#NDD execution

Explore tagged Tumblr posts

Text

#FxPro#forex broker#CFD trading#MetaTrader 4#MetaTrader 5#cTrader#FxPro Edge#no dealing desk#NDD execution#negative balance protection#fast order execution#trading platforms#trading instruments#account types#leverage#spreads#demo account#trading tools#economic calendar#trading calculators#VPS#regulated broker#FCA#CySEC#FSCA#SCB#trading 2025#broker review

0 notes

Text

Executive summary

A stunning new autism study was just published in the peer-reviewed scientific literature: “Vaccination and Neurodevelopmental Disorders: A Study of Nine-Year-Old Children Enrolled in Medicaid” by Mawson and Jacob.

The study examined Florida Medicaid data obtained from the now defunct DEVEXI.

Note: It is critically important to the US government that databases such as DEVEXI are shut down ASAP so that research revealing the harms of vaccination can no longer take place. Mawson was lucky to get access to this data before DEVEXI was shut down. He mentions in the paper a conversation with Mitch Praver, co-founder of DEVEXI on 07/19/2018.

Key findings are summarized in this stunning figure where NDD are neurodevelopmental disorders:

In plain English, from a child’s mental health standpoint, vaccination is a DISASTER.

85% of learning disabilities in kids is being caused by the CDC childhood vaccination schedule.

Let that sink in. PAR= 5.8/6.8 which is 85.3%

Relative Risk (RR) for autism for kids with just 11 vaccine visits was a stunning 4.4. Since most kids in America get the full CDC schedule, close to 80% of all autism cases in America are caused by vaccines

Here you go. This is called “dose-response” and it is a key marker of causality. This is not just a “correlation.” It is a DOSE DEPENDENT correlation which is another name for “causality.” It’s associated with vaccine visits, not office visits.

2 notes

·

View notes

Text

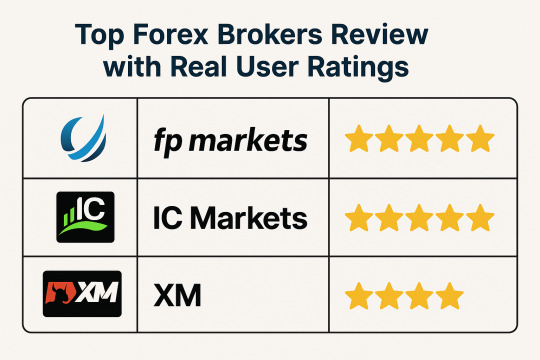

Top Forex Brokers Review with Real User Ratings

Choosing the right forex broker can be a critical step in a trader’s journey. In this Top Forex Brokers Review, we provide a clear and professional evaluation of the most trusted brokers in the market, incorporating real user ratings and insights. Whether you're a novice or an intermediate trader, this guide will help you compare the best platforms based on regulation, features, platform performance, and overall user satisfaction.

Key Qualities of a Top Forex Broker

Before diving into the Top Forex Brokers Review, it's important to understand what distinguishes a reliable broker:

Strong regulatory oversight by ASIC, FCA, or CySEC

Tight spreads with transparent fee structures

High-speed order execution

Dependable trading platforms such as MetaTrader 4, MetaTrader 5, or cTrader

Solid customer support and educational resources

Positive user reviews and community feedback

Broker Reviews Based on Features and User Experience

Eightcap

Regulated by ASIC and SCB with tight spreads

Integrates TradingView with MT4 and MT5

Offers a wide range of crypto CFDs and forex instruments

Eightcap is favored by traders who value innovation and advanced charting tools. Its crypto offering adds a competitive edge for diversified traders.

FP Markets

Licensed by ASIC and CySEC, providing strong regulatory safety

ECN-style execution with access to Iress, MT4, and MT5

Consistently high user ratings for customer service and execution speed

FP Markets is ideal for serious traders who want reliable pricing and a platform that’s proven to perform well under market pressure.

FBS

Regulated by IFSC and CySEC with flexible account types

Offers high leverage up to 1:3000 and strong promotional bonuses

Known for user-friendly support and localized services

FBS attracts beginners with its low entry requirements and variety of learning tools. Many users rate it highly for customer support responsiveness.

XM

Regulated by ASIC, IFSC, and CySEC with multi-lingual support

Low spreads from 0.0 pips and negative balance protection

Praised for educational materials and community outreach

XM remains a user favorite for its consistent performance and excellent learning ecosystem. It’s a well-rounded platform suitable for most traders.

IC Markets

Overseen by ASIC, CySEC, and FSA with true ECN trading

Raw pricing with ultra-low spreads and deep liquidity

Popular among algorithmic and professional traders

IC Markets consistently receives high user ratings for its stable infrastructure and efficient execution. A top choice for experienced traders.

FxPro

Regulated by FCA, CySEC, and FSCA with NDD execution

Offers MT4, MT5, and cTrader platforms

Rated highly for reliability and order transparency

FxPro is suitable for traders who value a mix of automation and discretion. Users commend its consistent uptime and trade execution.

Axi

Regulated by ASIC, FCA, and FMA with global recognition

Offers MT4 with integrated PsyQuation analytics

Well-rated for analytical tools and trader support

Axi provides a data-driven edge for traders who like to track performance and optimize strategies. Its educational services are also appreciated.

Pepperstone

Regulated by ASIC, FCA, and DFSA for broad international access

Offers low-latency trading with MetaTrader, cTrader, and TradingView

Frequently top-rated for speed and reliability

Pepperstone is a go-to broker for fast execution and deep liquidity. Scalpers and technical traders give it consistent five-star ratings.

HFM (HotForex)

Overseen by FCA, FSCA, and DFSA for global credibility

Offers multiple account types including Zero, PAMM, and copy trading

Rated well for its comprehensive educational content

HFM is a strong choice for both individual and social traders. New users often cite its ease of use and well-structured training programs.

Octa

Regulated by CySEC and FSA with bonus offers

Provides cashback and commission-free trading options

Known for a user-friendly mobile trading experience

Octa is best for entry-level traders who need simplicity and mobile-first functionality. User reviews highlight its intuitive platform and reward systems.

Real User Success Story: Learning Through Experience

Carlos Mendoza, a 29-year-old engineer from Peru, started trading part-time in 2022 with Pepperstone. Initially, he was drawn to the platform’s fast execution and tight spreads. Carlos spent months refining his strategy through demo accounts and later shifted to a live ECN account. With consistent support and educational tools, he scaled his capital from $500 to over $12,000 in 18 months. Carlos credits his growth to Pepperstone’s transparent pricing and the support of a strong online trading community.

How to Check If a Broker's Website is Safe?

Security is a vital concern when trading online. Here's how to assess a forex broker’s website for safety:

Regulatory Proof: Check for valid licenses from financial authorities such as ASIC, FCA, or CySEC.

SSL Encryption: Look for “https” and a padlock icon in the address bar.

Two-Factor Authentication: A secure platform will offer 2FA to protect user accounts.

Fund Segregation: Ensure client funds are kept separate from broker operational funds.

Clear Legal Documentation: Terms, privacy policies, and risk warnings should be readily available.

Click Now

Frequently Asked Questions (FAQs)

How can I tell if a broker is regulated?

Visit the official website and scroll to the footer where license numbers are usually listed. Verify them on the regulator’s site.

What’s the best platform for beginners?

Platforms like XM and FBS offer beginner-friendly tools, demo accounts, and educational resources for starting out.

Can I make money in forex with little capital?

Yes, but it requires discipline, strategy, and realistic expectations. Brokers like FBS and Octa offer micro and cent accounts.

What’s the difference between raw spreads and standard spreads?

Raw spreads come with lower pip differences but include commissions. Standard spreads are wider but often commission-free.

Are mobile trading apps reliable?

