#calculation of discounted cash flow

Explore tagged Tumblr posts

Text

#discounted cash flow#cash flow#why DCF important#uses of discounted cash flow#formula of discounted cash flow#calculation of discounted cash flow

0 notes

Text

A Guide for Local Business Owners

Running a local business can be both exciting and challenging. Whether you're just starting out or looking to grow, understanding key strategies is essential for success. This guide will cover important aspects to help you thrive in your community.

How Do I Make My Local Business Successful?

Know Your Customers: Understand who your target audience is. Use surveys or social media to gather insights about their preferences and needs. Tailoring your offerings can make a big difference.

Build Your Brand: Your brand is your business identity. Create a memorable logo and consistent messaging that reflects your values. A strong brand helps you stand out in a crowded market.

Leverage Digital Marketing: Having an online presence is crucial. Use social media to connect with customers and local SEO strategies to increase your visibility. Consider partnering with a professional SEO service to boost your online reach.

Engage with the Community: Being active in your local area can attract customers. Sponsor events or collaborate with other businesses to build goodwill and increase brand awareness.

Prioritize Customer Service: Exceptional service keeps customers coming back. Train your staff to provide a positive experience and actively seek customer feedback to improve.

How to Value a Business: A Simple Guide

Asset-Based Valuation: Calculate the total value of your assets (like inventory and equipment) and subtract your liabilities to determine your net worth.

Earnings Multiplier: Look at your average annual earnings and multiply it by an industry-specific multiplier. This can give you an estimate of your business's worth.

Market Comparison: Research recent sales of similar businesses in your area to gauge what buyers are willing to pay.

What Do Local Business Owners Want?

Increased Customers: Attracting more foot traffic is a priority. Effective marketing strategies are essential for this.

Financial Stability: Many aim for consistent cash flow and profitability. They value resources and tips for financial management.

Networking Opportunities: Building relationships with other local businesses can lead to valuable partnerships and referrals.

Support and Resources: Access to training and mentorship can help business owners navigate challenges effectively.

How Do You Attract Customers?

Optimize Your Online Presence: Ensure your website is user-friendly and mobile-responsive. Use local SEO techniques to improve your search rankings.

Utilize Social Media: Engage with your community on platforms like Facebook and Instagram. Share promotions, updates, and showcase your products.

Offer Promotions: Limited-time discounts can entice new customers. Consider implementing a loyalty program to reward repeat business.

Encourage Reviews: Positive reviews can greatly influence potential customers. Ask satisfied clients to leave feedback on platforms like Google and Yelp.

Conclusion

Running a successful local business takes effort and commitment. By knowing your market, valuing your business correctly, and effectively attracting customers, you can create a thriving enterprise. Your community is your greatest asset—engage with it, and watch your business flourish! For professional assistance in enhancing your online presence, reach out to a reliable SEO service

#local seo#seo strategy#seo expert#seo specialist#Local caitation#local citations#backlinks#professional seo services#on page seo#off page optimization#technical seo#A Guide for Local Business Owners

2 notes

·

View notes

Text

Finance 101 for marketers

In the world of business, it is common for specialized departments to operate in their silos. One notable example is the marketing team, which often focuses on brand building, creative and customer engagement, sometimes at the expense of a deeper understanding of the broader business and commercial workings of the company. This gap can lead to misaligned strategies and lost opportunities.

These are some of the common terms that I have come across over the past decade that every marketer should have a basic understanding.

GMV (Gross Merchandise Volume): This is the total sales value of merchandise sold through a particular marketplace over a specific time period. It measures the size of a marketplace or business, but not the company's actual revenue since it doesn't account for discounts, returns, etc.

Revenue: This is the total amount of income generated by the sale of goods or services related to the company's primary operations.

COGS (Cost of Goods Sold): This refers to the direct costs attributable to the production of the goods sold. This amount includes the cost of the materials and labor directly used to create the product.

Gross Margin: A financial metric indicating the financial health of a company. It's calculated as the revenue minus the cost of goods sold (COGS), divided by the revenue. This percentage shows how much the company retains on each dollar of sales to cover its other costs.

Operating Income: This is the profit realized from a business's core operations. It is calculated by subtracting operating expenses (like wages, depreciation, and cost of goods sold) from the company’s gross income.

Ordinary Income: This typically refers to income earned from regular business operations, excluding extraordinary income which might come from non-recurring events like asset sales or investments.

Net Profit: Also known as net income or net earnings, it's the amount of income that remains after all operating expenses, taxes, interest, and preferred stock dividends have been deducted from a company's total revenue.

PPWF (Price Pocket Waterfall): This term is used to describe the breakdown of the list price of a product or service down to the net price, showing all the factors that contribute to the price erosion. The "waterfall" metaphorically illustrates how the price "falls" or reduces step by step due to various deductions like discounts, rebates, allowances, and other incentives given to customers. This analysis is important for businesses to understand their actual pricing dynamics and profitability. It helps in identifying opportunities for price optimization and controlling unnecessary discounts or allowances that erode the final price received by the company.

Net Present Value (NPV): A method used in capital budgeting and investment planning to evaluate the profitability of an investment or project. It represents the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Internal Rate of Return (IRR): A metric used in financial analysis to estimate the profitability of potential investments. It's the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

CONQ (Cost of Non-Quality): This is the cost incurred due to providing poor quality products or services. It includes rework, returns, complaints, and lost sales due to a damaged reputation.

A&P (Advertising and Promotion): These are expenses related to the marketing and promotion of a company's products or services. It's a subset of the broader marketing expenses a company incurs.

Return on Investment (ROI): In simple terms, ROI measures the profitability of an investment. For marketing teams, this means understanding how campaigns contribute to the company's bottom line, beyond just tracking engagement metrics.

Return on Ad Spend (ROAS): ROAS specifically measures the efficiency of an advertising campaign. It assesses how much revenue is generated for every dollar spent on advertising. It's similar to ROI but focused solely on ad spend and the revenue directly generated from those ads. ROAS is exclusively used in the context of advertising and marketing. It helps businesses determine which advertising campaigns are most effective.

Customer Lifetime Value (CLV): This predicts the net profit attributed to the entire future relationship with a customer. Effective marketing strategies should aim at not only acquiring new customers but also retaining existing ones, thus maximizing CLV.

G&A (General and Administrative Expenses): These are the overhead costs associated with the day-to-day operations of a business. They include rent, utilities, insurance, management salaries, and other non-production-related costs.

2 notes

·

View notes

Text

The Top 10 Properties of Homoeopathy Management Software

Running a homeopathy clinic is more than just healing — it’s about managing patients, prescriptions, medicine inventory, billing, and compliance efficiently. The right Homeopathy Management Software can make all the difference in streamlining your operations while improving patient care.

But with so many options in the market, how do you choose the right one?

Here are the top 10 must-have features to look for in a powerful and reliable Homeo ERP software, whether you're based in Kerala, anywhere in India, or expanding globally.

1️⃣ Potency-Based Medicine Management

Homeopathy deals with potencies and dilutions that change the way medicines are administered and stocked.

Your software must allow:

Recording of potency levels (e.g., 30C, 200C, 1M)

Managing stock based on potency and combination

✅ Why it matters: Prevents dosage errors and improves prescription accuracy.

2️⃣ Batch & Expiry Tracking

Medicines nearing expiry? With batch-wise tracking, the system alerts you automatically.

✅ Why it matters: Ensures safe dispensing, avoids wastage, and supports regulatory compliance.

3️⃣ Custom Billing with Discount Schemes

Your software should allow:

Item-wise and potency-based pricing

Bulk buyer and seasonal discount schemes

Auto-tax calculations (GST, etc.)

✅ Why it matters: Speeds up billing and keeps records clean.

4️⃣ Patient Record Management (EMR)

Track patient visits, treatment history, and past prescriptions in one place.

✅ Why it matters: Enhances follow-up care and builds patient trust over time.

