#Indian rupee coins

Text

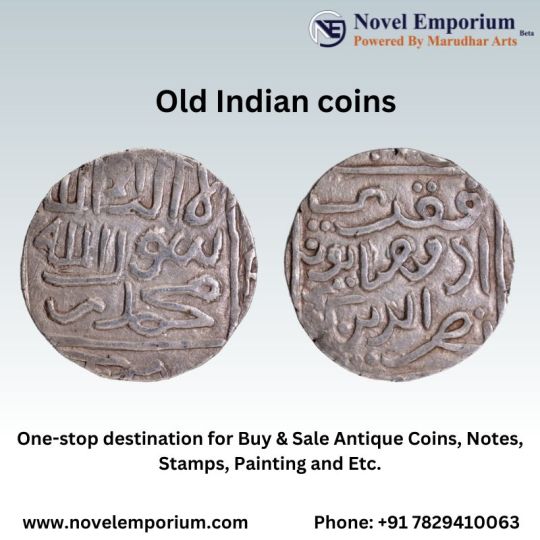

Online Marketplace to Buy & Sell Coins, Notes - Novel Emporium

Novel Emporium is India's only trusted portal for buyers & sellers, powered by Marudhar Arts. We specialize in selling & buying antique coins, notes, stamps, etc. Do you want to buy or sell ancient Indian coins, notes, stamps, and other collectibles online? Then Novel Emporium can be a one-stop online antique coin shop for you, and with us, you can collect complete antique items collections. We propose coins in different metals such as silver, gold, and copper.

Additionally, To know more about us - https://www.novelemporium.com/

Follow us on:

Facebook - https://www.facebook.com/RippleofNE

Twitter - https://twitter.com/RippleofNE

Instagram - https://www.instagram.com/novel_emporium_maru/

Pinterest - https://in.pinterest.com/RippleofNE/

Telegram - https://www.t.me/novelEmporium/

#British India coins for sale#buying and selling collectibles#buy coins online#online marketplace for buying and selling coins#buy notes online#buy stamps online#Indian rupee coins#novel emporium#buy antique coins online

1 note

·

View note

Text

#Rare Coins#old rare coins for sale#rare rupees coins#very rare indian coins#all rare old coins sale#bullion coins for sale

2 notes

·

View notes

Video

youtube

High value 5 rupees Coin || 5 Rs || Old Coins Value || Indian Hobby Tamil

#youtube#Indian Hobby Tamil#5 Rupees#5 rs#Old Coins value#Old Coin Value#IndianHobbyTamil#5 Rupees Coin Value

0 notes

Text

Indian Currency Collections

#Old Currency 10 Rupees#Special Currency Notes#Fancy Number Currency Notes#British Indian Currency Notes#Commemorative Coins#Mahatma Gandhi Coins#British India Coins#Ancient Coins.

0 notes

Text

INDT: First Ever Indian Rupee Pegged Stablecoin

INDT token is a stablecoin that reflects the price of INR. We aim to lay a solid foundation for developing INR-based stablecoins in the cryptocurrency space.

1 note

·

View note

Text

First Ever Indian Rupee Pegged Stablecoin

INDT token is a stablecoin that reflects the price of INR. We aim to lay a solid foundation for developing INR-based stablecoins in the cryptocurrency space. The INDT Token exists as a digital token built on top blockchains like Ethereum and BSC.

0 notes

Text

First Ever Indian Rupee Pegged Stablecoin

INDT token is a stablecoin that reflects the price of INR – one of the strongest currencies in the world. We aim to lay a solid foundation for developing INR-based stablecoins in the cryptocurrency space. INDT's immense potential offers users and businesses with advanced payment protocols over the traditional systems in place. The INDT Token exists as a digital token built on top blockchains like Ethereum and BSC.

1 note

·

View note

Text

The Sign of Four: The Strange Story of Jonathan Small (Part One of Two)

I will split this in two parts as I've got a lot to cover here.

