#formula of discounted cash flow

Explore tagged Tumblr posts

Text

#discounted cash flow#cash flow#why DCF important#uses of discounted cash flow#formula of discounted cash flow#calculation of discounted cash flow

0 notes

Text

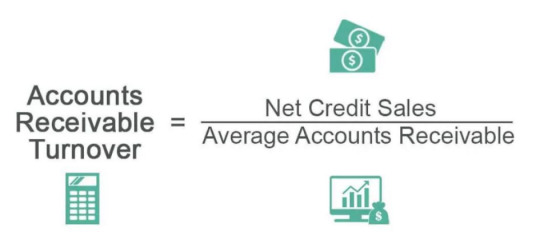

📘 Receivable Turnover Ratio: What It Means and Why It’s Crucial for Your Business

The receivable turnover ratio is more than just a number in your accounting software — it’s a direct window into how efficiently your business collects money. Whether you're an analyst reviewing stocks like Asian Paints, or a small business trying to manage cash flow, this ratio tells you how often receivables are converted into actual cash within a period.

🔍 Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

It’s classified under efficiency ratios, and it forms a part of broader financial statement analysis — crucial for understanding liquidity, cash flow health, and working capital efficiency.

🧮 How the Receivable Turnover Ratio is Calculated (With a Simple Example)

Let’s break it down with an example from the Indian market 📈

Imagine Hindustan Unilever Ltd. (HUL) made ₹10,000 crore in net credit sales last year and maintained an average accounts receivable of ₹1,000 crore.

🔢 That gives us:

Receivable Turnover Ratio = ₹10,000 crore / ₹1,000 crore = 10

This means HUL collects its receivables 10 times a year, or roughly once every 36 days.

High turnover indicates prompt collection — a positive sign for liquidity and credit control policies. A lower ratio might signal inefficient collections or weak credit screening of customers.

📊 What’s a “Good” Receivable Turnover Ratio? Here’s What the Numbers Say

There’s no universal “good” ratio — it depends on the industry. For instance:

🔹 FMCG companies like Dabur or Marico often have higher ratios because of fast-moving inventory and tight credit terms.

🔹 Automobile manufacturers like Tata Motors might show lower turnover due to B2B credit sales and longer cycles.

According to a 2023 Credit Research Foundation (CRF) report, the average receivable turnover ratio across Indian manufacturing firms stood at 7.4. In contrast, retail chains often score upwards of 12.

A good benchmark is to compare with your industry average, not cross-sector. This is where Strike Money becomes invaluable. The tool helps visualize receivable patterns, peer comparisons, and historic shifts — making data interpretation more actionable.

⚙️ How to Improve Your Receivable Turnover Ratio: 5 Key Strategies That Actually Work

A strong ratio reflects tight internal controls, disciplined credit policies, and timely collection systems. If your turnover is slipping, try these tactics 👇

💰 Tighten Credit Policies – Set clear terms and assess creditworthiness. Use third-party credit rating agencies in India like CRISIL and ICRA.

⏱️ Accelerate Invoicing – Issue invoices immediately upon delivery or service.

📞 Streamline Collections – Follow up diligently, automate reminders.

🔁 Offer Early Payment Discounts – Incentivize clients to pay faster.

📊 Monitor With Tools – Use platforms like Strike Money to track A/R trends and identify slow-paying clients.

A case study by Harvard Business Review in 2022 revealed that companies with receivable turnover ratios above industry medians showed 23% better free cash flows over five years.

🔁 Receivable Turnover vs Days Sales Outstanding (DSO): What’s the Difference?

These two metrics are siblings — closely related but slightly different in scope 🧩

⚖️ Receivable Turnover Ratio tells you how many times receivables are collected in a period.

📆 Days Sales Outstanding (DSO) tells you how many days it takes to collect.

🧠 Formula: DSO = 365 / Receivable Turnover Ratio

So if your turnover ratio is 10, your DSO is 36.5 days.

While turnover gives a rate-based view, DSO gives a time-based outlook. For a CFO at a company like Infosys, DSO offers a more relatable picture for cash flow planning.

💼 Real Examples From Indian Companies Using Receivable Turnover Effectively

Let’s explore how some Indian giants manage this ratio in the real world 🚀

📌 Asian Paints Ltd.: Known for its aggressive distribution network, the company maintains a receivable turnover ratio between 14–18 over the years. Their secret? Tight credit policies and tech-driven logistics.

📌 Pidilite Industries: Makers of Fevicol maintain a healthy ratio of 12–13, reflecting strong dealer relationships and efficient collections.

📌 Sun Pharma: As a pharma exporter, Sun Pharma often deals with international credit cycles. It balances a lower turnover of around 6–7 by ensuring credit is backed by robust documentation and export financing.

You can analyze these data points visually using Strike Money, which integrates quarterly reports and historical financials for side-by-side comparisons.

🚫 Common Mistakes When Interpreting the Receivable Turnover Ratio

Here are a few traps that even seasoned analysts fall into ❌

🔄 Including Cash Sales – The formula only considers net credit sales. Including all sales gives a distorted picture.

📅 Ignoring Seasonal Trends – A retail business may naturally have a skewed turnover post-holiday sales.

📉 Misreading a High Ratio – A very high ratio might look great but could signal overly strict credit policies that limit sales growth.

💡 Tip: Always cross-verify with DSO, inventory turnover, and current ratio for a fuller picture. Tools like Strike Money make this triangulation easier by plotting all efficiency ratios on interactive dashboards.

🔍 What Influences the Receivable Turnover Ratio?

Multiple operational, financial, and external factors influence your ratio. These include:

📈 Business Model – B2B companies often deal with longer credit cycles than B2C.

💳 Customer Profile – Institutional clients may delay payments compared to retail consumers.

🌍 Macroeconomic Conditions – In periods of inflation or recession, clients might delay payments, affecting turnover.

🧾 Regulatory Changes – In India, GST input credits and payment processing reforms impact payment behavior across sectors.

According to a RBI bulletin (2024), MSMEs in India faced an average payment delay of 45–50 days, leading to poor turnover ratios despite stable credit sales. This reinforces the need for internal control more than external dependence.

🧠 Why Receivable Turnover Is a Hidden Indicator of Business Health

Think of the receivable turnover ratio as a pulse check 🫀 on your liquidity. It directly reflects how fast your business converts sales into cash — critical for paying salaries, buying inventory, and funding growth.

🔍 Investors like Warren Buffett and Rakesh Jhunjhunwala (legacy) have repeatedly emphasized the importance of analyzing cash flow metrics over net profits. Receivable turnover is central to this.

A company showing consistent growth in sales but worsening receivable turnover is a red flag — it indicates money is stuck in receivables, not in the bank.

🧩 Combine this metric with other indicators like:

💡 Quick Ratio – For liquidity 📈 Operating Cash Flow – For real cash inflows 🔁 Inventory Turnover – For supply chain efficiency

With tools like Strike Money, you can track these over time, benchmark them against sector leaders, and visualize long-term trends that could otherwise be buried in raw data.

🧾 Final Word: Make Receivable Turnover Part of Your Regular Review

The receivable turnover ratio might not make headlines, but it quietly powers your business’s financial engine. It’s one of those “small hinges that swing big doors.”

🏁 Here’s what to remember:

🔹 Calculate it regularly 🔹 Compare it within your industry 🔹 Interpret it with context — don’t isolate it 🔹 Take corrective action if it drops 🔹 Use tools like Strike Money to visualize trends and opportunities

Whether you're a startup founder, retail investor, or finance manager — mastering this ratio equips you to handle cash crunches, negotiate better credit terms, and improve business efficiency.

Keep your receivables healthy — and your business will follow 🚀

0 notes

Text

The Rise of AI-Powered Financial Modeling: What It Means for Future Investment Bankers

Financial modeling has long been the backbone of investment banking—driving valuations, mergers, acquisitions, and strategic decisions. But in 2025, this skill is undergoing a radical transformation. AI-powered financial modeling is no longer just a futuristic concept—it’s here, and it’s reshaping how analysts work, how banks operate, and how careers in finance are built.

