#IPO Open Date

Explore tagged Tumblr posts

Text

Groww IPO GMP, Open Date, Allotment Status, Listing Date, DRHP

Groww IPO open date is expected to be in the end of year 2025. This new IPO is a book-built issue of Rs 6000 crore plus (expected). This upcoming IPO is a combination of fresh issue and offer-for-sale. The company valuation at $6 billion to $8 billion.

Read more..

#Groww IPO GMP#Groww IPO#Upcoming IPO#IPO details#IPO dates#IPO Price Band#IPO Issue Size#IPO GMP#IPO Allotment Status#IPO Registrar and Lead Managers#IPO FAQs#IPO#initial public offering#IPO Alert#IPO Objectives#IPO Time Table#IPO Open Date#IPO Close Date#IPO Lot Size Details#IPO Grey Market Premium#algo trading#algo trading app#bigul#algo trading india#algo trading platform#algo trading strategies#bigul algo#free algo trading software#algorithm software for trading#finance

0 notes

Text

Circus Circus, Las Vegas (1968-) Historic Timeline

Photo by Ralph Crane, October 18, 1968

'63: Land which had been owned by the Leigh Hunt estate since the 1920s sells to Irwin Molasky, Merv Adelson, and Harry Lahr of Paradise Homes Inc. The $2M sale, called "the largest land transaction in recent years," is the final Hunt holding in the area. The Molasky group sells to Sarno at a later date.

'68: Jay Sarno, Stanley Mallin, Judd McIntosh apply for license in Jan; construction begins in summer.

'68: Oct. 18, Circus Circus opens. Ringmaster Co. Ltd. (Sarno, etc) are the owners of the business owners and land owner. Rissman & Rissman, architect. There are five fountains in front of the casino, and an antique circus carousel fitted with new neon signs on the left. The casino has no hotel.

'71: Carousel moved to the far right over fountain 5. Slots-a-Fun casino opened in its place, 8/20/71.

'72: Casino tower east addition (400 rooms).

'74: May, Circo Resorts (Wm. Bennett & Wm. Pennington) lease and operate Circus Circus after searching for a casino that was "doing very badly, one on the verge of bankruptcy that we could turn around" (RJ 11/21/83).

'74: Slots-a-Fun sold to Ross Miller and later Carl Thomas.

'74: Hippodrome theater seems to have been closed in '74 during various changes made by Circo Resorts. The theater space is apparently forgotten in the MGM Resorts years, and rediscovered in the Phil Ruffin years.

'74: Circo Resorts has YESCO restore and reopening the carousel, which has been idle for several years. “The previous owner of the antique carousel never put aside funds for the repairs … Hand carved horses on the merry-go-round have been vandalized … missing horse legs, stolen lights and removed seat carvings.” The carousel operates again in ’75. (See notes)

‘75: Casino tower west addition opened in May, doubling the room count to 840. Valet parking area expands in front of the hotel. A driveway coverers fountain 3.

‘76: Sep., Lucky the clown sign by YESCO completed, replacing the carousel.

‘78: Circo Resorts name changed to Circus Circus Entertainment (CCE); midway separated from casino at unknown date circa ‘78.

‘79: Circusland RV park addition.

‘79: FBI wiretaps reveal Carl Thomas had been teaching mob figures how to skim from casino profits; his gaming license is revoked. Thomas was convicted in '83 and sentenced to 15 years in prison.

‘79: CCE buys back Slots-a-Fun casino.

‘80: Circus Circus Manor addition, developed by Ringmaster.

‘81: May, Shuttle opened.

‘82: May, Redesigned porte-cochère; remaining fountains covered with parking area.

'82: Circus Circus casino floor expanded southwest of the two towers; THE Steak House opens.

'82: Slots-a-Fun's original circular sign is removed. A canopy structure is built completely over Slots-a-Fun in Apr., deemed unsuitable, and dismantled weeks later.

'83: CCE buys Circus Circus hotel and property from Ringmaster; CCE taken public 10/25/83. News coverage around the time of the IPO includes an Associated Press article stating, "In five years the co. has seen revenues jump from $70M to 190M; income before taxes shoot from $13M to 33M; balance sheet shows assets of $265M; Circus properties consistently run at 99.5% occupancy." (RJ 11/21/83)

'86: Skyrise Tower addition.

'93: Grand Slam Canyon opens, aka Adventuredome since ’97.

'96: West tower addition.

'99: CCE name changed to Mandalay Resort Group.

2005: Mandalay sold to MGM Mirage.

2006: Most of the original statues by Montyne removed from the front of the resort.

2019: Circus Circus and Slots-a-Fun are part of a 102-acre sale by MGM Resorts to Phil Ruffin.

Photos of Circus Circus | Photos of Slots-a-Fun

Circa '68 – Carousel in its original position on the left.

Circa '72 – The carousel has been moved to the right side of the property, covering fountain 5. The first tower has opened.

Circa '76 – A driveway has covered fountain 3. Lucky the Clown sign replaced the carousel.

Circa '86 – with the Skyrise Tower.

Circa '96 – with the West tower.

Timeline sources. $2 Million Strip Land Deal Made. Review-Journal, 1/24/63 p1; Vegas ‘Disneyland’ OK’d by State. Review-Journal, 1/25/68; Circus Circus planning 810-room hotel addition. Review-Journal, 3/30/80; Circus Circus remodeling. RJ, 4/25/82; C. Weiss. Bennett confirms Circus Circus plan. Review-Journal, 7/24/83; C. Weiss. Circus Circus stock sold. RJ, 10/26/83; Robert Macy, Associated Press. Family-oriented Circus Circus a money machine. Review-Journal, 11/21/83; A.D. Hopkins. Well-known works of Las Vegas artist haunted off to garbage dump. RJ, 10/15/2006; D Scwartz. Grandissimo: the first emperor of Las Vegas: how Jay Sarno won a casino empire, lost it, and inspired modern Las Vegas. Winchester Books, 2013.

