#Outsourced Data Protection Officer

Explore tagged Tumblr posts

Text

In his first two weeks of office, President Trump signed several Executive Orders (EOs) to fulfill one of his many campaign promises—to reduce the size of the federal government. He has rolled back diversity, equity, and inclusion (DEI) initiatives, asserting that the federal government will no longer consider race, ethnicity, or other federally protected characteristics in hiring and retention decisions. In recent days, he announced a financial buyout to federal employees who do not wish to comply with the new Return to Office (RTO) mandate, which requires employees to be in an office for five days per week, despite concerns about available office space. The details of the buyout were outlined in an email with the subject line, “Fork in the Road,” sent by the Office of Personnel Management (OPM) on January 28, 2025, to over 2 million federal workers. The OPM also offered deferred resignation where federal employees could resign immediately and still be paid for the next several months. Meanwhile, those who decide to stay are not promised future employment and the memo stated new conditions for employees, that they be “loyal, trustworthy, and to strive for excellence in their daily work”; principles that likely will become benchmarks for future performance reviews.

Under the Trump administration, federal workforce reductions will happen, along with a greater deployment of artificial intelligence (AI), automation, and outsourcing to private firms. These new services will cost millions of dollars to design, deploy, and train the federal workforce, creating new national and data security threats as well, given the level of protected information at stake. But the influence of Big Tech leaders, who are formally and informally advising President Trump and his administration, may be accelerating a smaller government workforce based on their own values about corporate governance. Big Tech companies were among those that led the RTO mandates for their own employees after the pandemic with similar terms and conditions, as well as promises made that were not kept. Many of these same companies are making AI more technically advanced without realizing that millions of people are still impacted in the U.S. by the lack of digital access. As Biden era policies were working to address the connectivity challenges faced throughout the U.S., these programs are now being challenged, which will almost guarantee that even the best of AI technologies embedded in government functions may be inaccessible to most people.

78 notes

·

View notes

Text

Beyond Paperless: The Unexpected Reasons Businesses Need Printers

In today's digital world, the concept of a paperless office has gained significant traction. With the proliferation of cloud storage, electronic signatures, and digital workflows, it's easy to assume that traditional printers have become obsolete. However, the reality is quite the opposite. Despite the push towards digitization, printers continue to be indispensable tools for businesses. In this article, we'll explore the unexpected reasons why businesses still need printers and how they contribute to efficiency, security, and overall productivity.

The Convenience Factor

In a world where convenience is king, printers play a crucial role in streamlining everyday tasks. While digital documents have their advantages, there are still numerous instances where physical copies are necessary. Consider the following scenarios:

Client Meetings: Despite the prevalence of digital presentations, having hard copies of reports, proposals, and contracts can enhance the professionalism of client meetings.

Legal Documents: Many legal processes still require physical signatures and notarization, making printers essential for handling contracts, agreements, and other legal paperwork.

On-the-Go Printing: In fast-paced environments, the ability to quickly print boarding passes, event tickets, or last-minute documents can be a lifesaver.

Security and Compliance

Beyond convenience, printers play a critical role in maintaining the security and compliance of sensitive information. While digital files are susceptible to cyber threats, physical documents provide an added layer of security. Here's how printers contribute to safeguarding sensitive data:

Confidentiality: Printing sensitive documents in-house reduces the risk of unauthorized access compared to outsourcing printing services.

Regulatory Compliance: Many industries, such as healthcare and finance, have strict regulations regarding the handling of sensitive information. Printers equipped with secure printing features help businesses comply with these regulations.

Data Protection: By utilizing secure printing methods, businesses can prevent unauthorized access to printed documents, mitigating the risk of data breaches.

The Human Touch

In a world dominated by screens and digital interactions, the tactile experience businesses need printers of handling physical documents can have a profound impact. The act of reviewing a printed report, annotating a document with a pen, or sharing a physical handout fosters a sense of connection and engagement that digital files often lack. This human touch can enhance collaboration, creativity, and overall communication within a business environment.

FAQs

Q: With the rise of e-signatures, do businesses still need physical copies of documents? A: While e-signatures have streamlined many processes, certain legal and regulatory requirements still necessitate physical copies of documents. Additionally, some individuals may prefer physical documents for review and record-keeping purposes.

Q: How can printers contribute to environmental sustainability? A: Modern printers are designed with energy-efficient features and support sustainable printing practices such as duplex printing and toner-saving modes, reducing overall environmental impact.

Q: Are there security risks associated with network-connected printers? A: Like any networked device, printers can be vulnerable to cyber threats. However, implementing secure printing protocols and regularly updating printer firmware can mitigate these risks.

Conclusion

In conclusion, the "Beyond Paperless: The Unexpected Reasons Businesses Need Printers" highlights the enduring relevance of printers in today's business landscape. From enhancing convenience and security to fostering human connections, printers continue to be indispensable tools for modern workplaces. As businesses navigate the complexities of digital transformation, it's clear that the role of printers goes beyond paper – they are essential enablers of productivity, security, and efficiency. Embracing the synergy of digital and physical workflows, businesses can harness the full potential of printers to drive success in the digital age.

6 notes

·

View notes

Text

Bookkeeping Services in Delhi by SC Bhagat & Co.

Managing finances efficiently is the backbone of any successful business. Whether you are a startup, a small business, or a large enterprise, having a proper bookkeeping system in place is essential to ensure financial health and compliance with tax regulations. If you are looking for bookkeeping services in Delhi, SC Bhagat & Co. is a trusted partner to help streamline your financial records.

Why Bookkeeping is Essential for Your Business Bookkeeping involves the systematic recording, organizing, and tracking of all financial transactions made by a business. It provides a clear view of your business's financial status, helping you make informed decisions. Effective bookkeeping helps in:

Financial Analysis: By maintaining up-to-date financial records, businesses can regularly assess their financial health. Tax Compliance: Proper bookkeeping ensures all financial documents are in order for accurate and timely tax filing. Cash Flow Management: Tracking cash flow helps in maintaining sufficient funds for daily operations. Budgeting: It provides accurate data for future budgeting, reducing financial risks. Benefits of Outsourcing Bookkeeping Services Outsourcing bookkeeping tasks to professionals like SC Bhagat & Co. brings numerous benefits:

Cost Savings: You eliminate the need for an in-house accounting team, which saves on salaries, office space, and other resources. Accuracy: Professional bookkeepers have the experience and tools to ensure accuracy in your financial records. Time Efficiency: Outsourcing allows you to focus on core business activities while the experts handle your books. Compliance and Expertise: SC Bhagat & Co. ensures that your business complies with all financial and tax regulations, helping you avoid penalties. SC Bhagat & Co. – Your Reliable Bookkeeping Partner SC Bhagat & Co. is a renowned firm in Delhi offering comprehensive bookkeeping services. With years of experience, they cater to businesses across various industries. Here’s why SC Bhagat & Co. stands out:

Customized Solutions: They understand that every business has unique needs and provide tailored bookkeeping services. Expert Team: Their team of certified professionals is well-versed in the latest accounting software and bookkeeping practices. Accuracy and Timeliness: They ensure that all financial records are accurate and delivered on time, helping you stay ahead in your financial management. Confidentiality: The firm maintains high levels of data security to ensure your sensitive financial information is protected. Services Offered by SC Bhagat & Co. SC Bhagat & Co. offers a wide range of bookkeeping and accounting services, including:

Daily Transaction Recording: Keeping track of daily sales, purchases, payments, and receipts. Bank Reconciliation: Ensuring that your bank statements match your business's financial records. Expense Tracking: Managing all expenses to help reduce overheads and increase profits. Financial Reporting: Providing comprehensive financial reports, including balance sheets, income statements, and cash flow statements. Tax Preparation: Ensuring all financial records are in order for accurate and timely tax filings. Why Choose SC Bhagat & Co. for Bookkeeping Services in Delhi? SC Bhagat & Co. is a reliable name for bookkeeping services in Delhi, offering a combination of expertise, experience, and excellent customer service. By choosing them, you ensure:

