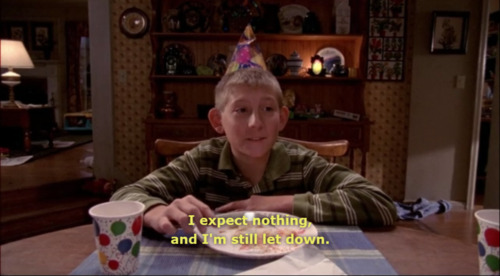

#Netflix cancelling shows left and right how about I cancel my subscription to follow this trend?

Text

Lockwood & Co. got cancelled

#Netflix cancelling shows left and right how about I cancel my subscription to follow this trend?#After 1899 I am still SO bitter you have no idea#Lockwood & Co.#Lockwood & co#🍐

16 notes

·

View notes

Note

I saw your post about the writer's strike and was wondering what is exactly is happening?? There's been a lot of noise on Twitter and Instagram but I just understand what's right and what's fake. I hope it's over soon and the writers can get what they deserve, and I hope it doesn't affect you in anyway either. I would like to show my support so please lmk how I can!! Much love and solidarity xoxo

Hi, anon. Thanks so much for this message.

I can completely understand being overwhelmed by the info on Twitter and Instagram, so its no wonder you're feeling confused on what's right or wrong in regards to information. I'd be happy to clear a few things up for you.

Firstly though, I need you and anyone else who does end up reading this to know that I'm in no way an expert, and I know is what's come from the right sources on Twitter and Instagram because they are actually the ones who are the experts here. In basic terms, the writers are asking the studios they work for to be paid fairly, compensated in terms of residuals from streaming, proper weekly wages, new structure to writers' rooms, duration of projects and much, much more. This post from Twitter is the WGA negotiations on the left, and the AMPTP (Alliance of Motion Picture and Television Producers) response on the right. And this from WGAWest on Instagram will explain the strike in minimal terms for you, but basically the fight is against the major studios: Netflix, Apple, Amazon, Disney, Warner Bros, NBCUniversal, Paramount and Sony which are all under the umbrella of AMPTP.

With that, I would suggest only following @WGAWest and @WGAEast on Twitter and Instagram, for all the latest developments from the strikes as they are posting extensively. They're posting photos from different writers at the strikes, so I suggest following some of them, too. Get a look at what's happening on the ground.

In terms of showing support, if you live close to L.A. or NYC then joining the picket lines is the best way to show your solidarity. If you're driving by, honk those horns in support! Really lay on them, make it hard for the big suits to do their jobs, just as much as they've made it hard for writers to theirs.

If you live further out (or way across the pond like me), then social media is your next best tool. If social media had been more prominent during the 2007-08 strike, it could've benefitted the fight so much. So tweet, retweet (don't like, it does nothing for spreading the word), add to your stories, post videos in support of the writers. This thread from a writer has some links to the Entertainment Community Fund, which is raising money for writers' assistants, crew and other people who could affected by this strike for however long it takes for studios to give writers the fair deal they're asking for. You can also visit wga.org the official site of Writers Guild America - West, and go to WGA 2023 Strike Rules to learn the full extent of what PRE-Wga people like me can do as the strike continues.

And there is one other thing you can do, but it's completely up to you and what you decide. I can't be the one to make this decision for others. A lot of people have been cancelling their subscriptions to the streamers, and citing their reason as "Other" and writing "I stand with the WGA" along with it. This is definitely a way to hit the studios where it hurts, because if you start to lose your audience then you better listen to the people who actually create your shows, huh? If you feel this passionately in your heart, then I say go for it, I know I have. Netflix is the one that most people are cancelling more than the rest, as its the most major problem for writers, giving that they can last the longest without new content. So I'm leaving that decision with you.

Lastly, this doesn't affect me YET. It could in the near future, if the strikes continue over the next few weeks, and months. I hope it won't come to that, that the nearly 12,000 writers in the Guild will receive what is rightly owed to them. I really don't think they're asking for unreasonable things. So we have to see what happens next. It's a scary time, but it's also exciting, to know that the fight for expressing our creativity is so fiery and passionate.

Thanks again for this message, I hope it helped.

#wayward-dreamer answers#anon message#wgastrong#wga strike#i stand with the wga#wga support#pre wga and proud

5 notes

·

View notes

Text

How to Watch Mad Men and More Great Shows for Free Right Now

Another day, another brand new streaming platform out there begging you to subscribe to its service so you can ignore your family members and binge-watch a bunch of TV shows and movies in the name of entertainment. This time, it's NBCUniversal's Peacock, which offers a free tier as well as two premium options (one with ads and one without). The service features a number of programs for free, including Friday Night Lights and even Parks and Recreation, but Peacock isn't the only place you can stream great shows without breaking the bank.

Below, we've gathered up a number of shows that don't require you to shell out money for Netflix, Hulu, Amazon Prime, Disney+, Apple TV+, HBO Max, Peacock, and/or whatever other streaming service subscriptions are out there. Sometimes you just need a simple freebie. And you know what? You deserve it. So check out the list below and take comfort in knowing it won't cost you a thing.

Watch it on: IMDb TV

Until recently you had to have a Netflix subscription to watch Mad Men, AMC's Emmy-award winning period drama from Matthew Weiner that was dedicated as much to style as it was to substance. The 1960s-set series, which traced the rise and fall of flawed Madison Avenue advertising executive Don Draper (Jon Hamm) through his own complicated relationship with identity, was a pointed commentary on the toxic masculinity, sexism, and racism of the era. It also changed the way we watch and talk about TV. If you haven't seen it yet, now's the perfect time to do so.

The Dick Van Dyke Show

Watch it on: Tubi (complete series), Pluto TV (complete series)

Realizing The Dick Van Dyke Show is streaming for free feels a bit like winning a secret lottery or viewing an exceptional piece of art without paying the museum admission fee. The popular comedy, which ran for five seasons, was created by Carl Reiner and starred Dick Van Dyke as the head writer of a TV show, while Mary Tyler Moore portrayed his wife. It's a timeless classic — one that took home 15 Emmys during its run, and if you've yet to experience it, you literally have no excuse at this point.

The Dick Van Dyke Show Photo: Michael Ochs Archives/Getty Images

Watch it on: ABC app (complete series)

Felicity is best known as the show in which Keri Russell cut her hair (not to be confused with the show in which Keri Russell wore a lot of great wigs, aka The Americans). Depicting Felicity Porter's (Russell) college years and the struggles that accompany trying to figure out who you're supposed to be, the show is also famous for Scott Speedman's whisper-talking and the ongoing battle of Ben (Speedman) vs. Noel (Scott Foley). Although the WB series was previously streaming on Hulu, you can now watch it for free on the ABC app.

A reimagining of the kitschy original series, Syfy's Battlestar Galacticastarred Edward James Olmos, Mary McDonnell, Katee Sackhoff, Tricia Helfer, Michael Hogan, James Callis, and Jamie Bamber and explored the aftermath of a nuclear attack by the Cylons, cybernetic creatures invented by man who evolved and rebelled against their creators. The show was critically acclaimed for the way it tackled the subjects of science, religion, and politics, and for the way it explored the deeply complicated notion of what makes us human. Everything from the miniseries to the two BSG films (Razor and The Plan) is currently available to stream for free on Syfy's website, so there's no better time to watch it. So say we all!

Watch it on: IMDb TV (complete series), Tubi (complete series), Pluto TV (first 13 seasons), YouTube (first 13 seasons)

For many millennials, the fourth series in the Degrassi franchise, Degrassi: The Next Generation, is the defining iteration of the long-running Canadian series. The drama series, which was sometimes so overly dramatic it was actually funny, tackled everything from date rape and suicide to sexual orientation and teen pregnancy. The series, which launched the careers of Drake (then known as Aubrey Graham) and Nina Dobrev, is streaming on multiple free platforms.