Carousel history & sources. Philadelphia Toboggan Company (PTC) #11 was built in '06 and first operated at Willow Grove Park, PA, until '23. It later operated in Cape May, NJ, and Coney Island, NY, and according to most sources, was in Bowling Green, KY, before it was relocated to Las Vegas in '67. The carousel was parted out after it was removed from Circus Circus. Grab a ring! Review-Journal, 8/21/74 p19; Circus Circus carousel wins planners approval. Review-Journal, 8/15/74 p15; Stir Up Action. Review-Journal, 9/19/74 p25; 68 Opening for Circus Circus here. Review-Journal, 10/26/75, p31c of “A Historical Look at Nevada’s Gaming and Resort Industry”; John Daniel. White Tiger in Daniel's Den. The Carousel News & Trader. 10/92 p14; PTC #11. Carousel News & Trader. Vol. 26, No. 6, Jun. 2010, p. 21; Marianne Stevens. The Strange Case of PTC #11. Carousel News & Trader, Jan. 2011 p10

17 notes

·

View notes

Text

Bajaj Housing Finance IPO opens on Monday: GMP jumps; shareholder quota, date, review, other details of upcoming IPO

Minimize your trading risks & trade smarter with www.intensifyresearch.com 10 DAYS FREE TRIAL - best SEBI-registered RA firm.

Ganesh Chaturthi Bumper Offer - 10 DAYS FREE TRIAL & FLAT 30% DISCOUNT on all Research Services

Get comprehensive knowledge

– nifty buy sell signals,

– best shares to buy,

– profit making stocks,

– low risk investment option & lot more

by the best SEBI-registered RA firm.

#finance#stock market#banknifty#nifty prediction#economy#nifty50#investing#nse#sensex#share market#bajaj finance#bajaj housing finance#home loan#ipo alert#ipo news#invest#investment#investors#stocks#investing stocks#forex#financial planning#startup#business#services

2 notes

·

View notes

Text

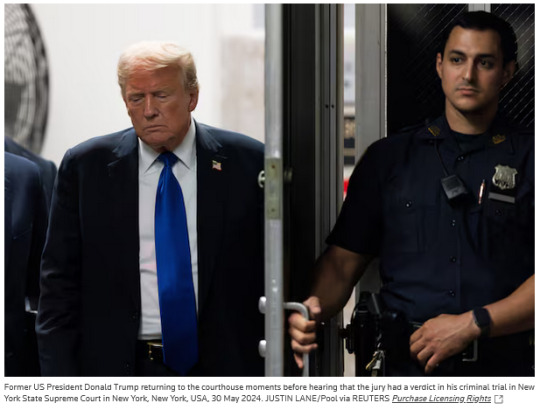

Trump found guilty: Stock markets slide, read investor reaction

https://www.reuters.com/legal/view-jury-finds-trump-guilty-all-counts-hush-money-trial-2024-05-30/

NEW YORK, May 30 (Reuters) - Donald Trump became the first U.S. president to be convicted of a crime on Thursday when a New York jury found him guilty of falsifying documents to cover up a payment to silence a porn star ahead of the 2016 election.

After deliberations over two days, the 12-member jury announced it had found Trump guilty on all 34 counts he faced. Unanimity was required for any verdict.

The verdict, which came back after the close of the U.S. stock market, plunges the United States into unexplored territory ahead of the Nov. 5 presidential election, when Trump, the Republican candidate, will try to win the White House back from Democratic President Joe Biden.

Shares in Trump Media & Technology Group (DJT.O), opens new tab

, parent of the former president's social media site Truth Social, fell 14% after the verdict.

TOM HAYES, CHAIRMAN, GREAT HILL CAPITAL, NEW YORK

“I think the next step will likely be an appeal. And if he appeals that would get pushed out past the election. So ultimately, the risk is that the rest of the world views this as a political prisoner, which undermines our legal and economic system."

"If the world starts to view it that the last bastion of democracy, free markets, fair legal system, is perceived to be tainted, you could start to see a shift in capital flows. We’ve been a major beneficiary of equity flows and demand for our Treasuries.”

BILL STRAZZULLO, CHIEF MARKETS STRATEGIST, BELL CURVE TRADING, BOSTON

“What I think ... is that the biggest threat to the economy, markets and democracy is Trump. He gets more and more unhinged every day and the fact that he’s convicted on all counts, I assume, will resonate with some people.

"The election will more than likely be a close election because we have a divided country. He has done everything he can to circumvent these various charges. For the American people, there’s no excuse. He’s a convicted felon. Period. End of story. If this is the guy you want in the White House, shame on you and shame on us as a country . . . The fact that today is a serious blow to his reelection chances is a big deal.”

JACK ABLIN, CHIEF INVESTMENT OFFICER, CRESSET CAPITAL, CHICAGO

“I don’t think there will be a lot of impact.”

“The market will just digest it and move on.”

“We likely know most of (Trump and Biden's) thoughts on economic policy and other crucial questions. Certainly, both seem to agree on running large deficits.”

Ablin said that even looking past the November election date, market volatility – as reflected in options pricing – remains low.

KEITH LERNER, CO-CHIEF INVESTMENT OFFICER, TRUIST ADVISORY SERVICES, ATLANTA

“There was a lot of uncertainty about the election before this. This adds to some of the uncertainty going forward, but in the interim is probably not going to be a significant market mover, and the market right now is relatively flat reacting to this news.”

JAMIE COX, MANAGING PARTNER, HARRIS FINANCIAL, RICHMOND, VIRGINIA

“I don’t know if it has any effect on markets necessarily. But it certainly has an effect on the recently-IPOed DJT. It’s market-moving news for that. The market has already discounted a guilty conviction in the hush money case because it was widely believed to be more of a side show. I think it would have been much more news for the market had he been not convicted. But at this particular moment, markets have been down all week for other reasons, specifically about inflation. That’s what markets is concerned with and not the theater of the trial of a former president.”

