#Hydraulic Motor Market Development

Text

#Hydraulic Motor Market COVID-19 Analysis Report#Hydraulic Motor Market Demand Outlook#Hydraulic Motor Market Primary Research#Hydraulic Motor Market Size and Growth#Hydraulic Motor Market Trends#Hydraulic Motor Market#global Hydraulic Motor market by Application#global Hydraulic Motor Market by rising trends#Hydraulic Motor Market Development#Hydraulic Motor market Future#Hydraulic Motor Market Growth#Hydraulic Motor market in Key Countries#Hydraulic Motor Market Latest Report#Hydraulic Motor market SWOT analysis#Hydraulic Motor market Top Manufacturers#Hydraulic Motor Sales market#Hydraulic Motor Market COVID-19 Impact Analysis Report#Hydraulic Motor Market Primary and Secondary Research#Hydraulic Motor Market Size#Hydraulic Motor Market Share#Hydraulic Motor Market Research Analysis#Hydraulic Motor Market Trends and Outlook#Hydraulic Motor Industry Analysis

1 note

·

View note

Text

#Hydraulic Motor Market COVID-19 Analysis Report#Hydraulic Motor Market Demand Outlook#Hydraulic Motor Market Primary Research#Hydraulic Motor Market Size and Growth#Hydraulic Motor Market Trends#Hydraulic Motor Market#global Hydraulic Motor market by Application#global Hydraulic Motor Market by rising trends#Hydraulic Motor Market Development#Hydraulic Motor market Future#Hydraulic Motor Market Growth#Hydraulic Motor market in Key Countries#Hydraulic Motor Market Latest Report#Hydraulic Motor market SWOT analysis#Hydraulic Motor market Top Manufacturers#Hydraulic Motor Sales market#Hydraulic Motor Market COVID-19 Impact Analysis Report#Hydraulic Motor Market Primary and Secondary Research#Hydraulic Motor Market Size#Hydraulic Motor Market Share#Hydraulic Motor Market Research Analysis#Hydraulic Motor Market Trends and Outlook#Hydraulic Motor Industry Analysis

0 notes

Text

Who is the Largest Heavy Equipment Manufacturer in India?

India's construction industry is booming, driven by massive infrastructure projects and urban development. Leading heavy equipment manufacturers support this growth. Here, we explore India's largest heavy equipment manufacturer, emphasizing its market dominance, product offerings, and contributions to the construction industry.

Dominant Player: Case Construction India

Case Construction India

Case Construction stands out as India's largest heavy equipment manufacturer. Established in 1979, Case India has grown to become a wholly-owned subsidiary of J.C. Bamford Excavators in the UK. With five state-of-the-art manufacturing plants in India, Case produces essential construction equipment like backhoe loaders, excavators, and compactors.

Market Presence and Product Range

Case India is renowned for its backhoe loaders, known for their versatility and reliability. They are preferred for various construction activities, from small urban projects to large-scale infrastructure developments. Besides backhoe loaders, Case manufactures:

Excavators: Known for robust performance and efficiency in digging and earth-moving tasks.

Wheel Loaders: Essential for material handling and transport within construction sites.

Compactors: Used for soil and asphalt compaction, ensuring stable foundations for structures.

Innovation and Technological Advancements

Case India's success is partly due to its focus on innovation and integrating advanced technology into its machinery. The company's intelligent and connected machines feature advanced telematics, GPS, and IoT technologies, allowing real-time monitoring and enhanced operational efficiency.

Commitment to Sustainability

Case India has developed eco-friendly machinery in response to increasing environmental regulations. Their electric and hybrid equipment reduces emissions and operational costs, aligning with global sustainability goals.

Other Notable Heavy Equipment Manufacturers in India

Tata Hitachi Construction Machinery Co. Pvt. Ltd.

A joint venture between Tata Motors and Hitachi Construction Machinery, Tata Hitachi offers reliable and efficient construction equipment, including hydraulic excavators, backhoes, and wheel loaders.

Caterpillar India

Caterpillar India, a subsidiary of Caterpillar Inc., offers a comprehensive range of durable and high-performance machinery, including excavators, loaders, and bulldozers.

Komatsu India

Komatsu India, a subsidiary of the Japanese multinational Komatsu Ltd., is known for its high-quality construction machinery, including hydraulic excavators, wheel loaders, and dump trucks.

Conclusion

Case Construction India leads India's heavy equipment manufacturing industry with its extensive product range, innovative technology, and commitment to sustainability. Case's advanced and reliable machinery will be crucial in shaping the industry's future as the construction sector grows.

For more detailed information and updates on the latest offerings from Case India and other leading manufacturers, visit their official websites and stay tuned to industry news.

0 notes

Text

Pressure Transducer Market Forecast 2024-2033

Overview and Scope

A pressure transducer is an instrument that detects fluid pressure and indicates the force the fluid exerts on surfaces in contact with it. Pressure transducers are utilized in a wide range of control and monitoring applications, such as flow, airspeed, level, pump systems, and altitude monitoring.

Sizing and Forecast

The pressure transducer market size has grown rapidly in recent years. It will grow from $7.08 billion in 2023 to $7.83 billion in 2024 at a compound annual growth rate (CAGR) of 10.6%. The growth in the historic period can be attributed to industrial automation, expansion of oil and gas exploration, healthcare applications, aviation and aerospace development, water and wastewater management, environmental monitoring..

The pressure transducer market size is expected to see rapid growth in the next few years. It will grow to $11.59 billion in 2028 at a compound annual growth rate (CAGR) of 10.3%. The growth in the forecast period can be attributed to smart cities development, precision agriculture practices, integration with wearable health devices, focus on water conservation, expansion of renewable energy.. Major trends in the forecast period include industry 4.0 adoption, adoption of mems technology, integration of wireless pressure transducers, emphasis on industry-specific customization, advancements in sensing technologies..

