#LogicGates

Explore tagged Tumblr posts

Text

youtube

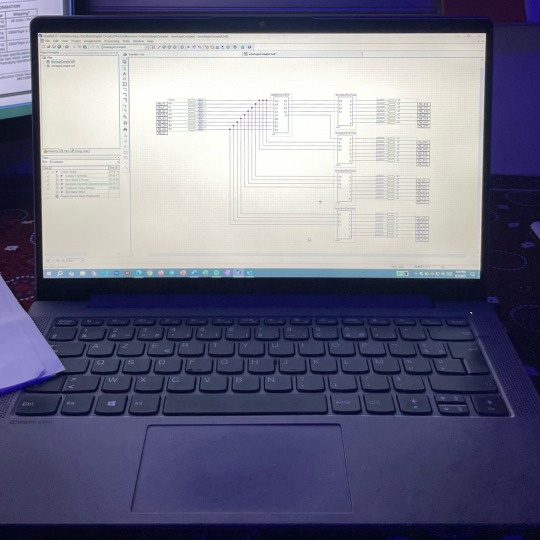

Xilinx Vivado VHDL Tutorial: Learn, Simulate, and Synthesize All Basic Gates for FPGA Design

Learn the essentials of VHDL coding as we delve into the creation of basic gates such as AND, OR, and XOR using Xilinx Vivado. Gain hands-on experience by simulating your designs within the Vivado environment, allowing you to troubleshoot and refine your VHDL code effectively.

Perfect for beginners, this tutorial ensures a thorough understanding of VHDL basics, gate implementation, simulation techniques, and synthesis methodologies within the Xilinx Vivado environment—equipping you with the skills to tackle more complex FPGA projects confidently.

youtube

Subscribe to "Learn And Grow Community"

YouTube : https://www.youtube.com/@LearnAndGrowCommunity Follow #learnandgrowcommunity

#xilinxvivado#vhdlbeginners#FPGAprogramming#digitaldesign#hdlcoding#logicgates#learnfpga#VHDLcoding#hardwaredesign#xilinxtutorial#programmingfpga#logicdesign#vivadodesignsuite#fpgatutorial#electronicengineering#Youtube

1 note

·

View note

Text

Logic Gate Logic gates are fundamental building blocks of digital circuits that perform logical operations on one or more binary inputs to produce a single binary output based on predefined truth table rules. These gates implement Boolean algebraic functions and are the foundation of digital logic design, enabling the creation of complex digital systems such as microprocessors, memory units, and control circuits.

Nomination Link :https://x-i.me/emcnom Get Connected Here: ================== Facebook : https://www.facebook.com/profile.php?id=61556074815651 Twitter : https://twitter.com/PencisE28647 Pinterest : https://in.pinterest.com/electronicconference/

#LogicGate#DigitalLogic#BooleanLogic#BinaryLogic#ANDGate#ORGate#NOTGate#NANDGate#NORGate#XORGate#XNORGate#GateLogic#CombinationalLogic#SequentialLogic#TruthTable#LogicDesign#ElectronicCircuits#DigitalCircuits

0 notes

Text

I didn’t think it was possible, but I found something better than the Sims.

#computerScience #digitalCircuit #integratedCircuits #combinatoryLogic #logicGates

0 notes

Text

Regulatory Change Management Solutions Market Size, Share, Growth Drivers, and Forecast to 2033

"Regulatory Change Management Solutions Market" - Research Report, 2025-2033 delivers a comprehensive analysis of the industry's growth trajectory, encompassing historical trends, current market conditions, and essential metrics including production costs, market valuation, and growth rates. Regulatory Change Management Solutions Market Size, Share, Growth, and Industry Analysis, By Type (Cloud Based, On-premises), By Application (Large Enterprises, SMEs), Regional Insights and Forecast to 2033 are driving major changes, setting new standards and influencing customer expectations. These advancements are expected to lead to significant market growth. Capitalize on the market's projected expansion at a CAGR of 8.7% from 2024 to 2033. Our comprehensive [95+ Pages] market research report offers Exclusive Insights, Vital Statistics, Trends, and Competitive Analysis to help you succeed in this Information & Technology sector.

Regulatory Change Management Solutions Market: Is it Worth Investing In? (2025-2033)

Global Regulatory Change Management Solutions market size is projected at USD 1056.89 million in 2024 and is anticipated to reach USD 2260.23 million by 2033, registering a CAGR of 8.7%.

The Regulatory Change Management Solutions market is expected to demonstrate strong growth between 2025 and 2033, driven by 2024's positive performance and strategic advancements from key players.

The leading key players in the Regulatory Change Management Solutions market include:

IBM

Thomson Reuters

Wolters Kluwer

Archer

Protiviti

ServiceNow

CUBE

MetricStream

SAI360

Resolver (Kroll)

RecordPoint

LogicGate

360factors

ai

Lexplosion

PerformLine

LogicManager

Regology

Clausematch

Request a Free Sample Copy @ https://www.marketgrowthreports.com/enquiry/request-sample/104105

Report Scope

This report offers a comprehensive analysis of the global Regulatory Change Management Solutions market, providing insights into market size, estimations, and forecasts. Leveraging sales volume (K Units) and revenue (USD millions) data, the report covers the historical period from 2020 to 2025 and forecasts for the future, with 2024 as the base year.

For granular market understanding, the report segments the market by product type, application, and player. Additionally, regional market sizes are provided, offering a detailed picture of the global Regulatory Change Management Solutions landscape.

Gain valuable insights into the competitive landscape through detailed profiles of key players and their market ranks. The report also explores emerging technological trends and new product developments, keeping you at the forefront of industry advancements.

This research empowers Regulatory Change Management Solutions manufacturers, new entrants, and related industry chain companies by providing critical information. Access detailed data on revenues, sales volume, and average price across various segments, including company, type, application, and region.

Request a Free Sample Copy of the Regulatory Change Management Solutions Report 2025 - https://www.marketgrowthreports.com/enquiry/request-sample/104105

Understanding Regulatory Change Management Solutions Product Types & Applications: Key Trends and Innovations in 2025

By Product Types:

Cloud Based

On-premises

By Application:

Large Enterprises

SMEs

Emerging Regulatory Change Management Solutions Market Leaders: Where's the Growth in 2025?

North America (United States, Canada and Mexico)

Europe (Germany, UK, France, Italy, Russia and Turkey etc.)

Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia and Vietnam)

South America (Brazil, Argentina, Columbia etc.)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Inquire more and share questions if any before the purchase on this report at - https://www.marketgrowthreports.com/enquiry/request-sample/104105

This report offers a comprehensive analysis of the Regulatory Change Management Solutions market, considering both the direct and indirect effects from related industries. We examine the pandemic's influence on the global and regional Regulatory Change Management Solutions market landscape, including market size, trends, and growth projections. The analysis is further segmented by type, application, and consumer sector for a granular understanding.

