#Mastercard Provider in Netherlands

Text

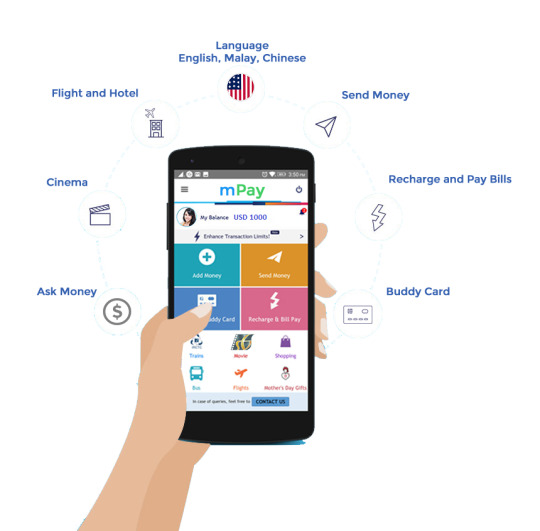

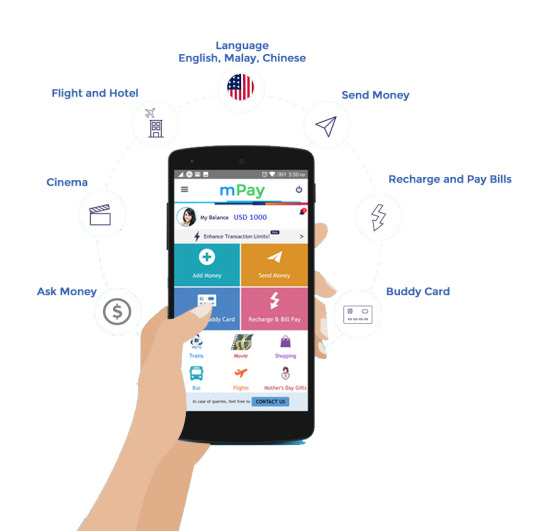

How can mobile banking apps help serve Fintech?

The Finance Industry and banking sector are among the top most heirs of digitalisation. The preface of Banking software provider in Lithuania has added further inflexibility and availability to banking.

The ultramodern mobile banking system has changed the hand of Fintech.

It has revolutionised the operation of the finance assiduity by reducing overhead costs and enhancing client experience. Then are some of the points that state how can mobile banking apps help serve Fintech

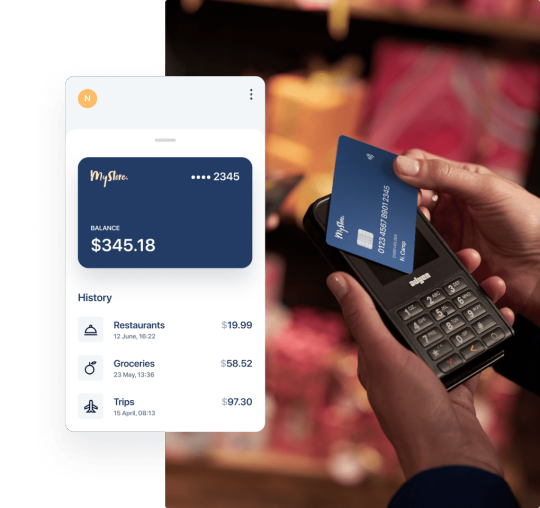

Mobile Banking Apps give flawless relations And amicable Deals

Mobile banking services have brought a significant shift in the way individualities can handle their finances. It has handed great ease and convenience by allowing easy access from anywhere. Mobile banking software loaded with stoner-friendly features facilitates amicable finance deals.

Whether it's allocating finance in finances, pullout of finances, or transfer of plutocrat, any type of finance sale fleetly. Also, the increase in operation of Money Transfer Software Provider in Netherlands deals has shown a growth of around 64.

Mobile Banking Apps Will Help Target Your followership And Ameliorate Services

Banking and Finance is a customer- driven assiduity. Experience and commerce play an essential part. fiscal institutions and banks constantly are contending with each other and using client service as a great differentiator.

The mobile banking system has opened doors of openings for these institutions. It has eased better connections with guests. The finance institutions can efficiently reach the target followership and communicate about finance products.

likewise, mobile banking services play an essential part in gathering client perceptivity for service enhancement.The data attained from mobile banking apps give precious information to offer customised services to the target followership.

structure Mobile Banking Apps Can Reduce Cost And Ameliorate perimeters

Fiscal institutions are utilising the power of the mobile banking system to convert branch guests to mobile banking guests.

Thereby reducing their cost and perfecting perimeters. The finance institution sees guests saving moment as a prospect for outspoken investment in the future.

Mobile Banking Apps Present New openings in the Lending Space

Mobile banking apps give believable information and client data to fiscal institutions. It's upgrading the functionality of fiscal institutions.The integration of Fintech has opened new avenues to detect new implicit guests. figure Mobile Banking Apps To Serve Underbanked Populations

A significant quantum of the underbanked population still doesn't comprehend the banking system.

The preface of mobile banking services and systems is bridging this gap. guests are more likely to use their mobile phones to carry out fiscal deals.

Mobile banking apps are stimulating the growth of fintech by enabling them to explore untapped areas.

THE BOTTOM LINE

Without a doubt, Mobile banking services are the future of finance. They are changing the overall functioning and operations of the finance sector.

Its impact on the customers and target audience is humungous. Hence, modern banks must unfold the fintech trends and incorporate mobile banking services strategically to boost their growth and development.

#Ebanking Solution Provider in London#Banking software provider in Malta#Emoney solution Provider in Malta#Virtual Card Provider in Malta#Card program provide in Birmingham#Co Branding card provider in Netherlands#White Label IBAN account in Italy#Mastercard Provider in Netherlands#Money Transfer Sofware Provider in Malta#ewallet Application Development Company in Estonia