Watch it on: ABC app (complete series)

Eli Stone really had it all, which is to say it had Victor Garber singing George Michael songs, Loretta Devine singing George Michael songs, and George Michael singing George Michael songs. What else is there? ABC's offbeat two-season comedy-drama starred a pre-Elementary Jonny Lee Miller as Eli Stone, a high-powered San Francisco lawyer whose brain aneurysm gave him prophetic visions — which usually involved his friends, family, and colleagues breaking into song. Aside from a couple of ill-advised plotlines (the pilot, which suggests vaccines cause autism, is best forgotten), the show was a blast: a weird but memorable cocktail that should have stuck around for more seasons because, as I mentioned, Victor Garber sang George Michael songs. Also, Sigourney Weaver played God?! -Kelly Connolly

Watch it on: YouTube (nearly every episode)

A true Canadian treasure, The Red Green Show was a long-running comedy starring Steve Smith as Red Green, a handyman who constantly tried to cut corners using duct tape and who had his own cable TV show. It was a parody of home improvement shows and outdoor programs and featured segments like Handyman Corner, Adventures with Bill, and The Possum Lodge Word Game. The show ran for 15 seasons, airing on PBS in the States.

TV Premiere Date Calendar: Find Out When Your Favorite Shows Are Back

Watch it on: IMDb TV (complete series), ABC app (complete series)

Critically beloved but struck down before its time, My So-Called Life has been praised for its realistic and honest portrayal of teenage life, not just via Angela Chase (Claire Danes), but through the show's young supporting cast as well. Now considered to be one of the best shows of all time, it tackled topics like homophobia, homelessness, drug use, and more without ever feeling preachy or like an after-school special. Also, Jordan Catalano (Jared Leto) could lean.

Watch it on: CW Seed (first five seasons), IMDb TV (first five seasons)

If you don't have Netflix but still want to watch Schitt's Creek, you'll be happy to know you can watch the first five seasons of the heartwarming, Emmy-nominated comedy series, about a wealthy family who loses everything they own except the town of the show's title, for free on CW Seed and IMDb TV.

Dan Levy and Catherine O'Hara, Schitt's Creek Photo: Pop TV

Watch it on: Peacock (complete series); IMDb TV (complete series)

You may never know what it feels like to have Coach Taylor (Kyle Chandler) be proud of you, but you can pretend by watching all five seasons of Friday Night Lights, a series that was as much about a Texas community as it was about the sport that united it. By the end of the show, you'll be asking yourself "What Would Riggins Do?" and tattooing "Clear eyes, full hearts, can't lose" on your body, all while chanting "Texas forever!" Trust me, it happens to everybody.

Watch it on: CW Seed (complete series)

It is relatively easy to forget that The CW series The Carrie Diaries was a prequel to Sex and the City, because the charming show, which lasted just two seasons, was able to stand on its own. The coming-of-age series that followed a teenaged Carrie Bradshaw (AnnaSophia Robb) was relatively innocent compared to the original series. The show's 1980s setting made it easier for the writers to focus on more harmless family storylines and teenage heartbreaks, but the show never shied away from the heartstring-tugging drama of young adulthood either. It's a shame the show never got the kind of ratings it deserved and wasn't able to exist beyond Carrie's high school years, but the Season 2 finale works well as a series finale, so viewers won't feel as if the story was left incomplete. android tv box

Watch it on: CW Seed (complete series)

It's a shame Bryan Fuller's saturated dramedy Pushing Daisies, about a pie-maker (Lee Pace) with the ability to bring the dead back to life, couldn't bring itself back to life after becoming a casualty of the 2007-08 writers' strike. A whimsical delight, the show featured the pie-maker teaming up with a local private eye (Chi McBride) to solve murders by reviving the victims for a brief time. Known for its quirky characters, eccentric visual style, and Jim Dale's pitch-perfect narration, it remains must-see TV.

Watch it on: IMDb TV (first seven seasons); Peacock

Columbo kicked off nearly every episode by revealing the crime and its perpetrator to the audience, which means unlike most crime dramas, the show was less about whodunnit and more about Peter Falk's iconic raincoat-wearing homicide detective catching them and getting them to confess. Oh, and just one more thing: it's great.

Watch it on: CW Seed (complete series)

The charming and playful Forever, which starred Ioan Gruffudd as an immortal medical examiner, was the one show that could have saved ABC's Tuesday at 10 p.m. death slot. But the network still canceled the series anyway, enraging the show's fans, who have never let the sting of its death go. Luckily, it now lives on, ahem, forever (aka until the content license expires) on CW Seed.

Watch it on: IMDb TV (complete series)

It sounds odd to say The Middle, which ran for nine seasons on ABC, was unfairly overlooked, but it always felt like the series, which followed the middle class Midwestern Heck family, was a bit of a hidden gem. It wasn't as popular with Emmy voters as, say, Modern Family, and critics also failed to give it its due, but it was a real, heartfelt, reliable family comedy with mass appeal, and you can stream it on IMDb TV for free. h96 tv box

Watch it on: ABC app (complete series)

Trophy Wife's short life — it was canceled after just one season — can probably be chalked up to its unfortunate title, which was meant to be ironic but ultimately kept viewers from tuning in and experiencing the warmth of the show and the relationships at its center. Malin Akerman starred as the young wife of Bradley Whitford's middle-aged lawyer, and the comedy explored the dynamics between the two, his children, and his two ex-wives, who were played by Marcia Gay Harden and Michaela Watkins. h96 max x3

Watch it on: NBC app (complete series)

Loosely based on the Biblical story of King David, Kings was a compelling drama before its time. Rudely cut down after just one season by NBC, the show starred Ian McShane as the king of the fictional kingdom of Gilboa, while Christopher Egan portrayed an idealistic young soldier whose counterpart is David. The show also starred Sebastian Stan, which is reason enough to want to check it out.

Watch it on: ABC app (complete series)

Ray Wise portrays Satan in Reaper, a supernatural dramedy about a slacker (Bret Harrison) who reluctantly becomes a reaper tasked with capturing escaped souls from hell after it's revealed his parents made a deal with the devil many, many years before. The fact the show only lasted two seasons is a crime against humanity. Luckily, you can watch it in its entirety for free on the ABC app. h96 max x3

Watch it on: IMDb TV (complete series)

A team of experts led by a kooky old scientist (John Noble), his son (Joshua Jackson), and an FBI agent (Anna Torv) investigate strange occurrences around the country, X-Files style, in the J.J. Abrams-produced Fringe. The series is one of the best broadcast science-fiction shows of all time, particularly in its first three seasons, and perfected the art of the serialized procedural by weaving the show's deep mythology and excellent character work into weekly standalone stories, making it easy to binge or watch in spurts. And by the time the end of Season 1 starts, you'll have a hard time stopping. -Tim Surette

Watch it on: Tubi (complete series), Vudu (complete series)

Although American TV producers would eventually adapt Being Human, the original British version, which followed three supernatural beings trying to live amongst humans, is far superior. The show, which ran for five seasons, starred Aidan Turner, Russell Tovey, and Lenora Crichlow as a vampire, werewolf, and ghost, respectively. So skip the U.S. version entirely and watch the U.K. series for free.

Watch it on: Pluto TV (complete series), Vudu (complete series), Tubi (complete series)

The Australian young adult-oriented series Dance Academy is not exactly what you'd call "great television," but it is great fun. Brimming with teen angst and melodrama, the series, which ran for three seasons and even had a follow-up movie, followed a handful of dancers at Sydney's National Academy of Dance as they trained in the sport they loved while also falling in and out of love with each other. The acting was sometimes questionable, but the series itself was addictive, not to mention one of the easiest binges you'll ever encounter. h96 max tv box

3rd Rock From the Sun

Watch it on: Tubi (complete series), Pluto TV (complete series), Crackle (all six seasons), Vudu (all six seasons)

You might think a show about a group of socially awkward, 1,000-year-old aliens in human skin suits who are trying (badly) to pose as a human family and blend into an ordinary Midwest town might sound ridiculous, and, well, that's fair. But 3rd Rock From the Sun was still charming in even its most bizarre moments and gave its cast a lot of room to play up their roles and create an ensemble of weirdos that, at some point or another, start to tap into their newfound humanity and relish their new home here on Earth. -Amanda Bell.

3 notes

·

View notes

Note

Prompt: Regina thinks Roland has an imaginary friend.

If Regina thought beinga single parent was hard, it was nothing compared to being a quasi-stepparent.

When Henry had imaginaryfriends from his not-so-imaginary storybook, Regina put him in therapy. Nowthat Roland had imaginary friends – talking mice and transforming robots andfriendly ghosts, Regina was seriously considering cancelling her Netflixsubscription.

