#Omisego

Explore tagged Tumblr posts

Text

MKR yatırımcıları, fiyat artışının ortasında servetlerini yüzde 100'ün üzerinde arttırdı!

MakerDAO (MKR), haziran ayından bu yana Merkezi Olmayan Finans (DeFi) piyasasında düzenleyici baskıların ve çok sayıda projenin karşılaştığı zorluklarla dolu çalkantılı bir yol izledi. Bununla birlikte MKR’nin öncülük ettiği altcoinler, bu çalkantıyı gölgede bırakacak gibi göründüğü için odakta bir değişiklik meydana geldi. Şu anda MKR’nin CoinGecko’daki değeri 1.346 dolar seviyesinde bulunuyor…

View On WordPress

0 notes

Text

Crypto token and its Key Features — Detail Guide.

Explore crypto tokens history and their Key features by reading this Detailed Guide, Tap to Read.

What is a token in crypto?

In relation to cryptocurrencies, a token is defined as a measure of value or a digital commodity created and maintained in a blockchain ledger. Most of the time, this is done through something called an Initial Coin Offering (ICO), where new coins are given to investors expecting established coins like Bitcoin, or Ethereum to be returned to their investors.

They may have several uses depending on the project they form part of. Some of those projects, for example, incorporate one as a currency within a closed group, while others aim at an asset, say real estate, or even stocks. They may also be used to gain entry into a certain service or platform.

History of Crypto Tokens

The timeline of the Create your crypto token is a fascinating narrative owing to the advent of blockchain technology and the growing demand for digital assets. Below is a synopsis of their evolution:

1. Primitive Stage (2008–2012)

The idea of crypto tokens was first envisaged with the inception of Bitcoin in 2009. Despite Bitcoin’s propelling the revolution of digital currency, it wasn’t a token as we know them today. Rather it was a digital currency that had its own blockchain as opposed to being a token in any other currency. It is during this time that issues about the potential of money that can be programmed began to arise.

2. The Birth of Ethereum (2015)

In 2015, under the command of Vitalik Buterin, a.k.a., a Canadian-Russian programmer, a new platform was released, called Ethereum, which changed the definition of the concept of tokens. In this case, when the first tokens were created on the Ethereum blockchain due to the concept of smart contracts, the token generation started. One of the tokens for supporting projects became the standard ERC-20, which allowed creating fungible tokens, and conducive to the emergence of many new projects.

3. The ICO Boom (2017)

The Initial Coin Offerings (ICOs) that emerged in the year 2017 caused a drastic change in the narrative surrounding crypto tokens. People started funding projects by issuing coins and accepting free tokens in exchange for swathes of bitcoins or ether. Basic Attention Token (BAT) and OmiseGo were some of these companies who raised hundreds of millions of subscribers. This era also came with its share of regulatory backlash as well as rampant fraudulent schemes.

4. The Rise of DeFi and NFTs (2019-Now)

The notion of crypto tokens was also broadened after the advent of DeFi (Decentralized Finance) movement in 2020 and emergence of non-fungible tokens (NFTs). In as much as DeFi protocols introduced non-centralized exchanges, so too we can say utility tokens were an addition that enabled the users to lend, borrow, and trade without the need of any middlemen. NFTs, on the other hand, became popular as digital items with the very few people that would own them all, typically ERC-721 on the ether network, art, music and collectibles.

5. Regulatory Developments and Maturity (2021-Now)

With age, came wisdom in the crypto realm and the legislatures of various governments commenced formulating appropriate boundaries for the classification and taxation of the tokens. Consequently, there has been a better demarcation between security tokens and utility tokens. Presently projects have increased their concern about legal issues and how projects are governed which has led to most projects creating tokens that allow users to vote on project issues.

6. Future Trends

In terms of future trends, the development of crypto tokens is expected to emphasize seamlessness, scalability and responsible use of resources. Solutions for transaction scalability such as cross-chain and layer-2 are intended to improve the efficiency of the transaction speeds and costs respectively, while innovations focus on the greener side of decentralization due to environmental issues.

How Crypto Tokens Work

Crypto tokens are cryptocurrency kinds of digital assets developed on top of pre-existing blockchain development networks using smart contracts that define their internal rules and operations. Unlike cryptocurrencies such as Bitcoin or Ethereum that run on their own blockchains, tokens exploit the capabilities of these networks to serve a variety of purposes.

Tokens can be subdivided into Fungible and Non-Fungible ones. Fungible tokens are interchangeable and usually represent currencies or utility in dApps (decentralized applications) and often follow specific protocols like ERC-20 on Ethereum. Such as, utility tokens are used to access goods and services whereas governance tokens allow the holders to participate in a project’s voting mechanism.

On the other hand, Non-fungible tokens represent newly found value units, embedded in characters and artworks, music, sports, and any other collectible item within the digital world. Each NFT consists of different attributes, which is why one cannot copy the distinguished figure and the created activity can be owned and managed.

