#Multi-GAAP Reporting

Explore tagged Tumblr posts

Text

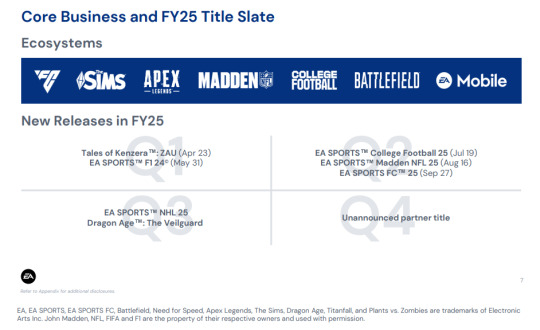

EA Q1 2025 Earnings Release - DA:TV and related mentions:

"Electronic Arts Reports Strong Q1 FY25 Results “EA delivered a strong start to FY25, beating net bookings guidance as we continue to execute across our business,” said Andrew Wilson, CEO of EA. “Our focus on delivering bigger, bolder, and more connected experiences for our players has never been sharper and is illustrated by the record-breaking launch of EA SPORTS College Football 25 as we head into another historic Q2 sports season at EA.” “Strong execution, live events and continued player engagement across our experiences, delivered Q1 results above expectations,” said Stuart Canfield, CFO of EA. “Looking ahead, the remarkable success of our launch week for College Football, combined with the upcoming launches for EA SPORTS Madden NFL, EA SPORTS FC and Dragon Age: The Veilguard, is building momentum for FY25 and beyond. We are well positioned to deliver our multi-year financial objectives.” Selected Operating Highlights and Metrics - During the quarter, EA revealed Dragon Age: The Veilguard gameplay, which trended #1 on YouTube Gaming and received millions of views. [...] About Electronic Arts In fiscal year 2024, EA posted GAAP net revenue of approximately $7.6 billion. Headquartered in Redwood City, California, EA is recognized for a portfolio of critically acclaimed, high-quality brands such as EA SPORTS FC™, Battlefield™, Apex Legends™, The Sims™, EA SPORTS™ Madden NFL, EA SPORTS™ College Football, Need for Speed™, Dragon Age™, Titanfall™, Plants vs. Zombies™ and EA SPORTS F1® . More information about EA is available at www.ea.com/news." EA, EA SPORTS, EA SPORTS FC, Battlefield, Need for Speed, Apex Legends, The Sims, Dragon Age, Titanfall, and Plants vs. Zombies are trademarks of Electronic Arts Inc. John Madden, NFL, FIFA and F1 are the property of their respective owners and used with permission.

Earnings Slides mentions:

Text in this image reads:

"Core Business and FY25 Title Slate New Releases in FY25 Q3: EA SPORTS NHL 25 Dragon Age : The Veilguard (Fel note: I think Q3 FY25 is October to December 2024 btw.) EA, EA SPORTS, EA SPORTS FC, Battlefield, Need for Speed, Apex Legends, The Sims, Dragon Age, Titanfall, and Plants vs. Zombies are trademarks of Electronic Arts Inc. John Madden, NFL, FIFA and F1 are the property of their respective owners and used with permission."

[source, two]

(context of this post: The call hasn't taken place yet, but before they do some of the associated documents get made available online.)

I think Q3 FY25 is October to December 2024 btw.

#dragon age: the veilguard#dragon age: dreadwolf#dragon age 4#the dread wolf rises#dragon age#bioware#video games#long post#longpost#as always I'll make another post with the rest of the usual stuff(+if any other mentions) after the call is done :)#if Q3 fy25 being oct-dec 2024 is confusing to you just know its bc Financial Years are different and weird compared to normal years ok 😭#so it must be coming out in October or November then ig! since while december is in the q3 window its not really fall anymore

79 notes

·

View notes

Text

Laabdhi: Your Trusted Accounting Company for Smart Financial Solutions

In today’s fast-paced and highly competitive business environment, accurate financial management is more than a necessity—it's a strategic advantage. This is where Laabdhi, a leading accounting company, plays a vital role. Renowned for its precision, professionalism, and personalized service, Laabdhi has become a trusted name among businesses looking to streamline their finances and achieve long-term growth.

Founded with a vision to simplify complex accounting processes, Laabdhi offers a full spectrum of financial services, including bookkeeping, tax planning, payroll, compliance, and CFO-level advisory. Whether you’re a startup looking for basic financial setup or a large enterprise seeking end-to-end accounting support, Laabdhi’s customized approach ensures that every client gets the attention and expertise they deserve.

One of Laabdhi’s strongest advantages lies in its deep understanding of diverse industries. With clients spanning sectors like manufacturing, retail, IT, healthcare, logistics, and e-commerce, the company brings industry-specific insights to every engagement. This allows them to not only ensure regulatory compliance but also identify cost-saving opportunities and provide data-driven financial strategies.

Technology is at the heart of Laabdhi’s operations. As a modern accounting company, Laabdhi uses the latest cloud-based accounting tools and software, ensuring accuracy, real-time reporting, and easy access to financial data. By automating repetitive tasks and integrating powerful analytics, Laabdhi helps businesses reduce human error, save time, and make informed decisions faster.

What truly sets Laabdhi apart is its client-first philosophy. The team prides itself on building strong relationships based on transparency, integrity, and clear communication. Every client is assigned a dedicated account manager, making it easy to discuss financial goals, ask questions, and receive timely updates. This hands-on approach has earned Laabdhi a loyal clientele and a reputation for exceptional service.

For businesses expanding internationally or managing multi-location operations, Laabdhi also offers outsourced accounting services. With an experienced team well-versed in global accounting standards such as GAAP and IFRS, the company ensures smooth financial operations across borders. Their offshore delivery model helps companies save significantly on operational costs while maintaining high standards of quality and compliance.

Another key strength is Laabdhi’s focus on taxation and regulatory compliance. The ever-changing tax landscape can be overwhelming for businesses, but Laabdhi’s experts stay ahead of updates and legislative changes. From income tax and GST filings to audit support and international tax advisory, they ensure that clients remain compliant while optimizing their tax liability.

In conclusion, if you’re searching for a reliable and forward-thinking accounting company, Laabdhi should be at the top of your list. With its strong technical expertise, industry knowledge, and commitment to client success, Laabdhi empowers businesses to focus on growth while leaving the numbers to the experts. From daily bookkeeping to strategic financial planning, Laabdhi delivers smart solutions that drive real results.

0 notes

Text

How Finance Leaders Future-Proof Operations with SAP + Outsourcing

In 2025, the role of finance leaders has evolved beyond managing budgets and reviewing reports. Today’s CFOs and financial controllers are expected to drive strategy, manage risk, ensure compliance, and lead digital transformation — all while keeping operations lean and efficient.

