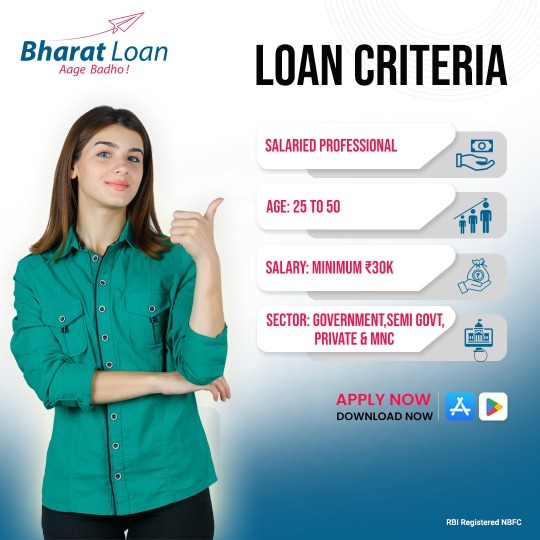

#Loan for salaried employees delhi

Text

Emergency Loan – Apply for an Urgent Personal Loan Online

An Emergency Loan is essentially a Personal Loan that can fulfill your urgent financial necessities. Get to know more here & Apply Now! More information visit our site.

#Instant personal loan Noida#instant paperless personal loan noida#instant payday loan noida#Same day approval loans delhi#Loan for salaried employees delhi#Emergency personal loans delhi#Same-day cash loans delhi#Immediate personal loans faridabad#Online personal loans faridabad#Instant Personal Loan Faridabad#Personal Loan for Salaried Employee Faridabad

0 notes

Text

car loan in delhi

Finiscope: Your Comprehensive Guide to Car Loans in Delhi

Navigating the process of securing a car loan in Delhi can seem overwhelming, especially with the variety of options available. Whether you’re eyeing a brand-new car or considering a reliable pre-owned vehicle, understanding how car loans work can simplify your decision-making process. In this blog, we’ll walk you through everything you need to know about car loans in Delhi — from eligibility and documentation to tips for securing the best rates.

Why Opt for a Car Loan?

Car loans are a practical solution for many people looking to buy a vehicle. They allow you to purchase a car without having to pay the entire amount upfront. By spreading the cost over several years, you can manage your finances more effectively and drive away in your dream car sooner.

1. Eligibility Criteria: Are You Qualified?

Before applying for a car loan, ensure you meet the eligibility requirements, which typically include:

- Age: Between 21 and 65 years.

- Income: A stable source of income is necessary. Self-employed individuals or salaried employees must demonstrate financial stability.

- Credit Score: A good credit score (usually 650 or higher) increases your chances of approval and can help you secure better interest rates.

- Residency: Must be a resident of Delhi.

Each lender may have additional criteria, so check their specific requirements.

2. Documentation: Get Your Paperwork Ready

To streamline the application process, gather the following documents:

- Proof of Identity: Aadhaar card, passport, or voter ID.

- Proof of Address: Utility bills, rent agreement, or recent bank statements.

- Proof of Income: Salary slips, bank statements, or income tax returns.

- Vehicle Details: For new cars, you’ll need the vehicle quotation from the dealer. For used cars, you’ll need the registration certificate and previous insurance documents.

Having these documents prepared in advance can speed up the approval process.

3. Loan Amount and Tenure: Understand Your Options

The loan amount you can get typically covers up to 80–90% of the car’s ex-showroom price. The exact amount and tenure will depend on:

- Car’s Price: Higher-priced cars may secure larger loan amounts.

- Income and Credit Score: Your financial health influences the amount you can borrow and the terms of the loan.

- Repayment Tenure: Loan tenures generally range from 1 to 7 years. Opt for a tenure that offers a balance between affordable EMI and manageable total interest costs.

4. Interest Rates: Find the Best Deal

Interest rates for car loans can vary widely. They usually range from 7% to 12% per annum. Factors influencing interest rates include:

- Credit Score: A higher score can lead to lower rates.

- Loan Tenure: Shorter tenures often have lower interest rates.

- Lender’s Policies: Different lenders have different rate structures and promotional offers.

Compare interest rates from multiple lenders to get the most competitive rate.

5. Application Process: How to Apply

You can apply for a car loan in Delhi through:

- Online Applications: Many banks offer a convenient online application process where you can fill out forms, upload documents, and track your application status.

- In-Person Applications: Visit the bank branch of your choice to submit your application and documents.

Processing times vary but generally take a few days to a couple of weeks.

6. Pre-Approved Loans: A Convenient Option

If you have a good relationship with a bank or a strong credit history, you might qualify for a pre-approved loan. This can simplify the buying process by giving you a clearer idea of your budget and potentially offering better terms.

Conclusion: Make Informed Decisions

Securing a car loan in Delhi can be a straightforward process if you’re well-informed and prepared. By researching lenders, understanding eligibility requirements, and comparing loan terms, you can find a car loan that suits your financial situation and helps you achieve your goal of owning a vehicle.

Ready to get started? Gather your documents, check your credit score, and explore your loan options. Whether you’re buying a new car or a used one, a well-chosen loan can make your dream car a reality.

For personalized advice or further assistance, feel free to reach out. Here’s to finding the perfect car loan and driving off in style!

Feel free to tailor this blog to better suit your specific audience or focus.

for more information

0 notes

Text

CashWalle: The Leading Loan Provider in Delhi

When it comes to finding a reliable loan provider in Delhi, CashWalle stands out as a top choice for many residents. Known for its customer-centric approach and comprehensive loan solutions, CashWalle has made a name for itself in the bustling financial landscape of the city.

Why Choose CashWalle?

CashWalle is not just any loan provider in Delhi; it’s a trusted partner that understands the diverse needs of its clients. Whether you're looking for a personal loan or any other type of financing, CashWalle offers tailored solutions designed to meet your specific requirements.

Speed and Convenience: CashWalle understands that when you need payday loans, time is of the essence. Their streamlined application process ensures that you can apply for a loan quickly and receive approval in record time. This efficiency helps you get the cash you need without unnecessary delays.

Quick and Easy Process: One of the standout features of CashWalle is their streamlined loan application process. Unlike traditional banks, CashWalle simplifies the application procedure, making it faster and more convenient for you. With minimal paperwork and quick approval times, accessing the funds you need has never been easier.