5️⃣ Inventory Management

Real-time stock visibility, reorder alerts, and supplier tracking all in one screen.

✅ Why it matters: Avoids overstocking or stockouts and improves cash flow.

6️⃣ Integrated Appointment Scheduling

Make it easier to:

Book appointments

Send reminders via SMS/email.

Avoid patient overlaps

✅ Why it matters: Improves patient experience and clinic flow.

7️⃣ Multi-User & Multi-Location Access

If your clinic has multiple doctors or branches, your software should allow centralized access.

✅ Why it matters: Helps you scale without operational chaos.

8️⃣ Mobile & Cloud Access

For anytime, anywhere access, pick a Homeo ERP solution that is mobile-friendly and compatible with cloud hosting.

✅ Why it matters: Enables remote monitoring, especially for growing clinics.

9️⃣ Reports & Analytics

Instant access to:

Daily sales reports

Patient visit trends

Most-used medicines

Financial summaries

✅ Why it matters: Data-driven decisions = faster growth.

🔟 Data Security & Backup

Ensure your software includes:

Regular automatic backups

Data encryption

Role-based user access

✅ Why it matters: Keeps patient and clinic data safe from loss or leaks.

🧩 Bonus: Local Support & Customization (especially in Kerala)

If you're operating in Kerala or South India, make sure your software provider:

Offers support in your local language

Understands regional compliance

Can provide on-site training and setup

✅ For example: Hiworth Solutions offers homeopathy ERP software tailored for clinics across Kerala and beyond.

🏁 Final Thoughts

Choosing the right homeopathy clinic software is not just a tech decision — it’s a business strategy. Look for a solution that helps you save time, reduce errors, improve patient relationships, and prepare your clinic for long-term growth.

At Hiworth Solutions, we specialize in Homeo ERP software designed specifically for the needs of homeopathy clinics, pharmacies, and hospitals.

👉 Want to see how it works?

To schedule a free demo and begin your digital transformation, get in touch with us.

#homeo erp software kerala#homeo erp software trivandrum#hospital management software trivandrum#erp#erp software#information technology#software

0 notes

Text

Using Business Loans to Manage Cash Flow During Economic Uncertainty

In today’s ever-changing business landscape, financial uncertainty has become a common challenge for entrepreneurs. Economic slowdowns, fluctuating demand, delayed payments, and inflation can strain a company’s working capital. During such periods, maintaining steady cash flow becomes critical to survival and success. One effective way to tackle this challenge is by utilizing a business loan, especially through modern platforms like Kissht that offer quick and flexible funding options like an instant business loan via a quick loan app.

1. The Importance of Cash Flow During Economic Slowdowns

Cash flow is the lifeblood of any business. It ensures that day-to-day operations continue smoothly including paying salaries, purchasing inventory, covering rent, and handling emergencies. When economic uncertainty hits, income may slow down while expenses continue.

A temporary cash flow gap, if not addressed quickly, can halt operations or force cost-cutting decisions. That’s why many business owners rely on digital lending platforms like Kissht, where they can access an instant business loan that supports ongoing financial commitments without delay.

2. Why Traditional Loans May Not Be Ideal in Uncertain Times

Traditional loans often involve lengthy paperwork, multiple in-person visits, and long processing times. During an economic downturn, business owners need quick access to capital not a prolonged application process. Moreover, some traditional lenders may tighten their lending criteria during such times.

This is where online loan app solutions stand out. Apps like Kissht offer quick loan app functionality that allows business owners to apply online and receive funds within a short period, depending on eligibility. This flexibility can be a game-changer for businesses trying to stay afloat or seize timely opportunities.

3. Kissht: A Smart Way to Apply for Instant Business Loans

Kissht is a digital platform that simplifies the borrowing process for both personal and business needs. With a user-friendly interface, minimal documentation, and transparent terms, Kissht allows business owners to apply for an instant business loan directly through a quick loan app.

You don’t need to visit a bank or go through complicated steps just download the app, upload your KYC and business details, and track your loan application in real time. This ease of access is especially helpful during uncertain financial periods when time is critical.

4. How Instant Business Loans Improve Cash Flow

An instant business loan can help your business by:

Covering urgent expenses such as rent, salaries, or vendor payments.

Supporting working capital during sales slumps or seasonal slowdowns.

Seizing short-term business opportunities (such as stocking inventory at a discount).

Avoiding delays in operations due to cash crunches.

Using a business loan calculator or a business loan EMI calculator allows you to plan repayments without overburdening your monthly budget.

5. Advantages of Using a Quick Loan App for Business Loans

Here’s how a quick loan app benefits businesses:

Accessibility: You can apply from anywhere, anytime.

Speed: Faster loan processing means quicker disbursal.

Transparency: Clear information about EMIs, repayment tenure, and documentation.

Digital Tracking: Real-time status updates reduce uncertainty.

Platforms like Kissht combine all these benefits, making the experience seamless and efficient especially useful when managing urgent financial needs.

6. Personal vs. Business Loans: Choosing the Right Option

When managing finances during uncertain times, it’s important to choose the right type of loan. A business loan is ideal for covering expenses like salaries, inventory, or marketing. If you need quick funds, applying for an instant business loan through Kissht’s quick loan app can be a smart move it’s fast, easy, and tailored for business needs.

A personal loan may help with smaller expenses but might come with higher interest rates. You can use tools like a personal loan EMI calculator to plan repayment, but it’s not always the best fit for business cash flow.

A loan against property works for large capital needs but takes longer to process and requires collateral. If time and flexibility matter, an instant business loan from Kissht is often the most practical option.

7. Tools That Help You Plan Repayments

Before applying for a loan, it’s important to calculate your EMI to understand how the loan fits into your monthly budget. You can use:

Business loan EMI calculator

Personal loan interest rate calculator

PL loan EMI calculator

These tools help you estimate monthly repayments and select the right tenure and loan amount, keeping cash flow smooth and manageable.

8. Steps to Apply for a Business Loan via Kissht

Here’s how you can apply for a business loan on Kissht in just a few steps:

Download the Kissht App from the Play Store or App Store.

Register your business or personal details.

Upload KYC and income documentation.

Choose loan type and amount e.g., instant business loan.

Submit and track your application status within the app.

This fully digital process ensures you’re not delayed by traditional paperwork or slow bank approvals perfect for managing cash flow during a financial crunch.

9. Final Thoughts

Managing cash flow during economic uncertainty is not easy but it is possible with the right financial tools. Using an instant business loan from Kissht, applied via a quick loan app, helps you bridge financial gaps without disrupting operations.

Whether you’re a small business owner, entrepreneur, or startup, platforms like Kissht provide flexible credit solutions to help you move forward with confidence even in uncertain times.

#advance loan#cash loan app#instant loan#loan app#loan apps#low-interest loan#short-term loan#quick loans#quick loan#personal loan app#online personal loans#online instant loans#instant money

1 note

·

View note

Text

How Startups Are Using Financial Modelling to Attract Investors in India’s Booming Tech Ecosystem

India’s startup ecosystem is on fire. With over 100 unicorns and thousands of early-stage ventures blossoming across sectors like fintech, edtech, healthtech, SaaS, and e-commerce, the landscape is vibrant—but also fiercely competitive. In this high-stakes environment, financial modelling has emerged as a powerful tool for startups to build credibility, secure funding, and scale with confidence.

For aspiring entrepreneurs and finance professionals alike, mastering financial modelling is no longer optional. If you’re in Kolkata and looking to break into this space, enrolling in the best Financial Modelling Course in Kolkata can give you the practical skills needed to thrive in this startup-driven economy.

Why Financial Modelling Matters in a Startup's Journey

When startups approach angel investors, venture capitalists, or private equity firms, they don’t just pitch an idea—they pitch a vision backed by numbers. These numbers aren’t just pulled from thin air. They come from detailed financial models that forecast how the business will grow, scale, and generate returns.

