#NZ Safety Nets

Text

Safety Nets Christchurch | Residential Fall Safety Net Christchurch | Safety Nets NZ | EZI Nets

When it comes to ensuring safety on construction sites and residential areas, having reliable safety netting companies is crucial. In Christchurch, there are several reputable companies that specialize in providing top-notch safety nets and fall protection solutions.

One such company is Safety Nets NZ, which offers a wide range of high-quality safety nets to meet the specific needs of different projects. Their expertise lies in residential fall safety netting in Christchurch and Canterbury region, ensuring that homeowners and construction workers have the necessary protection against falls.

Site Safe Christchurch is another organization that plays a vital role in promoting safe practices on construction sites. They work closely with safety netting companies like Safety Nets NZ to ensure compliance with industry standards and regulations.

Canterbury Safety Nets is also a trusted name in the region, offering reliable residential safety nets for various applications. Their commitment to quality and customer satisfaction makes them a preferred choice among homeowners and contractors alike.

Whether it's for residential or commercial purposes, having access to reliable safety nets can provide peace of mind knowing that you have taken proactive measures to prevent accidents and protect lives. With companies like Safety Nets NZ, Site Safe Christchurch, and Canterbury Safety Nets serving the community, you can trust that your safety needs are well taken care of.

#Safety Netting Companies#Safety Nets Nz#Site Safe Christchurch#NZ Safety Nets#Residential Fall Safety Net Christchurch#Canterbury Safety Nets#Safety Nets Christchurch#Residential Safety Nets Canterbury

0 notes

Text

Safety Nets in Canterbury: Protecting Homes with EZI Nets

Discover peace of mind with safety nets in Canterbury, brought to you by EZI Nets. Our residential safety nets in Canterbury provide a secure barrier for your home, ensuring the safety of your loved ones. Whether it's preventing falls or protecting your property during construction, our NZ safety nets are designed to meet your specific needs. Trust EZI Nets for top-quality safety solutions, keeping your home and family safe in Canterbury.

https://ezinets.co.nz/

0 notes

Note

Hey lovely. Wanted to ask you this as you work in the industry but who funds Louis’ tour? Is that the record company or is he doing it himself? And who pays his band, manager etc? I’m just curious as to how much support he’s getting from his record label or if he’s really doing a lot of self funding.

Hello, my love! I’m gonna try and explain this the simplest way possible so I don’t get into too much jargon and make you read a 3,000 word essay hehe. Also, contracts can all vary, but this is the most standard way of touring when it comes to big artists. Let’s goooooo!

Okay, SO, when a big artist (or band) go on tour, they will 99.9% of the time have a contractual Agreement with a concert promoter, this includes the likes of Australian exclusive promoter TEG (who Niall is touring Australia with this year), international promoter Live Nation (Harry toured worldwide with them, Louis did Australia/Asia with them and probably worldwide too because of global deals), Australia/NZ exclusive promoter Frontier Touring (T Swift for Australia, but she was with Live Nation in the US) and there are many other promoters worldwide too. You’ll see on some specific marketing material that the artist and promoter put out, it will have their logo at the bottom of the tour poster, and shows they are what is called a “sponsor” or the concert promoter for this tour. See examples of this below:

^ niall’s Australian tour with TEG live on the bottom right

^ one of Harry’s US posters with Live Nation at the bottom

^louis’ Singapore tour poster, also with Live Nation at the bottom

So basically, what these concert promoters do, is sponsor the artist. That means, the booking agent/tour manager will sign a contract with whichever promoter offers the best deal, and will tour with them. The reason why they sign up for a tour with a promoter, is because the promoter provides a safety net, and takes care of a lot of the things that come with touring that the artist and their team don’t wanna think about organising, and so they let them do it for them. This includes stuff like paying and organising crewing teams and riggers and those guys, work Visas to get into the country, marketing, venues and available dates for shows, catering, sound/lights/backline/LED, rent costs for the venue, security, flights, accommodation, etc., which is negotiated per the contractual Agreement.

The tour manager of the artist also works really closely with these guys to approve any staging, catering, or locally rented lighting rigs and all that specific fun stuff that the artist doesn’t travel with, but is particular about to make the shows/tour exactly how they want them (this will be in their production rider and hospitality rider that they supply the promoter with).

Let’s say, for example, Niall really wants to stay in a specific 5 star hotel in Brisbane, he wants a flight to Aus at a very particular time on a very specific date, he wants to bring 40 crew members with him, he needs a specific set of lights and a particular sound desk at each show (bc he’s my little drama queen). Him and his team are super busy on the other side of the world, they just don’t have time to organise all of that. It would be constant emails and phone calls back and forth with quotes, availability, submitting 40 work Visa applications, multiple suppliers saying “yes we can do that” and “no we can’t”, time zones, etc., so why not sign up with a promoter and let them do it for him?

So now, we get into the money side of things. Sure, niall knows he will make money if he tours without a promoter, he knows he’ll sell tickets in Aus, and he knows that he’d probably come out with a profit. But apart from not wanting to organise and spending a heap of money on all of this stuff, is it worth touring if he doesn’t think it’ll be sustainable and he’s basically lost money from doing it? No, it’s not. SO promoters know this, and they all fight for artists to sign with them, by offering up the biggest guarantee they can. This is often a guarantee vs ticket sales scenario.

So, if TEG were like “hey niall, we’ll guarantee you $800,000 to tour with us, or, 80% of ticket sales, whichever amount is higher”. A guarantee means he’s not relying on ticket sales alone. He knows that if none of his shows sell out and less people come than he thought, he’s still gonna get $800,000. Or, if he sells a heap of tickets, he gets more than that, yay! But if Frontier Touring were like “nah, come with us, we’ll give you $700,000 vs 90% of ticket sales, he’d have to consider the fact he might not make as much money, unless he really trusts that all of his shows sell out. So they usually go with whoever can give a higher guarantee.

