives post-recognition.

Long-Term Impact of DPIIT Recognition on Startup Growth

Sustainable Business Growth

DPIIT Recognition provides startups with a solid foundation for sustainable growth by confirming access to capital, mentorship, and government-backed initiatives.

Increased Market Visibility

Recognized startups enjoy increased visibility on government platforms, facilitating better networking and business expansion.

Improved Innovation Capacity

Tax savings and funding access allow startups to reinvest in research and development, driving innovation and competitiveness.

Global Business Expansion

Simplified compliance and funding support aid startups in expanding internationally, accessing larger markets, and increasing revenue streams.

Assumption

For startups hoping for long-term success and sustainable growth, obtaining DPIIT Registration is a calculated step. Beyond monetary rewards, DPIIT Recognition provides access to special funding opportunities, regulatory leniencies, and increased investor trust. The Startup India Certificate is a important validation that boosts credibility and opens doors for expansion. Startups should give this registration first priority in order to take use of the extensive network of resources intended to promote creativity and expansion. Startups can use DPIIT Recognition as a potent driver for quicker growth and commercial success by being aware of the advantages and taking use of the chances offered. Put your startup on the road to revolutionary growth and success by applying today.

#dpiit registration#DPIIT Recognition#startup india registration#dipp registration#startup india certificate

0 notes

Text

The Udyam Advantage: Boosting Your MSME's Credibility and Competitive

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of India's economy, contributing significantly to GDP, employment, and innovation. However, these businesses often face challenges such as limited access to credit, lack of market recognition, and regulatory complexities. The Indian government introduced the udyam certificate download pdf system to address these issues and provide a structured framework for MSME growth.

Udyam Registration offers a range of benefits that enhance the credibility and competitiveness of MSMEs. In this article, we will explore how registering under Udyam can empower your business and help it thrive in a competitive market.

Understanding Udyam Registration

Udyam Registration is an initiative by the Ministry of Micro, Small, and Medium Enterprises (MSME) to streamline the classification and recognition of MSMEs in India. It replaces the earlier Udyog Aadhaar Memorandum (UAM) and ensures a simplified, paperless, and cost-effective registration process.

Eligibility CriteriaAn enterprise can register as an MSME under Udyam based on its investment in plant and machinery or equipment and annual turnover:

Micro Enterprises: Investment up to Rs. 1 crore and turnover up to Rs. 5 crore.

Small Enterprises: Investment up to Rs. 10 crore and turnover up to Rs. 50 crore.

Medium Enterprises: Investment up to Rs. 50 crore and turnover up to Rs. 250 crore.

Advantages of Udyam Registration

1. Enhanced Credibility and Market RecognitionOne of the biggest advantages of Udyam Registration is increased credibility among customers, suppliers, and financial institutions. A registered MSME is recognized as a legitimate business entity, making it easier to gain trust and secure deals.

Example: If you are an MSME looking to collaborate with larger corporations, Udyam Registration strengthens your profile and increases your chances of being considered for partnerships.

2. Easy Access to Credit and Financial Assistance

MSMEs often struggle with inadequate funding, making it difficult to scale operations. Udyam-registered businesses can access various government-backed financial schemes, including:

Collateral-Free Loans: Under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme, businesses can avail loans without the need for collateral.

Lower Interest Rates: Many banks and NBFCs offer reduced interest rates for Udyam-registered MSMEs, easing financial burdens.

Subsidies on Patent Registration and ISO Certification: To encourage innovation and quality standards, the government provides financial assistance for obtaining patents and ISO certifications.

3. Priority in Government Tenders and Procurement

The government has mandated that a certain percentage of tenders be allocated exclusively to MSMEs. With Udyam Registration, businesses get priority in public procurement, increasing their chances of securing government contracts.

Additionally, registered MSMEs are exempt from earnest money deposits (EMD) while applying for tenders, reducing financial strain.

4. Protection Against Delayed Payments

One of the significant challenges faced by MSMEs is delayed payments from buyers, which affects cash flow and business sustainability. Under the MSME Development Act, Udyam-registered businesses are entitled to:

Timely Payments: Buyers must settle invoices within 45 days of delivery.

Interest on Late Payments: If payments are delayed, the buyer is liable to pay compound interest (three times the bank rate).

Legal Protection: In case of disputes, MSMEs can approach the MSME Samadhaan portal for quick resolution.