0 notes

Text

Best Hostinger VPS Hosting Review

https://themesfores.com/best-vps-hosting-review-hostinger-vps-hosting/

In this article, we will dive into the world of VPS hosting and explore one of the leading providers in the industry: Hostinger. If you are looking for reliable, affordable, and feature-packed VPS hosting solutions, Hostinger might be the perfect choice for you. In this review, we will discuss the various aspects of Hostinger's VPS hosting, including its features, pricing, pros and cons, customer reviews, and more. So let's get started! Hostinger India Review 2023 Speed: 4.6 4.6/5 Ease of use:4.6 4.6/5 Pricing: 4.1 4.1/5 Uptime: 4.5 4.5/5 Customer Support: 4.5 4.5/5 Tootal: 4.5 4.5/5 Visit Hostinger Best VPS Hosting Review: Hostinger VPS Hosting Virtual Private Server (VPS) hosting is a popular hosting solution that bridges the gap between shared hosting and dedicated servers. With VPS hosting, you get a virtualized environment that mimics a dedicated server, allowing you to have more control, resources, and flexibility for your website or application. Overview of Hostinger VPS Hosting Hostinger is a well-established web hosting company known for its affordable yet reliable hosting services. When it comes to VPS hosting, Hostinger offers a range of plans tailored to suit different needs and budgets. With their VPS hosting, you can expect high performance, excellent uptime, and a user-friendly experience. Hostinger Overview Speed VPS Hosting (Singapore) – 895 ms VPS Hosting (US) – 591.09 ms VPS Hosting (India) – 675.95 ms Uptime (02 Jan 2022 – 15-Jun 2023) VPS Hosting (Singapore): 99.95% VPS Hosting (US): 99.93% VPS Hosting (India): 99.85% Features hPanel, Free SSL, 1-click WordPress Installer, free domain for 1 year, Website Staging, Zyro Website Builder, Email Hosting Data Centers UK, USA, Singapore, India, Netherlands, Indonesia, and Lithuania. Servers Litespeed Servers Backup and Restoration Free weekly backups on all plans Daily backups on higher plans Selective restore feature available Website Migration Unlimited free migrations on all plans Security Free Let’s Encrypt SSL, 2FA, PatchStack Security, Cloudflare DNS Firewall, Bitninja Security, Malware Scanner Support Email Form, Live Chat, Knowledgebase, Video Tutorials Payment Options Visa, MasterCard, American Express, Discover, PayPal, Cryptocurrency, PayTM, Google Pay, UPI Payments in India Hosting Plans Share Hosting, WordPress Hosting, Cloud Hosting, cPanel Hosting, VPS Hosting, Minecraft Hosting, CyberPanel VPS Hosting Refund Policy 30-days money-back guarantee Pricing Starting from ₹419/mo ($4.99/mo) Visit Hostinger Features and Benefits of Hostinger VPS Hosting When it comes to VPS hosting, Hostinger has an impressive array of features that cater to the needs of both individuals and businesses. Let's take a closer look at the key features that make Hostinger stand out: High Performance and Reliability Hostinger's VPS hosting runs on high-performance hardware, including the latest Intel Xeon processors and SSD storage. This ensures fast loading times, smooth website performance, and a reliable hosting environment for your business. Scalability and Flexibility With Hostinger VPS hosting, you have the flexibility to scale your resources as your website grows. Whether you need more CPU power, RAM, or storage, you can easily upgrade your VPS plan with just a few clicks. Enhanced Security Measures Hostinger takes security seriously and provides robust security measures to protect your website from online threats. Their VPS hosting includes DDoS protection, secure FTP access, and regular backups, keeping your data safe and secure. Easy-to-use Control Panel Managing your VPS server is made easy with Hostinger's intuitive control panel. You can easily deploy applications, manage domains, monitor server performance, and perform various administrative tasks without any technical expertise. Full Root Access With Hostinger's VPS hosting, you get full root access to your server. This level of control allows you to customize your server environment according to your specific requirements. You have the freedom to install any software, configure settings, and optimize performance to suit your needs. Dedicated IP Address Each Hostinger VPS hosting plan comes with a dedicated IP address, which is particularly beneficial if you want to run applications that require a unique IP, such as an online store or a membership site. Multiple Operating Systems Hostinger supports a wide range of operating systems, including Linux distributions and Windows. Whether you're familiar with Linux or prefer a Windows environment, Hostinger has got you covered. Excellent Uptime Downtime can be detrimental to your website's success. Hostinger's VPS hosting boasts an impressive uptime guarantee, ensuring that your site remains accessible to visitors around the clock. With a reliable hosting infrastructure, you can minimize disruptions and maximize your website's availability. 24/7 Customer Support Hostinger offers round-the-clock customer support via live chat, ticketing system, and knowledge base. Their support team is knowledgeable and responsive, ready to assist you with any hosting-related queries or issues you may encounter. Different VPS Hosting Plans Offered by Hostinger Hostinger provides a range of VPS hosting plans to cater to different needs and budgets. Let's explore the options: KVM 1 ₹839 ₹ 419 Monthly 1 Cores & 4 GB RAM 50 GB SSD Storage 1 TB Bandwidth Weekly Backups Dedicated IP Address Full Root Access Apply Coupon SAVE 65% Extra Discount KVM 2 ₹1159 ₹ 579 Monthly 2 Cores & 8 GB RAM 100 GB SSD Storage 2 TB Bandwidth Weekly Backups Dedicated IP Address Full Root Access Apply Coupon SAVE 65% Extra Discount KVM 4 ₹2499 ₹ 919 Monthly 4 Cores & 16 GB RAM 200 GB SSD Storage 4 TB Bandwidth Weekly Backups Dedicated IP Address Full Root Access Apply Coupon SAVE 65% Extra Discount Hostinger Best VPS Hosting Review: Performance Lightning-Fast Speeds: One of the most crucial aspects of web hosting is speed. A slow-loading website can lead to a poor user experience and deter visitors from returning. Hostinger understands the importance of speed and has optimized their VPS hosting environment to deliver lightning-fast performance. With their cutting-edge hardware, SSD storage, and advanced caching techniques, Hostinger ensures that your website loads quickly, keeping visitors engaged and satisfied. Global Data Centers: Hostinger has a vast network of data centers strategically located around the globe. This global presence allows them to provide low-latency hosting solutions, ensuring that your website's content is delivered swiftly to visitors, regardless of their geographic location. By choosing a data center closest to your target audience, you can significantly reduce latency and improve the overall user experience. CDN Integration: To further enhance performance, Hostinger integrates with Content Delivery Networks (CDNs). CDNs store cached versions of your website's content on servers distributed worldwide. When a user accesses your site, the CDN delivers the content from the server closest to them, reducing load times and optimizing performance. Hostinger's seamless CDN integration makes it easy to boost your website's speed and deliver content efficiently. Robust Infrastructure: Hostinger invests in state-of-the-art infrastructure to ensure optimal performance for their VPS hosting. Their servers are built with the latest technologies and undergo regular maintenance and upgrades to guarantee reliability and efficiency. With Hostinger's robust infrastructure, you can expect minimal downtime and a consistently high-performing website. Pricing and Value for Money: Hostinger's VPS hosting plans are competitively priced, making them affordable for individuals and small businesses alike. Considering the features, performance, and reliability offered, Hostinger provides excellent value for money in the VPS hosting space. Pros and Cons of Hostinger VPS Hosting Pros: Affordable Pricing: Hostinger's VPS hosting plans are priced competitively, making them accessible to a wide range of users. Fast and Reliable Servers: Hostinger utilizes high-performance hardware and SSD storage, ensuring fast loading times and reliable server performance. User-friendly Control Panel: The intuitive control panel makes it easy for users to manage their VPS servers and perform administrative tasks without any technical expertise. Cons: cPanel and WHM: Hostinger has a limited number of CentOS 7 64bit with cPanel and WHM (Requires a License Purchase Additionally). Lack of Windows-based VPS Hosting: Hostinger currently doesn't offer VPS hosting with Windows operating system, limiting the options for users who specifically require Windows-based hosting. Customer Reviews and Testimonials Hostinger has received positive reviews from many satisfied customers. Users appreciate the affordability, performance, and responsive customer support provided by Hostinger. Here are some testimonials from Hostinger VPS hosting users: “I've been using Hostinger's VPS hosting for my business website, and I'm impressed with the speed and reliability. The customer support team is also very helpful.” John Doe “Hostinger offers great value for money. Their VPS hosting plans are feature-packed and affordable, perfect for small businesses like mine.” Sarah T Hostinger impressed me with amazing customer experience and effortless migration from my previous hosting provider. Jake SinclairBrand Designer Previous Next Tootal Reviews: 4.5 4.5/5 Comparison with Competitors When comparing Hostinger's VPS hosting with its competitors, it stands out for its affordability, performance, and user-friendly interface. While some competitors may offer more server locations or Windows-based VPS hosting, Hostinger's overall package makes it a strong contender in the market. Frequently Asked Questions (FAQs) 1. Is Hostinger's VPS hosting suitable for beginners? Yes, Hostinger’s VPS hosting is designed to be user-friendly and accessible even for beginners. Their control panel and intuitive interface make it easy to manage your VPS server without extensive technical knowledge. 2. Can I upgrade my VPS hosting plan in the future? Absolutely! Hostinger allows you to upgrade your VPS hosting plan as your website grows and requires more resources. You can easily scale up your CPU power, RAM, storage, and bandwidth with just a few clicks. 3. Does Hostinger offer a money-back guarantee? Yes, Hostinger offers a 30-day money-back guarantee on its VPS hosting plans. If you’re not satisfied with the service, you can request a refund within 30 days of signing up. 4. Can I host multiple websites on a Hostinger VPS server? Yes, you can host multiple websites on a Hostinger VPS server. Depending on the plan you choose, you can allocate resources to different websites and manage them separately within your control panel. 5. Does Hostinger provide customer support for VPS hosting users? Yes, Hostinger offers 24/7 customer support for its VPS hosting users. You can reach out to their support team via live chat or the ticketing system for any hosting-related queries or issues you may have. https://themesfores.com/best-vps-hosting-review-hostinger-vps-hosting/ #Hostinger #VPSHosting

1 note

·

View note

Text

Tokenization Market Share, Regional Scope - 2024, Business Outlook, Growth Opportunity Assessment

Global Tokenization Market was valued at USD 1.61 billion in 2021 and is expected to reach USD 5.25 billion by the year 2028, at a CAGR of 18.4%.

