#How to file the tds return

Link

How to File Your Income Tax Return for Free (2023-2024) | TDS Claim | इनकम टैक्स फाइल करना सीखें

Watch video on TECH ALERT yt

https://youtu.be/7_EfiRYR2Wg

#TechAlert #howto #shorts #technology #youtubeshorts #instagram #reels #reelsinstagram #reelsfb #reelsvideo #reelsviral #viralreels #youtuber #shorts #youtubeshorts #bhfyp #instalike #l #instadaily #likeforfollow #picoftheday #followers #smile #likeforlike #shorts #Youtube #reelsinstagram #shorts #youtube #incometax

2 notes

·

View notes

Video

youtube

TDS ki कक्षा|Part 3|Interest, Fees, Penalty, Prosecution, Expense Disallowance under TDS|Income Tax

TDS ki कक्षा TDS Knowledge series Part 3 @cadeveshthakur #tds #incometax #cadeveshthakur #trending #viral TDS compliance and the consequences associated with it. In this video, we’ll explore various sections of the Income Tax Act related to TDS (Tax Deducted at Source) and discuss the implications for defaulting taxpayers. Here’s the content breakdown: 📌 Timestamps 📌 00:00 to 00:56 Introduction 00:57 to 02:46 Content Part3 02:47 to 03:54 Example 03:55 to 08:48 Assessee in default 08:49 to 11:00 example 11:01 to 17:07 late fees 17:08 to 23:40 interest 23:41 to 31:51 how to calculate interest & fees 31:52 to 37:00 penalties 37:01 to 38:30 prosecution 38:31 to 39:43 disallowance 1. Section 201: Assessee in Default o Explanation of what constitutes an “assessee in default.” o Consequences for failure to deduct or pay TDS. o Key points: Interest (Section 201(1A)): When a deductor fails to deduct tax at source or doesn’t deposit it to the Government’s account, they are deemed an assessee in default. They become liable to pay simple interest: 1% per month (or part of a month) on the amount of tax from the date it was deductible to the date of deduction. 5% per month (or part of a month) on the amount of tax from the date of deduction to the date of actual payment. Interest as Business Expenditure: Clarification that interest paid under Section 201(1A) cannot be claimed as a deductible business expenditure. Penalty (Section 221): If a person is deemed an assessee in default under Section 201(1), they are liable to pay penalty under Section 221 in addition to tax and interest under Section 201(1A). The penalty amount cannot exceed the tax in arrears. Reasonable Opportunity: The assessee has the right to be heard and prove that the default was for good and sufficient reason. 2. Section 234E: Late Fee for TDS/TCS Returns o Explanation of late fees for non-filing or late filing of TDS/TCS returns. o Due dates for filing TDS/TCS returns. o Late fee calculation: INR 200 per day until the default continues (not exceeding the TDS/TCS amount). o FAQs on Section 234E. 3. Section 276B: Prosecution for Failure to Deduct TDS o Overview of prosecution provisions for non-compliance with TDS obligations. 4. Disallowance of Expenses (Section 40(a)(i)/(ii)) o Explanation of disallowance of expenses if TDS is not deducted or paid. #youtubevideos #youtube #youtubeviralvideos #tdsfreecourse #freecourse #taxdeductedatsource #TDSCompliance #IncomeTax #TaxDeduction #TCSReturns #LateFiling #Penalty #BusinessExpenditure #TaxLiabilities #FinancialCompliance #TaxPenalties #TaxationLaws #AssesseeInDefault #InterestPayment #TaxProcedures #LegalObligations #TaxAwareness #TaxEducation #FinancialLiteracy #TaxPlanning #TaxConsultancy #TaxAdvisory #TaxProfessionals #TaxUpdates #TaxGuidance #TaxTips #TaxAccounting #TaxFiling #TaxReturns #TaxPolicies #TaxChallenges #TaxSolutions #TaxExperts #TaxCompliance #TaxAware #TaxMistakes #TaxConsequences #TaxPenalties #TaxKnowledge #TaxRules #TaxRegulations #TaxBestPractices #TaxManagement #TaxUpdates #TaxNews #TaxInsights #TaxGuidelines #TaxCode #TaxEnforcement #TaxEnforcementActions #TaxPenaltyProvisions #TaxPenaltyLaws #TaxPenaltyGuidance #TaxPenaltyExplained #TaxPenaltyFAQs #TaxPenaltyCompliance #TaxPenaltyAvoidance #TaxPenaltyMitigation #TaxPenaltyResolution #TaxPenaltyAdvice #TaxPenaltyConsulting #TaxPenaltyExperts #TaxPenaltyHelp #TaxPenaltyTips #TaxPenaltyEducation #TaxPenaltyAwareness #TaxPenaltyPrevention #TaxPenaltyManagement #TaxPenaltyStrategies #TaxPenaltyUpdates #TaxPenaltyNews For more detailed videos, below is the link for TDS ki कक्षा TDS Knowledge series https://www.youtube.com/playlist?list=PL1o9nc8dxF1RqxMactdpX3oUU2bSw8-_R