Yes, if offered by reputable brokers like Pepperstone, Octa, or IC Markets. Always download apps from official stores.

youtube

Final Words: Make an Informed Choice

This Top Forex Brokers Review provides a transparent look at the best forex brokers as rated by real users. From Pepperstone to XM and FBS, each platform has its unique advantages. The right choice depends on your trading needs, experience level, and desired features. Take time to compare offerings, use demo accounts, and ensure platform safety. With informed decision-making, you’ll be well-positioned to succeed in your forex journey. Revisit this Top Forex Brokers Review anytime you need guidance on choosing the right broker.

0 notes

Text

Why Trade with ECN Forex Brokers? Expert Reviews & Features

The forex market is one of the largest financial markets in the world, attracting millions of traders globally. However, choosing the right broker is essential for a successful trading journey. Among the various types of brokers, ECN Forex Brokers stand out for their transparency, lightning-fast execution, and deep liquidity. If you are searching for ECN Forex Brokers Reviews to identify the most reliable and efficient platforms, this guide provides a detailed look at why ECN brokers are the best choice and highlights the Best ECN Forex Brokers for a superior trading experience.

What Are ECN Forex Brokers?

ECN Forex Brokers Reviews operate on a No Dealing Desk (NDD) model, meaning they do not take the opposite side of a trader’s position. Instead, they provide direct market access (DMA) by connecting traders with liquidity providers, such as banks, hedge funds, and financial institutions. This model ensures that traders benefit from tight spreads, real-time price feeds, and enhanced trade execution.

Key Features of ECN Forex Brokers

1. Raw Spreads & Transparent Pricing

One of the biggest advantages of ECN brokers is their ability to offer raw spreads starting from 0.0 pips. Unlike traditional brokers who add a markup, ECN brokers charge a small commission per trade, ensuring complete transparency in pricing.

2. No Dealing Desk (NDD) Execution

With an NDD execution model, ECN brokers eliminate the risks of price manipulation and requotes. This feature ensures that orders are executed at the best available prices in the market without interference.

youtube

3. Ultra-Fast Trade Execution

ECN brokers provide low-latency execution, making them ideal for high-frequency traders, scalpers, and algorithmic traders who rely on split-second trade execution.

4. Deep Liquidity and Market Access

By connecting traders with multiple liquidity providers, ECN brokers offer deep liquidity pools, leading to better pricing, reduced slippage, and seamless order fulfillment.

5. Scalping and Algorithmic Trading Friendly

Due to their tight spreads, fast execution, and lack of restrictions, ECN brokers are perfect for traders using scalping strategies and automated trading systems, including Expert Advisors (EAs) on MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Best ECN Forex Brokers: Expert Reviews

Here’s a list of the Best ECN Forex Brokers that provide outstanding trading conditions and advanced technology:

1. FP Markets

FP Markets is a highly regarded ECN broker offering raw spreads, ultra-fast execution, and high liquidity. It is well-known for its low-cost trading environment and advanced trading platforms.

2. FXPro

FXPro provides an NDD trading environment with tight spreads and deep liquidity. Its multiple account types cater to both beginner and professional traders.

3. Eightcap

Eightcap is a well-established ECN broker providing low-cost trading with access to deep liquidity. It supports multiple trading platforms and offers fast execution speeds.

4. IC Markets

IC Markets is a true ECN forex broker, offering some of the lowest spreads in the market. With high-speed execution and institutional-grade liquidity, IC Markets is a top choice for professional traders and scalpers.

5. FBS

FBS is an award-winning forex broker offering ECN accounts with raw spreads, low commission fees, and deep liquidity pools. It’s an excellent choice for all types of traders.

6. XM

XM offers an ECN-like trading environment, ensuring fast order execution, no requotes, and competitive spreads. It is also well-known for its strong regulatory framework.

7. Axi

Axi is a popular ECN broker providing competitive spreads, deep liquidity, and premium trading tools. It is particularly suitable for professional traders who require high-speed trade execution.

8. HFM (HotForex)

HFM, formerly HotForex, is a trusted ECN broker offering tight spreads, strong liquidity, and fast execution speeds. It is well-suited for both retail and institutional traders.

9. Pepperstone

Pepperstone is widely considered one of the best ECN brokers, offering low trading costs, direct market access, and advanced trading technology. With MT4, MT5, and cTrader, it is a preferred choice for scalpers and algorithmic traders.

How to Choose the Best ECN Forex Broker?

When selecting an ECN broker, consider the following factors:

Regulation & Security: Ensure the broker is regulated by top-tier authorities for a secure trading experience.

Trading Conditions: Look for low spreads, fast execution speeds, and transparent commissions.

Trading Platforms: Choose brokers offering MT4, MT5, and cTrader for an optimal trading experience.

Commission & Fees: Compare commission structures to find cost-effective brokers.

Customer Support: Reliable 24/7 customer service is crucial for uninterrupted trading.

Conclusion

ECN Forex Brokers are the best choice for traders looking for low spreads, high-speed execution, and direct market access. Whether you are a scalper, professional trader, or algorithmic trader, selecting the right ECN broker can maximize your profitability and trading efficiency. The Best ECN Forex Brokers, such as FP Markets, FX Pro, Eightcap, IC Markets, FBS, XM, Axi, HFM, and Pepperstone, provide exceptional liquidity, top-tier execution speeds, and superior trading conditions. If you're looking for honest ECN Forex Brokers Reviews, these brokers offer world-class trading solutions that cater to all types of traders.

0 notes

Text

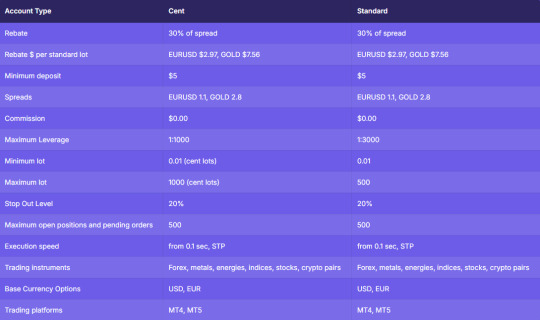

FBS Rebate, forexrebatehub.com

FBS Rebate 90% of IB

Rebate Rate: 30% of spread

Rebate Method: Weekly & Direct to account

Website : forexrebatehub.com

Highlight & Promotions!

Floating spread from 0.7 pips

Leverage up to 1:3000

No requotes: Orders are executed within the NDD (Non-Dealing Desk) and STP (Straight Through Processing) technologies

Islamic Accounts

0 notes

Text

BDR Pharmaceuticals, a global player in the pharmaceutical industry, is actively seeking qualified professionals for the roles of Executive and Senior Executive in Project Management. This exciting opportunity is available at their Baska, Halol facility and is ideal for candidates with experience in the pharmaceutical product life cycle, including oral solids, injectables, NDDS, and APIs. Open Positions at BDR Pharmaceuticals 1. Project Management - Executive / Senior Executive Location: BDR Pharmaceuticals International Pvt. Ltd., Baska, Halol Experience: 3 to 5 years in Project Management (preferably for the US/EU market) Qualification: M Pharmacy and MBA Vacancies: Multiple positions available Responsibilities: As a Project Management Executive or Senior Executive, you will be responsible for overseeing various stages of the pharmaceutical product life cycle. Your role will include managing projects related to formulations, including oral solids, injectables, Novel Drug Delivery Systems (NDDS), and Active Pharmaceutical Ingredients (APIs). You will also coordinate with cross-functional teams to ensure timely delivery and regulatory compliance. Manage project timelines and deliverables to meet business objectives. Collaborate with formulation, R&D, and regulatory teams to ensure product development aligns with the company's quality standards. Identify risks and develop mitigation strategies to keep the project on track. Coordinate with international markets, especially US/EU, for project compliance and regulatory submissions. Qualifications and Requirements Educational Qualification: M Pharmacy and MBA Experience: 3 to 5 years in pharmaceutical project management, with experience in US/EU markets being highly preferred. Skills: Strong organizational and project management skills In-depth knowledge of pharmaceutical formulations (oral solids, injectables, NDDS, APIs) Ability to work with cross-functional teams and manage multiple projects simultaneously Understanding of regulatory requirements in the pharmaceutical industry [caption id="attachment_57738" align="aligncenter" width="930"] BDR Pharmaceuticals Recruitment Notification[/caption] Application Process Interested candidates can apply by sending their updated resumes to Darpan Rajput at [email protected]. For more details, you can also contact 9016580529.