CW for discussions of nasty prison conditions.

The depth of the Thames is about 6.5 metres at low tide in Woolwich, near to the Plumstead Marshes as they were then. However, the river has strong currents and very little visibility, so it would be a risky operation even with 2024 diving technology for some rather small objects.

The rupee originally was a silver coin dating back to ancient times in India, becoming something of a standard currency during the Mughal period. The East India Company introduced paper rupees and while there was an attempt by the British to move their territory to the pound sterling, they soon gave up, minting their own rupees with the British monarch's head on. The currency was also non-decimal. India retained the currency post-independence and went decimal as well.

Mangrove trees are very common in equatorial coastline regions - they can remove salt from the water, which would kill many other trees.

Prisoners set to the Andaman Islands penal colony were forced to work nine to ten hours a day to construct the new settlement, while in chains. Cuts from poisonous plants and friction ulcers from the chains would often get infected, resulting in death.

The convict huts on Ross Island were two-storey affairs, with the bottom as a kitchen and took area, the prisoners sleeping on the upper floor. Designed this way as an anti-malaria measure, they however leaked and the prisoners themselves were constantly damp from the rainfall, offering them little protection from the mosquitoes in any event.

Ague is an obsolete term for malaria; adults experience chills and fever in cycles.

The British would conduct experiments with quinine as a malaria treatment by force-feeding it to the prisoners. This caused severe side effects.

The British would make use of locals as warders, who wore sashes and carried canes. I'd imagine they could probably be quite brutal.

Pershoe is a small town on the River Avon near Worcester. It has a railway station with an hourly service to London, taking just under two hours today.

"Chapel-going" in this context means that the people attended a non-conformist church i.e. not one part of the Church of England.

"Taking the Queen's/King's shilling" was a historical term for joining the armed forces - for the army this was officially voluntary, but sailors could be forcibly recruited, being known as "press-ganged" until 1815. You would be given the shilling upon initial enlistment or tricked into taking it via it being slipped into your opaque beer. You would return the shilling on your formal attestation and then receive a bounty which could be pretty substantial in terms of the average wage, although a good amount of that would then be spent on your uniform. Some enlisted, deserted and then reenlisted multiple times to get multiple payments. The practice officially stopped in 1879, but the slang term remains.

The 3rd Buffs refers to the latter 3rd Battalion, Buffs (East Kent Regiment), a militia battalion that existed from 1760 to 1953, although it effectively was finished in 1919. However, in reality, they did not go to India to deal with the rebellion, instead staying in Great Britain to cover for the regular regiments who did.

The British never formally adopted the Prussian "goose step" instead going for the similar, but less high-kicking, slow march.

The musket would possibly have been the muzzle-loaded Enfield P53, a mass-produced weapon developed at the Royal Small Arms Factory in Enfield. It was itself was the trigger of the Indian Rebellion in 1857 due to the grease used in the cartridges. They would also be heavily used in the American Civil War on both sides, especially the Confederate one as they smuggled a lot of them, with only the Springfield Model 1861 being more widely used. As a result, they are highly sought after by re-enactors. The British used them until 1867, when they switched to the breech-loading Snider-Enfield, many of the P53s being converted.

The crocodile would likely have been a gharial, which mainly eat fish. Hunting and loss of habitat has reduced their numbers massively, with the species considered "Critically Endangered" by the IUCN.

"Coolie" is a term today considered offensive that was used to describe low-wage Indian or Chinese labourers who were sent around the world, basically to replace emancipated slaves. Indentured labourers, basically - something the US banned (except as a riminal punishment) along with slavery in 1865. In theory they were volunteers on a contract with rights and wages, however abuses were rife. Indentured labour would finally be banned in British colonies in 1917.

Indigo is a natural dark blue dye extracted from plants of the Indigofera genus; India produced a lot of it. Today, the dye (which makes blue jeans blue) is mostly produced synthetically.