If you're planning to learn investment banking in Chennai, understanding this evolution is crucial to staying relevant and future-ready in an industry being redefined by technology.

What is AI-Powered Financial Modeling?

AI-powered financial modeling refers to the integration of artificial intelligence tools into the traditional processes of building financial models. These tools use machine learning and natural language processing to assist in tasks that used to take hours or days—like populating income statements, forecasting cash flows, conducting scenario analysis, or building discounted cash flow models.

Imagine a world where, instead of manually entering data line-by-line into Excel, an AI tool scans earnings reports, pulls the relevant figures, and generates a first draft of your model. That’s the future of finance, and it's already starting to become the present.

How AI is Transforming the Role of a Financial Analyst

Today’s junior investment banker is no longer just a spreadsheet wizard. With the help of AI, analysts can automate repetitive tasks like formatting pitchbooks, inputting historical data, and running sensitivity analysis. This shift allows professionals to spend more time on high-level analysis, strategic thinking, and client communication.

In fact, banks like Goldman Sachs, JPMorgan, and Barclays are already implementing AI tools to speed up their deal analysis processes. These tools help extract insights from thousands of documents, detect market patterns, and even generate reports—making them an invaluable part of modern financial operations.

If you choose to learn investment banking in Chennai, you’ll want to gain exposure to this AI-enhanced workflow. Courses that teach both the fundamentals of financial modeling and how to work with modern tools are the ones that will truly prepare you for success.

Why Learning Investment Banking in Chennai Is a Smart Move

Chennai is fast emerging as one of India’s most promising financial and technology hubs. With the presence of global banks, fintech startups, and analytics companies, it offers an ideal ecosystem to study and grow in this evolving field.

When you learn investment banking in Chennai, you benefit from an environment that supports both academic rigor and practical, industry-relevant training. More importantly, many of the institutes here are already integrating AI, financial automation, and data analytics into their programs—giving you a competitive edge in the job market.

Skills You Need to Thrive in the AI-Driven Finance World

To stand out in the age of AI-powered financial modeling, aspiring investment bankers should develop a mix of traditional and modern skills.

Start with a strong foundation in accounting and financial statement analysis. These fundamentals still form the core of every model, regardless of how much technology is involved.

Next, focus on mastering Excel—not just for formulas, but also for advanced functions, automation, and integration with AI tools. Tools like Excel Copilot and AI-enhanced plugins are making Excel smarter, and knowing how to use them effectively can dramatically increase your efficiency.

In addition to Excel, consider learning basic Python or financial scripting. These skills allow you to automate repetitive modeling tasks and create simulations. While you don’t need to become a full-fledged programmer, understanding how to work with AI in a hands-on way will help you collaborate better with tech teams and stand out in interviews.

Just as important is developing the ability to prompt AI tools like ChatGPT for financial insights. Prompt engineering—knowing how to ask the right questions—has become a powerful skill for modern analysts.

Finally, critical thinking and business acumen are key. AI can process and summarize data, but it’s up to you to interpret those results, apply them to real-world scenarios, and make strategic decisions based on them.

The Bottom Line: Be the Analyst AI Wants to Work With

AI is not here to replace you—it’s here to assist you. But that also means the expectations are higher. Employers are now looking for analysts who understand both finance and technology—people who can think strategically, model accurately, and collaborate with machines.

If you’re planning to learn investment banking in Chennai, don’t just look for a course that teaches Excel or valuation methods. Look for a program that prepares you for the future—where AI is not the enemy, but your most powerful teammate.

The future of investment banking will be shaped by those who embrace this shift early. And Chennai, with its blend of financial opportunity and tech innovation, is one of the best places to start.

0 notes

Text

Instant Working Capital Loan for Startups & SMEs – No Collateral Needed (2025)

Why Working Capital is the Lifeline of Your Business

Running a small business or startup in 2025 is exciting—but let’s be honest, it’s not without its challenges. Whether you’re launching a new venture or growing an existing one, cash flow can make or break your success. You might have the best products or services, but without steady working capital, daily operations can come to a halt.

That’s where a working capital loan for small businesses and startups becomes your best financial ally. In this guide, we’ll simplify everything you need to know—from how it works, where to get it, interest rates, documents, and even myths busted—to help you make the smartest funding decision.

What is a Working Capital Loan?

A working capital loan is a type of business loan specifically meant to finance the short-term operational needs of a business. This includes everyday expenses like rent, payroll, raw materials, marketing, and inventory.

Unlike long-term loans that are meant for purchasing assets or equipment, working capital loans for businesses ensure you don’t run out of cash while waiting for customer payments or during a slow sales season.

Who Needs a Working Capital Loan?

New business owners need cash to survive the initial months.

Startups are waiting on seed funding or investor payouts.

MSMEs are scaling their team or stocking inventory for seasonal demand.

Small manufacturers or traders need bridge funding between supply and sales.

Whether you're looking for a working capital loan for a new business in India or need help to manage fluctuating revenues, these loans provide the necessary breathing room.

Comparison Table: Best Working Capital Loan Providers in India (2025)

Tip: Choose a provider that aligns with your business size, speed needs, and repayment comfort. Don’t just go for the lowest interest rate.

Working Capital Loan Calculation

To calculate how much you need, use this simple formula:

Working Capital = Current Assets – Current Liabilities

If you’re still unsure, many online platforms offer working capital loan calculators. You just need to input:

Monthly expenses

Current receivables

Outstanding dues

And you’ll get a quick estimate of how much working capital you actually need to keep your business flowing smoothly.

How to Get a Working Capital Loan in India (2025 Process)

Getting a quick approval working capital loan online in 2025 has become easier than ever. Here’s the step-by-step breakdown:

Step 1: Check Eligibility

Minimum 6 months to 1 year of business operations.

Monthly turnover requirement (differs by lender).

Business registration documents.

Step 2: Compare Loan Offers

Look for low-interest working capital loans comparison across platforms like BankBazaar, LendingKart, and directly on bank websites.

Step 3: Apply Online

Fill in a working capital loan application on the lender's portal. Upload necessary documents like PAN, Aadhaar, GST returns, and bank statements.

Step 4: Loan Disbursal

Upon approval, funds are transferred to your account—sometimes within 24 hours.

Top Banks & Startup-Friendly Schemes

Here are some startup-friendly working capital loan schemes you should explore:

MUDRA Yojana (for new businesses and MSMEs)

Stand-Up India Scheme (for SC/ST/Women entrepreneurs)

SIDBI Startup Mitra

Kotak Startup Working Capital Loan

These schemes offer lower interest rates and relaxed eligibility for startups and MSMEs.

Long-Term Working Capital Financing Options

If your need is not short-term and you’re looking for longer repayment periods, consider:

Working Capital Term Loans (up to 5 years)

Overdrafts & Cash Credit Lines

Invoice Discounting & Receivables Financing

These allow more flexibility and sustainability for businesses scaling over the long term.

Types of Working Capital Loans

Understanding the type of loan that suits your requirements is key:

Real Scenario

I run a small packaging business in Pune. During Diwali season, orders doubled, but I didn’t have enough stock or staff to handle them. I applied for a quick working capital loan through LendingKart. It was approved in 48 hours, and I scaled operations in time. That loan saved my biggest sales season.

— Anil Mehta, Small Business Owner

Benefits of Working Capital Loans for Small Businesses

No need to dilute equity or seek investors

Quick processing and disbursal

Available even without collateral

Flexible repayment tenures

Helps manage cash flow during lean months

Documents Required for Working Capital Loan Application

PAN card of the business owner & entity

Aadhaar card

GST registration

Business registration proof (Udyam/MSME/Partnership Deed)

Last 6–12 months’ bank statements

ITR filings or audited financials (if applicable)

Final Thoughts: Should You Go for It?