0 notes

Text

The Role of Forex Brokers in the Global Financial Market

The Role of Forex Brokers in the Global Financial Market The global financial market is a vast and complex ecosystem where various financial instruments are traded. Among these, the foreign exchange (forex) market stands out as the largest and most liquid market in the world. Forex brokers play a crucial role in this market, acting as intermediaries between traders and the interbank market. This article explores the multifaceted role of forex brokers in the global financial market, highlighting their functions, types, and the importance of choosing the right broker.To get more news about WikiBit, you can visit our official website.

Functions of Forex Brokers Facilitating Trades: Forex brokers provide traders with access to the global forex market, which operates 24 hours a day, five days a week. They execute orders on behalf of traders, ensuring that trades are carried out accurately and efficiently. This includes both market orders, which are executed immediately at the current market price, and pending orders, which are executed when certain conditions are met. Pricing and Liquidity: Brokers aggregate pricing data from various liquidity providers, including major banks and financial institutions. This aggregated pricing is then made available to traders, often with competitive spreads. By ensuring sufficient liquidity, brokers help reduce the risk of slippage, where an order is executed at a different price than expected due to a lack of liquidity. Risk Management: Forex trading often involves leverage, allowing traders to control larger positions with a relatively small amount of capital. Brokers monitor traders’ account balances to ensure they have enough margin to cover their open positions. They may issue margin calls or automatically close positions if a trader’s account balance falls below the required margin level. Types of Forex Brokers Forex brokers can be broadly categorized into two types: dealing desk (DD) brokers and no dealing desk (NDD) brokers.

Dealing Desk Brokers: Also known as market makers, dealing desk brokers create their own market and take the opposite side of their clients’ trades. They profit from the spread between the bid and ask prices and may also trade against their clients. While this can lead to potential conflicts of interest, dealing desk brokers often provide fixed spreads and guaranteed liquidity. No Dealing Desk Brokers: NDD brokers, on the other hand, do not take the opposite side of their clients’ trades. Instead, they provide direct access to the interbank market, where multiple liquidity providers compete to offer the best prices. NDD brokers can be further divided into straight-through processing (STP) brokers and electronic communication network (ECN) brokers. STP brokers route clients’ orders directly to liquidity providers, while ECN brokers allow clients to interact with other market participants, including banks, hedge funds, and other traders. Choosing the Right Forex Broker Selecting the right forex broker is crucial for successful trading. Here are some factors to consider:

Regulation: Ensure that the broker is regulated by a reputable financial authority. Regulation provides a level of protection for traders, ensuring that the broker adheres to certain standards and practices. Trading Platform: A good trading platform should be user-friendly, reliable, and equipped with essential tools and resources. Popular platforms like MetaTrader 4 and MetaTrader 5 offer advanced charting tools, technical analysis, and automated trading capabilities. Customer Support: Reliable customer support is essential, especially for new traders. Look for brokers that offer 24/7 support through various channels, including live chat, email, and phone. Fees and Commissions: Compare the fees and commissions charged by different brokers. While some brokers offer low spreads, they may charge higher commissions. Consider your trading style and frequency to determine which fee structure is most cost-effective for you. Conclusion Forex brokers play a vital role in the global financial market by providing traders with access to the forex market, ensuring liquidity, and managing risk. Understanding the functions and types of forex brokers, as well as the factors to consider when choosing a broker, can help traders make informed decisions and enhance their trading experience. As the forex market continues to evolve, the role of brokers will remain integral to its operation and success.

0 notes

Text

The Advantages of JRFX Among Non Dealing Desk Forex Brokers

The Advantages of JRFX Among Non Dealing Desk Forex Brokers. In the vast landscape of Forex trading, the choice of broker plays a pivotal role in shaping one's trading journey. For traders seeking transparency, fair execution, and an environment free from conflicts of interest, non dealing desk (NDD) Forex brokers are the preferred option. Among these brokers, JRFX shines brightly with its array of advantages tailored to meet the needs of traders. Let's delve into the distinct advantages that set JRFX apart in the world of NDD Forex brokers.

Unveiling JRFX's Advantages

Direct Market Access: JRFX takes pride in offering its traders direct access to the interbank market. This means that when you execute a trade with JRFX, it goes directly to the market without any interference or manipulation. This direct market access ensures fast and reliable order execution, allowing traders to seize opportunities swiftly.

Transparent Pricing: Transparency is a cornerstone of JRFX's philosophy. With this broker, traders can rest assured that the prices they see on their screens are the same as those in the market. There are no hidden markups or sudden spikes in spreads. Every price movement is a true reflection of market dynamics, empowering traders with accurate information to make informed decisions.

Competitive Spreads: When it comes to trading costs, JRFX stands out with its competitive spreads. By partnering with top-tier liquidity providers, JRFX is able to offer tight spreads across a wide range of currency pairs. This ensures that traders can enter and exit positions with minimal cost, maximizing their profit potential.

No Requotes: Dealing with requotes can be frustrating for traders, especially during volatile market conditions. JRFX eliminates this concern by providing a no-requotes environment. When you place an order with JRFX, you get the price you see, without any delays or changes.

No Conflict of Interest: Unlike dealing desk brokers that may have conflicting interests with their clients, JRFX operates on a non dealing desk model. This means that JRFX does not take the opposite side of clients' trades. Instead, orders are routed directly to liquidity providers, ensuring that the broker's success is aligned with the success of its traders.

Advanced Trading Platforms: JRFX understands the importance of robust and user-friendly trading platforms. That's why they offer a range of advanced platforms, including MetaTrader 4 and 5. These platforms are equipped with powerful trading tools, charting capabilities, and expert advisors, catering to both novice and experienced traders alike.

Diverse Account Types: Recognizing that every trader has unique needs, JRFX provides a variety of account types to choose from. Whether you're a beginner looking to dip your toes in the market or a seasoned trader seeking advanced features, JRFX has an account tailored to your requirements.

JRFX's Commitment to Traders

In addition to these advantages, JRFX goes the extra mile to ensure that traders feel supported and empowered:

Educational Resources: JRFX offers a wealth of educational resources, including webinars, tutorials, and market analysis. These resources are designed to help traders enhance their knowledge and improve their trading strategies.

Responsive Customer Support: Traders can rely on JRFX's dedicated customer support team, available 24/5. Whether you have a technical issue, a question about your account, or simply need assistance, help is just a call or message away.

Security of Funds: With JRFX, traders can trade with peace of mind knowing that their funds are secure. The broker adheres to strict regulatory standards and employs robust security measures to safeguard clients' funds.

Conclusion: Elevate Your Trading with JRFX

In conclusion, JRFX ( https://www.jrfx.com/?804 ) stands out as a beacon among non dealing desk Forex brokers, offering a host of advantages tailored to meet the needs of today's traders. From direct market access to competitive spreads, transparent pricing, and advanced trading platforms, JRFX provides the tools and support for traders to thrive in the dynamic Forex market. Whether you're new to trading or a seasoned professional, JRFX's commitment to transparency, fairness, and innovation makes it a top choice for those seeking a reliable NDD broker. Experience the advantages of JRFX and elevate your trading journey today.