She couldn’t decide whatwas worse, Henry (rightfully) thinking that she was the Evil Queen, or Rolanddemanding that he let his rat friend help her cook dinner, because, as he said,“You don’t use enough salt.”’

Oh, she could show him salt.

It wasn’t a coincidencethat his imaginary rat friend showed up the first night that Robin and Rolandhad spent the night at her house. She wasn’t a bad cook, exactly; she had a fewthings she did well – lasagna and apple turnovers, with or without poison – butRoland hated tomatoes and his father was more than a little turned off byapples, so she improvised.

Improvised, and nearlyset fire to her kitchen. Thank God for fire extinguishers and peanut buttersandwiches.

Thank God Robin didn’tlike her for her kitchen skills. Well, how the hell was she supposed to be agood cook? Her mother raised her to marry well and rule kingdoms, not to maketuna casserole.

Despite the earlymisfire, they came back again and again, mostly for take-out and occasionallyfor boxed macaroni and cheese, and every time, Roland whispered over hisshoulder to some imaginary being who knew how to keep the pasta from stickingtogether.

She’d spent her entirelife being judged by her mother; being judged by a four-year-old was far moredamning to her self-confidence.

“He likes an imaginaryrat more than me,” she whined, when she and Robin were tucked into her bed andthe boys were long asleep.

“He loves you. Just…notyour cooking.”

“I cooked for Henry for11 years, and he never complained. And are you telling me that my cooking isworse than a spit of meat over a campfire?”

To Robin’s credit, hewas smart enough not to answer that question. “Of course Henry never complained.Henry isn’t a complainer. Roland, though…you know he can be a bit over the topsometimes.”

Remembering how loudlyRoland shrieked the first time he saw a shower, Regina nodded in agreement. “Shortof using magic to whip up a five-course meal every night, which I know willonly make things worse, what do I do here?”

Robin wasn’t a fan ofmagic, although he wasn’t nearly as afraid of it as his son, but even he had toadmit that the thought of a five-course meal out of thin air wasn’t the worstidea he’d ever heard. Especially if it came with magic to do the dishesafterward.

“I don’t know, Regina. Snowis a good cook. Maybe you could ask her for some tips?”

She levelled a frosty glare at him. “Maybe you could sleep in the backyard.”

He chuckled. “Then whowould keep your icy feet nice and warm at night?”

“Come up with anothersuggestion, please.”

Robin didn’t think ofhimself as a particularly indulgent parent, but he did let his son go onwhenever he got caught up in a flight of fancy. If he had a talking, cookingrat as a friend, better to let him enjoy his imagination. “Ask the rat foradvice. Tomorrow, when you’re making dinner.”

“That’s a pretty boldassumption, that you’ll be invited back to dinner.”

“Wouldn’t be much of athief if I weren’t bold, would I?” He smirked at her, and she lost the battleto keep a straight face. She tucked herself a little closer to him and shiftedher legs until her cold feet were pressed against his calves. “Regina, I’veseen you cook. You follow every recipe to the letter, right down to googlinghow much a pinch of salt should be. Roland’s got an imaginary friend who wantsto cook. Maybe you should use your own imagination and let him help. It couldn’thurt.”

“So, what you’re sayingis, to hell with Julia Child. Ask the imaginary rat for advice.” She turned theidea over in her head for a minute. “Fine. It’s less humiliating than askingSnow.”

He pressed a kiss to her forehead. “That’s my girl.”

***

Apparently, the rat waswell versed in cooking chicken and dumplings, because Roland fed her tips on searingthe meat, mixing the dumplings, and even the proper way to slice thevegetables. If he weren’t barely able to tie his own shoes, she’d happily handover the knife and cutting board and let him do all the work, but she listenedto his suggestions with a smile on her face.

She had to admit, it wasactually fun. Henry had never been much of a fan of what went on in thekitchen, only putting his book down long enough to grace her with his presenceat the table and toss aside a “Thanks, Mom,” after he put his plate andsilverware in the dishwasher. Roland asked a lot of questions while she worked,but they were good questions, and she had endless patience for small boys. Bythe time they sat down to what she was privately calling family dinner, she waslooking forward to seeing how the meal turned out.

Good. Better than good,actually. She was going to have to apologize to an imaginary rat for doubtinghim. Roland and Robin cleaned their plates, and even Henry said, “That wasreally good, Mom.” She shrugged and said it was nothing, but she looked down ather own plate and saw that it was practically licked clean.

Take that, Snow White. The Evil Queen can makea family dinner too.

She was so pleased athow well dinner turned out that she set the boys loose in the family room withthe wifi password and prayed that Robin would have the good sense to make surewhatever they chose didn’t have too many explosions, or Roland would wake up inthe middle of the night and crawl into bed with them, promising that he’dprotect them from invaders to the castle.

She was just loading thelast dish when a streak of movement caught her eye.

A rat.

A rat in her kitchen. Arat in her kitchen, a rat wearing a chef’s toque, was running hell bent for leathertowards her pantry.

Either she wascompletely losing her mind, or she was going to have to have a mighty long talk withsome of the other magic practitioners in Storybrooke who might know how a chef-trainedrat came to take up residence in her kitchen.

She’d worry about that tomorrow. Tonight, she left a large hunk of overpriced gouda on the butcher’s block before shutting off the kitchen lights. Her mother had raised her to be polite, after all, and say thank you when the occasion called for it.

41 notes

·

View notes

Photo

New Post has been published on https://simplemlmsponsoring.com/attraction-marketing-formula/list-building/24-of-the-best-call-to-action-examples-you-can-click-on/

24 of the Best Call-to-Action Examples You Can Click On

Whether you want more visitors to your website or sign-ups for your newsletter, your call-to-action (CTA) will play an integral role in encouraging people to take action.

More often than not, CTAs drive our next steps and we don’t even know it. For example, think about what enticed you to click on this article. Pretty cool, huh?

So how do you make sure people notice, engage with, and click on your CTA?

Below, we look at the 24 of the best call-to-action examples we could find, covering everything from newsletter sign-ups to eBook downloads.

The 24 best call-to-action examples for inspiration

CTAs are all about getting the right balance between simplicity, information, and intrigue. And to help you understand the best call-to-action types for each requirement, we’ve pulled together a wonderful mixture of examples for you.

1. Netflix: Free trial

The persuasive text in this CTA encourages you to take advantage of Netflix’s free trial. And the text just above the CTA also lets you know that the product is incredibly flexible and can be canceled whenever you wish. This helps builds confidence and knowledge before you click on the CTA.

Image Source: Netflix

2. Plated: Sign up now

First, Plated shows the benefits of the subscription, using phrases like “Everything you need,” “Amazing dinners,” and “Perfectly customized.” This builds a luxurious-yet-convenient picture of the product. Then, the CTA is highlighted with the bright pastel green box.

Image Source: Plated

3. Backlinko: Sign up

This CTA takes over the whole landing page, making it a really dominant feature. Adding to this is the great contrast between the lime green background and the red “Sign Up” button. It immediately grabs your attention and leads it to focus on the CTA.. Plus, its bold simplicity really instills a sense of confidence in the program.

Image Source: Backlinko

4. Lyft: Join in

In this email, Lyft draws the readers’ eyes straight to the CTA button, “Join in,” by using a bright pink color that matches its brand logo. If people want to know more before clicking on it, they can find easy-to-digest information right underneath it. And if they still want to know more, they can read the entire email without losing sight of the CTA.

Image Source: Really Good Emails

5. Dollar Shave Club: Get started

Instead of using the word “join,” the Dollar Shave Club has opted for “try.” This is slightly less committal and helps increase the confidence you feel in clicking the main CTA. This is further added to with the use of “risk-free” and the simple message about what you can expect from the service.

Image Source: Dollar Shave Club

6. Trello: Sign up—It’s free

Using a blue background, Trello ensures its CTA stands out with contrasting colors. The persuasive copy in white details the benefits of the product, while the green CTA button makes it clear what you need to do—sign up – for free!

Image Source: Trello

7. Campaign Monitor: Try it for free.

Call us biased, but we follow our own advice! Highlighted on a dark background, Campaign Monitor’s CTA is clear, concise, and informative. Users find confidence in the stats (250,000 businesses around the world are already using it) and the mention of no credit card being required. You also know help is instantly available with the button in the bottom right-hand corner.