Customer Support: CashWalle prides itself on offering exceptional customer service. The team of specialists is always ready to help with any inquiries or problems you may have. As a leading loan provider in Delhi, they emphasize clear communication and transparency throughout the loan process.

Competitive Rates: CashWalle understands that cost is a crucial factor when choosing a loan provider. They offer competitive interest rates and flexible repayment options, ensuring that you get the best value.

How to Get Started

Getting a loan from CashWalle is simple. You can start by visiting their website or making contact with their office. Their team will guide you through the process, helping you understand your options and choose the best loan for your situation.

Characteristics of Loan

Quick Access: Borrowers can often receive funds within a few hours or on the same day.

Small Amounts: Loans can range from Rs 10,000 to Rs 1,00,000. It depends on the lender.

High Interest Rates: As they are short-term, they often come with higher-than-average interest rates, which is a key factor to consider.

Benefits of Loan Provider in Delhi

Loans in India provide several advantages for individuals needing urgent financial assistance:

Speed and Convenience: The application process is usually straightforward; many providers allow you to apply online.

No Collateral Required: Most loans are unsecured, meaning you don’t have to risk your property or assets.

Accessible to Many: Borrowers with poor credit might still qualify, as lenders consider your income rather than credit history.

Pre-closure: There is No Pre-closure charges on the loans.

Eligibility Criteria for Loans in India

To apply for Loan, you generally need to meet certain basic criteria:

Age Requirement: You must be at least 21 years old and not more than 60 years old.

Income Proof: You must be a Salaried Employee and you'll need to provide proof of income, such as salary slips or bank statements.

Identification: Valid identity proof such as an Aadhar card, voter ID, or passport.

Bank Account: You must possess an operational bank account where the funds can be deposited.

It’s always wise to check with the particular lender for their specific eligibility requirements.

Conclusion

If you’re in Delhi and looking for a dependable loan provider in Delhi, CashWalle is a name you can trust. With their diverse loan options, quick processing times, and excellent customer support, they are dedicated to helping you achieve your financial goals. Explore CashWalle today and take the first step towards a brighter financial future.

0 notes

Text

The Delhi National Capital Region (NCR) is a bustling metropolitan area with a diverse population and a growing economy. With numerous financial needs ranging from home renovations to unexpected medical expenses, personal loans have become a popular financial tool for many residents. This article provides an overview of the top personal loan providers in Delhi NCR, highlighting their features, eligibility criteria, and application process to help you make an informed decision.

1. HDFC Bank

HDFC Bank is one of the leading personal loan providers in Delhi NCR. The bank offers competitive interest rates and flexible repayment tenures, making it a popular choice among borrowers.

Features:

Loan amounts range from INR 50,000 to INR 40 lakhs.

Interest rates start from 10.50% per annum.

Loan tenure from 12 to 60 months.

Quick disbursal, often within 24 hours of approval.

Eligibility Criteria:

Minimum age of 21 years and a maximum age of 60 years at the time of loan maturity.

Minimum net monthly income of INR 25,000.

Stable employment with at least 1 year of total work experience and 6 months with the current employer.

Application Process:

Applicants can apply online through the HDFC Bank website or visit a branch.

Required documents include identity proof, address proof, income proof, and bank statements.

2. ICICI Bank

ICICI Bank is another prominent player in the personal loan segment in Delhi NCR. Known for its customer-friendly services and extensive network, ICICI Bank offers a range of personal loan options to cater to different needs.

Features:

Loan amounts from INR 50,000 to INR 25 lakhs.

Interest rates starting from 10.75% per annum.

Loan tenure from 12 to 60 months.

Pre-approved loan offers for existing customers.

Eligibility Criteria:

Applicants must be between 23 to 58 years old.

Minimum monthly income requirement of INR 30,000.

At least 2 years of work experience with 1 year at the current company.

Application Process:

Applications can be made online or at an ICICI Bank branch.

Documentation required includes KYC documents, salary slips, and bank statements for the last 3 months.

3. State Bank of India (SBI)

State Bank of India (SBI) offers personal loans under its "Xpress Credit" scheme, which is ideal for salaried individuals in Delhi NCR looking for quick loan disbursals.

Features:

Loan amounts up to INR 20 lakhs.

Competitive interest rates starting from 10.30% per annum.

Flexible repayment tenure ranging from 12 to 72 months.

No requirement for a guarantor or collateral.

Eligibility Criteria:

Permanent employees of Central and State Government, Public Sector Undertakings, Private Companies, or institutions with a minimum net monthly income of INR 15,000.

Minimum age of 21 years and maximum age of 58 years.

Application Process:

Applications can be submitted online through the SBI website or by visiting a branch.

Required documents include identity proof, address proof, salary slips, and bank account statements.

4. My Mudra

My Mudra is a well-known non-banking financial company (NBFC) that offers personal loans with minimal documentation and quick processing times.

Features:

Loan amounts from INR 1 lakh to INR 25 lakhs.

Interest rates start from 13% per annum.

Flexible repayment tenure from 12 to 60 months.

Instant approval and disbursal within 24 hours for eligible customers.

Eligibility Criteria:

Minimum age of 23 years and maximum age of 55 years.

Salaried employees with a minimum monthly income of INR 25,000.

At least 1 year of work experience with 6 months at the current job.

Application Process:

Applicants can apply online via the My Mudra website or at any branch.

Documentation includes KYC documents, salary slips, and bank account statements for the last 3 months.

5. Kotak Mahindra Bank

Kotak Mahindra Bank offers personal loans tailored to meet the diverse needs of customers in Delhi NCR. The bank is known for its competitive interest rates and easy application process.

Features:

Loan amounts up to INR 25 lakhs.

Interest rates starting from 10.99% per annum.

Loan tenure from 12 to 60 months.

Digital loan process for a hassle-free experience.

Eligibility Criteria:

Minimum age of 21 years and maximum age of 60 years at the time of loan maturity.

Minimum monthly income of INR 20,000.

At least 1 year of work experience with 6 months at the current employer.

Application Process:

Applications can be made online or at a Kotak Mahindra Bank branch.

Required documents include KYC documents, income proof, and bank statements.