Additionally, the report provides a pre and post pandemic assessment of key growth drivers and challenges within the Regulatory Change Management Solutions industry. A PESTEL analysis is also included, evaluating political, economic, social, technological, environmental, and legal factors influencing the market.

We understand that your specific needs might require tailored data. Our research analysts can customize the report to focus on a particular region, application, or specific statistics. Furthermore, we continuously update our research, triangulating your data with our findings to provide a comprehensive and customized market analysis.

COVID-19 Changed Us? An Impact and Recovery Analysis

This report delves into the specific repercussions on the Regulatory Change Management Solutions Market. We meticulously tracked both the direct and cascading effects of the pandemic, examining how it reshaped market size, trends, and growth across international and regional landscapes. Segmented by type, application, and consumer sector, this analysis provides a comprehensive view of the market's evolution, incorporating a PESTEL analysis to understand key influencers and barriers. Ultimately, this report aims to provide actionable insights into the market's recovery trajectory, reflecting the broader shifts. Final Report will add the analysis of the impact of Russia-Ukraine War and COVID-19 on this Regulatory Change Management Solutions Industry.

TO KNOW HOW COVID-19 PANDEMIC AND RUSSIA UKRAINE WAR WILL IMPACT THIS MARKET - REQUEST SAMPLE

Detailed TOC of Global Regulatory Change Management Solutions Market Research Report, 2025-2033

1 Report Overview

1.1 Study Scope 1.2 Global Regulatory Change Management Solutions Market Size Growth Rate by Type: 2020 VS 2024 VS 2033 1.3 Global Regulatory Change Management Solutions Market Growth by Application: 2020 VS 2024 VS 2033 1.4 Study Objectives 1.5 Years Considered

2 Global Growth Trends

2.1 Global Regulatory Change Management Solutions Market Perspective (2020-2033) 2.2 Regulatory Change Management Solutions Growth Trends by Region 2.2.1 Global Regulatory Change Management Solutions Market Size by Region: 2020 VS 2024 VS 2033 2.2.2 Regulatory Change Management Solutions Historic Market Size by Region (2020-2025) 2.2.3 Regulatory Change Management Solutions Forecasted Market Size by Region (2025-2033) 2.3 Regulatory Change Management Solutions Market Dynamics 2.3.1 Regulatory Change Management Solutions Industry Trends 2.3.2 Regulatory Change Management Solutions Market Drivers 2.3.3 Regulatory Change Management Solutions Market Challenges 2.3.4 Regulatory Change Management Solutions Market Restraints

3 Competition Landscape by Key Players

3.1 Global Top Regulatory Change Management Solutions Players by Revenue 3.1.1 Global Top Regulatory Change Management Solutions Players by Revenue (2020-2025) 3.1.2 Global Regulatory Change Management Solutions Revenue Market Share by Players (2020-2025) 3.2 Global Regulatory Change Management Solutions Market Share by Company Type (Tier 1, Tier 2, and Tier 3) 3.3 Players Covered: Ranking by Regulatory Change Management Solutions Revenue 3.4 Global Regulatory Change Management Solutions Market Concentration Ratio 3.4.1 Global Regulatory Change Management Solutions Market Concentration Ratio (CR5 and HHI) 3.4.2 Global Top 10 and Top 5 Companies by Regulatory Change Management Solutions Revenue in 2024 3.5 Regulatory Change Management Solutions Key Players Head office and Area Served 3.6 Key Players Regulatory Change Management Solutions Product Solution and Service 3.7 Date of Enter into Regulatory Change Management Solutions Market 3.8 Mergers & Acquisitions, Expansion Plans

4 Regulatory Change Management Solutions Breakdown Data by Type

4.1 Global Regulatory Change Management Solutions Historic Market Size by Type (2020-2025) 4.2 Global Regulatory Change Management Solutions Forecasted Market Size by Type (2025-2033)

5 Regulatory Change Management Solutions Breakdown Data by Application

5.1 Global Regulatory Change Management Solutions Historic Market Size by Application (2020-2025) 5.2 Global Regulatory Change Management Solutions Forecasted Market Size by Application (2025-2033)

6 North America

6.1 North America Regulatory Change Management Solutions Market Size (2020-2033) 6.2 North America Regulatory Change Management Solutions Market Growth Rate by Country: 2020 VS 2024 VS 2033 6.3 North America Regulatory Change Management Solutions Market Size by Country (2020-2025) 6.4 North America Regulatory Change Management Solutions Market Size by Country (2025-2033) 6.5 United States 6.6 Canada

7 Europe

7.1 Europe Regulatory Change Management Solutions Market Size (2020-2033) 7.2 Europe Regulatory Change Management Solutions Market Growth Rate by Country: 2020 VS 2024 VS 2033 7.3 Europe Regulatory Change Management Solutions Market Size by Country (2020-2025) 7.4 Europe Regulatory Change Management Solutions Market Size by Country (2025-2033) 7.5 Germany 7.6 France 7.7 U.K. 7.8 Italy 7.9 Russia 7.10 Nordic Countries

8 Asia-Pacific

8.1 Asia-Pacific Regulatory Change Management Solutions Market Size (2020-2033) 8.2 Asia-Pacific Regulatory Change Management Solutions Market Growth Rate by Region: 2020 VS 2024 VS 2033 8.3 Asia-Pacific Regulatory Change Management Solutions Market Size by Region (2020-2025) 8.4 Asia-Pacific Regulatory Change Management Solutions Market Size by Region (2025-2033) 8.5 China 8.6 Japan 8.7 South Korea 8.8 Southeast Asia 8.9 India 8.10 Australia

9 Latin America

9.1 Latin America Regulatory Change Management Solutions Market Size (2020-2033) 9.2 Latin America Regulatory Change Management Solutions Market Growth Rate by Country: 2020 VS 2024 VS 2033 9.3 Latin America Regulatory Change Management Solutions Market Size by Country (2020-2025) 9.4 Latin America Regulatory Change Management Solutions Market Size by Country (2025-2033) 9.5 Mexico 9.6 Brazil

10 Middle East & Africa

10.1 Middle East & Africa Regulatory Change Management Solutions Market Size (2020-2033) 10.2 Middle East & Africa Regulatory Change Management Solutions Market Growth Rate by Country: 2020 VS 2024 VS 2033 10.3 Middle East & Africa Regulatory Change Management Solutions Market Size by Country (2020-2025) 10.4 Middle East & Africa Regulatory Change Management Solutions Market Size by Country (2025-2033) 10.5 Turkey 10.6 Saudi Arabia 10.7 UAE

11 Key Players Profiles

12 Analyst's Viewpoints/Conclusions

13 Appendix

13.1 Research Methodology 13.1.1 Methodology/Research Approach 13.1.2 Data Source 13.2 Disclaimer 13.3 Author Details

Request a Free Sample Copy of the Regulatory Change Management Solutions Report 2025 @ https://www.marketgrowthreports.com/enquiry/request-sample/104105

About Us: Market Growth Reports is a unique organization that offers expert analysis and accurate data-based market intelligence, aiding companies of all shapes and sizes to make well-informed decisions. We tailor inventive solutions for our clients, helping them tackle any challenges that are likely to emerge from time to time and affect their businesses.