A robust financial model communicates:

Revenue projections for the next 3–5 years

Operating expenses and burn rate

Break-even analysis

Customer acquisition cost (CAC) and lifetime value (LTV)

Unit economics

Funding requirements and expected ROI

These projections show investors that the startup’s founders understand their market, costs, and how their business will turn a profit—or at least grow fast enough to justify the investment.

The Indian Startup Boom: A Perfect Storm for Financial Modellers

India is now the third-largest startup ecosystem in the world, after the US and China. With the digital economy accelerating, investors are pouring billions into scalable tech ventures. However, investor scrutiny is higher than ever due to recent global funding slowdowns.

Now, it’s not enough to have a great pitch deck. Investors want to see clear, data-driven financial roadmaps. That’s where financial modelling steps in.

Professionals trained through the best Financial Modelling Course in Kolkata are helping startups prepare solid models that can stand up to investor due diligence. From sensitivity analysis to discounted cash flows and cohort-based revenue forecasting, the right models can turn a maybe into a yes.

How Startups Are Using Financial Models to Win Over Investors

1. Validating the Business Idea

Before seeking funding, startups use financial models to check whether the business idea is financially viable. This includes calculating how many customers are needed to reach profitability, and how long the runway is with current capital.

2. Pitch Deck Projections

Every investor pitch today includes financial projections. But not all projections are created equal. Models that reflect realistic assumptions, industry benchmarks, and multiple scenarios inspire investor trust and make the startup stand out.

3. Justifying Valuations

Startups often struggle to justify their high valuations. Solid models using DCF (Discounted Cash Flow) or Comparable Company Analysis help founders support their ask with logic and numbers.

4. Planning for Fund Utilization

Investors want to know: how exactly will the startup spend their money? Financial modelling helps allocate capital efficiently—across product development, marketing, hiring, and operations.

5. Managing Growth

As a startup scales, it needs to continuously update its models to make hiring plans, pricing decisions, and market expansion strategies. Good models aren’t static—they evolve with the business.

Real-World Example: Fintech Startup in Kolkata

Take the example of a rising fintech startup in Kolkata targeting small business lending. When preparing for their Series A round, they built a detailed financial model projecting their revenue based on user acquisition, average loan size, and default rates. They also modeled different growth scenarios: aggressive vs. conservative.

Using these models, they were able to:

Clearly demonstrate when they’d break even

Show the effect of scaling operations

Validate their ₹100 crore valuation ask

They successfully secured funding from a Mumbai-based VC firm—and credited their financial model as a major differentiator.

The Growing Demand for Financial Modelling Skills

Startups aren’t the only ones benefiting. Founders, finance teams, startup analysts, and even venture capital interns are expected to know how to build and interpret financial models.

If you're based in West Bengal and looking to enter this space, joining the best Financial Modelling Course in Kolkata can be your stepping stone. These courses teach:

Excel-based modelling techniques

Three-statement financial models

Valuation methods like DCF and EBITDA multiples

Scenario planning and Monte Carlo simulations

Fundraising and cap table modelling

With these skills, you can work in corporate finance, become a startup CFO, join a VC firm, or even start your own venture with financial clarity.

Final Thoughts

India’s startup boom is not slowing down—and as more founders chase limited capital, financial clarity will be their biggest weapon. Financial modelling is no longer just for investment bankers; it’s now a startup essential.

If you’re looking to be part of this transformation—whether as a founder, finance professional, or investor—now is the time to upskill. Enroll in the best Financial Modelling Course in Kolkata and gain the expertise to turn ideas into investor-ready opportunities.

0 notes

Text

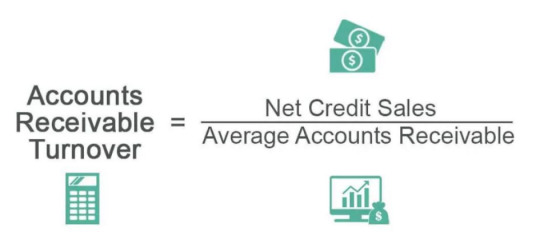

📘 Receivable Turnover Ratio: What It Means and Why It’s Crucial for Your Business

The receivable turnover ratio is more than just a number in your accounting software — it’s a direct window into how efficiently your business collects money. Whether you're an analyst reviewing stocks like Asian Paints, or a small business trying to manage cash flow, this ratio tells you how often receivables are converted into actual cash within a period.

🔍 Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

It’s classified under efficiency ratios, and it forms a part of broader financial statement analysis — crucial for understanding liquidity, cash flow health, and working capital efficiency.

🧮 How the Receivable Turnover Ratio is Calculated (With a Simple Example)

Let’s break it down with an example from the Indian market 📈

Imagine Hindustan Unilever Ltd. (HUL) made ₹10,000 crore in net credit sales last year and maintained an average accounts receivable of ₹1,000 crore.

🔢 That gives us:

Receivable Turnover Ratio = ₹10,000 crore / ₹1,000 crore = 10

This means HUL collects its receivables 10 times a year, or roughly once every 36 days.

High turnover indicates prompt collection — a positive sign for liquidity and credit control policies. A lower ratio might signal inefficient collections or weak credit screening of customers.

📊 What’s a “Good” Receivable Turnover Ratio? Here’s What the Numbers Say

There’s no universal “good” ratio — it depends on the industry. For instance:

🔹 FMCG companies like Dabur or Marico often have higher ratios because of fast-moving inventory and tight credit terms.

🔹 Automobile manufacturers like Tata Motors might show lower turnover due to B2B credit sales and longer cycles.

According to a 2023 Credit Research Foundation (CRF) report, the average receivable turnover ratio across Indian manufacturing firms stood at 7.4. In contrast, retail chains often score upwards of 12.

A good benchmark is to compare with your industry average, not cross-sector. This is where Strike Money becomes invaluable. The tool helps visualize receivable patterns, peer comparisons, and historic shifts — making data interpretation more actionable.

⚙️ How to Improve Your Receivable Turnover Ratio: 5 Key Strategies That Actually Work

A strong ratio reflects tight internal controls, disciplined credit policies, and timely collection systems. If your turnover is slipping, try these tactics 👇

💰 Tighten Credit Policies – Set clear terms and assess creditworthiness. Use third-party credit rating agencies in India like CRISIL and ICRA.

⏱️ Accelerate Invoicing – Issue invoices immediately upon delivery or service.

📞 Streamline Collections – Follow up diligently, automate reminders.

🔁 Offer Early Payment Discounts – Incentivize clients to pay faster.

📊 Monitor With Tools – Use platforms like Strike Money to track A/R trends and identify slow-paying clients.

A case study by Harvard Business Review in 2022 revealed that companies with receivable turnover ratios above industry medians showed 23% better free cash flows over five years.

🔁 Receivable Turnover vs Days Sales Outstanding (DSO): What’s the Difference?

These two metrics are siblings — closely related but slightly different in scope 🧩

⚖️ Receivable Turnover Ratio tells you how many times receivables are collected in a period.

📆 Days Sales Outstanding (DSO) tells you how many days it takes to collect.

🧠 Formula: DSO = 365 / Receivable Turnover Ratio

So if your turnover ratio is 10, your DSO is 36.5 days.

While turnover gives a rate-based view, DSO gives a time-based outlook. For a CFO at a company like Infosys, DSO offers a more relatable picture for cash flow planning.

💼 Real Examples From Indian Companies Using Receivable Turnover Effectively

Let’s explore how some Indian giants manage this ratio in the real world 🚀

📌 Asian Paints Ltd.: Known for its aggressive distribution network, the company maintains a receivable turnover ratio between 14–18 over the years. Their secret? Tight credit policies and tech-driven logistics.

📌 Pidilite Industries: Makers of Fevicol maintain a healthy ratio of 12–13, reflecting strong dealer relationships and efficient collections.

📌 Sun Pharma: As a pharma exporter, Sun Pharma often deals with international credit cycles. It balances a lower turnover of around 6–7 by ensuring credit is backed by robust documentation and export financing.

