#NFC Wallet Solution

Explore tagged Tumblr posts

Text

The Rise of Digital and Contactless Payments in the UAE

In today's fast-paced world, the way we pay for things is changing rapidly. In the UAE, digital and contactless payments are becoming the norm, making shopping and transactions easier than ever. Imagine walking into a store and completing your purchase with a quick tap or smartphone, no cash, no PIN, and no delay. This is becoming the everyday reality for people in the UAE as digital and contactless payments reshape the way transactions are made. In a country that values speed, convenience, and security, this shift towards cashless payments is not just a trend, but a key part of its digital future.

smartphones becoming an integral part of our daily lives, payment methods have also evolved. Digital wallets like Apple Pay, Samsung Pay, and Google Pay allow users to make payments with a simple tap of their phone, while contactless cards enable quick and secure transactions without needing to swipe or insert the card into a machine. These innovations mark the latest step in the payment evolution and have contributed to the rapid shift from cash to digital payments in the UAE.

From Cash to Cards to Digital: The Payment Evolution:

It wasn’t long ago that cash was the dominant method of payment solution in UAE. Individuals would carry cash to pay for their purchases, whether in grocery shops or restaurants . As time progressed, credit and debit cards became more common, offering greater convenience and security than handling cash. However, even these traditional payment methods have been overtaken by the rise of digital and contactless payments.

smartphones becoming an integral part of our daily lives, payment methods have also evolved. Digital wallets like Apple Pay, Samsung Pay, and Google Pay allow users to make payments with a simple tap of their phone, while contactless cards enable quick and secure transactions without needing to swipe or insert the card into a machine. These innovations mark the latest step in the payment evolution and have contributed to the rapid shift from cash to digital payments in the UAE.

Technology Boosts Digital and Contactless Payment Adoption in the UAE:

Mobile Payment Solutions:

Mobile payment solutions are one of the main reasons digital payments are becoming popular. With apps like Apple Pay, Google Pay, and Samsung Pay, users can store their credit or debit card information on their smartphones. When shopping, they can simply tap to pay on a payment terminal to make a purchase. This convenience appeals to many consumers who prefer quick and hassle-free transactions.

Digital Wallets:

Digital wallets are becoming increasingly popular in the UAE. These apps allow users to store multiple payment methods in one place, making it easy to manage finances. Users can load money into their digital wallets, pay bills, and send money to friends all from their smartphones. With the rise of e-commerce, digital wallets are especially appealing for online shopping, as they offer a quick and secure way to complete purchases. As a prominent digital payment method in UAE, they are transforming how people conduct transactions and manage their financial activities.

Near-Field Communication (NFC) Technology:

At the core of contactless is NFC payments. It allows two devices, such as a smartphone and a payment terminal, to communicate when they are close together. This means you can pay just by holding your phone or card near the terminal, no need to swipe or insert anything. This speed and simplicity are why more people in the UAE are choosing contactless payments. making NFC payment in UAE increasingly popular for everyday transactions.

Government Initiatives Support Cashless Transactions:

The UAE government actively promotes digital payments through initiatives like the Smart Dubai program. This initiative aims to create a smart, technology-driven city where digital transactions are the norm. By supporting cashless solutions, the government is encouraging businesses and consumers to embrace these payment methods in dubai.

Enhanced Security Features:

Security is a top priority for many consumers, and technology has made digital paymentsl safer than ever. Features like encryption and tokenization protect users' financial information during transactions. Additionally, many digital wallets and contactless cards require biometric authentication, such as fingerprints or facial recognition. These enhanced security measures help build trust among users, encouraging more people to embrace digital payments.

Artificial Intelligence (AI):

Artificial intelligence is changing how we handle payments in many ways. AI can look at spending habits and spot anything unusual, which helps prevent fraud. For example, if someone tries to use your credit card in a way that seems strange, AI can quickly alert your bank to check it out. Also, many businesses are using AI chatbots to help customers with payment questions. If you have a query about a charge or need assistance with a payment app, these chatbots can give you quick answers, making your experience smoother and more user-friendly.

Loyalty Programs and Rewards Integration:

Another exciting trend is the integration of loyalty programs and rewards within digital payment systems. Many digital wallets and mobile payment apps allow users to earn points or rewards with each purchase. This integration encourages consumers to choose digital payments over cash, as they can benefit from discounts, cashback, and other rewards while enjoying a convenient payment experience. As the popularity of mobile payment in UAE continues to grow, these loyalty programs further incentivize users to adopt digital payment methods.

To read more...

#Digital wallet in dubai#Digital payment method in uae#payment solutions#Contactless cards#Tap to pay#mobile payment united arab emirates#cashless payment#NFC payment in UAE#Business UAE#payment methods in dubai

0 notes

Text

My favourite wallet is no longer produced (as far as I can tell), so I decided to copy its pattern and teach myself to sew it. Bonus, I get to use 🖤💜aesthetic🖤💜 colours.

The original is a rugged trifold wallet with velcro closure. The fabric appears to be high-denier nylon or polyester canvas, with a waterproof PU backing.

For my copy, I used a black 400 denier nylon pack cloth with waterproof PU backing; and a puple 400 denier water-resistant polyester canvas with a neat twill weave. I bound the wallet edges in black 3/4" (10mm) wide twill tape, and used a scrap of purple 1" (25mm) wide nylon webbing for the coin pouch pull tab. For thread, I used Glide Trilobal Polyester in "Iris".

I chose Snag-Free Velcro, which has both hooks and loops in the same tape. The loops tend to be just a smidge taller than the hooks, which means you need to press the two tapes together to get good adherence (hence reducing unwanted adherence!). This might end up being a poor choice for a wallet, as I don't typically press my wallet closed with much force, and just folding it together isn't always enough to make the Velcro stick.

On the exterior, there's a little coin pouch with velcro closure

Brand new, there's a clear vinyl ID window on the centre panel of the original wallet's exterior, but this window always breaks in my experience, so I omitted it on mine.

Inside, there are three areas for holding cards, and a bill slot behind the card slot panel.

The left and centre -thirds have two side-loading card holders each; one front and back. In the front slot, the cards are partly visible; in the back, cards are hidden. The right panel also has two card holders, these are vertical-loading; in the back slot, cards are hidden by the cards in front.

I usually keep my tappable bus card in the centre of the bill slot (the area closest to the exterior of the closed wallet), so that I can tap the entire wallet to pay my bus fare. I added an elastic to help keep the bus card in its place, but I'm not entirely sold on this feature yet.

To protect my tappable payment cards, I would usually keep them in an RFID blocking envelope in a vertical card slot panel. But since I'm sewing my own entire wallet, I decided to line the whole card slot panel with RFID blocking fabric.

I also added a little flap to keep my receipts separate from my bills.

This being my first attempt at copying the wallet, I learned a lot in the process!

When this wallet wears out, I'll sew myself another; but with some changes, for sure.

Oh! Also!

The RFID-blocking fabric passed two basic tests:

wrap my phone the fabric (try to keep the wrapping only 1 layer thick); the phone has no reception (tested by sending myself emails; having someone call me; attempting NFC tap) ✅

with a tap-enabled payment card inside, tap the closed wallet at a tap-enabled point-of-sale till during payment; payment does not work ✅

Unfortunately, the wallet also blocks my bus pass. But I'd rather it block too much than too little; I can figure out a different solution for the bus pass.

I'm quite pleased with how this turned out, and am looking forward to making one for my partner!

3 notes

·

View notes

Text

How Customer Experience is Being Transformed This Year by Utility Payment Solutions ?

In recent years, the landscape of utility payment solutions has undergone a significant transformation driven by advancements in fintech. These changes have not only streamlined processes but have also profoundly impacted customer experience. From enhanced convenience to improved security measures, utility payment solutions have evolved to meet the growing demands of both consumers and utility providers alike.

