#OnlinePaymentGateway

Explore tagged Tumblr posts

Text

Optimize Your Forex Trading with Mobi’s Seamless Payment Solution

Elevate your online forex trading experience with Mobi's optimized digital payment solution. Enjoy seamless currency transactions and forex market operations, designed to offer unparalleled convenience and reliability. Mobi's Forex Payment Gateway is redefining the future of forex trading with its swift and secure processing, ensuring a heightened trading journey for you.

Take your trading to the next level—contact Go Mobi today and redefine your forex transactions with the best payment gateway solution.

Contact us at: https://gomobi.io/.

#online payment gateway#payment gateway#forex payment gateway#paymentprocessing#malaysia payment gateway#top payment gateway malaysia#malaysiapaymentgateway#onlinepaymentgateway#paymentgateway#best payment gateway malaysia

0 notes

Link

#bestpaymentgateway#bestpaymentgatewayforshopify#bestpaymentgateways#dropshippingpaymentgateway#ecommercepaymentgateway#internationalpaymentgateways#onlinepaymentgateway#paymentgateway#paymentgatewayshopify#paymentgateways#paymentprocessor#shopifypaymentgateway#shopifypaymentgateways#stripepaymentgateway#toppaymentgateways#woocommercepaymentgateway#woocommercepaymentgateways

0 notes

Text

Transform your finance business with SurekhaTech's FinTech Solutions

With over a decade of experience, we specialize in developing cutting-edge finance management systems tailored for banking, financial services, and insurance businesses. Our expertise lies in empowering BFSI businesses through innovative solutions, incorporating AI, IoT, and Blockchain technologies.

We offer a wide range of software solutions designed to streamline finance management, including payment and digital wallets, mobile banking, investment management, personal finance management, insurTech solutions, lending and borrowing platforms, fraud detection software, financial CRM software, and accounting software.

Experience the future of finance with SurekhaTech – your partner in FinTech innovation.

In addition to the above, feel free to visit our website for more detailed insights and solutions.

#fintech#finance#financesolutions#accounting#accountmanagement#bankingsystem#onlinepaymentgateway#softwaredevelopmentcompany#digitalsolution#digitaltransformation#SurekhaTechnologies#SurekhaTech

1 note

·

View note

Text

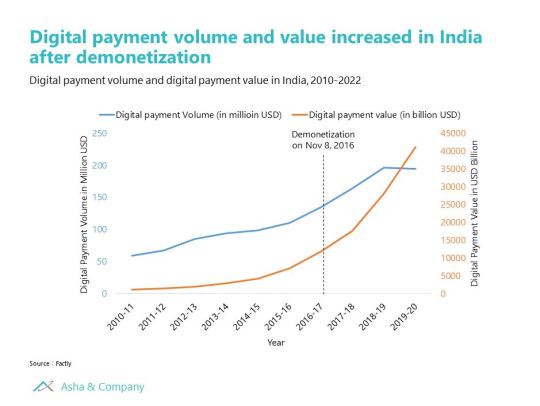

Rise of Digital Payment in India

Digital payments in India grew from 25B transactions in FY20 to 64B in FY22. This adoption of digital payment was fueled by the government's “Digital India” initiative, UPI payment, and lower mobile data costs. By 2026, India’s digital payment landscape is expected to grow to 411B transactions by FY27.

#market research#Digital Payment#digital payment solution#upi#Paytm#online payments#online paise kaise kamaye#onlinepaymentgateway#business intelligence#indian market

1 note

·

View note

Text

payg.in/payment-frauds-in-covid-19.html

Novel Payment Frauds in the times of COVID-19

Today, along with keeping oneself safe from the coronavirus (COVID-19), we ought to likewise be aware of cybercriminals. One of the methods of instalment seeing an expansion in fraud is the Unified Payment Interface (UPI), an advanced instalment stage that encourages cashless, continuous exchanges through cell phones.

