#I finally understand why some artists always seem on the verge of collapse

Text

The Big Boy with the Skull Face

1 hour vs 11 hours

#I finally understand why some artists always seem on the verge of collapse#this took so much out of me#I will be able to give very little for the next 3-5 business days#thanks for your understanding#this is why I’m a writer and not an artist#please appreciate this#that’s my kinnie right there#si no offense but I’m sick of looking at your face#never would’ve thought I’d say that#simon ghost riley#call of duty#modern warfare ii 2022#cod fanart#I did the art thing#it’s the crisis talking

88 notes

·

View notes

Text

Tesla Stock, Short Sellers, EVs and Autonomous Cars

If you follow Tesla's stock closely, you fall into one of 2 camps:

Tesla is going bankrupt. Its cars are crap. It never delivers on its promises, the whole company is mismanaged, run by a con artist who has built a house of cards waiting to collapse. Elon Musk has no idea what he's doing and his continued mismanagement is about to cause Tesla to crash and burn and its stock is on its way to $0.

Tesla is an amazing company. It makes the world's best cars. It continues to defy the odds, making cars deemed impossible by others, a reality. On its way to deliver a sustainable future, Tesla will own the transportation industry and become a Trillion-Dollar company. Elon Musk is a visionary, and key to Tesla's success.

The two camps are polar opposites and each camp gets more convinced of its position with every passing Tesla announcement. But of course, only one of these narratives can be correct.

This article will answer the question: is Tesla destined for greatness or doomed to fail?

Before we can answer that, lets review some fundamentals...

The Stock Market

The stock market is a complicated beast and understanding it is beyond the scope of this article. However, it would be good to review 2 fundamental rules of the stock market:

Rule #1: In the short term, a company's stock price is a reflection of supply & demand. More buyers than sellers equates to a higher price for the stock. More sellers than buyers equates to a lower price for the stock.

Rule #2: In the long term, a stock's price will largely represent the fundamental value of the company. Revenues, profits and growth are the 3 key contributors to the long-term price of a stock.

Easy enough, but because of the significant fluctuations of the stock market on a day-to-day basis due to rule #1, many believe investing in stocks is the equivalent of gambling. That's probably an accurate description for investors who have a short term horizon of days, weeks or even months. Without insider knowledge, its nearly impossible to predict a stock's performance on a short-term basis and with insider’s knowledge, it’s illegal to trade a stock. So short term investing is a lot like gambling.

But unlike gambling in the casino where the odds are always in the house’s favor, short term investing in stocks can be manipulated by simply changing investor opinions. To understand how this is done, watch this video by one of CNBCs biggest anchors and a daily stock manipulator, Jim Cramer:

youtube

Crazy as it seems, its perfectly legal to sell a stock you don’t own (this is called “shorting a stock”), then spread crazy, unsubstantiated rumors about the company being on the verge of bankruptcy. Then when investors panic and sell the stock, you “cover” your short position by purchasing the stock again at a lower price than what you had sold it for. In summary:

You sell a stock you don’t own (“shorting”)

You spread misinformation about the stock to lower its price

You purchase back the stock at a lower price

Tesla’s stock is currently one of the most shorted stocks in the stock market. More than 32 million shares of Tesla stock (about $8 Billion worth) are sold, for which the seller doesn’t own the stock. If you think this seems like some sort of crazy loophole scheme that some day we’ll look back at and wonder how this was ever legal, you’d be right. Short sellers have every incentive to spread Fear, Uncertainty and Doubt (known as FUD) about a stock in the hope that the stock goes down, ideally to $0 where they can purchase their shorted shares for a fraction of what they sold it for.

Not all investors gamble and bet on miserable outcomes.

The most successful investors generally have a long-term horizon of years, and they don’t generally gamble on anything. They evaluate companies based on fundamentals and future potential, then they invest in opportunities that have the highest potential return and hold on to the stock long-term.

This strategy is summed up in 1 sentence by the most successful investor of all time, Warren Buffett: “Our favorite holding period is forever.”

If you are a short-term investor, this article will have no value for you. I have zero knowledge of what Tesla's stock will do in the coming days, weeks or even months.

But if you are (or considering to be) a long-term investor in Tesla, we should be able to answer the question of whether or not Tesla has a bright future...

Disruptive Technology and the Innovator's Dilemma

In the late 90s, I read a book called The Innovator's Dilemma. In it, Clayton Christensen describes why market leaders are often set up to fail as technologies and industries change. His brilliant book was later named "one of the six most important books about business ever written" by The Economist. Christensen argues that market leaders tend to maintain their leadership positions because of their market reach and power, until that is, there is a disruptive technology that comes along and over time unseats them from their leadership position.

An easy way to understand this concept is to look backwards at industries that had dominant players that changed. Examples would include companies like IBM who maintained their leadership in the computing world (despite heavy competition), until the PC disruption occurred. Kodak maintained their leadership in Photography until the digital disruption occurred. Microsoft maintained its massive leadership in software, until the Internet disruption occurred.

Leading companies maintain their leadership because they have name recognition, a distribution network, lots of financial resources to fight new competition, not to mention the experience to build great products that helped them become a leader in the first place. IBM knew how to make mainframes. Kodak knew film. Microsoft knew desktop software, and so on.

However, when a disruptive technology comes along, there is no established market for the new technology. Even when there is a market, it's relatively small compared to the revenues of a market leader. Incumbent leaders see the new market as a distraction to their already established $20, $50, $100 Billion or larger businesses. Nobody has time to invest in and chase after a market that's 1/100th their core business.