Now, within these deals, sometimes the higher the guarantee, the more the artist has to pay for themselves (I’m keeping this at like… what a Harry/Niall/Louis level deal would kind of be, not like an Elton John level or something, because that would probably vary entirely). So, Niall has been guaranteed this insane amount of money, but TEG are then like “well… we’ll do all of this and you know you’re making money, but we do have a budget. So you can pay for your flights and work visas, and everything that you want that is above our budget cap, but we will try to keep everything under budget unless you approve to pay more for a specific thing you want”. Ya know? So yeah, Niall is like “hell yeah dudes, sounds good. Sign me up”. And then it’s all a bunch of finance organising etc., but yeah. Usually the smaller the band, the more they’ll pay for if they go with a promoter, because the promoter doesn’t want to take too many risks on them and still needs to make money. They’ll still get a guarantee, but will have to sort out more by themselves, and not treated exactly like royalty like Harry would be.

So long story short, the concert promoter funded Louis’ tour, and probably organised just about everything. The concert promoter sends the money to Louis’ agent (whether it be the guarantee or higher due to ticket sales), and they divide that amount to him, his manager (which is usually 15-20% but can differ with how famous the artist is), anyone else involved in contracts for % of touring, and then happy days. The tour is over and everything has been a lot easier than the tour manager(s) having to organise it all by themselves, and risk losing a bunch of money in doing so.

Thanks for the q, anon! Let me know if you need clarification on anything xx

12 notes

·

View notes

Text

Protect Your Business: The Importance of Public Liability Insurance

Running a business is an exhilarating journey, filled with opportunities and challenges. As you navigate this path, protecting your venture from unforeseen risks becomes paramount. One critical aspect of safeguarding your business is securing Public Liability Insurance.

This essential coverage of Best Public Liability Insurance NZ not only shields you from potential financial burdens but also enhances your reputation and trustworthiness among clients and partners.

What is Public Liability Insurance?

Public Liability Insurance is a type of insurance that covers the costs associated with legal claims made against your business by third parties. These claims typically arise from incidents where someone suffers injury or property damage due to your business operations. Whether you own a small café, a construction company, or a consultancy firm, this insurance is indispensable.

Why Your Business Needs Public Liability Insurance

Financial Protection: Accidents happen, and when they do, they can lead to costly legal battles. Public Liability Insurance ensures that your business is protected from the financial strain of compensation claims and legal fees. Without this coverage, a single claim could potentially cripple your finances and jeopardise your business's future.

Enhanced Credibility: Having Public Liability Insurance demonstrates professionalism and responsibility. Clients, customers, and partners are more likely to trust and engage with a business that has taken steps to protect their interests. This insurance can be a decisive factor when bidding for contracts or securing high-profile clients.

Legal Requirement: In many industries, Public Liability Insurance is not just a recommendation but a legal requirement. For instance, contractors and tradespeople often need to show proof of insurance to work on certain projects. Failing to comply can result in hefty fines and legal repercussions, putting your business at risk.

Peace of Mind: Knowing that you have a safety net in place allows you to focus on growing your business without the constant worry of potential lawsuits. Public Liability Insurance provides peace of mind, enabling you to operate with confidence and peace of mind.

Real-Life Scenarios Where Public Liability Insurance Matters

Retail Business: Imagine a customer slips on a wet floor in your store and sustains an injury. Without Public Liability Insurance, you could be liable for medical expenses and compensation, which could run into thousands of dollars.

Construction Company: A passerby is injured by falling debris at your construction site. The public liability insurance NZ would cover the legal costs and any awarded damages, protecting your business from financial ruin.

Event Planning: At an event you organised, a guest trips over electrical wiring and suffers a broken arm. Your Public Liability Insurance would cover the medical costs and any legal fees associated with the incident.

Choosing the Right Public Liability Insurance

When selecting public liability insurance, it's essential to consider the specific needs of your business. Here are a few tips:

Assess Your Risks: Identify potential hazards associated with your business operations. This assessment will help you determine the appropriate coverage level.

Compare Policies: Not all insurance policies are created equal. Compare different providers and policies to find one that offers comprehensive coverage at a competitive price.

Understand Exclusions: Be aware of what is and isn't covered by your policy. Some policies may exclude certain types of claims or incidents, so it's crucial to read the fine print.

Seek Professional Advice: Consulting with an insurance broker or professional can provide valuable insights and help you make an informed decision.

Summing Up

Public Liability Insurance is more than just a safety net; it's a strategic investment in your business's future. By protecting against the unexpected, you can focus on what you do best – running and growing your business.

Don't wait for an incident to realise the importance of this coverage. Act now, secure your public liability insurance NZ, and ensure your business is prepared for whatever comes its way.

Source - https://liability-insurance-cover.blogspot.com/2024/08/protect-your-business-importance-of.html

0 notes

Text

MBI Insurance for Startups: What New Zealand Entrepreneurs Should Know

Starting a new business is an exhilarating journey filled with opportunities and challenges. For entrepreneurs in New Zealand, ensuring that their startup is protected from potential risks is crucial.

One essential component of this protection is MBI insurance. This blog will explore what Top MBI insurance NZ offers and why it is a vital consideration for startups.

What is MBI Insurance?

MBI insurance, often called Management Buy-In insurance, is a type of coverage designed to protect businesses during a management buy-in scenario.