Image Source: Campaign Monitor

8. Whistle: Learn more

Here, someone’s signed up to hear more about Whistle, so it’s important the email actions this. The “Learn More” button meets this desire and stand out with their bright blue color. However, should the recipient feel they’re ready to proceed, the orange CTA “Buy Now” stands out at the bottom of the email. This is clever as it doesn’t make the email feel pushy or persuasive, it encourages readers to learn more before it presents the sell.

Image Source: Really Good Emails

9. Huemor: View our work.

As a web design agency, Huemor probably feels a little pressure to have a great landing page.

And it does.

By incorporating a beautiful background that looks hand painted (and, therefore, expertly creative) and adds to its bold statement (it’s landed someone on the moon), it really draws you in. Then, the pink CTAs guide your attention, allowing you to find out more whether it’s by contacting the agency or viewing its work.

Image Source: Huemor

10. Cools: Sign me up.

As a pop-up box, this CTA is incredibly visual and the red certainly calls for your undivided attention. The witty CTA “Make your inbox a little cooler…” adds a playful twist which helps keep you engaged so you don’t simply click off the box.

Image Source: Cools

11. Ugmonk: Enter giveaway

This exit pop-up from Ugmonk really works in keeping you on the site and engaging with the brand. It’s simple but effective in its messaging and the giveaway is the perfect temptation to submit your email address. You also feel comforted by the fact you can easily click “No thanks, I’m not interested” if you don’t wish to take part.

Image Source: Ugmonk

12. Rothy’s: Email address

This pop-up is warm and inviting thanks to its “Hello!” and understated, cool design. It tells people exactly what they can expect from the newsletters as well as the website. And, users don’t even need to click on anything. They just enter their email and hit enter. This makes it super convenient and won’t take you away from the page you’re browsing.

Image Source: Rothy’s

13. Marie Forleo: Download now.

This CTA shows how you don’t always need bright colors. Rather, the simple monochrome design works beautifully and adds to the strong, authoritative message Marie is sending. Plus, the text, teamed with the image on the right, shows you exactly what you’re going to get if you click “Download Now.”

Image Source: Marie Forleo

14. Crazy Egg: Show me my heatmap.

Not only does this CTA stand out on the pale background, but even the cartoon graphics are pointing toward it. This all draws your attention to exactly where it should be going. Again, stats build confidence and so does the “cancel anytime” reassuring text below.

Image Source: Crazy Egg

15. Laughing Constable: Download eBook

The graphics in this email are incredibly vibrant, but the CTAs always stand out as a contrasting color. The two CTAs not only accommodate for people scrolling down the email but also incorporate two different types of wording. The latter helps appeal to two different audiences.

Image Source: Really Good Emails

16. Nerd Fitness: More success stories

This CTA gets incredibly specific. And the compelling nature of the copy is brought to life in the before and after pictures that rest above it. This all works to build up momentum within the viewer, making them want to be a part of these success stories.

Image Source: Nerd Fitness

17. WDC: I wish to end whaling.

Another very specific CTA but one that pulls on your heartstrings. It appeals to the emotions of the reader, and compels them into taking action because of their beliefs. Clicking on the CTA means they’re making a pledge against the statistics they’re reading above the CTA.

Image Source: Campaign Monitor

18. Casper: Return to Cart.

While the CTA in this email is quite straightforward, it’s the added “Come back to bed” message that really drags you in. The simple dark blue and white format means you’re instantly drawn to the bolder blue text and buttons. Plus, Casper has ensured that if people aren’t ready for the “Return to cart” action, they can find out more by reading more reviews. This ensures recipients don’t feel restricted or pushed in their choice.

Image Source: Really Good Emails

19. Harry’s: Save the Stout.

This incredibly funny email from Harry’s really grabs your attention. You can’t help but feel drawn to the play button because of the high contrast in colors. Plus, with the added hashtag at the end, this CTA also works to get people sharing the humor with their friends.

Image Source: Really Good Emails

20. Cupid: Sign-up form

The “Join Now” CTA at the bottom of the signup form makes users feel as though it’s quick and easy to find love (just like the deliriously happy couple on the left). Plus, the clever idea of “catching” your match adds to the overall branding of Cupid.

Image Source: Cupid

21. WWF: Donate or Adopt

Notice how well the two key CTAs, “Donate” and “Adopt” match the background image. This helps them stand out without them looking out of place or obvious. WWF uses two colors to differentiate the CTAs but without making one more dominant than the other.

Why?

Whether you donate directly or adopt an animal, you’re still contributing to the cause.

Image Source: WWF

22. Krrb: Yes, Verified!

This email features two CTAs, one that takes more prominence than the other—the blue draws your eye far more than the gray. This is because the “Yes, verified!” button is the one the recipient’s hopefully going to click.

Image Source: Really Good Emails

23. BarkBox: Choose Your BarkBox or Give a Gift.

The two CTAs here boast equal dominance and simply mirror each other’s colors. However, the choice shows BarkBox really knows its customers—a lot will just want to give it as a gift and don’t want to subscribe themselves. The cool CTA in the bottom right also adds to the fun feel of the site while allowing customers to get the help they need.

Image Source: BarkBox

24. LastMinute: Find

The pink “Find” CTA really stands out on this website, fitting in with its overall theme. And to make sure you know what you’re looking for at all times, the clear black and white boxes differentiate the various search options you have (Flight, Hotel, Flight + Hotel, etc.).

Image Source: LastMinute

Wrap up

As you can see, the best call-to-action needn’t be time-consuming or elaborate. Instead, it just needs to be prominent, clear, and use engaging copy.

Incorporate some of these best practices on your website, in your emails, and on your pop-up forms and you should notice your click rates skyrocketing.

For more information on how to create stellar CTAs in your emails, read our guide, 4 Elements of Successful Email Calls to Action.

The post 24 of the Best Call-to-Action Examples You Can Click On appeared first on Campaign Monitor.

Read more: feedproxy.google.com

0 notes

Text

The Mare of Easttown Finale Broke HBO Max

https://ift.tt/eA8V8J

Late on the Sunday night of Memorial Day weekend, WarnerMedia did the unthinkable: they disappointed my mother.

At precisely 10:09 p.m. ET, the following text flashed across my phone screen “Omg. HBO is down! Too many people trying to watch Mare”

Sure enough, the anticipated finale for crime drama Mare of Easttown was not loading on the WarnerMedia streaming service HBO Max and it would remain inaccessible for around 25 minutes. The Internet reacted with disappointment similar to Mother Bojalad.

Everyone checking Twitter to confirm @hbomax is down during #MareOfEasttown finale. pic.twitter.com/xG4Ml7094R

— Cat Williams (@dizzycatdesign) May 31, 2021

#MareOfEasttown the IT guys at HBO Max right now. pic.twitter.com/5NnaKhX7d4

— Will Leggett (@wtleggett) May 31, 2021

How authentic is Mare of Easttown? HBO Max worked fine for me for six episodes but now is refusing to load for the seventh, in what I assume is a tribute to the Phillies' bullpen.

— Michael Baumann (@MichaelBaumann) May 31, 2021

Thankfully, HBO Max got itself into fighting shape and Mare of Easttown was eventually available to stream. Viewers got to see the shocking conclusion to the Kate Winslet miniseries. The outage, however, bodes ominously for streaming television’s future.

Sometimes things break on the Internet. The World Wide Web is a sophisticated, sensitive beast spawned from Transatlantic cables, millions of computers and servers, and just a dash of imagination. Longtime Internet users have grown accustomed to the occasionally imperfect nature of the medium. Occasionally things fall apart, the servers cannot hold. But outages and imperfections in our streaming enterprises cannot remain the status quo now that real money is involved.

Just about every major media conglomerate has made clear that the future of television (and in some sad cases, movies as well) will be streamed. Netflix leads the pack with 208 million subscribers worldwide. It’s followed by Amazon Prime Video (175 million), Tencent (123 million), iQIYI (119 million), and Disney+ (103 million). That’s nearly three-quarters of a billion people subscribing to just five streaming services (granted, the number is undoubtedly smaller as people subscribe to several streamers).