Conclusion

Choosing the right personal loan in Delhi NCR depends on various factors, including your financial needs, eligibility, and the interest rates offered. It is advisable to compare different loan options and read the terms and conditions carefully before making a decision. Whether you need funds for a medical emergency, home renovation, or any other personal need, the above-mentioned banks and financial institutions offer a variety of personal loan options to suit your requirements.

#personal loan in Delhi#personal loan in Delhi NCR#Personal Loan Providers in Delhi#instant personal loan in Delhi

0 notes

Text

Delhi NCR, encompassing Delhi, Gurgaon, Noida, Faridabad, and Ghaziabad, is a bustling metropolitan region with a dynamic lifestyle. The demand for personal loans has surged, driven by various needs such as medical emergencies, education, travel, home renovation, or consolidating debt. This guide provides a detailed overview of applying for a personal loan in Delhi NCR, covering eligibility criteria, application process, necessary documentation, and tips to enhance approval chances.

Understanding Personal Loans

A personal loan is an unsecured loan provided by banks and non-banking financial companies (NBFCs) without requiring collateral. Borrowers can use the loan amount for any personal financial needs. Interest rates and repayment terms vary based on the lender and the borrower’s credit profile.

Why Apply for a Personal Loan in Delhi NCR?

1. Medical Emergencies:

Personal loans can cover unexpected medical expenses, ensuring timely treatment without financial strain.

2. Education:

Financing higher education or specialized courses can be challenging. A personal loan can bridge this gap.

3. Home Renovation:

Enhancing or renovating your home can be expensive. Personal loans offer a hassle-free way to manage these costs.

4. Debt Consolidation:

Consolidating multiple debts into a single loan simplifies repayment and can reduce the overall interest burden.

5. Travel and Wedding Expenses:

Personal loans can fund dream vacations or weddings, allowing you to create cherished memories without financial worry.

Eligibility Criteria for Personal Loans in Delhi NCR

Different lenders have varying criteria, but common eligibility requirements include:

1. Age:

Borrowers should typically be between 21 to 60 years old.

2. Employment Status:

Both salaried and self-employed individuals are eligible. Salaried employees need to be in their current job for a minimum period (usually six months to a year), while self-employed individuals should have a stable business with a proven track record.

3. Income:

A minimum monthly income requirement, usually starting from INR 20,000, is mandatory. Higher income levels can improve the chances of approval.

4. Credit Score:

A good credit score (typically above 750) is crucial. It reflects the borrower’s creditworthiness and impacts the interest rate and loan amount approved.

5. Existing Liabilities:

Lenders assess current EMIs and liabilities to gauge repayment capacity.

Steps to Apply for a Personal Loan in Delhi NCR

1. Research and Compare Lenders:

Compare interest rates, processing fees, repayment terms, and customer reviews of various banks and NBFCs.

2. Check Eligibility:

Use online eligibility calculators provided by lenders to check your eligibility.

3. Prepare Documentation:

Gather necessary documents, including identity proof, address proof, income proof, and bank statements.

4. Apply Online or Offline:

Online: Visit the lender’s website or download their mobile app. Fill out the application form, upload documents, and submit.

Offline: Visit the nearest branch of the bank or NBFC, fill out the application form, and submit the documents.

5. Verification and Approval:

The lender verifies the documents and may call for additional information. Approval is based on meeting eligibility criteria and verification results.

6. Disbursement:

Upon approval, the loan amount is disbursed to your bank account, usually within a few days.

Necessary Documentation

1. Identity Proof:

Aadhaar Card

Passport

Voter ID

PAN Card

2. Address Proof:

Utility bills (electricity, water, gas)

Rent agreement

Passport

Bank statement

3. Income Proof:

Salary slips for the last three to six months

Form 16

Income tax returns (for self-employed individuals)

4. Bank Statements:

Bank statements for the last three to six months

5. Photographs:

Recent passport-sized photographs

Tips to Enhance Loan Approval Chances

1. Maintain a Good Credit Score:

Regularly check your credit score and take steps to improve it by paying bills on time, reducing debt, and avoiding new credit inquiries.

2. Choose the Right Loan Amount:

Borrow only what you need and can comfortably repay. A lower loan amount increases approval chances.

3. Provide Accurate Information:

Ensure all information provided in the application is accurate and matches the documents submitted.

4. Reduce Existing Debt:

Pay off existing loans and credit card balances to improve your debt-to-income ratio.

5. Show Stable Income:

Provide evidence of a stable and sufficient income to demonstrate your repayment capacity.

6. Opt for a Longer Tenure:

A longer tenure reduces the EMI amount, making it easier to manage repayments, though it might increase the total interest paid.

Common Pitfalls to Avoid

1. Applying with Multiple Lenders Simultaneously:

Multiple loan applications within a short period can negatively impact your credit score.

2. Ignoring Fine Print:

Carefully read the terms and conditions, focusing on interest rates, processing fees, prepayment charges, and late payment penalties.

3. Over-borrowing:

Borrowing more than needed can lead to unnecessary financial strain.

4. Not Checking Credit Score:

A low credit score can lead to rejection or higher interest rates. Regularly monitor your credit score.

5. Delaying EMI Payments:

Timely repayment of EMIs is crucial to maintain a good credit score and avoid penalties.

Conclusion

Applying for a Personal Loan Providers in Delhi is a straightforward process if you understand the requirements and prepare accordingly. By choosing the right lender, providing accurate information, and maintaining a good credit profile, you can secure a personal loan to meet your financial needs. Always compare multiple offers, understand the terms, and borrow responsibly to ensure a smooth loan experience.

#personal loan in Delhi#personal loan in Delhi NCR#Personal Loan Providers in Delhi#instant personal loan in Delhi#apply for personal loan in delhi#online personal loan in delhi

0 notes

Text

INR PLUS Service Provider: Home Loan for Private Employees

In today's ever-evolving real estate market, owning a dream home is a goal that many individuals aspire to achieve. However, for private employees, obtaining a home loan has often presented its own set of challenges. Traditional financial institutions have typically favored salaried individuals with a stable income source and regular paychecks. But fret not, because INR PLUS is here to bridge that gap and make homeownership a reality for private employees.

INR PLUS, a leading financial service provider, understands the unique requirements of private employees seeking online home loans. They have designed tailored loan options specifically catering to this segment of individuals. With their customer-centric approach and commitment to simplifying the loan process, INR PLUS has emerged as a trusted name in the industry.

