#LLP Annual Return

Text

Limited Liability Partnership (LLP) ROC Compliance

Limited Liability Partnership (LLP) ROC Compliance refers to the regulatory requirements that LLPs need to fulfill with the Registrar of Companies (ROC). In various jurisdictions, including India, LLPs are mandated to adhere to specific compliance norms set by the ROC to ensure transparency, legal conformity, and proper governance. These compliances typically include the timely filing of annual returns, financial statements, and other essential documents. Meeting LLP ROC Compliance is crucial for maintaining good standing with regulatory authorities and avoiding penalties. It underscores the commitment of LLPs to operate within the legal framework and uphold accountability in their business practices.

0 notes

Text

A complete guide on LLP Annual Filing and Process for LLP E-filing

Returns for a Limited Liability Partnership (LLP) should be filed on a regular basis to ensure compliance and avoid the harsh penalties imposed by the law for non-compliance. When compared to the compliance obligations placed on Private Limited Company, a Limited Liability Partnership has only a few compliances to follow each year. File your LLP annual returns with the professional help of Ebizfiling.

0 notes

Photo

Corpsee ITES Pvt Ltd company is the best llp compliance registration services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp compliance#llp annual return#annual filing for llp#checklist for llp registration#annual compliance for llp#annual return for llp#llp company compliance#llp compliance license#llp registration in india#llp registration india#online llp formation#register a llp in india#register llp online#register llp in india#registration of llp#llp formation india

0 notes

Text

LLP Annual Return Service - Form-11 Filing

Complete your LLP annual filing effortlessly with Form 11 Declaration with Paper Tax Services. Ensure compliance and focus on growing your business without worries. https://bit.ly/4cvLkRT

#Form 11 Filing Service#Form 11 Declaration#Form 11 for LLP#Form 11 for LLP Filing Service#LLP Annual return form 11#Form 11 LLP Filing#Form 11 LLP Filing Service#LLP Annual Filing Service#LLP Annual Return Filing#LLP Annual Return Filing Service

0 notes

Text

Top LLP Company Compliance in Kolkata

Top LLP Company Compliance in Kolkata: Simplifying Compliance with Filemydoc

Introduction:

In the bustling city of Kolkata, numerous limited liability partnership (LLP) companies thrive and contribute to the region's vibrant business ecosystem. However, with the ever-increasing complexities of legal and regulatory frameworks, ensuring compliance can be a daunting task for business owners. This article aims to shed light on the top LLP company compliance requirements in Kolkata and how Filemydoc, a trusted online platform, simplifies the compliance process.

1. Understanding LLP Company Compliance:

Compliance for LLP companies in Kolkata involves adhering to various legal and regulatory obligations. These obligations ensure that businesses operate ethically, maintain transparency, and meet the standards set by the government and relevant authorities. Key compliance requirements for LLP companies in Kolkata include:

a) Registrar of Companies (RoC) Compliance: LLPs must comply with the filing of annual returns, financial statements, and other statutory documents with the RoC.

b) Tax Compliance: Complying with the Goods and Services Tax (GST), income tax, and other applicable tax regulations is crucial for avoiding penalties and maintaining financial transparency.

c) Employment Compliance: LLPs must adhere to labor laws, employee benefits, provident fund, professional tax, and other employment-related compliances.

2. The Importance of Top LLP Company Compliance in Kolkata:

Maintaining compliance is not just a legal requirement but also crucial for the long-term success and reputation of any LLP company in Kolkata. Here's why top LLP company compliance is essential:

a) Avoiding Legal Consequences: Non-compliance can result in hefty penalties, legal disputes, and even the dissolution of the LLP. Adhering to the regulations ensures the company's sustainability and protects its stakeholders.

b) Building Trust and Credibility: Compliant companies foster trust among customers, investors, and partners. Demonstrating commitment to compliance enhances the company's reputation and credibility in the market.

c) Ensuring Operational Efficiency: Compliance procedures often involve streamlining internal processes, leading to improved operational efficiency and reduced risk of errors.

3. Introducing Filemydoc: Simplifying LLP Company Compliance:

Filemydoc, a leading online platform, offers a comprehensive solution for LLP company compliance in Kolkata. With its user-friendly interface and advanced features, Filemydoc simplifies the compliance process, allowing businesses to focus on their core operations. Key features of Filemydoc include:

a) Automated Compliance Reminders: Filemydoc sends timely notifications and reminders about upcoming compliance deadlines, ensuring companies never miss a crucial filing date.

b) Document Management System: The platform provides a secure and centralized repository to store and manage all compliance-related documents, eliminating the hassle of manual record-keeping.

c) Expert Guidance and Support: Filemydoc offers expert guidance and assistance from professionals well-versed in the complexities of LLP company compliance. Users can seek advice and resolve queries through the platform's support channels.

4. Top LLP Company Compliance Services Offered by Filemydoc:

Filemydoc offers a range of services designed to address the specific compliance needs of LLP companies in Kolkata. Here are some of the top services provided by Filemydoc:

a) Annual Compliance Filings: Filemydoc facilitates seamless filing of annual returns, financial statements, and other statutory documents with the RoC, ensuring companies stay compliant.

b) Tax Compliance: The platform assists in GST registration, filing GST returns, income tax return filing, and other tax-related compliances, helping companies meet their tax obligations accurately and efficiently.

c) Legal and Regulatory Support: Filemydoc provides expert advice and assistance on legal and regulatory matters, including company incorporation, changes in partnership agreements, and compliance audits.

d) Compliance Audit and Due Diligence: The platform offers comprehensive compliance audits to identify areas of improvement and ensure adherence to all relevant regulations. This service is particularly useful during mergers, acquisitions, or partnership restructuring.

e) Annual Maintenance Packages: Filemydoc offers customized annual maintenance packages that cover all major compliance requirements, enabling companies to outsource their compliance management and focus on their business growth.