I have covered the "Indian Mutiny" as the British called it here in my post on "The Crooked Man".

The Agra Fort dates back to 1530 and at 94 acres, it was pretty huge by any standards. Today, much of it is open to tourists (foreigners pay 650 rupees, Indians 50), although there are parts that remain in use by the Indian Army and are not for public access.

"Rajah" meaning king, referred to the many local Hindu monarchs in the Indian subcontinent; there were also Maharajahs or "great kings", who the British promoted loyal rajahs to the rank of. The Muslim equivalent was Nawab. However, a variety of other terms existed. The East India Company and the Raj that succeeded them used these local rulers to rule about a half their territory and a third of the population indirectly, albeit under quite a bit of influence from colonial officials. These rulers were vassals to the British monarch; they would collect taxes and enforce justice locally, although many of the states were pretty small (a handful of towns in some cases) and so they contracted this out to the British. As long as they remained loyal, they could get away with nearly anything.

562 of these rulers were present at the time of Indian independence in 1947. Effectively abandoned by the British (Louis Mountbatten, the last Viceroy, sending out contradictory messages), nearly all of them were persuaded to accede to the new India, where the nationalists were not keen on them, with promises they could keep their autonomy if they joined, but if not, India would not help them with any rebellions. Hyderabad, the wealthiest of the states, resisted and was annexed by force. The ruler of Jammu and Kashmir joined India in exchange for support against invading Pakistani forces, resulting in a war. A ceasefire agreement was reached at the beginning of 1949, with India controlling about two-thirds of the territory; the ceasefire line, with minor adjustments after two further wars in 1965 and 1971, would become known as the Line of Control, a dotted line on the map that is the de facto border and one of the tensest disputed frontiers on the planet.

India and Pakistan initially allowed the princely rulers to retain their autonomy, but this ended in 1956. In 1971 and 1972 respectively, their remaining powers and government funding were abolished.

Many of the former rulers ended up in a much humbler position, others retained strong local influence and a lot of wealth. The Nizam of Hyderbad, Mir Osman Ali Khan was allowed to keep his personal wealth and title after the annexation in 1948 - he had been the richest man in the world during his rule and used a 184-carat diamond as a paperweight, at least until he realised its actual value. The current "pretender", Azhmet Jah, has worked as a cameraman and filmmaker in Hollywood, including with Steven Spielberg.

12 notes

·

View notes

Text

Discover Rare Indian Coins: Where to Buy Indian Coins Online and Best Places for Collectors

For avid coin collectors and history enthusiasts, the allure of Indian coins is undeniable. From ancient relics to modern commemoratives, each coin tells a story of India’s rich heritage. If you're wondering where to buy Indian coins online, look no further. The digital marketplace offers an array of options for collectors of all levels. Whether you're hunting for the elusive 1964 Indian 1 rupee coin or seeking a Jawaharlal Nehru commemorative coin, this guide will help you navigate the best places to buy Indian coins and build your collection with ease.

The Appeal of Indian Coins

Indian coins are prized for their historical significance and intricate designs. Coins such as the 1964 Indian 1 rupee coin, which marked a transition in the country's numismatic history, are especially sought after. The 1964 rupee, made from copper-nickel, is notable for its durability and distinct design, making it a favorite among collectors. Another notable coin is the Jawaharlal Nehru commemorative coin, issued to honor India’s first Prime Minister. These coins capture pivotal moments in Indian history, making them invaluable to any collection.

Where to Buy Indian Coins Online

When searching for the best place to buy Indian coins, reliability and authenticity are paramount. Online platforms have made it easier than ever to access a vast array of coins, but choosing the right source is crucial.

Specialized Online Coin Stores: Websites like ShopCurios offer a curated selection of Indian coins, ensuring you get genuine and well-preserved pieces. With categories dedicated to different eras and types of coins, it's a convenient place for both novice and seasoned collectors.