You can analyze these data points visually using Strike Money, which integrates quarterly reports and historical financials for side-by-side comparisons.

🚫 Common Mistakes When Interpreting the Receivable Turnover Ratio

Here are a few traps that even seasoned analysts fall into ❌

🔄 Including Cash Sales – The formula only considers net credit sales. Including all sales gives a distorted picture.

📅 Ignoring Seasonal Trends – A retail business may naturally have a skewed turnover post-holiday sales.

📉 Misreading a High Ratio – A very high ratio might look great but could signal overly strict credit policies that limit sales growth.

💡 Tip: Always cross-verify with DSO, inventory turnover, and current ratio for a fuller picture. Tools like Strike Money make this triangulation easier by plotting all efficiency ratios on interactive dashboards.

🔍 What Influences the Receivable Turnover Ratio?

Multiple operational, financial, and external factors influence your ratio. These include:

📈 Business Model – B2B companies often deal with longer credit cycles than B2C.

💳 Customer Profile – Institutional clients may delay payments compared to retail consumers.

🌍 Macroeconomic Conditions – In periods of inflation or recession, clients might delay payments, affecting turnover.

🧾 Regulatory Changes – In India, GST input credits and payment processing reforms impact payment behavior across sectors.

According to a RBI bulletin (2024), MSMEs in India faced an average payment delay of 45–50 days, leading to poor turnover ratios despite stable credit sales. This reinforces the need for internal control more than external dependence.

🧠 Why Receivable Turnover Is a Hidden Indicator of Business Health

Think of the receivable turnover ratio as a pulse check 🫀 on your liquidity. It directly reflects how fast your business converts sales into cash — critical for paying salaries, buying inventory, and funding growth.

🔍 Investors like Warren Buffett and Rakesh Jhunjhunwala (legacy) have repeatedly emphasized the importance of analyzing cash flow metrics over net profits. Receivable turnover is central to this.

A company showing consistent growth in sales but worsening receivable turnover is a red flag — it indicates money is stuck in receivables, not in the bank.

🧩 Combine this metric with other indicators like:

💡 Quick Ratio – For liquidity 📈 Operating Cash Flow – For real cash inflows 🔁 Inventory Turnover – For supply chain efficiency

With tools like Strike Money, you can track these over time, benchmark them against sector leaders, and visualize long-term trends that could otherwise be buried in raw data.

🧾 Final Word: Make Receivable Turnover Part of Your Regular Review

The receivable turnover ratio might not make headlines, but it quietly powers your business’s financial engine. It’s one of those “small hinges that swing big doors.”

🏁 Here’s what to remember:

🔹 Calculate it regularly 🔹 Compare it within your industry 🔹 Interpret it with context — don’t isolate it 🔹 Take corrective action if it drops 🔹 Use tools like Strike Money to visualize trends and opportunities

Whether you're a startup founder, retail investor, or finance manager — mastering this ratio equips you to handle cash crunches, negotiate better credit terms, and improve business efficiency.

Keep your receivables healthy — and your business will follow 🚀

0 notes

Text

Step-by-Step Guide to Preparing a Comprehensive Valuation Report

A well-prepared valuation report is a critical document for businesses, investors, and stakeholders to make informed financial decisions. Whether it’s for mergers and acquisitions, taxation, compliance, or fundraising, an accurate valuation report offers transparency and clarity on the true worth of assets or shares. For companies and individuals in Madhapur, Hyderabad, Steadfast Business Consultants LLP (SBC) provides expert services to prepare comprehensive and reliable valuation reports tailored to your needs.

What Is a Valuation Report?

A valuation report is a formal document that details the estimated value of an asset, business, or security at a specific point in time. It includes the methodology used, assumptions made, financial data analyzed, and conclusions drawn by valuation experts. Preparing a thorough valuation report requires a systematic approach to ensure accuracy and credibility.

Step-by-Step Guide to Preparing a Valuation Report

1. Define the Purpose and Scope

The first step is to clearly understand the purpose of the valuation report. Are you preparing it for investment, regulatory compliance, tax assessment, or legal disputes? Defining the scope helps determine the valuation approach and the level of detail required. At Steadfast Business Consultants LLP (SBC), we work closely with clients in Madhapur, Hyderabad to identify their specific objectives.

2. Gather Relevant Data

Accurate valuation depends on comprehensive data collection. This includes financial statements, market data, industry trends, company records, and legal documents. For securities or shares, historical price data and transaction records are also essential. Collecting reliable data ensures the valuation report reflects the true economic value.

3. Choose the Appropriate Valuation Methodology

There are various methodologies to prepare a valuation report, such as:

Discounted Cash Flow (DCF) Analysis: Projects future cash flows and discounts them to present value.

Market Comparable Approach: Compares similar assets or companies to estimate value.

Asset-Based Approach: Calculates net asset value by subtracting liabilities from assets.

The choice depends on the asset type and purpose. Experts at SBC assess your situation to recommend the best method for accurate valuation.

4. Perform Financial Analysis

Next, analyze the financial data in detail. This includes reviewing revenue trends, profitability, debt levels, and growth potential. Financial ratios and projections play a crucial role in supporting the valuation figures presented in the report.

5. Make Assumptions and Adjustments

Valuation often involves assumptions about market conditions, growth rates, discount rates, and risk factors. Clearly documenting these assumptions in the valuation report ensures transparency and helps stakeholders understand the basis of the valuation. Adjustments may also be made for non-operating assets, contingent liabilities, or unique business factors.

6. Draft the Valuation Report

With all data and analyses completed, the valuation report is drafted. It typically includes:

Executive summary

Purpose and scope

Description of the business or asset

Valuation methodology

Financial analysis and assumptions

Valuation conclusion and supporting details

The report should be clear, concise, and professionally formatted to facilitate easy understanding.

7. Review and Finalize

Before delivering the valuation report, a thorough review process ensures accuracy and completeness. Steadfast Business Consultants LLP (SBC) in Madhapur, Hyderabad, emphasizes quality control and adherence to industry standards to produce trustworthy valuation reports.

Why Choose Steadfast Business Consultants LLP (SBC)?

At SBC, we bring extensive experience in preparing detailed valuation reports for clients across Madhapur, Hyderabad. Our expert team combines technical expertise with local market knowledge to deliver precise and actionable valuation insights.

Contact Us

If you need a professional valuation report tailored to your business or investment needs in Madhapur, Hyderabad, contact Steadfast Business Consultants LLP (SBC) today at 040–48555182. Let us guide you through the valuation process with confidence and clarity.

#tribunal services#valuation of securities#valuation of shares in hyderabad#valuation report#virtual cfo services

0 notes

Text

Instant Working Capital Loan for Startups & SMEs – No Collateral Needed (2025)

Why Working Capital is the Lifeline of Your Business

Running a small business or startup in 2025 is exciting—but let’s be honest, it’s not without its challenges. Whether you’re launching a new venture or growing an existing one, cash flow can make or break your success. You might have the best products or services, but without steady working capital, daily operations can come to a halt.

That’s where a working capital loan for small businesses and startups becomes your best financial ally. In this guide, we’ll simplify everything you need to know—from how it works, where to get it, interest rates, documents, and even myths busted—to help you make the smartest funding decision.

What is a Working Capital Loan?

A working capital loan is a type of business loan specifically meant to finance the short-term operational needs of a business. This includes everyday expenses like rent, payroll, raw materials, marketing, and inventory.

Unlike long-term loans that are meant for purchasing assets or equipment, working capital loans for businesses ensure you don’t run out of cash while waiting for customer payments or during a slow sales season.

Who Needs a Working Capital Loan?

New business owners need cash to survive the initial months.

Startups are waiting on seed funding or investor payouts.

MSMEs are scaling their team or stocking inventory for seasonal demand.

Small manufacturers or traders need bridge funding between supply and sales.

Whether you're looking for a working capital loan for a new business in India or need help to manage fluctuating revenues, these loans provide the necessary breathing room.