Therefore, disruptive technologies are often developed and improved by newcomers who see the potential. To a newcomer with $0 in revenues, $1 Billion is a great market opportunity to chase. To Ford, that’s 0.75% of their revenues. But once a new startup hits $1 Billion in revenues from a disruptive technology, they have major competitive advantage as they have been accumulating name recognition, a distribution network, the experience and talent to continue to be a leader in the disruptive category.

By the time Microsoft was a Billion-Dollar company, it was too late for IBM to dominate the new PC world. By the time Google became a Billion-Dollar company, it was too late for Microsoft to dominate the Internet world.

You get the idea. Lets move on to cars and Tesla...

The EV Disruption in the Car Industry

For nearly a hundred years, the US car industry has been lead by 3 automakers: Ford, Chrysler and GM. Internationally, they are joined by Toyota, VW, Hyundai, Nissan and small handful of others. For decades, these companies have fine tuned the art of designing, manufacturing, distributing and selling impressive cars that all rely on a fundamental marvel of engineering:

Harnessing the combustion of fossil fuels to power a transportation device.

For better or for worse, this pinnacle of human technology has helped humanity achieve unimaginable advancements that would not have been possible without the Internal Combustion Engine (ICE). But we also now know that ICE-based engines are responsible for huge amounts of greenhouse gasses that are rapidly warming earth and causing catastrophes around the globe.

For the past few decades, car companies had provided no real alternative to gas-powered vehicles, citing that electric cars are impractical, cost too much, and they are a niche market that nobody wants. They argued that electric cars end up being just as bad for the environment because they simply move the burning of fossil fuels from the vehicle to the power plant.

These excuses not to invest in electric vehicles, is the classic "incumbent leader vs. disruptive technology" syndrome.

It turns out that with the proper research and investment, electric cars are practical, they can be competitively priced, and they are far more efficient than gas-powered vehicles, even if the local power plant is burning coal! Most importantly, based on the success of Tesla's Model S, X and 3, it turns out that they are not a niche market after all. Given a good choice, consumers would pick electric cars over their gas-powered counterparts by a wide margin. The way we know this is because all 3 of Tesla's cars are leaders in their category and Tesla has shown that Electric cars can provide far superior performance, maintenance and joy of driving, than their gas-powered counterparts.

Tesla has Awakened the Giants

Great! Tesla has shown electric cars are in fact the future. All the major car companies now agree. Every major car company plans to completely revitalize their lineups with electric options. Finally! The giants have been awakened. With the enormous resources that these companies have (collectively near $1.5 Trillion in annual revenues), it's game over for Tesla, right?

Well, not so fast. Disruptive technology is unkind to the incumbents. Turns out Kodak was a pioneer in digital photography in the 1990s and had the most advanced digital photography technology in the world before digital photography was even a thing. My first digital camera was a Kodak - it's actually how I met my wife, but that's a different story. Similarly, GM was light years ahead of its competition back in 1996 with the EV1. But when you have a $100 Billion+ business selling gas-powered engines, and all of your headaches are caused by the business unit that's generating no revenues and is only costing your company hundreds of millions in investment, it's easy to see why these companies would shut down their disruptive technology research!

The argument today is that the car companies finally see the potential, and this time around, they are throwing $10s of billions at electric car lines, so the results will be different.

Here is the problem: Imagine you are Ford. You build more than 1 million trucks per year and you want to offer an electric version of your truck. You can't stop building the gas-powered trucks because that's your current bread and butter. Without it, you will die. So you have to add a whole new lineup of trucks that are electric. After years of trying, Ford has learned the hard way, that virtually nothing about their gas-powered Truck-building knowledge translates to building an electric truck. Their designers have no experience designing trucks where the battery needs to be in the floor. Their engineers are Mechanical Engineers who build combustion engines and know virtually nothing about electric circuits and electrical components necessary to control electric flow into an electric motor. Even their manufacturing processes are not easily translatable to building battery packs. It turns out it's so freakin hard, even for Ford, to build an electric truck, that it's given up and instead invested $500 Million into an electric startup called Rivian.

And Ford is not alone. The Tesla Model S was released in 2012. Since then, it quickly became the top selling car in the luxury sedan category, destroying the sales of Mercedes' S class, BMW's 7 series and a handful of other luxury cars. Every one of those luxury brands has been promising an electric "Tesla Killer" that has yet to arrive.

The disruption of Electric Vehicles is here and real, but there are no guarantees that existing car companies can make, or even survive the transition to EVs.

If the EV disruption wasn't enough to shake up the landscape, there are two other major disruptions affecting the car industry...

Car on Demand and Autonomous Vehicles

There is no question that ride sharing services like Uber and Lyft have completely changed and are disrupting consumer expectations for transportation. The convenience of having a car magically appear exactly where you happen to be, has even made many reconsider whether or not they need to own a car. If you can spend $500/month and have a Chauffeur drive you around everywhere, why would you buy a car that needs maintenance, pay for insurance, gas, and have the headache of driving when you could spend that time on a productive task?

Take away the driver, and you've eliminated the only negative in that equation. The risk of having a stranger drive you around, or to have to maintain an awkward conversation you don't want to have is gone. The driver is also the highest portion of the cost for the trip. The holy grail of transportation is getting a car on demand using autonomous technology to get you to your destination. Safer. Cheaper. More convenient.

Every car company, as well as Uber, Lyft, even Google and Apple realize this is the future. The race is on - the only question is when and who will emerge as the winners.