Whenever a user interacts with a token in such a way, the relevant transactions are processed and recorded on the blockchain platform and this preserves operational accountability as well as security. These tokens are kept in wallets, helping the user to buy, sell or use such tokens in different dApps. This decentralized system minimizes the need for middlemen and encourages users to interact with one another. As the crypto world matures, tokens irreplaceably enhance and transform the borders of finance, possession, and consumer digital experience.

Crypto token development Key Features

Knowing the characteristics of crypto token development is equally important for developers and users. Some of them are as follows:

1. Fungibility

Fungible tokens such as ERC20 tokens can be replaced by an unlimited number of copies. It will be easy to create an economic scenario where traditional currencies will be the mode of exchange.

2. Programmability

Definitions about the use of tokens may be included in the technical documents and white papers. This includes the multi-steps processes such as carrying out transactions, voting, and governance among others. Such programmability creates room for uniqueness in DeFi gaming.

3. Interoperability

Most of the coin tokens are created in such a way that they can be used in any wallet or exchange hence increasing access and use of these tokens. For growth of the crypto sphere, such integration is very important.

4. Security

Security is usually provided by the blockchain that the crypto token is based on. Smart contracts can be verified before deployment to mitigate situations where user’s funds may be compromised thus restoring faith in the token.

5. Decentralization

Most tokens are created to reside in a decentralized environment enhancing users to interact with each other without any third parties. This decentralization encourages openness and minimizes the chances of any foul play.

6. Governance

Governance features are present in many tokens offered in the crypto space allowing the holders to influence or partake in decisions concerning the future of the project. This provides the users with power and helps build the spirit of belonging in the community.

Conclusion

Creating crypto tokens is a fascinating process and one that is ever in motion presenting opportunities for creativity and foresight within the blockchain prism. It would be best for one to appreciate the process of development and the characteristics of crypto tokens if they would want to partake in this fast-evolving sector. It goes without saying that as the crypto ecosystem becomes more complex, the role of well-designed tokens will only become more vital, influencing financial markets, artistic endeavors, and more. In other words, developer, investor, or a mere hobbyist, the world of crypto tokens is full of opportunity which is yet to be tapped into.

FAQ:

What is a crypto token?

The term ‘crypto token’ refers to a digital entity developed on an already existing blockchain with a real utility or asset in the form of a vertical decentralized application (dApp) usage. Tokens serve a lot of purposes and one can use them to access services, vote, and even own items.

What is the difference between a cryptocurrency and a token?

The primary aspect distinguishing them is their composition: a cryptocurrency such as Bitcoin or Ethereum has its own blockchain, while a token is built on a pre-existing blockchain like Ethereum. While cryptocurrencies are usually used for transactional purposes, tokens are often associated with non monetary aspects within the software.

How do I store my crypto tokens?

Secure digital storage places for your crypto tokens are known as wallets, and they can either be software wallets for example mobile apps, web wallets, or hardware wallets which are physical devices. Wallets create private keys which ensure that your tokens are safe. Always ensure that you select a well-known wallet and safeguard your private key from prying eyes to avoid loss of funds.

1 note

·

View note

Text

Don't Miss Out on OMG! Your Simple Guide to Buying & Holding in 2024!

0 notes

Text

Unlocking Ethereum's Potential with Exploring Layer 2 Scaling Solutions

As the demand for decentralized applications (DApps) and non-fungible tokens (NFTs) continues to soar, the limitations of Ethereum's scalability have become increasingly apparent. Ethereum, the pioneering blockchain platform for smart contracts and DApps, has faced challenges such as high gas fees and network congestion due to its limited transaction throughput. To address these issues and unlock Ethereum's full potential, various Layer 2 scaling solutions have emerged. In this blog, we delve into the significance of Layer 2 solutions, explore different types, and assess their impact on Ethereum's scalability and usability.

Understanding Layer 2 Scaling Solution

Layer 2 scaling solutions are protocols or frameworks built on top of the Ethereum blockchain, designed to enhance its scalability by processing transactions off-chain or through alternative mechanisms. Unlike traditional on-chain transactions, Layer 2 solutions aim to reduce the burden on the Ethereum mainnet, thereby increasing transaction throughput and reducing costs. These solutions facilitate faster and cheaper transactions while maintaining the security guarantees of the Ethereum network.

Types of Layer 2 Scaling Solutions

State Channels: State channels enable participants to conduct off-chain transactions directly with each other, updating the state of their interactions off-chain. Once completed, the final state is then recorded on the Ethereum mainnet, minimizing the number of on-chain transactions required. Projects like Raiden Network and Celer Network utilize state channels to enable instant micropayments and scalable token transfers.