Segmentation & Regional Insights

The pressure transducer market covered in this report is segmented –

1) By Pressure: Absolute Pressure, Gauge Pressure, Differential Pressure

2) By Technology: Capacitive, Piezo Resistive, Thin Film, Ceramic Thick Film, Mems, Oil-Filled

3) By End-User: Automotive, Healthcare, Consumer Electronics, Oil and Gas

North America was the largest region in the pressure transducer market in 2023. The regions covered in the pressure transducer market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Major Driver Impacting Market Growth

The growth of the automobile sector is expected to propel the growth of the pressure transducer market. The automotive industry refers to the companies linked with the manufacturing, selling, and maintenance of motor vehicles. The pressure transducer is used in the automobile industry as an electronic pressure sensor to monitor the pressure of the vehicle’s vital components, such as engine oil, gearbox, and transmission oil, and hydraulic oil in the braking system, cooling system, and fuel systems. For instance, in July 2022, according to the European Automobile Manufacturers Association, a group of the automobile industry in the European Union, in 2021, automobile trade generated an annual trade of $81.7 billion (€79.5 billion) for the European Union, an increase of 4.6%. Therefore, the growth of the automobile sector will drive the pressure transducer market.

Key Industry Players

Major companies operating in the pressure transducer market report are Panasonic Holdings Corporation, Sensata Technologies Incorporated, ABB Limited, Honeywell International Incorporated, Validyne Engineering, Robert Bosch GmbH, NXP Semiconductors, Setra Systems Incorporated, ControlAir Incorporated, Kulite Semiconductor Products Incorporated, TE Connectivity Ltd., Endress+Hauser AG, Schneider Electric SE, Yokogawa Electric Corporation, Kistler Instrument Corporation, Emerson Electric Co., WIKA Instruments LP, Spectris PLC, Hitec Products Inc., LCM Systems Limited, Zemic Group, Bosch Sensortec GmbH, All Sensors Corporation, Thermo Fisher Scientific Inc., Rockwell Automation Inc., Siemens Building Technologies AG, Omron Corporation, First Sensor AG, Gems Sensors Inc., Kavlico Corporation, Ashcroft Inc. .

The pressure transducer market report table of contents includes:

1. Executive Summary

2. Pressure Transducer Market Characteristics

3. Pressure Transducer Market Trends And Strategies

4. Pressure Transducer Market — Macro Economic Scenario

5. Global Pressure Transducer Market Size and Growth

.

.

.

31. Global Pressure Transducer Market Competitive Benchmarking

32. Global Pressure Transducer Market Competitive Dashboard

33. Key Mergers And Acquisitions In The Pressure Transducer Market

34. Pressure Transducer Market Future Outlook and Potential Analysis

35. Appendix

Explore the trending research reports from TBRC:

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

0 notes

Text

1939 Lagonda V12 Engine Cabriolet.

Lagonda was founded in England in 1899 by American Wilbur Gunn. Lagonda is the Shawnee Indian name for Buck Creek in Gunn's native Springfield, Ohio. Automobile production began in the early 1900s, focusing on the luxury automotive segment, with continual development, improvement, and size throughout the years. The engines became more refined, culminating with the 4.5-liter, 6-cylinder Lagonda Rapide that was shown at the London Motor Show in 1934.

In 1935, lawyer Alan P. Good successfully outbid Rolls-Royce for control of Lagonda. Additionally, he was able to recruit W.O. Bentley as chief engineer followed by many of his former engineering staff from Rolls-Royce, the firm that had previously gained control over Bentley Motors Ltd in 1931. W.O. had been kept on as customer relations and testing advisor.

At Lagonda, W.O. and his newly formed team were tasked with improving the existing six-cylinder M45 chassis while simultaneously designing a new model. He improved the ignition and manifold on the M45 model and a new L45 model introduced in 1934. In October of 1936, the new LG6 was announced, featuring a torsion bar independent front suspension, a hypoid rear axle, and hydraulic brakes. The new V-12 model was also announced at the Olympia Motor Show, and the car's chassis were similar, with factory bodies offered on either chassis. Production did not begin until October 1937 and would continue until the outbreak of war in 1940. Customers favored the larger 12-cylinder engine over the six, with 189 examples of the twelve sold and just 85 of the six.

The Lagonda V-12s of 1937 to 1940s ranked among the finest automobiles and rivaled the contemporary multi-cylinder products on the market. The heart of the new Lagonda was its V12 engine by W.O. and engineer Stuart Tresilian, whom Bentley had recruited from Rolls-Royce. It had a 60-degree veed angle, and modern overhead-valve cylinder heads with a single overhead camshaft per cylinder bank. It had a short and compact stroke unit, with cylinder blocks cast in unit with the crankcase and side-by-side connecting rods. It was strong and lightweight thanks to leading-edge metallurgy and materials, with every component rigorously tested for reliability. The standard setup included a pair of new-design SU downdraft carburetors, helping to produce 180 horsepower at 5,500 engine revolutions.

0 notes

Text

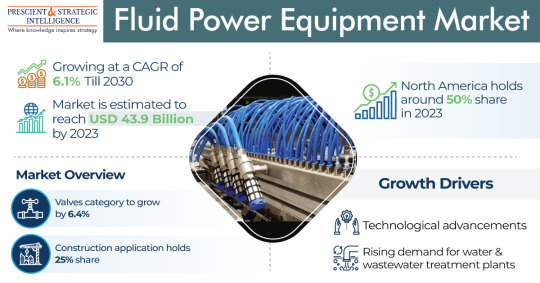

Fluid Power Equipment Market Will Touch USD 66.0 Billion in 2030

The fluid power equipment market was USD 43.9 billion in 2023, which will rise to USD 66.0 billion, advancing at a 6.1% compound annual growth rate, by 2030.

The growth of this industry is mainly because of the increasing need for water and wastewater treatment plants, and the continuous technological developments.

In 2023, hydraulic led the type category, with a revenue of USD 26.3 billion. This can be ascribed to the cost-effectiveness and high efficiency of this type, and its extensive adoption in oil & gas and construction applications.

The pneumatic category, on the other hand, will propel at a healthy rate during this decade. This is because these systems rely on compressed air pressure to send power and are extensively employed in numerous industrial applications.

Furthermore, pneumatic valves are available in different designs, sizes, and configurations, and thus, allow free flow in a single direction and avoid flow in the opposite direction.

In 2023, the construction category, based on end user, was the largest contributor to the fluid power equipment market, with a 25% share. This can be because of the high usefulness of these components in various applications like material demolition or handling in the construction sector.

The automotive category, on the other hand, is advancing at a tremendous rate, because of the increasing customer's disposable salary, along with the increasing standards of living, worldwide.

