#Investor Relations

Text

Bay Area tech exec says company lied to get $25M from investors, fired him for speaking up

A Bay Area tech founder has alleged in a wrongful termination lawsuit that his former company and its CEO repeatedly lied to investors and then fired him for protesting those actions.

In a lawsuit filed Wednesday in Santa Clara, Subburajan Ponnuswamy, who co-founded the digital security company Cloudbrink in 2019 and served as its chief technology officer, alleged that Cloudbrink CEO Prakash Mana used false information to secure funding from investors. In the complaint, Ponnuswamy alleged that Mana, who joined as CEO in 2020, had conducted a “‘fake it till you make it’ scheme” by falsifying revenue, purchase orders, and customer quotes in presentations for investors and board members. He also alleged that Mana promised customers Cloudbrink stock in exchange for helping him falsify the revenue.

In a statement from Cloudbrink provided by company spokesperson Mark Fox, the company wrote that it “affirmatively denies Ponnuswamy’s allegations and will be filing a formal denial in court at the appropriate time.”

“Our policy is not to comment on active litigation; however, we can say that Cloudbrink has an impeccable reputation in the marketplace, intends to vigorously defend itself in this lawsuit, and views the allegations as internally inconsistent and nonsensical. The Board is aware of Ponnuswamy’s allegations and remains in full support of Cloudbrink’s current leadership and direction,” the statement continued.

Ponnuswamy’s filing specifically points out Cloudbrink’s $25 million “Series A” funding round, which the company announced in November 2022; the former executive alleges that Mana used fake customer testimony and false revenue information to raise the money. He alleges that Mana then falsified invoices to assuage investors’ “due diligence” check.

“For some of the falsified revenue and/or customers, CEO Mana did not issue any invoices even after 6 months of claiming the revenue; for other ‘customers,’ CEO Mana created a batch of invoices right around the time of fundraising (months or quarters after claiming those as ARR), just to establish paper trails,” the complaint alleged. “Yet there was no evidence of those invoices ever being submitted to the alleged customer, and no funds were received from them.”

Ponnuswamy reportedly discussed his concerns with Cloudbrink’s board in four meetings with board members, and Mana’s conduct toward the chief technology officer became “increasingly retaliatory,” according to the complaint. Mana allegedly told Ponnuswamy at one point, “If you come into my swim lane, I’ll make sure to take parts of your swim lane.” Mana also asked Ponnuswamy to create fake user and customer accounts, which Ponnuswamy refused to do, according to the lawsuit.

Ponnuswamy alleged in the complaint that his forced exit came after he met in March with board members and representatives from The Fabric and Highland Capital Partners in March. Both companies were listed by Cloudbrink as lead investors in the $25 million funding round. The complaint said Ponnuswamy “presented hard evidence of falsification of [annual recurring revenue] and customer count.”

Two weeks later, the Cloudbrink board told Ponnuswamy that “while it appeared to be true that CEO Mana had been reporting fraudulent customers and revenues to the Board and investors, they could not terminate him for fear it would damage Cloudbrink’s sales operations and customers,” per the lawsuit.

Ponnuswamy alleged that the board then told him they would be firing him instead, and that they planned to “‘clean up’ the books.” Then they terminated his contract, the complaint reads. His last day was March 20.

“It became clear that the Company had decided to cover its tracks and side with CEO Mana’s unlawful ‘fake it till you make it’ scheme over lawful business practices,” the complaint reads.

Ponnuswamy wrote in a statement that “high-profile cases like Elizabeth Holmes and Sam Bankman-Fried are just the tip of the iceberg, with similar unlawful practices in smaller startups often going unreported or inadequately investigated due to company board complicity.” Two investors named in the lawsuit from The Fabric and Highland did not immediately respond to requests for comment.

Ponnuswamy alleges he was fired in retaliation and wrongfully terminated, without being provided the stock options he’d been promised.

“In effect, CEO Mana and the Board waited for Mr. Ponnuswamy to build the technology and ship product, careful not to issue any additional promised options, […] diluted his options, and terminated him because he repeatedly raised concerns about the Company’s unlawful and fraudulent conduct,” the complaint said. Ponnuswamy is seeking lost wages and punitive damages, among other relief.