0 notes

Link

[ad_1] Here’s a look at the most interesting products from the past month, featuring releases from: Anchore, BalkanID, Cyble, groundcover, Hunted Labs, LogicGate, McAfee, Obsidian Security, Outpost24, PentestPad, ProcessUnity, Resecurity, Searchlight Cyber, SecuX, ServiceNow, ThreatMark, and Verosint. New MCP server from groundcover redefines LLM observability A new MCP server, faster than any other on the market, has been launched from groundcover, the eBPF-driven observability platform. Developers can now enhance their AI-driven workflows with deep system context, powered by groundcover’s granular access to logs, metrics, and traces via eBPF. BalkanID IGA Lite reduces identity risk and ensures compliance Consisting of three streamlined modules: User Access Reviews (UAR) Lite, IAM Risk Analyzer Lite, and Lifecycle Management Lite, BalkanID’s IGA Lite is the self-service identity governance solution with publicly available pricing. It allows organizations to meet compliance and security requirements quickly and affordably, while providing a strategic path to IGA maturity. Resecurity One simplifies cybersecurity operations Resecurity One provides real-time cyber threat intelligence from multiple sources, enabling organizations to proactively identify and respond to cyber threats. With comprehensive threat intelligence feeds and advanced analytics, organizations can detect and thwart cyber attacks before they cause harm. Outpost24 simplifies threat analysis with AI-enhanced summaries Outpost24 announced the addition of AI-enhanced summaries to the Digital Risk Protection (DRP) modules within its External Attack Surface Management (EASM) platform. With Outpost24’s DRP modules, organizations are able to identify, monitor, and protect against threats before they can be exploited. Cyble Titan strengthens endpoint security Cyble announced Cyble Titan, its next-generation Endpoint Security. Designed to meet the evolving threat landscape, Cyble Titan integrates into the Cyble’s AI-Native Security Cloud, bringing together asset visibility, intelligence-led detection, and automated incident response in a unified solution. Anchore SBOM tracks software supply chain issues With the addition of Anchore SBOM, Anchore Enterprise now provides a centralized platform for viewing, managing and analyzing Software Bill of Materials (SBOMs), including the capability of “Bringing Your Own SBOMs”. Organizations can now gain comprehensive visibility into the software components present in both their internally developed and third-party supplied software to identify and mitigate security and compliance risks. ThreatMark offers protection against social engineering attacks and scams ScamFlag works through a simple three-step process: users access the feature within their existing banking app, take a screenshot or photo of suspicious content, and receive an instant analysis with recommended actions. The solution is delivered through a Software Development Kit (SDK) that banks can integrate with minimal effort, with full white-labeling options that maintain the bank’s brand identity and user experience. SecuX releases Bitcoin self-managed solution for SMBs SecuX launched hardware-based cybersecurity solution tailored for SMBs. At the core is Cyber Athena, an enterprise-grade cold wallet that integrates PUF-based authentication via PUFido and PUFhsm hardware modules, designed to meet rising demand for secure, self-managed Bitcoin custody. Hunted Labs Entercept combats software supply chain attacks Hunted Labs announced Entercept, an AI-powered source code security platform that gives enterprises instant visibility into suspicious behavior from the people and code in their software supply chain. McAfee’s Scam Detector identifies scams across text, email, and video On Android, SMS messages are auto-scanned, with alerts before opening, and on iPhone, suspicious messages are filtered or manually scanned via a quick check function. Scam Detector also protects email, flagging scams in Gmail, Microsoft, and Yahoo, while explaining why messages were flagged to help customers build their scam-spotting skills. For deepfake detection, McAfee identifies AI-manipulated videos on YouTube, TikTok, and other platforms, all processed on-device to protect the person’s privacy. Obsidian’s browser extension manages shadow SaaS and AI tools Obsidian Security has launched a new browser extension to help businesses safely use SaaS and AI apps online. The extension automatically finds and manages shadow SaaS and AI tools, blocks advanced spear-phishing attacks targeting access tokens, and gives real-time protection right in the user’s browser. PentestPad streamlines security testing workflows PentestPad announced a major rollout of new features to its platform, built to transform how modern security teams deliver penetration testing and manage vulnerabilities, clients and deliverables. ServiceNow unveils AI agents to accelerate enterprise self-defense The new AI agents, available within ServiceNow’s Security and Risk solutions, are designed to improve consistency, identify insights, and reduce response times. ProcessUnity Evidence Evaluator flags discrepancies in a third-party’s controls A key component of ProcessUnity’s Third-Party Risk Management (TPRM) Platform, Evidence Evaluator automatically reviews third-party evidence and populates assessment responses complete with references to the specified evidence in the source documents. Searchlight Cyber adds AI capabilities to summarize dark web posts and threads Searchlight’s latest AI capabilities release is designed to further increase the speed of investigations by helping analysts to quickly determine the relevance of conversations and threads to their objectives. This is achieved by providing AI overviews that summarize the contents, key statistics, and sentiment of dark web conversations Verosint Vera boosts identity threat detection and response Built on top of Verosint’s intelligent ITDR platform, Vera is an always-on, expert identity security analyst that works alongside security teams to improve response time, efficiency and effectiveness. Vera triages threats, investigates security events, and executes rapid threat response actions — all at scale and in real time. LogicGate brings risk management to individual business units By helping minimize operational disruptions, such as failed internal processes, inadequate systems, and natural disasters, ORM helps ensure the resilience of the organization. With role-based dashboards tailored to specific stakeholders and lines of defense, LogicGate’s new ORM solution enables Risk Cloud users to quantify and visualize operational risk across different business units. [ad_2] Source link

0 notes

Text

Vendor Risk Management Market Size, Share, Analysis, Forecast, and Growth Trends to 2032: Demand for Centralized Dashboards Boosts Market Value

The Vendor Risk Management Market was valued at USD 8.6 billion in 2023 and is expected to reach USD 30.3 billion by 2032, growing at a CAGR of 14.98% from 2024-2032.

Vendor Risk Management Market is witnessing rapid growth as organizations increasingly rely on third-party vendors for critical operations. Heightened regulatory scrutiny, rising cybersecurity threats, and the need for resilient supply chains are prompting businesses across the USA and Europe to adopt robust risk assessment frameworks. Companies are now prioritizing transparency, compliance, and real-time monitoring when evaluating vendor relationships.