Motors is leading the component category. This can be because motor components provide great torque & power, and are extensively employed across various sectors, including agriculture, construction, and automotive.

Moreover, the developments in motor technologies enhance their performance and efficiency, and thus, are cost-effective solutions for businesses to utilize for different applications.

On the other hand, the valves category will advance at the highest rate during this decade. This is ascribed to the growing requirement for valves to track high pressure, which will boost the demand for valve components.

North America led the industry in 2023, with a 50% share. This can be attributed to the existence of greater infrastructure, coupled with the rising progression in R&D and manufacturing activities.

Moreover, the increasing count of initiatives implemented to guarantee the worker's safety in oil & gas and chemicals sectors further boost the regional industry growth.

APAC will propel at the highest rate, of 6.5%, in the coming years. This will be because of the surging urbanized populace along with the increasing requirement for energy, and the progression of the construction and automobile sectors in Japan, China, and India.

With the rise in the requirement for water & wastewater treatment plants, the fluid power equipment industry will continuously progress in the coming years.

Source: P&S Intelligence

#Fluid Power Equipment Market Share#Fluid Power Equipment Market Size#Fluid Power Equipment Market Growth#Fluid Power Equipment Market Applications#Fluid Power Equipment Market Trends

1 note

·

View note

Text

Robot Tool Changers Market Recent Developments Study Analysis By 2033

A Robot Tool Changer (RTC) is a device used to quickly and easily change the tool or end-effector attached to a robot arm. This allows the robot to perform multiple tasks without the need to stop and change tools manually.

RTCs typically consist of two parts: a gripper that attaches to the robot arm and a tool-changing mechanism that is mounted on the robot. The gripper is opened and closed using a pneumatic or hydraulic cylinder, and the tool-changing mechanism is operated using an electric motor.

RTCs can be used with a variety of different robot types, including articulated, SCARA, and delta robots. They are often used in applications where the robot needs to perform multiple tasks, such as pick-and-place, welding, and assembly. For example, a robot that assembles cars might need to change its tool from a screwdriver to a wrench.

To Know More: https://www.globalinsightservices.com/reports/robot-tool-changers-market/?utm_id=Snehalkast

Market Outlook

In the current market scenario, there are various factors which are driving the growth of Robot Tool Changers market. Some of the key drivers are as follows:

Increasing demand for automation in various industries: With the increasing competition and need for efficiency and accuracy, there is a growing demand for automation in various industries such as automotive, food & beverage, pharmaceuticals, etc. This is one of the key drivers for the growth of Robot Tool Changers market as these devices help in increasing the productivity and efficiency of the manufacturing process.

Rising labor costs: The rising labor costs across the globe is another key driver for the growth of Robot Tool Changers market. These devices help in reducing the dependence on manual labor, thus leading to lower production costs.

Increasing adoption of collaborative robots: Collaborative robots are becoming increasingly popular in various industries as they offer several advantages over traditional robots such as being safe to work with, easy to program and operate, and cost-effective. This is leading to the increasing adoption of collaborative robots which in turn is driving the growth of Robot Tool Changers market.

Request Sample: https://www.globalinsightservices.com/request-sample/GIS10229/?utm_id=Snehalkast

Major Players

Some of the key players of Robot Tool Changers Market are ATI Industrial Automation Inc. (US), SCHUNK GmbH & Co. KG (Germany), Applied Robotics Inc. (US), Nitta Corporation (Japan), Carl Kurt Walther GmbH & Co. KG (Germany), DESTACO (US), Stäubli International AG (Switzerland), A Dover Company (US), American Grippers Inc (US), and PTM Präzisionstechnik GmbH (Germany).

0 notes

Text

Soaring High: Exploring Crane Manufacturers in India

In the bustling landscape of India's construction and industrial sectors, cranes stand as towering symbols of progress and efficiency. Let's take a closer look at some of the prominent crane manufacturers shaping India's skyline, including the renowned Indef brand.

1. TIL Limited (formerly Tata Motors): TIL Limited boasts a rich legacy of over 70 years in crane manufacturing. Renowned for its engineering excellence and innovative solutions, TIL offers a comprehensive range of cranes, including mobile, tower, and crawler variants. With a commitment to quality and customer satisfaction, TIL has established itself as a leader in the Indian crane industry.

2. ACE Cranes: ACE Cranes has emerged as a key player in India's crane manufacturing sector since its establishment in 1995. The company's focus on indigenous technology and customization has set it apart in the market. ACE's product portfolio includes hydraulic cranes, pick-n-carry cranes, and tower cranes, catering to diverse customer requirements with efficiency and reliability.

3. Escort Group: With a strong presence in the heavy engineering sector, Escort Group has made significant contributions to crane manufacturing in India. The company offers a range of cranes, including rough terrain and truck-mounted variants, known for their robustness and performance. Escort's cranes find applications in construction, infrastructure, and mining projects nationwide.

4. Indef: Indef, a leading name in the Indian crane industry, is renowned for its cutting-edge technology and superior quality. Specializing in material handling solutions, Indef offers a wide array of cranes, hoists, and lifting equipment tailored to meet the specific needs of various industries. The brand's commitment to innovation and reliability has earned it a loyal customer base across India.

5. Innovation and Global Reach: Indian crane manufacturers are embracing innovation to enhance efficiency, safety, and sustainability in crane operations. Technologies such as IoT and automation are being integrated to streamline processes and improve productivity. Furthermore, Indian cranes are gaining acceptance in international markets, contributing to the country's reputation as a hub for engineering excellence.

6. Challenges and Opportunities: While the Indian crane industry holds immense potential for growth, it also faces challenges such as regulatory complexities and skilled labor shortages. However, these challenges present opportunities for innovation and collaboration. By leveraging technology and fostering skill development initiatives, manufacturers can overcome hurdles and drive sustainable growth.

7. Conclusion: In conclusion, crane manufacturers in India play a crucial role in the nation's development journey. With a blend of indigenous innovation, global best practices, and a commitment to quality, these companies are shaping India's infrastructure landscape and making their mark on the global stage.

As India continues to progress towards its vision of economic prosperity, the towering presence of cranes serves as a testament to the country's engineering prowess and determination.

0 notes

Text

Segmenting the Power Tools Market: Strategies for Targeted Marketing Campaigns

Power Tools Market Overview:

In 2021, the power tools market was estimated to be worth USD 44.6 billion. According to projections, the power tools market will expand at a compound annual growth rate (CAGR) of 5.9% from USD 47.23 billion in 2022 to USD 73.8 billion by 2030.