#Tech Industry#Startups#Lawsuit#Wrongful Termination#Cloudbrink#Corporate Fraud#Whistleblower#Investor Relations#Digital Security

1 note

·

View note

Text

Learn how investor relations in private equity foster transparency, compliance, and trust, enhancing market efficiency and investor confidence.

Investor relations play a key role in publicly traded companies. The investor relation teams communicate vital information about the company's operations and financial status to the stakeholders and potential investors. IR teams also ensure that the company's top management and legal department are updated about the organization's financial health.

0 notes

Text

Optimizing Relationship Management with a Robust Investor’s CRM

#crm#relationship management#investorsdatabase#investor relations#financialservices#magistral consulting#outsourcing services

0 notes

Text

IFRS 16 Leases: Persistent Challenges for Finance Professionals

Shasat, a reputable name in the world of financial education and training, has unveiled an exciting and timely initiative: the IFRS 16 Leases Workshop. This program has been carefully designed to address the seismic shifts in lease accounting brought about by the IFRS 16 accounting standard, a pivotal change that's been hailed as the most significant in over 30 years.

With the introduction of IFRS 16, companies adhering to International Financial Reporting Standards (IFRS) are facing a transformative challenge. The longstanding practice of classifying leases as either operating or finance leases has been overhauled. Now, all leases are to be reported on the balance sheet, fundamentally altering the way businesses account for these financial obligations. It's worth noting that some exemptions still apply, specifically for short-term leases without purchase options or low-value assets.

This shift in lease accounting brings forth an era of enhanced transparency and clarity in financial reporting. Investors will benefit from financial statements that more accurately mirror the economic realities of businesses. This, in turn, simplifies the process of evaluating and comparing companies within the same industry, ultimately supporting more informed investment decisions.

Moreover, the implementation of IFRS 16 (also known as ASC 842 under US GAAP) results in a notable increase in assets, liabilities, and net debt. These changes have a direct impact on key accounting and financial ratios, which can influence a company's appeal to potential investors and its ability to secure essential financing.

For professionals and organizations looking to navigate these complex changes and optimize their financial reporting, the IFRS 16 Leases Workshop is an invaluable resource. It equips participants with the knowledge and skills required to effectively tackle the challenges posed by IFRS 16. The course covers a wide array of essential topics, including determining suitable lease portfolios, understanding asset identification criteria, evaluating lease terms, and accounting for various types of lease payments.

Participants will also gain insight into reassessing lease liabilities in the face of changing lease terms, understanding lease incentives, initial direct costs, and dismantling costs. The treatment of non-lease components in a lease contract and handling onerous leases under IFRS 16 are also addressed. The course further delves into the critical aspect of applying the appropriate discount rate to calculate lease liabilities and offers guidance on where to source these rates.

To accommodate professionals worldwide, Shasat has made the IFRS 16 Leases Workshop accessible through various platforms and locations. This inclusive approach ensures that individuals from diverse backgrounds and regions can benefit from this essential training.

Here is the schedule of upcoming programs by Shasat. However, we recommend you continue to visit Shasat's website for the most up-to-date program schedules.

IFRS 16 For Leases Workshop | GID 32001 | London: September 29, 2023

IFRS 16 For Leases Workshop | GID 32002 | Zurich: November 1, 2023

IFRS 16 For Leases Workshop | GID 32003 | Dubai: November 15, 2023

IFRS 16 For Leases Workshop | GID 32004 | Singapore: October 28, 2023

IFRS 16 For Leases Workshop | GID 32005 | Toronto: December 7, 2023

IFRS 16 For Leases Workshop | GID 32007 | Cape Town: October 7, 2023

IFRS 16 For Leases Workshop | GID 32008 | Sydney: November 24, 2023

IFRS 16 For Leases Workshop | GID 32009 | Miami: December 13, 2023

IFRS 16 For Leases Workshop | GID 32000 | Online: Available on request

For more details and to enrol in IFRS 16 Leases Workshop, please visit:

By participating in this comprehensive workshop, finance professionals and organizations can prepare themselves to meet the complexities of the IFRS 16 accounting standard head-on. This knowledge not only enhances financial reporting accuracy but also strengthens a company's appeal to potential investors and its ability to secure vital financing.

