#ICO Software

Explore tagged Tumblr posts

Text

What Role Does a Whitepaper Play in ICO Development

Overview of ICO Development

ICOs represent a preferred method through which blockchain projects gather capital. Through ICOs businesses can obtain funding by distributing digital tokens to investors who use cryptocurrency such as Bitcoin or Ethereum for the transaction. The ICO market turned into a booming market during recent periods because it provided developers an innovative path to project start-up without requiring traditional venture capital. Creating an ICO consists of three core steps that combine blockchain token development with token sale marketing and all needed legal elements for successful funding.

Good technology alone fails to create distinction between projects because current markets house too many ideas and projects. A successful ICO needs clear communication about project vision and goals as well as the roadmap where the ICO whitepaper plays a critical role.

Importance of a White Paper in ICO Projects

A whitepaper establishes the essential elements and technical specifications that explain an ICO platform development project's business model and core technical specifications. The whitepaper functions as an important document which investors refer to decide about ICO participation. The whitepaper functions as the project's primary business plan by explaining operations and funding usage together with anticipated results.

To gain investor and partnership trust while providing transparency the whitepaper must be a carefully composed document. An ICO space filled with scams and unclear objectives makes projects more legitimate but a professional whitepaper gives them an opportunity to create authenticity as well as project distinction. The whitepaper delivers investors essential information that enables them to make well-informed choices while outlining what the project should accomplish and how it will carry out its plans.

What Is a Whitepaper in ICO Development?

An ICO development whitepaper functions as a thorough document to present complete information about project technical aspects and business development besides financial framework details. Through this document potential investors receive full details about the goals of the project and its team and technology and token distribution system as well as possible investment return.

A project whitepaper presents a complete description of the mission and target objectives combined with identified problems alongside technical and business information and financial planning. Technical specifications about blockchain infrastructure join forces with other elements such as consensus algorithm and smart contracts and tokenomics (economic model of tokens) in the whitepaper document. The whitepaper contains legal information which includes how the token stands under current regulations as well as which jurisdiction oversees the ICO activities.

Potential investors utilize the whitepaper as their main research tool to explore project feasibility and market success as well as financial protection of their investments.

Key Components of an ICO Whitepaper

A well-structured whitepaper typically consists of the following key components:

Introduction and Executive Summary

Problem Statement

Solution and Product Description

Tokenomics

Roadmap

Market Analysis

Team and Advisors

Technical Architecture

Legal Considerations and Compliance

Token Sale and Fund Usage

How a Whitepaper Guides the Technical and Business Aspects of an ICO

An ICO whitepaper establishes guidelines which guide project development throughout the technical and organizational dimensions. The technical team obtains essential understanding regarding blockchain solution and token standards through the whitepaper along with its smart contract architecture. All developers plus team members stay aligned with identical visions and infrastructure expectations about the project through this document.

The whitepaper explains both how the business objectives will be reached while presenting the project targets. To grow the project stakeholders and business partners and investors need this whitepaper as an attraction tool. The project receives funding for development through clear information about tokenomics combined with explanations of market potential and future product direction provided in the whitepaper.

Case Studies: Successful ICO Whitepapers

Ethereum ICO

Goal: Through smart contracts Ethereum established a decentralized application (dApp) platform in its whitepaper.

Success Factors: Productivity factors include a clear definition of problems alongside thorough tokenomic details and transparent project timelines and ground-breaking technological solutions.

Tezos ICO

Goal: Tezos was to provide a blockchain protocol which autonomously governs itself through self-amending functionality.

Success Factors: Clear explanation of governance mechanisms and scalability, with a focus on long-term adaptability

White Papers that provided detailed transparent information helped ICOs to establish trust as they communicated their vision to successfully obtain funding.

Create your own ico platform development with BlockchainX, Read it out

Conclusion

ICO developers must form their project's reputation through the whitepaper because it goes beyond technical documentation. The whitepaper functions as a strategic document that provides everything from project visions to operational strategies and reveals necessary transparency details and regulatory requirements and investor engagement methods.

A well-written whitepaper exhibits professional standards which leads to attracting investors together with partners and skilled personnel. The whitepaper serves as a critical success factor because it provides complete project details combined with technical information and business descriptions and lays out clear directions to enhance an ICO's success.

0 notes

Text

In this video about ICO Software Development What are the Key Features you Look into by BlockchainX.

0 notes

Text

How Can ICO Development Solutions Support Your Long-Term Strategy in 2024?

In 2024, Initial Coin Offerings (ICOs) continue to be a powerful tool for fundraising and launching blockchain projects. However, the success of an ICO is not merely about raising capital; it’s also about how well it aligns with your long-term strategy. As the ICO landscape evolves, leveraging development solutions to support your long-term goals is crucial. This blog delves into how ICO development solutions can be instrumental in achieving sustained success and aligning with your broader strategic vision.

1. Understanding ICO Development Solutions

ICO Development Solutions refer to a range of services and tools designed to facilitate the planning, execution, and management of an ICO. These solutions encompass smart contract development, token creation, marketing strategies, legal compliance, and investor relations management. By incorporating these solutions, projects can ensure a structured approach to launching their ICOs and effectively meet their long-term objectives.

2. Building a Scalable Token Infrastructure

One of the most significant ways ICO development solutions support long-term strategy is through the creation of a scalable token infrastructure.

Custom Token Creation: ICO development services can help create custom tokens that align with your project’s needs and future scalability. This includes selecting the right blockchain platform, defining tokenomics, and ensuring interoperability with other platforms.

Smart Contract Development: Robust and secure smart contracts are essential for managing token transactions and implementing governance rules. Development solutions provide expertise in writing, testing, and deploying smart contracts that ensure transparency and reduce the risk of vulnerabilities.

Scalability: As your project grows, your token infrastructure must be able to handle increased demand. ICO development solutions often include scalability assessments and optimization strategies to ensure that your infrastructure can grow with your project.

3. Ensuring Regulatory Compliance

Regulatory compliance is critical for long-term success in the crypto space. ICO development solutions can help you navigate the complex regulatory landscape and avoid potential legal pitfalls.

Legal Framework: Development solutions often include legal advisory services to ensure that your ICO adheres to local and international regulations. This includes preparing necessary documentation, ensuring proper registration, and addressing concerns related to securities laws.