PETER CARDILLO, CHIEF MARKET ECONOMIST, SPARTAN CAPITAL SECURITIES, NEW YORK

“I don’t think it means much to the markets, what matters tomorrow is the PCE report. As we get closer to the election it could make a difference.”

“What does this mean going forward? We’ll have to wait and see if the Republicans even nominate him. Now that (Trump has) been found guilty there’s a good possibility that they’ll have a change of heart.”

“But regarding tomorrow, PCE will dominate the market action.”

Jumpstart your morning with the latest legal news delivered straight to your inbox from The Daily Docket newsletter. Sign up here.

Compiled by the Global Finance & Markets Breaking News team

6 notes

·

View notes

Text

Miss This IPO and Regret It? What the Prostarm Info Systems GMP Is Really Saying!

The Prostarm Info Systems IPO has created a buzz in the market, drawing attention from retail and institutional investors alike. As a prominent name in the power solutions sector, Prostarm Info Systems Limited IPO is being closely watched for its growth prospects, pricing, and market sentiment.

In this article, we’ll cover everything from the Prostarm Info Systems IPO date to the current Prostarm Info Systems IPO GMP, helping you make an informed investment decision.

🗓️ Prostarm Info Systems IPO Date and Timeline

The Prostarm Info Systems IPO date has been officially confirmed. The IPO opened for subscription on May 27, 2025, and will close on May 29, 2025. Investors have a narrow window to place their bids, making it crucial to act swiftly.

Following the closing of the IPO, the allotment is expected to be finalized in early June 2025, with listing scheduled on BSE and NSE shortly thereafter. Keeping track of the Prostarm Info Systems IPO date ensures you don’t miss out on any key milestones.

💰 Prostarm Info Systems IPO Price and Issue Details

The Prostarm Info Systems IPO price band has been set between ₹95 to ₹105 per share, offering a reasonable valuation for a company with a strong presence in the Indian power solution market. The IPO aims to raise around ₹168 crore through a fresh issue of 1.6 crore equity shares.

The Prostarm Info Systems IPO price has been strategically decided to attract both retail and high-net-worth individuals. Funds raised will be utilized for working capital needs, repaying debts, and general corporate purposes, supporting the company’s expansion plans.

It’s important to assess the Prostarm Info Systems IPO price in relation to its financial performance and industry positioning before subscribing.

🏭 About Prostarm Info Systems Limited IPO

Founded in 2008 and based in Navi Mumbai, Prostarm Info Systems Limited IPO brings a decade of experience in providing UPS systems, solar inverters, lithium-ion battery packs, and integrated solar solutions under the "Prostarm" brand.

The company has established three state-of-the-art manufacturing units and operates across 17 states and a union territory in India. With over 22 branch offices and multiple storage facilities, Prostarm Info Systems Limited IPO is set to capitalize on the growing demand for clean energy and efficient power backup systems.

The strong fundamentals and operational network make Prostarm Info Systems Limited IPO an attractive proposition for long-term investors.

📈 Prostarm Info Systems IPO GMP and Market Sentiment

As of May 28, 2025, the Prostarm Info Systems IPO GMP (Grey Market Premium) has shown mixed signals. Although early subscription numbers were strong — with a 9.7 times subscription on Day 2 — the GMP dropped slightly, indicating cautious optimism in the grey market.

Tracking the Prostarm Info Systems IPO GMP can provide insights into how the IPO might perform upon listing. However, it's worth noting that GMP is not an official indicator and should not be the sole factor in your investment decision.

Even though the Prostarm Info Systems IPO GMP has seen some fluctuations, the overall sentiment remains positive due to the company’s consistent revenue growth and sector demand.

📊 Financial Performance and Investment Outlook

The company posted a revenue of ₹259.23 crore and a net profit of ₹22.83 crore in FY24. With a Return on Net Worth (RoNW) of 32.12% and a healthy debt-to-equity ratio of 0.51, Prostarm Info Systems IPO demonstrates strong financial stability.

These numbers enhance investor confidence and support the valuation assigned under the Prostarm Info Systems IPO price. As India continues to push for digital infrastructure and clean energy solutions, the future outlook for Prostarm Info Systems IPO remains promising.

🧾 Final Thoughts

The Prostarm Info Systems IPO brings together strong fundamentals, sectoral demand, and financial consistency. Whether you’re looking at it from a listing gain perspective or a long-term investment opportunity, the offering has something to offer.

Before applying, ensure you review the Prostarm Info Systems IPO GMP, evaluate the Prostarm Info Systems IPO price, and stay updated with the official Prostarm Info Systems IPO date. The Prostarm Info Systems Limited IPO has the potential to deliver value if approached with informed decisions.

0 notes

Text

Key benefits of using the MO Riise app for upcoming IPO applications

The Indian IPO market is experiencing remarkable growth. In just the first quarter of 2025, India accounted for 22% of global IPO activity, raising $2.8 billion through 62 Initial Public Offerings. As IPO participation rises, so does the need for a platform that is efficient, research-backed, and easy to use. That is where MO Riise comes in.

Backed by Motilal Oswal, a SEBI-registered public entity, MO Riise is trusted by over 40 lakh investors and traders. It offers a focused, reliable way to discover, apply for, and track IPOs. If you are planning to invest in upcoming IPOs, look at how MO Riise can help you apply smarter and stay ahead.

Fast and friction-free IPO applications

MO Riise simplifies the entire IPO application process. Simply open a demat account online in 15 minutes to get started. Once you log in, the app allows you to select from a list of live and upcoming IPOs and apply in just a few taps.

Input your UPI ID, choose your lot size, and that is it—no technical knowledge or paperwork is required. The steps remain clear, and you don’t lose time going through external portals or handling manual inputs. With MO Riise, retail investors, both experienced and first-timers, can glide through the process confidently and independently.

Pre-apply before the rush

With MO Riise, you get the option to pre-apply for IPOs before the official subscription window opens. This feature enables you to submit your bid in advance. You will get the UPI mandate automatically once the IPO goes live. Just accept the UPI mandate to block the applicable amount and confirm the bid. It helps reduce last-minute delays, especially during heavily subscribed offers.

