#JLL//50s

Text

Jerry Lee Lewis, c. July 1959. From JLL.org

Elvis Presley, Knickerbocker Hotel, Hollywood, August 18, 1956. From ElvisPresleyMusic.com.

[ 12 Days of Christmas 💕 5/12 ]

At the start of my research, I found all sorts of stories, I wasn’t sure were even true. Like, Elvis and Jerry Lee riding around on motorcycles, with no clothes on the streets of Memphis, in the middle of the night? No way – but as time passed, the story got brought up to him three times (from what I know). He had a consistent reaction, that has led me to believe it happened.

Though, the stories are subjective, so you can draw your own conclusion!

The first reference of the story:

“In a crowded basement meeting room at the posh Omni-Memphis Hotel, 20-some journalists are attempting, with difficulty, to grill the subject of the forthcoming film “Great Balls of Fire”

The discussion, which never quite seems to interconnect, has degenerated to a foreign-sounding report’s question about whether the film’s subject, Jerry Lee Lewis – rock music’s archetypal bad boy – ever motorbiked naked with Elvis Presley, his fellow Memphian an ultra-rival.

“Motorbike?” Lewis says, archly, dismissively.

“Nekkid? Me and Elvis Presley?” His eyes suddenly narrow, “how’d you know that?”

“It’s in Joe Smith’s book,” says a reporter.

“You can’t believe nothin’…” Lewis mutters, his voice trailing off. “Well, that was 3 o’clock in the morning,” he suddenly adds, prompting explosive laughter from the journalists. “It really was,” he goes on with a grain.

“There was nobody out then—except this one policeman on a horse, and he was doing his dead-level best to catch us. Now, that was a sight. If anybody woulda saw that, we never woulda sold no more records. That woulda been the end of that.” Pause, his eyes narrowing again. “How’d you know that?”

“It’s in Joe Smith’s book,” the reporter repeats.

“Who’s Joe Smith?”

“The head of Capitol Records. Used to be head of Elektra Records.”

“Well, that’s ridiculous. That’s not right. Do you believe that?”

“You just told us it happened at 3 o’clock in the morning,” the reported notes.

“I can’t believe people will believe anything you say.”

“Well, is it true?” Another reporter asks.

“Yes. It’s true.”

Welcome, folks to talking with the Killer, a 54-year-old rock king dethroned before his time – in fact, before his prime – by the 1958 disclosure of a mad marriage to his 13-year-old second cousin.

The scandal caused Lewis, a Bible college dropout, to fall from rock ‘n’ roll grace into comparative oblivion – made all the more bruising by the fact that he was arguably the most intense performer, and most brilliant self-taught pianist, to ever rattle music stages around the world.”

From “THE KILLER BLOWS SMOKE FOR ‘FIRE’” by Jack Hurst and Country music. Chicago Tribune, June 24, 1989.

The second reference is from the book the reporter mentioned, actually, it’s called “Buddy Holly: Biography” by Ellis Amburn. In it, Ellis wrote that record executive Joe Smith and Jerry Lee spoke on the plane, during Buddy Holly, along with Paul Anka’s tour to Australia. They’d been drinking when Jerry Lee “confessed,” which is the word Ellis used. That yes, indeed, he and Elvis went on a naked motorcycle ride at 2:30 AM in Memphis, in a young Jerry Lee’s own words; “only for thirty-five or forty seconds, ‘round the corner and back.”

The third reference was from “Jerry Lee Lewis: His Own Story” by Rick Bragg. When asked the same question, instead of brushing it off or saying it wasn’t true. Jerry Lee laughed and said he can’t say anything about that because “Elvis isn’t here to defend himself.”

So, while Jerry Lee was right that you can’t believe everything anyone says, that doesn’t mean there aren’t patterns. Maybe, he thought it was funny to lie. Maybe, it happened and so what? It’s just two bros cruising down the street at night, naked on motorbikes, 5 feet apart – ‘cause they’re not gay. 😋

Other important lessons are if you do happen to go motorbiking naked with your supposed arch nemesis, don’t get caught, and don’t tell anyone about it!

#Jerry Lee Lewis#He saw Elvis nekkid#Elvis Presley#He didn't know how to act#only around the corner#only#It's like he tryna convince himself#Sun//JLL#Sun//EP#Sun//Together#Story Time#//MyPosts#//Edits#JLL//50s#EP//50s

31 notes

·

View notes

Text

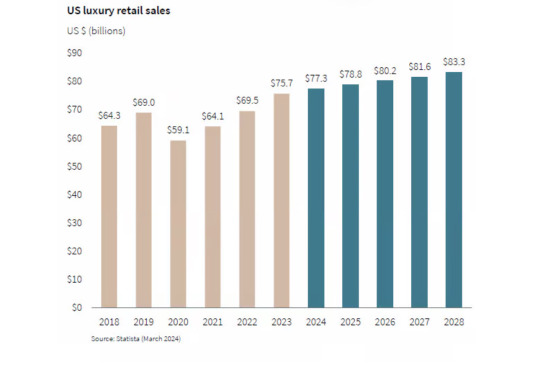

Luxury Retail Booms Across the U.S. with $75B in Sales

The luxury retail market in the U.S. has reached an impressive milestone, hitting $75 billion in 2023. This growth, driven by post-pandemic recovery, is noteworthy despite inflation cooling demand.

In-Store Shopping Resurgence

After two years of robust post-pandemic growth, luxury retail achieved an 8.6% annual growth rate from 2020 to 2023. The U.S. and Europe led the global luxury market, each accounting for 28% of sales. However, the U.S. market share dipped by 4% in 2023 due to inflationary pressures.

Brick-and-Mortar Dominance

Nearly 50% of new luxury stores opened last year were located in malls, contributing to Class A malls having the lowest vacancy rate at just 5.8%. According to Leap’s Amish Tolia, brands prefer physical stores, especially in high-end locations like Madison Avenue in NYC and Rodeo Drive in Beverly Hills. E-commerce, while convenient, has proven less profitable due to complex customer returns.

Expanding to New Markets

While prime urban areas remain popular, luxury retailers are increasingly expanding into secondary markets like Texas and North Carolina to reduce operational costs. Matthew Krell from Alvarez & Marsal emphasizes that profitability, not just sales volume, is driving this push into more affordable locations.

Looking ahead, luxury retail growth is expected to slow amid economic uncertainty. However, JLL projects the sector will still surpass $82 billion in sales by 2028. The in-store experience and strategic expansion into both top-tier and emerging markets will sustain momentum, even as growth normalizes at a 1.9% annual rate.