Power tools play a pivotal role across various industries, providing efficiency, precision, and productivity in tasks ranging from construction and manufacturing to woodworking and DIY projects. The global power tools market has witnessed substantial growth driven by technological advancements, industrial automation, and increasing demand for high-performance tools. This article provides an in-depth overview of the power tools market, including segmentation analysis, key takeaways, and regional insights.

For latest news and updates, request a free sample report of Power Tools Market

By Segmentation:

1. Product Type:

a. Electric Power Tools: This segment includes corded and cordless electric tools such as drills, saws, sanders, grinders, and routers, powered by electricity for versatile and efficient operation.

b. Pneumatic Power Tools: Pneumatic or air-powered tools utilize compressed air to drive mechanisms such as impact wrenches, nail guns, and sanders, offering high power-to-weight ratios and durability in industrial applications.

c. Hydraulic Power Tools: Hydraulic tools use hydraulic fluid to generate power for tasks such as cutting, bending, and pressing, commonly found in heavy-duty construction, automotive, and manufacturing operations.

2. End-User:

a. Construction: Power tools are indispensable in construction activities, including drilling, cutting, fastening, and finishing tasks, contributing to efficiency, accuracy, and safety on construction sites.

b. Manufacturing: Industries such as automotive, aerospace, electronics, and metal fabrication rely on power tools for precision machining, assembly, and surface finishing processes, enhancing productivity and product quality.

c. Woodworking: Woodworkers and carpenters utilize a wide range of power tools such as saws, routers, planers, and sanders to craft furniture, cabinets, and other wooden products with speed and precision.

d. DIY Enthusiasts: Homeowners and hobbyists use power tools for various do-it-yourself projects, renovations, and repairs, driving demand for compact, user-friendly tools with advanced features.

3. Region:

The global power tools market is segmented into key regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region exhibits distinct market dynamics influenced by factors such as industrialization, infrastructure development, technological adoption, and regulatory environment.

Key Takeaways:

1. Technological Advancements: Continuous innovation in power tool design, materials, and functionality, including brushless motors, lithium-ion batteries, and digital controls, enhances performance, durability, and user experience.

2. Industry 4.0 Integration: The convergence of power tools with digital technologies such as IoT (Internet of Things), AI (Artificial Intelligence), and cloud connectivity enables remote monitoring, predictive maintenance, and data-driven insights, optimizing operational efficiency and uptime.

3. Safety and Ergonomics: Manufacturers prioritize safety features and ergonomic designs in power tools to minimize user fatigue, reduce the risk of accidents and injuries, and enhance overall user comfort and productivity.

4. Market Expansion in Emerging Economies: Rapid urbanization, infrastructure development, and industrialization in emerging markets such as China, India, and Southeast Asia drive the demand for power tools, presenting growth opportunities for market players to expand their presence and product offerings.

Regional Insights:

1. North America: The United States and Canada lead the North American power tools market, driven by robust construction and manufacturing sectors, technological innovation, and a strong DIY culture.

2. Europe: Germany, the UK, and France are key markets in Europe, characterized by stringent safety regulations, emphasis on sustainability, and growing adoption of smart and connected power tools.

3. Asia Pacific: China, Japan, and India dominate the Asia Pacific market, fueled by rapid industrialization, urbanization, infrastructure investments, and increasing demand for high-quality power tools in manufacturing and construction sectors.

4. Latin America and the Middle East & Africa: These regions offer growth opportunities due to expanding construction activities, infrastructure projects, and investments in industrial development, driving demand for power tools and related equipment.

The power tools market continues to evolve with advancements in technology, changing end-user preferences, and evolving industry trends. Manufacturers, suppliers, and distributors need to adapt to these dynamics, focusing on innovation, safety, and market expansion to capitalize on growth opportunities globally. By understanding regional nuances and catering to diverse end-user needs, stakeholders can navigate the competitive landscape and drive sustainable growth in the dynamic power tools market.

Top trending report:

HVAC System Market

Industrial Hand Gloves Market

Water Purifier Market

Agriculture Equipment Market

Power Tools Market

0 notes

Text

What is the price of the bus processing machine (the price of the manufacturer of the Hubei Full Automatic Bus Machining Machinery)

Systemic failure refers to the determined failure that will occur if certain conditions are met; random failure refers to the occasional failure under the same conditions. The analysis of this type of failure is more difficult, and it is usually mostly partially partially partially partially partially part of the mechanical structure of the machine tools. Relax dislocation, some electrical workpiece characteristics drift or reduce reliability, and the internal temperature of the electrical device is related. The analysis of such faults must be excluded by repeated tests and comprehensive judgments.

The copper busbar machine is generally composed of three industrial stations: punching, bending and shearing. The hydraulic driver is used to control the control of each process by PLC. , It is a high -efficiency small machine tool for the large -scale processing mother of the electrical industry. As one of the three major stations, the scissors station, its function is to cut the copper row of 20 to 140mm and 3 to 15mm thick and ensure the smoothness of the incision and the vertical degree of the section. The focus and difficulty in design. What is the price of the bus processing machine

How should different types of parent machines choose lubricating oil? To give full play to the performance of the linear guide rail, it is necessary to choose the appropriate types and lubrication methods of lubricant according to the form, load, speed, etc. of the linear guide. However, compared with sliding rails, the straight -line guide rail has a very small dependence on the lubricant, so the amount of oil is small, the injection interval is also long, which can reduce the burden of maintenance management. Generally speaking, the lubricant used in the linear guide can be roughly divided into lubricants and lubrication

The lower and the restrictions of many other factors have not improved for a long time; since the reform and opening up, my country has begun to focus on the development of equipment manufacturing as the major event of the national economy and people's livelihood. CNC technology has gone through " The introduction of the Sixth Five -Year Plan, the digestion of "July Five", and the independent research and development of the "Eighth Five -Year Plan", the "Ninth Five -Year Plan" industrialization and engineering. It was not until the early 1980s that CNC technology began to be applied to the buser and twisted machines. Since then, the corresponding CNC parent -line machine products have been launched; since the new century, it has formed some research and development in China. The research and development platform that is produced in one, and many technical parent line machine companies with a large number of industry talents slowly grow up. These enterprises have basically possessed the comprehensive development and production capacity of CNC system products, and can adjust their own development direction at any time according to the situation of domestic and foreign related technologies, markets, and customer needs. These CNC systems, these CNC systems generally have good portability, extension capabilities, high computing accuracy, stable and reliable.