1. Convenience and Accessibility

One of the most noticeable transformations in utility payment solutions is the increased convenience they offer customers. Traditionally, paying utility bills involved manual processes such as visiting payment centers or mailing checks, which could be time-consuming and inconvenient. Today, fintech solutions have revolutionized this process by introducing online platforms and mobile applications. These platforms allow customers to pay their bills anytime, anywhere, using various payment methods such as credit/debit cards, bank transfers, or digital wallets. This flexibility not only saves time but also enhances accessibility, catering to a broader range of preferences and lifestyles.

2. Integration and Automation

Integration of utility payment solutions with other financial tools and services has also significantly enhanced customer experience. Modern fintech solutions often integrate seamlessly with personal finance management apps, allowing users to track their utility expenses alongside other expenditures. This integration provides customers with a holistic view of their financial health and helps in budgeting effectively. Moreover, automation features offered by these solutions enable customers to set up recurring payments or receive reminders, reducing the likelihood of missed payments and associated penalties. Such automation not only saves time but also improves financial planning and peace of mind for consumers.

3. Enhanced Security Measures

Security has always been a critical concern when it comes to financial transactions, and utility payments are no exception. Fintech solutions have introduced robust security measures to protect customers' sensitive information and transactions. Advanced encryption techniques safeguard data during transmission, ensuring that personal and financial details remain secure. Additionally, authentication methods such as biometrics or two-factor authentication (2FA) add an extra layer of security, preventing unauthorized access to accounts. These security enhancements not only build trust among customers but also mitigate risks associated with fraud and identity theft, thereby enhancing overall customer experience.

4. Personalization and Customer Engagement

Another significant transformation brought about by utility payment solutions is the focus on personalization and customer engagement. Fintech platforms leverage data analytics to understand customer behavior and preferences better. By analyzing past payment patterns, these solutions can offer personalized recommendations, such as suggesting the most convenient payment method or notifying customers about potential savings through energy-efficient practices. Furthermore, interactive customer support features, such as chatbots or live customer service representatives, ensure prompt resolution of queries and issues, thereby enhancing overall satisfaction and engagement.

5. Innovation in Payment Technologies

The evolution of payment technologies has also contributed to transforming customer experience in utility payments. Contactless payments, enabled through Near Field Communication (NFC) technology or QR codes, have gained popularity due to their convenience and speed. Customers can now simply tap their smartphones or scan a code to make payments, eliminating the need for physical cards or cash. Moreover, emerging technologies like blockchain are being explored to further enhance security and transparency in utility payment transactions. These innovations not only improve efficiency but also pave the way for future advancements in the fintech software sector.

6. Sustainability and Eco-Friendliness

Utility payment solutions are increasingly aligning with sustainability initiatives, contributing to a greener future. Many fintech platforms now offer paperless billing options, allowing customers to receive and manage bills digitally instead of in print. This not only reduces paper waste but also supports environmental conservation efforts. Furthermore, by promoting energy-saving practices and providing insights into consumption patterns, these solutions empower customers to make informed decisions that contribute to a more sustainable lifestyle. Such initiatives resonate with environmentally conscious consumers, thereby enhancing their overall satisfaction with utility payment services.

Conclusion

In conclusion, utility payment solutions have undergone a remarkable transformation in recent years, driven by advancements in fintech. These innovations have not only enhanced convenience, security, and accessibility but have also personalized customer experiences and promoted sustainability. As technology continues to evolve, utility payment solutions are expected to further improve, offering even greater benefits to consumers and utility providers alike. By embracing these advancements, businesses can foster stronger customer relationships and adapt to the changing demands of the digital age effectively. Thus, the future of utility payments looks promising, with continued emphasis on innovation, security, and customer-centricity shaping the landscape of customer experience in this sector.

2 notes

·

View notes

Text

Modern Paperless Registration Technologies to Make Your Event Successful

In recent years, the event industry has completely transformed how events are executed. Earlier execution of events used to take months, in the case of event registration and ticketing. The audience used to stay in long waiting lines to book their slot for the event. But gone are the days of long queues and waiting lines. The event industry has revolutionized in terms of event planning. Numerous modern paperless event registration technologies have been introduced to make your registration and ticketing process seamless and smooth.

In this blog, we are going to discuss modern paperless solutions for event registration and ticketing. So without further ado, let’s start:

Paperless Event Registration Technologies

There’s no doubt that everyone is opting for paperless solutions for their events. Here’s a list of paperless solutions that you can consider for your events.:

1. Online Registration Portals

Modern events start with online registration portals. These user-friendly platforms allow the audience to register for your event from their comfort zone. Online registration eliminates the need for paper forms and manual data entry. It streamlines the process and reduces the risk of errors. Attendees can provide all the necessary information, from personal details to dietary preferences, at their convenience.

Moreover, online registration portals offer real-time data tracking of whole event registrations, giving event organizers instant insights into attendee numbers and demographics. This data enables better planning and marketing decisions. Also, it ensures that your event is tailored to your audience's needs.

2. Mobile Event Apps

Mobile event apps have become indispensable tools for event planners and attendees alike. These apps offer a paperless approach to event management, providing attendees with all the information they need at their fingertips. Features often include event agendas, speaker profiles, interactive maps, push notifications for updates or changes, a 360-way finder and much more.

Additionally, mobile event apps facilitate networking by allowing attendees to connect with one another digitally. Attendees can exchange contact information, schedule meetings, and participate in interactive sessions or polls through the app.

3. QR Codes for Check-In

QR codes have become a staple in modern event registration. Attendees receive unique QR codes via email or mobile apps upon completing their registration. These QR codes serve as digital tickets and can be scanned at entry points, allowing for quick and contactless check-in. This technology reduces wait times and enhances security by ensuring that only registered attendees gain access.

Event organizers benefit from QR codes as well. They can track attendance in real-time, helping to manage session capacities and optimize resources. Moreover, QR codes provide valuable data insights, such as attendance patterns and peak entry times, which inform decision-making for future events.

4. Digital Badge Printing

Traditional printed badges are being replaced by digital badge printing solutions. These systems generate badges on-site, complete with attendee names, affiliations, and any other relevant information. Digital badges are not only eco-friendly but also allow for real-time corrections and updates. If an attendee's details change, the badge can be quickly reprinted without hassle.

Furthermore, digital badge printing systems can incorporate features like RFID or NFC technology. These badges can be used for session tracking, access control, and interactive experiences, providing event organizers with valuable data and attendees with enhanced engagement opportunities.

5. e-Tickets and Mobile Wallet Integration

e-tickets are another paperless alternative that enhances the attendee experience. Attendees receive electronic tickets via email, which can be stored in their mobile wallets. These e-tickets are easily accessible and eliminate the need for physical tickets. Attendees can present their e-tickets for entry by simply displaying them on their smartphones. This technology also supports last-minute event registrations and changes. Attendees can receive e-tickets instantly, even on the day of the event, making it convenient for both organizers and late registrants.:

6. Efficient Access Control with RFID Technology

RFID technology has gained prominence in modern event registration due to its efficiency and versatility. RFID badges or wristbands contain embedded RFID chips that can be scanned remotely using RFID readers. This technology offers seamless access control, as attendees can simply walk through RFID-enabled entry points without the need for physical scanning or manual checks.

The benefits of RFID technology in event registration are numerous. It reduces entry bottlenecks, allowing for swift and hassle-free access for attendees. Organizers can track attendance in real time, monitor session participation, and gather valuable data on attendee movement throughout the event venue. Incorporating RFID technology into your paperless event registration system not only streamlines access control but also contributes to a more efficient and secure event environment, ultimately enhancing the success of your event.

