#NICCode

Explore tagged Tumblr posts

Text

How to Find the Right NIC Code for Your Kirana Store?

Starting or registering at a Kirana Store and confused about the NIC Code? You’re not alone! Many small shop owners struggle with identifying the right business classification. But don’t worry — this guide will help you understand and find the correct NIC Code quickly and easily.

✅ What is NIC Code?

NIC (National Industrial Classification) Code is a number assigned by the Government of India to classify businesses based on their core activity.

It is essential for:

GST Registration

Udyam (MSME) Registration

Income tax filings

Licensing & schemes

If you run a Kirana Store, selecting the correct NIC Code helps the government identify the nature of your retail trade and offer the correct benefits.

📊 2-Digit NIC Code for Kirana Store

At the top level, businesses are categorized using 2-digit codes.

For Kirana Stores, the 2-digit NIC code is 47.

This code covers retail trade (excluding motor vehicles).

🔍 Breakdown of NIC Code for Grocery Shops

To be more specific, here is the full classification:

Level NIC Code Description

2-Digit Code 47 Retail trade, except of motor vehicles and motorcycles

4-Digit Code 4711 Retail sale in non-specialized stores with food, beverages, or tobacco

5-Digit Code 47110 Kirana Store sells everyday grocery items, snacks, packaged goods, etc.

So, if you’re running a Kirana Store, your most appropriate code is 47110.

📥 Where is NIC Code Required?

You’ll need to mention your NIC Code when registering for:

GSTIN

Udyam Aadhaar (for MSME benefits)

Shop & Establishment License

FSSAI Registration (if food products sold)

If you're operating a Kirana Store, make sure to use the correct code to avoid rejections or delays in government processes.

💡 Why It’s Important to Use the Right Code

Using the wrong NIC Code can lead to:

Rejection of your application

Missing out on subsidies or benefits

Incorrect tax treatment

Legal and compliance issues

For a Kirana Store, code 47110 ensures that you’re correctly classified under retail grocery business and eligible for related schemes and tax benefits.

Using these phrases in your application and website content helps improve search visibility and accuracy during verification.

📌 Pro Tips Before You Apply

✅ Always verify your business activity before selecting an NIC code.

🧾 Keep your product list ready — it helps during GST and MSME registration.

📄 Apply using government portals like udyamregistration.gov.in.

💬 If confused, consult a CA or registration expert to avoid errors.

🧾 Example Use Case

Ravi runs a Kirana Store in Lucknow. When registering for Udyam Aadhaar, he selected NIC Code 47110, which clearly defined his store as a retail grocery shop. As a result, he successfully availed MSME benefits, including zero-cost registration, loan eligibility, and government schemes.

📝 Summary

Choosing the right NIC Code for your Kirana Store is a simple but crucial step in your business journey. It helps you comply with government rules, access financial benefits, and classify your business properly.

✅ Final NIC Code for Kirana Store: 47110

(2-Digit Code: 47 → Retail Trade)

Want to know more about business registration for Kirana Stores or get help with GST? Drop your query in the comments or contact our experts!

#KiranaStore#NICCode#RetailBusinessIndia#MSMERegistration#UdyamAadhaar#GroceryStoreStartup#GSTRegistration#SmallBusinessTips#RetailShopOwner#BusinessRegistrationIndia

0 notes

Text

MSMEs: The Backbone of India’s Economy — Features, Benefits & Their Growing Impact

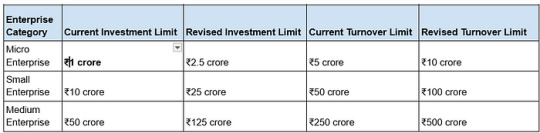

Micro, Small, and Medium Enterprises (MSMEs) are very important for India’s economy. They help in making money, selling goods to other countries, and giving jobs to people. The government updates the rules for MSMEs from time to time so that businesses can get benefits like easy loans, discounts, and tax savings. In the 2025 budget, Finance Minister Nirmala Sitharaman changed the MSME rules. Now, businesses can invest 2.5 times more money, and the sales limit is also doubled. This change will help small businesses grow, try new ideas, and succeed.

