#Import data Argentina

Explore tagged Tumblr posts

Text

How Can Argentina Import Export Data Empower Global Traders in 2025?

Introduction:

In the dynamic world of international trade, staying informed about market trends and data is crucial for success. For businesses looking to engage with Argentina's market, understanding the country's import and export data is essential. This article delves into the significance of Argentina trade data in 2025, highlighting how it can aid global traders in making informed decisions.

What Is Argentina Import Export Data and Why Is It Important?

Argentina Import Export Data encompasses detailed records of the country's international trade activities, including information on goods imported and exported, quantities, values, and trading partners. This data is vital for businesses to identify market opportunities, understand demand and supply dynamics, and develop strategic trade plans.

How Can Argentina Customs Data Enhance Trade Transparency?

Argentina Customs Data provides comprehensive insights into the country's trade operations, including tariff classifications, duty rates, and compliance requirements. By analyzing this data, traders can ensure adherence to regulations, optimize supply chains, and mitigate risks associated with cross-border transactions.

What Does Argentina Trade Data Reveal About Market Trends in 2025?

In 2025, Argentina's trade data indicates a significant shift in its economic landscape. The country recorded a trade surplus of $323 million in March 2025, reflecting a positive balance between exports and imports. This surplus is attributed to increased exports in sectors like agriculture and energy, driven by favorable global demand and domestic production enhancements.

How Is Argentina Shipment Data Beneficial for Logistics Planning?

Argentina Shipment Data offers granular details about the movement of goods, including shipping routes, transit times, and carrier information. This data is instrumental for logistics companies and traders to plan efficient transportation strategies, reduce costs, and improve delivery timelines.

What Insights Can Be Gained from Argentina Export Data?

Argentina Export Data sheds light on the country's outbound trade activities, highlighting key commodities, export volumes, and destination countries. For instance, in March 2025, Argentina's exports totaled $6.329 billion, with significant contributions from agricultural products and energy resources. Understanding this data enables businesses to identify high-demand markets and tailor their offerings accordingly.

How Does Argentina Import Data Reflect Domestic Consumption Patterns?

Analyzing Argentina Import Data reveals the country's consumption trends and dependency on foreign goods. In January 2025, Argentina's total imports grew by 25.4% year-over-year, indicating a robust demand for imported products. This surge is indicative of economic recovery and increased consumer spending, providing opportunities for international suppliers.

Who Are the Key Players in the Argentina Importers List?

The Argentina Importers List comprises businesses and entities actively engaged in importing goods into the country. Identifying these key players allows exporters to target potential clients, establish partnerships, and expand their market presence in Argentina.

How Can One Access Import Data Argentina for Market Research?

Accessing Import Data Argentina involves utilizing official trade databases, government publications, and specialized data providers. This data is crucial for conducting market research, assessing competition, and identifying potential entry points into the Argentine market.

What Role Does an Argentina Import Export Data Provider Play?

An Argentina Import Export Data Provider offers curated and detailed trade information, facilitating businesses in making data-driven decisions. These providers compile data from various sources, ensuring accuracy and comprehensiveness, which is essential for strategic planning and market analysis.

How to Effectively Search Argentina Shipment Data for Business Insights?

To effectively search Argentina Shipment Data, businesses should utilize advanced data analytics tools and platforms that allow for customized queries based on product categories, HS codes, and trading partners. This targeted approach enables companies to extract relevant insights and make informed logistical decisions.

What Does Export Data Argentina Indicate About Global Trade Relations?

Export Data Argentina provides a window into the country's trade relations and economic partnerships. The data reflects Argentina's role in the global market, showcasing its export strengths and areas of growth. For example, the country's energy exports have significantly contributed to its trade surplus, highlighting its position as a key energy supplier.

Conclusion:

In conclusion, Argentina's import and export data serve as invaluable resources for global traders seeking to engage with the country's market. By analyzing customs data, shipment records, and trade statistics, businesses can gain comprehensive insights into market dynamics, identify opportunities, and develop effective trade strategies. Staying informed through reliable data providers ensures that traders can navigate the complexities of international commerce with confidence and precision.

#Argentina Import Export Data#Argentina Customs Data#Argentina Trade Data#Argentina Shipment Data#Argentina Export Data#Argentina Import Data#Argentina Importers List#Import Data Argentina#Argentina Import Export Data Provider#Search Argentina Shipment Data#Export Data Argentina

0 notes

Text

Understanding Argentina’s Trade Data: A Detailed Overview

Argentina, with its diverse economy and strategic location, plays a significant role in global trade. To understand the dynamics of this trade, it is essential to delve into Argentina Customs Data, which provides a detailed look at the country’s import and export activities. This article aims to give a comprehensive overview of Argentina’s trade data, exploring key aspects such as importer and exporter data, import and export trends, and the importance of trade data analysis for businesses and policymakers.

Introduction to Argentina's Trade Data

Argentina’s trade data encompasses a wide range of information related to the country’s international trade activities. This includes data on imports, exports, and the various entities involved in these transactions. Understanding this data is crucial for businesses looking to enter the Argentine market, as well as for policymakers aiming to develop effective trade strategies.

Importance of Argentina Customs Data

Argentina Customs Data is vital for gaining insights into the country’s trade patterns. It includes detailed records of goods entering and leaving the country, providing information on quantities, values, and origins or destinations of traded goods. This data is essential for:

Market Analysis: Businesses can use this data to identify demand trends and potential market opportunities in Argentina.

Competitor Analysis: Understanding what competitors are importing or exporting can help businesses strategize their market entry or expansion.

Supply Chain Management: Importers and exporters can optimize their supply chains based on trade data, ensuring efficient logistics and cost management.

Key Components of Argentina Import Data

Argentina import data offers a detailed view of the goods and services brought into the country. It includes:

Product Descriptions: Detailed descriptions of imported goods.

HS Codes: Harmonized System codes used to classify products.

Import Values: Monetary value of imported goods.

Import Volumes: Quantities of goods imported.

Countries of Origin: Countries from which goods are imported.

Importer Data: Information about companies or entities that import goods into Argentina.

Trends in Argentina Import Data

Analyzing import data reveals several trends and patterns in Argentina’s trade activities:

Top Import Products: Argentina imports a variety of goods, including machinery, vehicles, chemicals, and pharmaceuticals.

Leading Import Partners: Countries like Brazil, China, and the United States are among Argentina’s top import partners.

Sectoral Insights: Different sectors show varying import patterns, influenced by factors such as economic conditions and regulatory changes.

Understanding Argentina Export Data

Export data Argentina provides insights into the goods and services sold to foreign markets. This data is crucial for understanding the country’s economic strengths and trade relationships. Key components include:

Product Descriptions: Detailed descriptions of exported goods.