Conclusion:

Maintaining compliance with the legal and regulatory requirements is paramount for LLP companies in Kolkata. With the complexities involved, partnering with a reliable online platform like Filemydoc can simplify the compliance process significantly. By leveraging Filemydoc intuitive interface, automated reminders, and expert support, businesses can ensure seamless compliance management, avoid penalties, and build a strong reputation. Embrace Filemydoc to streamline your LLP company compliance in Kolkata and stay ahead in the dynamic business landscape

#LLP Annual Return Filing#LLP Registration in India#Limited Liability Partnership (LLP) Registration in India

0 notes

Text

Process of closing an LLP in India

The Limited Liability Partnership (LLP) is a trendy type of business entity, established in 2008 by the Limited Liability Partnership Act, that integrates the features of a company and a partnership. In earlier articles, we discussed the documents mandated for LLP registration and the registration process itself.

This article aims to assist you with the procedure for closing an LLP in India.

Although LLPs offer several benefits over other kinds of business entities, such as ease of incorporation and limited liability for members, these advantages do not necessarily translate into flourishing business operations. This article will explain the Strike Off method of closure and provide an overview of other closure options.

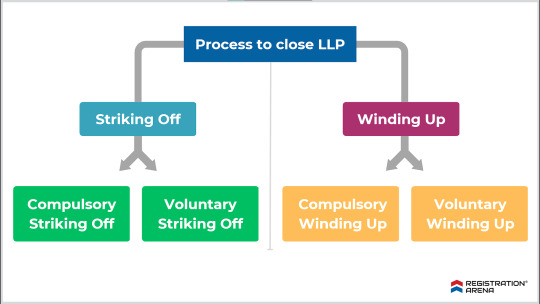

The process to close a Limited Liability Partnership

An LLP can be closed in two ways:

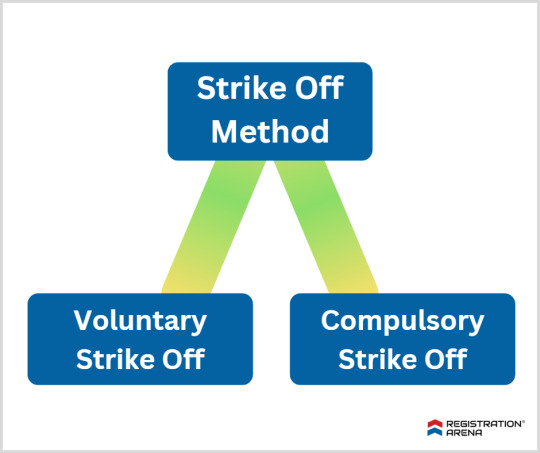

1. Strike-off method-

a. Voluntary Strike Off

The LLP should not have been engaged in commercial activities for a period of at least one year.

The LLP must file an application in Form 24 LLP with the Registrar of LLPs to apply for voluntary strike-off status.

The LLP should have completed all compliance requirements by the date of filing for closure. However, it is only required to file annual returns until the end of the year when commercial activities are discontinued.

The LLP must have obtained the approval of all parties involved, including members, creditors, and any regulatory authorities under whose domain the LLP works.

The LLP should not have any assets or liabilities as of the date of preparation of financial statements.

The process to close LLP through Strike Off method

In order to move forward with the Strike Off process, the LLP must follow the steps outlined below:

The LLP must plan a meeting of all partners to pass a resolution to strike off the name.

The LLP must pay all outstanding debts and liabilities before proceeding with the Strike Off process.

The meeting of partners must permit a designated partner to file the application for Strike Off.

The designated partner must file an application in e-Form 24 and submit it to the Registrar. The application must have the approval of all members.

Read more to know about the Procedure of Closing LLP in India

#closure of llp#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal services#legal consultation

0 notes

Text

Unveiling Limited Liability Partnership Registration: A Step-by-Step Guide

In the realm of business structures, Limited Liability Partnerships (LLPs) have emerged as a favored choice for entrepreneurs seeking a balance between liability protection and operational flexibility. Offering the advantages of both traditional partnerships and limited liability companies, LLPs provide a unique framework that appeals to a wide array of professionals and businesses. If you're considering forming an LLP, navigating through the registration process can seem daunting. However, fear not! In this comprehensive guide, we'll break down the intricacies of LLP registration, simplifying each step to set you on the path to success.

Understanding Limited Liability Partnerships

Before delving into the registration process, let's grasp the essence of Limited Liability Partnerships. An LLP combines features of both partnerships and corporations, providing its partners with limited personal liability akin to shareholders in a corporation. This implies that partners are not personally liable for the debts and obligations of the business beyond their investment. This protective shield for personal assets makes LLPs an attractive option for professionals such as lawyers, accountants, consultants, and small businesses.

Step-by-Step Guide to LLP Registration

1. Choose a Name

Ensure that your chosen name complies with the regulations stipulated by the relevant authority. It should not infringe on existing trademarks and should reflect the nature of your business.

2. Obtain Digital Signature Certificates (DSC)

LLP registration necessitates the use of Digital Signature Certificates (DSC) for filing various documents electronically. Obtain DSCs for all partners involved in the LLP.

3. Obtain Designated Partner Identification Number (DPIN)

This unique identification number is mandatory for all individuals intending to be appointed as partners.

4. Drafting LLP Agreement

The LLP agreement outlines the rights and duties of partners, profit-sharing ratios, decision-making procedures, and other pertinent details. Draft a comprehensive LLP agreement in accordance with the provisions of the LLP Act.