According to a recent study conducted by three major media companies, 25 million U.S. households are expected to cancel their cable subscriptions within the next five years in favor of streaming. That number is on top of the 25 million U.S. households that have already cut the cord. Streaming will soon be the norm, if it’s not already. And that all makes it a bit strange that some streamers don’t seem fully prepared to handle the technical burden of all that incoming traffic.

In HBO Max’s case with the Mare of Easttown finale, it wasn’t technically that much traffic to begin with. WarnerMedia’s streaming service held up just fine for big cinematic releases like Wonder Woman 1984 and Zack Snyder’s Justice League. Though viewership numbers in the streaming world remain unreliable, it makes sense that those big IPs would garner more total viewers than an HBO crime drama. Last week’s penultimate Mare garnered roughly 1.2 million viewers, which is excellent for pay cable but not an insurmountable technical challenge.

The issue likely lies in the way that we’ve traditionally watched television. For nearly the entirety of the medium’s existence, popular TV shows were appointment viewing. A viewer must be on their couch to watch an episode at a precise time or risk never seeing it again. In the streaming world, timeliness doesn’t matter as much anymore, with many viewers happy to watch a show whenever they get around to it. In fact, streamers like Netflix and Hulu just unceremoniously drop their new content at 12:01 a.m. PT.

Since Mare of Easttown was an HBO series that airs on terrestrial television as well, many streamers wanted to watch right at 10 p.m. so as to not get left behind. Unfortunately, it would seem as though that much traffic targeted at one moment was too much for HBO Max’s servers to bear.

We’re aware some customers may be experiencing issues streaming #HBOMax and appreciate your patience as we work to resolve this as quickly as possible.

— HBOMaxHelp (@HBOMaxHelp) May 31, 2021

With WarnerMedia still trying to bridge the streaming and traditional TV worlds gap through HBO and HBO Max, that kind of delay just shouldn’t be happening with streaming enterprises anymore. What’s more is that Warner and HBO have gone all in on the Game of Thrones prequel train, having commissioned no fewer than six spinoffs to the network’s titanic hit. Once those start rolling out of the gate, HBO Max can’t afford to be caught with its streaming pants down.

Ironically, reinforcements for HBO Max’s technical issues might be on the way thanks to a traditionally cable-focused company. AT&T recently admitted defeat in its stewardship of WarnerMedia and spun the company off into a merger with Discovery, Inc. Though Discovery is best known as a major cable player, the launch of its bespoke discovery+ streaming app went off without a hitch earlier this year.

cnx.cmd.push(function() { cnx({ playerId: "106e33c0-3911-473c-b599-b1426db57530", }).render("0270c398a82f44f49c23c16122516796"); });

With the combined powers of WarnerMedia and Discovery, perhaps the next appointment-viewing HBO crime drama won’t disappoint my mom.

The post The Mare of Easttown Finale Broke HBO Max appeared first on Den of Geek.

from Den of Geek https://ift.tt/2SKJklk

0 notes

Link

Lovecraft Country Ends with a Bang!

The season finale has found an audience — a very loyal audience. With creative, action-packed storytelling and a fantastic cast, how could it not? The socially-minded sci-fi horror fantasy netted a series high of 1.5 million viewers on Sunday night.

The season finale of the freshman series hit viewership highs on both linear and digital with 881,000 viewers tuning into the 9pm telecast which was 16% up from the series debut. On the digital side, there was almost a 90% increase from the season premiere.

On HBO Max, more subscribers viewed the finale of Lovecraft Country in its first day of availability than any other new episode of an original series on the streaming platform to date. On top of all that, Lovecraft Country has taken the #1 spot on HBO Max when it comes to original series. The first episode is currently approaching a staggering 10 million viewers.

Netflix Falls Short

Netflix fell short of its own guidance for earnings per share and subscriber growth in the third quarter,

Global subscribers totaled 195.15 million by September 30, up from 192.95 million as of June 30. The company had predicted it would add 2.5 million new subscribers, so the growth of 2.2 million was well short and the smallest of any quarter in years after a spectacular surge earlier this year amid COVID-19.

Competition, of course, has ramped up significantly in subscription streaming with Apple, Disney, WarnerMedia and NBCUniversal having joined the fray over the past year. Netflix said it was “thrilled” to be competing with so many rivals and noted Disney’s recent corporate reorg as a sign of how central streaming will be in the years to come. Of course, comparisons are very inexact given that Netflix is a pure-play streamer and its rivals have other businesses to look after, including legacy ones that throw off cash but are in decline.

Is it the competition, is it the quality of content, is it the ending of isolation and Covid quarantining? is Netflix headed for a dive now that all networks and stations have caught up with them? What is going to keep them on the monthly billfold? What are they going to do to make their $9.99 or $12.99 monthly charge worth it? Netflix has been cancelling series left and right maybe trying to lighten the load. Maybe their boat is too heavy – or maybe they are saving up capital for a bigger bolder move to help them compete with Disney+ and Peacock and HBO MAX.

One thing is for sure – these streaming platforms are a here to stay – and once this pandemic is over – who is going to earn the people’s trust, respect and money? It is great to see what you want, when you want it – and I don’t think in this digital age that streaming services are going to die out at all – but I do know that one service will try and become king and wipe out the rest.

Question is – who?

Disney is Dealt a Blow

On Monday, California Gov. Gavin Newsom teased the release of reopening rules for theme parks in the state, saying cryptically, “We are going to break up the theme parks…Not just one or two brands, it is many different parts of the theme park industry.”

California’s director of Health and Human Services Dr. Mark Ghaly said Tuesday that smaller theme parks can resume operations in the state’s Orange Tier. Capacity will be limited to 25% or 500 visitors, whichever is fewer. Only outdoor attractions may reopen and only to guests who are residents of the same county.

All theme parks — which includes Disneyland in Anaheim and Universal Studios Hollywood — may resume operations in Tier 4, Yellow, which is much further down the road. At that point, the guest limit is 25% across the board and indoor dining establishments can only operate at 25% capacity.

The announcement drew a swift, negative reaction from executives at Disneyland, Universal Studios Hollywood, Legoland and others.

Masks must be worn in all parks at all times, except when visitors are eating or drinking. Reservations will be required for all parks, with temperature checks at the gate.

Orange County, where Disneyland and Knott’s Berry Farm are, is currently in the Red Tier. Los Angeles, home to Universal Studios, is in the most restrictive tier, Purple.

Under the Red tier: movie theaters and cultural ceremonies can open to 25% capacity or 100 people, whichever is fewer; gyms can open indoors to 10% capacity; childcare, drive-in theaters, family entertainment centers and hotels can open with modifications. Concert venues and live theater and festivals are still prohibited to operate.

Under the Orange tier: movie theaters and restaurants can open to 50% capacity or 200 people, whichever is fewer; bars, nail salons, childcare facilities, church services, day camps, doctors, family entertainment centers, gyms can open with modifications. Concert venues and live theater and festivals are still prohibited to operate.

Covid Stops Aretha

Three weeks after resuming production, filming on National Geographic’s Genius: Aretha came to a halt today after a background actor tested positive for COVID-19, sources said. I hear production was suspended for the day. It is unclear at the moment how long the shutdown will last; such decisions are often made day by day. Genius studio Touchstone Television declined comment.

Genius: Aretha, about the legendary singer Aretha Franklin, had filmed 5 1/2 episodes of its eight-episode order when production shut down mid-March amid the escalating coronavirus outbreak. Two weeks later, Nat Geo delayed the premiere of the limited series, originally slated for May 25, for “later this year.” An early 2021 debut is now considered a possibility.

Everyone can’t wait to see a project on Aretha – a feature film is set to come out, this mini series is about to come out – granted the woman was a legendary singer who covered all genres, even operas, with ease, but was her life that interesting? I know I’d love to see it, just to see the changes in the world and in music throughout her legendary career. Much like Ray.

Everybody Loves Raymond Reunion

The cast of the classic CBS sitcom Everybody Loves Raymond will reunite for the first time since the show ended in 2005 to honor their late costar Peter Boyle and raise money to battle the disease that ended his life.