#bestpaymentgatewayIndia#freepaymentgateway#onlinepaymentgatewayinindia#onlinepaymentgateway#paymentgatewayprovidersinindia

0 notes

Text

Instant Payment Gateway Solutions | LetsPe: Secure and Efficient Transactions

Discover LetsPe's instant payment gateway solutions, offering secure and efficient transactions for your business. With a wide range of accepted payment methods, including credit cards, debit cards, and digital wallets, LetsPe ensures seamless processing and a hassle-free checkout experience for your customers. Trust in the secure and reliable technology provided by LetsPe to streamline your payment processes and enhance customer satisfaction. Experience the convenience of LetsPe's instant payment gateway solutions today.

0 notes

Video

youtube

In a rapidly evolving digital landscape, optimizing your business's efficiency and providing customers with seamless payment experiences are more critical than ever. Join us in this enlightening video as we delve into the world of payment processing. From high-risk industries like CBD and credit repair to the thriving e-commerce realm, we'll uncover the secrets to streamlining your operations and embracing the power of credit card payments.

📣 Unravel the Future of High-Risk Payment Solutions with TouchSuite®! 🎯💼📈

🔍 Seeking advanced payment processing for high-risk businesses? Dive into the vast range of services we offer in this video: from high-risk payment processing, merchant accounts, and e-commerce gateway solutions, to specialized services for credit repair and CBD industries.

🌐✉️📞 With a legacy of excellence and serving thousands of global businesses, TouchSuite® is your trusted high-risk payment solutions provider.

#AcceptCreditCardPayments #PeymentProcessing #MerchantAccounts #HighRiskPaymentProcessing #AcceptCreditCards #OnlinePaymentGateway #MerchantProcessing #CreditCardPaymentGateway #HighRiskMerchantAccount

0 notes

Text

Why Credit Ratings Matter: Understanding the Importance of Credit Ratings

In today's financial landscape, credit ratings play a crucial role in various aspects of our personal and business lives. Whether you're applying for a loan, seeking favorable interest rates, or even renting an apartment, your credit rating can significantly impact the opportunities available to you. Understanding the importance of credit ratings is essential for managing your financial well-being effectively.

Credit ratings are assessments of an individual's or organization's creditworthiness. They reflect the likelihood of the borrower repaying their debts based on their credit history, financial stability, and repayment patterns. Here's why credit ratings matter:

Access to Credit: Lenders, such as banks and financial institutions, rely on credit ratings to evaluate the risk associated with lending money. A good credit rating can help you secure loans, credit cards, and mortgages with favorable terms and interest rates. It gives lenders confidence in your ability to repay borrowed funds responsibly.

Cost of Borrowing: Credit ratings directly impact the cost of borrowing. A higher credit rating indicates lower credit risk, resulting in better interest rates and loan terms. On the other hand, a lower credit rating can lead to higher interest rates or even loan denials. Maintaining a good credit rating can save you money in the long run by reducing the cost of borrowing.

Rental Applications: Landlords and property managers often check credit ratings when assessing rental applications. A positive credit rating demonstrates financial responsibility and reliability, increasing your chances of being approved for a rental property. It also provides leverage in negotiating lease terms and security deposits.

Employment and Business Opportunities: Some employers and companies review credit ratings as part of their hiring or business partner selection process. While credit ratings alone may not determine eligibility, they can be a factor in assessing an individual's financial stability and responsibility. A good credit rating can enhance your professional reputation and open doors to certain job positions or business opportunities.

Insurance Premiums: In certain cases, credit ratings may influence insurance premiums. Insurance providers may consider credit ratings as an indicator of risk, potentially impacting the cost of auto insurance, homeowner's insurance, or other types of coverage. Maintaining a good credit rating can help keep insurance costs lower.

Future Financial Goals: Building and maintaining a good credit rating is essential for achieving future financial goals. Whether you plan to buy a home, start a business, or invest in real estate, a strong credit rating provides you with the financial foundation and credibility needed to pursue these endeavors.