Stay tuned for more insights on the evolving luxury retail landscape! #LuxuryRetail #EconomicTrends #RetailExpansion #MarketInsights

#commercial and industrial sectors#commercial real estate#retail#shopping#brands#real estate#investment#danielkaufmanrealestate#economy#real estate investing

0 notes

Link

#DESENVOLVIMENTOSUSTENTÁVEL#EFICIÊNCIAENERGÉTICA#GESTÃODEENERGIAS#OPINIÃODEESPECIALISTA#TECNOLOGIAEINOVAÇÃO

0 notes

Text

Premium Launches Drive Residential Sales

With a significant rise in the supply of high-value projects in the past few quarters, residential real estate has got a major boost with a noticeable growth in housing sales.

The number of residential units launched in the first half of 2024 reached a record high of 159,455, according to JLL. This translates to approximately 55 percent of the total units launched throughout the entire year of 2023. The supply of new residential projects has shown consistent growth this year.During the first half of 2024, majority of the new residential projects launched were in the upper-mid segments (INR 1-3 crore). However, there has been a significant growth in the share of premium and luxury segments compared to the same period in 2023. Developers have adapted their product launches and marketing strategies to meet changing buyer preferences, especially after the pandemic. As a result, there has been a noticeable increase in the supply of high-value projects in the past few quarters. In H1 2024, premium projects accounted for approximately 12 percent of new launches, while luxury projects accounted for around 6 percent.

During Q2 2024 (April-June 2024), Bengaluru, Mumbai and Delhi NCR emerged as the top cities in terms of new project launches, accounting for around 60 per cent share. Interestingly, among the three metro cities, Delhi NCR stood out with a significant 64 per cent share in Q2 high-end launches (homes priced INR 3 crore and above) as several prominent developers focused on launching luxury projects in Delhi NCR, particularly in Gurugram.

Source: Real Estate Intelligence Service (REIS), JLL Research

The current year has witnessed an impressive increase in both launches and sales momentum, with approximately 54-57 percent of last year’s total volume already achieved in just half a year. The consistent growth can be attributed to the successful launch of strategically tailored products by developers who have carefully assessed market demand and dynamics. Interesting to note, sales momentum has successfully complemented the new launches with around 30% of the H1 2024 sales (154,921 units) being contributed by projects that got launched during the last six months. Listed and reputed developers, consistently bringing in a substantial supply over the past few years have played a key role in this growing trend”, says Dr. Samantak Das , Chief Economist and Head of Research and REIS, India, JLL.

Premium segment residential market surges with a remarkable 169% Y-O-Y increase in H1 2024

Source: Real Estate Intelligence Service (REIS), JLL Research

“There has been a notable surge in launches within the premium segment (priced between INR 3-5 crore) and luxury segment (priced above INR 5 crore) compared to other segments. In H1 2024, launches in the premium segment surged by 169 percent Y-o-Y, followed by a 116 percent Y-o-Y increase in luxury segment launches. On the contrary, the mid segment projects (priced between INR 50 lakh -1 crore) experienced a 14 percent Y-o-Y decline during the same period. This speaks about developers’ active response to the surge in demand for high value homes among the target clientele” says Siva Krishan, Senior Managing Director (Chennai & Coimbatore), Head- Residential Services , India JLL.

Residential Prices on the Upsurge

Q2 2024 continued to witness residential price growth in the top seven cities (Delhi NCR, Mumbai, Chennai, Hyderabad, Bengaluru, Pune, Kolkata) of India, with Y-O-Y price increase ranging from 5 percent to 20 percent. The highest price increase was observed in Delhi -NCR, with a significant jump of approximately 20 percent , while Bengaluru followed closely with around 15 percent increase.

While Bengaluru has been witnessing around 15 percent growth Y-o-Y over the last few quarters, around 28 percent of its Q2 2024 new launches being sold out during the same quarter has acted as a driver for Y-o-Y price growth during the quarter. Furthermore, capital value increase at Whitefield and North Bangalore locations have acted as a catalyst. Availability of under-construction inventory in these cities getting restricted, is resulting in subsequent surge in prices. In response to the high demand for newly launched projects, developers are as well launching new phases of existing projects at elevated price levels, resulting in overall property price growth.

Residential sales momentum continued to be on a high growth curve in the first half of 2024 driven by strong supply from reputed developers, favourable economic conditions, and positive buyer sentiments. The period recorded highest ever half yearly sales, with a remarkable 22% increase compared to the same period in 2023, totalling 154,921 units. This upward trajectory in demand paves the way for sustained growth in the residential market. Most of the cities witnessed robust y-o-y growth in sales volume with the markets of Bengaluru, Mumbai, Pune, and NCR accounting for around 80% share in half-yearly sales.

In line with the trend observed in launches, in the first half of 2024, the sales of premium category projects (priced between INR 3-5 crore) saw a remarkable y-o-y growth of around 160 percent . Similarly, the luxury segment (priced above INR 5 crore) also experienced a significant sales increase of 60 per cent compared to the same period in the previous year.

Source: Real Estate Intelligence Service (REIS), JLL Research

As of Q2 2024, unsold inventory across the seven cities increased marginally on a Y-o-Y basis as launches outpaced sales. However, it is interesting to note that months to sell has declined Y-o-Y from 30 months in Q2 2023 to 24 months in Q2 2024.

Looking Ahead

The outlook for residential sales in 2024 remains positive, with an expected range of 315000 to 320000 units. This projection is based on the sustained growth momentum in the market. Additionally, supply is expected to match the demand as established developers are acquiring land in prime locations and growth corridors to launch their projects in the near to medium term. Some developers are also considering expanding their portfolio and entering new markets to increase their presence nationwide.

0 notes

Text

In Top Seven Cities in Q1 FY25, Supply of Affordable Housing Drops by 21%.

According to JLL India, the number of newly constructed affordable apartments (those priced under Rs 50 lakh) fell by 21% in seven major cities between April and June as more luxury flats are being offered by builders. Data on the housing markets of the top seven cities was issued by real estate consultancy JLL India on Friday. It revealed a 5% rise in the number of newly constructed apartments, from 151,207 units in the same time last year to 1,59,455 units from April to June of 2024.

Only apartments are included in the data. Plotted projects, rowhouses, and villas have not been included in the report.

Affordable flat supply in the June quarter accounted for 13,277 units of the total new supply, a decrease of 21% from 16,728 units in the same period the previous year.

The number of flats launched, which ranged in price from Rs 50 lakh to Rs 1 crore, decreased by 14% to 47,930 units from 55,701 units.

Within the price range of Rs 1-3 crore, there was a 3% increase in new supply, reaching 69,312 units from 67,119 units.

The number of flats launched, with prices ranging from Rs 3-5 crore apiece, more than doubled to 19,202 from 7,149 units.

In a comparable way, the new supply more than doubled to 9,734 units from 4,510 units in the category above Rs 5 crore.

Speaking about the pattern of an increase in the supply of high-end homes and a reduction in the supply of affordable homes, Siva Krishnan, Senior Managing Director (Chennai and Coimbatore), Head-Residential Services, India, JLL, noted that this indicates the active response of developers to the spike in demand for high-end homes among the target market.