Vendor Risk Management Market in the US Set to Surge Amid Growing Compliance Demands

Vendor Risk Management Market is evolving from a compliance checkbox to a strategic necessity. As global supply chains become more interconnected and vulnerable, enterprises are investing in advanced platforms that offer automation, predictive analytics, and integrated dashboards to continuously assess third-party risk. The focus has shifted toward proactive management and long-term resilience.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6629

Market Keyplayers:

RSA Security – Archer Third Party Governance

MetricStream – Third-Party Risk Management

OneTrust – Vendorpedia

Prevalent Inc. – Prevalent Third-Party Risk Management Platform

BitSight Technologies – BitSight Security Ratings

NAVEX Global – RiskRate

ProcessUnity – Vendor Risk Management

LogicGate – Risk Cloud for Third-Party Risk Management

Riskonnect – Third-Party Risk Management Solution

SAI360 – Vendor Risk Management

Aravo Solutions – Aravo for Third-Party Risk Management

Galvanize (now part of Diligent) – Third-Party Risk Management

IBM Corporation – OpenPages Third-Party Risk Management

SAP SE – SAP Risk Management

Coupa Software – Coupa Third-Party Risk Management

Market Analysis

The growing complexity of vendor ecosystems is pushing organizations to reimagine risk strategies. From financial health to data security, the risk landscape is multifaceted and dynamic. Enterprises, particularly in sectors like finance, healthcare, and manufacturing, are under pressure to maintain strict oversight of vendor performance and risk exposure. The USA leads in adoption due to stringent regulations and high-profile breaches, while Europe drives growth through GDPR compliance and regional supply chain mandates. Cloud-based VRM solutions are seeing significant traction across both regions.

Market Trends

Increased demand for automated vendor onboarding and monitoring

Integration with GRC (Governance, Risk, and Compliance) platforms

Use of AI and machine learning for risk scoring and predictive alerts

Enhanced cybersecurity assessments for third-party software vendors

Greater focus on ESG (Environmental, Social, Governance) compliance

Real-time performance tracking and contract management tools

Cross-functional collaboration between procurement, legal, and IT teams

Market Scope

The Vendor Risk Management Market is expanding as businesses face growing third-party risk exposure. Organizations are moving toward integrated platforms that not only ensure compliance but also provide strategic insights to enhance business continuity.

Centralized risk dashboards with multi-vendor visibility

Real-time alerts for SLA breaches and performance drops

Scalable systems for global supply chain management

Built-in regulatory compliance templates

Advanced analytics for continuous risk evaluation

Customizable workflows for vendor onboarding and audits

Forecast Outlook

The Vendor Risk Management Market is poised for sustained growth as risk landscapes become more volatile and regulatory environments more demanding. Technological advancements and evolving business models will fuel adoption of smarter, cloud-based solutions that offer flexibility, depth, and agility. As enterprises strive to stay resilient in the face of global disruptions, VRM solutions will become essential to strategic operations, especially across North American and European markets.

Access Complete Report: https://www.snsinsider.com/reports/vendor-risk-management-market-6629

Conclusion

In an era defined by digital interdependence, the Vendor Risk Management Market is no longer optional—it’s mission-critical. Forward-thinking organizations are turning to intelligent risk platforms to safeguard their operations, data, and reputation. Whether managing a network of suppliers in Germany or fintech vendors in the U.S., businesses that invest in proactive, tech-enabled risk solutions will lead the way in building trust, resilience, and competitive advantage.

Related Reports:

US businesses seek advanced solutions for sensitive data discovery to meet compliance needs

US demand for advanced risk analytics solutions continues to grow across finance and healthcare sectors

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Vendor Risk Management Market#Vendor Risk Management Market Scope#Vendor Risk Management Market Share#Vendor Risk Management Market Growth

0 notes

Text

LogicGate brings risk management to individual business units

http://securitytc.com/TL1kfh

0 notes

Text

LogicGate Wins ISACA Innovative Solutions for AI Governance Innovation

Unlock the Secrets of Ethical Hacking! Ready to dive into the world of offensive security? This course gives you the Black Hat hacker’s perspective, teaching you attack techniques to defend against malicious activity. Learn to hack Android and Windows systems, create undetectable malware and ransomware, and even master spoofing techniques. Start your first hack in just one hour! Enroll now and…

0 notes

Text

youtube

Xilinx Vivado for Beginners: VHDL Code for Every Gate

This guide is tailored for beginners, offering a straightforward path to mastering VHDL for gate designs in Xilinx Vivado. Build a strong foundation and gain confidence in your ability to craft digital circuits with ease!

Join "Learn And Grow Community"

#XilinxVivado #VHDLBeginners #FPGAProgramming #DigitalDesign #HDLCoding #LogicGates #LearnFPGA #VHDLCoding #HardwareDesign #XilinxTutorial #ProgrammingFPGA #LogicDesign #VivadoDesignSuite #FPGATutorial #ElectronicEngineering

#XilinxVivado#VHDLBeginners#FPGAProgramming#DigitalDesign#HDLCoding#LogicGates#LearnFPGA#VHDLCoding#HardwareDesign#XilinxTutorial#ProgrammingFPGA#LogicDesign#VivadoDesignSuite#FPGATutorial#ElectronicEngineering#Youtube

1 note

·

View note

Text

Nick Kathmann, CISO/CIO at LogicGate – Interview Series

New Post has been published on https://thedigitalinsider.com/nick-kathmann-ciso-cio-at-logicgate-interview-series/

Nick Kathmann, CISO/CIO at LogicGate – Interview Series

Nicholas Kathmann is the Chief Information Security Officer (CISO) at LogicGate, where he leads the company’s information security program, oversees platform security innovations, and engages with customers on managing cybersecurity risk. With over two decades of experience in IT and 18+ years in cybersecurity, Kathmann has built and led security operations across small businesses and Fortune 100 enterprises.

LogicGate is a risk and compliance platform that helps organizations automate and scale their governance, risk, and compliance (GRC) programs. Through its flagship product, Risk Cloud®, LogicGate enables teams to identify, assess, and manage risk across the enterprise with customizable workflows, real-time insights, and integrations. The platform supports a wide range of use cases, including third-party risk, cybersecurity compliance, and internal audit management, helping companies build more agile and resilient risk strategies

You serve as both CISO and CIO at LogicGate — how do you see AI transforming the responsibilities of these roles in the next 2–3 years?

AI is already transforming both of these roles, but in the next 2-3 years, I think we’ll see a major rise in Agentic AI that has the power to reimagine how we deal with business processes on a day-to-day basis. Anything that would usually go to an IT help desk — like resetting passwords, installing applications, and more — can be handled by an AI agent. Another critical use case will be leveraging AI agents to handle tedious audit assessments, allowing CISOs and CIOs to prioritize more strategic requests.

With federal cyber layoffs and deregulation trends, how should enterprises approach AI deployment while maintaining a strong security posture?

While we’re seeing a deregulation trend in the U.S., regulations are actually strengthening in the EU. So, if you’re a multinational enterprise, anticipate having to comply with global regulatory requirements around responsible use of AI. For companies only operating in the U.S., I see there being a learning period in terms of AI adoption. I think it’s important for those enterprises to form strong AI governance policies and maintain some human oversight in the deployment process, making sure nothing is going rogue.

What are the biggest blind spots you see today when it comes to integrating AI into existing cybersecurity frameworks?

