#income tax return filing and other

Text

Income Tax Return Filing for AY 2024-25

#incometax#incometaxreturn#incometaxindia#ITR#ITRfiling#ITreturns#incomecertificate#income tax return filing and other

0 notes

Text

Here's your regular service reminder that $48k/year sounds like a dream come true to people who have never made a living off their art or comics before, until you factor in the following:

Cost of assistants which is out-of-pocket (some creators literally don't hire assistants because of this which makes the process of meeting their deadlines even harder)

Cost of additional tools necessary to making webtoons and meeting deadlines, such as paying for drawing software, 3D models, etc.

Cost of emergency services such as healthcare are not covered by WT, so if your health deteriorates while you're working on your comic (which it often does for many creators whose bodies are destroyed from working long hours at a desk 7 days a week), WT will not help you.

No paid vacation time, no paid sick leave, no accommodations for people with kids, disabilities, etc. meaning if you have to take time off, WT will not be covering it.

Speaking of vacation time, Webtoons ONLY pays creators for completed and submitted episodes, meaning they will not pay you for pre-production time leading up to a series release OR have your back when you have to go on hiatus. Some creators manage multiple series to make ends meet and avoid stretches of unpaid hiatuses (IIRC I believe KitTrace does this with Nevermore and Shiloh rotating on and off hiatus one at a time) and others simply have to go without pay relying solely on their Patreons and other forms of income when they go on hiatus. And, as we've seen in the past, when they return from hiatus is often up to Webtoons, not them.

That $48k is basically just an average ballpark of what Webtoons pays creators for a season of content, and for those who recall, FastPass earnings are not given to creators until they make back that payment.

It's really hard to get people to FastPass when Webtoons is deliberately not advertising your series and, in some cases, outright SABOTAGING your attempts to advertise.

I don't even know if that $48k is before or AFTER taxes, I'm assuming before considering this is a self-employment contract, meaning you likely have to put away a good few thousand for taxes depending on your state tax rate and what you're able to write off. This also includes having to track assistant expenditures for filing.

The 60-80+ hour weeks many creators are having to pull to meet their deadlines turns that $48k/year into an ASTOUNDING drum roll ... $11 - $15/hour! Which is just barely over minimum wage in many states, and absolutely 100% not a living wage in most! And that's BEST CASE scenario in which you don't pay an assistant, don't suffer any health expenses, don't pay for 3D models / software, and POSSIBLY don't pay your taxes. Yaaaaay! 😒🖕

TL : DR $48k/year hasn't been a salary worth bragging about since 2005 ESPECIALLY not for such high-demand specialized work like this, fuck you Webtoons <3

165 notes

·

View notes

Text

Got this off-campus rental ad before they removed the wording. It's for the University of North Georgia near Dahlonega campus. The ads on the realty sites were cleaned up, b/c the house has been renovated, but it still mentions drugs in the description. Take a look.

New kitchen, but "No evictions or eviction filings within the past 3 years, All money judgments must be satisfied, Bankruptcy, if finished at owner’s discretion."

Hall with closets. "Must not have been convicted of any Violent crimes or drug-related offenses."

Cozy living room. "Verifiable Proof of income making three times the rental amount, self employed two years worth of tax returns and bank statements. SSI will need reward letter." (I think that's an award letter.)

Odd, is that wainscoting? "Also must have verifiable rental history (no family) and verification of employment//// Once your application is received, we will email you a form to sign and send back to us, so we can obtain verifiable rental and employment history."

"Non-refundable Administrative fee based upon your credit score that will be due at the time you move into the property for processing paper work, Minimum score 550// Fee can be from $200 up to $350." More orders than the Joint Chiefs of Staff!

Stairs to the bedrooms. "Pets- Maximum of two pets, under 40 pounds combined, NO AGGRESSIVE breeds, Onetime $250 NON-refundable pet fee per pet with $25 per pet added to monthly rent." ***Certified letter for Service animals*** We pay $300yr. for each pet and $50mo. this is a bargain.

Standard 3pc. bath. "Copy of a valid driver’s license and/or State issued ID"

Primary bedroom with a nice ceiling. "$50 Non-refundable application fee per Adult living in the home, that is anyone 18 years or older."

The other 2 bds. Must like dull gold walls. "You are required to carry renters insurance with a liability rider of $100,000 with AHC as the additional insured, /// We will not move you in, until you provide us with the Dec page." I have to have renter's ins., too.

Small deck w/large yard. I'd rent it, it's $200mo. less than my 1bd. lofted apt. "You are welcome to drive by the property, it is the due diligence of the renter to check out the property they are renting, morning, afternoon and night." What? Are shady people still lurking about? This property must've been trashed and the owner must've had some legal problems, too. All those rules! Too much trouble to rent this place.

Credit Score

700+ $200.00

650-699 $250.00

649-600 $300.00

599-550 $350.00

549 and under DENIED

https://www.forrent.com/ga/cumming/beautiful-home-totally-renovated-with-priv/jgn4nw

59 notes

·

View notes

Text

The IRS will do your taxes for you (if that's what you prefer)

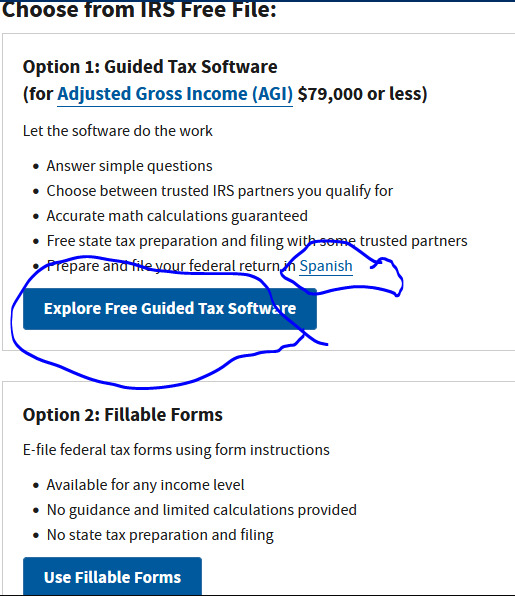

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

America is a world leader in allowing private companies to levy taxes on its citizens, including (stay with me here), a tax on paying your taxes.

