#Mortgage Lenders In California

Text

Orange County Home Mortgage

If you are looking for home mortgages in Orange County, you have several options to consider. It is important to compare the rates and terms of different lenders. Confido Loans is one of the best options out there, offering competitive rates and exceptional customer service to help you secure the ideal home mortgage for your needs.

#Mortgage Lenders in Irvine California#Orange County Mortgage Companies#Mortgage Companies in Orange County#Orange County Mortgage Brokers

0 notes

Text

To get the loan in hand at the right time you can take help of the Reverse Mortgage Lenders. However, being the homeowner you have to pay the property taxes in time. There are more things you need to take care like the homeowners insurance and one can use the asset as the main residence.

#Reverse Mortgage Loan California#Refinance Reverse Mortgage#Reverse Mortgage Lenders#reverse mortgage information#refinancing reverse mortgage#reverse mortgage loan california#reverse mortgage lenders

0 notes

Photo

Prudential Wholesale Lending is one of the best California mortgage lenders that can help you obtain financing for the purchase of a home or refinancing an existing mortgage. For more information about the interest rate or mortgage loan calculator, visit our website.

#best home loan lender#best home mortgage companies#best mortgage lenders california#california mortgage lenders#home loan mortgage companies#mortgage companies in california

0 notes

Text

Mortgage Calculator Service in California:

Use the free California Mortgage Calculator to estimate your monthly payment, including taxes, mortgage insurance, principal, and interest.

A mortgage calculator helps in calculating things in a few minutes.

Buying a new home is a time of dreams and opportunity, but navigating the mortgage process can also make it stressful and confusing. Different interest rates and repayment terms can make it difficult to compare mortgage loan offers.

Our mortgage calculator should help you understand everything. This helpful tool makes it easy to find mortgage loans and choose the best deal for you.

How to Use This Calculator:

Our mortgage calculator can help you understand how differences in interest rates and repayment terms affect the size of your monthly payment and the total cost of a home over time. Little information is required to get started. Adding a few more details using the calculator's optional advanced options can give you an even clearer idea of what your monthly mortgage payment might look like for different loans.

- House Price: This is the amount you pay the house seller. If you are in the early stages of home shopping, use the seller's asking price for comparison, but remember that this number is negotiable. If you are shopping in a highly competitive market and expect to be one of several bidders, you may want to bid above the asking price. In slower markets or for properties that have been on the market for a longer period of time, a bid below the asking price could be successful. Work with a real estate professional/ Mortgage Advisor to set your bidding strategy.

- Down Payment: When you enter the house price, the calculator automatically fills in the Down Payment field to reflect 20% of the house price. This is the standard down payment required for most traditional mortgages. Many mortgage lenders, including those who make government-backed loans, will accept lower down payments, usually in exchange for higher interest rates and/or fees - and with the stipulation that you pay for mortgage insurance, which you can factor into the calculator's advanced features.

- Term (in years): Enter the number of years required for the mortgage to be repaid. By default, this calculator assumes a 30-year mortgage, as this is the most common home loan term in America. Other standard mortgage terms include 15 years, 20 years, and 40 years. Adjust this number according to the offer you are evaluating. All things being equal, longer mortgage terms mean lower monthly payments, but also significantly higher interest costs over the life of the loan.

- Interest Rate: Enter the interest rate for the loan you are considering. Be sure to enter the interest rate, not the APR (annual percentage rate). These numbers may be similar, but the APR reflects interest costs plus additional financing costs like fees and mortgage insurance.

#mortgage#term#payments#downpayment#downpay#insurance#usa#united states#canada#advisor#mortgage adviser#financial advisers#calculator#calculations#california#year#loan#house#sale#service

186 notes

·

View notes

Text

By Tyler Durden

US mortgage lender loanDepot confirmed in an 8k filing on Monday that it is the latest victim of a cyberattack that has brought critical systems offline.

California-based loanDepot, which is the second-largest non-bank mortgage lender behind Rocket Mortgage, wrote in a filing that it “recently identified a cybersecurity incident affecting certain of the Company’s systems.”