Accurate and Timely Reports Comprehensive Bookkeeping Solutions Cost-effective Services Compliance with Latest Financial Regulations Final Thoughts Keeping accurate financial records is critical for the success and growth of your business. By outsourcing your bookkeeping services in Delhi to SC Bhagat & Co., you not only ensure compliance and accuracy but also gain access to expert advice, allowing you to focus on growing your business.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

2 notes

·

View notes

Text

Elevate Your Business with Online Accounting and Bookkeeping Services by MASLLP

Introduction:

In today’s fast-paced digital world, businesses of all sizes are looking for efficient ways to manage their finances. Online accounting and bookkeeping services have become a game-changer, providing businesses with real-time financial insights and streamlined operations. MASLLP offers top-notch online accounting and bookkeeping services designed to meet the unique needs of your business. In this blog, we will explore the benefits of these services and why MASLLP is the ideal partner for your financial management needs.

The Advantages of Online Accounting and Bookkeeping Services

Accessibility and Convenience One of the primary benefits of online accounting and bookkeeping services is accessibility. With MASLLP’s services, you can access your financial data anytime, anywhere. This flexibility allows you to make informed decisions on the go, without being tied to a physical office.

Real-Time Financial Insights Online accounting services provide real-time updates on your financial status. MASLLP ensures that your books are always up-to-date, giving you accurate insights into your business’s financial health. This real-time information is crucial for strategic planning and timely decision-making.

Cost-Effective Solution Outsourcing your accounting and bookkeeping to MASLLP can be more cost-effective than maintaining an in-house team. You save on salaries, benefits, and overhead costs while gaining access to professional expertise and advanced accounting software.

Enhanced Security Security is a top priority when it comes to financial data. MASLLP utilizes robust security measures to protect your sensitive information. Our online accounting platform ensures that your data is encrypted and secure, safeguarding it from unauthorized access.

Scalability As your business grows, your accounting needs will evolve. MASLLP’s online accounting and bookkeeping services are scalable, meaning they can easily adapt to your changing requirements. Whether you’re a startup or an established enterprise, our services can grow with you. Why Choose MASLLP for Online Accounting and Bookkeeping Services? Expertise and Experience MASLLP has a team of highly qualified professionals with extensive experience in accounting and bookkeeping. Our experts are well-versed in the latest industry practices and regulations, ensuring that your financial management is in capable hands. Tailored Solutions We understand that every business is unique. MASLLP offers customized accounting and bookkeeping solutions tailored to your specific needs. Our personalized approach ensures that you receive the support and services that are best suited to your business. Advanced Technology MASLLP leverages cutting-edge technology to provide efficient and accurate accounting services. Our advanced accounting software automates routine tasks, reduces errors, and enhances productivity, allowing you to focus on growing your business. Comprehensive Services Our online accounting and bookkeeping services cover a wide range of financial management needs, including: Bookkeeping: Accurate and timely recording of financial transactions. Financial Reporting: Preparation of financial statements and reports. Tax Preparation: Expert tax planning and compliance services. Payroll Services: Efficient payroll management and processing. Accounts Receivable and Payable: Management of incoming and outgoing payments. Exceptional Customer Support At MASLLP, we pride ourselves on providing exceptional customer support. Our team is always available to answer your questions, address your concerns, and provide guidance. We are committed to building long-term relationships with our clients based on trust and transparency. Conclusion Online accounting and bookkeeping services are essential for modern businesses seeking efficiency, accuracy, and scalability. MASLLP offers comprehensive, secure, and customized solutions that cater to your unique financial management needs. By choosing MASLLP, you gain a trusted partner dedicated to helping your business thrive. Don’t let financial management be a burden. Contact MASLLP today to learn more about our online accounting and bookkeeping services and how we can support your business’s growth and success.

#accounting & bookkeeping services in india#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#audit#ap management services

6 notes

·

View notes

Text

In the United States, call center companies play a pivotal role in providing customer support, sales assistance, technical troubleshooting, and various other services for businesses across a multitude of industries. These companies employ thousands of individuals nationwide and operate through various models, including in-house, outsourced, and virtual call centers. Let's delve into the landscape of call center companies in the USA.

1. Overview of the Call Center Industry:

The call center industry in the USA has witnessed significant growth over the years, driven by the increasing demand for cost-effective customer service solutions and the globalization of businesses. Today, call centers cater to diverse sectors such as telecommunications, banking and finance, healthcare, retail, technology, and e-commerce.

2. Major Players:

Several major call center companies dominate the industry, including:

Teleperformance: One of the largest call center companies globally, Teleperformance operates numerous centers across the USA, offering multilingual customer support, technical assistance, and sales services.

Concentrix: Concentrix is another key player, known for its innovative customer engagement solutions. It provides a wide range of services, including customer care, technical support, and digital marketing services.

Alorica: Alorica specializes in customer experience outsourcing solutions, serving clients in various industries. It offers services such as customer support, sales, and back-office support.

Sitel Group: Sitel Group is renowned for its customer experience management solutions. With a global presence, Sitel operates call centers in multiple locations across the USA, providing tailored customer support services.

TTEC: Formerly known as TeleTech, TTEC offers customer experience solutions, digital services, and technology-enabled customer care. It focuses on delivering personalized customer interactions through its contact centers.

3. Industry Trends:

The call center industry is continually evolving, driven by technological advancements and changing consumer preferences. Some notable trends include:

Digital Transformation: Call centers are increasingly integrating digital channels such as chat, email, and social media to enhance customer engagement and support omnichannel experiences.

AI and Automation: Automation technologies, including artificial intelligence (AI) and chatbots, are being adopted to streamline processes, improve efficiency, and provide faster resolutions to customer queries.

Remote Workforce: The COVID-19 pandemic accelerated the shift towards remote work in the call center industry. Many companies have embraced remote workforce models, allowing agents to work from home while maintaining productivity and efficiency.

Data Analytics: Call centers are leveraging data analytics tools to gain insights into customer behavior, preferences, and trends. This data-driven approach enables them to personalize interactions and optimize service delivery.

4. Challenges and Opportunities:

Despite its growth, the call center industry faces several challenges, including:

Staffing Issues: Recruiting and retaining skilled agents remains a challenge for many call center companies, particularly amid competition for talent and high turnover rates.

Security Concerns: With the increasing prevalence of cyber threats, call centers must prioritize data security and compliance to protect sensitive customer information.

However, the industry also presents numerous opportunities for growth and innovation:

Expansion of Services: Call center companies can diversify their service offerings to meet the evolving needs of clients, such as expanding into digital customer engagement, analytics, and consulting services.

Focus on Customer Experience: By prioritizing customer experience and investing in training and technology, call centers can differentiate themselves and gain a competitive edge in the market.

Globalization: With advancements in technology and communication infrastructure, call center companies can explore opportunities for global expansion and tap into new markets.

5. Future Outlook:

Looking ahead, the call center industry is poised for further growth and transformation. As businesses increasingly prioritize customer-centric strategies, call center companies will play a crucial role in delivering exceptional customer experiences and driving business success.

In conclusion, call center companies in the USA form a vital component of the customer service ecosystem, serving a wide range of industries and helping businesses enhance customer satisfaction and loyalty. With ongoing technological innovations and evolving customer expectations, the industry is poised for continued growth and innovation in the years to come.