ALSO READ:- udyam certificate download

5. Tax and Compliance Benefits

Udyam Registration offers several tax benefits, including:

Subsidized GST Rates: Many MSME products and services attract lower GST rates.

Direct Tax Exemptions: Certain expenses incurred by MSMEs are eligible for tax deductions.

Reimbursement of ISO Certification Fees: Promoting quality standards, the government reimburses costs associated with obtaining ISO certification.

6. Business Expansion and Export Benefits

For MSMEs looking to expand beyond domestic markets, Udyam Registration facilitates export promotion incentives such as:

Market Development Assistance (MDA): Helps MSMEs participate in trade fairs and exhibitions.

Subsidies on International Trade Fairs: The government provides financial support to MSMEs to showcase their products globally.

Access to Export Promotion Councils: MSMEs get membership in various export councils, increasing their reach to foreign buyers.

How to Register for Udyam

The Udyam Registration process is completely online and free of cost, making it accessible to all businesses. Here’s a step-by-step guide:

Step 1: Visit the Udyam Registration PortalGo to the official Udyam Registration website.

Step 2: Enter Aadhaar DetailsFor proprietorship firms, enter the proprietor’s Aadhaar number.

For partnership firms, enter the managing partner’s Aadhaar number.

For companies or LLPs, enter the authorized signatory’s Aadhaar number.

Step 3: Verify with OTPAn OTP will be sent to the registered mobile number linked to Aadhaar. Enter the OTP for verification.

Step 4: Provide Business InformationName and type of enterprise

PAN details (for businesses with turnover above Rs. 10 lakh)

Business address and bank details

Investment and turnover details

Step 5: Submit the ApplicationAfter entering all required details, submit the application. A unique Udyam Registration Number (URN) and e-certificate will be generated.

Common Myths and Misconceptions About Udyam Registration

1. Udyam Registration is Mandatory for All MSMEsFact: Udyam Registration is not mandatory, but it is highly recommended to avail government benefits.

2. Registration Involves a High FeeFact: The official registration process is completely free. Beware of third-party agents charging fees for registration.

3. Only Manufacturing Businesses Can RegisterFact: Both manufacturing and service-based enterprises can register under Udyam.

4. The Registration Process is ComplicatedFact: The process is simple, online, and paperless, requiring only Aadhaar and basic business details.

Conclusion

udyam aadhar download is a game-changer for MSMEs, providing them with the necessary credibility, financial support, and competitive edge to thrive in today’s dynamic business landscape. By registering under Udyam, MSMEs can unlock numerous benefits, from easier credit access to government contracts, tax exemptions, and legal protections.

#udyam registration#udyam registration online#print udyam certificate#apply udyam registartion#udyam registartion portal

0 notes

Text

How CGTMSE Assists MSMEs in the Financial Domain

Micro, Small, and Medium Enterprises (MSMEs) are the backbone of India's developing economy, promoting innovation and generating jobs. Nevertheless, access to finances is usually the significant obstacle for most entrepreneurs. To fill this lacuna, the government, and other financial institutions have launched some initiatives like the CGTMSE scheme – a strong credit guarantee scheme for MSMEs intended to enable collateral-free loans in India. Through this blog, we discuss how the CGTMSE scheme is helpful to MSMEs in the financial segment by improving lending procedures and lending much-needed relief to startups and existing businesses both.

Understanding CGTMSE and Its Impact

CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises) was initiated with the aim to offer business loans to small enterprises without collateral security. This is to say that entrepreneurs looking to get a startup business loan or msme loan for new business can get a loan even in the absence of significant collateral. By reducing lenders' risks, the CGTMSE loan mechanism facilitates it easier for financial institutions to provide lending for business.

Key Features:

Collateral-free loans India: Small business loans in India can be availed by entrepreneurs without pledging their assets.

MSME loan guarantee: The scheme is a safety net that increases lender confidence.

Help for startups: It is a key tool for entrepreneurs requiring startup finance India.

Government schemes for MSMEs: CGTMSE is a component of comprehensive MSME support measures by the Indian government for the development of the sector.

How the CGTMSE Scheme Works

The CGTMSE Loan Process

For effective financing, the CGTMSE loan process is kept simple:

How to Apply for CGTMSE: The entrepreneur must draft a detailed business plan, visit a collaborating lending institution, and submit the application.