While Uber and Lyft seem to have a technical advantage by already providing the exact same service, but using a driver, it's counter-intuitive to realize that Uber and Lyft are actually at a major disadvantage to providing driverless vehicle services. Assuming they build the autonomous technology necessary to accomplish driverless trips, the cost of having to buy the vehicles, then upgrade them post-production to add autonomy, will mean their cost per vehicle will be significantly higher. But even worse is the fact that these companies employ hundreds of thousands of drivers who make a living on the Uber and Lyft network. There would be no ambiguity who the bad guys are if Uber or Lyft start to put these drivers out of a job. The same companies that were once hailed as Job Creators would become the villains that are now killing the very jobs they created. It's unlikely that either Uber or Lyft will survive this transition, but fortunately for them, this transition will take years.

Then there is the car companies like GM, Ford, Daimler Benz and others who are investing billions in self-driving technologies. While car companies have a legitimate shot at building autonomous technologies, their expertise has never been in software development. Car companies are notoriously horrible at making software. Just look at how many taps, clicks and movements it takes to enter a destination address into any car navigation system. This is a problem that was solved by Google and Apple more than 10 years ago, yet for the past 10 years, none of the car companies have been able to figure out how to simply copy existing patterns for entering in an address into a navigation system. For these car companies to miraculously figure out computer vision, neural networks and all the other software technologies necessary for autonomous driving seems like an unlikely event.

The real competition for autonomous driving and car-on-demand is a 3-way race between Tesla, Google and maybe Apple.

Google seems to have the advantage here. It has had an autonomous research unit since 2004 and its Waymo car service is actually giving rides in production (with a backup driver). This advantage can't be underestimated. Google also has the resources to buy 100,000 cars, equip them with autonomy, and put them on the road. Such an investment would cost Google, a company with nearly $100 Billion in cash, just $10 Billion to do. Although to get to 1 Million autonomous cars, it would require all of Google’s cash, nearly a $100 Billion investment. Doable for a company like Google, but certainly not cheap. Google is in an awesome shape in this race.

Then there is Apple. With the secrecy that Apple operates with, it's unclear what Apple is planning, but we might be able to make some speculations. First, Apple definitely lags behind Google because they don't have nearly as many cars on the road. Second, it's highly unlikely Apple will choose to build its own cars. Manufacturing cars would take years, at least 3-5 years, to iron out. If they wanted to make cars, they would have had to start building plants a while ago. Apple’s best bet is to follow Google's strategy, use its massive cash reserves to buy cars, outfit them with autonomous technology, and put them on the road. Under the leadership of Tim Cook, it's unlikely this "me too" strategy of copying Google will work, especially if Apple's other businesses ever have hiccups. If Apple sales ever decrease, the pressure on Apple would be to stay focused on its core business of iPhones.

And finally, there is Tesla. Tesla is probably far behind Google in Autonomous technology, but what's impressive about Tesla is the rate of improvement. This rate of improvement is also accelerating because of the number of vehicles Tesla has on the market that are equipped with its self-driving hardware sensors. Lets do a little math...

For every car that is equipped with self-driving hardware:

Google, Apple and others spend somewhere between $100,000 - $150,000 plus pay for a backup driver (for now)

Tesla makes a gross profit of $10,000 - $20,000 (Model 3 or Model S/X) and gets a free backup driver (the owner)

This advantage for Tesla is absolutely insane. While others have to buy their cars, equip them with self-driving technology, then hire a backup driver to drive the car around, Tesla gets to sell its self-driving technology to its customers allowing its customers to finance the deployment of these cars all over the world, while it makes a profit on selling each one.

Think about that for a moment. In order for Google to put 1 Million self-driving cars on the road (after the technology is perfected), it will cost Google $100 Billion. Tesla on the other hand will make $10 to $20 Billion in profits by deploying a million self-driving vehicles. In fact, it's already done exactly that by deploying around 400,000 cars that have the hardware sensors needed for self-driving. It’s already gathering data from 400,000 cars, and its doing so while making money from each of those cars!

More than the cost of the cars, Tesla has another major advantage. The AI and Machine Learning needed to perfect self-driving is heavily data dependent. The more cars you have on the road with the hardware sensors, the bigger variety of road conditions you encounter, and therefore, the faster the AI algorithms learn. Tesla has the largest fleet of cars, deployed in the widest array of geographical locations, giving it a major advantage for data collection to teach its algorithms how to drive. And it’s doing this without having to employ backup drivers or paying for the cars. Tesla's backup drivers are the vehicle owners who paid full-price for the privilege of being a backup driver for Tesla’s autonomous AI going to school!

The Tesla advantage is incredible. Nothing like this has ever existed! This is a major disruptive advantage that no other car company in the world has. It’s also something that’s beyond the understanding of most Wall Street analysts. They have nothing to compare it to.

Tesla’s Autonomy Day

If Tesla's future is so bright, why is it that so many Wall Street analysts have a "Sell” or “Underperform” rating on the stock?

Great question! Let's dig into that.

Last week I had the fortunate experience of attending Tesla’s autonomy day. At the event, I had a chance to talk to several wall street analysts that cover Tesla. In my conversations, I realized a critical factor: Tesla is covered by “automotive analysts.” When I would ask about their thoughts on Uber or Lyft, they mentioned those stocks are covered by their “Internet analysts.” This is a huge discrepancy in viewpoints. The automotive industry hasn't had major new players in many decades. Existing players go bankrupt regularly (GM, Chrysler, etc.). Their margins are extremely low and investing in disruptive technologies usually means making an SUV that can give 20 miles per gallon - not exactly a revolutionary disruption. It's not that these analysts hate Tesla, it's that they are comparing Tesla to Ford or GM and they have no idea why Tesla would be worth more. In their world, a car company doesn't ever have a 10x increase in sales. Tesla is an anomaly that they don't understand. Car companies are often valued at just 0.5x revenues because of their low profit margins. Tesla is valued at 2x revenues, so it appears way over-valued.