According to the consultant, demand drove up flat sales in seven big cities, where they increased 22% from 126,587 units sold in April to June of 2024 to 154,921 units.

Delhi-NCR, Mumbai Metropolitan Region (MMR), Kolkata, Chennai, Bengaluru, Hyderabad, Pune, and Bengaluru are these seven cities.

#construction management#construction software#crm software#builders#construction#erp#consultant#developers#development#erp software

0 notes

Text

1 note

·

View note

Photo

LOAN IMAGE: Brian Gaswirth & Robert Suris DATE: 03/14/2024 ADDRESS: 1005 Spring Garden Road MARKET: Miami ASSET TYPE: Multifamily ~ UNITS: 240 LENDER: Ares Management Real Estate LANDLORD: Robert Suris - The Estate Companies (@TheEstateCompanies); FHCP BROKER: Brian Gaswirth (@BGassy) - JLL (@JLL) LOAN AMOUNT: $50,000,000 LOAN TYPE: Refinance NOTE: The Estate Companies and FHCP secured a $50 million refinancing for Soleste Spring Gardens, a luxury rental community in Miami's Spring Garden district, with financing arranged by a JLL team led by Brian Gaswirth. The property offers upscale units and amenities, strategically located within the Miami Health District alongside major medical institutions. #Miami #RealEstate #tradedmia #MIA #TradedPartner #Multifamily #RobertSuris #TheEstateCompanies #FHCP #AresCommercialRealEstateManagement #BrianGaswirth #JLL

#Miami#RealEstate#tradedmia#MIA#TradedPartner#Multifamily#RobertSuris#TheEstateCompanies#FHCP#AresCommercialRealEstateManagement#BrianGaswirth#JLL

0 notes

Text

[ad_1]

Pagewood has teamed up with CenterSquare Funding Administration to amass 9 industrial properties in Houston.

Houston-based Pagewood’s first institutional three way partnership, with Philadelphia-based CenterSquare, acquired the Gateway Industrial Commons, a portfolio of commercial property totaling 46 buildings located off Beltway 8, inside the metro’s Northwest hall, town’s rising inhabitants middle.

Native agency HRES Group was the vendor. Financing was secured from Minnesota-based business actual property investor Northmarq. The acquisition worth wasn’t disclosed.

The portfolio, totaling 621,400 sq. ft and unfold over greater than 34 acres, consists of two nine-building complexes, at 1500 Brittmoore Street and 6100 Brittmoore Street, that are the 2 largest properties within the portfolio. The opposite properties included within the acquisition are:

1656 Townhurst Drive

1330 Sherwood Forest

1411 Upland Drive

1771 Upland Drive

6989 West Little York Street

4125 Hollister Avenue

4041 Hollister Avenue

Companions Actual Property was tapped to lease the portfolio, branded as Gateway Industrial Commons.

The three way partnership plans renovations, together with mechanical gear enhancements, facade renovations and panorama enhancements, based on a information launch.

Industrial growth has slowed in Houston, as rising building prices have constricted the market.

Building begins declined final yr, plummeting over 50 p.c, based on JLL. Nonetheless, leasing exercise surged to its third-highest annual tally on report, with roughly 35 million sq. ft of leases in 2023. Though emptiness noticed a slight uptick within the fourth quarter, reaching practically 8 p.c, analysts anticipate a forthcoming stabilization, with a subsequent decline projected by midyear.

Notable leases within the fourth quarter embody Western Submit’s 317,000 sq. ft at 14402 Fallbrook Drive Weiser Enterprise Park, developed by Trammell Crow Firm.

Emptiness charges in Houston’s northwest submarket declined through the fourth quarter, logging greater than one-third of the metro’s leases, representing 34 p.c of the metro’s new leases. The submarket’s progress is because of its expansive accessible land and prepared entry to San Antonio and Austin.

[ad_2]

Supply hyperlink

0 notes

Text

Oasis Security leaves stealth with $40M to lock down the wild west of non-human identity management

When people hear the term “identity management” in an enterprise context, they typically think of apps that help users authenticate who they are on a network in order to access certain services. In a security context, however, human users are just the tip of the iceberg when it comes to managing access and making sure it doesn’t get breached.

A whole, considerably more complex, universe of machine-based authentications underpin how just about everything IT works with everything else — a universe that is arguably considerably even more vulnerable to hacking simply because of that size and complexity, with some 50 “non-human” identities for every human typically in an organization, and sometimes more. Today, a startup out of Israel called Oasis Security is emerging from stealth with technology that it has built to address this.

.adtnl6r-container { display: flex; flex-direction: column; align-items: center; width: 80%; max-width: 600px; margin: 20px auto; background-color: #FF3300; border: 1px solid #ddd; border-radius: 10px; overflow: hidden; box-shadow: 0 0 10px rgba(0, 0, 0, 0.1); } .adtnl6r-banner { width: 100%; max-height: 250px; overflow: hidden; border-bottom: 1px solid #ddd; } .adtnl6r-banner img { width: 100%; height: auto; max-height: 250px; } .adtnl6r-content { width: 100%; padding: 20px; box-sizing: border-box; text-align: center; } .adtnl6r-title { font-size: 1.8em; font-weight: bold; margin-bottom: 10px; color: #fff; } .adtnl6r-description { font-size: 1.2em; color: #fff; margin-bottom: 15px; } .adtnl6r-learn-more-button { display: inline-block; padding: 10px 20px; font-size: 1.2em; font-weight: bold; text-decoration: none; background-color: #0066CC; color: #fff; border-radius: 50px; /* Pill style border-radius */ border-color: #0066CC; transition: background-color 0.3s; } .adtnl6r-learn-more-button:hover { background-color: #45a049; color: #000; } .adtnl6r-marker { font-size: 0.8em; color: #fff; margin-top: 10px; }

Your Path to Online Virality! Reach people through websites, mobile apps, blogs, Facebook, Instagram, TikTok, LinkedIn, etc.

Advertise Everywhere!

Take Action

Ads by Adtional

It’s coming out of stealth only today but has already raised funding and acquired customers while still under the radar. The fast-casual food chain Chipotle, property firm JLL and Mercury Financial are among its early users.

The funding, meanwhile, speaks to the early enthusiasm from investors. Led by Sequoia (specifically Doug Leone and Bogomil Balkansky); Accel, Cyberstarts, Maple Capital, Guy Podjarny (founder of Snyk) and Michael Fey (co-founder and CEO of enterprise browser startup Island) also participated across two different rounds that are being announced today: a $5 million seed and a $35 million Series A.

Sidenote on the funding: one investor mentioned Oasis to me months ago, describing the jockeying among VCs to back the still-unlaunched Oasis as an “incredible frenzy.”

The crux of what Oasis is tackling is the fact that non-human identity — which covers not just how two apps may interact together by way of an authentication, but also how two machines or any processes might work in tandem in an organization — may have become an amporphous but essential aspect of how modern businesses work today. But because so much of it does not involve people at all, there is a strong lack of visibility around how much of it works, including when it doesn’t work.