While there are a couple of areas I can think of, the most impactful blind spot would be where your data is located and where it’s traversing. The introduction of AI is only going to make oversight in that area more of a challenge. Vendors are enabling AI features in their products, but that data doesn’t always go directly to the AI model/vendor. That renders traditional security tools like DLP and web monitoring effectively blind.

You’ve said most AI governance strategies are “paper tigers.” What are the core ingredients of a governance framework that actually works?

When I say “paper tigers,” I’m referring specifically to governance strategies where only a small team knows the processes and standards, and they are not enforced or even understood throughout the organization. AI is very pervasive, meaning it impacts every group and every team. “One size fits all” strategies aren’t going to work. A finance team implementing AI features into its ERP is different from a product team implementing an AI feature in a specific product, and the list continues. The core ingredients of a strong governance framework vary, but IAPP, OWASP, NIST, and other advisory bodies have pretty good frameworks for determining what to evaluate. The hardest part is figuring out when the requirements apply to each use case.

How can companies avoid AI model drift and ensure responsible use over time without over-engineering their policies?

Drift and degradation is just part of using technology, but AI can significantly accelerate the process. But if the drift becomes too great, corrective measures will be needed. A comprehensive testing strategy that looks for and measures accuracy, bias, and other red flags is necessary over time. If companies want to avoid bias and drift, they need to start by ensuring they have the tools in place to identify and measure it.

What role should changelogs, limited policy updates, and real-time feedback loops play in maintaining agile AI governance?

While they play a role right now to reduce risk and liability to the provider, real-time feedback loops hamper the ability of customers and users to perform AI governance, especially if changes in communication mechanisms happen too frequently.

What concerns do you have around AI bias and discrimination in underwriting or credit scoring, particularly with “Buy Now, Pay Later” (BNPL) services?

Last year, I spoke to an AI/ML researcher at a large, multinational bank who had been experimenting with AI/LLMs across their risk models. The models, even when trained on large and accurate data sets, would make really surprising, unsupported decisions to either approve or deny underwriting. For example, if the words “great credit” were mentioned in a chat transcript or communications with customers, the models would, by default, deny the loan — regardless of whether the customer said it or the bank employee said it. If AI is going to be relied upon, banks need better oversight and accountability, and those “surprises” need to be minimized.

What’s your take on how we should audit or assess algorithms that make high-stakes decisions — and who should be held accountable?

This goes back to the comprehensive testing model, where it’s necessary to continuously test and benchmark the algorithm/models in as close to real time as possible. This can be difficult, as the model output may have desirable results that will need humans to identify outliers. As a banking example, a model that denies all loans flat out will have a great risk rating, since zero loans it underwrites will ever default. In that case, the organization that implements the model/algorithm should be responsible for the outcome of the model, just like they would be if humans were making the decision.

With more enterprises requiring cyber insurance, how are AI tools reshaping both the risk landscape and insurance underwriting itself?

AI tools are great at disseminating large amounts of data and finding patterns or trends. On the customer side, these tools will be instrumental in understanding the organization’s actual risk and managing that risk. On the underwriter’s side, those tools will be helpful in finding inconsistencies and organizations that are becoming immature over time.

How can companies leverage AI to proactively reduce cyber risk and negotiate better terms in today’s insurance market?

Today, the best way to leverage AI for reducing risk and negotiating better insurance terms is to filter out noise and distractions, helping you focus on the most important risks. If you reduce those risks in a comprehensive way, your cyber insurance rates should go down. It’s too easy to get overwhelmed with the sheer volume of risks. Don’t get bogged down trying to address every single issue when focusing on the most critical ones can have a much larger impact.

What are a few tactical steps you recommend for companies that want to implement AI responsibly — but don’t know where to start?

First, you need to understand what your use cases are and document the desired outcomes. Everyone wants to implement AI, but it’s important to think of your goals first and work backwards from there — something I think a lot of organizations struggle with today. Once you have a good understanding of your use cases, you can research the different AI frameworks and understand which of the applicable controls matter to your use cases and implementation. Strong AI governance is also business critical, for risk mitigation and efficiency since automation is only as useful as its data input. Organizations leveraging AI must do so responsibly, as partners and prospects are asking tough questions around AI sprawl and usage. Not knowing the answer can mean missing out on business deals, directly impacting the bottom line.

If you had to predict the biggest AI-related security risk five years from now, what would it be — and how can we prepare today?

My prediction is that as Agentic AI is built into more business processes and applications, attackers will engage in fraud and misuse to manipulate those agents into delivering malicious outcomes. We have already seen this with the manipulation of customer service agents, resulting in unauthorized deals and refunds. Threat actors used language tricks to bypass policies and interfere with the agent’s decision-making.

Thank you for the great interview, readers who wish to learn more should visit LogicGate.

#adoption#agent#Agentic AI#agents#agile#ai#AI adoption#ai agent#AI AGENTS#AI bias#ai governance#ai model#ai tools#AI/ML#algorithm#Algorithms#applications#approach#attackers#audit#automation#bank#banking#banks#benchmark#Bias#Business#challenge#chief information security officer#cio

0 notes

Text

A Beginner’s Guide to Risk Analysis for Entrepreneurs

Risk is part of the game when you’re building something from scratch. You already know that instinctively—but relying only on instinct isn’t enough when the future of your startup or business is on the line. You need a reliable way to recognize what could go wrong before it does. That’s where risk analysis comes into play. It’s not about being paranoid—it’s about being prepared. When you understand how to evaluate threats to your operations, your finances, your team, or your product, you’ll make sharper decisions, avoid costly mistakes, and steer your company with more confidence. This guide breaks down what risk analysis actually looks like in a real-world business setting and how to make it part of your strategy—even if you’re just getting started.

What Risk Analysis Actually Means in Business

In a startup or small business, risk analysis means taking a closer look at the things that could disrupt your goals—then putting systems in place to handle them. You’re assessing both the likelihood that something might happen and the potential impact it could have. Whether it’s a supply chain issue, a shift in market demand, or a legal complication, your ability to anticipate problems is directly tied to your long-term success.

Think of it as a decision filter. Before launching a product, signing a lease, or hiring a new vendor, you ask: “What could go wrong here, and what would it cost me if it does?” Risk analysis gives you a structure for answering that question in a meaningful way. You move from gut feeling to calculated judgment.

The Types of Risk You Need to Track

To do this well, you first need to understand the main categories of business risk. Financial risks are the most obvious—anything that affects your cash flow, funding, pricing, or revenue model. But operational risks—like equipment failures, tech outages, or employee turnover—can hit you just as hard.

Market risks come from shifts in customer preferences, industry trends, or competitive pressure. You also have compliance risks, which include anything tied to regulation, contracts, or industry standards. And don’t overlook strategic risks—the ones tied to high-level decisions like entering a new market or pivoting your business model. Each one carries its own weight, and you can’t afford to ignore any of them.