The main axis power system of the automatic parent line machine price is the source of the device collection power. In the device, it mainly plays the role of collecting roll wires. According to the differences in the models and application fields AC inverter motor, AC gear deceleration motor, AC motor+large reducer and other types. The main technical parameters are foil -type parent line machine equipment speed, maximum use of wire diameter, maximum coil weight, and so on.

The display screen uses a large screen (7 -inch) color screen to display the touch formula. It has a password protection function to modify unqualified data. If the customer uses not a standard workpiece, you can also set the data according to the requirements of the non -standard workpiece to set the data for yourself. Processing, it is very convenient to operate.

The low -voltage CNC bus is mainly used to process the low -voltage coils in the transformer coil. Generally, it is dominated by wrapped flat wires and foil belts. Such equipment has large torque and a solid body structure. The high -voltage CNC bus is mainly used for the entanglement of the high -voltage coil in the transformer coil. The processing process usually uses single or multiple round lines, multi -layer wound; high -voltage coils generally have a large number of processing circles. At the same time It is not much different from the low -voltage CNC bus. It can be done using a general CNC bus. What is the price of the bus processing machine

If the above situation occurs, it can be determined that the zero line is disconnected. Three -phase power distribution transformer generates a zero -line disconnection failure within the power supply range of the three -phase power distribution transformer, that is, the zero -line bus is disconnected. The specific performance is the same as that of the zero -line disconnection of the three -phase and four -line branch, but the range is greater, the harm is more serious, and the loss is huge.

0 notes

Text

Aircraft Electrical System Market May Set New Growth Story

Advance Market Analytics published a new research publication on "Aircraft Electrical System Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Aircraft Electrical System market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/63856-global-aircraft-electrical-system-market-1

The Aircraft Electrical System Market report covers extensive analysis of the key market players, along with their business overview, expansion plans, and strategies. The key players studied in the report include: AMETEK, Inc. (United States), Safran S.A. (France), Astronics Corporation (United States), Amphenol Corporation (United States), Esterline Technologies (United States), Honeywell Corporation (United States), Meggitt PLC (United Kingdom), Thales Group (France), United Technologies Corporation (United States), Crane Aerospace & Electronics (United States)

Definition:

Advancements in High-Density Battery Solutions for Electric Aircraft will help to boost global aircraft electrical system market in the forecasted period. An aircraft electrical system is a significant part of aircraft that has the capability to generate electricity. It is an independent network of components that generate, distribute, utilize, and store electrical energy .It is mainly driven by APU (auxiliary power unit) and a hydraulic motor or a RAT (Ram Air Turbine). Most aircraft are equipped with either a 28-volt- or a 14-volt direct current electrical system.

The following fragment talks about the Aircraft Electrical System market types, applications, End-Users, Deployment model etc. A thorough analysis of Aircraft Electrical System Market Segmentation: by Application (Aircraft Utility Management, Configuration Management, Power Generation Management, Flight Controls & Operations), Platform (Commercial Aviation, Military Aviation, Business & General Aviation), Component (Variable Frequency Generator, Generator Control Unit, Power Electronics, Transformer Rectifier Unit, Power Distribution Systems, Integrated Drive Generator), System (Power Generation, Conversion, Distribution, Energy Storage)

Aircraft Electrical System Market Drivers:

Upsurging Technological Advancements in Aircraft Based Electric Systems

Enhanced Aircraft Performance with The Increasing Uses of Electrical Energy

Aircraft Electrical System Market Trends:

Introduction to High-Density Battery Solutions for Electric Aircraft

Growing Adoption of No-Bleed Systems Aircraft Architecture and Hybrid Or Electric Propulsion System Design

Aircraft Electrical System Market Growth Opportunities:

Growing Use of Lightweight Wiring in Aircraft Electrical Systems

Introduction to Fuel Cell Technology, and Electric Actuation System

As the Aircraft Electrical System market is becoming increasingly competitive, it has become imperative for businesses to keep a constant watch on their competitor strategies and other changing trends in the Aircraft Electrical System market. Scope of Aircraft Electrical System market intelligence has proliferated to include comprehensive analysis and analytics that can help revamp business models and projections to suit current business requirements.

We help our customers settle on more intelligent choices to accomplish quick business development. Our strength lies in the unbeaten diversity of our global market research teams, innovative research methodologies, and unique perspective that merge seamlessly to offer customized solutions for your every business requirement.

Have Any Questions Regarding Global Aircraft Electrical System Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/63856-global-aircraft-electrical-system-market-1

Strategic Points Covered in Table of Content of Global Aircraft Electrical System Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Aircraft Electrical System market

Chapter 2: Exclusive Summary and the basic information of the Aircraft Electrical System Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Aircraft Electrical System

Chapter 4: Presenting the Aircraft Electrical System Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2018-2022

Chapter 6: Evaluating the leading manufacturers of the Aircraft Electrical System market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2023-2028)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Aircraft Electrical System Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/reports/63856-global-aircraft-electrical-system-market-1

What benefits does AMA research study is going to provide?

Latest industry influencing trends and development scenario

Open up New Markets

To Seize powerful market opportunities

Key decision in planning and to further expand market share

Identify Key Business Segments, Market proposition & Gap Analysis

Assisting in allocating marketing investments

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact US :

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 201 565 3262, +44 161 818 8166

[email protected]

#Global Aircraft Electrical System Market#Aircraft Electrical System Market Demand#Aircraft Electrical System Market Trends#Aircraft Electrical System Market Analysis#Aircraft Electrical System Market Growth#Aircraft Electrical System Market Share#Aircraft Electrical System Market Forecast#Aircraft Electrical System Market Challenges

0 notes

Text

Leading Construction Equipment Manufacturers of 2024 in India

India's construction industry is rapidly growing, fueled by significant infrastructure projects and urban development initiatives. The construction equipment manufacturers that supply the machinery needed for these projects are critical to this expansion. Here, we explore India's top construction equipment manufacturers for 2024, emphasizing their innovations, market presence, and contributions to the industry.