0 notes

Text

DBG Markets - Your Ultimate CFD Online Trading Platform

Experience the world of CFD online trading with DBG Markets, one of the most trusted online trading providers globally. Trade Contracts for Difference (CFDs) on a wide range of markets including forex, precious metals, shares, indices, and commodities. DBG Markets offers a transparent and low-cost trading experience with Straight-Through-Processing (STP) and NDD (No Dealing Desk) execution, providing raw interbank FX spreads as low as 0 pips. Benefit from multi-regional licenses, 24/7 customer support, and a variety of trading products including cryptocurrencies.

1 note

·

View note

Text

Dealing Desk: What it Means, How it Works

What Is a Dealing Desk?

A dealing desk is a centralized location within a financial institution, such as a bank or brokerage firm, where financial transactions are executed. In the context of forex (foreign exchange) trading, a dealing desk refers to a department or a desk within a brokerage firm that facilitates the buying and selling of currencies on behalf of their clients.

Here's how it works in the context of forex trading:

Customer Orders: Retail traders place orders to buy or sell currencies through their brokers. These orders can vary in size and are placed electronically via trading platforms.

Dealing Desk Operation: When a trader places an order, it is typically sent to the broker's dealing desk. At the dealing desk, traders or automated systems assess the market conditions, the broker's inventory, and the available liquidity from liquidity providers.

Execution: Based on their assessment, the dealing desk decides how to execute the trade. They might choose to match the order with an opposite order from another client (internal matching), offset the trade in the interbank market, or in the case of a market maker, take the other side of the trade using their own inventory of currencies.

There are two main types of dealing desks in the forex market:

1. Market Maker Dealing Desk: Market makers are brokers who create a market for their clients. When you place a trade with a market maker, they can take the opposite side of your trade. They profit from the spread, which is the difference between the buying (bid) and selling (ask) prices. Market makers often provide liquidity and ensure that there is a market available for trading, especially for retail clients.

2. Straight Through Processing (STP) or No Dealing Desk (NDD): Brokers operating with STP or NDD do not have a dealing desk. Instead, they pass clients' orders directly to liquidity providers such as banks and other financial institutions. These brokers earn a commission or charge a markup on the spread without taking the opposite side of the trade. This model is considered more transparent and eliminates potential conflicts of interest.

The choice between dealing desk models can affect the execution speed, spreads, and potential conflicts of interest in forex trading. It's essential for traders to understand the type of dealing desk their broker operates to make informed trading decisions.

Understanding Dealing Desks

Understanding dealing desks is crucial for traders, especially in the context of the foreign exchange (forex) market. A dealing desk is a centralized entity within a financial institution, typically a brokerage firm, where financial instruments like currencies, stocks, or derivatives are bought and sold. Dealing desks play a significant role in facilitating trades between buyers and sellers. Here are the key points to understand about dealing desks:

Types of Dealing Desks:

1. Market Maker Dealing Desk:

Role: Market makers are brokers or financial institutions that create a market for their clients. They quote both buy (bid) and sell (ask) prices for various financial instruments.

Execution: When a trader places an order, a market maker can choose to take the opposite side of the trade. They profit from the spread, which is the difference between the bid and ask prices.

Advantages: Market makers provide liquidity, ensuring that there are always buyers and sellers in the market. They are especially important for retail traders.

2. No Dealing Desk (NDD) or Straight Through Processing (STP) Desk:

Role: NDD or STP brokers do not operate a dealing desk in the traditional sense. Instead, they pass clients' orders directly to liquidity providers or the interbank market.

Execution: Orders are executed without the broker taking the opposite side of the trade. These brokers charge a small commission or markup on the spreads.

Advantages: NDD/STP desks often provide faster and more transparent trade execution. They eliminate potential conflicts of interest between the broker and the trader.

Key Concepts to Understand:

1. Spreads:

Spreads represent the difference between the bid and ask prices. Dealing desks, especially market makers, profit from the spreads.

2. Liquidity Providers:

Financial institutions, banks, and other market participants that provide liquidity by offering buy and sell prices. Dealing desks, especially NDD/STP brokers, connect traders to these liquidity providers.

3. Order Execution:

Dealing desks are responsible for executing client orders. Market makers can execute orders internally, while NDD/STP brokers route orders to external liquidity providers.

4. Conflict of Interest:

Market maker dealing desks may have a potential conflict of interest since they can take the opposite side of their clients' trades. NDD/STP desks eliminate this conflict by not participating in the trades.

Understanding the type of dealing desk your broker operates is essential for making informed trading decisions. It can impact the execution speed, costs, and overall trading experience. Traders should choose a dealing desk type that aligns with their trading preferences and objectives.

Read more: https://computertricks.net/dealing-desk-what-it-means-how-it-works/

0 notes

Text

Bitcoin Gemini Review

Bitcoin Gemini that work through Dealing Desks (DD) bring in cash through spreads and giving liquidity to their customers. They are additionally called "market creators". Then again, NDD expedites essentially connect two gatherings together and don't execute their customers' orderes through a Dealing Desk. For those searching for a CFD merchant that permits you to exchange forex and are situated in one or the other Australia or New Zealand, we would suggest investigating Plus500. Despite the fact that the dealer has an exceptionally solid presence in the UK space, they hold the entirety of the necessary licenses to acknowledge brokers from both Australia and New Zealand.

As an organization recorded on the stock trade, Plus500 reveals all its financials and is viewed as one of the most legitimate forex exchanging stages the business. The base store for forex exchanging on Plus500 is 100 and the influence offered on their forex exchanging accounts is a limit of 1:30.Despite the fact that there is no assurance of making benefits when crypto exchanging, utilizing dependable and genuine stages like the ones we recorded is an incredible method to improve your odds of making benefits.Bitcoin Gemini

In the event that you are searching for an exceptionally progressed stage and you are a more experienced broker, at that point FP Markets is likely your smartest option. Dispatched in 2005 and situated in Australia, the agent offers immense influence levels of up to 500:1. On top of this, and maybe above all, FP Markets are an ECN intermediary, implying that among different advantages, you'll approach super low spreads.

Since we comprehend the division of Bitcoin Geminis, it is additionally imperative to realize that there are various kinds of Bitcoin Geminis out there. The various choices accessible these days implies that you are bound to locate a Bitcoin Gemini fit to your necessities – regardless of whether it be high influence, low spreads, or a huge forex reward.Bitcoin Gemini The following are the various sorts of Bitcoin Geminis clarified. Forex, or basically FX, alludes to the exchanging of unfamiliar monetary standards. As homegrown money valuations vary on a second-by-second premise, this makes it a profoundly dynamic speculation section. The forex exchanging industry is currently crucial to such an extent that more than $5 trillion is exchanged consistently.

https://www.cryptoerapro.com/bitcoin-gemini/

1 note

·

View note

Text

Forex Trading Platform - Tradefxp

Forex Trading Platform - Tradefxp

TradeFxP is one of the Global Market Leaders - We've been proud to join independent traders in the prospect of the global currency markets since 2012. Today, we persist in inquiring about ourselves to deliver traders what they require to flourish.

At TradeFxP Ltd, we know what it's like to trade. With the ranking of a multinational fintech and the dexterity of a start-up, we're here to arm you with everything you need to take on the global markets with enthusiasm. We process a norm of US$5.55bn of trades every day.

Forex Trading Platform

Our team of experienced professionals is dedicated to providing our clients with the highest level of service and support. We offer a variety of Trading Instruments including Forex, Spot Metal, Energies, Indices, Stocks / CFD, and Crypto; trading platforms including desktop, and mobile applications, to ensure that our clients can access the forex market from anywhere at any time.

At our Forex Trading Platform, we understand that the foreign exchange market can be complex and volatile, which is why we provide our clients with comprehensive educational resources and market analysis to help them make informed trading decisions. We also offer a range of trading tools and features, including automated trading, to help our clients maximize their trading potential.