Unlike traditional lenders, INR PLUS recognizes the employment structure of private sector employees, acknowledging the irregularity of income and the absence of a fixed paycheck. They have adeptly structured their loan offerings to accommodate these specific circumstances, making it easier for private employees to avail themselves of loans for purchasing their dream homes.

One of the most significant advantages of the INR PLUS home loan service for private employees is their flexible eligibility criteria. INR PLUS takes into account an individual's overall financial profile, including income stability, credit history, and employment track record. By conducting a holistic assessment, they have successfully extended financial support to numerous deserving individuals who would have otherwise been overlooked by traditional lenders.

Another key aspect that sets INR PLUS apart from its competitors is its commitment to providing personalized customer service. The INR PLUS team strives to understand the unique financial circumstances and goals of each applicant, creating customized loan solutions that are tailored to their specific needs. Whether it's ensuring a smooth loan application process or providing guidance on documentation, the team at INR PLUS goes the extra mile to assist borrowers at every step of the way.

Furthermore, INR PLUS offers competitive interest rates and flexible repayment options, allowing borrowers to manage their finances more effectively to get loans for a low cibil score. With transparent terms and conditions, borrowers can rest assured that there won't be any hidden charges or surprises along the way.

INR PLUS recognizes that buying a home is a major financial decision and aims to simplify the process while minimizing the stress associated with it. Their expert financial advisors provide comprehensive guidance, ensuring that borrowers have a thorough understanding of the loan terms and conditions before making any commitments.

The success stories of numerous private employees who have availed themselves of INR PLUS's home loan service speak volumes about the company's dedication and reliability. Testimonials from satisfied customers highlight the efficient and hassle-free experience they had while securing their dream homes.

If you are a private employee with aspirations of owning a home, INR PLUS should be your go-to service provider. With their extensive knowledge, customer-centric approach, and commitment to providing financial solutions to private sector employees, INR PLUS has become a trusted and reliable partner for home loans. Take the first step towards your dream home today by contacting INR PLUS and let them guide you on your path to homeownership.

Contact us for more details:-

Contact Number:- 9891751729

"Rainbow Fincorp

101, Vardhman Prakash Plaza Sector -20 Dwarka

Near Hyundai Showroom. New Delhi-110075"

1 note

·

View note

Text

Apply Home Loan in Private Employees and Government Employees | INR PLUS

Purchasing a home is a dream that many individuals strive to achieve. However, the soaring property prices often pose a significant obstacle to fulfilling this dream. To bridge the financial gap, home loans have become increasingly popular among both private employees and government employees, offering a feasible path towards homeownership. INR PLUS, a leading financial institution, understands the unique needs of these individuals and provides tailored solutions to fulfill their aspirations.

Private Employees:

Private sector employees form a substantial part of the workforce in many countries. While some might assume that securing a home loan for private employees could be challenging, INR PLUS believes otherwise. The institution takes into account various factors, such as the applicant's income, credit history, and overall financial stability, to determine loan eligibility.

To apply for a home loan as a private employee, one needs to provide the necessary documents, including salary slips, bank statements, income tax returns, and identity proof, among others. Additionally, having a good credit score significantly enhances the chances of loan approval. INR PLUS offers competitive interest rates and flexible repayment options to ensure convenience for private employees.

Government Employees:

Government employees often enjoy stability, regular income, and job security, making them reliable borrowers. Recognizing the importance of homeownership for this segment, INR PLUS extends attractive home loan schemes exclusively designed for government employees. These loans come with special benefits, including lower interest rates, relaxed eligibility criteria, and longer repayment tenures.

To apply for a home loan as a government employee, one must furnish the necessary documents, such as salary slips, bank statements, income tax returns, employment proof, and identity proofs, among others. INR PLUS streamlines the loan application process, making it hassle-free for government employees to fulfill their homeownership dreams.

Benefits of INR PLUS Home Loans:

INR PLUS offers a multitude of benefits to both private and government sector employees seeking home loans. Some key advantages include:

1. Competitive interest rates: INR PLUS provides home loans at competitive interest rates, ensuring affordability for borrowers.

2. Flexible repayment options: The institution offers flexible repayment options, allowing borrowers to choose a tenure that suits their financial capabilities.

3. Speedy processing: INR PLUS understands the urgency of owning a home and strives to process home loan applications quickly and efficiently.

4. Extensive loan amount: Depending on the applicant's eligibility, INR PLUS provides substantial loan amounts, enabling borrowers to purchase their desired homes.

5. Special offers and discounts: INR PLUS frequently introduces exclusive offers and discounts for both private and government sector employees, making it easier for them to acquire their dream homes.

Conclusion:

INR PLUS recognizes the importance of homeownership for private and government sector employees and aims to make this dream a reality. With competitive interest rates, flexible repayment options, and a streamlined application process, INR PLUS ensures that applying for a home loan becomes an accessible and convenient process. Whether you're a private employee or a government employee, INR PLUS is here to make your dream of owning a home a tangible reality.

For More Information

Visit: https://www.inrplus.in/

Contact: +91-9891751729

Mail At: [email protected]

Rainbow Fincorp

101, Vardhman Prakash Plaza Sector -20 Dwarka

Near Hyundai Showroom. New Delhi-110075

#Home Loan For Government employees#Home Loan for Private Employees#Housing Loan for Government Employees#Apply home loan online#Apply housing Loan online

0 notes

Text

Instant and Cashless Loans from ATD Money

If you need access to cash quickly, an instant digital loan could be just the ticket. These loans feature flexible lending norms and an easier disbursal process than traditional bank loans.

There are various instant loans available today, such as buy now pay later plans; however, only licensed lenders are capable of providing this type of service.

Online personal loan app

ATD Money offers an array of financial products, such as personal loans. Their user-friendly app makes applying for loans quick and simple. ATD Money boasts some of the lowest interest rates on fast cash loans! Thousands of satisfied customers attest to its reliability - their headquarters are in Delhi and they operate offices all across India.

No matter your short-term loan needs - be they unexpected expenses or funding a project - ATD Money has an instant personal loan solution tailored to you. As an online microfinance platform that operates within legal requirements to treat all its clients fairly, ATD Money offers various loan types with competitive interest rate guarantees and stands out as being different from competitors with its low-interest rate guarantee.