A working capital loan for a small business or new startup isn’t just about getting money—it’s about gaining control over your cash flow. If your revenue is seasonal, your clients pay late, or you’re in growth mode, this could be your smartest decision in 2025.

Just remember: Borrow smart. Compare terms. Read the fine print. And most importantly, only borrow what you can repay without hurting your business.

FAQs on Working Capital Loans (2025)

1. Can I get a working capital loan for a new business in India?

Yes, startups and new businesses can apply under government schemes like MUDRA or from fintech lenders offering startup-friendly terms.

2. What is the typical interest rate for working capital loans?

Interest rates range from 9% to 16%, depending on the lender, credit profile, and collateral (if any).

3. Is collateral mandatory for a working capital loan?

Not always. Many SME working capital loans are without collateral, especially from online lenders or government schemes.

4. How long does it take for loan approval?

With online applications, quick working capital loans can be approved within 24–72 hours, especially with complete documentation.

5. How is working capital loan repayment structured?

Repayment is usually done through EMIs or bullet payments over 12 to 60 months depending on the loan structure.

#working capital loan for new business#working capital loan for small business#working capital loan calculation#what is working capital loan#how to get working capital loan#working capital loan application#working capital loan for business#business working capital loan#working capital loan for new business in india#quick working capital loans#best working capital loan providers#long-term working capital financing options#low interest working capital loans comparison#top banks for working capital loans in India#startup-friendly working capital loan schemes#SME working capital loan without collateral#quick approval working capital loan online

1 note

·

View note

Text

What is the Sell Through Rate Formula and Why It Matters

In the competitive world of retail and eCommerce, every product that sits too long on the shelf chips away at your profit margins. That’s where the Sell Through Rate Formula comes in. It’s more than just a calculation—it’s a window into the health of your inventory and the effectiveness of your sales strategy.

Whether you run a boutique, manage an online store, or oversee inventory in a large chain, understanding and applying the sell through rate formula is crucial to optimizing performance, avoiding overstock, and maximizing profit.

Understanding the Sell Through Rate Formula

The Sell Through Rate Formula is used to measure how much of your inventory has been sold within a given timeframe compared to how much stock you initially received.

The Formula:

Sell Through Rate (%) = (Units Sold ÷ Units Received) × 100

Example:

If you receive 300 units of a product and sell 210 in one month:

(210 ÷ 300) × 100 = 70%

A 70% sell-through rate indicates strong product performance, while lower percentages may point to sluggish movement or misaligned inventory planning.

Why the Sell Through Rate Formula is Crucial for Business Growth

Using the sell through rate formula regularly can help you:

Avoid Overstocking: Minimize excess inventory that drains resources.

Prevent Stockouts: Recognize when a product is moving fast and needs replenishment.

Track Product Popularity: Identify your top-sellers and slow movers.

Optimize Marketing Campaigns: Push products that need support or capitalize on hot items.

Improve Financial Planning: Align cash flow and revenue projections with actual performance.

It’s a simple yet powerful tool that drives smarter decisions across the board.

Sell Through Rate Formula vs Turnover Rate

Many people confuse the sell through rate formula with inventory turnover, but the two measure different things:

Sell Through Rate Formula tells you how much of a specific product has been sold out of the initial stock received.

Inventory Turnover measures how often you sell and replace inventory within a specific timeframe.

The key difference? Sell-through is focused on performance at the SKU level, while turnover provides a broader inventory view.

Best Practices for Using the Sell Through Rate Formula

If you want to get the most out of the sell through rate formula, follow these steps:

Track Weekly or Monthly: The shorter the timeframe, the quicker you can act.

Pair with Promotions: Analyze STR before and after campaigns to measure impact.

Monitor Across Categories: Some products will naturally have lower or higher rates.

Use Accurate Data: Always include returns and restocks to get a true reading.

Set STR Benchmarks: Know what’s considered “good” for your industry.

With regular use, the formula becomes a diagnostic tool—letting you fine-tune operations in real time.

How to Improve Sell Through Rate

Once you know how to use the sell through rate formula, here are a few proven tactics to boost your numbers:

Reposition Products: Give slow movers better visibility online or in-store.

Bundle Offers: Pair low and high STR items together in value packs.

Flash Discounts: Use limited-time deals to stimulate demand.

Improve Descriptions and Imagery: For eCommerce, this can significantly influence conversions.

Gather Customer Feedback: Understand what’s stopping people from buying.

Every improvement adds to a healthier inventory cycle and more consistent revenue.

Sell Through Rate Formula Across Different Business Types

The beauty of the sell through rate formula is its versatility. Here's how it applies across industries:

Fashion Retail: Use STR to clear seasonal collections before they go out of style.

Grocery Stores: Manage perishable items by adjusting based on weekly sell-through rates.

Electronics: Plan restocks for fast-selling gadgets and avoid obsolete tech.

Home Decor: Track which styles are trending to shape future product lines.

Online Marketplaces: eCommerce stores can manage virtual shelf space more effectively.

No matter the business, this formula helps you stay agile in a dynamic market.

Using Technology to Automate Sell Through Tracking

Manually tracking sell-through is okay when you're small—but as your business scales, automation becomes essential.

Use tools like:

POS Systems: Capture real-time sales data.

Inventory Management Software: Platforms like TradeGecko, Zoho, or NetSuite can auto-calculate STR.

Analytics Dashboards: Use Google Data Studio or Shopify Analytics for visual insights.

AI Forecasting Tools: Predict stock needs based on past STR and external market data.

These integrations help ensure you’re always working with up-to-date, actionable insights.

Conclusion

The sell through rate formula isn’t just about numbers—it’s about narrative. It tells you what your customers want, when they want it, and how you can better deliver it. By calculating, tracking, and optimizing this key metric, you gain a clear advantage in managing inventory, forecasting demand, and maximizing sales potential.

Start using the sell through rate formula regularly and watch your business become leaner, smarter, and more profitable.

FAQs

Q1: What is the sell through rate formula? A: It calculates the percentage of stock sold out of the total received during a specific time.

Q2: Why is sell through rate important? A: It helps businesses track product performance and improve inventory planning.

Q3: What is a good sell through rate? A: Typically, 70–90% is strong, but it varies by industry and product category.

Q4: How often should I calculate sell through rate? A: Weekly or monthly for best insights and timely actions.

Q5: Can I use the sell through rate formula in eCommerce? A: Absolutely—it’s crucial for tracking online product performance.

Q6: How is sell through rate different from turnover rate? A: STR focuses on how much of a received stock is sold, while turnover tracks total inventory cycles.

Q7: How do I improve sell through rate? A: Use promotions, reposition products, offer bundles, and monitor customer feedback.

Q8: What tools help automate sell through rate tracking? A: POS systems, inventory software, and analytics platforms like Shopify and Zoho.

Q9: Does seasonality affect sell through rate? A: Yes, certain times of the year will impact STR depending on product demand.

Q10: Can I use sell through rate formula for digital products? A: Yes, though it’s more relevant for physical stock, it can be adapted for digital SKUs in bundles or licenses.

0 notes

Text

Mastering Valuation: How Discounted Cash Flow Holds the Edge

When it comes to valuing a business or an investment, few methods command the respect and widespread use as the Discounted Cash Flow (DCF) analysis. Despite the emergence of newer valuation tools and models, DCF remains a cornerstone in finance for a reason—it provides a fundamental, intrinsic value based on the actual cash the business is expected to generate over time.

In an age where markets can be volatile and speculative, understanding why DCF still reigns supreme is essential for investors, analysts, and finance professionals alike. This blog unpacks the core mechanics of DCF, its advantages, and why it continues to be a trusted valuation method in today's complex financial environment.

What is Discounted Cash Flow (DCF)?