5. File Incorporation Documents

Compile and file the necessary incorporation documents with the Registrar of Companies (ROC). These documents typically include Form 1 (Incorporation Document) and Form 2 (Details of LLP Agreement). Pay the requisite fees along with the submission.

6. Registrar Approval and Certificate of Incorporation

Upon submission of documents, the Registrar will scrutinize the application. If all requirements are met satisfactorily, the Registrar will issue a Certificate of Incorporation, officially recognizing the LLP's existence.

7. Obtain PAN and TAN

After obtaining the Certificate of Incorporation, apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the LLP.

8. Compliance with Regulatory Requirements

Ensure compliance with all regulatory requirements post-incorporation. This includes maintaining proper accounting records, filing annual returns, and adhering to tax obligations.

2 notes

·

View notes

Text

LLP Registration in Chennai: Key Steps

LLP Registration in Chennai: A Comprehensive Guide

Introduction to LLP

A Limited Liability Partnership (LLP) is a famous business structure in India that combines the benefits of both a company and a partnership firm. It offers LLP Registration in Chennai to its partners, meaning their assets are protected in case of business debts and liabilities. LLPs are governed by the Limited Liability Partnership Act 2008 and are suitable for small and medium-sized enterprises.

Why Choose LLP?

Limited Liability: Partners have limited liability, protecting their assets.

Separate Legal Entity: LLPs have a separate legal identity from their partners.

Flexible Management: Partners can manage the LLP internally as per their agreement.

Less Compliance: Compared to companies, LLPs have fewer compliance requirements.

Tax Benefits: LLPs enjoy various tax advantages, including exemptions from certain taxes applicable to companies.

Steps for LLP Registration in Chennai

1. Obtain a Digital Signature Certificate (DSC)

Each designated partner of the LLP must obtain a Digital Signature Certificate (DSC), which is used for online document filing with the Ministry of Corporate Affairs (MCA).

2. Apply for Director Identification Number (DIN)

Partners must apply for a Director Identification Number (DIN) online by submitting the DIR-3 form.

3. Name Reservation

File the LLP-RUN (Reserve Unique Name) form to reserve a unique name for your LLP. Ensure the name complies with the naming guidelines provided by the MCA.

4. Incorporation of LLP

Once the name is approved, file the incorporation form FiLLiP (Form for Incorporation of Limited Liability Partnership) along with the required documents:

Address proof of the registered office

Identity and address proof of partners

Subscription sheet signed by the partners

Consent of the partners

5. LLP Agreement

Draft and file the LLP Agreement, which outlines the rights and duties of the partners, profit-sharing ratio, and other operational details. This agreement must be filed within 30 days of the incorporation.

Documents Required for LLP Registration

Partners' Documents:

PAN Card

Address proof (Aadhaar Card, Voter ID, Passport, or Driving License)

Residential proof (Bank Statement, Utility Bill)

Registered Office Documents:

Proof of address (Electricity Bill, Property Tax Receipt)

No-Objection Certificate (NOC) from the property owner if the office is rented

LLP Agreement:

Details of the rights and duties of partners

Profit-sharing ratio

Post-Registration Compliance

LLP Agreement Filing: Submit the LLP Agreement to the MCA within 30 days of incorporation.

PAN and TAN Application: Apply for PAN and TAN for the LLP.

Bank Account: Open a bank account in the name of the LLP.

Annual Filings: File Form 8 (Statement of Account & Solvency) and Form 11 (Annual Return) annually.

Income Tax Return: File income tax returns annually by 31st July or 30th September, depending on the audit requirement.

Conclusion

LLP registration in Chennai is straightforward and offers numerous advantages, including limited liability, separate legal entity status, and flexible management. Following the steps outlined above, you can ensure a smooth registration process and compliance with all legal requirements.

0 notes

Text

Step-by-Step Guide to Registering an LLP in Bangalore

Introduction

LLP Registration in Bangalore is a structured process that combines the benefits of both a partnership and a corporation. This guide provides a comprehensive overview of the steps involved in registering an LLP in Bangalore, including the necessary documentation, costs, and timelines.

Understanding LLP

A Limited Liability Partnership (LLP) is a business structure that protects individual partners from personal liability for the partnership's debts. This means that each partner's liability is limited to their investment in the LLP, making it an attractive option for many entrepreneurs. LLPs are governed by the Limited Liability Partnership Act 2008 and are registered with the Ministry of Corporate Affairs (MCA).LLP Registration for NRI and Foreign Nationals

Benefits of LLP

Limited Liability: Protects personal assets from business liabilities.

Flexibility: Combines features of partnerships and corporations.

No Minimum Capital Requirement: Partners can contribute capital in various forms.

Easy Compliance: Less stringent regulatory requirements compared to private limited companies.

Prerequisites for LLP Registration

Before starting the registration process, ensure you have the following:

Minimum Two Partners: An LLP must have at least two designated partners, one of whom must be an Indian resident.

Digital Signature Certificate (DSC): Required for signing electronic documents.

Designated Partner Identification Number (DPIN): Unique identification for each designated partner.

Registered Office Address: A valid address for official correspondence.

Step-by-Step Registration Process

Step 1: Obtain a Digital Signature Certificate (DSC)

The first step is to apply for a Digital Signature Certificate for all designated partners. The DSC is essential for signing various forms electronically. You can obtain a DSC from government-recognized agencies and can choose between Class 2 or Class 3 certificates.

Step 2: Apply for a Designated Partner Identification Number (DPIN)

Next, each designated partner must apply for a DPIN using Form DIR-3. This form requires submission of identity proof (like Aadhaar or PAN) and must be digitally signed by existing partners. The DPIN is crucial for compliance with all future filings.