The company offers flexible repayment terms that enable borrowers to select the optimal option based on their needs, making borrowing large sums easier than ever. Loan programs range from short-term payday loans to longer-term personal loans and its application process is designed for quick approvals.

As multiple lenders are offering instant personal loans, not all are created equally. Before making your selection, be sure to conduct thorough research on each lender by reading reviews from actual loan recipients as well as comparing terms and fees before choosing one. Checking with the Better Business Bureau website also can provide invaluable insight.

ATD Money is a microfinance platform providing loan options for salaried employees. Established in 2018, ATD Money's goal is to offer financial services that improve customers' lives and its lending products include payday and salary advances as well as unsecured business loans. Furthermore, mobile banking service and digital payments are offered alongside its lending products; its apps can be found on iOS and Android devices while customer service representatives speak multiple languages - making applications for loans quick and simple no matter where in the world you may be located.

Salary advance loan

Salary advance loans provide salaried employees with short-term funding solutions for unexpected expenses. Usually unsecured with low-interest rates, this loan makes repayment easier than many other forms. Plus, its simple application process and quick processing time make this an appealing option; either online or at retail locations near you; price comparison tools will even assist in this regard!

The company provides several loan products, including payday and salary advance loans for salaried employees. These short-term unsecured loans can be used for emergency expenses or personal projects without credit checks or collateral requirements - an excellent alternative to traditional bank loans for people with poor credit!

ATD Money is an innovative microfinance platform offering loans to citizens of India. Their goal is to offer financial services that enhance people's lives while working within the law to treat customers fairly. ATD Money offers various financial services - including their free mobile app which makes taking out personal loans easy! Their application process is fast and straightforward while their secure connections ensure quick document upload.

ATD Money website makes applying for instant mini cash loans easy; just register, apply and see if you qualify! Plus you can view your current loan status online as well as make repayments instantly!

ATD Money is a microfinance company offering various loans to salaried workers, such as payday and salary advance loans. These loans can help meet emergency expenses or fund new projects and can be easily applied for online or at retail locations - conveniently paid back over time in instalments to build credit scores and build goodwill among lenders. ATD Money charges a processing fee and an annual interest rate of 24% but these are considerably lower than most lenders' charges.

Unsecured business loan

If you need funding for a new or expanding business, an unsecured business loan could be the right option for you. While these types of loans usually carry lower risks than other types of financing options, late fees and damage to credit could still result. Furthermore, should your repayment fail on time your lender could seize any assets you own to recover their losses from this debt.

Unsecured business loans can be found both from traditional and online lenders. Each lender varies in terms of requirements, terms, and rates so before selecting one take some time to compare each and compare their offerings as well as read online reviews to gain an idea of other borrowers' experiences with that lender.

Unsecured business loans provide many advantages over secured options because they do not require collateral from borrowers in exchange for funding, making them ideal for startups or new businesses that have yet to establish revenue streams or acquire real estate or equipment as security for funding. Unfortunately, due to this absence of collateral, these types of loans typically have more stringent eligibility criteria and higher interest rates.

There are various unsecured business loans, from term loans and lines of credit to invoice factoring or merchant cash advances, each designed for different business owners with differing credit profiles. While term loans and lines of credit tend to favour those with good to excellent credit histories, other flexible options exist with relaxed requirements that could even accommodate business owners with poorer scores such as invoice factoring or merchant cash advances.

No matter which unsecured business loan option you pursue, you must find the ideal lender. A successful lender should boast reliable yet cost-effective financial solutions with competitive rates, fast approval processes and seamless application procedures.

Instant mini cash loan

If you need cash quickly, an instant loan online may be your perfect solution. Like traditional personal loans, this type of instant loan requires less paperwork and can be processed more rapidly; additionally, it has flexible repayment terms depending on your credit score.

Some individuals use instant loans for high-cost medical treatments and debt consolidation. Others need quick funds for family vacations or lifestyle goals. They must choose an appropriate lender to avoid paying a higher interest rate.

Your options for instant mini-cash loans vary. Some have their loan application website while others allow you to apply anywhere using an app. In either case, basic information will need to be provided including name, address and employment status as well as possibly providing valid bank account numbers and ID cards as proof.

Borrowing money from family or friends may also provide instant access to funds; this option tends to be less costly than taking out a loan from a financial institution; however, be sure to be able to pay the full amount back as quickly as possible and consider any late payments which could cause significant debt over time.

Not only can you take out an instant loan, but you may also consider taking out a loan against your savings or insurance policy as another means of accessing immediate funds - just be wary that such loans often carry higher interest rates than others.

ATD Money offers fast loans for a wide range of needs. Their requirements are minimal, enabling most people to meet them. Their approval process is quick and they can get your funds to you in as little as 24 hours! They charge one-time processing fees and an annual interest rate of 24% while offering an efficient online experience that makes their service user-friendly.

#payday loans#quick cash loans#personal loans#instant loan#cash loans#loan app in india#payday loans in india#advance salary loan#fast cash loans online#loan apps

0 notes

Text

Get Quick Cash Now With a No Credit Check Personal Loan

If you need some quick cash, you might be thinking about payday loans. But be aware that these types of loans can be very expensive.

One alternative to a payday loan is a salary advance loan. These loans are available to salaried employees and can be approved in just minutes.

Approval in minutes

If you need cash fast, it’s best to use a loan app that can process your application in minutes. However, be aware that not all personal loan apps are created equal. Make sure the loan app you choose is RBI-registered and has a good reputation. Also, be sure to check the rates and fees associated with the loan before you apply. These charges can have a big impact on your finances in the long run.

ATD Money is an online microfinance company that offers several different types of loans, including payday and salary advance loans. These loans are typically unsecured and do not require credit checks, so you can borrow them even if you have bad credit. They are a great option for salaried employees who need to cover emergency expenses or fund a personal project.

You can apply for a loan through the ATD Money website or mobile app. After your application is approved, you can receive your funds within a day or two. The company also offers a variety of repayment options, so you can repay your loan as quickly as possible.

ATD Money is a reliable lender that works within the law to ensure that its customers are treated fairly. Its website features a wide variety of loan categories and includes a comparison tool to help you compare prices and monthly payments. The company is headquartered in Delhi and has a large team of customer-facing employees. Its mission is to improve the lives of people by providing them with financial services. It also strives to reduce the environmental impact of its operations. The company is a member of the Responsible Finance Forum and has an A+ rating with the Better Business Bureau.