#youtube#what is tds#tax deducted at source#how to file tds return#how to issue tds certificate#tds due dates fy 2024-25#tds due dates fy 2023-24#tds free course#cadeveshthakur

0 notes

Text

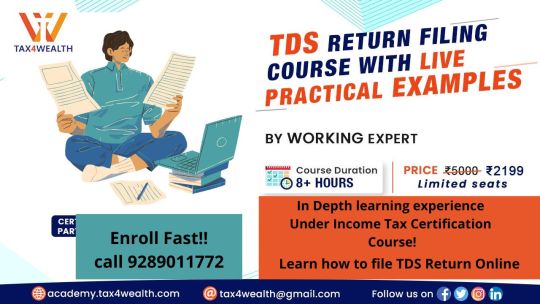

TDS Return Filing Course at Academy Tax4wealth

TDS Return Filing course comes under the Income Tax Certification course. This is one of the best online income tax course which is established in a self-paced getting to know style. You will be trained to File TDS Returns Online.

More info:

#Income Tax Certification Course#File TDS Online#How to File TDS Online#ITR Filing Course#TDS Filing Course#TDS Filing Online#TDS Return Online

0 notes

Link

0 notes

Link

0 notes

Link

How to File TDS Return Online

0 notes

Text

[Writing WIP Questionnaire]

Reflecting on my drafts folder w/ the previously-skipped section of the questions I was answering here.

If you read this: . . .don’t look @ me. LOL.

(Exposing my secrets -- and also hiding from them.)

-

Sum up one or more of your wips!

Most aren’t for tumblr-posting, mind u.

But:

(Divided up by which character has narration rights)

-a Vette story I keep forgetting abt, where she is trying to figure out TD’s post-binge fate on Nar Shaddaa, having decided she’s actually invested in this weird Sith’s wellbeing.

-Quinn experiencing TD’s response to betrayal (TD: “I’m not mad, I just want you to acknowledge your life is in /my/ hands. Forever.”)

-like 4 separate WIPs of ‘joint midlife crisis’ Zahied & TD engaging in their unsanctioned fraternizing in early times/getting to know each other -- however eagerly (TD) or reluctantly (Zahied).

-Alliance-era, mid-50s Zahied thinks hard abt where he is, tells TD he ready to dump him (probably. Soon. --For real, though. NO relapses. When it’s done it’s /done/, 100%. Swearing off this shit- . . . Yes, he’ll still teach ur damn kids their hand-to-hand fighting.)

-Alliance-era TD, fraught with relationship issues/feelings(???) beyond his comprehension (dumped by his boyfriend; wife still touchy that he is hot for his boss; boss ignoring him b/c 1. she has never considered him significant or attractive 2. she’s busy with the happiness of being reunited with her bug husband), takes a team (incl. his Apprentice) to Hoth for a mission, where they lose contact with home base & can’t send an update to confirm they’re still alive. --He thinks that’s fine he didn’t want to hear from anyone there for a While anyway-- (but something else Will go wrong.)

