#LLP annual filing

Text

30-May-24 - LLP Form 11

Annual Return of LLP for FY 23-24

30-May-24 : FC-4 - Annual Return of Foreign Company (Branch / Liaison /Project Office)

✅ Extended of Date for exercise of Option by GTA to pay GST itself from 15 Mar, 2024 to 31st May, 2024

✅31-May-24

Form 24Q, 26Q, 27Q

Quarterly statements of TDS for January- March

0 notes

Text

LLP Form 11 due dates

Ensure compliance with LLP regulations by staying informed about LLP Form 11 due dates. Our seamless LLP annual return filing services make the process hassle-free. Stay ahead with our expert assistance, meeting deadlines effortlessly. Optimize your LLP's performance by filing Form 11 on time, ensuring legal compliance and peace of mind. Trust us for reliable LLP compliance solutions, tailored to your needs.

Get in touch with our experts today!

Email: [email protected]

Mobile: +91 9643203209

Website: https://ebizfiling.com/

0 notes

Text

A complete guide on LLP Annual Filing and Process for LLP E-filing

Returns for a Limited Liability Partnership (LLP) should be filed on a regular basis to ensure compliance and avoid the harsh penalties imposed by the law for non-compliance. When compared to the compliance obligations placed on Private Limited Company, a Limited Liability Partnership has only a few compliances to follow each year. File your LLP annual returns with the professional help of Ebizfiling.

0 notes

Text

Annual filings for Limited Liability Partnership

There are numerous matters to be performed to keep compliance for a Limited Liability Partnership (LLP) and keep away from heavy consequences for non-compliance below the law. For example, the go back filings need to be filed periodically. As in comparison to the compliance necessities positioned at the personal restrained companies, Limited Liability Partnerships have just a few compliance necessities to observe every yr, that's pretty low. However, the fines appear to be pretty high. LLPs is probably charged as much as INR five lakh in consequences for non-compliance, while a Private Limited corporation may handiest be charged INR 1 lakh in consequences for non-compliance.

LLP compliance

Due to the truth that Limited Liability Partnerships are separate prison entities, it's far the duty of the elected companions to keep a right ee-e book of debts and record an annual go back with the Ministry of Corporate Affairs (MCA) according with the law.

Except for restrained legal responsibility partnerships with annual turnover over Rs.forty lakhs and contributions over Rs.25 lakh, auditing in their books of debts isn't required. Hence, an LLP isn't required to get their books of account audited if it fulfils the above-stated condition, so the yearly submitting method may be simplified.

The Statement of Account & Solvency for Limited Liability Partnerships need to be filed inside thirty (30) days from the give up of the economic yr, and the Within sixty (60) days of the give up of the economic yr, the yearly go back need to be filed.

Limited Liability Partnerships are required to keep a economic yr from April 1st to March thirty first, much like companies. Every LLP is needed to put up a Statement of Accounts and Solvency with the aid of using October thirtieth of every economic yr, and its annual go back is due on May thirtieth each yr although the LLP has now no longer finished any enterprise in the course of the modern economic yr. Even if the LLP hasn't began any enterprise, a number of the LLP annual submitting are mandatory.

Solvency and Accounts Statements

As a part of its responsibilities as an LLP Annual Filing, all enrolled LLPs are required to maintain correct books of debts and put up them to the nation in Form eight, which incorporates records concerning the earnings made, different economic records associated with the enterprise, and different economic records associated with the enterprise. As nicely as being attested with the aid of using the signatures of the detailed companions, Form eight ought to additionally be licensed with the aid of using a chartered accountant, a corporation secretary, or a value accountant who's actively concerned within side the enterprise. There is a best of Rs.a hundred in step with day in case you fail to record the announcement of debts and solvency file for the economic yr with the aid of using the said due date. The due date for submitting shape eight each yr is October 30.

Filing of the Annual Return

In order to record annual returns according with the law, the LLPs ought to fill out the prescribed shape-eleven. The shape is taken into consideration to be a precis of the control affairs of the LLP, along with the wide variety of companions in addition to their names. Moreover, the shape eleven need to be filed with the aid of using thirtieth May each yr.