KYC/AML Integration: Know Your Customer (KYC) and Anti-Money Laundering (AML) processes are essential for compliance and building trust with investors. ICO development solutions can integrate KYC/AML procedures into your platform, helping you meet regulatory requirements and build credibility.

4. Optimizing Investor Relations

Effective investor relations are crucial for maintaining trust and ensuring long-term support. ICO development solutions can enhance how you engage with and manage your investors.

Transparent Communication: Development solutions can help establish communication channels and platforms for regular updates and engagement. This includes creating investor dashboards, providing detailed project reports, and addressing investor queries promptly.

Reward Mechanisms: Implementing reward mechanisms, such as loyalty programs or staking benefits, can incentivize long-term investment. ICO development solutions can assist in designing and integrating these mechanisms into your ICO platform.

5. Implementing a Comprehensive Marketing Strategy

A well-planned marketing strategy is essential for the success of an ICO and its long-term sustainability. ICO development solutions can support this through various means.

Targeted Marketing Campaigns: Development solutions often include marketing services to create and execute targeted campaigns. This involves identifying and reaching out to your target audience through various channels, such as social media, email, and industry events.

Content Creation and SEO: Crafting compelling content and optimizing it for search engines can drive traffic and attract potential investors. ICO development services can provide content creation, SEO, and digital marketing expertise to enhance your ICO’s visibility.

Community Building: Building a strong community around your project is vital for long-term success. Development solutions can assist in creating and managing online communities, fostering engagement, and leveraging community feedback to improve your project.

6. Integrating with Existing Ecosystems

For long-term success, your ICO should integrate seamlessly with existing blockchain ecosystems and platforms.

Partnerships and Integrations: ICO development solutions can facilitate partnerships with other projects, platforms, and ecosystems. This includes integrating with decentralized exchanges (DEXs), partnering with industry influencers, and collaborating with complementary projects.

Cross-Platform Compatibility: Ensuring that your token is compatible with various platforms and wallets enhances its usability and adoption. Development solutions can help ensure cross-platform compatibility and smooth integration with popular blockchain networks.

7. Monitoring and Adapting to Market Trends

The crypto market is dynamic, and staying ahead of trends is crucial for long-term success. ICO development solutions can help you monitor market trends and adapt your strategy accordingly.

Analytics and Reporting: Development solutions often include tools for tracking and analyzing ICO performance. This data can provide insights into investor behavior, market trends, and the effectiveness of your marketing strategies.

Agility and Adaptation: Being able to quickly adapt to changes in the market or regulatory environment is essential. ICO development services can offer ongoing support and adjustments to ensure your project remains relevant and successful.

8. Post-ICO Support and Growth

After the ICO, the focus shifts to maintaining momentum and achieving long-term goals. ICO development solutions can provide post-ICO support to ensure continued success.

Ongoing Development: Post-ICO, your project may require additional development work, such as further smart contract enhancements or platform updates. Development solutions can provide ongoing support to address these needs.

Community Engagement: Continuing to engage with your community and investors is crucial for sustaining interest and support. Development solutions can help maintain communication and manage community initiatives.

Conclusion

In 2024, leveraging ICO development solutions is essential for aligning your ICO with your long-term strategy. From building a scalable infrastructure and ensuring regulatory compliance to optimizing investor relations and implementing a comprehensive marketing strategy, these solutions provide the tools and expertise needed to achieve sustained success. By integrating these solutions into your ICO planning and execution, you can better position your project for long-term growth and impact in the evolving blockchain landscape.

0 notes

Text

Top ICO Fundraising Dashboard Features Explained

Image showcasing the key user interface elements of an ICO Development – from token purchase modules to live transaction tracking and real-time insights.

0 notes

Text

Capitalizing on Opportunity: Maximizing Business Growth with ICO Software in the 2024 Bull Market

In the ever-evolving landscape of business, staying ahead of the curve is paramount to success. With the resurgence of Initial Coin Offerings (ICOs) and the bullish market trends of 2024, entrepreneurs are presented with a unique opportunity to leverage ICO software for exponential growth. In this comprehensive guide, we delve into the intricacies of ICO software and how it can be instrumental in maximizing business growth during this opportune time.

Understanding ICO Software

ICO software refers to the technological infrastructure utilized to launch and manage Initial Coin Offerings. These offerings enable businesses to raise capital by issuing digital tokens to investors in exchange for cryptocurrencies such as Bitcoin or Ethereum. The software streamlines the entire process, from token creation and distribution to investor management and compliance.

Leveraging Tokenization for Growth

Tokenization: Revolutionizing Fundraising

Tokenization has revolutionized the traditional fundraising landscape by providing businesses with a decentralized and efficient means of accessing capital. By digitizing assets and offering them as tokens on blockchain networks, companies can democratize investment opportunities and reach a global pool of investors.

Enhanced Liquidity and Accessibility

One of the key advantages of ICO software is the enhanced liquidity and accessibility it offers to both businesses and investors. Unlike traditional fundraising methods, which often involve lengthy waiting periods and regulatory hurdles, ICOs enable rapid access to funds while providing investors with instant liquidity through cryptocurrency exchanges.

Navigating Regulatory Compliance

Navigating Regulatory Compliance

While ICOs offer tremendous potential for fundraising, navigating regulatory compliance remains a critical aspect for businesses. Regulatory frameworks vary across jurisdictions, and failure to comply with applicable laws can result in severe penalties and legal repercussions.

ICO Software Solutions

To address the complexities of regulatory compliance, many ICO software solutions incorporate robust compliance features. These features may include Know Your Customer (KYC) procedures, Anti-Money Laundering (AML) protocols, and smart contract functionality to ensure transparency and adherence to regulatory standards.

Maximizing Business Growth with ICO Software

Scaling Operations

ICO software empowers businesses to scale their operations rapidly by providing access to a global pool of investors. With streamlined fundraising processes and enhanced liquidity, companies can expedite growth initiatives such as product development, market expansion, and strategic partnerships.

Building Community Engagement

Community engagement is paramount in the success of ICOs, and effective communication is key to building a loyal investor base. ICO software often includes features for managing community forums, conducting token distributions, and fostering transparent communication channels to engage investors and stakeholders.