This situation arises when a new management team, often with external investors, buys into a company and takes over the business's management.

MBI insurance provides financial protection against risks that might arise during this transition period.

The insurance covers a range of potential issues, including financial losses due to poor management decisions, unexpected changes in leadership, and other operational risks.

MBI insurance can offer a crucial safety net for startups, which are particularly vulnerable during their formative years.

Why MBI Insurance is Important for New Zealand Startups

Protecting Against Management Risks

Startups are inherently risky ventures, and adding a new management team can introduce additional complexities. MBI insurance NZ helps mitigate these risks by providing coverage for losses that may occur due to management errors or omissions.

If the new management team makes decisions that lead to financial losses or operational disruptions, MBI insurance can help cover these costs.

For entrepreneurs, this means that their business investment and personal finances are better protected.

This peace of mind is invaluable, allowing them to focus on growing their startup rather than worrying about potential management risks.

Enhancing Business Credibility

Having MBI insurance can enhance a startup's credibility in the eyes of investors, partners, and clients. It demonstrates that the business is proactively managing and mitigating risks.

Investors are more likely to have confidence in a startup with comprehensive insurance coverage, as it is committed to responsible management and risk management practices.

Having MBI insurance can be a significant advantage for startups seeking funding or strategic partnerships.

It can help attract investors by showcasing that the business is well-prepared to handle potential challenges and uncertainties.

Facilitating Smooth Transitions

Transition periods can be challenging for startups, especially when introducing new management. MBI insurance facilitates smoother transitions by providing financial support if issues arise during this period.

Whether it’s a sudden departure of key personnel or unforeseen operational challenges, MBI insurance can help ensure that the business remains stable and continues to function effectively.

A smooth transition is crucial for startups to maintain momentum and achieve long-term success. MBI insurance can provide the necessary support to navigate these changes without significant disruptions.

Financial Protection Against Unforeseen Events

The startup landscape is fraught with uncertainties, and unforeseen events can have a significant impact on a business's financial health.

MBI insurance offers financial protection against various unexpected events, including legal disputes, regulatory challenges, or other issues that may arise during a management buy-in.

This financial cushion can be a lifesaver for entrepreneurs, helping cover unexpected costs and maintain business operations.

It ensures that the startup can weather financial storms and continue to pursue its growth objectives without being derailed by unexpected setbacks.

How to Choose the Right MBI Insurance Policy

Selecting the right MBI insurance policy is essential to ensure that your startup is adequately protected. Here are some key considerations when choosing an MBI insurance policy in New Zealand:

1. Assess Your Startup’s Needs

Every startup is unique, and its insurance needs will vary based on industry, size, and specific risks. Assess your startup’s needs and identify the key risks MBI insurance should cover.

This may include management errors, operational disruptions, or financial losses.

2. Compare Insurance Providers

Different insurance providers offer various MBI insurance policies with varying coverage options and premiums.

Compare policies from multiple providers to find the best suits your startup’s needs and budget. Consider factors such as coverage limits, exclusions, and additional benefits offered.

3. Seek Professional Advice

Consult with a professional insurance advisor or broker who specialises in MBI insurance. They can provide expert guidance and help you navigate the complexities of insurance policies.

A professional can assist in tailoring a policy that meets your startup’s specific requirements and ensures comprehensive coverage.

4. Review and Update Regularly

As your startup grows and evolves, its insurance needs may change. Regularly review and update your MBI insurance policy to ensure it continues to provide adequate protection.

Stay informed about changes in the business environment and adjust your coverage accordingly.

Conclusion

For entrepreneurs, MBI insurance NZ is vital to a comprehensive risk management strategy.

It protects against management-related risks, enhances business credibility, facilitates smooth transitions, and offers financial support during unforeseen events.

By carefully choosing the right MBI insurance policy and working with professional advisors, startups can safeguard their investments and focus on achieving their growth objectives.

Source - https://autolifecarinsurancenz.blogspot.com/2024/07/mbi-insurance-for-startups-what-new.html

#mbi insurance nz#best mechanical breakdown insurance nz#mechanical insurance nz#car mechanical insurance nz

0 notes

Text

Home

Understanding the Warranty Options for Used Cars in Auckland, NZ

When it comes to purchasing a used car in Auckland, NZ, understanding the available warranty options can significantly impact your buying decision. A warranty provides peace of mind, safeguarding against unforeseen mechanical failures and costly repairs. This comprehensive guide delves into the different types of warranties available, their benefits, and essential considerations for Auckland car buyers. You may find more details about this at used cars auckland nz

The Importance of Warranties for Used Cars

Purchasing a used car inherently involves a degree of risk. Unlike new cars, used vehicles have a history that could include wear and tear, previous accidents, or mechanical issues. Warranties serve as a safety net, offering protection and financial security should problems arise post-purchase. They not only help cover repair costs but also enhance the resale value of the vehicle by assuring potential buyers of its maintained condition.

Types of Warranties Available

In Auckland, used car warranties come in various forms, each catering to different needs and budgets. Understanding these options is crucial to making an informed decision.

Dealer Warranties:

When purchasing from a dealership, the car often comes with a dealer warranty. These warranties typically cover major mechanical components such as the engine, transmission, and drivetrain for a specific period or mileage limit. Dealer warranties vary in terms of coverage and duration, so it's vital to read the fine print and understand the exclusions and conditions.

Manufacturer’s Extended Warranties:

Some manufacturers offer extended warranties for used cars. These warranties extend the original new car warranty for a specified period. They often provide comprehensive coverage, similar to the original warranty, and are transferable, adding value if you decide to sell the car. However, these warranties can be more expensive and may require the vehicle to meet certain conditions.