Auction Sites: Online auction platforms can be a goldmine for rare and valuable coins. Sites like eBay or Heritage Auctions frequently feature Indian coins, including the coveted 1964 Indian 1 rupee coin. However, it’s essential to verify the credibility of the seller and the authenticity of the coins before making a purchase.

Numismatic Associations and Forums: Joining numismatic communities online can be incredibly beneficial. Websites like CoinCommunity or NumisBids not only provide marketplaces but also offer expert advice and detailed information about coins. Engaging with fellow collectors can lead to trustworthy buying recommendations and even direct purchases.

Why Choose ShopCurios

While there are many options available, ShopCurios stands out for its dedication to quality and authenticity. This platform specializes in Indian coins, ensuring that every piece has been carefully vetted. Whether you’re searching for the 1964 Indian 1 rupee coin or the Jawaharlal Nehru commemorative coin, ShopCurios provides a reliable and comprehensive selection.

Tips for Buying Indian Coins Online

Verify Authenticity: Always purchase from reputable dealers. Look for certifications or guarantees of authenticity.

Research: Before buying, research the coin’s history and market value. Understanding the significance and current market price will help you make an informed decision.

Condition: The condition of a coin significantly affects its value. Look for coins that are well-preserved and have clear inscriptions and designs.

Ask for Documentation: Whenever possible, ask for any available documentation or provenance that can provide background information on the coin.

Conclusion

Building a collection of Indian coins can be a rewarding hobby, offering a tangible connection to India's rich cultural and historical tapestry. When considering where to buy Indian coins online, prioritize authenticity and reliability to ensure your collection is both genuine and valuable. Whether through specialized online stores like ShopCurios or other reputable platforms, the key is to conduct thorough research and connect with the numismatic community. Happy collecting!

0 notes

Text

How to Buy Bitcoin (BTC) in India : A Comprehensive Guide for 2024

Explore our comprehensive guide on how to buy Bitcoin in India in 2024. Navigate the world of cryptocurrency with ease, understand the legal framework, and make informed decisions about your Bitcoin investments.

In the dynamic realm of digital currencies, Bitcoin (BTC) has steadfastly maintained its position as a premier cryptocurrency. Its growing global acceptance and recognition have sparked a surge in Bitcoin purchases, particularly in India. This detailed guide is designed to steer you through the process of buying Bitcoin in India in 2024.

The cryptocurrency environment in India has experienced numerous fluctuations, marked by regulatory hurdles and the emergence of fresh opportunities. Despite these challenges, the Indian market’s enthusiasm for Bitcoin and other cryptocurrencies remains robust. This guide offers you a step-by-step walkthrough, insights into its future, and reasons for investing in Bitcoin in India, ensuring you are well-equipped with the necessary information to make informed decisions in the ever-changing cryptocurrency landscape.

Whether you are an experienced investor seeking to broaden your portfolio with digital assets, or a novice venturing into the crypto world, this guide is tailored to assist you in understanding and navigating the process of purchasing Bitcoin in India in a safe and efficient manner.

What is Bitcoin?

Bitcoin, a leading cryptocurrency in terms of market capitalization, is a digital currency that operates similarly to real-world currencies such as dollars and other fiat currencies. However, it is not under the control of any third-party entities like banks, governments, or corporations. Bitcoin can be earned through a process known as mining, which involves verifying Bitcoin transactions. Additionally, Bitcoin can be bought on various open exchanges or received in exchange for goods or services.

Bitcoin was created in 2008 by an individual or group using the pseudonym Satoshi Nakamoto. The creation of Bitcoin was a response to the distrust of centralized banks following the Great Recession. Bitcoin’s first blockchain, known as the genesis block, was launched on January 3, 2009.