Plasma: Plasma is a framework for building scalable decentralized applications by creating hierarchical tree structures of sidechains, also known as "child chains," anchored to the Ethereum mainnet. These child chains can process transactions independently, with the final state periodically committed to the Ethereum mainnet for security. Projects like OMG Network (formerly OmiseGO) leverage Plasma technology to achieve high transaction throughput and low fees.

Rollups: Rollups are Layer 2 scaling solutions that bundle multiple transactions into a single compressed data structure, known as a "rollup," which is then submitted to the Ethereum mainnet for verification. There are two types of rollups: optimistic rollups and zk-rollups. Optimistic rollups rely on fraud proofs, allowing users to challenge incorrect data submissions, while zk-rollups utilize zero-knowledge proofs for efficient data verification and privacy. Prominent projects such as Arbitrum and zkSync employ rollup technology to significantly enhance Ethereum's scalability without compromising security.

Benefits of Layer 2 Scaling Solutions

Improved Scalability: By offloading transactions from the Ethereum mainnet, Layer 2 solutions dramatically increase the platform's scalability, enabling thousands of transactions per second.

Reduced Gas Fees: With fewer transactions processed on-chain, gas fees are substantially lowered, making Ethereum more accessible for users and developers alike.

Enhanced User Experience: Faster transaction confirmation times and lower costs improve the overall user experience, driving adoption of DApps and NFTs on the Ethereum ecosystem.

Environmental Sustainability: Layer 2 scaling solutions contribute to reducing Ethereum's carbon footprint by minimizing energy-intensive on-chain transactions.

Challenges and Considerations

While Layer 2 scaling solutions offer promising benefits, they also present challenges and considerations that need to be addressed:

Security: Ensuring the security of Layer 2 solutions is paramount, as they rely on off-chain mechanisms and periodic interaction with the Ethereum mainnet.

Interoperability: Achieving interoperability between different Layer 2 solutions and the Ethereum mainnet is essential for seamless user experience and ecosystem growth.

Adoption: Educating users and developers about the benefits and functionalities of Layer 2 solutions is crucial for widespread adoption and integration into decentralized applications.

Regulatory Compliance: Compliance with regulatory requirements and standards may pose challenges for Layer 2 protocols, particularly concerning privacy and data protection.

Future Outlook

As Ethereum continues to evolve, Layer 2 scaling solutions will play a pivotal role in shaping its future scalability and usability. With ongoing research and development efforts, we can expect further innovation in Layer 2 technologies, leading to even greater scalability, efficiency, and decentralization. As the Ethereum ecosystem expands, Layer 2 solutions will empower developers to build scalable DApps and NFT platforms, driving the next wave of blockchain adoption and innovation.

Conclusion

Layer 2 scaling solutions represent a significant milestone in Ethereum's journey towards achieving mass adoption and scalability. By addressing the platform's limitations and enhancing its performance, these solutions pave the way for a more inclusive, efficient, and sustainable blockchain ecosystem. As the Ethereum community embraces Layer 2 technologies, we are witnessing the dawn of a new era of decentralized applications and NFT platforms, ushering in a future where blockchain technology revolutionizes various industries and empowers individuals worldwide.

#Ethereum Layer 2 Scaling Solutions#Ethereum Scaling Solutions Provider#Layer 2 Solutions for Ethereum dApps#Layer 2 Solutions For Ethereum#Ethereum Layer 2 Scalability Solutions