In most of the world, the tax authorities prepare a return for each taxpayer, sending them a prepopulated form with all their tax details — collected from employers and other regulated entities, like pension funds and commodities brokers, who must report income to the tax office. If the form is correct, the taxpayer signs it and sends it back (in some countries, taxpayers don’t even have to do that — they just ignore the return unless they want to amend it).

No one has to use this system, of course. If you have complex finances, or cash income that doesn’t show up in mandatory reporting, or if you’d just prefer to prepare your own return or pay an accountant to do so for you, you can. But for the majority of people, those with income from a job or a pension, and predictable deductions, say, from caring for minor children, filing your annual tax return takes between zero and five minutes and costs absolutely nothing.

Not so in America. America is one of the very few rich countries (including Canada, though this is changing), where the government won’t just send you a form containing all the information it already has, ready to file. As is common in complex societies, America has a complex tax code (further complexified by deliberate obfuscation by billionaires and their lickspittle Congressjerks, who deliberately perforate the tax code with loopholes for the ultra-rich):

https://pluralistic.net/2021/08/11/the-canada-variant/#shitty-man-of-history-theory

That complexity means that most of us can’t figure out how to file our own taxes, at least not without committing scarce hours out of the only life we will ever have to poring over the ramified and obscure maze of tax-law.

Why doesn’t the IRS just send you a tax-return? Well, because the tax-prep industry — an oligopoly dominated by a handful of massive, ultra-profitable firms — bribes Congress (that is, “lobbies”) to prohibit this. They are aided in this endeavor by swivel-eyed lunatic anti-tax obsessives, like Grover Nordquist and Americans for Tax Reform, who argue that paying taxes should be as difficult and painful as possible in order to foment opposition to taxation itself.

The tax-prep industry is dominated by a single firm, Intuit, who took over tax-prep through its anticompetitive acquisition of TurboTax, itself a chimera of multiple companies gobbled up in a decades-long merger orgy. Inuit is a freaky company. For decades, its defining CEO Brad Smith ran the company as a cult of personality organized around his trite sayings, like “Do whatever makes your heart beat fastest,” stenciled on t-shirts worn by employees. Other employees donned Brad Smith masks for selfies with their Beloved Leader.

Smith’s cult also spent decades lobbying to keep the IRS from offering a free filing service. Instead, Intuit joined a cartel that offered a “Free File” service to some low- and medium-income Americans:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

But the cartel sabotaged Free File from the start. They blocked search engines from indexing their Free File services, then bought Google ads for “free file” that directed searchers to soundalike programs (“Free Filing,” etc) that hit them for hundreds of dollars in tax-prep fees. They also funneled users to versions of Free File they were ineligible for, a fact that was only revealed after the user spent hours painstaking entering their financial information, whereupon they would be told that they could either start over or pay hundreds of dollars to finish filing with a commercial product.

Intuit also pioneered the use of binding arbitration waivers that stripped its victims of the right to sue the company after it defrauded them. This tactic blew up in Intuit’s face after its victims banded together to mass-file thousands of arbitration claims, sending the company to court to argue that binding arbitration wasn’t enforceable after all:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

But justice eventually caught up with Intuit. After a series of stinging exposes by Propublica journalists Justin Elliot, Paul Kiel and others, NY Attorney General Letitia James led a coalition of AGs from all 50 states and DC that extracted a $141m settlement for 4.4 million Americans who had been tricked into paying for Turbotax services they were entitled to get for free:

https://www.msn.com/en-us/news/us/turbotax-to-begin-payouts-after-it-cheated-customers-new-york-ag-says/ar-AA1aNXfi

Fines are one thing, but the only way to comprehensively end the predatory tax-prep scam is to bring the USA kicking and screaming into the 20th century, when most of the rest of the world brought in free tax-prep for ordinary income earners. That’s just what’s happening: the IRS is trialing a free tax prep service for next year’s tax season:

https://www.washingtonpost.com/business/2023/05/15/irs-free-file/

This, despite Intuit’s all-out blitz attack on Congress and the IRS to keep free tax-prep from ever reaching the American people:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That charm offensive didn’t stop the IRS from releasing a banger of a report that made it clear that free tax-prep was the most efficient, humane and cost-effective way to manage an advanced tax-system (something the rest of the world has known for decades):

https://www.irs.gov/pub/irs-pdf/p5788.pdf

Of course, Intuit is furious, as in spitting feathers. Rick Heineman, Intuit’s spokesprofiteer, told KQED that “A direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem. That solution will unnecessarily cost taxpayers billions of dollars and especially harm the most vulnerable Americans.”

https://www.kqed.org/news/11949746/the-irs-is-building-its-own-online-tax-filing-system-tax-prep-companies-arent-happy

Despite Upton Sinclair’s advice that “it is difficult to get a man to understand something, when his salary depends on his not understanding it,” I will now attempt to try to explain to Heineman why he is unfuckingbelievably, eye-wateringly wrong.

“e-file…is wholly redundant”: Well, no, Rick, it’s not redundant, because there is no existing Free File system except for the one your corrupt employer made and hid “in the bottom of a locked filing cabinet stuck in a disused lavatory with a sign on the door saying ‘Beware of the Leopard.’”

“nothing more than a solution in search of a problem”: The problem this solves is that Americans have to pay Intuit billions to pay their taxes. It’s a tax on paying taxes. That is a problem.

“unnecessarily cost taxpayers billions of dollars”: No, it will save taxpayers the billions of dollars (they pay you).

“harm the most vulnerable Americans”: Here is an area where Heineman can speak with authority, because few companies have more experience harming vulnerable Americans.