Third-Party Warranties:

Third-party warranties are offered by independent companies and provide flexibility in terms of coverage options and pricing. These warranties can cover a wide range of components and systems, depending on the chosen plan. It's essential to research the reputation and reliability of the third-party provider, as the quality of service can vary significantly.

Factors to Consider When Choosing a Warranty

Selecting the right warranty for your used car involves evaluating several key factors to ensure it meets your needs and provides adequate protection.

Coverage Details:

Thoroughly examine what is covered under the warranty. Standard warranties typically cover major components like the engine, transmission, and electrical systems. However, some warranties may include additional features like roadside assistance, rental car reimbursement, and coverage for hybrid or electric vehicle components.

Duration and Mileage:

Warranties come with specific time and mileage limits. Assess your driving habits to choose a warranty that aligns with your expected usage. If you drive frequently or plan to keep the car for an extended period, opt for a longer warranty with higher mileage limits.

Claim Process:

Understanding the claim process is crucial. Some warranties require repairs to be done at authorized service centers, while others offer more flexibility. Ensure the claim process is straightforward and the provider has a reputation for efficient and hassle-free service.

Cost and Payment Options:

Warranties vary in cost based on the level of coverage and the vehicle's make, model, and age. Compare different warranty plans to find one that fits your budget. Additionally, check if the provider offers flexible payment options, such as monthly installments, to ease the financial burden.

Exclusions and Limitations:

Every warranty has exclusions and limitations. Common exclusions include regular maintenance, wear-and-tear items like brake pads and tires, and pre-existing conditions. Be aware of these limitations to avoid unexpected expenses.

Making an Informed Decision

To make an informed decision, conduct thorough research and consider seeking advice from automotive experts or trusted mechanics. Read customer reviews and testimonials to gauge the reliability and reputation of the warranty provider. Additionally, ask for a sample contract to review the terms and conditions before committing.

The Role of Consumer Rights in New Zealand

New Zealand's Consumer Guarantees Act (CGA) offers significant protection to buyers of used cars. Under the CGA, vehicles purchased from dealers must be of acceptable quality, fit for purpose, and match the description given. If a car fails to meet these guarantees, the buyer is entitled to a repair, replacement, or refund. It's important to understand your rights under the CGA and how they complement the warranty coverage.

1 note

·

View note

Text

The Ultimate Guide to Choosing Pet Insurance: What You Need to Know

In today's world, our furry companions are more than just pets—they're beloved members of our families. When it comes to providing for their health and well-being, pet insurance can be a crucial tool. However, navigating the world of pet insurance nz can be complex and overwhelming.

To help you make an informed decision, we've put together this ultimate guide covering everything you need to know about choosing the right pet insurance.

Understanding Pet Insurance Basics

Before delving into the specifics, it's essential to grasp the fundamentals of pet insurance. Pet insurance operates similarly to health insurance for humans, covering certain medical expenses for your pet. Policies typically reimburse a percentage of eligible veterinary costs after you've met your deductible.

This financial safety net can be a lifesaver in emergencies, ensuring that your pet receives necessary medical care without causing financial strain.

Coverage Options: What's Included and Excluded

One of the most critical aspects of choosing pet insurance nz is understanding what each policy covers. While specifics can vary between providers, most plans cover accidents and illnesses, such as broken bones, infections, and cancer treatments.

Additionally, some policies may include coverage for routine care like vaccinations and dental cleanings, while others may offer these as optional add-ons. It's crucial to review the coverage details carefully, paying attention to any exclusions, pre-existing conditions, and waiting periods.

Factors to Consider When Choosing a Policy

When selecting a pet insurance policy, several factors should influence your decision:

- Cost: Compare premiums, deductibles, and reimbursement percentages to find a policy that fits your budget.

- Coverage Limits: Check for annual or lifetime caps on payouts. Higher limits provide more comprehensive coverage.

- Reimbursement Method: Understand whether reimbursements are based on actual veterinary costs or a benefit schedule.

- Pre-existing Conditions: Determine how the policy handles pre-existing health issues, as these may not be covered.

- Provider Reputation: Research customer reviews and ratings to gauge the reliability and customer service of the insurance company.

Types of Pet Insurance Plans

Pet insurance plans come in various forms, each tailored to different needs and budgets:

- Accident-Only Plans: These plans cover injuries resulting from accidents, such as broken bones or swallowed objects.

- Accident and Illness Plans: The most common type of coverage, these plans include accidents and a range of illnesses.

- Wellness Plans: Often offered as an add-on, wellness plans cover routine care like vaccinations, flea prevention, and dental cleanings.

- Comprehensive Plans: These all-inclusive plans cover accidents, illnesses, and often routine care, providing the most extensive coverage.

Conclusion

Choosing the right pet insurance nz requires thoughtful consideration and research. By understanding the basics of pet insurance, evaluating coverage options, considering key factors, and following practical tips, you can ensure that your furry friend receives the best possible care without financial worries.

Remember, investing in pet insurance is an investment in your pet's health and well-being, providing peace of mind for you and your beloved companion.

0 notes

Text

Retirement Planning with Property Investments: Smart Strategies for the Future

Retirement planning can seem like a daunting task, especially with the myriad of investment options available. However, one avenue that continues to stand the test of time is property investments.

Whether you're a seasoned investor or just starting to dip your toes into the world of financial planning, incorporating Commercial property investments in NZ into your retirement strategy can provide stability, growth, and peace of mind for the future.

Understanding the Power of Property Investments

When it comes to building wealth and securing your financial future, property investments offer a unique set of benefits. Unlike other investment vehicles, such as stocks or bonds, property investments provide tangible assets that have the potential to appreciate over time.