Step 3: Name Reservation

To reserve your LLP name, file the LLP-RUN (Reserve Unique Name) application through the MCA portal. It’s advisable to conduct a name search on the MCA website to ensure your desired name is unique and complies with naming regulations. You can propose two names; if rejected, you can resubmit within 15 days.

Step 4: Drafting the LLP Agreement

The LLP agreement outlines the rights, duties, and obligations of partners. All partners must sign it, and details such as profit-sharing ratios, responsibilities, and management structures should be included. This agreement is crucial as it governs the internal workings of the LLP.

Step 5: Filing Incorporation Documents

Submit the incorporation documents to the Registrar of Companies (ROC). The key documents include:

LLP Agreement

Form 2 (Incorporation Document)

Identity and Address Proof of Partners

Proof of Registered Office Address (like a utility bill or rental agreement)

Ensure all documents are signed digitally using DSC.

Step 6: Certificate of Incorporation

Upon successful verification of documents, the ROC will issue a Certificate of Incorporation. This certificate signifies that your LLP is officially registered and can commence business operations.

Post-Incorporation Compliance

After registration, there are several compliance requirements:

PAN and TAN Registration: Apply for Permanent Account Number (PAN) and Tax Deduction Account Number (TAN).

Open a Bank Account: Open a bank account in the name of the LLP.

Annual Filings: File annual returns with ROC using Form 11 and maintain financial statements.

Cost of LLP Registration

The costs associated with registering an LLP in Bangalore typically include:

Item

Cost

Digital Signature Certificates

₹3,000

Government Fees

₹1,500

Professional Fees

₹3,999

Total Estimated Cost

₹8,499

These costs may vary depending on additional services or consultancy fees.

Conclusion

Registering an LLP in Bangalore is a straightforward process that offers significant advantages to entrepreneurs seeking limited liability protection while maintaining operational flexibility. By following this step-by-step guide, you can efficiently navigate through the registration process and set up your business successfully.

If you would like more help or detailed questions about specific steps or documentation, please consult with professionals who specialise in business registrations in Bangalore.

0 notes

Text

Limited Liability Partnership (LLP) Firm Registration: Benefits, Process, and Requirements | Legal Man

A Limited Liability Partnership (LLP) combines the advantages of both a company and a partnership, making it a popular choice for entrepreneurs. Here's a detailed overview of Limited Liability Partnership (LLP) Firm Registration in India:

What is LLP?

An LLP is a hybrid entity that offers the benefits of a partnership while limiting the partners' liabilities. It was introduced in India by the Limited Liability Partnership Act, 2008. Unlike traditional partnerships, LLPs protect partners from personal liability beyond their investment, making them a safer option for business owners.

Benefits of LLP

LLPs have numerous benefits, which make them a preferred choice for professionals and businesses:

Limited Liability: One of the main advantages is that the partners’ liability is limited to their capital contribution. This means that the personal assets of the partners are protected in case of losses or business debts.

Separate Legal Entity: An LLP is treated as a separate legal entity, independent of its partners. This allows the LLP to own assets, enter into contracts, and sue or be sued in its own name.

No Maximum Limit on Partners: While a traditional partnership can have a maximum of 20 partners, an LLP can have an unlimited number of partners.

No Minimum Capital Requirement: Unlike companies, there is no minimum capital required to form an LLP. This feature is attractive for startups or small businesses.

Less Compliance and Regulations: LLPs have fewer regulatory compliance requirements compared to private limited companies. For instance, they don't require annual audits unless their turnover exceeds a certain limit.

Tax Benefits: Limited Liability Partnership (LLP) Firm Registration enjoy tax advantages such as avoiding Dividend Distribution Tax (DDT), which applies to companies. Profits distributed among partners are tax-free after they pay the income tax.

Easy Transfer of Ownership: Transfer of ownership or changes in partners is simpler in an LLP as compared to a traditional partnership or company.

Steps for LLP Registration

Obtain Digital Signature Certificate (DSC): Since the registration process is online, all the designated partners of the LLP need to obtain a Digital Signature Certificate (DSC). The DSC is used to sign electronic documents.

Apply for Director Identification Number (DIN): Each designated partner of the LLP must have a Director Identification Number (DIN), which can be obtained from the Ministry of Corporate Affairs (MCA).

Name Reservation: An LLP must reserve its name through the RUN-LLP (Reserve Unique Name - Limited Liability Partnership) service provided by the MCA. It’s advisable to check name availability before submission to avoid rejections.

Filing of Incorporation Form: After the name is approved, the Form for Incorporation of LLP (FiLLiP) must be submitted. This form contains details about the LLP’s partners, registered office, and other necessary documents.

LLP Agreement: An LLP agreement defines the rights and duties of the partners and the firm. It must be filed within 30 days of LLP incorporation and can be amended as required.

Documents Required for LLP Registration

Partners’ Documents:

PAN Card of all partners (mandatory)

Address proof (Passport, Voter ID, Driver's License)

Residence proof (Bank statement, electricity bill, telephone bill)

Registered Office Documents:

Address proof of the registered office

NOC from the landlord if the office is rented

LLP Agreement: Drafting the LLP Agreement is essential, and it should include details like profit-sharing ratio, responsibilities, and roles of partners.

post-Registration Compliance

Once the Limited Liability Partnership (LLP) Firm Registration done, it is subject to annual compliance requirements such as:

Filing Annual Returns: Form 11, which contains the details of partners, must be filed annually.

Statement of Accounts & Solvency: LLPs must maintain proper financial records and file Form 8 annually, which declares solvency and financial status.