How to Identify Risks Before They Happen

You start with brainstorming. It’s not glamorous, but it works. Grab a whiteboard—or a Google Doc—and list everything that could impact your business negatively. Loop in your co-founder, your advisor, or your team. Ask questions like: What if we lose our biggest client? What if our software gets hacked? What if our supplier raises prices?

Once you have that list, categorize it by type—financial, operational, market, and so on. Then assign a rough likelihood to each risk (low, medium, high) and estimate the impact if it occurs (minor inconvenience to existential threat). This simple matrix helps you sort what’s worth watching closely versus what’s less likely to blow up in your face.

The Tools That Can Help You Do This Faster

Risk analysis doesn’t have to be manual. There are free and paid tools out there that can speed up your process. Start with a basic SWOT analysis if you're brand new to the process—listing strengths, weaknesses, opportunities, and threats gives you a big-picture view.

From there, you can build a risk matrix in Excel or Google Sheets. For a more advanced setup, software like RiskWatch, Resolver, or LogicGate offers full dashboards and scoring systems—useful if you’re managing a fast-scaling team or have investors who expect detailed reporting. These tools let you automate tracking, assign owners to risk items, and generate updates on a schedule, which is key for keeping risk top of mind, not buried in last quarter’s planning doc.

Turning Risk Awareness into Real Strategy

Spotting risk is only half the job. You have to build response strategies that actually protect your business. For each major risk you identify, create a plan: how to avoid it, how to reduce its impact, and how to recover if it happens. This could mean buying insurance, drafting stronger contracts, or lining up alternate suppliers.

You also need to assign clear responsibilities. Who handles what if a supplier goes under or a system goes offline? Who talks to customers? Who manages the financial response? When everyone knows their role before a crisis hits, your recovery time shrinks—and that can be the difference between staying open or shutting down.

Why You Should Review Risks Regularly

Too many founders make the mistake of treating risk analysis as a one-time checklist. But your risk profile changes constantly. New markets, new hires, new customers—each of these introduces new variables. If you're not reviewing your risks quarterly (or at least biannually), you're working with outdated assumptions.

Set a reminder to revisit your matrix. Look for risks that have become more likely—or ones that are no longer relevant. Update your action plans. If your product is changing, or you're scaling, make sure your mitigation strategies still hold up. Staying current is what gives your planning teeth.

What Are the Steps in Risk Analysis?

Identify potential risks

Assess likelihood and impact

Prioritize high-risk areas

Create mitigation plans

Review and update regularly

What Most Entrepreneurs Get Wrong About Risk

Too often, you focus only on the risks that feel urgent—like cash shortages or tech glitches. But ignoring the “quiet” risks like market shifts or regulatory exposure can be just as dangerous. Those are the slow burns that creep up on you when you’re not paying attention.

Another common mistake? Thinking that having a risk means you’ve failed. Risks are normal. They're not a sign of weakness—they’re a sign that you’re in business. The problem only comes when you refuse to acknowledge them or take action. The companies that survive aren't the ones that avoid all risk—they're the ones that manage it well.

Building a Culture That Values Risk Awareness

Risk analysis isn’t just a planning tool—it’s a mindset. If you want to make it work long-term, it has to become part of how your team thinks and works. Encourage open conversation about problems and concerns. Reward proactive thinking. Build workflows where risk checks are built into decisions—not tacked on at the end.

You also want your team to feel safe flagging problems early. The sooner risks are spotted, the easier they are to handle. If your company is still small, this means setting the tone from day one. If you're scaling, it means training your managers to think in terms of risk as well as opportunity.

Risk Analysis Is the Guardrail, Not the Roadblock

You don’t need to eliminate every risk. That’s not the point. The point is to understand which risks you’re taking and to take them on purpose—not by accident. When you build risk analysis into your decision-making, you don’t move slower—you move smarter. You take bold steps with your eyes open. And in this economy, that’s not just a smart move—it’s a necessary one.

Want to Dive Deeper into Smarter Business Decisions? Check out Walter Morales on SoundCloud for insights on entrepreneurship, risk management, and sustainable growth. Whether you're a first-time founder or scaling your business, these audio episodes offer real talk and practical strategies to help you lead with clarity and confidence.

