#IoT chip market

Text

IoT Chips and Artificial Intelligence in the Evolving Market Landscape. FMI Foresees the IoT Chip Market Capturing a Significant Market Share of US$ 7.69 billion by 2033

The IoT chip market is forecasted to garner revenue of US$ 7.69 billion in 2033, up from US$ 4.4 billion in 2023, advancing at a rate of 5.7% from 2023 to 2033.The demand for advanced and efficient IoT chips is skyrocketing with the increasing adoption of IoT devices and solutions across various sectors.

The proliferation of IoT devices, from smart home appliances and wearables to industrial sensors and autonomous vehicles, is a primary driver of the market’s expansion.The need for seamless connectivity and efficient data processing in these devices is fueling the demand for specialized IoT chips, facilitating market size expansion.

The integration of AI capabilities in IoT chips is unlocking new possibilities for intelligent decision-making and automation. AI-powered IoT chips can analyze and interpret data in real time, enabling predictive maintenance, advanced analytics, and autonomous operations.

To Get a Sample Copy of the Report Visit:

https://www.futuremarketinsights.com/reports/sample/rep-gb-14567

Despite the significant growth potential, the IoT chip market faces challenges such as interoperability issues, data privacy concerns, and the need for seamless integration with existing infrastructure. However, these challenges also present opportunities for innovation, collaboration, and partnerships among IoT chip manufacturers, device manufacturers, and software developers.

Edge computing, which brings data processing and analytics closer to the source of data generation, presents significant opportunities in the market for IoT chips.

By integrating edge computing capabilities into IoT chips, manufacturers can enable real-time data analysis, reduce latency, and enhance decision-making at the network’s edge. This opens up possibilities for intelligent IoT applications that require quick response times.

Companies that invest in developing IoT chips with enhanced edge computing capabilities can position themselves at the forefront of this transformative technology, catering to the evolving needs of IoT deployments.

Key Takeaways:

In 2022, North America held a value share of 32.5% in the IoT chip industry, with the United States alone accounting for 20.3%.

The European market accounted for a value share of 23.4% in 2022, with Germany contributing 10.4%.

In 2022, the sensors segment held a significant value share of 39.2% based on hardware.

The market value for IoT chips reached US$ 4.23 billion in 2022, with a CAGR of 3.6% from 2018 to 2022.

Based on end use, the manufacturing sub-segment was predicted to account for a 14.8% share in 2022.

The market for IoT chips in India is likely to secure a 6.5% CAGR from 2023 to 2033.

How Intense Is the Competition in IoT Chip Market?

The competition in the IoT chip industry is highly intense. The rapid growth and increasing demand for IoT devices have attracted numerous players, including established semiconductor manufacturers, technology giants, and start-ups.

The market is experiencing significant growth due to the proliferation of connected devices across various industries. This growth potential attracts existing players and new entrants, creating a crowded and highly competitive landscape.

Collaboration and strategic partnerships are common in the IoT chip industry as companies seek to leverage complementary expertise and resources. These alliances often aim to deliver comprehensive IoT solutions, combining hardware, software, and connectivity.

Competition arises not only between individual companies but also among alliances and consortia. The IoT chip industry is global, with players vying for market share in different regions. Competition is not limited to specific geographic locations but spans multiple continents, with companies targeting various markets to expand their customer base and revenue streams.

The market encompasses a wide range of industries, and this diversification leads to competition among companies specializing in different sectors, each striving to capture market share and establish dominance in their respective niches.

Click to Buy Your Exclusive Report Immediately! https://www.futuremarketinsights.com/checkout/14567

Key Segments

By Hardware:

Processors

Connectivity Integrated Circuits (ICs)

Sensors

Memory devices

Logic devices

By Power Consumption:

Less than 1 W

1-3 W

3-5 W

5-10 W

More than 10 W

By End-use Application:

Wearable Devices

Healthcare

Consumer Electronics

Automotive & Transportation

Building Automation

Manufacturing

Retail

BFSI

Oil & Gas

Agriculture

Aerospace & Defense

Key Region:

North America

Latin America

Asia Pacific

Europe

The Middle East and Africa

0 notes

Text

Genio 510: Redefining the Future of Smart Retail Experiences

Genio IoT Platform by MediaTek

Genio 510

Manufacturers of consumer, business, and industrial devices can benefit from MediaTek Genio IoT Platform’s innovation, quicker market access, and more than a decade of longevity. A range of IoT chipsets called MediaTek Genio IoT is designed to enable and lead the way for innovative gadgets. to cooperation and support from conception to design and production, MediaTek guarantees success. MediaTek can pivot, scale, and adjust to needs thanks to their global network of reliable distributors and business partners.

Genio 510 features

Excellent work

Broad range of third-party modules and power-efficient, high-performing IoT SoCs

AI-driven sophisticated multimedia AI accelerators and cores that improve peripheral intelligent autonomous capabilities

Interaction

Sub-6GHz 5G technologies and Wi-Fi protocols for consumer, business, and industrial use

Both powerful and energy-efficient

Adaptable, quick interfaces

Global 5G modem supported by carriers

Superior assistance

From idea to design to manufacture, MediaTek works with clients, sharing experience and offering thorough documentation, in-depth training, and reliable developer tools.

Safety

IoT SoC with high security and intelligent modules to create goods

Several applications on one common platform

Developing industry, commercial, and enterprise IoT applications on a single platform that works with all SoCs can save development costs and accelerate time to market.

MediaTek Genio 510

Smart retail, industrial, factory automation, and many more Internet of things applications are powered by MediaTek’s Genio 510.

Leading manufacturer of fabless semiconductors worldwide, MediaTek will be present at Embedded World 2024, which takes place in Nuremberg this week, along with a number of other firms. Their most recent IoT innovations are on display at the event, and They’ll be talking about how these MediaTek-powered products help a variety of market sectors.

They will be showcasing the recently released MediaTek Genio 510 SoC in one of their demos. The Genio 510 will offer high-efficiency solutions in AI performance, CPU and graphics, 4K display, rich input/output, and 5G and Wi-Fi 6 connection for popular IoT applications. With the Genio 510 and Genio 700 chips being pin-compatible, product developers may now better segment and diversify their designs for different markets without having to pay for a redesign.

Numerous applications, such as digital menus and table service displays, kiosks, smart home displays, point of sale (PoS) devices, and various advertising and public domain HMI applications, are best suited for the MediaTek Genio 510. Industrial HMI covers ruggedized tablets for smart agriculture, healthcare, EV charging infrastructure, factory automation, transportation, warehousing, and logistics. It also includes ruggedized tablets for commercial and industrial vehicles.