Take the Child Tax Credit. This is the most successful social program in living memory, a single initiative that did more to lift American children out of poverty than any other since the days of the Great Society. It turns out that giving poor people money makes them less poor, which is weird, because neoliberal economists have spent decades assuring us that this is not the case:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

But the Child Tax Credit has been systematically sabotaged, by Intuit lobbyists, who successfully added layer after layer of red tape — needless complexity that makes it nearly impossible to claim the credit without expert help — from the likes of Intuit:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It worked. As Ryan Cooper writes in The American Prospect: “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies”:

https://prospect.org/economy/2023-05-17-irs-takes-welcome-step-20th-century/

So yes, I will defer to Rick Heineman and his employer Intuit on the subject of “harming the most vulnerable Americans.” After all, they’re the experts. National champions, even.

Now I want to address the peply guys who are vibrating with excitement to tell me about their 1099 income, the cash money they get from their lemonade stand, the weird flow of krugerrands their relatives in South African FedEx to them twice a year, etc, that means that free file won’t work for them because the IRS doesn’t actually understand their finances.

That’s a hard problem, all right. Luckily, there is a very simple answer for this: use a tax-prep service.

Actually, it’s not a hard problem. Just use a tax-prep service. That’s it. No one is going to force you to use the IRS’s free e-file. All you need to do to avoid the socialist nightmare of (checks notes) living with less red-tape is: continue to do exactly what you’re already doing.

Same goes for those of you who have a beloved family accountant you’ve used since the Eisenhower administration. All you need to do to continue to enjoy the advice of that trusted advisor is…nothing. That’s it. Simply don’t change anything.

One final note, addressing the people who are worried that the IRS will cheat innocent taxpayers by not giving them all the benefits they’re entitled to. Allow me here to simply tap the sign that says “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies.” In other words, when you fret about taxpayers being ripped off, you’re thinking of Intuit, not the IRS. Just calm down. Why not try using fluoridated toothpaste? You’ll feel better, and I promise I won’t tell your friends at the Gadsen Flag appreciation society.

Your secret is safe with me.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this thread to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

[Image ID: A vintage drawing of Uncle Sam toasting with a glass of Champagne, superimposed over an IRS 1040 form that has been fuzzed into a distorted halftone pattern.]

#pluralistic#earned income tax credit#eitc#irs#grover nordquist#guillotine watch#turbotax#taxes#death and taxes#freefile#monopoly#intuit

177 notes

·

View notes

Text

Today’s Reminder that it’s not a Trump “hush money” trial. Hush money payments are generally legal.

It’s a Trump “Criminal Fraud” Trial.