Human identity management is already fertile ground for bad actors, who use phishing and many other techniques to catch people off guard, to steal their identities and use them to essentially worm their way into networks. Oasis’ founder and CEO Danny Brickman says that non-human identity is very much the next frontier for those bad actors.

“If we’re just playing the statistics game, if it’s true that identity is the new perimeter when it comes to security, then this is the new risk for organizations,” he said in an interview in London. “If you have 50 times more non-human identities than human ones, that means the attack surface is 50 times larger.” For CISOs, he added, how to handle non-human identities “is top of mind right now.”

To tackle this, Oasis has built a three-part system, which in its most simplest terms can be described as “discover, resolve, automate”.

The first of these builds and tracks a full picture of how a network looks and operates, and creates, essentially, a giant recreation of all the places where machines or any non-human identities interface with each other. It describes this as a visualised map.

It can then use this map to track what data moves around where, and when it appears that something is not working as it should. That might or might not be related to an authentication: it could also relate to how data moves through a system once it’s authenticated. In both cases, Oasis then provides remediation suggestions to respond to anything unusual. As with many remediation solutions, these suggestions can be carried out automatically or triaged by humans.

The third part is the proactive continuing work: an automated refresh of the map and the ongoing observation around it.

Brickman’s track record is as elusive as the threat that his startup is aiming to contain, but the basics of it give some clue as to why investors were willing to give him money before the product even launched, and why the startup is able to sign on users so early on.

He spent more than seven years in the Israeli Defense Forces, where he worked in cybersecurity. There, he tells me he led a team that identified and then fixed a major problem in the military.

What was that problem, and how it was fixed? Brickman wouldn’t say, no matter how many ways I asked him.

Leading a team of engineers, he said, “We worked in a basement. Nobody knew about our project. We didn’t want to lose momentum.” Eventually, they had a breakthrough, and they won an innovation prize awarded by the head of the army for the work. Which no one still knows about, it seems.

It was through that work that Brickman met many other engineers, including Amit Zimmerman, who became his co-collaborator on that secret, award-winning project and is now his co-founder at Oasis, where he is the chief product officer.

There are a number of companies that are now focusing on the challenge of tracking non-human, machine-to-machine authentication and identity management. One of them, another Israeli startup called Silverfort, just last week announced a big funding round of its own. Silverfort is taking a big-picture approach to the problem, including human identity as part of its bigger remit: its premise is that the two continue to be inextricably linked, so one must consider them simultaneously in order to truly secure a system.

This is not something that Oasis wants to look at, for now at least. True to its name, it thinks that there is something salient and distinct and ultimately more lucrative in definitively quantifying and solving the myriad problems in the non-human space first.

“We’re focused on non human identity,” Brickman said. “We want to drive the value from there.”

“Identity is the new perimeter, and non-human identity is the gaping hole in that perimeter,” said Balkansky at Sequoia Capital in a statement. “We are excited to work with the Oasis team to solve one of the biggest challenges in cybersecurity today. The company has come out of the gate very strong and fast, signing up blue chip customers less than a year after it was founded, which is a testament to the latent demand for such a solution and to this team’s capabilities and commitment.”

.adtnl6r-container { display: flex; flex-direction: column; align-items: center; width: 80%; max-width: 600px; margin: 20px auto; background-color: #FF3300; border: 1px solid #ddd; border-radius: 10px; overflow: hidden; box-shadow: 0 0 10px rgba(0, 0, 0, 0.1); } .adtnl6r-banner { width: 100%; max-height: 250px; overflow: hidden; border-bottom: 1px solid #ddd; } .adtnl6r-banner img { width: 100%; height: auto; max-height: 250px; } .adtnl6r-content { width: 100%; padding: 20px; box-sizing: border-box; text-align: center; } .adtnl6r-title { font-size: 1.8em; font-weight: bold; margin-bottom: 10px; color: #fff; } .adtnl6r-description { font-size: 1.2em; color: #fff; margin-bottom: 15px; } .adtnl6r-learn-more-button { display: inline-block; padding: 10px 20px; font-size: 1.2em; font-weight: bold; text-decoration: none; background-color: #0066CC; color: #fff; border-radius: 50px; /* Pill style border-radius */ border-color: #0066CC; transition: background-color 0.3s; } .adtnl6r-learn-more-button:hover { background-color: #45a049; color: #000; } .adtnl6r-marker { font-size: 0.8em; color: #fff; margin-top: 10px; }

Your Path to Online Virality! Reach people through websites, mobile apps, blogs, Facebook, Instagram, TikTok, LinkedIn, etc.

Advertise Everywhere!

Take Action

Ads by Adtional

0 notes

Text

A Guide to Investing in Commercial Projects in Gurgaon

Are you looking for a shop for sale in Gurgaon? Find expert tips and the ideal locations for your commercial venture in this bustling city by Elan Group.

Gurgaon, known as Gurugram, is one of India's fast-growing cities. It's becoming a major business centre with many ongoing projects. This provides various opportunities for businesses, regardless of their size. Let's look at some significant projects in Gurgaon and understand why investing in commercial projects in Gurgaon is a wise choice.

Key Commercial Projects in Gurgaon

Elan Empire - Sector 66, Gurgaon

Elan Empire is a mixed-use development, combining premium office spaces, high-end retail outlets, and a luxury hotel. Nestled in Sector 66, Gurgaon, it's strategically designed to foster a dynamic business environment, making it an attractive option for enterprises.

Elan Paradise - Sector 50, Gurgaon

Elan Paradise, another mixed-use development, offers luxury shop for sale in gurgaon, commercial outlets, and serviced apartments. Located in Sector 50, Gurgaon, it aims to provide a unique and upscale shopping experience for residents and visitors.

Elan Epic - Sector 70, Gurgaon

Elan Epic is a landmark commercial development known for its iconic architecture and world-class amenities. Situated in Sector 70, Gurgaon, it features retail shops, a food court, a multiplex, and studio apartments, making it a hub for business and entertainment.

Elan Miracle - Sector 84, Gurgaon

Elan Miracle redefines luxury in commercial projects. Located in Sector 84, Gurgaon, it encompasses premium office spaces, high-end retail outlets, and entertainment zones. The attention to detail and focus on creating a luxurious ambience make it an ideal choice for businesses seeking a distinguished presence in Gurgaon.

Elan Town Centre - Sector 67, Gurgaon

Elan Town Centre offers retail shops, a food court, a multiplex, and serviced apartments. Its strategic location in Sector 67, Gurgaon, provides excellent connectivity to major residential and commercial areas, ensuring high footfall for businesses.

Elan Mercado - Sector 80, Gurgaon

Elan Mercado, located in Sector 80, Gurgaon, boasts a vibrant atmosphere and a diverse range of retail offerings. With retail shops, a food court, and studio apartments, it presents an enticing opportunity for businesses looking to establish a presence in Gurgaon.