“Upon detecting unauthorized activity, the Company promptly took steps to contain and respond to the incident, including launching an investigation with assistance from leading cybersecurity experts, and began the process of notifying applicable regulators and law enforcement.

“Though our investigation is ongoing, at this time, the Company has determined that the unauthorized third party activity included access to certain Company systems and the encryption of data. In response, the Company shut down certain systems and continues to implement measures to secure its business operations, bring systems back online and respond to the incident.”

Shares of loanDepot are down 5% in premarket trading in New York.

The lender noted it will “continue to assess the impact of the incident and whether the incident may have a material impact on the Company.”

5 notes

·

View notes

Text

For most of his life, Cory Infinger has lived down a hill and along a bend in the Little Wekiva River, a gentle stream meandering northwest of Orlando. During Hurricane Ian, in September 2022, the stream swelled, inundating the homes of his family and his neighbors and also the street where they live, making it impassable.

Overnight Ian had moved slowly and violently over the state’s interior, dropping historic amounts of rain, after coming ashore in southwest Florida as a category 4 hurricane, its high winds and storm surge flattening coastal communities there.

For Infinger the deluge forced a hasty morning evacuation with his wife and youngest two of their three children. It would displace the family for months as their home underwent massive repairs. More than a year later the ordeal has left the family rattled, especially his 16- and 8-year-old children, said Infinger, who grew up fishing and trapping turtles along the Little Wekiva and now enjoys doing the same with his kids. (A 22-year-old son no longer lives at home.)

“You could tell they were sad when we came back to get the last few things,” he recalled of his kids as he described the family’s temporary stay in a rental house, and then the move back to their newly remodeled home. “It took them a while to get used to, this is our new house. Everything had changed.”

In the last seven years Florida has weathered five major hurricanes. Michael, which made landfall in 2018 in the Panhandle, was the first category 5 hurricane to strike the continental United States since Andrew in 1992. Ian, in 2022, was the costliest hurricane in state history and third-costliest on record nationwide, after Katrina in 2005 and Harvey in 2017. Recent major Florida hurricanes also include Irma in 2017, Nicole in 2022, and Idalia in 2023.

If the disasters sharpened Floridians’ resolve, in the immediate aftermath, to build back stronger and better, another crisis may be causing some to rethink where they live and the rising risk as the global climate warms.

After Ian, Infinger’s taxes and homeowners insurance, which he pays together into a bank escrow account as part of his regular mortgage payment, jumped by $450 a month. That amount could be considered moderate in a state where annual home insurance rates in the five and six figures have not been unheard of in recent years, and many homeowners have received letters from their insurers informing them that their existing policies will not be renewed.

Some homeowners have received multiple such letters from multiple insurers, leaving them scrambling from one policy to the next, as lenders require mortgage holders to carry insurance. Others whose homes are paid off are going without insurance altogether, to spare the expense.

“We deal with it,” said Infinger, who, with his wife, is considering moving away from the Little Wekiva in the coming years. For now, he said, “there’s nothing really we can do about it.”

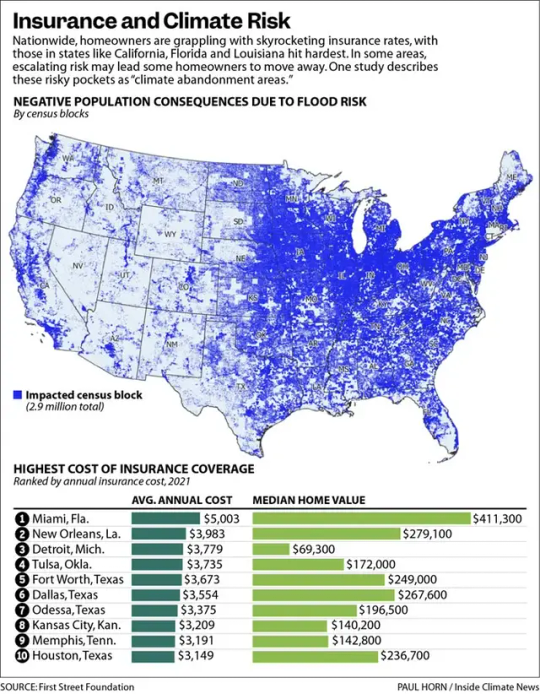

Across the country, homeowners are grappling with skyrocketing insurance rates and dropped policies, with those in states such as California, Florida, and Louisiana hit hardest. Growing evidence suggests the soaring costs only hint at the widespread unpriced risk facing homeowners as the warming climate leads to rising seas and more damaging hurricanes and wildfires.