Ray Romano, Patricia Heaton, Brad Garrett, Monica Horan and Raymond creator and Executive Producer Phil Rosenthal will participate in a 90-minute event that will include table readings of popular scenes from the series. (Costar Doris Roberts died in 2016.) Set for this Friday, October 23, at 9 p.m. ET/6 p.m. PT., the event will benefit the Peter Boyle Research Fund of The International Myeloma Foundation.

No Peter Boyle, no Doris Roberts, this show might not be as joyous as we think. Doing it for a great cause, but without the two parents who basically were the whole show – these table readings could be flat as a pancake.

Jeff Bridges Has Lymphoma

The sweet and beloved Jeff Bridges has been diagnosed with lymphoma. The Dude himself confirmed his illness on Twitter on Monday afternoon.

“As the Dude would say.. New S**T has come to light. I have been diagnosed with Lymphoma. Although it is a serious disease, I feel fortunate that I have a great team of doctors and the prognosis is good,” he shared. “I’m starting treatment and will keep you posted on my recovery.

Bridges, 70, wrote in a follow-up tweet that he’s received support from friends and family. The Big Lebowski star also urged his social media followers to vote in the upcoming election.

Lymphoma is a cancer of the lymphatic system. An estimated 8,480 people are diagnosed annually.

A big week to be sure, kids. You can catch me here every Thursday on PlaceToBeNation.com. Thanks for reading!

0 notes

Text

Social media influencer reveals she became a £200,000 home owner at 22

Hazel Wood was just 22 when she put the deposit down on her first home

A new study has revealed one third of Millennials will never save enough money to buy their own home but one Youtube star bought her first home at 22 without financial help from the ‘bank of mum and dad’.

Hazel Wood, from Essex, now 23, has revealed how she saved up a deposit and wants to help other young people get on the housing ladder.

She insisted saving up for your first property doesn’t have to mean giving up on holidays or going out with friends, saying: ‘I did have to make sacrifices but I still provided myself with a monthly allowance to spend on what I wanted like socializing or shopping.

‘And during my two years of saving, I had multiple holidays. I just had to budget for them in advance.

‘With a bit of planning, I really believe it’s possible for other young people to get on the housing ladder.’

The social media influencer and junior financial planner said: ‘I bought my first home in July last year. I saved a £20,000 deposit within two years by myself and I covered all the associated costs with no help from family.

It meant she became the owner of a £200,000 one-bed apartment in Witham, Essex, in July 2018 with the aid of a Help to Buy equity loan.

Hazel, now 23, said she cut down drastically on expenditure while single-mindedly saving

With the help of the government’s Help To Buy scheme she is now a proud homeowner

Hazel’s beautiful home is now expanding her interests on Youtube with many of her 85,000 followers asking her for saving or decorating tips

She said she and her friends would drink at home before going out, saving money and cutting down to just £10 a night having to be spent buying her own drinks in bars

She said it was a goal to own her own home from her teens, but that she only started saving seriously once she turned 20 – saving money by living with her parents.

She also assessed all her outgoings and cut out any non-essential expenditure.

She explained: ‘In my head, I had this goal that I wanted to save £20,000 in two years.

‘Rather than renting elsewhere, I remained living at my parents’ house which allowed me to save a lot more. And in that two-year period, I was very strict on myself.

‘I reviewed all my essential expenditure such as food, phone bills and my car finance to see if I was able to reduce it.

‘For example, just changing my car saved me over £100 per month. Whilst switching to a SIM-only deal at the end of your phone contract can reduce costs considerably.

She said she and her friends would drink at home before going out, saving money and cutting down to just £10 a night having to be spent buying her own drinks in bars

A new survey reveals one third of Millennials may never own their own home but Hazel has managed it by 22

The only help she received from her mother and father was houseroom, saving her the expense of rent and bills in another property while she saved.

‘I also cut out down on my non-essential spending. For instance, I cancelled my Spotify, Netflix and Hayu subscriptions which can save you around £25 per month. Every little counts.’

Alongside her more drastic cutbacks, Hazel set aside a monthly allowance of £200 which allowed her to still have nights out with her friends and even go on holiday.

She said: ‘Every month, I would automatically put a massive chunk of my salary into my savings. I definitely had to make sacrifices to do this. For example, I pretty much stopped eating out and I cut down on clothes shopping.’

She said the £200 ‘doesn’t seem like a lot but when you’re saving, you realize £50 per week is enough to still go out with your friends or go out for a cheap meal if you really want.

‘Instead of going out to a pricey bar for cocktails, my friends and I would have pre-drinks at home and then go out. So I would only end up spending around £10 at a bar.

Last summer Hazel could walk through the front door (above) of a home she owned, aged 22

Yesterday she sat down with TV property expert Phil Spencer for an interview to be broadcast on his youtube channel Phil Spencer TV

‘Sometimes I would save up some of my allowance over a few months and go on holiday. I actually went on several holidays in the two years that I was saving!

‘I would scour the internet for the cheapest city break deals. I would only go away for a weekend to keep it economical and then give myself a strict holiday spending budget.

‘It’s certainly possible to still socialize when you’re saving. You just have to change up how you spend time with your friends – go for a walk with them or cook dinner at home together.’

Hazel’s top five tips for saving for a house

MAKE A PLAN: Decide how much you want to save and put a plan in place as to how long it’s going to take you to do this. Whether it will take two years or five years, getting in the mindset now and starting to save will make all the difference.

STAY FOCUSED: Go visit potential houses and show-homes to stay focused on your goal. It’s an exciting (and free!) weekend activity that will keep you motivated.

ASSESS YOUR OUTGOINGS: Look at your essential outgoings and see if they can be reduced. Also cut back on all non-essential spending. Do you need Spotify? Can you take your lunch from home instead of eating out? Can you go for a walk with your friends rather than going out for drinks?

EVALUATE YOUR CAREER: Talk to your employer and see what you can do to increase your salary. Complete any employer-sponsored exams that will accelerate your career and find out what you need to do to get promoted! Every time I gained a pay rise at work, I would financially act as if I hadn’t and transfer the extra money straight to my savings. If you can’t get a pay rise, look into getting a part-time job to bump up your savings.

REWARD YOURSELF: This is so important! Celebrate every time you’ve hit your monthly goals and treat yourself to something small. Saving for a house is a lot like being on a diet. You need to reward yourself every so often so you can stay on track and not overspend.

Source: Hazel Wood

Resourceful Hazel also looked into ways she could increase her income as a paraplanner – the junior member of a financial planning team. She sat all her finance exams back-to-back in her first year of saving in order to get a pay-rise.

She also visited show homes to stay motivated, although she said looking back there were times she would kick herself for not saving enough one month, rather than celebrating what she had achieved.

She said: ”I would advise potential homebuyers to treat themselves during the saving process. Give yourself a pat on the back for coming so far!’

By early 2018 she had reached her £20,000 goal and put her deposit down on a one-bedroom apartment in Witham, but continues to put money aside.

She said: ‘Despite my £20,000 deposit, I wasn’t able to borrow enough to buy a £200,000 property with it because of my income.

‘So I went for a Help To Buy equity loan which allows you to use a five per cent deposit whilst the government gives you a 25 per cent loan.

‘In the end, I only had to put £10,000 as a deposit for the property and had half of my savings left over which I then used to cover legal fees, ground rent, service charge and furniture.’

Social media influencer Hazel has 85,000 followers across YouTube and Instagram. She said: ‘I love having my own flat. It’s enabled me to widen my YouTube content as I have an entire property to roam freely around. I can decorate it as I wish and give interior design tips to my followers.

‘I get lots of requests from my subscribers to talk about saving for a deposit or buying your first home. I have filmed videos on these topics and plan to continue with it.

‘I still try to save even now and I would love to buy another larger property in the next five years.

‘It would be fantastic to keep my current flat as a rental property but that’s a dream more than an actual goal at this stage.

‘Just having my own home right now is worth it’

The savvy savers who are on the ladder early: how other young homeowners have done it

Tom and Emily Hunt from Yorkshire took a risk and landed their dream home totally mortgage free by the age of 30.

They got five per cent deposits, were disciplined with their savings and then made smart steps to move up the property ladder – eventually buying a beautiful 200-year-old converted former coach house – perfect for starting their own family.