Additionally, rental income from investment properties can serve as a reliable source of passive income during retirement.

Diversification: A Key Component of Retirement Planning

Diversifying your investment portfolio is essential for mitigating risk and maximising returns. Including property investments in your retirement strategy allows you to spread your risk across different asset classes.

This diversification can help protect your savings from market fluctuations and economic downturns, providing a more stable foundation for your retirement nest egg.

Long-Term Growth Potential

One of the most attractive features of property investments NZ is their long-term growth potential. While the real estate market may experience short-term fluctuations, historical data has shown that property values tend to appreciate over time.

By investing in properties with strong growth potential, you can capitalise on this upward trend and build significant wealth for your retirement years.

Generating Passive Income

Generating passive income is a key objective for many retirees, as it allows them to maintain their desired lifestyle without relying solely on savings or pension payments. Property investments offer an excellent opportunity to generate passive income through rental yields.

By acquiring rental properties, you can enjoy a steady stream of income throughout your retirement years, helping to cover living expenses and enhance your overall financial security.

Tax Advantages of Property Investments

In addition to potential growth and passive income, property investments also offer various tax advantages that can further boost your retirement savings. Depreciation, mortgage interest deductions, and property tax deductions are just a few examples of how real estate investors can minimise their tax liability and maximise their after-tax returns.

Consulting with a tax professional can help you fully leverage these benefits and optimise your retirement strategy.

Risk Management and Due Diligence

While property investments can offer numerous benefits for retirement planning, it's essential to approach them with caution and diligence. Conducting thorough research, performing property inspections, and carefully analysing market trends are all critical steps in mitigating risk and ensuring the success of your investment endeavours.

Additionally, maintaining an emergency fund can provide a safety net to cover unexpected expenses or vacancies, safeguarding your retirement income.

Ending Notes

Property investments can be a valuable component of your retirement planning strategy, offering stability, growth, and passive income opportunities for the future. By diversifying your portfolio, capitalising on long-term growth potential, and leveraging tax advantages, you can build a secure financial foundation that supports your retirement goals.

However, it's essential to approach new Auckland developments with careful consideration and thorough due diligence to mitigate risk and maximise returns. With proper planning and guidance, you can harness the power of real estate to create a prosperous and fulfilling retirement lifestyle.

#property investments NZ#auckland new developments#housing developments auckland#new housing developments auckland

0 notes

Text

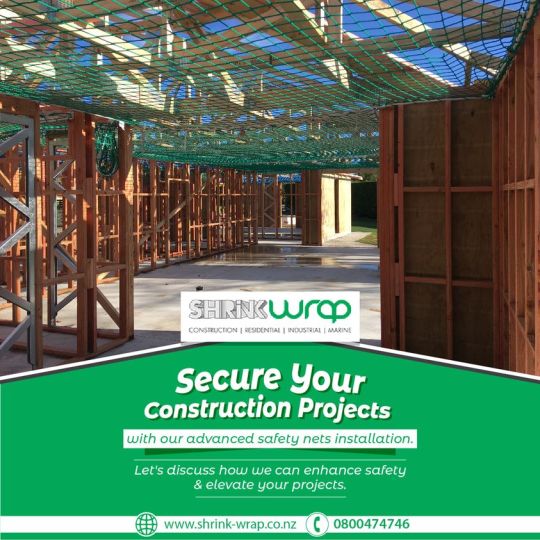

Secure your construction projects with our advanced safety nets installation. Let's discuss how we can enhance safety and elevate your projects.

#ShrinkWrap#ShrinkWrapping#Christchurch#NewZealand#ConstructionWrap#BuildingWrap#BoatWrapping#Marinewrap#Constructionrenovation#Renovation#Transport#Storage#Safetynet#Safetynets#Constructionnet#Buildingnet

0 notes

Text

Disability Insurance of Fintradetech Ensuring your Financial Security for the future

Fintradetech's Disability Insurance helps you secure your financial future in the event of an unforeseen disability. Our policy provides a steady stream of income so you don't have to worry about lost wages or a lack of financial security. We understand that disability can be unpredictable, and our policy gives you the peace of mind you need to move forward. With our Disability Insurance, you can rest assured that your financial security is protected for the future.

0 notes

Text

Harnessing Capital: How Business Lending Services Can Fuel Success

In the ever-evolving landscape of entrepreneurship, access to capital remains a critical factor in determining the success or failure of a business venture. For many aspiring entrepreneurs and established companies alike, the ability to secure the necessary funds to start or grow their enterprises can be a daunting challenge. This is where business lending services come into play.

In this blog post, we will explore the significance of business lending NZ services and how they can be a powerful catalyst for your business's success.

The Role of Business Lending Services

Before delving into the ways business lending services can fuel your success, it's important to grasp their fundamental role.

Simply put, business lending services are designed to provide financial assistance to businesses, allowing them to access the capital needed to meet various objectives. Whether you are launching a startup, expanding operations, or dealing with unexpected expenses, they offer a lifeline that can make all the difference.

Visit this website - Startup Business Lending NZ

Diverse Financing Options

One of the most significant advantages of business lending is the array of financing options they offer. From traditional bank loans to innovative online lending platforms, there are various avenues to explore. This diversity ensures that businesses of all sizes and industries can find a suitable financing solution tailored to their unique needs.

Whether you require a small working capital loan or a substantial investment for expansion, business lending services can provide the financial flexibility you need.

Speed and Convenience

In the fast-paced world of business, timing is often critical. Traditional lending institutions can be notorious for their lengthy approval processes and paperwork requirements. However, business lending services have revolutionised the lending landscape by offering speed and convenience.