-Agent Vensys is assigned as chaperone for traitor-on-probation Sith Lord Liio (going Where? idk) -- which may be AU content, or I might make it canon. . . or I might split off into 2 different versions (one where they potentially makeout a little, & one for sailing the crack ship onward to far-distant horizons that veer OOC for at least 1 of them). Lolll.

-(?canon?) Kallir has a nice day.

-Kallir runs afoul of a posse of Imperial troops privately harboring anti-Sith sentiments in a garrison on Taris (? question mark). (Visiting pumpkin Agent was witnessed holding hands with a Sith who recently came by) -- I’m evaluating how much violence I’ll include as canon. (Less than I wrote. . . but some. He definitely gets bullied. Punches someone in the throat. Maybe knifes a guy a little bit?? I wrote that scene, but I’m not sure it’ll fit.)

-Kallir undergoing an entire ordeal living among space pirates & becoming slightly unhinged.

-in AU: Kallir (the Minister of Intelligence), dragged away from the tail end of a formal ball, puts up with Vensys plying his charms at him (again)

-total shipping AU: Kallir, Liio, & Zahied, lonely hearts club, attempt to distract one another from mountains of baggage in the only way that comes to their minds when they recognize everyone else is hot and thirsty. (Fellas. . . you’re a mess. Sorry I’m so into that.)

Which story took the most research?

Well- the extent of research I’m willing to do is stuff like “what’s this place/object look like in SWTOR?”, or “what does the internet say about these star wars aliens?”

Which story has the most lore?

TD going to Hoth to blow up a Star Fortress maybe (regrettably, I don’t know the relevant lore & I’ve been incapable of doing the gameplay I want to do to get there).

Current word count of all your main wips?

I do Not track those stats. . . I think I know which are the longest, though.

-Part 1 of Liio/Kallir/Zahied AU is. . . 54 pages (for. . .3-4 scenes, essentially. dkfshgkjf).

-Part 2 combined WIPs are 15 + 6 + 3 + .2 (a paragraph)

(split up due to time-jumping mid-draft, starting a new file, & returning to unfinished business when I feel like it)

Fic that isn’t a total departure from character canon:

-Part 1 (of the in-depth edition) of Kallir’s pirate story is a 32 page WIP, w/ an 18-page side chapter (which might not get any longer)

-Part 2: 6 pages so far.

-Aftermath follow-up: 7 so far.

How many projects do you have going on right now? Are there any that you doubt you’ll ever finish?

(My answer to question 1 is more-or-less my entire list)

It’s hard to say I Won’t finish anything, but also--I don’t often finish writings.

What was you first major project? How far along is it?

And I wouldn’t necessarily call any of them ‘major’ projects (pirate fic got pretty big--but. idk). . .

My first SWTOR fic was for TD & Quinn, and I got lost on it. lol. It’s one of those drafts that feels convoluted to look at (there’s a lot of patchwork pieces), & I’m not sure exactly how much of it is worth having in there or what I actually Want to write into it. (Quinn is hilarious to write, though.)

What are some tropes and character dynamics found in your wips?

. . . gay little scene-slice stories of charged & intimate interactions--aggressive or/and soothing. Just people having their emotional problems in various Situations (sometimes amid danger/stress. . . sometimes when they are trying to enjoy themselves. . . Sometimes those mix).

So. . . tame (generally tame.) psychological whump (mainly psychological.) I Guess. H/C-aligned.

Describe the setting of one or more of your wips

All my stories are in settings of Convenience, and usually defined more by who is there than details of the place itself. (eg. I’m picturing “Kallir gets bullied for having a Sith bf” somewhere on Taris b/c it seems like the kind of place where the military doesn’t get a lot of oversight). Nothing too exciting (or original).

What are some things that inspired your stories? Real events? Maybe a dream?

Game events sometimes, of course. ehehh.

I also have. . . not uncommonly come up w/ concepts for scenarios based on outfits. (Pirate fic arose b/c I previewed the Belsavis zap collar on Kallir. Vensys’ formal outfit was the starting point for that AU fic with the formal event)

What story are you the proudest of? Why?