0 notes

Text

Geçen hafta yaşadığımız SEC dump’ından sonra hangi altcoin yahut altcoinler için yatırım yapacağımız konusu değerli. Zira ABD Menkul Değerler ve Borsa Komitesi, piyasa pahası 100 milyar dolar olan 67 kripto varlığı üzerinde bir baskı başlattı. Kripto para piyasasının toplam pahası son yedi gün içinde %8,3 düştü. Şu anda 1 trilyon doların biraz üzerinde seyrediyor. Uzmanlar, bir sonraki kripto boğa koşusunda sahipleri için çıkar sağlaması olası kripto para ünitelerinin bir listesini derledi. Detaylara bakalım.SEC’in listesiUzmanlar, yatırımcıların bir sonraki boğa koşusunda kar elde etmek için biriktirdikleri beş altcoin belirledi. Buna nazaran SEC, Binance’e karşı açtığı davada 10, Coinbase’e karşı açtığı davada ise 13 kripto para ünitesini menkul değer olarak listeledi. Ayrıyeten ABD mali düzenleyicisi, iki kripto para ünitesi borsasına karşı açtığı davada menkul değerler listesine daha fazla varlık ekledi. Öteki taraftan liste toplam piyasa kıymeti 100 milyar dolar olan 67 kriptoya ulaştı.Aşağıda SEC’in menkul değer olarak etiketlediği kripto para ünitelerinin bir listesi yer alıyor:XRP (XRP), Telegram’s Gram (TON), LBRY Credits (LBC), OmiseGo (OMG), DASH (DASH), Algorand (ALGO), Naga (NGC), Monolith (TKN), IHT Real Estate (IHT), Power Ledger (POWR), Kromatica (KROM), DFX Finance (DFX), Amp (AMP), Rally (RLY), Rari Governance Token (RGT), DerivaDAO (DDX), XYO Network (XYO), Liechtenstein Cryptoasset Exchange (LCX), Kin (KIN), Salt Lending (SALT), Beaxy Token (BXY), DragonChain (DRGN), Tron (TRX), BitTorrent (BTT), Terra USD (UST), Luna (LUNA), Mirror Protocol (MIR), Mango (MNGO), Ducat (DUCAT), Locke (LOCKE), EthereumMax (EMAX), Hydro (HYDRO), BitConnect (BCC), Meta 1 Coin (META1), Filecoin (FIL), BNB (BNB), Binance USD (BUSD), Solana (SOL), Cardano (ADA), Polygon (MATIC), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Axie Infinity (AXS), COTI (COTI), Paragon (PRG), AirToken (AIR), Chiliz (CHZ), Flow (FLOW) Internet Computer (ICP), Near (NEAR), Voyager Token (VGX) and Nexo (NEXO), Mirrored Apple Inc. (mAAPL), Mirrored Amazon.com, Inc. (mAMZN), Mirrored Alibaba Group Holding Limited (mBABA), Mirrored Alphabet Inc. (mGOOGL), Mirrored Microsoft Corporation (mMSFT), Mirrored Netflix, Inc. (mNFLX), Mirrored Tesla, Inc. (mTSLA), Mirrored Twitter Inc. (mTWTR), Mirrored iShares Gold Trust (mIAU), Mirrored Invesco QQQ Trust (mQQQ), Mirrored iShares Silver Trust (mSLV), Mirrored United States Oil Fund, LP (mUSO), Mirrored ProShares VIX Short-Term Futures ETF (mVIXY).Öne çıkan 5 altcoinTwitter’da @0xFinish ismiyle ünlü olan kripto uzmanı, yatırımcıların kan banyosu sırasında biriktirmeleri için beş altcoin belirledi. Uzmana nazaran, bu altcoin kümesi bir sonraki boğa koşusunda kar sağlama potansiyeline sahip. Ayrıyeten yatırımcılar devam eden kan banyosu sırasında bunları indirimli olarak toplayabilir. Listede şu altcoin kümesi var.Arbitrum (ARB)Frax Share (FXS)Curve DAO (CRV)GMX (GMX)Chainlink (LINK)Altcoin Arbitrum, Off-chain labs tarafından geliştirilen bir Layer 2 ölçeklendirme tahlili. Ayrıyeten proje büyük bir pazar hissesi hacmi yakaladı. DeFiLlama’dan alınan datalara nazaran, Arbitrum’da kilitli varlıkların toplam bedeli 2,1 milyar doların üzerinde. Protokolün ARB token’ı bu yazının yazıldığı sırada tüm vakitlerin en yüksek düzeyi olan 8,67 doların %88,41 altında. Buna nazaran 1 dolar düzeyinden süreç görüyor. Ayrıyeten Frax Share, yatırımcıların Frax ekosistemindeki stablecoinlerin ve altyapı protokollerinin yönetişiminde hisse sahibi olduğu bir hizmet tokeni. FXS fiyatı geçtiğimiz hafta %25 düştü. Yatırımcılara tokeni tüm vakitlerin en yüksek düzeyi olan 42,80 doların yaklaşık %90 altında alım fırsatı sundu. Şu an FXS fiyatı 4,88 dolar.Curve DAO’nun CRV tokeni, otomatik bir piyasa işaretleyicisinin DeFi yardımcı program tokeni. Protokol, farklı ERC-20 tokenlarının değişimine yardımcı oluyor. Başka taraftan token takaslarını destekliyor. Bu yazının yazıldığı sırada CRV fiyatı Cumartesi gününden bu yana %4,3 artışla 0,672 dolar düzeyindeydi.

Altcoin GMX, Arbitrum Layer 2 ağında daima bir borsa olan merkezi olmayan borsa GMX için bir idare tokeni. Başka taraftan GMX fiyatı bir gecede yaklaşık %2 artışla 45,15 dolar oldu. Token, tüm vakitlerin en yüksek düzeyi olan 91,07 doların %50,41 altında. cointahmin.com olarak yer vereceğimiz son kripto para LINK. Buna nazaran Chainlink’in tokeni LINK, merkezi olmayan oracle platformunu temsil ediyor. LINK, piyasadaki kripto kan banyosuna karşın Cumartesi gününden bu yana %2,4 çıkar kaydetti. Şu an 5,17 dolardan süreç görüyor.