To meet these growing demands, many finance leaders are embracing a powerful combination: SAP + outsourced bookkeeping. Together, they’re creating a scalable, future-ready finance function that helps businesses grow smarter — not just faster.

Here’s how this approach is helping finance leaders build resilient, high-performing operations.

The Pressure on Modern Finance Teams

The financial landscape is more complex than ever. Businesses now face challenges like:

Global expansion and multi-currency transactions

Evolving regulatory and compliance requirements

Increased demand for real-time financial data

Rising costs of in-house talent and technology

Higher expectations from investors and stakeholders

These challenges demand more than just a basic bookkeeping setup — they require a strategic, technology-enabled solution that can scale with the business. That’s where SAP-driven outsourced bookkeeping comes in.

What Is SAP + Outsourcing?

SAP is one of the world’s most trusted ERP (Enterprise Resource Planning) platforms. It automates and integrates critical business functions like accounting, payroll, inventory, CRM, and reporting.

Outsourced bookkeeping, meanwhile, involves partnering with a third-party provider to manage daily financial tasks such as:

Transaction recording

Invoicing and billing

Bank reconciliations

Financial reporting

Compliance support

When finance leaders combine SAP’s power with outsourced expertise, they create a finance infrastructure that’s built for long-term growth and agility.

Key Benefits for Finance Leaders

1. Real-Time Financial Visibility

One of SAP’s biggest advantages is real-time access to financial data. Dashboards and live reporting features allow finance leaders to track:

Cash flow

Profitability

Expenses

Budget vs. actuals

Instead of waiting for end-of-month reports, CFOs and decision-makers can now act on insights instantly — reducing delays and improving responsiveness.

2. Scalable and Flexible Operations

As businesses grow, their finance operations often become more complex. SAP’s robust infrastructure supports:

Multi-entity and multi-currency accounting

Global compliance frameworks

Integration with CRMs, HR, and supply chain systems

Outsourcing partners with SAP expertise can scale services as needed — whether your business is entering a new market or acquiring a new company. Finance leaders get the flexibility to grow without friction.

3. Cost Optimization

Hiring and retaining skilled finance professionals — especially those with SAP experience — can be expensive. Outsourcing offers a cost-effective alternative, giving companies access to expert support without the overhead.

Plus, SAP’s automation capabilities reduce the need for manual data entry and redundant processes, freeing up resources for higher-value strategic work.

4. Improved Accuracy and Compliance

SAP is built to support international accounting standards like GAAP and IFRS. Its automation features help eliminate human error, ensure consistent data entry, and keep audit trails intact.

Combined with a knowledgeable outsourced bookkeeping team, finance leaders can confidently meet deadlines, stay compliant, and be always audit-ready.

5. Faster Reporting and Decision-Making

Time-consuming manual reports are a thing of the past. SAP generates financial statements, forecasts, and analytics on demand. Your outsourced team maintains these reports and customizes them based on your business needs.

For finance leaders, this means faster decision-making, stronger forecasting, and data-backed strategic planning.

6. Focus on Core Strategy

Outsourcing allows internal finance teams to move away from repetitive tasks and focus on:

Financial planning and analysis (FP&A)

Risk management

Growth strategy

Investment planning

By offloading operational bookkeeping to SAP-powered experts, finance leaders can redirect their time and energy to initiatives that drive business success.

A Future-Ready Finance Stack

In 2025 and beyond, finance is no longer just about keeping the books clean — it’s about building a resilient, adaptable, and insight-driven operation. SAP offers the technology backbone, while outsourcing delivers the flexibility and expertise.

When combined, they enable finance leaders to:

Adapt quickly to market changes

Maintain financial health during rapid growth

Support complex business models with ease

Stay compliant across global markets

Final Thoughts

Finance leaders who embrace SAP + outsourcing are taking proactive steps to future-proof their operations. This modern model reduces costs, enhances visibility, improves compliance, and sets the foundation for long-term, sustainable growth.

If you’re still relying on outdated systems or siloed teams, now is the time to evolve. With the right outsourcing partner and SAP infrastructure in place, your finance function can move from reactive to strategic — and lead the way forward.

0 notes

Text

The Role of Oracle Hyperion in Financial Consolidation and Close Processes

In today’s fast-paced business environment, accurate and timely financial consolidation and close (FCC) is more important than ever. Enterprises must aggregate data from multiple sources, ensure compliance with local and international standards, and deliver financial statements that reflect the company’s true performance—all within increasingly tighter deadlines.

This is where Oracle Hyperion, part of the broader Oracle EPM suite, plays a transformative role.

Why Financial Consolidation and Close Matter

Financial consolidation involves combining financial data from various subsidiaries and business units into a unified set of financial statements. The closing process, meanwhile, refers to the activities required at the end of a financial period to finalize accounts.

These processes are essential for:

Ensuring accurate financial reporting

Meeting regulatory and compliance requirements

Supporting strategic decision-making

Enhancing stakeholder confidence

Yet, manual consolidation is often plagued by errors, delayed timelines, and a lack of transparency.

How Oracle Hyperion Simplifies Financial Close

Oracle Hyperion Financial Management (HFM) is a purpose-built solution that automates and streamlines consolidation and reporting. It provides a structured, auditable, and scalable approach to managing the close process, offering:

Automation of repetitive tasks like intercompany eliminations and currency translations

Real-time consolidation for faster and more accurate reporting

Built-in controls and validations to improve data accuracy

Audit trails for transparency and accountability

Multi-GAAP support, enabling compliance with various accounting standards

By reducing manual intervention and spreadsheet dependency, Hyperion significantly shortens the close cycle and lowers the risk of reporting errors.

Ensuring Financial Accuracy and Transparency

One of the key benefits of Oracle Hyperion is data integrity. Through centralized data management, organizations can rely on a “single version of the truth” across their financial systems. This ensures:

Accurate intercompany reconciliation

Consistent application of accounting rules

Transparent workflows and user access controls

Organizations also gain the ability to drill down from consolidated figures to transactional details, enhancing traceability and confidence in reported results.

Regulatory Compliance and Legal Reporting

For companies operating across borders, compliance is non-negotiable. Oracle Hyperion and the wider Oracle EPM Cloud suite support regulatory frameworks including:

IFRS and local GAAP

Tax provisioning and statutory reporting

ESG and sustainability reporting

With prebuilt templates, automated calculations, and audit-friendly features, Oracle EPM ensures that regulatory compliance becomes a built-in part of the reporting process—not an afterthought.