In its initial years, Bitcoin had no tangible monetary value, and only miners had access to the blockchain. The first Bitcoin transaction took place over a year later when a man in Florida arranged for a Papa John’s Pizza worth $25 to be delivered in exchange for 10,000 Bitcoins, which were then valued at four coins per penny. As of March 2023, the same amount of Bitcoin would be valued at approximately $248 million.

What Things Will You Need To Buy Bitcoin In India?

Prior to initiating an online account with a cryptocurrency exchange, it’s essential to authenticate your identity using certain documents. The rules for account setup may vary across different exchanges, but having the following items readily available can expedite the process:

Photos of your Aadhaar card or another valid ID may be required for upload

A secure internet connection is recommended as public WiFi can pose security risks

A mobile phone for implementing two-factor authentication

An account with an exchange that is operational in India

A bank account from which you can withdraw and deposit rupees into your exchange

A safe method for storing cryptocurrency. Most brokerages provide a reliable built-in wallet or secure vault system for this purpose.

How To Buy Bitcoin in India?

Once you’ve prepared everything and configured your account on a cryptocurrency exchange, you’re all set to invest in Bitcoin and other digital currencies. Here’s a step-by-step guide to making your initial purchases:

Step 1: Log into your preferred cryptocurrency exchange account using a secure WiFi connection.

Step 2: Navigate to the option to purchase crypto on the brokerage’s platform. Ensure you’ve selected the right digital asset you intend to buy. You could opt for coins like Bitcoin (BTC), Ethereum (ETH) or Binance Coin (BNB), for instance. Different exchanges offer different currency options, so verify that they support the cryptocurrency you’re interested in before creating an account.

Step 3: Decide on the amount you wish to buy and confirm that you have sufficient funds or fiat currency in your brokerage account to cover the transaction.

Step 4: Review your purchase. Make sure you’re comfortable with the current price of the cryptocurrency and are aware of the overall market trend at the time. It might also be worthwhile to check if there have been any recent changes in the government’s stance on the legality of cryptocurrencies.

Step 5: If everything appears to be in order, click on the “buy” button to finalize your purchase. You can then keep your newly acquired assets in the exchange’s built-in wallet or transfer them to other hot or cold storage options.

Given the significant appreciation in Bitcoin’s value, many individuals may be hesitant to acquire an entire Bitcoin. However, brokerages provide the option to purchase Bitcoin fractions. For instance, one could acquire as little as 0.004 BTC or even less. Cryptocurrency exchanges present a variety of trading methods for Bitcoin and other digital currencies. You have the choice to buy and retain your Bitcoin, or engage in frequent trading such as day trading or swing trading.

For those in India interested in trading Bitcoin, they could establish a Bitcoin wallet and place an offer on a peer-to-peer exchange. Following this, they could deposit funds to trade with another individual for Bitcoin.

5 Reasons Why You Should Invest in Bitcoin

Robust Network Security

The Bitcoin network is fortified by an immense amount of computational power, rendering it the world’s most secure blockchain. The security of the Bitcoin network is continually enhanced with the increasing number of miners and nodes, making it progressively challenging for attackers to breach or manipulate the system.

Established Resilience

Bitcoin has demonstrated its durability over time, weathering numerous market downturns, technological hurdles, and regulatory issues. This resilience instills greater confidence in investors about its long-term stability, indicating a higher probability of continued growth and value increase.

Broad Acceptance

A growing number of global businesses now recognize Bitcoin as a valid payment method, and it’s increasingly employed as a safeguard against currency depreciation and inflation. This widespread acceptance further strengthens its status as a premier digital currency, enhancing its appeal as an investment choice.

Dominance in the Market

Bitcoin commands a substantial portion of the cryptocurrency market, accounting for more than 40% of the total market value. This dominance implies that it is considerably more stable and secure than other less cryptocurrencies, which are more vulnerable to market volatility and external factors.

High Liquidity

Compared to other cryptocurrencies, Bitcoin offers superior liquidity. This means that Bitcoin can be readily bought and sold without significantly affecting its market value, a critical factor for investors who wish to seamlessly enter and exit positions.