Comparison Table: Best Working Capital Loan Providers in India (2025)

Tip: Choose a provider that aligns with your business size, speed needs, and repayment comfort. Don’t just go for the lowest interest rate.

Working Capital Loan Calculation

To calculate how much you need, use this simple formula:

Working Capital = Current Assets – Current Liabilities

If you’re still unsure, many online platforms offer working capital loan calculators. You just need to input:

Monthly expenses

Current receivables

Outstanding dues

And you’ll get a quick estimate of how much working capital you actually need to keep your business flowing smoothly.

How to Get a Working Capital Loan in India (2025 Process)

Getting a quick approval working capital loan online in 2025 has become easier than ever. Here’s the step-by-step breakdown:

Step 1: Check Eligibility

Minimum 6 months to 1 year of business operations.

Monthly turnover requirement (differs by lender).

Business registration documents.

Step 2: Compare Loan Offers

Look for low-interest working capital loans comparison across platforms like BankBazaar, LendingKart, and directly on bank websites.

Step 3: Apply Online

Fill in a working capital loan application on the lender's portal. Upload necessary documents like PAN, Aadhaar, GST returns, and bank statements.

Step 4: Loan Disbursal

Upon approval, funds are transferred to your account—sometimes within 24 hours.

Top Banks & Startup-Friendly Schemes

Here are some startup-friendly working capital loan schemes you should explore:

MUDRA Yojana (for new businesses and MSMEs)

Stand-Up India Scheme (for SC/ST/Women entrepreneurs)

SIDBI Startup Mitra

Kotak Startup Working Capital Loan

These schemes offer lower interest rates and relaxed eligibility for startups and MSMEs.

Long-Term Working Capital Financing Options

If your need is not short-term and you’re looking for longer repayment periods, consider:

Working Capital Term Loans (up to 5 years)

Overdrafts & Cash Credit Lines

Invoice Discounting & Receivables Financing

These allow more flexibility and sustainability for businesses scaling over the long term.

Types of Working Capital Loans

Understanding the type of loan that suits your requirements is key:

Real Scenario

I run a small packaging business in Pune. During Diwali season, orders doubled, but I didn’t have enough stock or staff to handle them. I applied for a quick working capital loan through LendingKart. It was approved in 48 hours, and I scaled operations in time. That loan saved my biggest sales season.

— Anil Mehta, Small Business Owner

Benefits of Working Capital Loans for Small Businesses

No need to dilute equity or seek investors

Quick processing and disbursal

Available even without collateral

Flexible repayment tenures

Helps manage cash flow during lean months

Documents Required for Working Capital Loan Application

PAN card of the business owner & entity

Aadhaar card

GST registration

Business registration proof (Udyam/MSME/Partnership Deed)

Last 6–12 months’ bank statements

ITR filings or audited financials (if applicable)

Final Thoughts: Should You Go for It?

A working capital loan for a small business or new startup isn’t just about getting money—it’s about gaining control over your cash flow. If your revenue is seasonal, your clients pay late, or you’re in growth mode, this could be your smartest decision in 2025.

Just remember: Borrow smart. Compare terms. Read the fine print. And most importantly, only borrow what you can repay without hurting your business.

FAQs on Working Capital Loans (2025)

1. Can I get a working capital loan for a new business in India?

Yes, startups and new businesses can apply under government schemes like MUDRA or from fintech lenders offering startup-friendly terms.

2. What is the typical interest rate for working capital loans?

Interest rates range from 9% to 16%, depending on the lender, credit profile, and collateral (if any).

3. Is collateral mandatory for a working capital loan?

Not always. Many SME working capital loans are without collateral, especially from online lenders or government schemes.

4. How long does it take for loan approval?

With online applications, quick working capital loans can be approved within 24–72 hours, especially with complete documentation.

5. How is working capital loan repayment structured?

Repayment is usually done through EMIs or bullet payments over 12 to 60 months depending on the loan structure.

#working capital loan for new business#working capital loan for small business#working capital loan calculation#what is working capital loan#how to get working capital loan#working capital loan application#working capital loan for business#business working capital loan#working capital loan for new business in india#quick working capital loans#best working capital loan providers#long-term working capital financing options#low interest working capital loans comparison#top banks for working capital loans in India#startup-friendly working capital loan schemes#SME working capital loan without collateral#quick approval working capital loan online

1 note

·

View note

Text

Reasons to Choose a Commercial Vehicle Loan Over Traditional Financing

In India’s dynamic transportation sector, accessing the right financial support is crucial for business growth. Whether you're purchasing a new truck or expanding your logistics fleet, a Commercial vehicle loan offers specific advantages over traditional financing methods. This guide will walk you through the benefits, key decision factors, and why commercial vehicle financing is the smarter choice for modern entrepreneurs and fleet owners.

Market Overview: Understanding Commercial Vehicle Loans in India

The Indian market for commercial vehicle loans has grown significantly due to rising demand in logistics, infrastructure, and e-commerce sectors. Unlike traditional financing, commercial vehicle financing is designed specifically to meet the needs of transport business owners, offering tailor-made solutions such as flexible tenures, competitive interest rates, and financing for Used commercial vehicle loans.

Several financial institutions — from public and private banks to NBFCs and specialized vehicle finance companies — offer these loans. Choosing the right lender depends on their loan terms, interest rates, customer service, and industry expertise.

4 Key Factors to Consider Before Applying for a Commercial Vehicle Loan

1. Commercial Vehicle Loan Eligibility

Eligibility to apply for commercial vehicle loan is mostly based on your credit score, the turnover of the business, and documents. The lender assesses your credit history to gauge risk and repayment ability. Knowing each lender's specific eligibility conditions also ensures a hassle-free loan sanctioning process.

2. Interest Rate on Commercial Vehicle Loan

The commercial vehicle loan interest rate is a crucial factor that impacts your total repayment amount. These rates vary based on your credit profile, loan tenure, and market conditions. Also, consider additional charges such as processing fees, foreclosure penalties, and late payment fees when comparing offers.

3. Loan Tenure Options

Loan term can hugely impact your monthly EMIs. A short loan term means higher EMIs but less interest paid overall. A long loan term means smaller EMIs but more interest paid over time. Align your decision with your cash flow and business objectives.

4. Down Payment Requirements

The down payment is an upfront cost that affects your loan amount and approval chances. Lower down payments may attract higher interest rates, while higher down payments reduce the principal and may result in better terms. Evaluate your financial capacity and negotiate accordingly.

Strategic Benefits of Choosing Commercial Vehicle Financing Over Traditional Loans

Opting for a commercial vehicle loan offers unique advantages that traditional loans may not provide:

Tailored Solutions for Growth: Be it adding more fleets or replacing old models with more recent ones, commercial vehicle financing is more adaptable and expandable to fund your business expansion.

Customised Payment Terms: Choose lenders that provide grace periods, step-up EMIs, and restructuring facilities to manage you through difficult market cycles.

Support for Used Vehicles: Unlike most traditional loans, many NBFCs and private lenders provide used commercial vehicle loans, helping you reduce capital expenditure while expanding your operations.

Strong Lender Relationships: Developing long-term relationships with specialised lenders can open doors for future financing, discounts, and quick approvals.

Regulatory Awareness: Dedicated vehicle lenders often assist borrowers in complying with local and national transport loan regulations, reducing legal complexities.

Why Commercial Vehicle Loans Are the Best Option

Selecting a commercial vehicle loan over a regular business loan can make a big difference in your money planning, lessen operational pressure, and make fleet growth easier. Compare lenders, compare quotes, and leverage tools such as EMI calculators to arrive at wise choices.

Mahindra Finance, for example, offers up to 60 months of tenure for new vehicles and up to 36 months for used ones, depending on the asset type, making it easier to plan your finances. Their simplified documentation and customer-first approach help business owners secure quick and reliable financing.

FAQs on Commercial Vehicle Loans

1) What are the eligibility criteria for a commercial vehicle loan?