MSME Loan Guarantee: Upon submitting the application, the lender issues a guarantee under the credit guarantee scheme for MSMEs.

Approval and Disbursement: After fulfilling the eligibility requirements, companies can avail funds without the fear of offering collateral security.

For MSMEs and financial institutions as well, it is important to know how to obtain a CGTMSE loan without collateral and how to avail CGTMSE for startups, which are key factors in making the most of this scheme.

CGTMSE Login and Charges

Borrowers and financial institutions can conveniently check the status of their loan through the cgtmse login page on the website. Moreover, applicants should also be cognizant of some charges:

CGTMSE fee and CGTMSE charges: These are minor charges payable as a component of the guarantee service to keep the scheme running and continue to finance MSMEs throughout the nation.

Increasing Financial Access for MSMEs

The CGTMSE scheme has played a vital role in increasing lending to business. With the risk factor reduced, banks and NBFCs are more comfortable providing business loans to small firms and startup business loan products. Here's how it makes a big difference:

Risk Reduction for Lenders: With the guarantee scheme by its side, the risk of investment is greatly minimized.

Encouragement of Collateral-free Loans: This facilitates even people who do not own substantial assets to avail themselves of the necessary capital.

Boost to MSME Subsidy Programs: The initiative is complementing other MSME subsidy schemes to provide an exhaustive support structure to small and medium-sized enterprises.

The initiative also has direct implications for the Government's large schemes for MSMEs as well as MSME support efforts by Indian government for developing a vibrant and inclusive business ecosystem.

Steps to Use CGTMSE for Startups and Enterprises

Those who are thinking about how to get CGTMSE should consider the following simple step-by-step process:

Get Your Business Plan Ready: Make sure to provide detailed financial estimates and the intended use of the loan.

Select a Lending Partner: Contact banks or NBFCs who are part of the credit guarantee scheme.

Make Your Application: Fill in the required paperwork and start your application process.

Activate CGTMSE Login: Use the cgtmse login portal to track your application status and manage your profile.

Understand the Charges: Be informed about the applicable cgtmse charges and cgtmse fee.

Receive Collateral-free Funding: Once approved, leverage collateral-free loans India to fuel your business growth.

Following these steps to avail CGTMSE for startups can significantly enhance your chances of securing the needed funding efficiently.

Conclusion

In the ever-changing financial world, the CGTMSE scheme is a revolutionary instrument that not only encourages startup funding India but also ensures that small company business loans and other business lending options become available to all those aspiring entrepreneurs. With a simplified CGTMSE loan procedure and complete support measures, the scheme is playing a vital role in improving MSME growth. By providing a credible credit guarantee scheme and addressing collateral-related issues, it opens the door to a more inclusive and stronger economic future in India.

Embrace the potential of collateral-free loans in India and take the first step towards a successful business by exploring the opportunities offered by the CGTMSE scheme today.

#CGTMSE scheme#MSME loan guarantee#Credit guarantee scheme for MSMEs#Collateral-free loans India#CGTMSE loan process#Government schemes for MSMEs#How to apply for CGTMSE#Startup funding India#Small business loans India#MSME subsidy programs

0 notes

Text

Starting or expanding a business can be challenging without proper financial support, especially for small and medium enterprises (SMEs). The Government of India provides MSME (Micro, Small, and Medium Enterprises) loans to empower entrepreneurs and ensure business growth. If you’re looking to apply for msme loan, this comprehensive guide will walk you through the process and highlight everything you need to know.

What is an MSME Loan?

An MSME loan is a financial initiative introduced by the Government of India to support small businesses, startups, and entrepreneurs. These loans are often provided at lower interest rates and come with flexible repayment options to encourage economic growth and job creation.

Benefits of MSME Loans

Affordable Interest Rates: MSME loans often have subsidized interest rates, making them accessible for small businesses.

No Collateral: Many government-backed MSME loans do not require collateral, which reduces the risk for entrepreneurs.

Quick Processing: Applications are processed faster to meet urgent business needs.

Wide Range of Schemes: Entrepreneurs can choose from various schemes based on their requirements, such as Mudra Loan, Credit Guarantee Fund Scheme, and Stand-Up India.

Eligibility Criteria for MSME Loans

Before you begin the process to apply for an MSME loan, ensure your business meets these eligibility requirements:

Business Type: Your enterprise must fall under micro, small, or medium categories as defined by the Government of India.

