#Emoney solution Provider in Malta

Text

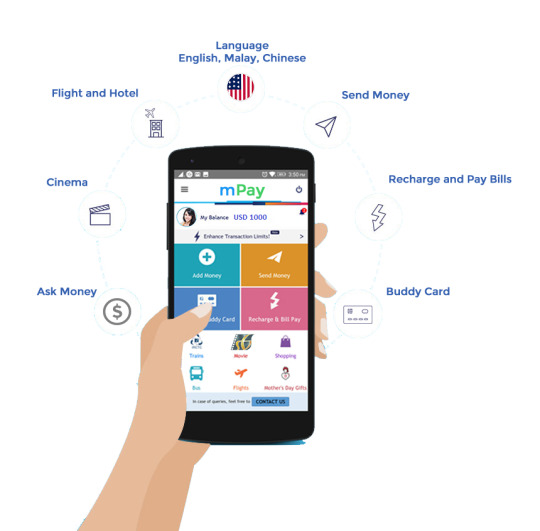

How can mobile banking apps help serve Fintech?

The Finance Industry and banking sector are among the top most heirs of digitalisation. The preface of Banking software provider in Lithuania has added further inflexibility and availability to banking.

The ultramodern mobile banking system has changed the hand of Fintech.

It has revolutionised the operation of the finance assiduity by reducing overhead costs and enhancing client experience. Then are some of the points that state how can mobile banking apps help serve Fintech

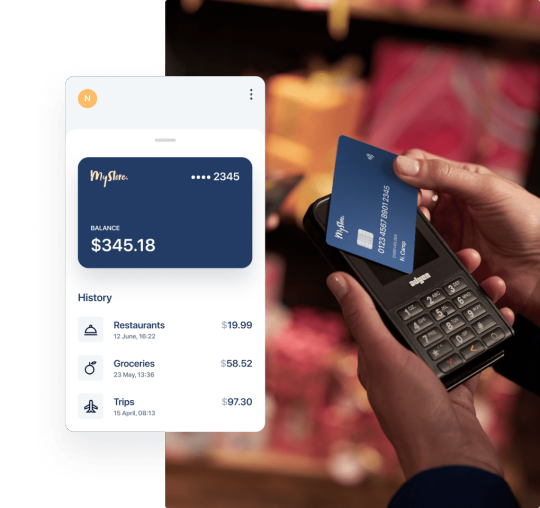

Mobile Banking Apps give flawless relations And amicable Deals

Mobile banking services have brought a significant shift in the way individualities can handle their finances. It has handed great ease and convenience by allowing easy access from anywhere. Mobile banking software loaded with stoner-friendly features facilitates amicable finance deals.

Whether it's allocating finance in finances, pullout of finances, or transfer of plutocrat, any type of finance sale fleetly. Also, the increase in operation of Money Transfer Software Provider in Netherlands deals has shown a growth of around 64.

Mobile Banking Apps Will Help Target Your followership And Ameliorate Services

Banking and Finance is a customer- driven assiduity. Experience and commerce play an essential part. fiscal institutions and banks constantly are contending with each other and using client service as a great differentiator.

The mobile banking system has opened doors of openings for these institutions. It has eased better connections with guests. The finance institutions can efficiently reach the target followership and communicate about finance products.

likewise, mobile banking services play an essential part in gathering client perceptivity for service enhancement.The data attained from mobile banking apps give precious information to offer customised services to the target followership.

structure Mobile Banking Apps Can Reduce Cost And Ameliorate perimeters

Fiscal institutions are utilising the power of the mobile banking system to convert branch guests to mobile banking guests.

Thereby reducing their cost and perfecting perimeters. The finance institution sees guests saving moment as a prospect for outspoken investment in the future.

Mobile Banking Apps Present New openings in the Lending Space

Mobile banking apps give believable information and client data to fiscal institutions. It's upgrading the functionality of fiscal institutions.The integration of Fintech has opened new avenues to detect new implicit guests. figure Mobile Banking Apps To Serve Underbanked Populations

A significant quantum of the underbanked population still doesn't comprehend the banking system.

The preface of mobile banking services and systems is bridging this gap. guests are more likely to use their mobile phones to carry out fiscal deals.

Mobile banking apps are stimulating the growth of fintech by enabling them to explore untapped areas.

THE BOTTOM LINE

Without a doubt, Mobile banking services are the future of finance. They are changing the overall functioning and operations of the finance sector.

Its impact on the customers and target audience is humungous. Hence, modern banks must unfold the fintech trends and incorporate mobile banking services strategically to boost their growth and development.