Conclusion

As we navigate the dynamic landscape of the 2024 bull market, the strategic utilization of ICO software presents unprecedented opportunities for businesses to capitalize on growth. By leveraging tokenization, navigating regulatory compliance, and maximizing community engagement, entrepreneurs can position their ventures for success in the digital economy. Embrace the power of ICO software and embark on a journey towards sustainable growth and prosperity in the era of decentralized finance.

0 notes

Text

What are ICOs and how to take advantage of them to make profits?

For high-tech and capital-intensive startups, financing is vital to compete and survive in the market.

One of the fundamental and, at the same time, most difficult steps for entrepreneurs is to find and choose between different sources of capital to finance their startup. Currently, taking advantage of blockchain technology, startups have recently begun to finance their operations with ico development service( ICOs ). This is also often known as token sales.

In ICOs, entrepreneurs distribute digital assets, such as coins and tokens, to investors in exchange for capital. These tokens take on different functions and utilities within the issuer’s network as soon as the project is launched. Initial coin offerings (ICOs) are a novel form of financing that has generated billions of dollars in the blockchain ecosystem. Potentially challenging traditional funding vehicles such as venture capital or business angel investments.

What are ICOs?

Initial coin offerings (ICOs) or Token Sales are a form of financing in which companies, mainly startups, raise funds through tokens or cryptocurrencies that they have created themselves. In the case of ICOs, units (tokens) of a virtual currency are sold that are still in a very early stage of development or even in the status of a theoretical white paper.

This sale, to raise funds, is usually against Bitcoin ( BTC ) or Ether ( ETH ) and not in traditional currencies such as euros or dollars. The proceeds benefit the project developers. Furthermore, it is intended to ensure sustainable financial viability for the continued development of the virtual currency offered. ICOs are different from traditional crowdfunding to the extent that blockchain technology transfers some of its implications and characteristics. For example: transparency, immutability, decentralization and openness, to the properties of the ICO.

An initial coin offering is typically announced with the disclosure of a whitepaper that describes the token sale, the underlying IT protocol and blockchain, as well as the project and business model. It also describes the distribution and function of the token, the rights of its holder and its value. The most common way to offer tokens is through an auction, with the proceeds going to fund the startup or project.

What functionality do they have?

An ICO token is a cryptocurrency issued specifically for a project in question. Among its functionalities, this has to digitally represent a right or a set of rights. The simplest form of representation is that of the token. This simple token, called utility, does not convey any rights over the company, the project or the product. Their investment incentive is due to the real prospect of an increase in value in case the associated project is successful and demand for the tokens increases.

There are also usage tokens, which, similar to a voucher or license, transmit access or the rights to use a product or service. An example of this is the American startup Protocol Lab: its Filecoin aims to become the currency of a decentralized computer network in which users can rent each other unused storage space. Your tokens represent the rights to use the buffered storage space on your website.

ICO also function as assets or products. Among other things, these tokens can embody ownership of something. An example of this is the Chinese company Tether, whose USDT token represents a right to one of the US dollars held by the company in each case. They can also function as work tokens, where providers do not issue tokens for payment, but in exchange for work. So-called “advisory agreements” are those in which consultants are hired whose services are rewarded as part of the token sale.

How can you make money by staying up to date with ICOs?

Before investing in any ICO, you should do thorough research on them. There is currently a large list of ICO software development, which due to their projected figures attract a large number of investors. Many of these will yield some very attractive figures, numbers that will surely catch the attention of any investor. Names like IOTA, Stratis and NEO, which have risen to the ranks with gains of over 100,000%, can seem very attractive to investor.

However, looking back, there is a bigger reason why these companies have found success. It is about the vision of the company and the results it offers to the community. There is no formula you can follow to know if an ICO will be profitable or not. But learning as much as you can about the company’s product, team, and vision can help give you peace of mind with your investment.

To make money with ICOs, you must be up to date with the information about them and take these aspects into account to consider the profitability they can provide:

Know and follow up on the team of developers, the best ICOs have a great team of developers behind them.

Review the technical document and defined roadmap, this is important because it can be an easy way to determine if a company is legitimate or not.

Follow up on social networks, checking the reviews of the company you are interested in.

Is it safe to participate in them?

Given that investors who get involved in an ICO do so at a very early stage of project development, it is an extremely speculative risk business. This type of business is associated with enormous profit opportunities, but also with the risk of total loss. If you invest in an ICO, you can make a lot of money, examples like NEO , Ethereum or Spectrecoin are proof of this. But there is no way every initial coin offering will later become a valuable coin.

Therefore, choose your investment vehicle carefully and only invest money that you can get back if in doubt. This high risk, on the one hand, is because numerous inexperienced investors are attracted by easy access via the Internet and the promise of quick money. Most projects consist of complex technical topics, the evaluation of which requires deep technical understanding and extensive research.

Learn More Visit: ICO Software development

On the other hand, the technical simplification of the ICO process itself increasingly attracts unprofessional providers. Due to the early financial entry into the project, it is difficult to predict whether it will ever be completed and launched and whether it will develop favorably or fail later. Furthermore, due to their internationality, ICOs carry the risk of more difficult legal enforcement, as different legal systems and bodies often clash with each other.

#ico development services#initial coin offering#blockchain#ico software development#ico coin development#ico#advantage#profits

0 notes

Text

#ico development#ico software development#ico software development company#ico development services#ico token development#ico development solutions#ico development company

0 notes

Text

ICO Software Development: What are the Key Features you Look into

In this Article about ICO Software Development: What are the Key Features you Look into. Read out here,

What is an Initial Coin Offering (ICO)?

An initial coin imparting is the cryptocurrency industry’s equal to an initial public supplying (IPO) or preliminary public imparting (IPO). An ICO is a technique used by crypto initiatives to elevate finances to create a brand new cryptocurrency, app, or provider. Investors interested in investing can purchase a preliminary coin present (ICO) to get hold of a new crypto token from the agency or venture. The tokens provided by the ICO can also have application in that task or software.