Age of Business: Some schemes require a minimum operational period for eligibility.

Business Plan: A clear business plan demonstrating how the funds will be utilized.

Creditworthiness: A good credit score increases your chances of approval.

Steps to Apply for MSME Loan Online

The process of applying for an MSME loan has been simplified with digital platforms. Here’s how you can go about it:

Step 1: Prepare Essential Documents

Having your documents ready is the first step to a smooth application process. Commonly required documents include:

Business Registration Certificate

PAN Card and Aadhar Card

Bank Statements (Last 6 Months)

Income Tax Returns (Last 2-3 Years)

GST Registration Details

Detailed Business Plan

Step 2: Choose the Right Loan Scheme

Explore various government schemes for MSME loans to find one that suits your needs. Popular schemes include:

PM Mudra Yojana: For micro and small enterprises.

CGTMSE: Offers collateral-free loans.

Stand-Up India: For women and SC/ST entrepreneurs.

SIDBI Loans: Provided by Small Industries Development Bank of India for startups.

Step 3: Visit the Official Portal

To apply for MSME loans online, go to the official MSME portal or visit related bank websites.

Step 4: Fill in the Application Form

Provide your personal details such as name, contact number, and address.

Fill out business-related details like business type, turnover, and loan requirement.

Upload necessary documents in the required format.

Step 5: Submit and Track Application

Double-check the details before submitting your application.

Note down the reference number to track your application status.

Key Government Portals for MSME Loan Application

Udyam Registration Portal: For business registration and loan schemes.

Mudra Loan Portal: For micro and small business loans.

PSB Loans in 59 Minutes: A platform to get loan approvals within 59 minutes.

Tips for a Successful MSME Loan Application

Prepare a Solid Business Plan: Highlight how the funds will contribute to business growth.

Improve Credit Score: Maintain a good repayment history to build trust.

Choose the Right Loan Amount: Borrow what you can repay comfortably.

Be Transparent: Provide accurate and complete information during the application process.

Common Challenges in Applying for MSME Loans

Insufficient Documentation: Missing documents can delay approval.

Low Credit Score: A poor credit history can lead to rejection.

Scheme Mismatch: Applying under the wrong scheme reduces chances of approval.

How to Overcome Rejection?

Review Rejection Reasons: Understand why your application was denied.

Improve Documentation: Ensure all paperwork is accurate and up-to-date.

Seek Professional Help: Consult financial advisors to rectify issues.

Advantages of Applying Online

Convenience: Apply from anywhere without visiting a bank.

Faster Processing: Digital applications are processed quicker.

Transparency: Real-time tracking of loan applications.

Conclusion

Applying for an MSME loan online is a straightforward process when you follow the right steps. The government has made several efforts to ensure financial assistance reaches small businesses, empowering them to thrive. With proper preparation, a clear business plan, and the right scheme, securing an how to apply msme loan online can be the stepping stone for your entrepreneurial success.

#msme loan apply online#how to apply for msme loan#apply for msme loan#how to apply msme loan online#apply for msme loan online

0 notes

Text

MSME Registration: A Comprehensive Guide to Empowering Small Businesses

Micro, Small, and Medium Enterprises (MSMEs) play a pivotal role in driving economic growth, generating employment, and fostering innovation in any country. To support and encourage these enterprises, governments worldwide, including India, have introduced MSME registration schemes. This article delves into the nuances of MSME registration, its benefits, the registration process, and its significance for small businesses.

What is MSME Registration?

MSME registration is a government initiative aimed at classifying businesses into micro, small, and medium enterprises based on their investment and turnover. This classification ensures that these businesses receive appropriate benefits and incentives designed to promote their growth and sustainability.

Key Definitions:

Micro Enterprises: Investment up to ₹1 crore and turnover up to ₹5 crore.

Small Enterprises: Investment up to ₹10 crore and turnover up to ₹50 crore.

Medium Enterprises: Investment up to ₹50 crore and turnover up to ₹250 crore.

Why is MSME Registration Important?

Access to Financial Benefits: Registered MSMEs can avail of various government subsidies, low-interest loans, and tax exemptions.

Ease of Business Operations: MSME registration simplifies processes like opening bank accounts, applying for tenders, and securing funding.

Market Protection: Certain government tenders and procurement processes are exclusively reserved for MSMEs.

Legal Safeguards: MSMEs are protected under the Micro, Small, and Medium Enterprises Development Act (MSMED), ensuring timely payments and redressal of grievances.