Use Cases in Turkish Enterprises

Many Turkish organizations across sectors have benefited from Oracle Hyperion implementations. Here are a few examples from Constellation Consulting Group’s portfolio:

📌 Retail Sector: A national retail chain streamlined consolidation across its growing network of stores, reducing close time by over 40%. 👉 Read the case study

📌 Healthcare Group: A leading healthcare provider improved compliance and reduced reporting errors by implementing Oracle Hyperion for financial consolidation. 👉 Read the case study

📌 Media & Entertainment: A Turkish media giant modernized its close process by automating eliminations and creating real-time dashboards for executive leadership. 👉 Read the case study

These implementations showcase the flexibility and power of Hyperion in adapting to local business needs while maintaining global best practices.

Constellation’s Expert Guidance

At Constellation Consulting Group, we help businesses unlock the full potential of Oracle Hyperion and Oracle EPM Cloud. Our experienced consultants provide:

End-to-end implementation and integration

Custom configurations to align with your chart of accounts

Training and ongoing support

Audit-ready documentation and compliance reviews

Whether you're a multinational firm or a regional enterprise in Türkiye, our tailored solutions are designed to support your journey to faster, more accurate, and compliant financial closes.

0 notes

Text

Simplify Business Finances With SunSystems Expense Management Software

Managing business finances shouldn’t feel like solving a Rubik’s cube blindfolded. In today's fast-paced world, companies need accounting software that not only tracks numbers but also simplifies complex operations. That’s where SunSystems, a globally recognized financial management solution, comes into play—especially when paired with robust expense management tools.

Whether you're running a startup, a growing SME, or a multinational organization, SunSystems can help streamline your financial processes and make your expense tracking less of a headache.

What Is SunSystems?

Overview of SunSystems Accounting Software

SunSystems is a powerful, flexible accounting and financial management software developed by Infor. It’s designed for organizations that need to manage complex financial data across multiple currencies, countries, and regulations—all from a single platform.

Who Uses It and Why It Matters

SunSystems is trusted by thousands of companies in industries like hospitality, non-profits, financial services, and professional services. It’s ideal for organizations that want comprehensive financial control without the complexity of large ERP systems.

Top Benefits of SunSystems for Businesses

Streamlined Financial Management

SunSystems eliminates manual processes, allowing businesses to automate tasks like invoice processing, reporting, and account reconciliation. It centralizes all financial data, ensuring consistency and accuracy.

Greater Efficiency and Accuracy

Human error is one of the biggest financial risks. With automated functions, businesses can reduce errors and improve audit trails, giving finance teams more time to focus on strategic decisions.

Real-Time Reporting and Decision-Making

Need instant insights? SunSystems provides real-time dashboards, financial KPIs, and visual reports that make decision-making faster and smarter.

Expense Management: A Critical Business Function

What Is Expense Management?

Expense management refers to the systems and policies businesses use to process, pay, and audit employee-initiated expenses. This includes everything from travel receipts to software subscriptions.

The Problem With Manual Expense Tracking

Manual processes are slow, error-prone, and hard to audit. They can lead to overspending, non-compliance, and frustrated employees. And let’s be honest—nobody enjoys filling out spreadsheets or chasing down receipts.

Key Components of Effective Expense Management

Automated approval workflows

Integration with credit card and bank feeds

Real-time expense visibility

Policy enforcement

Audit-ready records

How SunSystems Handles Expense Management

Automation of Expense Reporting

Employees can submit expenses digitally, attach receipts via mobile, and get approvals routed automatically. This saves hours of admin work and speeds up reimbursement.

Budget Monitoring and Control

Managers can view expenses against departmental budgets in real time. That means no more surprises at month-end—and better control over spending.

Employee Reimbursements and Workflow Approvals

Built-in workflows ensure that expense claims are reviewed and approved in the correct order, following company policies. No more delays or bottlenecks.

Key Features of SunSystems Accounting Software

Unified Ledger and Smart Coding

Unlike many traditional systems, SunSystems accounting software uses a single ledger for all transactions, simplifying account structures and reducing duplication. Smart coding structures mean faster and more intuitive data entry.

Multi-Currency and Multi-Language Support

Operating in multiple countries? SunSystems supports over 190 currencies and multiple languages—perfect for global teams.

Compliance With Global Financial Standards

Whether it's GAAP, IFRS, or local standards, SunSystems is built to comply. It keeps your financial reporting consistent across borders.

Integrations and Compatibility

Connects With ERP, CRM, Payroll, and More

SunSystems offers open APIs and built-in connectors to integrate with other critical systems like SAP, Salesforce, Workday, and ADP.

Enhancing Business Intelligence Through Integrations

When integrated with BI tools like Power BI or Qlik, SunSystems becomes a powerhouse for data visualization and predictive analytics.

Advanced Reporting and Analytics

Custom Dashboards and Reports

Create custom dashboards for different user roles—executives, finance staff, department heads—each with real-time KPIs and data that matter most.

Forecasting and Budget Planning Tools

With advanced analytics features, SunSystems can help you forecast cash flow, compare budgets vs. actuals, and prepare more accurate financial plans.

Cloud vs On-Premise Deployment

Pros and Cons of Each Option

On-Premise: More control, but higher upfront cost and IT maintenance.

Cloud: Faster setup, lower cost, and easy remote access.

Why Cloud-Based Deployment Is Growing

More businesses are moving to the cloud for its flexibility, automatic updates, and ability to access data from anywhere.

Real-World Applications and Case Studies

Success Stories Across Industries

Hospitality: A global hotel chain cut expense report processing time by 70%.

Non-Profit: An NGO improved transparency with grant-specific expense tracking.

Finance: A firm used SunSystems to meet multi-regulation compliance seamlessly.

ROI From SunSystems Implementation

Companies report faster month-end closing, reduced audit costs, and increased employee satisfaction with easy expense tools.

Security and Compliance Features

Data Encryption and Access Controls

Your financial data is protected with enterprise-grade encryption, role-based access, and multi-factor authentication.

GDPR, SOX, and Other Regulatory Support

SunSystems helps you stay compliant with global standards and easily produce reports required for audits.

Implementation Strategy

Steps to a Smooth Transition

Define goals

Clean legacy data

Train users

Go live in phases

Training and Support Essentials

SunSystems offers extensive documentation, training sessions, and ongoing support through certified partners.

How to Choose the Right Provider

What to Ask Before Buying

Is this solution scalable for my business size?

What integrations are available?

How is data migration handled?

Importance of Ongoing Customer Support

Choose a vendor that offers 24/7 support, regular updates, and a solid user community.

Conclusion

If you’re tired of drowning in spreadsheets or losing control over your company’s expenses, it might be time to explore SunSystems accounting software with integrated expense management. It’s modern, powerful, and scalable—and designed to simplify business finances from the ground up.

FAQs

1. Is SunSystems suitable for global operations?

Yes, it supports multi-currency, multi-language, and multi-entity accounting, making it ideal for international businesses.