In 2017, the cryptocurrency marketplace was booming and so became the quantity of ICOs. However, most of them by no means delivered the service they’d promised and traders misplaced their investment. Similarly, different preliminary cryptocurrency offerings have both no longer finished well or have turned out to be fraudulent. To take part in a cryptocurrency ICO, an investor should buy a cryptocurrency that is better set up in the marketplace. This calls for doing some research into how cryptocurrency exchanges and crypto wallets paintings. Keep in mind that most ICOs are not regulated, so traders ought to be careful while researching and making an investment in them.

What is ICO Software?

ICO software development is a specialised platform or device used to manipulate and execute Initial Coin Offerings (ICOs), which are fundraising events inside the cryptocurrency and blockchain area. The software program typically facilitates groups and startups to increase capital by offering virtual tokens to traders in exchange for cryptocurrencies like Bitcoin or Ethereum.

Essentially, ICO software streamlines the whole ICO process, from token creation to fundraising and post-ICO management, even as making sure safety and regulatory compliance. It’s a crucial device for any blockchain task looking to release a successful token sale.

Key Features to Look for in ICO Software

When selecting an ICO software program in your cryptocurrency project, it’s essential to bear in mind a number of functions with a purpose to make certain a clean and successful token sale. Here are the crucial component features you need to look for in ICO software program:

User-Friendly Interface (UI/UX)

A smooth, intuitive interface ensures that both the project team and consumers have a continuing revel in. Investors need to be capable of navigating effortlessly through the registration approach, token purchase, and transaction confirmation.

Smart Contract Integration

Smart contracts mechanically execute and enforce the phrases of the ICO, such as token distribution, funding limits, and investor eligibility.

Security and Data Protection

ICOs handle big sums of cryptocurrency and private facts, making security paramount to prevent fraud, hacks, and statistics breaches.

Token Creation and Management

You want an Solution that permits you to easily create, distribute, and manage your tokens in the course of the ICO process.

Compliance with Regulations (KYC/AML)

Regulatory compliance is essential to avoid felony problems all through and after the ICO. KYC (Know Your Customer) and AML (Anti-Money Laundering) exams assist to make sure that most effective eligible buyers can participate.

Scalability and Performance

ICOs regularly see a surge in visitors at some point of launch, so the software has to take care of large numbers of users and transactions without issues.

Security Features for Fundraising

Security is important to protect budget during the ICO length. Anti-bot and anti-fraud mechanisms help safeguard towards malicious activities.

Post-ICO Token Management

After the ICO is over, handling the tokens and maintaining buyers

Examples of successful initial coin offerings (ICOs)

Since ICOs are a famous method to raise funds for cryptocurrency or crypto tasks, there have been a few ICOs that have been a hit. Here are the most important ICOs that crypto buyers may keep in mind:

Ethereum ICO: Many cryptocurrency lovers have been eager to invest inside the first programmable blockchain. The Ethereum ICO commenced in July 2014 and ended in September. It featured over 60 million tokens, and the task raised $18.4 million well worth of Bitcoin (BTC). Today, Ethereum is the second-largest cryptocurrency by market capitalization.

Cardano ICO: Cardano promised to improve upon the blockchain delivered through Ethereum. Its ICO became even more of a hit. In January 2017, Cardano’s ICO raised $62.2 million. It might finally upward thrust to the pinnacle five cryptocurrencies in phrases of marketplace capitalization.

Tezos ICO: Tezos raised $232 million through its ICO in July 2017. However, it was not an entire fulfillment. Due to delays in the distribution of tokens through the ICO, a category-action lawsuit was filed. Tezos reached an agreement well worth $25 million with all events in 2020.

Dragon Coins ICO: There are many failed ICOs. Dragon Coins is one such example. It raised $320 million in March 2018. However, the challenge is facing many controversies that led to a speedy drop within the fee of its crypto. Its marketplace cap fell under $1 million in 2021.

Conclusion:

In Conclusion, choosing the proper ICO software program utility is a pivotal choice for ensuring the fulfillment of your cryptocurrency mission. Key capabilities which consist of smart agreement integration streamline token distribution and put into effect transparency, at the same time as robust protection functions shield every charge variety and investor information. Compliance with KYC/AML guidelines is vital to fulfill felony necessities and construct trust with customers, ensuring your ICO runs without problems without criminal setbacks.

Moreover, someone-high-quality interface complements what investors enjoy, making it smooth for them to navigate and participate within the token sale. Scalability is another vital issue, as your ICO platform has to address website traffic spikes and a growing investor base. Features like fee gateway integration for more than one cryptocurrencies and fiat currencies increase your attainment and increase participation.

Ultimately, the proper ICO software no longer only simplifies the fundraising technique but also helps lengthy-term growth, making sure your venture’s fulfillment in the competitive blockchain ecosystem.

Connect with BlockchainX to create you ico software, stay tune.

0 notes

Text

Launching your own ICO platform with Simple steps help of BlockchainX

Connect with Us: ICO Platform Development

0 notes

Text

How Do ICO Development Solutions Affect the Timing of Your Token Sale?

Initial Coin Offerings (ICOs) have revolutionized the way startups raise capital by leveraging blockchain technology. The success of an ICO, however, is not solely dependent on the concept or the technology but also significantly influenced by the timing of the token sale. This blog delves into how ICO development solutions impact the timing of your token sale and why it's crucial to get it right.

Understanding ICO Development Solutions

ICO development solutions encompass a range of services designed to facilitate the creation, launch, and management of an ICO. These services typically include:

Whitepaper Development: Crafting a comprehensive document that outlines the project's vision, technology, business model, and tokenomics.

Smart Contract Development: Coding the smart contracts that govern the token distribution and sales process.

Token Design and Development: Creating the token's architecture, including its specifications and standards (e.g., ERC-20, ERC-721).

Platform Integration: Setting up the infrastructure for token sales, including the integration with cryptocurrency wallets and exchanges.

Marketing and PR: Strategies to promote the ICO and build a community around the project.

Legal and Compliance: Ensuring that the ICO adheres to legal regulations and compliance requirements in various jurisdictions.

The timing of an ICO is a critical factor that can make or break the project. Here’s how various ICO development solutions impact the timing of your token sale:

1. Development Timeline

The complexity of your ICO development solutions can directly impact the timeline of your token sale. Here’s how:

Smart Contract Development: Writing and testing smart contracts is a time-consuming process. Complex tokenomics or innovative features require extensive coding and auditing. Delays in smart contract development or security audits can push back your ICO launch date.