Income Tax Filing: LLPs are required to file their Income Tax Return by the prescribed date, based on their turnover and audit requirements.

Who Should Register an LLP?

LLP is ideal for:

Professionals like CA, CS, doctors, or architects who want to form a firm.

Entrepreneurs and startups looking for a flexible yet protected business structure.

Businesses that plan to scale but want to avoid the compliance burden of private limited companies.

Service providers who operate with multiple partners and wish to safeguard their personal assets.

Conclusion

The LLP structure is gaining popularity due to its flexibility, low compliance burden, and limited liability protection. It’s a smart choice for small businesses, startups, and professionals. With minimal capital requirements, tax advantages, and simplified legal formalities, Limited Liability Partnership (LLP) Firm Registration has become a preferred option for many entrepreneurs in India.For more details, refer to Legal Man.

#Limited Liability Partnership (LLP) Firm Registration#private limited company registration#ROC Compliances#indian subsidiary incorporation

0 notes

Text

ROC Filing Requirements for Startups

Startups often face challenges with regulatory compliance, and ROC filing is one such requirement that must not be overlooked. At Saptax Hub, we specialize in guiding startups through the ROC filing process, offering our services for ROC Filing in Delhi.

What is ROC Filing for Startups?

ROC filing involves the submission of annual returns and financial documents to the Registrar of Companies. For startups operating as private limited companies or LLPs, compliance with ROC filing is mandatory. This process is essential for maintaining legal standing and ensuring transparency.

Key ROC Filing Requirements for Startups

Form INC-20A (Commencement of Business Certificate): After incorporation, a startup must file this form within 180 days to declare the commencement of business.

Form AOC-4: Financial statements including the balance sheet, profit and loss account, and audit report must be submitted annually.

Form MGT-7 (Annual Return): This is a mandatory annual filing, capturing the company’s structure, shareholders, and governance details.

Common Challenges Faced by Startups

Lack of Awareness: Many startups are unaware of their filing obligations and deadlines.

Limited Resources: Startups often lack the in-house expertise to handle legal filings and compliance.

Penalties for Non-Compliance: Failure to meet ROC filing deadlines can lead to penalties, impacting the financial health of the startup.

How Saptax Hub Can Help

At Saptax Hub, we offer end-to-end solutions for ROC Filing in Delhi for startups. Our experienced team of Chartered Accountants will ensure that your startup complies with all ROC filing requirements, helping you focus on growing your business.

Conclusion

For startups looking to streamline their compliance processes, Saptax Hub, a trusted CA Firm in Delhi, provides reliable ROC filing services. Contact us today to ensure your startup stays compliant with the law.

0 notes

Text

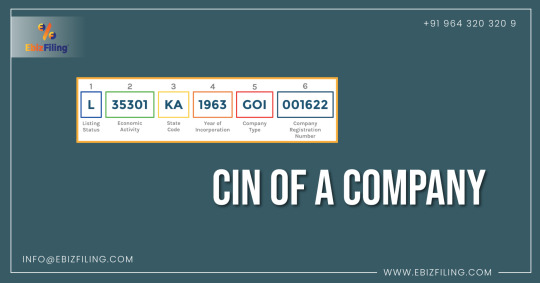

What is Corporate Identification Number (CIN)?

Introduction

This blog includes information on the corporate identification number (CIN), covering information on the CIN for companies, what it is, how to check it, and other related information. The Registrar of Companies (ROC) assigns each company incorporated in India with a unique identification number known as a Corporate Identification Number (CIN). After receiving their Registration Certificate, companies are granted their CIN by the ROC. The CIN is significant because every business is required to include this specific number on all documents submitted to the MCA, such as audits and other reports.

What is CIN Number?

The Ministry of Corporate Affairs issues the Corporate Identification Number (CIN), a 21-digit alpha-numeric identifier, to businesses that are formed in India after they have registered with the ROC in various states across the country.

All businesses that register in India are issued a CIN; examples are listed below.

One Person Company (OPC)

Nidhi Company

Limited Liability Company

State-owned enterprises

The company from Section 8 and others

On the other hand, Limited Liability Partnerships (LLP) registered in India do not acquire a CIN. LLPs are given a special 7-digit identifying number called the LLPIN (Limited Liability Partnership Identifying Number) by the ROC.

Description of the 21-digit of CIN

Section 1

The first character of a CIN shows whether a company is “Listed” or “Unlisted” on the Indian stock exchange. So, the first character indicates if the company is a stock market listed company. The CIN of a company will start with the letter “L” if it is listed, and with the letter “U” if it is not.

Section 2

The next five numeric digits classify a company’s economic activity or the industry to which it belongs. This categorization is based on the kind of economic activity that a facility like that would carry out. The MCA (Ministry of Corporate Affairs) has issued numbers to each category and industry.

Section 3

The next two letters represent the Indian state where the company is registered. As an illustration, GJ signifies Gujarat, MH signifies Maharashtra, KA signifies Karnataka, and so on. It works in the same way that a vehicle registration number does.

Section 4

The next four digits in a CIN number represent the year in which the company was created.

Section 5

The next three letters stand for the company class. These three letters indicate whether a company is a public limited or private limited company. If the CIN number is FTC, it means the business is a subsidiary of a foreign corporation, whereas the Government of India means the business is owned by the Indian government.

Section 6

The final six numerical digits represent the registration number provided by the concerned ROC (Registrar of Companies).

The importance of a company’s CIN number

The 21-digit CIN has a unique importance that is easy to understand and simplifies the identification of important corporate data.

It is used to obtain the fundamental data on businesses that are registered in the nation with the MCA (Ministry of Corporate Affairs).