At its essence, DCF is a valuation technique that estimates the present value of an investment based on its expected future cash flows. The key idea is simple: money available today is worth more than the same amount in the future due to its earning potential—this is the time value of money.

The DCF formula discounts future cash flows back to the present using a discount rate, often the company’s weighted average cost of capital (WACC). This process accounts for risk and opportunity cost, helping investors arrive at a value that reflects both potential and uncertainty.

Why DCF is So Widely Used

Intrinsic Value Focus: Unlike market-based methods that rely on peer comparisons or multiples, DCF looks inward at the company’s own fundamentals. It isn’t swayed by market sentiment or trends.

Flexibility: DCF can be tailored to virtually any company or project, regardless of industry or size, as long as reasonable cash flow projections can be made.

Forward-Looking: Instead of relying on historical data alone, DCF forces analysts to forecast future performance, encouraging a deep understanding of the business drivers.

Risk Adjustment: By adjusting the discount rate, investors can factor in different levels of risk, making the model adaptable across sectors and economic cycles.

Breaking Down the Components of DCF

To appreciate why DCF remains a vital valuation tool, it’s important to understand its main components:

Cash Flow Projections: These are estimates of the company’s free cash flows (FCF), often forecasted over 5-10 years. Free cash flow represents the cash generated after accounting for operating expenses and capital expenditures.

Terminal Value: Since businesses often last beyond the forecast period, terminal value estimates the value of all future cash flows beyond the forecast horizon, typically calculated using a perpetuity growth model or exit multiple.

Discount Rate: This rate reflects the required return investors expect, often influenced by the risk profile of the company and market conditions.

Common Misconceptions About DCF

Many investors shy away from DCF because they view it as complicated or overly sensitive to assumptions. While it is true that small changes in inputs can significantly affect valuation, this sensitivity is a strength rather than a flaw. It forces analysts to be thorough and transparent about their assumptions.

Moreover, DCF’s complexity encourages a more disciplined investment process, one that goes beyond superficial comparisons and market hype. It demands a granular understanding of the company’s business model, competitive landscape, and growth prospects.

DCF in Today’s Market Environment

In 2025, with global markets facing inflation pressures, geopolitical tensions, and rapid technological disruptions, DCF analysis remains relevant and invaluable. Its forward-looking nature helps investors cut through noise and focus on sustainable value creation.

Recent news highlights from financial markets emphasize how volatile interest rates impact discount rates, thereby influencing valuations. For example, as central banks adjust monetary policies worldwide, companies with stable and predictable cash flows become increasingly attractive—a dynamic clearly captured in DCF models.

Additionally, sectors such as renewable energy, technology, and healthcare are seeing heightened investor interest, driven by long-term growth potential. Applying DCF analysis in these industries helps quantify that potential amid market uncertainties.

The Rise of Finance Education in the Region

With the expanding global interest in sophisticated valuation methods, the demand for finance education has surged. Professionals in regions with burgeoning financial hubs are keen to master valuation techniques like DCF.

For instance, the popularity of the online CFA course in UAE has grown remarkably, reflecting the desire among finance professionals to gain deep analytical skills that include valuation mastery. These educational programs equip candidates to confidently apply tools such as DCF in real-world scenarios, enhancing their credibility and decision-making prowess.

Practical Tips for Using DCF Effectively

To get the most out of DCF, consider these best practices:

Use Conservative Assumptions: Overly optimistic cash flow forecasts can inflate valuations. Base projections on historical data and realistic growth rates.

Stress Test Inputs: Run multiple scenarios with varying discount rates and growth assumptions to understand the range of possible valuations.

Focus on Quality of Cash Flows: Differentiate between recurring operational cash flow and one-time items.

Don’t Rely Solely on DCF: Use it in conjunction with other valuation methods to get a holistic view.

Limitations to Keep in Mind

Despite its advantages, DCF is not without limitations:

Dependence on Estimates: Future cash flows are uncertain, and errors in projections can lead to inaccurate valuations.

Terminal Value Sensitivity: Often, a large portion of valuation comes from terminal value, which can be speculative.

Complexity: Requires deep understanding and data availability, which might be challenging for some businesses.

Why DCF Remains an Authority in Valuation

The staying power of DCF comes from its grounding in finance theory and practical utility. It directly links valuation to the fundamental cash-generating capacity of the business, which is the ultimate driver of shareholder value. For finance professionals aiming to sharpen their valuation expertise, the CFA curriculum 2025 offers a deeper, more updated approach to mastering key financial concepts like DCF. With its expanded focus on practical applications and real-world case analysis, the curriculum equips candidates for roles in investment banking, equity research, and portfolio management—where valuation acumen is essential.

Final Thoughts

Discounted Cash Flow analysis is far from obsolete; in fact, it’s more relevant than ever. Its ability to adapt to various industries, incorporate risk, and provide intrinsic valuations makes it indispensable in today’s investment toolkit.

As global finance professionals increasingly embrace rigorous valuation standards, education and practical application of DCF continue to grow, especially in fast-evolving markets. Whether you are an investor, analyst, or student, mastering DCF can elevate your financial insight and decision-making.

The method’s durability proves that when it comes to valuing assets, understanding the true worth beneath market noise will always matter. DCF doesn’t just survive—it thrives as the gold standard for valuation.

0 notes

Text

A Business Owner's Guide to Valuing and Selling Your Company in NJ

Deciding to sell your business is a significant milestone, often marking the end of one journey and the start of another. For many New Jersey business owners, it’s a once-in-a-lifetime decision—one that comes with complex emotions and critical financial implications. Whether you're planning for retirement, shifting focus, or responding to market conditions, preparing well in advance ensures a smoother, more rewarding outcome.

At the heart of the process lies a pivotal consideration: Finding The Right Buyer who not only offers the right price but also aligns with your business’s future vision and values.

Understanding Business Valuation Basics

Before listing your business for sale, it's essential to understand how much it's truly worth. Valuation isn't a one-size-fits-all formula—it varies depending on your industry, revenue model, assets, liabilities, and growth potential.

Here are common valuation methods used:

Earnings Multiple Approach: Often based on EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiplied by an industry benchmark.

Asset-Based Valuation: Focuses on tangible and intangible assets minus liabilities, used more for asset-heavy businesses.

Market Comparison: Compares your business to recent sales of similar companies within your industry and region.

Discounted Cash Flow (DCF): Projects future earnings and discounts them to present value. This method is best suited for high-growth companies.

Working with a professional appraiser or M&A advisor ensures your valuation is credible and defensible when negotiating with potential buyers.

Preparing for Sale: What Buyers Look For

Prospective buyers—whether individuals, private equity firms, or strategic acquirers—will be evaluating your business through a critical lens. Preparing in advance not only boosts value but also increases buyer confidence.

Key Areas to Focus On:

Clean Financial Records Accurate, up-to-date financial statements and tax returns are non-negotiable. Consider having them reviewed or audited by a certified accountant.

Operational Efficiency Documented processes, strong supply chain management, and scalable systems are all signs of a healthy business.

Customer Diversification A business that relies heavily on one or two clients is riskier than one with a diversified customer base.

Strong Management Team Buyers want assurance that the business can run smoothly without you. Invest in leadership development and consider succession planning.

Legal and Regulatory Compliance Clean up any outstanding legal issues, ensure licenses are current, and confirm compliance with employment laws and industry regulations.

Choosing the Right Exit Strategy

There are several pathways to sell your business. The best option depends on your personal goals, business structure, and timing.

Options Include:

Full Sale to a Third Party: This is the most straightforward option and may offer the highest immediate return.

Management Buyout (MBO): Existing management takes over ownership, preserving continuity.

Sale to a Strategic Buyer: Often a competitor or industry player, this buyer sees value beyond the financials.

Private Equity Recapitalization: You sell a portion of the company, often remaining involved as it grows under new investment.

Each exit option presents different tax implications, payout timelines, and levels of involvement post-sale.