Tokenization is the process of transforming sensitive data into non-sensitive tokens that can be utilized in a database or internal system without being made public. Tokenization protects sensitive data by replacing it with an irrelevant value of the same length and format as the original. The tokens are subsequently delivered to an organization's internal systems to be used, while the original data is kept in a token vault. Tokenized data, unlike encrypted data, is impregnable and irrevocable. Tokens cannot be returned to their original form since the token and its original number are unrelated mathematically.

Market Dynamics and Factors:

Tokenization shields businesses from the financial ramifications of data theft. Even if there is a breach, no user personal data may be accessed. By eliminating credit card details from POS devices and internal systems, credit card tokenization helps online companies improve data security from the point of data capture to storage. Data tokenization secures credit card and bank account information in a virtual vault, allowing organizations to communicate sensitive information over wireless networks safely. Tokenization is only effective if a payment gateway is used to securely store sensitive data.

Download a Free Sample Copy of the Market Report:

https://introspectivemarketresearch.com/request/16212

Major Key Players for Tokenization Market:

American Express Company,AsiaPay Limited,Bluefin Payment Systems LLC,Card link,Fiserv Inc.,Futurex LP,HelpSystems LLC,HST Campinas SP,IntegraPay,Marqeta Inc.,Mastercard Inc.,MeaWallet AS,Micro Focus International plc,Paragon Payment Solutions,Sequent Software Inc.,Shift4 Payments LLC,Sygnum Bank AG,Thales TCT,TokenEx LLC,VeriFone Inc.,Visa Inc. and other major players.

Tokenization Market Segmentation:

By Type

Solution

Services

By Deployment

On-Premise

Cloud

By End User

Retail & E-commerce

Transportation & Logistics

BFSI

IT & Telecommunications

Others

Geographic Segment Covered in the Report

North America (U.S., Canada, Mexico)

(Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

(Germany, U.K., France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

(China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

(Turkey, Saudi Arabia, Bahrain, Kuwait, Qatar, UAE, Israel, South Africa)

(Brazil, Argentina, Rest of SA)

Inquiry Before Purchase:

https://introspectivemarketresearch.com/inquiry/16212

Scope of the Report:

The report encompasses the entire analysis of market size in previous years for major segments and countries, as well as future estimates. The Tokenization Market study looks deeply into the worldwide market's competitive landscape. The study also provides the names of key market players and the methods they used to gain a dominant position in the industry. It also includes useful market insights, dynamics and factors, and market analysis techniques such as PESTEL analysis, PORTER's Five Forces analysis, value chain analysis, SWOT analysis, BCG matrix, and Ansoff matrix.

Key Benefits for Industry Participants & Stakeholders:

Industry drivers, restraints, and opportunities covered in the study

Neutral perspective on the market performance

Recent industry trends and developments

Competitive landscape & strategies of key players

Potential & niche segments and regions exhibiting promising growth covered

Historical, current, and projected market size, in terms of value

In-depth analysis of the Tokenization Market

Purchase the Report:

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16212

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Linkedin| Twitter| Facebook

Email: [email protected]

#Tokenization Market#Tokenization Market Size#Tokenization Market Share#Tokenization Market Growth#Tokenization Market Trend#Tokenization Market segment#Tokenization Market Opportunity#US Tokenization Market#Tokenization Market Forecast#Tokenization Industry#Tokenization Industry Size

0 notes

Text

3 Best Debit Cards With Rewards

The use of a reward debit card rather than a reward credit card will reduce your risk of building up debts.

With a reward debit card, you can save more on cash while avoiding the accruement of debts.

Bank of America Visa Debit Card

The Bank of America Advantages Plus account is a checking account offered by the world's largest bank.

Listed below are a few of the primary features offered by Advantages Plus accounts

- Minimum opening requirements of $100

- Minimum balance of $0

- Monthly maintenance fee of $12 with an option for a fee waiver

- Fee-free ATM feature

- Offers a variable cashback percentage

- Offers cashback services when you make a purchase via BankAmeriDeal

BankAmeriDeal is a mobile app that enables you to earn cashback rewards when you make a purchase with your debit card. This app must be connected to a BankAmerica account.

Deals are updated on the BankAmeriDeal. The cashback will be deposited into your Bank America account thirty days after you complete a BankAmeriDeal transaction.

Discover Cashback Debit

Discover Cashback Debit enables you to access Cashback rewards of up to $3,000.

The following are some features of this only bank card

- Minimum opening requirements of $0

- minimum balance of $0

- Maintenance fee of $0

- Free to use ATM

- All debit card transaction earns you a 1% cashback reward

- Absence of fees and charges for regular check orders, overdraft, halter payments, online payments, and more.

PayPal Business Debit Mastercard

PayPal Business Debit Mastercard is available in Belgium, France, Netherlands, Portugal, Austria, France, Spain, Germany, Ireland, Italy, the United Kingdom, and the United States.

In the last two years, PayPal & Mastercard have concentrated on increasing the number of debit cards available to small companies in Europe.

Small companies can now access their PayPal balances quickly and potentially earn infinite cash back on their qualified purchases thanks to the PayPal Business Credit Mastercard.

With Mastercard being one of the most frequently used credit cards in the world, PayPal's business clients can now use the funds in their PayPal accounts in more than 52 million places where Mastercard is accepted.

Free debit cards with money on them

Prepaid cards that provide cash as a Sign-up bonus include Brinks Prepaid Mastercard, PayPal Prepaid Mastercard, NetSpend Visa Prepaid Card, The Mango Premium, Kids' Debit Card, and Walmart MoneyCard.

Frequently Asked Questions

Which debit card gives highest reward points?

HDFC Bank Debit card is known for giving the highest reward points.

In addition to this, they offer an impressive array of benefits. One of them includes a 5 Reward Points for every Rs. 100 that you spend using your HDFC Bank Reward Debit Card.

Big Bazaar, Apollo, Snapdeal, BPCL, IRCTC, SmartBuy, and PayZapp are some of the retail partners that have partnered with PayZapp. In addition, the customer would get Rs 1,935 for every Rs 13,750 spent at a partner retailer.

Can debit cards have rewards?

Since the majority of debit cards do not come with incentives for spending, a card that offers uncapped benefits is a standout feature. However, this feature does not come without a price, as you will be required to pay either an annual or a monthly charge for it.

Which is the best debit card Visa or MasterCard?

MasterCard and Visa have both competed in many ways but both are equally safe and provide comparable advantages.

Although VISA has a somewhat larger market share and processes more transactions globally, MasterCard is also widely accepted by retailers.

Why does Costco only take Visa?

By making an agreement with Visa, Costco came up with a method to save money. In return for the warehouse club's commitment to solely take Visa payments, the creditor reduced Costco's merchant charge to a paltry 0.4%.

How good is Capital One bank?

Capital One Bank offers the greatest blend of online banking services. It offers no checking or savings charge fee, and it comes with a competitive savings rate. Other features it offers include a high CD rate, excellent customer service, absence of overdraft fees, and more.

