#udyamregistration

Explore tagged Tumblr posts

Text

Unlock the Secrets of Udyam Registration for Partnership Firms

The Udyam Registration, previously known as Udyog Aadhaar Memorandum (UAM), has been a transformative initiative by the Indian government to support and empower micro, small, and medium-sized enterprises (MSMEs). For partnership firms, this registration offers a host of benefits and opportunities.

Update Udyam Certificate: One of the key advantages of Udyam Registration is the ability to Update Udyam Registration online. Business details may change over time, and this feature allows you to keep your registration accurate and up-to-date, reflecting the current state of your partnership firm.

Apply Online for Udyam Partnership Firm: The online application process for partnership firms is user-friendly and efficient. You can easily submit the necessary documents and information online, reducing the time and effort required for registration.

Online Enquiry for Udyam: The digital platform has simplified the process of making inquiries related to Udyam Registration. You can get information, clarification, and assistance regarding the registration process, making it easier to navigate.

Print UAM Registration Online: Once your partnership firm's Udyam Registration is approved, you can conveniently print your Udyam Certificate online. This certificate is not just a document; it's your ticket to a plethora of benefits and opportunities reserved for MSMEs.

Print Udyam Certificate: After successfully obtaining your Udyam Registration, you can print the Udyam Certificate, which serves as proof of your registration. Displaying this certificate can build trust among clients and partners, enhancing your firm's credibility.

Access to Government Schemes: Udyam Registration opens the door to various government schemes and incentives specifically designed for MSMEs. These schemes can provide financial assistance, subsidies, and priority in procurement, giving your partnership firm a competitive edge.

Financial Benefits: Banks and financial institutions often offer preferential treatment to Udyam-registered businesses. This includes easier access to credit facilities and lower interest rates, which can be advantageous for managing finances and expansion.

Global Opportunities: Udyam Registration can also pave the way for international collaborations and exports. Many foreign companies prefer to engage with Udyam-registered Indian businesses, offering the potential for global growth.

Simplified Compliance: Udyam Registration streamlines the compliance process by consolidating various government-related registrations into one. This reduces the administrative burden on your partnership firm.

Competitive Advantage: Displaying your Udyam Certificate on your website and marketing materials can enhance your firm's reputation and attract clients who prefer working with registered MSMEs.

Conclusion

Udyam Registration is a game-changer for partnership firms in India. It offers numerous benefits, ranging from financial advantages to global opportunities. By utilizing online services such as updating your Udyam Certificate, applying online, making online inquiries, and printing your Udyam Certificate, you can unlock the full potential of this registration and take your partnership firm to new heights of success. Don't miss out on the secrets of Udyam Registration; embrace them and witness the transformation in your business.

2 notes

·

View notes

Text

How an MSME Verification API Simplifies Udyam Registration Checks Instantly

Instantly verify Udyam Registration details with Gridlines’ MSME verification API. Automate MSME onboarding, prevent fraud, and ensure KYB compliance at scale.

#MSMEVerification#UdyamRegistration#KYB#APIVerification#GridlinesAPI#FintechCompliance#BusinessVerification#FraudPrevention#DigitalOnboarding#MSMEIndia

0 notes

Text

What is MSME Registration?

MSME registration is an official process that provides recognition to Micro, Small, and Medium Enterprises (MSMEs) under the Udyam Registration Portal by the Government of India. This registration enables businesses to avail of various benefits, including subsidies, tax exemptions, and financial assistance, which can greatly help in their growth and development.

Why is MSME Registration Important?

MSME registration offers numerous advantages that help small businesses thrive:

Government Recognition: It provides official recognition for small businesses, enhancing their credibility and trustworthiness.

Easy Access to Loans: MSMEs can easily access loans and credit facilities with lower interest rates.

Tax Benefits: Registration helps businesses access various subsidies and tax exemptions, reducing operational costs.

Eligibility for Government Schemes: MSMEs can qualify for government tenders and schemes, opening up new business opportunities.

Documents Required for MSME Registration

To register for MSME, ensure you have the following documents:

Aadhaar Card of the business owner

PAN Card of the business owner or company

GSTIN (if applicable)

Business Address Proof (Utility Bill, Rent Agreement, or Incorporation Certificate)

Bank Account Details

NIC Code of business activity

Step-by-Step Process for MSME Registration Online

Follow these steps to register your MSME:

Visit the Udyam Registration Portal

Go to the Udyam Registration Portal.