HS Codes: Classification codes for exported products.

Export Values: Monetary value of exported goods.

Export Volumes: Quantities of goods exported.

Destination Countries: Countries to which goods are exported.

Exporter Data: Information about companies or entities that export goods from Argentina.

Major Export Products from Argentina

Argentina is known for exporting a wide range of products, with significant contributions from the agricultural and industrial sectors. Major export products include:

Agricultural Goods: Soybeans, corn, wheat, and beef are among the top agricultural exports.

Industrial Goods: Automobiles, machinery, and chemicals represent significant industrial exports.

Energy Products: Crude oil and petroleum products are also key exports.

Analyzing Argentina Exporter Data

Argentina exporter data is crucial for businesses and policymakers to understand the landscape of entities involved in export activities. This data includes:

Company Profiles: Information on exporting companies, including their size, location, and export volumes.

Product Portfolios: Details on the range of products exported by each company.

Market Reach: Insights into the international markets targeted by Argentine exporters.

Argentina Trade Data for Strategic Planning

Argentina trade data, encompassing both import and export data, is essential for strategic planning. Businesses can leverage this data to:

Identify Market Opportunities: Analyze demand and supply trends to identify lucrative market opportunities.

Optimize Supply Chains: Use trade data to streamline supply chains, reducing costs and improving efficiency.

Mitigate Risks: Understand market risks and develop strategies to mitigate them, ensuring sustainable business growth.

Conclusion

Understanding Argentina’s trade data is essential for businesses and policymakers alike. Argentina Customs Data, including detailed import and export records, provides invaluable insights into the country’s trade activities. By analyzing Argentina importer data and exporter data, stakeholders can make informed decisions, optimize operations, and identify new opportunities in the dynamic Argentine market. As global trade continues to evolve, staying informed with up-to-date trade data will remain a critical component of successful business strategies.

#Argentina Customs Data#Argentina Importer data#Import data Argentina#Argentina import data#Argentina Trade Data#Argentina export data#Argentina exporter data#export data Argentina

0 notes

Text

Argentina's import data unveils the nation's economic interactions on the global stage. Covering a spectrum of goods, from agricultural products to machinery, the data provides crucial insights into Argentina's trade patterns, helping businesses make informed decisions in navigating the complexities of international trade and economic dynamics.

#Argentina import data#Argentina importers Details#Argentina Buyers Details#Argentina import Shipment data

0 notes

Note

Esteemed Neil, loath as I am to drag you away from the extremely important task of writing S3 of Good Omens, but today I found out that in Argentina there's a Welsh-speaking town called "Gaiman", and wondered if you knew of it, if you've ever been there, or if you'd like to go there one day? https://en.wikipedia.org/wiki/Y_Wladfa (Google maps reference: https://www.google.co.uk/maps/place/Gaiman,+Chubut+Province,+Argentina/@-43.2944744,-65.498858,2494m/data=!3m1!1e3!4m6!3m5!1s0xbe01475674ab3a95:0xdfc196695789206e!8m2!3d-43.2895976!4d-65.492011!16zL20vMDRfOWM0?entry=ttu )

Yup...

445 notes

·

View notes

Text

I'm going to ask people to stop spreading the idea that all black people disappeared from Argentina because "we killed them all". Is Argentina racist? Of course it is. But leaving aside the African and Afro-descendant population of recent migrations (20th century), the problem with the Afro-descendant population in Argentina is that it's still incredibly invisibilized, especially the one with roots going back to colonial times.

1) Any Argentine will have heard of the "crisol de razas", ("melting pot"), the metaphor linked to the supposed "homogeneous" integration of the entire foreign population that arrived in the country during the era of the great waves of immigration (1890-1920). This concept, in addition to establishing a false equivalence between "nationality" and "race", always left out the Afro-descendant and indigenous population, not because they didn't exist but because there was a need to create the myth of a "white Argentina".

2) There are other sources of invisibilization:

a) At the end of the 18th century, the Spanish monarchy approved a Real cédula called "gracias al sacar" which established "monetary compensation" (a payment, so to speak) so that freed black people could acquire the status of "white" and thus access some of the privileges and benefits that this position entailed (it's important to note that in colonial times, at least here, "white", "black" or "indian" were legal categories rather than racial).

b) During most of the 20th century, the DNI (Documento Nacional de Identidad, "National Identity Card") included a description of the physical traits of individuals, one of which was skin color. One such color was "trigueño", a category difficult to describe accurately because it was used very broadly to describe people who were "brown" or "morenos", neither black nor white. As Miriam Gomes (activist and literature professor) mentions (in Spanish), many black people were pigeonholed in this category (in Spanish, see min. 21:40), which contributed to their invisibilization. Imagine that this category was so broad that even my own paternal grandmother, who has Mapuche (but not black) ancestry, was also labeled as "trigueña".

3) According to the 2022 Census, the population that recognizes itself as Afro-descendant or has black or African ancestors totals 302,936 people in the national territory. This population group constitutes 0.7% of the total number of people living in private homes, while in the 2010 Census it represented 0.4%. [[I must remember that we should take into account the possibility that for whatever reason there are people who don't know or don't identify themselves as Afro-descendants even though they are]]. The third graph of the linked document shows that most of the Afro-descendant population in Argentina is located in those provinces/jurisdictions that concentrated the black population (either enslaved or free) during the colonial period (i.e. Buenos Aires, Cordoba, Santa Fe and the Ciudad Autónoma de Buenos Aires). Unfortunately, this graph doesn't provide information on the migratory origin of this population, but according to the data I risk establishing a certain continuity with the colonial period.

4) I will strongly urge you to follow Afro-Argentine activists and people who write about their history to get any doubts you may have out of your mind: I recommend Miriam Gomes, Sandra Chagas, Piba afroqom (@ pibaafroqom on Instagram), Mesa Afro Córdoba (@ mesaafrocordoba on instagram), Malungo Libros (@ malungo_libros), GEALA (Grupo de Estudios Afrolatinoamericanos), Comisión 8N (@ comision8n), and Asociación Misibamba (@ misibamba).

127 notes

·

View notes

Text

Since it's getting screenings in other countries too now, I highly, highly recommend you go watch the movie Ainda Estou Aqui aka I'm Still Here if you can. Not because of the Oscars but because of how relevant it still (unfortunately) is today.

The latter half of the 20th century saw a wave of US-backed military coup d'états sinking Latin America in decades of far-right authoritarian dictatorial regimes, who cooperated between themselves and the United States to coordinate the violent repression of "political enemies" that resulted in the torture, disappearance and murder of a still unknown total number of people, among them students, workers, activists, minorities, members of armed resistance groups and even members of the military themselves.