1 note

·

View note

Text

OmiseGO Криптовалюта OMG Майнинг, Кошелек, Курс BitcoinWiki

В рамках платформы выпущена OmiseGo криптовалюта, которая торгуется на популярных криптовалютных биржах. Это означает, что цены в общем и целом начали снижение в первой половине 2018. Тем не менее, многие верят, что так называемый медвежий рынок скоро закончится. Такое событие принято называть бычий рынок (если вам интересно)! Большинство экспертов уверены, что криптовалютные цены начнут вновь…

View On WordPress

0 notes

Text

Криптовалюта OmiseGO OMG

Как уже было сказано, изначально криптовалюта работала на платформе эфира. Однако затем внедрили собственную платформу на базе алгоритма Proof of stake. Реализация собственной платформы позволила сделать платежную систему более защищенной и безопасной. Отрицательная динамика монеты породила в криптосообществе сомнения в отношении потенциала платформы. Масла в огонь подлили разработчики, которые…

View On WordPress

0 notes

Text

O OmiseGO, também conhecido como OMG Network, é uma solução de escalabilidade para o Ethereum que visa reduzir os custos de gás e acelerar a confirmação das transações. Compatível com tokens ERC-20 e ETH, o OMG Network busca resolver problemas de escalabilidade enfrentados pelo Ethereum, proporcionando uma experiência mais eficiente e econômica para os usuários. Como funciona o OmiseGO (OMG)? O OmiseGO é uma solução de segunda camada, conhecida como Layer 2, construída em cima da blockchain do Ethereum. Essa abordagem permite que as transações sejam processadas em uma camada secundária, liberando espaço nos blocos da blockchain principal do Ethereum. Podemos pensar no OmiseGO como uma espécie de "blockchain em cima de uma blockchain". Essa solução oferece a mesma segurança do Ethereum, porém com taxas de transação mais baixas e tempos de confirmação mais rápidos. Além disso, o OmiseGO é compatível com todos os tokens ERC-20 e ETH. O sucesso do OmiseGO já pode ser comprovado pelo fato de que uma parte do fornecimento da maior stablecoin do mundo, o Tether (USDT), foi emitida na rede OMG. Vale ressaltar que o OmiseGO é apenas uma das soluções de segunda camada disponíveis para escalar o Ethereum, existindo também outras opções como Optimism, Loopring e zkSync. Por que o OmiseGO (OMG) é importante? A congestão de rede é um dos principais problemas enfrentados pelo Ethereum. Embora as transações geralmente sejam rápidas e confirmadas em 10-20 segundos, em momentos de alta demanda e aumento do preço do gás, os tempos de transação podem se estender por horas, e até mesmo dias. Quando há uma grande demanda por espaço nos blocos, as transações com taxas de gás mais altas têm prioridade, fazendo com que transações com taxas mais baixas fiquem em espera por um longo período. Isso cria dois problemas na rede Ethereum: altas taxas de gás e tempos longos de confirmação. O OmiseGO resolve esse problema oferecendo transações de baixo custo e alta velocidade. A rede é capaz de processar milhares de transações por segundo, a um terço do custo médio de uso do Ethereum. Essa solução não é apenas importante para negociações de tokens, mas também para aplicativos de finanças descentralizadas (DeFi) que são implantados no Ethereum. A congestão de rede continuará sendo um problema mesmo após a atualização Ethereum 2.0, que busca melhorar a escalabilidade do Ethereum. Além disso, a implementação completa do Ethereum 2.0 levará anos. Portanto, soluções de segunda camada como o OmiseGO ainda serão necessárias para fornecer transações mais rápidas e taxas de gás mais baixas aos usuários. Casos de uso do OmiseGO (OMG) As exchanges de criptomoedas podem se beneficiar do uso do OmiseGO para realizar transações de tokens ERC-20 mais rápidas e com menor custo, em vez de utilizar a rede Ethereum. Além das exchanges, provedores de carteiras também podem se beneficiar de sistemas rápidos, com alta capacidade e baixo custo. Embora geralmente pensemos nesse tipo de solução em termos de ativos financeiros e criptomoedas, o OmiseGO também pode ser usado para transações de pontos comunitários sem intermediários e em diversos outros sistemas de recompensas online. Um exemplo disso é o sistema de pontos comunitários do Reddit, que mostrou-se altamente eficiente quando utilizado com a rede OMG. Isso foi possível graças ao desenvolvimento recente do Community Points Engine (CPE). A token OMG O token OMG é um token de staking e foi utilizado para financiar o desenvolvimento do projeto. O OmiseGO realizou uma ICO em 2017, arrecadando 25 milhões de dólares. O OMG também é usado para pagar taxas na rede, porém o suporte para outras moedas está em desenvolvimento. O token também é utilizado pelos validadores que executam os nós de rede e validam os blocos. Em troca de seus serviços, eles recebem taxas de transação. Como armazenar o OmiseGO (OMG) Como o OMG é um token ERC-20, ele pode ser armazenado em uma variedade de carteiras. Isso inclui