Why Invest in Commercial Property in Gurgaon?

Investing in commercial property in Gurgaon offers a multitude of benefits, making it a wise decision for businesses of all sizes:

High Rental Yields

Gurgaon's strong demand for commercial space results in attractive rental yields. According to a Knight Frank report, the average rental yield for commercial property in Gurgaon is around 8%. This means that commercial property owners can expect a steady and substantial income from their investments.

Long-Term Appreciation

Gurgaon's rapid development and economic growth bode well for the appreciation of commercial property values in the long term. A report by JLL predicts a Compound Annual Growth Rate (CAGR) of 10% in the capital value of commercial properties over the next five years. This growth potential makes Gurgaon an excellent choice for investors seeking capital appreciation.

Tax Benefits

Investors in commercial property can leverage various tax benefits, including depreciation and capital gains tax exemption. These tax incentives can significantly reduce the overall tax burden on the investor, enhancing the profitability of the investment.

Diversification

Investing in commercial property allows for portfolio diversification, reducing investment risk. Commercial property is a relatively illiquid asset, but it is less correlated with other asset classes like stocks and bonds. This means that it can help mitigate overall risk within an investment portfolio.

Shop for Sale in Gurgaon

If you're in the market for a shop for sale in Gurgaon, you have a range of options at your disposal. Several commercial projects in Gurgaon offer shops for sale, catering to different business needs and preferences. Some of the key commercial projects with shops for sale include:

Elan Town Centre

Elan Mercado

Elan Empire

Elan Paradise

Elan Epic

These projects provide a variety of shop sizes and types to accommodate businesses of different sizes. Their strategic locations in prime areas of Gurgaon ensure excellent visibility and accessibility, which are crucial factors for a thriving business.

Investing in commercial property in Gurgaon is a strategic move for businesses of all sizes. The city's favourable regulatory environment, rapid development, high rental yields, and long-term appreciation create a conducive ecosystem for commercial real estate investments.

For those seeking a shop for sale in Gurgaon, The Elan Group provides prime location options with innovative designs and dedicated support services, backed by a track record of excellence.

Contact Us to book your property at Elan Group.

#elan the mark gurgaon#elan the mark in gurgaon#elan the mark new launch#elan the mark project on dwarka expressway#elan the mark commercial property#best elan commercial project#elan the mark sector 106 gurgaon#elan the mark#elan the mark 106#new launch elan the mark

0 notes

Text

Jerry Lee Lewis! Through the '50s, '60s, '70s, '80s, '90s, 2000s, 2010s, and 2020s.

[ 12 Days of Christmas 1 / 12. ]

I wasn't sad for Jerry Lee when hearing of his passing. For his family, yes. For him, no. He accomplished more than some ever will, let alone what was expected of him. He lived a long life, that alone is an accomplishment and should be celebrated. So, what better way to celebrate his memory than on Christmas?

Here's to you, Killer.

#Jerry Lee Lewis#Sun//JLL#JLL//50s#JLL//60s#JLL//70s#JLL//80s#JLL//90s#JLL//2000s#JLL//2010s#JLL//2020s#JLL//Edits#12 Days of Christmas#//MyPosts#Rock and Roll#Rockabilly#Country

3 notes

·

View notes

Text

Indian investors driving the surge - A dive into Dubai's booming real estate market

Dubai’s thriving real estate market offers a wide variety of properties, attracting Indians, who are increasingly investing in Dubai

Dubai’s thriving real estate market offers a wide variety of properties, attracting individuals from all over the world, including India, who are increasingly purchasing and investing in real estate in Dubai. Indians have consistently been among the top 3 nationalities to buy properties in Dubai, since 2004. Between 2015 to 2021 alone, India investors purchased real estate worth AED 83.62 billion in the city.

Aside from residential properties, Dubai is also home to significant commercial real estate projects, including office spaces, retail canters, and hospitality properties. The presence of free zones and various business-friendly policies has attracted international companies, thereby positively impacting the demand for rentals.

Real estate is one of the crucial drivers of the UAE economy, with the sector contributing to nearly 5.5% of the total GDP. As Dubai is experiencing a strong post covid recovery, so is its real estate market.

Dubai’s Economic Recovery

Dubai has seen a swift economic recovery post-Covid, largely driven by a boom in the property market, increased tourism, and inflows of foreign capital. The city has set large ambitions with a 10-year economic plan, known as D33, aiming to double the economy’s size and make Dubai one of the top four global financial centres within a decade. Further, government initiatives such as the golden visa have played a significant role in attracting foreign investment, talented individuals and boosting issuance of new business licences by over 50%.

The property market has been a strong player in Dubai’s economic recovery, with average property prices rising 12.8% in Q1 of this year and villa prices increasing by nearly 15%. Dubai was the world’s fourth busiest ultra-prime property market last year, with 219 home sales valued over $10 million.

As Dubai solidifies its position as a regional hub for finance and business, we are seeing a direct impact of this on the real estate market that is attracting investors and driving further development in the sector.

Dubai’s Real Estate Market

Dubai’s real estate market is expected to grow to over AED 300 billion by the end of the year. Unique Properties, a leading real estate agency in Dubai has stated that they see a strong surge in the sector for the second half of 2023. Data indicates that both the residential and commercial markets grew with significant margins in 2023, when compared to 2022. The residential market registered about AED 93 billion in sales in the first half of the year, which is a 46.7% jump from 2022, while the commercial sector experiences a 30% jump from 2022, to reach AED 2.86 billion in sales.

This notable growth in the real estate market can largely be attributed to the government initiatives that are attracting foreign investments and a strong recovery from the Covid-19 pandemic.

Dubai’s commercial real estate space is looking very promising, at a time when real estate advisors agree that it is important to invest in office spaces. JLL, a leading professional services firm specialising in real estate highlighted the wider impact of the future of work on the real estate sector at their ‘future for work’ event in Dubai. According to JLL’s Future of Work Survey, 77% of commercial real estate leaders agree that investing in high-quality office spaces will be a greater priority than expanding the total footprint of their developments. When it comes to the UAE, the country’s office sector has rapidly bounced back from the pandemic woes. According to the Demand Study conducted by JLL- for Grade A office spaces in Dubai, in the last two years, not only has the sector seen a resurgence in demand, but it also saw the first half of 2022, nearly matching pre-pandemic levels.

Real estate and tech

Dubai’s real estate sector recognises the importance of embracing innovation, leading to the emergence of prop-tech or property technology. These innovative technologies aim to streamline the processes associated with property deals and contribute to the continued growth of the market. Prop-tech solutions are further trying to increase the convenience of searching and purchasing real estate and ultimately enhancing market access by providing more accurate data about the market.