Fill in Business Details

Enter your Aadhaar and PAN Card details.

Provide business name, type, and location.

Submit Required Documents

Upload necessary documents in PDF format.

Pay MSME Registration Fees

MSME registration is free under the Udyam Registration Portal (Only professional assistance fees apply).

Receive MSME Certificate

After approval, you can download your Udyam MSME Certificate.

Checking MSME Registration Status

You can check the status of your MSME registration on the Udyam Portal by entering your Udyam Registration Number (URN).

FAQs on MSME Registration

What is the cost of MSME registration in India? MSME registration under the Udyam Registration Portal is free. Only professional assistance fees may apply.

How long does MSME registration take? It typically takes 1-2 working days to process and issue the MSME certificate.

Can I apply for MSME registration online? Yes, MSME registration is completely online through the Udyam Registration Portal.

Do I need GST for MSME registration? No, GST registration is not mandatory for MSME registration unless applicable to your business.

Get Expert Assistance for MSME Registration

Ensure a smooth MSME registration process with expert guidance from NG & Associates. We provide hassle-free assistance to help you register your MSME online. Contact us today!

#MSMERegistration#UdyamRegistration#SmallBusiness#MicroEnterprise#BusinessGrowth#TaxBenefits#GovernmentSchemes

0 notes

Text

MSMEs: The Backbone of India’s Economy — Features, Benefits & Their Growing Impact

Micro, Small, and Medium Enterprises (MSMEs) are very important for India’s economy. They help in making money, selling goods to other countries, and giving jobs to people. The government updates the rules for MSMEs from time to time so that businesses can get benefits like easy loans, discounts, and tax savings. In the 2025 budget, Finance Minister Nirmala Sitharaman changed the MSME rules. Now, businesses can invest 2.5 times more money, and the sales limit is also doubled. This change will help small businesses grow, try new ideas, and succeed.

The Union Budget 2025–26 brings new plans to support small businesses (MSMEs) because they are important for India’s growth, just like farming, investment, and exports.

The rules for what counts as an MSME have changed, allowing more businesses to qualify.

Small businesses will find it easier to get loans because the government is increasing loan protection.

A special program will help first-time business owners from weaker backgrounds with money support.

New efforts will also boost industries like footwear, leather, and toy making.

In this blog, we will talk about How to register an MSME in India, the different Government schemes and subsidies for MSMEs, and the Role of MSMEs in economic development. We will also look at some of the Best business ideas for MSMEs in India and the Latest Budget Changes in MSME policies in India. Additionally, we will explore MSME Registration, the various MSME Schemes, and the many MSME Benefits available for small businesses. Lastly, we will discuss the MSME Definition and the MSME Growth and Challenges in India that affect this sector.

Role of MSMEs in Economic Development

MSMEs play a very important role in India’s economy because they help in many different ways:

1. Employment Generation — MSMEs provide jobs to more than 110 million people. This makes them the second-largest source of employment after agriculture.

2. Contribution to GDP — These businesses add 30% to India’s GDP, which makes the economy stronger.

3. Export Growth — MSMEs are responsible for more than 45% of India’s exports. This helps the country trade with other nations.

4. Rural Development — Many MSMEs work in villages and small towns. This reduces migration to big cities and helps in the overall development of rural areas.

5. Innovation and Entrepreneurship — Small businesses and startups create new ideas and technologies. This leads to more jobs and business opportunities.

Despite these achievements, MSME growth and challenges in India still exist. Some of the challenges include limited access to credit, outdated technology, and regulatory burdens.

How to Register an MSME in India

MSME Registration, which was earlier called Udyog Registration, is now known as Udyam or MSME Registration. The new system is improved with better features, making it easier to use.

Getting MSME Registration is simple and has many benefits, like tax savings, subsidies, and easy loan approvals. The process is completely online and can be done through the Udyam Registration Portal. Here’s an easy step-by-step guide to help you:

1. Go to the Udyam Registration Portal — This is the official government website where businesses can register.

2. Enter Aadhaar Details — The business owner needs to provide their Aadhaar number, which should be linked to their business.

3. Fill in Business Information — Important details like PAN, GST number, and business category need to be entered.

4. Self-Declaration of Business Type — Choose whether your business is a Micro, Small, or Medium Enterprise based on its turnover and investment.