2. Can it manage expenses for remote teams?

Absolutely. With mobile apps and cloud access, remote employees can submit and track expenses easily.

3. How customizable is the reporting system?

Very. You can tailor dashboards and reports for different users and business needs using built-in or integrated BI tools.

4. What industries benefit most from SunSystems?

Finance, non-profits, hospitality, education, and professional services are top users—but it’s adaptable to nearly any industry.

5. How long does setup and training take?

It depends on your organization’s size and complexity, but small to mid-sized businesses can go live in a few weeks with the right support.

0 notes

Text

Healthcare CFO Services

K-38 Consulting partners with startups and rapidly growing Healthcare CFO Services. As the healthcare industry continues to evolve rapidly—driven by technological innovations, regulatory changes, and increased demand for quality patient care—growing healthcare companies face mounting financial complexity. From managing cash flow and regulatory compliance to preparing for investor meetings and long-term growth, financial leadership has never been more crucial. This is where Healthcare CFO services play a transformative role.

Whether provided by a full-time Chief Financial Officer (CFO) or outsourced fractional CFO services, these strategic financial roles offer the expertise needed to help growing healthcare companies scale effectively. They not only bring clarity to the numbers but also help guide the organization through operational optimization, accurate and timely financial reporting, and strategic investor relations.

1. Streamlining Financial and Operational Processes

A key function of healthcare CFO services is streamlining financial and operational processes. In a growing healthcare company, disparate systems, manual workflows, and lack of standardized financial procedures can become major bottlenecks.

a. Financial Systems Optimization

Healthcare CFO services assess current systems and recommend the implementation or optimization of enterprise resource planning (ERP) systems or financial management platforms that integrate accounting, billing, payroll, and inventory management. Automation of repetitive tasks—such as invoicing, reconciliation, and payroll—reduces errors and enhances productivity.

b. Process Standardization

CFOs help standardize accounting and reporting processes across departments or facilities, ensuring consistency and accuracy. This becomes particularly important for multi-location practices, clinics, or health systems looking to scale without increasing inefficiencies.

c. Cost Management and Operational Efficiency

With deep industry insight, a healthcare CFO can identify cost-saving opportunities without compromising on patient care. This might involve renegotiating vendor contracts, optimizing staffing levels, or introducing performance-based budgeting. The ultimate goal is to drive operational efficiency while maintaining high service standards.

2. Improving Financial Reporting and Compliance

Accurate and timely financial reporting is a cornerstone of business sustainability, especially in a heavily regulated industry like healthcare.

a. Enhanced Financial Visibility

CFOs ensure that the company has reliable, real-time financial dashboards and regular reporting mechanisms. These reports help management make informed decisions, track KPIs, and assess the financial health of the organization. Healthcare CFOs are adept at developing reports that not only fulfill compliance needs but also aid in strategic planning.

b. Regulatory Compliance

Healthcare companies operate under strict financial and operational regulations—ranging from HIPAA and HITECH to Medicare and Medicaid billing compliance. A CFO ensures adherence to these regulations and prepares the company for audits, minimizing risk exposure.

c. GAAP and Financial Best Practices

Healthcare CFO services bring in-depth knowledge of Generally Accepted Accounting Principles (GAAP) and industry-specific financial standards. By aligning financial reporting with best practices, they instill confidence in stakeholders—including lenders, insurers, and investors.

3. Strategic Investor Relations Management

Investor relations play a pivotal role for growing healthcare companies that seek funding, strategic partnerships, or exit opportunities such as mergers, acquisitions, or IPOs.

a. Fundraising Strategy

Whether the goal is to raise venture capital, secure a private equity investment, or access debt financing, CFOs help craft a compelling financial narrative. They prepare detailed financial models, business plans, and investor pitch decks that resonate with potential backers.

b. Due Diligence Preparation

Investors conduct rigorous due diligence before committing capital. A CFO ensures all financial documents, forecasts, and compliance reports are audit-ready. They also serve as a key point of contact between the company and potential investors, answering questions and reinforcing trust.

c. Long-Term Financial Planning

Investor relations go beyond funding rounds. A CFO builds long-term financial roadmaps aligned with investor expectations and market trends. They help set milestones, track performance, and continuously refine strategies based on financial insights and growth data.

4. Supporting Strategic Growth and Scalability

Beyond numbers and compliance, healthcare CFOs contribute directly to the company’s strategic growth initiatives.

a. Mergers and Acquisitions (M&A)

For healthcare companies considering expansion through acquisitions, CFOs lead the financial due diligence, valuation, and integration process. They assess targets, negotiate deal structures, and manage post-transaction consolidation efforts.

b. Geographic and Service Line Expansion

Whether opening new facilities, entering new markets, or launching new services like telehealth, a CFO evaluates the financial feasibility, manages capital allocation, and ensures ROI tracking. They weigh the cost-benefit of each initiative and align it with the company’s broader financial goals.

c. Technology Investment and Innovation

Healthcare CFOs play an important advisory role in decisions related to IT infrastructure, data analytics tools, and AI-powered platforms. They help determine which investments will yield the best return, both financially and in terms of patient outcomes.

5. Outsourced CFO Services: A Smart Option for Growing Companies

For early-stage or mid-sized healthcare organizations, hiring a full-time CFO may not be financially feasible. In such cases, outsourced CFO services provide a cost-effective alternative. Fractional or interim CFOs offer high-level expertise on a part-time or project basis, helping companies bridge the gap until they’re ready for a full-time executive.

Outsourced CFOs offer:

Deep healthcare industry knowledge

Scalable services tailored to company growth

Objective financial advice without internal bias

Flexible contracts to fit short- or long-term needs

This approach allows healthcare companies to access top-tier strategic finance support without the overhead of a full executive salary.

Conclusion

Healthcare CFO services are a vital asset for companies aiming to scale in a competitive and complex industry. By streamlining internal processes, improving financial reporting, ensuring regulatory compliance, and managing investor relations strategically, CFOs empower healthcare organizations to grow sustainably and confidently.

Whether through a full-time CFO or outsourced services, investing in experienced financial leadership isn’t just smart—it’s essential. As the healthcare landscape continues to shift, having a financial expert to navigate the uncertainties and unlock new opportunities can mean the difference between surviving and thriving.

0 notes

Text

Why Oracle Fusion Financials is Preferred by Large Enterprises.

In today's fast-paced and highly competitive business environment, large enterprises require robust, scalable, and intelligent financial solutions to manage their operations efficiently. Oracle Fusion Financials has emerged as the go-to choice for many global corporations due to its advanced features, modern architecture, and ability to support complex financial processes seamlessly.

In this blog, we explore why Oracle Fusion Financials stands out and why it's the preferred financial management solution for large enterprises.