0 notes

Link

[ad_1] Nicholas Kathmann is the Chief Information Security Officer (CISO) at LogicGate, where he leads the company’s information security program, oversees platform security innovations, and engages with customers on managing cybersecurity risk. With over two decades of experience in IT and 18+ years in cybersecurity, Kathmann has built and led security operations across small businesses and Fortune 100 enterprises.LogicGate is a risk and compliance platform that helps organizations automate and scale their governance, risk, and compliance (GRC) programs. Through its flagship product, Risk Cloud®, LogicGate enables teams to identify, assess, and manage risk across the enterprise with customizable workflows, real-time insights, and integrations. The platform supports a wide range of use cases, including third-party risk, cybersecurity compliance, and internal audit management, helping companies build more agile and resilient risk strategiesYou serve as both CISO and CIO at LogicGate — how do you see AI transforming the responsibilities of these roles in the next 2–3 years?AI is already transforming both of these roles, but in the next 2-3 years, I think we’ll see a major rise in Agentic AI that has the power to reimagine how we deal with business processes on a day-to-day basis. Anything that would usually go to an IT help desk — like resetting passwords, installing applications, and more — can be handled by an AI agent. Another critical use case will be leveraging AI agents to handle tedious audit assessments, allowing CISOs and CIOs to prioritize more strategic requests.With federal cyber layoffs and deregulation trends, how should enterprises approach AI deployment while maintaining a strong security posture?While we’re seeing a deregulation trend in the U.S., regulations are actually strengthening in the EU. So, if you’re a multinational enterprise, anticipate having to comply with global regulatory requirements around responsible use of AI. For companies only operating in the U.S., I see there being a learning period in terms of AI adoption. I think it’s important for those enterprises to form strong AI governance policies and maintain some human oversight in the deployment process, making sure nothing is going rogue.What are the biggest blind spots you see today when it comes to integrating AI into existing cybersecurity frameworks?While there are a couple of areas I can think of, the most impactful blind spot would be where your data is located and where it’s traversing. The introduction of AI is only going to make oversight in that area more of a challenge. Vendors are enabling AI features in their products, but that data doesn’t always go directly to the AI model/vendor. That renders traditional security tools like DLP and web monitoring effectively blind.You’ve said most AI governance strategies are “paper tigers.” What are the core ingredients of a governance framework that actually works?When I say “paper tigers,” I’m referring specifically to governance strategies where only a small team knows the processes and standards, and they are not enforced or even understood throughout the organization. AI is very pervasive, meaning it impacts every group and every team. “One size fits all” strategies aren’t going to work. A finance team implementing AI features into its ERP is different from a product team implementing an AI feature in a specific product, and the list continues. The core ingredients of a strong governance framework vary, but IAPP, OWASP, NIST, and other advisory bodies have pretty good frameworks for determining what to evaluate. The hardest part is figuring out when the requirements apply to each use case.How can companies avoid AI model drift and ensure responsible use over time without over-engineering their policies?Drift and degradation is just part of using technology, but AI can significantly accelerate the process. But if the drift becomes too great, corrective measures will be needed. A comprehensive testing strategy that looks for and measures accuracy, bias, and other red flags is necessary over time. If companies want to avoid bias and drift, they need to start by ensuring they have the tools in place to identify and measure it.What role should changelogs, limited policy updates, and real-time feedback loops play in maintaining agile AI governance?While they play a role right now to reduce risk and liability to the provider, real-time feedback loops hamper the ability of customers and users to perform AI governance, especially if changes in communication mechanisms happen too frequently.What concerns do you have around AI bias and discrimination in underwriting or credit scoring, particularly with “Buy Now, Pay Later” (BNPL) services?Last year, I spoke to an AI/ML researcher at a large, multinational bank who had been experimenting with AI/LLMs across their risk models. The models, even when trained on large and accurate data sets, would make really surprising, unsupported decisions to either approve or deny underwriting. For example, if the words “great credit” were mentioned in a chat transcript or communications with customers, the models would, by default, deny the loan — regardless of whether the customer said it or the bank employee said it. If AI is going to be relied upon, banks need better oversight and accountability, and those “surprises” need to be minimized.What’s your take on how we should audit or assess algorithms that make high-stakes decisions — and who should be held accountable?This goes back to the comprehensive testing model, where it’s necessary to continuously test and benchmark the algorithm/models in as close to real time as possible. This can be difficult, as the model output may have desirable results that will need humans to identify outliers. As a banking example, a model that denies all loans flat out will have a great risk rating, since zero loans it underwrites will ever default. In that case, the organization that implements the model/algorithm should be responsible for the outcome of the model, just like they would be if humans were making the decision.With more enterprises requiring cyber insurance, how are AI tools reshaping both the risk landscape and insurance underwriting itself?AI tools are great at disseminating large amounts of data and finding patterns or trends. On the customer side, these tools will be instrumental in understanding the organization’s actual risk and managing that risk. On the underwriter’s side, those tools will be helpful in finding inconsistencies and organizations that are becoming immature over time.How can companies leverage AI to proactively reduce cyber risk and negotiate better terms in today’s insurance market?Today, the best way to leverage AI for reducing risk and negotiating better insurance terms is to filter out noise and distractions, helping you focus on the most important risks. If you reduce those risks in a comprehensive way, your cyber insurance rates should go down. It’s too easy to get overwhelmed with the sheer volume of risks. Don’t get bogged down trying to address every single issue when focusing on the most critical ones can have a much larger impact.What are a few tactical steps you recommend for companies that want to implement AI responsibly — but don’t know where to start?First, you need to understand what your use cases are and document the desired outcomes. Everyone wants to implement AI, but it’s important to think of your goals first and work backwards from there — something I think a lot of organizations struggle with today. Once you have a good understanding of your use cases, you can research the different AI frameworks and understand which of the applicable controls matter to your use cases and implementation. Strong AI governance is also business critical, for risk mitigation and efficiency since automation is only as useful as its data input. Organizations leveraging AI must do so responsibly, as partners and prospects are asking tough questions around AI sprawl and usage. Not knowing the answer can mean missing out on business deals, directly impacting the bottom line.If you had to predict the biggest AI-related security risk five years from now, what would it be — and how can we prepare today?My prediction is that as Agentic AI is built into more business processes and applications, attackers will engage in fraud and misuse to manipulate those agents into delivering malicious outcomes. We have already seen this with the manipulation of customer service agents, resulting in unauthorized deals and refunds. Threat actors used language tricks to bypass policies and interfere with the agent’s decision-making.Thank you for the great interview, readers who wish to learn more should visit LogicGate. [ad_2] Source link

0 notes

Text

Top 10 Tools for Effective Strategic Financial Management

1. Financial Modeling Software (Excel / Google Sheets / Quantrix)

Purpose: Scenario planning, forecasting, and valuation modeling.

Why: Had to estimate financial outcomes and analyze strategic decisions.

2. Enterprise Resource Planning (ERP) Systems (e.g., SAP, Oracle NetSuite, Microsoft Dynamics)

Purpose: Consolidating core finance processes across departments.

Why: Provides real-time visibility into the financial performance and report accuracy.

3. Budgeting & Forecasting Software (e.g., Adaptive Insights, Planful, Anaplan)

Used for: Corporate planning, rolling forecasts, and variance analysis.

Why: Simplifies planning cycles and aligns budgeting with corporate strategy.

4. Business Intelligence (BI) Tools (Power BI, Tableau, Qlik)

Used for: Trend analysis, data visualization, and performance dashboards.

Why: Enables the translation of raw financial data into actionables of strategy.

5. Strategic Planning Software (ClearPoint Strategy, Cascade, OnStrategy)

Used for: Goal alignment, KPI tracking, and execution of strategy.

Why: Aligns financial goals with company-wide business strategy.

6. Risk Management Tools (e.g., LogicGate, Resolver, SAP GRC)

Used for: Financial and operational risk identification and management.

Why: Required for regulatory reporting and stress-testing plans.

7. Cash Flow Management Tools (e.g., Float, CashAnalytics, Tesorio)

Used for: Liquidity monitoring, working capital management, and cash forecasting.

Why: Strategic borrowing and investment planning requires expert management of cash flows.

8. Financial KPI Dashboards (e.g., Klipfolio, Databox)

Used for: Monitoring financial metrics like ROI, ROE, EBITDA, etc.

Why: Real-time knowledge of performance versus strategic goals.

9. Scenario Planning & Sensitivity Analysis Tools (e.g., Synario, Vena Solutions)

Used for: Stress-testing strategies in different economic or business scenarios.

Why: Enabling anticipatory adaptation and more robust strategy.

10. Valuation Tools (e.g., PitchBook, Morningstar Direct, Finbox)

Used for: Company valuations, M&A analysis, and investment choices.

Why: Enables strategic consideration of mergers, acquisitions, or divestitures.

Conclusion

Strategic financial management is a powerful discipline or tool that can significantly help business students both in achieving their academic and career goals and in shaping or analyzing real-world business strategies.

For more insights on effective strategic financial management visit at - https://www.eimt.edu.eu/swiss/doctorate-in-business-administration

0 notes

Text

Digital Risk Management Market Growth Potential, Trends, and Forecast 2032

Digital Risk Management Market was valued at USD 9.82 billion in 2023 and is expected to reach USD 34.68 billion by 2032, growing at a CAGR of 15.12% from 2024-2032.

Digital Risk Management (DRM) is becoming a critical priority for businesses as cyber threats, data breaches, and regulatory compliance challenges continue to rise. Organizations across industries are adopting advanced DRM solutions to safeguard their digital assets and ensure operational continuity.