As a regulated forex company, we take our client's security and privacy seriously. We use state-of-the-art security protocols and encryption technologies to ensure that our client's data and funds are protected at all times.

Whether you are a novice or an experienced forex trader, we have the tools, resources, and expertise to help you succeed in the global forex market. Join us today and start trading with confidence in the Forex Trading Platform.

Low spreads beginning from 0 pips for main instruments, 41 currency pairs.

Streaming forex rates, Instant Execution technology (on MT4 NDD).

Certified execution of limit orders, stop losses (S/L) and take profits (T/P) at the stated price.

The minimum lot is 1 000 units of base currency (0.01 of a standard lot).

The minimum deposit is 10 USD or an equivalent amount in another currency.

Leverage: minimum – 1:1, maximum 1:500 (minimum margin is 0.1% of the trade volume). On MT4 ECN DMA NDD account – 1:100. In case, you roll over your position to the day next to the opening, the compensation date changes automatically.

Swaps calculations in pips are based on LIBOR rates, then converted into the account currency according to 00.00 server time exchange rates and credited to your trading account.

We keep your costs down with competitive spreads and quality trade executions.

Since 2012, we've been funding technology and building a deep network of liquidity partners, so we can invariably quote tight spreads in most market conditions.

For more details visit our website: Forex Trading Platform

Contact: +44 7441 443348

Address: 20-22 Wenlock Rd,London N1 7GU,United Kingdom

Website: https://tradefxp.com/home

Email: [email protected]

1 note

·

View note

Text

The Evolution Of Forex Brokers And What It Means For Traders

For the modern trader, Forex brokers have become a crucial part of their trading journey. But what many don't realize is that these brokers have evolved considerably over time - with significant implications for traders today. In this article, we'll explore how Forex brokers have changed and why it matters to you as a trader. We'll look at growing competition in the industry, new technologies driving changes, and the impact on your own trading experience. So if you want to stay ahead of the curve and make sure you're making full use of all available opportunities, read on!

Definition Of Forex Brokers

Forex brokers are intermediaries that facilitate the trading of foreign currencies in the global currency market. They provide services to both retail and institutional traders, giving them access to a range of platforms and tools they can use to trade effectively. Brokers also offer leverage which allows traders to increase their buying power without having to deposit large amounts of cash upfront.

Traditionally, forex brokers were financial institutions such as banks or investment firms who acted as middlemen for clients wishing to transact in foreign exchange markets. With advances in technology, online forex brokerages have emerged offering direct access trades through their own proprietary platforms or those provided by third-party providers like MetaTrader 4 (MT4). These types of brokers usually charge lower fees than traditional ones due to their reduced overhead costs.

Today, there's a variety of different types of forex brokers available ranging from non-dealing desk (NDD) brokers who route orders directly into the interbank market all the way up to ECN/STP brokers with multiple liquidity pools connected via Electronic Communications Networks (ECNs). This provides traders with more choice when it comes to finding a suitable broker for their particular needs.

History Of Forex Brokers

The history of Forex brokers is an interesting one. It has been a long and winding road for the industry, with many changes occurring over time. Let's take a look at some of the most significant developments that have taken place in this ever-evolving world:

Today, there are numerous types of Forex brokers ranging from full service brokerage firms offering comprehensive solutions tailored specifically for large institutions all the way down to discount brokers catering mainly towards smaller retail clients looking for low cost execution only services. No matter what type of trader you are, you can be sure that there will always be a suitable broker out there ready to serve your needs effectively while adhering to regulatory requirements at all times.

Impact Of Online Technology On Forex Trading

The development of online technology has had a tremendous impact on the Forex trading market. It has allowed traders to access global markets, easily and quickly execute trades, and take advantage of real-time data and analysis tools. With advances in technology, brokers have been able to offer more competitive pricing structures, improved customer service, automated order flows, and even copy-trading capabilities. This has enabled retail investors to trade forex with ease from almost anywhere in the world. Furthermore, many brokers now offer mobile apps that allow customers to monitor their accounts and make trades conveniently from any device.

The availability of such wide range of services means that it is important for traders to shop around when choosing an online broker. They should look at fees charged by different brokers as well as other features they provide such as platform usability, educational resources or customer support options available. Additionally, some brokers may specialize in certain types of strategies like scalping or day trading while others might be better suited for longer term investments.

In addition to traditional currency pairs offered by most forex brokers, there are also alternative instruments available such as cryptocurrencies which can bring new opportunities for profitable trading despite being highly volatile assets. Brokers must ensure that they are compliant with regulations related to digital currencies since these vary significantly across countries so making sure your chosen provider offers appropriate services is essential before you start trading.

Regulatory Requirements

The impact of online technology on forex trading has been immense. It has revolutionized the way brokers and traders interact, allowing for more efficient ways to conduct business. However, while new technology makes it easier to access markets, there are still important regulatory requirements that must be adhered to in order to ensure that all transactions remain fair and secure.

Table 1 | Regulatory Requirements: | Requirement | Explanation | |-------------|-------------------------------------| | AML/KYC | Anti-money laundering & Know Your Client Procedures | | Risk Management | Ensuring trades do not exceed capital or risk limits | | Safety of Funds | Keeping customer funds separate from broker's operating capital |

Regulatory authorities such as CySEC, ASIC, FCA, NFA etc., have established a range of rules and regulations governing the activities of forex brokers in specific countries. These include measures related to anti-money laundering (AML) and know your client (KYC) procedures which must be followed by any regulated broker looking to legally operate within their jurisdiction. Additionally, they set out strict guidelines around risk management processes ensuring that no trades can exceed certain pre-defined capital or risk limits; this is done to protect both investors’ money as well as the reputation of brokers themselves. Finally, these organisations also require that all customer funds are kept completely separate from the broker’s own operating capital at all times for added safety and security.

By enforcing these stringent measures across each aspect of their operations, forex brokers can provide clients with greater confidence when conducting business through them knowing that their investments will always remain secure whilst simultaneously increasing their chances of making profitable long term investments. As technology continues to evolve however so too do the demands placed upon those responsible for its regulation – meaning that it falls upon individual companies themselves to ensure they continuously keep up-to-date with current legislation in order maintain their regulatory compliance status going forward.

Different Types Of Brokers

Brokers are the gatekeepers of the Forex market and come in a range of types. They provide traders with access to trading platforms, liquidity providers, and other services. The three main types of brokers are Market Makers, ECN Brokers, and STP/DMA brokers.

Market makers make money by hedging their own trades against those made by clients. This type of broker provides trading opportunities while also taking on some risk. By doing so they can offer competitive spreads and often times no commissions. However, because these brokers take positions opposite their clients, there is a conflict of interest that may lead to slippage or other problems for traders using them.

ECN (Electronic Communications Network) brokers allow direct access to interbank prices without any interference from the broker themselves. These brokers charge fees per trade but tend to have lower spreads than market makers as they don’t need to hedge their own trades. As such they are well suited for scalpers and high frequency traders who require extremely tight spreads and low latency execution speeds.

STP (Straight Through Processing)/DMA (Direct Market Access) brokers use technology to pass orders directly onto liquidity pools rather than through an internal dealing desk like Market Maker or ECN brokers do. This means that all client orders get passed unchanged straight onto liquidity providers which then execute the order at whatever price is available in real time meaning faster execution speed with minimal slippage occurring when news events move markets quickly. While this type of broker tends to have slightly higher spreads than ECNs due to having more overhead costs associated with setting up their system correctly, it's still one of the most popular choices amongst professional forex traders seeking reliable pricing and ultra-fast order execution speeds without resorting to less regulated offshore firms.

These different types of Forex brokers each bring something different to the table depending on what kind of trader you are; understanding which one best fits your needs will help ensure success in your journey into currency trading markets around the world.