They bought a small house in Sheffield with a plot of land nearby and to fund the build, Mr Hunt sold his bachelors pad, clearing £30,000, while Mrs Hunt, a government economist, had £65,000 equity from her house that she could contribute. The pair were also careful with savings and took out a £40,000 loan as a top up.

Tom and Emily Hunt took advantage of five per cent deposits, were disciplined with their savings and then made smart steps to move up the property ladder

Outside their eco-home in 2010

Their Shropshire dream Home the Coach House cost the pair £135,000 for the buildings and the added land that came with it.

The sale of the eco-friendly ‘Hunt House’ realised a profit of £150,000 which was used to buy their dream family home, and because they were able to offer cash up front, they paid £35,000 below the advertised market price.

‘We offered £125,000 cheekily but we eventually increased it to £135,000 which was still a fantastic deal because we were able to pay in cash having done so well on Hunt House.

‘The renovation cost we footed with the savings we’d made in the interim along from our works,’ Mr Hunt explained.

The Coach House appeared set-up beautifully for the next stage of their journey and so the Hunts, who had been careful with their savings over the past five years, decided they were ready to take the plunge

By combining disciplined savings, calculated risks and smart money saving investments, the Hunts went from starter homes purchased with five percent deposits, to a dreamy family home and lifestyle business.

While it wasn’t easy, and certainly required serious hard work and belief, the pair were able to pay off their mortgage and buy a house outright – and all before they both turned 31.

Nathan Doe and Tyla Stanworth bought their Newport home together last June, despite being just 21 and 20 and earning £30,000 between them.

Mr Doe, 21, said: ‘We were living with my dad for a year, that was our base, but obviously had to pay him rent. We really don’t drink and don’t go out partying.’

Nathan Doe and Tyla Stanworth (pictured) have managed to buy their first home, in Newport, south Wales, before the age of 21, without the help of their parents

Ms Stanworth, 20, added: ‘Deciding to buy the house did mean that we had to make sacrifices as the majority of our combined wages went straight into the savings.

‘We never went out, our shopping lists consisted of noodles and beans, but in the long run it was so worth it.’

The young homeowners have both been working full time since they left school, enrolling in apprenticeship programmes instead of going to university.

The couple were handed the keys to their £220,000 detached three-bedroom home in Newport, south Wales last June.

Nathan and Tyla, 21 and 20, bought their Newport home together last June

It meant giving up nights out and living on beans and noodles for a year, but now they have a beautiful home to call their won

Mr Doe now works as a train planning and diagramming specialist for ArrivaTrains Wales and his partner has a job in the facilities and finance team at Qualifications Wales.

He said they saved for their £11,500 deposit by putting money into a Government help to buy ISA. But after stamp duty and additional costs it was more like £25,000.

They also benefited from a help to buy equity loan – a five-year interest free loan that paid for 20 per cent of the cost of the house.

The post Social media influencer reveals she became a £200,000 home owner at 22 appeared first on Gyrlversion.

from WordPress https://www.gyrlversion.net/social-media-influencer-reveals-she-became-a-200000-home-owner-at-22/

0 notes

Text

4 Hot New Financial Apps & Services On The Scene

I’ve been coming across a LOT of great financial apps and services lately, so thought we’d do a round up of some of my favorites here – Cliffs Notes style :)

All of these apps/services below are either new-to-me, new in general, or up and coming and looking like they’re about to change up the game here… And believe me, I’m getting a greaaaaat handle on what’s going on in our blogging community as I’ve started scanning EVERY SINGLE BLOG POST our industry puts out EVERY SINGLE DAY! Roughly 200-250/day.

You can do the same, if you have hundreds of hours to spare ;) –> http://ift.tt/2pXksnE

Hope you find this helpful!

#1) Blooom — A way to automatically optimize and manage your 401(k)

This one’s my #1 favorite on the list because a) I could have used it a TON back in my employment years!! and b) Hardly anyone is doing this right now – but it affects millions and millions of people.

Ever wondered what the hell you’re doing with your 401(k) or 403(b)/401(a)/457 accounts? Then this is the company for you. For $10/mo Blooom will not only make sure you’re invested into the right – lower cost – funds for your situation, but also physically *manage it all* for you so you literally don’t have to do a thing anymore (though of course it’s always good to know what’s going on and stay in control).

You sign up once, get your free analysis of how your account is looking currently, and then either go away and continue managing it all yourself (accepting their recommendations or not) – OR – continue forward and let them do all the monitoring and heavy lifting for you from now on.

Everything is handled by certified financial advisors who you get direct access to (a nice perk in its own), and the best pat is that they can’t put you in any random or outside funds or upsell you on anything because there’s nothing to upsell you on! You’re limited to the funds that your employer has hand-picked for you to choose from, for better or for worse, so it’s just a matter of optimizing them in the best way for you.

If you’re already comfortable managing your 401(k) and don’t need any help, then Blooom isn’t for you. If you prefer to have someone else do it for you while keeping you in the loop, then I’d def. check them out.

You can learn more get your free analyzation here: Blooom.com ($10 flat rate per month)

#2. Chime – a simple online bank w/ built-in app features!

This is one of the first banks I’d check out if I wasn’t such a fanboy of USAA. Similar to Simple Bank who we’ve featured here before, Chime gets how ridiculous Big Banks treat their customers and wants to make the banking process as easy and helpful as possible.

Without fees, without hidden costs, and definitely without headache.

What separates them from the other online banks though is their understanding of how much we LOVE our apps and features coming out left and right. Their vision is to have everything in one centrally located and connected place where you don’t need a bank plus 15 other apps to log into to get $hit done. You just have one – Chime (in their perfect world :)) – and you’re good.

They’re still a ways away from this, but they’ve already rolled out some of the more popular savings tricks from apps which is currently available to anyone with a Chime account. Here’s a list of some of their features:

Save When You Spend – Similar to Acorns and other “round up” applications, Chime will help you save more by rounding up all your transactions to the nearest dollar every time you buy something. They’ll then automatically transfer the difference right into savings for you.

Save When You Get Paid – You know how everyone tells you to “pay yourself first?” Well, this does exactly that. Activate this feature once, and then chime will automatically transfer 10% of every paycheck in the future right into your savings account before you even have a chance to spend it. Nice and simple (and smart).

Early Direct Deposit – This one I’ve never heard of before (?), but basically if you’re a member of Chime and your employer directly deposits your paychecks every payroll, you can sometimes see your money show up in your Chime account up to two days faster than normal. Again, never seen this before as I’ve been out of the 9-5 world for a while, but sounds kinda cool?

Pay Friends – Lastly, Chime makes it super easy to xfer money between friends with a click of some buttons.

You can find more info about Chime here: ChimeBank.com (FREE / BudgetsAreSexy readers get $5.00 bonus at sign up)

(They also have a pretty cool sister site where people can see how much they’re *really* spending in nonsense fees from the Big Banks out there: BankFeeFinder.com. Even if you’re not in the market for a new bank, I highly encourage you to run their analyzation anyways so you can see exactly what’s going on with your current bank! Some of them are good at hiding stuff! (I’m looking at you, Bank of America))

#3. Trim – a personal financial assistant that saves money for you

While not exactly an *app* (Trim works through text messaging and Facebook Messenger), they act in pretty much the same way. And particularly, to better help you save money.

They do this through four ways:

#1. Trim Financial Manager – Hook up your bank accounts once, and then Trim will analyze your transaction history and allow you to do a number of pretty slick things right there directly through them:

Cancel any unwanted subscriptions (and let you know what subscriptions you even have!)

Set spending alerts

Get balances

Find out how much you spent on Netflix/etc last month

And even fight fees automatically with your bank

#2. Trim Savings – Connect your Visa card to them through FB Messenger (must be a Visa, and must go through FB Messenger), and then get the following free perks:

Coupons that automatically get applied to your card

$1.00 on any grocery purchase greater than $5.00 (you’ll get 10 of these)

$1.00 on any dining purchase greater than $5.00 (you’ll get 10 of these too)

$10.00 on any movie purchase greater than $20.00 (you’ll only get 1 of these)

In total you can nab $40.00 of cash back, again – only through your Visa card.

#3. Trim Comcast Negotiator – Sign up through either FB Messenger or text message, then connect your Comcast bill and credit card you use to pay it with, and Trim will start negotiating it down on your behalf. If they succeed in saving you money, they take 25% of the savings for the first month only, and then you get to keep all the rest, and if they fail they don’t charge a thing. They say the average savings is between $5.00 and $50.00 every month – PRETTY COOL!!!