The fully integrated, extensive feature set of Genio 510 makes such diversity possible:

Support for two displays, such as an FHD and 4K display

Modern visual quality support for two cameras built on MediaTek’s tried-and-true technologies

For a wide range of computer vision applications, such as facial recognition, object/people identification, collision warning, driver monitoring, gesture and posture detection, and image segmentation, a powerful multi-core AI processor with a dedicated visual processing engine

Rich input/output for peripherals, such as network connectivity, manufacturing equipment, scanners, card readers, and sensors

4K encoding engine (camera recording) and 4K video decoding (multimedia playback for advertising)

Exceptionally power-efficient 6nm SoC

Ready for MediaTek NeuroPilot AI SDK and multitasking OS (time to market accelerated by familiar development environment)

Support for fanless design and industrial grade temperature operation (-40 to 105C)

10-year supply guarantee (one-stop shop supported by a top semiconductor manufacturer in the world)

To what extent does it surpass the alternatives?

The Genio 510 uses more than 50% less power and provides over 250% more CPU performance than the direct alternative!

The MediaTek Genio 510 is an effective IoT platform designed for Edge AI, interactive retail, smart homes, industrial, and commercial uses. It offers multitasking OS, sophisticated multimedia, extremely rapid edge processing, and more. intended for goods that work well with off-grid power systems and fanless enclosure designs.

EVK MediaTek Genio 510

The highly competent Genio 510 (MT8370) edge-AI IoT platform for smart homes, interactive retail, industrial, and commercial applications comes with an evaluation kit called the MediaTek Genio 510 EVK. It offers many multitasking operating systems, a variety of networking choices, very responsive edge processing, and sophisticated multimedia capabilities.

SoC: MediaTek Genio 510

This Edge AI platform, which was created utilising an incredibly efficient 6nm technology, combines an integrated APU (AI processor), DSP, Arm Mali-G57 MC2 GPU, and six cores (2×2.2 GHz Arm Cortex-A78& 4×2.0 GHz Arm Cortex-A55) into a single chip. Video recorded with attached cameras can be converted at up to Full HD resolution while using the least amount of space possible thanks to a HEVC encoding acceleration engine.

FAQS

What is the MediaTek Genio 510?

A chipset intended for a broad spectrum of Internet of Things (IoT) applications is the Genio 510.

What kind of IoT applications is the Genio 510 suited for?

Because of its adaptability, the Genio 510 may be utilised in a wide range of applications, including smart homes, healthcare, transportation, and agriculture, as well as industrial automation (rugged tablets, manufacturing machinery, and point-of-sale systems).

What are the benefits of using the Genio 510?

Rich input/output choices, powerful CPU and graphics processing, compatibility for 4K screens, high-efficiency AI performance, and networking capabilities like 5G and Wi-Fi 6 are all included with the Genio 510.

Read more on Govindhtech.com

#genio#genio510#MediaTek#govindhtech#IoT#AIAccelerator#WIFI#5gtechnologies#CPU#processors#mediatekprocessor#news#technews#technology#technologytrends#technologynews

2 notes

·

View notes

Text

Daily Semiconductor Industry Information By Lansheng Technology

1. At the VLSI Symposium 2023, which will be held next month, Intel will demonstrate the PowerVia technology verification chip.

2. On May 5th, Samsung Electronics is expected to surpass its main competitor TSMC in the field of chip foundry within 5 years.

3. According to media reports, Meta recruited a team from the British artificial intelligence chip company Graphcore. The team previously worked in Oslo, Norway, and was developing AI networking technology at Graphcore until late last year.

4. On May 5, 2023, semiconductor product companies Alpha and Omega Semiconductor once fell by 11.64% in intraday trading, and once touched $20.64. The stock price hit a new low since November 18, 2020.

5. Following in the footsteps of #Samsung, SK Hynix and Micron, the US chip giant Qualcomm’s latest quarterly revenue fell -16.9% year-on-year to US$9.275 billion, and its net profit fell sharply -41.9%. The three major business segments of mobile phones, automobiles and IoT All have declined to varying degrees, and its forecast data for the third fiscal quarter is also lower than market expectations.

Lansheng Technology Limited (https://www.lanshengic.com/) is a global distributor of electronic components that has been established for more than 10 years, headquartered in Shenzhen China, who mainly focuses on electronic spot stocks

6 notes

·

View notes

Text

CES 2023: MediaTek Shows Off Latest in Wi-Fi and IoT Tech

The new year has finally arrived, and we’re getting a load of awesome tech to go along with it. As such, MediaTek has announced several new technologies ahead of the Consumer Electronics Showcase (CES) 2023 in Las Vegas, and they bring some promising new advancements for Wi-Fi and smart home technology. Let’s take a look!

Genio 700 Platform

To kick things off, the company announced its latest addition to its Genio platform for IoT devices, which aims to bring improvements to smart home and smart retail tech, to name a couple. In particular, the series’ MediaTek Genio 700 is an octa-core chipset designed for just this purpose, featuring two ARM A78 cores running at 2.2GHz and six ARM A55 cores at 2.0GHz while providing 4.0 TOPs AI accelerator. It also comes with support for FHD60+4K60 display, as well as an ISP for better images. According to Richard Lu, Vice President of MediaTek IoT Business Unit:

“When we launched the Genio family of IoT products last year, we designed the platform with the scalability and development support that brands need, paving the way for opportunities to continue expanding. With a focus on industrial and smart home products, the Genio 700 is a perfect natural addition to the lineup to ensure we can provide the widest range of support possible to our customers.”

The Genio 700 SDK will allow designers to customize products using Yocto Linux, Ubuntu, and Android. With this support, customers can easily develop their own products with a minimal amount of effort, regardless of application type. Additionally, the chipset will have support for high-speed interfaces, including PCIe 2.0, USB 3.2 Gen1 and MIPI-CSI interface for cameras, Dual-Display support including FHD60+4K60 with AV1, VP9, H.265 and H.264 (video decode) support, industrial grade design and wide temp with 10 years longevity, ARM SystemReady certification for providing a standard and easy way to integrate the platform, as well as ARM PSA certification for increased security.

The Genio 700 will be commercially available in Q2 2023.

Wi-Fi 7 Ecosystem

MediaTek also unveiled its new Wi-Fi 7 ecosystem, making it one of the first adopters of the fastest Wi-Fi tech available right now. The company says that this new breakthrough is the result of investing into Wi-Fi 7 technology, aimed at improving always-on connected user experiences for use across smart devices, streaming products, residential gateways, and more.