Pre-application also gives you more time to study documents like the Red Herring Prospectus (RHP) and assess company financials. For those who prefer to plan ahead, this feature adds both efficiency and confidence to the IPO journey.

Access to critical IPO insights

Putting your hard-earned money into an IPO without proper research can be risky. MO Riise brings clarity to your decisions by offering detailed IPO insights. You can go through the company’s RHP, download research PDFs, and track live subscription status. The app also lays out timelines, application categories, financial highlights, and company background. This enables you to make decisions based on reliable information, not guesswork.

Track record of your applications

MO Riise adds long-term value by maintaining a complete record of every IPO application you make. It saves key details like application date, lot size, UPI request status, and allotment result, all in one place. You don’t need to search through emails or note down details manually. Everything is stored and organised automatically.

Over time, it builds a complete history of your IPO activity, which helps you review success rates, spot trends in allotments, and make better choices for upcoming offerings.

Expert support and community access

Motilal Oswal’s legacy brings credibility and expertise to the MO Riise app. You get access to:

24/7 support for any queries related to IPOs, stocks, or account management.

Educational content like articles, video lessons, and user guides to boost your knowledge.

StoCoMo, India’s first investor community, with over 1.5 lakh members. You can attend weekly sessions and live webinars to understand IPOs and stocks better, learn from others’ experiences, and pick up strategies shared by Motilal Oswal experts.

To sum up

For individuals looking to participate in upcoming IPOs with greater speed, clarity, and control, MO Riise offers a clear edge. From fast, accurate applications to early bidding and detailed tracking, it’s just the app you need for IPO investing. Whether you are planning to apply for a single upcoming IPO or multiple bids, the app helps you plan ahead, act faster, and avoid costly mistakes.

Download MO Riise today and begin your IPO journey with confidence.

0 notes

Text

Belrise Industries Limited IPO GMP Today: Your Friendly Investment Guide

Belrise Industries IPO – Complete Overview

Belrise Industries Ltd. is opening its doors to public investors after more than three decades as a trusted auto-component maker. Since 1988, the company has crafted everything from chassis frames and suspension assemblies to polymer parts and mirrors. Heavyweights like Tata Motors, Honda, Mahindra, and Jaguar Land Rover rely on Belrise. Now, with the Belrise Industries limited IPO GMP, retail and institutional buyers can get in on this growth story.

Belrise Industries IPO Details

IPO Opening Date: May 21, 2025

IPO Closing Date: May 23, 2025

Price Band: ₹85–₹90 per share

Face Value: ₹5

Lot Size: 166 shares (minimum)

Total Issue Size: 23.88 crore shares (₹2,150 Cr)

Listing Venues: BSE & NSE

With a clearly defined Belrise Industries IPO price band, you know exactly what you’ll pay per share, and the Belrise Industries IPO date window gives you three days to apply.

Company Financial

Belrise’s latest numbers (₹ Crore) show solid momentum:

Revenue:

FY23: 6,620.78

FY24: 7,555.67

Nine months to Dec 2024: 6,064.76

Profit After Tax (PAT):

FY23: 356.70

FY24: 352.70

Nine months to Dec 2024: 245.47

Total Assets:

FY23: 5,679.15

FY24: 6,041.65

Nine months to Dec 2024: 6,587.69

Borrowings:

FY23: 2,271.40

FY24: 2,440.98

Nine months to Dec 2024: 2,599.80

These figures highlight Belrise’s steady top-line growth and a healthy balance sheet ahead of its Belrise Industries Limited IPO GMP.

The Objective of the Issue

The IPO proceeds will be used to:

Fully or partially refinance existing borrowings.

Support capital expenditure for capacity expansion and new product lines.

Fund general corporate purposes.

This mix of debt reduction and growth investment aims to strengthen the company’s financial flexibility and fuel future innovation.

Peers of Belrise Industries

Belrise sits alongside several established auto-component firms:

Bharat Forge Ltd.

UNO Minda Ltd.

Motherson Sumi Wiring India Ltd.

JBM Auto Ltd.

Endurance Technologies Ltd.

Minda Corporation Ltd.

Comparing metrics like P/E ratios helps gauge where Belrise stands on valuation and growth potential.

Evaluation

Belrise Industries Ltd P/E (FY24): ~18.8×

Industry Average P/E: 50.4×

At a P/E under 19×, the Belrise IPO looks competitively priced versus its peers, offering attractive entry valuations for growth-focused investors.

IPO’s Strengths

Strong Client Base: Long-term contracts with top OEMs.

Vertical Integration: In-house R&D, tooling, and assembly.

EV-Ready Portfolio: Parts for both combustion and electric vehicles.

Proven Track Record: Over 35 years in the auto space.

Robust Margins: Consistent profitability even in a cyclical industry.

IPO’s Weaknesses

Customer Concentration: Top ten clients account for over 84% of revenues.

Cyclical Demand: A downturn in auto sales could dent order books.

Forex Exposure: Exports leave the company open to currency movements.

Belrise Industries IPO GMP Today

Grey Market Premium (IPO GMP Today) offers a snapshot of demand before listing:

GMP as of May 17, 2025: ₹17 per share

Estimated Listing Price: ₹90 (upper band) + ₹17 GMP = ₹107

Tracking the Live IPO GMP and Belrise Industries grey market premium helps set realistic expectations for listing-day performance.

Promoters and Management of Belrise Industries Ltd.

Shrikant Shankar Badve (Chairman & MD)

Supriya Shrikant Badve (Director)

Sumedh Shrikant Badve (Director)

The promoter group currently holds about 99.8% pre-issue, reflecting strong family control and alignment.

IPO Lead Managers

Axis Capital Ltd.

HSBC Securities & Capital Markets Pvt. Ltd.

Jefferies India Pvt. Ltd.

SBI Capital Markets Ltd.