Read the full article

0 notes

Text

Global Faster Payment Service (FPS) Market Size to Reach USD 3,067 Million by 2030, At Growth Rate (CAGR) of 21.20%

The global market for Faster Payment Service (FPS), estimated at USD 543.5 million in 2022, is projected to reach USD 3,067 million by 2030, with a CAGR of 21.20% during the forecast period from 2022 to 2030.

FPS allows individuals and businesses to transfer money between bank accounts almost instantly. This enables faster settlement of payments, making it suitable for various purposes such as bill payments, salary transfers, online purchases, and peer-to-peer transactions. FPS is often integrated into online and mobile banking platforms offered by banks and financial institutions. Users can conveniently initiate and manage payments through these channels, providing greater flexibility and convenience.

Major Market Players

Key players in the global Faster Payment Service (FPS) market include ACI Worldwide, FIS, Fiserv Inc., wirecard, Mastercard, Temenos Headquarters SA, Global Payments Inc., Capgemini, Icon Solutions Ltd, M & A Ventures LLC, PAYRIX, Nexi Payments SpA, Obopay, and Ripple, among others. Recent developments include Fiserv launching the EnteractSM, a cloud-based customer relationship management platform, and ACI Worldwide partnering with BI-FAST to extend their real-time payment services in Indonesia.

Get more Information About the Faster Payment Service (FPS) Market here & Take a Sample Copy:

https://introspectivemarketresearch.com/request/16608

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

Faster Payment Service Market Segmentation:

By Mode of Payment

Single Immediate Payments

Forward-Dated Payments

Direct Corporate Access Payments

Domestic P2P Payments

P2M Payments

B2B Payments

Others

By Component

Solutions

Payment gateway

Payment processing

Payment Security

Services

Others

By Deployment

Cloud

On-Premises

By End Use Industry

Retail and E-Commerce

Banking, Financial Services, & Insurance (BFSI)

IT & Telecom

Travel & Tourism

Others

Inquire or Share Your Questions If Any Before the Purchasing This Report @

https://introspectivemarketresearch.com/inquiry/16608

Regional Insights:

Regional Outlook (Revenue in USD Million; Volume in Units, 2023-2030)

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Acquire This Report:

https://introspectivemarketresearch.com/request/16608

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Email:[email protected]

#Faster Payment Service (FPS)#Faster Payment Service (FPS) Market#Faster Payment Service (FPS) Market Size#Faster Payment Service (FPS) Market Share#Faster Payment Service (FPS) Market Growth#Faster Payment Service (FPS) Market Trend#Faster Payment Service (FPS) Market segment#Faster Payment Service (FPS) Market Opportunity#Faster Payment Service (FPS) Market Analysis 2022#US Faster Payment Service (FPS) Market#Faster Payment Service (FPS) Market Forecast#Faster Payment Service (FPS) Industry#Faster Payment Service (FPS) Industry Size#china Faster Payment Service (FPS) Market#UK Faster Payment Service (FPS) Market

0 notes

Text

Global Faster Payment Service (FPS) Market Size to Reach USD 3,067 Million by 2030, At Growth Rate (CAGR) of 21.20%

The global market for Faster Payment Service (FPS), estimated at USD 543.5 million in 2022, is projected to reach USD 3,067 million by 2030, with a CAGR of 21.20% during the forecast period from 2022 to 2030.

FPS allows individuals and businesses to transfer money between bank accounts almost instantly. This enables faster settlement of payments, making it suitable for various purposes such as bill payments, salary transfers, online purchases, and peer-to-peer transactions. FPS is often integrated into online and mobile banking platforms offered by banks and financial institutions. Users can conveniently initiate and manage payments through these channels, providing greater flexibility and convenience.

Major Market Players

Key players in the global Faster Payment Service (FPS) market include ACI Worldwide, FIS, Fiserv Inc., wirecard, Mastercard, Temenos Headquarters SA, Global Payments Inc., Capgemini, Icon Solutions Ltd, M & A Ventures LLC, PAYRIX, Nexi Payments SpA, Obopay, and Ripple, among others. Recent developments include Fiserv launching the EnteractSM, a cloud-based customer relationship management platform, and ACI Worldwide partnering with BI-FAST to extend their real-time payment services in Indonesia.

Get more Information About the Faster Payment Service (FPS) Market here & Take a Sample Copy:

https://introspectivemarketresearch.com/request/16608

Updated Version 2024 is available our Sample Report May Includes the:

Scope For 2024

Brief Introduction to the research report.

Table of Contents (Scope covered as a part of the study)

Top players in the market

Research framework (structure of the report)

Research methodology adopted by Worldwide Market Reports

Moreover, the report includes significant chapters such as Patent Analysis, Regulatory Framework, Technology Roadmap, BCG Matrix, Heat Map Analysis, Price Trend Analysis, and Investment Analysis which help to understand the market direction and movement in the current and upcoming years.

Faster Payment Service Market Segmentation:

By Mode of Payment

Single Immediate Payments

Forward-Dated Payments

Direct Corporate Access Payments

Domestic P2P Payments

P2M Payments

B2B Payments

Others

By Component

Solutions

Payment gateway

Payment processing

Payment Security

Services

Others

By Deployment

Cloud

On-Premises

By End Use Industry

Retail and E-Commerce

Banking, Financial Services, & Insurance (BFSI)

IT & Telecom

Travel & Tourism

Others

Inquire or Share Your Questions If Any Before the Purchasing This Report @

https://introspectivemarketresearch.com/inquiry/16608

Regional Insights:

Regional Outlook (Revenue in USD Million; Volume in Units, 2023-2030)

North America (US, Canada, Mexico)

Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC)

Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

South America (Brazil, Argentina, Rest of SA)

Acquire This Report:

https://introspectivemarketresearch.com/request/16608

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Email:[email protected]

#Faster Payment Service (FPS)#Faster Payment Service (FPS) Market#Faster Payment Service (FPS) Market Size#Faster Payment Service (FPS) Market Share#Faster Payment Service (FPS) Market Growth#Faster Payment Service (FPS) Market Trend#Faster Payment Service (FPS) Market segment#Faster Payment Service (FPS) Market Opportunity#Faster Payment Service (FPS) Market Analysis 2022#US Faster Payment Service (FPS) Market#Faster Payment Service (FPS) Market Forecast#Faster Payment Service (FPS) Industry#Faster Payment Service (FPS) Industry Size#china Faster Payment Service (FPS) Market#UK Faster Payment Service (FPS) Market

0 notes

Text

Real-Time Payment Market Global Demand Analysis & Opportunity Outlook 2035

research analysis on “Real-Time Payment Market: Global Demand Analysis & Opportunity Outlook 2035” delivers a detailed competitors analysis and a detailed overview of the global real-time payment market in terms of market segmentation by payment, deployment, end user, component, enterprise size, and by region.

Growing Demand for Faster and Instant Payment Methods to Drive Growth of Global Real-Time Payment Market

The global real-time payment market is estimated to grow majorly on account of the increased demand for faster payment methods among consumers and businesses. Consumers and business owners are searching for a faster and instant payment method, due to the rise of online shopping and e-commerce as well as the requirement for instant settlements of funds. According to a survey launched in 2022, U.S. consumers are looking for faster payments in more areas of their increasingly demanding lives, with four out of five saying they would be interested in paying businesses as soon as possible.

Some of the major growth factors and challenges that are associated with the growth of the global real-time payment market are:

Growth Drivers:

The surge in Adoption of Real-time Payment Trends in Various Domains

Rising Focus on Technological Advancement

Challenges:

Many payment systems are still based on the traditional infrastructure that does not support the real-time payment method and also some people prefer to use the old infrastructure instead of the new one. This can make it difficult and expensive to upgrade these systems to support real-time payment. Moreover, security concerns associated with are some of the major factors anticipated to hamper the growth of the global real-time payment market.