2 notes

·

View notes

Text

Unlocking Success with Utah CPA IT: Navigating the World of IT Services for Accountants

In today's fast-paced digital landscape, Utah CPA firms depend on reliable IT services from Utah CPA IT to thrive. Your accounting tasks operate smoothly, backed by the technological prowess of Utah CPA IT services.

Therefore, let's delve into this world where Utah CPA IT simplifies complex tech matters. Here, we break down the jargon and make IT accessible to everyone.

Utah CPA IT Services: A Beacon of Efficiency

We'll explore how Utah CPA IT services are transforming the way accountants operate in the Beehive State. No longer are IT woes a headache; instead, they become an ally, streamlining your operations.

Navigating Utah IT Outsourcing

Utah CPA IT services offer a lifeline through IT outsourcing, allowing your firm to focus on core accounting tasks while experts handle your technology needs. This strategic move not only brings cost savings but also ensures peace of mind, knowing that your IT infrastructure is in the hands of professionals who understand the unique requirements of CPA firms in Utah.

Utah IT Support: Your 24/7 Lifesaver

Discover the world of Utah IT support, where issues are resolved swiftly, ensuring you're never left in the dark. Whether it's a minor glitch or a major technical challenge, our expert team is here to provide prompt solutions, keeping your operations running smoothly without missing a beat.

Unlocking Potential with Utah Office 365 Support

Discover how Utah CPA IT services go beyond the basics to leverage the full potential of Office 365, significantly boosting your team's productivity. Also, unleash the collaborative features, data accessibility, and seamless communication that Office 365 offers with the support of Utah CPA IT experts.

Defending Your Castle: Utah Cybersecurity

Explore the realm of Utah cybersecurity and how it shields your sensitive data from digital marauders.

Throughout this journey, we'll keep the path well-lit, ensuring you understand every step. Therefore, let's begin this expedition into the world of Utah CPA IT, simplifying the complex for the benefit of all.

Understanding the IT Needs of CPA Firms

Utah CPA firms, like any other businesses, rely on technology to operate efficiently. But what exactly are their IT needs, and why are they crucial? Let's break it down in simple terms.

The Basics of IT for CPAs

CPA firms in Utah use computers, software, and the internet for their day-to-day tasks. Moreover, they need reliable IT systems to manage financial data, communicate with clients, and stay compliant with ever-changing regulations.

Utah CPA IT Challenges

Security: Protecting sensitive financial data from cyber threats is a top concern.

Efficiency: IT systems must be efficient to ensure quick data processing.

Communication: Smooth communication within the firm and with clients is essential.

Why Utah IT Support Matters

Utah IT support providers play a vital role. They help CPA firms choose the right technology, set up systems, and provide assistance when issues arise. Also, think of them as IT problem solvers.

Outsourcing for Efficiency

Many Utah CPA firms choose to outsource their IT needs. Also, this means hiring experts from outside the firm to handle IT tasks. In addition, it's like hiring a specialist for a specific job, ensuring that everything runs smoothly.

Benefits of Utah CPA IT Services

When it comes to the benefits of Utah CPA IT services, the advantages are crystal clear. Moreover, let's delve into why more and more CPA firms in Utah are turning to IT services to boost their efficiency and success.

1. Enhanced Efficiency

Utah CPA IT services streamline your daily operations. also, with expert assistance at your fingertips, tasks that used to take hours can now be completed in minutes. Also, giving your team more time to focus on crucial financial matters.

2. Cost Savings

By opting for Utah IT outsourcing, you can significantly reduce your IT expenses. No need to worry about maintaining an in-house IT team or purchasing expensive hardware and software. This means more savings in the long run.

3. Reliable IT Support

With Utah IT support, you're never alone in your IT journey. Also, experts are available 24/7 to resolve any issues or answer your questions promptly. Say goodbye to downtime and hello to uninterrupted workflow.

4. Seamless Integration with Office 365

Utah CPA IT services ensure a seamless connection with Utah Office 365 support. This means improved collaboration, easy access to files, and enhanced communication within your firm.

5. Strong Cybersecurity

Your data's security is a top priority. Utah CPA IT services offer robust Utah cybersecurity measures to safeguard your sensitive financial information from cyber threats and breaches.

In conclusion, investing in Utah CPA IT services is a smart move. It boosts efficiency, saves you money, and provides reliable support for your accounting firm. Make the switch today, and watch your productivity soar.

Choosing the Right IT Solutions for Utah CPA Firms

In today's tech-driven world, Utah CPA firms must choose the best IT solutions to thrive. Moreover, selecting the ideal Utah CPA IT support is crucial. Here's a simplified guide:

1. Identify Your Needs

Start by understanding your CPA firm's unique IT requirements. What specific challenges do you face? Knowing this will guide your decision.

2. Research Local Providers

Look for Utah IT outsourcing companies that specialize in serving CPA firms. They understand the local market and your industry's needs.

3. Check Expertise

Ensure the provider has experience working with CPA firms in Utah. Expertise matters when it comes to managing your IT systems effectively.

4. Assess Scalability

Your IT needs may grow over time. Choose a provider that can scale its services as your firm expands.

5. Evaluate Security Measures

Data protection is vital for CPA firms. Verify that the Utah IT support provider has robust cybersecurity measures in place.

6. Consider Cost-Efficiency

While cost is a factor, focus on the long-term benefits. Utah Office 365 support, for instance, can enhance productivity and justify the investment.

7. Read Client Reviews

Check reviews and testimonials from other Utah CPA firms. Additionally, their experiences can offer valuable insights.

8. Request a Consultation

Contact potential providers for a consultation. Discuss your needs and assess their responsiveness and willingness to assist.

Implementing and Integrating Utah CPA IT Solutions

In the world of accounting, Utah CPA IT solutions are vital. They make things smoother, but how do you get started?

Getting Started with Utah CPA IT

First, you need to understand what Utah CPA IT is all about. In addition, it's not rocket science. Moreover, Utah CPA IT is simply about using smart technology to help CPA firms work better.

Selecting the Right Utah IT Outsourcing Partner

Next, find the right folks to help you out. You need a reliable Utah IT outsourcing partner. They'll be your IT buddies.

Utah IT Support: Your IT Lifesavers

Think of Utah IT support as your ready to friend that you can rely on in any moment. They are here to rescue you when tech troubles strike.

Seamless Integration with Utah Office 365 Support

Now, let's talk about making everything fit together. Also, Utah Office 365 support can make your work-life more organized and efficient.

Locking Down with Utah Cybersecurity

Safety first! Utah cybersecurity ensures your precious data stays safe and sound.

Putting it All Together

Once you have your Utah CPA IT solutions lined up, it's time to put everything into action. But, don't worry; it's not as complicated as it sounds.

Your IT partner will work with your CPA firm to make sure all the tech pieces fit seamlessly. In other words, they will set up the right software, ensure your data is safe, and provide ongoing support.

In addition, the best part is that you don't have to be a tech wizard to make it happen. Also, Utah CPA IT experts will guide you through every step. It's like having a knowledgeable tech companion right beside you.

Conclusion

In conclusion, at AnchorSix embracing Utah CPA IT services is the key to unlocking success for CPA firms in the digital age. With the ever-increasing importance of technology, having a reliable IT backbone is no longer a luxury but a necessity. Utah CPA IT services not only simplify complex tech matters but also transform IT from a source of headaches into a strategic ally that streamlines your operations.

Moreover, from outsourcing IT needs to providing 24/7 support, our expert team ensures that your technology infrastructure is in capable hands. Also, the benefits are crystal clear: enhanced efficiency, cost savings, reliable IT support, seamless integration with Office 365, and robust cybersecurity. This investment in simplicity, efficiency, and peace of mind will elevate your accounting firm's productivity and success. Therefore, make the switch today and watch your firm thrive in the digital landscape.