These banks will guide the issue structure, pricing, and allocation, ensuring regulatory compliance and broad market reach.

Dividend Policy

In FY23, Belrise paid out ₹1 per share, amounting to ₹2.03 crore in dividends. The company aims to maintain a balanced distribution policy while reinvesting in growth.

Conclusion

The Belrise Industries IPO GMP combines a fair Belrise Industries IPO price, a compelling IPO GMP Today of ₹17, and robust financials to create a well-rounded investment opportunity. With its strong client relationships, vertical integration, and EV-ready product suite, Belrise offers everyday investors an accessible entry into India’s auto-component boom. Don’t forget to apply between May 21–23, 2025, and check your Belrise Industries IPO allotment status on May 26. Here’s to informed investing and a `successful listing on May 28!

#finance#investing#investment#investsmart#stock market#stock trading#investing stocks#ipo alert#ipo news#gmp#belrise ipo#Belrise industries ipo gmp

0 notes

Text

Borana Weaves Limited IPO: A Golden Opportunity in The Indian Textile Market

The Indian textile industry, known for its deep-rooted heritage and massive economic contribution, is witnessing a new chapter with the launch of Borana Weaves Limited IPO. As the company prepares to go public, investors are keenly watching this opportunity to invest in a firm that embodies both traditional craftsmanship and modern scalability.In this blog, we take a closer look at the Borana Weaves Limited IPO, its business potential, IPO details, market impact, and whether this could be your next smart investment.

About Borana Weaves Limited

Borana Weaves Limited is a rapidly growing textile manufacturing company with a strong presence in weaving, designing, and supplying quality fabrics. Rooted in India’s rich textile heritage, the company caters to both domestic and international markets with an emphasis on innovation, sustainable production, and craftsmanship.

From cotton to blended fabrics, Borana Weaves has established itself as a reliable player in the textile supply chain. With advanced weaving technologies, a skilled workforce, and increasing demand for its products, the company is now poised for its next growth phase going public through an IPO.

IPO Highlights

Here are the key details of the Borana Weaves Limited IPO (as per preliminary information):

IPO Opening Date: Tuesday May 20, 2025

IPO Closing Date: Thursday May 22, 2025

Face Value: ₹10 per equity share

Issue Price Band: ₹205 to ₹216 per share

Lot Size: 69 Shares

Listing on: BSE, NSE

Total Issue Size: 67,08,000 shares (aggregating up to ₹144.89 Cr)

Minimum Investment: ₹14,904

The IPO will include a fresh issue of equity shares aimed at funding the company’s working capital requirements, modernization of manufacturing facilities, and general corporate purposes.

Why Borana Weaves Limited Stands Out

1. Strong Industry Fundamentals

India is the world’s second-largest producer of textiles and garments in india . With a growing middle class, government support through schemes like PLI (Production-Linked Incentives), and a global shift toward India as a manufacturing hub, the sector is expected to grow steadily.

2. Quality Centric Approach

The company emphasizes quality control at every stage from raw material procurement to final fabric delivery. Its compliance with global standards best investment plan in india makes it a trusted supplier for both local brands and export partners.

3. Modern Weaving Facilities

Borana Weaves has invested in state-of-the-art weaving machinery, digital looms, and design software that allow for efficiency, innovation, and scalability an edge over smaller and more traditional competitors.

4. Sustainability & Innovation

With a global push toward eco-friendly textiles, Borana Weaves is incorporating sustainable practices like organic cotton use, reduced water consumption, and waste recycling into its production process.

Opportunities for Investors

A high-demand sector backed by government incentives

A company with a balanced blend of tradition and innovation

Export potential due to global demand for Indian fabrics

A chance to invest at the ground level in a high-potential SME IPO

Additionally, the IPO pricing is expected to be reasonable for retail investors, allowing participation with a relatively low capital requirement.

Risks to Consider

As with any investment, there are risks:

Raw material price fluctuations, especially cotton

Dependence on labor-intensive operations

Volatility in export demand due to global trade dynamics

Being an SME IPO, liquidity post-listing may be lower than mainboard listings

That said, a well-researched approach and long-term view can help mitigate some of these risks.

Should You Invest in Borana Weaves Limited IPO?

If you’re an investor looking to diversify into the manufacturing or textile sector, the Borana Weaves IPO presents a promising opportunity. It offers an entry into a Brokerage Charges Online stable and growing industry with a company that has shown steady progress and a vision for sustainable growth.However, retail investors should always consider the fundamentals, valuation, and market conditions before subscribing. Reviewing the company’s Red Herring Prospectus (RHP) and consulting with a financial advisor is always recommended.

Final Thoughts

Borana Weaves Limited’s IPO marks a significant milestone not just for the company, but for the Indian textile industry at large. It highlights the shift of traditional businesses embracing modern markets and offers retail investors a chance to be part of this transformation.As India continues to strengthen its position in the global textile supply chain, companies like Borana Weaves will be key players BSE weaving success for themselves and their investors alike.

0 notes

Text

Prostarm Info Systems IPO GMP, Open Date, Allotment Status

Prostarm Info Systems IPO opens on May 27, 2025, with a price band of ₹95–₹105 per share. Read all about issue details, lot size, GMP updates, and key dates.

Read more..

#Prostarm Info Systems IPO GMP#Prostarm Info Systems IPO#Upcoming IPO#IPO details#IPO dates#IPO Price Band#IPO Issue Size#IPO GMP#IPO Allotment Status#IPO Registrar and Lead Managers#IPO FAQs#IPO#initial public offering#IPO Alert#IPO Objectives#IPO Time Table#IPO Open Date#IPO Close Date#IPO Lot Size Details#IPO Grey Market Premium#algo trading#algo trading app#algo trading india#bigul#algo trading strategies#algo trading platform#bigul algo#free algo trading software#algorithm software for trading#finance

0 notes

Text

Borana Weaves IPO: Price band set at ₹205–216 per share; check issue details, key dates, more

Borana Weaves IPO: Borana Weaves IPO will open for subscription on May 20 at a price band of ₹205 to ₹216 per share. The company plans to use IPO proceeds for a new manufacturing facility and working capital, with listing expected on May 27.