As many as 6.8 million properties nationwide have been affected by insurance problems, but that number represents a fraction of the 39 million homes and businesses vulnerable to flooding, hurricanes, and wildfires whose risk has not been priced into their policies, according to a study by the First Street Foundation, a nonprofit researching climate risk. Together these 39 million properties constitute what the study characterizes as an “insurance bubble,” defined by properties likely overvalued because of underpriced or subsidized insurance.

Other research suggests the changing climate has not been priced into the real estate market in a way that reflects the risk. A separate study published last year in Nature Climate Change, a peer-reviewed journal, estimates that residential properties vulnerable to flooding are overvalued by $121 billion to $237 billion, in part because of the subsidized National Flood Insurance Program.

The study found that the most overvalued properties are concentrated in coastal counties where there are no flood risk disclosure laws and where there is less personal concern about climate change. Much of the overvaluation is driven by properties situated outside of the 100-year flood zones designed by the Federal Emergency Management Agency. Low-income households especially are in danger of losing home equity, potentially leading to wider wealth gaps. In Florida, properties are overvalued by more than $50 billion, according to the study.

The unpriced risk is important for many reasons. Municipalities that rely on property tax revenue may be vulnerable to potential shortfalls, the study says. The National Climate Assessment pointed out last year that the overvaluation of coastal properties makes it difficult to move people out of harm’s way, because of the limited amount of compensation available through flood insurance and federal flood disaster assistance programs.

“Florida is one of the riskiest places from a climate impact standpoint that you can live in,” said Rob Moore, director of the flooding solutions team at the Natural Resources Defense Council. “One only needs to look through a few years of front pages to see how many major hurricanes have struck this state, and that definitely had an impact on how both private insurers and insurers in the public realm are looking at risk and pricing it in the state of Florida.”

“We’re so far behind in regard to pricing in the climate. That’s why we’re seeing these big [insurance] spikes in places like Florida and California and Louisiana,” said Jeremy Porter, head of climate implications research at the First Street Foundation. “It’s the first mechanism to start to price climate into the housing market.”

2 notes

·

View notes

Text

Now First Republic is racing to reassure customers and clients that it can avoid the fate of Silicon Valley Bank, which collapsed last week after its depositors fled.

[...]

It’s a stunning turn of events for the lender, which built up a wealth-management franchise with some $271 billion in assets, putting it in rarefied air among American institutions. It’s the emphasis on that business that could make First Republic’s fate different from SVB and New York’s Signature Bank.

While it expanded rapidly into capital call lines of credit and lending to venture capitalists — services in which SVB specialized — its specialty serving the affluent is seen as making it more attractive to its larger rivals than its California counterpart.

“First Republic Bank grew up in wealth,” whereas “SVB started in portfolio companies,” said Joe Maxwell, managing partner at Fintop Capital, a fintech venture capital firm. Even though there’s a lot of overlap, where they started is still “part of their DNA,” he said.

[...]

Herbert founded First Republic in 1985, based on a hunch that jumbo home mortgages to wealthy, established Californians was too good a business to pass up. SVB’s model of providing banking to startups was conceived a few years prior — over a poker game.

[...]

Both originate single-family mortgages, but SVB had lent less than $9 billion. That’s a fraction of First Republic’s $99 billion balance, which made up 59% of their loan portfolio (it gave Mark Zuckerberg a 1.05% rate in 2012). It had another $22 billion in multifamily loans and $11 billion in other commercial real estate.