Income Tax Act Filings and Audits

According to the Limited Liability Partnership Act, 2008, Limited Liability Partnerships with a turnover of extra than Rs.forty lakh or a contribution of extra than Rs.25 lakh are required to have their books of account audited with the aid of using practicing chartered accountants. In the case of an LLP required to have his books audited, September thirtieth is the closing date for submitting the tax go back.

Note: With impact from AY 2021-22 (FY 2020-21), the edge restrict for a tax audit has been improved to Rs.five crore if the taxpayer’s coins receipts are restrained to five% of gross receipts or turnover, and if the taxpayer’s coins bills are restrained to five% of mixture bills.

LLPs without a tax audit closing date are due July thirty first for taxes. Limited Liability Partnerships which have engaged in any worldwide transactions with related establishments or have undertaken exact home transactions are required to record Form 3CEB. It ought to be licensed with the aid of using a practicing Chartered Accountant. Limited Liability Partnerships that need to record this shape can achieve this with the aid of using thirtieth November.

The LLP ought to record its profits tax go back in Form ITR5 the use of the digital signature of the detailed partner, which may be performed on line through the profits tax website.

0 notes

Text

Avoiding Common Mistakes in LLP Annual Filing

Limited Liability Partnerships (LLPs) have become a popular choice for businesses due to their flexible structure, limited liability protection, and fewer compliance requirements than other entities like private limited companies. However, LLPs in India still need to adhere to annual filing requirements to ensure legal compliance. This guide provides an overview of the essential aspects of annual filing for LLPs.

0 notes

Text

LLP Annual Return Service - Form-11 Filing

Complete your LLP annual filing effortlessly with Form 11 Declaration with Paper Tax Services. Ensure compliance and focus on growing your business without worries. https://bit.ly/4cvLkRT

#Form 11 Filing Service#Form 11 Declaration#Form 11 for LLP#Form 11 for LLP Filing Service#LLP Annual return form 11#Form 11 LLP Filing#Form 11 LLP Filing Service#LLP Annual Filing Service#LLP Annual Return Filing#LLP Annual Return Filing Service

0 notes

Text

Annual filing for LLPs refers to the process of submitting mandatory documents and forms to the Registrar of Companies (RoC) each year. These filings provide the government with up-to-date information about the LLP's financial status and operations. Failure to comply with these requirements can result in penalties and legal consequences.

0 notes

Text

Navigating Annual Compliance: A Guide for Pvt Ltd Companies

Annual compliance is not just a legal requirement; it's a cornerstone of good corporate governance and transparency. For private limited (Pvt Ltd) companies in India, adhering to annual compliance regulations is essential to maintain legal standing, uphold accountability, and ensure smooth operations. In this blog, we'll explore the key aspects of annual compliance for Pvt Ltd companies and why it matters.

Understanding Annual Compliance

Annual compliance for Pvt Ltd companies entails fulfilling various legal and regulatory obligations mandated by the Companies Act and other relevant statutes. These obligations include holding annual general meetings (AGMs), filing financial statements, maintaining statutory registers, and complying with tax laws. These tasks are designed to promote transparency, protect stakeholders' interests, and uphold the integrity of the corporate sector.

The Importance of AGMs

AGMs are pivotal events in the annual compliance calendar for Pvt Ltd companies. During these meetings, shareholders gather to discuss and approve financial statements, appoint auditors, declare dividends, and address any other matters concerning the company's affairs. AGMs serve as a platform for shareholders to exercise their rights, engage with company management, and assess the company's performance and governance practices.

Filing Financial Statements

Filing accurate and timely financial statements with the Registrar of Companies (RoC) is a crucial aspect of annual compliance. These statements, including the balance sheet, profit and loss account, and cash flow statement, provide insights into the company's financial health and performance. Compliance with filing requirements ensures transparency, facilitates investor confidence, and mitigates the risk of regulatory penalties.

Maintaining Statutory Registers

Pvt Ltd companies are required to maintain various statutory registers, including registers of members, directors, and charges. These registers contain vital information about the company's ownership, management structure, and financial obligations. Keeping these registers updated and accurate is essential for regulatory compliance, facilitating due diligence processes, and demonstrating good corporate governance practices.