5. Submit for Verification — After filling in all the details, submit the form for verification.

Once your application is approved, you will get a unique MSME certificate. This certificate helps you enjoy MSME Benefits.

Benefits of Udyam Registration for businesses

Udyam Registration offers several benefits to businesses, especially Micro, Small, and Medium Enterprises (MSMEs):

Access to Government Schemes- Businesses can avail of subsidies, financial assistance, and other benefits under various government schemes.

Simplified Loan Process- Easier access to collateral-free loans and lower interest rates.

Tax and Duty Exemptions- Eligibility for certain tax exemptions and reduced import/export duties.

Protection Against Delayed Payments- Legal protection and interest on delayed payments from buyers.

Priority in Government Tenders- Preference in bidding for government contracts.

Enhanced Credibility- Boosts trust and marketability with a recognized certification.

Government Schemes and Subsidies for MSMEs

The Indian government has started many MSME Schemes to help small businesses grow and get financial support. Some of the most popular schemes are:

1. Prime Minister’s Employment Generation Programme (PMEGP) This scheme provides financial help to start small businesses. It offers loans with government subsidies to create job opportunities and promote self-employment.

2. Interest Subsidy Eligibility Certificate (ISEC) ISEC lowers loan interest rates for small businesses and cooperatives. It makes borrowing more affordable, helping businesses grow and expand easily.

3. Credit Guarantee Trust Fund for Micro & Small Enterprises (CGTMSE) Small businesses can get loans without collateral through CGTMSE. It supports entrepreneurs by providing financial assistance for business expansion.

4. Market Promotion & Development Scheme (MPDA) MPDA helps artisans and small businesses promote their products. It provides funds for marketing, exhibitions, and branding to boost sales and income.

5. Financial Support to MSMEs in ZED Certification Scheme MSMEs receive financial aid to improve product quality and efficiency. The scheme helps businesses get certifications, training, and better production methods.

These MSME Benefits make sure that businesses get better access to money, helping them grow and succeed in both local and international markets.

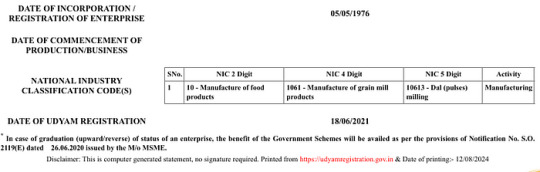

Udyam registration certificate

NIC code

“NIC” refers to the National Industry Classification code. It is used to classify the primary activity and sector of an enterprise. the NIC codes are related to dal (pulses) milling under the manufacturing sector-

NIC 2 Digit- 10 — Manufacture of food products

NIC 4 Digit- 1061 — Maufacture of grain mill products

NIC 5 Digit- 10613 — Dal (pulses) milling

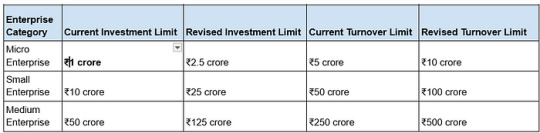

Latest Budget Changes in MSME Policies in India

Key Highlights of Union Budget 2025–26 for MSMEs-

Better Classification System

-MSME investment and turnover limits have been increased by 2.5 times and 2 times, making it easier for them to grow.

More Credit Support -Small businesses can now get up to ₹10 crore in credit guarantee, helping them access ₹1.5 lakh crore in loans over five years.

-Startups will get a ₹20 crore credit guarantee, with lower loan fees.

-MSME exporters can get loans up to ₹20 crore.

Credit Cards for Micro Enterprises -₹5 lakh credit cards will be given to micro businesses, with 10 lakh cards issued in the first year.

Support for New Entrepreneurs

-A ₹10,000 crore Fund of Funds will support startups.

-₹2 crore loans for 5 lakh first-time women, SC, and ST entrepreneurs.

Boost for Labour-Intensive Industries

-Footwear, leather, and toy industries will get government support to create more jobs.

Manufacturing and Clean Energy -A National Manufacturing Mission will help small and big industries grow.

-Support for clean energy industries like solar panels, EV batteries, and wind turbines.

These steps will help MSMEs grow, create jobs, and strengthen India’s economy.

How Can Biz Consultancy Help You Start Your MSME Business?