The UAE is already home to 55% of prop tech startups in the MENA region. “With Dubai’s ambitious plans to double the population by 2040 to 5.8 million people, further residential supply will be required to meet the growing demand,” said Rami Tabbara, co-founder at fractional real estate investment platform Stake. “Couple the growing market with a strong startup ecosystem, ease of business formation and low taxes, Dubai is ripe to be disrupted through proptech innovation.”

In just two years, we’ve enabled thousands of investors to buy AED 154 million worth of properties in Dubai and paid them over AED4.6 million in rental income” Tabbara said.

Indian Demand for Dubai’s real estate

According to data from the Dubai Land Department (DLD), Indian’s have been the dominant force in Dubai’s property market over the last decade. In 2022, Indian’s emerged as top home buyers in Dubai, with purchases worth Rs 35 thousand crores, according to the recent reports. Indian’s have spent almost twice the money on buying residential properties in the city over the last 2 years, with the average price of houses bought by Indians ranging from Rs. 3.6 to 3.8 crores. This trend is largely driven by businesspeople and active investors.

The high rental yields is one of the main factors that is attracting Indian investors to Dubai. Real estate investors can expect a return on investment of about 5–7% in rental yield, which has remained stable over the past few years. For many investors Dubai offers better rates than large Indian cities like Mumbai and Delhi. However, there are a number of factors that make Dubai an attractive spot for Indian investors, besides the rental yields.

Dubai is strategically located between Asia, Europe, and Africa, making it an ideal hub for international trade and commerce. This is a major push for Indian investors and business owners who are looking to expand their operations into new markets.

Dubai’s stable political climate and business-friendly environment have helped in creating a secure environment for Indian investors to safeguard their investments. Further, the government has also supported foreign investments and several implemented measures to make the city more attractive to investors.

Dubai’s strong and growing economy presents numerous opportunities for investors from India who seek to capitalise on the region’s growth potential. With no income or capital gains taxes, Dubai positions itself as an attractive destination especially for Indian’s who may have to pay significant taxes back home.

Dubai is renowned for providing its residents with a great quality of life. The city offers world class infrastructure, top notch residential and commercial properties, business and shopping centres, and a safe environment making it an ideal place for people to live. The large expat community in Dubai, including the substantial Indian population contributes to a sense of familiarity and comfort for Indian investors and residents.

Above all, due to the diversification strategies of Dubai, a thriving real estate market has been created, and this market is only expected to grow, and Indian investors do not want to miss out on the opportunities presented by this dynamic market.

The future

The demand for Dubai’s real estate market is only expected to grow in the years to come, with Indian investors playing a pivotal role in its growth. Some of the key drivers for this optimistic outlook are the tech boom with a growing amount of support for startups, which is transforming Dubai into a global hub for innovation. Additionally, government support with significant infrastructure projects such as the extension of the metro’s red line and the upgrading of roads and bridges, will only continue to stimulate economic growth, create more business opportunities, and attract more investments.

0 notes

Text

What are the reasons to invest in Hyderabad real estate?

The JLL City Momentum Index names Hyderabad as the world's most dynamic city. The city has the most accessible markets and is well located in south India. We are all aware that while making real estate investments, connectivity is the most important thing to take into account.

The IT cluster in Hyderabad stimulates demand for both financial markets and assets. The sharp increase in the number of working professionals is due to it. The IT hub in Hyderabad has expanded quickly over the years. It has thus generated a number of real estate investment opportunities. Given that the tech giants have strengthened Hyderabad's basis, real estate investment in the city won't let you down.

Hyderabad's markets have a good ability to evolve with the times. It advances swiftly and is amenable to new fashions. Since their emergence, the new digital trends have caused a stir in the markets. As a result, they offer increased possibilities for the markets for data centers. The e-commerce industry has also expanded as a result of its strategies. Thanks to Hyderabad, investors now have a variety of opportunities. Investing in new markets makes sense for the overall growth of the city.

Telangana residents are entitled to a variety of benefits, including tax reductions. For the fiscal years 2020–2021, the Telangana state government exempted homeowners from paying 50% of their property taxes. In the upcoming fiscal year, homeowners who have already paid their property taxes are also eligible for rebates.

Real estate market growth is significantly influenced by infrastructure. The Metro Rail Project and the Outer Ring Road serve as the city's connecting points. All large, successful MNCs have their corporate offices in Hyderabad. What possible real estate investment plan could be better than Hyderabad? The best online real estate investment company in South India, Aparna Constructions, offers real estate investment opportunities in Hyderabad. Aparna Constructions can help you get the perfect house in Hyderabad before prices start to rise.

0 notes

Text

Amidst banking crisis, prices soften and new lenders emerge

Pan-European investors taking comfort from the first signs of recovery in the markets of March were caught out by an icy blast hailing from the west. Massive amounts of customer withdrawals had provoked the crash of Silicon Valley Bank in California, followed swiftly by the failure of its US-peer Signature Bank.

But on closer shores, institutions proved no more secure. Days later, banking group UBS agreed to take over its Zurich-headquartered peer Credit Suisse in a £2.65 billion deal pushed through by Swiss authorities to calm the markets. Although swift action seems to have swerved a collapse that could have triggered a tsunami of banking failures, a leap in Swiss National Bank sight deposits suggests that both Credit Suisse and UBS may have taken large chunks of emergency liquidity to secure the merger, as reported by Reuters. And real estate investors know too well that when banks are saved, there are always accounts to settle at a later date.

Rising financing costs

The latest round of banking tremors has come in the wake of a year of rising swap rates and increasingly expensive financing for players in commercial real estate. A new European lending report published last week reveals that borrowers are now paying up to 6% all-in interest for loans on prime European properties, compared to just 2-3 per cent a year ago. Opportunistic or repositioning assets are priced 60-100 bpd wider.

The Bayes Business School European Commercial Real Estate Lending Report shows that in Europe, German bank lenders still offer some of the highest loan-to-value (LTV) for investment assets (between 75-80 per cent) and loan-to-cost (LTC) for development lending (between 77-82%). Other European bank lenders have been more conservative (between 55-60 per cent LTV and 60-75 per cent LTC).

Loan size also matters. Smaller loans might be priced higher because there is less lender appetite, as well as very large loans (up to €100 million), which might require more than one underwriting lender. The typical sweet spot is between €20 and 50 million, which attracts the lowest and most competitive lending rates (between 1.5-2.5% variable margin rate for a five-year loan term plus Euribor).

Importantly, the loan trend is finally having an impact on prices. "Where property yields for prime offices have been ranging from 2.75% to 3.5% the level of financing rates cannot be sustained and are forcing property values down or leaving assets and borrowers stranded," notes the research, authored by Nicole Lux, senior research fellow at Bayes Business School.

Non-traditional lenders

Amidst this gloomy outlook, there are some bright spots for equity players as values soften, and for hospitality buyers pursuing debt in the alternative space. “Finance is still available to hotel real estate investors,” affirms Patrick Saade, senior managing director of JLL’s EMEA hotels and hospitality division.