Navigating the Due Diligence Process

Once a buyer expresses serious interest, the due diligence process begins. This is where all aspects of your business are reviewed in detail, from financial performance and legal standing to employee agreements and vendor contracts.

To streamline due diligence:

Prepare a data room with all critical documents

Be transparent about risks and challenges

Have advisors—legal, financial, and tax—on hand for quick response

Buyers are more likely to move forward when the process is organized and transparent.

Working With the Right Advisors

Selling a business involves legal, financial, and operational expertise. Assembling a trusted advisory team can help you avoid costly mistakes and make informed decisions.

Your ideal advisory team may include:

M&A Advisor or Business Broker: Helps identify potential buyers, market the business, and negotiate terms.

CPA or Financial Advisor: Prepares financials and advises on tax strategy.

Business Attorney: Drafts and reviews legal documents and ensures regulatory compliance.

Wealth Advisor: Helps plan for life after the sale and manage newfound assets.

With the right support, you're more likely to achieve a sale that meets both your financial and emotional goals.

Conclusion

Successfully selling your company is about more than a valuation figure—it's about ensuring your business transitions into the right hands and continues to thrive. The process can be lengthy and complex, but thoughtful preparation, realistic expectations, and Finding The Right Buyer will ensure that the legacy you've built is preserved and rewarded.

By starting early, assembling a strong advisory team, and staying aligned with market dynamics, New Jersey business owners can secure not only a profitable exit—but also peace of mind.

0 notes

Text

How to Excel in Financial Modeling for Delhi Businesses

Introduction

Financial modeling is a crucial skill for businesses in Delhi aiming to manage finances, predict future performance, and make informed decisions. Mastering financial modeling requires strategic learning, practical application, and industry-specific knowledge. This guide outlines key strategies for excelling in financial modeling in Delhi's dynamic business environment.

1. Understand the Fundamentals of Financial Modeling

To build a strong foundation in financial modeling, you must understand the core concepts:

Financial Statements: Master the income statement, balance sheet, and cash flow statement.

Forecasting Techniques: Develop skills in projecting future revenue, expenses, and cash flow.

Valuation Methods: Learn methods such as Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), and Precedent Transactions.

2. Gain Proficiency in Excel

Excel is the primary tool used for financial modeling. Focus on mastering these Excel skills:

Advanced Functions: Learn key formulas like VLOOKUP, HLOOKUP, INDEX-MATCH, and IFERROR.

Data Analysis Tools: Familiarize yourself with PivotTables, Power Query, and data visualization tools.

Automation Skills: Develop knowledge of macros and VBA for efficient modeling.

3. Develop Industry-Specific Knowledge

Delhi's business landscape is diverse, with key industries such as:

IT and Technology: Understand SaaS revenue models and IT expenditure analysis.

Retail and E-commerce: Focus on inventory turnover, customer acquisition costs, and sales forecasts.

Hospitality and Real Estate: Master occupancy rates, RevPAR, and property valuation models.

4. Practice Real-World Financial Models

Building practical models for Delhi-based businesses enhances learning. Focus on:

Startup Financial Projections: Craft detailed financial forecasts for new ventures.

Budgeting and Forecasting Models: Develop annual budgets with scenario analysis.

Investment Analysis Models: Create models that assess the viability of expansion or acquisitions.

5. Utilize Online Resources and Courses

Many educational platforms provide specialized financial modeling courses for Delhi professionals:

Coursera and Udemy: Offer comprehensive courses in financial modeling.

Delhi-based Institutes: Institutions like IMS Proschool, CFI, and BSE Institute provide hands-on training.

6. Network with Financial Experts in Delhi

Networking provides insights into market trends, industry challenges, and emerging opportunities. Attend:

Financial Workshops: Events hosted by organizations like NASSCOM and TiE Delhi-NCR.

Industry Seminars: Forums discussing economic trends impacting Delhi businesses.

7. Stay Updated with Financial Trends in Delhi

Delhi's economic landscape is dynamic, with changing policies and emerging sectors. Follow:

News Portals: Platforms like Economic Times and Business Standard for local updates.

Market Reports: Research on industry growth patterns in Delhi.

8. Leverage Financial Modeling Software

In addition to Excel, explore software like:

Tableau: For data visualization and analytics.

Power BI: For advanced reporting and business intelligence.

QuickBooks and Tally: For financial management in Delhi's small to medium enterprises.

9. Develop Presentation Skills

Financial modeling isn't just about numbers; effective presentation ensures insights are actionable. Focus on:

Storytelling with Data: Use charts and graphs to convey insights clearly.

Clear Visuals: Avoid cluttered spreadsheets; highlight key metrics effectively.

10. Gain Certification in Financial Modeling

Obtaining a certification adds credibility and enhances career opportunities. Recommended certifications include:

**Financial Modeling and Valuation Analyst (FMVA)

Chartered Financial Analyst (CFA)

Certified Management Accountant (CMA)

Conclusion

Excelling in financial modeling for Delhi businesses requires technical expertise, industry knowledge, and strategic application. By mastering Excel, practicing real-world models, and staying informed about Delhi's economic trends, you can create powerful financial models that drive business growth and success.

0 notes

Text

Think You Know Valuation? These 10 Business Valuation Myths Might Prove You Wrong!

Business valuation is often seen as a straightforward process—plug in some numbers, apply an industry multiple, and there you have it, a precise valuation. But the reality? It’s far more complex.

For business owners and investors in dynamic markets like Dubai and Abu Dhabi, understanding business valuation is crucial. Whether you’re planning an acquisition, securing funding, or preparing for an exit, separating fact from fiction ensures sound decision-making.

Let’s uncover some of the most common myths surrounding business valuation and what truly determines the worth of a business.

Common Business Valuation Myths That Can Derail Your Strategy

Myth 1: Business Valuation is Just a Simple Calculation

Reality: Business valuation is an in-depth analysis, not a single formula.

Many assume that business valuation in Dubai and Abu Dhabi follows a one-size-fits-all approach—apply a revenue multiple, and the valuation is set. In reality, professional valuation considers multiple factors, including financial performance, economic trends, market conditions, and company-specific risks. Expert judgment plays a key role in determining an accurate valuation.

Myth 2: The Value of a Business Equals Its Book Value

Reality: Book value is just an accounting metric, not market value.

Book value reflects net assets based on historical costs but does not account for intangible assets such as brand equity, customer relationships, and intellectual property. A comprehensive business valuation in Abu Dhabi or Dubai assesses both tangible and intangible assets to determine a fair market price.

Myth 3: Valuation and Price Are the Same

Reality: Price is what you pay; value is what the business is worth.

Valuation estimates a business’s worth based on objective analysis, but the actual transaction price depends on negotiations, buyer motivations, and market conditions. Business valuation in Dubai considers factors like synergies, strategic fit, and deal structures, all of which influence the final sale price.

Myth 4: Business Value is Determined Solely by Past Performance

Reality: Future growth potential is a major driver of valuation.

While historical financials provide insights, investors focus on future cash flow and growth opportunities. Business valuation in Abu Dhabi often incorporates forward-looking projections, industry trends, and risk assessments to determine a business’s true worth.

Myth 5: Only Large Companies Need Valuation

Reality: Businesses of all sizes benefit from valuation.

Small and medium enterprises (SMEs) often assume valuation is only necessary for large corporations. However, business valuation in Dubai is essential for fundraising, securing loans, exit strategies, and making strategic decisions, regardless of company size.

Myth 6: Industry Multiples Give the Most Accurate Valuation

Reality: Multiples provide a benchmark, not a definitive valuation.

While industry multiples offer a quick estimate, they don’t capture company-specific strengths and risks. A thorough business valuation in Abu Dhabi uses multiple approaches, including discounted cash flow (DCF), asset-based valuation, and market comparables, to ensure accuracy.

Myth 7: If Two Businesses Have the Same Revenue, They Have the Same Value

Reality: Profitability, risks, and operational efficiency matter.