If you are planning to start your business in the MSME sector, Biz Consultancy is here to guide you at every step. From business setup and registration to obtaining necessary approvals and government support, they provide end-to-end assistance. Whether you need help with legal formalities, funding opportunities, or compliance requirements, Biz Consultancy ensures a smooth and hassle-free business journey, helping you establish a strong foundation for success.

Conclusion

MSMEs are the backbone of India’s economic growth. They create jobs, add to the country’s GDP, and support both rural and urban economies. The government is working hard to make the MSME sector stronger by offering MSME registration, financial schemes, and helpful policies. With more focus on innovation, sustainability, and making business easier, MSMEs are ready to play an even bigger role in shaping India’s future.

If you’re thinking about starting your own MSME, this is the perfect time to use government support and take advantage of the opportunities available.

#bizconsultancy#msme#msmes#msmeregistration#msmebenefits#msmefeatures#msmebusiness#msmebudget2025#msmelatestbudget#niccode#udyamregistration#economicdevelopment#growth

0 notes

Text

🚀 Are you an #entrepreneur or a #smallbusiness owner? It’s time to get your business officially recognized! MSME Registration is the key to unlocking various government benefits, including easier access to loans, subsidies, and tax benefits. 🏢💼 Don’t miss out on these opportunities. Register your MSME today! . 💼 Why should you register your business under MSME? 🔹 Access to lower interest rates on loans 🏦 🔹 Subsidy on patent registration 💡 🔹 Priority sector lending from banks 💼 🔹 Protection against delayed payments ⚖️ . Get in touch with us today: 🌐 www.globaljurix.com 📧 [email protected] 📞 +91-88001 00284 | +91-98100 62387

0 notes

Text

Streamline MSME Verification with Gridlines' Robust API Solution

Udyam registration and Udyog Aadhaar reference are unique IDs assigned to small and medium-sized enterprises by the Ministry of MSMEs. These identifiers serve as official government recognition, verifying the legitimacy and operational status of MSMEs. Gridlines’ MSME Verification API provides instant validation of these registrations, reducing fraudulent risks and ensuring compliance with regulatory standards.

Why Gridlines

Instant MSME Validation

Enables immediate confirmation of Udyam registrations, crucial for verifying small and medium enterprise identities as recognized by the Ministry of MSMEs.

Efficient Partner Integration

Accelerates the integration of business partners or merchants, streamlining the onboarding process for better operational flow.

Regulatory Compliance Check

Assures that businesses are operating in accordance with government standards, maintaining legal and regulatory compliance.

Reliable Security Measures

Strengthens the verification process with robust security, ensuring the legitimacy of MSME merchants.

#MSMEVerification#UdyamRegistration#UdyogAadhaar#GridlinesAPI#BusinessCompliance#SecureVerification#InstantValidation#FraudPrevention#DigitalVerification#MSMESolutions#APIIntegration

0 notes

Text

MSME Registration and Licensing: A Complete Guide by Corporate Mitra

Micro, Small, and Medium Enterprises (MSMEs) play a crucial role in boosting the economy, generating employment, and fostering innovation. However, to avail of the various benefits offered by the government and to gain credibility in the market, MSMEs must go through the process of registration and licensing. In this blog, we’ll guide you through the essential steps for MSME registration and licensing with the assistance of Corporate Mitra.

What is MSME Registration?

MSME registration is the process through which businesses involved in manufacturing, production, processing, or preservation of goods and services can register themselves as an MSME with the government. The registration is crucial for accessing government schemes, financial benefits, subsidies, and other incentives.

Benefits of MSME Registration:

Financial Assistance: Registered MSMEs can easily access financial support from banks and financial institutions at lower interest rates.

Government Schemes: Various schemes and incentives, like tax rebates and subsidies, are available for registered MSMEs.

Credibility: Registration adds to your business credibility and improves your chance of securing contracts from larger companies or government bodies.

Protection against Delayed Payments: MSME registration provides protection to smaller businesses against delayed payments from customers.

Easy Access to Licensing: MSMEs enjoy simplified procedures for obtaining licenses and approvals.

How to Register as an MSME?

The MSME registration process in India is straightforward and can be completed online. The Ministry of Micro, Small and Medium Enterprises (MSME) has developed the Udyam Registration portal to facilitate this process. Here’s how to register:

Visit the Udyam Registration Portal: Navigate to the official Udyam portal.