7. Virtual Attendee Check-In

For hybrid or fully virtual events, modern paperless registration technologies extend to virtual attendee check-in. Attendees can access virtual event platforms with ease using unique login credentials provided during registration. This eliminates the need for physical check-in points and allows attendees to participate from anywhere in the world.

Virtual check-in also enables event organizers to monitor attendee engagement during virtual sessions. They can track attendance, participation in polls or Q&A sessions, and resource downloads. This data informs post-event analytics and helps tailor future virtual events to attendee preferences.

8. Data Analytics and Reporting Tools

Modern paperless registration technologies come equipped with robust data analytics and reporting tools. Event organizers can access detailed reports on attendee demographics, registration trends, session popularity, and engagement metrics. These insights enable organizers to make data-driven decisions, refine marketing strategies, and continuously improve event experiences.

Additionally, reporting tools support post-event evaluations, helping organizers assess the event's success and identify areas for enhancement. The ability to gather and analyze data efficiently is a cornerstone of event success in the digital age.

Moreover, the data insights generated by these technologies allow for more targeted marketing efforts, reducing marketing expenses and improving the return on investment (ROI) for event promotions.

Conclusion

By the end of this blog, we know that in a world where efficiency, convenience, and sustainability are paramount, modern paperless registration technologies have become indispensable tools for event organizers. These technologies not only simplify the event registration process but also enhance attendee experiences, provide valuable data insights, and support environmental sustainability efforts. Embracing these innovations is a strategic move that can elevate your event, making it more successful and aligning it with the expectations of today's digital-savvy attendees. I hope you like the blog. Thank you for reading.

2 notes

·

View notes

Text

Secure Payment with Mobile Card Reader Machine in UK

Effective and secure payment processing is critical for UK businesses seeking flexibility and reliability. Mobile Card Reader Machine in UK devices have revolutionized transactions by allowing merchants to accept card and mobile wallet payments anywhere. With robust encryption and PCI compliance, these compact terminals safeguard sensitive data while enabling fast checkouts. Compare Card Processing offers expert guidance to help businesses select the ideal mobile reader that matches their sales volume, connectivity needs, and budget.

Streamlining Transactions with Mobile Card Reader Machine in UK

In fast-paced retail environments, a Mobile Card Reader Machine in UK transforms customer checkouts for increased efficiency. Compare Card Processing emphasizes selecting devices with intuitive interfaces and seamless connectivity options. By leveraging Bluetooth or Wi-Fi enabled readers, sales staff can complete transactions directly at the point of sale or on the shop floor. This flexibility speeds up service, reduces queues, and improves customer satisfaction.

Ensuring Data Security with Advanced Encryption Technologies

Data protection is paramount in payment processing, and a Mobile Card Reader Machine in the UK relies on end-to-end encryption to guard sensitive information. Compare Card Processing advises businesses to choose terminals compliant with the latest PCI DSS regulations, which enforce strict security standards. Tokenization further shields card details by replacing them with unique identifiers. Regular firmware updates and built-in tamper detection mechanisms protect against evolving threats.

Optimizing Mobility and Flexibility for On-the-Go Payments

A Mobile Card Reader Machine in the UK enables businesses to accept payments beyond traditional counters, perfect for pop-ups, markets, or delivery services. Compare Card Processing highlights lightweight models that pair effortlessly with smartphones or tablets via Bluetooth. Battery longevity and offline processing capabilities ensure uninterrupted service in remote locations or areas with unstable connectivity. Instant settlement features deposit funds directly to merchant accounts, accelerating cash flow.

Integrating Mobile Readers with Existing POS Systems

Integrating a Mobile Card Reader Machine in the UK into existing POS architecture creates a seamless sales ecosystem. Compare Card Processing guides merchants to select solutions compatible with leading point-of-sale software, inventory management, and accounting platforms. This synchronization automates transaction recording, reduces manual entry errors, and provides real-time sales insights. Customizable interfaces and API support allow for tailored workflows that match specific business requirements.

Enhancing Customer Experience through Contactless Payments

Contactless technology has become a consumer expectation, and a Mobile Card Reader Machine in the UK that supports NFC taps delivers fast, hygienic transactions. Compare Card Processing encourages merchants to enable contactless limits and dual-interface readers that accept both chip cards and mobile wallets. This frictionless payment option speeds up queues and reduces keypad interactions, reassuring health-conscious customers. Personalized receipts and loyalty integrations further elevate the shopping experience.

Reducing Costs with Transparent Fee Structures

Ongoing costs can impact profitability, and businesses need clarity on processing fees associated with a Mobile Card Reader Machine in the UK. Compare Card Processing helps clients compare fixed and variable rate plans, ensuring transparency in per-transaction charges, rental fees, and settlement schedules. Understanding fee breakdowns — including interchange, service provider margins, and network costs — allows merchants to negotiate favorable terms and budget accurately.

Meeting Compliance Standards for Peace of Mind

Adhering to industry regulations is essential, and a Mobile Card Reader Machine in the UK must meet stringent compliance requirements. Compare Card Processing ensures clients select devices certified for PCI DSS, GDPR, and local UK financial guidelines. Regular security audits, vulnerability scans, and compliance training bolster organizational readiness. Device management portals allow administrators to monitor firmware versions, revoke compromised units, and enforce security policies.

Conclusion

dynamic Payment Solutions Industry, adopting a Mobile Card Reader Machine in UK equips businesses with the agility and security required for modern commerce. By partnering with Compare Card Processing, merchants gain access to tailored advice, ensuring their mobile readers meet performance, connectivity, and compliance needs. From streamlined checkouts and contactless payments to transparent fee structures and robust data protection, these devices drive customer satisfaction, operational efficiency, and cost savings.

0 notes

Text

Mobile Wallet Payment Technologies Market Size, Share, Trends, Growth Opportunities and Competitive Outlook

Global Mobile Wallet Payment Technologies Market - Size, Share, Demand, Industry Trends and Opportunities

Global Mobile Wallet Payment Technologies Market, By Type (Proximity Payment, Remote Payment), Purchase Type (Airtime Transfers and Top-Ups, Money Transfers and Payments, Merchandise and Coupons, Travel and Ticketing), End User (Hospitality and Tourism Sector, BFSI, Media and Entertainment, Retail Sector, Education, IT and Telecom), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends

Access Full 350 Pages PDF Report @

**Segments**

- **Technology Type**: The mobile wallet payment technologies market can be segmented based on the type of technology employed, which includes NFC (Near Field Communication), QR code, and BLE (Bluetooth Low Energy) among others. NFC technology enables secure contactless transactions by allowing data exchange between two devices in close proximity. QR code technology is popular due to its simplicity and ease of use for both merchants and consumers. BLE technology is gaining traction for its ability to provide seamless connections between devices for quick and efficient transactions.

- **Application**: Another important segment in the mobile wallet payment technologies market is based on application areas. This includes retail, transportation, healthcare, and entertainment industries among others. Retail sector accounts for a significant share in the market as mobile wallets offer convenience and security for both online and in-store purchases. In the transportation sector, mobile wallets are used for ticketing and fare payments, while in healthcare, they facilitate secure payment transactions for medical services. The entertainment industry uses mobile wallets for ticket purchases and in-app transactions.

- **Region**: Geographically, the mobile wallet payment technologies market can be segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa regions. North America is a major market for mobile wallet payment technologies due to high smartphone penetration and the presence of key market players. Europe is also witnessing significant growth in the market driven by increasing adoption of digital payment solutions. The Asia Pacific region is poised for rapid expansion with the growing smartphone user base and rising disposable incomes. Latin America and Middle East & Africa are also emerging markets with increasing adoption of mobile payment technologies.