Benefits of MSME Registration

1. Credit and Finance Access:

Registered MSMEs enjoy easier access to credit due to government-backed schemes and partnerships with financial institutions. Initiatives like the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) provide collateral-free loans.

2. Tax Benefits:

Tax holidays and exemptions are provided to registered MSMEs, reducing their financial burden and enabling them to reinvest in business growth.

3. Government Subsidies:

Subsidies on electricity bills, patent registration, and barcode registration are offered to encourage operational efficiency.

4. Reduced Interest Rates:

Banks often provide loans to MSMEs at lower interest rates, facilitating capital acquisition and expansion.

5. Protection Against Delayed Payments:

MSMEs have the legal right to claim interest on delayed payments from buyers, ensuring cash flow stability.

How to Register as an MSME?

MSME registration is a straightforward online process designed to ensure accessibility and ease of use for entrepreneurs.

Step 1: Visit the Official Portal

The registration process begins on the official Udyam Registration Portal (https://udyamregistration.gov.in/).

Step 2: Provide Business Details

Name and type of enterprise (proprietorship, partnership, etc.).

Aadhaar number of the business owner.

PAN card and GSTIN details (if applicable).

Step 3: Classification and Financial Information

Enter investment and turnover details to determine the business’s classification as micro, small, or medium.

Step 4: Verification and Submission

Once all details are filled, verify the information and submit the application. An acknowledgment and unique registration number will be provided upon successful submission.

Challenges Faced by MSMEs

Despite the benefits of MSME registration, many small businesses encounter hurdles:

Lack of Awareness: Many entrepreneurs are unaware of the registration process and its associated benefits.

Complex Documentation: Incomplete or incorrect documentation can delay the registration process.

Limited Technological Access: Small business owners in rural areas often face challenges in accessing online registration portals.

Delayed Payments: Despite legal safeguards, MSMEs frequently face payment delays from large corporations, affecting their liquidity.

Recent Updates and Initiatives for MSMEs

Governments continually update policies to make MSME registration more beneficial. Recent initiatives include:

Emergency Credit Line Guarantee Scheme (ECLGS): Designed to provide financial support to MSMEs during crises like COVID-19.

Atmanirbhar Bharat Abhiyan: Encourages self-reliance among Indian MSMEs by promoting domestic production and reducing dependency on imports.

Digitalization Drive: Initiatives to educate MSMEs on digital tools for registration, marketing, and operations.

Tips for MSMEs Post-Registration

Maintain Accurate Financial Records: Ensure compliance with investment and turnover limits to retain MSME status.

Leverage Government Schemes: Stay informed about updates and avail of benefits like subsidies, grants, and training programs.

Focus on Innovation: Invest in research and development to stay competitive in the market.

Adopt Digital Marketing: Use online platforms to increase visibility and reach a larger audience.

Conclusion

MSME registration is a gateway to numerous benefits and opportunities for small businesses. It not only provides financial and operational support but also fosters a conducive environment for growth and innovation. Entrepreneurs should prioritize registration to unlock the full potential of their businesses. By staying informed about updates and leveraging the benefits, MSMEs can significantly contribute to economic development and achieve long-term sustainability.

0 notes

Text

Collateral-Free Business Loans for Startups in India – Get Funded Instantly in 2025!

Looking to expand your business but stuck with funding issues? You’re not alone. In 2025, more Indian entrepreneurs than ever are searching for instant, collateral-free business loans that can be approved online, with no income proof, no security, and low interest rates.

Whether you're a startup dreaming big or a small business needing quick working capital, this guide offers all the practical insights and comparisons to help you choose the best business loan options in India today.

Why Business Loans Are Booming in 2025

The Indian startup ecosystem and SME sector are growing rapidly, but access to capital remains a hurdle. Traditional banks often demand heaps of paperwork, collateral, and a strong credit score. But that’s changing fast in 2025, with fintechs, NBFCs, and even government initiatives offering:

Instant digital loan for business

Collateral-free business loan application

Loan against property for business expansion

Funding options for startups in India with no income proof

Common Problems Entrepreneurs Face When Seeking Business Loans

Let’s address the real challenges:

“How do I get a business loan online without a CIBIL score?”

“I need a short-term loan for daily business expenses—where do I apply?”

“Are there any micro-loans for small businesses like mine?”