On the other hand, you have companies like Uber and Lyft being evaluated by "Internet Analysts." As a result, despite the extremely low margins of Uber and Lyft, these companies are getting valuations that are 10x their revenues! In comparison, Tesla has a faster growth rate, higher margins, and a larger market potential, but is being valued (on a revenue basis) at about 1/5th the price!

Tesla’s self-driving technology is not yet perfect, but it’s pretty damn good:

youtube

Even if it takes Tesla several years to iron out the AI software, every year, it just keeps accumulating vehicles that all have self-driving hardware. Then with 1 Over The Air (OTA) update, all of them can become Robo Taxis overnight. Imagine a company that goes from having 0 Robo Taxis to all of a sudden having 1 million or 2 million Robo Taxis all over the world! Each one has the potential to add thousands of dollars to Tesla’s profits.

Elon Musk and Tesla Mistakes

Tesla and by extension, Elon Musk, have made their share of mistakes. Turns out great companies make mistakes all the time on the road to success. Some pay for them with punishments on the stock price...

In 2011, Netflix announced they were splitting their DVD business and separately charging for streaming and DVD. The results were pandemonium. Wall Street analysts turned on Netflix. Short sellers cashed in on the panic and cited competition from HULU and Verizon - announcing the death of Netflix. They spend too much, have too much debt and not enough cash to live long. Sound familiar? As the stock price nose-dived from $40/share (split adjusted) to just $9 per share, it seemed like the panic was real and Netflix’s days were numbered. Just look at their stock chart during that period:

But of course, the panic was not real. The rumors of Netflix’s demise was just pure fabrication and despite so many people losing money for selling on the panic that was falsely generated, nobody ever went to jail! That’s what’s wrong with short sellers. They create a false narrative on purpose specifically with the intention of causing a stock to go down.

In the years that followed, Netflix continued to deliver quarter after quarter and eventually the false narrative of Netflix getting destroyed could no longer be supported. As a result, Netflix’s stock shot back up and has gone up more than 42x (that’s 4,200%!!!) since 2011 lows.

The arrow in this chart points to the right-most part of the chart above!

If you had invested $2,500 in Netflix when the Wall Street experts had turned on them with “Sell” ratings and journalists were predicting the end of Netflix, your investment would be worth $100,000 today!

Similar stories exist for Apple in 2000 under Steve Jobs, and Facebook in their first year of going public. Who remembers the headlines “Twitter is Dead” just a few years ago? The stock is up more than 200% since Twitter was declared dead. The examples are endless. When the foundation of a company is solid, irrational fears create opportunities to buy.

In fact, Warren Buffett has another great quote that applies here: “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

Evaluating Tesla Rationally

So how can you tell if Tesla is truly over-valued and about to go bankrupt, or if it’s legitimately a great buy because of all the panic and fear that has been created? Great question. While we wait for all the Tesla Killer EVs to come out, let’s look at the facts around Tesla:

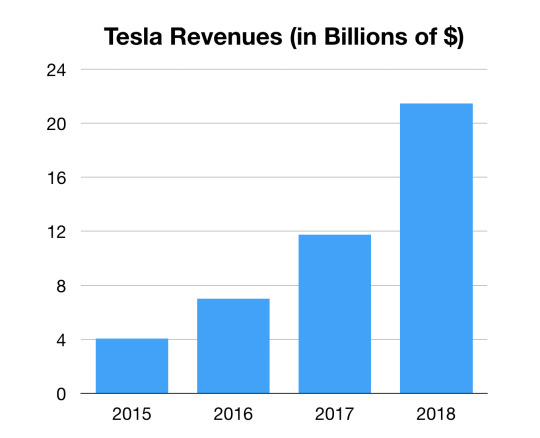

#1: Tesla Revenues have increased by 400% in 4 years!

No other public company in the world has had this kind of growth with similar numbers. In fact, Tesla’s awful, horrible, couldn’t get worse, Q1 2019 results generated more revenues than Tesla did in all of 2015! Tesla’s stock price is roughly about the same as it was in 2015. The stock has a ton of stored energy.

#2: Tesla has 3 cars, each of which are the #1 selling car in their category. Not by a small margin, but by a large margin! The Model S, X and Model 3 are all the best-selling cars in their respective categories, which is pretty incredible when you consider how few variations they have.

#3: Tesla Q1 2019, supposedly their worst quarter ever, had a year-over-year revenue increase of more than 33% and they made 110% more cars than the same quarter in Q1 2018.

#4: Tesla car owners are amongst the happiest, most satisfied and most likely to buy another Tesla, than any other car company! Have you ever spoken to a Tesla owner that said “oh man, I wish I never bought a Tesla?”

#5: The fastest super cars in the world have a hard time keeping up with Tesla’s 7 passenger SUV, but if that wasn’t bad enough for the future of gas-powered vehicles, the new Tesla Roadster 2 goes from 0 – 60 MPH in just 1.9 seconds!