Easy application process

A personal loan can help you get over a financial hump, pay off debt faster or make a large purchase. It can also be a great way to build your credit. Personal loans are available from many lenders, but every lender has its own application process. The key is to do your research and understand the process before you apply. This will help you avoid any surprises and make the best decision for your situation.

Before applying for a personal loan, check your credit score. A good credit score will improve your chances of getting approved for a loan and lower the interest rate that you will be charged. You should also look for any errors on your report and correct them immediately. You can also improve your credit by paying off any outstanding debt or lowering your debt-to-income ratio.

The ATD Money personal loan app is an easy-to-use tool that allows you to quickly and easily get a loan. It offers a variety of loan products, including payday loans and cash advances, which are ideal for people who need extra income during a difficult time. Moreover, it offers affordable rates and is safe to use. The company’s website features a convenient comparison tool, which makes it easy to choose the right loan for your needs.

ATD Money is a microfinance company that provides short-term financial services to citizens of India. It offers a variety of loan options, including salary loans and advance salary loans, and works within the law to ensure that its customers are treated fairly. In addition, it is committed to protecting the environment and reducing its impact on the planet.

When choosing a loan application, be sure to read the terms and conditions carefully. You should also know whether or not you will be required to provide additional documentation. Each lender has its own requirements, but most will ask for your name, address and contact information, as well as a proof of income. Some lenders will also request a bank statement and other documents.

ATD Money is a mobile-based microfinance platform that offers unsecured personal loans to salaried employees. Its loans range from Rs3,000 to Rs50,000, and the entire application process is done online. The company also has a customer service department to assist you with any questions you may have about the process.

No credit check

A no-credit check personal loan is a quick and easy way to get the money you need. It is typically used to cover unexpected expenses, like medical bills or car repairs. These loans are usually short-term, and you can apply for one online or in person. They are typically more expensive than traditional loans, but they can be a good option if you need cash quickly.

Many companies offer payday loans with no credit check to help people with poor or no credit. These lenders may charge higher interest rates than traditional loans, but they are more flexible in how much they lend. Some may also require collateral, such as a vehicle or home. If you are unable to repay the loan, you could lose your assets. However, if you are responsible with your payments, you can use these loans to build or rebuild your credit.

You can apply for a payday loan no credit check through a lender network, such as LendYou. This service provides a free online form that will send your information to lenders offering payday or personal loans for bad credit. The process is simple and fast, and you can receive a loan offer in minutes. Once you have accepted an offer, the lender will deposit the funds into your bank account.

Another option is to take out a secured loan from a bank or credit union. Secured loans are typically backed by an asset such as your home or automobile, and they can provide lower interest rates than traditional loans. You can obtain a secured loan from banks, private lenders, or even some federal credit unions. These loans can be a great way to build your credit history, but they must be repaid on time or you will face serious consequences.

A good alternative to a no-credit-check loan is to save money instead. This is a better long-term solution, but it may not be possible for everyone to do right now. Having an emergency fund can be a lifesaver in a financial crisis, and it can also help you avoid taking out more debt in the future.

No collateral required

If you need money for a major expense, a personal loan may be the right solution. These unsecured loans can be used for anything from paying off medical bills to funding a vacation. They are also a great alternative to credit cards, which often have high interest rates and fees. But before you apply, be sure to do your research. Several online lenders, credit unions and banks offer personal loans with no collateral required. But which one is the best fit for you?

There are many different kinds of personal loans, and each lender has its own requirements. For example, some lenders will request a list of your recurring monthly expenses and compare them to your income. This will help them determine if you can afford the monthly payment and whether it would stretch your budget too thinly. Others will require you to provide some form of security in the form of cash or a bank account.

The best personal loans are those that offer low interest rates, flexible repayment terms and a clear set of terms for the loan. They are designed to help you manage your financial situation and pay off debt quickly. Many of these loans can be secured by a home equity line of credit, or HELOC. Other types of personal loans can be secured by other assets, such as car equity or stocks.

One of the most popular personal loans is the salary advance loan, or “payday” loan. These are short-term unsecured loans that are available to salaried employees with a good credit score. They are easy to obtain and can be paid back within a few business days.

The company offers a variety of loan options and is dedicated to serving its customers well. Its website features a wide variety of information about the different loan products they offer, including a comparison tool to help you compare prices and rates. It also has a mobile app that makes it easy to get a loan when you need it. In addition to its loans, ATD Money also provides a number of other financial solutions, including mobile banking and digital payments.

0 notes

Text

Recovery of Debts by Corporate: Cheque & Negotiable Instruments Act, 1881 | Corporate Debt Recovery Attorney in Delhi NCR | Corporate Debt Recovery Lawyer in Delhi NCR |

In the modern world, cheques are being used in almost every form of transaction, be it debts, loan guarantees, employee salary payments etc. But there comes a bane with every boon. “Check Bounce” nowadays, is one of the most prevalent and common forms of financial problems in India, and this problem is also being faced by many corporate houses at a large scale. The law deems this to be a criminal offence in accordance with Section 138 of the Negotiable Instruments Act, 1881 respectively.

#LEGAL EXPERT FOR BUSINESS AND CORPORATE LAWS IN GURUGRAM#LEGAL EXPERT FOR BUSINESS AND CORPORATE LAWS IN DELHI#LAWYER FOR BUSINESS AND CORPORATE LAWS IN GURUGRAM#LAWYER FOR BUSINESS AND CORPORATE LAWS IN DELHI#BUSINESS CORPORATE LEGAL EXPERT NEAR ME#BUSINESS CORPORATE LAW FIRM IN DELHI#BUSINESS AND CORPORATE LAWYER NEAR ME#BEST LAWYER FOR COMMERCIAL LAWS IN DELHI-NCR#BEST LAWYER FOR BUSINESS AND CORPORATE LAWS IN GURUGRAM#BEST LAWYER FOR BUSINESS AND CORPORATE LAWS IN DELHI

0 notes

Text

Quick Personal Loan Same Day | Solve Your Money Problems

That’s where an emergency personal loan online comes into play. Before diving deep into the discussion, let us first find out what an emergency loan is. These specially designed instruments can aid when you need funds on short notice. Visit the blog to read more.