Provide Business Details: Fill in details like the name of your business, type of business, address, and other relevant information.

Enter Aadhaar Number: The Aadhaar number of the business owner is mandatory for registration.

Business Details: Provide details about the business's investment in plant and machinery or equipment, and turnover.

Submit the Form: Once you fill in all the details, submit the form and wait for approval.

Corporate Mitra can assist you throughout this registration process, ensuring all forms are filled correctly and that your business benefits from MSME registration.

Licensing for MSMEs:

Along with MSME registration, your business may require specific licenses to operate legally. These licenses vary depending on the type of business, industry, and location. Some of the common licenses required by MSMEs are:

GST Registration: For businesses involved in the supply of goods or services, GST registration is mandatory.

Trade License: A trade license from the local municipal authority is required to carry out business operations legally.

Factory License: For businesses operating in manufacturing, a factory license from the local authorities is essential.

FSSAI License: Food businesses need an FSSAI license to ensure food safety and quality.

Import-Export Code (IEC): For businesses involved in export and import activities, an IEC from the Directorate General of Foreign Trade (DGFT) is required.

Corporate Mitra provides end-to-end solutions for acquiring necessary licenses and permits, streamlining the entire process for you.

Key Considerations for MSME Registration and Licensing:

Eligibility: Ensure that your business falls under the MSME category based on your investment and turnover.

Documents Required: Have all necessary documents ready, such as Aadhaar details, business address proof, and financial details.

Compliance: After registration, ensure that your business stays compliant with all government regulations and filing requirements.

Why Choose Corporate Mitra for MSME Registration and Licensing?

Corporate Mitra is a trusted partner for businesses looking to register as an MSME or obtain necessary licenses. With years of experience in company registration and legal compliances, Corporate Mitra ensures a smooth and hassle-free process. Here’s how we can help:

Expert Guidance: Our experts provide detailed consultations, guiding you through every step of MSME registration.

End-to-End Services: From registration to licensing, we handle all the paperwork and formalities on your behalf.

Timely Completion: We prioritize fast processing to ensure your registration and licensing are completed on time.

Cost-Effective: We offer competitive pricing without compromising on quality service.

Conclusion:

MSME registration and licensing are vital steps for businesses to unlock a range of government benefits and establish credibility. With Corporate Mitra’s expert services, you can navigate this process smoothly and efficiently. Register your MSME today and take your business to new heights with the support of Corporate Mitra!

#MSMERegistration#MSMEIndia#MSMELicensing#MSMECompliance#SmallBusinessIndia#MSMEBenefits#UdyamRegistration#BusinessRegistration#MSMESupport#CorporateMitra#SmallBusinessLicensing#MSMELaw#BusinessGrowthIndia#StartupIndia

0 notes

Text

A Comprehensive Guide to Udyam Classification Criteria. | Legal Terminus

The Government of India has revised the classification criteria for MSMEs under the Atma Nirbhar Bharat Abhiyan. The updated classification is as follows:

Micro Enterprises:

Annual Turnover: Up to ₹5 crore

Investment: Up to ₹1 crore

Small Enterprises:

Annual Turnover: Up to ₹50 crore

Investment: Up to ₹10 crore

Medium Enterprises:

Annual Turnover: Up to ₹250 crore

Investment: Up to ₹50 crore

Visit Legal Terminus to know more about Udyam Registration in India.

0 notes

Text

What is Udyam Registration?

Udyam Registration is a government initiative in India, aimed at simplifying the registration process for Micro, Small, and Medium Enterprises (MSMEs) under the Ministry of MSME. It replaces the earlier Udyog Aadhaar system, providing a more accessible platform for businesses to register online. This process requires an Aadhaar number and involves self-declaration of business details. Udyam Registration offers various benefits, including access to government schemes, financial assistance, and a unique registration number, fostering growth and formal recognition for MSMEs.

0 notes

Text

How do I obtain an Udyam registration certificate?

Udyam Registration is a simple online process for micro, small, and medium enterprises (MSMEs) to get recognition and benefits from the government. It has replaced the Udyog Aadhaar registration system.