Digital Risk Management Market is evolving rapidly due to increased cloud adoption, remote work models, and sophisticated cyber threats. With the expansion of digital ecosystems, businesses require proactive risk management strategies to mitigate financial losses, reputational damage, and regulatory penalties. The integration of AI, automation, and predictive analytics is transforming the DRM landscape, enabling enterprises to identify and neutralize risks before they escalate.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3787

Market Keyplayers:

IBM Corporation (IBM OpenPages, IBM Security QRadar)

Oracle Corporation (Oracle Risk Management Cloud, Oracle Governance, Risk, and Compliance)

SAP (SAP Business Integrity Screening, SAP Risk Management)

SAS Institute Inc. (SAS Risk Management for Banking, SAS Fraud Management)

Broadcom (Symantec Endpoint Protection, Symantec Data Loss Prevention)

NAVEX Global Inc (NAVEX EthicsPoint, NAVEX Risk & Compliance Management)

LogicManager Inc. (LogicManager Risk Management, LogicManager Incident Management)

Metric Stream (MetricStream GRC Platform, MetricStream Third-Party Risk Management)

Rapid7 (InsightVM, InsightIDR)

Microsoft Corporation (Microsoft Compliance Manager, Microsoft Defender for Identity)

ServiceNow Inc. (ServiceNow GRC, ServiceNow Security Incident Response)

Rsam (Rsam GRC Platform, Rsam Third-Party Risk Management)

Proofpoint Inc. (Proofpoint Email Protection, Proofpoint Cloud App Security Broker)

RSA Security LLC (RSA Archer GRC, RSA SecurID)

Optiv Security Inc. (Optiv Cybersecurity, Optiv Managed Security Services)

Qualys Inc. (Qualys Vulnerability Management, Qualys Policy Compliance)

OneTrust (OneTrust GRC, OneTrust Privacy Management)

Riskonnect Inc. (Riskonnect Risk Management, Riskonnect Incident Management)

ZeroFox Holdings Inc. (ZeroFox Social Media Risk Protection, ZeroFox External Threat Intelligence)

SecurityScorecard (SecurityScorecard Enterprise, SecurityScorecard Risk Assessment)

Archer Technologies LLC (Archer GRC Platform, Archer IT Risk Management)

Galvanize (Galvanize HighBond, Galvanize Governance, Risk, and Compliance)

LogicGate Inc. (LogicGate GRC Platform, LogicGate Third-Party Risk Management)

Resolver Inc. (Resolver Risk Management, Resolver Incident Management)

BitSight (BitSight Security Ratings, BitSight for Third-Party Risk)

Hyperproof Inc. (Hyperproof Compliance Management, Hyperproof Risk Management)

Market Trends

AI and Automation in DRM – AI-powered threat detection and automated incident response are enhancing risk management efficiency.

Regulatory Compliance and Governance – Businesses are investing in compliance-driven DRM strategies to meet stringent data protection laws.

Rise in Cybersecurity Threats – The increase in ransomware, phishing, and insider threats is driving demand for advanced DRM solutions.

Cloud Security and Zero Trust Frameworks – With growing cloud adoption, organizations are implementing Zero Trust architectures to strengthen digital security.

Enquiry of This Report: https://www.snsinsider.com/enquiry/3787

Market Segmentation:

By Component

Software

Services

By Deployment

Cloud

On-premise

By Organization Size

Large Enterprise

Small and Medium Size Enterprise

By Industry Vertical

BFSI

IT

Telecom

Healthcare

Retail

Manufacturing

Market Analysis

Expanding Digital Transformation – The rise of IoT, AI, and cloud computing is increasing digital vulnerabilities.

Growing Cybersecurity Incidents – Data breaches and cyberattacks are forcing enterprises to adopt proactive risk management solutions.

Increased Regulatory Scrutiny – Governments worldwide are enforcing stricter compliance regulations, driving the adoption of DRM solutions.

Demand for Real-Time Threat Intelligence – Businesses are integrating predictive analytics and AI to detect and prevent cyber threats effectively.

Future Prospects

Advancements in AI and Machine Learning – Predictive analytics will play a crucial role in identifying emerging risks.

Blockchain for Secure Transactions – Blockchain-based security solutions will enhance data integrity and fraud prevention.

Integration of Cloud and Edge Security – Hybrid security models will protect both cloud-based and edge computing environments.

Adoption of Risk-Based Authentication – Businesses will implement AI-driven risk assessment models to enhance identity verification.

Access Complete Report: https://www.snsinsider.com/reports/digital-risk-management-market-3787

Conclusion

The Digital Risk Management market is set for significant expansion as organizations prioritize cybersecurity, compliance, and risk mitigation strategies. Companies that invest in AI-driven threat intelligence, automation, and regulatory compliance frameworks will gain a competitive edge in managing digital risks effectively. As the digital landscape continues to evolve, DRM solutions will become indispensable for securing business operations and ensuring data privacy.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Digital Risk Management market#Digital Risk Management market Analysis#Digital Risk Management market Scope#Digital Risk Management market Growth

0 notes

Text

001 MULTIPLEXERS, DEMULTIPLEXERS AND ENCODERS

download notes

#Counters#DigitalCircuits#DigitalElectronics#DownloadDigitalElectronicsNotes#ElectricalEngineering#ElectronicDevices#ElectronicsEngineering#EngineeringConcepts#FlipFlops#FreeEEENotes#LogicGates#Multiplexers#STEMCourses#StudyElectronics#UniversityEEE

0 notes

Text

🚀 74HC00D,653 Logic Gate – Quad 2-Input NAND Gate by Nexperia

Upgrade your digital circuits with the 74HC00D,653, a high-speed Quad 2-Input NAND Gate by Nexperia. This versatile IC is designed for superior performance with low power dissipation and high noise immunity, making it ideal for various applications in electronics and automation.

�� Specifications:

✅ Quad 2-Input NAND Gate (4 independent gates)

✅ Supply Voltage: 2V – 6V

✅ High-Speed CMOS Logic with TTL compatibility

✅ Low Power Dissipation and high switching speed

✅ 14-pin SOIC Package for compact designs

🔥 Key Features:

🔹 Fast Switching Performance for real-time applications

🔹 Wide Temperature Range for industrial use

🔹 ESD Protection (2000V HBM) for enhanced reliability

🔹 Ideal for Logic Circuit Designs

💡 Applications:

📌 Digital Logic Circuits – Building essential logic functions

📌 Timing & Oscillator Circuits – Precision pulse generation

📌 Multiplexers & Signal Processing – Efficient data management

📌 Industrial Automation & Computing – Reliable control systems

🔗 Buy Now at Xon Electronics – Available in USA | India | Australia | Europe 🌍

Click Here: https://www.xonelec.com/mpn1/nexperia/74hc00d653

Learn Now: https://www.xonelec.com/blog/74hc00d-653-logic-gates-by-nexperia-in-india-usa

#XonElectronics #74HC00D #NANDGate #LogicGates #Nexperia #EmbeddedSystems #DigitalCircuits #Electronics #Engineering #Tech

0 notes