Visit us: https://anchorsix.com/

2 notes

·

View notes

Text

Stay Ahead and Become #1: Risk Management Through Business Process Outsourcing Services

Nothing kills a small business dream faster than a compliance nightmare that comes out of nowhere. One day you're crushing it, the next day you're drowning in legal paperwork because you missed some obscure regulation that nobody told you about.

I've watched too many brilliant entrepreneurs get blindsided by risks they never saw coming. Data breaches, regulatory fines, compliance violations – it's like playing whack-a-mole with your business's future.

Here's the plot twist: the smartest small businesses aren't trying to become compliance experts themselves. They're using business process outsourcing services to handle this stuff while they focus on what actually makes them money.

Think of it as having a team of bodyguards for your business, except instead of protecting you from physical threats, they're protecting you from the legal and regulatory landmines that can blow up your dreams.

The Risk Reality Check That'll Keep You Up at Night

Let's talk about what really happens when small businesses try to wing it with compliance and risk management.

Picture this: you're running an online store, business is booming, then GDPR hits and suddenly you owe the government more money than you made last quarter. Or your customer data gets hacked because your security was about as solid as a screen door.

The scary part? Most business owners don't even know what they don't know. Regulations change faster than fashion trends, and keeping up feels like trying to drink from a fire hose while riding a unicycle.

Data protection laws, employment regulations, industry-specific compliance requirements – it's enough to make your head spin. And the penalties for getting it wrong? They can literally shut you down.

That's where business process outsourcing services become your secret weapon. Instead of trying to become an expert in everything, you let the professionals handle the stuff that could torpedo your business if done wrong.

How the Right BPO Services Turn Risk Into Your Competitive Advantage

Here's what most people miss: good business process outsourcing services don't just manage risks – they turn compliance into a competitive edge.

While your competitors are scrambling to figure out the latest regulations, you're already covered. While they're dealing with security breaches and compliance headaches, you're focused on growing your business and dominating your market.

These specialized teams live and breathe this stuff. They've got dedicated compliance officers, security experts, and risk management specialists who stay on top of every regulatory change. It's like having a crystal ball for business risks.

The security measures alone are mind-blowing. We're talking military-grade encryption, 24/7 monitoring, and backup systems that would make Fort Knox jealous. Try building that infrastructure yourself – your accountant will probably faint when they see the price tag.

Regular audits happen automatically, not when you remember to schedule them (which let's be honest, never happens when you're busy growing a business). These folks are constantly checking, testing, and improving to stay ahead of potential problems.

Why Small Businesses Can't Afford to Skip This Anymore

I know what you're thinking: "Compliance sounds expensive and boring." You know what's really expensive? Getting sued or fined because you cut corners on risk management.

Last year alone, small businesses paid over $2.8 billion in regulatory fines. That's billion with a B. Most of those penalties were completely avoidable with proper compliance management.

But here's the thing that really gets me fired up: business process outsourcing services don't just protect you from disasters – they free up your brain space to focus on what you love doing.

Instead of staying up until midnight reading compliance manuals, you can work on product development or customer relationships. Instead of worrying about whether your data security meets the latest standards, you can focus on strategies to dominate your market.

Take web design, for example. You could spend months learning about accessibility compliance and data protection regulations, or you could ask Why Outsource Web Design Services? and get a site that's both beautiful and compliant.

Same logic applies to digital marketing. Managing customer data while running campaigns is tricky business, which is why smart entrepreneurs wonder Is Outsourced Digital Marketing REALLY Worth It? – because they know experts handle both results and compliance.

The Flexibility Factor That Changes Everything

Here's where things get really interesting. Small businesses need to stay nimble, but compliance requirements can feel like wearing concrete shoes while trying to run a marathon.

The beauty of outsourcing these services? You get enterprise-level protection with startup-level flexibility. Need to expand into new markets with different regulations? Your BPO partner already knows the rules. Launching a new product line with specific compliance requirements? They've probably done it before.

It's like having a Swiss Army knife for business risks – the right tool for every situation, without having to buy and learn how to use each tool separately.

Seasonal businesses especially love this approach. During busy periods, you get more support. During slow times, you're not paying for full-time compliance staff who don't have enough to do.

Red Flags That Should Make You Run the Other Way

Not all business process outsourcing services are created equal. Some providers will promise the moon and deliver a handful of space dust.

Here are the warning signs that scream "danger ahead":

Vague answers about their compliance frameworks. If they can't clearly explain how they handle regulations specific to your industry, keep looking. Good providers eat, sleep, and breathe compliance standards.

No track record with businesses like yours. A provider who's great with Fortune 500 companies might be overkill (and overpriced) for your needs. You want partners who understand the small business hustle.

Reluctance to provide references or case studies. Quality providers are proud of their work and happy to show off their success stories. If they're dodgy about sharing results, that's a massive red flag.

Poor communication during the sales process. If getting straight answers feels like pulling teeth now, imagine how frustrating it'll be when you need help with an actual compliance issue.

The Smart Way to Choose Your Risk Management Partner

Finding the right business process outsourcing services partner is like finding a good doctor – you want someone you can trust with your business's health.

Start by looking for providers who specialize in your industry or have extensive experience with small businesses. Generic solutions rarely work well for specific compliance needs.

Ask about their incident response procedures. What happens if something goes wrong? How quickly can they respond? What's their track record for handling crises? These aren't fun questions to ask, but they're crucial.

Transparency is everything. You should understand exactly what they're doing, how they're doing it, and how they measure success. If they speak in compliance jargon that makes your eyes glaze over, find someone who can explain things in plain English.

Why This Investment Pays for Itself

Look, I get it. Adding another expense to your budget feels painful, especially when you're trying to grow. But think of compliance and risk management as insurance for your dreams.

The peace of mind alone is worth the investment. When you know your bases are covered by experts, you sleep better at night and make better decisions during the day.

Plus, many business process outsourcing services actually save you money in the long run. No need to hire full-time compliance staff, buy expensive security software, or pay for training that becomes outdated in six months.

The competitive advantage is huge too. While your competitors are dealing with compliance headaches, you're out there winning customers and growing your market share.

Conclusion

Running a successful small business means taking calculated risks, not stupid ones. Trying to handle complex compliance and risk management yourself falls squarely in the "stupid risk" category.

Business process outsourcing services give you the protection and expertise you need to dominate your market without losing sleep over regulatory nightmares. It's not about being paranoid – it's about being smart.

The businesses that become market leaders aren't necessarily the ones that take the biggest risks. They're the ones that manage risks intelligently while focusing their energy on growth and innovation.

Your competitors are either already doing this or they're about to learn some expensive lessons. Which group do you want to be in?

Frequently Asked Questions

Q: What are the greatest compliance risks facing small businesses? A: The most frequent and most expensive risk exposures are unauthorized use of data, breaches of employment laws, sector-specific regulation breaches and non-compliance with tax obligations.

Q. What are the average costs of noncompliance to small business? A: They can be fined anywhere from thousands to millions of dollars, as well as their legal fees and the reputational harm, which may very well cost more than the fine itself.

Q. Can I run compliance management in-house instead of outsourcing? Q: You can, but it’s also an investment in hiring and training and tools and staff time that most small businesses can’t execute with much effect.

Q: How can I tell if a BPO is really compliant? A: Ask for certifications, audit reports, client references, and clear documentation around their compliance frameworks and processes.

Q: What if my BPO vendor fails to comply? A: Select companies, first and foremost, who have fully insured comprehensive coverage, with easy-to-understand liability release agreements and incident response plans that protect your business interest alongside adequate coverage.