#4. Amazon Price Patrol – Lastly, Trim will monitor your Amazon transactions if you want them to, and then anytime they find a discrepancy in the price you paid vs the current price of an item, they’ll automatically go out and get you a refund for the difference. It’s very similar to Paribus if you remember our review of them the other year, but it’s also still in beta mode so may be a little wonky until they get it all streamlined. Still, another cool task to give to robots while we’re out enjoying our lives ;)

You can learn more about all these features here: AskTrim.com (FREE, except for the Comcast commission part)

#4. Stockpile — A way to buy fractional shares of stocks

I’m going to cheat with this one and share a pretty infographic instead of writing up a summary :) These guys have popped up almost every single day since starting our Blogger Feeds Tracker, so either they’re really great at marketing, or they’re starting to take off (or a little of both?)

Either way, here’s what they’re about below. The gifting option is my favorite! Much better to receive a gift of stock than another random tschotske or toy right?? Especially for kids?

Click here to learn more: StockPile.com (99 cents/trade, BudgetsAreSexy readers get $5.00)

And those are my 4 latest favorites in the fintech world!

More and more are coming out every day which is AWESOME (we need as much help as we can get!), so I’ll try and be better about doing more of these roundups around here. I wanted to do full in-depth reviews of all these guys, but it just wasn’t happening so hopefully this is enough for you to go on :)

Here’s a list of some of our past reviews over time too, in case you’ve missed any:

WealthSimple — A financial company that helps you build a portfolio of low-fee funds (ETFs), without charging you an exorbitant amount to do so. They’ll then manage it all for you, help you grow it, and offer advice along the way. So pretty much a “robo-advisor”, just without any minimum balance requirements and set up to be as simple as possible. (Available in Canada too!)

brightpeak financial (FREE) — A division of Thrivent Federal Credit Union that rewards you for saving money into their “emergency savings account” (such a perfect name for an account, right?) Stash $50/mo into it for two years, and brightpeak will drop an additional $100 into it for you.

Clarity Money (FREE) — A new app that claims they’ll be killing Mint.com (hah!). Hook up your accounts with them once, and then Clarity will analyze all the data and make suggestions on how to better optimize and save your money. But rather than just telling or showing you what to do, you actually have the ability to *take action* there directly in the app – the major difference between them and most other fintech apps.

Self Lender — An alternative way to build credit back by saving. Their “credit builder account” offers a CD (certificate of deposit) that you *pay into* every month until the term is up, all the while recording your good payment history. It’s not free, but it could be a good option for anyone struggling hard w/ their credit right now.

Qoins (FREE) — Similar to Acorns, this app rounds up all your daily transactions to the nearest dollar, and then applies the difference straight to your debts. I don’t know why this is the first app that’s offered this over the years (??), but of course I’m loving it! Anything that gets you to take action is good, even if it’s just a handful of dollars each month!

Tip Yourself (FREE) — An app that allows you to transfer small dollar amounts from your checking account to a Tip Jar so you can reward yourself anytime, anywhere, whether it’s just $1.00 or a larger amount for something special! Been following these guys for over a year now and REALLY like what they’re doing. So easy and uncomplicated!

Debitize (FREE) — If you’ve ever wanted to mix the benefits of both credit cards and debit cards (credit cards for the rewards, and debit so the bill doesn’t rack up!), this is the tool for you. Debitize monitors your credit cards for new activity, and then automatically initiates a transfer out of your checking account into your Debitize account whenever you make a charge. When your credit card bill comes due, Debitize pays it for you – automatically and on time – with the funds from your Debitize account. So you still go about your business using credit cards as normal, but now without the fear of not having the $$$ in your account to pay for it at the end of the month.

Honey (FREE) — One of the easiest ways to save while shopping online. Download the browser extension once, and then at check out click the Honey button and it’ll automatically scour the internet for coupons, and apply each one of them to your cart until it finds the one with the most savings. Sometimes it’s $1.00, and others $10.00 (depending on what you’re buying), and in all cases it literally only takes like 15 seconds. I’d say it finds me something about 50% of the time.

Digit (Free for 100 days, then $2.99/mo) — My all-time favorite, despite them now charging $2.99/mo for it. Attach your bank accounts with them one, and then have their digital robots analyze your income/expenses and automatically transfer out a few dollars here and there that they know you won’t miss. They’re one of the pioneers in this automated savings game, and I believe in their vision so much that I actually joined their board of advisors! As of January of this year, BudgetsAreSexy readers who have signed up to them have saved $4,608,568.32 – pretty wild!

Acorns — My 2nd all-time favorite app, that rounds up all your transactions and drops the spare change into a diversified portfolio of funds for you. They’re one of the first apps to ever offer this, and in combination with Digit you’d have a helluva system already going in tandem :)

And then lastly, Personal Capital (FREE) — One of the PF world’s favorite fintech company which helps you visualize your entire financial picture all in one spot. Connect up your accounts one time, and then get immediate insight into your spending, income, investments, and our personal favorite – net worth. It’s a turbocharged Mint.com, only geared towards investing more so than budgeting.

So there you have it – 15 hot apps & services out there ;)

Meant to just stick to the top 4, but oh well haha…. Better chances that you find something new you like, eh? And to think how far we’ve come since this:

Happy $$$ growing!!

********

Needless to say, most of these apps/reviews above include affiliate links which means I’ll benefit financially if you end up signing up to any of them. As you know from over the years though, I only share companies I love and use myself, or those I think will greatly help others in different situations than I’m in (like the debt apps). In either case though, I never share anything just for the payout and do my best to provide value to y’all. Please let me know what you think whenever you sign up to any of them, or if you’d like me to check out other apps out there you find are powerful!

4 Hot New Financial Apps & Services On The Scene published first on http://ift.tt/2ljLF4B

0 notes

Text

4 Hot New Financial Apps & Services On The Scene

I’ve been coming across a LOT of great financial apps and services lately, so thought we’d do a round up of some of my favorites here – Cliffs Notes style :)

All of these apps/services below are either new-to-me, new in general, or up and coming and looking like they’re about to change up the game here… And believe me, I’m getting a greaaaaat handle on what’s going on in our blogging community as I’ve started scanning EVERY SINGLE BLOG POST our industry puts out EVERY SINGLE DAY! Roughly 200-250/day.

You can do the same, if you have hundreds of hours to spare ;) –> http://ift.tt/2pXksnE

Hope you find this helpful!

#1) Blooom — A way to automatically optimize and manage your 401(k)

This one’s my #1 favorite on the list because a) I could have used it a TON back in my employment years!! and b) Hardly anyone is doing this right now – but it affects millions and millions of people.

Ever wondered what the hell you’re doing with your 401(k) or 403(b)/401(a)/457 accounts? Then this is the company for you. For $10/mo Blooom will not only make sure you’re invested into the right – lower cost – funds for your situation, but also physically *manage it all* for you so you literally don’t have to do a thing anymore (though of course it’s always good to know what’s going on and stay in control).

You sign up once, get your free analysis of how your account is looking currently, and then either go away and continue managing it all yourself (accepting their recommendations or not) – OR – continue forward and let them do all the monitoring and heavy lifting for you from now on.

Everything is handled by certified financial advisors who you get direct access to (a nice perk in its own), and the best pat is that they can’t put you in any random or outside funds or upsell you on anything because there’s nothing to upsell you on! You’re limited to the funds that your employer has hand-picked for you to choose from, for better or for worse, so it’s just a matter of optimizing them in the best way for you.

If you’re already comfortable managing your 401(k) and don’t need any help, then Blooom isn’t for you. If you prefer to have someone else do it for you while keeping you in the loop, then I’d def. check them out.

You can learn more get your free analyzation here: Blooom.com ($10 flat rate per month)

#2. Chime – a simple online bank w/ built-in app features!

This is one of the first banks I’d check out if I wasn’t such a fanboy of USAA. Similar to Simple Bank who we’ve featured here before, Chime gets how ridiculous Big Banks treat their customers and wants to make the banking process as easy and helpful as possible.

Without fees, without hidden costs, and definitely without headache.