Borana Weaves IPO: Borana Weaves IPO price band has been fixed in the range of ₹205 to ₹216 per equity share of the face value of ₹10 for its upcoming public issue. Borana Weaves IPO date of subscription is from Tuesday, May 20 to Thursday, May 22. The allocation to anchor investors for Borana Weaves IPO is scheduled to take place on Monday, May 19.

The IPO floor price is 20.5 times the face value of the equity shares, and the cap price is 21.6 times the face value of the equity shares. The price-to-earnings ratio based on diluted EPS for fiscal 2024 at the lower end of the price band is 17.33 times, and at the upper end of the price band is 18.26 times.

Investors can apply for Borana Weaves IPO in a lot size of 69 equity shares, and in multiples thereafter.

Borana Weaves IPO has reserved not less than 75% of the shares in the public issue for qualified institutional buyers (QIB), not more than 15% for non-institutional investors (NII), and not more than 10% of the offer is reserved for retail investors.

Tentatively, Borana Weaves IPO basis of allotment of shares will be finalised on Friday, May 23, and the company will initiate refunds on Monday, May 26, while the shares will be credited to the demat account of allottees on the same day following the refund. Borana Weaves share price is likely to list on BSE and NSE on Tuesday, May 27.

About Borana Weaves

Borana Weaves Limited is a producer of unbleached synthetic grey fabric located in Surat, Gujarat. The company’s unbleached synthetic grey fabric is commonly utilised as a foundation for additional processing (including dyeing and printing) in sectors such as fashion, traditional textiles, technical textiles, home decor, and interior design.

Additionally, the firm produces polyester textured yarn (PTY Yarn), which is made by heating polyester oriented yarn (POY Yarn), the raw material used in creating grey fabric.

Borana Weaves Limited operates three manufacturing facilities in Surat, Gujarat, that are equipped with textile manufacturing technologies for various processes, including texturising, warping, operating water jet looms, and folding textiles.

As of September 30, 2024, the company had 15 operational texturising machines, 6 warping machines, 700 water jet looms, and 10 folding machines in its three facilities.

According to the red herring prospectus (RHP), there are no listed industry competitors in India or overseas, which could pose challenges in comparing and assessing their financial performance against other firms within the same sector.

Borana Weaves has shown impressive growth over the last three fiscal years. In FY 2024, the company disclosed revenue of ₹199.10 crore, representing a significant rise from ₹135.40 crore in FY 2023 and ₹42.30 crore in FY 2022.

Borana Weaves IPO details

Borana Weaves IPO, which is worth ₹144.89 crore, comprises of fresh issue of 67,08,000 equity shares. There’s no offer-for-sale (OFS) component.

Borana Weaves IPO objective is to use the net proceeds from the offering for several purposes, including financing the establishment of a new manufacturing facility to enhance its production capacity for grey fabric in Surat, Gujarat, India; providing additional working capital; and covering general corporate needs.

Beeline Capital Advisors Pvt Ltd serves as the book-running lead manager for Borana Weaves IPO, and Kfin Technologies Limited acts as the registrar for this offering.

“Investments in the securities market are subject to market risks.”

Intensify Research services is a SEBI registered Research analyst Indore committed to empowering investors with the most reliable stock market insights. Our team of expert analysts uses advanced tools and strategies to provide that enhance your chances of success. To visit- Intensifyresearch.com »

1 note

·

View note

Text

Step-by-Step Guide to Open Demat Account Online

In today’s fast-paced digital age, investing in the stock market has become increasingly accessible. One of the most crucial steps to begin your investment journey is to open Demat account online. Whether you’re a beginner or an experienced investor looking to streamline your trading experience, an online Demat account offers unmatched convenience and efficiency.

This comprehensive guide will walk you through the step-by-step process of how to open Demat account online, the documents required, benefits, and key points to keep in mind.

What is a Demat Account?

A Demat (short for "Dematerialized") account allows investors to hold shares and securities in an electronic format. It eliminates the need for physical share certificates, reducing the risk of theft, forgery, and damage. It is similar to a bank account, but instead of money, it holds shares, mutual funds, ETFs, bonds, and other investment instruments.

To trade in Indian stock markets, especially on platforms like NSE and BSE, a Demat account is essential.

Why Open Demat Account Online?

The process of opening a Demat account has transitioned from offline paperwork to seamless digital onboarding. Here’s why more investors prefer to open Demat account online:

Convenience: Complete the process from your home or office, without visiting a physical branch.

Faster Processing: Accounts are typically activated within 24-48 hours.

Paperless KYC: PAN, Aadhaar, and e-signature verification make the process efficient.

User-Friendly Interfaces: Modern platforms offer intuitive dashboards for trading and portfolio tracking.

Step-by-Step Process to Open Demat Account Online

Step 1: Choose a Depository Participant (DP)

A DP acts as an intermediary between the investor and the central depositories (NSDL or CDSL). Start by selecting a SEBI-registered DP who offers online account opening services. Ensure the DP provides low brokerage charges, a strong tech platform, and good customer support.

Step 2: Visit the DP’s Website or Mobile App

Navigate to the official website or download the DP’s app. Click on the option to open Demat account online. Most platforms clearly display this on their homepage.

Step 3: Fill in Personal Details

You’ll be required to submit the following information:

Full name (as per PAN)

Date of birth

Mobile number

Email ID

PAN card number

Aadhaar card number (linked with your mobile for OTP verification)

These details are crucial for KYC (Know Your Customer) compliance.

Step 4: Upload Required Documents

Scan and upload these documents for verification:

PAN Card (mandatory)

Aadhaar Card (for address proof and e-sign)

Photograph (passport size)

Cancelled Cheque or bank statement (to link your bank account)

Income Proof (if you wish to trade in derivatives like F&O)

Ensure the documents are clear and readable to avoid rejection.