In 2014, Brazil's National Truth Comission officially reported 434 people as dead or missing. Additionally, around 20.000 brazilians are estimated to have been subjected to torture at the hands of the State. In practice, however, the numbers are much higher, and they don't even take the State's project of genocide against indigenous peoples into acount.

Keep in mind that the data I'm showing only corresponds to Brazil, but this was happening all over the continent, in Bolivia, Argentina, Chile, Paraguay, Uruguay, Peru, Ecuador. And even before the wave of coups in South America, the US had been doing the same thing in Central America and The Caribbean.

To this day, most of the perpetrators of this violence, despite being well known, never had to pay for their crimes. On the contrary, they're praised for it more often than we'd like, and all meanwhile thousands of families are to this day deprived of even as much as a body to bury.

This was never "a thing of the past", because Latin Americans are still very much suffering from the wounds inflicted on us during that time, we're reminded of them every day and we feel them every day, no matter how many far-right politicians and their minions try to deny it. Our countries haven't been treated as anything other than colonies since 1492.

The fact that these stories aren't too well known outside of our borders, along with the current political climate in the US and the rest of the world, and specially because of the internal efforts to erase them, I think now more than ever it's important to inform yourself, help keep those memories alive and fight alongside us.

#latamblr#brblr#latin america#latin american history#i'm still here#oscars 2025#us imperialism#sem anistia#cinema brasileiro#fernanda torres#sevent

49 notes

·

View notes

Text

South America's rivers hit record lows as Brazil drought impact spreads

South America's Paraguay River, a key thoroughfare for grains, has hit a record low in Paraguay's capital Asuncion, with water levels depleted by a severe drought upriver in Brazil that has hindered navigation along waterways in the Amazon.

The depth of the Paraguay River, measured versus a "zero" index rather than the riverbed, has dropped below minus 0.82 meter, breaking the previous record low in October 2021, data from the national Meteorology and Hydrology Directorate shows. The body expects the river will keep falling with no rain forecast.

The Parana River in Argentina is also near year lows around grains hub Rosario. Both the Paraguay and Parana rivers start in Brazil, eventually joining and flowing into the sea near Buenos Aires. They are important routes for soy, corn and other trade.

"In the northern section [of the Paraguay waterway], navigation is practically halted due to the extreme drop in water levels," the Paraguayan oilseed and grain crushing chamber CAPPRO told Reuters in written comments.

Continue reading.

#brazil#politics#paraguay#environmentalism#environmental justice#brazilian politics#paraguayan politics#international politics#image description in alt#mod nise da silveira

8 notes

·

View notes

Text

Malargüe—A satellite dish best served cold: Cryogenic upgrade boosts capacity by almost 80%

In late July 2024, the Malargüe deep-space communication station completed an important upgrade of its antenna feed that will allow missions to send much more data back to Earth, a capacity increase of almost 80%.

With more deep-space missions, more international requests, new and more intense data streams, the demand for deep-space ground stations has never been higher. Yet the offer is reaching nearly full capacity. To give a breath of air to the three deep-space antennas in its global ground station network (Estrack), the European Space Agency started a vast upgrade of its stations, including the use of novel cryogenic technology.

In late July, the program completed the cryogenic works on its Argentina-based Malargüe antenna, thus allowing the station to download up to 80% more science data from its increasingly complex science missions, with a boost of up to 60% for deep-space missions like Juice and BepiColombo.

The completion of the upgrade will alleviate operational capacity demands for ESA missions in the coming years, while also providing new capabilities for future missions.

How does it work? When receiving a signal and decoding it, antennas can be affected by background interference—or thermal noise—that limits their sensitivity and data transfer rate. One way to reduce this noise is to cryo-cool the link connecting the physical antenna to the station's electronic signal transmitter and receiver—also called the "antenna feed."

"Increasing the signal-to-noise ratio is key when designing, upgrading and operating antennas," explains Stéphane Halté, ESA ground station project manager.

"At a temperature of 10 Kelvin (-263°C) instead of room temperature, we can reduce the noise to a minimum and increase the antenna's capacity by between 60 and 80%."

The new cryocooled feeds incorporate a new generation of ultra-low noise cryogenic amplifiers (LNA) developed with university partners such as ETH Zurich (Switzerland) and Chalmers (Sweden). These LNAs are now commercialized through spin-off companies (LNF and Diramics).

The same technology is used today for the development of quantum computers. This is an example where ESA technology development can support the overall scientific community and support the competitiveness of European companies.

The Ka band cryocooled feed development has been funded through the ESA Technology Development Element program and the first prototype was manufactured and tested by Callisto Space (France). The operational units have been manufactured by Callisto and the integration has been performed in ESA's Deep Space stations by the Canadian company Calian.

Malargüe is the second antenna to have been upgraded with cryocooled feeds. It follows the path of Cerebros in 2023. This cryogenic technology is now a standard for ESA ground stations and the new antennas, like the New Norcia 3 one, will feature it.

2 notes

·

View notes

Text

The Higher School of Mechanics of the Navy of Argentina (Spanish: Escuela Superior de Mecánica de la Armada)

ESMA was the main detention center for leftist women political prisoners during the Junta's Dirty War. As Dr. Barbara Sutton has pointed out beyond political repression, it was a place where the very nature and character of the subversive leftist woman was to be remade. "The activist body was apparently to be replaced, in the case of women, by a domesticated, conventionally beautiful, feminine body." The tamed leftist female was never to be a threat to Argentine capitalist patriarchy ever again. A Junta officer boasted there would never be a Marxist woman with her pants left on at ESMA.

So it is with great symbolism that women from across Latin America gathered together reclaiming this very ex-ESMA site for a feminist conference. Including the Marxist-Feminist wing of the Brazilian Communist Party- Coletivo Feminista Classista Ana Montenegro

On the 7th day, the Classist Feminist Collective Ana Montenegro participated in the Feminist Forum, which preceded the 15th Regional Conference on Women in Latin America.

The Women’s Forum is a plural and collective building space that encompasses different women’s organizations and LGBTQIA+ population, in order to formulate proposals for the Regional Conferences on Women. These are intergovernmental spaces to debate political formulations for women in the region.

The group that promoted this space was made up of more than 100 feminist organizations from all over Latin America and the Caribbean and the theme was the social organization of care. The space was permeated by various expressions of struggle and resistance of Latina and Caribbean women. Indigenous women from different ethnicities, afrodescendants, different political and cultural organizations were present, bringing the debate on reproductive work, from different perspectives.