I dunnoooo-- I have. . . a weird relationship w/ my writings. I don’t have consistent feelings about them (whether I think anything is so good or absolutely Unbearably terrible/cringe changes based on my own moods), and. . . A lot of the time I’m ashamed even making some/most of them for various reasons.

. . .BUT.

I was (and still am) pretty proud of how I wrote our charas in the pumpkin-meets-Severine mini-story from a While back (which I just re-blogged cuz of the improvement edits last night). hehe. On fire w/ that one, writing a couple of my favorite personalities--successfully (I’d say) channeling a character that’s not even mine.

And I don’t feel like I wasted my time if it’s a gift 4 a friend & I’ve been able to make their day with it. <3 We luv our charas. hell yeaaaaaaa

2 notes

·

View notes

Text

TRACES – Overview of e-TDS and e-TCS

Introduction

Welcome to the world of TDS, the traceability system for e-Commerce! In this blog post we'll discuss what e-TDS is and how it works.

e-TDS

e-TDS is a new system of tax collection introduced by the government of India. It is a part of the e-Nivaran project, an initiative to digitize all processes related to tax collection.

The main objective behind this system is to bring transparency and efficiency in government schemes by reducing manual work, avoiding corruption and ensuring better customer experience through online transactions at minimal cost.

e-TCS

e-TDS is the online version of TDS.

e-TCS is a web-based application used to submit income tax returns online, file income tax returns electronically, and receive updates on various things like income tax rates and deductions.

there are two parts of TDS traces.

There are two parts of TDS traces. One is e-TDS, which is done through the internet. The other one is e-TCS, which is done through a computer software.

The main purpose of using these two kinds of systems is to ensure that your money reaches its destination without any loss or delay in between; this way you can be sure that all your transactions are safe from frauds like card cloning and theft etc.,

Conclusion

From the above, you can conclude that e-TDS and e-TCS are two different technologies for creating digital time series data. Both have their own advantages and disadvantages, but both of them can be used together with any other technology to get the best results.

4 notes

·

View notes

Text

Lynn Chu

Garland recites that the DOJ always uses the "least intrusive means possible." What he's trying to imply is that their break-in and ransack of Trump's home was the LEAST that Trump deserved. He insinuates that Trump was resisting, or refusing, to return documents. This is obviously false. But note how he merely suggests lies, to smear and excite the TDS part of the Biden base. Similarly he pompously "defends" the FBI rank and file. Whom no one attacked. It's FBI and DOJ management that are behaving deplorably. The vile communist Biden administration. Lies and deflections and elisions is all that Democrats are about now. And imposing communism on America.

4 notes

·

View notes

Text

Apply for new pan card in New York

A Permanent Account Number (PAN) card is an essential document for various financial transactions and is required for all Indian citizens and entities conducting business in India. If you’re an Indian residing in New York or an Indian-origin individual needing a PAN card, the process to apply for one has been streamlined and can be completed from abroad. Here’s a comprehensive guide on how to apply for a new PAN card in New York.

What is a PAN Card?

A PAN card is a unique 10-character alphanumeric identifier issued to all tax-paying entities in India. These entities include individuals, companies, partnerships, trusts, and foreign nationals conducting business in India. The PAN is unique to each entity and is valid for a lifetime, regardless of any changes in address or employment.

Importance of a PAN Card

Tax Identification and Compliance:

Income Tax Returns: PAN is essential for filing income tax returns. It ensures that the tax-related activities of individuals and entities are tracked.

TDS/TCS: It helps in the tracking of tax deducted at source (TDS) and tax collected at source (TCS).

2. Financial Transactions:

Banking: Required for opening bank accounts, applying for loans, and conducting transactions above a certain limit.

Investments: Necessary for investments in securities, mutual funds, and fixed deposits exceeding a specified amount.

Property: Essential for purchasing or selling immovable property above a certain value.

3. Identity Proof:

PAN card is widely accepted as valid proof of identity across various sectors, including financial institutions, government services, and private organizations.