Tax Compliance Obligations

Annual compliance for Pvt Ltd companies also extends to tax-related obligations. This includes filing annual tax returns, such as income tax returns and Goods and Services Tax (GST) returns, and paying applicable taxes within the prescribed deadlines. Compliance with tax laws is critical to avoid penalties, maintain financial integrity, and uphold the company's reputation.

Conclusion:

Annual compliance is a non-negotiable responsibility for Pvt Ltd companies in India. By fulfilling their legal and regulatory obligations, these companies demonstrate their commitment to transparency, accountability, and sound corporate governance. However, navigating the complexities of annual compliance can be challenging, requiring careful planning, attention to detail, and expertise in regulatory matters. Seeking professional assistance from legal and financial advisors can help Pvt Ltd companies stay on top of their compliance obligations and ensure continued success in the dynamic business landscape.

0 notes

Text

Top LLP Company Compliance in Kolkata

Top LLP Company Compliance in Kolkata: Simplifying Compliance with Filemydoc

Introduction:

In the bustling city of Kolkata, numerous limited liability partnership (LLP) companies thrive and contribute to the region's vibrant business ecosystem. However, with the ever-increasing complexities of legal and regulatory frameworks, ensuring compliance can be a daunting task for business owners. This article aims to shed light on the top LLP company compliance requirements in Kolkata and how Filemydoc, a trusted online platform, simplifies the compliance process.

1. Understanding LLP Company Compliance:

Compliance for LLP companies in Kolkata involves adhering to various legal and regulatory obligations. These obligations ensure that businesses operate ethically, maintain transparency, and meet the standards set by the government and relevant authorities. Key compliance requirements for LLP companies in Kolkata include:

a) Registrar of Companies (RoC) Compliance: LLPs must comply with the filing of annual returns, financial statements, and other statutory documents with the RoC.

b) Tax Compliance: Complying with the Goods and Services Tax (GST), income tax, and other applicable tax regulations is crucial for avoiding penalties and maintaining financial transparency.

c) Employment Compliance: LLPs must adhere to labor laws, employee benefits, provident fund, professional tax, and other employment-related compliances.

2. The Importance of Top LLP Company Compliance in Kolkata:

Maintaining compliance is not just a legal requirement but also crucial for the long-term success and reputation of any LLP company in Kolkata. Here's why top LLP company compliance is essential:

a) Avoiding Legal Consequences: Non-compliance can result in hefty penalties, legal disputes, and even the dissolution of the LLP. Adhering to the regulations ensures the company's sustainability and protects its stakeholders.

b) Building Trust and Credibility: Compliant companies foster trust among customers, investors, and partners. Demonstrating commitment to compliance enhances the company's reputation and credibility in the market.

c) Ensuring Operational Efficiency: Compliance procedures often involve streamlining internal processes, leading to improved operational efficiency and reduced risk of errors.

3. Introducing Filemydoc: Simplifying LLP Company Compliance:

Filemydoc, a leading online platform, offers a comprehensive solution for LLP company compliance in Kolkata. With its user-friendly interface and advanced features, Filemydoc simplifies the compliance process, allowing businesses to focus on their core operations. Key features of Filemydoc include:

a) Automated Compliance Reminders: Filemydoc sends timely notifications and reminders about upcoming compliance deadlines, ensuring companies never miss a crucial filing date.

b) Document Management System: The platform provides a secure and centralized repository to store and manage all compliance-related documents, eliminating the hassle of manual record-keeping.

c) Expert Guidance and Support: Filemydoc offers expert guidance and assistance from professionals well-versed in the complexities of LLP company compliance. Users can seek advice and resolve queries through the platform's support channels.