Two businesses with similar revenue may have vastly different valuations due to variations in margins, cost structures, customer retention, and competitive positioning. A high-revenue business with weak profitability may be worth less than a leaner, more profitable company.

Myth 8: A Business’s Value is Static

Reality: Valuation fluctuates with market dynamics.

Economic conditions, industry shifts, and internal performance affect valuation over time. Regular business valuation in Dubai helps track changes and identify opportunities for growth or restructuring.

Myth 9: Valuation is Only Needed When Selling a Business

Reality: Valuation is critical for strategic planning and compliance.

Beyond mergers and acquisitions, business valuation in Abu Dhabi plays a role in investment decisions, shareholder agreements, financial reporting, and legal matters. Understanding a company’s worth aids in effective decision-making at all stages.

Myth 10: Higher Valuation Means More Success

Reality: Overvaluation can be just as damaging as undervaluation.

An inflated valuation can deter investors and lead to failed transactions, while undervaluation means leaving money on the table. A well-balanced valuation ensures fair negotiations and sustainable business growth.

From Business Valuation Myths to Market Reality

Business valuation isn’t just about crunching numbers—it’s a strategic process. Misconceptions, such as equating book value with market value or assuming valuation dictates the final price, can lead to costly mistakes.

For businesses in Dubai and Abu Dhabi, an informed approach to valuation ensures stronger negotiations and better financial outcomes. Whether you’re preparing for a sale, seeking investors, or planning long-term growth, understanding valuation’s key drivers is essential.

MS: Your Trusted Partner for Accurate Business Valuation in Dubai & Abu Dhabi

At MS, we provide expert business valuation services tailored to your specific needs. We go beyond industry benchmarks and standard formulas to deliver precise, insightful valuations that reflect real market conditions. Whether you’re buying, selling, or strategizing for growth, our team ensures that your valuation is free from myths and based on actual business potential.

Get in touch with us to uncover the true value of your business today.

0 notes

Text

The Benefits of Using Retail POS for Inventory and Sales Tracking

Why Retail POS Systems Are Your Store’s Secret Weapon

Imagine running a retail business without knowing exactly what’s selling, what’s collecting dust, or how much cash flow you’re losing to manual errors. Scary, right?

That’s where a Retail POS (Point of Sale) system transforms chaos into clarity.

Let’s break down why modern retailers—from boutique shops to mega-chains—are ditching spreadsheets and embracing POS tech to dominate inventory and sales tracking.

1. Real-Time Inventory Tracking: No More “Out of Stock” Surprises

A Retail POS system acts like a 24/7 inventory detective. Here’s how:

Automated Updates: Every sale, return, or exchange updates stock levels instantly.

Low-Stock Alerts: Get notified before your bestselling lipstick or sneakers run out.

Multi-Location Sync: Manage warehouse vs. store inventory seamlessly.

2. Sales Analytics That Actually Make Sense

Retail POS systems turn raw data into actionable insights.

Top-Selling Products: Spot trends (e.g., “Organic skincare sells 2x faster on weekends”).

Customer Behavior: Track peak shopping hours, average basket size, and loyalty program engagement.

Employee Performance: See who’s upselling like a pro and who needs training.

“Data doesn’t lie—it just needs the right tools to speak.”

3. Reduce Human Error (Because Nobody’s Perfect)

Manual entry = Typos, mismatched prices, and receipt disasters. A POS system fixes this with:

Barcode Scanning: Eliminate pricing errors.

Automated Tax Calculations: GST, VAT, or sales tax—done right, every time.

Integrated Sales Reports: No more Excel formulas gone wrong.

Did you know? 47% of retailers say inventory inaccuracies cost them sales. A POS system slashes this risk.

4. Boost Customer Experience Without the Guesswork

Your POS isn’t just for you—it’s for your customers too.

Fast Checkouts: Scan, pay, done. No queues, no frustration.

Personalized Promotions: Use purchase history to offer tailored discounts (e.g., “Loved those jeans? Here’s 15% off matching tops!”).

Omnichannel Sync: Let shoppers buy online, return in-store, or vice versa.

Pro Tip: 68% of customers pay more for brands that personalize their experience.

5. Scalability: Grow Without the Growing Pains

Whether you’re a startup or a retail giant, POS systems adapt to your size:

Add New Stores/Counters: Integrate locations in minutes.

Seasonal Flexibility: Handle holiday rushes without hiring temp staff for data entry.

Third-Party Integrations: Plug into e-commerce platforms (Shopify, WooCommerce) or accounting tools (QuickBooks).

6. Security: Protect Your Business (and Your Customers)

Retail POS systems guard against:

Theft: Track suspicious voids or discounts.

Data Breaches: Encrypt customer payment info.

Audit Risks: Maintain GST-compliant records for 6+ years effortlessly.

Why GinesysOne is the Retail POS Partner You Need?

At Ginesys, we’ve spent decades perfecting retail tech, and GinesysOne is our crown jewel.

Here’s how it stands out:

Unified Platform: Manage inventory, sales, CRM, and accounting in one place.

AI-Driven Insights: Predict demand, optimize stock, and automate reordering.

Built for India: Handle GST filings, multi-state tax rules, and compliance effortlessly.

Omnichannel Mastery: Sync physical stores, websites, and marketplaces like Amazon/Flipkart.

Why settle for basic POS when you can have a retail revolution?👉 Explore GinesysOne: https://www.ginesys.in/

0 notes

Text

Optimizing Working Capital for Businesses Across the Nation

Working capital is the lifeblood of any business, ensuring smooth day-to-day operations and financial stability. It represents the difference between a company’s current assets and liabilities, influencing its liquidity, efficiency, and short-term financial health. Optimizing working capital is essential for sustaining growth, improving profitability, and maintaining financial resilience in an increasingly competitive market.

This article explores effective strategies for managing and optimizing working capital, helping businesses across the nation stay financially agile.

Understanding Working Capital

Working capital for large business is a key financial metric that determines a company's ability to meet short-term obligations and fund operations. It is calculated using the following formula:

Working Capital = Current Assets - Current Liabilities

A positive working capital indicates that a business has enough resources to cover its short-term liabilities, whereas a negative working capital can signal potential liquidity challenges.

Importance of Optimizing Working Capital

Effective working capital management ensures a business remains financially healthy while improving cash flow and operational efficiency. Benefits of optimizing working capital include:

Improved Liquidity: Ensures businesses can meet their obligations without disruption.

Better Operational Efficiency: Enhances inventory management, accounts payable, and receivable processes.

Financial Stability: Helps businesses withstand economic downturns and unforeseen financial challenges.

Higher Profitability: Reduces costs associated with interest and borrowing while maximizing cash flow.

Strategies for Optimizing Working Capital

1. Improve Accounts Receivable Management

Accounts receivable plays a crucial role in working capital optimization. Businesses should focus on reducing the time taken to collect payments from customers by:

Establishing clear payment terms and policies.

Offering early payment incentives.

Automating invoicing and payment reminders.

Conducting regular follow-ups on outstanding invoices.

Utilizing credit checks to assess customers’ payment reliability before extending credit.

2. Streamline Accounts Payable Process

While collecting receivables faster is important, businesses should also strategically manage their accounts payable to maintain liquidity. Key approaches include:

Negotiating favorable payment terms with suppliers.

Taking advantage of discounts for early payments where possible.

Avoiding late payment penalties and interest charges.

Automating payments to ensure accuracy and efficiency.

3. Optimize Inventory Management

Inventory is a major component of working capital, and inefficient inventory management can tie up significant cash. Businesses should:

Implement just-in-time (JIT) inventory strategies to reduce excess stock.

Leverage demand forecasting techniques to optimize stock levels.

Use inventory management software to track real-time stock movement.

Regularly review slow-moving or obsolete inventory and adjust purchasing strategies accordingly.