Token Design and Development: The process of designing and creating a token involves deciding on its technical standards and features. Custom tokens with unique functionalities or those requiring special integration with existing platforms might take longer to develop.

Platform Integration: Setting up and integrating with exchanges and wallets can take varying amounts of time depending on the platform’s requirements and responsiveness. The more complex the integration, the longer it may take.

To mitigate delays, it’s essential to plan the development timeline meticulously and allow for unforeseen challenges in the process.

2. Regulatory and Compliance Considerations

Regulatory compliance is another critical factor that affects the timing of an ICO. ICO development solutions must include legal and compliance aspects, which can significantly impact the launch schedule:

Regulatory Approvals: Depending on the jurisdiction, obtaining the necessary regulatory approvals can be a lengthy process. Some countries have strict regulations regarding ICOs, which require detailed documentation and legal compliance before the sale can commence.

Legal Reviews: ICOs must undergo thorough legal reviews to ensure they adhere to applicable laws. This process can involve reviewing the whitepaper, tokenomics, and contractual obligations, potentially causing delays.

A well-planned legal strategy, involving experienced legal counsel from the beginning, can streamline the process and avoid last-minute delays.

3. Market Conditions and Timing

The timing of your ICO is influenced by market conditions, and ICO development solutions can help you navigate these conditions:

Market Research: ICO development solutions often include market research and analysis to determine the optimal timing for the token sale. Understanding market trends, investor sentiment, and competitive landscape is crucial for choosing the right time to launch.

Marketing Strategy: A robust marketing and PR strategy can help create buzz and build momentum before the ICO launch. However, if the marketing campaign is not well-aligned with market conditions or is delayed, it can affect the timing and overall success of the ICO.

An integrated approach, combining market research with strategic marketing, can enhance the timing and impact of your ICO.

4. Pre-ICO and Token Sale Preparation

Preparation activities before the ICO launch play a significant role in determining the timing:

Pre-ICO Phase: Many projects conduct a pre-ICO or private sale to raise initial capital and gauge interest. The timing of the pre-ICO can impact the main ICO launch, as it provides insights into investor interest and market readiness.

Testing and Audits: Before launching the ICO, it is crucial to conduct thorough testing of the smart contracts and overall system. Delays in testing or addressing identified issues can push back the ICO launch.

A well-organized preparation phase, including pre-ICO activities and thorough testing, helps ensure a smooth and timely ICO launch.

5. Community and Investor Engagement

Building and maintaining a community of supporters and investors is essential for the success of an ICO:

Community Building: Effective community engagement strategies, such as social media campaigns and community forums, can help build excitement and anticipation for the ICO. Delays in community engagement or insufficient outreach can affect the timing and success of the token sale.

Investor Relations: Maintaining communication with potential investors and addressing their concerns promptly can influence the timing of investments and the overall success of the ICO.

Engaging with the community and investors early and consistently helps ensure a favorable timing for the ICO launch.

6. Contingency Planning

Contingency planning is crucial for managing unexpected delays:

Unexpected Issues: Technical glitches, regulatory hurdles, or market volatility can affect the ICO timeline. Having contingency plans in place for potential delays ensures that you can adapt to changes and maintain momentum.

Flexibility: Being flexible with your ICO timeline allows you to respond to unforeseen challenges without compromising the overall success of the token sale.

By anticipating potential issues and having contingency plans, you can better manage the timing of your ICO.

Conclusion

ICO development solutions play a pivotal role in determining the timing of your token sale. From development timelines and regulatory compliance to market conditions and community engagement, each aspect influences when and how effectively you can launch your ICO. By carefully planning and integrating these solutions, you can optimize the timing of your token sale and increase the chances of a successful launch.

0 notes

Text

caught up with geoffrey's game awards (abridged)

thank you sean murray for the free starborn ship without making me do expeditions in no mans sky. i do not like doing those at all

split fiction and stage fright are our immediate most anticipateds. we're an overcooked and it takes two family

muppets went from annoying to surprisingly relatable in their progressive roasts. maybe they thought if they vocalized those very true and real gripes, people would feel the opposite? I know I didn't

absolutely rotten vibes from brandy pitchfork or whatever his name is. rancid, putrid vibes

speaking of videogame men I dislike. it's really annoying how good troy baker sounds in that indiana jones game. I dont like that man but he is frustratingly gifted

is the new team ico game gonna make me bond with and cry over a big robot head? that's so sick

warframe lady was best dressed of the night. I am such a sucker for tartan textures

an old prediction of mine came true - the flashy USPs of apple's $3500 headset were effortlessly repackaged into a software feature on a $300 oculus rift or whatever it was. womp womp

i really like tati gabrielle so i hope that new space game is good. with an unfortunate amount of brand placements for one teaser. and i do hope druckmann isn't writing it! he is isn't he!

swen baldursgate is the opposite of randy geared box in every way it seems like. great speech! also pedro eustache you will always be famous king

overall, video games are still a nightmare factory of burnout, sunk costs, and gambling, and are predictably barreling towards catastrophic entropy; but at least the nepo baby commercial slop awards show is marginally improving its year-on-year competency. and I genuinely do mean that! it's like always just a bit better. nothing too memable this time either. I'm sure chris judge was tied and gagged somewhere in the back rows

14 notes

·

View notes

Text

American R&B singer Aliaune Thiam, professionally known as Akon, has long wanted to help Senegal, the country he grew up in. He started Akon Lighting Africa in 2014 to install cheap Chinese solar-powered lighting systems across the continent. He hoped to do something more significant for Senegal. But how to fund it?

The answer turned out to be the same one adopted by a growing number of governments and entrepreneurs: a mixture of cryptocurrency and urban planning. It’s a combination that offers the promise of development without any of the tricky details—and which tends to turn out to be little more than vaporware. There was Bitcoin City in El Salvador, but also Painted Rock in Nevada, Satoshi Island in Vanuatu, Cryptoland in Fiji, or the Crypto-Kingdom of Bitcointopia in Utah.