In today's dynamic financial environment, staying ahead of accounting standards is imperative. The IFRS 16 Leases Workshop by Shasat offers an unparalleled opportunity to do just that. Register now to gain a competitive edge in your industry and navigate the evolving world of finance with confidence.

#IFRS 16#Lease Accounting#Financial Reporting#Accounting Standards#Financial Education#Financial Transparency#Investor Relations

0 notes

Text

In the age of digital transformation, the role of a Real Estate Fund Administrator has become indispensable for ensuring the smooth operation and growth of real estate funds. Fundtec’s commitment to innovation, industry expertise, and client-centric approach positions it as a key partner in navigating the complexities of fund administration. As the financial landscape continues to evolve, Fundtec remains dedicated to delivering cutting-edge solutions that drive the success of real estate funds and other investment vehicles.

#Real Estate Fund Administration#Property Accounting#Investor Services#Net Asset Value (NAV) Calculation#Property Valuation#Lease Management#Compliance Management#Regulatory Reporting#Asset Appraisal#Portfolio Analysis#Investor Relations#Reconciliation#Property Acquisition#Asset Disposition#Fund Performance Reporting#Property Due Diligence#Real Estate Investment Trust (REIT) Administration#Asset Management#Financial Reporting#Real Estate Fund Technology

0 notes

Text

Andrew Sparke and QMines: Unleashing the Power of Advancements at Mt Chalmers

QMines, under the dynamic leadership of Andrew Sparke, has made significant strides in advancing the Mt Chalmers copper and gold mine. In just 18 months since listing, QMines has achieved remarkable resource upgrades, positioning itself as a key player in the mining industry. With a vision to unlock the full potential of Mt Chalmers, QMines is determined to establish a thriving copper and gold operation while prioritizing resource estimation, metallurgical testing, and environmental studies.

Delivering Resource Upgrades:

QMines' relentless pursuit of excellence has led to the successful delivery of the third and fourth resource upgrades at Mt Chalmers. These upgrades have propelled the measured, indicated, and inferred resources to an impressive 11.86 million metric tonnes at a remarkable 1.22% contained copper equivalent. Notably, 84% of these resources fall within the measured and indicated JORC categories, reflecting the high confidence level in the project's potential.

Unveiling the Deposits:

Mt Chalmers is home to four identified deposits, with Mt Chalmers and Woods Shaft already established as valuable resources. QMines is committed to converting the remaining two deposits, Botos and Mount Warminster, into resources, further enhancing the project's scale and viability. The exploration efforts aim not only to maximize the potential of existing deposits but also to unearth additional Volcanic-Hosted Massive Sulphide (VHMS) deposits, ensuring a sustainable supply of copper and gold.

Continued Exploration and Development:

QMines' unwavering dedication to the Mt Chalmers project extends into the future. Through 2023 and beyond, the company plans to intensify its exploration and development initiatives. Resource estimation will be refined to uncover untapped potential, while metallurgical testing will provide valuable insights into optimizing extraction processes. Environmental studies will be conducted in alignment with QMines' commitment to sustainable mining practices.

Engaging Stakeholders for Progress:

QMines recognizes the importance of collaboration in driving project development. Andrew Sparke and his team are actively engaging with potential investors, community stakeholders, and strategic partners to foster meaningful relationships. By involving all relevant parties, QMines aims to build a strong foundation for success, ensuring a positive impact on local communities and stakeholders.

Conclusion:

Under the visionary leadership of Andrew Sparke, QMines has achieved remarkable advancements at Mt Chalmers. With resource upgrades, an ambitious exploration agenda, and a commitment to sustainable practices, QMines is well-positioned to shape the future of copper and gold mining in the region. As the company continues to unlock the vast potential of Mt Chalmers, it stands as a testament to Andrew Sparke's expertise and QMines' dedication to innovation and responsible resource development.