Trump stands accused of violating criminal statutes on Election Fraud [17-152)] and on Tax Fraud [1801(a)(3) and 1802]

~~~~~~~~~~ELABORATION ~~~~~~~~~~~~~~~

New York Election Law § 17-152 prohibits a conspiracy to use “unlawful means” to promote or prevent a person’s election. The phrase “unlawful means” is interpreted broadly and is not limited to crimes but rather includes any conduct unauthorized by law. In denying Trump’s motion to dismiss, Justice Merchan upheld DA Bragg’s theory under this statute, namely: “the People allege that Defendant intended to violate N.Y. Election Law § 17-152 by conspiring to ‘promote the election of any person to a public office… by entering a scheme specifically for purposes of influencing the 2016 presidential election; and that they did so by ‘unlawful means,’ including by violating FECA through the unlawful individual and corporate contributions by Cohen, Pecker, and AMI; and… by falsifying the records of other New York enterprises and mischaracterizing the nature of the repayment for tax purposes.’ People’s Opposition at pg. 25

For the purposes of tax violations, Bragg relies on two related tax provisions: New York Tax Law §§ 1801(a)(3) & 1802. Section 1801(a) sets out relevant tax fraud acts, with subsection (3) prohibiting “knowingly suppl[ying] or submit[ting] materially false or fraudulent information in connection with any [tax] return, audit, investigation, or proceeding.” The tax fraud includes four elements: (1) a tax document filed, submitted or supplied; (2) falsity; (3) materiality; and (4) intent (willfulness). Any person who commits a tax fraud act, including under 1801(a)(3), is guilty, at a minimum, of criminal tax fraud in the fifth degree, a Class A misdemeanor crime under Section 1802, where the tax liability is less than $3,000. No additional mens rea is required, such as an intent to evade taxes or defraud the state. In this case, the primary alleged tax violation was Cohen falsely declaring the reimbursement as income, which artificially increased his tax liability. As Justice Merchan already found, however, an allegation of tax fraud where the state “was not financially harmed … and instead would wind up collecting more tax revenue” does not preclude the tax violation from being a predicate act for the first degree falsification of business records.

34 notes

·

View notes

Text

Philosopher and presidential Green Party candidate Cornel West currently owes more than half a million dollars between unpaid taxes and unpaid child support, according to tax records.

Records show West owes nearly $466,000 in federal income taxes from 2013 until 2017. This came after he accrued (and later repaid) a debt of nearly $725,000 from 1998-2005, and more than $34,000 in 2008, according to tax records in Mercer County, New Jersey – where he owns a home.

Additionally, West has an outstanding $49,500 child support judgement from 2003, records show.

The debts were first reported by The Daily Beast.

The tax debts have not been paid off as of 30 days ago – the last available data, according to Mercer County records. ABC News reached out to West and his campaign to see if West had plans to pay off the debt or set up a payment plan; they have not returned those requests for comment.

The outstanding child support payment is owed to Aytul Gurtas, his former partner and mother of one of his children. ABC News was unable to reach Gurtas for comment.

While it's not clear how long West didn't pay child support, New Jersey family lawyer Kathleen Stockton said that the amount of money appears substantial. The average U.S. child support obligation is about $5,800 per year, according to census data, making West's nearly $50,000 more than eight times that.

Stockton noted that it is possible West paid Gurtas and didn't register it with the court – though West has given no indication of that.

When the question of his debts was brought up on The Breakfast Club radio morning show last week, West told the radio show host "Charlamagne the God" that they were being used as a "distraction" from his presidential campaign, which has focused on ending poverty, mass incarceration and environmental degradation.

"Any time you shine a flashlight under somebody's clothes, you're gonna find all kind of mess, because that's what it is to be human," West said.

Earlier on the show, West mentioned he was "broke as the Ten Commandments financially, personally, collectively."

West's debts are personal, not related to the campaign, so they may not directly bear on the finances of his candidacy. Still, personal finance issues have been known to interfere with campaigns: Florida Sen. Marco Rubio's sometimes imprudent management of his own finances were scrutinized during his 2016 campaign for president, and then-Wisconsin Gov. Scott Walker's personal debt seemed to undermine his message of fiscal hawkishness.

According to West's financial disclosure filed with the Federal Election Commission in August 2023, he currently makes at least $200,000 annually. That includes his professorship at the Union Theological Seminary, where his annual income falls upward of $100,000; his speaking engagements, where he makes at least another $100,000; and his retirement fund, which earns him somewhere between $5,000 and $15,000 annually. His spouse, a professor, makes at least $50,000 per year.

Kedric Payne, an ethics lawyer with the Campaign Legal Center, said in an email to ABC News that the U.S. Office of Government Ethics advises candidates to disclose debts the size of West's.

"The federal disclosure law requires candidates for president to report liabilities owed over $10,000. Child support is excluded, but OGE advises that overdue taxes are reportable. If West in fact owes taxes, voters have a right to know why this isn't disclosed," Payne wrote.

West's associate, author Christopher Phillips described West as "authentic" and someone who hasn't hesitated to spend his own money to help others.

Phillips, who said he has known West for eight years, said that when he first met West over the phone, the scholar volunteered to lecture and spend time with his students at the University of Pennsylvania, where Phillips was a writing fellow.

"He said he could come down on his own nickel, and he spent the entire day breaking philosophical bread with my students … just because he likes what I do," Phillips said.

The campaign did not respond to ABC News' multiple requests for comment.

#us politics#news#abc news#green party#Cornel West#third party#2023#2024 elections#unpaid taxes#unpaid child support#Aytul Gurtas#Kathleen Stockton#The Breakfast Club#Charlamagne the God#Federal Election Commission#Kedric Payne#Campaign Legal Center#U.S. Office of Government Ethics#financial disclosure#Christopher Phillips

37 notes

·

View notes

Note

another question about filing taxes: if i've worked multiple jobs in the previous year, is it okay for me to leave certain jobs out if i get a higher refund for doing so? or could this get me into a lot of trouble?

This is a great way to get audited. And when you get audited, they will charge you back taxes and maybe even fees. So you might get a higher tax return! Buuuuuut then you might have to pay it all back later when you get audited.

Again, the rule is that you report ALL your income to the IRS. From our article about how to file taxes:

The United States is known for many things. It’s the global center of hot dog eating contests; the birthplace of Dwayne “The Rock” Johnson; and one of the only countries whose tax collectors say, “We know how much you owe in taxes this year, but we want you to take a guess at it. And if you guess wrong, we’re going to punish you.”

No seriously: that’s literally what tax filing season is all about.

