#IncomeTaxFiling

Text

Top Auditor & Tax Consultant in Bangalore - KR Puram

#finance#income tax#auditor#taxconsultant#KRPuram#Bangalore#GSTregistration#TDSreturnfiling#incometaxfiling#professionalTaxRegistration#PFregistration#ESIregistration#auditservices#companyregistration#financialcompliance#financialplanning#taxservices#foodpermitregistration#businessaudit#localtaxconsultant#businessconsultant#auditorinBangalore#taxconsultantinKRPuram#financialservices

0 notes

Text

You'll need a number of crucial records and pieces of information for Income Tax Filing in India. Get your Form 16, which details your pay and tax deductions, from your employers. Get your Form 16A or 16B and the necessary 1099s if you receive income from investments or other sources, such as freelancing. Gather records for tax exemptions and deductions, including medical, education, and home loan interest receipts. To ensure proper filing and refunds, ensure you have your bank account details, Aadhaar number, and PAN card details. For consistency, consult your tax returns from the prior year as well. By keeping these records organized, you can guarantee that Indian tax laws submit your tax return and expedite the process. If you find this process challenging and want professional help with Online Income Tax Filing, reach out to Eazy Startups today. Visit our website if you need more information.

0 notes

Text

10 Crucial documents required for ITR Filing in India - Tax Craft Hub

Filing an Income Tax Return (ITR) in India requires several essential documents to ensure accuracy and compliance with tax regulations. The key documents include Form 16, which is provided by employers and summarizes salary details and TDS deductions. Form 26AS is also crucial as it contains information on tax credits. PAN Card and Aadhaar Card serve as primary identification proofs. Additionally, one needs bank account statements, interest certificates, and TDS certificates to detail income from various sources. Details of investments in tax-saving instruments, proofs of deductions under Section 80C to 80U, and home loan statements are necessary to claim deductions. Lastly, rental agreements and receipts for claiming House Rent Allowance (HRA), along with any capital gains statements, complete the list of essential documents for ITR filing in India.

For More Information About Required for ITR Filing in India

0 notes

Text

Trust Taxgoal for Professional CA Consultancy Services

Trust Taxgoal for CA consultancy services that enhance your financial strategy. Our skilled CAs offer insights into tax optimization, financial reporting, and regulatory requirements, ensuring your business operates smoothly and efficiently.

Website Url: https://taxgoal.in/

0 notes

Text

Income Tax Return Filing has been enabled for A.Y. 2024-25, Dont wait for Due Date! File Your ITR for Last 2 year. Contact Us +91 9818209246

#incometaxrefund#incometaxreturn#incometaxfiling#incometax#AdvanceTax#taxplanning#taxfilingservices#income tax return filing and other

0 notes

Text

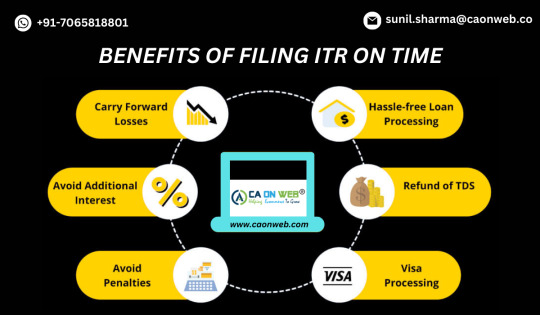

Benefits of Filing Income tax Return on Time

0 notes

Text

0 notes

Text

Income Tax Return File

Filing an Income Tax Return File is a crucial yearly task that must not be taken lightly. All employed individuals, small business owners, and self-employed professionals are required by the government to file their taxes annually. The Income Tax Return File contains a comprehensive summary of the taxpayer's income, deductions, and credits. In addition, by doing so, the individual can accurately determine if they owe the government additional taxes or if they are eligible for refunds. It is important to note that failure to file an Income Tax Return may lead to penalties, fines, and even legal proceedings. Therefore, every taxpayer must start gathering their financial information and documentation as soon as possible to file their taxes promptly. By doing so, not only will they avoid any possible legal consequences, but they will also contribute to the country's economy by paying their fair share of taxes.