Top Construction Equipment Manufacturers in India

Case Construction India

Case Construction remains a dominant player in the construction equipment market. Known for its robust and reliable machinery, Case offers various products, including excavators, loaders, and bulldozers. The company's commitment to innovation is evident in its efforts to integrate advanced technology into its equipment, enhancing efficiency and reducing environmental impact.

Komatsu Ltd.

Komatsu Ltd. continues to be a significant force in the construction equipment sector. The Japanese manufacturer is renowned for its high-quality machinery, which includes hydraulic excavators, wheel loaders, and dump trucks. Komatsu's focus on technological advancements, such as hybrid excavators and intelligent machine control systems, has made it a preferred choice for many construction companies in India.

Volvo Construction Equipment

Volvo Construction Equipment (Volvo CE) is celebrated for its durable and environmentally friendly machinery. Volvo CE offers a range of equipment, including articulated haulers, wheel loaders, and excavators. The company's commitment to sustainability is reflected in its development of electric and hybrid machines, which reduce emissions and operational costs.

JCB India Ltd.

JCB India Ltd. is a leading manufacturer in the Indian construction equipment market. Known for its backhoe loaders, excavators, and compactors, JCB has a strong presence across the country. The company's emphasis on innovation and customer service has helped it maintain a loyal customer base. JCB's intelligent and connected machinery introduction has further strengthened its market position.

Tata Hitachi Construction Machinery Co. Pvt. Ltd.

Tata Hitachi Construction Machinery Co. Pvt. Ltd. is a joint venture between Tata Motors and Hitachi Construction Machinery. This collaboration combines Tata's extensive market knowledge with Hitachi's technological expertise. Tata Hitachi offers a wide range of construction equipment, including hydraulic excavators, backhoe loaders, and wheel loaders, known for their reliability and efficiency.

Innovations and Market Trends

The construction equipment industry in India is evolving with several key trends shaping its future. Manufacturers are focusing on:

Technological Advancements

Integrating advanced technologies such as telematics, GPS, and IoT (Internet of Things) into construction equipment is revolutionizing the industry. These technologies enable real-time monitoring and data analysis, improving efficiency and reducing downtime.

Sustainability

With increasing environmental regulations, manufacturers are developing eco-friendly machinery. Electric and hybrid equipment is gaining popularity, offering reduced emissions and lower operating costs. Companies like Volvo CE and Caterpillar are leading the charge in this area.

Customization and Versatility

Manufacturers are offering more customized solutions to meet the specific needs of different projects. Versatile machines that can perform multiple functions are becoming more common, helping contractors optimize their fleets and reduce costs.

Expert Insights

Ravi Kumar, a construction industry expert, shares his views on the future of construction equipment in India:

"The Indian construction equipment market is poised for significant growth. With major infrastructure projects in the pipeline, the demand for advanced and efficient machinery is rising. Manufacturers that invest in technology and sustainability will lead the market. Focusing on after-sales service and customer support will also be crucial for maintaining a competitive edge."

Conclusion

India's leading construction equipment manufacturers for 2024 are setting new benchmarks in innovation, sustainability, and customer service. Companies like Case, Komatsu, Volvo CE, JCB, and Tata Hitachi drive the industry forward with their advanced machinery and commitment to excellence. As the construction industry grows, these manufacturers will play a vital role in shaping its future.

Visit these manufacturers' official websites to get more detailed insights and explore their latest offerings. Stay updated with industry news.

0 notes

Text

The Automobile Liquid Accumulator Market Is Estimated To Witness High Growth Owing To Rising Automobile Production And Sales Globally

The automobile liquid accumulator is a pressure vessel that is used in automobile braking and suspension systems to store hydraulic or nitrogen gas under pressure. It maintains reasonable pressure in the lines even when the pump is not working. The growing automobile production and sales globally is fueling the demand for automobile liquid accumulators that are used in braking and suspension systems of vehicles. The global automobile market has been witnessing strong growth over the past few years with developing regions leading the sales.

The global Automobile Liquid Accumulator Market is estimated to be valued at US$ 2080.75 Mn in 2023 and is expected to exhibit a CAGR of 4.1% over the forecast period 2024 to 2031, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

One of the key drivers for the growth of the automobile liquid accumulator market is the rising automobile production and sales globally. As per data by International Organization of Motor Vehicle Manufacturers, total automobile sales reached over 95 million units in 2021 registering a growth of 3.3% from 2020. Developing regions like Asia Pacific witnessed strong sales growth over the past decade led by countries like China and India. This rising automobile demand is fueling the need for automobile suspension and braking systems, which in turn is driving the demand for automobile liquid accumulators used in these systems. Moreover, the increasing technological advancements in suspension and braking systems by automakers to improve vehicle performance and safety is further augmenting the market growth of automobile liquid accumulators over the forecast period.

SWOT Analysis

Strength: The automobile liquid accumulator market has strong growth prospects due to increasing vehicle production and sales globally. Automobile manufacturers are focusing on developing advanced accumulator systems to improve vehicle efficiency and performance. New product launches catering to electric and hybrid vehicles will further drive their demand.

Weakness: High costs associated with research and development of advanced accumulator technologies can restrain market growth. Stringent emissions norms requiring upgrades to existing accumulator designs also increase production expenses.

Opportunity: Rising demand for fuel-efficient vehicles especially in developing nations provides major opportunities for accumulator manufacturers. The growing electric vehicle market also offers scope to develop customized accumulator solutions. Hybrid versions of commercial vehicles could boost replacement demand.

Threats: Trade wars and economic uncertainty impact automobile sales negatively affecting accumulator demand. Strict environmental rules pose compliance challenges. New energy technologies for vehicles may replace conventional accumulator usage over the long term.

Key Takeaways

The global automobile liquid accumulator market growth is expected to witness high growth over the forecast period driven by increasing vehicle production worldwide. The global Automobile Liquid Accumulator Market is estimated to be valued at US$ 2080.75 Mn in 2023 and is expected to exhibit a CAGR of 4.1% over the forecast period 2024 to 2031.

Regional analysis:

Asia Pacific dominates automobile liquid accumulator usage owing to its large automobile manufacturing base. China is currently the largest producer and consumer of vehicles globally with annual output exceeding 25 million units. Other Asian countries like India and Japan also have sizable automobile industries relying heavily on accumulators. The Asia Pacific region accounts for over 60% of the global market share currently.