Most people with jobs have taxes deducted from their paychecks throughout the year. The Internal Revenue Service (IRS), the entity responsible for handling tax matters in the United States, keeps pretty good records of that shit. They almost always over-tax some of us for reasons that are convoluted and boring and best left to another article. And they under-tax others for much less complex reasons.

But what that means is, at the end of a tax year, the IRS will owe some of us money, and some of us will owe the IRS money. And we have to file paperwork with the government (“filing taxes“) to get that all sorted out.

So they KNOW about those other jobs. If you signed paperwork and got 1099s or W2s from the jobs... the IRS got copies of that paperwork too. If there's a paper trail, they expect you to pay up.

How to File Your Taxes FOR FREE in 2022: Simple Instructions for the Stressed-out Taxpayer

58 notes

·

View notes

Text

https://thehill.com/business/4694024-irs-direct-file-free-tax-filing-permanent/

The free online tax filing program piloted this year by the IRS will be made permanent and its scope will be expanded, Treasury Secretary Janet Yellen announced Thursday.

Known as “Direct File,” the online platform will be integrated with state tax systems and expanded beyond the limited number of deductions that it can currently process, Yellen and IRS Commissioner Danny Werfel told reporters.

“We’re making Direct File — the new product we piloted this year — permanent,” Yellen said, touting the boost in IRS funding from the Inflation Reduction Act.

Werfel said that the size of the expansion hadn’t yet been decided but that it would gradually become larger over the coming years to include most common tax situations, focusing on those of “working families.”

Currently, the system can only process income earned in the form of W2 wages — the way most U.S. workers are paid — along with a handful of credits like the Child Tax Credit and Earned Income Tax Credit.

Werfel mentioned a number of tax situations where the IRS saw demand for inclusion in direct file, including health care and retirement tax credits.

“The premium tax credit — under the Affordable Care Act, those that get their health insurance in the affordable care act marketplace and therefore receive a premium tax credit. That was something that was not in our eligibility scope this year,” Werfel said.

“There were other refundable tax credits that were out of scope. There was certain retirement income that was out of scope,” he added.

Republicans and the private tax preparation software industry have railed against the new program. House Republicans voted to rescind funding for Direct File as soon as they took control of the lower chamber in 2023.

“There are also significant questions as to whether the IRS has the legal authority to implement such a program without congressional authorization,” Senate Finance Committee ranking member Mike Crapo (R-Idaho) said in a statement last year.

Werfel did not talk Thursday about additional types of income that could be made eligible for direct file, such as investment returns, rental property income, or independent contractor income filed on 1099-Ks.

The process of expanding Direct File will begin with figuring out which additional states will be included beyond the initial 12 where it was available this year.

“It really depends on state readiness,” Werfel said. “There will be no limit to the number of states that can participate in the coming year.”

The cost of the program for next year could be up to $75 million as outlined in the IRS’s strategic operating plan annual supplement, a sum that Werfel said the IRS would not “significantly or materially exceed.”

6 notes

·

View notes

Text

Income Tax Return Filing has been enabled for A.Y. 2024-25, Dont wait for Due Date! File Your ITR for Last 2 year. Contact Us +91 9818209246

#incometaxrefund#incometaxreturn#incometaxfiling#incometax#AdvanceTax#taxplanning#taxfilingservices#income tax return filing and other

0 notes

Text

WASHINGTON — Black taxpayers are at least three times as likely to be audited by the Internal Revenue Service as other taxpayers, even after accounting for the differences in the types of returns each group is most likely to file, a team of economists has concluded in one of the most detailed studies yet on race and the nation’s tax system.

The findings do not suggest bias from individual tax enforcement agents, who do not know the race of the people they are auditing. They also do not suggest any valid reason for the I.R.S. to target Black Americans at such high rates; there is no evidence that group engages in more tax evasion than others.

Instead, the findings document discrimination in the computer algorithms the agency uses to determine who is selected for an audit, according to the study by economists from Stanford University, the University of Michigan, the University of Chicago and the Treasury Department.

Some of that discrimination appears to be rooted in decisions that I.R.S. officials made over the past decade as they sought to maintain tax enforcement in the face of budget cuts, by relying on automated systems to select returns for audit.

Those decisions have produced an approach that disproportionately flags tax returns with potential errors in the claiming of certain tax credits, like the earned-income tax credit, which supplements low-income workers’ incomes in an effort to alleviate poverty. Those tax returns are more often selected for audits, regardless of how much in owed taxes the agency might recover.

The result is audit rates of Black Americans that are between three and five times the rate of other taxpayers, even when comparing that group to other taxpayers who also claim the E.I.T.C.

👉🏿 https://www.nytimes.com/2023/01/31/us/politics/black-americans-irs-tax-audits.html

Black people earn less, but are taxed more. There is also a marriage penalty that works against married Black people.

👉🏿 https://podcasts.apple.com/us/podcast/planet-money/id290783428

42 notes

·

View notes

Text

“The returns showed that Trump had business income, taxes, expenses or other financial items in nearly two-dozen countries, as well as multiple foreign bank accounts, including an account in China from 2015 to 2017.”

40 notes

·

View notes

Text

WASHINGTON – Hunter Biden, the president’s son, was indicted on charges he failed to pay his income taxes, Justice Department special counsel David Weiss announced Thursday.

The announcement came months after a plea deal over tax and gun charges collapsed. Under the agreement, which a federal judge rejected, Hunter Biden was set to plead guilty to two misdemeanor counts of failing to pay taxes in 2017 and 2018.

Biden is charged in a California federal court with three felony tax offenses and six misdemeanors. He engaged in a scheme in which he failed to pay at least $1.4 million in self-assessed taxes from 2016 through 2019, and also evaded tax assessment for 2018 when he filed false returns, according to the indictment.

From 2016 to 2020, Biden spent money "on drugs, escorts and girlfriends, luxury hotels and rental properties, exotic cars, clothing, and other items of a personal nature, in short, everything but his taxes," according to the indictment.

Separately, Weiss has charged Hunter Biden in Delaware with three federal gun charges, basically alleging he lied about using drugs when he bought a revolver in 2018. Biden pleaded not guilty to the charges Oct. 3.

"Based on the facts and the law, if Hunter’s last name was anything other than Biden, the charges in Delaware, and now California, would not have been brought," said Abbe Lowell, an attorney for Hunter Biden, in a statement.