4. Top LLP Company Compliance Services Offered by Filemydoc:

Filemydoc offers a range of services designed to address the specific compliance needs of LLP companies in Kolkata. Here are some of the top services provided by Filemydoc:

a) Annual Compliance Filings: Filemydoc facilitates seamless filing of annual returns, financial statements, and other statutory documents with the RoC, ensuring companies stay compliant.

b) Tax Compliance: The platform assists in GST registration, filing GST returns, income tax return filing, and other tax-related compliances, helping companies meet their tax obligations accurately and efficiently.

c) Legal and Regulatory Support: Filemydoc provides expert advice and assistance on legal and regulatory matters, including company incorporation, changes in partnership agreements, and compliance audits.

d) Compliance Audit and Due Diligence: The platform offers comprehensive compliance audits to identify areas of improvement and ensure adherence to all relevant regulations. This service is particularly useful during mergers, acquisitions, or partnership restructuring.

e) Annual Maintenance Packages: Filemydoc offers customized annual maintenance packages that cover all major compliance requirements, enabling companies to outsource their compliance management and focus on their business growth.

Conclusion:

Maintaining compliance with the legal and regulatory requirements is paramount for LLP companies in Kolkata. With the complexities involved, partnering with a reliable online platform like Filemydoc can simplify the compliance process significantly. By leveraging Filemydoc intuitive interface, automated reminders, and expert support, businesses can ensure seamless compliance management, avoid penalties, and build a strong reputation. Embrace Filemydoc to streamline your LLP company compliance in Kolkata and stay ahead in the dynamic business landscape

#LLP Annual Return Filing#LLP Registration in India#Limited Liability Partnership (LLP) Registration in India

0 notes

Text

Process of closing an LLP in India

The Limited Liability Partnership (LLP) is a trendy type of business entity, established in 2008 by the Limited Liability Partnership Act, that integrates the features of a company and a partnership. In earlier articles, we discussed the documents mandated for LLP registration and the registration process itself.

This article aims to assist you with the procedure for closing an LLP in India.

Although LLPs offer several benefits over other kinds of business entities, such as ease of incorporation and limited liability for members, these advantages do not necessarily translate into flourishing business operations. This article will explain the Strike Off method of closure and provide an overview of other closure options.

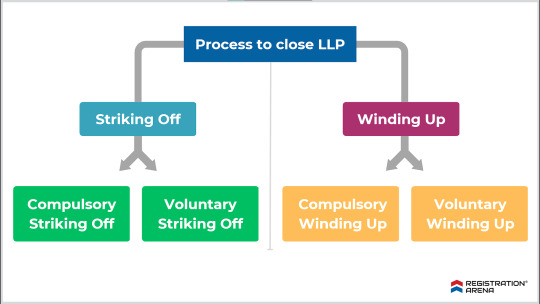

The process to close a Limited Liability Partnership

An LLP can be closed in two ways:

1. Strike-off method-

a. Voluntary Strike Off

The LLP should not have been engaged in commercial activities for a period of at least one year.

The LLP must file an application in Form 24 LLP with the Registrar of LLPs to apply for voluntary strike-off status.

The LLP should have completed all compliance requirements by the date of filing for closure. However, it is only required to file annual returns until the end of the year when commercial activities are discontinued.

The LLP must have obtained the approval of all parties involved, including members, creditors, and any regulatory authorities under whose domain the LLP works.

The LLP should not have any assets or liabilities as of the date of preparation of financial statements.

The process to close LLP through Strike Off method

In order to move forward with the Strike Off process, the LLP must follow the steps outlined below:

The LLP must plan a meeting of all partners to pass a resolution to strike off the name.

The LLP must pay all outstanding debts and liabilities before proceeding with the Strike Off process.

The meeting of partners must permit a designated partner to file the application for Strike Off.

The designated partner must file an application in e-Form 24 and submit it to the Registrar. The application must have the approval of all members.

Read more to know about the Procedure of Closing LLP in India

#closure of llp#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal services#legal consultation

0 notes

Link

Corpsee ITES Pvt Ltd company is the best llp compliance services provide. LLP stands for Limited Liability Partnership and is a concoction of a corporation and a partnership, LLPs are gaining tremendous popularity among investors because it provides several advantages that have helped boost the need and want to create more LLPs among entrepreneurs.