To get an Udyam Registration Certificate in India, which is necessary for MSMEs to access various government benefits and schemes, follow these steps:

Visit the Udyam Registration Portal

Create an Account

Fill in the Registration Form

Upload Required Documents

Submit the Form

Pay the Registration Fee

Receive Registration Certificate

Renewal and Updates

Udyam Registration Fees in India at BizFoc

The government does not charge any fee for Udyam Registration; it is free for MSMEs. However, at BizFoc, we charge a nominal fee of Rs 499 to assist you with the Udyam Registration process. This fee is for our service, not a government charge.

Tranding Topics: LLP Registration , GST Registration , Startup India Registration , Private limited Company Registration

#UdyamRegistration#UdyamCertificate#MSMERegistration#BusinessRegistration#StartupIndia#SmallBusinessSupport#Entrepreneurship#BizFocServices#BusinessGrowth#MSMEIndia

0 notes

Text

Udyam Registration and Its Impact on Corporate Governance

Udyam Registration, an initiative by the Ministry of Micro, Small, and Medium Enterprises (MSME) in India, has revolutionized the landscape for small businesses by formalizing their operations. This digital registration system provides a unique identification number and a certificate to MSMEs, enabling them to access various government benefits and support schemes. Beyond these immediate benefits, Udyam Registration plays a significant role in enhancing corporate governance within the MSME sector. This article explores how Udyam Registration influences corporate governance practices, contributing to greater transparency, accountability, and overall business integrity.

Understanding Udyam Registration

Udyam Registration was introduced on July 1, 2020, replacing the earlier Udyog Aadhaar Memorandum (UAM). It simplifies the registration process for MSMEs, making it entirely online and paperless. The initiative aims to provide a unique identity to MSMEs, streamline access to government schemes, and ensure accurate data collection for better policy formulation. The registration process requires businesses to provide their Aadhaar, PAN, and GST details, facilitating a comprehensive digital database of registered enterprises.

Enhancing Transparency

One of the core principles of corporate governance is transparency. Udyam Registration promotes transparency by requiring MSMEs to disclose critical information about their business operations, financials, and ownership structures. This information is accessible to government agencies and financial institutions, fostering an environment where business practices are open and verifiable. Enhanced transparency builds trust among stakeholders, including investors, customers, and suppliers, as they can access reliable information about the registered MSMEs.

Promoting Accountability

Accountability is another fundamental aspect of corporate governance. Udyam Registration ensures that MSMEs are accountable for their business practices by formalizing their operations. Registered businesses are required to comply with various regulations and standards, making them more answerable to regulatory bodies and stakeholders. This accountability extends to financial reporting, where registered MSMEs must maintain accurate records and submit periodic financial statements. The formalization of businesses through Udyam Registration also means that they are subject to audits and inspections, further ensuring adherence to ethical business practices.

Facilitating Access to Financial Resources

Access to financial resources is critical for business growth and development. Udyam Registration plays a pivotal role in improving access to credit and financial services for MSMEs. Registered businesses are eligible for priority sector lending from banks, lower interest rates on loans, and collateral-free loans under schemes like the Credit Guarantee Fund Scheme. This access to financial resources enables MSMEs to invest in technology, infrastructure, and market expansion, fostering sustainable growth. Improved financial access also means that MSMEs can better manage their cash flows, reducing the risk of financial mismanagement and enhancing overall corporate governance.

Enabling Participation in Government Schemes

Government schemes and subsidies play a crucial role in supporting MSMEs. Udyam Registration makes businesses eligible for a range of government initiatives aimed at promoting innovation, technology adoption, and market competitiveness. These schemes include subsidies on patent registration, financial assistance for technology upgradation, and incentives for participating in trade fairs. Access to these schemes reduces operational costs for MSMEs and encourages them to adopt best practices and modern technologies. Participation in government schemes also requires compliance with specific criteria and standards, further promoting good corporate governance practices.

Strengthening Legal Compliance

Legal compliance is a cornerstone of corporate governance. Udyam Registration ensures that MSMEs comply with the regulatory requirements set forth by the MSMED Act and other relevant laws. Registered businesses are more likely to adhere to labor laws, environmental regulations, and tax obligations. Compliance with legal requirements not only protects MSMEs from legal penalties but also enhances their reputation and credibility. Moreover, the structured framework of Udyam Registration facilitates easier monitoring and enforcement of compliance, ensuring that MSMEs operate within the legal boundaries.