As per Alan Hsu, MediaTek’s corporate vice president and general manager of the Intelligent Connectivity Business unit:

“Last year, we gave the world’s first Wi-Fi 7 technology demonstration, and we are honored to now show the significant progress we have made in building a more complete ecosystem of products. This lineup of devices, many of which are powered by the CES 2023 Innovation Award-winning Filogic 880 flagship chipset, illustrates our commitment to providing the best wireless connectivity.”

To put it simply, Wi-Fi 7 uses r320MHz channel bandwidth and 4096-QAM modulation to improve overall speeds and user experience. Multi-Link Operation (MLO) also enables Wi-Fi connections to aggregate channel speeds and greatly reduce link interruption in congested environments.

MediaTek’s Wi-Fi 7 solution uses a 6nm process, which reduces power consumption by 50%, a 25x reduction in CPU utilization, and 100x lower MLO switch latency. 4T5R and penta-band mesh are also included to address a larger area of coverage and higher number of linked devices.

The company also demoed several devices which use its latest Filogic chips, combining Wi-Fi 7 access point technology to broadband operators, retail router channels and enterprise markets. In particular, MediaTek’s Filogic 380 chipset is designed to bring Wi-Fi 7 connectivity to all client devices, including TVs, smart devices, and computers.

With that said, MediaTek’s push to innovate and integrate Wi-Fi 7 technology was met with much praise, particularly from its partners including AMD, Lenovo, ASUS, TP-Link, BUFFALO LINK, Korea Telecom, Hisense, Skyworks, Qorvo, Litepoint, and NI.

MediaTek x Federated Wireless

Additionally, MediaTek has also been working with Federated Wireless in successfully completing interoperability testing for Automated Frequency Coordination (AFC) on MediaTek Filogic Wi-Fi 7 and Wi-Fi 6E chips.

For those unfamiliar with the term, AFC systems allow for standard power operation for indoor and outdoor unlicensed devices, including 5G CPEs, fiber gateways, and ethernet gateways, to transmit over 850 MHz of spectrum in the 6 GHz frequency band. This improves range for Wi-Fi products, as well as faster connectivity speeds and improved capacity, which comes into play alongside the arrival of Wi-Fi 7 technology. According to Alan Hsu, MediaTek’s corporate vice president of Connectivity:

“Our leadership in Wi-Fi technology would not be complete without ensuring our customers have easy access to AFC solutions. We are very happy to partner with Federated Wireless and to have finished an extensive series of integration testing. Our Filogic Wi-Fi 7 and 6E chips, including the CES 2023 Innovation Award-winning Filogic 880, will soon support Standard Power operation in the 6GHz spectrum for companies producing Wi-Fi devices.”

The aforementioned AFC interoperability testing consisted of a set of positive and negative tests drawn from the Wi-Fi Alliance (WFA) AFC System certification specification. The positive tests included verifying the proper AFC calculation and response of spectrum availability at several locations, while the negative tests included verifying proper AFC System error handling. Kurt Schaubach, chief technology officer at Federated Wireless states:

“We are proud to partner with MediaTek to perform these critical interoperability tests to ensure that the commercial industry is ready for standard power device operations to begin. Federated Wireless prides itself on being a premier collaborator with our partners and customers interested in spectrum sharing solutions.”

The completion of these tests will allow customers to use Federated Wireless’ AFC system on MediaTek Filogic Wi-Fi 7 and 6E chips (upon full approval by the FCC).

Read the full article

3 notes

·

View notes

Text

Smart Glove Market - Forecast (2021 - 2026)

The Smart Glove Market size is analyzed to grow at a CAGR of 9.6% during the forecast 2021-2026 to reach $4.67 billion by 2026. Smart Glove is considered as a wide range of Sensor technology gloves for advanced and customized solutions, such as hand protection, high-tech rehab device and other assistive device services. The Smart Gloves are designed electronic devices with microcontrollers to offer avant-garde opportunities for various kinds of application suitable to the business requirements, including industrial grade gloves and medical grade gloves, and thus, contribute to the Smart Glove market growth. The rapid prominence of the Internet of Things (IoT), artificial intelligence and connected devices, along with the increasing innovations in wearable health devices, smart personal protective equipment, integrated with GPS, wireless communication features and in-built voice assistance have supported the Smart Glove Industry development successfully. In fact, the growth of the market is also observed due to the growing advancement of the Bluetooth chip, flex sensors, microcontroller, and accelerometer. Furthermore, the progression of microencapsulation and nanotechnology pave the way for sensor technology which offers lucrative growth possibilities. The influx of brands like Samsung, Apple, and Fossil are broadening the functionalities, which further promotes Smart Glove Market.

Smart Glove Market Report Coverage

The report: “Smart Glove Industry Outlook – Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Smart Glove Industry.

By Offerings: Software and Service

By Application: Fitness & Wellness, Specific Health Monitor, Infotainment, Ergonomic wearable and others

By Industry Verticals: Pharmaceuticals & Healthcare, Food & Beverages, Enterprise and Industrial, Consumer Electronics and others

By Geography: North America (U.S, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan, India, South Korea, Australia and Others), South America(Brazil, Argentina and others)and RoW (Middle east and Africa).

Request Sample

Key Takeaways

The growing demand of wearable medical devices owing to the increasing awareness on fitness and a healthy lifestyle along with prominence of connected devices in Healthcare, contribute to the growth.

Asia Pacific is estimated to hold the highest share of 40% in 2020, followed by North America, owing to the significant adoption of IoT, large scale implementation of a wide range of ubiquitous systems, such as wearable computing and sensor technology across the several business verticals.

The advancements in consumer electronics with a wide range of technical advantages, including touch sensitive features and miniature designs, resulted into the market growth.