"Now, after five years of investigating with no new evidence -- and two years after Hunter paid his taxes in full -- the U.S. Attorney has piled on nine new charges when he had agreed just months ago to resolve this matter with a pair of misdemeanors," Lowell said.

Biden faces a maximum penalty of 17 years in prison if convicted on the tax charges, the Justice Department said in a press release. It noted that actual sentences for federal crimes are typically less than maximum penalties.

Congressman Jason Smith, who heads the House Ways and Means Committee, said in a statement that the new charges further confirm the need for Congress to conduct an impeachment inquiry of Joe Biden "in order to uncover all the facts." The charges address years in which Hunter Biden earned millions of dollars by selling access to a family brand that was built on Joe Biden's political career, he said.

What are the tax charges?

While failing to pay his taxes, Biden allegedly spent millions on an extravagant lifestyle. In 2018, for example, he made about $383,000 in payments to women and spent about $151,00 on clothes and accessories, according to the charges.

Biden faces two felony charges of filing a false return and one felony charge of tax evasion. The six misdemeanor counts are for allegedly failing to file returns or pay his taxes when required.

Prosecutors have said Hunter Biden took in $2.4 million in income in 2017 and $2.1 in 2018 through Ukrainian energy firm Burisma, a Chinese-development firm, as well as domestic business interests and legal services.

Leo Wise, an assistant U.S. attorney, said at a July court hearing that an accountant prepared Biden's taxes both of those years, but his corporate and personal taxes were not paid. During this period, Hunter Biden made large cash withdrawals and covered other expenses like car payments on a Porsche, Wise said.

Hunter Biden told the court a "third party" paid the back taxes along with interest and fees pursuant to a personal loan he has not begun to repay.

Why did the judge reject the plea agreement?

Prosecutors had recommended probation for the two misdemeanor tax charges in the plea agreement, despite each carrying a maximum sentence of 12 months in prison. The agreement over the gun charge anticipated a pretrial diversion program that would wipe the charge off Biden’s record if he complied.

House Republicans called the agreement a “sweetheart deal” for lack of jail time.

U.S. District Judge Maryellen Noreika rejected the deal because of a dispute between prosecutors and defense lawyers over what it meant. Biden's lawyers argued that he would be protected from prosecution in future cases, but prosecutors denied that.

7 notes

·

View notes

Text

Assorted thoughts on Kamala Harris.

I voted for her in 2016, in the California Senate primary. At the time I was hanging out with BLM activists, and Harris seemed like she had potentially interesting ideas about race and crime and how to improve the situation in realistic ways (I still love my BLM friends but they have never had realistic ideas for how to make things better).

She does not seem to be corrupt or crooked in any traditional sense. Per WSJ:

Harris and Emhoff together earned $450,299 in 2023, according to a jointly filed tax return. That consists of the $218,784 Harris reported earning in wages as vice president and $174,994 Emhoff made as a visiting professor at Georgetown University Law Center. Around $6,000 came in from royalties on Harris’s books. They made $50,603 in taxable interest on bank accounts and other investments.

The couple’s income is significantly lower than it was before Harris took office as vice president. Emhoff, who was a partner at the corporate law firm DLA Piper, left the practice in August 2020 before Harris was inaugurated. He made more than $1.2 million in partnership income at DLA Piper in 2020.

Harris was also making more from her two books published in 2019. She has profited a total of $749,484 since 2020.

The couple has retirement assets and bank account balances worth somewhere between $3.6 million and $7.36 million.

A significant portion of Harris’s and Emhoff’s net worth is held in retirement accounts, according to government ethics forms.

I.e. she and her husband have been moderately successful and are living within their resulting means.

The childless cat lady thing: I do generally agree with J.D. Vance that childless people have less stake in society and their political opinions should count for less, but it doesn't apply to every individual. Note that Joe Biden, who was a thoroughly decent and generally honest man, seems to have committed his most corrupt acts in support of his prodigal son.

She's probably of middling intellect. She went to law school at UC Hastings, where the median LSAT of a recent class was 160, about the 75th percentile. Recall that the last woman to run against Trump went to Yale Law, where the median LSAT was 173, or the 99th percentile. I don't know anything about law school histories but from what I know of the UC system in general, Hastings Law was probably worse when Harris went there. Will this matter? Other than Joe Biden and John McCain, all the presidents in my memory and everybody who ran against them were top tier intellects. Running for president and being president requires one to speak to broad audiences about many complex issues, and that's a lot easier when you understand the complex issues deeply.

The enthusiasm for her does not seem durable. So far it looks like a combination of orange man bad, relief that the candidate is someone other than Biden of the June 27 debate, and lingering vestiges of "black girl magic" from ca. 2018.

What is her position on Israel and Hamas? Sooner or later she's going to have to make that clear. That she hasn't yet alienated either the Jewish or jihadi wing of the Democratic Party seems to be mostly the result of not taking any firm stance in public.

She is a fierce prosecutor, and in her brief Senate career was best known for her questioning at hearings. I think this plays into what Black men tend to dislike about Black women, and will end up hurting her with that demographic.

Trump's nickname for her, "Border Czar Harris," is brilliant in typical Trump form. First, it's original, to her if not to him. Second, it frames her as an incompetent cop, while letting the listener do most of the work themselves. Third, even if it's not quite true, she can't argue with it because the reality is worse, i.e. that she was not actually that involved in the so-called Biden-Harris administration's immigration policy.

As a national politician, her biggest issue is abortion. What is the substantive policy there in a post-Dobbs nation? Even if she got lucky and Clarence Thomas died or something, it doesn't seem like Roberts is eager to re-instate Roe v. Wade via some other case. That leaves legislation, which Congress was unable ever to do despite a half-century of platform planks about "codifying Roe." I don't know how they could even do that now under the 10th Amendment, but what do I know.

Her fundraising ads on YouTube are somewhat scolding: "today, not tomorrow,..." Compare J.D. Vance saying If you can't afford to donate because of the Biden economy, that's fine, take care of your family. I guess it's working for now but can it last 3+ months?

4 notes

·

View notes

Text

Turbotax is blitzing Congress for the right to tax YOU

Every year, Americans spend billions on tax prep services, paying a heavily concentrated industry of giant, wildly profitable firms to send the IRS information it already has. Despite the fact that most other rich countries have a far more efficient process, many Americans believe that adopting this process here is either impossible, immoral, or both.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That puts tax preparation in the same bucket as other forms of weird American exceptionalism — like the belief that we’re too untrustworthy to have universal healthcare, or that we’re so violent that we must all have assault rifles to protect ourselves from one another.