Eligibility depends on your credit score, business turnover, and KYC documentation, including income, ID, and address proof.

2) How is the interest rate on a commercial vehicle loan calculated?

Interest rates vary based on creditworthiness, loan tenure, vehicle type, and market trends. Use a commercial vehicle loan calculator for accurate estimates.

3) What is the typical interest rate range for commercial vehicle loans?

Interest rates vary normally from 10% to 18%, based on the lender, vehicle age (new or old), and the borrower's profile.

4) Is it possible to take a loan on a used commercial vehicle?

Yes, numerous lenders offer used commercial vehicle loans with flexible tenures and personalised repayment alternatives.

0 notes

Text

Capital Budgeting: A Blueprint for Business Growth

In today’s highly competitive business environment, capital budgeting isn’t just a financial function—it is the cornerstone for sustained business growth. Every startup or mid-sized companies, long-term success hinges on high-stake business decisions. Here, using a cloud based accounting software or a unified business application can transform traditional budgeting into a smarter and more scalable process.

This blog explores the importance of capital budgeting and how leveraging an all in one business management software with built-in compliance management software features can change capital budgeting into a strategic instrument for business growth.

What is Capital Budgeting?

Capital budgeting refers to the structured process of evaluating major long-term investments—typically capital expenditures (CapEx)—based on their potential to generate future cash flows. These are capital intensive decisions such as setting up new facilities, acquiring new assets or expanding into new markets. Upgrading to an advanced inventory and accounting software to correctly capture CapEx becomes crucial for sustained growth.

Unlike regular operational spending, capital budgeting shapes a company’s strategic direction for years. This makes it essential to invest in professional bookkeeping and payroll services, smart compliance software, and other long-term resource planning efforts.

Why is Capital Budgeting Necessary? When Should You Start?

Companies rely on capital budgeting to answer critical strategic questions:

Should we invest in a new production facility?

Is it the right time to expand into another region or market?

How can shareholder value be maximized?

Is it time to invest in a unified business application?

Should we upgrade our cloud accounting systems or HRM & payroll automation?

Would investing in a regulatory compliance software enhance compliance and business value?

What other investments will deliver long-term value?

Capital budgeting provides a data-driven framework for such high-impact decisions thus minimizing risks and improving ROI. Integrating tools like financial management software, compliance management software, and advanced taxation software can help assess risks, feasibility and track compliance across projects. Professional GST and payroll accounting services can help startups make informed capital budgeting decisions.

Capital budgeting should be performed prior to any major investment decision, annual planning, or significant organizational pivot. Common scenarios include:

New market entry

Upgrading to an org-wide business application, accounts payable/accounts receivable systems, GST billing software or e-invoicing software

Investing in smart manufacturing software

Business expansion through company incorporation or acquisitions

Capital Budgeting Methodologies

1. Discounted Cash Flow (DCF) Methods

These methods account for the time value of money and are easily executed using SaaS accounting software or business finance software:

Net Present Value (NPV): Difference between present value of inflows and outflows.

Internal Rate of Return (IRR): Break-even discount rate at which NPV equals zero.

Profitability Index (PI): Ratio of inflows to investment; values over 1 indicate viability.

2. Payback Period Methods

It is ideal for businesses that need insights into liquidity. Tools like accounts payable/receivable software or expense management systems automate these calculations:

Payback Period: Time to recover initial investment from inflows.

Discounted Payback Period: More realistic, factoring in the time value of money.

3. Throughput Analysis

Best suited for manufacturing, this model evaluates profit from enhanced output capacity. It emphasises on optimising revenue generation by fixing operational bottlenecks. When paired with inventory management software, fixed assets software, or purchase order management systems, it reveals operational efficiencies.

Business Benefits of Capital Budgeting

1. Informed Decision-Making

Powers prudent decision making by aligning investment with strategy—leveraging insights from accounting software for startups, payroll and tax software, and order-to-cash software.

2. Risk Mitigation

Scenario planning tools highlight operational, financial and compliance risks. Integrated with advanced tools like compliance tracking systems, GST reconciliation software, and AI-powered tax compliance platforms, risks can be detected and managed early on.

3. Efficient Resource Allocation

Rank and prioritize investment opportunities to deploy capital judiciously, using bookkeeping software, policy management software, and smart business applications.

4. Improved Cash Flow Planning

Enhances liquidity management drawing insights from accounts payable/accounts receivable software, payroll services, and e-TDS reporting tools.

5. Increased Stakeholder Confidence

Showcase transparency with audit-ready reports backed by e-invoicing software and regulatory reporting software.

6. Sustainable Financial Stability

Encourage long-term gains through data-backed, compliance-ready decisions—not guesswork.

Modernizing Capital Budgeting: From Spreadsheets to Software

Challenges with Traditional Spreadsheets

Manual data entry errors

Outdated versions during collaboration

No dynamic forecasting

Limited integration with tax filing and payroll support tools

Why Switch to a Unified Business Application

Modern business automation software transforms budgeting by offering:

Automated calculations (NPV, IRR, etc.) via smart business application

Real-time data from cloud accounting software backed by bookkeeping and payroll services

Scenario planning with insights from compliance audit software and inventory accounting systems

Regulatory readiness via tools like GST invoice matching software and document management systems

Capital Budgeting: A Blueprint for Business Growth

Capital budgeting is more than a financial metric—it's a blueprint for growth. By moving from static spreadsheets to intelligent business applications like cloud-based compliance solutions, accounting & inventory management platforms, and AI business applications, companies unlock new dimensions of efficiency and agility.

Whether you're managing form 16 filings, planning labor welfare fund contributions, or optimizing GSTR-2B vs Purchase Register matching, modern compliance automation tools empower you to make smarter, safer, and more strategic investment decisions.

1 note

·

View note

Text

Fair Market Value for ESOPs: What It Is and How to Calculate It

Understanding the Fair Market Value (FMV) of Employee Stock Ownership Plans (ESOPs) is essential for any organization offering equity compensation. Whether you're a startup founder, HR professional, or finance executive, knowing how to accurately determine FMV ensures compliance with tax regulations, builds employee trust, and reflects the true value of your company’s shares. In this in-depth guide by Xumane, we break down everything you need to know about FMV as it relates to ESOPs. We start with the basics—what fair market value means, why it matters, and how it impacts both the company and its employees. From there, we walk you through the most commonly used valuation methods such as the Discounted Cash Flow (DCF) method, Comparable Company Analysis, and Net Asset Value approach.

0 notes

Text

I'm Looking to Outsource Accounting! What Services Do Accountants Provide to Small Businesses?

Accounting services can range from basic bookkeeping to complex financial processes. Some accounting outsourcing firms provide end-to-end services while others offer selective expertise.

Besides, some accounting service outsourcing providers handle only industry-specific accounting tasks.

Therefore, you need to look out for this and any specific needs of your business when choosing an accounting services partner.

Following are the eight commonly outsourced accounting services for small businesses:

Bookkeeping Tasks: Maintaining accurate and up-to-date financial records. It covers performing general ledger entries, accounts receivable and payable, and bank reconciliations.

Accounting Workflows: The accounting tasks may cover operational, general and management, and financial management aspects.

Accounts Payable Service: Managing the payment of invoices to vendors, ensuring timely and accurate payments, ensuring good relationships with suppliers.

Accounts Receivable Service: Tracking and collecting payments from customers, ensuring timely revenue recognition and minimizing bad debt.

Invoice Processing: Tasks cover the creation, sending, and tracking of invoices, streamlining the billing process and improving cash flow.

Payroll Processing: Calculating and processing employee paychecks, calculating applicable deductions, and making required tax payments. Thus, delivering timely and accurate payroll administration.

Tax Preparation and Compliance: Preparing tax returns for individuals, businesses, and partnerships. And ensure that compliance with federal, state, and local tax regulations is in order.