Access our detailed report at:

By component, the global real-time payment market is segmented into services and solutions. The solutions segment is to garner the highest revenue by the end of 2035 by growing at a significant CAGR over the forecast period. There is an increasing demand for real-time payment solutions as well as the need to provide payment services. In order to expand their companies in new markets, payment gateway operators cooperate with merchants all over the world. Given the large volume of transactions carried out by merchants, gateway systems have been integrated into their sales channels. Such as, In the year 2020, Shopify agreed with Alibaba Group Holding Limited, which is a payment gateway provider for Alipay.

By region, the Europe real-time payment market is to generate the highest revenue by the end of 2035. This growth is anticipated by increasing integration of real-time payment and escalating development and innovation in infrastructure all across the Europe region. Most of the European sectors such as in the UK and the Netherlands experienced growth in volumes and values of real-time fund transfers with the launch of P27 in the Nordic region, these factors are expected to drive the expansion of the real-time payment market in this region.

This report also provides the existing competitive scenario of some of the key players of the global real-time payment market which includes company profiling of Fiserve Inc., Paypal Holdings Inc., Mastercard Inc., CRED, Visa Inc., Worldplay Inc., Volante Technologies Inc., others.

Request Report Sample@

0 notes

Text

Table of Contents

With ByBit beginning to cease operations in the U.K., British users are looking for alternative crypto trading platforms, especially those offering both crypto futures and crypto investments aside from spot trading. There are several factors to consider, including licensing status, user experience, fees, the range of supported assets, and GBP support. Let’s go through each of these factors.

Licensing status & GBP support

There are two types of exchanges available for crypto enthusiasts in the U.K.: those who have registered with the Financial Conduct Authority (FCA) and offshore entities. The case with offshore exchanges requires a thorough evaluation from users’ side; it’s recommended that anyone wanting to engage with such a platform makes sure that it has decent operating licences and has a clean record. Take this as an example: Binance has acquired licences in several jurisdictions, but not major ones, and they have been under scrutiny by authorities in the U.S., France, Netherlands, Brazil, Canada, and Australia. The uncertainty that comes with Binance’s licensing status will most likely lead to increased regulatory risks, an aspect users must definitely take into account.

At the same time, of course, the British need an exchange that supports GBP deposits and withdrawals. Even better if there are GBP trading pairs, given that there is not yet a trusty GBP stablecoin. An alternative exchange that meets these requirements is Bitget, which allows for crypto purchases in GBP via Visa/Mastercard and conveniently offers four GBP trading pairs: BGB/GBP, BTC/GBP, ETH/GBP, and USDT/GBP - basic cryptocurrencies for either holding or easy buying/selling of other crypto assets. It receives operating licences from the U.S. and Canada, hence KYC is a must. Another option for crypto enthusiasts in the UK searching for alternatives to Binance and Bybit might consider KuCoin. The platform has recently incorporated the Faster Payment System (FPS) for GBP, offering a swift and straightforward method for users to deposit fiat currency. Furthermore, to aid users in this transition, KuCoin hosted an informative AMA session, guiding users through the deposit process and the subsequent transition into cryptocurrencies.

User experience

For justifiable reasons, fees and the range of supported assets and services all belong to the big category of user experience. Assuming that Bitget is the object of evaluation in this case, one should now proceed to collect as much information about the exchange as possible.

How many trading pairs are there on Bitget? The exchange supports 580 coins and counting, with ca. 800 spot trading pairs and 200 futures pairs. Is it diversified enough for you, i.e. can you find your preferred coin/trading pair in Bitget’s provided selection? If yes, then the next step is to check out and compare the fees.

There is a difference between the fee schedule between spot and futures markets; most of the time, exchanges apply the same fee for Makers (those with large-sized orders, normally market makers and institutional investors) and Takers (retail investors) on spot markets and special offers for Makers on futures markets. Bitget charges a 0.1% spot fee for all spot orders, which can be deducted by 20% when paid with the exchange’s token BGB, and a standard 0.02%/0.06% futures fee. Registered VIPs will have access to a tiered fee structure, but it’s not our focus here. Most similar to Bitget is KuCoin with a 20% discount for fee payments using the platform’s token KCS, 0.1% spot fee, and 0.02%/0.06% futures fee. Gemini, eToro or Kraken (those regulated by the FCA) impose higher fees, so it’s back to square one with the question of local regulatory protections or versatile offshore options. Between Bitget and KuCoin, which exchange token shows more potential in the long-term, assuming you want to take advantage of the 20% fee discount? What else can you use the exchange token for besides paying for fees? Holding

exchange tokens, in general, means you are eligible for exclusive deals and services introduced by that particular exchange such as staking or savings services, farming, airdrops, or, in the case of Bitget, you can earn more as a copy trader if your BGB holdings reach a certain amount.

Final Words

The example above is meant to give U.K. users an idea on how to ask themselves the essential questions and encourage them to do proper research before initiating engagements with any exchange. Suggestions and recommendations oftentimes fall in the category of subjective opinions, thus selecting the one platform that best suits personal needs is undoubtedly the only tip users should ever take.

0 notes

Text

Mobile Money Market to Scale New Heights as Market Players Focus on Innovations 2023 – 2028

Global Mobile Money Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, players market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions to improved profitability. In addition, the study helps venture or private players in understanding the companies in more detail to make better informed decisions.

Major Players in This Report Include:

Vodafone Group Plc. (United Kingdom)

Gemalto (Netherlands)

Fidelity National Information Services, Inc. (FIS) (United States)

Google Inc. (United States)

Mastercard Incorporated (United States)

Bharti Airtel Limited (India)

Orange S.A. (France)

Monitise Plc (United Kingdom)

Mahindra Comviva (India)

PayPal Holdings, Inc. (United States)

Over the last decade, global digitalization has been increased robustly. In addition to this, the usage of Bit Money based trading has vigorously escalated the demand for mobile money. Furthermore, growing awareness about the advanced technologies as well as the increasing usage of smart devices will generate significant demand over the forecasted period with better communication facilities. However, the majority of the low-income population have adopted the low-quality applications which are prone to theft and higher transactional costs which might stagnate the business growth. Since mobile money is one of the innovative payment types. Introduction to these highly automated platforms has simplified the use of financial services by mobile devices.

Market Drivers Growing Awareness About Advanced Digital Payment Software

Robustly Increasing Smartphone Industry leading to Rising Demand for Mobile Money

Market Trend Introduction to Secure Remote Commerce (SRC) which Simplifies the Digital Transactions

Growing Adoption of Technologically Secure Biometric Authentication Technology

Opportunities Minimized Gap Between Actual and Virtual Financial

Enhanced Flexibility Provisions Among the Mobile Money Services

Challenges Lack of Secure Platform Provision from Undeveloped Economies

Skilled and Literate Consumer Base is Required for Ideal Use of Mobile Money

The Mobile Money market study is being classified 19515

Presented By

AMA Research & Media LLP

0 notes

Text

Payment Bank Solutions Market Growing Popularity and Emerging Trends in the Industry

Latest Report Available at Advance Market Analytics, “Payment Bank Solutions Market” provides pin-point analysis for changing competitive dynamics and a forward looking perspective on different factors driving or restraining industry growth.The global Payment Bank Solutions market focuses on encompassing major statistical evidence for the Payment Bank Solutions industry as it offers our readers a value addition on guiding them in encountering the obstacles surrounding the market. A comprehensive addition of several factors such as global distribution, manufacturers, market size, and market factors that affect the global contributions are reported in the study. In addition the Payment Bank Solutions study also shifts its attention with an in-depth competitive landscape, defined growth opportunities, market share coupled with product type and applications, key companies responsible for the production, and utilized strategies are also marked.Some key players in the global Payment Bank Solutions market are

IBM (United States)

ACI Worldwide (United States)

MasterCard (United States)

Infosys Finacle (India)

Mahindra Conviva (India)

Gemalto (Netherlands)

Airpay (India)

Htachi payments (India)

Payment pathways (United States)

Finopaytech (India)

Payment bank offers unique payment solutions to the customer and helps in modernization of banking. These solutions are developed for unbanked segments or location which does not have a bank. However, payment banks cannot lend money or issue credit cards. Payment banks accepts deposits, provides mobile payments, offers net banking services, fund transfers, issuance of ATM card and also it sells third party financial products. Moreover, the payment bank solutions are developed for organizations which are looking for payment banks and small finance banks licenses.