How to Store Bitcoin in India?

Blockchain wallets serve as a storage space for Bitcoins. Beyond currency storage, these crypto wallets also hold keys that are used for signing data, encryption, and transaction facilitation. Cryptocurrency wallets come in two forms:

Cold Wallets

These are crypto wallets that keep users’ private keys offline. They operate together with compatible software. The security of cold wallets is higher as they do not digitally store information.

Hot Wallets

These wallets operate via internet connectivity. They permit users to send and receive internet tokens, thereby enabling business transactions.

Conclusion

The journey of buying Bitcoin in India in 2024, while filled with its own unique challenges and complexities, is a rewarding and enlightening experience. This guide has aimed to provide you with a comprehensive understanding of the process, from understanding what Bitcoin is, to the necessary preparations for buying Bitcoin, and finally, the step-by-step process of making your purchase.

In the rapidly changing world of digital currencies like Bitcoin, staying updated and adaptable is key. Continuous learning about new trends and regulations is vital. Investments in cryptocurrencies should be well-researched and risks should be understood. Despite the potential for high returns, the volatile crypto market also poses a risk of significant losses. Hence, only invest what you can afford to lose.

Finally, as the popularity of Bitcoin and other cryptocurrencies continues to grow in India and around the world, so too does the need for clear, comprehensive, and accessible guides like this one. Whether you’re a seasoned investor or a newcomer to the world of cryptocurrency, we hope this guide has been helpful in your journey towards buying Bitcoin in India in 2024. Happy investing!

#bitcoin#crypto#cryptocurrency#india#digitalcurrency#cryptocurreny trading#btc#bitcoinprice#cryptotrading

0 notes

Text

Ringing in the Digital Rupee Era: How CBDCs Could Transform Indian Finance

The way we pay for things is constantly evolving. From barter systems to coins and paper money, and now the rise of digital wallets and UPI, our financial landscape is ever-changing. Central Bank Digital Currencies (CBDCs) are the next potential chapter in this story, and India is at the forefront of exploring their possibilities.

What are CBDCs?

Imagine a digital version of the rupee issued directly by the Reserve Bank of India (RBI). That's essentially a CBDC. Unlike private cryptocurrencies like Bitcoin, CBDCs are government-backed and regulated, offering stability and security.

Also Read: Journey Of Poonawalla Fincorp’s Managing Director – Abhay Bhutada

Potential Benefits of CBDCs for India

Financial Inclusion: Millions of Indians still lack access to traditional banking systems. CBDCs, with their potential for wider accessibility through mobile phones, could be a game-changer for financial inclusion. Imagine paying bills or receiving government benefits instantly through your phone. This could be particularly impactful in rural areas where bank branches are scarce.

Boosting Efficiency: CBDCs could streamline cross-border transactions, potentially reducing processing times and costs significantly. This could be a boon for Indian businesses engaged in international trade. For instance, imagine a small business owner in Mumbai importing textiles from Thailand. With CBDCs, the entire payment process could be settled within minutes, compared to the current system which can take days or even weeks.

Transparency and Security: CBDCs could potentially offer a more transparent and secure way to conduct transactions. Every transaction could be recorded on a secure, tamper-proof digital ledger, making it easier to track and prevent fraud. This could be a significant advantage over cash, which is susceptible to theft and loss.

Greater Control for the RBI: With CBDCs, the RBI could have more control over the money supply and potentially implement new monetary policies more effectively. For example, the RBI could program CBDCs to expire after a certain period, encouraging spending and stimulating the economy.

Also Read: Unveiling Abhay Bhutada: A Leader’s Inspiring Odyssey In Finance

Challenges to Consider

Privacy Concerns: The digital nature of CBDCs raises privacy concerns. How will user data be protected? Can anonymity be maintained in transactions, especially for smaller purchases? These are questions that need careful consideration. The RBI will need to strike a balance between ensuring transparency and protecting user privacy.