#Andrew Sparke#QMines#Mt Chalmers#Resource Upgrades#Copper and Gold Mining#Exploration and Development#Metallurgical Testing#Environmental Studies#Sustainable Mining Practices#Stakeholder Engagement#Mining Industry#VHMS Deposits#Copper Equivalent#JORC Categories#Australian Mining#Resource Estimation#Community Impact#Investor Relations#Strategic Partnerships#Mining Project Management.

0 notes

Text

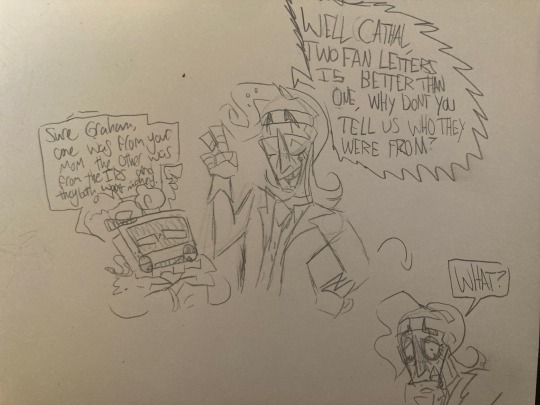

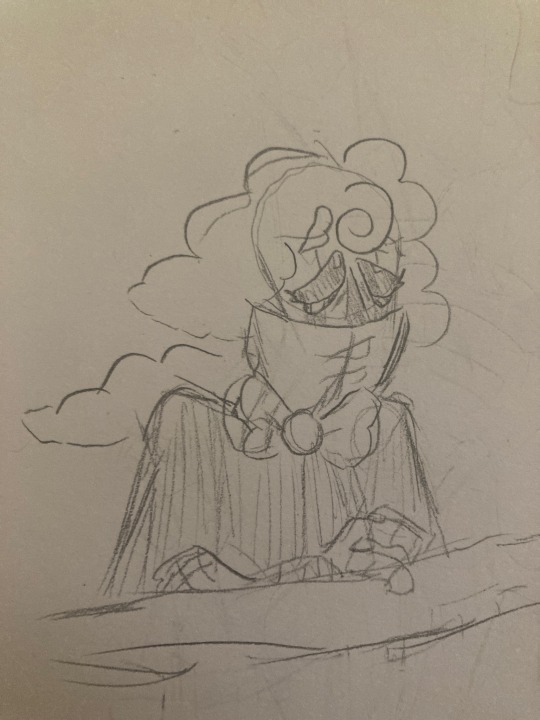

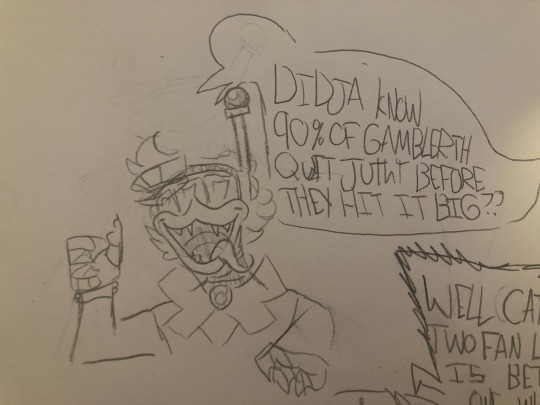

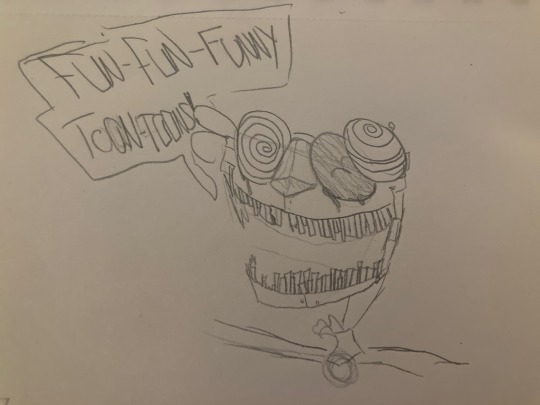

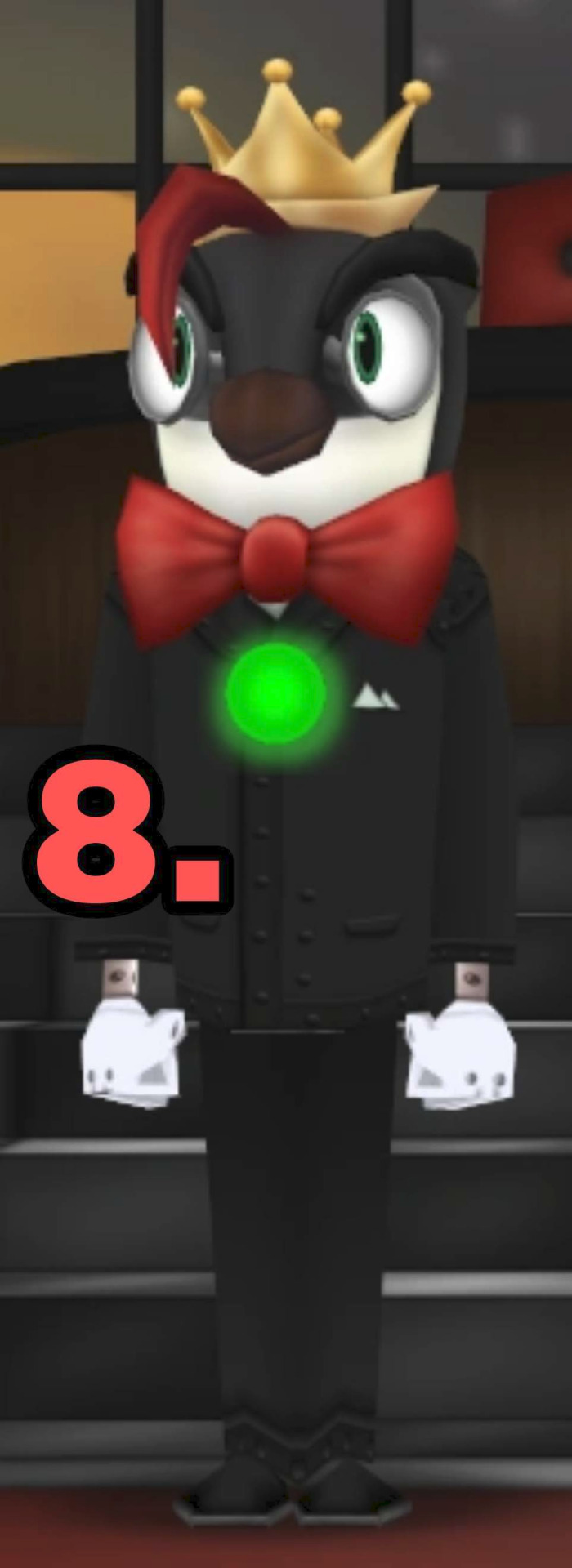

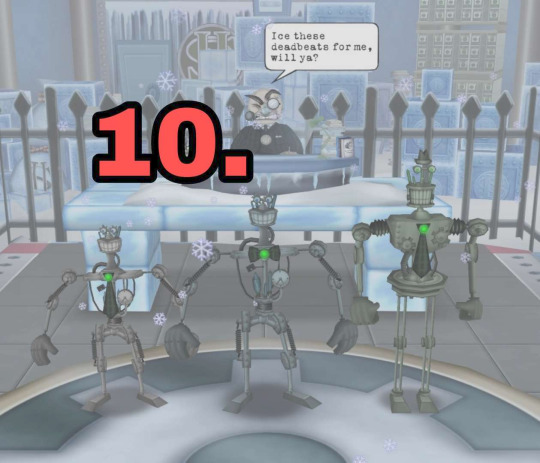

Some doodle requests for twitter!