What's Trending in Market: Adoption of Mobile Technology for Online Shopping and Online Banking

Increased Adoption of Cloud Based Applications

Challenges: Lack of Knowledge for Payment Banking Solutions

Market Growth Drivers: Rising Usage of Mobile Technology for Financial Assistance in Remote Areas

Increasing Internet Penetration in Developing Economies

The Global Payment Bank Solutions Market segments and Market Data Break Downby Components (Software (Mobile apps, Platform), Hardware (Debit cards, ATM cards, Forex cards)), Nature of payments (Person to Person (P2P), Person to Business (P2B), Business to Person (B2P), Business to Business (B2B)), Payment banks Offerings (Deposits, Mobile payments, Banking services, Fund transfer, Others), Organization size (SMEs, Large enterprises)

Presented By

AMA Research & Media LLP

0 notes

Text

Mobile Money Market is set for a Potential Growth Worldwide: Excellent Technology Trends with Business Analysis

Advance Market Analytics released a new market study on Global Mobile Money Market Research report which presents a complete assessment of the Market and contains a future trend, current growth factors, attentive opinions, facts, and industry validated market data. The research study provides estimates for Global Mobile Money Forecast till 2027*.

Over the last decade, global digitalization has been increased robustly. In addition to this, the usage of Bit Money based trading has vigorously escalated the demand for mobile money. Furthermore, growing awareness about the advanced technologies as well as the increasing usage of smart devices will generate significant demand over the forecasted period with better communication facilities. However, the majority of the low-income population have adopted the low-quality applications which are prone to theft and higher transactional costs which might stagnate the business growth. Since mobile money is one of the innovative payment types. Introduction to these highly automated platforms has simplified the use of financial services by mobile devices.

Key Players included in the Research Coverage of Mobile Money Market are:

Vodafone Group Plc. (United Kingdom)

Gemalto (Netherlands)

Fidelity National Information Services, Inc. (FIS) (United States)

Google Inc. (United States)

Mastercard Incorporated (United States)

Bharti Airtel Limited (India)

Orange S.A. (France)

Monitise Plc (United Kingdom)

Mahindra Comviva (India)

PayPal Holdings, Inc. (United States)

What's Trending in Market: Introduction to Secure Remote Commerce (SRC) which Simplifies the Digital Transactions

Growing Adoption of Technologically Secure Biometric Authentication Technology

Challenges: Lack of Secure Platform Provision from Undeveloped Economies

Skilled and Literate Consumer Base is Required for Ideal Use of Mobile Money

Opportunities: Minimized Gap Between Actual and Virtual Financial

Enhanced Flexibility Provisions Among the Mobile Money Services

Market Growth Drivers: Growing Awareness About Advanced Digital Payment Software

Robustly Increasing Smartphone Industry leading to Rising Demand for Mobile Money

The Global Mobile Money Market segments and Market Data Break Down by Mode of Transaction (Nfc/Smart Cards, Direct Mobile Billing, Mobile Web/Wap Payments, Short Message Service (SMS), Stk/USSD), Location of Payment (Remote Payments, Proximity Payments), Nature of Payment (Person to Person, Person to Business, Business to Person, Business to Business), Type of Purchase (Airtime transfer and top-ups, Money transfers and payments)

To comprehend Global Mobile Money market dynamics in the world mainly, the worldwide Mobile Money market is analyzed across major global regions. AMA also provides customized specific regional and country-level reports for the following areas.

• North America: United States, Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia and Brazil.

• Middle East & Africa: Saudi Arabia, United Arab Emirates, Israel, Turkey, Egypt and South Africa.

• Europe: United Kingdom, France, Italy, Germany, Spain, Belgium, Netherlands and Russia.

• Asia-Pacific: India, China, Japan, South Korea, Indonesia, Malaysia, Singapore, and Australia.

Presented By

AMA Research & Media LLP

0 notes

Text

Role of Ebanking Solution Provider

Banking software provider in Netherlands banks with rich end- to- end capability and functionality to streamline their operations. They enable them to give individualized top- notch services to guests. Backed up with innovative robotization services and passionate expert advisers ; no bank will ever be packed out of business.

Emoneywallets of the banking system

Ebanking Solution Provider in London enable fiscal institutions to manage their own finances and indeed give convenience to their guests. utmost inventors have created platforms that distribute digital and supported data across all channels. The software gives banks unlimited reach to guests moment, hereafter and indeed in the future. This helps them to understand client requirements indeed before they state them, and come up with the stylish way to meet them. Online banking results are substantially characterized by their capability to do further of the following;

1. confining Digital Fraud Best Practices

Banks face challenges to manage both impalpable and palpable means, security protocols are of great significance. While watchwords have been used for a long time to cover important information, some banks have fallen victims of attacks executed by cyber culprits who use crucial logging ways, sophisticated technology and phishing to compromise the bank’s systems.

moment, Banking software provider in Estonia are gaining fashionability as a result to guarding banking systems. So, what's banking security software? The software controls access to any system by matching the behavioural and physiological characteristics of an individual to database information.

Banking software has been designed to ameliorate functional effectiveness by barring tedious executive processes involved with maintaining access

cards, watchwords and leg figures. This technology has the capability to cover, track and report attendance situations and access to outfit.

As a supplement to conventional word access, banks that want to beef up security can incorporate a combination of biometric procedures and digital access. In fact, numerous companies use this online banking result moment.

2. The Rise In requirements Processing – Merchant Services

The failure and success of any bank depend on its client’s fiscal operation. But finance operation can be veritably grueling in moment’s terrain. Online banking results can be veritably helpful for digital banking, the leading Financial Apps Development Company in UK have worked with hundreds of guests in website design, strategy, marketing and data operation. They help banks to get good control over guests ’ finance operation.

A banking software is used by colorful banking companies to govern their income, lending, recessions, deposits, administration and much further. It helps maximize gains and ensures sustainability. Every bank should have good online banking results to face the challenge of administration services and operation of client finances.

3. Overview Of Motivation Credit

At present, electronic credits are the norm across the globe. Banks need a point that manages online banking results,e.g., credit cards, disbenefit cards,e-wallets and a range of systems. Thanks to digital banking software inventors, banks can cipher all credits fleetly and with a dropped liability of mortal- grounded crimes.

Conclusion

Banks should look for digital banking software inventors that can offer good fiscal operation at cost effective value. A good banking software can keep track of arrears, keep records streamlined, minimize paperwork, insure data integrity and security, balance several client accounts, coordinate balance wastes, income statements and indeed charges, keep all deals transparent and much further.

#Ebanking Solution Provider in London#Banking software provider in United Kingdom#Emoney solution Provider in Netherlands#Virtual Card Provider in Malta#Card program provide in France#Co Branding card provider in Spain#IBAN account provider in Manchester#IBAN account provider in Italy#White Label IBAN account in Italy#Mastercard Provider in Estonia#Money Transfer Sofware Provider in Haiti#ewallet Application Development Company in France

0 notes

Text

Mobile Payment Market: Global Insights and Trends 2023, Advancement Outlook till 2030

The global Mobile Payment Market size is predicted to garner USD 17,706.10 billion by 2030, with a growing CAGR of 25.8% from

2020-2030.