Impact on Traditional Banks: The widespread adoption of CBDCs could potentially impact the role of traditional banks. How will they adapt to this new financial landscape? While some fear CBDCs could disintermediate banks, others believe they could create new opportunities for collaboration. Banks could leverage their expertise to offer value-added services on top of the CBDC infrastructure.

Technological Infrastructure: India needs a robust digital infrastructure to support the smooth functioning of CBDCs. This includes ensuring reliable and affordable internet connectivity reaches even remote areas. Additionally, robust cybersecurity measures will be crucial to protect the CBDC system from potential cyberattacks.

The Road Ahead

The RBI is currently in the pilot phase of exploring CBDCs. While there's no set timeline for their launch, it's a sign that India is taking a proactive approach to the future of money.

Also Read: Who is Abhay Bhutada?

A Word from the Banking Professional

As a banking professional, I believe CBDCs have the potential to revolutionize the Indian financial system, echoing the sentiment of legendary investor Warren Buffett who once said, "Innovation distinguishes between a leader and a follower." They offer exciting possibilities for greater financial inclusion, efficiency, and security. However, it's crucial to address privacy concerns, ensure a smooth transition for traditional banks, and invest in robust digital infrastructure. The success of CBDCs will depend on careful planning, open communication with all stakeholders, and a commitment to building a secure and inclusive digital financial ecosystem.

The arrival of the digital rupee, in the form of a CBDC, could be a defining moment for Indian finance. It's a story we'll all be watching closely in the coming years.

0 notes

Text

The old rupee note is a symbol of the past, With its intricate designs. Old kings coins hold memories that last, Though faded and worn, its value remains, A glimpse into history, where time refrains. Visit Novel Emporium to buy your favourite Old India Coins

#Buy Indian Sultanate Coins#Indian Sultanates Coins#Tipu Sultan Coins#British India Coins#british gold coins#Old British Coins for Sale#Antique coin buyers#Antique coins#Ancient India Coins#mahatma gandhi coins#George King coins#old 1000 rupee note sale

1 note

·

View note

Video

youtube

High Value rare Coins || Old Coins Value || INDIAN HOBBY TAMIL

#youtube#Indian Hobby Tamil#High Value Rare Coins#Old Coins Value#India Coin Value#1 Rupee Coin Price#1 Pice Horse coin Price

0 notes

Text

#1 rupee coin reserve bank of india#twenty rupee coins india#indian 20 paise coins#1947 coins in india.

0 notes

Text

Know Some Beginners’ Tips to Trade in Cryptocurrency Mugafi

Even though cryptocurrency trade is relatively a new concept in India, it’s gaining huge popularity among investors in terms of lucrative returns and wealth creation. Unlike trading in shares and debentures, which is governed by the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI), trading in crypto is free from any third-party regulations. All operations and transactions under the crypto market are governed and regulated by the crypto community itself.

Although the cryptocurrency trade is booming as a new lucrative option for investment in the market, it can be quite challenging for individuals who are doing it for the first time.

To help you get a proper understanding of cryptocurrency, further, we have discussed some beginner tips on how to trade in cryptocurrency.

What are Cryptocurrencies?

Cryptocurrency is a type of digital asset that is used to exchange services and goods over the internet. Crypto exchanges or companies issue ‘Tokens’ that can be purchased or traded for products and services online. Cryptocurrencies can be acquired only digitally.

There are various types of cryptocurrencies available digitally such as Litecoin, Ethereum, Dark Coin, Dogecoin, Dash, etc. However, Bitcoin was the first and most popular type of cryptocurrency available in the market.

Although Bitcoin can be acquired with Indian rupees, others require the purchase of bitcoins and other cryptocurrencies. Thus, to make cryptocurrency trading, it is mandatory to have a ‘digital wallet’, which is a web-based tool to store money.

In simple terms, an investor creates an account on a cryptocurrency exchange and then spends the real money to trade cryptocurrencies such as Bitcoin or Ethereum.

How to Do Cryptocurrency Trade ‘Safely’?

In order to gain the maximum return on investment, it is important to have a proper understanding of how cryptocurrencies work. In the last decade, cryptocurrencies have occupied a large market share and have a current market value of around $4 Trillion.

Cryptocurrencies are very similar to shares and stocks, thus it is volatile to market conditions. So, to reap maximum return it is important to constantly monitor values to trade effectively. Let’s take a look at some simple tips to do cryptocurrency trade.

Start Small!

For beginners, it is wiser to start investing with a small amount. As we have mentioned earlier that cryptocurrencies are very similar to the stock market, it is highly volatile and unpredictable. Thus, it is imperative to determine risk tolerance before making any decisions.

Ideally one should start investing with a minimum amount that they can afford to lose. Moreover, make sure you have a piece of fair information about the cryptocurrency market. Once you determine the risk factor, set aside a modest portion of the money to invest in cryptocurrency. For beginners, they should limit their investment to 5-10% of their income.

Pick the Right Cryptocurrency Exchange

A cryptocurrency exchange is an app or web platform where investors trade their crypto (buy or sell). In short, it is the place where all the actions happen. These days, there are a plethora of crypto exchange platforms available online. They offer various benefits and features to help you do cryptocurrency trade (buy and sell crypto). Keeping your investment objective in mind zero in on one that provides you features like lower fees, a secure wallet and an easy transaction process.

Choose a Cryptocurrency and Stick to It

Nowadays, there is an extensive range of cryptocurrency exchanges to choose from. Before you choose one, make sure to research the most popular ones in your region and understand them adequately. Once you decide which cryptocurrency to invest in, stick to it. If you are investing in crypto for the first time then it is advised to invest in one of them rather than investing in five separate ones. This will provide you with a much better understanding of the market and how cryptocurrency works. Moreover, it will help you to create a strong portfolio for future investments.

Get a Secure Cryptocurrency Wallet

A cryptocurrency wallet is where the investors store the private and public key that acts as a link between them and the blockchain where the crypto assets are. Basically, cryptocurrency wallets are a vault that secures the key that one requires to access their cryptocurrency on the blockchain. Without a key one cannot perform any crypto transactions.

There are three types of wallets:

Online wallet– The quickest to set up but least secured

Software wallet– It is an app that you download. It is safer compared to the online wallet

Hardware wallet– a portable device that you plug into your computer using USB, it is the safest option

The wallet you require is determined based on the coin you wish to buy. For example, if you wish to buy bitcoin, then you will need to have a bitcoin wallet. You can find plenty of options for a secure wallet as per the coin you wish to purchase.

Payment Method

Before making an investment, check the payment methods allowed to buy cryptocurrency. Most cryptocurrency exchanges allow bank transfers and credit cards. Ensure that these methods are completely secured and are as per your convenience.

The Bottom Point!

Although cryptocurrency trade is the burgeoning investment trend in the market. It is imperative to understand how it works before investing in it. For beginners, make sure you determine your risk appetite and evaluate the various aspects of cryptocurrency trading before making an informed choice.

READ MORE...AI Story Generator Tool, Script & Screenplay Writing software | Mugafi

0 notes

Text

Indira Gandhi 5 Rupees Coin1985- Unique Collectible

Discover the iconic Indira Gandhi 5 Rupees coin with a portrait of the influential leader. Explore its significance and add it to your coin collection.In the diverse world of Indian currency, the Copper-nickel 5 rupee coin occupies a special place. Minted in 1985, this coin is a commemorative tribute to one of India's most iconic leaders, Indira Gandhi. Its issuance marked a pivotal moment in the country's monetary history, introducing the 5 rupee denomination for the first time. Read More

1 note

·

View note