“It’s a misconception to think it’s not. In addition to traditional lenders, new lenders have set up shop to fill the gap, from private credit to private equity players.”

The Hotel Maria

Cheyne Capital is one lender which is expanding in the hospitality space. Last month, the alternative asset manager provided a €62 million senior loan to Samla Capital Oy to finance the redevelopment of The Hotel Maria, a luxury hotel located in the heart of Kruununhaka, Helsinki. The project represents Cheyne’s second real estate transaction in Finland.

Daniel Schuldes and Michael Fournier of Cheyne Capital said: “As a firm, we continue to see attractive lending opportunities in the luxury hotel sector as consumers seek out enhanced lifestyle experiences. We’re therefore proud to support Samla Capital Oy with the financing of this prestigious project and look forward to the delivery of a world-class hotel in Finland.”

Added Samppa Lajunen, founder and portfolio manager of Samla Capital Oy: “Luxury tourism is a growing market and the demand for hotels that meet this need is also emerging across Finland. We are pleased to be partnering with Cheyne Capital, who understands the value of The Hotel Maria's concept and the luxury hotel sector.”

The finished hotel will consist of 117 rooms, two restaurants, two bars, a spa, a gym, a ballroom, and a small chapel, and is expected to launch in December 2023.

Green loan options

Other hospitality firms are finding success in the green loan space. Recently, citizenM secured a dual currency €243.3 million and £201.7 million sustainability linked loan (SLL) facilitated by HSBC UK and HSBC Continental Europe, ABN AMRO Bank and Aareal Bank.

By refinancing existing debt as a SLL, citizenM has tied its funding to specific environmental, social and governance (ESG) targets, which include reducing operating CO2 emissions and improving existing green building certifications across its European owned hotel assets. CitizenM, which operates 31 hotels across nine countries and 18 cities, said it was one of the first European hospitality businesses to adopt the SLL funding structure.

CitizenM at London Victoria Station

Fred Bos, head commercial clients sector, sustainability and E&E expertise at ABN Amro, sees the ”cooperation as a positive step towards the prevention of climate change and as an opportunity to grow our loan book in a responsible way”. He adds: “We look forward to scaling what we have achieved with this financing structure more widely across the highly attractive hotel industry.”

For Saade, too, fears over retreating bank financing may currently be overstated. “Financing is more expensive today if we look at swap rates linked to Euribor. Yet the right asset and the right sponsor are still going to get quite aggressive financing from the banks,” he notes.

“The right asset but an unknown sponsor can still obtain financing if they can supply a guarantee. For anything that is more exotic and more complicated, the gap is being filled by the credit funds and private equity. Specialist credit funds are excited as they know there is a gap to fill - we have been very active matching lenders to investors in that space.”

In conclusion, he notes: “Whoever has a refinancing event approaching will be hoping that their cash flow has caught up as they still might have to put equity down.

“But we are not seeing a huge wave of distress on the horizon, although some high-levered owners will have to sell at some point.”

0 notes

Text

Amidst banking crisis, prices soften and new lenders emerge

Pan-European investors taking comfort from the first signs of recovery in the markets of March were caught out by an icy blast hailing from the west. Massive amounts of customer withdrawals had provoked the crash of Silicon Valley Bank in California, followed swiftly by the failure of its US-peer Signature Bank.

But on closer shores, institutions proved no more secure. Days later, banking group UBS agreed to take over its Zurich-headquartered peer Credit Suisse in a £2.65 billion deal pushed through by Swiss authorities to calm the markets. Although swift action seems to have swerved a collapse that could have triggered a tsunami of banking failures, a leap in Swiss National Bank sight deposits suggests that both Credit Suisse and UBS may have taken large chunks of emergency liquidity to secure the merger, as reported by Reuters. And real estate investors know too well that when banks are saved, there are always accounts to settle at a later date.

Rising financing costs

The latest round of banking tremors has come in the wake of a year of rising swap rates and increasingly expensive financing for players in commercial real estate. A new European lending report published last week reveals that borrowers are now paying up to 6% all-in interest for loans on prime European properties, compared to just 2-3 per cent a year ago. Opportunistic or repositioning assets are priced 60-100 bpd wider.

The Bayes Business School European Commercial Real Estate Lending Report shows that in Europe, German bank lenders still offer some of the highest loan-to-value (LTV) for investment assets (between 75-80 per cent) and loan-to-cost (LTC) for development lending (between 77-82%). Other European bank lenders have been more conservative (between 55-60 per cent LTV and 60-75 per cent LTC).

Loan size also matters. Smaller loans might be priced higher because there is less lender appetite, as well as very large loans (up to €100 million), which might require more than one underwriting lender. The typical sweet spot is between €20 and 50 million, which attracts the lowest and most competitive lending rates (between 1.5-2.5% variable margin rate for a five-year loan term plus Euribor).

Importantly, the loan trend is finally having an impact on prices. "Where property yields for prime offices have been ranging from 2.75% to 3.5% the level of financing rates cannot be sustained and are forcing property values down or leaving assets and borrowers stranded," notes the research, authored by Nicole Lux, senior research fellow at Bayes Business School.

Non-traditional lenders

Amidst this gloomy outlook, there are some bright spots for equity players as values soften, and for hospitality buyers pursuing debt in the alternative space. “Finance is still available to hotel real estate investors,” affirms Patrick Saade, senior managing director of JLL’s EMEA hotels and hospitality division.

“It’s a misconception to think it’s not. In addition to traditional lenders, new lenders have set up shop to fill the gap, from private credit to private equity players.”

The Hotel Maria

Cheyne Capital is one lender which is expanding in the hospitality space. Last month, the alternative asset manager provided a €62 million senior loan to Samla Capital Oy to finance the redevelopment of The Hotel Maria, a luxury hotel located in the heart of Kruununhaka, Helsinki. The project represents Cheyne’s second real estate transaction in Finland.

Daniel Schuldes and Michael Fournier of Cheyne Capital said: “As a firm, we continue to see attractive lending opportunities in the luxury hotel sector as consumers seek out enhanced lifestyle experiences. We’re therefore proud to support Samla Capital Oy with the financing of this prestigious project and look forward to the delivery of a world-class hotel in Finland.”

Added Samppa Lajunen, founder and portfolio manager of Samla Capital Oy: “Luxury tourism is a growing market and the demand for hotels that meet this need is also emerging across Finland. We are pleased to be partnering with Cheyne Capital, who understands the value of The Hotel Maria's concept and the luxury hotel sector.”

The finished hotel will consist of 117 rooms, two restaurants, two bars, a spa, a gym, a ballroom, and a small chapel, and is expected to launch in December 2023.

Green loan options

Other hospitality firms are finding success in the green loan space. Recently, citizenM secured a dual currency €243.3 million and £201.7 million sustainability linked loan (SLL) facilitated by HSBC UK and HSBC Continental Europe, ABN AMRO Bank and Aareal Bank.