1 note

·

View note

Text

In Budget 2023-24, the central government has shown pity for the common man. Only those earning more than 7 lakhs per annum are now liable to pay income tax. Those with an annual income of less than 7 lakhs have been exempted from income tax. It must be said that this is a huge burden for the average wage earner. The biggest mistake in the Indian taxation system is that the middle class people who are paying double the taxes than before due to the increase in the prices of petrol, diesel, gas.. have to pay income tax even on the little income they earn. Now this government has amended it. At least this time the income tax slab has been greatly increased.

It should also be said that the central government has taken huge decisions in the new budget. As the reputation of India increases internationally, the number of people who want to visit India will increase. So it is a great thing that the central government has come up with the idea of bringing new plans for India tourism. The Center has introduced a new scheme called “Dekho Apna Desh”. And when the world is facing recession, the new reforms will strengthen Indian banking. As any transaction in the country is ultimately tied to the bank, this will lead to changes in other sectors. Allocations to agriculture sector have increased. Special provisions were made for women. At a time when the world is chasing electric vehicles, the reduction in taxes on lithium-ion batteries will give relief to the sector. However, it can be said that in this budget only decisions have been taken that benefit the common man. For More information http://bhalamedia.com/ncome-tax-exemption-limit-2023/

#incometaxseason#incometaxreturn#incometaxindia#incometaxes#incometaxrefund#incometaxreturnfiling#incometaxfiling#incometaxupdate#incometaxdepartment#incometaxreturns#incometaxballers#incometaxtime#incometaxupdates#incometaxpreparation#incometaxact#.#Created by Inflact Hashtags Generator

0 notes

Text

0 notes

Text

With the Employee Stock Option Plan, employers can offer shares to their employees. Eazystartups can seamlessly help you in this regard.

#OnlineTaxandAccountingServices#IncomeTaxFiling#IncomeTaxReturnFiling#IncomeTaxReturn#IncomeTaxReturnOnline#IncomeTax ReturnIndia#OnlineTaxFilingIndia

0 notes

Text

Trusted Personal/ Salaried Return filing-ITR-1

Get peace of mind with Taxgoal's trusted services for filing your personal or salaried income tax return using the ITR-1 form. Our experts ensure accurate and hassle-free tax filing, maximizing your deductions and minimizing liabilities. With Taxgoal, experience a seamless process that guarantees compliance with the latest regulations. Rely on us to manage your taxes while you focus on what matters most. Contact us(+91-9138531153) today to learn more about our services and prices.

0 notes

Text

Income Tax Return Filing for AY 2024-25

0 notes

Text

#ITRdeadline#incometaxfiling#Businesssetup#Incorporatecompany#ISOregistration#GST#trademark#companyregistration#taxandaccounting#FssaiRegistrationServices#taxfiling#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#partnershipcompanyregistration#msmeregistrationintamilnadu#copyrightregistration#trustregistration#PFclaim#taxconsultancyinchennai#taxservices#ITfiling#kanakkiyal#chennai#legaldocumentation#businessregistration#license

0 notes

Text

APJ & CO. Good Accounting And Taxation Service Provider in Ahmedabad. Gujarat. We serve Taxation, Bookkeeping, Income tax, and GST Registration.

0 notes

Text

#auditor #taxconsultant #KRPuram #Bangalore #GSTregistration #TDSreturnfiling #incometaxfiling #professionalTaxRegistration #PFregistration #ESIregistration #auditservices #companyregistration #financialcompliance #financialplanning #taxservices #foodpermitregistration #businessaudit #localtaxconsultant #businessconsultant #auditorinBangalore #taxconsultantinKRPuram #financialservices

0 notes