Smart Glove Market Segment Analysis – By Industry Verticals

By Industry Verticals, the Smart Glove Market is segmented into Pharmaceuticals & Healthcare, Food & Beverages, Enterprise and Industrial, Consumer Electronics and others. The Enterprise and Industrial segment held the major share of 37% in 2020, owing to the propensity for cutting-edge products and significant investment to pursue radical evolutions in commercial applications. In order to address the growing requirement of several end users across automotive, oil & gas, manufacturing and logistics, customizable smart gloves with built-in scanners are introduced for more effective operations. In April 2019, the manufacturer of a smart, wearable technology, ProGlove, unveiled its MARK 2 to a U.S. audience ProMat in Chicago. The new MARK 2 enables the user to scan up to 5 feet away from a device and can connect to a corporate network via Bluetooth Low Energy (BLE), with up to 15-hour charge battery. ProGlove provides hands-free scanning solutions across a number of industries, and thus, in September 2020, Panasonic announced a partnership with ProGlove, to combine the mobile computing solutions of the two companies in order to offer rugged, innovative and user-friendly wireless barcode scanners. The strategic collaboration is also formulated to deliver seamless as-a-stand-alone scanning solution with an embedded Panasonic’s voice picking solutions for the warehouse operations, supply chain, and inventory checking. Therefore, the growing demand of integrated gesture sensor solutions for dynamic workstations, and a more efficient working environment accelerated the demand of Smart Glove Market.

Inquiry Before Buying

Smart Glove Market Segment Analysis – By Geography

Asia Pacific is estimated to hold the highest share of 40% in 2020, followed by North America in Smart Glove Market. The early adoption of IoT, large scale implementation of a wide range of ubiquitous systems, such as wearable computing and sensor technology across the several business verticals, along with the growing interest of consumers towards ‘sensorized’ fitness wearable devices are estimated to drive the market in these regions. Furthermore, numerous research investments propel the innovations of soft and stretchable electronics design that propel a competitive edge to smart wearable solutions. In January 2021, HaptX Inc. announced the release of HaptX Gloves DK2. The HaptX Gloves DK2 is an upgraded design and the world's most advanced haptic feedback gloves, which deliver unprecedented realism, with more than 130 points of tactile feedback per hand. These gloves have astoundingly real-life superpowers with VR, XR, and robotics technologies to meet the demand of various enterprises for quality requirements. Hence, the promising demand of industrial wearable and other smart personal protective equipment in these regions are estimated to drive the Smart Glove Market.

Smart Glove Market Drivers

Growing prominence of healthcare wearable

The growing demand of wearable medical devices owing to the increasing awareness on fitness and a healthy lifestyle along with prominence of connected devices in Healthcare, contribute to the growth of Smart Glove Market. Moreover, the rise of high-tech devices to usher clinical-grade wearable with 3G and 4G connection led to various viable solutions. In July 2020, UCLA bioengineers designed a glove-like device that can translate American Sign Language (ASL) into English speech in real time through a smartphone app. The entire system is integrated upon a pair of gloves with thin, stretchable sensors to translate hand gestures into spoken words. Hence, the sizable demand of personalized care, specific health issue monitoring devices and user-friendly, compact medical wearable propelled the growth of the Smart Glove Market.

Schedule a Call

Advancements in consumer electronics

The advancements in consumer electronics with a wide range of technical advantages, including touch sensitive features and miniature designs, resulted into the growth of Smart Glove Market. The advent of digitalization and latest development in sensor technology to enhance user performances is further driving the market. In April 2019, British music tech company Mi.Mu, founded by Grammy award-winning artist Imogen Heap announced the release of newly designed Mi.Mu gloves, allowing artists to map hand gestures to music software. The new gloves of Mi.Mu are durable with a removable battery system that offers artists complete control over their musical performances. Moreover, the breakthrough innovation in microfibre sensor technology offers strain sensing capabilities that provides gesture-based control. In August 2020, A team of researchers from the National University of Singapore (NUS), led by Professor Lim Chwee Teck, developed a smart glove, known as 'InfinityGloveTM', which enables users to mimic numerable in-game controls using simple hand gestures. Therefore, the launch of sophisticated wearable electronics products, extensive glove's capabilities and rising usage of convenient-to-use devices are some of the factors that are estimated to drive the Smart Glove Market.

Smart Glove Market Challenge

High price of Smart Glove solution

The market of Smart Glove is expanding due to the significant technologies development, using the amalgamation of sensing and feedback operation to denote smarter systems. Thus, the commercially available devices, pertaining to smart glove features are prominently expensive, which is a major constraint that demotivated the rapid adoption. Thus, factors such as less sensible investment and unobtainability of some of the latest smart gloves technology around some regions due to high cost are likely to restrict the Smart Glove Market.

Market Landscape

Partnerships and acquisitions along with product launches are the key strategies adopted by the players in the Smart Glove Market. The Smart Glove Market top 10 companies include Apple Inc, Flint Rehab, Haptx, Lab Brother Llc, Maze Exclusive, Neofect, Samsung Electronics Co Ltd, Seekas Technology Co., Ltd, Vandrico Solution Inc, ProGlove, Workaround Gmbh and among others

Buy Now

Acquisitions/Technology Launches/Partnerships

In December 2019, HaptX, the leading provider of realistic haptic technology announced the partnership with Advanced Input Systems along with a Series A financing round of $12 million. This acquisition provides a great opportunity for HaptX as they can finance the production of the next generation of HaptX Gloves, which represents the world’s most realistic gloves for virtual reality and robotics, coupled with product development, manufacturing, and go-to-market collaboration.

In November 2019, Ansell Limited, a leading provider of safety solutions, announced a partnership with ProGlove, a renowned industrial wearable manufacturer. The acquisition is formed to deliver advanced hand protection solutions to ensure the personal protective equipment (PPE) compliance in the workplace.

For more Electronics Market reports, please click here

#Smart Glove Market price#Smart Glove Market Forecast#Smart Glove Market Growth#Smart Glove Market Report#Smart Glove Market Research#Smart Glove Market Share#Smart Glove Market Size#Smart Glove Market Trend#Smart Glove Market Outlook

2 notes

·

View notes

Text

Machine Condition Monitoring Market Professional Survey and In-depth Analysis Research Report Forecast to 2030

Machine Condition Monitoring Industry Overview

The global machine condition monitoring market size was valued at USD 2.91 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030.

Need to provide advanced diagnostics and help determine a machine's health has underpinned market growth. Manufacturers have sought condition monitoring systems to optimize and monitor performance and maintenance of their equipment. Besides, the trend for lean manufacturing has prompted manufacturers to seek condition monitoring to bolster production efficiency, minimize downtime, and enhance spare parts supplies and cost prediction. Stakeholders have exhibited traction for condition monitoring for enhanced productivity, equipment longevity, elimination & reduction of downtime, minimizing scrap parts, and leveraging automation based on real-time machine condition data.

Gather more insights about the market drivers, restrains and growth of the Machine Condition Monitoring Market

For instance, in November 2022, Doble Engineering Company which offers asset health checks through their diagnostic test, services, and software for electric industry, released a new product, Calisto cable condition monitoring for medium and high voltage cable systems. The new Calisto cable offers secure and dependable cable operation, lowering the risk of failures, reducing total cost of ownership and solutions, and giving near crucial real-time data regarding cable health.