“Which lender offers the lowest interest rate for a business loan in India?”

We’ve compiled this in-depth guide to help you solve all of these problems—fast.

Top 5 Instant & Collateral-Free Business Loans in India – 2025

Funding Options for Startups in India – 2025 Overview

Startups with zero revenue or early traction often find it hard to get traditional funding. Here's what they can do in 2025:

Government Loan Scheme for New Entrepreneurs – Like the Stand-Up India Scheme, Mudra Loans, and PMEGP, which support new businesses with subsidized loans.

NBFCs and Fintechs – Offering instant digital loans for business without heavy documentation.

Startup Accelerators – Many offer grants, seed funding, and convertible debt.

Loan Against Property for Business – For those with real estate assets but no steady income proof.

“In 2025, over 70% of startup loans are now digitally approved—often within 24 to 48 hours.”

Microloans for Small Businesses – What You Should Know

If you run a local business, like a small store, salon, or Kirana, you can access micro loans starting from just ₹10,000. These are usually:

Short-term (3 to 12 months)

Offered by NBFCs, banks, or even UPI-based apps

Approved with minimal documentation

Platforms like Paytm Business Loan, KreditBee, and NeoGrowth are leading this segment in 2025.

How to Get a Business Loan Online in 2025 (Step-by-Step)

Applying for a business loan has never been easier. Here’s how:

Choose Your Loan Type – Short-term, long-term, micro, or loan against property.

Select a Lender or App – Compare interest rates, tenure, and eligibility.

Fill Out the Digital Application – Using PAN, Aadhaar, bank statements.

Upload Documents Digitally – Or use Aadhaar-based e-KYC.

Get Instant Approval – Many platforms offer loans within 24–48 hours.

No need to visit a bank

Zero collateral needed for most digital loans

No income proof required for select NBFCs

Commercial Loan for Business Expansion – Who Should Apply?

If you’re looking to scale operations, buy inventory, or expand branches, consider:

Loan Against Property for Business – High amount, longer tenure

Unsecured Commercial Loans – Quick processing but lower amount

Government Schemes like CGTMSE – For MSME expansion without collateral

Pro Tip: Combine a short-term working capital loan with a long-term commercial loan for better flexibility.

Short-Term Loans for Daily Business Expenses

Running low on working capital? Need funds to pay salaries or manage operations?

Apply for short-term loans like:

Working Capital Loans

Overdraft Facilities

Line of Credit for Small Businesses

These loans range from ₹50,000 to ₹10 Lakhs and are often approved within hours by NBFCs.

Government Loan Scheme for New Entrepreneurs – 2025 Update

Here are the 3 top-performing government-backed loan schemes in India this year:

PMEGP (Prime Minister’s Employment Generation Programme)

Up to ₹25 lakhs

Subsidy up to 35%

For new manufacturing & service businesses

MUDRA Loans (Under PMMY)

Shishu (up to ₹50,000), Kishor (up to ₹5L), Tarun (up to ₹10L)

For small and micro-businesses

No collateral required

Stand-Up India Scheme

Loans between ₹10L–₹1Cr

For SC/ST and women entrepreneurs

Collateral-free under CGTMSE

Frequently Asked Questions (FAQs)

1. Which loan is best for a startup in India with no income proof?

NBFCs like Lendingkart and FlexiLoans offer instant loans without income proof if you have decent bank statements or digital transactions. MUDRA loans are also ideal.

2. What is the lowest interest rate for business loans in India in 2025?

Government schemes offer starting rates from 8.25% p.a. Private lenders and NBFCs offer from 1% per month (i.e., ~12% annually).

3. Can I get a loan for business expansion using property?

Yes, most banks like HDFC, ICICI, and Axis offer loan against property for business purposes up to ₹5 Crores.

4. Are there collateral-free options for small businesses?

Absolutely. Most fintech lenders now offer collateral-free business loan applications with fast approval.

5. How fast can I get an online business loan in India?

With digital lenders, approval can be instant, and disbursal may happen within 24–48 hours, depending on document verification.

Final Thoughts

2025 is the best time for Indian entrepreneurs to take control of their financial growth. Whether you're launching a new venture, managing daily cash flow, or expanding operations, there’s a loan tailored to your needs.

From instant digital loans and micro business loans to government-backed schemes and low-interest funding, the options are wide—and accessible. And the best part? Most don’t need collateral or extensive paperwork.