Key players:

Key players operating in the automobile liquid accumulator market are Liebherr-International AG, Shanghai Zhenhua Heavy Industries Co., Ltd., Wison Group, Konecranes, Kalmar, Kranunion GmbH, Sany Group Co., Ltd., Noell Crane Systems (China) Limited, Anupam Industries Limited. They cater to original equipment manufacturers as well as the aftermarket through product innovations and expansions.

Get more insights on this topic: https://www.newsstatix.com/automobile-liquid-accumulator-market-industry-insights-trends-automobile-liquid-accumulator-market/

Explore more information on this topic, Please visit: https://techaxen.com/forging-an-ancientals-forming-process-still-thriving-in-modern-times/

#Automobile Liquid Accumulator#Automobile Liquid Accumulator Market size#Automobile Liquid Accumulator Market share#Automobile Liquid Accumulator Market demand#Automobile Liquid Accumulator Market analysis

0 notes

Text

Industrial Robotic

The Genesis of Industrial Robots: A Historical Perspective

Industrial robots have been an integral part of the manufacturing industry for decades. The evolution of industrial robots can be traced back to the 1930s when the earliest known industrial robot was created by Griffith “Bill” P. Taylor. Since then, the development of industrial robots has been marked by several key milestones and breakthroughs. In the 1950s, George Devol developed the first industrial robot, a two-ton device that autonomously transferred objects from one place to another with hydraulic actuators. In the 1960s, the first industrial robot was installed in a General Motors plant in New Jersey. In the 1970s, the first microprocessor-controlled robot was developed. In the 1980s, the first robot with six degrees of freedom was introduced. In the 1990s, the first collaborative robot was developed. Today, industrial robots are used in a wide range of applications, from welding and painting to assembly and packaging.

The global industrial robotics market is poised for dynamic growth. The report identifies several qualitative factors that are driving this growth, including dramatic developments in technology and new applications as well as global trends of rising labour costs, increasing labour turnover and shortages, and decreasing equipment costs and global competition. The report also identifies key options for unleashing the market’s full growth potential, including developing standards for interoperability, promoting robotics-related upskilling and retraining at scale, and bringing robotics to small and medium-sized companies.

Types of Industrial Robots: From Assembly Lines to Smart Factories

Industrial robots are used in a wide range of applications, from welding and painting to assembly and packaging. There are several types of industrial robots available on the market, each with its unique capabilities and strengths. Here’s a brief overview of some of the most common types of industrial robots:

Articulated Robots: These robots have a flexible movement and can be quite powerful, capable of lifting heavy objects. They are most commonly used for tasks like picking and placing, sorting, assembling, welding, and finishing.

Cartesian Robots: These robots move in straight lines along three axes and are ideal for tasks that require high precision and repeatability, such as drilling, milling, and cutting.

SCARA Robots: These robots have a horizontal arm that can move in a circular motion and are ideal for tasks that require high speed and precision, such as assembly and packaging.

Delta Robots: These robots have a unique design that allows them to move very quickly and are ideal for tasks that require high speed and precision, such as pick-and-place operations.

Gantry Robots: These robots have a large work envelope and are ideal for tasks that require high payloads and long reach, such as material handling and palletizing.

Cylindrical Robots: These robots have a cylindrical work envelope and are ideal for tasks that require high speed and precision, such as assembly and packaging.

Collaborative Robots (Cobots): These robots are designed to work safely alongside humans and are ideal for tasks that require human-robot collaboration, such as assembly, packaging, and inspection.

Advanced Sensor Technologies: Enhancing Precision and Safety in Industrial Robotics

Advanced Sensor Technologies are revolutionizing the field of industrial robotics by enhancing precision and safety. These sensors are designed to capture data from the environment, robot, and/or user, and play a crucial role in increasing the safety, autonomy, and adaptability of robots.

Magnetic sensors contribute to self-diagnostics and fault detection, improving system reliability. Vision sensors provide visual perception capabilities, enabling robots to analyze and interpret visual information for complex tasks.

In addition, smart sensors are an integral part of the Fourth Industrial Revolution and are widely used to add safety measures to human-robot interaction applications. With the advancement of machine learning methods in resource-constrained environments, smart sensor systems have become increasingly powerful.

The presence of robots in a variety of scenarios has increased substantially in recent years, as their ability to solve diverse tasks has improved. In all cases, sensing technologies play a crucial role in capturing the necessary information from the environment, robot, and/or user. To address any specific task, the robot has to be equipped with different kinds of sensors to perceive the surroundings, such as touch sensors, laser rangefinders, GPS, visual sensors or combined vision-depth platforms. In some applications, a combination of these is used, and data-fusion algorithms must be implemented. Currently, machine learning and deep learning approaches may play an important role in data analysis, interpretation, and fusion. Additionally, some specific tasks can be performed more efficiently if a team of robots is used, so an optimal combination of the information captured between the different sensors is crucial. In this sense, IoT (Internet of Things) approaches may ease this labour

Programming Industrial Robots: Bridging the Gap Between Man and Machine

Programming industrial robots is a complex task that requires a deep understanding of the underlying hardware and software. Industrial robots are designed to perform repetitive tasks with high precision and accuracy, and they are widely used in manufacturing, assembly, and other industries. In recent years, there has been a growing interest in bridging the gap between man and machine, and this has led to the development of new programming techniques and tools.

it is essential to have a deep understanding of the underlying hardware and software of industrial robots. Robot programming languages are sometimes needed to implement robot-specific functionality, and a helpful tool for bridging the gap between high-level languages and robot controllers. It allows easily reading and writing a robot controller’s variables from a Java program.

In addition, machine learning and deep learning approaches may play an important role in data analysis, interpretation, and fusion1. Currently, machine learning methods are being used to improve the performance of industrial robots, and this has led to the development of new programming techniques and tools.

Industry 4.0 and the Rise of Smart Manufacturing: Integrating Robotics into the Digital Landscape

The integration of robotics into the digital landscape is a key component of Industry 4.0. Robots are increasingly used in manufacturing for tasks ranging from repetitive assembly to complex quality control. The development of mobile robots capable of navigating complex environments and working in teams to complete tasks is a hallmark of Industry 4.0. The use of robots in manufacturing not only reduces labor costs but also enhances precision and consistency. The integration of robotics into the digital landscape has enabled manufacturers to optimize their operations, reduce costs, and improve product quality.