carteiras de software (baseadas em web ou mobile) ou até mesmo em exchanges como o Binance. O OMG também pode ser armazenado em carteiras de hardware de armazenamento a frio, como o Ledger e o Trezor, quando combinado com o MyEtherWallet ou MyCrypto. Conclusão O OmiseGO, também conhecido como OMG Network, é uma solução de escalabilidade para o Ethereum que proporciona transações mais rápidas e com menor custo. Com sua abordagem de segunda camada, o OmiseGO ajuda a resolver os problemas de congestionamento da rede Ethereum, oferecendo uma alternativa eficiente e econômica para os usuários. Com sua compatibilidade com tokens ERC-20 e ETH, o OmiseGO tem uma ampla gama de casos de uso, desde transações em exchanges até sistemas de pontos comunitários. Com o token OMG, os usuários podem participar do staking e contribuir para a validação da rede. No geral, o OmiseGO é uma solução importante para melhorar a experiência dos usuários no ecossistema do Ethereum.

0 notes

Video

instagram

🎯😂 . . . . Repost @cryptofunny • • • • • #ethereum #bitcoin #cryptocurrency #cryptotrade #blockchain #cryptolife #altcoins #income #cryptomining #eth #btc #omisego #crypto #cryptonews #ripple #litecoin #coinbase #cryptomeme #cryptomemes #cryptotrading #ethtrader #ripple #investing #realestate #money #finance #stocks #wallstreet #memes #bitcoincash #comedy https://www.instagram.com/p/CAibMcMALtO/?igshid=qixbo7maw6m

#ethereum#bitcoin#cryptocurrency#cryptotrade#blockchain#cryptolife#altcoins#income#cryptomining#eth#btc#omisego#crypto#cryptonews#ripple#litecoin#coinbase#cryptomeme#cryptomemes#cryptotrading#ethtrader#investing#realestate#money#finance#stocks#wallstreet#memes#bitcoincash#comedy

20 notes

·

View notes

Text

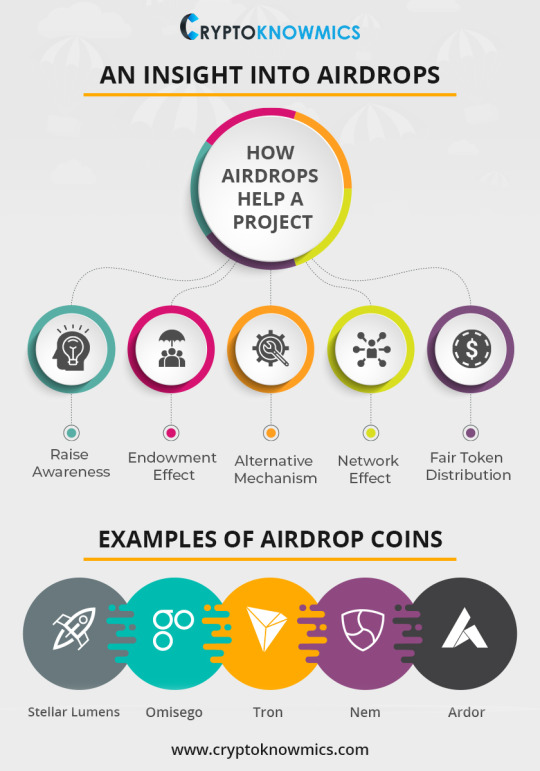

📢📢 How Airdrop help a Project

This infographic provides a guide to airdrops and examples of airdrop coins. It shows reasons, advantages of airdrops and Illustrations of airdrop coins. To know more about Latest Airdrop, Click here 👉 https://www.cryptoknowmics.com/airdrop

#RaiseAwareness#Createtheendowmenteffect#AlternativeMechanism#Tron#Creationofthenetworkeffect#FairTokenDistribution#StellarLumens#Omisego#Nem#Ardor#Recentairdrops#Ethereumairdrop#CryptocurrencyAirdrops#Hottestairdrop#NewAirdrop#FreeAirdrop#Telegramairdrop#BestAirdrops#Newcryptocurrencyairdrop#Airdropemail#Recentcryptocurrencyairdrop#Telegrambotairdrop#Emailairdrop#latestairdrops#LTCAirdrop

4 notes

·

View notes

Photo

Crypto Bear Market Provides Opportunity For Major Corps, As CP Group Acquires Omise The crypto bear market has been the longest on the record books, causing most cryptocurrencies to decline in value by 85% or higher.