The Union Budget 2025–26 brings new plans to support small businesses (MSMEs) because they are important for India’s growth, just like farming, investment, and exports.

The rules for what counts as an MSME have changed, allowing more businesses to qualify.

Small businesses will find it easier to get loans because the government is increasing loan protection.

A special program will help first-time business owners from weaker backgrounds with money support.

New efforts will also boost industries like footwear, leather, and toy making.

In this blog, we will talk about How to register an MSME in India, the different Government schemes and subsidies for MSMEs, and the Role of MSMEs in economic development. We will also look at some of the Best business ideas for MSMEs in India and the Latest Budget Changes in MSME policies in India. Additionally, we will explore MSME Registration, the various MSME Schemes, and the many MSME Benefits available for small businesses. Lastly, we will discuss the MSME Definition and the MSME Growth and Challenges in India that affect this sector.

Role of MSMEs in Economic Development

MSMEs play a very important role in India’s economy because they help in many different ways:

1. Employment Generation — MSMEs provide jobs to more than 110 million people. This makes them the second-largest source of employment after agriculture.

2. Contribution to GDP — These businesses add 30% to India’s GDP, which makes the economy stronger.

3. Export Growth — MSMEs are responsible for more than 45% of India’s exports. This helps the country trade with other nations.

4. Rural Development — Many MSMEs work in villages and small towns. This reduces migration to big cities and helps in the overall development of rural areas.

5. Innovation and Entrepreneurship — Small businesses and startups create new ideas and technologies. This leads to more jobs and business opportunities.

Despite these achievements, MSME growth and challenges in India still exist. Some of the challenges include limited access to credit, outdated technology, and regulatory burdens.

How to Register an MSME in India

MSME Registration, which was earlier called Udyog Registration, is now known as Udyam or MSME Registration. The new system is improved with better features, making it easier to use.

Getting MSME Registration is simple and has many benefits, like tax savings, subsidies, and easy loan approvals. The process is completely online and can be done through the Udyam Registration Portal. Here’s an easy step-by-step guide to help you:

1. Go to the Udyam Registration Portal — This is the official government website where businesses can register.

2. Enter Aadhaar Details — The business owner needs to provide their Aadhaar number, which should be linked to their business.

3. Fill in Business Information — Important details like PAN, GST number, and business category need to be entered.

4. Self-Declaration of Business Type — Choose whether your business is a Micro, Small, or Medium Enterprise based on its turnover and investment.

5. Submit for Verification — After filling in all the details, submit the form for verification.

Once your application is approved, you will get a unique MSME certificate. This certificate helps you enjoy MSME Benefits.

Benefits of Udyam Registration for businesses

Udyam Registration offers several benefits to businesses, especially Micro, Small, and Medium Enterprises (MSMEs):

Access to Government Schemes- Businesses can avail of subsidies, financial assistance, and other benefits under various government schemes.

Simplified Loan Process- Easier access to collateral-free loans and lower interest rates.

Tax and Duty Exemptions- Eligibility for certain tax exemptions and reduced import/export duties.

Protection Against Delayed Payments- Legal protection and interest on delayed payments from buyers.

Priority in Government Tenders- Preference in bidding for government contracts.

Enhanced Credibility- Boosts trust and marketability with a recognized certification.

Government Schemes and Subsidies for MSMEs

The Indian government has started many MSME Schemes to help small businesses grow and get financial support. Some of the most popular schemes are:

1. Prime Minister’s Employment Generation Programme (PMEGP) This scheme provides financial help to start small businesses. It offers loans with government subsidies to create job opportunities and promote self-employment.

2. Interest Subsidy Eligibility Certificate (ISEC) ISEC lowers loan interest rates for small businesses and cooperatives. It makes borrowing more affordable, helping businesses grow and expand easily.

3. Credit Guarantee Trust Fund for Micro & Small Enterprises (CGTMSE) Small businesses can get loans without collateral through CGTMSE. It supports entrepreneurs by providing financial assistance for business expansion.

4. Market Promotion & Development Scheme (MPDA) MPDA helps artisans and small businesses promote their products. It provides funds for marketing, exhibitions, and branding to boost sales and income.