From the debates and directions of the working group, a set of proposals have been approved that demonstrate how capital and the patriarchy appropriate the work of women's care for their reproduction and that this is further emphasized in the countries of the global South.

During the forum, the debate on regulating prostitution has gained great visibility. A group of women, victims of trafficked and sexual exploitation, have submitted reports of the violence they have suffered and showed data that indicates an increase in trafficking of women to places where prostitution has been regulated.

In addition, we call attention to the complaints made by Mapuches women, who have fellow women imprisoned in Argentina due to the struggles for the demarcation of their lands.

The space was so rich, with important discussions and lessons.

Long live the struggles of Latina and Caribbean working women!

#Coletivo Feminista Classista Ana Montenegro#marxism-feminism#political prisoners#women's rights#violence against women#Partido Comunista Brasileiro#esma#feminismo classista

4 notes

·

View notes

Text

Soybean Export from India: Trends, Data, & Market Outlook for 2025

India's agricultural exports continue to gain momentum, with soybean standing as a key contributor. Known for its high nutritional value and diverse industrial applications, soybeans play a pivotal role in the global agri-commodity market. As the world’s demand for plant-based proteins and sustainable oils increases, India's position as a significant player in soybean exports strengthens. This article delves into the current trends in soybean export from India, examines soybean export data, highlights key soybean exporters in India, and explores major soybean-exporting countries for 2024-2025.

The Landscape of Soybean Export from India

India has emerged as a prominent exporter of soybeans, contributing significantly to global trade. Factors such as robust agricultural policies, advancements in farming techniques, and a focus on export-oriented production have bolstered India's soybean export capabilities.

In the 2024-2025 period, soybean exports from India are expected to grow due to increasing international demand. Indian soybeans are sought after for their quality, competitive pricing, and adherence to international standards. The primary export destinations for Indian soybeans include Southeast Asia, the Middle East, and European countries.

Soybean Export Data for 2024-2025

Tracking soybean export data reveals significant insights into India’s performance in the global market.

Volume and Value of Exports: India exported approximately 2.5 million metric tons of soybeans in the fiscal year 2023-2024, generating over $1.2 billion in revenue. The 2024-2025 projections suggest a 10-12% growth, driven by increasing demand from new and existing markets.

Major Importers of Indian Soybeans:

Indonesia and Vietnam: These countries use Indian soybeans primarily for feed and food processing industries.

United Arab Emirates (UAE): A significant importer due to its booming food industry and demand for plant-based products.

European Union (EU): Particularly Germany and the Netherlands, where soybeans are used for biofuels and plant-based protein products.

Export Growth Drivers:

India’s strategic position in Asia ensures shorter shipping times to key markets.

Increased global preference for non-GMO soybeans, a segment where India has an advantage.

Key Soybean Exporters in India

India’s soybean export industry is supported by numerous stakeholders, including farmers, processing companies, and export houses top soybean exporters in India are.

SOPA (Soybean Processors Association of India): SOPA plays a vital role in promoting soybean exports from India. It ensures the quality and branding of Indian soybeans, making them competitive in global markets.

Major Exporting Companies:

ITC Limited: Known for its robust supply chain and adherence to quality standards.

Adani Wilmar: A significant player in agri-exports, including soybeans and soy-derived products.

Ruchi Soya Industries: One of India's largest exporters, supplying non-GMO soybeans globally.

Emerging Players: Smaller exporters and agri-tech startups have also entered the market, leveraging technology to enhance productivity and streamline exports.

India’s Position Among Soybean Exporting Countries

Globally, India ranks among the top 10 soybean exporting countries. However, countries like Brazil, the United States, and Argentina dominate the export landscape.

Global Competitors:

Brazil: The world’s largest soybean exporter, primarily supplying China.

United States: A major exporter with advanced farming technology and extensive trade networks.

Argentina: Known for its high-quality soymeal exports.

India’s Competitive Edge:

Organic and non-GMO soybeans.

Competitive pricing compared to Western exporters.

Proximity to Asian and Middle Eastern markets.

Challenges in Competing Globally: While India has advantages, challenges such as inconsistent yield, fluctuating prices, and logistical issues need addressing to solidify its global standing.

Emerging Trends and Opportunities in Soybean Export

The soybean industry is undergoing transformation due to changing consumer preferences and technological advancements. Key trends for 2024-2025 include:

Shift to Plant-Based Diets: The rise of veganism and plant-based diets globally is driving demand for soy products, including tofu, soy milk, and soy protein isolates.

Sustainability and Traceability: Exporters focusing on sustainable farming and traceability in supply chains will have a competitive edge in international markets.

Government Support: Initiatives such as export incentives, enhanced logistics, and trade agreements are expected to boost soybean exports.

Value-Added Soy Products: Diversifying into soy-derived products like soymeal, soy oil, and soy protein can open new revenue streams for Indian exporters.

Challenges Facing Soybean Export from India

Despite its growth potential, the industry faces several hurdles:

Climate Change: Unpredictable weather patterns can impact crop yields.

Infrastructure Bottlenecks: Limited storage and transportation facilities hinder efficient exports.

Price Volatility: Global soybean prices are influenced by geopolitical and economic factors, impacting Indian exports.

Addressing these challenges through policy reforms and industry collaboration will be critical for sustained growth.

Future Outlook for Soybean Export from India

The future of soybean exports from India looks promising. With the global demand for soybeans expected to rise by 15-20% in the next decade, India has the opportunity to enhance its market share. Key strategies for growth include:

Investing in sustainable farming practices.

Strengthening trade relations with emerging markets like Africa and Latin America.

Promoting value-added soy products through branding and innovation.

Conclusion

Soybean export from India are poised for remarkable growth in the 2024-2025 period. By leveraging its strengths in quality production and strategic geographic positioning, India can expand its footprint in the global soybean market. However, addressing challenges like climate change, infrastructure, and price volatility will be essential for realizing its full potential. With the concerted efforts of farmers, exporters, and policymakers, India is set to cement its position as a leading player in the global soybean trade.

#soybean export from India#soybean export data#soybean exporters in India#soybean exporting countries#trade data#global trade data#international trade

2 notes

·

View notes

Text

On a recent evening, Micaela Maldano unfurled a blanket in a public park in El Jagüel, a poor suburb of Buenos Aires. On it, the 28-year-old arranged used clothes, a mate tea gourd, and a backpack—secondhand household goods she hoped to trade directly for food. “It’s getting harder and harder to eat,” Maldano said. “There are tons of people who are hungry.” She called the taste of meat, an Argentine staple, a “distant memory.”