#toontown#toontown corporate clash#ttcc#pacesetter#multislacker#rainmaker#duck shuffler#vice president#S.V.P#public relations representative#bobby jr#witch hunter#satalite investors#featherbedder#firestarter#graham ness payser#cathal ray toby bravecog#misty monsoon#buck ruffler#allan bravecog#winston byrd#prester virgil#tawney c. esta#flint bonpyre

77 notes

·

View notes

Text

#satellite investors#toontown corporate clash#toontown#corporate clash#toontown cogs#toontown oc#ttcc#styx#hydra#nix#charon#kerberos#nox#YES SHE IS ALSO HERE!!!!#i think kerby is a bigger fella. an he likes pickin people up#hoistin em over his shoulders like a bag o dough#btw bc of the bent antennae on their ear styx is half-deaf#i think i bungled which ear it was but its supposed to be in their right ear. (no hearing in that ear at ALL)#theyre all from different depts to me. but also related. like. all originally were hired in to be in 'their' departments but that was just-#--so they could ensure they were all hired in GENERAL. you feel me?

22 notes

·

View notes

Text

Where are Factory Foreman, Director of Land Acquisition, Scapegoat, Clerk and Club President?

Unfortunately, Tumblr polls only allow me to fit 10 contestants! The 10 contestants were chosen based on how low the difference was between them & their winning opponent. Those 5 were the least close in their respective poll, so they are unlikely to really make a difference if they returned in the poll….that's how I see it anyways!

Also for clarity: The numbers ARE NOT a ranking. They're numbered to help with images. Idk it would help me so maybe it'll help someone out there XD The contestants are all ordered in alphabetical order to eliminate as much bias as possible!!! Good luck!

#toonblr#derrick hand#director of public affairs#director of public relations#head attorney#litigator#mint supervisor#public relations representative#redd 'heir' wing#sads the skelecog#satellite investors#toontown corporate clash#ttcc#toontag#cogblr#dana s. charme#desmond kerosene#nix#mundie mudsnapper#winston byrd#charon#hydra#styx#kerberos#tumblr polls#poll bracket#reblogs & sharing with friends are super appreciated for this poll cuz im not sure all the tags will work!!!!! praying#also if you saw the first post fail no you didnt#BATT00NY POLLS

36 notes

·

View notes

Text

#i love my bitches#doge#shib#to the moon#lol#best memes#dank memes#relatable memes#funny memes#tumblr memes#meme#dank#dankmemes#lol memes#memes#investor#investors#investing#investment#crypto#deadpool#cryptocommunity#cryptocurrency#elon musk

3 notes

·

View notes

Text

to be clear, i'm not entirely convinced the entire lore.fm thing was like idk intentionally/deliberately malicious - and i can understand/see the need for better TTS, and i certainly Feel it abt for e.g. the quality of TTS voices. but i think there's massive issues with how it's being rolled out, esp wrt to the lack of transparency (like the prev rb mentions, where are they getting the money to finance the whole project, since it's ad-free, if its not thru generative ai?) and the intensely dodgy "opt-out" option, rather than making it opt-in. crucially, i think, is the fact that they're not working along with ao3 to actually roll this out. the way fics would then be 'transferred' essentially to the app, without the original author being acknowledged (or maybe even consenting because it's opt-out??? like how many people on ao3 are actually going to know abt the existence of this app, let alone that they need to email to opt out???) or credited in any way like idk!!! but i can respect the original intentions (like i suppose i could be a cynic and claim intentional maliciousness but i don't really want to? like idk i get the feeling of protectiveness and defensiveness, but i think it's such a leap to go and claim a brown person's like idk crocodile tears-ing - i think there was a lot of immediate concern and the exact nature of the concern has maybe not been entirely articulated clearly to them???) and im glad they're going back to rework the idea, and i do hope that there's wider & important discussions around accessibility tools.

#idk it's been hard to engage with this because i think we DO need to talk abt accessibility tools. like why should ppl be stuck with#that robotic ass voice. and have you ever tried getting tts to read fandom specific terms or anything. its not great!!!#and there's just been a lot of v acidic vitriol over this. while i get the feeling of doubling down to protect yourself i think sometimes#not everything needs to be approached w a pitchfork. and sometimes ppl do deserve the benefit of the doubt.#they're clearly willing to listen and cancel the app even tho i think the precise issue with it has been unclearly communicated#idk! i saw some other things abt AI floating around related to the investors for the app but i haven't seen that much abt it#it feels like a conversation that should be happening though.