5. Financial Support to MSMEs in ZED Certification Scheme MSMEs receive financial aid to improve product quality and efficiency. The scheme helps businesses get certifications, training, and better production methods.

These MSME Benefits make sure that businesses get better access to money, helping them grow and succeed in both local and international markets.

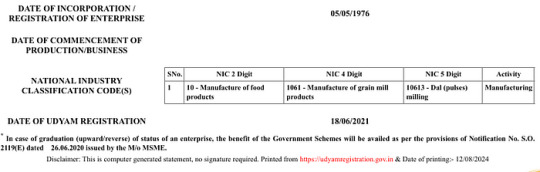

Udyam registration certificate

NIC code

“NIC” refers to the National Industry Classification code. It is used to classify the primary activity and sector of an enterprise. the NIC codes are related to dal (pulses) milling under the manufacturing sector-

NIC 2 Digit- 10 — Manufacture of food products

NIC 4 Digit- 1061 — Maufacture of grain mill products

NIC 5 Digit- 10613 — Dal (pulses) milling

Latest Budget Changes in MSME Policies in India

Key Highlights of Union Budget 2025–26 for MSMEs-

Better Classification System

-MSME investment and turnover limits have been increased by 2.5 times and 2 times, making it easier for them to grow.

More Credit Support -Small businesses can now get up to ₹10 crore in credit guarantee, helping them access ₹1.5 lakh crore in loans over five years.

-Startups will get a ₹20 crore credit guarantee, with lower loan fees.

-MSME exporters can get loans up to ₹20 crore.

Credit Cards for Micro Enterprises -₹5 lakh credit cards will be given to micro businesses, with 10 lakh cards issued in the first year.

Support for New Entrepreneurs

-A ₹10,000 crore Fund of Funds will support startups.

-₹2 crore loans for 5 lakh first-time women, SC, and ST entrepreneurs.

Boost for Labour-Intensive Industries

-Footwear, leather, and toy industries will get government support to create more jobs.

Manufacturing and Clean Energy -A National Manufacturing Mission will help small and big industries grow.

-Support for clean energy industries like solar panels, EV batteries, and wind turbines.

These steps will help MSMEs grow, create jobs, and strengthen India’s economy.

How Can Biz Consultancy Help You Start Your MSME Business?

If you are planning to start your business in the MSME sector, Biz Consultancy is here to guide you at every step. From business setup and registration to obtaining necessary approvals and government support, they provide end-to-end assistance. Whether you need help with legal formalities, funding opportunities, or compliance requirements, Biz Consultancy ensures a smooth and hassle-free business journey, helping you establish a strong foundation for success.

Conclusion

MSMEs are the backbone of India’s economic growth. They create jobs, add to the country’s GDP, and support both rural and urban economies. The government is working hard to make the MSME sector stronger by offering MSME registration, financial schemes, and helpful policies. With more focus on innovation, sustainability, and making business easier, MSMEs are ready to play an even bigger role in shaping India’s future.

If you’re thinking about starting your own MSME, this is the perfect time to use government support and take advantage of the opportunities available.

#bizconsultancy#msme#msmes#msmeregistration#msmebenefits#msmefeatures#msmebusiness#msmebudget2025#msmelatestbudget#niccode#udyamregistration#economicdevelopment#growth

0 notes

Text

Midjourney Video

With the release of video (silent) on Midjourney, I just can't stop trying to generate images to animate! It's exceptionally easy, but some formats work better than others. Tutorial.

https://videopress.com/v/lSu3UXal?resizeToParent=true&cover=true&loop=true&playsinline=true&preloadContent=metadata&useAverageColor=true

https://videopress.com/v/ATrZHeC9?resizeToParent=true&cover=true&loop=true&playsinline=true&preloadContent=metadata&useAverageColor=true

https://videopress.com/v/HM4jFd1H?resizeToParent=true&cover=true&loop=true&playsinline=true&preloadContent=metadata&useAverageColor=true

https://videopress.com/v/44IogZpY?resizeToParent=true&cover=true&loop=true&playsinline=true&preloadContent=metadata&useAverageColor=true

Source: Midjourney Video

0 notes

Link

Check NIC code for MSME - You will be required National Industrial Classification Code for MSME Registration.

0 notes