“Don’t let a lack of capital stop your business dreams. The right funding option is just a few clicks away.”

#commercial loan for business expansion#lowest interest rate for business loan in India#micro loans for small businesses#funding options for startups in India#government loan scheme for new entrepreneurs#loan against property for business#how to get a business loan online#instant digital loan for business#collateral-free business loan application#short-term loan for daily business expenses

0 notes

Text

Starting or expanding a business can be challenging without proper financial support, especially for small and medium enterprises (SMEs). The Government of India provides MSME (Micro, Small, and Medium Enterprises) loans to empower entrepreneurs and ensure business growth. If you’re looking to how to apply msme loan, this comprehensive guide will walk you through the process and highlight everything you need to know.

What is an MSME Loan?

An MSME loan is a financial initiative introduced by the Government of India to support small businesses, startups, and entrepreneurs. These loans are often provided at lower interest rates and come with flexible repayment options to encourage economic growth and job creation.

Benefits of MSME Loans

Affordable Interest Rates: MSME loans often have subsidized interest rates, making them accessible for small businesses.

No Collateral: Many government-backed MSME loans do not require collateral, which reduces the risk for entrepreneurs.

Quick Processing: Applications are processed faster to meet urgent business needs.

Wide Range of Schemes: Entrepreneurs can choose from various schemes based on their requirements, such as Mudra Loan, Credit Guarantee Fund Scheme, and Stand-Up India.

Eligibility Criteria for MSME Loans

Before you begin the process to apply for an MSME loan, ensure your business meets these eligibility requirements:

Business Type: Your enterprise must fall under micro, small, or medium categories as defined by the Government of India.

Age of Business: Some schemes require a minimum operational period for eligibility.

Business Plan: A clear business plan demonstrating how the funds will be utilized.

Creditworthiness: A good credit score increases your chances of approval.

Steps to Apply for MSME Loan Online

The process of applying for an MSME loan has been simplified with digital platforms. Here’s how you can go about it:

Step 1: Prepare Essential Documents

Having your documents ready is the first step to a smooth application process. Commonly required documents include:

Business Registration Certificate

PAN Card and Aadhar Card

Bank Statements (Last 6 Months)

Income Tax Returns (Last 2-3 Years)

GST Registration Details

Detailed Business Plan

Step 2: Choose the Right Loan Scheme

Explore various government schemes for MSME loans to find one that suits your needs. Popular schemes include:

PM Mudra Yojana: For micro and small enterprises.

CGTMSE: Offers collateral-free loans.

Stand-Up India: For women and SC/ST entrepreneurs.

SIDBI Loans: Provided by Small Industries Development Bank of India for startups.

Step 3: Visit the Official Portal

To apply for MSME loans online, go to the official MSME portal or visit related bank websites.

Step 4: Fill in the Application Form

Provide your personal details such as name, contact number, and address.

Fill out business-related details like business type, turnover, and loan requirement.

Upload necessary documents in the required format.

Step 5: Submit and Track Application

Double-check the details before submitting your application.

Note down the reference number to track your application status.

Key Government Portals for MSME Loan Application

Udyam Registration Portal: For business registration and loan schemes.

Mudra Loan Portal: For micro and small business loans.

PSB Loans in 59 Minutes: A platform to get loan approvals within 59 minutes.

Tips for a Successful MSME Loan Application

Prepare a Solid Business Plan: Highlight how the funds will contribute to business growth.

Improve Credit Score: Maintain a good repayment history to build trust.

Choose the Right Loan Amount: Borrow what you can repay comfortably.

Be Transparent: Provide accurate and complete information during the application process.

Common Challenges in Applying for MSME Loans

Insufficient Documentation: Missing documents can delay approval.

Low Credit Score: A poor credit history can lead to rejection.

Scheme Mismatch: Applying under the wrong scheme reduces chances of approval.

How to Overcome Rejection?

Review Rejection Reasons: Understand why your application was denied.

Improve Documentation: Ensure all paperwork is accurate and up-to-date.

Seek Professional Help: Consult financial advisors to rectify issues.

Advantages of Applying Online

Convenience: Apply from anywhere without visiting a bank.

Faster Processing: Digital applications are processed quicker.

Transparency: Real-time tracking of loan applications.