#llp annual compliance cost#online llp compliance services#llp compliance online services india#Annual Compliance for LLP Company#LLP Annual Filing in India#llp compliance services india#llp compliance services#annual compliance of llp#llp compliance checklist 2022#limited liability partnership in india#online llp formation#llp registration procedure#llp company registration in india#register llp online#register a llp in india

0 notes

Text

Back in 2022 at the annual Code Conference, where tech luminaries submit to onstage interviews, an audience member asked Apple CEO Tim Cook for some tech support. “I can’t send my mom certain videos,” he said; she used an Android device, which means she can't access Apple’s iMessage. Cook’s now-infamous response: “Buy your mom an iPhone.”

Cook’s remark and Apple’s recent decision to block the third-party app Beeper from bridging the Android-to-iMessage interoperability chasm are two of the many examples of allegedly monopolistic behavior cited in the US government’s antitrust suit against Apple. Central to the case is Apple’s practice of “locking in” iPhone customers by undermining competing apps, using its proprietary messaging protocol as glue, and generally making it challenging for people to switch to other phones.

Those accusations are backed up by lawyerly references to the Sherman Act. But the complaint also shows the Department of Justice crafting a cultural narrative, trying to tell a technology tale with a clear message—like an episode of the crime drama Dragnet, says antitrust expert William Kovacic, who teaches at George Washington University and King’s College, London.

The Apple antitrust lawsuit, filed Thursday by the DOJ and more than a dozen state attorneys general, claims that in addition to degrading the quality of third-party apps, Apple “affirmatively undermines the quality of rival smartphones.” Because messages sent between iPhones via Apple’s proprietary network appear in blue bubbles, but those from Android phones appear in green and are excluded from many iMessage features, Apple has signaled to consumers that rival phones are of less quality, the suit alleges.

The suit includes references to the negative cultural and emotional impact of the restrictiveness of some Apple products. It ranges beyond the typical antitrust case, in which investigators might focus on supracompetitive pricing or the conditions of corporate deals that restrict competition. The core of US antitrust cases has long been proving consumers paid higher prices as a result of anticompetitive practices. But a few key paragraphs within the 88-page filing mention the exclusion and social shaming of non-iPhone users confined inside green chat bubbles, distinguishing this case from some of the more recondite explanations of tech market competition in recent years.

“Many non-iPhone users also experience social stigma, exclusion, and blame for ‘breaking’ chats where other participants use iPhones,” the suit reads. It goes on to note that this is particularly powerful for certain demographics, like teenagers, who The Wall Street Journal reported two years ago “dread the ostracism” that comes with having an Android phone.

The DOJ argues that all of this reinforces the switching costs that Apple has baked into its phones. Apple is so dominant in the smartphone market not because its phones are necessarily better, the suit alleges, but because it has made communicating on other smartphones worse, thereby making it harder for consumers to give up their iPhones.

Legal experts say this social stigma argument will need much stronger support to hold up in court, because it doesn’t fit with traditional definitions of antitrust. “What is Apple actually precluding here? It’s almost like a coolness factor when a company successfully creates a network effect for itself, and I’ve never seen that integrated into an antitrust claim before,” says Paul Swanson, a litigation partner at Holland & Hart LLP in Denver, Colorado, who focuses on technology and antitrust. “This is going to be an interesting case for antitrust law.”

Regardless, the DOJ’s complaint builds a powerful message from the cacophony of consumer voices that have vented frustrations with iMessage’s lack of interoperability in recent years. And it’s part of a broader, democratizing theme introduced by Jonathan Kanter, the assistant attorney general for the DOJ’s Antitrust Division, says Kovacic, who previously served as chair of the Federal Trade Commission. “Kanter basically said, ‘We’re trying to make this body of law accessible to ordinary human beings and take it away from the technicians,’” Kovacic says. “Storytelling is overstated in some ways, but my sense is that a lot of work went into this filing.”

Apple has rejected the DOJ’s allegations. In an earlier statement to WIRED, Apple spokesperson Fred Sainz said that the lawsuit “threatens who we are and the principles that set Apple products apart in fiercely competitive markets” and added that its products work “seamlessly” together and “protect people’s privacy and security.”

Cultural arguments about the harms of the iPhone’s stickiness will resonate with a lot of consumers, even if they end up being legally indefensible. Blue bubble vs. green bubble messaging has become a much more mainstream debate that transcends the wonky, technical underpinnings of iMessage’s protocol. Apple has also consistently boasted of iPhone and iMessage’s tight security, while seemingly denying third-party apps—such as Beeper—the ability to offer a similar level of security between iPhones and Android phones.