**Market Players**

- **Apple Inc.**: Apple Pay is a leading mobile wallet payment technology that offers secure and convenient transactions for Apple device users. The platform supports NFC technology for contactless payments and is widely accepted by merchants worldwide.

- **Google LLC**: Google Pay is another major player in the mobile wallet payment technologies market, offering a seamless payment experience for Android users. The platform supports NFCApple Inc. and Google LLC are prominent players in the mobile wallet payment technologies market, dominating with their widely used platforms, Apple Pay and Google Pay, respectively. Apple Pay has gained a competitive edge by leveraging its brand loyalty and ecosystem, catering primarily to Apple device users. The integration of NFC technology for contactless payments has positioned Apple Pay as a secure and user-friendly solution embraced by a vast network of merchants globally. The seamless payment experience offered by Google Pay has solidified its market presence, particularly among Android users. The platform also supports NFC technology, ensuring convenience and efficiency in transactions for both consumers and businesses.

In addition to Apple Inc. and Google LLC, other key players in the mobile wallet payment technologies market include Samsung Electronics Co., Ltd with Samsung Pay and PayPal Holdings, Inc. with PayPal. Samsung Pay has emerged as a significant competitor in the market, leveraging its widespread adoption across Samsung devices and compatibility with both NFC and MST (Magnetic Secure Transmission) technologies. This versatility allows Samsung Pay to cater to a broad user base, enhancing its competitiveness in the mobile payment landscape. PayPal, on the other hand, has established itself as a trusted digital payment platform, offering secure transactions for online purchases and money transfers. The platform's widespread acceptance by merchants and consumers has reinforced its position as a leading player in the mobile wallet payment technologies market.

Furthermore, financial institutions and tech companies are increasingly entering the mobile wallet payment technologies market to capitalize on the growing demand for digital payment solutions. Companies such as Visa Inc., Mastercard Incorporated, and PayPal's subsidiary, Venmo, are actively expanding their mobile payment offerings to meet evolving consumer preferences for convenient and secure transactions. These market players are investing in advanced technologies, such as biometric authentication and tokenization, to enhance the security features of their mobile wallet platforms and build trust among users.

The mobile wallet payment technologies market is witnessing rapid innovation and strategic partnerships to enhance the functionalities and user experience of mobile payment solutions. Integration of additional features, such as loyalty programs,**Global Mobile Wallet Payment Technologies Market Analysis:**

- **Segments** - **Technology Type**: The mobile wallet payment technologies market is segmented based on the type of technology employed, including NFC, QR code, and BLE. NFC enables secure contactless transactions, QR code technology is known for its simplicity, and BLE is gaining popularity for its seamless connections. - **Application**: This segment includes retail, transportation, healthcare, and entertainment industries. Mobile wallets offer convenience and security in retail, while they facilitate ticketing in transportation and secure payment transactions in healthcare. - **Region**: Geographically, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominates due to high smartphone penetration, while Asia Pacific is showing rapid expansion with a growing smartphone user base.

- **Market Players**: - **Apple Inc.**: Apple Pay offers secure transactions for Apple users with NFC support. - **Google LLC**: Google Pay provides a seamless payment experience for Android users with NFC technology. - **Samsung Electronics Co., Ltd**: Samsung Pay caters to Samsung device users with NFC and MST technologies. - **PayPal Holdings, Inc.**: PayPal is a trusted digital payment platform accepted widely by merchants and consumers.

Financial institutions and tech companies like Visa, Mastercard, and Venmo are also entering the market with advanced technologies like biometric authentication and tokenization to enhance security. The market is witnessing innovation and partnerships to improve mobile

Mobile Wallet Payment Technologies Key Benefits over Global Competitors:

The report provides a qualitative and quantitative analysis of the Mobile Wallet Payment Technologies Market trends, forecasts, and market size to determine new opportunities.

Porter’s Five Forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make strategic business decisions and determine the level of competition in the industry.

Top impacting factors & major investment pockets are highlighted in the research.

The major countries in each region are analyzed and their revenue contribution is mentioned.

The market player positioning segment provides an understanding of the current position of the market players active in the Personal Care Ingredients

Table of Contents: Mobile Wallet Payment Technologies Market

1 Introduction

2 Market Segmentation

3 Executive Summary

4 Premium Insight

5 Market Overview

6 Mobile Wallet Payment Technologies Market, by Product Type

7 Mobile Wallet Payment Technologies Market, by Modality

8 Mobile Wallet Payment Technologies Market, by Type

9 Mobile Wallet Payment Technologies Market, by Mode

10 Mobile Wallet Payment Technologies Market, by End User

12 Mobile Wallet Payment Technologies Market, by Geography

12 Mobile Wallet Payment Technologies Market, Company Landscape

13 Swot Analysis

14 Company Profiles

The investment made in the study would provide you access to information such as:

Mobile Wallet Payment Technologies Market [Global – Broken-down into regions]

Regional level split [North America, Europe, Asia Pacific, South America, Middle East & Africa]

Country wise Market Size Split [of important countries with major market share]

Market Share and Revenue/Sales by leading players

Market Trends – Emerging Technologies/products/start-ups, PESTEL Analysis, SWOT Analysis, Porter’s Five Forces, etc.

Market Size)

Market Size by application/industry verticals

Market Projections/Forecast

Critical Insights Related to the Mobile Wallet Payment Technologies Included in the Report:

Exclusive graphics and Illustrative Porter’s Five Forces analysis of some of the leading companies in this market

Value chain analysis of prominent players in the market

Current trends influencing the dynamics of this market across various geographies

Recent mergers, acquisitions, collaborations, and partnerships

Revenue growth of this industry over the forecast period

Marketing strategy study and growth trends

Growth-driven factor analysis

Emerging recess segments and region-wise market

An empirical evaluation of the curve of this market

Ancient, Present, and Probable scope of the market from both prospect value and volume

Browse Trending Reports:

Sodium Formate Market Flavour Systems Market Mobile Wallet Payment Technologies Market Rock Salt Market Bipolar Discrete Semiconductor Market Dome Security Market Chlorinating Agents Market Multi-Cuvette Spectrophotometer for Molecular Diagnostics Market Boron Nitride Nanotubes in Nanomedicine Market Cast Saw Devices Market Information Technology (IT) Operations Analytics Market In Vitro Diagnostics (IVD) Quality Control Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]

0 notes

Text

Near Field Communication Market: Emerging Trends Shaping the Future

Near Field Communication (NFC) technology has become a cornerstone of modern digital interaction, enabling seamless communication between devices in close proximity. As the near field communication market expands rapidly, several emerging trends are shaping its trajectory, influencing industries such as retail, healthcare, transportation, and finance. This article explores the key trends driving the evolution of the NFC market and highlights their implications for businesses and consumers.

Rise of Contactless Payments

One of the most significant trends in the NFC market is the growing adoption of contactless payments. The shift towards digital wallets and contactless cards has accelerated, fueled by increasing smartphone penetration and heightened consumer demand for quick, secure payment solutions. The COVID-19 pandemic further boosted this trend by encouraging contactless interactions to minimize physical touchpoints. As a result, NFC-enabled payment systems have become ubiquitous, with major financial institutions and retailers investing heavily in NFC infrastructure.

Expansion of NFC Applications Beyond Payments

In parallel, the expansion of NFC applications beyond payments is gaining momentum. NFC is increasingly used for identity verification, access control, and ticketing, offering enhanced convenience and security. For example, many public transportation systems worldwide have integrated NFC technology to enable easy ticket purchase and validation through mobile devices. Similarly, smart homes and offices are leveraging NFC for secure entry systems, replacing traditional keys with NFC-enabled devices. This diversification of NFC use cases is opening new revenue streams and market opportunities.