0 notes

Text

Why Small Businesses Thrive by Outsourcing Accounting with Vital OutSol

For many small business owners, keeping up with bookkeeping, invoicing, payroll, and tax filings can feel like a never‑ending burden. The early days of managing spreadsheets give way to missed deadlines, cash flow confusion, and constant stress—none of which spark joy. Fortunately, there’s a better path: outsourcing accounting services for small business needs. Partnering with a specialist like Vital OutSol turns financial chaos into clarity, freeing you to grow your business with confidence.

1. Reclaim Your Time and Peace of Mind

Your focus should be on client satisfaction, product quality, or marketing—not data entry at 2 a.m. When Vital OutSol handles your accounting, you reclaim hours every week. No more chasing invoices, reconciling bank statements, or piecing together profit-and-loss reports. Instead, you can dedicate your energy to what matters: building your brand and serving your customers.

2. Benefit from Professional-Level Expertise

Not everyone needs a four-year accounting degree—but every business benefits from financial savvy. With Vital OutSol, you tap into a team of CPAs, bookkeepers, and financial analysts who are trained in current regulations, best practices, and the latest software. They can optimize systems, detect inefficiencies, and generate insights you might miss working solo.

3. Scale Smart with Flexible Services

The thing about small business is that "small" doesn’t stay small. As you expand—from five to fifty employees, or from local sales to national reach—financial complexity grows too. But with Vital OutSol, you don’t need to hire and manage your own finance team. Their services scale seamlessly: you get what you need when you need it, all on a subscription-based model that protects your cash flow.

4. Deep Insights for Better Decisions

Cloud accounting platforms can be full of data, but without interpretation, numbers are just pixels. Vital OutSol delivers more than reports—they deliver insights. Want to know if your new product launch is costing more than it’s bringing in? Need a clear picture of your burn rate before your next funding round? They provide dashboards and analysis that make sense—and guide action. You’re no longer guessing; you’re making informed decisions.

Why Businesses Should Outsource Accounts Payable Tasks

One often overlooked—but critical—area is managing outgoing payments. Good accounts payable practices keep vendors happy, cash flow healthy, and the risk of duplicate payments low. That’s why many companies now outsource accounts payable services to stay efficient and avoid operational bottlenecks.

1. Never Miss a Due Date Again

Running late on vendor payments can strain relationships and cost you in late fees or disrupted supplies. Vital OutSol tracks every incoming invoice, approves it according to your workflow, and makes payments on time. You don’t have to remember due dates—or lose sleep over them.

2. Keep Operations Accurate and Transparent

Manual invoice entry leads to human errors: typos, incorrect amounts, and duplication. By outsourcing, you gain a system that scans, validates, matches, and logs every payment. If ever questioned, you have a clear audit trail. It’s financial hygiene with friendly accountability.

3. Redirect Staff Time and Focus

Every hour your internal team spends chasing down approvals, printing checks, or resolving payment errors is an hour not spent growing your core business. Outsourcing these tasks means freeing up your team to pursue revenue-driving initiatives—customer calls, product development, marketing, or service improvement.

How Vital OutSol Transforms Your Financial Back Office

We hear from many clients: they don’t know what they don’t know about how smooth it can be. Vital OutSol’s approach focuses on four key pillars:

Personalized Onboarding They don’t hand over generic forms; they sit down with you, learn your business model, and design your financial process flow—from invoicing to reporting.

Best-in-Class Tech Whether you're using QuickBooks Online, Xero, or a custom ERP, they integrate seamlessly, setting up automated workflows that cut down manual work.

Ongoing Oversight You get regular reports and check-ins—not just when something goes wrong, but to keep you ahead. Monthly financial health sessions help maintain momentum.

Client-Centric Support Your finance team becomes your safe space for questions and guidance. Whether it's looking for tax deductions, troubleshooting payment issues, or projecting next quarter’s cash flow, they’ve got your back.

Real-World Impact: Client Success Stories

Artisan Bakery Startup Founder Jenna stopped waking up on weekends to chase invoices or pay suppliers late. Within two months, Vital OutSol streamlined the bakery’s accounting, implemented autopay, and launched user-friendly monthly reports. Result: happier staff, steadier cash flow, and more focus on baking.

Regional Engineering Services Firm Scaling quickly, needing to track contractor payments and payroll across three sites, this firm relied heavily on Vital OutSol’s accounts payable services to process hundreds of invoices monthly, reconcile statements, and maintain strong vendor terms.

What Makes Vital OutSol Unique

Not all outsource accounting providers are alike. Here’s why Vital OutSol stands apart:

Full-Service Back Office: Accounting, payroll, tax, AP/AR, and even virtual CFO support.

Growth-Focused Support: They’re not order-takers—they’re long-term business partners.

Transparent Pricing: No surprise markups or hidden fees; everything is clearly outlined in advance.

Strict Security: Bank-grade cloud software, encryption protocols, and internal controls protect your data.

Dedicated Support: Your dedicated finance partner knows your history and goals—no bouncing around support desks.

Is Outsourcing Right for You?

If you’re a business owner who:

Feels overwhelmed by bookkeeping and payments

Struggles to understand Profit & Loss or cash flow

Worries about compliance, taxes, or audits

Wants to spend more time growing—not balancing the books then it’s time to consider outsourcing.

Vital OutSol offers a free consultation to explore your challenges and create an action plan tailored to your needs. No pressure—just clarity on next steps.

Final Thoughts: A Smarter Route to Growth

Don’t let finance chaos hold you back. By outsourcing accounting services for small business owners and opting to outsource accounts payable services, you gain more than cost savings—you gain clarity, efficiency, and peace of mind.

With Vital OutSol as your financial partner, you can focus on building your brand, delighting your customers, and growing the business you’ve always dreamed of—while leaving the numbers to the people who love them.

Ready to take the stress out of accounting? Visit vitaloutsol.com to learn more and book a free discovery call. Your growth journey starts here.

0 notes

Text

Empowering Businesses with Reliable Tech Solutions

In the fast-paced digital age, businesses in Davis, California are increasingly relying on technology to stay ahead of the competition. Whether it's data management, cybersecurity, cloud solutions, or technical support, having a trusted IT partner is more important than ever. That’s where Davis IT Services come into play. These services provide tailored tech solutions to meet the unique needs of local businesses, ensuring operational efficiency, data security, and long-term growth.

What Are IT Services?

IT (Information Technology) services refer to the application of technical and business expertise to enable organizations to create, manage, and optimize information and business processes. In Davis, IT services range from basic computer support to complex network management and cloud computing.

Some of the most common IT services offered include:

Managed IT Services

Cybersecurity Solutions

Cloud Computing

Data Backup & Recovery

Helpdesk & Technical Support

IT Consulting

Software and Hardware Installation

Network Design & Maintenance

Why Are Davis IT Services Important?

The city of Davis is known for its vibrant academic community, small businesses, startups, and tech-savvy population. Whether you're a small retail shop, a nonprofit, or a growing enterprise, IT services can significantly impact your daily operations. Here's why investing in professional IT support matters:

1. Boosts Business Efficiency

A streamlined IT infrastructure allows businesses to work faster and smarter. From automated processes to optimized workflows, Davis IT service providers ensure that technology enhances productivity rather than hindering it.

2. Reduces Downtime

Technical glitches, server crashes, or software failures can be devastating to a business. With proactive monitoring and rapid-response support, local IT companies minimize downtime and keep your operations running smoothly.

3. Improves Data Security

Cybersecurity threats are constantly evolving. Local IT firms in Davis help businesses defend against ransomware, phishing attacks, data breaches, and more by deploying the latest in antivirus, firewalls, and threat detection tools.

4. Ensures Regulatory Compliance

Businesses in healthcare, finance, and other regulated industries must follow strict data protection rules. Davis IT services assist in ensuring compliance with regulations like HIPAA, PCI-DSS, and GDPR.