4. Enhance Cash Flow Forecasting

Accurate cash flow forecasting helps businesses anticipate future cash needs and avoid liquidity crises. To improve forecasting:

Monitor cash inflows and outflows regularly.

Identify seasonal fluctuations and plan accordingly.

Use financial modeling to predict potential cash shortfalls.

Establish emergency funds for unexpected expenses.

5. Reduce Unnecessary Expenses

Cost-cutting is a crucial element in optimizing working capital. Businesses can achieve this by:

Reviewing operational expenses to identify cost-saving opportunities.

Outsourcing non-core activities to reduce overhead.

Implementing energy-saving measures to lower utility costs.

Renegotiating contracts with vendors and service providers.

6. Access Working Capital Financing Wisely

While businesses should focus on internal optimizations, external financing options can help manage Unsecured Personal Loans gaps. Common financing solutions include:

Short-term business loans to cover immediate cash flow needs.

Invoice factoring to receive immediate cash against outstanding invoices.

Business lines of credit for flexible access to funds.

Trade credit agreements with suppliers to extend payment terms.

7. Leverage Technology for Efficiency

Technology can significantly improve working capital management by automating financial processes and reducing manual errors. Businesses can:

Implement enterprise resource planning (ERP) systems to integrate financial data.

Use cloud-based accounting software for real-time cash flow monitoring.

Adopt digital payment solutions to expedite transactions.

Challenges in Managing Working Capital

Despite the benefits of working capital optimization, businesses often face challenges such as:

Economic Uncertainty: Market fluctuations can impact cash flow and demand forecasting.

Customer Payment Delays: Late payments from customers can strain cash reserves.

Supplier Constraints: Dependence on a few suppliers can lead to disruptions in procurement.

Operational Inefficiencies: Poor coordination between departments can slow down financial processes.

To overcome these challenges, businesses must adopt proactive financial management strategies and continuously refine their working capital processes.

Conclusion

Optimizing working capital for business nationwide is essential for businesses of all sizes to maintain financial health, improve cash flow, and drive sustainable growth. By managing accounts receivable and payable efficiently, optimizing inventory, leveraging technology, and forecasting cash flows accurately, businesses can enhance their liquidity and profitability.

Implementing these strategies will help businesses across the nation navigate financial challenges and build a strong foundation for long-term success. Prioritizing working capital management ensures stability and resilience, enabling companies to seize growth opportunities while mitigating financial risks.

0 notes

Text

The value of money does not remain the same at all points of time. The money available at the present time is worth more than the same amount in the future. Itt has the potential to earn returns (or interest as the case may be).

Consider the following options, assuming there is no uncertainty associated with the cash flow: Receiving Rs.100 now. Receiving Rs.100 after one month. All investors would prefer to receive the cash flow now. Rather than wait for a month, though the amount to be received has the same value. This preference is attributed to the following reasons:

Instinctive preference for current consumption over future consumption.

The Ability to invest the Rs.100 for a month like a bank account or deposit. It earn a return so that it grows in value to more than Rs. 100 after one month. Clearly, Rs.100 available now is not equivalent to Rs.100 received after a month. The value associated with the same sum of money received at various points on the timeline is called the time value of money (popularly known as TVM). The time value of money received in earlier periods as compared to that received in later time periods will be higher. Since most decisions in finance involve cash flows spread over more than one period (monthly, quarterly, yearly etc.). The time value of money is a key principle in financial decision-making.

Present value

Present value is the amount that you would pay today for a cash flow that comes in the future. It brings the future value down to today’s price. It is based on the basic principle of time value of money that value of money keeps reducing as time passes. There are two ways in which the present value can be calculated. If there is a future value that has been given then this can be brought to the present by discounting it by the rate of return. This will give an idea of what the value of the future amount is worth today.

PV = FV/(1+r)^n Where FV= Future Value

PV= Present Value

r = rate of return for each compounding period

n = number of compounding periods For a one time receipt,

PV is calculated as per the following formulae:

PV = C/(1+r)^n

In case of a regular cash flow the present value can be calculated by the following formula

PV = C * ((1-(1/(1+r)^n))/r) Where C is the regular cash flow

Please go to the above link to read the full article. Thanks for reading

#timevalueofmoney#howtocalculatetimevalueofmoney#how to calculate present value#how to calculate present value of annuities#personal finance#personalfinanceplans#mathskills#mathematics#math of financial#financial math#stock market ofindia#stock market math

0 notes

Text

Financial Modeling Specialist: The Backbone of Investment and Business Decision-Making

The leading type of modeling known as financial modeling is mainly seen in investment banking, corporate finance, and financial analyzing. A financial modeling expert works in financial projections, analyzing investment opportunities, and other business decisions. These people build models that businesses use to assess risk, forecast growth, and optimize performance.

In this information-oriented world, the significance of financial models in corporate and individual investment decisions is becoming increasingly critical. The functions of a financial modeling specialist would have included company valuation, mergers and acquisitions, or perhaps predicting future cash flows; they are instrumental in the financial industry itself.

This blog discusses the roles of financial modeling specialists, what those specialists are, the skills, career opportunities available, and why it has become a huge demand.

What is a Financial Modeling Specialist?

A financial modeling specialist is an expert who creates and interprets the model for a company when the organization calibrates its performance against expected standards determined by an investment grouping. They also evaluate by financial, cost, and benefit analysis the attractiveness of new investment opportunities and decision-making support for corporate choices. These professionals tend to work for investment banks, private equity firms, corporate finance, or financial consulting institutions.

Their major undertaking is the construction of models which would represent a company's changing financial position over time and predict its future performance based on a variety of assumptions. Such models assist investment decisions in the following ways-they help determine profitability, market trends, and potential risks involved before any investment judgments are made.

Key Roles of a Financial Modeling Specialist

Building Financial Models - Developing models for understanding how a company will perform over time, forecasting future earnings, and performing valuations.

Company Valuation - Quantifying values of firms using methods including Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), and Precedent Transactions.

Risk Analysis - Assessing and avoiding financial threats with sensitivity analysis and scenario planning.

Investment Analysis - Analyzing supporting investment undertakings with mergers and acquisitions and setting up venture capital funding.

Budgeting and Forecasting - Imparting financial guidance in planning and allocation of resources.

Capabilities Required for Financial Modeling Specialist

A financial modeling practitioner excels in the combination of the analytical and technical side. The fundamental skills include:

1. Strong Financial Knowhow

He/she should have a good level of understanding of financial statements, accounting principles, and valuation techniques.

2. Advanced Excel Skills

Microsoft Excel is financial modeling's main software tool. These specialists should demonstrate proficiency in formulas, pivot tables, and data visualization.

3. Business Acumen

Following how the market is going, how an industry market is performing, and the economic factors affecting it will help in realistically preparing each financial model.

4. Problem-Solving

A financial model looks at projections formed by many variables. A strong analytical mind and good problem-solving ability are necessary.

5. Communication and Presentation Skills

Models must present data clearly and simply for those trying to understand them, such as investors, executives, and financial analysts.

Financial Modeling in Business and Investment Contexts

Generally speaking, it finds diverse applications in all forms of financial decision-making. It hardly has spare time in:

Investment Banking - Refers to building the deals, IPOs, and M&A transactions.

Corporate Finance - Refer to the financial planning and monitoring of performance.

Private Equity & Venture Capital - Examines startups and their investment outcomes.

Risk Management - By identifying financial risks, making attempts to mitigate losses from the occurrence of such risks.

Job Opportunities for Financial Modeling Specialist

The appetite for specialist skills in financial modeling is becoming larger in most sectors. Careers available for financial modeling experts include:

Investment Banking -interest in merger and acquisition or financial advisory.

Equity Research - concerning trends in the stock market and performance of the companies

Corporate Finance - would manage the financial planning and budget.

Financial Consulting - consulting business firms on financial strategy.

Private Equity & Hedge Funds - concerns assessing investments.