To improve or maintain a good credit rating, it's important to practice responsible financial habits. This includes paying bills on time, keeping credit card balances low, minimizing debt, and regularly reviewing your credit reports for accuracy.

In conclusion, credit ratings are critical for accessing credit, obtaining favorable terms and interest rates, and making significant financial decisions. Understanding the importance of credit ratings empowers you to take control of your financial health and work towards achieving your long-term goals.

0 notes

Text

The Benefits of Using a Payment Gateway for E-Commerce Businesses

In the rapidly evolving world of e-commerce, the seamless processing of payments is crucial for the success of any online business. A online payment gateway serves as the backbone of online transactions, facilitating the transfer of information between the customer, the merchant, and the bank. Here's why integrating a payment gateway is essential for e-commerce businesses and the myriad benefits it brings.

1. Enhanced Security

One of the most significant advantages of using a payment gateway is the enhanced security it provides. Payment gateways are equipped with robust encryption protocols and secure transaction processes that protect sensitive customer information, such as credit card numbers and personal data, from cyber threats and fraud. Compliance with Payment Card Industry Data Security Standard (PCI DSS) further ensures that the e-commerce platform adheres to strict security guidelines, fostering customer trust and confidence.

2. Increased Conversion Rates

A seamless and efficient payment process can significantly boost conversion rates. Payment gateways streamline the checkout process, reducing the chances of cart abandonment. Features such as multiple payment options, one-click payments, and saved card details for returning customers make the purchasing experience smooth and hassle-free. This convenience encourages customers to complete their transactions, thereby increasing sales and revenue.

3. Global Reach

For e-commerce businesses aiming to expand their reach internationally, a payment gateway is indispensable. Payment gateways support multiple currencies and international payment methods, allowing customers from around the world to make purchases using their preferred payment options. This global accessibility not only broadens the customer base but also enhances the shopping experience for international buyers.

4. Automated Payment Processing

Payment gateways automate the payment process, reducing the need for manual intervention and minimizing human error. Automated processes include transaction authentication, fund transfers, and payment confirmations. This efficiency not only speeds up transactions but also ensures accuracy, allowing businesses to manage their cash flow more effectively and allocate resources to other critical areas.

5. Real-Time Transaction Insights

Access to real-time transaction data is another significant benefit of using a payment gateway. E-commerce businesses can monitor transactions as they happen, enabling them to quickly identify and resolve any issues. Real-time insights also provide valuable data for analyzing customer behavior, tracking sales trends, and making informed business decisions. This data-driven approach can help businesses optimize their strategies and improve overall performance.

6. Improved Customer Experience

A E-commerce payment gateway enhances the overall customer experience by offering a seamless and secure checkout process. Features like mobile payment integration, recurring billing, and digital wallets cater to the diverse preferences of modern consumers. By providing a smooth and convenient payment experience, businesses can build customer loyalty and encourage repeat purchases.

7. Integration with E-Commerce Platforms

Most payment gateways are designed to integrate seamlessly with popular e-commerce platforms like Shopify, WooCommerce, and Magento. This compatibility ensures that businesses can easily set up and manage their payment processes without extensive technical expertise. The integration also allows for additional features, such as fraud detection, automated invoicing, and subscription management, further streamlining business operations.

8. Cost-Effective Solution

While there are fees associated with using a payment gateway, the overall benefits far outweigh the costs. Payment gateways reduce the risk of fraud, improve transaction efficiency, and enhance the customer experience, leading to increased sales and revenue. Additionally, the automation and real-time insights provided by payment gateways can help businesses save on operational costs and focus on growth.

Conclusion

In conclusion, the adoption of a payment gateway service provider is a strategic move for any e-commerce business aiming to thrive in a competitive market. The benefits of enhanced security, increased conversion rates, global reach, automated processes, real-time insights, improved customer experience, seamless integration, and cost-effectiveness make payment gateways an indispensable tool for modern e-commerce. By leveraging these advantages, businesses can not only streamline their operations but also provide a superior shopping experience, ultimately driving success and growth in the digital marketplace.