Financial Reporting: Formulating financial statements and reports, including cash flow statements, income and expense reports, and balance sheets. So, you get valuable insights into your company’s performance and financial health for the reporting period.

How Much Does It Cost to Outsource Small Business Accounting Services?

The cost of outsourcing accounting services for small business can depend on many factors. These include the size and complexity of operation, the range and level of services availed, customization for unique needs, expertise and service quality of the service provider, bundled services, discounts offered, etc.

Outsourcing typically results in significant cost savings compared to hiring a full-time accountant. Nevertheless, when evaluating outsourcing options, it’s crucial to consider the overall value proposition rather than solely focusing on upfront costs.

Usually, cost-effective access to skills and expertise, time savings, and risk mitigation benefits outweigh the initial investment, making outsourcing a worthwhile decision for many small businesses.

Outsourcing accounting can halve your costs spent on an in-house operation, depending on the range and type of services used. This can result in significant savings for your business.

Save up to 35-60% when you outsource accounting services from Centelli. ‘Your peace of mind’ is among the key benefits we pack in. Book a free Consultation today!

0 notes

Text

The Power of Business Valuation in Private Equity Investments

Private equity investments are built on a foundation of careful analysis and strategic thinking, with business valuation serving as the essential first step. It’s not just about determining a company’s current worth—it’s about understanding how that value can evolve and create opportunities for growth and profit. In this dynamic environment, accurate valuation becomes a critical driver informing every investment decision, from identifying promising targets to crafting winning strategies.

The Core Role of Business Valuation

Valuation is more than a financial exercise in private equity—it’s a comprehensive assessment of a company’s potential. Private equity firms use valuation to examine a target’s economic health, market position, and operational capabilities. This thorough examination reveals the proper drivers of value: innovative products, loyal customers, or a strong competitive advantage.

Valuation also helps investors separate fact from fiction. By grounding investment decisions in complex data and realistic forecasts, private equity firms can avoid the pitfalls of speculation and focus on creating sustainable value. This approach doesn’t just protect investors—it also benefits the companies themselves by setting a clear baseline for growth and improvement.

Popular Valuation Methods in Private Equity

Private equity firms draw on several trusted valuation methods, each offering a unique perspective on a company’s potential. The discounted cash flow (DCF) method calculates value based on expected future earnings, adjusted for risk and the time value of money. This method is ideal for companies with reliable cash flows and precise growth trajectories.

Meanwhile, the comparable company analysis (CCA) method evaluates how similar businesses are valued in the market, providing context for a fair purchase price. It helps private equity investors understand whether a target is priced above or below its industry peers, which can be crucial for negotiations.

Precedent transactions analysis (PTA) is another key tool, using data from recent sales of similar companies to estimate a target’s worth. This historical lens can reveal market trends and help set realistic pricing expectations. Many private equity firms blend these methods to ensure their valuations are comprehensive and reflect multiple viewpoints.

Shaping Investment Structures with Valuation

Valuation is not just a number—it’s the starting point for structuring deals that make sense for investors and sellers. A higher valuation might lead private equity firms to propose creative financing solutions, such as earn-outs or convertible debt, to balance risk and reward. These structures align interests and give both sides confidence in the deal’s long-term viability.

Private equity firms often have more leverage for investments with lower valuations to negotiate favorable terms, such as lower purchase prices or more equity control. In every scenario, valuation data shapes the deal's contours, guiding discussions about ownership, management, and exit strategies.

The influence of valuation doesn’t end when the deal closes. Post-acquisition, private equity firms use valuation findings to prioritize initiatives and identify ways to enhance operational performance. Whether streamlining processes or launching new products, these strategies are grounded in valuation insights and help create long-term value for all stakeholders.

Navigating Market Forces in Valuation

Market conditions significantly impact how private equity firms approach valuation. During periods of economic expansion, valuations tend to be higher, requiring investors to be more selective and creative to generate attractive returns. In these times, firms may focus on improving operational efficiencies or expanding product lines to unlock additional value.

In contrast, economic downturns can create opportunities for private equity investors to acquire assets at discounted prices. In these markets, rigorous valuation is even more critical—it helps firms spot hidden value and avoid overpaying for assets that may struggle to recover.

Industry dynamics also shape valuation. Rapid technological changes or evolving consumer preferences can dramatically shift a company’s prospects. By factoring these changes into their valuation models, private equity investors can build a more realistic picture of future performance and avoid surprises.

Valuation as a Strategic Imperative

At its core, valuation is a strategic advantage for private equity firms. It ensures investment decisions are based on solid data and clear thinking rather than gut feelings or short-term trends. This disciplined approach helps firms build trust with their investors and partners, laying the groundwork for successful collaborations.

Valuation also fosters a culture of accountability. By continually revisiting and refining their valuation models, private equity firms can adapt to market changes and stay focused on long-term results. This adaptability is crucial in a fast-paced industry where fierce competition and opportunities can shift overnight.

Business valuation is the compass that guides private equity firms through the complexities of investment decisions. It informs how deals are structured, risks are managed, and opportunities are realized. By mastering valuation, private equity investors can make smart decisions that drive growth, build relationships, and unlock the full potential of the companies they back. In the world of private equity, this commitment to rigorous analysis and strategic foresight defines success.

0 notes

Text

Understanding the True Cost of Invoice Factoring for Canadian Businesses

Invoice factoring is widely recognized for its ability to improve cash flow by converting unpaid invoices into immediate working capital. However, understanding the cost of factoring is essential before engaging with a factoring company. Unlike loans, factoring doesn't charge interest but instead applies a fee based on the value of the receivables, the risk profile of the debtor, and the terms of repayment. Each of these variables plays a significant role in determining the total expense of the service.

A Breakdown of Factoring Costs Across Industries

Factoring costs are not fixed and can vary significantly depending on the industry and the factoring provider. For example, high-risk sectors like construction may face higher fees than industries with predictable payment cycles, such as staffing or freight. Additionally, volume and frequency of invoices influence pricing. Businesses that factor larger invoice amounts or use factoring more frequently often qualify for lower rates due to economies of scale.

When analyzing the financial implications, it’s crucial to consider both the upfront fees and any additional administrative charges, such as setup costs, wire fees, and due diligence assessments. Comparing multiple providers on these points allows for a more accurate evaluation of the total expense.

How Factoring Rates Are Calculated

Factoring rates are typically expressed as a percentage of the invoice value, ranging from 1% to 5% per 30-day period. Several factors impact this rate, including:

Customer creditworthiness: The stronger the payer’s credit profile, the lower the risk—and thus, the lower the rate.

Invoice volume: Larger monthly invoice totals may qualify for reduced pricing tiers.

Payment terms: Longer invoice due dates generally increase costs, as funds are advanced for a longer period.

Industry risk: Sectors with unstable payment histories or frequent disputes may carry a premium.

Some providers offer tiered rate structures where the fee increases incrementally over time, encouraging faster payment by customers and aligning costs with aging receivables.

Hidden Factors That Affect the Cost of Factoring Invoices

It’s essential to go beyond headline percentages when evaluating the cost of factoring invoices. Many providers advertise competitive rates but include additional charges that inflate the actual cost. These can include:

Minimum usage requirements

Early termination fees

Reserve release charges

Lock-in periods or exclusivity clauses

Businesses must thoroughly review all contract terms and clarify any ambiguous pricing components. Understanding how fees are structured helps avoid surprises and ensures the factoring agreement remains financially beneficial.

When Does a Factoring Fee Make Sense for Your Business?

A factoring fee is justified when the cost of waiting for payment outweighs the cost of accessing funds immediately. For many businesses, this trade-off is favorable—especially when delays in customer payments impact payroll, vendor relationships, or the ability to take on new orders.

If a company can convert accelerated cash into profitable activities—such as fulfilling high-margin sales or negotiating supplier discounts—the return often exceeds the fee paid to the factor. This cash flow advantage is particularly valuable during growth periods or in cyclical industries with peak operating seasons.