Integration with the Internet of Things (IoT)

Another emerging trend is the integration of NFC with the Internet of Things (IoT). As IoT devices proliferate, NFC provides a simple and efficient way to connect and communicate between devices. NFC tags embedded in IoT devices allow users to instantly pair or configure gadgets by simply tapping their smartphones. This integration facilitates smoother user experiences and supports the growth of smart environments, such as connected homes, cities, and industrial setups. The synergy between NFC and IoT is expected to drive significant innovation and market growth in the coming years.

Focus on Enhanced Security

Security remains a critical focus area within the NFC market. As NFC transactions and data exchanges increase, so does the risk of unauthorized access and fraud. Consequently, there is a rising emphasis on enhancing NFC security protocols, including encryption and biometric authentication. The adoption of multi-factor authentication methods combining NFC with fingerprint or facial recognition is becoming more prevalent. These advancements help build consumer trust and support broader adoption of NFC-enabled services, particularly in sectors requiring stringent security measures such as banking and healthcare.

Transformative Applications in Healthcare

The healthcare industry, in particular, is witnessing transformative NFC applications. NFC technology is being employed for patient identification, medication management, and asset tracking within medical facilities. The ability to quickly access patient data through NFC-enabled wristbands or cards improves the accuracy and efficiency of healthcare delivery. Moreover, NFC-enabled devices facilitate remote monitoring and telemedicine services, aligning with the growing demand for digital health solutions. This trend underscores NFC’s potential to enhance patient care and operational efficiency in healthcare settings.

Sustainability and Environmental Impact

Sustainability and environmental concerns are also influencing the NFC market. As businesses seek to reduce waste and adopt greener practices, NFC technology offers innovative solutions. For instance, NFC tags embedded in packaging enable consumers to access product information digitally, reducing the need for printed materials. Additionally, NFC facilitates circular economy initiatives by supporting product authentication and recycling processes. These eco-friendly applications not only appeal to environmentally conscious consumers but also help companies meet regulatory requirements and corporate social responsibility goals.

Growth of Wearable Technology

The rise of wearable technology represents another promising avenue for NFC growth. Wearables such as smartwatches, fitness trackers, and smart rings increasingly incorporate NFC capabilities to enable contactless payments, access control, and data sharing. The convenience of having NFC embedded in devices worn daily drives user engagement and opens up new possibilities for personalized services. As wearable adoption expands, the NFC market benefits from the continuous innovation and increased demand for integrated, user-friendly solutions.

Advancements in NFC Chip Technology

Advancements in NFC chip technology are contributing to the market’s evolution. Improvements in chip design, such as reduced size, lower power consumption, and enhanced durability, are enabling NFC integration in a wider array of devices, including smaller gadgets and industrial equipment. These technological enhancements facilitate more versatile NFC applications and help overcome previous limitations related to device compatibility and battery life.

Regional Market Growth Dynamics

Regional growth dynamics also play a crucial role in shaping the NFC market landscape. Asia-Pacific, in particular, is emerging as a key driver of NFC adoption due to its large population, rapid urbanization, and increasing digital literacy. Countries in this region are witnessing extensive NFC deployment in sectors such as retail, transportation, and healthcare, supported by government initiatives promoting digital payments and smart city development. Meanwhile, North America and Europe continue to see steady NFC market growth, driven by technological advancements and consumer demand for innovative digital services.

Conclusion

The Near Field Communication market is undergoing dynamic transformation influenced by several emerging trends. The widespread adoption of contactless payments, diversification of NFC applications, integration with IoT, enhanced security measures, and growth in healthcare and wearable technology are key factors propelling the market forward. Additionally, sustainability efforts, technological advancements, and regional growth patterns further contribute to shaping the future of NFC. As these trends continue to evolve, NFC technology is poised to become an even more integral part of daily life, enabling smarter, safer, and more connected experiences for users worldwide.

0 notes

Text

Future trends in ferry ticketing: Contactless payments and mobile tickets.

The transportation industry is undergoing a technological revolution, and ferry services are no exception. As customer expectations evolve and digital transformation becomes imperative, ferry operators are increasingly embracing modernization in their ticketing systems. The shift towards contactless payments and mobile ticketing is not just about convenience—it is about improving operational efficiency, safety, and the overall passenger experience. In a post-pandemic world where hygiene and speed are more critical than ever, these digital solutions are becoming the cornerstone of modern ferry operations.

The Rise of Contactless Payments in Ferry Services

Contactless payment technology has become a game-changer in the ferry industry. No longer reliant on paper tickets and cash transactions, ferry services are increasingly integrating tap-and-go solutions that streamline boarding and improve efficiency.

Technology Behind Contactless Payments

The backbone of contactless payment systems lies in technologies such as Near Field Communication (NFC), Radio Frequency Identification (RFID), and mobile wallets like Apple Pay, Google Wallet, and Samsung Pay. NFC allows secure transactions between two electronic devices within close proximity. RFID enables automatic identification and tracking through tags embedded in smart cards or devices. These technologies offer reliable, quick, and secure methods for processing payments, ensuring minimal contact and maximum convenience.

Benefits for Passengers and Operators

For passengers, contactless payments translate into faster check-ins, reduced queuing times, and a smoother boarding process. These systems reduce the friction often associated with traditional ticketing, allowing travelers to use bank cards or mobile phones without the need for cash or physical tickets. For operators, the benefits include improved transaction speed, better data collection for passenger analytics, reduced overhead from cash handling, and enhanced security against theft and fraud.

Challenges and Solutions in Implementation

While the adoption of contactless systems presents numerous benefits, implementation is not without its hurdles. Technical challenges include upgrading existing infrastructure, ensuring compatibility across devices, and maintaining data security. Infrastructural issues often involve retrofitting older vessels or terminals to support modern systems. User adoption can also be slow, particularly among less tech-savvy demographics.

Solutions include phased implementation strategies, comprehensive staff training, public awareness campaigns, and user-friendly interfaces that simplify the transition. Moreover, government subsidies and public-private partnerships can assist in covering the initial investment costs, ensuring a smooth modernization journey.

Mobile Ticketing and Its Impact on Ferry Travel

The rise of smartphones has led to a surge in mobile ticketing, allowing passengers to purchase, store, and use tickets directly from their devices. This shift enhances the travel experience and aligns with global trends in digital transformation.

Features of Modern Mobile Ticketing Apps

Modern mobile ticketing applications offer a suite of features designed to simplify travel. These include:

Ticket purchase and payment integration

Real-time service updates and alerts

QR code or barcode scanning for ticket validation

Digital storage and history of past trips

Multi-modal transport integration, allowing a single app to manage buses, trains, and ferries

These functionalities make mobile ticketing more than a transactional tool—it becomes a comprehensive travel companion.

Enhanced Customer Experience Through Mobile Tickets

Mobile ticketing enhances accessibility and convenience. Travelers no longer need to queue at ticket counters or worry about losing paper tickets. The ability to book and manage trips on-the-go ensures a seamless experience, especially for commuters and tourists. Additionally, digital platforms often support multiple languages, making them accessible to international passengers.

Security Measures in Mobile Ticketing

Security remains a top priority. Modern mobile ticketing platforms use end-to-end encryption, two-factor authentication (2FA), and biometric verification to protect user data and transactions. These measures mitigate risks such as fraud, unauthorized access, and data breaches, building trust among users and ensuring compliance with data protection regulations.

Integration of Contactless and Mobile Ticketing with Smart Ferry Ecosystems

As ferry systems become more digitally connected, contactless and mobile ticketing are integrating into broader smart transportation ecosystems that leverage IoT, cloud computing, and big data.