In the meantime, for the past 4 years that I have been following Tesla, these have been the headlines:

These headlines are just Friday’s top stories about Tesla on Yahoo Finance. Day after day, the stories on Tesla’s stock in the finance news pages are negative. Meanwhile, Tesla continues to defy the odds and makes products everyone else thinks it was impossible. The very same people who thought the Model S was not possible, then the Model X, then the Model 3, then producing 5,000 of them per week, are amongst the loudest critics still! Not a single one ever goes on CNBC and says “you know what, I was wrong - turns out, Tesla can make 5,000 Model 3s per week. I was wrong!” Yet, there they are, day-after-day, making their next bogus prediction of doom. You would think I made this stuff up. It’s crazy! Just watch this exchange between CNBC anchors and Cathy Woods (start at around 3:48 into it for the Tesla portion):

youtube

If Tesla continues to deliver with the Model Y, the Tesla Truck, Roadster 2, the Semi and other future cars, and there is little reason to think they wouldn’t considering their track record, Tesla will likely exceed $200 Billion in revenues within 10 years.

And that’s not even taking the potential upside of autonomous driving. If their dream of creating a Robo Taxis becomes a reality, their margins will easily double or triple during that same timeframe. When you combine these factors, Tesla has a shot to be a Trillion-Dollar company in 10 years. That would put their stock price at over $5,000/share!

I’m going to end with 1 more Warren Buffet quote: "If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes.”

P.S. I’m not affiliated with Tesla in any way. I’m just a tech investor (been doing it for 25 years) who has never seen a more crystal clear opportunity with a public company. In hindsight, it’s obvious that companies like Apple, Netflix, Facebook, etc. were going to be huge successes, but sometimes the FUD factor (Fear, Uncertainty and Doubt) that is created around companies by their competitors, journalists and “shorts” (those who bet against the stock then go out and make up lies and false rumors), causes stocks to have a mismatch between their value and their actual price.

And there’s this:

youtube

7 notes

·

View notes

Link

Short Soumate AU - the concept was “your soulmark is a reference to what your soulmate likes the most”, and I rather liked it!

Tagging @doctorroseprompts, in case this can fit into a prompt!

I hope you’ll like it! :-)

He had scoured every modern art museum, every ephemeral exhibition throughout the country, combed through thousands of websites about painting, drawing, sculpting, bought hundreds of magazines and books about the subject. No name, no face he had encountered had caused that spark he was desperately looking for.

He tossed his ticket in a nearby bin, annoyed and disappointed he hadn’t found her in that tedious expo in a dark corner of London. Listening to wrinkled man on the verge of falling asleep each time he stopped talking in that monotonous crow had put his patience to the test. Looking at depressing paintings about death and phantasmagorical creatures made by an artist who obviously didn’t know black and grey weren’t the only colours that existed hadn’t helped. Maybe it wasn’t a bad thing he hadn’t found her there, actually. He didn’t know what he would feel if his soulmate happened to be a deranged woman fascinated by necromancia and festering cadavers.

A liquid shiver rolled down his spine at the thought, and he hurried to take out his list of current exhibitions he needed to go to.

“Nope to Nighthorses 66, then,” he mumbled under his breath, crossing the name of the exhibition with the pencil he always kept in his pocket. “Next is… S.C.M. Just hope this doesn’t stand for super creepy monsters."

He shoved his quickly shortening list back into his pocket and headed for the nearest underground station. It was already quite late in the afternoon, and he knew he should call it a day, head back home and get a full night of sleep if he didn’t want to doze off over his desk the morning later. But he also knew the disappointment and frustration of not making any progress, the longing he felt to finally find her growing into some kind of unhealthy obsession only predicted long hours spent tossing and turning in his sheets without finding Morpheus’ comforting embrace.

He took a quick look at his watch, ignoring the soulmark on his arm as if it’d just been a cheap tattoo he would forever regret, and made his decision. He hopped out of the train a few stations later, didn’t look twice at the large mural on the wall he had learnt a few years back had been painted by a foreign young artist, and made his way up the stairs. He was getting tired to try and see her where she wasn’t. A sticker on lamp post with a cartoonish drawing. Crass tags in back alleys, elaborated frescos on iron curtains. Street traders who sold ridiculously expensive prints of artworks stolen on the Internet. Everywhere he looked, he was tempted to believe it was her, and every time, he was a tad more disillusioned when he found out it wasn’t.

His worn chucks squished on the wet pavement as he made his way to one of his favorite places. It was a cramped bookshop in the corner of an ever-deserted street he had discovered the first time he had moved in this part of the city, rather by accident than real intention, and he came back to it every week, some weeks every day. It wasn’t as much the books as the owner that always brought his steps back to that small shop that smelled of yellowed paper and dust. Rose, was her name. A young woman with honey-eyes and wheat-hair, full lips and round nose. He knew she was just his friend, but sometimes, he wished his soulmark could be a small pile of books, or a meaningful quote from her favorite author - not that odd-shaped moon that belonged in a Van Gogh painting. His soulmate was an artist, not a bookworm. Not the woman he had dreamt of so often he believed he must have broken a hundred rules and, though unwillingly, cheated on his real soulmate on several occasions. Not Rose. Never Rose.

The small bell chimed when he pushed the ancient door open and the sound of his steps died on the heavy carpet. She was nowhere in sight - probably in the cellar she called a storage room, or in the broom cupboard she called an office. She would eventually pop out, like she usually did whenever the bell rang. His feet took him to the only alley he was interested in, and he picked up an old encyclopedia that had lost a bit of its varnish. He had always wanted to buy this book, but it almost was a relic, and not only did it look like it, it was also worth it. He sifted through random pages, smiling at the centuries-old mathematical formulas and theorems that had long been replaced by more precise, and especially more valid ones.

“You should buy it before it’s gone.”