3 notes

·

View notes

Text

.

#saw some posts about how basically this website is dying for one reason or another#and like usually I’m like hell yeah stick it to the corporations!!!#but one thing a lot of people don’t realize is that the amount of measures it takes to run a business in tech#is really…a lot#and to have 0 marketing involved to generate revenue is even worse#social media is a free service for the sole reason that users are technically a ploy to advertise to#what users here basically did was demand that tumblr provide to us while also remain minimal in their advertising#which basically means they aren’t generating revenue conventionally#blazing posts and purchasing check marks were a temporary problem to a long term solution#if this website requested to be ran the same way AO3 and wiki does users would immediately attack staff#it’s a really shit situation but also tumblr shouldn’t have listened so much to their users#the net worth of tumblr isn’t worth much to investors given all this unless#i should also add that gated communities (like discord) has negatively impacted the amount of users on this site#less users means less interaction with content creators (dominantly artists)#less content creators means less content#u guys get the gist#I’d like to add to question every business related explanation on this website#y’all can complain to hell and back about tumblr but it was one of the lesser evils as far as ads went

5 notes

·

View notes

Text

hi (dropz thiz all on you like a 16 ton weight)

(leavez)

#toontown corporate clash#kerberoskuiper#satellite investors#dopr#director of public relations#dopr is NOT winstony :3

11 notes

·

View notes

Text

Global IPOs: Unveiling New Avenues of Investment Opportunities

0 notes

Text

havin some overall Thots about ted lasso, but may wait until the finale next week to fully get them out there. nothing that i haven't seen being said about this season, which is that the pacing is very odd, and i remember being surprised way back when it was announced that it was going to be three seasons and not four. i do not fully believe that it was intended to be three in the way the creators have said. feels more like something out of necessity, than the best way to tell the story, which, i wouldn't have anything against that if that was the case, i fucking love the sense8 final movie for existing, although i know/one can see that it had to tie some very fast knots and drop a bunch of potential storylines -- this final season feels similar. id prefer a rushed ending to no ending at all, if that's the way the tv-landscape looks (and these days it really does look like that as we know).

i can see how they've gotten to the conclusions of multiple of the storylines, but the methods used to get there have been uneven. but that is interesting, may wanna poke at it some more after the final episode. overall this has been a pleasant journey to go on though. i feel very warmly about these characters and the ethos of the show.

#im watching ted lasso#ted lasso#as a watching experience ive very much enjoyed it -- it's one ive watched partially with friends + i love football#so im not feeling an intense emotion about this im just... im seeing it#even as i enjoy specific scenes - everything jamie/keeley/roy related - nate and beard in the hallway#all the football boys together scenes#all the playing scenes#which are the things i come back to the show for#id say the one upset there is that i had hoped for more focus on nate -- but he definitely needed another season imo#he wasnt done baking yet and they rushed it#the other two things are 1. wish there had been more focus on sam overall#2. im not convinced with how theyve portrayed football culture in this last season -- gone a tad off the deep end into too lovey dovey#i know thats part of the fantasy this show is trying to present -- but i dont think it needs to *solve* football and billionaire investors#and toxic masculinity and everything else that is bad within the microcosm of said football#it can keep its reach smaller imo and be more impactful for it#fuck now i AM writing stuff but in the tags instead stop

7 notes

·

View notes

Text

Why Consistent Investor Updates Are Crucial for Building Credibility

To the extent that they provide valuable information to the stakeholders, investor relations are very important for a company’s performance and sustainability in the long run. In keeping the bond firm with the investors, it becomes very important to gain their trust. It’s quite effective to achieve this through the investors by offering frequent updates. Here are why these regular updates are important as it relates to the need to build and sustain credibility.

#investor relations consultant#investment advisory services#investor relations advisory firms#top investment advisor in India

0 notes