Machine condition monitoring measures equipment parameters to prevent breakdown and identify changes that could hint at developing faults. The technique has gained ground across oil & gas, automotive, power generation, metal & mining, marine, and aerospace. It is an invaluable part of predictive maintenance that has become trendier to boost asset life and cost savings, ensure operator safety, and streamline operations. Besides, prevalence of IoT has brought a paradigm shift to foster communication between devices. Adopting smart machines has led stakeholders to make informed decisions and boost diagnostic efficiency.

Global landscape grappled with headwinds, including semiconductor shortages and COVID-19 pandemic. Semiconductor shortages compelled factory closures and manufacturers to halt operations. Moreover, onset of COVID-19 outbreak led to reduction in hardware production and supply chain disruptions. With plants reopening post-COVID, soaring demand for electronic goods triggered a backlog for chips. However, surging need for remote supervision has provided promising growth opportunities for manufacturers and suppliers of machine condition monitoring.

The post-COVID period has witnessed Industrial Internet of Things (IIoT) trends and the prevalence of Industry 4.0, mainly due to demand for real-time monitoring of assets. Rising penetration of IIoT has enabled manufacturers to connect assets to actuators and smart sensors to enhance industrial and manufacturing processes. Real-time data collected from various IoT devices catalyze seamless supervision and control of plant operations. As stakeholders prioritize business agility, demand for IIoT will further expand across industry verticals. For instance, in September 2022, ABB, a technology leader in automation and electrification, partnered with Samotics, an asset health monitoring system provider, to enhance its condition monitoring services. They will utilize resources of each organization to provide information about health and energy efficiency of machines. ABB will incorporate a plug-and-play monitoring IIoT solution from Samotics into its digital offering as a first step.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

The global application integration market size was valued at USD 15.90 billion in 2023 and is projected to grow at a CAGR of 19.8% from 2024 to 2030.

The global sustainable manufacturing market size was estimated at USD 203.65 billion in 2023 and is expected to grow at a CAGR of 11.6% from 2024 to 2030.

Key Companies & Market Share Insights

Incumbent players and startups are poised to emphasize organic and inorganic strategies, including mergers & acquisitions, product offerings, technological advancements, innovations, and geographical expansion. Trend for predictive maintenance and growing footfall of IoT will serve as catalysts to expand their footprint across untapped areas. For instance, in February 2023, Seed Group partnered with Samotics, a provider of asset health monitoring, to introduce condition monitoring services to the Middle East. With Samotics' SAM4 technology utilizing electrical signature analysis (ESA) to monitor critical assets, the partnership aims to cater to a growing demand for advanced condition monitoring solutions in the region's thriving industrial sector. Besides, in April 2022, Emerson reportedly contemplated updating machinery health platform to leverage end-users to adopt a modern interface to address and identify a host of standard equipment failures before influencing plant availability. Meanwhile, in April 2022, SKF teamed up with Amazon Web Services to provide an easy-to-scale and easy-to-use condition monitoring and analysis solution. The company expects it will redefine industrial machine reliability and predictive maintenance. Some of the prominent players in the global machine condition monitoring market include:

ALS

Emerson Electric Co.

General Electric

Honeywell International Inc.

Megget PLC

NATIONAL INSTRUMENTS CORP

Parker Hannifin

Rockwell Automation, Inc.

SKF

Schaeffler AG

Order a free sample PDF of the Machine Condition Monitoring Market Intelligence Study, published by Grand View Research.

0 notes

Text

Semiconductor Market Growth Statistics and Key Players Insights (2024-2032)

The semiconductor industry forms the backbone of modern electronics, enabling the development of cutting-edge technologies across various sectors. Semiconductors are essential components in devices such as smartphones, computers, medical equipment, and automotive systems, driving advancements in computing power, energy efficiency, and miniaturization. As demand for faster processing, lower energy consumption, and innovative applications grows, the global semiconductor industry continues to experience rapid expansion, making it one of the most critical sectors in the global economy. This industry is positioned at the heart of the digital transformation, paving the way for future innovations in artificial intelligence, 5G, and the Internet of Things (IoT).

The Semiconductor Market Size was USD 573.42 billion in 2023 and is expected to reach USD 1641.9 billion by 2032, growing at a CAGR of 12.4% over the forecast period of 2024-2032.

Future Scope

The semiconductor industry is expected to continue its upward trajectory as technological innovations push the boundaries of computing power and efficiency. Emerging technologies such as quantum computing, advanced AI algorithms, and high-performance edge computing are driving demand for more powerful and efficient semiconductor solutions. Furthermore, the increasing integration of semiconductors into renewable energy systems, autonomous vehicles, and smart cities is set to further expand the industry’s potential. Governments and private sector investments in semiconductor manufacturing, research, and development are also accelerating advancements, fostering a new era of high-performance semiconductors tailored to future needs.

Trends

Key trends reshaping the semiconductor landscape include miniaturization, increased energy efficiency, and the evolution of chip architectures. The industry is moving towards smaller, more powerful chips capable of handling complex AI workloads, 5G networks, and advanced sensors for IoT devices. The growing need for energy-efficient technologies is driving innovations in semiconductor materials, such as gallium nitride (GaN) and silicon carbide (SiC), which offer superior performance in power electronics. Additionally, advances in semiconductor packaging techniques, such as 3D stacking and system-in-package (SiP) solutions, are enabling higher performance at reduced sizes and costs.

Applications

Semiconductors are integral to various applications across industries. In consumer electronics, they power smartphones, laptops, and wearable devices, while in automotive systems, they enable autonomous driving, advanced driver-assistance systems (ADAS), and electric vehicle technologies. In healthcare, semiconductors facilitate the development of medical devices and diagnostic equipment, improving patient care through real-time monitoring and precision treatment. Additionally, the industrial sector leverages semiconductors for automation, robotics, and energy-efficient systems, driving productivity and sustainability in manufacturing processes.

Solutions and Services

The semiconductor industry offers a range of solutions and services that cater to the diverse needs of multiple sectors. These include custom chip design, fabrication, and testing services, as well as software tools for optimizing chip performance. Advanced semiconductor manufacturing facilities are evolving to meet the demand for high-volume production of next-generation chips, focusing on precision, scalability, and cost-effectiveness. Industry players are also investing in developing AI-driven solutions that enhance the design and manufacturing processes, reducing time-to-market and increasing production yield.