#Ebanking Solution Provider in London#Banking software provider in Malta#Emoney solution Provider in Malta#Virtual Card Provider in Malta#Card program provide in Birmingham#Co Branding card provider in Netherlands#White Label IBAN account in Italy#Mastercard Provider in Netherlands#Money Transfer Sofware Provider in Malta#ewallet Application Development Company in Estonia

0 notes

Text

Role of Ebanking Solution Provider

Banking software provider in Netherlands banks with rich end- to- end capability and functionality to streamline their operations. They enable them to give individualized top- notch services to guests. Backed up with innovative robotization services and passionate expert advisers ; no bank will ever be packed out of business.

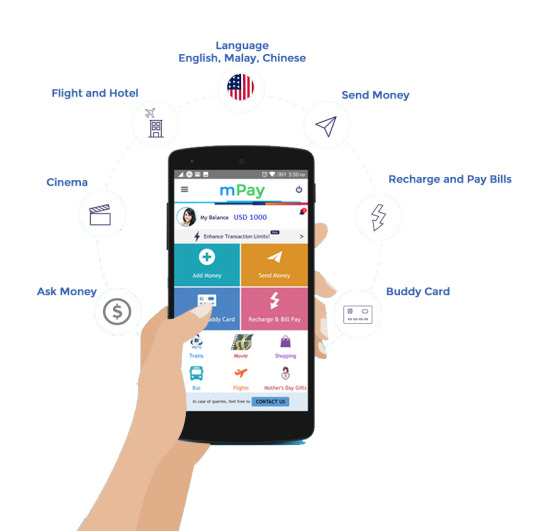

Emoneywallets of the banking system

Ebanking Solution Provider in London enable fiscal institutions to manage their own finances and indeed give convenience to their guests. utmost inventors have created platforms that distribute digital and supported data across all channels. The software gives banks unlimited reach to guests moment, hereafter and indeed in the future. This helps them to understand client requirements indeed before they state them, and come up with the stylish way to meet them. Online banking results are substantially characterized by their capability to do further of the following;

1. confining Digital Fraud Best Practices

Banks face challenges to manage both impalpable and palpable means, security protocols are of great significance. While watchwords have been used for a long time to cover important information, some banks have fallen victims of attacks executed by cyber culprits who use crucial logging ways, sophisticated technology and phishing to compromise the bank’s systems.

moment, Banking software provider in Estonia are gaining fashionability as a result to guarding banking systems. So, what's banking security software? The software controls access to any system by matching the behavioural and physiological characteristics of an individual to database information.

Banking software has been designed to ameliorate functional effectiveness by barring tedious executive processes involved with maintaining access

cards, watchwords and leg figures. This technology has the capability to cover, track and report attendance situations and access to outfit.

As a supplement to conventional word access, banks that want to beef up security can incorporate a combination of biometric procedures and digital access. In fact, numerous companies use this online banking result moment.

2. The Rise In requirements Processing – Merchant Services

The failure and success of any bank depend on its client’s fiscal operation. But finance operation can be veritably grueling in moment’s terrain. Online banking results can be veritably helpful for digital banking, the leading Financial Apps Development Company in UK have worked with hundreds of guests in website design, strategy, marketing and data operation. They help banks to get good control over guests ’ finance operation.

A banking software is used by colorful banking companies to govern their income, lending, recessions, deposits, administration and much further. It helps maximize gains and ensures sustainability. Every bank should have good online banking results to face the challenge of administration services and operation of client finances.

3. Overview Of Motivation Credit

At present, electronic credits are the norm across the globe. Banks need a point that manages online banking results,e.g., credit cards, disbenefit cards,e-wallets and a range of systems. Thanks to digital banking software inventors, banks can cipher all credits fleetly and with a dropped liability of mortal- grounded crimes.

Conclusion

Banks should look for digital banking software inventors that can offer good fiscal operation at cost effective value. A good banking software can keep track of arrears, keep records streamlined, minimize paperwork, insure data integrity and security, balance several client accounts, coordinate balance wastes, income statements and indeed charges, keep all deals transparent and much further.

#Ebanking Solution Provider in London#Banking software provider in United Kingdom#Emoney solution Provider in Netherlands#Virtual Card Provider in Malta#Card program provide in France#Co Branding card provider in Spain#IBAN account provider in Manchester#IBAN account provider in Italy#White Label IBAN account in Italy#Mastercard Provider in Estonia#Money Transfer Sofware Provider in Haiti#ewallet Application Development Company in France

0 notes