First Republic got rescued by some other banks while nobody would take SVB but the FDIC, part of that could be just the order in which they happened but I think Bloomberg is trying to throw some shade on this.

5 notes

·

View notes

Text

youtube

Business Name:

World Premier Realty & American Home Loans

Street Address:

1848 Willow Pass Rd #208

City:

Concord

State:

California (CA)

Zip Code:

94520

Country:

United States

Business Phone:

(925) 825-8494

Business Email:

[email protected]

Website:

https://www.worldprhomes.com/

Facebook:

https://www.facebook.com/people/World-Premier-Realty-American-Home-Loans/100063647270066/#=

Business Description:

At World Premier Realty WPR & American Home Loans AHL we uphold an ongoing commitment to providing an elevated level of personal service. Our clients come first, and as a result, they are able to achieve more than they ever dreamed with their real estate investment. Because we expect more from our associates, you can expect more from us when it comes to the important sale or purchase of your property. When it comes to your next move, we want you to experience the difference exceptional real estate service can make.

Google My Business CID URL:

https://www.google.com/maps?cid=14480934420677147158

Business Hours:

Sunday 9am-7pm

Monday 9am-7pm

Tuesday 9am-7pm

Wednesday 9am-7pm

Thursday 9am-7pm

Friday 9am-7pm

Saturday 9am-7pm

Payment Methods:

Cash

Visa

Master

Discover

Amex

Services:

First time home buyers, Short Sale Transactions, Liquidating bank owned distressed properties, Property Management

Keywords:

First time home buyers, Short Sale Transactions, Liquidating bank owned distressed properties, Property Management

Location:

Service Areas:

2 notes

·

View notes

Text

Best place for an easy 100% mortgage loan to purchase a house in Georgia and California. Direct Lender Max Yates NMLS#134265

2 notes

·

View notes

Text

If you want faster refinancing options with features like affordable monthly instalments and longer tenure, connect with Confido loans. The company provides you with the best and current mortgage rates in the County to stay financially healthy.

1 note

·

View note

Text

Business Name:

Persevere Lending

Street Address:

600 San Ramon Valley Blvd #202

City:

Danville

State:

California

Zip Code:

94526

Country:

USA

Business Phone:

(925) 837-1314

Business Email:

[email protected]

Website:

https://www.perseverelending.com/

Facebook:

https://www.facebook.com/PersevereLending/

LinkedIn:

https://www.linkedin.com/company/private-capital-investment/

Business Description:

Persevere Lending was founded with unwavering ethics and integrity, and it is our mission to represent all of our clients with the highest level of respect and accountability. We understand the challenges and anxiety that people endure throughout their real estate financing process, and we can help to mitigate their stress and uncertainty by navigating them through the loan process in a concise, professional, and transparent manner. Private real estate financing is designed for strategic and/or opportunistic capital requirements for borrowers unable to obtain traditional financing. Persevere Lending is dedicated to providing our borrower clients with creative, efficient, and effective loans.

Google My Business CID URL:

https://www.google.com/maps?cid=16073399824335601456

Business Hours:

Sunday 9am–12:15pm

Monday 8am-6pm

Tuesday 8am-6pm

Wednesday 8am-6pm

Thursday 8am-6pm

Friday 8am-6pm

Saturday 9am–12:15pm

Payment Methods:

Cash

Visa

Master

Discover

Amex

Paypal

Services:

Private Money Loans for Refinance, and Acquisition and Construction Loan Programs for Residential and Commercial Properties

Keywords:

Private Money Loans for Refinance, and Acquisition and Construction Loan Programs for Residential and Commercial Properties

Location:

Service Areas:

2 notes

·

View notes

Text

You have to know the details of a reverse mortgage before you can opt for the option of Refinance Reverse Mortgage. In matters of a reverse mortgage, the lender will pay you regular cash. However, both the loan and the interest remain due when you plan to sell the property or in the case when you leave the premise, and also in case of sudden demise.