Role of Data Analytics in Optimizing Ticketing and Operations

Digital ticketing Kiosk systems generate vast amounts of data that can be analyzed to improve operations. Passenger flow patterns, peak travel times, and route popularity can inform scheduling, staffing, and capacity planning. This data-driven approach enhances service reliability, reduces operational costs, and improves customer satisfaction.

Interoperability with Other Transport Modes

Seamless travel requires interoperability between different modes of transportation. Integrated ticketing systems allow passengers to use a single platform or smart card across buses, trains, and ferries. This unified experience encourages the use of public transport and supports city-wide mobility plans.

Environmental and Economic Impacts of Digital Ferry Ticketing

Digital ticketing systems are not only convenient and efficient—they are also environmentally sustainable and economically advantageous.

Reducing Carbon Footprint through Paperless Ticketing

By eliminating paper tickets, ferry operators contribute to reducing deforestation, energy consumption, and waste. Digital systems also reduce the need for physical infrastructure such as ticket booths and printing equipment, leading to a smaller carbon footprint and supporting broader environmental goals.

Cost Efficiency for Ferry Operators

Digital ticketing minimizes expenses associated with paper, ink, labor, and error correction. Automated systems reduce reliance on manual processing, leading to fewer human errors and lower operational costs. Additionally, real-time analytics allow for dynamic resource allocation, further boosting efficiency.

Future Outlook: Innovations Shaping Ferry Ticketing

The future of ferry ticketing is being shaped by advanced technologies that promise even greater security, efficiency, and personalization.

Biometric Authentication and AI Integration

Biometric systems such as facial recognition and fingerprint scanning are being explored for ticket validation. These technologies offer a frictionless experience while enhancing security. AI is also being used to analyze passenger behavior, predict demand, and personalize services.

Blockchain for Ticketing Transparency and Security

Blockchain technology can revolutionize ticketing by creating tamper-proof, transparent, and decentralized records. This can prevent issues such as ticket fraud, duplication, and resale. Smart contracts can automate refunds and enforce terms of service, ensuring fairness and trust.

Personalization and Dynamic Pricing Models

AI-powered platforms can offer tailored ticketing options based on travel history, preferences, and demand patterns. Dynamic pricing models, similar to those used in airlines, can optimize revenue while offering value to passengers through real-time discounts and peak/off-peak pricing.

Conclusion

The modernization of ferry ticketing systems through contactless payments and mobile technology represents a transformative shift in maritime transportation. These innovations enhance the passenger experience, improve operational efficiency, and support sustainable practices. As ferry operators continue to integrate these solutions with smart technologies and data analytics, the industry is poised for a future of seamless, secure, and personalized travel. Embracing these advancements today ensures that ferry services remain competitive, resilient, and aligned with the expectations of tomorrow's travelers.

#ticketing#ticketing kiosk#timemanagement#kiosk#technology#trends#viral#software#selfservice#software development#business#tech trends#tech innovation#web development#programing#futurestic#future technology

1 note

·

View note

Text

NFC Applications: How Near Field Communication is Powering Everyday Technology

In today’s fast-paced digital world, Near Field Communication (NFC) has become a silent driver behind many seamless, contactless experiences. From mobile payments to smart marketing and enhanced security systems, NFC technology is transforming the way devices communicate and people interact with the digital ecosystem.

What is NFC?

NFC (Near Field Communication) is a short-range wireless communication technology that allows two devices to exchange data when they are within close proximity—typically less than 4 centimeters. It’s an extension of RFID (Radio Frequency Identification), but NFC allows for two-way communication, making it ideal for secure, interactive, and instant transactions.

Top NFC Applications Across Industries

Let’s explore the key areas where NFC is making a significant impact:

1. Contactless Payments

Arguably the most well-known use of NFC is in mobile payments through platforms like Google Pay, Apple Pay, and Samsung Pay. By tapping your smartphone or smartwatch at a payment terminal, NFC enables quick and secure cashless transactions, reducing the need for physical wallets.

Keywords used naturally: contactless payments, NFC technology, mobile payments, cashless transactions.

2. Access Control & Smart Security

NFC is widely used in access control systems—from unlocking hotel rooms with your smartphone to secure entry into office buildings. NFC-enabled smart cards and key fobs ensure convenient, yet secure, authentication methods.

Applications:

Employee ID badges

Residential smart locks

Public transportation cards

Keywords: NFC access control, smart security systems, NFC authentication.

3. Digital Business Cards

The traditional business card is evolving. NFC-powered digital business cards allow professionals to share contact information with just a tap. This not only reduces printing waste but also ensures that the shared data is always up-to-date.

Keywords: NFC business cards, smart contact sharing.

4. Smart Posters and Marketing

NFC marketing is revolutionizing how brands interact with customers. Smart posters embedded with NFC tags can redirect users to promotional videos, websites, product pages, or event signups when scanned. This interactive approach drives higher engagement.

Use Cases:

Museums with interactive exhibits

In-store product promotions

Event check-ins via NFC

Keywords: NFC marketing, smart posters, interactive customer engagement.

5. Healthcare Applications

In the healthcare sector, NFC helps improve patient care and record management. NFC wristbands can store critical patient information, allowing for quick identification and reducing human error.

Keywords: NFC in healthcare, patient tracking with NFC, digital health records.

6. IoT and Smart Home Integration

NFC enhances the Internet of Things (IoT) by simplifying device pairing and control. Imagine tapping your phone on a speaker to play music or scanning a tag near your bedside lamp to trigger a morning routine.

Keywords: NFC and IoT, NFC smart home, device pairing with NFC.

7. Inventory and Asset Management

In retail and logistics, NFC helps in inventory tracking and asset management. With an NFC tag on each product, businesses can manage stock levels, verify authenticity, and reduce theft or loss.

Keywords: NFC inventory tracking, NFC logistics, asset management technology.

Benefits of NFC Technology

Speed: Transfers data almost instantly.

Security: Uses encryption and secure channels for transactions.

Convenience: No need for pairing or manual setups.

Eco-friendly: Reduces paper usage in marketing and documentation.

Final Thoughts

NFC is no longer a futuristic concept—it’s part of our daily lives. As more businesses adopt NFC-enabled solutions, the potential for innovation across sectors like finance, retail, healthcare, and smart living continues to grow.

Whether you’re a marketer exploring NFC-based campaigns or a business owner interested in contactless customer experiences, embracing this technology could give you a competitive edge.

0 notes

Text

Secure Your Crypto Future with the SafePal S1 Pro: The Next-Gen Hardware Wallet You Need

In the ever-evolving world of cryptocurrency, securing your assets is more critical than ever. With rising threats of cyberattacks, phishing scams, and exchange vulnerabilities, choosing a reliable hardware wallet isn't just smart—it's essential. That’s where the SafePal S1 Pro comes in, a cutting-edge solution from the trusted SafePal Wallet brand, designed to keep your digital assets safe and in your control.

Whether you're new to crypto or a seasoned investor, the SafePal S1 Pro delivers advanced security, offline storage, and user-friendly features that put you in charge of your assets. And if you're ready to upgrade your crypto security, don't forget to take advantage of exclusive savings with a SafePal Wallet coupon code.

What Makes the SafePal S1 Pro a Game-Changer?

The SafePal S1 Pro isn’t just another hardware wallet—it’s a next-level security device built with state-of-the-art technology and practical design. Here’s why it stands out in a crowded market:

🔒 Air-Gapped Security: Unlike many other wallets, the S1 Pro operates completely offline. It doesn’t rely on Bluetooth, Wi-Fi, NFC, or USB, which dramatically reduces its vulnerability to online threats.

📱 QR Code Authentication: The S1 Pro uses QR codes for signing transactions—keeping your private keys completely isolated from the internet, while still making it easy to manage transactions via the SafePal App.

🔐 EAL 5+ Secure Element: Your private keys are stored in a certified security chip with top-level encryption, ensuring that your crypto is protected even if the device falls into the wrong hands.