1 note

·

View note

Photo

Bakkt pourrait lister les contrats à terme Bitcoin en juillet/ Échange de crypto-monnaie, bitflyer,CoinMarketCap,poloniex,bitfinex

Bitseven.com - La plateforme de crypto-négociation très attendue et souvent retardée Bakkt a annoncé aujourd'hui que ses contrats à terme bitcoins seraient cotés sur un marché sous réglementation fédérale dans les prochains mois. Selon la société, deux contrats à terme seront listés: Un contrat à terme quotidien, qui permettra aux clients d’effectuer des transactions sur un marché le jour même. Un contrat à terme mensuel, qui permettra d'effectuer des transactions dans le mois précédent et sur la courbe de prix à terme. "En collaboration avec nos partenaires boursiers et compensateurs chez ICE Intercontinental Exchange, la société mère du New York Stock Exchange], nous travaillerons avec nos clients au cours des prochaines semaines pour préparer les tests d'acceptation des utilisateurs (UAT) pour les contrats à terme et la garde d’actifs, qui devrait débuter en juillet", a déclaré Kelly Loeffler dans un article de blog, ajoutant que de plus amples détails devaient encore être communiqués. "Pour la livraison physique et le stockage sécurisé des bitcoins, un dépositaire qualifié assurera un service de conservation, sous réserve de l'approbation des autorités de réglementation", a déclaré la PDG. Selon elle, la protection reposera sur les assurances, la cybersécurité et une conformité globale, notamment un programme de lutte contre le blanchiment d'argent et des analyses de blockchain. La société collabore avec le département des services financiers de l’État de New York pour devenir une société de fiducie et un dépositaire qualifié des actifs numériques, aux côtés de leurs produits à terme réglementés par la CFTC (la Commodity Futures Trading Commission). Bakkt a longtemps été considéré comme un grand pas en avant des investisseurs traditionnels dans la crypto qui pourrait favoriser l’adoption de Bitcoin et d’autres ressources numériques. Près du pic, le prix de bitcoin a augmenté d’environ 1% au cours de la dernière heure et de près de 6% au cours des 24 dernières heures, se négociant à 7,454 USD (14:54 UTC.) Parmi les partenaires et les investisseurs de Bakkt figurent des sociétés telles que Boston Consulting Group, CMT Digital, Eagle Seven, Galaxy Digital, Starbucks, Goldfinch Partners, Alan Howard, Horizons Ventures, Intercontinental Exchange, la branche de capital-risque de Microsoft, M12, Pantera Capital, PayU, branche fintech de Naspers et Protocol Ventures. Selon les rapports, Bakkt aura besoin de beaucoup de volume de transactions pour atteindre un rendement de 740 millions USD.

BitSEVEN | Echange mercantile de Bitcoin Echangez avec un maximum de 100x de profit Echangez Bitcoin et autres cryptocurrences avec un maximum de 100x de profit Exécution rapide, frais bas, disponible seulement sur BitSEVEN

https://www.bitseven.com/fr

#bitcoin cach#nouvelles de bitcoin#Bitconnecte#CoinDesk#Coinbese#Bitcoin#Vetchain#Binance#Omisego#Partages de bit#Bitcoin d’or

2 notes

·

View notes

Text

LA TECNOLOGÍA BLOCKCHAIN

Durante los últimos años numerosas empresas, fondos de inversión, Gobiernos o entidades bancarias, han abrazado la tecnología blockchain para disfrutar en un futuro (casi podemos decir que presente), de una posición ventajosa en lo que muchos han denominado: la Revolución Industrial de internet. En este magnífico artículo publicado por Xataka, se explica resumidamente en qué consiste esta tecnología y que ventajas ofrece.

--- Si te interesa esta tecnología, --- PINCHA AQUí --- para acceder a mi blog dedicado al blockchain ---

El concepto de cadena de bloque fue aplicado por primera vez en 2009 como parte de Bitcoin. La cadena de bloques genera valor añadido a multitud de procesos, ya sean industriales, de carácter administrativo o, simplemente, en procesos que se dan en nuestra vida cotidiana. Una de sus aplicaciones, la más famosa, son las criptomonedas, siendo Bitcoin (BTC) su mayor y más antiguo exponente.

En este primer post, voy a compartir algunos de mis proyectos blockchain favoritos. Actualmente existen infinidad de proyectos, cada uno con su propio token y aplicación. Alguno de ellos, están basados en los llamados smart contracts o contratos inteligentes (otra aplicación de la cadena de bloques que merece un post aparte), siendo Ethereum (ETH) su máximo exponente.