Step 5: Complete In-Person Verification (IPV)

As per regulatory norms, IPV is mandatory. This can be done via a quick video call through the DP’s platform. You may be asked to display your original PAN card and answer a few simple questions.

Some platforms use AI-based video IPV, where you simply record a short video showing your face and PAN card.

Step 6: E-Sign Using Aadhaar OTP

To finalize your application, you will need to e-sign the form using your Aadhaar number. An OTP will be sent to your Aadhaar-linked mobile number for verification. Once entered, your application is electronically signed.

Step 7: Account Activation and Login Credentials

After successful verification, you will receive:

Demat Account Number (Beneficiary ID) – This is your unique 16-digit number.

Login Credentials – For accessing your trading dashboard.

Client Master Report – Containing details like DP ID and Client ID.

You’re now ready to start investing in stocks, mutual funds, IPOs, and more.

Benefits of Opening a Demat Account Online

Instant Access: Start trading within 1-2 business days.

Real-Time Portfolio Tracking: Stay updated on your holdings, gains, and market value.

Secure Transactions: Every trade is authenticated and recorded with minimal risk.

Integrated Services: Many platforms also offer research, margin trading, and investment in other financial products.

Points to Keep in Mind

Charges: Understand account opening fees, annual maintenance charges (AMC), and transaction charges.

Customer Support: Opt for a DP that provides prompt support through chat, email, or call.

Mobile App Ratings: Choose a platform with a user-friendly and stable mobile app.

Brokerage Plan: Some offer flat-fee brokerage while others have a percentage-based structure.

Conclusion

To open Demat account online is one of the smartest decisions for anyone planning to invest in the financial markets. With the simplified digital process, minimal documentation, and quick activation, it’s never been easier to take control of your financial future.

0 notes

Text

Arunaya Organics Ltd And Kenrik Industries Ltd IPO Launch

India’s share market continues to present exciting opportunities for investors, with several new companies tapping into public markets for expansion and growth. Two recent entrants, Arunaya Organics Ltd and Kenrik Industries Ltd, are all set to launch their Initial Public Offerings (IPOs). Both companies brokerage account operate in dynamic sectors and bring different investment angles for shareholders. Here’s a comprehensive analysis of their IPO launches, financial outlooks, and key considerations for investors.

Arunaya Organics Ltd is a specialty chemicals company, established in 2010, catering to industries such as textiles, paints, plastics, food processing, and mining. It specializes in manufacturing dyes, pigments, and intermediates, positioning itself in stock market company in india a high-demand and value-added sector.

Key IPO Details:

IPO Type: Book Building SME IPO

Price Band: ₹55–₹58 per share

Lot Size: 2,000 shares

Minimum Investment: ₹116,000

Issue Size: ₹33.99 crore

Listing Platform: NSE SME (Emerge)

IPO Opening Date: April 29, 2025

IPO Closing Date: May 2, 2025

0 notes

Text

Ather Energy IPO Opens Tomorrow, April 28: Key Dates, Price Band, GMP, And More

Last Updated:April 27, 2025, 12:28 IST Ather Energy IPO GMP: Ather Energy’s IPO opens on April 28, 2025. Fresh shares worth Rs 2,626.76 crore and sale shares worth Rs 2,980.76 crore will be issued. Ather Energy IPO will open for subscription tomorrow, Monday, April 28. Ather Energy IPO GMP: Ather Energy IPO will open for subscription from Monday, April 28, marking the first big public issue in…

0 notes

Text

Dar Credit and Capital IPO GMP: A Comprehensive Overview by Finowings

The Dar Credit and Capital IPO has garnered significant attention in the financial markets, with a notable Grey Market Premium (GMP) indicating strong investor interest. As a leading financial platform, Finowings provides an in-depth analysis of this IPO, its GMP trends, and what it means for potential investors.

Dar Credit and Capital IPO Details

IPO Opening Date: May 21, 2025

IPO Closing Date: May 23, 2025

Price Band: ₹57 to ₹60 per share

Lot Size: 2,000 shares

Total Issue Size: ₹25.66 crore

Listing Platform: NSE SME

Expected Listing Date: May 28, 2025

Dar Credit and Capital Limited, established in 1994, is a Kolkata-based Non-Banking Financial Company (NBFC) focusing on providing unsecured loans to underserved segments, including low-income individuals and small enterprises.

Grey Market Premium (GMP) Insights

As of May 22, 2025, the Dar Credit and Capital IPO GMP stands at ₹16, suggesting a potential listing price of ₹76 per share. This represents a 26.67% premium over the upper end of the price band.

The consistent GMP indicates robust demand in the grey market, reflecting positive investor sentiment and expectations of strong listing gains.

Finowings' Perspective

The strong GMP and oversubscription figures position the Dar Credit and Capital IPO as a noteworthy opportunity in the SME segment. However, potential investors should consider the following:

Market Volatility: GMPs are indicative but not guaranteed; market conditions can influence listing performance.

Company Fundamentals: While the company serves a niche segment, assessing its financial health and growth prospects is crucial.

Investment Horizon: Determine whether you're looking for short-term listing gains or long-term value appreciation.

Stay Updated with Finowings

For real-time updates on IPOs, GMP trends, and market analyses, visit our live GMP Today. Finowings is committed to providing accurate and timely information to empower your investment journey.

0 notes

Text

Key benefits of using the MO Riise app for upcoming IPO applications

The Indian IPO market is experiencing remarkable growth. In just the first quarter of 2025, India accounted for 22% of global IPO activity, raising $2.8 billion through 62 Initial Public Offerings. As IPO participation rises, so does the need for a platform that is efficient, research-backed, and easy to use. That is where MO Riise comes in.

Backed by Motilal Oswal, a SEBI-registered public entity, MO Riise is trusted by over 40 lakh investors and traders. It offers a focused, reliable way to discover, apply for, and track IPOs. If you are planning to invest in upcoming IPOs, look at how MO Riise can help you apply smarter and stay ahead.