💼 Multi-Currency Support: With support for over 100 blockchains and thousands of tokens (including BTC, ETH, BNB, SOL, and NFTs), the SafePal S1 Pro is ideal for diversifying your portfolio.

📲 User-Friendly Interface: A large 1.8-inch screen and physical buttons make navigation simple—even for beginners—while firmware updates keep your wallet current and secure.

Why Choose SafePal Wallet?

SafePal Wallet is more than just a product—it’s a full ecosystem built for modern crypto users. Trusted by over 10 million users worldwide, SafePal offers secure hardware and software wallets, a seamless mobile app, and integration with top DeFi and Web3 platforms.

Whether you’re storing, swapping, or staking, SafePal Wallet gives you the tools to manage your assets without relying on centralized exchanges. Your keys, your crypto.

Save More with a SafePal Wallet Coupon Code

Looking to buy your SafePal S1 Pro at the best price? Make sure to use a SafePal Wallet coupon code during checkout! These exclusive codes give you access to special discounts, helping you save on premium security.

You can find the latest SafePal Wallet coupon codes by signing up for the newsletter at SafePal Wallet, or by following SafePal on social media. Stay connected to get the best deals and updates on new products.

Final Thoughts: Invest in Your Peace of Mind

In the world of crypto, security is non-negotiable. The SafePal S1 Pro offers unmatched offline protection, full control of your assets, and the confidence to navigate the digital finance space securely. Backed by the trusted SafePal Wallet brand, it’s the smart choice for anyone serious about protecting their crypto.

Ready to take the next step? Visit SafePal.com, grab your SafePal S1 Pro, and don’t forget to apply your SafePal Wallet coupon code for exclusive savings!

0 notes

Text

Vending Machines for Sale: A Comprehensive Guide to Buying the Right One

Vending machines for sale are becoming an increasingly popular investment for entrepreneurs and businesses looking for passive income opportunities. Whether you're interested in snacks, beverages, or specialty products, vending machines offer a low-maintenance way to generate revenue.

This guide will help you understand the different types of vending machines for sale, key factors to consider before purchasing, and tips for maximizing profits.

Types of Vending Machines for Sale

1. Snack Vending Machines

Snack vending machines are among the most common types available. They dispense chips, candy, cookies, and other packaged snacks. These machines are ideal for offices, schools, and public spaces with high foot traffic.

Key Features:

Multiple product selections

Cashless payment options (credit/debit cards, mobile payments)

Energy-efficient models available

2. Beverage Vending Machines

Beverage machines offer cold drinks, including sodas, water, juices, and energy drinks. Some advanced models can even dispense hot beverages like coffee or tea.

Key Features:

Refrigeration systems to keep drinks cold

Can-vs-bottle dispensing options

Touchscreen interfaces for user convenience

3. Combo Vending Machines

Combo machines provide both snacks and beverages in a single unit, making them a space-efficient solution for locations where installing two separate machines isn’t feasible.

Key Features:

Dual dispensing mechanisms

Larger capacity than standalone machines

Ideal for small break rooms or convenience stores

4. Specialty Vending Machines

These machines cater to niche markets, offering products like:

Fresh food (sandwiches, salads)

Electronics (phone chargers, headphones)

Health and beauty products (lotions, sanitizers)

Key Features:

Customizable product trays

Temperature control for perishable items

Higher profit margins due to unique offerings

Factors to Consider Before Buying Vending Machines for Sale

1. Location

The success of your vending business heavily depends on location. High-traffic areas like malls, hospitals, and universities tend to generate more sales.

Best Locations for Vending Machines:

Office buildings

Schools and universities

Gyms and recreation centers

Public transportation hubs

2. Machine Cost and ROI

Vending machines for sale come in a wide price range, from a few hundred dollars for used models to several thousand for high-tech machines. Consider:

Initial purchase cost

Maintenance and repair expenses

Expected monthly revenue

3. Payment Options

Modern consumers prefer cashless transactions. Look for machines that support:

Credit/debit cards

Mobile wallets (Apple Pay, Google Pay)

NFC and contactless payments

4. Maintenance and Durability

Choose machines from reputable brands known for reliability. Key maintenance considerations include:

Ease of cleaning

Availability of replacement parts

Warranty and customer support

5. Product Selection and Inventory Management

Stocking the right products is crucial for maximizing sales. Consider:

Popular items in your target location

Seasonal trends (e.g., cold drinks in summer, hot beverages in winter)

Inventory tracking features in smart vending machines

Where to Find Vending Machines for Sale

1. Direct Manufacturers

Buying directly from manufacturers ensures you get the latest models with warranties. Some well-known brands include:

Crane Merchandising Systems

Royal Vendors

Automated Merchandising Systems (AMS)

2. Online Marketplaces

Websites like eBay, Craigslist, and Facebook Marketplace often list vending machines for sale, including used and refurbished options.

3. Vending Machine Distributors

Specialized distributors offer both new and refurbished machines, along with business support services.

4. Auctions and Liquidation Sales

Government auctions or business liquidations can provide heavily discounted machines, though they may require repairs.

Maximizing Profit with Your Vending Machine Business

1. Optimize Product Pricing

Conduct market research to set competitive prices

Adjust pricing based on demand and location

2. Regular Restocking and Maintenance

Keep machines fully stocked to avoid lost sales

Schedule routine cleaning and servicing

3. Leverage Technology

Use smart vending machines with real-time sales tracking

Implement remote monitoring to manage stock levels

4. Marketing and Promotions

Offer discounts on slow-moving items

Use social media to promote your vending locations

1 note

·

View note

Text

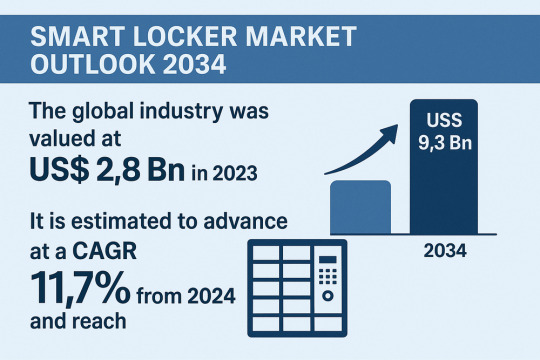

Smart Locker Market to Reach $9.3 Billion by 2034: What’s Driving the Growth?

The global smart locker market, valued at USD 2.8 billion in 2023, is poised for robust expansion over the next decade. Driven by surging e-commerce penetration, the need for secure parcel management, and rapid technology adoption across industries, the market is projected to register a compound annual growth rate (CAGR) of 11.7% from 2024 to 2034, reaching USD 9.3 billion by 2034.

Market Overview

Smart lockers secure, automated storage units integrated with sensors, connectivity, and management software are revolutionizing package handling and asset management across residential, commercial, institutional, industrial, and transportation sectors. They offer 24/7 secure access, real-time notifications, and advanced analytics, mitigating risks of theft, loss, and delivery delays. The COVID-19 pandemic underscored the importance of contactless solutions, accelerating deployments in logistics hubs, last-mile delivery networks, corporate campuses, educational institutions, and multi-family dwellings.

Market Drivers & Trends

E-Commerce Boom & Last-Mile Optimization The exponential rise of online shopping has intensified demand for reliable, contactless pickup and drop-off solutions. Retailers and logistics providers deploy smart lockers at convenient locations—supermarkets, transit stations, apartment complexes—to streamline deliveries, reduce failed delivery attempts, and cut operational costs.

Safety & Security Requirements With package theft (“porch piracy”) on the rise, consumers and businesses are adopting smart lockers to secure shipments. Integrated access control (PIN codes, biometrics, smartphone authentication) ensures only authorized users retrieve parcels.