5. Supports Remote Work

Post-pandemic, remote work has become standard for many. IT service providers in Davis enable secure remote access, cloud storage, and communication tools that empower a hybrid workforce.

Key IT Services Offered in Davis

Let’s break down the top Davis IT services that businesses are leveraging today:

1. Managed IT Services

With managed services, you can outsource your entire IT department or specific functions. This includes continuous monitoring, maintenance, software updates, and troubleshooting — all handled by a dedicated team.

2. Cybersecurity Solutions

From endpoint protection to intrusion detection systems (IDS), Davis IT firms offer comprehensive cybersecurity frameworks. Regular security audits and employee training also help mitigate risk.

3. Cloud Services

Cloud computing allows businesses to access data and applications from anywhere, reducing the need for physical infrastructure. Davis IT service providers assist with cloud migration, setup, and management using platforms like Microsoft Azure, Google Cloud, and AWS.

4. IT Consulting

Need guidance on scaling your infrastructure or adopting new technologies? IT consultants in Davis provide strategic insights and technology roadmaps aligned with your business goals.

5. Backup & Disaster Recovery

Protecting your data is crucial. IT professionals in Davis offer automated backups and disaster recovery plans to ensure data integrity in the face of emergencies or system failures.

6. Network Setup & Maintenance

Whether you're establishing a new office or upgrading an old system, expert network design and maintenance ensure strong connectivity, speed, and security.

7. Helpdesk and Technical Support

Round-the-clock technical support is vital for reducing tech-related disruptions. Davis-based IT companies offer fast, friendly, and reliable helpdesk services for software, hardware, and connectivity issues.

Who Needs Davis IT Services?

Almost every industry can benefit from professional IT support. Common sectors in Davis using IT services include:

Education & Research – With UC Davis at its core, the city has a high demand for educational IT solutions.

Healthcare – Clinics and practices need secure systems to protect patient data and meet HIPAA standards.

Retail – POS systems, inventory management, and e-commerce integrations require continuous IT support.

Real Estate – Agents and brokers rely on cloud-based tools, secure databases, and fast communication systems.

Legal & Financial Firms – These industries depend on secure networks and compliance-driven IT environments.

Choosing the Right Davis IT Service Provider

Selecting the right IT partner is a critical business decision. Here are a few tips to guide your choice:

Experience – Look for a provider with a solid track record and industry-specific experience.

Range of Services – Ensure they offer the services your business currently needs and might require in the future.

Scalability – As your business grows, your IT needs will evolve. Choose a firm that can scale with you.

Support & Availability – 24/7 support and local presence can make a big difference during an IT emergency.

Custom Solutions – Avoid one-size-fits-all approaches. The best IT firms in Davis provide tailored plans.

Client Reviews – Read reviews and testimonials to get insights into customer satisfaction and service quality.

Benefits of Hiring a Local Davis IT Company

Why go local? While national chains may seem appealing, Davis-based IT providers offer distinct advantages:

Faster Response Times – Being local means quicker onsite visits and faster troubleshooting.

Better Communication – Face-to-face meetings help build trust and ensure clarity in your IT strategy.

Community Understanding – Local providers understand the unique needs of Davis businesses and the challenges they face.

Final Thoughts

Technology is the backbone of modern businesses. Without the right IT support, even the most promising companies can fall behind. That’s why Davis IT Services are more than just a convenience — they’re a necessity. Whether you're a startup looking for a basic tech setup or an established company aiming for a digital transformation, a trusted IT partner in Davis can help you reach your goals securely and efficiently.

0 notes

Text

Top 15 Proven Strategies to Reduce Costs for Your Business

In today’s competitive environment, reducing operational costs is essential for maintaining profitability and long-term sustainability. Whether you’re a startup or an established enterprise, identifying ways to cut unnecessary expenses can free up resources for growth and innovation. Here are the top 15 proven strategies to reduce costs for your business—without compromising on quality or performance.

1. Embrace Remote Work

Reducing office space and utilities by allowing employees to work from home part- or full-time can significantly cut overhead costs. Cloud tools and communication platforms make remote work seamless and efficient.

2. Automate Routine Tasks

Leverage automation tools for accounting, email marketing, HR, and customer service. Automation minimizes manual errors, increases efficiency, and saves time and labor costs.

3. Outsource Non-Core Functions

Instead of hiring full-time staff for roles like IT, content creation, or legal services, consider outsourcing. This allows you to pay only for what you need when you need it.

4. Optimize Corporate Travel Management

Business travel is a significant expense for many companies. Partnering with corporate travel companies can help you negotiate better rates, streamline bookings, and monitor travel spending. A strong corporate travel management system also ensures policy compliance and cost control.

5. Negotiate with Vendors

Review contracts with suppliers regularly and negotiate better terms or explore alternative vendors. Bulk purchasing and long-term relationships can lead to significant discounts.

6. Go Paperless

Digital documentation reduces printing, paper, and storage costs. It also improves organization and security when using cloud storage systems.

7. Switch to Energy-Efficient Systems

Invest in energy-efficient lighting, appliances, and HVAC systems. This not only cuts electricity bills but also reduces your environmental footprint.

8. Reevaluate Software Subscriptions

Audit all paid software subscriptions regularly. Cancel unused tools or consolidate into all-in-one platforms that offer multiple features under one roof.

9. Use Data Analytics

Data-driven insights help identify inefficiencies in workflows, customer behavior, and resource utilization—leading to smarter, cost-saving decisions.

10. Encourage Cross-Training

Train employees across multiple roles to reduce dependency on hiring for every new function. It increases workforce flexibility and reduces hiring costs.

11. Implement a BYOD Policy

A Bring Your Own Device (BYOD) policy reduces the need to purchase hardware for employees. Ensure cybersecurity protocols are in place to protect sensitive data.

12. Reduce Meetings

Time is money. Streamlining meetings—or replacing them with status updates via collaboration tools—boosts productivity and reduces wasted hours.

13. Utilize Freelancers for Projects

Hire freelancers or gig workers for short-term or specialized projects. It’s a flexible and cost-effective way to manage workloads without long-term commitments.

14. Monitor and Control Travel Spending

Implement travel policies that enforce budget caps and preferred vendors. Use centralized corporate travel management software to track expenses, ensure compliance, and optimize itineraries through trusted corporate travel companies.

15. Invest in Employee Retention

Hiring and training new employees is costly. Invest in team engagement, recognition programs, and career development to reduce turnover and retain top talent.

Final Thoughts

Cost reduction isn’t about cutting corners—it’s about making smarter decisions that improve efficiency and profitability. From optimizing corporate travel management to leveraging automation and remote work, there are countless ways to reduce business expenses. Evaluate your operations, identify inefficiencies.

0 notes

Text

Hire Remote Developers with SMT Labs IT Staff Augmentation

In today's fast-paced digital world, growing your tech team quickly and effectively can make all the difference. Whether you're a startup looking to scale fast or an enterprise wanting to fill skill gaps, IT staff augmentation offers a flexible, cost-effective solution. And when it comes to finding top-tier remote talent, SMT Labs delivers unmatched value. Here's how.

What Is IT Staff Augmentation—and Why You Need It

IT staff augmentation means integrating external developers into your team to handle specific projects or skill gaps without the overhead of full-time hires. Compared to traditional hiring or long-term outsourcing, it offers:

Flexibility – Easily scale your team up or down based on project needs

Speed – Quickly onboard experienced developers without months‑long hiring cycles

Cost‑efficiency – No need to pay for idle capacity, office space, or benefits

Specialized expertise – Plug in niche skills—from iOS to React Native, backend to DevOps

Pretty compelling, right? Now, let's talk about SMT Labs and why their staff augmentation service stands out.