Advantages And Disadvantages Of Using A Broker

Now that we have reviewed the different types of forex brokers, let’s examine some of their advantages and disadvantages. Generally speaking, a broker can provide traders with access to tradeable assets on the global markets. This includes currency pairs, stocks, options, commodities and more. Brokers also offer trading platforms which allow users to place trades in real time.

One major advantage of using a broker is that it allows individuals to take part in high-risk investments without having to commit large amounts of capital upfront. Leverage is often available through most brokers meaning traders can increase their exposure by borrowing funds from them. Additionally, many brokers now offer educational resources such as webinars and tutorials so new users can learn how the market works before putting their money at risk.

On the other hand, there are several downsides to consider when choosing a broker. Many charge fees for services like account maintenance or deposits/withdrawals, while others may require minimum deposits before allowing you to begin trading. Furthermore, depending on where you live some brokers may not be regulated or insured meaning your funds could potentially be at risk if something were to happen to the company itself or its servers went offline unexpectedly.

It's important for all traders - both experienced and novice - to thoroughly research any potential broker they're thinking about working with before making any commitments. By doing this they'll ensure they get the best service possible while minimizing their risks associated with foreign exchange investing.

Leverage And Margin Requirements

Leverage and margin requirements are two of the most important considerations for any forex trader. Leverage is essentially a loan offered by brokers to traders, allowing them to increase their buying power and take larger positions in the market. This can be incredibly helpful if used responsibly, but it also carries an inherent risk as losses can quickly mount up with highly leveraged trades. Margin requirements refer to how much capital must be deposited by a trader before they can open a position on the Forex market. Generally speaking, higher leverage means lower margin requirements, giving traders access to more funds than what would typically be required when trading without leverage.

From the early days of online forex trading, brokers have gradually increased both their maximum allowable leverage and reduced margin requirements. Today some brokers offer account levels where traders can access up to 1:1000 in terms of maximum available leverage while only requiring very low margins as deposits. On one hand this provides many advantages for traders who wish to take advantage of large amounts of leverage or trade using smaller accounts; however, such high levels of leverage come at great risk should prices move against the position held by the trader.

The evolution of broker offerings over time has paved the way for new opportunities for forex traders around the world that simply did not exist previously due to limited options for leveraging and margining capabilities provided by brokers themselves. As with any financial decision though, there is always a balance between potential reward and risk which needs to be carefully weighed before entering into any type of transaction involving money or assets.

Fees And Commissions Charged By Brokers

Fees and commissions are a major factor for traders when choosing their broker. Brokers typically earn revenue by charging fees or commissions on trades as well as spreads, which is the difference between the bid and ask price of an asset. This can have a significant impact on traders' profits, so it's important to understand how brokers make money and what fees they charge.

Overall, understanding all these different types of fees and commissions charged by forex brokers is essential for successful trading since they will have an impact on profitability and risk management strategies. To maximize returns while minimizing losses, traders should always compare broker fee structures before making their decision about where to trade currencies online.

Finding The Right Broker

Finding the right broker is essential for any forex trader. It's important to do your research and find a reputable one that meets all of your needs. Start by looking at their regulations, fees, trading platforms, customer service and more.

It’s also key to make sure they have good reviews from other traders who have used them in the past. Read up on forums and check out what customers are saying about them. This will give you an insight into how reliable the broker is before you sign up with them.

In addition, it’s worth asking questions if there’s anything you don’t understand or feel uncertain about when selecting a broker. Don't be afraid to shop around until you find the best fit for you - after all, this is likely where most of your trading capital will go!

Implications For Traders

Now that we have a better understanding of the evolution of forex brokers, it's time to explore what this means for traders. With the increasing sophistication and complexity of trading platforms and technology, there are both opportunities and challenges for traders.

First, advanced technology provides an opportunity for investors to trade more efficiently with greater accuracy and faster execution times. Additionally, automated systems can provide access to global markets without requiring significant manual intervention or capital investment. Furthermore, increased transparency in pricing ensures that traders get optimal prices on trades. This leads to lower costs per transaction which ultimately translates into higher profits for traders.

The challenge lies in finding the right broker who can meet your needs and help you achieve success as a trader. It is important to do thorough research before choosing a broker so that you can make sure they offer all the features necessary to build a successful trading strategy. You should also be aware of any extra fees associated with their services as these could end up significantly cutting into potential profits if not taken into account beforehand. Finally, it pays dividends to stay informed about current industry trends by reading market news and staying abreast of technological developments related to online trading platforms.

In summary, while forex brokers have come a long way over the years and offer many advantages for today’s traders, careful consideration must still be given when selecting one as each individual may have different requirements from their broker in order to be successful.

Frequently Asked Questions

What Are The Most Important Criteria To Consider When Selecting A Forex Broker?

When selecting a forex broker, there are several important criteria to consider. From the range of products offered and the trading conditions they provide, to their level of customer service and security measures, each factor is essential when deciding on an appropriate trading partner.

The first thing to look at is what kind of services they offer. Do they have access to the markets you want to trade in? What type of spreads do they charge? Are there any additional fees or commissions involved? Are the platforms user-friendly and intuitive for traders? All these questions need answers before committing to a particular broker.

It’s also worth checking out how reliable their customer support is. 24/7 multi-lingual assistance should be available as well as email, telephone and online chat options – anything less than that could become problematic if something goes wrong with your trades. Additionally, it's important to make sure your funds are secure; research which regulatory body regulates them and whether deposits are kept segregated from operational capital or not.

Finally, review all their policies so you know exactly what you’re signing up for:

Does The Broker Offer Customer Service In My Language?

When it comes to selecting a forex broker, customer service is an important factor. Does the broker offer assistance in your language? If you don't understand English or another common trading language such as French or Spanish, having access to support that speaks your native tongue is invaluable.

It's also important to consider if the brokers' customer service staff can provide adequate help when needed. Do they have experienced traders on their team who can answer questions and provide advice when necessary? Is their response time fast enough for the type of trades you perform? These are all things to take into account before choosing a broker.

In addition, does the platform offer automated features like stop loss protection? This ensures that even if you experience technical difficulties while trading, there will be safeguards in place so that any losses won't exceed what you had predetermined as acceptable risk levels. All these factors should be taken into consideration when deciding which broker best suits your needs.

How Much Capital Do I Need To Open An Account?

When it comes to investing in the forex market, one of the most important questions a trader can ask is how much capital they need to open an account. This is a key factor that will determine their success as a forex trader and help them avoid unnecessary risks.

The amount of money necessary for opening an account depends largely on the type of broker chosen and the minimum deposit required by each individual broker. Some brokers have no minimum deposits at all, while others require up to $10,000 or more. It's also important to consider any other fees associated with setting up an account such as commissions, leverages, spreads and so forth before making your decision.

In addition to considering these factors when deciding how much money you'll need to open an account, traders should be sure to research the different types of accounts available from various brokers in order to find the best fit for their trading goals and needs. Understanding what kind of services are offered by each broker is another critical element in finding the right FX brokerage - taking into consideration customer service options such as multi-lingual support teams, educational resources and automated tools which may vary among different providers.

Taking time to do this research upfront can save investors a lot of headache down the line and ensure that they're well prepared for successful forex trading experience.

Are There Any Hidden Charges Or Fees Associated With Using A Forex Broker?

Are there any hidden charges or fees associated with using a forex broker? This is an important question to ask before committing to working with one. When trading currencies, you want the most transparent and cost-effective process possible. Here's what you should know about potential hidden costs:

Forex brokers are vital partners in helping traders navigate foreign exchange markets successfully. With careful consideration given to their services and pricing structures, traders can ensure they get the best value when opening accounts with brokers and avoid unnecessary surprises along the way. By understanding all costs associated with each provider upfront—both visible and hidden—you can make informed choices while minimizing risks going forward.

Is It Possible To Trade On Margin Without A Broker?