Key Points

Semiconductors are fundamental to the electronics industry, driving innovations in multiple sectors.

Quantum computing, AI, and 5G are key drivers of semiconductor demand.

Miniaturization and energy efficiency are leading trends in semiconductor design.

Semiconductors are critical in applications ranging from consumer electronics to autonomous vehicles and healthcare.

Industry solutions include custom chip design, AI-driven manufacturing, and scalable production technologies.

Read More Details: https://www.snsinsider.com/reports/semiconductor-market-3959

Contact Us:

Akash Anand — Head of Business Development & Strategy

Email: [email protected]

Phone: +1–415–230–0044 (US) | +91–7798602273 (IND)

0 notes

Text

IoT Chip Market Surges Past US$ 4.4 Billion, Projected to Reach US$ 7.69 Billion by 2023

The global IoT chip market is on a trajectory to exceed US$ 4.4 billion by 2023 and is expected to exhibit remarkable growth at a CAGR of 5.7% through 2033, reaching a staggering US$ 7.69 billion. This surge can be attributed to the increasing prevalence of internet connectivity in technologically advanced nations and the emergence of cost-effective smart wireless sensor networks, both of which are poised to significantly bolster the IoT chip industry.

Integration of IoT devices in industrial units has created a huge opportunity for IoT semiconductor companies around the world. Advancement in the installation of IoT devices in vehicles is also predicted to increase the demand for IoT chipsets during the forecast time period.

To Get a Sample Copy of the Report Visit:

https://www.futuremarketinsights.com/reports/sample/rep-gb-14567

Key Takeaways

The global IoT chip market size is expected to expand moderately over the forecast period of 2022 to 2032, which is measured to be approximately US$ 295.6 Bn in terms of absolute dollar growth.

Among the different types of hardware used for building IoT chipboard, the logic device is the higher-performing segment with a CAGR of 5.4% over the forecast period.

On the basis of various end-use applications of narrowband IoT chips, the sales of IoT chips for building automation devices are the most popular segment in the present market. This segment is expected to observe significant growth during the forecasted years with a predicted CAGR of 5.2%

The regional IoT chip market of North America dominates the global market of the presence of top IoT semiconductor companies in the USA and Canada. The USA market is predicted to be worth US$ 256.7 Bn by the end of the year 2032, attributing to up to 35% of the total revenue contributed.

The emergence of a lot of IoT chip manufacturers in China, Japan and South Korea has positioned the geographic region of Asia Pacific as the second most attractive region for the global IoT chip market. These three top-performing countries of Asia Pacific together contribute nearly US$ 80 Bn out of total US$ 440 Bn revenue in 2022.

Drivers and Opportunities

The IoT chip market’s growth is further accelerated by the widespread implementation of IPv6, which provides a substantial increase in IP address space, facilitating seamless device connectivity in the Internet of Things (IoT) ecosystem. Additionally, the integration of cutting-edge technologies such as Artificial Intelligence (AI) is expected to fuel the adoption of IoT devices, consequently propelling the demand for IoT chips.

Competitive Landscape – Regional Trends

The competitive landscape of the IoT chip market is witnessing dynamic regional trends. Technologically advanced nations, particularly in North America, are leading in IoT chip adoption due to their robust infrastructure and early IoT integration. However, Asia-Pacific is emerging as a key growth region with a rapidly expanding IoT ecosystem and increasing investments in IoT infrastructure.

Restraints

Despite its promising growth, the IoT chip market faces certain limitations, including concerns over data security and privacy, which are critical in IoT applications. Addressing these challenges is imperative to ensure the sustainable growth of the market.

Request Methodology:

https://www.futuremarketinsights.com/request-report-methodology/rep-gb-14567

Region-wise Insights – Category-wise Insights

Within the IoT chip market, different regions are showing varied patterns of growth. North America and Europe are the frontrunners in terms of market share, driven by high-tech industries and IoT adoption in sectors like healthcare and automotive. In contrast, the Asia-Pacific region is experiencing exponential growth due to its vast consumer base and increasing industrial IoT applications.

In terms of categories, IoT chips catering to edge computing and low-power devices are witnessing robust demand, driven by applications in smart homes, wearables, and industrial automation.

Key Segments

By Hardware:

Processors

Connectivity Integrated Circuits (ICs)

Sensors

Memory devices

Logic devices

By Power Consumption:

Less than 1 W

1-3 W

3-5 W

5-10 W

More than 10 W

By End-use Application:

Wearable Devices

Healthcare

Consumer Electronics

Automotive & Transportation

Building Automation

Manufacturing

Retail

BFSI

Oil & Gas

Agriculture

Aerospace & Defense

Key Region:

North America

Latin America

Asia Pacific

Europe

The Middle East and Africa

0 notes

Text

Accelerometer Market is Anticipated to Witness High Growth Owing to Increasing Usage in Consumer Electronics

Accelerometers are sensors that monitor linear acceleration experienced by a device. They are critical components of inertial sensors used in navigation systems, motion gaming, virtual reality, and various other consumer electronics devices. Accelerometers help detect magnitude as well as the direction of the linear acceleration, as instruments move from a state of rest or uniform motion. The miniaturization of MEMS technology has enabled the development of small, lightweight, and affordable accelerometers with increased sensitivity. This has expanded the application scope of accelerometers across several industries.

The Accelerometer Market is estimated to be valued at US$ 3.16 Billion in 2024 and is expected to exhibit a CAGR of 6.7% over the forecast period 2024-2031.

Accelerometers find widespread adoption in various consumer electronics, automotive, industrial, healthcare, and other devices. They are integral parts of motion tracking and navigation systems in smartphones, wearables, and virtual/augmented reality headsets. The rising penetration of smartphone-based features and motion gaming is driving the demand for high-performance and low-power accelerometers. Furthermore, accelerometers help detect vibration, movement, tilt, and fall in various industrial equipment and machinery for predictive maintenance purposes. The growing industrial automation and emphasis on worker safety are fueling the adoption of accelerometers.

Key Takeaways

Key players operating in the accelerometer market are Analog Devices, Bosch Sensortec, Honeywell International, Murata Manufacturing, and STMicroelectronics N.V.

The rising demand for wearables, smartphones, drones, and virtual/augmented reality devices presents significant growth opportunities in the consumer electronics segment.

Advancements in MEMS technology, miniaturization techniques, and low-power circuit design are enabling the development of highly sensitive and portable next-generation inertial sensors.