4. Prevention of Tax Evasion:

The PAN system links all financial transactions of an individual or entity, thereby reducing the chances of tax evasion and ensuring transparency.

Features of a PAN Card

If you want to apply for new pan card so you can contact us +1 (416) 996–1341 or [email protected] for apply new pan card in new york.

Unique Identification Number:

Each PAN card has a unique 10-character alphanumeric code that follows a specific format, ensuring no two PAN cards are identical.

2. Validity:

The PAN card remains valid for a lifetime. It is not affected by changes in personal information such as address or employment status.

3. Universal Acceptance:

Recognized across India as a valid proof of identity and essential for various financial and legal transactions.

4. Structure of PAN:

The PAN number consists of 10 characters, where the first five characters are letters, followed by four numerals, and the last character is a letter. For example, ABCDE1234F.

The fourth character signifies the type of PAN holder (individual, company, trust, etc.).

5. Details on the Card:

The PAN card contains the cardholder’s name, father’s name, date of birth, signature, and a photograph. For non-individual entities, it includes the entity’s name and date of incorporation.

Applying for a New PAN Card

Who Can Apply?

Individuals: Indian citizens, NRIs, PIOs, and OCIs.

Entities: Companies, firms, HUFs, trusts, and foreign nationals/entities conducting business in India.

Conclusion

Apply for a new PAN card in New York is a straightforward process if you follow the correct steps and provide the necessary documentation. Whether you’re an NRI or an individual of Indian origin, having a PAN card is crucial for managing your financial affairs in India. By following this guide, you can ensure a hassle-free application experience and receive your PAN card without any complications.

Contact Us-

Phone- +1 (416) 996–1341

Email Us- [email protected]

0 notes

Link

Filing TDS return for the first time? Yes, then here are the few things you should know before filing your first TDS return.

#you have not filed any statement for the mentioned tan#tan registration#tan registration on traces#traces website#income tax website#tan registration on income tax website#how to file first tds return#how to file tds return#tds return#tan#tds

0 notes

Text

Income Tax Certification Course at Academy Tax4wealth

Academy Tax4wealth Introduces Income Tax Certification Course for all students and Professionals to enhance their careers.

Under the Income Tax Certification Course, Learn How to File ITR Online.

Also, you can learn How to File TDS Returns Online.

https://academy.tax4wealth.com/public/category/income-tax-certification-coursehttps://academy.tax4wealth.com/

#Income Tax Certification Course#File ITR Online#How to File ITR Online#ITR Filing Course#TDS Filing Course#TDS Filing Online#TDS Return Online

0 notes

Link

#How to File TDS Return Online#TDS return filing#filing of tds return#TDS return#TDS return online#Tax Deductible at Source TDS#tds return e-filing#e-TDS file

0 notes

Text

What are the benefits of effective tax planning?

Tax planning is about finding a way out of how to pay less tax by managing your money. The idea is to use the rules and benefits provided by the government to lower your tax bill. It involves making smart decisions about your finances and business to reduce the tax you owe. By planning at the start of the year, you can confirm using all the tax rules to your advantage. This helps you save money legally and avoid any last-minute rush to sort out your taxes.Taking an income tax course helps you learn about filing taxes. An online income tax accounting course, like the one offered by Finprov, is a great way to understand the topic thoroughly. Finprov’s accounting professional courses are designed to teach you how to prepare and file your income tax returns accurately and effectively. Our income tax course covers different types of income, tax systems, old and new tax schemes, basics of TDS & TCS, deadlines, penalties, accounting records, and bookkeeping. We also offer practical live training and placement assistance to all the learners.

0 notes

Text

TDS Refund Services in Lucknow: Maximizing Your Tax Returns

In today's complex tax landscape, navigating through various deductions and refunds can be daunting. One such area that often perplexes taxpayers is TDS or Tax Deducted at Source. Understanding how to efficiently claim TDS refunds can significantly impact one's financial well-being. This article delves into the intricacies of TDS refund services, particularly in Lucknow, to assist taxpayers in optimizing their tax returns.