Trading on margin without a broker is an attractive prospect for some traders, as it allows them to increase their potential returns by leveraging larger positions with only a small amount of upfront capital. But what are the risks associated with trading on margin without a broker?

The biggest risk is that there is no one to help you manage your positions and ensure that losses don't get out of hand. When trading on margin, you could end up owing more than you have in your account if the market moves against you. This can easily put you in financial ruin if proper caution isn’t taken.

Another downside to trading on margin without a broker is lack of access to resources like research reports and automated alerts. Brokers often provide these services at an additional cost, but they can be invaluable tools when navigating the choppy waters of the Forex markets. Without any guidance or assistance, inexperienced traders will likely find themselves quickly overwhelmed and unable to make informed decisions.

In order to successfully trade on margin without a broker, it's essential to understand all the risks involved and take extra precautions such as setting strict limits on how much money can be risked per position and using stop-loss orders whenever possible. Even then though, novice traders may still struggle due to lack of experience or knowledge about the markets - making brokerage services potentially indispensable for those wanting to trade safely and profitably in this highly volatile environment.

Conclusion

In conclusion, selecting a Forex broker is an important decision that requires careful consideration. As a trader, you need to ensure the broker meets all of your criteria and provides customer service in your language if needed. Additionally, consider how much capital you'll need to open an account and any fees associated with trading through the broker. Lastly, it's possible to trade on margin without a broker but this isn't recommended as there are risks involved.

Overall, when choosing a Forex broker I recommend doing plenty of research beforehand and seeking advice from experienced traders who have used them before. By taking these steps you can ensure that you find the right match for you based on your individual needs. Plus, once you feel comfortable with your selection you can start trading confidently knowing that it’s the right choice for me.

Selecting the right Forex broker will give me peace of mind so I can focus on my trades rather than worrying about hidden charges or other issues. With the evolution of brokers over time, traders now have more options than ever before which can make finding one easier than ever before!

0 notes

Text

What Makes JRFX Stand Out Among Non Dealing Desk Forex Brokers?

In the bustling world of Forex trading, choosing the right broker is akin to finding a reliable navigator in uncharted waters. Non dealing desk (NDD) Forex brokers have emerged as a beacon of transparency and fairness in the industry, offering traders a level playing field. Among these brokers, JRFX shines brightly with its unique features and offerings that set it apart from the competition. Let's explore what makes JRFX stand out among non dealing desk Forex brokers.

The JRFX Advantage

Cutting-Edge Technology: At the core of JRFX's offerings is its commitment to cutting-edge technology. The broker employs state-of-the-art trading platforms that are not only powerful but also user-friendly. Traders have access to platforms such as MetaTrader 4 and 5, equipped with advanced charting tools, expert advisors, and real-time data feeds.

Direct Market Access: JRFX prides itself on providing traders with direct market access. This means that orders are executed straight into the market without any interference. By bypassing a dealing desk, JRFX ensures lightning-fast order execution and minimal slippage, allowing traders to capitalize on market opportunities.

Competitive Spreads: Trading costs can significantly impact a trader's bottom line. JRFX addresses this concern by offering competitive spreads across a wide range of currency pairs. Through partnerships with top-tier liquidity providers, JRFX is able to offer some of the tightest spreads in the industry, reducing trading costs for its clients.

No Requotes, No Slippage: Nothing can be more frustrating for a trader than experiencing requotes or slippage, especially during crucial trading moments. With JRFX, traders can say goodbye to these concerns. The broker guarantees no requotes and minimal slippage, ensuring that traders get the price they see on their screens.

Transparent Pricing: Transparency is a cornerstone of JRFX's philosophy. Traders can rest assured that they are getting fair and transparent pricing with JRFX. There are no hidden fees or sudden spikes in spreads. Every price movement is a true reflection of market conditions, empowering traders to make informed decisions.

No Conflict of Interest: Unlike dealing desk brokers, JRFX operates on a non dealing desk model. This means that the broker does not take the opposite side of clients' trades. Orders are routed directly to liquidity providers, eliminating any conflict of interest. JRFX's success is directly tied to the success of its traders.

Multiple Account Types: JRFX understands that traders have varying needs and preferences. That's why the broker offers a range of account types to cater to different trading styles. Whether you're a beginner looking to start small or an experienced trader seeking advanced features, JRFX has an account tailored for you.

Elevating the Trading Experience

In addition to its standout features, JRFX goes above and beyond to enhance the trading experience for its clients:

Educational Resources: JRFX provides a wealth of educational resources, including webinars, tutorials, and market analysis. Traders can sharpen their skills and stay updated on market trends and strategies.

Dedicated Customer Support: Traders can rely on JRFX's responsive and knowledgeable customer support team, available 24/5. Whether you have a question about your account or need assistance with a trade, help is just a phone call or message away.

Regulatory Compliance: JRFX places the utmost importance on the security of its clients' funds. The broker is regulated by reputable authorities, ensuring that stringent regulatory standards are met. Clients can trade with confidence, knowing that their funds are safe and secure.

JRFX's "Golden March" Promotion

Adding to the excitement, JRFX is currently running its "Golden March" promotion, offering traders a chance to enhance their trading experience:

$5035 Promotion: JRFX is launching the "Golden March" promotion worth $5035.

$35 Welcome Bonus: New customers can receive a $35 welcome bonus without making a deposit when opening their first account.

Up to 100% Deposit Bonuses: Bonuses are also available for deposits, with bonuses of up to 100%.

Maximum Bonus of $5,000: The maximum bonus amount a customer can receive is $5,000.

Bonus in Gold: All bonuses are in Gold and can be used directly for trading in foreign exchange and precious metals.

Withdrawal Option: Bonuses can also be withdrawn to bank cards, subject to meeting certain conditions.

Conclusion: Experience the JRFX Difference

In conclusion, JRFX stands out as a beacon of excellence among non dealing desk Forex brokers. With its innovative technology, direct market access, competitive spreads, and transparent pricing, JRFX ( https://www.jrfx.com/?804 ) provides traders with the tools they need to succeed in the dynamic Forex market. Whether you're a seasoned trader or just starting out, JRFX offers a trading environment that is fair, transparent, and designed for success. Elevate your trading experience with JRFX and discover why it is a top choice among NDD brokers.

0 notes

Text

Introduction About Tickmill:

Tickmill is one of the maximum relied on buying and selling structures and foreign exchange agents withinside the marketplace. It gives buying and selling offerings including Forex, Indices, Commodities, Bonds, CFDs at the MetaTrader4 buying and selling platform in extra than eighty markets. Before you make investments and begin to make cash on any platform, agreeing with this is a key factor. Therefore, you have to clearly have a take a observe this screenshot earlier than we flow in addition to this Tickmill review.

The buying and selling platform is a great broking that fits each laptop in addition to cellular structures that cowl most important structures including Windows, Mac, Web, Android, and iOS System. The buying and selling platform (part of Tickmill Group) become hooked up in 2015 with its head workplace in Seychelles. It become hooked up because of the motion of the retail customers of Armada Markets (an FSA regulated body) to Tickmill in Seychelles. As this broking expanded, it reached the UK and purchased extra regulatory licenses. It is now a regulated broking that gives extra than eighty

CFD units for change consist of:

Forex

Indices

Commodities

Bonds

Features

Some of the buying and selling functions of Tickmill are defined below:

Tickmill gives tighter spreads, which begin from zero. zero pips; those inexpensive and aggressive buying and selling situations which can be supplied via way of means of this broking suggest that variable spreads in VIP and Pro debts begin as little as zero. zero pips for a number of the most important foreign money pairs.

This broking gives commission-loose inventory, indices, and bonds, CFDs, etc. There aren't any commissions for CFDs buying and selling for the most important inventory indices, futures, and bonds. Further, commissions for VIP and Pro debts are exceptionally inexpensive, assuming that spreads for those debts can begin with as minimal as zero. zero pips.