1. Comprehensive and Integrated Financial Suite

Oracle Fusion Financials offers a full suite of financial applications, including:

General Ledger

Accounts Payable and Receivable

Fixed Assets

Cash Management

Expense Management

This integrated approach eliminates the need for multiple disparate systems, reducing complexity and improving data consistency across the enterprise.

2. Cloud-Native Architecture

Lower IT maintenance costs

Seamless updates and patches

Enhanced security and compliance features

Cloud deployment also means faster implementation and access to the latest innovations without disruption to daily operations.

3. Real-Time Financial Reporting and Analytics

One of the biggest advantages of Oracle Fusion Financials is its built-in business intelligence. Enterprises can access real-time dashboards, drill-down reports, and predictive analytics, enabling:

Faster decision-making

Improved financial forecasting

Better visibility into financial performance

The solution uses Oracle's powerful analytics engine and machine learning to provide actionable insights.

4. Global Compliance and Localization

Large enterprises often operate across multiple countries with different tax laws, currencies, and accounting standards. Oracle Fusion Financials supports:

Multi-currency and multi-language transactions

Localization for over 100 countries

Compliance with global accounting standards like IFRS and GAAP

This ensures enterprises can stay compliant while operating globally with minimal friction.

5. Scalability and Performance

As businesses grow, their systems must keep pace. Oracle Fusion Financials is designed to scale with an organization, handling complex organizational structures and high transaction volumes with ease. It’s built on Oracle’s modern cloud infrastructure, ensuring high performance and availability.

6. Automation and Efficiency

Oracle Fusion Financials leverages AI and machine learning to automate routine tasks such as invoice processing, account reconciliations, and fraud detection. This results in:

Reduced manual errors

Faster close processes

Lower operational costs

7. Strong Ecosystem and Support

Oracle’s extensive partner and developer ecosystem provides enterprises with access to:

Certified implementation partners

Pre-built integrations with third-party systems

Continuous learning and support resources

This ecosystem ensures a smoother implementation and ongoing optimization of the financial system.

Final Thoughts

Oracle Fusion Financials is not just a financial management solution it's a strategic enabler for growth and efficiency. Its modern architecture, real-time capabilities, global compliance features, and automation tools make it the preferred choice for large enterprises looking to transform their finance operations and gain a competitive edge.If you're a large enterprise aiming for agility, visibility, and control in your financial operations, Oracle Fusion Financials is worth the investment. To Your bright future join Oracle Fusion Financials.

#jobguarantee#oraclefusion#oraclefusionfinancials#financecareers#hyderabadtraining#100jobguarantee#financejobs#erptraining#careergrowth#erptree

0 notes

Text

How Outsource Bookkeeping Services in USA Can Boost Your Business Growth

As business owners face increasing pressure to stay competitive, reduce operational costs, and focus on core objectives, one area that often becomes a challenge is financial management. Maintaining accurate financial records is crucial, yet time-consuming. That’s where outsource bookkeeping services in USA come into play.

Many companies—whether startups, SMEs, or growing enterprises—are now outsourcing their financial operations to professional firms. This trend is especially strong in the United States, where businesses want to reduce administrative overhead and gain access to skilled financial professionals. Firms like OS Solutions have become go-to partners, offering tailored bookkeeping services in USA that support business growth without the burden of managing an in-house finance team.

What Are Bookkeeping Services?

Before diving into the benefits of outsourcing, let’s clarify what bookkeeping involves. Bookkeeping services USA typically include:

Recording daily transactions

Managing accounts payable and receivable

Reconciling bank statements

Generating financial statements

Handling payroll and tax-related reporting

Budget forecasting and cash flow analysis

Proper bookkeeping ensures compliance with tax laws, enhances transparency, and enables businesses to make strategic decisions based on accurate financial data.

Why Outsource Bookkeeping Services in USA?

1. Save Time and Focus on Core Business Functions

Business owners wear many hats, especially in small and mid-sized companies. Spending hours on invoices, expense tracking, and reconciliations diverts attention from growth-generating activities like marketing, product development, and customer service. By choosing outsource bookkeeping services in USA, businesses can free up valuable time while ensuring their books are in expert hands.

2. Cut Down on Operational Costs

Hiring a full-time bookkeeper or accounting team requires a significant financial commitment—including salaries, benefits, workspace, training, and accounting software. Outsourcing eliminates those overhead costs. You pay only for the services you need, when you need them. OS Solutions offers flexible pricing plans designed to accommodate various business sizes, making it cost-effective and scalable.

3. Access to Skilled Professionals

Accounting regulations in the U.S. change frequently, and compliance is non-negotiable. With bookkeeping services in USA, you get access to professionals trained in current federal and state tax laws, GAAP standards, and advanced accounting tools. Instead of spending resources training internal staff, your business benefits from immediate expertise.

4. Improve Financial Accuracy

Manual bookkeeping often leads to human error. Misclassified transactions, missed deductions, and delayed reconciliations can result in financial penalties or poor decisions. Outsourced services leverage automation tools and systematic review processes to reduce errors significantly.

For example, OS Solutions uses cloud-based accounting software integrated with AI tools to flag anomalies and ensure accuracy in real time.

5. Scalability for Business Growth

As businesses grow, their financial needs evolve. What works for a 5-person startup won’t meet the needs of a 50-person company with multi-channel revenue streams. Outsourced providers are equipped to scale services as you expand—whether that means handling more transactions, adding payroll services, or preparing for investor audits.

6. Access to Real-Time Reporting and Insights

Financial data is most useful when it’s timely. Modern bookkeeping services USA provide dashboards, KPIs, and real-time financial statements that help you monitor performance and cash flow. This allows decision-makers to take action faster—whether it's adjusting pricing strategies or planning for expansion.

Why Choose OS Solutions for Bookkeeping Services in USA?

OS Solutions stands out as a trusted provider of bookkeeping services in USA by offering comprehensive, secure, and customized services to businesses of all sizes. Here's what makes us different:

Expert Team: Trained professionals with deep industry experience.

Cloud-Based Tools: Access your financial data 24/7 from anywhere.

Tailored Services: Choose only what you need—monthly reports, full-service bookkeeping, payroll, or tax prep.

Confidential & Secure: We prioritize data protection with secure systems and strict confidentiality agreements.

Dedicated Support: Our account managers are always available to answer questions and provide insights.

When you choose OS Solutions, you’re not just outsourcing a task—you’re gaining a partner invested in your growth.

Real-World Example: A Growth Story

A boutique marketing agency based in Chicago was spending nearly 20 hours a month managing their books. As the client base grew, invoicing delays, missed payments, and reporting errors became common. They decided to partner with OS Solutions.

Within six months:

Monthly bookkeeping time reduced by 85%

Reporting accuracy improved by 98%

They gained a clear financial roadmap to hire two new team members and launch a new service

This success story highlights how the right financial partner can unlock new opportunities.