SMT Labs: Your Remote Development Partner

Based in Indore, India, SMT Labs has been delivering web and mobile solutions since 2017. They’ve built a reputation with global clients—especially in the USA—for high-quality development services, including robust staff augmentation offerings.

Highlights of SMT Labs’ Staff Augmentation

Dedicated remote developers—From part-time to full-time, as per your project’s lifecycle .

Flexible engagement models—Need 40–80 hours/month? Or a full 160‑hour monthly commitment? They’ve got you covered.

Rich technology stack—iOS, Android, Flutter, React Native, Node.js, PHP, Python, AI/ML… you name it, they support it.

100% replacement guarantee—If a developer doesn’t fit, SMT Labs will replace them with no hassle.

IP & NDA protection—Critical for any remote work engagement .

Time‑zone flexibility—Seamless overlap with your operational hours.

Transparent reporting—Daily, weekly, or monthly progress updates and code delivery.

Specialties: Hire Software Developers On‑Demand

Whether you need React Native developers, iOS/Android/mobile app experts, or a full-stack/backend team, SMT Labs has you covered:

Mobile App Developers

iOS & Android (native) – Swift, Objective-C, Kotlin, Java

Cross-platform – React Native, Flutter

Frontend Web Developers

React.js, Angular, Vue.js, Bootstrap, HTML/CSS

Backend & Full‑Stack Engineers

Node.js, Python, PHP, Laravel, MySQL, MongoDB, AWS, Azure

AI/ML, Data & DevOps

From machine learning models to cloud automation

Plus, they provide QA engineers, project managers, DevOps, cloud specialists, and more.

Top Benefits of Choosing SMT Labs

Let’s break down why hiring remote developers through SMT Labs can transform your project's trajectory:

1. Speed & Agility

No waiting months for full-time hires. Get vetted, ready-to-start developers within days.

2. Cost Savings

Access skilled engineers in India’s competitive talent market—without sacrificing quality.

3. Technical Depth

Their team spans a wide tech stack—from mobile and web to AI and cloud—ensuring you get the right expertise for your project.

4. Scalability

Easily adjust resource levels—scale up when deadlines are tight, scale down post-launch.

5. Risk Mitigation

With the replacement guarantee and strong NDAs, your project stays smooth and secure.

6. Quality & Communication

SMT Labs is transparent, agile, and focused on consistent delivery backed by years of global project work.

How It Works

The process is simple and client-focused:

Requirement call – You outline your needs and priorities.

Talent shortlist – SMT Labs screens and suggests best-fit profiles.

You interview – Pick the developer(s) who fit your team style.

Onboard & start – They assist with setup and begin work under your management.

Enjoy daily/weekly code delivery and transparent communication from your remote team.

Ideal Use Cases

Replacing or supplementing in-house dev teams

Building an MVP or scaling a product rapidly

Adding niche skillsets (e.g., React Native, AI/ML)

Needing project management, QA, DevOps, or cloud skills

Looking to cut cost without compromising quality

Basically: hire software developers, hire remote developers, hire programmer, hire mobile app developers, hire iOS or React Native developers—all with a flexible, risk‑mitigated model.

How to Get Started with SMT Labs

Step 1: Go to their “Hire Developers” page and fill in your requirements.

Step 2: They'll arrange a call to align on your goals.

Step 3: Review profiles and interview.

Step 4: Onboard your dedicated remote developers and begin delivering value.

You’ll enjoy the flexibility to start, pause, or scale engagement easily—perfect for agile teams looking to evolve quickly.

Final Thoughts

If your project requires top-tier talent—whether you're looking to hire software developer, hire mobile app experts, or hire React Native developers—and you need them fast, cost-effectively, and securely, SMT Labs is your ideal partner.

With their deep technical expertise, flexible talent model, and commitment to quality and transparency, SMT Labs’ IT staff augmentation service helps you build strong, scalable teams in weeks—not months.

Ready to hire remote developers? Connect with SMT Labs now to start scaling smarter and accelerating your roadmap.

Contact SMT Labs Today Reach out to their team via the “Hire Developers” page.

#staffaugmentation#hire software developers#hire remote developers#hire software programmer#hiring a software developer#hire mobile app developers#hire ios app developer#hire React Native developer#it staff augmentation#it staff augmentation services#it staff augmentation company#it staff augmentation services in usa

0 notes

Text

How to Start a Successful Medical Billing Business: A Step-by-Step Guide for Entrepreneurs

How to Start a Successful Medical Billing business: A Step-by-Step Guide for Entrepreneurs

Entering the healthcare industry as a medical billing business owner can be a rewarding venture, especially with the increasing demand for efficient revenue cycle management solutions. Whether you’re an entrepreneur seeking to capitalize on growing healthcare needs or a healthcare professional aiming to diversify your income streams, starting a medical billing business offers promising opportunities. This extensive guide will walk you step-by-step through the process of establishing a successful medical billing company from scratch.

Understanding the Medical Billing Industry: Why It Matters

Medical billing is a vital component of the healthcare revenue cycle management process. It involves submitting and follow-up on claims with health insurance companies to ensure healthcare providers get paid promptly. With the complex and ever-changing landscape of healthcare billing regulations, many providers outsource these services to specialized companies.This creates a lucrative business opportunity for new entrepreneurs who understand the nuances of medical billing.

Step 1: Conduct In-Depth Market Research

identify Your Target Market

Private medical practices

Dental offices

Chiropractic clinics

Physician groups

Specialty clinics (e.g., dermatology, cardiology)

Assess Competition and Demand

Analyze local competitors, pricing strategies, and service gaps. Use tools like Google Maps, industry directories, and surveys to gauge demand and discover underserved niches.

Step 2: Develop a Business Plan

Your business plan should delineate your goals, target market, marketing strategy, operational structure, financial projections, and growth plan. A comprehensive plan helps clarify your vision and serves as a blueprint for success.

Include Key Elements:

Business overview

Market analysis

Services offered (claims processing, patient billing, collections)

Pricing model

Funding requirements and financial forecast

Marketing and client acquisition strategies

Step 3: Ensure Legal and Regulatory Compliance

Register Your Business

Select a business structure (LLC, corporation, sole proprietorship)

Register with state authorities

Obtain necesary licenses and permits

Understand Healthcare Laws and Regulations

Key regulations include the Health Insurance Portability and Accountability Act (HIPAA), which mandates data privacy and security standards. Ensuring compliance is critical for protecting patient information and avoiding legal penalties.

step 4: Acquire Necessary Certifications and Training

While formal certifications are not mandatory, obtaining credentials like Certified Medical Reimbursement Specialist (CMRS) can boost credibility. Also, invest in training on billing software, coding standards, and regulatory compliance.

Step 5: Invest in Medical Billing Software and Equipment

Choose reliable billing software with features such as electronic claim submission, patient management, payment posting, and reporting.Popular options include Kareo, AdvancedMD, and MediTouch. Ensure your hardware (computers, secure servers) meets security standards.

Key features to look for:

Feature

Benefit

User-amiable interface

Saves time and reduces errors

Integration capabilities

Connects with EMRs and payment gateways

Automated claim follow-ups

Improves collection rates

Security measures

protects sensitive patient data

Step 6: Build a Skilled Team

Hiring experienced billers, coders, and administrative staff is crucial.Alternatively, for initial stages, you can outsource some functions or freelance specialists.

Practical tips for team building:

Hire staff with HIPAA compliance knowledge

Invest in ongoing training

Implement quality assurance processes

Step 7: Develop a pricing and Service Model

Decide whether to charge a flat fee, percentage of collections, or hourly rates. Clearly communicate your value proposition and flexibility to attract diverse healthcare providers.

step 8: Market Your Medical Billing Business

effective Marketing strategies:

Create a professional website optimized for SEO with keywords like “medical billing services,” “healthcare revenue cycle management,” and “medical billing company.”