Online applications, streamlined approval processes, and quick disbursement of funds mean that you can seize opportunities and address challenges without delay.

Tailored Solutions

Every business is unique, and so are its financial needs. Business lending recognises this fact and often provides tailored financing solutions.

Whether you need a short-term loan to cover seasonal fluctuations or a long-term investment to fuel sustainable growth, these services can work with you to structure a loan that aligns with your business's goals and financial capabilities.

Building Credit and Relationships

Establishing a positive credit history is vital for any business. Consistently meeting your financial obligations through business lending NZ services can help you build a strong credit profile.

Moreover, developing relationships with these lenders can be advantageous in the long run. As your business grows, your financing needs may evolve, and having a trusted lending partner can simplify the process of securing additional capital.

Mitigating Risk and Managing Cash Flow

Unforeseen challenges are an inherent part of business. Business lending can serve as a valuable risk management tool. By having access to a financial safety net, you can navigate unexpected expenses or downturns with greater ease, ensuring the continuity of your operations.

Additionally, these services can assist in optimising your cash flow, helping you maintain a healthy financial balance.

Conclusion

Business lending services are not just about loans; they are about unlocking opportunities, managing challenges, and fuelling the success of your business. Their flexibility, speed, and tailored solutions make them an invaluable resource for entrepreneurs and established companies alike. So, whether you are embarking on a new venture or looking to take your business to the next level, consider harnessing the power of business lending NZ services to propel your success.

Remember, the world of business is dynamic, and having the right financial partner can be a game-changer.

Source - https://crediflex6.wordpress.com/2023/10/11/harnessing-capital-how-business-lending-services-can-fuel-success/

0 notes

Text

Why Public Liability Insurance Is Crucial For Your Business?

Running a business is like embarking on a thrilling adventure. There are highs, lows, and unexpected twists along the way. Amidst all the excitement, it's crucial to consider the potential risks that come with operating a business. One of the most significant steps you can take to protect your business in New Zealand is by investing in Public Liability Insurance NZ. In this blog post, we'll delve into why having Public Liability Insurance NZ is absolutely crucial for your business's success and peace of mind.

Understanding Public Liability Insurance NZ

Before we dive into why Public Liability Insurance NZ is so vital, let's ensure we're on the same page regarding what it actually is. Public Liability Insurance NZ is designed to protect your business from legal and financial liabilities if your business activities cause injury to a person or damage to property.

Whether you own a small cafe, a construction company, or a consulting firm, Public Liability Insurance NZ is a must-have. It provides coverage for legal costs and compensation payments in the event that a third party sues your business for injury or property damage.

Protection Against Unforeseen Circumstances

No matter how cautious you are, accidents can happen. A customer might slip on a wet floor in your store, or a visitor could be injured by falling objects at your construction site. Without Public Liability Insurance NZ, your business could be facing significant financial loss due to legal fees and compensation payouts.

By having Public Liability Insurance NZ in place, you can rest assured that your business is protected against such unforeseen circumstances. It serves as a safety net, allowing you to focus on running your business with confidence, knowing that you're covered if something goes wrong.

Compliance with Legal Requirements

In New Zealand, having Public Liability Insurance NZ is not just a smart business move; it's often a legal requirement, especially if your business involves interactions with the public. Many contracts and agreements with clients or vendors also stipulate the need for Public Liability Insurance NZ.

Failing to have adequate Public Liability Insurance NZ could result in legal penalties and may even jeopardise your business's reputation. By ensuring that your business is properly insured, you not only comply with legal obligations but also demonstrate your commitment to operating responsibly.

Building Trust with Clients and Customers

Having Public Liability Insurance NZ sends a powerful message to your clients and customers. It shows that you take your business seriously and that you are prepared to take responsibility for any unforeseen events that may occur.

When potential clients know that your business is insured, they are more likely to trust you and feel confident in doing business with you. It's a clear indicator that you value their safety and well-being, which can go a long way in building long-term relationships and fostering loyalty.

Peace of Mind for You and Your Employees

Running a business is already challenging enough without having to worry about potential legal liabilities. Public Liability Insurance NZ provides you and your employees with peace of mind, knowing that your business is protected against the unexpected.

With the right Public Liability Insurance NZ policy in place, you can focus on growing your business, knowing that you have a reliable safety net to fall back on if things don't go as planned.

Conclusion

In conclusion, Public Liability Insurance NZ is not just an optional expense; it's a fundamental aspect of running a business in New Zealand. From protecting your finances to building trust with clients, the benefits of having Public Liability Insurance NZ are undeniable. Don't wait until it's too late – invest in Public Liability Insurance NZ today and safeguard the future of your business.

Source - https://liability-insurance-cover.blogspot.com/2024/06/why-public-liability-insurance-is.html

#public liability insurance#liabilities insurance#public liability insurance nz#business interruption insurance

0 notes

Text

How Mechanical Breakdown Insurance Keeps You Driving

Have you ever found yourself stranded on the side of the road due to a sudden car breakdown? It's a scenario that many of us can relate to, and the inconvenience and unexpected expenses that come with it can be overwhelming.

However, there's a solution that can provide a safety net for such unforeseen circumstances - Best Mechanical Breakdown Insurance nz. In this blog post, we'll delve into the world of MBI, exploring its benefits, cost-saving advantages, and the peace of mind it offers to drivers.

Mechanical Breakdown Insurance

Imagine this: you're cruising down the highway when suddenly, your car's engine starts sputtering, and you're forced to pull over.