The opportunities nationwide for financial modeling professionals in India are growing phenomenally.

The Indian financial sector is expanding rapidly with investments flowing into various sub-functions- fintech, banking, and corporate finance. The demand for financial modeling specialists in the Indian market has emerged with companies now concerned about data-driven decision-making.

Factors Responsible for Growth in Financial Modelling Jobs in India

Excellent Opportunity - Increasing venture capital investment requires strong financial modeling for funding decisions.

Private Equity and M&A Escalating - Assessment of acquisition targets and movement in the marketplace from the acquisition standpoint is sought by companies more than ever.

Corporate Finance-Growth-Unprecedented- That means all companies are now looking at financial performance and require financial analysts.

Pune: India's Growing Financial Hub

Pune is now becoming a strong financial and educational hub for investment firms, fintech startups, and multinationals. As such, skilled finance professionals have ample opportunities to exploit in the city, whereas opportunities for aspiring financial modeling specialists are boundless.

There exist highly structured training programs, like the Top Investment Banking Courses in Pune, to benefit practitioners wishing to upgrade themselves with knowledge in financial modeling, valuation, and investment strategy. These courses equip candidates with the necessary expertise to thrive in investment banking and corporate finance.

Conclusion

A Financial Modeling Specialist is significant in investment banking, corporate finance, and making accurate business decisions. As firms increasingly lean toward data-driven insights, the need for qualified professionals in this domain increases. The financial sector in India is expanding rapidly, putting plenty of job opportunities into any professional concerned with finance. Pune, with its evolving financial ecosystem, is fast becoming a preferred destination for finance aspirants. As such, professionals are encouraged to attend the Best Investment Banking Course in Pune to sharpen their market-ready skills in financial modeling, valuation, and investment strategy.

0 notes

Text

How Generative AI is Revolutionizing Financial Modeling in Investment Banking

Investment banking has always been about precision, speed, and strategic decision-making. At the heart of this industry lies financial modeling—the art and science of translating raw data into insights that can make or break multi-million-dollar deals. But as the complexity of markets grows, so does the need for better, faster tools.

Enter Generative AI—the latest technological leap that’s turning heads across global investment firms. While artificial intelligence has already made waves in areas like algorithmic trading and credit risk assessment, Generative AI is now poised to transform how investment bankers create and interpret financial models.

And if you're an aspiring professional aiming to thrive in this rapidly evolving industry, enrolling in a top-tier investment banking course in Dubai can give you the competitive edge to master both traditional finance and the AI-powered future.

What is Generative AI and Why Does It Matter?

Generative AI refers to advanced machine learning models (like ChatGPT, Claude, or custom LLMs) that can generate content, simulate scenarios, and interpret complex data inputs. In finance, these models are being trained to produce accurate forecasts, dynamic financial models, risk assessments, and even write investment memos.

Imagine typing:“Build a 5-year DCF model for a SaaS company with 20% YoY growth and 70% gross margin.”And having an AI instantly generate the model with charts, analysis, and commentary.

That’s not the future—it’s happening now.

The Traditional Challenges in Financial Modeling

Before we dive into how generative AI solves problems, let's briefly understand what makes financial modeling so labor-intensive:

Time-consuming: Creating models from scratch takes hours or days

Error-prone: Manual data entry and formula errors can lead to costly mistakes

Complexity: Modeling for M&A, IPOs, or LBOs often requires deep sector expertise and constant revisions

Limited scenario flexibility: Testing multiple variables and assumptions manually can be overwhelming

Generative AI is eliminating these barriers by offering speed, accuracy, and adaptability.

Applications of Generative AI in Financial Modeling

1. Automated Model Generation

With tools like OpenAI’s Codex and Microsoft Excel integrations, generative AI can now auto-generate financial models based on minimal prompts. Whether it's a Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), or Leveraged Buyout (LBO) model, AI can build templates faster than any junior analyst.

Real-World Use Case:Firms like Morgan Stanley are building internal AI copilots to assist analysts with model building and interpretation—reducing workload and minimizing human error.

2. Scenario Simulation & Forecasting

One of the biggest advantages of generative AI is its ability to simulate multiple “what-if” scenarios:

What if interest rates rise 2%?

What if EBITDA margins shrink by 5%?

What if the client merges with a competitor?

Generative AI can model out these scenarios instantly, providing bankers with deeper insights for client presentations and investment strategies.

3. Data Cleaning and Integration

Before any model can be built, raw data must be cleaned, organized, and contextualized. Generative AI can now help:

Clean historical financial statements

Match data from multiple sources

Identify outliers or inconsistencies

This automates the grunt work and lets analysts focus on strategy and interpretation.

4. Narrative Generation and Executive Summaries

Investment banking isn't just about numbers—it's about storytelling. After building a model, bankers often need to prepare detailed decks and executive summaries for clients or boardrooms.

Generative AI tools can now automatically generate summaries, investment memos, and even pitchbook outlines based on the model outputs.

Imagine having AI write:“This model suggests a 14% IRR under the base case scenario, with upside potential reaching 20% under favorable market conditions.”

It’s not science fiction—it’s productivity reimagined.

The Human + AI Partnership

While Generative AI can do a lot, it’s not replacing investment bankers anytime soon. The human judgment, domain expertise, and strategic thinking required in investment banking are still irreplaceable. But AI is becoming the ultimate assistant—cutting time, increasing accuracy, and amplifying human potential.

To thrive in this new era, professionals need to combine financial modeling skills with a working knowledge of AI. And that’s where an investment banking course in Dubai becomes invaluable.

Why Dubai is Emerging as a Fintech and Investment Hub

Dubai is no longer just a business gateway between East and West—it’s quickly becoming a global center for finance and technology. With strategic initiatives like the DIFC Innovation Hub and partnerships with AI startups, the city is positioning itself as a leader in AI-powered finance.

By choosing an investment banking course in Dubai, students can:

Learn traditional and modern modeling techniques side by side

Get hands-on experience with AI tools used by top firms

Network with professionals at the forefront of fintech innovation

Participate in real-world case studies involving AI in finance

One such program is offered by the Boston Institute of Analytics, which blends core financial skills with modern tools like Python, Tableau, and AI-based modeling platforms.

What You’ll Learn in an AI-Integrated Investment Banking Course

A future-ready investment banking course in Dubai will cover:

Financial Statement Analysis

Valuation Techniques (DCF, CCA, Precedent Transactions)

M&A and IPO Modeling

AI Tools for Forecasting and Scenario Simulation

Generative AI Applications in Finance

Pitchbook and Deal Deck Preparation

Real-life case studies and simulations

By the end of the course, students don’t just know Excel—they’re ready to work with AI-powered platforms and solve complex problems in real-time.

Challenges and Ethical Considerations

Generative AI isn’t without its pitfalls:

Overreliance on automation can lead to missed context

Data bias or poor training sets can skew predictions

Confidentiality risks exist when working with sensitive financial data

Hence, ethical use, governance frameworks, and human oversight must remain central—something that a structured course will emphasize.

Conclusion: Are You Ready for the AI-Powered Future of Finance?

Generative AI is rewriting the rules of financial modeling, and investment bankers who embrace this technology will be at the front of the new financial revolution.

If you're looking to future-proof your career, now is the time to act. Enroll in an investment banking course in Dubai that prepares you for the AI-integrated finance world—with a curriculum that’s global in scope, cutting-edge in content, and deeply practical in approach.

0 notes

Text

Discover the Power of Discounted Cash Flow Analysis

Our DCF tools are designed for accuracy and ease of use, helping you evaluate financial decisions with confidence. Whether you’re a seasoned investor or just beginning to explore financial analysis, our tools simplify the process.

With Cash GPS’s DCF solutions, you can:

Accurately calculate the present value of future earnings.

Evaluate investments and business opportunities with precision.

Make informed decisions backed by reliable data.

Why choose our Discounted Cash Flow?