Apple has suggested that the design of iMessage is not anticompetitive, because iPhone users can install and use any third-party messaging app they please, as long as it’s available in the App Store. Apps like Facebook Messenger, WhatsApp, and Signal can all be installed on iPhones and give messages sent from users on Android or iPhone equal treatment.

The DOJ takes aim at that, too, saying that these other apps first require opt-in from consumers on both sides of a conversation because they form closed systems of their own. And the case points out that Apple hasn’t given app developers any technical means of accessing the iPhone messaging APIs that would allow SMS-like, cross-platform, “text to anyone” functions from those apps.

Swanson says he still believes Apple has been careful to take the necessary steps to legally preserve consumer choice, which is one of the fundamental principles in US antitrust law. “You probably can’t do sophisticated messaging on a T9 phone these days,” he says, referencing the predictive text system that dominated before the iPhone popularized touchscreens. “But there are plenty of other options in the market that won’t deprive you of a network effect.”

Kovacic believes that as the case continues, the DOJ will have to bring forward new evidence and arguments to stand up the cultural aspects of its suit. That could involve tapping theories of economics and the psychology of human behavior to attempt to explain why some technology consumers may unconsciously favor certain products they are emotionally attached to. More likely, he says, the DOJ will have to present contemporaneous business notes that show Apple’s anxiety about competitive apps or emerging technologies, and how the company responded in apparently dubious ways.

One way the DOJ tries to stand up its allegations is by comparing Apple to an earlier antitrust target: Microsoft. In a historic antitrust case filed in 1998, the DOJ presented evidence that Bill Gates’ company was fearful that software like the Netscape browser could weaken the market power of Windows, Kovacic says.

Steven Sinofsky, a former longtime Microsoft executive, wrote in a highly charged blog post on Saturday that he suspects many of the suit’s arguments about Apple’s products will prove to be irrelevant. “Almost all of the [DOJ-Apple] battles will end up being about the terms and conditions of contracts which is the stuff lawyers and courts are good at, and not on product design,” he wrote. “The vast majority of the settlement in the Microsoft case ended up being terms and conditions licensing Windows.”

In other words, the DOJ has shown some of its cards in this initial complaint—and told a story that will resonate with many frustrated smartphone users. But to keep the case alive the agency will have to present additional, concrete, evidence that Apple’s anxieties about its products being devalued led it to act in ways that caused actual harm. If the DOJ wants to make the case against Apple as historic as the one against Microsoft it will have to prove, as Kovacic puts it, “that the anecdotes aren’t just storytelling.”

7 notes

·

View notes

Text

Limited Liability Partnership (LLP) ROC Compliance

Limited Liability Partnership (LLP) ROC Compliance refers to the regulatory requirements that LLPs need to fulfill with the Registrar of Companies (ROC). In various jurisdictions, including India, LLPs are mandated to adhere to specific compliance norms set by the ROC to ensure transparency, legal conformity, and proper governance. These compliances typically include the timely filing of annual returns, financial statements, and other essential documents. Meeting LLP ROC Compliance is crucial for maintaining good standing with regulatory authorities and avoiding penalties. It underscores the commitment of LLPs to operate within the legal framework and uphold accountability in their business practices.

0 notes

Text

Business Setup in India by MAS LLP: Your Partner for Growth

Setting up a business in India is a lucrative opportunity due to its growing economy, diverse market, and skilled workforce. However, navigating the legal and regulatory framework can be challenging. That’s where MAS LLP steps in, offering expert assistance to help you establish your business smoothly and efficiently.

Why Choose MAS LLP for Business Setup in India?

MAS LLP is a leading consultancy that specializes in business formation and compliance services. With years of experience, MAS LLP has assisted numerous entrepreneurs and companies in setting up their businesses across India. Here’s why partnering with MAS LLP is a smart choice:

Comprehensive Services

MAS LLP provides a full suite of services, from company registration and legal compliance to tax advisory and financial consulting. Their team of experts ensures that every step of the business setup process is handled professionally.