This is where MBI comes into play. Unlike traditional auto insurance, which primarily covers accidents and damage from external factors, MBI specifically targets mechanical failures and issues. It serves as a shield against the financial burden of unexpected car repairs, providing coverage for major components such as the engine, transmission, and electrical systems.

The coverage provided by MBI is a game-changer for drivers, offering protection from costly repair bills that can arise from wear and tear over time. By understanding the distinct nature of MBI and its focus on mechanical issues, drivers can equip themselves with a comprehensive safety net for their vehicles.

The Cost-Saving Benefits of MBI

One of the most compelling aspects of MBI is its ability to save drivers money in the long run. It goes beyond the limitations of standard warranties and traditional auto insurance plans by covering repairs that may not be included in these options.

For instance, engine failure, electrical malfunctions, and other mechanical issues can be addressed through MBI, providing a financial safety net for drivers when the unexpected occurs.

Consider the peace of mind that comes with knowing that even complex and costly repairs are covered under MBI. This cost-saving benefit not only eases the financial burden on drivers but also ensures that their vehicles are well-protected against a wide range of mechanical issues.

Peace of Mind on the Road

Picture this: you're embarking on a long road trip, and the last thing you want to worry about is the possibility of a breakdown in the middle of nowhere.

This is where MBI truly shines, offering drivers peace of mind knowing that unexpected mechanical issues will be taken care of. It's the assurance that, no matter what lies ahead on the road, your vehicle is safeguarded against unforeseen mechanical failures.

Additionally, MBI provides the convenience of access to a network of authorised repair facilities, ensuring that drivers have reliable resources to turn to when repairs are needed. This level of support and assurance can make all the difference for drivers seeking a seamless and stress-free driving experience.

Choosing the Right MBI Plan

Selecting the right MBI plan is a crucial decision for drivers looking to protect their vehicles. It's essential to consider factors such as coverage limits, deductibles, and additional benefits when evaluating MBI options. By understanding the nuances of each plan, drivers can make informed choices that align with their specific driving needs and preferences.

Furthermore, reviewing the terms and conditions of MBI plans is paramount in ensuring that the selected coverage meets expectations. Whether it's assessing the scope of coverage or exploring additional perks offered within the plan, a thorough evaluation can lead to a well-informed decision that sets the stage for a secure and worry-free driving experience.

Conclusion

The road to peace of mind begins with understanding and embracing the benefits of Mechanical Breakdown Insurance nz. From its cost-saving advantages to the assurance it provides on the road, MBI stands as a valuable asset for drivers seeking to safeguard their vehicles from unexpected mechanical issues.

By exploring their options for obtaining MBI and choosing the right plan, drivers can embark on their journeys with confidence, knowing that their vehicles are well-protected against the uncertainties of the road.

#mbi insurance nz#mechanical breakdown insurance nz#mechanical insurance nz#car mechanical insurance#best mechanical breakdown insurance nz

0 notes

Text

5 Steps to Secure Your Future: Advice from Financial Advisers

When it comes to securing your financial future, the guidance of experts is invaluable. This is where financial advisors in Auckland step in, helping you navigate the complex world of money management. Whether you're just starting your financial journey or looking to make smarter choices, these professionals offer advice that can make a significant difference. In this article, we'll break down the top 5 steps recommended by financial advisers that can help you pave the way to a more secure future.

Set Clear Financial Goals

Setting goals is like plotting a course on a map; it gives you direction and purpose. In the same way, defining your financial objectives is the first step to securing your future. Be it saving for a home, funding your child's education, or planning for retirement, having clear goals allows you to tailor your financial decisions accordingly. Financial advisers often stress the importance of setting both short-term and long-term goals, as they provide a roadmap for your financial journey.

Create a Realistic Budget

Budgeting might not sound exciting, but it's the foundation of financial stability. Think of it as a roadmap for your spending habits. A budget helps you track your income and expenses, ensuring you're living within your means and saving for your goals.

Financial advisers recommend categorising your expenses, prioritising needs over wants, and leaving room for unexpected costs. By sticking to a budget, you gain control over your finances and can allocate resources effectively.

Build an Emergency Fund

Life is full of surprises, and having a safety net can make all the difference. An emergency fund, suggested by financial advisors Auckland, is a stash of money set aside for unexpected situations like medical emergencies, car repairs, or sudden job loss.

Aim to save enough to cover 3 to 6 months' worth of living expenses. This fund acts as a cushion, preventing you from going into debt when life throws a curveball.

Invest Wisely for Growth

While saving is important, investing takes your financial strategy up a notch. Financial advisers emphasise the value of investing to grow your wealth over time. Depending on your risk tolerance and financial goals, you might consider stocks, bonds, mutual funds, or real estate.

Diversifying your investments spreads risk and increases your potential for returns. Remember, investing is a long-term game, so patience is key.

Seek Professional Guidance from Financial Advisers

No journey is complete without a trustworthy guide. This is where NZ financial advisers truly shine. These experts have an in-depth understanding of the financial landscape and can provide personalised advice tailored to your unique situation. They can help you fine-tune your goals, optimise your budget, create a strategic investment plan, and adjust your strategy as circumstances change. Their expertise transforms your financial aspirations into actionable plans.

Conclusion

In conclusion, securing your financial future might seem like a daunting task, but with the right steps and guidance from financial advisers, it becomes an achievable goal.

By setting clear goals, budgeting wisely, building an emergency fund, investing strategically, and seeking professional advice, you're taking proactive steps toward a stable and prosperous future.

Remember, just like you'd trust a map for a journey, trust the insights of financial advisors Auckland to navigate the intricate paths of finance.

Your future self will thank you for the effort you put in today. So, embark on this journey with confidence, and let the wisdom of financial experts light your way.