Encouraging Ethical Business Practices

Ethical business practices are integral to good corporate governance. Udyam Registration promotes ethical conduct by formalizing MSMEs and subjecting them to regulatory scrutiny. Registered businesses are expected to maintain high standards of integrity and fairness in their dealings with customers, employees, and other stakeholders. The formal registration process also discourages unethical practices such as underreporting income or avoiding taxes, as businesses are required to provide accurate financial and operational information. By fostering a culture of ethics and integrity, Udyam Registration helps MSMEs build a positive reputation and long-term trust with stakeholders.

Impact on Investor Confidence

Investor confidence is crucial for the growth and sustainability of businesses. Udyam Registration enhances investor confidence by providing a transparent and accountable framework for MSMEs. Investors are more likely to invest in businesses that are formally registered, as they can access reliable information about the company's financial health, ownership structure, and compliance status. The assurance of good corporate governance practices also reduces the perceived risk for investors, making MSMEs more attractive investment opportunities. Enhanced investor confidence translates into better access to capital, facilitating business expansion and innovation.

Improving Market Access

Market access is essential for business growth and competitiveness. Udyam Registration opens up new market opportunities for MSMEs by enabling them to participate in government procurement processes and international trade fairs. Registered businesses often receive preference in government tenders, providing them with opportunities to showcase their products and services to a broader audience. Improved market access not only boosts sales but also facilitates networking and collaboration with larger firms and global partners. By expanding their market reach, MSMEs can achieve sustainable growth and contribute significantly to economic development.

Conclusion

Udyam Registration has a profound impact on corporate governance within the MSME sector. By enhancing transparency, promoting accountability, facilitating access to financial resources, enabling participation in government schemes, strengthening legal compliance, and encouraging ethical business practices, Udyam Registration fosters a robust corporate governance framework. This framework not only supports the growth and development of MSMEs but also enhances their credibility, investor confidence, and market access. As MSMEs continue to navigate the challenges of the modern business landscape, Udyam Registration remains a critical tool in promoting good corporate governance and ensuring sustainable business success.

1 note

·

View note

Text

MSME Registration We help you to file for MSME Registration with the Ministry of Micro, Small & Medium Enterprises to avail several incentives, benefits & Concessions as a registered MSME. Get MSME Certificate or Udyam Certificate within 1 hours

0 notes

Text

MSME Verification API: A Smarter Way to Validate Udyam Registration

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of the Indian economy. According to the Ministry of MSME, over 1.5 crore Udyam registrations have been recorded as of 2024. As digital platforms, fintechs, and lenders increasingly work with these enterprises, verifying their legitimacy becomes a critical step—both for regulatory compliance and fraud prevention.

That’s where a MSME verification API comes in.

Why MSME Verification Is Crucial

Whether you're offering credit, onboarding sellers, or conducting KYB (Know Your Business) checks, verifying Udyam Registration ensures the business:

Is officially registered under the MSME Act

Has submitted correct business category (Micro/Small/Medium)

Provides a valid Udyam Registration Number (URN)

Matches key identity fields like PAN and Aadhaar

Manual verification through the Udyam portal is possible—but not scalable. It’s time-consuming, error-prone, and not viable when onboarding thousands of MSMEs.

What Is an MSME Verification API?

An MSME verification API allows platforms to instantly validate Udyam details in real-time by simply submitting the URN (Udyam Registration Number). It pulls data directly from government sources and returns structured, validated fields such as:

Legal business name

Udyam Registration Number

Business category (Micro/Small/Medium)

Date of registration

PAN & Aadhaar linkage

Business address

The API checks if the registration exists, matches inputs with official records, and ensures the enterprise is legitimate.

Benefits of Using Gridlines’ MSME Verification API

Gridlines’ MSME verification API simplifies the process for platforms that deal with high volumes of MSMEs. Here’s what makes it indispensable:

✅ Instant Validation: Eliminate manual lookups and delays—get real-time Udyam verification in milliseconds.

✅ Fraud Detection: Spot mismatched or fake Udyam numbers early to prevent fraud in lending or vendor onboarding.

✅ KYB Compliance: Stay compliant with RBI and fintech KYB mandates by verifying every business partner digitally.

✅ Seamless Integration: The API integrates easily into loan origination systems, onboarding flows, or marketplaces.