Expert Knowledge of Indian Regulations

India's business environment is governed by complex laws and regulations, including the Companies Act, FDI norms, and various tax laws. MAS LLP has in-depth knowledge of these regulations, ensuring that your business complies with all legal requirements from the start.

Tailored Solutions for Different Business Structures

Whether you are looking to establish a private limited company, a partnership, an LLP, or a sole proprietorship, MAS LLP can help you choose the right structure based on your business goals and operational needs.

Steps to Setting Up a Business in India with MAS LLP

Business Structure Selection

Choosing the right business structure is crucial for long-term success. MAS LLP provides guidance on selecting the best structure, whether it's an LLP, private limited company, or branch office.

Company Registration

MAS LLP will help you with the process of registering your business with the Ministry of Corporate Affairs (MCA). This includes obtaining a Director Identification Number (DIN), Digital Signature Certificate (DSC), and filing the required documents for incorporation.

Tax Registration

Once your business is registered, MAS LLP assists in obtaining necessary tax registrations such as GST, PAN, and TAN, ensuring your company is compliant with India’s tax laws.

Legal Compliance

Keeping up with regulatory requirements is essential for any business. MAS LLP provides ongoing legal compliance support, including annual filings, audit reports, and statutory compliance.

Banking and Financial Setup

MAS LLP also assists with setting up business bank accounts, payment gateways, and financial structuring, helping you manage your financial operations efficiently.

Why Set Up a Business in India?

India is a growing economy with a young, dynamic workforce and a vibrant consumer market. By setting up your business here, you tap into a diverse and large customer base, benefit from government incentives for startups, and gain access to various sectors like IT, manufacturing, and retail.

Additionally, India offers excellent opportunities for foreign investors with simplified FDI policies. With MAS LLP by your side, you can navigate the challenges of setting up a business in India with ease and focus on what really matters—growing your business.

Conclusion

MAS LLP is your go-to partner for setting up a business in India. Their expertise in regulatory compliance, business formation, and financial consulting ensures that you can establish your business smoothly and start operating without any legal or financial hurdles.

Whether you are a local entrepreneur or a foreign investor, MAS LLP offers tailored solutions to meet your unique business needs. Get in touch with MAS LLP today and take the first step towards establishing a successful business in India!

6 notes

·

View notes

Text

Company Incorporation Consultants in Delhi by SC Bhagat & Co.

Starting a new business in Delhi can be a rewarding venture, but it also comes with its own set of legal and administrative challenges. One of the critical steps in building your business is the incorporation process, which requires careful attention to various regulations. This is where professional assistance from SC Bhagat & Co., a leading company incorporation consultant in Delhi, becomes invaluable.

Why Choose Professional Company Incorporation Consultants?

Incorporating a company involves several legal procedures, such as:

Selecting the correct business structure

Filing the necessary paperwork with regulatory authorities

Complying with tax laws

Obtaining approvals and licenses

The process can be complex and time-consuming for new entrepreneurs. SC Bhagat & Co. helps streamline this procedure, ensuring compliance with all legal requirements while minimizing delays.

Services Offered by SC Bhagat & Co.

As one of the top company incorporation consultants in Delhi, SC Bhagat & Co. offers a range of services that cater to startups, small businesses, and large corporations. These include:

Business Structure Advisory

Choosing the right business structure is crucial for long-term success. The firm provides guidance on various business entities, including:

Private Limited Company

Limited Liability Partnership (LLP)

One Person Company (OPC)

Public Limited Company

SC Bhagat & Co. ensures that you opt for the structure best suited to your business goals and tax advantages.

Registration Services

From company name reservation to filing of incorporation documents, SC Bhagat & Co. handles the entire registration process. They assist with:

Drafting Memorandum and Articles of Association (MOA/AOA)

Digital signature certificates (DSC)

Director Identification Number (DIN)

Filing with the Ministry of Corporate Affairs (MCA)

Their comprehensive approach makes the process seamless and efficient.