He hurried to slide the heavy book back in its space at the sound of her smiling voice and twirled on his feet to greet her with a smile of his own.

“Rose, hi, how…” he started before his mouth gaped open and his voice died in his throat.

He first noticed the dark blue apron she was wearing over her eternal oversized jumper. Then he spotted the pencil she had stuck behind an ear. And he finally understood the multicoloured stains dotting and streaking the apron were paint. That wasn’t right. Rose loved books. She was a bookseller. Not an artist. He would know if she were, after so much time spent sharing coffees and pointless conversations. So much time spent wishing she could be the one.

“Fine, if your question was how are you,” she giggled, wiping her hands on her apron so she could give his shoulder a friendly slap without harming his pinstriped jacket. “How are you?”

“I, uh, yeah, good, I suppose,” he nodded - he found his voice again when he managed to ame his heart hammering against his ribs. “What are you doing with all that equipment?”

“What does it look like I’m doing, John?” she taunted as she motioned for him to follow her through the maze of crammed corridors. “I was about to close, I didn’t think anyone would come so I just started working on a little something. D’you wanna sneak a peek?”

“You never told me you liked painting,” he said, almost reproachful.

“You never asked.”

She led him to the door that was plastered with a large sticker that read storage, offered him a shy smile and pushed the door open with a finger.

He couldn’t move. Instead of a dark, small room filled to the brim with rows of old books, he saw a bright, large space void of anything. Anything but paintings, hanging on the walls, haphazardly propped up against the walls. Colours bursting out of the canvas like fireworks, fiery landscapes and smooth still-lives, abstract shapes that made him feel so many things at once his heart flew to his throat, meticulous portraits of people she probably knew given the depth and the familiariaty that oozed from the faces. She was painter. A very talented painter. An artist. Rose was an artist.

“I wanted to show you the one I’m working on,” she said as she strutted towards her easel that was directed towards the window, unaware he was staring a her as if she’d just turned into one of the monsters he’d seen at the weird exhibition. “I think… You’re the expert, maybe you can tell me if I did it right?”

He could only nod even though he barely heard her words and watched, speechless and on the verge of collapsing under the weight of the unexpected revelation. Rose was an artist. She turned her easel towards him, and what he saw made his stomach twist into tight and uncomfortable knots.

“That’s a golden spiral,” he said, running a feverish hand through his spikes of hair. “Logarithmic spiral, it’s… Maths.”

“Yeah, I know,” she smiled, a quivering smile that lacked its usual enthusiasm. “Does it look… Dunno, accurate?”

“Accurate isn’t the first word that came to my mind,” he said softly, taking a few steps towards the painting to let his fingers hover over the snake of yellow and soft orange. “This looks beautiful, Rose. Why did you paint this?”

“‘Cause I found out…’ she started, sheepishly rocking on the ball of her feet. “What my soulmark is. I didn’t want to know, because I’ve always thought I would meet my soulmate whether I knew or not. But then… I mean, you came along and you made it really hard to resist the temptation.”

“What’s your soulmark, Rose? Please, show me.”

He held his breath as she slowly rolled her sleeve up her arm, stared at her pale skin covered with lines and lines of tiny numbers from her wrist to the crook of her elbow. He wanted to scream his joy, cry his relief, he wanted to hug her and kiss her and let his whole body and soul finally love her. But he simply blinked and swallowed it all down. She had never told him about her mark. She had never wanted him to know, and she probably had a hundred good reasons not to tell him.

“That’s the Fibonacci sequence,” he told her, unconsciously tugging on his own sleeve to make sure she wouldn’t see his mark. “It’s… My favorite sequence, actually.”

“I know,” she shrugged with an embarrassed twist of her lips. “I mean, I figured. You’ve bought several books about that sequence from me, you know. Doctor Smith, clever scientist and mathematician and all.”

He noticed the dejection in her voice, the way she gently kicked the foot of her easel and lowered her eyes to the carpet. He was hurt, deep and violent, that she didn’t seem to want any of what he had to offer, but that didn’t make him any less indifferent to her own pain. He slipped a finger under her chin to catch her eyes and give her a gentle look she didn’t want.

“Talk to me, Rose,” he said softly, fully cupping her cheek when she started to bow her head again. “Tell me what’s wrong.”

“I know you’ve got a bit of Starry Night on your arm,” she answered with a sharp nibble on her lip. “I know that… You would have found out I like painting, sooner or later.”

“Why wait until now, then?” he asked, befuddled by the tears that started to roll down her cheeks. “Rose, I don’t understand, what’s wrong?”

“Look at me, John,” she sighed, swatting his hand away from her face. “Look at me and tell me I’m the soulmate you’ve always wanted. Tell me I was made for you. Tell me you can ever love me. I don’t want you to think I’m the one is all. There has to be someone else for you, John.”

They matched. He didn’t understand why she refused to see it, refused to believe it, refused to accept she could be his soulmate. They matched. That’s all he understood. Her mark was a mathematical sequence. His mark was actually borrowed from a Van Gogh painting. They matched. And he had fallen for that woman so long ago, To know he had already learnt everything he loved about her, to know she was the one. That left no room for tears or unhappiness.

Despite her protests, he cupped bot her cheeks again and hurried to press a soft, lingering on her lips before she could draw back. Rose was an artist. Rose was the one.

“You’re the one I’ve always wanted,” he whispered, catching her lips between his again to steal her answer. “You were made for me, like I was made for you.”