For those of you who aren’t familiar with how they do it in, say, the UK, here’s how it works: your employer submits all of your paystubs to the tax authorities; likewise the custodians of your pension and other people who send you money. The tax authority also knows about your major deductions, like your kids or other dependents.

The tax authority uses this information to fill in a tax return for you and they mail it to you. It’s simple and easy to understand. If they missed some information, or if your tax status has changed, or if you’ve got new deductions, you can amend this return — or throw it away and start over by yourself or with a tax professional.

For the vast majority of Britons, filing their tax returns takes a few minutes once a year, and it’s free. For the minority who don’t fit the standard form, the system works like it does in the US — you either tackle it alone, or do it with professional help.

The IRS could easily do the same thing. Even in a world where many of us are being “casualized” and have income coming in as independent contractors, the IRS knows about it, thanks to the 1099 form. Sure, the IRS might make mistakes, and if you’re worried about that, you can either manually review the precompleted return or pay someone to do it.

It’s a no-brainer, or it would be — if it wasn’t for decades of lobbying by the massively concentrated tax-prep industry — wildly profitable corporate giants like HR Block and Intuit, the parent company of Turbotax, who spent 20 years lobbying congress, spending millions to ensure that Americans would have to pay the Turbotax tax in order to pay their income tax.

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

The tax-prep industry couldn’t have done this on their own — their astroturf campaigns were joined by a grassroots of useful idiots, betwetters like Grover Norquist and his acolytes, who openly demand that tax preparation be as difficult and painful as possible, to drum up support for their campaign to “get the US government down to the size where we can drown it in the bathtub.”

These extremists are joined by many independent tax-prep specialists, who are seemingly convinced that every taxpayer has 11 dependents, four different kinds of pension savings, and six all-cash side-hustles, two of them international. Some people do have complicated taxes — as a writer with income from all over the world, I’m one of them — but most people don’t.

The point of getting the IRS to send you pre-populated tax returns isn’t to deny you the opportunity to pay excellent, knowledgeable tax-prep specialists if you need them — it’s to spare most of us from the needless expense of paying Intuit and HR Block to perform the rote form-filling by which the rake in billions in profits.

In reality, the campaign to defund the IRS isn’t — and will never be — about helping “the little guy.” As Propublica’s IRS Files demonstrate, the defunded, shriveled IRS is a billionaire’s plaything, which is why America’s top 400 earners pay less tax than you do:

https://pluralistic.net/2022/04/13/taxes-are-for-the-little-people/#leona-helmsley-2022

The commonsense utility of the IRS supplying you with prepopulated returns is so obvious that the tax-prep industry has had to really work to hold it at bay. The most successful scam was Freefile, a program cooked up by the tax-prep cartel that claimed it would provide free tax-prep to low-income Americans.

Freefile was a literal fraud: Intuit and its co-monopolists used a raft of deceptive “dark patterns” to trick people — students, veterans, retirees, and the poorest among us — into paying for services that they were entitled to use for free. Almost no one managed to find and use the Freefile offerings they’d hidden in a locked filing cabinet in a disused subbasement behind a sign reading “Beward Of the Leopard.”

This was so obviously crooked that the companies were eventually forced to give it up, but they weren’t done — their eye-watering, voluminous terms of service contained buried binding arbitration clauses that prohibited the people they ripped off from suing them:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Despite — or, more realistically, because of — the rising fury at the tax-prep industry’s years of unchecked corruption, Intuit has actually increased its lobbying spending this year: Open Secrets reports that in 2022, Intuit showered lawmakers with a record $3.5m:

https://www.opensecrets.org/news/2023/02/turbotax-parent-company-intuit-is-pouring-more-money-than-ever-into-lobbying-amid-push-for-free-government-run-tax-filing/

Their target? The $15m that the Inflation Reduction Act allocated to the Treasury Department to explore free tax filing. Intuit’s line is that this would be “a waste of taxpayer money” and a “conflict of interest” — the same tired boomer nonsense that Norquist has been shoveling since the Reagan administration. Once again, the proposal isn’t to ban Intuit from offering tax prep services — it’s to create a public option that lets people freely choose to pay for tax prep if they think they need it. It’s a breathtaking act of paternalism to claim that we’re all sheeple, too stupid to spot the IRS’s greedy attacks on our pocketbooks.

Here’s a choice quote from Intuit: “Creating a government run tax preparation program would be a waste of taxpayer dollars and further disenfranchise low income taxpayers. A direct to IRS tax prep system is a multi-billion dollar solution looking for a problem.”

https://www.businessinsider.com/turbotax-free-tax-filing-biden-inflation-reduction-act-hr-block-2023-1

Unsaid: the tax prep industry rakes in billions of dollars from American taxpayers every single year. The $44.8m the cartel has spent lobbying against free filing since 1998 is a fantastic investment — for them. The dividends they reap from it come out of all of our pockets.

Another bargain? Hiring ex-government officials to work for Intuit, lobbying their former colleagues:

https://www.opensecrets.org/federal-lobbying/clients/lobbyists?cycle=2022&id=D000026667&t0-Revolving+Door+Profiles=Revolving+Door+Profiles

Or, as Senator Elizabeth Warren bluntly put it, “adroit influence peddling”:

https://www.opensecrets.org/news/2022/06/members-of-congress-call-for-an-investigation-of-intuits-lobbying-practices-amid-mounting-turbotax-controversies/

The neoliberal economists’ theory of regulatory capture is a kind of helpless nihilism, grounded in the Public Choice Theory doctrine that says that regulators will always be captured, so we should just get rid of regulators or make them as weak as possible, so they won’t become cordyceps-ridden puppets of the industries they oversee:

https://doctorow.medium.com/regulatory-capture-59b2013e2526

But capture isn’t inevitable. Sure, if you have a referee that’s weaker than the teams, you’ll never get a fair game — nevermind what happens when the ref either used to work for one of the teams or is sure of a cushy job with them when the season’s over. If you want a small government, you need small corporations — need to block the anticompetitive mergers and predatory conduct that lets companies grow so large that they can fit their regulators into the little change pocket in their blue-jeans.

https://doctorow.medium.com/small-government-fd5870a9462e

Anyone who lived through witchhunts, torture and mass surveillance after 9/11 has good reason to want their government small enough to be accountable — but a doctrine of small governments and giant corporations is a plutocrat’s charter — a recipe for regulatory capture so grotesque it is indistinguishable from farce.