Tips for a Successful Bookkeeping Outsourcing Experience

To maximize the benefits of outsourcing, consider the following:

✅ Define Your Needs Clearly

Outline what services you require—basic bookkeeping, payroll, tax preparation, or financial planning. This helps set expectations from the start.

✅ Choose a Reputable Firm

Look for credentials, reviews, client testimonials, and experience. Make sure they understand your industry.

✅ Ensure Data Security

Your financial data is sensitive. Ensure your provider uses encrypted platforms and secure data storage.

✅ Set Up Clear Communication

Regular check-ins and reporting schedules keep both parties aligned.

✅ Evaluate Performance Regularly

Review the partnership periodically to assess ROI and service quality.

Frequently Asked Questions

1. What services are included in outsource bookkeeping services in USA?

Typically, services include transaction recording, bank reconciliation, accounts payable/receivable management, financial reporting, and sometimes payroll and tax support—depending on the provider.

2. Are outsourced bookkeeping services suitable for small businesses?

Yes. Small businesses often benefit the most from outsourcing due to the cost savings and access to expertise they otherwise couldn’t afford in-house.

3. How do I know my financial data is secure with a third-party provider?

Firms like OS Solutions use encrypted, cloud-based software, secure servers, and sign NDAs to ensure your data is fully protected.

4. Can I access my books anytime if I outsource?

Absolutely. With cloud-based systems, you have 24/7 access to your financial data, dashboards, and reports.

5. How do I get started with OS Solutions?

Contact our team via our website or schedule a free consultation. We’ll assess your needs and recommend a plan that fits your business model and budget.

Final Thoughts

In today’s fast-paced market, financial efficiency and strategic clarity are essential. By leveraging outsource bookkeeping services in USA, you save time, reduce costs, improve accuracy, and gain expert support—all without the burden of managing a full-time team.

OS Solutions is here to help you streamline your operations and support your next phase of growth. Our tailored bookkeeping services USA are built to empower businesses to focus on what they do best—while we handle the numbers.

0 notes

Text

Why Olivo Technologies Offers the Best Accounting Software Saudi Arabia Businesses Can Rely On

In the ever-evolving business landscape of Saudi Arabia, financial accuracy and operational efficiency are critical to sustainable growth. As the Kingdom moves swiftly toward digitization—guided by Vision 2030—companies are seeking modern solutions to replace outdated systems and manual processes. Among the most critical tools in this transformation is accounting software.

This article explores why Olivo Technologies stands out as a leader in delivering the best accounting software Saudi Arabia companies can rely on for streamlined financial management, compliance, and long-term scalability.

✅ The Growing Demand for Accounting Software in Saudi Arabia

With increased regulations from the Zakat, Tax and Customs Authority (ZATCA)—including the FATOORAH (e-invoicing) system, Value-Added Tax (VAT), and growing emphasis on digital audits—businesses of all sizes are now mandated to stay digitally compliant. Manual accounting simply isn’t sustainable anymore.

Enter Olivo Technologies.

We understand the local regulatory framework and have designed accounting software that is specifically tailored to Saudi Arabia’s business environment.

🔍 Why Choose Olivo Technologies?

Here are the key features that make our accounting software a top choice in the Kingdom:

✅ Fully VAT-Compliant & ZATCA-Ready Stay compliant with Saudi Arabia’s tax laws with auto-calculations and pre-set templates.

✅ Arabic & English Interface Multi-language support to ensure ease of use for diverse teams.

✅ FATOORAH-Integrated Seamless e-invoicing functionality that meets all the requirements from ZATCA.

✅ Cloud-Based Access Manage your finances from anywhere—ideal for remote teams and growing enterprises.

✅ Customizable Modules From inventory to payroll, CRM to procurement, the software adapts to your needs.

✅ Real-Time Dashboards & Reports Make data-driven decisions with visually rich financial dashboards.

✅ Secure & Scalable Enterprise-grade encryption and the ability to scale as your business grows.

💼 Who Can Benefit from Olivo Technologies' Accounting Software?

Our solution is designed to cater to:

Small to Medium Enterprises (SMEs)

Corporates and Holding Groups

E-commerce Platforms

Healthcare Providers

Retail Chains

Logistics & Transportation Companies

Contractors & Real Estate Businesses

No matter your industry, our software is robust, intuitive, and perfectly suited to the Saudi market.

📊 The Business Impact of Using Olivo Technologies’ Accounting Software

Businesses that switch to our accounting software report:

⏱️ 50% Time Saved on monthly financial tasks

💰 Reduced Errors through automation

�� Improved Data Security

📈 Better Strategic Planning using real-time insights

🤝 Improved Client & Vendor Relationships via faster billing and payments

🌍 Local Expertise with Global Standards

While our software is built for the local market, it meets global accounting standards (GAAP and IFRS) ensuring seamless growth for companies looking to expand regionally or internationally.

Plus, our dedicated support team based in Saudi Arabia ensures you get timely assistance in Arabic or English—whenever you need it.

📢 Ready to Digitize Your Finances?

Choosing Olivo Technologies means choosing efficiency, compliance, and innovation. Don’t let outdated systems hold your business back.

Join hundreds of businesses across Riyadh, Jeddah, Dammam, and beyond who have made the switch to smarter financial management.

🔗 Contact Us Today

Explore how Olivo Technologies' accounting software in Saudi Arabia can elevate your business operations.

📍 Visit us at: https://olivotech.com/accounting-software/ 📞 Call us: 966506195881 📧 Email: [email protected]

#AccountingSoftwareSaudiArabia#OlivoTechnologies#FATOORAHCompliant#VATSaudiArabia#ZATCACompliance#SaudiBusinessSoftware#CloudAccountingKSA#FinanceAutomation#DigitalTransformationKSA

0 notes

Text

Save Time & Money: Why Businesses Prefer Outsourcing Bookkeeping to India

In today's fast-paced business environment, companies constantly look for ways to optimize costs and improve efficiency. One of the most effective strategies businesses adopt is leveraging outsourced bookkeeping services. By outsourcing financial tasks to experts in India, companies can focus on core operations while reducing expenses. This growing trend of outsourced bookkeeping is revolutionizing the way businesses manage their financial records.

The Cost Advantage of Bookkeeping Outsourcing India

One of the primary reasons businesses prefer Bookkeeping Outsourcing in India is cost-effectiveness. Hiring in-house bookkeepers in countries like the U.S., U.K., or Australia comes with high salaries, employee benefits, office expenses, and training costs. In contrast, outsourcing to India provides access to highly skilled professionals at a fraction of the cost, significantly reducing overhead expenses.