“John…” she tried to complain, though she was slowly melting into his arms, little by little, a little more each time his hot breath caressed her chin and his lips danced against her own. “I’m not…”

“There’s no one else for me. You, just you. God, why did you have to wait so long, Rose, we’ve lost so much time. All that time spent looking for you when I had already found you. All that time spent pretending I didn’t love you when I could have shown you how much I do. “

“You do?” she breathed out, pulling away to see that truth in his eyes.

He only sat on her stool and pulled her sitting over his lap, his mouth hungrily looking for those lips he wanted to devour, his chest pressing hard against that body he wanted to touch, his heart reaching out for that shared loved he wanted to drown into. Rose wasn’t just an artist. She was his soulmate.

#ficandchips#doctorroseprompts#ten x rose#soulmate#au#john smith x rose tyler#first kiss#fluff#romance#<3

41 notes

·

View notes

Photo

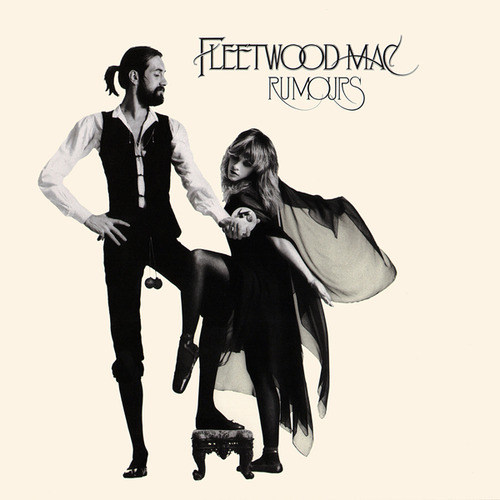

Rumours by Fleetwood Mac, 1977

1977; what a legendary and beautiful year for music. Not only did disco music become a very popularized genre during that time, but it was also the year when many sub-genres of rock (such as soft rock) began to rise. Four decades on and ‘Rumours’ is still considered to be one of the best selling and highest acclaimed albums of all time, selling over 45 million copies. I personally believe It is one of Mac’s finest works and in the following, I will tell you exactly why. I will also include the reason for its huge impact.

Let’s begin with the complicated background story: We all know by now that the album is mainly based on the troubled relationships between Stevie Nicks and Lindsey Buckingham as well as John and Christine McVie. Mick Fleetwood was also struggling with his marriage. The members had no time to grief or come to terms with the separations as they were already working on their follow-up to ‘Fleetwood Mac’, the first album which included the Buckingham Nicks duo for the first time and spawned commercial success. Additionally, each member developed a serious drug problem. Everyone was battling their own demons yet somehow they ended up creating a masterpiece of an album that built an entire legacy.

The album starts with Second Hand News, which I at first found to be nothing but a mindless tune, only to realize later that none of the songs on this album are mindless. During the chorus, you can hear Lindsey imitating some guitar riffs. However, once I thought more into the lyrics I found the song rather amusingly ironic. The song simply means being not relevant in one former partner’s life, yet still ’laying him down in tall grass and letting him do his stuff’. As Stevie is used for the background vocals, you can hear her frustration. Which will become more evident in the next track; Dreams. Not only did this song end up being Fleetwood Mac’s highest charting hit song in the US, but this song was specifically directed towards Lindsey. For Stevie, this song was a way of an invitation for Lindsey to leave their relationship as she wanted to leave likewise. Lindsey later on commented on this by saying:

Whatever Stevie’s music was, somehow I was the soulmate that just knew exactly what to do with it and that never went away. It just became bittersweet in terms of wanting to do it. There were times where I had the urge not wanting to help her, and that’s a weird thing to admit but these were the challenging things. – Lindsey Buckingham

In my opinion, this is truly one of the most memorable songs on this album. Not only does the guitar compliment the song so wonderfully, but the melodic vibe you get from Stevie is unforgettable. In contrast to Lindsey’s rather bitter-sweet lyrics, Stevie tried to be condescending and delicate yet honest in this song. Additionally, it becomes evident how each song in this album is a dialogue between the songwriters. Because the members had not the time to take a break from each other, they could let their anger and frustration out towards their former partners in their songs, which Lindsey clearly did. Despite the anger he expresses for Stevie in the song Never Going Back Again, his main statement for this song is rather hopeful and positive. Lindsey sings about how Stevie left him feeling miserable and alone because of the break-up, but once he became involved with another woman, she made him finally realize his life after Stevie can be just as fulfilling and sweet. I would like to praise the simple yet beautiful and uplifting acoustic guitar playing of Lindsey as it compliments the main message of the song very well. Don’t Stop, the infamous song which would later be used for Bill Clinton’s 1993 campaign theme song, is another gem with a powerfully positive message written by Christine McVie. In this song, you can feel the magical chemistry Christine and Lindsey have when it comes to working together on music. Because of the personal problems everyone was dealing at that time, Christine felt obligated to address the issues by making a clear statement that no matter what you are going through right now, it will get better; you just have to be more optimistic.

Another retaliation to Stevie’s Dreams is Go Your Own Way, the band’s biggest radio hit single to date.This was the first Fleetwood Mac song I have ever heard, which is why this song will always have a special place in my heart. The lyrics are yet very similar to those of Dreams, but expressed in a more blunt and bitter way. Stevie was incredibly offended by this song, specifically the line “Packing up, shacking up is all you want to do” as it makes her seem like she wanted to “shack up with other guys”, which she contradicted. Even when you look at the live performances of this song, you can always observe Stevie’s annoyance she has towards this song through her facial expression. This is one of the many reasons why this song is considered to be the greatest, most melodically and rhythmic bitter-breakup rock song to date. In Addition, John’s bass playing is out of this world and blends with Mick’s drums and Lindsey’ guitar playing perfectly.