Conclusion

Applying for an MSME loan online is a straightforward process when you follow the right steps. The government has made several efforts to ensure financial assistance reaches small businesses, empowering them to thrive. With proper preparation, a clear business plan, and the right scheme, securing an msme loan apply online can be the stepping stone for your entrepreneurial success.

#how to apply msme loan#msme loan apply#msme loan apply online#msme loan online#apply for msme loan online#apply for msme loan

0 notes

Text

The Udyam Advantage: Boosting Your MSME's Credibility and Competitive

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of India's economy, contributing significantly to GDP, employment, and innovation. However, these businesses often face challenges such as limited access to credit, lack of market recognition, and regulatory complexities. The Indian government introduced the udyam certificate download pdf system to address these issues and provide a structured framework for MSME growth.

Udyam Registration offers a range of benefits that enhance the credibility and competitiveness of MSMEs. In this article, we will explore how registering under Udyam can empower your business and help it thrive in a competitive market.

Understanding Udyam Registration

Udyam Registration is an initiative by the Ministry of Micro, Small, and Medium Enterprises (MSME) to streamline the classification and recognition of MSMEs in India. It replaces the earlier Udyog Aadhaar Memorandum (UAM) and ensures a simplified, paperless, and cost-effective registration process.

Eligibility CriteriaAn enterprise can register as an MSME under Udyam based on its investment in plant and machinery or equipment and annual turnover:

Micro Enterprises: Investment up to Rs. 1 crore and turnover up to Rs. 5 crore.

Small Enterprises: Investment up to Rs. 10 crore and turnover up to Rs. 50 crore.

Medium Enterprises: Investment up to Rs. 50 crore and turnover up to Rs. 250 crore.

Advantages of Udyam Registration

1. Enhanced Credibility and Market RecognitionOne of the biggest advantages of Udyam Registration is increased credibility among customers, suppliers, and financial institutions. A registered MSME is recognized as a legitimate business entity, making it easier to gain trust and secure deals.

Example: If you are an MSME looking to collaborate with larger corporations, Udyam Registration strengthens your profile and increases your chances of being considered for partnerships.

2. Easy Access to Credit and Financial Assistance

MSMEs often struggle with inadequate funding, making it difficult to scale operations. Udyam-registered businesses can access various government-backed financial schemes, including:

Collateral-Free Loans: Under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme, businesses can avail loans without the need for collateral.

Lower Interest Rates: Many banks and NBFCs offer reduced interest rates for Udyam-registered MSMEs, easing financial burdens.

Subsidies on Patent Registration and ISO Certification: To encourage innovation and quality standards, the government provides financial assistance for obtaining patents and ISO certifications.

3. Priority in Government Tenders and Procurement

The government has mandated that a certain percentage of tenders be allocated exclusively to MSMEs. With Udyam Registration, businesses get priority in public procurement, increasing their chances of securing government contracts.

Additionally, registered MSMEs are exempt from earnest money deposits (EMD) while applying for tenders, reducing financial strain.

4. Protection Against Delayed Payments

One of the significant challenges faced by MSMEs is delayed payments from buyers, which affects cash flow and business sustainability. Under the MSME Development Act, Udyam-registered businesses are entitled to:

Timely Payments: Buyers must settle invoices within 45 days of delivery.

Interest on Late Payments: If payments are delayed, the buyer is liable to pay compound interest (three times the bank rate).

Legal Protection: In case of disputes, MSMEs can approach the MSME Samadhaan portal for quick resolution.

ALSO READ:- udyam certificate download

5. Tax and Compliance Benefits

Udyam Registration offers several tax benefits, including:

Subsidized GST Rates: Many MSME products and services attract lower GST rates.

Direct Tax Exemptions: Certain expenses incurred by MSMEs are eligible for tax deductions.

Reimbursement of ISO Certification Fees: Promoting quality standards, the government reimburses costs associated with obtaining ISO certification.

6. Business Expansion and Export Benefits

For MSMEs looking to expand beyond domestic markets, Udyam Registration facilitates export promotion incentives such as:

Market Development Assistance (MDA): Helps MSMEs participate in trade fairs and exhibitions.

Subsidies on International Trade Fairs: The government provides financial support to MSMEs to showcase their products globally.

Access to Export Promotion Councils: MSMEs get membership in various export councils, increasing their reach to foreign buyers.

How to Register for Udyam

The Udyam Registration process is completely online and free of cost, making it accessible to all businesses. Here’s a step-by-step guide: