#FinancialAdvice

Explore tagged Tumblr posts

Text

"Financial Planning for the 99%" by Wilbert Guilford, a Certified Public Accountant in Phoenix, offers practical, accessible financial advice for everyday people. This book provides essential tools and strategies to take control of your finances, from budgeting to investing, regardless of income.

It's time to secure your financial future! Visit https://guilfordtaxman.com/about2/ to learn more and start your financial journey today!

6 notes

·

View notes

Text

#RetirementPlanning#GovernmentEmployees#FinancialAdvice#PensionPlanning#TaxTips#ResignationVsRetirement#RetirementMistakes#GEPF#DhevanNaicker#EarlyRetirement#GEPF2PotSystems#GEPFResignationSpecialist#PensionFunds#SouthAfrica#WealthManagement#FinancialPlanning#RetireWell

2 notes

·

View notes

Text

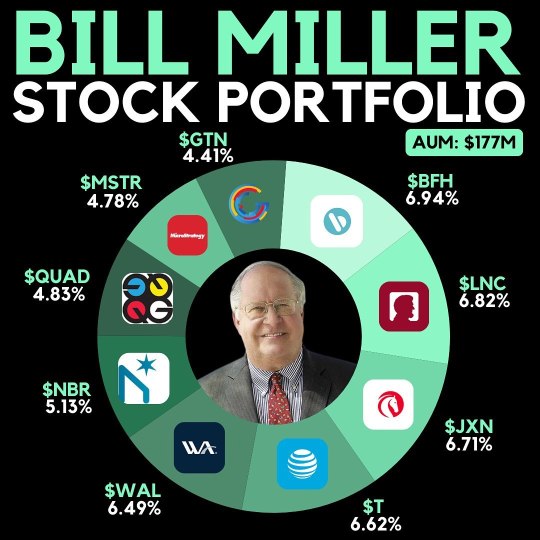

Bill Miller, a renowned hedge fund manager, recently disclosed the top holdings of his fund, which manages $177 million in assets. Here are his key investments: 1. Bread Financial: 6.94% 2. Lincoln National: 6.82% 3. Jackson Financial: 6.71% 4. AT&T: 6.62% 5. Western Alliance: 6.49% 6. Nabors: 5.13% 7. Quad Graphics: 4.83% 8. Microstrategy: 4.78% 9. Gray Television: 4.41% Have you considered any of these stocks in your portfolio? 💼 Investing wisely often requires understanding what successful managers are doing. It's essential to keep an eye on the strategies of experts like Bill Miller, as their insights can guide your own financial decisions. 💡 I believe that diversifying your investments based on proven strategies is key to achieving long-term financial success. Take charge of your financial journey today! 🚀

#BillMiller#HedgeFund#Investing#StockMarket#FinancialAdvice#PortfolioManagement#InvestmentStrategy#WealthManagement#FinancialSuccess#StockPick#Diversification#ValueInvesting#MarketTrends#InvestmentInsights#FinanceTips

2 notes

·

View notes

Text

Mastering Your Finances: A Roadmap to Long-Term Financial Health

Introduction

Achieving financial stability is a crucial step toward a secure and stress-free life. Effective financial management enables you to avoid debt, save for the future, and make informed investment decisions. In this comprehensive guide, we will explore practical tips and strategies to help you master your finances and achieve long-term financial health.

Section 1: Building a Strong Financial Foundation

A solid financial foundation is akin to the bedrock of a grand architectural marvel. Without it, the structure above cannot stand tall and resilient against the test of time.

Spend Less Than You Earn The cornerstone of financial stability lies in the principle of spending less than you earn. Much like the conservation of energy, where output should not exceed input, your financial health thrives when your expenditures are less than your income. Begin by meticulously tracking your expenses. Utilize tools like budgeting apps or a simple spreadsheet to categorize and monitor every dollar spent. Create a budget that aligns with your financial goals, allowing you to live within your means and avoid unnecessary debt.

Emergency Fund An emergency fund serves as your financial safety net, a buffer against life's unpredictable events. Aim to save 3-6 months' worth of living expenses in an easily accessible account. This fund acts as a safeguard, ensuring you can navigate unexpected expenses, such as medical bills or car repairs, without derailing your financial progress. The importance of this fund cannot be overstated, as it provides peace of mind and stability in turbulent times.

Section 2: Investing Wisely

Investing is the art and science of making your money work for you. However, like any scientific endeavor, it requires careful research, understanding, and strategic planning.

Understand Before You Invest Before diving into the world of investments, take the time to understand the various options available. Whether it's stocks, bonds, real estate, or other assets, each investment vehicle comes with its own set of risks and rewards. Conduct thorough research and consider seeking advice from a financial advisor. Their expertise can provide valuable insights and help you make informed decisions.

Don't Invest More Than You Can Afford to Lose A cardinal rule in investing is to never put at risk more money than you can afford to lose. Diversification is your ally in mitigating risk. Spread your investments across different asset classes and sectors to minimize the impact of any single investment's poor performance. This approach, known as diversification, enhances the stability and potential growth of your portfolio.

Section 3: Managing Debt Effectively

Debt, if managed wisely, can be a tool for growth. However, if left unchecked, it can become a burden that stifles financial progress.

Good Debt vs. Bad Debt Not all debt is created equal. Good debt, such as student loans or mortgages, can be considered investments in your future. They often come with lower interest rates and have the potential to increase your earning power or net worth. Conversely, bad debt, like high-interest credit card debt, can quickly spiral out of control. Focus on paying off high-interest debt first to free yourself from its financial stranglehold.

Debt Reduction Strategies There are several effective strategies for reducing debt. The snowball method involves paying off your smallest debts first, providing a psychological boost as you eliminate balances one by one. The avalanche method focuses on paying off debts with the highest interest rates first, saving you money on interest over time. Consider consolidating your debt into lower-interest loans or credit cards to make your payments more manageable.

Section 4: Boosting Your Income

Increasing your income is a proactive approach to achieving financial goals faster. It provides additional resources to save, invest, and pay off debt.

Side Hustles and Freelancing In today's gig economy, opportunities for side hustles and freelance work abound. Whether it's driving for a rideshare service, offering consulting services, or starting an online business, additional income streams can significantly enhance your financial situation. This extra income can be directed towards debt reduction, savings, or investments, accelerating your journey towards financial stability.

Investing in Yourself Your most valuable asset is yourself. Investing in your education and skills can have long-term benefits for your career and earning potential. Consider taking courses, attending workshops, or gaining certifications in your field. Continuous personal and professional development not only enhances your employability but also opens doors to higher income opportunities.

Section 5: Reducing Expenses and Saving Money

Reducing expenses is akin to tightening the bolts on a well-oiled machine. Every bit of savings contributes to smoother financial operations and long-term stability.

Cutting Unnecessary Costs Take a critical look at your spending habits and identify unnecessary expenses. Cancel subscriptions you no longer use, cook at home instead of dining out, and find ways to save on utilities and other monthly bills. Small changes in your spending habits can accumulate into significant savings over time.

Smart Shopping Adopt smart shopping strategies to maximize your savings. Compare prices, use coupons, and take advantage of sales to save money on everyday items. By being a savvy shopper, you can stretch your dollars further and make your budget work more efficiently.

Conclusion

Achieving financial stability requires a combination of smart spending, wise investing, and proactive debt management. By following these tips and staying committed to your financial goals, you can build a secure future and achieve long-term financial health. Remember to stay informed, adapt to changing circumstances, and celebrate your progress along the way.

Additional Resources

Consider consulting a financial advisor for personalized advice and guidance.

Utilize budgeting and investment apps to track your progress and stay on top of your finances.

Continuously educate yourself on personal finance and investing to make informed decisions.

In the grand tapestry of life, your financial health is a thread of paramount importance. With knowledge, discipline, and strategic planning, you can weave a future of stability, security, and prosperity.

Call to Action

Are you ready to take control of your financial future? Join our community at [Your Blog Name] for more in-depth articles and resources on financial management, investing, and achieving financial freedom. Don't forget to subscribe to our YouTube channel, [Unplugged Financial], where we dive into the history of money, explore the current financial landscape, and discuss how Bitcoin can revolutionize the financial world. Together, we can navigate the path to financial independence and create a brighter future.

Stay Connected:

Visit our blog: Bitcoin Revolution

Subscribe to our YouTube channel: Unplugged Financial

Let's learn, grow, and achieve financial freedom together!

#FinancialFreedom#MoneyManagement#InvestingTips#DebtFreeJourney#PersonalFinance#Budgeting#FinancialAdvice#SmartInvesting#EmergencyFund#SideHustles#FinancialStability#WealthBuilding#CryptoRevolution#Bitcoin#FinancialLiteracy#MoneyMatters#SaveMoney#IncreaseIncome#FrugalLiving#FinancialGoals#financial education#financial empowerment#financial experts#cryptocurrency#digitalcurrency#blockchain#finance#unplugged financial#globaleconomy

5 notes

·

View notes

Text

Investrove USA

Dive into the world of investing with Investrove! Our videos offer quick, actionable tips to help you navigate the financial markets like a pro. Whether you're a beginner or seasoned investor, our bite-sized videos provide valuable insights to boost your portfolio. Subscribe now for more expert advice on stocks, cryptocurrencies, and investment strategies.

2 notes

·

View notes

Text

Fernando Aguirre 4 Essential Tips to Equity Securities

In the world of finance, mastering equity securities is crucial for investors seeking to build a robust portfolio. Renowned investor Fernando Aguirre Executive Vice Chairman at DHS Ventures, shares 4 indispensable tips to navigate the complexities of equity investments.

2 notes

·

View notes

Text

Can I Customise My SIP?

You can, indeed. Investing a certain amount each month is the most common SIP, but investors can alter how they use SIPs to allocate funds. Investors can choose to make monthly, bi-weekly, or fortnightly investments through a lot of fund firms.

2 notes

·

View notes

Text

#529Plan#AssetAllocation#CryptoInvesting#Diversification#DividendInvesting#FinancialAdvice#FinancialAdvisor#FinancialEducation#FinancialGoals#FinancialPlanning#HighYieldSavings#InvestmentOptions#InvestmentPortfolio#PassiveIncome#PeerToPeerLending#RealEstateInvesting#RetirementPlanning#RoboAdvisors#RothIRA#SavingsStrategies#SideBusiness#StockMarket#StocksAndBonds#WealthManagement#Investing#SHARE.#Facebook#Twitter#Pinterest#LinkedIn

2 notes

·

View notes

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes

Text

अपने परिवार के भविष्य को सही बीमा योजना के साथ सुरक्षित करें - सिर्फ़ आपके लिए अनुकूलित! प्रहिम इन्वेस्टमेंट्स में, हम आपकी ज़रूरतों और बजट के अनुसार सही कवरेज चुनने में आपकी मदद करते हैं।

Contact us :- Websites : - https://prahiminvestments.com/ Call today If you have Question Ask us : 093157 11866 , 01204150300

#prahim#prahiminvestments#insurance#FuturePlanning#secure#lifeinsurance#termplan#terminsurance#InvestInYourself#financialadvice#InvestSmart#investments#InvestmentStrategy#savings#financialadvisor#financialservice#FinancialSuccess#SIP#termplaninsurance#termplans

0 notes

Text

youtube

How Much Are You Paying for Financial Advice?

It's crucial for investors to ask the right questions, as the true cost of financial advice can often be difficult to fully understand.

0 notes

Text

Stock Market Risks and How to Avoid Them A Simple Guide (2025)

Are you investing in the stock market or planning to start? Then it's crucial to understand the major risks involved and how you can protect your money with the right strategies.

Key Risks in Stock Market Investments:

Market Volatility – Sudden price movements that can affect your portfolio

Wrong Stock Selection – Investing in poorly performing or unstable companies

Fake News and Rumors – Making decisions based on unverified information

Emotional Investing – Reacting to fear or greed instead of analysis

Lack of Diversification – Putting all your money into one sector or stock

Smart Ways to Avoid These Risks:

Always research before investing

Think long-term instead of chasing short-term gains

Diversify your portfolio using SIPs or index funds

Consult a professional financial advisor when needed

Read the full guide for detailed strategies and examples: Stock Market Risks & How to Avoid Them – Full Guide (2025)

0 notes

Text

Top 10 Small Business Finance Tips for Beginners in the USA

Starting a small business as an entrepreneur is very challenging and thrilling. Especially if you are the new entrepreneur of countries like United States, Australia, Canada, United Kingdom, Germany, Sweden, Norway, Switzerland, Singapore, or Japan, then making the right financial decisions is the key to the success of your business. In this article we will discuss the top 5 Small Business Finance Tips, which is essential for new entrepreneurs.

1. Create powerful Small Business Finance Tips and Financial Planning

It is very important to create a well -organized business plan first. This plan must have your goals, outline of the goals and the final financial planning.

Whatever included in an effective financial plan:

Profit and Loss Details (Profit & Loss Statement)

Cash Flow predicted

Break-even analysis

Balance Sheet predict

This plan will help you address the financial challenges of the future and guide the right investment.

2. Understand Cash Flow and observe regularly

Cash Flow is the life of your business. It is not only if the paper is profitable, but the flow of real money is also important. Effective cash flows for daily expenses, salary, and other expenses are essential.

Cash Flow to keep in order to keep:

Review Cash Flow Report per month

Future Cash Demand Be already assumed

Send and collect the bill on time

Avoid unnecessary expenses

A healthy cache flow means that your business will survive and move on to new opportunities. Small Business Finance Tips

READ MORE…

#SmallBusiness#FinanceTips#SmallBusinessFinance#BeginnerFinance#FinanceForBeginners#BusinessFinance#EntrepreneurTips#FinancialLiteracy#USA#Top10Tips#MoneyManagement#Startups#BusinessGrowth#FinancialSuccess#Budgeting#Investing#CashFlow#WealthBuilding#Entrepreneurship#FinancialAdvice

0 notes

Text

#gepf#dhevannaicker#pensionfunds#retirementplanning#taxtips#pensionplanning#gepf2potsystems#earlyretirement#financialadvice#financialplanning#retiresa#retirement#retireearly#southafrica#gepf sa#retirevsresign#early retirement#retirement planning#retirementwellnesssa#retirement savings#resignation benefits#resignation

0 notes

Text

Pfizer Dividend Calculator

Discover how Pfizer's dividends can impact your investment portfolio. Our Pfizer Dividend Calculator provides insights into potential returns, helping you make informed decisions.

Reference: https://www.dividendusa.com/pfizer-dividend-calculator/

#dividend#financialeducation#pfizer#moneymanagement#capitalism#economy#finance#investing#stockmarket#financialmarkets#financialadvice

1 note

·

View note