Visit- https://medium.com/@rupe3693/quick-personal-loan-same-day-solve-your-money-problems-0745fa58eae6

#instant personal loan for low cibil score noida#instant payday loan gurgaon#Personal Loan for Salaried Employee Faridabad#urgent payday loans Kolkata#emergency personal loan app Ahmedabad#instant personal loan for salaried gurgaon#immediate loan#Same day approval loans delhi#Payday Loans for Salaried Employees faridabad#Best instant personal loan app Gurgaon#emergency personal loan approval gurgaon#best instant personal loan app Ahmedabad#Short Term Loan Services faridabad#best instant loan app kolkata#Loan for salaried employees delhi#Online emergency loan instant approval noida

0 notes

Text

Redefining Financial Solution - Personal loan in Faridabad

Everyone is in the pursuit of achieving more; it can be getting a new car, a salary hike, a new job that pays more, starting a business, etc. While making sure every need and want is fulfilled, what if financial emergencies arise and you are left with nothing? When such situations arise, anyone, especially salaried employees, can access support from Bharat Loan, offering short-term loans ranging from ₹5k to ₹1Lakh. Visit the blog to read more.

Visit- Redefining Financial Solution - Personal loan in Faridabad

#Apply Online For Emergency Loan Ghaziabad#Salaried Loan Providers Ghaziabad#Best Instant Personal Loan App Ghaziabad#Instant Emergency Loan Ghaziabad#Best Instant Personal Loan App Ahmedabad#Payday Loans For Salaried Employees Faridabad#Urgent Personal Loans Ghaziabad#Emergency Personal Loans Delhi#Instant Personal Loan App Ahmedabad

0 notes

Text

Instant loan in Delhi

Personal Loan from Private Financer in Delhi with Instant Approval for salaried employee from best Private Financer in New Delhi.

0 notes

Text

How to Finance Home Gym Equipment with a Personal Loan?

We all wish to lead a physically fit and healthy life, but in this high-paced environment, living under the constant stress of outperforming in our professional lives and running after our goals, it takes a backseat.

The situation is true not only for urban/top metro cities in India but also common in most of the small cities of India, where youth neglect the importance of staying physically and mentally fit.

But given the changing dynamics, people nowadays are realizing the importance of staying physically fit. It helps in improving overall appearance, boosts energy level, and can better handle a challenging situation which helps to build a strong professional image.

Realising the importance, many office campuses and residential societies have come up with a dedicated fitness centre/gym, where employees or members can walk freely and sweat out. Or, you can take a membership at your nearest fitness centre facility.

However, considering the current situation to avoid crowded places and also the paucity of time due to various work engagements, it gets difficult to visit the gym every time, thus affecting our physical training routine.

In such a scenario, setting up your gym at your home is the best option, as you will always have access and can train as per your convenience. You don’t have to depend on commercial fitness centres and find a perfect time slot to work on your fitness routine. Also, it’s quite economical to set up a personal gym.

Having said that, let’s learn more about home gym equipment financing and some of its advantages.

Gym Equipment Financing

Depending on your training requirements, the cost of gym equipment can range from a few thousand rupees to lakh. For instance, one of the most basic requirements is a treadmill, which costs above Rs 50,000 for a good model and set dumbbells and home kit gym equipment will cost a few thousand.

Thus, the cost of installing a complete range of gym equipment can run in a few lakh which is a huge financing challenge.

In such a scenario, choosing an online personal loan for home gym equipment financing is the best way to make it happen. With access to credit of up to Rs 25 lakh and reasonable EMIs, you can give shape and customise your home gym as per your requirement.

Must Read: What is the Minimum Salary Required for a Personal Loan?

Advantages of Gym Equipment Financing

Flexible Tenure: With a maximum tenure of up to 60 months, using a personal loan EMI calculator, you can select the tenure of online personal loan as per your repayment capability

Affordable Interest Rate: The interest rate on online personal loan starts from 11.99%, which makes it an attractive and cost-effective option for home gym equipment financing

No End-use Restriction: With no end-use restriction, you can purchase gym equipment or customise your home gym as per your requirement

No Collateral Required: Unlike mortgage loans, online personal loan for gym equipment financing doesn’t require you to put your assets on the block to secure the loan

Instant Approvals: Contrary to other categories of loans, personal loans are approved instantly (within 24 hours) and the amount is directly credited to your account. Therefore, you don’t have to wait for long to arrange for funds.

Minimum Documentation: You just need to submit KYC documents, address proof and income proof to buy gym equipment on easy EMI .

Eligibility Criteria for Personal Loan

Must be a resident citizen of India

Should be between 21 to 60 years of age

Must have a regular source of income or gainfully employed

Should have a good credit score

Minimum Income Level

For salaried professional residing in Delhi and Mumbai: Rs 25,000

For salaried professional residing in rest of India: Rs 20,000

For self-employed, the minimum income level differs based on profession and industry

Documents Required

Duly filled application form

KYC documents (PAN, AADHAR)

Proof of address

Last three months salary slips

Last six months bank statement

IT returns or form 16

Proof of Income and business financial statements (for self-employed)

How to Successfully Apply for a Personal Loan?

If you are unsure about your loan application approval or the amount you will be able to raise for purchasing home gym equipment, using the online personal loan eligibility calculator will give you an instant estimate and approval chance.

Must Read: How to Apply for a Personal Loan

The Fullerton India personal loan eligibility depends on multiple factors like employment status, income level, credit score, age and more. Also, using the personal loan EMI calculator, you can set your monthly EMI and tenure as per your preference.

When it comes to your health and fitness, you should not compromise on it and inculcate the habit of training regularly and consistently. Having a home gym helps you to get into shape at your convenience and also helps you to save a lot on membership fees, time travelling to the gym, and most important, reduced medical expenses and a healthy mind.

Source: https://www.smfgindiacredit.com/knowledge-center/how-to-finance-home-gym.aspx

0 notes

Text

Personal Loan Provider in Delhi NCR

The National Capital Region (NCR), encompassing Delhi and its surrounding areas, is one of India's most vibrant and bustling regions. With a rapidly growing population and dynamic economic activities, the demand for personal loans in Delhi NCR has surged in recent years. Personal loans offer a quick and efficient way to meet various financial needs, from medical emergencies and home renovations to education expenses and debt consolidation. This article provides a comprehensive overview of the leading personal loan providers in Delhi NCR, detailing their offerings, benefits, and application processes.