Industrial robotics has been a rapidly growing field in recent years, with the potential to increase efficiency and productivity in industrial settings. However, the high implementation costs of robots mean that large organizations tend to invest more than SMEs in using and integrating robots into their operations. The report highlights the challenges faced by operators, such as interoperability and cybersecurity vulnerabilities, as they strive to incorporate evolving technologies. One trend that is likely to gain traction is the incorporation of AI and machine learning in robots to aid decision-making 1. The report also includes country-level data on new installations and growth and highlights how robots contribute to a reduced carbon footprint, making them an imperative tool for driving sustainability efforts.

In terms of future trends, path smoothing techniques in robot navigation are an area of active research. The aim of this research is to improve the efficiency and safety of robot navigation in industrial settings. Both autonomous mobile robots and autonomous vehicles (outdoor robots or self-driving cars) are discussed.

For more information visit our website: www.unboxindustry.com

1 note

·

View note

Text

Hydraulic Crawler Cranes Market Growth, Trends, Analysis, 2022-2029

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the Global Hydraulic Crawler Cranes Market size at USD 2.09 billion in 2022. During the forecast period between 2023 and 2029, BlueWeave expects the Global Hydraulic Crawler Cranes Market size to grow at a CAGR of 5.77% reaching a value of USD 3.05 billion by 2029. The oil and gas industry's growing use of hydraulic crawler cranes, as well as the construction industry's expanding projects due to the world's rapidly developing infrastructure, especially in emerging nations, are key growth factors for the market.

Hydraulic Crawler Cranes – Overview

A hydraulic crawler crane is a heavy-duty machinery used for hoisting and lifting. A hydraulic crane's internal hydraulic system enables it to raise higher loads than smaller cranes, which are driven by electric or diesel motors. A hydraulic crawler crane is a useful tool for many tasks, such as lifting and installing diaphragm walls or drilled pilings. The equipment is built tough to endure the demands of the job site. They install powerful winches that can operate in free fall or under control.

Sample Request @ https://www.blueweaveconsulting.com/report/hydraulic-crawler-cranes-market/report-sample

Global Hydraulic Crawler Cranes Market – By Application

Based on application, the Global Hydraulic Crawler Cranes Market is segmented into the building industry, traffic industry, energy and utilities, and mining. The building industry segment holds the largest share of the Global Hydraulic Crawler Cranes Market. According to the data from Refinitive, more than 2,500 global infrastructure projects were announced in 2020, a significant spike of 5.5% from the previous year. The countries are mainly focused on the development of the renewable energy sector. The World Bank invested about USD 8 billion in transmission and distribution infrastructure for renewable energy generation. Such projects and investments directly influence the demand for hydraulic crawler cranes in the building industry.

Impact of COVID-19 on Global Hydraulic Crawler Cranes Market

The unprecedented COVID-19 pandemic hindered the growth of the Global Hydraulic Crawler Cranes Market. The demand for hydraulic crawler cranes fell dramatically when the main end-user industries for these cranes, the oil and gas and construction sectors, ceased operations. The disruptions in the production of hydraulic crawler cranes and supply chain disruption further impeded the market growth. However, with the recommencement of construction activities, the Global Hydraulic Crawler Cranes Market is anticipated to gain pace during the forecast period.

Competitive Landscape

Major players operating in the Global Hydraulic Crawler Cranes Market include Kobelco Sumitomo, Manitowoc, Casagrande SpA, Hitachi Liebherr, Sennebogen, Zoomlion, Terex, Sany, Link-BELT, and FuWa Heavy Industry Machinery Co, Ltd.

To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product launches.

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

Flourishing Construction Sector Boosts Hydraulic Cylinder Market

The hydraulic cylinder market was USD 14,558.9 million in 2023, and it will increase to USD 19,879.8 million, propelling at a 4.7% compound annual growth rate, by 2030.

The growth is because of the surging need for these products in the manufacturing, construction, automotive, mining, oil & gas, and agriculture sectors, coupled with rapid technological improvements.

Because of the rising development of the construction and material handling sectors owing to the government's focus on reviving infrastructure projects across different nations, hydraulic cylinder requirements are rising.

A major driver for this industry is the developing construction sector. In the construction sector, trenches, excavators, road construction planers, backhoes, grinders, concrete or asphalt machines, motor graders, concrete cutting saws, dumpers, skid steers, and dozers, employ hydraulic cylinders for different applications like pulling, pushing, digging, or lifting.

The double-acting category, based on function, led the industry in 2023, with a 70% share. These cylinders have extensive application in ship motors, large steam engines, industrial furnaces, power plants, earthmoving machinery, and various other construction equipment.

Moreover, these cylinders can produce force in both the retracting and extending strokes. This bidirectional capability is very advantageous in applications where force must be controlled or applied in two directions. Many sectors rely on these parts for their equipment and hardware due to their capacity to support diverse functional necessities.

The welded category, based on specification, was the largest contributor to the hydraulic cylinder market in 2023, with a 45% share. Welded alternatives have extensive applications across different sectors, including mining, oil & gas, construction, waste handling, heavy equipment, and material handling. These cylinders are favored for their robustness as well as durability.

The telescopic category, on the other hand, will advance significantly, with a 6% CAGR, during this decade. These products can be changed to single-acting or double-acting cylinders for an extensive range of construction, agricultural, material handling, and waste handling applications.

APAC is likely to advance at the fastest rate, of 7%, in the years to come. The surging requirement for agriculture, mining, and construction equipment is the factor driving the growth of the regional industry.

The region’s agriculture and construction sectors are observing swift progression because of the increasing demand for infrastructure as well as food, respectively, in emerging economies.

North America will also advance at a robust rate during this decade, because of the rising funding across different sectors. Furthermore, the government's emphasis on strengthening the defense and aerospace sectors will boost the adoption of these products in this continent.

With the thriving construction sector across the globe, the hydraulic cylinder industry will continue to advance in the coming years.

Source: P&S Intelligence

#Hydraulic Cylinder Market Share#Hydraulic Cylinder Market Size#Hydraulic Cylinder Market Growth#Hydraulic Cylinder Market Applications#Hydraulic Cylinder Market Trends

1 note

·

View note