Market Drivers

The surging penetration of smartphones and tablet PCs integrated with advanced motion tracking features such as motion gaming is a key factor driving the accelerometer market.

The incorporation of accelerometers in various industrial IoT applications for vibration monitoring, machine health tracking, and predictive maintenance is propelling the demand.

The growing demand for drone-based applications across industries is augmenting the need for precise motion sensing and navigation, thereby fueling the sales of accelerometers.

Current Challenges in Accelerometer Market

The accelerometer market is growing at a fast pace due to increasing demand from different application areas such as consumer electronics, automotive, healthcare, and industrial. However, there are few challenges being faced by the market players. One of the major challenges is price war among the competitors due to oversupply. The commodity type low-end accelerometers are having very low profit margins which is affecting the overall market. Another challenge is slow adoption rate of advanced MEMS accelerometers in developing regions. Cost sensitivity in applications like gaming consoles and wearable is also limiting the usage of high-performance sensors. Developing low-power and miniature sensors with same level of accuracy is one of the key focus areas for technology development in the market.

SWOT Analysis

Strength: MEMS based miniaturized accelerometer sensors offers higher sensitivity and accuracy. Wide application areas from consumer goods to industrial is boosting the overall demand.

Weakness: Commoditization of basic accelerometers is lowering the average selling price. Dependence on few chip manufacturers for raw materials supply.

Opportunity: Untapped growth potential in application segments like autonomous vehicles, drones, VR/AR devices. Emerging technologies like IoT and Industry 4.0 also providing new opportunities.

Threats: Threat from alternate motion sensing technologies like gyroscopes. Economic slowdowns impacting discretionary spending on consumer electronics.

Geographic Regions with Highest Market Share

North America region currently holds the largest share of over 30% in the global accelerometer market led by U.S. Presence of major players and higher adoption of mobile devices, drones, and VR applications are driving the North America market. Asia Pacific region is anticipated to grow at fastest CAGR during the forecast period due to growing demand from China, Japan, and South Korea for mobile phones, wearables, and automotive applications.

Fastest Growing Geographical Region

Asia Pacific region is projected to exhibit highest growth during the forecast period attributed to increasing consumption of consumer electronics from emerging economies like China and India. Rapid urbanization and rising disposable incomes are boosting the sales of smartphones, tablets, and wearables incorporated with motion sensing technologies. Growing emphasis on vehicle safety and autonomous driving functions is also propelling the automotive accelerometer demand from countries like China, Japan, South Korea.

Get more insights on this topic: https://www.newsanalyticspro.com/accelerometer-market-is-estimated-to-witness-high-growth-owing-to-rising-adoption-in-consumer-electronics/

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

What Are The Key Data Covered In This Accelerometer Market Report?

:- Market CAGR throughout the predicted period

:- Comprehensive information on the aspects that will drive the Accelerometer growth between 2024 and 2031.

:- Accurate calculation of the size of the Accelerometer and its contribution to the market, with emphasis on the parent market

:- Realistic forecasts of future trends and changes in consumer behaviour

:- Accelerometer Industry Growth in North America, APAC, Europe, South America, the Middle East, and Africa

:- A complete examination of the market's competitive landscape, as well as extensive information on vendors

:- Detailed examination of the factors that will impede the expansion of Accelerometer vendors

FAQ’s

Q.1 What are the main factors influencing the Accelerometer?

Q.2 Which companies are the major sources in this industry?

Q.3 What are the market’s opportunities, risks, and general structure?

Q.4 Which of the top Accelerometer companies compare in terms of sales, revenue, and prices?

Q.5 Which businesses serve as the Accelerometer distributors, traders, and dealers?

Q.6 How are market types and applications and deals, revenue, and value explored?

Q.7 What does a business area’s assessment of agreements, income, and value implicate?

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it

#Accelerometer Market Trend#Accelerometer Market Size#Accelerometer Market Information#Accelerometer Market Analysis#Accelerometer Market Demand

1 note

·

View note

Text

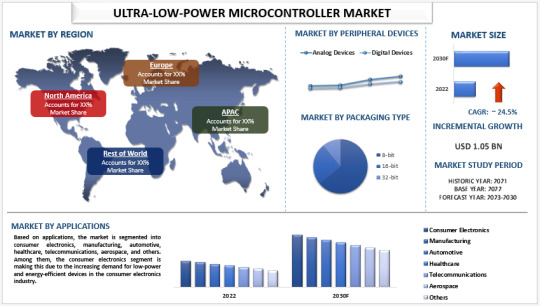

Ultra-Low-Power Microcontroller Market Size, Share, Growth & Forecast

According to a new report by Univdatos Market Insights, The Ultra-Low-Power Microcontroller Market was valued at 1.05 billion in 2022 and is expected to grow at a steady rate of around 24.5% in the forecasted period (2023-2030) owing to the rising penetration of IoT devices. An Ultra-Low-Power Microcontroller is a type of microcontroller that is designed to operate with minimal power consumption. These microcontrollers are typically used in battery-powered devices that require long battery life, such as wearable devices, Internet of Things (IoT) sensors, and medical devices. The increasing demand for wearable devices and smart homes has led to a rising demand for Ultra-Low-Power Microcontrollers.

The rising demand for medical devices and energy-efficient devices has had a significant impact on the ultra-low-power microcontroller (ULMPC) market size. The increasing need for portable and wearable medical devices, such as glucose meters, heart rate monitors, and blood pressure monitors, has driven the demand for ULMPCs that can operate for extended periods of time on a single battery charge. In addition, the growing trend towards energy-efficient buildings and homes has also led to an increase in demand for ULMPCs in building automation and energy management systems. These systems require microcontrollers that can control lighting, heating, and cooling systems in an energy-efficient manner, which is where ULMPCs come in. Moreover, IoT (Internet of Things) devices are becoming more and more common in our daily lives. These devices are often small and low-power, which makes them well-suited for use in IoT applications. To power these devices, many manufacturers are turning to ultra-low-power microcontrollers (ULMPCs). These chips are designed to use very little power, which allows them to run for long periods of time on a small battery or other power source. This is especially important in IoT applications, where devices may be scattered over a large area and may not always be connected to a power source. As the number of IoT devices continues to grow, the demand for ULMPCs is also likely to increase.

Access Sample PDF Here- https://univdatos.com/get-a-free-sample-form-php/?product_id=47387Some of the recent developments are:

In Oct 2021, Renesas Electronics Corporation revealed the establishment of a new division within its 32-bit RA Family of microcontrollers (MCUs).