According to the Tickmill review, the trades located thru the Tickmill buying and selling platform are very rapid and the structures NDD model (non-dealing table model) are located on a mean of much less than zero.15 seconds. Further, FIX API gets the right of entry to imply rapid execution of orders for investors.

During intervals of large volatility and excessive hazard withinside the marketplace, the customers of Tickmill can advantage from no re-fees while they're setting orders over the platform’s asset offerings. Traders have to make investments withinside the marketplace handiest while they could take the excessive hazard of dropping cash unexpectedly because of leverage withinside the markets. They have to additionally take observe of each hazard caution recommended to them.

Tickmill permits using numerous strategies, which consist of scalping, hedging, arbitrage, and algorithmic strategies. It invitations all investors who use this type of buying and selling fashion and method to change on their platform as consistent with their change necessities.

Securities Dealer via way of means of Seychelles’ FSA regulates Tickmill UK Ltd, because of this that the client’s finances are given utmost safety and are saved in a separate financial institution account. Tickmill has tied up with tier-1 banks for this facility. This assures you that your finances are secure and there may be no excessive hazard of dropping your cash.

The Tickmill UK Ltd internet site presents in-intensity facts approximately margin necessities and additionally has a margin calculator. This allows investors to seize all suitable buying and selling opportunities.

Click here to see the ratings and standings of other brokers

0 notes

Text

Iris Publishers - Journal of Archives of Clinical Case Studies-Cranial Electrotherapy Stimulation as A Treatment with Three Violent Jail Inmates and One Violent Tourette’s Subject

Author by Ronald R Mellen

Abstract

The present article reviews three previously published single case studies of violent jail inmates and one violent Tourette’s subject. The treatment utilized a cranial electrotherapy stimulation device (Alpha-Stim) to reduce violent behaviors and clinical symptoms in the four subjects. The studies were completed between 2009 and 2018. In each of the inmates studied, positive changes in clinical measures and reductions in aggressive behaviors were found. In the Tourette’s subject improvements were also noted through self-assessments of clinical issues and tics. Important changes were also noted in improvements in daily life activities.

Keywords:Clinical; Detention; Electrotherapy

Introduction

There are multiple types of aggressive inmates including the predatorial, and those whose violent behaviors are responses to environmental cues. A third group are those suffering with neurodevelopmental disorders (NDD) such as individuals experiencing advanced stage Tourette’s.

The three inmates in the reviewed studies were recommended by either the County Sheriff or the Director of the Jail/Detention Center. The principal investigator’s request, each time, was for the most physically violent inmate in custody. One of the most common descriptors of the recommended inmates was “He is always involved in every fight.” The NDD subject was referred by his wife.

Treatment

The treatment variable, the Alpha-Stim SCS, was the same for each of the inmate/subjects. It is a handheld device that uses a 9 V battery to produce a proprietary electric current. The device uses clips that attach to the earlobes. It is simple to use, yet frequently produces significant positive changes in the behaviors of inmates. It accomplishes this by encouraging the brain to produce higher levels of the neurotransmitter serotonin. The increased serotonin leads to a calming on the inmate’s brain functioning and reduces the frequency of their engaging in violent behavior. The treatment also reduces cholinergic activity in the thalamo-cortical circuit (anxiety & stress). Increasing serotonin levels and, at the same time, reducing cholinergic activity in the inmate’s brain produces a brainmodulation effect which also increases positive decision-making. There are over 100 published studies Kirsh [1] that successfully used the Alpha-Stim as its treatment for psychological dysfunctions & pain management.

Methodology

The four single case studies all followed the same basic research design. Each study used the Alpha-Stim as the treatment variable. The dependent variables were administered pre- and post-treatments to assess possible effects of the Alpha-Stim. The dependent variables measured changes in personality traits, clinical symptoms, and executive functioning. Self-Assessments & assessments-by-others were sometimes completed. In one study qEEG readings were taken pre-and post-treatment. INMATE RR [2] RR’s demographics are presented below in greater detail than the other inmates since all were found to have personal histories reflecting significant difficult family & early life experiences. The Tourette’s subject had a positive personal history.

The subject, RR, was a 19-year-old Caucasian of average height and weight with no physical or apparent cognitive disabilities. He reported never having been married but that he had a 14-monthold daughter who lived overseas. The subject’s family was composed of biological parents, two stepparents, two sisters and two stepsisters. His ordinal position was third. During his childhood he lived with his mother and step-father. He described his mother as an intermittent recovering alcoholic and his stepfather as a chronic marijuana abuser. His biological father had a history of methamphetamine abuse and had at least one criminal conviction. The inmate reported an extensive history of fistfights with his biological father. RR described his childhood as unhappy, painful, hard to remember, and that he, himself, was active, aggressive, irresponsible, rebellious, and stubborn. He had problems getting along with others and experienced frequent nightmares. He also reported an intense fear of failure and a fear of falling that began in childhood.

When he was 13 years old, while living in Chicago, Illinois, he was brutally initiated into a gang. He was sentenced to boot camp for gang activity but was kicked out of the camp for fighting and he eventually went AWOL. He fought on the streets especially where drugs were involved. His nose has been broken twice and he stated that he has had “more black-eyes than he can count”. A history of head trauma can be important in understanding the behaviors of many violent inmates. Subject RR reported two serious instances of head trauma. The first was at the age of four years when the horse kicked him in the head. The injury required 48 stitches to the left eyebrow area. The injured area was near the orbitofrontal cortex, which is involved with controlling emotions. The second injury to the head also required many stitches. This injury occurred when he was 17 years old and a passenger in a serious car wreck.

While his drug history included marijuana, cocaine, pills, opiates, and barbiturates, he began using crack cocaine and methamphetamines at the age of 17 years. Most recently he was using meth intravenously. At the time this research was carried out inmate RR had been court ordered to complete the detention center’s Substance Abuse Treatment Program. If he failed to complete the program, he was court-ordered to be sent immediately to the state prison system. If he successfully completed the program, he would be sent home.

The Director of the Detention Center related RR’s experiences in the treatment program prior to starting the Alpha-Stim treatment. He noted that in this program inmates resided in pods with a population of 8 to10 inmates. During the first week RR was involved in a physical altercation. As a result, he was assigned to Administrative Segregation (Ad Seg) for 40 days in order “to think things over.” Upon release he was involved in a second fight and received 40 additional days in Ad Seg. He was again released from Ad Seg at which time he attacked a jail security officer and threatened the officer’s wife. The director liked the young inmate, but the sequence of events had exhausted his patience with RR. The director told the inmate that this would be his last Ad Seg. If he engaged in any aggressive behavior, he would be sent immediately to state prison. The inmate stated he did not care if he went to prison, and the prognosis was extremely poor indeed. Inmate RR volunteered for the Alpha-Stim treatment which began immediately upon his being was released from Ad Seg.

Treatment Program

The inmate completed 15 treatments with the Alpha-Stim each lasting 40 minutes. All treatments were completed within a 45- day treatment period. The daily treatment amperage, which was chosen by the inmate based on comfort with the device, ranged between 300 and 400 uA. The dependent variables included the 16 Personality Factors Inventory and personal self-assessments by the inmate as well as behavioral assessments by the Substance Abuse Program leader.

Results

Post treatment results from the 16 Personality Factors Inventory indicated support for the following changes: increases in warmth, emotional stability, spontaneity, social boldness, openness to change, affiliativeness, and self-discipline. Decreases were observed in threat sensitivity, tension, and apprehensiveness.

A weekly assessment of the inmate was completed by the substance abuse program leader who noted that prior to the third treatment session the inmate stated he felt “more natural”, rather than feeling agitated. He was found to share his thoughts with other members in his pod. On the fourth day of treatment, he reported increase ability to concentrate while on the fifth day he reported he felt less negative toward other people. In summary the inmate was found to show improvement in his ability to address issues with Pod family members.