0 notes

Text

Home Loans In California

Whether an experienced investor or a first-time home buyer, you still need help from the best home loans in California that will provide the best rates and quick closure. By providing mortgage products from conventional, jumbo, FHA, VA, USDA, non-QM (bank statement, no income, investor), reverse mortgage, and HELOC, to name a few. This mortgage lender in California will serve you the best.

2 notes

·

View notes

Text

What Should You Look For In A Financing Real Estate Rental Loans California?

Investing in real estate is a proven strategy for building wealth, but finding the right financing can be challenging. Bull Venture Capital, a California-based private money lender, offers customized solutions for real estate investment loans, specifically designed to support rental property investments.

Why Choose Bull Venture Capital?

Speed and Efficiency: Unlike traditional mortgages, which can take months to close, Bull Venture Capital prides itself on fast closings, often within seven days. This rapid turnaround allows investors to seize lucrative opportunities quickly.

Flexible Loan Programs: Bull Venture Capital offers a variety of real estate investment loans to meet different needs, including residential, commercial, and multifamily properties. Whether you're looking to purchase a new rental property or refinance an existing one, there’s likely a program that fits your requirements.

High Loan-to-Value Ratios: With LTV ratios up to 90% of the purchase price and 100% of renovation costs, investors can maximize their leverage. This high LTV is especially beneficial for those planning to renovate and increase the value of their properties.

Competitive Rates: Starting at 6.8%, Bull Venture Capital offers competitive interest rates, especially given the flexibility and speed of their lending process. With no upfront costs and minimal documentation required, the process is both accessible and efficient.

Ideal Candidates for Bull Venture Capital Loans

Bull Venture Capital’s loan programs are suitable for a range of investors, including:

Real Estate Developers: Those developing new properties from the ground up can benefit from the substantial funding available for construction projects.

Property Flippers: Investors looking to purchase, renovate, and sell properties quickly will appreciate the high LTV and fast closing times.

Buy-and-Hold Investors: Those aiming to build a rental portfolio can leverage flexible loan terms and competitive rates to grow their investments efficiently.

Conclusion

Navigating the world of Financing Real Estate Rental Loans California can be complex, but Bull Venture Capital provides California investors with a reliable partner. Offering fast, flexible, and competitive loan options, Bull Venture Capital supports real estate investors in seizing opportunities and maximizing returns. Whether you’re looking to flip a property or expand your rental portfolio, their tailored financing solutions can help you achieve your investment goals.

#real estate rental loans california#No appraisal loans#no income documentation loans#hard money loans for real estate

0 notes

Text

How Much Are Closing Costs in Orange County California: Real Estate Transactions Guide

Credit: Image by Alena Darmel | Pexels

Unlocking the Mystery: How Much Are Closing Costs in Orange County, California?

What are, and how much are closing costs in Orange County, California?

Other costs that come under closing costs are those charged when closing a real estate deal and can be paid either by the buyer or the seller, licensed agents, etc.

In Orange County, the specific sum may differ depending on parameters such as the property's value, the particular terms of the mortgage loan, and the details of the individual transaction.

Understanding these expenses is equally important, especially for anyone in the market who wants to purchase or sell a house in this prime area.

This article defines the various charges included under the broad umbrella of closing costs in Orange County to assist anyone in estimating the charges correctly.

Key Elements of Closing Costs

Loan Origination Fees

These are fees that the borrower perceives as a cost that the lender has imposed on the borrower for providing the loan. They usually range from five percent to one percent of the loaned amount.

Appraisal Fees

A realtor must be hired to make an appraisal to help determine the property's value. This fee may range typically from $300 to $600.

Title Insurance

Title insurance covers future events related to a property's title. The price difference ranges, on average, from $500 to about $1500.

Escrow Fees

An escrow company assists the whole deal with the cash distribution process, completing the entire process as expected. The costs generally used to obtain an escrow may range from $500 to $2000.

Recording Fees

Your local government could collect these fees from you to help you process the requirements needed to transfer the property into your name. They usually cost at least $100 to $250.

Real Estate Agent Commissions

Real estate agent commissions often vary from 5% to 6% of the sale amount and are shared equally between the seller's and the buyer's agent.