How to Estimate Factoring Invoices Cost Before Signing

Estimating the factoring invoices cost requires a detailed analysis of your average invoice size, payment terms, customer base, and total monthly volume. Start by collecting quotes from multiple factoring providers, ensuring each quote includes:

Advance rate (usually 80% to 95%)

Monthly or daily fee percentage

Reserve policies

Additional service charges

Comparing offers side by side will highlight not just the most affordable option, but the provider whose terms align best with your business operations. Keep in mind that the lowest rate isn’t always the best fit—reliability, transparency, and customer service also matter significantly in long-term factoring relationships.

The Bottom Line on Cost Management in Factoring

Businesses that use factoring strategically often find it to be a scalable and flexible funding solution. The key lies in understanding the total cost structure, aligning the provider’s terms with operational needs, and ensuring the benefit gained from faster cash flow outweighs the expense.

As the demand for alternative financing continues to grow, invoice factoring remains a competitive option—especially when used with clarity and cost control in mind. Proper planning, negotiation, and due diligence are essential steps toward making factoring a cost-effective, long-term financial tool.

0 notes

Text

What is the Sell Through Rate Formula and Why It Matters

In the competitive world of retail and eCommerce, every product that sits too long on the shelf chips away at your profit margins. That’s where the Sell Through Rate Formula comes in. It’s more than just a calculation—it’s a window into the health of your inventory and the effectiveness of your sales strategy.

Whether you run a boutique, manage an online store, or oversee inventory in a large chain, understanding and applying the sell through rate formula is crucial to optimizing performance, avoiding overstock, and maximizing profit.

Understanding the Sell Through Rate Formula

The Sell Through Rate Formula is used to measure how much of your inventory has been sold within a given timeframe compared to how much stock you initially received.

The Formula:

Sell Through Rate (%) = (Units Sold ÷ Units Received) × 100

Example:

If you receive 300 units of a product and sell 210 in one month:

(210 ÷ 300) × 100 = 70%

A 70% sell-through rate indicates strong product performance, while lower percentages may point to sluggish movement or misaligned inventory planning.

Why the Sell Through Rate Formula is Crucial for Business Growth

Using the sell through rate formula regularly can help you:

Avoid Overstocking: Minimize excess inventory that drains resources.

Prevent Stockouts: Recognize when a product is moving fast and needs replenishment.

Track Product Popularity: Identify your top-sellers and slow movers.

Optimize Marketing Campaigns: Push products that need support or capitalize on hot items.

Improve Financial Planning: Align cash flow and revenue projections with actual performance.

It’s a simple yet powerful tool that drives smarter decisions across the board.

Sell Through Rate Formula vs Turnover Rate

Many people confuse the sell through rate formula with inventory turnover, but the two measure different things:

Sell Through Rate Formula tells you how much of a specific product has been sold out of the initial stock received.

Inventory Turnover measures how often you sell and replace inventory within a specific timeframe.

The key difference? Sell-through is focused on performance at the SKU level, while turnover provides a broader inventory view.

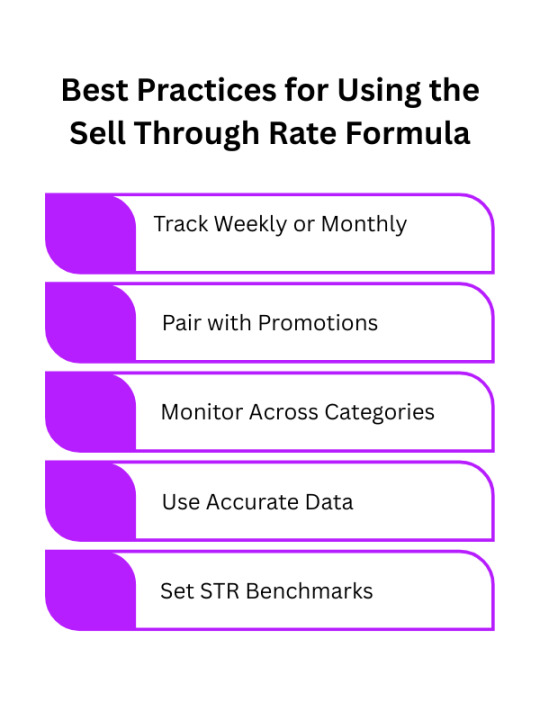

Best Practices for Using the Sell Through Rate Formula

If you want to get the most out of the sell through rate formula, follow these steps:

Track Weekly or Monthly: The shorter the timeframe, the quicker you can act.

Pair with Promotions: Analyze STR before and after campaigns to measure impact.

Monitor Across Categories: Some products will naturally have lower or higher rates.

Use Accurate Data: Always include returns and restocks to get a true reading.

Set STR Benchmarks: Know what’s considered “good” for your industry.

With regular use, the formula becomes a diagnostic tool—letting you fine-tune operations in real time.

How to Improve Sell Through Rate

Once you know how to use the sell through rate formula, here are a few proven tactics to boost your numbers:

Reposition Products: Give slow movers better visibility online or in-store.

Bundle Offers: Pair low and high STR items together in value packs.

Flash Discounts: Use limited-time deals to stimulate demand.

Improve Descriptions and Imagery: For eCommerce, this can significantly influence conversions.

Gather Customer Feedback: Understand what’s stopping people from buying.

Every improvement adds to a healthier inventory cycle and more consistent revenue.

Sell Through Rate Formula Across Different Business Types

The beauty of the sell through rate formula is its versatility. Here's how it applies across industries:

Fashion Retail: Use STR to clear seasonal collections before they go out of style.

Grocery Stores: Manage perishable items by adjusting based on weekly sell-through rates.

Electronics: Plan restocks for fast-selling gadgets and avoid obsolete tech.

Home Decor: Track which styles are trending to shape future product lines.

Online Marketplaces: eCommerce stores can manage virtual shelf space more effectively.

No matter the business, this formula helps you stay agile in a dynamic market.

Using Technology to Automate Sell Through Tracking

Manually tracking sell-through is okay when you're small—but as your business scales, automation becomes essential.

Use tools like:

POS Systems: Capture real-time sales data.

Inventory Management Software: Platforms like TradeGecko, Zoho, or NetSuite can auto-calculate STR.

Analytics Dashboards: Use Google Data Studio or Shopify Analytics for visual insights.

AI Forecasting Tools: Predict stock needs based on past STR and external market data.

These integrations help ensure you’re always working with up-to-date, actionable insights.

Conclusion

The sell through rate formula isn’t just about numbers—it’s about narrative. It tells you what your customers want, when they want it, and how you can better deliver it. By calculating, tracking, and optimizing this key metric, you gain a clear advantage in managing inventory, forecasting demand, and maximizing sales potential.

Start using the sell through rate formula regularly and watch your business become leaner, smarter, and more profitable.

FAQs

Q1: What is the sell through rate formula? A: It calculates the percentage of stock sold out of the total received during a specific time.

Q2: Why is sell through rate important? A: It helps businesses track product performance and improve inventory planning.

Q3: What is a good sell through rate? A: Typically, 70–90% is strong, but it varies by industry and product category.

Q4: How often should I calculate sell through rate? A: Weekly or monthly for best insights and timely actions.

Q5: Can I use the sell through rate formula in eCommerce? A: Absolutely—it’s crucial for tracking online product performance.

Q6: How is sell through rate different from turnover rate? A: STR focuses on how much of a received stock is sold, while turnover tracks total inventory cycles.

Q7: How do I improve sell through rate? A: Use promotions, reposition products, offer bundles, and monitor customer feedback.

Q8: What tools help automate sell through rate tracking? A: POS systems, inventory software, and analytics platforms like Shopify and Zoho.

Q9: Does seasonality affect sell through rate? A: Yes, certain times of the year will impact STR depending on product demand.

Q10: Can I use sell through rate formula for digital products? A: Yes, though it’s more relevant for physical stock, it can be adapted for digital SKUs in bundles or licenses.

0 notes