Use Cases Across Industries

Fintechs & NBFCs: Verify Udyam status before loan disbursal to MSMEs

Marketplaces: Onboard only genuine sellers with valid Udyam registration

Insurers: Confirm MSME eligibility for sector-specific insurance products

B2B Platforms: Build trust by validating vendor and supplier credentials

Final Thoughts

MSMEs are key players in India’s economic growth—but only when verified and trusted. By integrating a MSME verification API, platforms can automate Udyam checks, prevent fraud, and speed up onboarding without compromising compliance.

Start verifying Udyam registrations the smart way—visit Gridlines MSME API to learn more.

#MSMEVerification#UdyamRegistration#KYB#APIVerification#GridlinesAPI#FintechCompliance#BusinessVerification#FraudPrevention#DigitalOnboarding#MSMEIndia

0 notes

Text

youtube

Apply For Udyam Registration Msme Registration | उद्यम रजिस्ट्रेशन ऑनलाइन

ree Consultancy Call Us or WhatsApp : 8851616800

0 notes

Text

Online MSME/Udyam Registration Services Delhi

Get hassle-free MSME/Udyam registration services in Delhi with Taxgoal. Our online platform simplifies the process, ensuring quick and efficient registration for your Micro, Small, or Medium Enterprise. Benefit from expert guidance, timely submissions, and seamless documentation. Empower your business with the ease of online MSME registration through Taxgoal. To know more visit here: https://taxgoal.in/service/msme-udyam-registration/

0 notes

Text

Start Small, Dream Big: MSME Registration In India With Companies Next

So, you’ve got a brilliant business idea, a burning entrepreneurial spirit, and a desire to make your mark in the Indian market. Congratulations! But before you dive headfirst into the exciting world of business ownership, there’s one crucial step: MSME registration.

Now, registering your business can seem like a daunting task, filled with paperwork and bureaucratic hurdles. But fear not, fellow entrepreneur! This is where Companies Next comes in, your one-stop shop for hassle-free MSME registration in India.

Why Register as an MSME?

The Micro, Small and Medium Enterprises (MSME) sector is the backbone of the Indian economy, contributing significantly to GDP and employment generation. Recognizing this, the government offers a plethora of benefits for registered MSMEs, including:

Tax benefits: Lower tax rates, exemptions, and subsidies.

Easy access to credit: Preferential loan rates and loan guarantees from banks and financial institutions.

Government tenders: Participation in government procurement programs.

Subsidies and grants: Financial assistance for technology upgradation, marketing, and skill development.

Companies Next: Your MSME Registration Partner

Companies Next is a leading online platform dedicated to simplifying business setup and compliance for entrepreneurs like you. They understand the challenges you face and offer a comprehensive range of services to make MSME registration a breeze:

Expert guidance: Their team of experienced professionals will guide you through the entire process, from choosing the right business structure to completing the required documentation.

Online platform: Their user-friendly platform allows you to register your MSME online, saving you time and effort.

Document assistance: They will help you prepare all the necessary documents, ensuring accuracy and completeness.

Post-registration support: They don’t abandon you after registration! They provide ongoing support for compliance, including GST registration, trademark registration, and annual filings.

The Companies Next Advantage

Affordability: Their services are competitively priced, making them accessible to entrepreneurs of all budgets.

Transparency: They maintain complete transparency throughout the process, keeping you informed at every step.

Convenience: Their online platform and expert support make the entire process convenient and hassle-free.

Reliability: They have a proven track record of successful MSME registrations, giving you peace of mind.

Ready to Take the Next Step?

With Companies Next by your side, registering your MSME in India doesn’t have to be a daunting task. So, stop waiting and start your entrepreneurial journey today! Head over to their website, www.companiesnext.com, or give them a call to discuss your business idea and get started on your path to success.

Remember, starting small doesn’t mean dreaming small. With the right support and the right registration, your MSME can be the next big thing in the Indian market. So, take the plunge, register with Companies Next, and watch your business dreams take flight!

Disclaimer: This blog post is for informational purposes only and does not constitute legal advice. Please consult with a qualified professional for your specific needs.

SOURCE

#MSMERegistration#UdyamRegistration#MSMEBenefits#SmallBusinessIndia#GovernmentSchemes#FinancialSupport#BusinessGrowth#MSMEIndia#Entrepreneurship#MarketAccess#TaxBenefits#SMEs#BusinessDevelopment#IndianEconomy#MSMEFunding

0 notes