Fast and friction-free IPO applications

MO Riise simplifies the entire IPO application process. Simply open a demat account online in 15 minutes to get started. Once you log in, the app allows you to select from a list of live and upcoming IPOs and apply in just a few taps.

Input your UPI ID, choose your lot size, and that is it—no technical knowledge or paperwork is required. The steps remain clear, and you don’t lose time going through external portals or handling manual inputs. With MO Riise, retail investors, both experienced and first-timers, can glide through the process confidently and independently.

Pre-apply before the rush

With MO Riise, you get the option to pre-apply for IPOs before the official subscription window opens. This feature enables you to submit your bid in advance. You will get the UPI mandate automatically once the IPO goes live. Just accept the UPI mandate to block the applicable amount and confirm the bid. It helps reduce last-minute delays, especially during heavily subscribed offers.

Pre-application also gives you more time to study documents like the Red Herring Prospectus (RHP) and assess company financials. For those who prefer to plan ahead, this feature adds both efficiency and confidence to the IPO journey.

Access to critical IPO insights

Putting your hard-earned money into an IPO without proper research can be risky. MO Riise brings clarity to your decisions by offering detailed IPO insights. You can go through the company’s RHP, download research PDFs, and track live subscription status. The app also lays out timelines, application categories, financial highlights, and company background. This enables you to make decisions based on reliable information, not guesswork.

Track record of your applications

MO Riise adds long-term value by maintaining a complete record of every IPO application you make. It saves key details like application date, lot size, UPI request status, and allotment result, all in one place. You don’t need to search through emails or note down details manually. Everything is stored and organised automatically.

Over time, it builds a complete history of your IPO activity, which helps you review success rates, spot trends in allotments, and make better choices for upcoming offerings.

Expert support and community access

Motilal Oswal’s legacy brings credibility and expertise to the MO Riise app. You get access to:

24/7 support for any queries related to IPOs, stocks, or account management.

Educational content like articles, video lessons, and user guides to boost your knowledge.

StoCoMo, India’s first investor community, with over 1.5 lakh members. You can attend weekly sessions and live webinars to understand IPOs and stocks better, learn from others’ experiences, and pick up strategies shared by Motilal Oswal experts.

To sum up

For individuals looking to participate in upcoming IPOs with greater speed, clarity, and control, MO Riise offers a clear edge. From fast, accurate applications to early bidding and detailed tracking, it’s just the app you need for IPO investing. Whether you are planning to apply for a single upcoming IPO or multiple bids, the app helps you plan ahead, act faster, and avoid costly mistakes.

Download MO Riise today and begin your IPO journey with confidence.

0 notes

Text

Key Insights About Integrity Infrabuild Developers IPO Investment

Another SME IPO has arrived, and this time it's from a Gujarat firm - Integrity Infrabuild Developers Ltd. So, is the Integrity Infrabuild Developers IPO a good investment? Let's analyze it in simple terms.

What Does the Company Do?

Integrity Infrabuild Developers deals with constructing roads, bridges, and government buildings. They have been operating as a Class-A government contractor in Gujarat since 2017.

The company deals primarily with government projects in Gujarat, and as of March 2025, they have:

₹205.98 crore value of total projects

₹42.91 crore completed

₹163.07 crore ongoing

They have a workforce of 53 employees, comprising engineers, workers, and admin personnel.

IPO Details at a Glance

Here's what you should know about the Integrity Infrabuild Developers IPO:

IPO Opens: May 13, 2025

IPO Closes: May 15, 2025

Listing Date: May 20, 2025

IPO Price: ₹100 per share

Lot Size: 1,200 shares (₹1,20,000 minimum investment)

Total Issue Size: ₹12 crore (12 lakh shares)

Exchange: NSE SME

Why Is the Company Raising Money?

The company will utilize the IPO money for:

Purchasing new construction equipment

Meeting day-to-day working capital requirements

Finance general business expenses

Financial Health in Simple Words

Let's have a brief look at their past years' financial performance:

Revenue

FY 2023: ₹45.23 lakh

FY 2024: ₹64.63 lakh

Up to Dec 2024: ₹68.97 lakh

Net Profit (PAT)

FY 2023: ₹0.29 lakh

FY 2024: ₹0.95 lakh

Till Dec 2024: ₹1.94 lakh

Net Worth: Increased from ₹1.78 lakh in 2023 to ₹4.56 lakh as of end 2024

This consistent growth informs us that the business is growing in a good manner.

Integrity Infrabuild Developers IPO GMP (Grey Market Premium)

As of May 10, 2025, the Integrity Infrabuild Developers IPO GMP is ₹0. This indicates there's no grey market premium yet. The listing price is expected to still be ₹100 per share.

Get the latest updates by referring to the Live IPO GMP prior to the listing date. Today's IPO GMP can provide you with an indication about the market mood.

Industry Comparison

See how this IPO is versus comparable companies:

Udayshivakumar Infra – P/E: 6.82x

V R Infraspace – P/E: 67.04x

Industry Average – 37.04x

Integrity Infrabuild Developers P/E – 32.68x

On paper, it appears reasonably valued—neither too costly nor too cheap.

Promoters and Shareholding

Key promoters:

Keyurkumar Sheth

Rajendrakumar Sheth

Disha Keyurkumar Sheth

Prior to IPO: 99.99% held by the promoters

Post IPO: Reduces to 72.09%

Do You Apply?

If you are a believer in India's infrastructure growth story, then Integrity Infrabuild Developers IPO could be on your radar. The firm is profitable, possesses a healthy order book, and is reasonably priced.

But if you are hoping for listing gains in the short term, then the current IPO GMP today indicates no listing pop in sight. It's a long-term bet.

Final Words

The Integrity Infrabuild Developers IPO provides an opportunity to invest in a stable, government-oriented construction firm. Though it's not making waves in the grey market, its long-term fundamentals appear to be stable.

If you are going to invest, ensure it aligns with your financial objectives. And as always, consult your advisor first before investing.

0 notes