Maldano is not alone. More Argentines are resorting to desperate measures such as bartering to put food on their tables as the country weathers an economic crisis. Financial tumult has long been part of life in Argentina, which ended 2023 with an annual inflation rate of more than 200 percent. But humble households such as Maldano’s have fallen into deeper precarity since far-right libertarian President Javier Milei was inaugurated last December. Maldano rents an apartment with her boyfriend, and the two rely mostly on his salary and informal trades to get by.

Days after taking office, Milei devalued the Argentine peso by more than 50 percent, and already sky-high inflation rates ascended even further. Since then, the cost of gas in Argentina has roughly doubled. Food prices have risen by roughly 50 percent, according to official government data. Health care costs have increased at a similar clip. Around the two-month mark of Milei’s presidency, Argentina’s annual inflation rate topped 250 percent, surpassing that of Venezuela to become the highest in Latin America.

As the price hikes intensified, Milei slashed subsidies for services ranging from transportation to utilities, honoring his campaign pledge to take a metaphorical “chainsaw” to public spending. The move put even more pressure on Argentines’ pocketbooks.

On the campaign trail, Milei—a political outsider—suggested abolishing Argentina’s central bank and dollarizing its economy, outlandish proposals that raised eyebrows among observers. But in office, his strategy has so far been more conventional: a fiscal adjustment plan designed to reverse longstanding government deficits through budget cuts and tax hikes. The president has described his austerity package, a significant departure from the Argentine tradition of reckless government spending, as “shock therapy.”

“It’s a fairly traditional approach to stabilization,” said Benjamin Gedan, the director of the Latin America Program at the Wilson Center. “That doesn’t mean it’s not dramatic and high stakes. … It’s an act of either political courage or political suicide.”

For everyday citizens, Milei’s austerity has been devastating. Salaries and pensions have not come close to keeping up with inflation. Workers’ purchasing power fell by roughly 14 percent month-over-month at the end of 2023, a contraction not seen in decades. Demand for food at soup kitchens is surging. A study released earlier this month from the Catholic University of Argentina estimates that the country’s poverty rate surpassed 57 percent in January. According to the same group of researchers, 49.5 percent of Argentines lived in poverty in December 2023, when Milei took over. At the end of 2022, 43.1 percent were considered poor.

Sebastián Menescaldi, an economist and the director of the Buenos Aires-based EcoGo consultancy, forecasts that the most painful period of Milei’s economic shock is yet to come. Starting this month, utility price hikes will combine with back-to-school costs to wallop families’ bottom lines. (In Argentina, summer breaks run from Christmas through February.) In March and beyond, “people will feel like they are drowning,” Menescaldi said.

As average Argentines suffer, Milei’s strategy has yielded some positive macroeconomic indicators. The peso devaluation has made imports more expensive, slowing them down—and decreasing the amount of money flowing out of Argentina. As a result, the cash-strapped central bank has started replenishing some of its dwindling dollar reserves. Meanwhile, the government posted an elusive budget surplus in January. And although monthly inflation reached a crushing 20.6 percent that month, it was lower than December’s rate of 25.5 percent.

But experts agree that the fiscal adjustments that made those trends possible could provoke a looming recession; Milei’s spate of spending cuts, they argue, will choke economic growth. The Institute of International Finance, an association of global financial firms, is predicting that the Argentine economy will contract 7.8 percent in the first quarter of this year. The International Monetary Fund, meanwhile, forecasts a 2.8 percent annual contraction.

Milei’s administration hopes that a recession will prove short-lived, but Menescaldi said that is unlikely. The economist is forecasting a “strong” upswing in unemployment and a further rise in the poverty rate. Because a gap persists between the official peso-dollar exchange rate and the black-market rate used by most Argentines, Milei might institute another inflationary currency devaluation in the future. Contributing to Argentina’s uncertainty are the governance challenges facing Milei, whose fledgling libertarian party occupies a minority of seats in Congress and holds no provincial governorships.

So far, the president has not displayed the political savvy needed to navigate that difficult political terrain. When a sweeping bill that would have deregulated swaths of the economy failed to become law due to congressional pushback, Milei inveighed against opposition lawmakers as “traitors” who “voted against the people.” Meanwhile, an attempt to pass labor law reforms via executive order was blocked by the courts. Enacting structural reforms as ambitious as the ones proposed by Milei “takes enormous patience, skill, and willingness to compromise,” Gedan said. “It’s not clear that [Milei] has those.”

Milei has drawn criticism for his apparent lack of focus on the nation’s woes. Recent headlines in Argentina have fixated on an ongoing feud between the president and a leftist pop star, who criticized cuts to public funding for the arts and described Milei’s rise as “dangerous.” And at the end of February, Milei flew to the United States to speak at the 2024 Conservative Political Action Conference alongside other far-right Trumpian acolytes.

Still, recent public opinion surveys show a majority of Argentines continue to support Milei. A poll released at the end of February pegged his approval rating at 52 percent, higher than any other national politician. The president has placed responsibility for households’ mounting economic difficulties on his “inheritance” from Peronist predecessors, and the blame game seems to be working. “He still retains a very robust amount of support,” said Federico Zapata, a political scientist and the director general of the polling firm Escenarios. Menescaldi added, “Argentine society largely agrees that this fiscal adjustment is something that we had to do.”

Time will tell whether the public will remain on board with Milei’s reforms as the standard of living deteriorates. Resistance is already building: It took Argentina’s largest labor union just seven weeks to call for a general strike in opposition to Milei’s government, which took place in January. Rail service workers, health care workers, and government employees walked off the job for additional work stoppages in February. Teachers’ strikes have already disrupted the beginning of the school year.

Some experts worry that anti-Milei mobilization could escalate into full-blown social upheaval if economic conditions fail to turn around. On the street, everyday Argentines have begun making concerned references to the 2001 debt crisis, which led to civil unrest and bloody riots. “I think there are going to be lootings, and just really tough times coming up,” Maldano said.

In Gedan’s view, Argentina is currently “teetering on the edge of a cliff.” If the Milei experiment ends in failure, it is difficult to envision Argentines giving another pro-market candidate a chance. “Most people agree that … everything is either going to collapse or, somehow, [Milei is] going to survive politically long enough to show the benefits of his policies,” Gedan said. “But just sputtering along on the verge of a crisis doesn’t seem to be possible anymore.”

6 notes

·

View notes

Text

Exploring Argentina Import and Export Data: A Guide to Argentina's Trade Insights

Introduction to Argentina’s Trade Data

Argentina, one of South America's largest economies, plays a crucial role in global trade. To understand Argentina's economic landscape, Argentina import data and Argentina export data provide key insights into the flow of goods entering and leaving the country. These datasets, along with Argentina Customs Data and Argentina Trade Data, offer businesses, economists, and policymakers valuable information to make informed decisions in international trade. Analyzing this data can help businesses uncover market trends, understand competition, and assess the demand for products in Argentina.