In Feb 2021, STMicroelectronics recently introduced a new line of microcontrollers, the STM32U5* series, which are ultra-low-power devices that offer advanced performance and enhanced cybersecurity features.

Conclusion

The ultra-low-power microcontroller (ULMPC) market is expected to grow significantly in the coming years due to the increasing demand for energy-efficient and portable devices. The market is driven by the need for low-power devices that can operate for extended periods of time on a single battery charge, which is particularly important for IoT devices and medical devices. The development of advanced ULMPCs with increased processing power and more features is also contributing to the growth of the market. Furthermore, the rising demand for energy-efficient buildings and homes has also increased the demand for ULMPCs in building automation and energy management systems.

Contact Us:

UnivDatos Market Insights

Email - [email protected]

Contact Number - +1 9782263411

Website -www.univdatos.com

0 notes

Text

Silicon Wafer Market to Surge at a Robust Pace in Terms of Revenue Over 2032

Allied Market Research, titled, “Silicon Wafer Market By Type, Wafer Size and Application: Global Opportunity Analysis and Industry Forecast, 2023-2032", the silicon wafer market was valued at $15.4 billion in 2022, and is estimated to reach $25.9 billion by 2032, growing at a CAGR of 5.4% from 2023 to 2032.

Silicon wafer is a material used for producing semiconductors, which can be found in all types of electronic devices that improve the lives of people. Silicon which is used in Silicon Substrate comes second as the most common element in the universe; it is mostly used as a semiconductor in the technology and electronic sector. This super-flat disk is refined to a mirror-like surface. Besides, it is also made of subtle surface irregularities which make it the flattest object worldwide. It is also extremely clean, free of impurities and microparticles, qualities that are essential in making it the perfect substrate material for modern semiconductors. Silicon wafer can be used in producing chips and microchips in electronic gadgets. Due to the uniqueness of the electrical currents via silicon wafers, these semiconductors are used in creating ICs (integrated circuits). The ICs act as commands for specific actions in various electronic devices. The silicon wafer market share is the main element in integrated circuits. Simply put, integrated circuits are a composite of a variety of electronic elements that are brought together to perform a particular function.

The semiconductor industry in silicon wafer industry has been a significant driver behind critical innovations in significant sectors like electronics, automobiles, and automation, with semiconductor technology emerging as the building block of all modern technologies. The advancements and innovations in this field are immediately impacting all downstream technologies. Foundries are increasingly investing in new advanced packaging techniques, especially silicon substrate based. Foundry vendors are researching improving transistor density with techniques like utilizing two-dimensional materials instead of silicon as the channel to develop Monolithic 3D Integrated Circuits. For instance, TSMC's chip on wafer on Substrate technology developed the world's largest silicon interposer that features room for two massive processors combined with 8 HBM memory devices in a package.

Meanwhile, the silicon wafer market demand is hindered by susceptibility to changes in delivery chain dynamics and fluctuations within the charges of raw uncooked materials. The creation of si wafer is predicated on obtaining high-purity silicon, and any disruptions inside the delivery chain, which includes shortages or geopolitical tensions affecting the accessibility of raw uncooked materials, can impact manufacturing costs and result in charge fluctuations. Moreover, the complicated production processes concerned with wafer production make it conscious of technological advancements, developing challenges for producers to hold competitiveness and adapt unexpectedly. These elements contribute to market unpredictability, influencing the growth and profitability of the SI Wafer enterprise.

However, a great possibility in the SI Wafer market arises from the increasing demand for superior semiconductor technology in numerous sectors. The rise of technologies which include 5G, synthetic intelligence, and the Internet of Things (IoT) is riding the demand for more sophisticated and compact electronic gadgets. This developing demand for high-performance and electricity-green semiconductor components is propelling the growth of the silicon wafer market size. In addition, the exploration of novel applications in electric vehicles, renewable strength, and clever devices complements the marketplace's capability. With ongoing technological progress, the silicon wafer enterprise is suitably located to enjoy the evolving panorama of electronic advancements.

The silicon wafer market segmentation is done on the basis of wafer size, type, end user, and region. By wafer size, the market is segmented into 1 to 100mm, 100 to 300mm and above 300mm. By type, the market is divided into P type and N type. As per end user, the market is segmented into consumer electronics, automotive, industrial, telecommunication and others.

By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina and rest of Latin America), and Middle East and Africa (UAE, Saudi Arabia, South Africa and rest of MEA).

KEY FINDINGS OF THE STUDY

The silicon wafer market growth projections is expected to be significantly in the coming years, driven by the increase in demand for secure communication.

The market is expected to be driven by innovations in significant sectors like electronics, automobiles, and automation.

The market is highly competitive, with several major players competing for market share. The competition is expected to intensify in the coming years as new players enter the market. The Asia-Pacific region is expected to be a major market for silicon wafer market due to increased investments in consumer electronics and automotive industries in the region.

Competitive analysis and profiles of the major silicon wafer market analysis, such as Shin-Etsu Handotai, Siltronic AG, SUMCO CORPORATION, SK Inc., Globalwafers Co. Ltd, GRINM Semiconductor Materials Co., Ltd., Okmetic, Wafer Works Corp., Addison Engineering, Inc., Silicon Materials, Inc. are provided in this report. Market players have adopted various strategies such as investment, agreement, and expansion, to expand their foothold in the silicon wafer market.

0 notes

Text

Nvidia’s 10% Plunge Triggers Tech Selloff: Worst Chip Stock Day Since 2020

unexpected 10% stock drop sent shockwaves through the tech industry, leading to the worst day for chip stocks since March 2020. This plunge was driven by concerns over market saturation, regulatory challenges, valuation concerns, and increasing competition in the AI chip space.

The ripple effect impacted major players like AMD, Intel, and Qualcomm, as well as semiconductor ETFs and related industries. While reminiscent of the March 2020 crash, this event was more sector-specific.

Despite short-term volatility, the long-term outlook for the semiconductor industry remains positive, fueled by AI, 5G, and IoT trends. Investors are advised to focus on fundamentals, diversify their portfolios, and maintain a long-term perspective.

Key areas to watch include AI advancements, automotive sector growth, data center expansion, and edge computing evolution. While the current turbulence is significant, it's important to remember that the semiconductor industry continues to be a cornerstone of technological progress.

Read more

#nvidia stock#ChipStockCrash#TechInvesting#SemiconductorIndustry#MarketVolatility#market volatility#ai chips#investment strategy#stock market analysis#TechSectorTrends#GPUMarket

0 notes

Text

0 notes