In 2018, Akon announced a new cryptocurrency, to be called “akoin.” Akoin would enable Africans to, as the singer put it at a launch event, “advance themselves independent of the government”—in some manner. Most importantly, akoin would fund the creation of Akon City, an advanced planned city to be built in Senegal. Akon announced akoin and Akon City at the Cannes Lions Festival in June 2018. Akon said in November of that year that he had “everything planned out” for the city. But both Akon City and the akoin token remained only ideas for many months.

Akon was interested by the promises of cryptocurrency—specifically, free money by some unclear mechanism—but he was not up on the details of its technical or financial issues: “I come with the concepts and let the geeks figure it out,” he said. The akoin team featured initial coin offering (ICO) entrepreneurs such as Lynn Liss of ICO Impact and Crystal Rose Pierce.

The akoin cryptocurrency was pre-sold in a 2019 crypto token offering called “token of appreciation.” Each dollar “donation” would give you up to four tokens which would convert to akoin.

Akoin had not launched in Senegal at the time, despite billboards across the country. The West African CFA franc is the only legal currency in Senegal; BCEAO, the central bank, warned that akoin could not be used as a currency in the country.

Akoin promised all manner of functionality—special akoin wallet software, direct exchange with other cryptocurrencies or with cellphone minutes, an application marketplace, various “building blocks for entrepreneurship.” None of this was ever implemented.

Akoin finally started trading on a crypto exchange in November 2020. The akoin token didn’t do anything or have any particular utility; it was just a crypto token that you could trade. Pre-sale buyers dumped their akoin immediately and the price crashed. That’s not unusual: As of 2022, 24 percent of new cryptos fell 90 percent or more in their first week.

Akon posted on social media in January 2020 that he had “finalized the agreement for AKON CITY in Senegal”—though he had previously claimed that construction had already started in March 2019. The new city would be built near the small town of Mbodiène, about 100 kilometers south of the capital, Dakar.

Akon City would be a “smart city” inspired by the futuristic African nation of Wakanda from the 2018 movie Black Panther. The city would feature boldly curved skyscrapers, shopping malls, music and movie studios, “eco-friendly” tourist resorts, and a parking garage for flying cars.

Akon claimed in August 2020 that $2 billion of the $6 billion needed to build Akon City had been secured. He laid the foundation stone for the city on Aug. 31, 2020, and said that construction would start “next year,” in 2021.

Construction did not start in 2021, to the disappointment of locals. It was not clear where the $6 billion needed to build Akon City would come from. A representative for KE International, the United States-based contractor for Akon City, told AFP that more than $4 billion had been secured, with Kenyan entrepreneur Julius Mwale as lead investor, and that construction would start in October 2021—but it did not.

By 2022, Akon told the BBC that construction was “100,000 percent moving.” He said the COVID-19 pandemic was partly to blame for the delays. Akon was surprised at the “thousands of studies” that had to be done before work could even commence.

Senegal’s Society for the Development and Promotion of Coasts and Tourist Zones (SAPCO) had claimed the land by eminent domain in 2009 before offering it to Akon City in 2020. By 2023, no building work had been done at the Akon City site—though Axiome Construction insisted that geotechnical studies and environmental assessments were still under way. By this time, according to the Guardian, the only construction was a youth center nearby in Mbodiène, paid for personally by Akon—and built upon the foundation stone that he had laid in 2020.

Senegal finally lost patience with the project. Akon had missed several payments to SAPCO, and in June of this year, SAPCO sent a formal notice to Akon warning that work had to start by the end of July or SAPCO might take back almost all of the land grant.

Akon had already been looking for other opportunities to place akoin. In April 2021, he started talking to Uganda about setting up an Akon City there as well. In January 2022, the Ugandan government allocated him one square mile in Mpunge, in the Mukono district—despite objections from the National Unity Platform party and protests from Mpunge residents wanting compensation, which could not be paid before 2025.

Akon said that Akon City, Uganda, might be completed by 2036. At a 2021 news conference, he evaded questions on what the new city would cost or how it would be funded. The Forum for Democratic Change party said that the Ugandan Akon City would never happen and accused the government of granting “sweetheart deals” to developers.

Akon City was tech solutionism that leveraged the political power of celebrity. Akon wanted to launch a large project and thought that cryptocurrency, the buzzword of 2018, might fund his dream. He thought that this one weird trick would do the job.

In this case, the miracle technology was crypto. These days, such pushes by celebrities or entrepreneurs of new projects will typically use artificial intelligence—whatever that might mean in a particular case—as the marketing hook for a “smart city.

In his 2023 book Let Them Eat Crypto, Peter Howson of Northumbria University detailed how to head off solutionism-inspired blockchain projects that were heavy on publicity but light on the necessary bureaucratic work on the ground. His approach is broadly applicable to tech solutionism in general: Pay attention to the men behind the curtain. Howson has written recently on “smart city” plans as marketing for crypto tokens.

The Akon City plan was a worked example of speculative urbanization. A project is proposed with science-fiction concept drawings and a pitch aimed at tourists rather than locals; land is allocated; something might eventually be built, but it will bear little resemblance to the brochures. Christopher Marcinkoski of the University of Pennsylvania described Akon City as just one of many such initiatives, particularly in Africa, calling it “very much a real estate play.” The important output from such projects is local political capital—even as they never work out as advertised.

Cryptocurrency was an application of speculative urbanization to money—a high concept, a pitch to financial tourists, and the only end result being a token to speculate on and a tremendous amount of fraud. The Akon City project, however good Akon’s own intentions, seems functionally to have been merely the pitch for a crypto offering that failed—leaving an empty site, disappointed locals, and an embarrassed figurehead.

By 2024, akoin had been removed from the few crypto exchanges it had been listed on; it was effectively worthless. Akon sold short videos on Cameo—but he would not do requests related to cryptocurrency.

The speculative urbanization pitch rolls on. Actor Idris Elba has recently floated plans for an “environmentally friendly smart city” on Sherbro Island off Sierra Leone.

6 notes

·

View notes

Text

Navigating the Maze of Crypto Scams: Effective Strategies for Prevention and Recovery

Introduction: The Rising Threat of Cryptocurrency Scams

As cryptocurrencies gain widespread acceptance, the lure of quick profits has not only attracted investors but also cybercriminals, leading to a surge in crypto-related scams. Protecting your digital assets against these threats requires a proactive approach, encompassing awareness, prevention, and recovery strategies.