[Image ID: An ogrish, tophatted, cigar-chomping giant holds the US Capitol building aloft contemptuously, pinched between the thumb and forefinger of a white-gloved hand. He stands at a podium bearing the Turbotax checkmark logo, yanking a lever in the form of a golden dollar-sign. He stands before a IRS 1040 tax form.]

intuit, turbotax, irs, taxes, death and taxes, corruption, monopoly, freefile, grover norquist, regulatory capture,

#pluralistic#intuit#turbotax#irs#taxes#death and taxes#corruption#monopoly#freefile#grover norquist#regulatory capture

139 notes

·

View notes

Text

Self Assessment Tax Returns – A Complete Guide

The UK Self-Assessment tax system requires individuals and businesses to report their income and pay taxes if not deducted automatically. Taxpayers must file a Self-Assessment Tax Return annually if they fall into various categories, including self-employment, high earners, or those with specific types of income like savings or foreign earnings. Registration involves obtaining a Unique Taxpayer Reference (UTR) and setting up an online account. Deadlines are critical: informing HMRC by October 5th for new filers, submitting paper returns by October 31st, and online returns by January 31st. Accuracy in reporting income, expenses, and other financial details is crucial to avoid penalties, with options to amend returns if necessary. Maintaining records is essential, with different retention periods based on circumstances. Late filing or payment incurs penalties, but appeals are possible with valid reasons. Overall, compliance ensures taxpayers meet their obligations under UK tax law while managing their financial affairs responsibly.

Read More: Self Assessment Tax Return: Guide

2 notes

·

View notes

Text

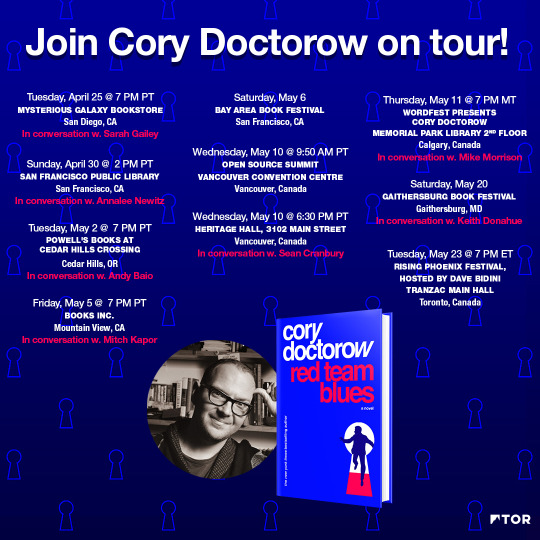

Taxes 2024: glass's quick and gritty guide to free filing those bitches

By god I hate doing my taxes but what I hate more is paying money for someone to do them for me.

Here's the thing. If taking your W2s and property taxes to someone with the training and paying them $70 makes you feel better. Do it. BUT if you're stubborn and bitchy, you CAN do it yourself and if you're reading this post I'm going to make the assumption that your AGI is less than $79000 and therefore you qualify for free file. (and if you don't know what an AGI is then yes, you qualify).

It's honestly going to be okay. We will get through it together.

This guide is not going to be thorough, and while I will try to answer questions if you ask them, I'm not an expert: my knowledge comes from filing my own taxes for the fourth (fifth?) year in a row using the free file program and going through a number of life changes that I have to reflect on my taxes.

The post includes a link and screenshots. I will describe the bare minimum information of the images in Alt Text, but will not fully transcribe the full text as all the images will be from the IRS website which has accessibility options.

Here we go:

I want you to go to this page and then chose the first big blue button (unless you want it all in Spanish, then click on Spanish and I'll pray for you that it's all the same process)

If you are a brave, brave soul then take the fillable forms and be free, my children. I cannot help you there.

BUT if you chose the guided software options it's going to take you to these options

You may chose to browse options on your own. This does feel somewhat choose-your-own-adventure and I'm not your mother or your boss. HOWEVER. I implore you to take the guidance as far as you can. Chose the big blue button that says "Find Your Trusted Partner(s)" (very polycurious, if I may say).

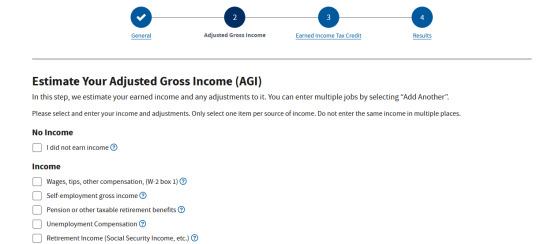

This survey is meant to be straightforward. There is a little blue questionmark that opens to explain the filing statuses very clearly and in detail. Chose the right status for you, then some other questions will show up. Answer the questions that come up (again, this general page should be info that is straightforward. most of us should be able to answer the general questions with just what's in our heads), then click next when the questions are done.

Now, you will need to know your income for this page, which probably mean you need your W2s or whatever other forms you might have that reflect/summarize your 2023 income. You don't need to get into extreme detail, you just need totals. Worked a couple of jobs and have W2s for all of them? Add "box 1" from each W2 together, select the first box under "Income" and type in your total in the fillable box that opens.

Further down this page is space for adjustments to your income, so stuff about student loans and health savings would be helpful, but again this survey isn't about the nitty gritty. Round numbers are fine.

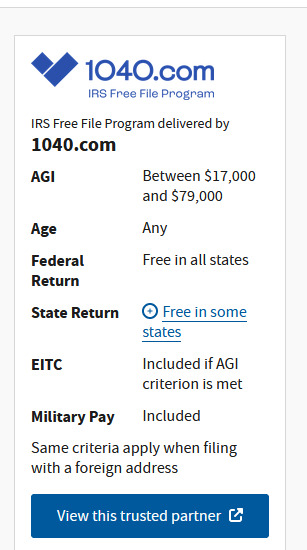

Once you're done here, you'll click next and then it'll ask you about the Earned Income Tax Credit which is really just about if you have kids or not. Answer that question, click next and BOOM

This is the only free file partner that I qualify for this year (again, life changes), but in previous years I have used HRBlock and Tax Slayer. All three sites have been guided similarly to this survey and as easy to use as can be possible given the US tax system.

Thus ends my guided portion, as going to 1040(.)com will show you a great deal of my personal info, but I will give you a few more notes:

Throughout the year, collect your tax forms/important papers in a safe, secure place that YOU WILL NOT FORGET. (preferably a safe or at least a heavy fireproof security box).

Once you get to the tax website you're going to use, you will need all those papers.

Start your filing early. I like to start when I get my W2s.

For one, you'll get everything done and then in April when someone, stressed and anxious, asks if you remember that taxes are due, you can smugly say you filed ages ago. For another, if you do run into significant issues, you have lots of time to resolve them.

Don't necessarily file super early. Sometimes congress does stuff that affects taxes as late as March. It's easier and less stressful to edit your pending forms than it is to file a correction.

When you have all the information in, look up the local and national news and see if there's anything going on regarding taxes. This year there's talk about extending the child tax credit. I haven't kept up with that because it doesn't apply to me, but it might be important to you. If there's nothing happening that might affect you, go ahead and file.

If you have a question, ask! Even the free file services have a help section

I lied, one last snip. This is from 1040. They have an FAQ section, and it's not just about the site itself. I have submitted questions to all three services I've used and all of them have answered me.

They won't hold your hand through every step, but if you have a specific question, they'll do their best to answer it.

You can also do a general internet search! "what this form?" and "do i need to include XYZ on my taxes" are all things i've found the answers for by searching them on duckduckgo

HRBlock has a huge amount of accessible information that I've used often.

I'll wrap here by just saying - if you get frustrated, save your work and walk away.

I called my employer's HR to ask something, waited a couple days then started an email to them, and realized the answer as I was writing the email.

The earlier you start, the more time you have to figure things out. You can do it. Good luck.

#US taxes#taxes#tax help#sorry it's all one block of text. I don't have the energy to make it less Like This

4 notes

·

View notes