Sin más dilación, estos son 15 de mis proyectos favoritos que sigo prácticamente desde sus inicios. Entre paréntesis encontramos la nomenclatura de su respectivo token:

1. TRON (TRX)

2. RIPPLE (XRP)

3. NEO (NEO)

4. ICON (ICX)

5. LITECOIN (LTC)

6. IOTA (MIOTA)

7. NEM (XEM)

8. ONTOLOGY (ONT)

9. ZCASH (ZEC)

10. VECHAIN (VET)

11. QTUM (QTUM)

12. OMISEGO (OMG)

13. VERGE (XVG)

14. CARDANO (ADA)

15. EOS (EOS)

#blockchain#bitcoin#ethereum#litecoin#neo#ripple#icon#iota#xem#ontology#zcash#zcashmining#mining#vechain#qtum#omisego#verge#cardano#eos#btc#eth#litecoin (ltc)#ripple (xrp)#cripto#criptomonedas#dapp#digital cash#banc#economy#currency

2 notes

·

View notes

Link

Blockchain for business! What’s in it for start-ups, investors and enterprises. Article#1 of the Blockchain Disruption and Opportunities Series

https://yvasvn.com/blog/global-cross-boarder-transactions/

4 notes

·

View notes

Photo

Kurs Litecoina traci 10%, w bessie/ wymiana bitcoinów bitfinex, bitmex, bittrex, bithumb, bitonbay, cena bitcoin, bitcointalk

Litecoin kosztował 70,740$, o godzinie 09:50 (07:50 GMT), jak wykazuje. Tym samym kurs Litecoina stracił w trakcie dnia 10,25% wartości. W związku ze spadkiem kursu Litecoina, zmniejszyła się również kapitalizacja rynkowa kryptowaluty, osiągając poziom $4,463B i notując spadek o 2,47%. Najwyższa kapitalizacja rynkowa kryptowaluty wynosi $14,099B. W ciągu ostatnich 24 godzin, cena Litecoina wahała się w przedziale od $70,643 do $74,729. Natomiast w ciągu ostatnich 7 dni Litecoin zanotował stratę na poziomie 9,24% wartości. W ciągu ostatnich 24 godzin, wolumen obrotu kryptowalutą wyniósł $2,932B, czyli 6,00% całkowitego wolumentu obrotów na rynku kryptowalut. W ciągu ostatnich 7 dni wolumen obrotu Litecoina wahał się w przedziale od $70,6429 do $82,9826. Ze swoją obecną ceną, Litecoin znajduje się 83,16% od swojego historycznego maksimum, zanotowanego na poziomie $420,00 , osiągniętego w dniu: 12 Grudzień 2017. Notowania innych kryptowalut Kurs kryptowaluty Bitcoin znajduje się na poziomie $5.428,1, jak wskazuje, odnotowując tym samym spadek o 1,40%. Kurs kryptowaluty Ethereum znajduje się na poziomie $162,28, jak wskazuje, czyli notuje stratę o 7,40%. Kapitalizacja rynkowa kryptomonety Bitcoin wynosi $98,852B, czyli 54,76% całkowitej kapitalizacji rynkowej kryptowalut, podczas gdy kapitalizacja rynkowa kryptomonety Ethereum wynosi $17,726B, czyli 9,82% całkowitej kapitalizacji rynkowej kryptowalut.

BitSEVEN I : Giełda Handlowa, maksymalna dźwignia do 100x Handluj bitcoinami i innymi kryptowalutami z maksymalną dźwignią do 100x. Szybka realizacja, niskie opłaty dostępne tylko na BitSEVEN.

https://www.bitseven.com/pl

bitcoin wiadomości, Bitconnect, bitcoin do dolaraCoinDesk, Coinbase, Ethereum, Ripple, Bitcoin Cash, EOS, Stellar Lumens, Litecoin, Cardano, IOTA, Tether, TRON

#Omisego#Ledgerwallet#99bitcoins#kalkulator walutowy#Coinbase#bitcoin price#etherscan#Localbitcoins#kopanie bitcoinów#BitMart

1 note

·

View note

Photo

MUCH CONGRATS @cosmicbrownie ‼️🎉💰🎁🐕 winner of 1,776 Dogecoins!!!! 🎉🎉💰💰💰💰💰💰🐕🇺🇸 and such wow to all the shibe participation!! 💪💪🐕🐕🐕🐕🐕🐕🙏😁 #shibesquad #cryptomemes #bitcoin #dogecoin #ethereum #litecoin #vertcoin #hardwarewallet #makeitraincrypto #bitcoinfuture #altcoins #partylikeits1776 #patrioticdog #siacoin #omisego #ripplecoin #dogecoins #cryptogiveaway #dogecoingiveaway #muchwow #dogeforpresident #cosmicbrownies #cosmicbrownie #crypto #sandiego #hodl #dogesquad #hodlgang #doge #tothemoon 🐕🐕🐕🚀🌕 (at San Diego, California)

#sandiego#hodl#cosmicbrownies#bitcoinfuture#ripplecoin#muchwow#vertcoin#hardwarewallet#siacoin#tothemoon#dogesquad#ethereum#omisego#altcoins#cosmicbrownie#litecoin#dogecoingiveaway#dogeforpresident#makeitraincrypto#hodlgang#cryptogiveaway#doge#cryptomemes#dogecoin#bitcoin#patrioticdog#partylikeits1776#dogecoins#shibesquad#crypto

2 notes

·

View notes