In this article, we will examine the significance of Argentina’s import and export data, the information it includes, and the value it brings to businesses and trade professionals.

What is Argentina Import Data?

Argentina import data refers to detailed records of goods brought into the country. Managed primarily by Argentina’s customs authorities, this data includes essential information such as product types, quantities, values, and origins. For businesses, import data is an essential tool for understanding market demand and identifying potential suppliers or competitors. By analyzing import data Argentina, companies can spot trends in popular imports, assess pricing structures, and plan their entry into the Argentine market.

For instance, a business planning to sell electronic goods in Argentina can review Argentina import data to see which products are imported frequently and at what prices. This data-driven approach can be beneficial in making strategic decisions and gaining a competitive edge in the market.

Why is Argentina Trade Data Important for Businesses?

Argentina trade data provides an in-depth overview of the country’s trade activities, covering both imports and exports. This data is highly valuable to companies engaged in cross-border trade for several reasons:

Market Demand Analysis: Trade data helps identify which products are in demand, allowing businesses to tailor their offerings.

Competitor Insight: By analyzing trade data, companies can monitor competitors’ import and export activities and adjust their strategies.

Supply Chain Optimization: Trade data highlights sourcing trends, enabling businesses to optimize their supply chains for cost-efficiency.

Risk Management: By understanding trade patterns, companies can anticipate economic shifts and mitigate potential risks.

With access to Argentina trade data, companies can strengthen their presence in the market, make informed decisions, and optimize their operations based on actual trade flows and trends.

What Information Does Argentina Import Data Include?

Argentina importer data typically contains various details that are valuable for market analysis:

Product Descriptions: Detailed descriptions of imported items, often categorized by product type.

Harmonized System (HS) Codes: Internationally standardized codes that classify products, allowing for easy categorization.

Volume and Value: Information on the quantity and monetary value of goods imported, providing insights into market demand.

Country of Origin: Identifies where products are sourced from, helping businesses assess Argentina’s key trading partners.

Importers’ Details: Information about the companies bringing goods into Argentina, which can help businesses identify local competitors or potential partners.

With this data, companies can develop targeted strategies based on accurate and current market insights. Understanding what products are imported and from which countries can guide businesses in selecting suppliers, assessing pricing trends, and evaluating the competition.

Exploring Argentina Export Data: Key Insights for International Trade

Argentina export data provides an in-depth look at the goods and products Argentina ships to global markets. Like import data, export data reveals valuable details such as the types of goods exported, their destinations, and their volumes. Argentina’s exports are diverse, with significant contributions from agriculture, mining, and industrial products. For companies interested in Argentina’s exports, analyzing export data Argentina is essential.

This data helps companies understand the products that Argentina specializes in, such as soybeans, corn, wheat, and minerals. Export data also provides insights into Argentina’s relationships with its trading partners, which can assist businesses in assessing market demand and evaluating Argentina’s export competitiveness.

Understanding Argentina Exporter Data and Its Benefits

Argentina exporter data is a focused subset of trade data that highlights companies engaged in exporting goods from Argentina. This data helps businesses:

Identify Potential Partners: For foreign companies interested in importing Argentine products, exporter data serves as a directory of potential suppliers.

Analyze Export Trends: Businesses can identify sectors with significant export volumes, offering insights into Argentina’s economic strengths.

Evaluate Competitiveness: By analyzing export patterns, companies can understand which products are performing well in international markets.

For instance, a company in Europe seeking to import Argentine wine can review exporter data to locate reliable suppliers and evaluate Argentina’s export volumes to determine market stability.

How Can Businesses Access Argentina Trade Data?

Access to Argentina Trade Data can be obtained through various channels:

Government and Customs Portals: Argentina’s customs and trade authorities publish periodic trade reports and summaries. These resources offer a high-level overview of Argentina’s import and export patterns, though they may lack comprehensive details.

Subscription-Based Data Providers: Specialized data providers offer in-depth and organized trade data, often requiring a subscription. These platforms allow businesses to search for specific information, filter results, and even use analytical tools for better insights.

Industry Associations and Market Research Firms: Many industry organizations and research firms offer market reports that contain Argentina trade data as part of broader economic analyses.

Businesses needing reliable and up-to-date data often rely on subscription-based services for a more detailed and user-friendly experience.

Benefits of Using Argentina Customs Data for Compliance

Argentina Customs Data is an invaluable resource for ensuring compliance with trade regulations. This data includes information on tariffs, taxes, and documentation requirements for imports and exports, helping businesses stay compliant with Argentine law. Key benefits of customs data include:

Understanding Duties and Taxes: Customs data provides details on applicable import duties and taxes, enabling accurate budget planning.

Document Preparation: By understanding the documentation required for specific goods, companies can streamline customs procedures and reduce the chances of delays.

Compliance Assurance: Regular access to customs data helps businesses remain up-to-date with regulatory changes, reducing risks associated with non-compliance.

For businesses engaged in cross-border trade, Argentina customs data is essential for ensuring smooth operations and avoiding fines or shipment delays.

How Argentina Import Data Aids in Supply Chain Management

Effective supply chain management requires a strong understanding of market trends and sourcing opportunities. Argentina import data provides insights into potential suppliers, import volumes, and pricing structures, helping businesses optimize their supply chains in several ways:

Identifying Reliable Suppliers: Historical import data reveals which suppliers are consistently delivering products, making it easier for businesses to select dependable partners.

Cost Management: Import data provides price points that help companies negotiate better terms or source products from more cost-effective suppliers.

Inventory Planning: By understanding import trends, companies can adjust their inventory levels to meet demand without overstocking or stockouts.

With Argentina import data, businesses can make data-driven decisions that improve efficiency, reduce costs, and ensure reliable supply chains.

How Small and Medium-Sized Enterprises (SMEs) Can Benefit from Argentina Importer Data

For small and medium-sized enterprises (SMEs), Argentina importer data offers strategic advantages that can help level the playing field with larger competitors:

Niche Market Identification: SMEs can use import data to identify gaps in the market and focus on underserved niches.

Competitive Pricing: Access to pricing data helps SMEs set competitive prices without compromising profit margins.

Partner Development: Importer data allows SMEs to identify local importers or suppliers, facilitating partnerships that support growth.

By using Argentina importer data, SMEs can better understand the market landscape, refine their strategies, and position themselves for success.