A company’s CIN (Corporate Identification Number) must be submitted on all transactions with the relevant ROC (Registrar of Companies), and it is used to track all of its activities beginning with the time the ROC first established the company.

CIN numbers can be used to identify or track organizations for various levels of information maintained by MCA/ROC. The CIN provides details about the Registrar of Companies (ROC) as well as the identification of the company.

How to obtain a CIN number for your company?

Once you have chosen the type of business you want to establish, the steps to obtaining a CIN are as follows.

Get a DSC (Digital Signature Certificate).

Obtain a DIN (Director Identification Number).

The new user registration process must be finished.

After completing this, complete the company incorporation process.

Incorporate the Company

After receiving the company’s incorporation papers, the MCA (Ministry of Corporate Affairs) will evaluate and approve the application. After all of the application’s data has been verified, the CIN is assigned.

“Effortlessly meet compliance with our comprehensive LLP Annual Return Filing services. Expert assistance for seamless filings, ensuring your business stays on track. Stay focused on growth while we handle the paperwork.”

Summary

A business registration number, also referred as a CIN (Corporate Identification Number), a special identification number issued by the ROC (Registrar of Companies). In simple terms, a CIN is a special code that includes both the company’s identification number and extra details about how it operates.

0 notes

Text

Key Compliance Requirements For Startup And MSME

What is a Startup ?

Startups is a newly established company founded to develop or bing a unique product or service to market and make it irresistible and irreplaceable for customers.

What is an MSME & Its classification ?

MSME stands for Micro, Small, and Medium Enterprises. The criteria for the classification is as follows -

A. Micro Enterprises: Investment in plant and machinery or equipment does not exceed Rs. 1 crore and the annual turnover is up to Rs. 5 crores.

B. Small Enterprises: Investment in plant and machinery or equipment exceeds Rs. 1 crore up to Rs. 10 crore and the annual turnover is between Rs. 5 crores and Rs. 50 crores.

C. Medium Enterprises: Investment in plant and machinery or equipment exceeds Rs. 10 crores up to Rs. 50 crores and the annual turnover is between Rs. 50 crores and Rs. 250 crores.

Compliance specific to MSMEs

Section 9 of the MSMED ((Micro, Small and Medium Enterprises Development) Act defines specific companies for which MSME Form 1 is a crucial compliance. These companies submit MSME Form 1 once every six months to the Ministry of Corporate Affairs (MCA).

The listed companies are required to submit an annual return of outstanding payments of MSMEs to the Registrar of Companies (ROC) every year, which includes information on the amount due for payment and the reason for the delay. These companies can file MSME Form 1 only if their outstanding payment to MSME suppliers has exceeded 45 days.

MSME Form 1

The MSME-1 is a half-yearly return that the specified companies need to file regarding their outstanding payments to the MSME. In this manner, the ROC can keep track of the companies that have outstanding dues towards MSMEs and the MSME suppliers who need to receive payments. Specified companies are companies-

That have obtained goods or services from the MSME.

Whose payments to the MSMEs exceed 45 days from the date of acceptance or deemed acceptance of the goods or services.

Compliance with legal, financial, and regulatory requirements forms the very foundation of long-term sustainability and growth of any startup or MSME. These certifications establish customer trust and show commitment to meeting industry standards and regulatory requirements. Below is a list of compliance requirements for both startups & MSMEs :-

1. Business Registration and Licensing Company Formation

Proper registration under the appropriate form, whether proprietorship, partnership, LLP, or a private limited company. The Companies Act, 2013 and the Limited Liability Partnership (LLP) Act, 2008, govern registrations in India and require startups to submit several documents, including the company’s Memorandum of Association (MoA), Articles of Association (AoA), LLP Agreement, proof of identity and address of the directors/partners and details of the registered office address. The registration process can be completed online through the Ministry of Corporate Affairs (MCA) website.

A. Trade License: It means a trade or professional license that is required for the business by its nature.

B. Industry Specific Licenses: These would correspond to the particular industry regulations addressed by restaurants, for instance, food safety aspects, or the environmental clearances required for a manufacturing unit.

Registration specific to MSMEs -

A. Udyam Registration: MSMEs must register on the Udyam Registration portal to obtain an MSME certificate, which is necessary to avail various government schemes, subsidies, and benefits. This replaces the earlier system of Udyog Aadhaar.

B. Classification: Ensure your enterprise falls under the correct category (Micro, Small, or Medium) based on investment in plant & machinery/equipment and turnover.

2. Tax Compliance

A. Income Tax: The concerned entity has to register itself for income tax and continue to comply with its provisions by filing returns on time and paying advance taxes.

B. Goods and Services Tax (GST): If the turnover is more than the threshold prescribed under GST, then there will have to be registration under it. Timely filing of GST returns and payment of taxes.

C. Other Taxes: Depending upon the business, there may be requirements of compliance in respect of other taxes such as excise duty, customs duty, or state-specific taxes.

3. Laboure and Employment Laws Employee Provident Fund

If there are 20 or more employees, ensure compliance regarding employees -

A. Employees State Insurance: Get registered under Employees State Insurance if it employs more than 10 employees and ensure medical benefits as required.

B. Employees' Provident Fund (EPF): Organisation with 20 or more employees must register for PF. However, smaller establishments can also register voluntarily to provide benefits to their employees.

C. Minimum Wages Act: A minimum wage as concerned and prescribed by the law shall be provided to employees.

D. Employment Contracts: All employees shall be provided with formal employment contracts. Every employee shall have an employment contract that requires clearly stated working hours, leaves, and discharge conditions in compliance with labor laws.

4. Intellectual Property Rights (IPR) Trademarks

Branding and logos are intellectual property and, hence should be registered as trademarks.