Songbird is, in my opinion, one of the most underrated songs on the album, which justifies my point that Christine is truly under appreciated when it comes to her songwriting ability. The general public always seems to give attention mostly to Stevie’s and Lindsey’s relationship, which is why Christine tends to be the shadow of the songwriters in the band. However, in my opinion, Christine is the backbone, who holds the band together. Of course, every member is equally important, but when you think of the great songs that Christine has contributed to this album, I ask myself why she never gets the full credit she deserves. The mesmerizing piano playing alone left me stunned, as it is one of the most beautiful melodies I have ever heard. It gave me goosebumps and made me teary eyed, as it is a very lovely and moving song. Subsequently, It is a great transition to one of the world’s greatest rock songs called The Chain. I will NEVER stop stressing the fact that this is the signature song of Fleetwood Mac. To think that this song would have not been what it is, a timeless gem, if Stevie Nicks hadn’t added the lyrics which she had written during the Buckingham Nicks days, is astonishing. It all started with John McVie’s famous bass line which he had created out of nothing, the rest is history. To me, this is a song about the tensed and broken relationships of the members at that time, which was on the verge of collapsing. Understandably, everyone was sick of each other and strongly believed that this would have been the last Fleetwood Mac album to be ever released, yet somehow the chain kept them together for all these years. No matter how exhausted they were from each other, they managed to put their problems aside and work together as a group. Everyone contributed something to this song and unlike the other tracks on Rumours, the members could finally put all their creative differences aside and record a song in such a perfect harmony. On the contrary, when you listen to the live performances of this song, especially in the earlier years, you can practically cut the tension with a knife since it seems to me like Stevie and Lindsey are having a screaming match.

Christine McVie is probably the only member of the band who wrote somehow optimistic love songs, as the next track You Make Loving Fun proves that. To me, this song felt kind of out of place when I compared it with the other tracks on the album. Nonetheless, it is a wonderfully dreamy and well-written song. Considering the fact that she was dating someone at the time, Christine tends to look things on the brighter side and distributes hopeful and buoyant songs on this album. Nevertheless, Christine dedicates one specific song to the father figure of this band - Mick Fleetwood. On the track Oh Daddy, Christine tries to sympathize with Mick, as he was the only member who did not get involved with any drama in the band, unlike the others who were constantly battling with relationship problems and arguing with each other. Furthermore, Mick was the only member with children, which is why he developed the role of a father in the group. To this day, Oh Daddy is Mick’s all-time favorite Christine-written song. I Don’t Want To Know is the song I truly did not care about after finding out that this was the song that replaced Silver Springs. If you are a Fleetwood Mac fan, you are probably aware of the infamous song Silver Springs and the endless battle Stevie had to go through because none of the members wanted to include the song on Rumours, as it allegedly did not fit on the album. Lindsey would end up re-record the vocals on I Don’t Want To Know, an uptempo breakup song that was written by Stevie during the Buckingham Nicks days. Meanwhile, Stevie had to find out about the devastating news through Mick, who suggested her to re-record the vocals as well. Stevie wouldn’t have contributed anything to this song if it hadn’t been for the fact that she would only have two songs on the album. Consequently, Stevie would establish a solo career years later, since she could never fully express herself artistically. The album ends with what I find to be one of the many highlights of this legendary record; Gold Dust Woman. Stevie’s voice adds a beautifully haunting sound to this excellent song. My favorite part of this masterpiece is probably the outro, in which you can hear a type of wailing sound in the background. I could not find any reasons behind that sound other than Lindsey saying ‘I’d say we were under duress’. This is the only song on the album that indirectly discusses Stevie’s drug addiction, as she ‘’digs her grave’’. Stevie battled her cocaine addiction at that time, which lead to several injuries in her later years. It is evident that she could’ve easily died while living this self-destructive lifestyle. It didn’t help that Stevie constantly worked with her fellow members who were struggling with their own drug problems as well. It is shocking when you think about the excessive drug consumption the members went through, yet they still managed to survive. As we all know this could have ended up in the complete opposite direction, to the road of demise that unfortunately many artists went to in the 1970′s.

All in all, this record is the main basis behind this band’s success. This is why their music has been in our lives for over 40 years. Rumours personify all the emotions that someone goes through after a break-up. Imagine having to work with the person you shared your most intimate moments with and now even though you have broken up, you spend every single second together for the sake of making music. Some people could not imagine doing that and yet many bands, in this case, Fleetwood Mac, had to cope with this dilemma. To leave the band or to continue making music despite feeling uncomfortable at first?This album documents one of the most difficult and painful times in the members’ lives; the heartbreak, the sadness, the anger but as well as the sense of hope. Every single track on this album shares a story, a piece of mind that the songwriter felt like opening up to. This album truly has no layers, it is blunt and it is honest yet somehow it sounds like a soundtrack to a drama movie, which is why many people adore it so much. Even if you find the album not to be musically impressive (which is a shame), you should be able to appreciate not only its historical significance but also the lyrical composition. Being in your worst state you could ever be yet still being able to create a masterpiece that would be the blueprint to pop rock music is motivating for all the listeners who are currently going through emotional issues. Remember: no matter what you are going through right now, it will eventually get better.

#rumours#fleetwood mac#stevie nicks#lindsey buckingham#christine mcvie#john mcvie#mick fleetwood#1977#second hand news#dreams#never going back again#don't stop#go your own way#songbird#the chain#you make loving fun#i don't want to know#oh daddy#gold dust woman

8 notes

·

View notes