Understanding Crypto Scams: The Basics

Identifying Common Types of Cryptocurrency Scams

Cryptocurrency scams can take various forms, each designed to part unsuspecting victims from their digital assets. Some prevalent types include:

Investment Scams: These scams promise extraordinary returns through crypto investments and are often structured like traditional Ponzi schemes.

Exchange Scams: Victims are tricked into using fake cryptocurrency exchanges, which may disappear overnight.

Wallet Scams: Scammers create fake wallets to steal user credentials and drain their holdings.

ICO Scams: Initial Coin Offerings (ICO) that are fraudulent, where the crypto token is either non-existent or the ICO itself is based on false promises.

Red Flags and Warning Signs

The key to avoiding cryptocurrency scams is recognizing warning signs, such as:

Promises of guaranteed high returns with little risk.

Anonymous teams or unverifiable developer identities.

Pressure to invest quickly or offers that seem too good to be true.

Techniques for Investigating Crypto Scams

Unraveling crypto scams requires a blend of technical expertise and investigative rigor. Effective techniques include:

Blockchain Analysis: Tools and software are used to analyze transactions and track the flow of stolen funds across the blockchain.

IP Address Tracking: Identifying the IP addresses associated with fraudulent activities can help pinpoint the scammer’s location.

Collaboration with Regulatory Bodies: Working with cryptocurrency exchanges and regulatory authorities can help in freezing fraudulent accounts.

Strategies for Recovering Lost Cryptocurrencies

Losing cryptocurrency to a scam can be devastating, but there are ways to attempt recovery:

Act Quickly: Immediate action can increase the chances of recovering stolen assets.

Crypto Recovery Services: Specialized services can assist in tracing lost or stolen cryptocurrencies and negotiating their return.

Legal Recourse: In some cases, legal intervention might be required to recover large sums.

Preventative Measures to Secure Your Assets

Implementing robust security measures is crucial in safeguarding your cryptocurrencies:

Utilize two-factor authentication (2FA) for all transactions.

Store large amounts of cryptocurrency in cold storage solutions.

Educate yourself continually about new types of scams in the crypto space.

Conclusion: Staying One Step Ahead of Crypto Scammers

As the crypto market continues to evolve, so too do the tactics of scammers. Staying informed, vigilant, and proactive is your best defense against these digital threats. For victims of crypto fraud, recovery may be challenging but not impossible, with the right guidance and support. For comprehensive support in crypto fraud investigation and recovery, visit www.einvestigators.net, your trusted partner in protecting and recovering your digital wealth.

3 notes

·

View notes

Text

Revolutionizing Fundraising: The Role of ICO Software

In the fast-paced world of finance and technology, traditional fundraising methods are being disrupted by the emergence of blockchain-based crowdfunding platforms known as Initial Coin Offerings (ICOs). ICOs have revolutionized fundraising by providing a decentralized and efficient way for entrepreneurs and startups to raise capital and launch innovative projects. At the heart of every successful ICO lies a sophisticated software infrastructure tailored to streamline the token sale process. In this blog post, we'll explore the pivotal role of ICO software in revolutionizing fundraising and empowering entrepreneurs to bring their visions to life.

The Evolution of Fundraising: Enter ICOs

Traditional fundraising methods, such as venture capital, initial public offerings (IPOs), and crowdfunding, have long been associated with high barriers to entry, geographical limitations, and lengthy processes. ICOs have emerged as a disruptive alternative, leveraging blockchain technology to democratize access to capital and unlock new opportunities for entrepreneurs worldwide. By issuing digital tokens on a blockchain network, ICOs enable entrepreneurs to raise funds from a global pool of investors, bypassing traditional intermediaries and regulatory hurdles.

The Role of ICO Software in Revolutionizing Fundraising

ICO software plays a pivotal role in revolutionizing fundraising by providing the digital infrastructure necessary to facilitate every aspect of the token sale process. From token creation and distribution to investor management and regulatory compliance, ICO software streamlines the fundraising journey, empowering entrepreneurs to focus on building innovative projects and engaging with their communities. Let's delve into the key functionalities of ICO software:

Token Creation and Management: ICO software enables entrepreneurs to create and manage custom tokens that represent ownership or participation in their projects. By defining token economics, distribution models, and smart contract functionalities, entrepreneurs can tailor their token offerings to attract investors and align with their project's goals.

Smart Contract Integration: Smart contracts are self-executing contracts with predefined terms and conditions written into code. ICO software integrates smart contracts to automate various processes, including token issuance, distribution, and escrow services. Smart contract automation enhances transparency, security, and efficiency in the token sale process, minimizing the risk of fraud and human error.

Investor Management: ICO software provides tools for managing investor relations, including investor onboarding, KYC/AML verification, and communication channels. By maintaining transparent and responsive communication with investors, entrepreneurs can build trust, foster community engagement, and maximize participation in their token sales.

Regulatory Compliance: Regulatory compliance is a critical consideration in ICO fundraising, as non-compliance can lead to legal repercussions and reputational damage. ICO software incorporates compliance features, such as KYC/AML verification, investor accreditation, and jurisdictional restrictions, to ensure adherence to applicable laws and regulations.

Empowering Entrepreneurs with ICO Software

ICO software empowers entrepreneurs to revolutionize fundraising by providing a streamlined and accessible platform for launching innovative projects. By leveraging the power of blockchain technology and smart contract automation, entrepreneurs can democratize access to capital, engage with global investors, and bring their visions to life in the digital age. With ICO software at their disposal, entrepreneurs have the tools and resources they need to disrupt industries, drive innovation, and create lasting impact in the world of finance and technology.

Conclusion

In conclusion, ICO software plays a transformative role in revolutionizing fundraising by providing entrepreneurs with the digital infrastructure needed to launch successful token sales. By streamlining the token sale process, enhancing transparency and security, and ensuring regulatory compliance, ICO software empowers entrepreneurs to unlock new opportunities, engage with global investors, and drive innovation in the digital economy. As blockchain technology continues to evolve, ICO software will remain at the forefront of revolutionizing fundraising and shaping the future of finance.