Source From: 5 Steps to Secure Your Future: Advice from Financial Advisers

0 notes

Text

Investing in Quality: What to Look for When Buying Soccer Goals in NZ

Hello, soccer enthusiasts! Whether you're a parent looking to set up a backyard pitch, a coach outfitting a local team, or a school updating its sports facilities, investing in the right soccer goals is essential. With numerous options available, it can be challenging to know what to look for. Fear not! This guide will help you navigate the process of finding the perfect soccer goals in New Zealand. Let's dive in!

Why Quality Matters

First and foremost, investing in quality soccer goals ensures safety, durability, and a better playing experience. High-quality goals can withstand harsh weather conditions and the rigors of intense play, making them a cost-effective choice in the long run. Poorly constructed goals, on the other hand, can pose safety risks and require frequent replacements.

Material Matters

Frame Construction

The material of the frame is a critical factor when you Buy Soccer Goals in NZ. Look for goals made from robust materials like aluminum or steel. Aluminum is lightweight and resistant to rust, making it a popular choice for portable goals. Steel, while heavier, offers exceptional strength and stability, ideal for permanent installations.

Netting Quality

The netting should be strong and weather-resistant. Polyethylene and nylon are common materials that offer durability and resilience. Ensure that the netting is tightly woven to withstand powerful shots and varying weather conditions.

Size and Portability

Standard Sizes

Soccer goals come in various sizes to cater to different age groups and levels of play. The standard sizes are:

5-a-side: 3m x 2m

7-a-side: 4m x 2m

11-a-side (full size): 7.32m x 2.44m

Choose a size that fits your needs, keeping in mind the age and skill level of the players.

Portability

If you need flexibility, consider portable goals. These goals are easy to assemble, disassemble, and transport, making them perfect for training sessions or temporary setups. Ensure that they have secure anchoring systems to prevent them from tipping over during play.

Safety Features

When you Buy Soccer Goals in NZ, safety should be a top priority. Look for goals with rounded edges and corners to prevent injuries. Additionally, make sure the goals have stable bases or come with ground anchors to keep them securely in place. Check for compliance with safety standards such as those set by FIFA or your local sports authorities.

Ease of Assembly

Ease of assembly is another important factor, especially for those who will be setting up and taking down the goals frequently. Look for goals that come with clear instructions and all necessary hardware. Some models feature quick-setup designs that can save you time and hassle.

Budget Considerations

While it’s tempting to go for the cheapest option, remember that you often get what you pay for. Investing a bit more upfront in high-quality soccer goals can save you money in the long run. Compare different brands and models, and read reviews to find a balance between cost and quality.

Where to Buy

When it comes time to Buy Soccer Goals in NZ, consider reputable sports equipment retailers. Online stores offer a wide variety of options and often feature customer reviews that can provide valuable insights. Local sports shops can also be a great resource, offering personalized service and the opportunity to see the products in person.

Conclusion

Investing in quality soccer goals is a smart move that pays off in safety, durability, and enjoyment. By considering factors such as material, size, portability, safety features, ease of assembly, and budget, you can make an informed decision that will benefit players and coaches alike. Remember, when you Buy Soccer Goals in NZ, you're not just purchasing equipment; you're investing in the future of your soccer community. Happy goal hunting!

Feel free to share your experiences and any tips you have in the comments below. Let's keep the conversation going and help each other make the best choices for our teams and players!

Source By - https://tinyurl.com/3s3b7b6u

0 notes

Text

In the Saddle and Covered: Exploring Options for Horse Insurance

As a horse owner, rider, or business involved in equine activities, understanding the importance of horse insurance is paramount. It not only provides financial protection but also offers peace of mind in the event of unexpected circumstances.

In this comprehensive guide, we will explore the various types of horse insurance nz available, empowering you to make informed decisions about safeguarding your equine investments.

Types of Horse Insurance:

Mortality Insurance

Mortality insurance is a fundamental aspect of protecting your valuable horses. In the unfortunate event of death or euthanasia due to illness, injury, or accident, this type of insurance provides coverage, ensuring that your investment is safeguarded against unforeseen circumstances.

Major Medical Insurance

Major medical insurance is a crucial component of comprehensive coverage for horses. It covers veterinary expenses related to illness or injury, offering financial support when your equine companion requires medical attention. Whether it's for colic treatment, surgery, or ongoing care, this insurance proves invaluable in ensuring the well-being of your horse.

Loss of Use Insurance

Loss of use insurance provides compensation if your horse becomes permanently unable to perform its intended use due to injury or illness. For both individual owners and businesses involved in equine activities, having this coverage in place offers peace of mind, knowing that financial protection is available in the event of such unfortunate circumstances.

Liability Insurance

Liability insurance is essential for individuals and businesses engaged in equine activities. It protects against legal claims arising from third-party bodily injury or property damage caused by horses. Whether it's a riding accident or damage to third-party property, this insurance provides a safety net against potential liabilities within the equestrian community.

Choosing the Right Coverage:

When evaluating the appropriate coverage for your specific needs, it's essential to consider factors such as the value of your horse, its usage, and your budget. Consulting with experienced equestrian insurers can provide valuable insights and help tailor coverage to your individual requirements, ensuring that you have the most suitable protection in place.

Conclusion

In conclusion, exploring the various options for horse insurance nz empowers you to make informed decisions about safeguarding your equine investments. By understanding the significance of different types of coverage, you can take proactive steps to ensure the financial protection and well-being of your horses.

We encourage you to reach out to our expert team for personalised guidance and comprehensive coverage options that align with your specific needs.

0 notes