The global mobile payment market is increasing significantly as more companies invest in mobile banking and payment technologies. This report provides an overview of the global economy, the macroeconomic environment affecting the market, and current market trends and challenges. It also includes detailed information on past performance and projected potential opportunities for businesses in this sector. The report gives business directors a comprehensive summary of the competitive landscape and helps them to strategies effectively.

The global mobile payment market is a broad and dynamic field, with a variety of factors impacting its growth and development. This includes business cycles, demographics, and microeconomic factors. A thorough analysis of current business conditions has also been incorporated into the study to ensure accuracy. An in-depth evaluation of financial factors such as production value, growth rate, and key regions have been used to provide actionable strategies for businesses looking to increase their profits.

Key players in the mobile payment market include:

Orange S.A.

Bharti Airtel Limited

Vodacom Group Limited

Safaricom Limited

Econet Wireless Zimbabwe Limited

Millicom International Cellular SA

MasterCard Incorporated

PayPal Holdings, Inc

Mobile payments are currently experiencing a rapid growth in popularity and adoption as consumers look for easier, more convenient ways to pay. In this market report, you'll get an in-depth look at the leading companies driving this trend, along with insights into their strategic approaches. With the data presented, current and aspiring players can gain the knowledge they need to develop their own successful mobile payment strategies.

Global businesses have been affected by the COVID-19 pandemic, as strict lockdowns have affected production facilities everywhere.

Due to changes in consumer behavior resulting from the pandemic, revenue for the global mobile payment market has been significantly impacted. However, with the industry beginning to recover, it is expected that the mobile payment market will experience an increase in revenue in the near future.

The Mobile Payment Market research report provides a comprehensive analysis of the current industry state, evaluating the market size, share, growth rate, revenue and outlook. The report draws on primary and secondary research methodologies to make informed predictions about the future performance of this sector. The study includes statistics and figures that show market data collected by Porter's five forces model, PESTEL and SWOT analysis among other techniques.

The Mobile Payment Market report is an all-inclusive exploration of the industry that evaluates key segments and emerging trends. The report examines sales, demand, product developments, and production capacity to provide a holistic overview of the market. It further delves into supplier chains, distribution chains, and company performance across different regional markets. With this data at hand, prominent players and newcomers in the industry can analyses their production, marketing, and sales strategies to optimize their operational activities.

By Mode of Transaction, the mobile payment market can be categorized into:

Short Message Service (SMS)

Near-Field Communication (NFC)

Wireless Application Protocol (WAP)

The mobile payment market is further classified based on Applications as follows:

Entertainment

Energy & Utilities

Healthcare

Retail

Hospitality & Transportation

Others

The mobile payment market is classified based on region as follows:

North America

U.S.

Canada

Europe

UK

Germany

France

Netherlands

Spain

Italy

Rest of Europe

Asia-Pacific

China

India

Japan

South Korea

Australia

Rest of Asia-Pacific

RoW

Latin America

Middle East

Africa

Table of Content:

INTRODUCTION

MARKET SNAPSHOT, 2019-2030 Million USD

PORTER’S FIVE FORCE MODEL ANALYSIS

MARKET DYNAMICS

Global Mobile Payment Market, By Payment Type

Global Mobile Payment Market, By Transaction Mode

Global Mobile Payment Market, By End User

Global Mobile Payment Market, By Purchase Type

Global Mobile Payment Market, By Application

Global Mobile Payment Market, By Region

COMPANY PROFILES

Request For Free Samples: https://www.nextmsc.com/mobile-payment-market/request-sample

The recent global mobile payment market research report gives comprehensive analysis of the industry, including growth potentials, business tactics, and projected sale figures. While conducting the research, key social and economic factors that can affect the business were also taken into consideration. This study contains crucial data to help companies make well-informed decisions when coming up with appropriate growth strategies. The report also provides insights into the size and share of the market that are held by different players in the mobile payment industry.

This market report provides thorough insights into the Mobile Payment Market analysis, highlighting current trends and regional forecast. Companies can use this report to assess competition and make business plans based on company and industry trends. The research results allow companies to stay up-to-date with the changing market dynamics of global mobile payment. Through in-depth scientific papers and other reliable sources, accurate and valid data has been collected for comprehensive analysis.

In addition, findings will cover the potential revenues growth of top leading companies across different regions such as North America, Europe, Asia Pacific, Latin America, Africa and Middle East. Furthermore, key technological advancements will be highlighted to help businesses recognize opportunities in these markets.

About Us

Next Move Strategy Consulting specializes in market intelligence, providing comprehensive research reports to help multinational companies increase their market share. Using a unique combination of primary and secondary research, data collection and analytics, we have been serving over 1,000 customers including 90% of the Fortune 500 for more than a decade.

Our expertise covers 10 different sectors of the industry, with top-notch syndicated reports and customized projects designed to meet your company's specific needs. We prioritize client satisfaction from pre-consultation to after-sales services to ensure the best results for strategic decision making.

For More Insights, Please Visit: https://www.nextmsc.com/

#marketgrowth#marketshare#marketsize#market demand#market analysis#maketvalue#market forecast#market value#MobilePrepaidMarket

0 notes

Text

Blockchain Payment Tool Market Major Technology Giants in Buzz Again | BitPay, Coinomi, Cryptopay, Electroneum

Advance Market Analytics published a new research publication on Global Blockchain Payment Tool Market Insights, to 2027 with 232 pages and enriched with self-explained Tables and charts in presentable format. In the study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Blockchain Payment Tool market was mainly driven by the increasing R&D spending across the world.

Major players profiled in the study are:

Electroneum (United Kingdom), BitPay (United States), Coinomi (United States), Cryptopay (United Kingdom), Blockonomics (India), CoinsPaid (Estonia), Paytomat (Estonia), Confirmo (Singapore) and ZuPago HyBrid (HD) (United Kingdom)

Get Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/193439-global-blockchain-payment-tool-market#utm_source=DigitalJournalVinay

Scope of the Report of Blockchain Payment Tool

Blockchain payment system is drawing a lot of attention for its promising performance and applications. One relevant application or use case we have all seen and heard of is cryptocurrency trading. Blockchain networks are successfully hosting cryptocurrency exchanges such as Bitcoin, Ether etc. Blockchain refers to a chain of blocks. The blocks contain time-stamped digital records of any transactions or data exchange on the distributed network of computers. Blockchain technology was initially used to support the digital currency Bitcoin but is now being explored for various applications that dont involve bitcoin.

On 30th April 2022, Crypto lender Nexo said it has teamed up with global payments company Mastercard to launch what it calls the world’s first “crypto-backed” payment card. It signals the latest move by crypto and incumbent financial networks to join forces as digital assets become more mainstream. Nexo said the card, available in selected European countries initially, allows users to spend without having to sell their digital assets such as bitcoin, which are used as collateral to back the credit granted.

The Global Blockchain Payment Tool Market segments and Market Data Break Down are illuminated below:

by Type (Cross-Boundary, Non-Cross-Boundary), Application (BFSI, Retail, Logistics, Healthcare and Lifesciences), Providers (Application providers, Middleware providers, Infrastructure providers)

Market Opportunities:

Increase in Funding and Investments in Blockchain Payment Tools By Key Players, Eventually, new players, which are better ready to use the Po-tential of Blockchain, will give a Strong motivation to this improvement and Technology is Potentially the Absolu

Market Drivers:

Blockchain Innovation has started an lively Discussion among Researchers and Blockchain Payments Represents a Major Cornerstone of Banking and the Cradle of this Technology

Market Trend:

Rapid Use of Computers and Mobiles in financial aspects and payments and Increase in Popularity of Blockchain Among Retailers/Distributors for Better Supervision & Data Management

What can be explored with the Blockchain Payment Tool Market Study?