#payment gateway#online payment gateway#forex payment gateway#malaysia payment gateway#top payment gateway malaysia#paymentgateway#paymentprocessing#onlinepaymentgateway#best payment gateway malaysia#malaysiapaymentgateway

0 notes

Link

Key Details

What is a payment processor?

What is a merchant account?

What is a payment gateway?

Who is involved in payment processing?

Applying for Payment Processors: The Process

Merchant Account Application: Approval Questions

Payment Processors: Getting Started

How do online payments work?

#paymentprocessing#paymentmethods#payments#onlinepaymentgateway#onlinepaymentprocessing#PaymentProcessingGuide

0 notes

Text

https://www.asha.inc/blogs/digital-payments-india/

#market research#Digital Payment#digital payment solution#upi#Paytm#online payments#online paise kaise kamaye#onlinepaymentgateway#business intelligence#indian market

0 notes

Text

payg.in/understanding-merchant-dashboard-systems.html

Understanding Merchant Dashboard System

Accepting payments through multiple channels is a quick and simple approach to develop your business. With a Merchant Dashboard, one can start processing credit and debit cards for all forms of purchases and can easily integrate in your system within a minute.

#bestpaymentgatewayIndia#freepaymentgateway#onlinepaymentgatewayinindia#onlinepaymentgateway#paymentgatewayprovidersinindia

0 notes

Text

Secure and Fast Instant Payment Gateway in India for Your Business Needs

LetsPe, most secure and fastest payment gateway in India. Payment gateway platform provides seamless payment processing for businesses of all sizes. Our platform is designed to provide businesses and customers with secure and instant payment processing. As India's leading instant payment gateway, we provide a seamless user experience that ensures maximum convenience and peace of mind. With easy integration options, start accepting payments in no time.

#instantpaymentgatewayinindia#instantpaymentgateway#onlinepaymentgatewayinindia#onlinepaymentgateway#letspe#letspeonlinepayment gateway

0 notes

Photo

Digital Portal for Fee Management

Transform one of the most time-consuming components of managing an educational institution’s finances into a breeze. vmedulife provides a fee management system that covers all the features you’ll need in a school ERP system to not only accelerate student school fee collection but also to provide an enhanced experience for students and parents.

vmedulife’s online fee management software’s secure payment channel allows parents to pay their children’s fees with a few mouse clicks. In addition, when successful payments are made, the school software generates and sends them automated e-receipts.

https://blog.vmedulife.com/digital-portal-for-fee-management/

0 notes

Text

#emerchantpro#Offshoremerchantaccount#OffshoreMerchantAccountInstantApproval#OffshorePaymentGateway#Offshorepaymentprocessing#onlinepaymentgateway

0 notes

Text

Choosing The Right Digital Payment Solution for Your Small Business

Most of the established eCommerce businesses have integrated digital payment solutions into their business amid this Covid pandemic. Several payment gateway solutions are available in the market and selecting the right one for your business is difficult. It's more necessary to have a customer-centric approach if your's is a startup e-commerce venture. In this scenario, you need a payment gateway for a safe and quick payment transfer. The selection of payment gateway also depends on your business type. There are many reasons why you should choose a payment gateway regardless of your business scale.

Tips for Choosing The Best Payment Gateway for Your Business

Select Based on Setup Fee or Transaction Charges

If you are a startup company, it would be difficult for you to pay the initial setup fee. Thus it's better to consider a payment gateway for reduced charges. The payment gateway offers lower transaction charges.

Automatic Billing Support

If your product needs a subscription, then go with digital payment solutions with automatic payment. Many famous gateways offer this support.

Purchase Funnel

Take account of the number of steps required for reaching the payment confirmation page. The minimum the number of steps, more customers will be attracted. Otherwise, there is a high chance of customers turning down the payment.

Use multiple payment gateway solutions for easy customer transactions. The popularity of the online payment gateway is also important to give your business a push.

0 notes