A. Patents and Copyrights : If applicable, register innovative products or processes under Patents and original content under Copyright.

B. Confidentiality Agreements: Use non-disclosure agreements to protect sensitive business information.

5. Environmental and Safety Regulations Environmental Compliance

Ensure compliance with the environmental regulations on waste management, pollution control, and obtaining environmental clearances. Comply with the regulations at workplaces concerning fire safety, hazard management, and health of employees.

6. Financial Reporting and Audits Statutory Audits

Conduct an annual statutory audit under the statute and ensure filing the financial statements with the regulatory authorities in a timely manner.

A. Internal Audits: Develop internal audits to track the financial health and also adherence to the internal policies.

B. Accounting Standards: Follow accounting standards laid down by the regulating bodies either under the Institute of Chartered Accountants of India or under the International Financial Reporting Standards.

7. Data Protection and Privacy Data Protection

Data protection is becoming increasingly crucial for businesses in India. As a business, it is essential to implement data protection measures, such as secure storage of customer data and complying with data protection regulations such as GDPR, CCPA etc.

8. Anti-Money Laundering and Know Your Customer AML Compliance

Put in place anti-money laundering policies and procedures, particularly in financial services. KYC norms for Customer Identification and Prevention of Frauds.

9. Corporate Governance Board Meetings

Hold Board Meetings and compliances related to the Minutes of Meetings. Holding of AGMs and compliances related to Shareholders' Rights and Obligations. Certain categories of companies are required to appoint a qualified Company Secretary to look after compliance.

10. Sector-Specific Compliance Healthcare

Compliance related to Health-related Regulations, Licensing, and Patient Confidentiality Laws.

11. Compliance with Foreign Direct Investment FDI Norms

Adhere to the FDI norms while taking foreign investment, which inter alia, includes reporting requirements and sectoral caps.

12. Consumer Protection Laws Fair Trade Practices

Comply with the consumer protection Acts that ensure transparency and quality with fair pricing.

13. Corporate Social Responsibility Compliance with CSR

If your business has a net worth of ₹500 crore or more, a turnover of ₹1,000 crore or more, or a net profit of ₹5 crore or more, comply with CSR obligations, including spending on social activities and filing CSR reports.

JJTax

1 note

·

View note

Text

Limited Liability Partnership (LLP) Registration: A Comprehensive Guide

A Limited Liability Partnership (LLP) is a popular form of business structure that combines the benefits of a partnership and a company. It offers the flexibility of a partnership while providing the advantage of limited liability to the partners. LLPs are especially preferred by professionals, startups, and small businesses due to their simplicity in compliance and operational flexibility.

This article outlines the step-by-step process for LLP registration, including the necessary documents, eligibility, and benefits.

What is an LLP?

An LLP is a separate legal entity formed under the Limited Liability Partnership Act, 2008. It allows partners to operate the business with limited liability, meaning their personal assets are protected in case of the LLP’s debt or legal issues. In an LLP, the liabilities of partners are limited to the extent of their contribution to the partnership, which makes it an attractive option for entrepreneurs.

Key Features of LLP

Separate Legal Entity: An LLP is a separate legal entity from its partners, meaning it can own assets, enter into contracts, and sue or be sued in its name.

Limited Liability: Partners have limited liability protection, meaning their personal assets are safe.

No Minimum Capital Requirement: LLPs have no minimum capital requirement, which makes them accessible for businesses of any size.

Flexibility in Management: The internal structure of an LLP is flexible, and partners can manage the business without mandatory compliance rules like those for private limited companies.

Perpetual Succession: The LLP’s existence is not affected by changes in its partners.

Documents Required for LLP Registration

To register an LLP, you will need to submit the following documents:

PAN Card of all partners

Address proof of partners (Aadhar card, driving license, or voter ID)

Proof of registered office address (rent agreement, utility bill)

Passport-sized photographs of partners

Digital Signature Certificate (DSC) for one or more designated partners

Step-by-Step Process for LLP Registration

Obtain Digital Signature Certificate (DSC): Every designated partner in the LLP must have a DSC for signing documents digitally. The DSC can be obtained from certified agencies by submitting identity proof and address proof.

Apply for Director Identification Number (DIN): Each designated partner must have a DIN, which is issued by the Ministry of Corporate Affairs (MCA). You can apply for DIN while filing the LLP registration application.

Name Reservation: The LLP name must be unique and compliant with MCA naming guidelines. You can check the availability of the name through the MCA portal and reserve it using the RUN-LLP form.

Filing the Incorporation Form: Once the name is approved, you need to file Form FiLLiP (Form for Incorporation of Limited Liability Partnership) on the MCA portal. Along with this form, you must submit the incorporation documents, including partner details and the LLP agreement.

LLP Agreement: An LLP Agreement is a crucial document that defines the rights, responsibilities, and roles of the partners. It must be filed within 30 days of incorporation. The agreement must be notarized and submitted to the MCA in Form 3.

Obtain Certificate of Incorporation: After verifying the documents, the Registrar of Companies (ROC) will issue the Certificate of Incorporation, which signifies that the LLP is officially registered.

LLPIN: Once incorporated, the LLP is issued a unique LLPIN (Limited Liability Partnership Identification Number).

Post-Registration Compliance

After registering an LLP, there are ongoing compliance requirements, such as:

Annual Return (Form 11): LLPs must file their annual return with the MCA.

Statement of Account and Solvency (Form 8): This form must be filed annually to declare the LLP’s financial health.

Income Tax Returns: LLPs must file income tax returns with the Income Tax Department.

Benefits of LLP Registration

Limited Liability Protection: Partners are only liable for the amount they have invested in the LLP, ensuring personal asset protection.