Gain Market Understanding

Identify Growth Opportunities

Analyze and Measure the Global Blockchain Payment Tool Market by Identifying Investment across various Industry Verticals

Understand the Trends that will drive Future Changes in Blockchain Payment Tool

Understand the Competitive Scenarios

Track Right Markets

Identify the Right Verticals

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Blockchain Payment Tool Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/193439-global-blockchain-payment-tool-market#utm_source=DigitalJournalVinay

Strategic Points Covered in Table of Content of Global Blockchain Payment Tool Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Blockchain Payment Tool market

Chapter 2: Exclusive Summary the basic information of the Blockchain Payment Tool Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Blockchain Payment Tool

Chapter 4: Presenting the Blockchain Payment Tool Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2016-2021

Chapter 6: Evaluating the leading manufacturers of the Blockchain Payment Tool market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2022-2027)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Blockchain Payment Tool Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/buy-now?format=1&report=193439#utm_source=DigitalJournalVinay

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA 08837

#Blockchain Payment Tool Market Analysis#Blockchain Payment Tool Market Forecast#Blockchain Payment Tool Market Growth#Blockchain Payment Tool Market Opportunity#Blockchain Payment Tool Market Share#Blockchain Payment Tool Market Trends

0 notes

Text

The rise of the fintech space sparked the emergence of highly successful global companies with the potential to change the international financial landscape. To put things in perspective, fintech company PayPal reportedly processed $1.36 trillion in payments in 2022 - more than the 2022 GDP of the Netherlands at $991 billion.

With companies such as Paypal, Stripe, Visa, and Mastercard figuring majorly in the facilitation of transactions worldwide, it is no surprise that experts project the fintech industry to become a $1.5 trillion industry by 2030.

Luiz Góes, CEO of the upstart Dubai fintech company Layered Financial Independence (LFi), shares 3 Secrets Behind Building a Successful Fintech Company.

Identify a Target Market and Pain Point

For a fintech idea to get off the ground, it must have a core purpose - a customer pain point it aims to solve. A company's fintech industry strategies can be laid to waste if the business fails to uphold this simple yet vital premise.

A founder needs to engage in deep and extensive Market Research to determine two things:

A problem or challenge for which technology can provide a solution;

A sizeable customer base for whom the new product will be of particular use.

These two aspects will be the foundational principles driving product development and company growth. By solving a significant pain point experienced by a sizeable customer base, a fintech product can achieve Market viability, and the company can carve out its niche.

Additionally, it is essential to build a robust customer persona that integrates a deep understanding of the target Market and their needs. Gaining a better understanding of the target Market can help fintech startups continuously tailor their products and offerings with improvements and upgrades.

Build a Great Product or Service

A great concept is only valuable when it comes with equally great execution. Even if the idea is sound and the Market is available, if the product you introduce to the public fails to address the customer pain point it aims to solve, it is a valueless endeavor.

A great product development process keeps the end user in mind. It focuses on how the user intends to solve a problem, how user interactions occur, and how the product can respond more intuitively to resolve a customer's pain point faster.

In addition to focusing on functionality, a fintech startup must consider compliance. Jurisdictions around the world uphold varying regulatory frameworks for fintech products and startups. Laws and regulations across differing jurisdictions can severely affect the functionalities offered by a fintech application.

Thus, startups must carefully choose where to launch their products and what functionalities will be available to users. Otherwise, the intended target Market could end up with a severely impaired product that fails to meet expectations.

Discover LFi’s innovative smartphone:

[embed]https://www.youtube.com/watch?v=vHYmgYYXoo8[/embed]

Secure the Right Funding

According to data released by CB Insights, funding concerns caused 47% of startup failures last year. This figure is double the percentage of companies that failed for the same reason in 2021.

As economies worldwide continue to contract and governments focus on austerity measures to maintain stability, it will be all the more important for startup companies to Secure the right funding partnerships to weather the storm.

Keep in mind that there are various types of startup funding options available. Choose funding based on your fintech startup's growth stage, goals, and business model. Venture Capital and angel investors are two funding models that fintech startups can engage with to Secure financing.

Venture Capital

If your fintech brand classifies as an early-stage company with a high growth potential, you can approach venture Capital (VC) firms to Secure funding.

Venture Capital firms provide early stage-high-growth startups with funding in exchange for Equity or shareholdership. This financing comes from pooled funds that VC firms are qualified to hold.

Apart from providing funding, VC firms typically require a member of the firm to have a seat on the board of directors to provide high-level guidance on strategy and decision-making.

Angel Investors

Angel investors are also another viable funding source for fintech startups. Like VCs, angel investors can provide funding, advice, and support to fintech brands looking to get off the ground. However, unlike VC firms that source financing from pooled funds, angel investors take on the risk as individuals, which means they take all the gains if the startup takes off.

Choosing the right funding source can mean the difference between success and failure for a startup early on. As such, it is crucial for fintech brands to carefully consider their options before deciding.

Luiz Góes on Fintech Leadership

As a fintech startup founder, Luiz Góes believes these three concepts are fundamental to succeeding in the startup landscape and achieving leadership in the fintech space.

"Product-Market fit, product excellence, and robust funding are the building blocks of a vigorous startup company," claims Góes.

"Behind these three ingredients, fintech startups can develop a strong go-to-Market that capitalizes on this period of product building as we prepare for the next Bull Market," he added.

Meet the team behind the LFi One:

[embed]https://www.youtube.com/watch?v=emruS91JzXo[/embed]

About LFi

LFi is a technology company that aims to empower the global fintech movement with new and innovative offerings that combine cutting-edge hardware with next-generation Software. Leveraging the power of advanced computing and Blockchain Technology, LFi seeks to realize a future of financial independence through integrated products and solutions.

Discover More. Dive deeper into LFi's groundbreaking journey. Visit our website or follow us on social to keep up with our latest Updates.

Website

0 notes

Text

Fuel CardMarket Analysis, Size, Growth, Competitive Strategies, and Worldwide Demand

Global Fuel Card Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, players market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions to improved profitability. In addition, the study helps venture or private players in understanding the companies in more detail to make better informed decisions.

Major Players in This Report Include:

ExxonMobil (United States)

Shell (Netherlands)

American Express (United States)

HSBC (United Kingdom)

Citibank (United States)

Standard Chartered (United Kingdom)

SPC (Singapore)

Caltex (Australia)

DBS (Singapore)

UOB (Singapore)

Fuel card systems assist fleet providers in receiving a slew of perks. These cards aid in the capture of low-level data such as vehicle miles and other information such as fuel filling in gallons, as well as the growing need for vehicle maintenance. The gasoline card service providers have begun to integrate the telematics interface and are working on the development of robust and reliable reporting tools. The expansion of the gasoline cards market is fueled by the need for better fuel management and the use of digital transaction solutions in the transportation industry. Furthermore, the market's growth is fueled by effective fleet management, which is made possible by improved data acquisition.

Market Drivers Increase in Digital Payments and Reduction of Fuel Theft through Chip-Based and Pin Cards

Constant Innovations in Fuel Card Technology

Market Trend Omni-channel experience, Loyalty Offerings, and Migration to EMV (Europay, MasterCard, and Visa)

Opportunities Increasing Number of Cashless Transactions in Developing Economies such as Brazil, China, India, South Africa, and Mexico owing to Economic Advancement

Technological Advancements such as Contactless and Prepaid Technology

Challenges Fluctuations in Fuel Prices Internationally

The Fuel Card market study is being classified 13095

Presented By

AMA Research & Media LLP