By refinancing existing debt as a SLL, citizenM has tied its funding to specific environmental, social and governance (ESG) targets, which include reducing operating CO2 emissions and improving existing green building certifications across its European owned hotel assets. CitizenM, which operates 31 hotels across nine countries and 18 cities, said it was one of the first European hospitality businesses to adopt the SLL funding structure.

CitizenM at London Victoria Station

Fred Bos, head commercial clients sector, sustainability and E&E expertise at ABN Amro, sees the ”cooperation as a positive step towards the prevention of climate change and as an opportunity to grow our loan book in a responsible way”. He adds: “We look forward to scaling what we have achieved with this financing structure more widely across the highly attractive hotel industry.”

For Saade, too, fears over retreating bank financing may currently be overstated. “Financing is more expensive today if we look at swap rates linked to Euribor. Yet the right asset and the right sponsor are still going to get quite aggressive financing from the banks,” he notes.

“The right asset but an unknown sponsor can still obtain financing if they can supply a guarantee. For anything that is more exotic and more complicated, the gap is being filled by the credit funds and private equity. Specialist credit funds are excited as they know there is a gap to fill - we have been very active matching lenders to investors in that space.”

In conclusion, he notes: “Whoever has a refinancing event approaching will be hoping that their cash flow has caught up as they still might have to put equity down.

“But we are not seeing a huge wave of distress on the horizon, although some high-levered owners will have to sell at some point.”

0 notes

Text

Amidst banking crisis, prices soften and new lenders emerge

Pan-European investors taking comfort from the first signs of recovery in the markets of March were caught out by an icy blast hailing from the west. Massive amounts of customer withdrawals had provoked the crash of Silicon Valley Bank in California, followed swiftly by the failure of its US-peer Signature Bank.

But on closer shores, institutions proved no more secure. Days later, banking group UBS agreed to take over its Zurich-headquartered peer Credit Suisse in a £2.65 billion deal pushed through by Swiss authorities to calm the markets. Although swift action seems to have swerved a collapse that could have triggered a tsunami of banking failures, a leap in Swiss National Bank sight deposits suggests that both Credit Suisse and UBS may have taken large chunks of emergency liquidity to secure the merger, as reported by Reuters. And real estate investors know too well that when banks are saved, there are always accounts to settle at a later date.

Rising financing costs

The latest round of banking tremors has come in the wake of a year of rising swap rates and increasingly expensive financing for players in commercial real estate. A new European lending report published last week reveals that borrowers are now paying up to 6% all-in interest for loans on prime European properties, compared to just 2-3 per cent a year ago. Opportunistic or repositioning assets are priced 60-100 bpd wider.

The Bayes Business School European Commercial Real Estate Lending Report shows that in Europe, German bank lenders still offer some of the highest loan-to-value (LTV) for investment assets (between 75-80 per cent) and loan-to-cost (LTC) for development lending (between 77-82%). Other European bank lenders have been more conservative (between 55-60 per cent LTV and 60-75 per cent LTC).

Loan size also matters. Smaller loans might be priced higher because there is less lender appetite, as well as very large loans (up to €100 million), which might require more than one underwriting lender. The typical sweet spot is between €20 and 50 million, which attracts the lowest and most competitive lending rates (between 1.5-2.5% variable margin rate for a five-year loan term plus Euribor).

Importantly, the loan trend is finally having an impact on prices. "Where property yields for prime offices have been ranging from 2.75% to 3.5% the level of financing rates cannot be sustained and are forcing property values down or leaving assets and borrowers stranded," notes the research, authored by Nicole Lux, senior research fellow at Bayes Business School.

Non-traditional lenders

Amidst this gloomy outlook, there are some bright spots for equity players as values soften, and for hospitality buyers pursuing debt in the alternative space. “Finance is still available to hotel real estate investors,” affirms Patrick Saade, senior managing director of JLL’s EMEA hotels and hospitality division.

“It’s a misconception to think it’s not. In addition to traditional lenders, new lenders have set up shop to fill the gap, from private credit to private equity players.”

The Hotel Maria

Cheyne Capital is one lender which is expanding in the hospitality space. Last month, the alternative asset manager provided a €62 million senior loan to Samla Capital Oy to finance the redevelopment of The Hotel Maria, a luxury hotel located in the heart of Kruununhaka, Helsinki. The project represents Cheyne’s second real estate transaction in Finland.

Daniel Schuldes and Michael Fournier of Cheyne Capital said: “As a firm, we continue to see attractive lending opportunities in the luxury hotel sector as consumers seek out enhanced lifestyle experiences. We’re therefore proud to support Samla Capital Oy with the financing of this prestigious project and look forward to the delivery of a world-class hotel in Finland.”

Added Samppa Lajunen, founder and portfolio manager of Samla Capital Oy: “Luxury tourism is a growing market and the demand for hotels that meet this need is also emerging across Finland. We are pleased to be partnering with Cheyne Capital, who understands the value of The Hotel Maria's concept and the luxury hotel sector.”

The finished hotel will consist of 117 rooms, two restaurants, two bars, a spa, a gym, a ballroom, and a small chapel, and is expected to launch in December 2023.

Green loan options

Other hospitality firms are finding success in the green loan space. Recently, citizenM secured a dual currency €243.3 million and £201.7 million sustainability linked loan (SLL) facilitated by HSBC UK and HSBC Continental Europe, ABN AMRO Bank and Aareal Bank.

By refinancing existing debt as a SLL, citizenM has tied its funding to specific environmental, social and governance (ESG) targets, which include reducing operating CO2 emissions and improving existing green building certifications across its European owned hotel assets. CitizenM, which operates 31 hotels across nine countries and 18 cities, said it was one of the first European hospitality businesses to adopt the SLL funding structure.

CitizenM at London Victoria Station

Fred Bos, head commercial clients sector, sustainability and E&E expertise at ABN Amro, sees the ”cooperation as a positive step towards the prevention of climate change and as an opportunity to grow our loan book in a responsible way”. He adds: “We look forward to scaling what we have achieved with this financing structure more widely across the highly attractive hotel industry.”

For Saade, too, fears over retreating bank financing may currently be overstated. “Financing is more expensive today if we look at swap rates linked to Euribor. Yet the right asset and the right sponsor are still going to get quite aggressive financing from the banks,” he notes.

“The right asset but an unknown sponsor can still obtain financing if they can supply a guarantee. For anything that is more exotic and more complicated, the gap is being filled by the credit funds and private equity. Specialist credit funds are excited as they know there is a gap to fill - we have been very active matching lenders to investors in that space.”

In conclusion, he notes: “Whoever has a refinancing event approaching will be hoping that their cash flow has caught up as they still might have to put equity down.

“But we are not seeing a huge wave of distress on the horizon, although some high-levered owners will have to sell at some point.”

0 notes