Operational Flexibility: LLPs have fewer compliance requirements than private limited companies, allowing more focus on business operations.

Separate Legal Entity: LLPs can own property, enter into contracts, and maintain legal standing independent of the partners.

Tax Benefits: LLPs are subject to lower tax rates and are exempt from Dividend Distribution Tax (DDT).

Conclusion

LLP registration is a straightforward and efficient process that offers many benefits, especially for small businesses, startups, and professionals. It provides the advantages of a corporate structure with minimal compliance burdens, making it an ideal choice for businesses looking to operate flexibly while protecting partners’ personal assets. By following the necessary steps and complying with post-registration requirements, entrepreneurs can enjoy the benefits of running an LLP.

0 notes

Text

1 note

·

View note

Text

Top Advantages of Choosing LLP for Your Business

In today's competitive business environment, entrepreneurs are constantly searching for the ideal business structure that offers flexibility, legal protection, and operational efficiency. One such structure that has gained immense popularity is Llp Company Registration In Bangalore. Offering the best of both worlds the limited liability of a company and the operational flexibility of a partnership LLP has become the go-to choice for many business owners.

1. Limited Liability Protection

The most significant advantage of an LLP is its limited liability feature. In a traditional partnership, the partners' personal assets are at risk in case of business losses or legal issues. However, in an LLP, the liability of each partner is limited to the amount they have contributed to the business. This means personal assets are protected, and partners aren't held personally responsible for the debts or obligations of the firm beyond their capital investment.

This feature provides peace of mind to entrepreneurs, as they are protected from personal bankruptcy or legal consequences if the business faces financial difficulties or legal disputes. It also encourages people to start businesses without the fear of personal financial ruin.

2. Operational Flexibility

One of the standout advantages of LLPs is their flexibility. Unlike corporations, where shareholders have little say in the day-to-day operations, an LLP allows its partners to manage the business directly. The operational structure can be customized based on the partners’ agreement, offering flexibility in management roles, profit-sharing, and decision-making authority. This is a key advantage, especially for small and medium enterprises where founders want hands-on control over their business without the rigid governance structures of a corporation.

Additionally, an LLP does not require board meetings, resolutions, or exhaustive compliance protocols as in the case of private limited companies. This reduces the operational burden on business owners, allowing them to focus on growing the business.

3. No Minimum Capital Requirement

In some forms of business entities, such as private limited companies, there is a minimum capital requirement to start the business. However, an LLP offers the advantage of having no minimum capital requirement. Whether a business is launched with a small or large investment, the flexibility in capital contribution makes it easier for entrepreneurs to kickstart their ventures.

This characteristic is particularly beneficial for startups and small businesses that may not have significant initial funding but wish to enjoy the benefits of a registered business entity.

4. Separate Legal Entity

This means that the LLP itself can own assets, incur liabilities, enter contracts, and sue or be sued in its name. This offers added protection to the partners as the business activities are legally distinct from personal affairs.

5. Tax Benefits

One of the most attractive advantages of an LLP is its tax efficiency. In India, LLPs are taxed at a flat rate of 30%, which is lower compared to corporations that may face additional taxes such as dividend distribution tax. Moreover, there is no dividend tax on the profits distributed among the partners in an LLP, whereas in a corporation, dividends paid to shareholders are subject to additional taxation.

6. Reduced Compliance Requirements

LLPs enjoy significantly fewer compliance requirements compared to other business structures such as private limited companies or corporations. While LLPs are required to file annual returns, maintain financial records, and undergo audits (only if turnover exceeds a certain threshold), the overall compliance burden is lighter. For instance, LLPs are not subject to the requirement of holding annual general meetings (AGMs) or filing resolutions with the registrar for every decision, unlike corporations.

7. Perpetual Succession

Unlike a traditional partnership, where the partnership dissolves upon the death or insolvency of a partner, an LLP enjoys perpetual succession. This means that the LLP continues to exist irrespective of changes in the composition of its partners. The business is unaffected by events like a partner leaving, passing away, or declaring bankruptcy.

8. Attracting Investors

For businesses looking to attract external funding, the LLP structure offers a credible and flexible platform. LLPs are seen as more formal and reliable compared to sole proprietorships or traditional partnerships, which may not inspire confidence in investors. Since LLPs are separate legal entities, external investors can invest without becoming personally liable for the business's liabilities, making the business more attractive for angel investors, venture capitalists, and even private equity.

9. International Flexibility

For businesses with global aspirations, the LLP structure is internationally recognized and respected. Many countries, including the U.S., the UK, and Australia, have provisions for LLPs, making cross-border partnerships and collaborations more streamlined. International clients, vendors, and partners are likely to feel more comfortable doing business with an LLP,

LLPs are also eligible to engage in foreign investments, facilitating the expansion of Indian businesses abroad or foreign businesses in India. The regulatory framework surrounding LLPs is conducive to international trade and collaboration.

10. Easy Dissolution

If a business reaches a point where it is no longer viable, dissolving an LLP is relatively straightforward compared to other business entities. While it requires due legal processes, the partners can agree to dissolve the LLP and wind up its affairs without extensive legal complications. This flexibility is valuable for entrepreneurs who may wish to pivot to new ventures or exit a business without getting entangled in prolonged closure procedures.

Conclusion

the Llp Company Registration In Bangalore structure offers a unique blend of limited liability, operational flexibility, and tax benefits, making it an ideal choice for businesses of all sizes. It combines the advantages of a corporate entity with the simplicity of a partnership, giving entrepreneurs the freedom to operate efficiently while enjoying legal and financial protection. Whether you're a startup, a growing small business, or an established firm, opting for an LLP can offer long-term benefits that promote growth, innovation, and stability.

0 notes