Understanding TDS

What is TDS?

Tax Deducted at Source (TDS) is a system introduced by the Income Tax Department of India to collect tax at the source of income generation. It ensures that tax is deducted in advance from certain types of payments, such as salary, interest, rent, commission, etc.

How does TDS work?

Employers or entities making payments are required to deduct a certain percentage of tax before making payment to the recipient. This deducted amount is then deposited with the government on behalf of the recipient.

TDS Refund Process

Claiming a TDS refund involves several steps and criteria.

Refund eligibility requirements for TDS

A TDS refund is available to people who overpaid in comparison to their real tax burden. This typically occurs when a person is in a lower tax category or when the amount of TDS that has been deducted exceeds their actual tax burden.

How to request a refund of TDS

It is necessary to file an income tax return (ITR) with proper information about income, deductions, and TDS in order to request a TDS refund. If the tax department verifies that more TDS was paid, they will give the taxpayer a refund.

Advantages of Using a Service Company

Using a TDS refund service provider has a number of benefits.

Expertise and Efficiency

One of the most significant advantages of utilizing a TDS refund service provider is tapping into their expertise. These professionals possess an in-depth understanding of tax laws, regulations, and procedures, ensuring that your refund process is executed with precision and efficiency. By entrusting your tax-related concerns to seasoned experts, you can navigate through the intricate maze of tax regulations with confidence.

Maximized Returns

Efficiency translates to maximized returns. With a TDS refund service provider at your disposal, you can rest assured that every eligible rupee is claimed. These experts possess the acumen to identify all potential avenues for refunds, ensuring that you receive the maximum refund possible. By leveraging their knowledge and experience, you can optimize your tax returns and bolster your financial well-being.

Simplified Procedure

It can be difficult to navigate the TDS refund process, especially for people who are not familiar with its complexities. But when you have an experienced service provider on your side, the procedure is simplified and trouble-free. These professionals carefully attend to every detail in handling every part of the refund procedure, from filing the paperwork to communicating with tax authorities. By doing this, you may concentrate on your primary duties and leave the intricate details of tax refunds to knowledgeable professionals.

Fast Refunds

Time is critical in the fast-paced society we live in today. Being perpetually delayed in receiving your tax return can be annoying and inconvenient. Thankfully, working with a TDS refund service provider speeds up the refund procedure and guarantees that you get your money back quickly. With their proactive approach and efficient handling of paperwork, you can bid farewell to lengthy delays and welcome swift refunds with open arms.

Compliance and Accuracy

Tax laws are always changing, which makes it difficult for taxpayers to comply. However, compliance becomes simple when you have a committed service provider managing your tax matters. These experts make sure that your tax filings are accurate and fully compliant with current legislation by staying up to date on any regulatory modifications and amendments. You may protect your financial interests and reduce the chance of mistakes and penalties by leaving your tax problems in the capable hands of others.

Personalized Assistance

Since each taxpayer's circumstances are different, they require customized solutions made to meet their particular requirements. TDS refund service providers are aware of this variability and give individualized support to meet each client's needs. Whether you work for a living, own a business, or are self-employed, these professionals create customized plans to maximize your tax returns and reduce your liabilities. You may confidently negotiate the tax system with their tailored approach, knowing that your financial objectives are being given first priority.

Selecting the Appropriate Service Provider

Credibility and background

It's critical to take into account a service provider's reputation and track record of managing TDS refund cases when choosing one.

Customer endorsements and assessments

It is possible to gain insight into the dependability and effectiveness of the service provider by reading the endorsements and reviews left by prior customers.

As part of the all-inclusive startup support offered by My Startup Solution, we help match companies with reputable TDS refund service providers in Lucknow. Here's how we make this procedure easier:

Needs Assessment: To begin, we try to ascertain the precise TDS refund services needs of your startup. This entails assessing your present tax status, locating any overdue TDS deductions, and choosing the best refund procedure.

Provider Matching: We make use of our network of trustworthy TDS refund service providers in Lucknow based on your needs assessment. We carefully choose service providers who have a history of satisfying customers and guaranteeing maximum returns.