Home Inspection Fees

A home inspection costs between $300 and $500 and helps ensure that all the property's parts are functional.

Notary Fees

These are sometimes needed to notarize other documents that might be required, and the cost could be $100-$150.

Pest Inspection Fees

Some instances require a pest inspection, usually costing between $100 and $200.

Prepaid Expenses include property tax, home insurance, and mortgage interest. The figure may differ depending on the kind of property and loan.

Factors Affecting Closing Costs

Several factors can affect closing costs in Orange County, including:

Property Price

Closing costs for homes sold at higher prices are typically higher because they are calculated based on a percentage of the sales price.

For instance, expenses such as title insurance, escrow fees, and transfer taxes are often proportional to the property's value. Additionally, more significant mortgage amounts can increase loan origination, appraisal, and points fees.

Therefore, buyers and sellers should expect higher closing costs for properties sold at significant amounts.

Type of Loan

Besides, additional requirements are specific to some types of loans and the relevant fees. For example, the F.H.A. loan may be simplified by its relatively high costs, such as requiring a more significant down payment or other initial costs. Still, it has lower interest rates than conventional loans.

Negotiation

Commission may also be bargained between the purchaser and the property vendor. For example, a seller can offer to 'buy down' a part of the closing cost attached to the real estate to assure the buyer to close the transaction.

Service Providers

Consumers must opt for fewer service providers, including title companies, Escrow Companies, home inspectors, and other title closing costs. It is also important to note that fees differ from broker to broker, so it is prudent to note the fees charged.

Location

Certain local taxes and fees, like special assessments or transfer taxation, may vary depending on the particular neighborhood or district within Orange County.

For example, some areas might have higher special assessment fees for community improvements, while transfer taxes might differ based on local ordinances.

Both buyers and sellers must be mindful of these potential variations when exploring properties in different parts of the county, as they can impact the overall cost of the transaction.

Awareness of these factors allows individuals to make informed decisions and accurately assess the financial implications of their real estate transactions.

Reducing Closing Costs

Both consumers and sellers can take steps to minimize their closing costs, including:

Shop Around

It's beneficial to contact multiple lenders and different title and escrow companies to inquire about their fees. By comparing rates, you can strive to find the most reasonable and competitive pricing for your needs.

Negotiate

In most cases, there is usually a bargaining process with the other side about splitting or reimbursing some or all the closing costs. For instance, a seller may propose to the buyer that he or she bear the invoice of the owner’s title insurance.

Review the Loan Estimate

Borrowers are entitled to receive the loan estimate from the lender within three days of application completion. To establish the probable closing costs, read the document and establish whether any areas of understanding are ambiguous or if any fees seem to be inordinately high.

Ask for Seller Concessions

Potential buyers can also ask sellers for certain contingencies to pay some closing costs while bargaining for the purchase price. This can be particularly helpful in a buyer’s market because sellers might be more open to such an approach.

Use a No-Closing-Cost Loan

Different lenders provide no-closing-cost mortgage loans in which the closing costs are included in the Mortgage Balance or paid off through a higher Mortgage Rate. Although this helps save money initially, it leads to an increased term of paying off the borrowed sum.

The following points explain why closing costs should be considered an integral part of real estate transactions in Orange County, California. Both buyers and sellers must also be aware of these costs to conduct a transaction efficiently.

In every real estate transaction, expenses related to the conveyance of title to real estate must be ascertained, and these expenses may indeed affect the financial relationships between the two entities.

Get more fascinating information on our website at https://occoastrealestate.com/orange-country-closing-costs/.

#Community Information#Real Estate Blogs#Homes for Sale#Orange County CA Real Estate#Orange County CA Closing Costs#Property Taxes#Escrow#Title Insurance#Appraisal Fees#Loan Origination Fees#Home Inspection#Transfer Taxes#Recording Fees#Attorney Fees#Notary Fees#HOA Fees#Home Warranty Fees#Pest Inspection Fees#Survey Fees

0 notes