Challenges in Using Argentina Import and Export Data

While Argentina import and export data is valuable, accessing and interpreting it can present certain challenges:

Data Accessibility: Comprehensive trade data often requires a subscription, making it costly for smaller businesses.

Data Accuracy: Discrepancies or delays in data updates can affect the accuracy of analysis.

Complexity: Trade data can be extensive and detailed, requiring tools or expertise to analyze effectively.

Despite these challenges, the benefits of trade data for business strategy and market insight make it a worthwhile investment for many companies.

Conclusion: Leveraging Argentina’s Import and Export Data for Success

Argentina import data, Argentina export data, and broader Argentina trade data are powerful resources for businesses looking to succeed in the Argentine and global markets. This data provides essential insights for understanding market demand, optimizing supply chains, assessing competitive landscapes, and ensuring regulatory compliance. For companies aiming to enter or expand in Argentina, trade data is not only beneficial but necessary for informed, data-driven decision-making.

Whether used by large corporations or SMEs, Argentina’s trade data supports various aspects of business strategy, enabling companies to thrive in a competitive, evolving marketplace.

#Argentina import data#Argentina Custom import data#Import data Argentina#Argentina import shipment data#Argentina Importer data#Argentina Buyers Data#Argentina Customs Data#Argentina Shipment Data#Argentina Trade Data#Argentina export data#Argentina exporter data#Argentina custom export data#export data Argentina#Argentina export shipment data#Argentina suppliers Data

0 notes

Text

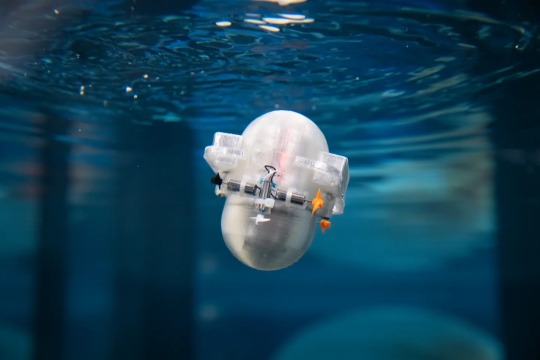

Aquatic Robot Market to Eyewitness Huge Growth by 2030

Latest business intelligence report released on Global Aquatic Robot Market, covers different industry elements and growth inclinations that helps in predicting market forecast. The report allows complete assessment of current and future scenario scaling top to bottom investigation about the market size, % share of key and emerging segment, major development, and technological advancements. Also, the statistical survey elaborates detailed commentary on changing market dynamics that includes market growth drivers, roadblocks and challenges, future opportunities, and influencing trends to better understand Aquatic Robot market outlook. List of Key Players Profiled in the study includes market overview, business strategies, financials, Development activities, Market Share and SWOT analysis: Atlas Maridan ApS. (Germany), Deep Ocean Engineering Inc. (United States), Bluefin Robotics Corporation (United States), ECA SA (France), International Submarine Engineering Ltd. (Canada), Inuktun Services Ltd. (Canada), Oceaneering International, Inc. (United States), Saab Seaeye (Sweden), Schilling Robotics, LLC (United States), Soil Machine Dynamics Ltd. (United Kingdom) Download Free Sample PDF Brochure (Including Full TOC, Table & Figures) @ https://www.advancemarketanalytics.com/sample-report/177845-global-aquatic-robot-market Brief Overview on Aquatic Robot: Aquatic robots are those that can sail, submerge, or crawl through water. They can be controlled remotely or autonomously. These robots have been regularly utilized for seafloor exploration in recent years. This technology has shown to be advantageous because it gives enhanced data at a lower cost. Because underwater robots are meant to function in tough settings where divers' health and accessibility are jeopardized, continuous ocean surveillance is extended to them. Maritime safety, marine biology, and underwater archaeology all use aquatic robots. They also contribute significantly to the expansion of the offshore industry. Two important factors affecting the market growth are the increased usage of advanced robotics technology in the oil and gas industry, as well as increased spending in defense industries across various countries. Key Market Trends: Growth in AUV Segment Opportunities: Adoption of aquatic robots in military & defense

Increased investments in R&D activities Market Growth Drivers: Growth in adoption of automated technology in oil & gas industry

Rise in awareness of the availability of advanced imaging system Challenges: Required highly skilled professional for maintenance Segmentation of the Global Aquatic Robot Market: by Type (Remotely Operated Vehicle (ROV), Autonomous Underwater Vehicles (AUV)), Application (Defense & Security, Commercial Exploration, Scientific Research, Others) Purchase this Report now by availing up to 10% Discount on various License Type along with free consultation. Limited period offer. Share your budget and Get Exclusive Discount @: https://www.advancemarketanalytics.com/request-discount/177845-global-aquatic-robot-market Geographically, the following regions together with the listed national/local markets are fully investigated: • APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka) • Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania) • North America (U.S., Canada, and Mexico) • South America (Brazil, Chile, Argentina, Rest of South America) • MEA (Saudi Arabia, UAE, South Africa)Furthermore, the years considered for the study are as follows: Historical data – 2017-2022 The base year for estimation – 2022 Estimated Year – 2023 Forecast period** – 2023 to 2028 [** unless otherwise stated] Browse Full in-depth TOC @: https://www.advancemarketanalytics.com/reports/177845-global-aquatic-robot-market

Summarized Extracts from TOC of Global Aquatic Robot Market Study Chapter 1: Exclusive Summary of the Aquatic Robot market Chapter 2: Objective of Study and Research Scope the Aquatic Robot market Chapter 3: Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis Chapter 4: Market Segmentation by Type, End User and Region/Country 2016-2027 Chapter 5: Decision Framework Chapter 6: Market Dynamics- Drivers, Trends and Challenges Chapter 7: Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile Chapter 8: Appendix, Methodology and Data Source Buy Full Copy Aquatic RobotMarket – 2021 Edition @ https://www.advancemarketanalytics.com/buy-now?format=1&report=177845 Contact US : Craig Francis (PR & Marketing Manager) AMA Research & Media LLP Unit No. 429, Parsonage Road Edison, NJ New Jersey USA – 08837 Phone: +1 201 565 3262, +44 161 818 8166 [email protected]

#Global Aquatic Robot Market#Aquatic Robot Market Demand#Aquatic Robot Market Trends#Aquatic Robot Market Analysis#Aquatic Robot Market Growth#Aquatic Robot Market Share#Aquatic Robot Market Forecast#Aquatic Robot Market Challenges