Introductions and Coordination: We help your startup and the chosen TDS refund service providers make introductions. Throughout the engagement process, we guarantee efficient communication and coordination, guaranteeing that all of your questions are answered right away.

Quality Control: My Startup Solution is dedicated to providing high-quality services. We keep a careful eye on the TDS refund process and step in to help if problems occur to make sure you get the best support possible.

Remarks and Follow-Up: Following the TDS reimbursement procedure, we ask your startup for comments on the services rendered by our affiliated suppliers. We make use of your comments to enhance our provider network and service offerings over time.

TDS refund services can make a big difference in how much money is saved on taxes. Taxpayers can maximize their financial returns by working with a reliable service provider in Lucknow to help them manage the intricacies of TDS refunds. Businesses in Lucknow may easily and confidently obtain reputable TDS refund service providers with the help of My Startup Solution, freeing them up to concentrate on their primary business operations while guaranteeing compliance and optimizing tax benefits.

0 notes

Text

A comprehensive guide to Form 16A: A TDS Certificate

Form 16A is a TDS certificate that is issued by the deductor on a quarterly basis. It is a statement concerning the nature of payments, the amount of TDS, and the deposited TDS payments to the Income Tax department. It also consists of brokerage, interest, professional fees, contractual payments, rent, and other sources of income.

Unlike Form 16, which only consist salary structure, Form 16A of income tax charge TDS from:

Receipts from business or profession fees.

Rental receipts from a property or rent.

Sale proceeds from capital assets.

Additional source.

Important components of Form 16A

The important components of Form 16A are:

Details of the Employer: It contains the name, TAN, and PAN of the employer.

Details of Employee: It contains the name, TAN, and PAN of the employee.

Mode of Payment: Both offline and online modes of payment are available.

Receipt number of TDS: The receipt number of TDS helps in the tracking of back details.

The date and deposit tax amount with the income tax department help track information.

Significance of Form 16A

Form 16A plays a pivotal role while filing an income tax return, especially when someone has other sources of income apart from their salary. Here are the key benefits of Form 16A:

Filing of income tax returns: The details contained in Form 16A help employees file their income tax returns. It guides employees in reporting their total income, which includes salary and other sources.

Tracking of TDS: It helps every individual keep track of the tax deducted at source (TDS) on their income. It gives you a summary of TDS deducted at source.

Income Proof: Form 16A works as evidence of an individual's total earnings from other sources. Government agencies and financial institutions, like banks, easily accept this source as income proof.

Loan Applications: This form is important in verifying the loan applications. Financial institutions often need a record of the assets and liabilities of an individual to check the guarantee on loan repayment.

How to download Form 16A?

Below are the following steps to download Form 16A:

Visit the official website of the income tax department.

Complete the registration process on the website.

Click the "Download" tab, and then select Form 16A.

Fill in the PAN details, and then click “Go to continue.”.

Click submit and download Form 16A.

What is the difference between Form 16 and Form 16A?

Form 16 and Form 16A are both TDS certificates, but there are certain differences between them. The following are the differences between Form 16 and Form 16A:

Form 16 is a TDS certificate deducted from salary, whereas Form 16A is issued for income other than salary.

Form 16 is issued by the employer, whereas Form 16A is issued by financial institutions.

Form 16 is used for deducting tax from salary, whereas Form 16A is for removing taxes from another source of income apart from salary.

Final Thoughts

Paying taxes is the responsibility of the citizens of the nation. It is evident that the process of filing an income tax return and Form 16A is restless and troublesome. Some technical terms of income tax are not known to the new taxpayer. Worry not, because Eazybills will solve every tax-related problem and also offer TDS tracking.

So? What are you waiting for? Connect to us today through our website, where our professional team will guide you according to your requirements.

#form 16A#income tax return#tds certificate#file income tax return#easy billing software#gst billing software#free invoicing software#billing software#free billing software#best billing software#online billing software#online invoicing software#best invoice software

0 notes