1. HDFC Bank

HDFC Bank is one of the largest and most trusted private sector banks in India. It offers personal loans tailored to the needs of residents in Delhi NCR.

Loan Amount and Tenure: HDFC Bank offers personal loans ranging from ₹50,000 to ₹40 lakhs with flexible repayment tenures from 12 to 60 months.

Interest Rates: Interest rates for HDFC personal loans start at around 10.50% per annum, which can vary based on the applicant's profile and creditworthiness.

Eligibility: Salaried individuals with a minimum monthly income of ₹25,000 are eligible. Applicants need to be between 21 to 60 years old.

Processing Time: HDFC Bank is known for its quick disbursal, often within 24 hours of loan approval.

Special Features: Pre-approved offers for existing customers, minimal documentation, and an easy online application process.

2. ICICI Bank

ICICI Bank is another major player in the personal loan segment in Delhi NCR, offering competitive rates and flexible options.

Loan Amount and Tenure: ICICI Bank provides personal loans from ₹50,000 up to ₹20 lakhs with repayment periods ranging from 12 to 60 months.

Interest Rates: Interest rates start from 11.25% per annum, varying based on the borrower’s credit profile.

Eligibility: Salaried individuals aged between 23 and 58 years with a minimum monthly income of ₹17,500.

Processing Time: ICICI Bank promises quick loan processing, with funds disbursed within 3 seconds for pre-approved customers.

Special Features: Online loan management, balance transfer options, and minimal paperwork for existing customers.

3. State Bank of India (SBI)

State Bank of India, the country’s largest public sector bank, offers personal loans with attractive terms for residents of Delhi NCR.

Loan Amount and Tenure: SBI offers personal loans up to ₹20 lakhs, with repayment tenures from 12 to 72 months.

Interest Rates: The interest rates start at 10.90% per annum, depending on the applicant’s profile and loan amount.

Eligibility: Both salaried and self-employed individuals are eligible. Salaried individuals need to have a minimum monthly income of ₹15,000.

Processing Time: While the processing might be slightly longer compared to private banks, SBI is known for its transparent processes and customer-friendly terms.

Special Features: No hidden charges, overdraft facility, and special rates for pensioners and government employees.

4. Axis Bank

Axis Bank offers personal loans with quick processing and competitive rates, making it a popular choice in Delhi NCR.

Loan Amount and Tenure: Axis Bank provides loans ranging from ₹50,000 to ₹15 lakhs, with repayment terms of 12 to 60 months.

Interest Rates: Interest rates start from 10.49% per annum.

Eligibility: Salaried individuals aged between 21 and 60 years with a minimum monthly income of ₹15,000.

Processing Time: Axis Bank offers quick approval and disbursal, often within 48 hours.

Special Features: No requirement for collateral, balance transfer facility, and customized loan offerings for existing customers.

5. Bajaj Finserv

Bajaj Finserv is a leading non-banking financial company (NBFC) that offers personal loans with flexible terms.

Loan Amount and Tenure: Bajaj Finserv provides personal loans up to ₹25 lakhs with repayment tenures ranging from 12 to 60 months.

Interest Rates: Interest rates start from 13% per annum, depending on the borrower’s credit profile.

Eligibility: Salaried individuals with a minimum monthly income of ₹25,000. Applicants must be between 23 and 55 years old.

Processing Time: Known for its swift approval process, Bajaj Finserv disburses loans within 24 hours of approval.

Special Features: Pre-approved offers, minimal documentation, and the Flexi Loan facility that allows interest-only EMIs.

6. Kotak Mahindra Bank

Kotak Mahindra Bank provides personal loans with attractive terms and quick processing for Delhi NCR residents.

Loan Amount and Tenure: Kotak Mahindra Bank offers personal loans from ₹50,000 to ₹20 lakhs with tenures ranging from 12 to 60 months.

Interest Rates: Interest rates start at 10.99% per annum.

Eligibility: Salaried individuals aged between 21 and 60 years with a minimum monthly income of ₹20,000.

Processing Time: The bank ensures fast processing, with loan disbursal within a few days.

Special Features: Online application, part-prepayment facility, and balance transfer options.

7. Fullerton India

Fullerton India is another reputable NBFC offering personal loans to residents of Delhi NCR.

Loan Amount and Tenure: Fullerton India provides loans up to ₹25 lakhs with repayment periods of 12 to 60 months.

Interest Rates: Interest rates start at 11.99% per annum.

Eligibility: Both salaried and self-employed individuals can apply. Salaried applicants need to have a minimum monthly income of ₹20,000.

Processing Time: Fullerton India is known for its quick loan processing and disbursal within 72 hours.

Special Features: Flexible loan options, easy online application, and minimal documentation.

Tips for Choosing the Right Personal Loan Provider

Compare Interest Rates: Always compare the interest rates offered by different lenders. Even a slight difference in rates can significantly impact the total repayment amount.

Check Eligibility Criteria: Ensure you meet the eligibility criteria before applying to avoid rejection and a negative impact on your credit score.

Read the Fine Print: Understand all terms and conditions, including fees, prepayment charges, and penalties, before signing any loan agreement.

Evaluate Customer Service: Opt for lenders with good customer service and support to ensure a smooth borrowing experience.

Look for Special Features: Some lenders offer additional benefits like pre-approved loans, flexible repayment options, and balance transfer facilities, which can be advantageous.

Conclusion

The demand for personal loan online in Delhi NCR is met by a variety of banks and NBFCs, each offering unique benefits and terms. Whether you choose a traditional bank like HDFC or SBI, or an NBFC like Bajaj Finserv or Fullerton India, it’s crucial to thoroughly research and compare your options. By doing so, you can secure a personal loan that best suits your financial needs and ensures a stress-free borrowing experience.

#personal loan in Delhi#Personal Loan Providers in Delhi#personal loan in Delhi NCR#instant personal loan in Delhi

0 notes

Link

What Are The Disadvantages Of Changing Jobs? - The decision to change jobs has some advantages and disadvantages. But before that let’s analyze why would someone required to change a job. There are many probabilities like satisfaction in the job, salary, and better career opportunities.

#12th pass job salary 50000#best career options after 12th commerce#how to write a recommendation letter for an employee#How To Apply For Education Loan In SBI#Team Leader Jobs In Delhi -Standard Chartered

0 notes