Compliance and Taxation Support

Once incorporated, companies are required to meet various compliance standards, including:

GST registration and filing

Annual financial statements

Regulatory audits

SC Bhagat & Co. offers ongoing support to ensure your business stays compliant with both state and central laws, thus avoiding penalties and legal hurdles.

Legal Advisory and Licensing

Navigating the legal landscape in India can be tricky. SC Bhagat & Co. also provides assistance in obtaining the necessary business licenses and permissions, such as:

Trade license

Import-export code (IEC)

Professional tax registration

Why SC Bhagat & Co. Stands Out

With years of experience in the field, SC Bhagat & Co. has become synonymous with trust and expertise in company incorporation consulting in Delhi. Here’s why they stand out:

Expert Team: Their team consists of highly qualified professionals, including chartered accountants and legal experts.

Personalized Service: They tailor their services according to the specific needs of your business.

Quick Turnaround: Their efficient processes ensure timely incorporation and compliance.

Post-Incorporation Support: Even after your company is set up, SC Bhagat & Co. provides continuous support for your legal and financial needs.

Conclusion

Incorporating a company is a significant step in the journey of entrepreneurship. With the expert guidance of SC Bhagat & Co., you can rest assured that all legal and regulatory requirements will be handled efficiently, allowing you to focus on growing your business. If you're looking for reliable company incorporation consultants in Delhi, SC Bhagat & Co. should be your first choice.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

Checklist for LLP Annual Filing: Stay Compliant with Ease

Annual Filing for LLP: A Comprehensive Guide

Limited Liability Partnerships (LLPs) have become a popular choice for businesses due to their flexible structure, limited liability protection, and fewer compliance requirements than other entities like private limited companies. However, LLPs in India still need to adhere to annual filing requirements to ensure legal compliance. This guide provides an overview of the essential aspects of annual filing for LLPs.

Importance of Annual Filing for LLPs

Annual filing for LLPs is not just a legal obligation but also a means to maintain transparency in business operations. Timely filing ensures that the LLP remains in good standing with the Registrar of Companies (RoC) and avoids penalties, legal issues, or disqualification of partners.

Essential Annual Compliance Requirements for LLPs

LLPs in India are required to comply with several annual filing requirements, including:

a. Filing of Annual Return (Form 11)

Due Date: Within 60 days from the end of the financial year, typically by 30th May.

Details: Form 11 is an annual return that contains the details of the LLP’s partners and changes in their designations during the financial year. It also provides information about the total contribution by partners and the LLP's status.

b. Statement of Account & Solvency (Form 8)

Due Date: 30th October of each financial year.

Details: Form 8 must be filed with more information regarding the LLP's financial position, including a declaration of solvency or insolvency and a statement of assets and liabilities. This form must be certified by designated partners and an auditor (if applicable).

c. Income Tax Return (ITR) Filing

Due Date: 31 July for LLPs not required to undergo audit and 30 September for LLPs required to undergo audit under the Income Tax Act or any other law.

Details: LLPs must file their income tax returns annually, providing details of income, expenses, and taxes paid or payable.

d. Filing of DIR-3 KYC

Due Date: 30th September of each financial year.

Details: Designated partners of an LLP are required to file DIR-3 KYC and ensure that their details are updated with the MCA.

Consequences of Non-Compliance

Failure to comply with the annual filing requirements can lead to significant penalties:

Late Fees: LLPs face a late fee of ₹100 per day for each form until the date of filing.

Penal Actions: Persistent non-compliance can lead to legal action, including striking the LLP of the RoC.

Disqualification of Partners: Partners of the LLP may be disqualified from holding directorships or partner positions in other LLPs or companies.

Steps to Ensure Timely Compliance

To avoid penalties and ensure smooth operations, LLPs should:

Maintain Accurate Records: Keep all financial records, partner details, and other relevant information updated and accurate.

Set Reminders: Schedule reminders for key compliance dates to avoid missing deadlines.

Hire a Professional: Consider engaging a qualified chartered accountant or company secretary to handle the filing process.

Conclusion

Annual filing for LLPs is crucial for maintaining the business’s legal standing and credibility. By understanding the requirements, adhering to timelines, and ensuring accurate filings, LLPs can focus on growth while complying with statutory obligations.

0 notes