India has a vast talent pool of certified accountants and finance experts who offer top-notch outsourced bookkeeping services. This means businesses can maintain high financial accuracy without breaking the bank. Moreover, the currency exchange rate further adds to the cost benefits of outsourcing bookkeeping to India.

Access to Skilled Professionals

The Indian finance industry is renowned for its expertise, with many Chartered Accountants and finance professionals well-versed in global accounting standards like GAAP and IFRS. Businesses that opt for outsourced bookkeeping in India gain access to professionals proficient in various accounting software, such as QuickBooks, Xero, Sage, and Zoho Books.

These skilled professionals handle bookkeeping tasks efficiently and ensure compliance with regulatory requirements. Their expertise in managing accounts, preparing financial reports, and handling tax-related matters allows businesses to maintain accurate financial records without investing in extensive in-house training.

Scalability and Flexibility

Business growth often comes with increased bookkeeping demands. Hiring an in-house team to manage fluctuating workloads can be costly and time-consuming. Bookkeeping Outsourcing India allows companies to scale their bookkeeping needs as required. Whether a business requires full-time, part-time, or project-based bookkeeping, outsourcing offers the flexibility to adapt to changing demands without long-term commitments.

Additionally, outsourcing firms in India offer customized services tailored to each company’s needs, allowing businesses to pay only for the required services. This flexibility benefits startups and small businesses that want to manage costs effectively.

Time Savings and Efficiency

Managing financial records requires meticulous attention to detail and significant time investment. By opting for outsourced bookkeeping services, businesses can redirect their focus toward growth, customer engagement, and strategic planning. Outsourcing firms in India operate with well-defined processes and the latest accounting technologies to ensure efficiency and accuracy in bookkeeping.

With professionals handling their books, companies can expect timely financial reports, improved cash flow management, and seamless tax preparation. Moreover, outsourcing partners in India work across different time zones, ensuring round-the-clock service and quicker turnaround times for financial tasks.

Data Security and Compliance

Many businesses hesitate to outsource financial processes due to concerns about data security. However, Indian outsourcing firms prioritize confidentiality and compliance with international data protection laws. Bookkeeping Outsourcing India providers implement robust security measures to protect sensitive financial information, including encrypted data storage, multi-factor authentication, and strict access controls.

Additionally, they ensure compliance with the respective country's financial regulations, reducing the risk of errors, penalties, and legal issues. This level of security and regulatory adherence makes outsourcing bookkeeping to India a reliable option for businesses worldwide.

Conclusion

Outsourced bookkeeping services in India provide the perfect answer for businesses seeking a cost-effective, scalable, and efficient solution. By choosing outsourced bookkeeping, companies gain access to expert financial professionals, save time, and ensure compliance with international accounting standards. Bookkeeping Outsourcing India offers a strategic advantage that allows businesses to streamline operations and focus on growth.

Infinzi, a trusted provider of bookkeeping outsourcing services, empowers businesses with accurate financial management, secure data handling, and customized solutions tailored to their needs. With their expertise, companies can achieve financial efficiency and cost savings, making outsourcing a smart business move.

0 notes

Text

How Best ERP Software Solutions Help in Compliance and Financial Management

How Best ERP Software Solutions Help in Compliance and Financial Management

In today’s fast-paced business environment, organizations must navigate a complex landscape of regulatory requirements and financial management challenges. Enterprise Resource Planning (ERP) software plays a critical role in ensuring businesses remain compliant with industry standards while streamlining financial operations. The best ERP solutions integrate compliance and financial management features, reducing risks, enhancing transparency, and improving decision-making.

Ensuring Regulatory Compliance

1. Automated Compliance Tracking

ERP systems come with built-in regulatory frameworks that help businesses adhere to industry standards, such as IFRS, GAAP, VAT, and tax regulations. These systems automatically update to reflect new laws, ensuring companies remain compliant without manual intervention.

2. Audit Trail and Documentation

A robust ERP system maintains a detailed audit trail, recording all transactions and modifications. This feature helps organizations prepare for audits, providing a clear record of financial activities and ensuring accountability.

3. Data Security and Access Control

Compliance regulations often require businesses to safeguard sensitive financial data. ERP solutions provide role-based access controls, encryption, and secure storage, reducing the risk of data breaches and unauthorized access.

4. Tax Compliance and Reporting

ERP software simplifies tax calculations and filings by automating tax rates, deductions, and exemptions based on jurisdiction. This reduces errors and ensures timely submission of tax reports, preventing penalties.

Enhancing Financial Management

1. Real-Time Financial Insights

ERP solutions provide real-time dashboards and analytics, allowing businesses to monitor financial performance. This enables proactive decision-making, helping companies optimize cash flow, manage expenses, and maximize profitability.

2. Integrated Accounting and Reporting

Best ERP solutions integrate accounting modules that cover general ledger, accounts payable, accounts receivable, and financial reporting. This ensures accurate financial statements, reducing discrepancies and enhancing reliability.

3. Budgeting and Forecasting

ERP software allows businesses to create detailed budgets and financial forecasts, helping them plan for future expenses, investments, and revenue streams. This strategic approach enhances financial stability and growth.

4. Automated Payment Processing

With ERP, companies can automate payroll, vendor payments, and invoicing, reducing manual errors and improving efficiency. This also ensures timely payments, strengthening relationships with employees and suppliers.

5. Multi-Currency and Multi-Entity Management

For businesses operating globally, ERP solutions support multi-currency transactions and financial consolidation across multiple entities. This simplifies international operations and ensures compliance with different financial regulations.

Conclusion

The Best ERP Software Solutions provide an integrated approach to compliance and financial management, ensuring businesses stay compliant while optimizing financial processes. From automated compliance tracking to real-time financial insights, these solutions empower organizations to operate efficiently and mitigate risks. Investing in a reliable ERP system is a strategic move that enhances transparency, security, and financial performance in today’s competitive market.

0 notes

Text

Financial consolidation software: A necessity in today’s complex financial world

In today’s globalized business environment, financial reporting has become increasingly complex due to multiple accounting standards like IND AS, IFRS, and GAAP. Companies must handle inter-company eliminations, currency translations, and vast amounts of data, making financial consolidation software essential for accuracy and efficiency.

Key benefits of financial consolidation software

Automation for faster reporting: Financial consolidation software automates data collection from various subsidiaries, eliminating manual errors and accelerating reporting. For example, BiCXO, Oracle, and SAP help large corporations streamline IND AS compliance by integrating multiple data sources, ensuring accuracy and efficiency.

Multi-GAAP & multi standard compliance: Companies operating in multiple jurisdictions must comply with different accounting standards. Financial consolidation tools allow businesses to generate IFRS, US GAAP, and local GAAP reports simultaneously, ensuring regulatory compliance while minimizing errors.