IoT & Cloud-Based Analytics Connectivity via Wi-Fi, Bluetooth, NFC, and cellular networks enables automated monitoring, predictive maintenance, dynamic allocation of locker space, and utilization insights. AI-driven analytics optimize inventory distribution and enhance user experience.

Customized Solutions for Specialized Goods Temperature-controlled lockers support last-mile delivery of perishable groceries, pharmaceuticals, and laboratory specimens. Thermal management and modular compartmentalization ensure product integrity.

Regulatory & Sustainability Pressures Municipalities and corporations seek solutions to reduce carbon footprint of multiple delivery attempts. Consolidated locker deployments lower vehicle miles traveled and greenhouse gas emissions.

Latest Market Trends

Integration with Mobile Wallets & Apps Users increasingly leverage mobile apps and digital wallets to unlock compartments, track package status, and receive push notifications. Mobile-first interfaces are now standard.

Expansion into Multi-Tenant Residential Buildings Property developers embed smart locker ecosystems into new constructions to offer value-added amenities, improve tenant satisfaction, and differentiate offerings.

Plug-and-Play Modular Systems Scalable locker banks enable businesses to expand capacity on-demand. Plug-and-play modules simplify installation and future upgrades.

Partnerships with Last-Mile Tech Providers Collaboration between parcel locker manufacturers and drone, robotics, or autonomous vehicle companies is emerging to create end-to-end automated delivery networks.

Blockchain for Audit Trails Early pilots utilize distributed ledger technology to record chain-of-custody events for high-value shipments, enhancing transparency and reducing disputes.

Access key findings and insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86223

Key Players and Industry Leaders

Prominent vendors shaping the global smart locker landscape include:

ASSA ABLOY AB – Integrating smart access control across locker portfolios.

Allegion Plc – Broadening product lines with cloud-enabled locker solutions.

Avent Security – Specializing in modular, temperature-controlled lockers.

Dahua Technology – Offering AI-driven surveillance and analytics in locker systems.

dormakaba Group – Combining mechanical expertise with digital management platforms.

Honeywell International Inc. – Delivering enterprise-grade locker management software.

igloocompany Pte Ltd – Pioneering parcel locker networks in Asia.

Master Lock Company LLC. – Known for ruggedized, weatherproof locker designs.

MIWA Lock Co. – Integrating biometric authentication into high-security lockers.

Samsung Electronics Co., Ltd. – Leveraging consumer electronics expertise for locker interface design.

Spectrum Brands, Inc. – Expanding access control offerings into locker portfolios.

Vivint, Inc. – Bundling smart home security with locker access solutions.

These companies focus on R&D, strategic alliances, and targeted acquisitions to enhance technological capabilities and geographic reach.

Recent Developments

November 2023: Blue Dart Express partnered with India Post to install automated digital parcel lockers at select post offices nationwide. Authorized personnel deposit deliveries, and recipients access packages via unique codes—enabling flexible, round-the-clock collection.

March 2022: Quadient and DHL launched an extensive rollout of outdoor smart parcel lockers across Sweden, providing consumers with secure self-service pick-up points and reducing delivery failure rates.

January 2024: igloo expanded its locker network in Singapore’s suburban residential estates, integrating cloud-based analytics to optimize locker utilization and reduce idle capacity.

April 2025: dormakaba introduced biometric-enabled lockers for hospital and laboratory environments, ensuring traceable access to controlled substances and sensitive equipment.

Market New Opportunities and Challenges

Opportunities

Emerging Economies: Rapid urbanization and e-commerce growth in Asia, Latin America, and Africa create fertile ground for locker deployments.

Smart City Initiatives: Municipal plans to deploy shared locker hubs at transit nodes can drive large-scale adoption.

Cross-Industry Convergence: Integration of lockers with coworking spaces, gym facilities, and parcel shops presents new partnership models.

AI-Powered Predictive Maintenance: Leveraging machine learning to foresee component failures enhances uptime and reduces service costs.

Challenges

High Initial Capital Outlay: Infrastructure costs and integration with existing IT systems may deter small and mid-sized enterprises.

Data Security & Privacy: Handling user credentials and tracking data demands robust cybersecurity measures and compliance with evolving regulations (e.g., GDPR).

Interoperability Standards: Absence of universal communication standards across locker ecosystems can hamper large-scale interoperability.

Last-Mile Network Complexity: Integrating lockers into fragmented delivery networks—involving multiple carriers—requires seamless coordination.

Future Outlook

The smart locker market is set to evolve into a critical component of the global logistics and asset-management ecosystem. By 2034, we anticipate:

Hyper-Connected Lockers: Fully integrated into smart city infrastructures, enabling dynamic allocation based on pedestrian and vehicle traffic flows.

Autonomous Replenishment: Drone and robotics fleets replenishing locker stock in real time, responding to demand signals from e-commerce platforms.

Advanced User Experiences: Voice-activated access, augmented reality (AR) wayfinding within locker halls, and AI-driven personalization.

Vertical-Specific Solutions: Tailored offerings for healthcare, cold chain, automotive manufacturing, and other sectors with stringent compliance requirements.

Sustainability Focus: Solar-powered locker banks and carbon-neutral installation programs to align with corporate ESG goals.

Analysts assert that as technology costs decline and value propositions become clearer, adoption will spread beyond major metropolitan areas into suburban and rural markets.

Market Segmentation

Segment

Details

By Type

Deadbolt locks, lever handles, server locks & latches, knob locks, others

By Communication

Bluetooth, Wi-Fi, Z-Wave, NFC, others

By Locking Mechanism

Keypad, card key, touch/biometric, key fob, smartphone

By End-Use

Commercial, residential, institutional & government, industrial, transportation & logistics

Regional Insights

Asia Pacific: Largest market share in 2023, driven by rapid e-commerce expansion, smart city programs, and strong uptake of IoT/cloud computing solutions. Key countries: China, India, Japan, South Korea, ASEAN nations.

North America: High adoption of advanced analytics and strong presence of leading vendors fuel growth. Retail, residential, and institutional segments are particularly active.

Europe: Focus on sustainability and urban logistics optimization. Germany, the U.K., and France lead with smart city pilots and intermodal transport locker installations.

Latin America & MEA: Emerging markets present significant growth potential, though hampered by infrastructural and regulatory challenges.

Why Buy This Report?

This comprehensive report offers:

In-depth market analysis from 2020 to 2023, with detailed forecasts through 2034.

Quantitative units covering market value (US$ billion) and volume (thousand units).

Extensive profiling of leading players, including product portfolios, strategic initiatives, financial overviews, and sales footprints.

Segment-level and regional breakdowns, highlighting growth pockets and investment hotspots.

Detailed qualitative assessments: drivers, restraints, opportunities, Porter’s Five Forces, value chain, and trend analyses.

Ready-to-use Excel datasheets for custom modeling and scenario planning.

Whether you are a technology vendor, investor, logistics provider, or smart city planner, this report equips you with actionable insights to make informed strategic decisions and capitalize on emerging opportunities in the smart locker landscape.

Frequently Asked Questions

1. What is driving the growth of the smart locker market? Surging e-commerce volumes, last-mile delivery challenges, rising concerns over package theft, and the integration of IoT/cloud analytics are key growth drivers.

2. Which regions offer the highest growth potential? Asia Pacific leads today, but Latin America, the Middle East & Africa, and secondary markets in North America and Europe present significant untapped opportunities.

3. What are the main barriers to adoption? High upfront costs, data security/privacy concerns, and the lack of universal interoperability standards across locker ecosystems.

4. How are smart lockers being used beyond parcel delivery? Applications include IT asset management, medical device distribution, temperature-controlled food and pharmaceutical logistics, and secure document storage.