0 notes

Text

Unveiling the Mystery: How Cryptocurrency Tracing Can Expose Fraud

Cryptocurrency tracing refers to the process of tracking and analyzing cryptocurrency transactions on the blockchain to uncover fraudulent activity. In this guide, we'll explore how cryptocurrency tracing can be used to expose fraud in the world of digital currencies.

Understanding Cryptocurrency Fraud

Types of Cryptocurrency Fraud: Cryptocurrency fraud encompasses various schemes, including Ponzi schemes, phishing attacks, exchange hacks, and initial coin offering (ICO) scams.

Common Tactics Used by Fraudsters: Fraudsters use tactics such as fake investment schemes, fraudulent ICOs, ransomware attacks, and pump-and-dump schemes to deceive and defraud unsuspecting victims.

The Role of Cryptocurrency Tracing in Exposing Fraud

Tracing Transactions on the Blockchain: Cryptocurrency transactions are recorded on the blockchain, providing a transparent and immutable ledger that can be analyzed to trace the flow of funds and identify fraudulent activity.

Identifying Suspicious Activity Patterns: Through blockchain analysis, suspicious activity patterns, such as large transfers to unregistered exchanges or mixing services, can be identified and investigated further.

Tracking Stolen Funds: Cryptocurrency tracing can be used to track stolen funds from exchange hacks or fraudulent schemes, potentially leading to the recovery of stolen assets and prosecution of perpetrators.

Tools and Techniques for Cryptocurrency Tracing

Blockchain Analysis Software: Specialized software tools, such as blockchain explorers and analytics platforms, are used to analyze blockchain data and identify patterns of fraudulent activity.

Address Clustering: Address clustering techniques group together related cryptocurrency addresses to track the movement of funds across the blockchain.

Network Analysis: Network analysis tools help visualize the flow of funds between cryptocurrency addresses and identify connections between different entities involved in fraudulent activity.

Real-World Examples of Cryptocurrency Tracing

Silk Road Investigation: Law enforcement agencies successfully traced and seized millions of dollars' worth of Bitcoin used in illegal transactions on the Silk Road darknet marketplace.

Mt. Gox Hack Recovery: Through blockchain analysis, investigators were able to trace and recover a portion of the funds stolen in the infamous Mt. Gox exchange hack.

Challenges and Limitations of Cryptocurrency Tracing

Privacy Concerns: While blockchain transactions are pseudonymous, privacy coins and mixing services can obscure the traceability of funds, making it more challenging to trace fraudulent activity.

Complexity of Blockchain Analysis: Analyzing large volumes of blockchain data requires specialized skills and resources, making it difficult for law enforcement and regulatory agencies to keep up with evolving fraud schemes.

Jurisdictional Issues: Cryptocurrency transactions are borderless, posing challenges for law enforcement agencies to coordinate investigations and enforce regulations across jurisdictions.

The Future of Cryptocurrency Tracing

Advances in Blockchain Analytics: Continued advancements in blockchain analytics technology will enhance the ability to trace and analyze cryptocurrency transactions, improving detection and prevention of fraud.

Collaboration Between Industry and Law Enforcement: Increased collaboration between cryptocurrency exchanges, blockchain analytics firms, and law enforcement agencies will facilitate information sharing and enhance efforts to combat fraud.

Conclusion

Cryptocurrency tracing plays a vital role in exposing and combating fraud in the digital currency ecosystem. By leveraging blockchain analysis tools and techniques, investigators can trace the flow of funds, identify fraudulent activity, and hold perpetrators accountable. Despite challenges and limitations, continued innovation and collaboration hold promise for the future of cryptocurrency tracing in uncovering fraud and protecting investors.

2 notes

·

View notes

Text

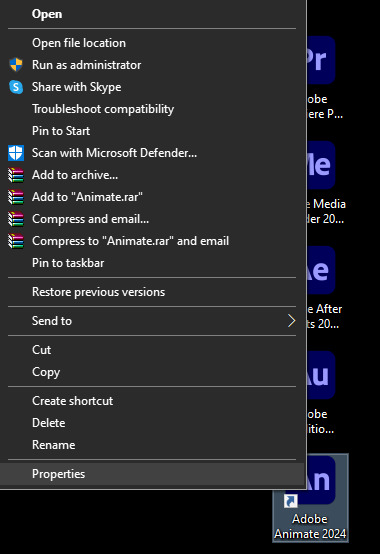

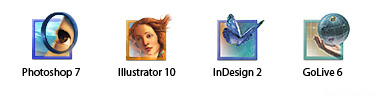

Fixing Adobes stupid modern icons on Windows

So if you're a frequent adobe user you're probably aware that back in 2020 the icons for a number of their software went from being color coated to homogenized.

While I do understand the motivation to do this it is frankly, very stupid! No longer can you tell at a glance which software is which, you must be vigilant at all times. The amount of times I thought I was opening Audition only to realize I clicked on After Effects must be in the hundreds. While this might sound like a minor problem each these programs can take up 30 seconds to a minute (depending on your hard drive speed) to boot up and close. So if your working on a project that requires you to switch between softwares frequently, that avoidable mistake can add up quick! NO MORE I SAY! Together we shall fix this! (but only on windows, sorry mac users :/)

Step 1

Download the file below V

Place the folder somewhere accessible that you will remember. I recommend creating a new folder in "C:\Program Files\Adobe" called "Icons"

Step 2

Right click on the shortcut whose Icon you want to change and click on "Properties" and then "Change Icon..."

Click "Browse..." and navigate to the folder downloaded in Step 1 and select the icon you want to use and press "open"

Step 3

Violia! We have our new icons! Wasn't that easy!

Sadly every time you update the software you will need to repeat this process, but as long as you have the .ico files it should be pretty painless.

If you found this helpful let me know! Hopefully one day adobe will get their shit together and this guide will be obsolete. Hell maybe we'll even get lucky and they'll start using the 2001 icons again. *sigh* A girl can dream...

#Adobe#adobe creative suite#adobe premiere pro#adobe animate#adobe flash#tutorial#adobe after effects#adobe audition#software

2 notes

·

View notes