Inter-company eliminations: Eliminating inter-company transactions manually is time-consuming and error-prone. Financial consolidation software automates this process, reducing reconciliation time and preventing revenue duplication in global corporations.

Accurate currency translation: Multinational companies dealing with different currencies benefit from automated currency conversions and exchange rate adjustments, ensuring accurate consolidated financial statements.

Why companies need financial consolidation software

With ever-evolving financial regulations and tight reporting deadlines, businesses cannot afford to rely on manual consolidation. Platforms like BiCXO empower finance teams by automating tedious processes, ensuring compliance, and providing real-time insights. Adopting financial consolidation software is no longer a choice it’s a necessity for faster closing cycles, improved accuracy, and strategic financial management.

To read the full detailed article visit our website by clicking here

#businessintelligence#bicxo#bi tool#business intelligence software#business intelligence#data#bisolution#business solutions#businessefficiency#data warehouse#financial consolidation#financial analysis#financial reporting#financialplanning#finance#software services#reporting software#software

0 notes

Text

Reconciling Nonprofit Development and Finance Numbers

If you've ever felt the tension between finance and development teams in a nonprofit, you're not alone. But why does this gap exist in the first place? Let's break it down in simple terms and get you ready to ace that next board meeting.

Why the Numbers Don't Line Up:

Different Languages: Finance and development often speak different languages. What development calls a "commitment," finance might label a "receivable." It's not wrong, just different.

Timing is Everything: Development might count a gift when it's verbally promised, while finance waits until the grant letter arrives. This can create timing differences in when revenue is reported by each team.

Rules of the Game: Accounting standards (like GAAP) have specific rules about when to count money. These rules might not always match how your development team tracks donations.

Different Audiences: Finance teams focus on reporting that will pass the annual audit, while development teams prioritize donor relationships and fundraising goals. These differing audiences and areas of focus can lead to conflicts in how and when donations are recorded.

Reporting Pressures: Development teams may feel pressure to show strong fundraising results, while finance needs to ensure accurate financial statements. This can create tension when the numbers don't match up.

what you can do:

Schedule Regular Sync-Ups: Monthly "Finance-Development Alignment" meetings are a must. Cover top donations, gift pipeline, and upcoming board reports. Pro tip: Use Asana for action items with clear owners and deadlines.

Create a Translation Guide: Bridge the gap between finance and development lingo. Show real-world examples of how terms translate across departments. For instance, demonstrate how a "pledge" in Development becomes a "receivable" in Finance. Share this guide with your board to boost their understanding.

Implement Monthly Reconciliations: If these issues recur within your team, spend some time to uncover why discrepancies happen. Is it a timing issue or different recognition criteria? Use findings to refine processes and prevent future issues. It's not about pointing fingers; it's about continuous improvement.

Master Your Agreements: For multi-year grants or complex donations, create a simple table with crucial details. Include grant amount, payment schedule, recognition rules, and any restrictions. Ensure both teams are on the same page.

Develop a Multi-Year Grant Tracker: Build an Excel workbook with all grant details including grant name, total amount, grant term, payment dates, restrictions, and any conditions on the grant. Update weekly and use it as your go-to resource for aligning finance and development teams.

Align Your Reporting Systems: Create a solid monthly data transfer process if you can't use a single system. Set clear deadlines for exporting, importing, and reconciling data.

Clarify Projections vs. Actuals: Consistency is key. Try color coding for clarity: blue for actuals, green for projections, red for variances. Include context for significant differences.

Educate Your Board on Financial Statements: Conduct a "Financial Statement 101" session for your board. Walk them through key areas of your statements, explaining how development activities impact the numbers. Use real examples from your organization to make it relatable. Your accountant should be able to help with this.

Implementing these strategies can transform how your finance and development teams collaborate. Reach out to your accountant for help. Remember, your accountant should be more than just a number-cruncher – they should be a strategic partner in bridging these departmental gaps and driving your organization's mission forward.

1 note

·

View note

Text

Reconciling Nonprofit Development and Finance Numbers

If you've ever felt the tension between finance and development teams in a nonprofit, you're not alone. But why does this gap exist in the first place? Let's break it down in simple terms and get you ready to ace that next board meeting.

Why the Numbers Don't Line Up:

Different Languages: Finance and development often speak different languages. What development calls a "commitment," finance might label a "receivable." It's not wrong, just different.

Timing is Everything: Development might count a gift when it's verbally promised, while finance waits until the grant letter arrives. This can create timing differences in when revenue is reported by each team.

Rules of the Game: Accounting standards (like GAAP) have specific rules about when to count money. These rules might not always match how your development team tracks donations.

Different Audiences: Finance teams focus on reporting that will pass the annual audit, while development teams prioritize donor relationships and fundraising goals. These differing audiences and areas of focus can lead to conflicts in how and when donations are recorded.

Reporting Pressures: Development teams may feel pressure to show strong fundraising results, while finance needs to ensure accurate financial statements. This can create tension when the numbers don't match up.

What you can do:

Schedule Regular Sync-Ups: Monthly "Finance-Development Alignment" meetings are a must. Cover top donations, gift pipeline, and upcoming board reports. Pro tip: Use Asana for action items with clear owners and deadlines.

Create a Translation Guide:Bridge the gap between finance and development lingo. Show real-world examples of how terms translate across departments. For instance, demonstrate how a "pledge" in Development becomes a "receivable" in Finance. Share this guide with your board to boost their understanding.

Implement Monthly Reconciliations:If these issues recur within your team, spend some time to uncover why discrepancies happen. Is it a timing issue or different recognition criteria? Use findings to refine processes and prevent future issues. It's not about pointing fingers; it's about continuous improvement.

Master Your Agreements:For multi-year grants or complex donations, create a simple table with crucial details. Include grant amount, payment schedule, recognition rules, and any restrictions. Ensure both teams are on the same page.

Develop a Multi-Year Grant Tracker:Build an Excel workbook with all grant details including grant name, total amount, grant term, payment dates, restrictions, and any conditions on the grant. Update weekly and use it as your go-to resource for aligning finance and development teams.

Align Your Reporting Systems:Create a solid monthly data transfer process if you can't use a single system. Set clear deadlines for exporting, importing, and reconciling data.

Clarify Projections vs. Actuals:Consistency is key. Try color coding for clarity: blue for actuals, green for projections, red for variances. Include context for significant differences.

Educate Your Board on Financial Statements:Conduct a "Financial Statement 101" session for your board. Walk them through key areas of your statements, explaining how development activities impact the numbers. Use real examples from your organization to make it relatable. Your accountant should be able to help with this.

Implementing these strategies can transform how your finance and development teams collaborate. Reach out to your accountant for help. Remember, your accountant should be more than just a number-cruncher – they should be a strategic partner in bridging these departmental gaps and driving your organization's mission forward.

0 notes