2 notes

·

View notes

Note

okok picture this with me cuz im new here and i had a semi vision but im uneducated

the horny induced evil powerpoint by uccio

how many slides what photos what type of points does he make in it

like what races does he use to convince vale that marc is satan reincarnated (pre 2015/ sepang 2015)

ofc he talks about the ranch visit and the mechanics and all but what other stuff

i think like 30+ slides with photos and sources in every slide and with a large tabel of content, with like 5 categories: he races bad; he is not italian; he is 14 years younger; he will be helping jorge lorenzo in the championship; im better, your long time friend, im all you need please vale plea se plea

thoughts?

the way i can tell you exactly the points that uccio made in the evil powerpoint (because vale used them in his explanations as to why th spaniard conspiracy was happening)...

he starts with argentina 2015 (vale and marc had an incident, marc fell. this is his evidence n1 of why marc would want vale not winning) and then of course assen 2015. he backs it up with the ranch visit and, most importantly, he implants doubt in vale's mind about whether marc was really a fan. an important thing to remember is that uccio never, never liked marc, even when him and vale where friendly. he never trusted him. and what best example is there to really show how marc isn't a real fan then laguna seca 2013? (which is also where they hooked up for the first time. in my heart) bam, the corkscrew overtake makes an appearance

and then of course he puts the telemetry datas in the powerpoint completely disregarding any declaration marc made in the post race interview

and he ppt is like, massive, because uccio has been working on it for months at this point (even years maybe)

4 notes

·

View notes

Text

Germany approves major acquisition of missiles

Fernando Valduga By Fernando Valduga 12/19/2023 - 15:00 in Armaments, Military

Germany has begun a significant strengthening of its defense capabilities with the approval of substantial acquisitions of PATRIOT, IRIS-T and Meteor missiles.

The first major decision involves the replenishment of IRIS-T air-to-air missiles, which have been a crucial part of the armament of Tornado attack aircraft and Eurofighter multifunction fighters since 2005. An order of 120 IRIS-T missiles, valued at 108 million euros, aims to compensate for the missiles delivered to Ukraine under the IRIS-T SLS anti-aircraft systems. This measure by the German Armed Forces (Bundeswehr) was a response to Ukraine's urgent need to defend itself against Russian air strikes. The new missiles, scheduled for delivery in 2026, are part of a broader framework agreement that potentially covers up to 1,280 missiles.

In addition, the committee gave the green light for the acquisition of 500 guided missiles, along with spare parts, for the PATRIOT air defense system. The investment in this program reaches 3.01 billion euros. The Bundeswehr special modernization fund will finance the purchase of 400 missiles for approximately 2.4 billion euros, the remaining 100 missiles, costing about 602 million euros, to be covered by the regular defense budget. This acquisition aims to replenish exhausted military arsenals and improve Ukraine's anti-aircraft defenses. The NATO Support and Procurement Agency (NSPA) will facilitate both orders, with deliveries planned between 2027 and 2033.

Germany also approved a third program to start research for the modernization of the long-range air-to-air missile Meteor, an integral part of the armament of the Eurofighter Typhoon. With a budget of 34.9 million euros, the project will explore improvements in the radar search engine, propulsion system, data connection and missile warhead, with research starting next year and expected results by 2025. Namely, five other European countries are participating in this project, probably including the main users of Eurofighter: Germany, Spain, Italy, the United Kingdom and, presumably, France.

Tags: weaponsMilitary AviationBundeswehrIRIS-TLuftwaffe - German Air ForceMBDA METEOR

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. He uses Canon equipment during his photographic work in the world of aviation.

Related news

MILITARY

Successful launch of the U.S. Army's Altius 700 drone from a Black Hawk helicopter

19/12/2023 - 14:00

MILITARY

Timelapse video records recovery of the U.S. Navy P-8A from inside the sea

19/12/2023 - 12:00

MILITARY

Global fleet C-27J Spartan reaches the important mark of 250,000 flight hours

19/12/2023 - 11:00

MILITARY

Russian forces accidentally slaughter their own Su-25 jet in eastern Ukraine

19/12/2023 - 09:00

MILITARY

USAF: C-5M performs reverse replenishment of a KC-10

19/12/2023 - 08:36

MILITARY

Ukraine should receive two Mi-171 donated by Argentina

18/12/2023 - 21:51

4 notes

·

View notes

Text

https://www.advancemarketanalytics.com/reports/8760-global-coding-bootcamps-market-1

Advance Market Analytics released a new market study on Global Coding Bootcamps Market Research report which presents a complete assessment of the Market and contains a future trend, current growth factors, attentive opinions, facts, and industry validated market data. The research study provides estimates for Global Coding Bootcamps Forecast till 2028*.

Coding bootcamps is refer as the bootcamps which enable students with little coding proficiency so that they can focus on the most important aspects of coding and can immediately apply their new coding skills to solve problems of real-world. The goal of the many attendees of coding bootcamps is of transition into a career in web development. They do this by normally learning to build applications at a professional level, which basically provides the foundation, that they need primarily to build production-ready applications and demonstrate the skills they have to add real value to a potential employer

Key Players included in the Research Coverage of Coding Bootcamps Market are:

App Academy (United States), Bloc (United States), General Assembly (United States), Hack Reactor (United States), Makers Academy (England), 4Geeks Academy (United States), Academia de Cdigo (Portugal), AcadGild (India), Barcelona Code School (Spain), Big Sky Code Academy (United States)

What's Trending in Market: Growing ready-to-work coding bootcamps

Rising in the adoption of online learning

Challenges: Growing in the demand for software engineers in both developed and developing economies

Opportunities: APAC market to register high growth

Increasing availability of various flexible shift in the Coding Bootcamps

Market Growth Drivers: Short duration of training complemented with low-cost options ensure the cost-effectiveness of coding bootcamps

Rising in the use of mobile devices among individual consumers, as the use of wireless networks such as 2G and 3G has increased

The Global Coding Bootcamps Market segments and Market Data Break Down by Type (Full-time bootcamps, Part-time bootcamps), Application (Job seekers, Students, Professionals, Others), Industry (Individual learners, Institutional learners)

Get inside Scoop of the report, request for free sample @: https://www.advancemarketanalytics.com/sample-report/8760-global-coding-bootcamps-market-1

To comprehend Global Coding Bootcamps market dynamics in the world mainly, the worldwide Coding Bootcamps market is analyzed across major global regions. AMA also provides customized specific regional and country-level reports for the following areas.

• North America: United States, Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia and Brazil.

• Middle East & Africa: Saudi Arabia, United Arab Emirates, Israel, Turkey, Egypt and South Africa.

• Europe: United Kingdom, France, Italy, Germany, Spain, Belgium, Netherlands and Russia.

• Asia-Pacific: India, China, Japan, South Korea, Indonesia, Malaysia, Singapore, and Australia.

2 notes

·

View notes