Network with local healthcare providers and attend industry conferences

Leverage social media platforms and online directories

Offer free consultations or demos to attract clients

Step 9: Focus on Client Relationship Management

Providing excellent customer service, timely communication, and transparent billing will help retain clients and generate referrals.

Benefits of Starting a Medical billing Business

Growing demand with increasing healthcare complexity

Flexible working environment and scalable operations

potential for recurring revenue streams

Opportunity to help healthcare providers improve cash flow and efficiency

Practical Tips for Success

Stay updated on coding and regulatory changes

Invest in high-quality software and training

network with healthcare professionals regularly

Maintain strict compliance with HIPAA and data security standards

Continuously monitor and optimize your billing processes

Case Study: From Startup to Thriving Billing Service

Jane Doe launched her medical billing startup in her hometown of Springfield. By focusing on niche specialties like physical therapy clinics and leveraging strategic marketing, she grew her client base within the first year. Implementing robust software and training her team on compliance, Jane reduced claim denials by 15% and increased provider satisfaction. Today, her company processes over $5 million in claims annually, exemplifying how dedication and strategic planning can lead to success in the medical billing industry.

First-Hand Experience: Key Lessons Learned

Invest in education: Knowledge about coding and compliance cannot be overlooked.

Prioritize data security: Protect patient information to maintain trust and avoid legal issues.

Build relationships: Strong partnerships with healthcare providers lead to steady growth.

Be adaptable: healthcare laws evolve,and staying current is essential for continued success.

Conclusion

Starting a successful medical billing business is a promising venture that combines healthcare expertise with entrepreneurial spirit. By conducting thorough market research, developing a solid business plan, ensuring compliance, investing in appropriate software, and establishing strong relationships with healthcare providers, you can build a sustainable and profitable business. Remember, continuous learning and adaptability are key in this dynamic industry. With dedication and strategic planning, your medical billing company can become a vital partner in healthcare revenue cycle management.

https://medicalbillingcodingcourses.net/how-to-start-a-successful-medical-billing-business-a-step-by-step-guide-for-entrepreneurs/

0 notes

Text

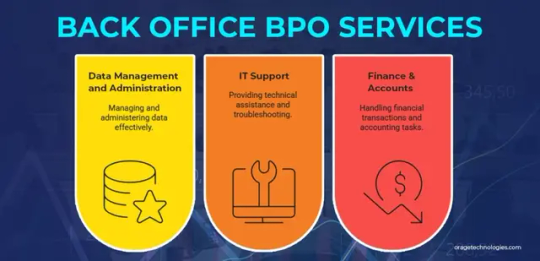

What is Back Office BPO: Benefits & Revenue Generation

While Front Office BPO is widely recognized for customer-facing roles, Back Office BPO encompasses critical internal operations like data management, IT support, finance, and HR. This blog explores what Back Office BPO entails, its key services, benefits, revenue models, and the human capital required for success.

What is Back Office BPO?

Back-office business Process Outsourcing (BPO) involves delegating non-core, internal tasks to specialized service providers. These tasks, such as accounting, payroll, data entry, and IT support, are essential for operations but do not directly engage customers or drive strategic goals. Industries like telecommunications, healthcare, real estate, and government agencies frequently leverage Back-Office BPO to streamline processes.

Key Back Office BPO Services

Below are the primary services offered under Back Office BPO:

Data Management and Administration

This involves handling tasks like data entry, form processing, and claims management, either manually or through automation. Service providers ensure ethical data collection, organization, and security, enabling front-end teams to focus on strategic priorities.

IT Support

Non-client-facing IT functions, such as troubleshooting software issues, maintaining hardware, and managing network infrastructure, are outsourced to specialists. These providers implement data protection, recovery procedures, and ticket management systems for efficient issue resolution.

Finance & Accounting

Service providers manage non-core financial tasks, including accounts payable/receivable, budgeting, forecasting, and audit report preparation. They ensure compliance with regulations, delivering accurate and timely financial reports.

Benefits of Back Office BPO

Back Office BPO creates mutual value for companies and service providers, with options for onshore or offshore outsourcing based on needs and expertise.

For Companies

Cost Savings: Outsourcing reduces overhead costs (salaries, infrastructure, equipment) by 20-25% for onshore and 40-60% for offshore, depending on location and task complexity.

Access to Expertise: Specialized talent standardizes workflows, improving accuracy and scalability to meet seasonal or growth demands.

Risk Mitigation: Providers ensure compliance, reducing operational risks, and maintain backup systems for disaster recovery.

Focus on Core Goals: Delegating back-office tasks frees leadership to prioritize strategic initiatives.

For Service Providers

Stable Revenue: Timely delivery builds credibility, fostering long-term contracts and predictable income.

Business Growth: A flexible approach allows providers to diversify services (e.g., finance, HR), increasing ROI.

Global Credibility: Offshore providers benefit from currency exchange advantages, while onshore providers gain contracts through faster, compliant implementation.

Referrals: Strong relationships attract new clients through word-of-mouth and cross-selling.

Revenue Generation in Back Office BPO

Back Office BPO is a profitable model for both parties, driven by financial and operational efficiencies.

For Companies

Cost Reduction: Manpower costs drop by 30-35% (onshore) or 50-60% (offshore). IT and infrastructure savings reach 65-70%, while hiring and training costs are eliminated.

Productivity Gains: Outsourcing boosts efficiency by 15-25%, allowing leadership to focus on strategy and innovation.

Intangible Benefits: Streamlined operations enhance decision-making and delegation effectiveness.

For Service Providers

Service Fees: Revenue comes from recurring fees or per-seat/hourly rates, with performance-based incentives tied to KPIs.

Scalability: Shared costs across multiple processes (e.g., technology, training) improve margins.

Client Acquisition: Long-term partnerships and referrals expand business opportunities, enhancing global reputation.

Human Capital Required

Effective Back Office BPO relies on skilled personnel at both the company and service provider levels.

For Companies

Contract Managers: Experienced staff to oversee third-party agreements.

Operations Team: A small team to address daily service provider queries.

Accounts Team: Personnel to verify and approve invoices.

Stakeholder Managers: Segment heads to ensure collaboration success and stakeholder satisfaction.

For Service Providers

Process-Specific Staff: For example, data management requires data entry operators, team leads, quality analysts, and operations managers.

Support Functions: HR and admin teams provide essential support for operational efficiency.

Leadership: Heads of departments advise, manage, and deliver outputs while maintaining stakeholder relationships.

Overview

Back Office BPO fosters a win-win partnership, driving economic growth by creating jobs locally and globally. The hierarchy typically includes front-line agents (handling tasks like data entry), supervisors (coaching teams), operations managers (overseeing process improvements and quality), and accounting teams (managing transactions). Leadership ensures strategic alignment and stakeholder satisfaction, making Back Office BPO a cornerstone of operational efficiency.

0 notes

Text

What Are the Top Benefits of IT Services and Support?

Technology today has become the central element of most operations in running businesses. Companies will find it impossible to operate without good IT infrastructure in terms of management of data, facilitating remote working or resistance to cyber threats. It is here that IT services and support come in.

All sizes of businesses can use the services of professionals in the field of IT to assist them in maintaining their systems, resolving problems faster and ensuring the smooth running of the business functions without interference.

Let us examine some of the best advantages that IT services and support have to businesses today.

1. Reliable System Performance

Among the most important benefits of IT services and support is availability of stable business systems. IT experts ensure that the servers, software, and networks are watched to detect the problems before they become serious ones.

Routine servicing minimizes shutdown, speeds the system and aids in the productivity of its workers. When technical problems are addressed promptly and efficiently, companies become less prone to interference and improve their performances in general.

2. Enhanced Security and Data Protection